Resonance Consultancy Reveals the World's Best Cities for 2025

LONDON, Nov. 20, 2024 (GLOBE NEWSWIRE) — Resonance is a leading advisor in place strategy, place branding, and place marketing, and its annual World’s Best Cities rankings quantify and benchmark the relative quality of place, reputation and competitive identity of the planet’s metropolitan areas with a metro population of 1M or more.

The Best Cities data is lauded as one of the world’s most thorough annual city rankings, based on original methodology that analyzes both the performance and perception of cities around the world.

The 10th annual World’s Best Cities rankings—powered this year by a new partnership with Ipsos—is an important, timely analysis of the urban regions that are leading in the areas most important to attracting workforce, visitors and businesses.

Download the 2025 World’s Best Cities Report and all 100 city profiles at WorldsBestCities.com.

Learn more about how Resonance Consultancy can help your city or community at ResonanceCo.com.

“Resonance once again analyzed the principal cities of global metropolitan areas with populations of more than 1M,” says Resonance President & CEO Chris Fair. “Our goal in producing these reports for a decade now is to create the most comprehensive and holistic approach to measuring and benchmarking both perception and performance of cities available.”

This year’s rankings are more revelatory than ever, powered by Resonance’s new partnership with Ipsos to incorporate perception-based data by surveying more than 22,000 people in 30 countries for the first time—the results of which also demonstrate that people all over the world still very much aspire to live, visit and work in the world’s largest cities.

The overall World’s Best Cities rankings are determined by analyzing this public perception, combined with a wide range of factors that have demonstrated moderate to strong correlations with attracting prime age population (age 25 – 44), visitor expenditure, and/or business formation.

“The phrase ‘perception is reality’ is often used when developing reputation management strategies for companies, but the same holds true for destinations,” says Jason McGrath, Executive Vice President, Head of Corporate Reputation at Ipsos. “By merging the top-of-mind destinations where people tell us they want to live, work and visit with the rigorous evaluation of place that Resonance has been conducting for a decade, we have created a more comprehensive evaluation of cities and can better advise destinations on how to strengthen their reputation.”

Based on each city’s perception and performance for livability, lovability, and prosperity, these are the World’s Top 10 Best Cities for 2025:

1. London, UK

2. New York, USA

3. Paris, France

4. Tokyo, Japan

5. Singapore

6. Rome, Italy

7. Madrid, Spain

8. Barcelona, Spain

9. Berlin, Germany

10. Sydney, Australia

(The full ranking and extensive profiles of all 100 of the World’s Best Cities are available at WorldsBestCities.com.)

Dive deeper into the ranking with the free Secrets of the World’s Best Cities webinar on Dec. 10, 2024.

About Resonance Consultancy

Resonance creates transformative strategies, brands and campaigns that empower destinations, cities and communities to realize their full potential. As leading advisors in real estate, tourism and economic development, Resonance combines expertise in research, strategy, branding and communications to make destinations, cities and developments more valuable and more vibrant. ResonanceCo.com

About Ipsos

Ipsos is one of the largest market research and polling companies globally, operating in 90 markets and employing nearly 20,000 people. Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. Our 75 business solutions are based on primary data from our surveys, social media monitoring, and qualitative or observational techniques. “Game Changers”—our tagline—summarizes our ambition to help our 5,000 clients navigate with confidence our rapidly changing world. Founded in France in 1975, Ipsos has been listed on the Euronext Paris since July 1, 1999. The company is part of the SBF 120 and Mid-60 indices and is eligible for the Deferred Settlement Service (SRD). ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com

About World’s Best Cities

Best Cities is the home of Resonance’s exclusive ranking of the world’s top urban regions. The data is used by leading news outlets, trusted by city leaders, and is widely considered to be the world’s most comprehensive annual city ranking. Bloomberg calls it, “The most comprehensive study of its kind; it identifies cities that are most desirable for locals, visitors, and businesspeople alike, rather than simply looking at livability or tourism appeal.” WorldsBestCities.com | #BestCities

Tom Gierasimczuk Resonance Consultancy 604-649-8664 tom@resonanceco.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SoFi Stock vs. Palantir Stock: Wall Street Expects Earnings to Soar 48% for One and 115% for the Other in 2025

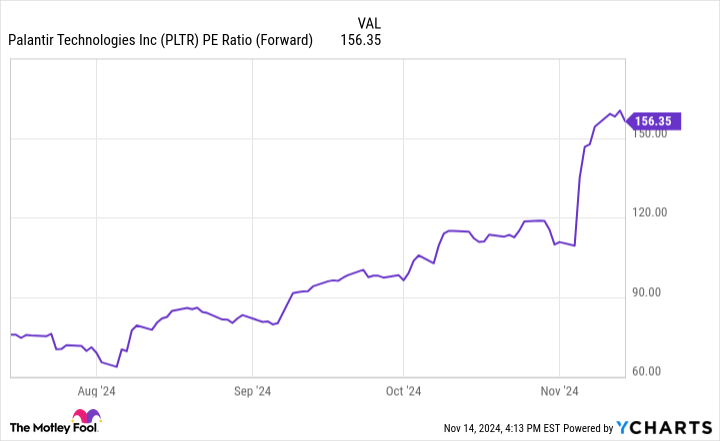

Many tech and artificial intelligence (AI) stocks trade at huge valuations, implying big earnings growth in the years to come, which is why investors are so bullish on these companies. They are buying earnings and growth in the future. The fintech SoFi Technologies (NASDAQ: SOFI) and the artificial intelligence company Palantir Technologies (NYSE: PLTR) both fit this description. Each has had a big year, with SoFi’s stock up over 41% this year and Palantir’s up over 296%.

With 2024 winding down, Wall Street is forecasting 48% earnings growth for one and a whopping 115% earnings growth for the other, according to data provided by Visible Alpha. Is Wall Street too optimistic about these stocks?

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Analysts expect Palantir’s diluted earnings per share to rise from $0.21 this year to $0.31 in 2025, implying a nearly 48% upside. Nine brokers provided estimates, with a low estimate of $0.25 and a high estimate of $0.42. Companies and governments use Palantir’s software to analyze vast amounts of data. The platform bridges the gap between complex AI and machine-learning language models and human analysis.

For example, the government uses Palantir in its counter-terrorism efforts to analyze and visualize data from unrelated sources to detect patterns and gain actionable insights. Palantir has raised awareness for its platform with its Artificial Intelligence Platform boot camps. The company allows customers to test out its platform and helps them use the tech to solve real problems with their business.

It’s easy to see how Palantir’s products could be useful for nearly every sector. What’s unclear is how differentiated Palantir is and whether that constitutes a true moat. You could probably say this about most AI businesses right now. Some believe Palantir is a leader, while others are less inclined to agree with its huge valuation.

After a stellar run for the stock, some analysts believe it will be more difficult to maintain the growth because the company will be up against difficult comparables. Palantir’s 48% earnings growth is nothing to sneeze at but it likely doesn’t justify this kind of valuation.

The fintech company SoFi aims to serve customers’ financial needs by providing bank accounts, personal budgeting tools, an investment platform, and loans including mortgages, student loans, and personal loans. SoFi also has a tech division that sells products and services that help power core banking activities for banks and other companies looking to add financial services.

NIO Inc. Reports Unaudited Third Quarter 2024 Financial Results

Quarterly Total Revenues reached RMB18,673.5 million (US$2,661.0 million)i

Quarterly Vehicle Deliveries were 61,855 units

SHANGHAI, Nov. 20, 2024 (GLOBE NEWSWIRE) — NIO Inc. NIO HKEX: 9866,NIO) (“NIO” or the “Company”), a pioneer and a leading company in the global smart electric vehicle market, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Operating Highlights for the Third Quarter of 2024

- Vehicle deliveries were 61,855 in the third quarter of 2024, consisting of 61,023 vehicles from the Company’s premium smart electric vehicle brand NIO and 832 vehicles from the Company’s family-oriented smart electric vehicle brand ONVO, representing an increase of 11.6% from the third quarter of 2023, and an increase of 7.8% from the second quarter of 2024.

| Key Operating Results | ||||

| 2024 Q3 | 2024 Q2 | 2024 Q1 | 2023 Q4 | |

| Deliveries | 61,855 | 57,373 | 30,053 | 50,045 |

| 2023 Q3 | 2023 Q2 | 2023 Q1 | 2022 Q4 | |

| Deliveries | 55,432 | 23,520 | 31,041 | 40,052 |

Financial Highlights for the Third Quarter of 2024

- Vehicle sales were RMB16,697.6 million (US$2,379.4 million) in the third quarter of 2024, representing a decrease of 4.1% from the third quarter of 2023 and an increase of 6.5% from the second quarter of 2024.

