1 No-Brainer Electric Vehicle (EV) Stock to Buy Right Now (Hint: It's Not Tesla)

Tesla has proven to be one of the best investments of the past 10 years. Over that time period, sales by the ground-breaking electric vehicle (EV) maker have soared nearly 2,900% even as its stock price has vaulted by nearly 1,400% — substantially enriching its early investors.

But the electric vehicle industry remains in its infancy, and so it pays to seek out current opportunities. For those looking to invest in the next Tesla, there’s one up-and-coming electric car stock you need to be aware of now: Rivian Automotive (NASDAQ: RIVN). Here’s why.

More risk can create more reward

You’re likely well aware of the trade-off between risk and reward. But in practice, this trade-off is harder to determine. After all, there’s nothing guaranteeing you a higher potential payoff for taking on extra risk. It’s important, then, to stack the odds in your favor. That’s exactly what investors are getting with Rivian Automotive stock right now.

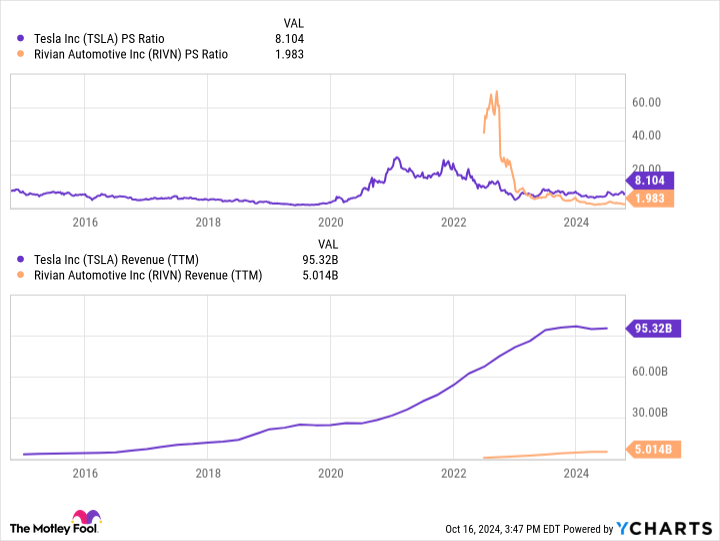

Let’s rewind time and look at what Tesla was up to nearly a decade ago, when its sales base was only around $5 billion. At that time, the company only had two high-end luxury models for sale: the Roadster and the Model S. Its first crossover, the Model X — also a luxury vehicle priced above $100,000 — would debut soon, but the market was growing increasingly wary that Tesla would ever be able to crack the mass market in any major way.

In 2014, Tesla shares were priced around 10 times sales. In 2016, that valuation slipped to 8 times sales. And by 2020, Tesla shares were priced below 2 times sales. CEO Elon Musk would later reveal that the company was “about a month” away from bankruptcy.

Would you have invested in Tesla right then? Without knowing the future, most investors would have stayed far away. Yet this was one of the best times in Tesla’s history to jump in. As sales from its mass market vehicles — the Model Y and Model 3 — began to gain traction, Tesla’s revenue more than tripled from 2020 through 2024, from $30 billion to more than $90 billion. Shares have soared more than 1,000% in value over the past five years due to the success of these two vehicles.

Right now, Rivian is about to follow the same trajectory. Earlier this year, it announced three new mass market models: the R2, R3, and R3X. Similar to what Tesla used to offer, Rivian only currently has a couple of high-end luxury vehicles for sale, the R1S and R1T, both of which cost around $100,000. The R2, R3, and R3X, meanwhile, are expected to be priced under $50,000 — similar to the Model Y and Model 3.

If these new models have the success that Tesla’s mass market vehicles had, expect Rivian’s sales base to soar. There’s just one problem: These vehicles aren’t expected to be delivered until 2026 at the earliest. Some versions may not hit the road until 2027 or 2028.