- Vehicle marginii was 13.1% in the third quarter of 2024, compared with 11.0% in the third quarter of 2023 and 12.2% in the second quarter of 2024.

- Total revenues were RMB18,673.5 million (US$2,661.0 million) in the third quarter of 2024, representing a decrease of 2.1% from the third quarter of 2023 and an increase of 7.0% from the second quarter of 2024.

- Gross profit was RMB2,007.4 million (US$286.0 million) in the third quarter of 2024, representing an increase of 31.8% from the third quarter of 2023 and an increase of 18.9% from the second quarter of 2024.

- Gross margin was 10.7% in the third quarter of 2024, compared with 8.0% in the third quarter of 2023 and 9.7% in the second quarter of 2024.

- Loss from operations was RMB5,237.8 million (US$746.4 million) in the third quarter of 2024, representing an increase of 8.1% from the third quarter of 2023 and an increase of 0.5% from the second quarter of 2024. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB4,590.7 million (US$654.2 million) in the third quarter of 2024, representing an increase of 8.3% from the third quarter of 2023 and a decrease of 2.3% from the second quarter of 2024.

- Net loss was RMB5,059.7 million (US$721.0 million) in the third quarter of 2024, representing an increase of 11.0% from the third quarter of 2023 and an increase of 0.3% from the second quarter of 2024. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB4,412.6 million (US$628.8 million) in the third quarter of 2024, representing an increase of 11.6% from the third quarter of 2023 and a decrease of 2.7% from the second quarter of 2024.

- Cash and cash equivalents, restricted cash, short-term investment and long-term time deposits were RMB42.2 billion (US$6.0 billion) as of September 30, 2024.

| Key Financial Results for the Third Quarter of 2024 | |||||||||||||

| (in RMB million, except for percentage) | |||||||||||||

| 2024 Q3 | 2024 Q2 | 2023 Q3 | % Changeiii | ||||||||||

| QoQ | YoY | ||||||||||||

| Vehicle Sales | 16,697.6 | 15,679.6 | 17,408.9 | 6.5% | -4.1% | ||||||||

| Vehicle Margin | 13.1% | 12.2% | 11.0% | 90bp | 210bp | ||||||||

| Total Revenues | 18,673.5 | 17,446.0 | 19,066.6 | 7.0% | -2.1% | ||||||||

| Gross Profit | 2,007.4 | 1,688.7 | 1,523.3 | 18.9% | 31.8% | ||||||||

| Gross Margin | 10.7% | 9.7% | 8.0% | 100bp | 270bp | ||||||||

| Loss from Operations | (5,237.8) | (5,209.3) | (4,843.9) | 0.5% | 8.1% | ||||||||

| Adjusted Loss from Operations (non-GAAP) | (4,590.7) | (4,698.5) | (4,240.4) | -2.3% | 8.3% | ||||||||

| Net Loss | (5,059.7) | (5,046.0) | (4,556.7) | 0.3% | 11.0% | ||||||||

| Adjusted Net Loss (non-GAAP) | (4,412.6) | (4,535.2) | (3,953.2) | -2.7% | 11.6% | ||||||||

Recent Developments

Deliveries in October 2024

- The Company delivered 20,976 vehicles in October 2024. The deliveries consisted of 16,657 vehicles from the Company’s premium smart electric vehicle brand NIO, and 4,319 vehicles from the Company’s family-oriented smart electric vehicle brand ONVO. As of October 31, 2024, the Company had delivered 170,257 vehicles in 2024, with cumulative deliveries reaching 619,851.

Launch of ONVO L60

- On September 19, 2024, ONVO’s first model, the L60, a mid-size family smart electric SUV was launched. The production and delivery of the ONVO L60 have been steadily ramping up since late September 2024.

NIO China Strategic Investment

- On September 29, 2024, the Company entered into definitive agreements for investment in NIO Holding Co., Ltd., a PRC subsidiary in which it holds 92.1% controlling equity interest (“NIO China”), with Hefei Jianheng New Energy Automobile Investment Fund Partnership (Limited Partnership), Anhui Provincial Emerging Industry Investment Co., Ltd. and CS Capital Co., Ltd. (collectively, the “Strategic Investors”), pursuant to which the Strategic Investors will invest an aggregate of RMB3.3 billion in cash in NIO China. Concurrently, NIO will invest an aggregate of RMB10 billion in cash in NIO China (collectively, the “Investment Transaction”). Upon completion of the Investment Transaction, NIO will hold 88.3% controlling equity interest in NIO China. In addition, NIO also has the right to invest an additional RMB20 billion in NIO China by December 31, 2025, based on the same price and terms of the Investment Transaction. The Investment Transaction is subject to regulatory and internal approvals, as well as the satisfaction of customary closing conditions. NIO and the Strategic Investors will each inject cash into NIO China in two installments according to the arrangements in the definitive agreements.

CEO and CFO Comments

“In the third quarter of 2024, we achieved a record-breaking delivery of 61,855 smart electric vehicles. NIO brand has firmly secured the top position in China’s BEV market for vehicles priced over RMB 300,000, holding more than a 40% market share in the first three quarters of this year,” said William Bin Li, founder, chairman and chief executive officer of NIO, “Deliveries of the ONVO L60 have also commenced, with production capacity set to rapidly expand in the next few months. The Company’s total delivery volume for the fourth quarter is expected to reach a new record.”

“NIO’s executive flagship, the ET9, is in the final preparation stage of mass production. The ET9 embodies NIO’s full-stack technological expertise with cutting-edge global innovations, and its mass production will further solidify NIO’s positioning in the premium segment. In addition, firefly, a boutique brand positioned in the compact vehicle segment, will be unveiled at NIO Day 2024, further enriching our product portfolio and catering to a larger user base,” added William Bin Li.

“Ongoing cost optimizations helped increase the vehicle gross margin to 13.1% in the third quarter of 2024. With continued expansion in sales volume and steady improvement in gross margin, our free cash flow turned positive this quarter,” added Stanley Yu Qu, NIO’s chief financial officer, “Starting next year, our three brands are poised to embark on a robust product cycle, projected to elevate the Company’s sales volume to new heights. We expect this momentum will drive continued improvements in the Company’s operational and financial performance.”

Financial Results for the Third Quarter of 2024

Revenues

- Total revenues in the third quarter of 2024 were RMB18,673.5 million (US$2,661.0 million), representing a decrease of 2.1% from the third quarter of 2023 and an increase of 7.0% from the second quarter of 2024.

- Vehicle sales in the third quarter of 2024 were RMB16,697.6 million (US$2,379.4 million), representing a decrease of 4.1% from the third quarter of 2023 and an increase of 6.5% from the second quarter of 2024. The slight decrease in vehicle sales over the third quarter of 2023 was mainly due to the lower average selling price as a result of changes in product mix, partially offset by the increase in delivery volume. The increase in vehicle sales over the second quarter of 2024 was mainly attributable to an increase in delivery volume.

- Other sales in the third quarter of 2024 were RMB1,976.0 million (US$281.6 million), representing an increase of 19.2% from the third quarter of 2023 and an increase of 11.9% from the second quarter of 2024. The increase in other sales over the third quarter of 2023 was mainly due to the increase in sales of parts, accessories and after-sales vehicle services, and provision of power solutions, as a result of the continued growth in the number of users, and partially offset by a decrease in revenue from sales of used cars. The increase in other sales over the second quarter of 2024 was mainly due to the increase in sales of parts, accessories and after-sales vehicle services and provision of power solutions, as a result of the continued growth in the number of users.

Cost of Sales and Gross Margin

- Cost of sales in the third quarter of 2024 was RMB16,666.2 million (US$2,374.9 million), representing a decrease of 5.0% from the third quarter of 2023 and an increase of 5.8% from the second quarter of 2024. The decrease in cost of sales over the third quarter of 2023 was mainly attributable to the decreased material cost per vehicle, partially offset by the increase in delivery volume. The increase in cost of sales over the second quarter of 2024 was mainly attributable to the increase in delivery volume, partially offset by the decreased material cost per vehicle.

- Gross profit in the third quarter of 2024 was RMB2,007.4 million (US$286.0 million), representing an increase of 31.8% from the third quarter of 2023 and an increase of 18.9% from the second quarter of 2024.

- Gross margin in the third quarter of 2024 was 10.7%, compared with 8.0% in the third quarter of 2023 and 9.7% in the second quarter of 2024. The increase in gross margin over the third quarter of 2023 was mainly attributable to the increased vehicle margin and the increased sales of parts, accessories and after-sales vehicle services with relatively higher margins. The increase in gross margin over the second quarter of 2024 was mainly attributable to the increased vehicle margin.