Suffice to say, the market remains skeptical, just as it was before Tesla’s major sales increase. Rivian stock is now priced under 2 times sales — a 75% valuation discount to Tesla — despite trading at a premium early on in its trading history. A lot can happen over the next few years, and Rivian will require billions in new capital to get to where it wants to be.

But if you’re willing to take on this extra risk and remain patient, there could be a sizable payday a few years down the road.

Use this strategy to profit with Rivian stock

Because there won’t be many hard catalysts for Rivian until its mass market vehicles hit the roads, expect the share price to be very volatile, reacting to small shifts in investor sentiment, and of course broader overall market swings.

For this reason, the best strategy for investing in Rivian stock is likely to employ dollar-cost averaging. Instead of putting $1,000 to work right away, for instance, you may want to split that sum into 10 $100 monthly investments. That way, your portfolio takes advantage of any temporary downswings in the share price.

But even if you employ dollar-cost averaging, the biggest skill you need to make money with Rivian stock will be patience. The market isn’t willing to value the company higher until it sees results. But that hesitancy is what’s creating today’s buying opportunity. You’ll just need to remain patient, willing to ride out or even take advantage of volatility in the stock price.

Should you invest $1,000 in Rivian Automotive right now?

Before you buy stock in Rivian Automotive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Rivian Automotive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.

1 No-Brainer Electric Vehicle (EV) Stock to Buy Right Now (Hint: It’s Not Tesla) was originally published by The Motley Fool

NIO, ASML, And CVS Health Are Among Top 10 Large Cap Losers Last Week (Oct 14-18): Are The Others In Your Portfolio?

These ten large-cap stocks were the worst performers in the last week. Are they in your portfolio?

- NIO Inc. NIO stock lost 16.35% last week as U.S.-listed Chinese stocks fell after China’s September exports missed estimates. China stimulus uncertainty has also weighed on stocks recently.

- KLA Corporation KLAC stock dipped 15.58%, probably due to continued weakness following weak guidance from ASML.

- Centene Corporation CNC shares were down 14.38%. The company will report third-quarter results on October 25.

- Elevance Health shares dipped 14.17% after analysts cut forecasts following third-quarter earnings.

- ASML Holding N.V. ASML shares tumbled 13.97% after the company accidentally released earnings a day ahead of schedule and cut its 2025 sales forecast.

- Temu parent PDD Holdings Inc. PDD stock fell 13.91%, as did U.S.-listed Chinese stocks after China’s September exports missed estimates. China stimulus uncertainty has also weighed on stocks recently.

- Molina Healthcare Inc. MOH shares were down 12.24%, probably in sympathy with Elevance Health, Inc. ELV, which reported third-quarter earnings miss and issued soft FY24 guidance.

- Lam Research Corporation LRCX stock dived 12.12%, probably in sympathy with Taiwan Semiconductor Manufacturing Company Ltd. TSM, which reported better-than-expected earnings and issued strong guidance.

- Erie Indemnity Company ERIE fell 9.92% last week after Spruce Point Management issued a short-sell report on the stock. The company was under pressure due to Category 5 Hurricane Milton.

- CVS Health Corporation CVS stock fell 9.44% last week after the company cut its Q3 outlook.

Also Read:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Tesla Investor Ross Gerber Calls It 'Game Over' As Google's Waymo Expands Robotaxi Presence In West LA

Ross Gerber, CEO of Gerber Kawasaki Wealth and a prominent investor in Tesla Inc. TSLA, recently shared his thoughts on X regarding the competitive landscape in autonomous driving, specifically highlighting Alphabet Inc. GOOGL GOOG subsidiary Google’s Waymo.

What Happened: He stated, “Google has the money and resources to scale globally. Costs will come down and their system will have several revenue sources. Like ads.”

Gerber’s remarks come in light of Waymo’s recent expansion into Los Angeles, where they have increased their robotaxi service area significantly.

He noted, “A Waymo came up to us yesterday… they are everywhere in West LA. Wasn’t sure why it was there. Then a girl came out. Professed her love for Waymo and took off. Robotaxi has been solved by Google. It works. Game over.” This anecdote underscores the growing presence and acceptance of Waymo’s autonomous vehicles in urban settings.