- Vehicle margin in the third quarter of 2024 was 13.1%, compared with 11.0% in the third quarter of 2023 and 12.2% in the second quarter of 2024. The increase in vehicle margin from the third quarter of 2023 was mainly attributable to decreased material cost per unit, and partially offset by lower average selling price as a result of changes in product mix. The increase in vehicle margin from the second quarter of 2024 was mainly due to the decreased material cost per unit.

Operating Expenses

- Research and development expenses in the third quarter of 2024 were RMB3,318.7 million (US$472.9 million), representing an increase of 9.2% from the third quarter of 2023 and an increase of 3.1% from the second quarter of 2024. Excluding share-based compensation expenses, research and development expenses (non-GAAP) were RMB2,902.8 million (US$413.6 million), representing an increase of 9.8% from the third quarter of 2023 and an increase of 0.5% from the second quarter of 2024. The increase in research and development expenses over the third quarter of 2023 was mainly due to the increased personnel costs in research and development functions. Research and development expenses remained relatively stable compared with the second quarter of 2024.

- Selling, general and administrative expenses in the third quarter of 2024 were RMB4,108.8 million (US$585.5 million), representing an increase of 13.8% from the third quarter of 2023 and an increase of 9.3% from the second quarter of 2024. Excluding share-based compensation expenses, selling, general and administrative expenses (non-GAAP) were RMB3,901.4 million (US$555.9 million), representing an increase of 13.9% from the third quarter of 2023 and an increase of 8.5% from the second quarter of 2024. The increase in selling, general and administrative expenses over the third quarter of 2023 and the second quarter of 2024 was mainly attributable to (i) the increase in personnel costs related to sales functions, and (ii) the increase in sales and marketing activities associated with new product launch.

Loss from Operations

- Loss from operations in the third quarter of 2024 was RMB5,237.8 million (US$746.4 million), representing an increase of 8.1% from the third quarter of 2023 and an increase of 0.5% from the second quarter of 2024. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB4,590.7 million (US$654.2 million) in the third quarter of 2024, representing an increase of 8.3% from the third quarter of 2023 and a decrease of 2.3% from second quarter of 2024.

Net Loss and Earnings Per Share/ADS

- Net loss in the third quarter of 2024 was RMB5,059.7 million (US$721.0 million), representing an increase of 11.0% from the third quarter of 2023 and an increase of 0.3% from the second quarter of 2024. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB4,412.6 million (US$628.8 million) in the third quarter of 2024, representing an increase of 11.6% from the third quarter of 2023 and a decrease of 2.7% from the second quarter of 2024.

- Net loss attributable to NIO’s ordinary shareholders in the third quarter of 2024 was RMB5,141.6 million (US$732.7 million), representing an increase of 11.1% from the third quarter of 2023 and an increase of 0.3% from the second quarter of 2024. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB4,403.2 million (US$627.5 million) in the third quarter of 2024.

- Basic and diluted net loss per ordinary share/ADS in the third quarter of 2024 were both RMB2.50 (US$0.36), compared with RMB2.67 in the third quarter of 2023 and RMB2.50 in the second quarter of 2024. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per share/ADS (non-GAAP) were both RMB2.14 (US$0.31), compared with RMB2.28 in the third quarter of 2023 and RMB2.21 in the second quarter of 2024.

Balance Sheet

- Balance of cash and cash equivalents, restricted cash, short-term investment and long-term time deposits was RMB42.2 billion (US$6.0 billion) as of September 30, 2024.

Business Outlook

For the fourth quarter of 2024, the Company expects:

- Deliveries of vehicles to be between 72,000 and 75,000 units, representing an increase of approximately 43.9% to 49.9% from the same quarter of 2023.

- Total revenues to be between RMB19,676 million (US$2,804 million) and RMB20,383 million (US$2,904 million), representing an increase of approximately 15.0% to 19.2% from the same quarter of 2023.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.

Conference Call

The Company’s management will host an earnings conference call at 7:00 AM U.S. Eastern Time on November 20, 2024 (8:00 PM Beijing/Hong Kong/Singapore Time on November 20, 2024).

A live and archived webcast of the conference call will be available on the Company’s investor relations website at https://ir.nio.com/news-events/events.

For participants who wish to join the conference using dial-in numbers, please register in advance using the link provided below and dial in 10 minutes prior to the call. Dial-in numbers, passcode and unique access PIN would be provided upon registering.

https://s1.c-conf.com/diamondpass/10043136-gh7y6t.html

A replay of the conference call will be accessible by phone at the following numbers, until November 27, 2024:

| United States: | +1-855-883-1031 |

| Hong Kong, China: | +852-800-930-639 |

| Mainland, China: | +86-400-1209-216 |

| Singapore: | +65-800-1013-223 |

| International: | +61-7-3107-6325 |

| Replay PIN: | 10043136 |

About NIO Inc.

NIO Inc. is a pioneer and a leading company in the global smart electric vehicle market. Founded in November 2014, NIO aspires to shape a sustainable and brighter future with the mission of “Blue Sky Coming”. NIO envisions itself as a user enterprise where innovative technology meets experience excellence. NIO designs, develops, manufactures and sells smart electric vehicles, driving innovations in next-generation core technologies. NIO distinguishes itself through continuous technological breakthroughs and innovations, exceptional products and services, and a community for shared growth. NIO provides premium smart electric vehicles under the NIO brand, and family-oriented smart electric vehicles through the ONVO brand.

Safe Harbor Statement

This press release contains statements that may constitute “forward-looking” statements pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,” “plans,” “believes,” “estimates,” “likely to” and similar statements. NIO may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in announcements, circulars or other publications made on the websites of each of The Stock Exchange of Hong Kong Limited (the “SEHK”) and the Singapore Exchange Securities Trading Limited (the “SGX-ST”), in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about NIO’s beliefs, plans and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: NIO’s strategies; NIO’s future business development, financial condition and results of operations; NIO’s ability to develop and manufacture vehicles of sufficient quality and appeal to customers on schedule and on a large scale; its ability to ensure and expand manufacturing capacities including establishing and maintaining partnerships with third parties; its ability to provide convenient and comprehensive power solutions to its customers; the viability, growth potential and prospects of the battery swapping, BaaS, and NIO Assisted and Intelligent Driving and its subscription services; its ability to improve the technologies or develop alternative technologies in meeting evolving market demand and industry development; NIO’s ability to satisfy the mandated safety standards relating to motor vehicles; its ability to secure supply of raw materials or other components used in its vehicles; its ability to secure sufficient reservations and sales of its vehicles; its ability to control costs associated with its operations; its ability to build its current and future brands; general economic and business conditions globally and in China and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in NIO’s filings with the SEC and the announcements and filings on the websites of each of the SEHK and SGX-ST. All information provided in this press release is as of the date of this press release, and NIO does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Non-GAAP Disclosure

The Company uses non-GAAP measures, such as adjusted cost of sales (non-GAAP), adjusted research and development expenses (non-GAAP), adjusted selling, general and administrative expenses (non-GAAP), adjusted loss from operations (non-GAAP), adjusted net loss (non-GAAP), adjusted net loss attributable to ordinary shareholders (non-GAAP) and adjusted basic and diluted net loss per share/ADS (non-GAAP), in evaluating its operating results and for financial and operational decision-making purposes. The Company defines adjusted cost of sales (non-GAAP), adjusted research and development expenses (non-GAAP), adjusted selling, general and administrative expenses (non-GAAP) and adjusted loss from operations (non-GAAP) and adjusted net loss (non-GAAP) as cost of sales, research and development expenses, selling, general and administrative expenses, loss from operations and net loss excluding share-based compensation expenses. The Company defines adjusted net loss attributable to ordinary shareholders (non-GAAP), adjusted basic and diluted net loss per share/ADS (non-GAAP) as net loss attributable to ordinary shareholders and basic and diluted net loss per share/ADS excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value. By excluding the impact of share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, the Company believes that the non-GAAP financial measures help identify underlying trends in its business and enhance the overall understanding of the Company’s past performance and future prospects. The Company also believes that the non-GAAP financial measures allow for greater visibility with respect to key metrics used by the Company’s management in its financial and operational decision-making.

The non-GAAP financial measures are not presented in accordance with U.S. GAAP and may be different from non-GAAP methods of accounting and reporting used by other companies. The non-GAAP financial measures have limitations as analytical tools and when assessing the Company’s operating performance, investors should not consider them in isolation, or as a substitute for net loss or other consolidated statements of comprehensive loss data prepared in accordance with U.S. GAAP. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure.