Why It Matters: This critique comes amid a broader conversation about the competitive landscape of autonomous driving. Recently, Waymo’s co-founder expressed optimism about Tesla’s self-driving vision, citing its extensive data collection as a key advantage. In contrast, Gerber’s comments highlight potential vulnerabilities in Tesla’s technology.

Meanwhile, Uber’s CEO Dara Khosrowshahi has discussed the competitive robotaxi market, noting Uber’s strategic positioning through partnerships with companies like Waymo. This dynamic market is further complicated by Uber’s shift from developing autonomous vehicles to leveraging its ridesharing network, creating a strong competitive edge.

Gerber’s recent critique of Google’s business model, adds another layer to the discussion, as he warns of threats from AI search competitors like ChatGPT and Perplexity AI. This highlights the rapidly evolving landscape of technology and its impact on established giants.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Shiba Inu Ready For A Lift-Off To The Moon? Popular Analyst Predicts 50% Surge For Memecoin As Burn Rate Spikes 389%

A well-known cryptocurrency analyst issued a bullish prediction for Shiba Inu SHIB/USD, coinciding with a significant jump in the token’s burn rate over the last 24 hours.

What Happened: On Sunday, widely followed X personality Kevin observed a “rounding bottom formation with an inverse head-and-shoulders” pattern for the popular dog-themed meme coin, prompting a massive 50% price increase projection.

For those unaware, inverse head-and-shoulders is a key chart pattern that signals a potential shift from a bearish to a bullish trend.

Additionally, Shiba Inu’s Moving Average Convergence Divergence (MACD) indicator flashed a buy signal, according to data from charting platform TradingView.

The MACD is primarily used to gauge an asset’s overall trend. When the MACD line crosses above the signal line, it is interpreted as bullish.

In another development, the coin’s burn rate spiked 389% in the last 24 hours, with nearly 6.3 million SHIBs going up in smoke and exerting more deflationary pressure on the cryptocurrency.

Why It Matters: The second-largest meme coin by market valuation has been on a roll over the month, gaining over 32%.

An unknown whale recently withdrew 105.9 billion SHIB, valued at $1.99 million, from cryptocurrency exchange Coinbase, signaling strong accumulation and anticipation for future price rises.

Kevin’s prediction aligns with the current bullish trend in the cryptocurrency market. Leading cryptocurrencies like Bitcoin BTC/USD and Ethereum ETH/USD have rallied sharply in recent days, boosting expectations for new all-time highs.

Price Action: At the time of writing, SHIB was exchanging hands at $0.00001897, up 1.98% in the last 24 hours, according to data from Benzinga Pro.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should you buy Nvidia stock now? It may be a once-in-a-generation opportunity

Nvidia has been one of the most hyped and closely followed stocks in recent memory as the fortunes of the broader market increasingly hinge on the AI chip leader.

At one point this year, the stock accounted for more than a third of the S&P 500’s gains, and some investors even held watch parties for Nvidia’s earnings release.

Nvidia’s astronomical run to a $3 trillion company has also been somewhat divisive as many on Wall Street have doubted that the stock can sustain further gains while others see the AI boom fueling more upside.

That’s left investors asking, “should I buy Nvidia stock right now, or sell it?”

Analysts at Bank of America have an answer: In a note on Thursday, they reiterated their buy rating on Nvidia stock and raised their price target to $190 from $165, implying it could soar 38% higher from Friday’s closing price.

At $190 a share, Nvidia’s market cap would also explode to $4.7 trillion from $3.4 trillion today.

In fact, BofA is so bullish on Nvidia stock that analysts called it a “generational opportunity,” estimating a total addressable market of more than $400 billion for AI accelerators.

“AI models (demand) continue to evolve, with the cadence of new LLM model launches now increased to 3-5 times/yr per developer (OpenAI, Google, Meta, etc.), and each new major generation requiring 10-20x compute requirement to train,” analysts said.