The Company mitigates these limitations by reconciling the non-GAAP financial measures to the most comparable U.S. GAAP performance measures, all of which should be considered when evaluating the Company’s performance.

For more information on the non-GAAP financial measures, please see the table captioned “Unaudited Reconciliation of GAAP and Non-GAAP Results” set forth at the end of this press release.

Exchange Rate

This announcement contains translations of certain Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from Renminbi to U.S. dollars were made at the rate of RMB7.0176 to US$1.00, the noon buying rate in effect on September 30, 2024 in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the Renminbi or U.S. dollars amounts referred could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

For more information, please visit: http://ir.nio.com.

Investor Relations

ir@nio.com

Media Relations

global.press@nio.com

Source: NIO

| NIO INC. | ||||

| Unaudited Condensed Consolidated Balance Sheets | ||||

| (All amounts in thousands) | ||||

| As of | ||||

| December 31, 2023 | September 30, 2024 | September 30, 2024 | ||

| RMB | RMB | US$ | ||

| ASSETS | ||||

| Current assets: | ||||

| Cash and cash equivalents | 32,935,111 | 23,791,903 | 3,390,319 | |

| Restricted cash | 5,542,271 | 4,920,257 | 701,131 | |

| Short-term investments | 16,810,107 | 13,358,496 | 1,903,570 | |

| Trade and notes receivables | 4,657,652 | 1,903,642 | 271,267 | |

| Amounts due from related parties | 1,722,603 | 5,122,638 | 729,970 | |

| Inventory | 5,277,726 | 6,818,641 | 971,649 | |

| Prepayments and other current assets | 3,434,763 | 4,140,854 | 590,067 | |

| Total current assets | 70,380,233 | 60,056,431 | 8,557,973 | |

| Non-current assets: | ||||

| Long-term restricted cash | 144,125 | 101,216 | 14,423 | |

| Property, plant and equipment, net. | 24,847,004 | 24,618,039 | 3,508,042 | |

| Intangible assets, net……………………………………………… | 29,648 | 29,648 | 4,225 | |

| Land use rights, net | 207,299 | 203,321 | 28,973 | |

| Long-term investments | 5,487,216 | 3,731,701 | 531,763 | |

| Right-of-use assets – operating lease | 11,404,116 | 11,890,060 | 1,694,320 | |

| Other non-current assets | 4,883,561 | 3,358,601 | 478,597 | |

| Total non-current assets | 47,002,969 | 43,932,586 | 6,260,343 | |

| Total assets | 117,383,202 | 103,989,017 | 14,818,316 | |

| LIABILITIES | ||||

| Current liabilities: | ||||

| Short-term borrowings | 5,085,411 | 6,010,924 | 856,550 | |

| Trade and notes payable | 29,766,134 | 30,197,021 | 4,303,041 | |

| Amounts due to related parties, current | 561,625 | 264,508 | 37,692 | |

| Taxes payable | 349,349 | 558,558 | 79,594 | |

| Current portion of operating lease liabilities | 1,743,156 | 1,781,617 | 253,878 | |

| Current portion of long-term borrowings | 4,736,087 | 4,229,267 | 602,666 | |

| Accruals and other liabilities | 15,556,354 | 14,430,852 | 2,056,380 | |

| Total current liabilities | 57,798,116 | 57,472,747 | 8,189,801 | |

| Non-current liabilities: | ||||

| Long-term borrowings | 13,042,861 | 11,281,994 | 1,607,671 | |

| Non-current operating lease liabilities | 10,070,057 | 10,575,748 | 1,507,032 | |

| Deferred tax liabilities | 212,347 | 210,166 | 29,948 | |

| Amounts due to related parties, non-current | – | 318,481 | 45,383 | |

| Other non-current liabilities | 6,663,805 | 8,059,286 | 1,148,439 | |

| Total non-current liabilities | 29,989,070 | 30,445,675 | 4,338,473 | |

| Total liabilities | 87,787,186 | 87,918,422 | 12,528,274 | |

| NIO INC. | ||||

| Unaudited Condensed Consolidated Balance Sheets | ||||

| (All amounts in thousands) | ||||

| As of | ||||

| December 31, 2023 | September 30, 2024 | September 30, 2024 | ||

| RMB | RMB | US$ | ||

| MEZZANINE EQUITY | ||||

| Redeemable non-controlling interests | 3,860,384 | 4,552,963 | 648,792 | |

| Total mezzanine equity | 3,860,384 | 4,552,963 | 648,792 | |

| SHAREHOLDERS’ EQUITY | ||||

| Total NIO Inc. shareholders’ equity | 25,546,233 | 11,346,837 | 1,616,912 | |

| Non-controlling interests | 189,399 | 170,795 | 24,338 | |

| Total shareholders’ equity | 25,735,632 | 11,517,632 | 1,641,250 | |

| Total liabilities, mezzanine equity and shareholders’ equity | 117,383,202 | 103,989,017 | 14,818,316 | |

| NIO INC. | ||||||||

| Unaudited Condensed Consolidated Statements of Comprehensive Loss | ||||||||

| (All amounts in thousands, except for share and per share/ADS data) | ||||||||

| Three Months Ended | ||||||||

| September 30, 2023 | June 30, 2024 | September 30, 2024 | September 30, 2024 | |||||

| RMB | RMB | RMB | US$ | |||||

| Revenues: | ||||||||

| Vehicle sales | 17,408,864 | 15,679,623 | 16,697,558 | 2,379,383 | ||||

| Other sales | 1,657,687 | 1,766,345 | 1,975,970 | 281,573 | ||||

| Total revenues | 19,066,551 | 17,445,968 | 18,673,528 | 2,660,956 | ||||

| Cost of sales: | ||||||||

| Vehicle sales | (15,491,494 | ) | (13,773,438 | ) | (14,516,999 | ) | (2,068,656 | ) |

| Other sales | (2,051,734 | ) | (1,983,815 | ) | (2,149,156 | ) | (306,252 | ) |

| Total cost of sales | (17,543,228 | ) | (15,757,253 | ) | (16,666,155 | ) | (2,374,908 | ) |

| Gross profit | 1,523,323 | 1,688,715 | 2,007,373 | 286,048 | ||||

| Operating expenses: | ||||||||

| Research and development | (3,039,089 | ) | (3,218,522 | ) | (3,318,740 | ) | (472,917 | ) |

| Selling, general and administrative | (3,609,319 | ) | (3,757,458 | ) | (4,108,806 | ) | (585,500 | ) |

| Other operating income | 281,174 | 77,967 | 182,406 | 25,993 | ||||

| Total operating expenses | (6,367,234 | ) | (6,898,013 | ) | (7,245,140 | ) | (1,032,424 | ) |

| Loss from operations | (4,843,911 | ) | (5,209,298 | ) | (5,237,767 | ) | (746,376 | ) |

| Interest and investment income | 288,014 | 362,731 | 310,123 | 44,192 | ||||

| Interest expenses | (88,546 | ) | (176,141 | ) | (203,761 | ) | (29,036 | ) |

| Gain on extinguishment of debt | 170,193 | — | — | — | ||||

| Share of income/(losses) of equity investees | 7,781 | (73,607 | ) | (199,662 | ) | (28,452 | ) | |

| Other (losses)/income, net | (88,645 | ) | 52,351 | 309,654 | 44,125 | |||

| Loss before income tax expense | (4,555,114 | ) | (5,043,964 | ) | (5,021,413 | ) | (715,547 | ) |

| Income tax expense | (1,610 | ) | (2,019 | ) | (38,265 | ) | (5,453 | ) |

| Net loss | (4,556,724 | ) | (5,045,983 | ) | (5,059,678 | ) | (721,000 | ) |

| Accretion on redeemable non-controlling interests to redemption value | (77,159 | ) | (83,022 | ) | (91,400 | ) | (13,024 | ) |

| Net loss attributable to non-controlling interests | 5,254 | 2,635 | 9,443 | 1,346 | ||||

| Net loss attributable to ordinary shareholders of NIO Inc. | (4,628,629 | ) | (5,126,370 | ) | (5,141,635 | ) | (732,678 | ) |

| Net loss | (4,556,724 | ) | (5,045,983 | ) | (5,059,678 | ) | (721,000 | ) |

| Other comprehensive (loss)/income | ||||||||

| Foreign currency translation adjustment, net of nil tax | (61,222 | ) | 89,483 | (298,383 | ) | (42,519 | ) | |

| Total other comprehensive (loss)/income | (61,222 | ) | 89,483 | (298,383 | ) | (42,519 | ) | |

| Total comprehensive loss | (4,617,946 | ) | (4,956,500 | ) | (5,358,061 | ) | (763,519 | ) |

| Accretion on redeemable non-controlling interests to redemption value | (77,159 | ) | (83,022 | ) | (91,400 | ) | (13,024 | ) |

| Net loss attributable to non-controlling interests | 5,254 | 2,635 | 9,443 | 1,346 | ||||

| Comprehensive loss attributable to ordinary shareholders of NIO Inc. | (4,689,851 | ) | (5,036,887 | ) | (5,440,018 | ) | (775,197 | ) |

| Weighted average number of ordinary shares/ADS used in computing net loss per share/ADS | ||||||||

| Basic and diluted | 1,735,661,387 | 2,049,836,045 | 2,055,159,231 | 2,055,159,231 | ||||

| Net loss per share/ADS attributable to ordinary shareholders | ||||||||

| Basic and diluted | (2.67 | ) | (2.50 | ) | (2.50 | ) | (0.36 | ) |

| NIO INC. | ||||||||

| Unaudited Reconciliation of GAAP and Non-GAAP Results | ||||||||

| (All amounts in thousands, except for share and per share/ADS data) | ||||||||

| Three Months Ended September 30, 2024 | ||||||||

| GAAP Result |

Share-based compensation |

Accretion on redeemable non-controlling interests to redemption value |

Adjusted Result (Non-GAAP) |

|||||

| RMB | RMB | RMB | RMB | |||||

| Cost of sales | (16,666,155 | ) | 23,688 | — | (16,642,467) | |||

| Research and development expenses | (3,318,740 | ) | 415,955 | — | (2,902,785) | |||

| Selling, general and administrative expenses | (4,108,806 | ) | 207,413 | — | (3,901,393) | |||

| Total | (24,093,701 | ) | 647,056 | — | (23,446,645) | |||

| Loss from operations | (5,237,767 | ) | 647,056 | — | (4,590,711) | |||

| Net loss | (5,059,678 | ) | 647,056 | — | (4,412,622) | |||

| Net loss attributable to ordinary shareholders of NIO Inc. | (5,141,635 | ) | 647,056 | 91,400 | (4,403,179) | |||

| Net loss per share/ADS attributable to ordinary shareholders, basic and diluted (RMB) | (2.50 | ) | 0.32 | 0.04 | (2.14) | |||

| Net loss per share/ADS attributable to ordinary shareholders, basic and diluted (USD) | (0.36 | ) | 0.04 | 0.01 | (0.31) | |||

| Three Months Ended June 30, 2024 | ||||||||

| GAAP Result |

Share-based compensation |

Accretion on redeemable non-controlling interests to redemption value |

Adjusted Result (Non-GAAP) |

|||||

| RMB | RMB | RMB | RMB | |||||

| Cost of sales | (15,757,253 | ) | 18,698 | — | (15,738,555 | ) | ||

| Research and development expenses | (3,218,522 | ) | 330,110 | — | (2,888,412 | ) | ||

| Selling, general and administrative expenses | (3,757,458 | ) | 161,945 | — | (3,595,513 | ) | ||

| Total | (22,733,233 | ) | 510,753 | — | (22,222,480 | ) | ||

| Loss from operations | (5,209,298 | ) | 510,753 | — | (4,698,545 | ) | ||

| Net loss | (5,045,983 | ) | 510,753 | — | (4,535,230 | ) | ||

| Net loss attributable to ordinary shareholders of NIO Inc. | (5,126,370 | ) | 510,753 | 83,022 | (4,532,595 | ) | ||

| Net loss per share/ADS attributable to ordinary shareholders, basic and diluted (RMB) | (2.50 | ) | 0.25 | 0.04 | (2.21 | ) | ||

| Three Months Ended September 30, 2023 | ||||||

| GAAP Result |

Share-based compensation |

Accretion on redeemable non-controlling interests to redemption value |

Adjusted Result (Non-GAAP) |

|||

| RMB | RMB | RMB | RMB | |||

| Cost of sales | (17,543,228 | ) | 22,197 | — | (17,521,031 | ) |

| Research and development expenses | (3,039,089 | ) | 395,856 | — | (2,643,233 | ) |

| Selling, general and administrative expenses | (3,609,319 | ) | 185,496 | — | (3,423,823 | ) |

| Total | (24,191,636 | ) | 603,549 | — | (23,588,087 | ) |

| Loss from operations | (4,843,911 | ) | 603,549 | — | (4,240,362 | ) |

| Net loss | (4,556,724 | ) | 603,549 | — | (3,953,175 | ) |

| Net loss attributable to ordinary shareholders of NIO Inc. | (4,628,629 | ) | 603,549 | 77,159 | (3,947,921 | ) |

| Net loss per share/ADS attributable to ordinary shareholders, basic and diluted (RMB) | (2.67 | ) | 0.35 | 0.04 | (2.28 | ) |

i All translations from RMB to USD for three months ended September 30, 2024 were made at the rate of RMB7.0176 to US$1.00, the noon buying rate in effect on September 30, 2024 in the H.10 statistical release of the Federal Reserve Board.

ii Vehicle margin is the margin of new vehicle sales, which is calculated based on revenues and cost of sales derived from new vehicle sales only.

iii Except for gross margin and vehicle margin, where absolute changes instead of percentage changes are calculated.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Meta Taps Former Salesforce AI Chief To Lead Enterprise AI Push

Meta Platforms Inc. META has appointed Clara Shih, former Salesforce Inc CRM artificial intelligence chief, to head its newly formed Business AI division, marking a significant expansion of the social media giant’s AI strategy for enterprise customers.

What Happened: Shih, who announced her move via LinkedIn on Tuesday, will spearhead Meta’s efforts to develop AI tools for businesses using Meta’s social platforms. “Our vision is to make cutting-edge AI accessible to every business, empowering all to find success and own their future in the AI era,” Shih stated.

The appointment comes as Meta accelerates its unique open-source AI approach, differentiating itself from competitors like Microsoft Corp. MSFT-backed OpenAI and Alphabet Inc.’s GOOG GOOGL Google.

Rather than monetizing AI through direct subscriptions, Meta aims to enhance its existing advertising and social media platforms using its Llama language models.

See Also: Dan Ives Expects ‘Drop The Mic Performance’ Tomorrow From Nvidia: Here’s Why

Why It Matters: Meta’s AI push has gained momentum under CEO Mark Zuckerberg‘s leadership. During the company’s third-quarter earnings call, Zuckerberg revealed plans for Llama 4, announcing an unprecedented computing infrastructure utilizing over 100,000 Nvidia Corp. NVDA H100 GPUs. The next-generation model is scheduled for release in early 2025.

The company has already begun integrating AI-generated content into its platforms, including AI-created photo carousels on Facebook and AI chatbots on Instagram.

Bank of America Securities recently labeled Meta an “AI Story,” citing the growing adoption of Llama and Meta AI. The firm projects AI-driven advertising improvements to materialize by 2025.

The move follows Meta’s strong third-quarter performance, where the company exceeded analyst expectations while signaling increased capital investment in AI infrastructure. Zuckerberg has touted the company’s $405 billion Llama 3.1 model as having superior cost performance compared to competing closed models.

Read Next:

Image via Pixabay

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ECB warns of 'bubble' in AI stocks as funds deplete cash buffers

FRANKFURT (Reuters) – The European Central Bank warned on Wednesday about a “bubble” in stocks related to artificial intelligence (AI), which could burst abruptly if investors’ rosy expectations are not met.

The warning came as part of the ECB’s twice-yearly Financial Stability Review, a laundry list of risks ranging from wars and tariffs to cracks in the plumbing of the banking system.

The central bank for the 20 countries that share the euro noted the stock market, particularly in the United States, had become increasingly dependent on a handful of companies perceived as the beneficiaries of the AI boom.

“This concentration among a few large firms raises concerns over the possibility of an AI-related asset price bubble,” the ECB said. “Also, in a context of deeply integrated global equity markets, it points to the risk of adverse global spillovers, should earnings expectations for these firms be disappointed.”

The ECB noted investors were demanding a low premium to own shares and bonds while funds had cut their cash buffers.

“Given relatively low liquid asset holdings and significant liquidity mismatches in some types of open-ended investment funds, cash shortages could result in forced asset sales that could amplify downward asset price adjustments,” the ECB said.

Among other risks, the ECB flagged the euro area was vulnerable to more trade fragmentation – a key source of concerns for policymakers and investors since Donald Trump won the U.S. Presidential election earlier this month.