Their confidence in Nvidia has been boosted by others in the chip sector like Taiwan Semiconductor and ASML, which both recently signaled strong AI demand. BofA’s meetings with executives at Broadcom and Micron as well as comments from AMD have yielded similar indications.

Meanwhile, Nvidia CEO Jensen Huang also touted huge demand for the company’s next-generation AI chip.

“Blackwell is in full production, Blackwell is as planned, and the demand for Blackwell is insane,” he told CNBC earlier this month. “Everybody wants to have the most, and everybody wants to be first.”

Adding to BofA’s bullish case for Nvidia is its underappreciated enterprise partnerships with the likes of Accenture, ServiceNow, Microsoft, and others as well as its software products that help reinforce Nvidia’s dominance in hardware. They combine to create a deeper overall Nvidia ecosystem for AI.

Plus, Nvidia could generate more than $200 billion in free cash flow over the next two years, rivaling even Apple, BofA estimated.

Earnings reports later this month from tech giants that are developing AI technologies, such as Microsoft, Google, and Amazon, should provide more insight into demand. And Nvidia is due to report Nov. 20.

While some on Wall Street have expressed skepticism on whether massive investments in AI are translating to the bottom line, the tech sector is locked in a cutthroat race to be first on the scene with the latest advances in AI.

“We continue to see the pace of new model development increase,” BofA said. “LLMs in particular are being developed for both larger size and better reasoning capabilities, which both require greater training intensity.”

This story was originally featured on Fortune.com

Bitcoin, Ethereum, Dogecoin On The Rise As 'Uptober' May Be Finally Here: Analysts Predict Bullish Breakout For King Crypto, ETH's Rally To $3,300

Leading cryptocurrencies maintained bullish momentum over the weekend, boosting expectations for new all-time highs.

| Cryptocurrency | Gains +/- | Price (Recorded at 8:45 p.m. EDT) |

| Bitcoin BTC/USD | +1.26% | $69,123.24 |

| Ethereum ETH/USD |

+3.79% | $2,744.10 |

| Dogecoin DOGE/USD | +0.96% | $0.1444 |

What Happened: Bitcoin jumped above $69,000 late evening, a level not seen since the first week of June. The world’s largest cryptocurrency was up 8.9% in October, a month that has historically seen gains of over 21% on average.

Ethereum spiked to $2,750, the highest it has been since the August meltdown. The second-largest cryptocurrency soared nearly 12% last week.

In the past 24 hours, 56,654 traders were liquidated, with the total liquidations coming in at $134.09 million. More than $805 million in Bitcoin shorts would be wiped out if the leading cryptocurrency hits $72,000, according to Coinglass.

Bitcoin’s Open Interest rose 2.87% in the last 24 hours, while money locked in Ethereum’s futures market soared 8.84%, indicating bullish momentum.

Market sentiment was one of “Greed” as of this writing, according to the Cryptocurrency Fear & Greed Index.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 8:45 p.m. EDT) |

| Apecoin (APE) | +62.30% | $1.42 |

| dYdX (DYDX) | +27.87% | $1.26 |

| Mog Coin (MOG) | +11.94% | $0.00000228 |

The global cryptocurrency stood at $2.39 trillion, following a jump of 2.20% in the last 24 hours.

Stock futures edged higher Sunday overnight. The Dow Jones Industrial Average Futures was up 53 points, or 0.13%, as of 8:45 p.m. EDT. Futures tied to the S&P 500 gained 0.12%, while Nasdaq 100 Futures added 0.14%.

The rise followed a lucrative week for blue-chip indexes, with the Dow Jones Industrial Average and the S&P 500 closing at record highs Friday. to close at a new record high of 43,239.05. The Dow was up 2.23% since October began, while the broad-based index lifted 1.77% in the same period.

Tech titans like Tesla Inc. TSLA and Amazon.com Inc. AMZN are all set to report their earnings this week, serving as important market triggers.

See More: Best Cryptocurrency Scanners

Analyst Notes: Noted cryptocurrency researcher and trader Rekt Capital stated that Bitcoin would break out from the multi-month downtrend channel toward at least $70,000 if it records a weekly close above the red resistance.

With King Crypto managing to do just that, it remains to be seen whether the analyst’s prediction is correct.

Widely followed cryptocurrency analyst Ali Martinez drew attention to the bullish pivot of the MVRV Momentum indicator, considered a “go-to” metric to evaluate Bitcoin’s trend.

Regarding Ethereum, the analyst highlighted the possibility of the coin rising to $3,300 provided the $2,660 holds.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

World’s $100 Trillion Fiscal Timebomb Keeps Ticking

(Bloomberg) — Even before global finance chiefs fly into Washington over the next few days, they’ve been urged in advance by the International Monetary Fund to tighten their belts.

Most Read from Bloomberg

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen

Two weeks ahead of a potentially era-defining US election, and with the world’s recent inflation crisis barely behind it, ministers and central bankers gathering in the nation’s capital face intensifying calls to get their fiscal houses in order while they still can.

The fund, whose annual meetings begin there on Monday, has already pointed to some of the themes it hopes to press home with a barrage of projections and studies on the global economy in coming days.

The IMF’s Fiscal Monitor on Wednesday will feature a warning that public debt levels are set to reach $100 trillion this year, driven by China and the US. Managing Director Kristalina Georgieva, in a speech on Thursday, stressed how that mountain of borrowing is weighing on the world.

“Our forecasts point to an unforgiving combination of low growth and high debt — a difficult future,” she said. “Governments must work to reduce debt and rebuild buffers for the next shock — which will surely come, and maybe sooner than we expect.”

Some finance ministers may get further reminders even before the week is over.

UK Chancellor of the Exchequer Rachel Reeves has already faced an IMF warning of the risk of a market backlash if debt doesn’t stabilize. Tuesday marks the last release of public finance data before her Oct. 30 budget.

The UK tax office is taking a tougher approach to clawing back debts, insolvency specialists say, a bid to squeeze £5 billion ($6.5 billion) in extra revenue.

What Bloomberg Economics Says:

“For all the talk of black holes, the overall effect of Reeves budget will be a policy that’s looser, not tighter, relative to the previous government’s plans.”

—Ana Andrade and Dan Hanson, economists. For full analysis, click here

Meanwhile, Moody’s Ratings has slated Friday for a possible report on France, which faces intense investor scrutiny at present. With its assessment one step higher than major competitors, markets will watch for any cut in the outlook.

As for the biggest borrowers of all, the glimpse of the IMF’s report already published contains a grim admonishment: your public finances are everyone’s problem.

“Elevated debt levels and uncertainty surrounding fiscal policy in systemically important countries, such as China and the United States, can generate significant spillovers in the form of higher borrowing costs and debt-related risks in other economies,” the fund said.

Elsewhere in the coming week, a rate cut in Canada and a hike in Russia are among the possible central bank moves anticipated by economists.

Click here for what happened in the past week, and below is our wrap of what’s coming up in the global economy.

US and Canada

Economists see a pair of home sales reports showing that declining mortgage rates are merely helping to stabilize the US residential real estate market. On Wednesday, the National Association of Realtors will issue data on contract closings for previously owned homes, followed a day later by government figures on sales of new homes.

Economists project modest increases in September sales of both existing and new homes. Resales remain hamstrung by limited inventory that’s keeping asking prices elevated and hurting affordability. While purchases of previously owned properties remain near the weakest pace since 2010, builders have capitalized: New-home sales have gradually picked up over the past two years with the help of incentives.

Other US data in the coming week include September durable goods orders, plus capital goods shipments that will help economists fine-tune their estimates of third-quarter economic growth. The Federal Reserve also issues its Beige Book, an anecdotal readout of the economy.

Regional Fed officials speaking in the coming week include Jeffrey Schmid, Mary Daly and Lorie Logan.

Meanwhile, the Bank of Canada is increasingly expected to cut rates by 50 basis points after inflation cooled to 1.6% in September and some measures of the labor market remain weak.