The President-elect had made tariffs a key element of his pitch to voters during the campaign and several ECB policymakers have said these measures, if implemented, would hurt growth in the euro area.

The ECB also noted euro area governments – particularly Italy and France – would be borrowing at much higher interest rates over the coming decade, strengthening the need for prudent fiscal policies.

(Reporting By Francesco Canepa; Editing by Alex Richardson)

NaaS Technology Inc. Reports Unaudited 2024 Third Quarter Financial Results

BEIJING, Nov. 20, 2024 /PRNewswire/ — NaaS Technology Inc. (“NaaS” or the “Company”) NAAS, the first U.S. listed EV charging service company in China, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Highlights for the Third Quarter of 2024:

- Accomplished significant net profit milestone in the third quarter of 2024.

- Non-IFRS net profit[1] in the third quarter of 2024 reached RMB20.6 million (US$2.9 million). IFRS net loss approached breakeven with a historical low of RMB8.3 million (US$1.2 million).

- Gross profit margin reached a historical high of 57% for the third quarter of 2024.

- Strategic business focus started to take effect with the core charging services business continuing to deliver robust growth.

- Charging services revenue increased by 36% year over year for the third quarter of 2024, accounting for 95% of total revenue.

- Charging services business continued to realize positive network effects that increased the proportion of orders with positive NTR[2] to a record high of 73% in the third quarter of 2024.

- Continuous progress in AI-driven technology, with NaaS Energy Fintech (NEF) system strengthening our value proposition to users and charging operators within our ecosystem.

- Number of transaction users through the Company’s platform was up by 34% year over year for the third quarter of 2024 and the cumulative number of connected chargers was up by 49% year over year for the third quarter of 2024, whilst sales expense decreased by 81% year over year for the third quarter of 2024, reflecting improved cost efficiency.

- Deployment of the “Zhejiang Province Charging Infrastructure Governance and Supervision Service Platform” supports the Zhejiang provincial government to optimize EV charging supply/demand balance and signifies NEF’s both business and financial value.

“We reached a significant financial milestone in the third quarter of 2024, delivering a positive non-IFRS net profit for the first time,” said Ms. Yang Wang, Chief Executive Officer of NaaS. “This accomplishment not only reflects our effectiveness in driving profitability but also marks a pivotal point in our growth strategy. By concentrating on our core charging services – which exhibit strong potential for profitability and growth – and leveraging our technology and data insights, we are actively enhancing the industry’s supply and demand connection. The surge in charging demand and the dispersed distribution of charging stations have heightened the market’s need for AI-driven and digital charging solutions to allocate resources effectively. Our NaaS Energy Fintech system and ongoing upgrades empower charging operators to improve operational efficiency, making us an essential partner in their charging infrastructure development efforts. Through strategic focus and resource optimization technology, we are well-positioned to capitalize on market developments and drive the Company’s sustainable growth.”

Mr. Steven Sim, Chief Financial Officer of NaaS, added, “In the third quarter of 2024, we made significant strides in profitability, achieving four consecutive quarters of gross margin improvement, culminating in a record high of 57%. This progress was propelled by our strategic focus on core charging services business and disciplined approach to efficiency enhancement and cost reduction, which have led to substantial decreases in operating costs through refined management and resource optimization. Moreover, by proactively discontinuing lower-margin offline businesses, we have significantly bolstered our financial health. These results demonstrate our commitment to disciplined financial management and delivering sustained value for our stakeholders.”

Business Updates:

Strategy

1. Highlighting AI-Driven Evolution in EV Charging at CIFTIS 2024

In September 2024, Ms. Yang Wang, Chief Executive Officer of NaaS, delivered a keynote speech at the 2024 China International Fair for Trade in Services (CIFTIS) during the UAE-Beijing Economic Forum. Her remarks emphasized China’s accelerating transition from traditional fuel to electric vehicles and AI’s pivotal role in reshaping the transportation energy landscape.

2. Strategic Emphasis on Interconnectivity Charging Business and AI Innovations

In October 2024, NaaS announced a strategic emphasis on its interconnectivity charging business, leveraging AI technology and industry partnerships to accelerate ecosystem development on both the supply and demand sides of China’s rapidly growing electric vehicle charging industry. The company is expanding its charging station network by attracting local operators with advanced AI-powered services. NaaS has made significant investments in developing neural network algorithms to optimize charging efficiency and elevate the user experience. The NEF (NaaS Energy Fintech) system, introduced last year, employs advanced AI algorithms to intelligently manage site selection for charging stations, revenue assessments, operational scheduling, maintenance, and more.

Ecosystem

1. Participation in Zhejiang Province’s Charging Infrastructure Governance and Regulatory Service Platform

In July 2024, NaaS participated in the development and launch of the “Zhejiang Province Charging Infrastructure Governance and Regulatory Service Platform.” This platform utilizes real-time data to achieve a scientifically planned layout of charging infrastructure. It optimizes existing charging facilities, enhances the matching efficiency between supply and demand for new energy vehicle charging, and effectively promotes high-quality development of the charging infrastructure industry in Zhejiang Province. This initiative further advances major actions such as promoting new energy vehicles in rural areas.

2. Strategic Cooperation with FAW-Volkswagen and IM Motors

In August 2024, NaaS announced a deep cooperation with FAW-Volkswagen in the field of charging services. Together with its strategic partner Kuaidian, NaaS is sharing a nationwide network of quality public charging stations and services to provide intelligent, efficient, and convenient charging experiences for FAW-Volkswagen new energy vehicle owners. On September 26, 2024, NaaS entered a strategic partnership with IM Motors, an electric vehicle joint venture among Alibaba, SAIC Motor, and Zhangjiang Hi-Tech. This collaboration significantly expands NaaS’ automotive ecosystem partnerships, leveraging its extensive nationwide charging network to offer IM Motors’ customers enhanced service features.

3. Partnership with Leading Charging Station Operator in Fujian Province

In October 2024, NaaS announced a strategic partnership with a leading regional charging station operator in Fujian Province. This collaboration will integrate over 100 charging stations and more than 1,600 DC fast chargers into NaaS’ strategic partner Kuaidian’s charging service network. The partnership focuses on charging facility interconnectivity, targeted traffic guidance, and seamless payments, enhancing the availability and convenience of charging services in the region.

4. Expansion in charger connections to enhance supply-side infrastructure

In October 2024, NaaS announced that as of September 30, 2024, the Company has connected approximately 1.15 million chargers to its charging network. The rapid expansion in the charging network underscores the Company’s dedication to enhancing China’s supply-side infrastructure and providing efficient, accessible EV charging solutions nationwide.

ESG

1. Participation in China’s First Carbon Inclusive City Cooperation Alliance

In July 2024, at the Hubei Carbon Market’s 10th anniversary event, China’s first Carbon Inclusive City Cooperation Alliance was officially established. As a green and low-carbon scenario provider for new energy vehicle charging services, NaaS joined the alliance as an inaugural member. The alliance includes 32 enterprises such as Tencent, Alipay, Amap, and China Merchants Bank, covering carbon-inclusive managers and platform operators in multiple cities including Beijing, Shanghai, Guangzhou, and Shenzhen.

2. Release of 2023 Environmental, Social, and Governance Report

In August 2024, NaaS released its 2023 Environmental, Social, and Governance report. The report outlines NaaS’ progress toward its long-term ESG goals, central to the company’s vision and mission. It details strategic initiatives to weave sustainability into various sectors, aligned with its vision to “Empower the World with Green Energy.” The report highlights the Company’s innovative business model driving energy transitions, efforts toward green and low-carbon development, and strategies to sustainably rejuvenate rural areas.

3. Joining the China ESG Alliance as the First Member in EV Charging Service Sector

In October 2024, NaaS announced that it joined the China ESG Alliance as the first member from China’s electric vehicle charging sector. This strategic move underscores NaaS’ dedication to advancing sustainable practices and enhancing green, low-carbon initiatives across the industry. “Joining the China ESG Alliance is a pivotal step for NaaS as we continue to drive sustainable practices across our entire operation,” stated Ms. Yang Wang, Chief Executive Officer of NaaS.

2024 Third Quarter Financial Results

Revenues

Total revenues reached RMB44.4 million (US$6.3 million) for the third quarter of 2024. During this quarter, charging services revenues reached RMB42.4 million (US$6.0 million) with a growth rate of 36% year over year. Meanwhile, our strategy to move away from low margin energy solution projects resulted in a reduction of energy solutions revenues by 99% year over year to RMB0.6 million (US$0.1 million). Overall, the reduction of revenues from low margin energy solution projects contributed to the 55% reduction in total revenues year over year despite the robust growth in both our charging services revenues and new initiatives revenues.

The 36% growth in charging services revenues year over year was mainly attributable to steady growth in GTR[3] and NTR for NaaS’ charging services, as its market presence and network strengths began to deliver tangible benefits. Charging volume and number of orders transacted through NaaS’ network reached 1,284 GWh and 52.8 million, respectively, in the third quarter of 2024, while the proportion of orders with positive NTR increased to 73%. These factors contributed to an increase in revenue generated from its charging services. NaaS offers platform-based incentives to end-users to boost the use of its network. Charging services revenues are recorded net of end-user incentives. Costs associated with end-user incentives and recorded as reductions to total revenues totaled RMB109.2 million (US$15.6 million) and RMB82.9 million for the third quarter of 2024 and 2023, respectively.

The decrease in energy solutions revenues by 99% year over year was primarily attributable to our strategy to shift away from low margin and infrequent energy solutions projects.

New initiatives revenues were RMB1.5 million (US$0.2 million) for the third quarter of 2024, representing an increase of 71% year over year. This growth was primarily driven by the Company’s efforts to derive new sources of income from promotion services over its charging services network.

Cost of revenues, gross profit and gross margin

Total cost of revenues decreased 73% year over year to RMB19.3 million (US$2.8 million) for the third quarter of 2024. We have reduced costs by a greater margin to revenue growth as less resources were deployed for energy solution projects with lower margins.

The robust performance of our charging services business drove a record-high gross margin of 57%. Our gross profit for the third quarter of 2024 was RMB25.2 million (US$3.6 million) as compared to RMB28.6 million in the same period 2023.

Operating expenses

Total operating expenses decreased by 70% year over year to RMB83.3 million (US$11.9 million) for the third quarter of 2024. Total non-IFRS operating expenses[4] decreased by 67% year over year to RMB68.4 million (US$9.7 million) for the third quarter of 2024. Operating expenses as a percentage of revenues decreased year over year to 187% for the third quarter of 2024 from 279% for the third quarter of 2023, while non-IFRS operating expenses as a percentage of revenues decreased year over year to 154% for the third quarter of 2024 from 211% for the third quarter of 2023, mainly due to the optimization in operations.

Selling and marketing expenses decreased by 81% year over year to RMB29.7 million (US$4.2 million) for the third quarter of 2024. The decrease was mainly attributable to reduction in incentives to end-users as ongoing enhancements in our service enable us to lessen the reliance on user subsidies to induce usage. Costs associated with excess incentives to end-users recorded as selling and marketing expenses were RMB16.0 million (US$2.3 million) for the third quarter of 2024, compared with RMB78.0 million in the same period of 2023. The significant reduction in these costs was attributable to the realization of network benefits and continuous enhancement in our service which enabled the Company to manage platform-based incentives as a percentage of the commission fees it generated through its charging services more effectively.

Administrative expenses decreased by 52% year over year to RMB48.7 million (US$6.9 million) for the third quarter of 2024. The decrease was primarily due to the optimization of the Company’s organizational and operational structure.

Research and development expenses decreased by 72% year over year to RMB4.9 million (US$0.7 million) for the third quarter of 2024 as the Company refines the balance of resources dedicated to technical developments.

Finance costs

Finance costs were RMB5.5 million (US$0.8 million) for the third quarter of 2024.

Income tax

Income tax benefits were RMB59.5 million (US$8.5 million) for the third quarter of 2024, compared with income tax expenses of RMB2.3 million for the same period of 2023 as we materialize tax benefits from certain operating entity that turned profitable.

Net loss and non-IFRS net profit attributable to ordinary shareholders; net margin and non-IFRS net margin

Net loss attributable to ordinary shareholders was RMB7.7 million (US$1.1 million) for the third quarter of 2024, compared with a net loss attributable to ordinary shareholders of RMB366.9 million for the same period in 2023. Non-IFRS net profit[5] attributable to ordinary shareholders was RMB21.2 million (US$3.0 million) for the third quarter of 2024, compared with non-IFRS net loss attributable to ordinary shareholders of RMB175.7 million for the same period in 2023. Net margin for the third quarter of 2024 was negative 17%, compared with negative 371% for the same period of 2023. Non-IFRS net margin for the third quarter of 2024 was 48%, compared with negative 178% for the same period of 2023. Please refer to the section titled “Unaudited reconciliations of IFRS and non-IFRS measures” for details.

|

[1] Non-IFRS net profit was arrived at after excluding share-based compensation expenses, fair value changes of convertible instruments, and fair value changes of financial assets at fair value through profit or loss from net profit. Please refer to the section titled “Non-IFRS Financial Measures” for details. |

|

[2] NTR means Net Take Rate and measures NaaS’ return from transactions arising from its mobility connectivity services after adjusting for incentives which are paid to end-users through NaaS’ partnered platform in the form of discounts and promotions to boost the use of its network. NTR is calculated by taking NaaS’ gross receipts from transactions, deducting transaction outgoings and incentives, and adding income from membership programs. The result is then expressed as a percentage of the total transaction value. |

|

[3] GTR means Gross Take Rate and is calculated as the percentage of NaaS’ commission income derived from the gross transaction value at charging stations, indicating the Company’s share of charging stations’ gross income. |

|

[4] Non-IFRS operating expenses were arrived at after excluding share-based compensation expenses from operating expenses. Please refer to the section titled “Non-IFRS Financial Measures” for details. |

|

[5] Non-IFRS net profit was arrived at after excluding share-based compensation expenses, fair value changes of convertible instruments, and fair value changes of financial assets at fair value through profit or loss from net profit. Non-IFRS net margin was calculated by dividing non-IFRS net profit by total revenue. Please refer to the section titled “Non-IFRS Financial Measures” for details. |

Conference Call Information

The Company’s management will host an earnings conference call at 8:00 AM U.S. Eastern time on November 20, 2024 (9:00 PM Beijing/Hong Kong time on November 20, 2024).

For participants who wish to join the conference using dial-in numbers, please complete online registration using the link provided below prior to the scheduled call start time.

Participant Online Registration:

https://dpregister.com/sreg/10194471/fdf6d1042c

Upon registration, each participant will receive details for the conference call, including dial-in numbers, passcode and a unique access PIN. To join the conference, please dial the provided number, enter the passcode followed by your PIN, and you will join the conference.

Additionally, a live and archived webcast of the conference call will be available on the Company’s investor relations website at http://ir.enaas.com.

A replay of the conference call will be accessible approximately one hour after the conclusion of the live call until November 27, 2024, by dialing the following telephone numbers:

|

US Toll Free: |

+1-877-344-7529 |

|

International: |

+1-412-317-0088 |

|

Replay Passcode: |

6398178 |

Exchange Rate

This press release contains translations of certain RMB amounts into USD at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from RMB to USD were made at the rate of RMB7.0176 to US$1.00, the noon buying rate in effect on September 30, 2024, in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the RMB or USD amounts referred could be converted into USD or RMB, as the case may be, at any particular rate or at all. For analytical presentation, all percentages are calculated using the numbers presented in the financial statements contained in this earnings release.

Non-IFRS Financial Measures

The Company uses non-IFRS measures such as non-IFRS net profit, non-IFRS net margin and non-IFRS operating expenses in evaluating its operating results and for financial and operational decision-making purposes. The Company believes that non-IFRS financial measures help identify underlying trends in the Company’s business that could otherwise be distorted by the effect of certain expenses that the Company includes in its results for the period and effects certain instruments convertible to the Company’s equity. The Company believes that non-IFRS financial measures provide useful information about its results of operations, enhances the overall understanding of its past performance and future prospects and allow for greater visibility with respect to key metrics used by its management in its financial and operational decision-making.

Non-IFRS financial measures have limitations as analytical tools and should not be considered in isolation or construed as an alternative to IFRS financial measures or any other measure of performance or as an indicator of its operating performance. Investors are encouraged to review non-IFRS financial measures and the reconciliation to their most directly comparable IFRS measures. Non-IFRS financial measures presented here may not be comparable to similarly titled measures presented by other companies. Other companies may calculate similarly titled measures differently, limiting their usefulness as comparative measures to the Company’s data. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure.

For more information on the IFRS and non-IFRS financial measures, please see the section titled “Unaudited reconciliations of IFRS and non-IFRS financial measures.”

About NaaS Technology Inc.

NaaS Technology Inc. is the first U.S. listed EV charging service company in China. The Company is a subsidiary of Newlinks Technology Limited, a leading energy digitalization group in China. The Company provides one-stop solutions to energy asset owners comprising charging services, energy solutions and new initiatives, supporting every stage of energy assets’ lifecycle and facilitating energy transition.

Safe Harbor Statement

This press release contains statements of a forward-looking nature. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. You can identify these forward-looking statements by terminology such as “will,” “expects,” “believes,” “anticipates,” “intends,” “estimates” and similar statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on current expectations, assumptions, estimates and projections about the Company and the industry. All information provided in this press release is as of the date hereof, and the Company undertakes no obligation to update any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that its expectations will turn out to be correct, and investors are cautioned that actual results may differ materially from the anticipated results. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: NaaS’ goals and strategies; its future business development, financial conditions and results of operations; its ability to continuously develop new technology, services and products and keep up with changes in the industries in which it operates; growth of China’s EV charging industry and EV charging service industry and NaaS’ future business development; demand for and market acceptance of NaaS’ products and services; NaaS’ ability to protect and enforce its intellectual property rights; NaaS’ ability to attract and retain qualified executives and personnel; the COVID-19 pandemic and the effects of government and other measures that have been or will be taken in connection therewith; U.S.-China trade war and its effect on NaaS’ operation, fluctuations of the RMB exchange rate, and NaaS’ ability to obtain adequate financing for its planned capital expenditure requirements; NaaS’ relationships with end-users, customers, suppliers and other business partners; competition in the industry; relevant government policies and regulations related to the industry; and fluctuations in general economic and business conditions in China and globally. Further information regarding these and other risks is included in NaaS’ filings with the SEC.

For investor and media inquiries, please contact:

Investor Relations

NaaS Technology Inc.

E-mail: ir@enaas.com

Media inquiries:

E-mail: pr@enaas.com

|

NAAS TECHNOLOGY INC. |

||||||||||||||||||||||||

|

UNAUDITED CONSOLIDATED STATEMENTS OF LOSS AND OTHER COMPREHENSIVE LOSS |

||||||||||||||||||||||||

|

For the Three Months Ended |

For the Nine Months Ended |

|||||||||||||||||||||||

|

September 30, |

September 30, |

September 30, |

September 30, |

|||||||||||||||||||||

|

(In thousands, except for share and per share |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

||||||||||||||||||

|

Continuing operations |

||||||||||||||||||||||||

|

Revenues |

||||||||||||||||||||||||

|

Charging services revenues |

31,258 |

42,369 |

6,038 |

81,648 |

135,106 |

19,253 |

||||||||||||||||||

|

Energy solutions revenues |

66,787 |

556 |

79 |

87,754 |

15,100 |

2,152 |

||||||||||||||||||

|

New initiatives revenues |

890 |

1,523 |

217 |

2,972 |

5,526 |

787 |

||||||||||||||||||

|

Total revenues |

98,935 |

44,448 |

6,334 |

172,374 |

155,732 |

22,192 |

||||||||||||||||||

|

Cost of revenues |

(70,383) |

(19,298) |

(2,750) |

(120,778) |

(94,927) |

(13,527) |

||||||||||||||||||

|

Gross profit |

28,552 |

25,150 |

3,584 |

51,596 |

60,805 |

8,665 |

||||||||||||||||||

|

Operating expenses |

||||||||||||||||||||||||

|

Selling and marketing expenses |

(157,909) |

(29,697) |

(4,232) |

(309,630) |

(149,359) |

(21,283) |

||||||||||||||||||

|

Administrative expenses |

(100,800) |

(48,674) |

(6,936) |

(407,482) |

(222,602) |

(31,721) |

||||||||||||||||||

|

Research and development expenses |

(17,314) |

(4,920) |

(701) |

(36,327) |

(37,697) |

(5,372) |

||||||||||||||||||

|

Total operating expenses |

(276,023) |

(83,291) |

(11,869) |

(753,439) |

(409,658) |

(58,376) |

||||||||||||||||||

|

Other gains, net |

4,484 |

7,964 |

1,135 |

11,445 |

22,246 |

3,170 |

||||||||||||||||||

|

Operating loss |

(242,987) |

(50,177) |

(7,150) |

(690,398) |

(326,607) |

(46,541) |

||||||||||||||||||

|

Fair value changes of convertible instruments |

(120,400) |

(19,851) |

(2,829) |

(120,400) |

(27,648) |

(3,940) |

||||||||||||||||||

|

Fair value changes of financial instruments at |

(585) |

6,464 |

921 |

14,546 |

(59,127) |

(8,426) |

||||||||||||||||||

|

Finance costs |

(8,262) |

(5,466) |

(779) |

(22,529) |

(28,614) |

(4,077) |

||||||||||||||||||

|

Loss before income tax |

(372,234) |

(69,030) |

(9,837) |

(818,781) |

(441,996) |

(62,984) |

||||||||||||||||||

|

Income tax |

(2,267) |

59,513 |

8,481 |

(511) |

66,708 |

9,506 |

||||||||||||||||||

|

Loss from continuing operations |

(374,501) |

(9,517) |

(1,356) |

(819,292) |

(375,288) |

(53,478) |

||||||||||||||||||

|

Profit from discontinued operations |

9,308 |

1,205 |

172 |

10,070 |

3,801 |

542 |

||||||||||||||||||

|

Net loss |

(365,193) |

(8,312) |

(1,184) |

(809,222) |

(371,487) |

(52,936) |

||||||||||||||||||

|

Net loss attributable to: |

||||||||||||||||||||||||

|

Equity holders of the Company |

(366,863) |

(7,684) |

(1,095) |

(811,183) |

(370,553) |

(52,803) |

||||||||||||||||||

|

Non-controlling interests |

1,670 |

(628) |

(89) |

1,961 |

(934) |

(133) |

||||||||||||||||||

|

(365,193) |

(8,312) |

(1,184) |

(809,222) |

(371,487) |

(52,936) |

|||||||||||||||||||

|

NAAS TECHNOLOGY INC. |

|||||||||||||||||||||||||

|

UNAUDITED CONSOLIDATED STATEMENTS OF LOSS AND OTHER COMPREHENSIVE LOSS |

|||||||||||||||||||||||||

|

For the Three Months Ended |

For the Nine Months Ended |

||||||||||||||||||||||||

|

September 30, |

September 30, |

September 30, |

September 30, |

||||||||||||||||||||||

|

(In thousands, except for share |

RMB |

RMB |

US$ |

RMB |

RMB |

US$ |

|||||||||||||||||||

|

Basic and diluted loss per share |

|||||||||||||||||||||||||

|

Basic |

(0.166) |

(0.004) |

(0.001) |

(0.369) |

(0.144) |

(0.021) |

|||||||||||||||||||

|

Diluted |

(0.166) |

(0.004) |

(0.001) |

(0.369) |

(0.144) |

(0.021) |

|||||||||||||||||||

|

Basic and diluted loss per ADS |

|||||||||||||||||||||||||

|

Basic |

(33.295) |

(0.705) |

(0.100) |

(73.850) |

(28.828) |

(4.108) |

|||||||||||||||||||

|

Diluted |

(33.295) |

(0.705) |

(0.100) |

(73.850) |

(28.828) |

(4.108) |

|||||||||||||||||||

|

Basic and diluted loss per share |

|||||||||||||||||||||||||

|

Basic |

(0.163) |

(0.003) |

(0.000) |

(0.366) |

(0.142) |

(0.020) |

|||||||||||||||||||

|

Diluted |

(0.163) |

(0.003) |

(0.000) |

(0.366) |

(0.142) |

(0.020) |

|||||||||||||||||||

|

Basic and diluted loss per ADS |

|||||||||||||||||||||||||

|

Basic |

(32.616) |

(0.571) |

(0.081) |

(73.119) |

(28.446) |

(4.054) |

|||||||||||||||||||

|

Diluted |

(32.616) |

(0.571) |

(0.081) |

(73.119) |

(28.446) |

(4.054) |

|||||||||||||||||||

|

Weighted average number of |

2,249,586,003 |

2,693,665,713 |

2,693,665,713 |

2,218,815,732 |

2,605,322,746 |

2,605,322,746 |

|||||||||||||||||||

|

Weighted average number of |

2,249,586,003 |

2,693,665,713 |

2,693,665,713 |

2,218,815,732 |

2,605,322,746 |

2,605,322,746 |

|||||||||||||||||||

|

Net loss |

(365,193) |

(8,312) |

(1,184) |

(809,222) |

(371,487) |

(52,936) |

|||||||||||||||||||

|

Other comprehensive |

|||||||||||||||||||||||||

|

Fair value changes on equity |

(4,363) |

20,433 |

2,912 |

(25,979) |

(23,657) |

(3,371) |

|||||||||||||||||||

|