Europe, Middle East, Africa

As with other regions, attention will largely be focused on Washington; more than a dozen appearances of European Central Bank’s Governing Council members are scheduled stateside.

That includes President Christine Lagarde, who’ll be interviewed by Bloomberg Television’s Francine Lacqua in Washington on Tuesday.

Similarly, Bank of England Governor Andrew Bailey will speak in New York on Tuesday, while Swiss National Bank President Martin Schlegel is scheduled to appear on Friday.

Among euro-area economic reports, consumer confidence on Wednesday, purchasing manager indexes the following day, and the ECB’s inflation expectations survey on Friday may be the highlights. Similarly, Germany’s Ifo Institute will release its closely watched business confidence gauge at the end of the week.

Aside from the possible rating assessment on France, S&P may also release reports on Belgium and Finland on Friday.

Turning east, two central bank decisions are likely to draw attention, starting on Tuesday with Hungary, which may keep borrowing costs unchanged.

The Bank of Russia has signaled that continued inflationary pressures could lead to another rate hike on Friday. They lifted it 100 basis points to 19% in September, and a similar move would return the rate to the 20% level imposed in an emergency increase after President Vladimir Putin began the February 2022 full-scale invasion of Ukraine.

Finally, data on Wednesday from South Africa is expected to show inflation slowed to 3.8% in September, boosting the chances of another rate cut next month. The central bank said it now forecasts consumer-price growth to stay in the bottom half of its 3% to 6% target band over the next three quarters.

Asia

Lenders in China, with a nudge from the People’s Bank of China, are expected to join the campaign to revive business activity by trimming their loan prime rates on Monday. The 1-year and 5-year rates are seen sliding by 20 basis points to 3.15% and 3.65%, respectively.

At the end of the week, data will show if the nation’s industrial profits bounced back in September after slumping more than 17% in August. The most recent numbers showed the economy expanding at the lowest pace in six quarters during that three-month period.

Elsewhere, the region gets a cluster of PMIs on Thursday, including from Japan, Australia and India.

Singapore is forecast to report Wednesday that consumer inflation slowed in September, with price growth updates for that month also due from Hong Kong and Malaysia.

On Friday, Japan will report Tokyo CPI for October, a key indicator that will capture corporate price changes at the start of the fiscal second half.

South Korea will release third-quarter growth figures on Wednesday that may show the economy’s momentum has slowed marginally.

During the week, South Korea releases early trade statistics for October, with Taiwan and New Zealand releasing trade numbers for September.

Among the region’s central banks, many leading officials will attend the IMF meetings in Washington. Reserve Bank of Australia Deputy Governor Andrew Hauser holds a fireside chat on Monday, and three days later the bank publishes its annual report.

Reserve Bank of New Zealand chief Adrian Orr speaks on policy on the sidelines of the IMF confab, and Uzbekistan’s central bank will decide Thursday whether to pause for a second meeting following its July rate cut.

Latin America

Brazil watchers will be keen to see the weekly forecasts in the central bank’s so-called Focus survey due on Monday.

Expectations for inflation, borrowing costs and debt metrics have lately taken a decidedly gloomy turn given doubts about the government’s fiscal discipline.

In Mexico, GDP proxy data should be consistent with the loss of momentum that has many economists marking down their third-quarter growth forecasts. The economy is expected to slow for a third year in 2024.

GDP proxy data for Argentina will probably show South America’s second-biggest economy sputtering and still in the grip of a recession that’s likely to extend into 2025.

Paraguay’s central bank holds its rate setting meeting; policymakers have kept borrowing costs at 6% for the past six months with inflation running slightly above the 4% target.

On the prices front, neither investors nor policymakers will be cheered by mid-month inflation reports from Brazil and Mexico given the early consensus for higher headline readings.

The data here will likely do nothing to dent the prospects of Brazil’s central bank tightening policy again on Nov. 6, while at the same time giving Banxico pause about a third straight cut at its Nov. 14 gathering.

–With assistance from Laura Dhillon Kane, Brian Fowler, Robert Jameson, Monique Vanek, Vince Golle, Brendan Scott and William Horobin.

(Updates with UK tax office in eighth paragraph)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Nvidia stock is in beast mode again!

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

I have never been one to have a cluttered desk at work.

To me, everything has a place. Awesome desk organization, awesome outcomes, is how my head works.

But I broke this rule slightly by the close of trading on Friday. Going forward, I will have a paper cutout of Nvidia (NVDA) CEO Jensen Huang in his trademark leather jacket thumbtacked to the wallboard (see pic below). And I’ll tell you why.

For one full day this week I forgot to check Nvidia’s stock price my usual 10 times a day — only checking in five times. I let myself (and you all) down because, in the blink of an eye, Nvidia’s stock went from a quick sell-off from the Monday record highs back to those same highs come the end of the week.

I missed it!

The stock is up 13% in October, dusting the 1.4% gain for the S&P 500. AMD’s (AMD) stock is down by 5% this month, similar to Intel (INTC).

So Jensen’s face on my desk is a reminder to check in with Nvidia’s stock price and fundamentals numerous times a day. And to ask everyone I encounter about Nvidia, even people not in the chip space (as I did at one annual CEO dinner this week hosted by ServiceNow’s (NOW) CEO Bill McDermott).

Here’s what I was reminded of by recommitting to an Nvidia obsession: Something insanely bad from a company-specific perspective will be the only thing taking this market darling down for any prolonged period of time. To be honest with you, I don’t see where that insanely bad stuff would sprout from over the next few quarters.

Neither do the array of plugged-in characters I chat up each week.

“I don’t think when you get to Nvidia, there is any hype at all. I have known Jensen for decades, and he is the real deal. What these guys are doing is very real and very powerful,” C3.ai (AI) founder and CEO Tom Siebel told me on Yahoo Finance’s Opening Bid podcast (video above; listen in below).

Hey Sam Altman, you should watch what Siebel thinks about your latest valuation…

Anyhow, Hewlett Packard Enterprise (HPE) CEO Antonio Neri has known Jensen for ages. I didn’t get the sense Nvidia’s products were anything but super hot sellers in a chat with him, yours truly, and Seana Smith on Yahoo Finance’s Catalysts.

“When you think about the large-scale [cloud] providers, what they want is to come to market with the latest technologies. And obviously, Blackwell is a key component of that as they go from air-cooled to the liquid cooling, more power density and more performance, and they are on track to do that,” Neri said about Nvidia.

Speaking of Blackwell — Nvidia’s new ultra-high-powered AI chip — the analyst community feels as if they are readying to jack up their fourth quarter profit forecasts on better-than-expected demand.

“We believe demand is outstripping supply for Nvidia 15:1, and the Street is realizing this AI party is still at 9 pm and being led by the Godfather of AI Jensen and Nvidia. TSMC had monster [earnings] numbers, and Blackwell looks like an Aaron Judge debut coming out of the gates,” Wedbush analyst Dan Ives told me.

The JPMorgan team estimates “several billion dollars” in Blackwell revenue in Nvidia’s fourth quarter. Huge if it happens, underscoring the appetite to build out AI infrastructure.

Believe me, I look at Nvidia very critically, just like all the companies I report on.

But geez, it sure looks as if Nvidia being back in beast mode makes a lot of sense — as does having a cutout of Jensen at my desk.

“Jensen is an innovator, great leader, great operator. You can’t count those guys out of anything,” Siebel added.

Three times each week, I field insight-filled conversations with the biggest names in business and markets on Opening Bid. Find more episodes on our video hub. Watch on your preferred streaming service. Or listen and subscribe on Apple Podcasts, Spotify, or wherever you find your favorite podcasts.

Brian Sozzi is Yahoo Finance’s Executive Editor. Follow Sozzi on X @BrianSozzi and on LinkedIn. Tips on deals, mergers, activist situations, or anything else? Email brian.sozzi@yahoofinance.com.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance