2 High-Yield Dividend Stocks to Buy Now and Help You Generate Passive Income

Companies with high dividend yields have a much better chance of providing investors with predictable income regardless of what the broader stock market is doing. The key, of course, is to stick with companies that can afford their payouts. After all, a dividend expense is only as good as the company paying it.

And companies that don’t have a runway for future earnings growth won’t be able to raise their dividend without jeopardizing their balance sheet. With that in mind, here’s why United Parcel Service (NYSE: UPS) and Kinder Morgan (NYSE: KMI) stand out as two top dividend stocks to buy now.

UPS has more work to do to regain investor excitement

UPS will report third-quarter 2024 earnings on Oct. 24. With the stock trading less than 9% from its four-year low, it will be a “show me” quarter for the delivery giant.

In its last quarterly report, UPS guided for full-year consolidated revenue of $93 billion, a consolidated operating margin of 9.4%, and capital expenditures of $4 billion. UPS has pulled back on spending to cut costs and restore its margins, which went from a 10-year high to a 10-year low in less than two years.

In March, UPS held an investor presentation and announced new three-year financial targets of $108 billion to $114 billion in consolidated revenue by 2026, an adjusted operating margin above 13%, and $17 billion to $18 billion in free cash flow. The plan had two phases, with 2024 focusing on volume and adjusted operating profit dollar growth, and 2025 and 2026 focused on volume and adjusted operating profit margin growth.

Last quarter, UPS returned to domestic volume growth for the first time in nine quarters — which was a step in the right direction toward achieving its 2024 goal. But as for now, the three-year targets look out of reach and could be delayed until 2027.

UPS must implement more concrete measures to get back on track and accelerate sales growth momentum into next year. In the meantime, UPS yields a hefty 4.9%, and management has indicated that maintaining its current payout is a top priority.

Oil and gas infrastructure is proving its value

Between 2016 and the end of 2023, Kinder Morgan stock’s price increased less than 20% compared to a 133% rise in the S&P 500 index. Factoring in dividends, Kinder Morgan returned a much better 77%, but it was still a drastic underperformance from the S&P 500’s 170% total return during that period.

So, heading into 2024, Kinder Morgan investors had grown used to mediocrity. The main draw of buying and holding the stock was the dividend. But Kinder Morgan’s stock price has surged over 40% year to date. Even after that rise, Kinder Morgan still yields 4.6% — illustrating just how high its yield was when the stock was more beaten down.

Pipeline and infrastructure companies like Kinder Morgan have been on a tear this year due to expectations for increased natural gas domestic demand, and the opportunity for higher exports to Mexico and overseas by cooling and condensing gas into liquid form. Higher demand is vital for justifying new project investment. When Kinder Morgan is at its best, it builds new projects that can return steady cash flow over time, funneling a portion of that cash into even more projects and paying a growing dividend to shareholders.

Part of the reason Kinder Morgan has been such a poor-performing stock over the last decade or so is due to concerns that its infrastructure assets could lose value over time as natural gas demand weakened and the energy mix shifted more toward renewables. Less natural gas production could also lead to less justification for new projects, jeopardizing Kinder Morgan’s business model.

Those concerns certainly haven’t gone away, but there are signs that natural gas could remain a part of the energy mix well into the medium term. In addition to the demand drivers mentioned, natural gas could also power data centers and support the energy needs of artificial intelligence.

Kinder Morgan generates plenty of cash to reinvest in the business and fuel its growing payout, making it a reliable high-yield dividend stock to consider now.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Kinder Morgan. The Motley Fool recommends United Parcel Service. The Motley Fool has a disclosure policy.

2 High-Yield Dividend Stocks to Buy Now and Help You Generate Passive Income was originally published by The Motley Fool

This Vanguard ETF Has Generated 620% Returns in 10 Years. Is It Still a Buy?

If you’re not sure where to invest in the stock market, you should consider holding an exchange-traded fund (ETF) in your portfolio. Doing so can drastically simplify your decision-making process. ETFs hold dozens, hundreds, and sometimes even thousands of stocks. They can give you some excellent exposure through just a single investment. Vanguard funds, in particular, are popular choices due to their low fees and solid stock selection.

In some cases, you can also achieve considerable returns from investing in ETFs. One exceptional example is the Vanguard Information Technology Index Fund ETF (NYSEMKT: VGT), which has generated some significant returns for investors in the past decade. Can it still be a good investment today?

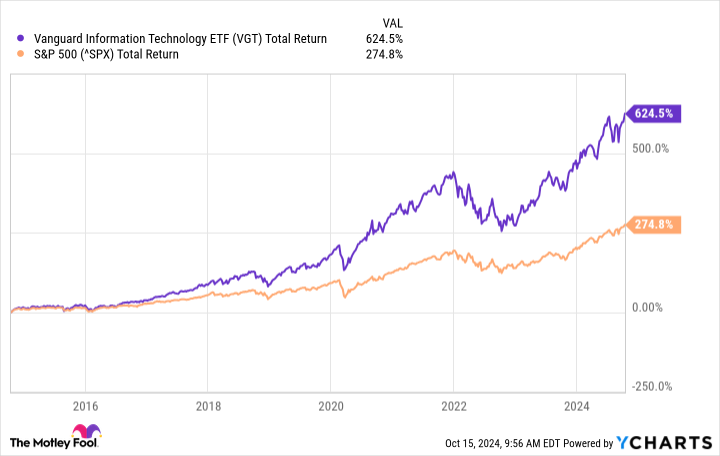

The Vanguard Information Technology ETF is up 620% in 10 years

A big reason the Vanguard Information Technology fund has been a phenomenal investment to own over the past decade is because it focuses on top tech stocks, including big names such as Apple, Microsoft, and Nvidia — three companies that are benefiting from the excitement over artificial intelligence (AI) in recent years. Together, those three stocks account for 44% of the fund’s total weight. Overall, there are 316 stocks in the ETF.

When including the ETF’s dividend (it yields a modest 0.6%), its total returns over the past 10 years come in at around 620%. That means a $25,000 investment in the fund then would be worth approximately $180,000 right now. In comparison, if you made the same size investment mirroring the S&P 500, it would be worth considerably less today, totaling around $94,000.

Why the fund can still rally higher

As well as the ETF has performed over the past decade, there’s still a bullish case to be made for investors who are contemplating the fund, which is due to the potential in AI.

Research company Gartner projects that AI chip sales will total at least $119 billion by 2027, which is more than double the $53 billion it totaled just last year. That’s good news for Nvidia and other chipmakers, as it suggests demand will remain strong. The overall AI market is also looking promising. Analysts from Fortune Business Insights estimate that globally, it will grow at a compound annual growth rate of 20.4% until 2032.

While the Vanguard fund isn’t exclusively an AI fund, tech stocks as a whole will benefit from businesses building AI models and related products and services. Companies will invest in new AI technologies, and they will need to upgrade their existing IT infrastructure to help ensure they have the capabilities to handle the added workloads. Many tech companies are at least indirectly involved with AI in some way, even if they aren’t creating AI-specific products and services.

Should you invest in the Vanguard Information Technology ETF?

The Vanguard Information Technology ETF has a modest expense ratio of 0.10%, and it offers investors a great way to gain exposure to the best tech stocks in the world.

Given the soaring valuations in tech, investors may feel uneasy about investing in this type of fund. But while there may be a correction in the cards for some highly priced tech stocks in the near future, the long-term trajectory still looks promising. Tech has, for the most part, been a great option for long-term investors, and it has allowed investors to generate some incredible returns along the way.

As long as you plan to stay invested for years, this Vanguard fund can be a great investment to hold in your portfolio.

Should you invest $1,000 in Vanguard World Fund – Vanguard Information Technology ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Fool recommends Gartner and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

This Vanguard ETF Has Generated 620% Returns in 10 Years. Is It Still a Buy? was originally published by The Motley Fool

Trump's Rally Hits a Sour Note: Audio Woes And Frustrations In Detroit

During a rally in Detroit, Donald Trump greeted a packed audience after a 17-minute audio malfunction prevented him from speaking.

This incident marked the second time a week that a Trump rally faced disruption, a notable concern as the campaign against Vice President Kamala Harris enters its final days, reported NBC News.

Recent polling suggests the race is tightly contested, making these missteps particularly impactful.

During the audio outage, Trump roamed the stage, interacting with technical staff and attendees, but refrained from mingling with the crowd. When the sound was restored, he did not hold back his frustration.

“I won’t pay the bill for this stupid company,” he declared, blaming the unnamed audio provider for the disruption, NBC News added.

He further threatened, “If it goes out again, I’ll sue the a– off that company.”

Also Read: Harris Clings To Narrow National Lead As Trump Gains Ground

Despite the setback, the rally continued for another hour. However, Trump struggled to shake off the initial audio problems, lamenting that he had to “scream” to make himself heard, even after the system was back up and running.

In a lighter moment, Trump jokingly expressed his desire for Michigan Republican Senate nominee Mike Rogers to join him on stage, but quipped that he didn’t want Rogers to speak from the “crappy” microphone. Ultimately, Rogers did not make an appearance alongside Trump.

As the campaign enters its final weeks, these audio failures serve as a reminder of the challenges faced on the trail, especially in such a crucial political landscape.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

EF Hutton Announces Withdrawal of Lawsuits by Joseph Rallo and David Boral

NEW YORK, Oct. 20, 2024 (GLOBE NEWSWIRE) — EF Hutton LLC (“EF Hutton”) a relationship-driven investment bank focused on growth issuers and their investors, announces that Principals Joseph Rallo and David Boral have withdrawn their lawsuits.

Mr. Rallo and Mr. Boral have mutually decided to take their businesses in different directions, with Mr. Boral retaining the broker-dealer and its holding company and Mr. Rallo retaining the EF Hutton brand, name, and trademark. Any public statements they made about each other as they worked through the separation of their business should not be viewed as a reflection on Mr. Rallo or Mr. Boral. Both Mr. Rallo and Mr. Boral are pleased to put their dispute behind them and move forward with confidence that their new, separate business ventures will be successful.

About EF Hutton

EF Hutton LLC is an investment bank headquartered in New York, NY, which provides strategic advisory and financing solutions to middle market and emerging growth companies. EF Hutton has a proven track record of offering superior strategic advice to clients across the globe in any sector, with access to capital from the USA, Asia, Europe, UAE, and Latin America.

EF Hutton is a leader on Wall Street, having raised over $16 billion in capital across more than 275 transactions through various product types. Since 2022, by deal count, the firm has been #1 in US IPO issuance and #1 in SPAC issuance, per Bloomberg and SPAC Insider. EF Hutton is one of the most active investment banks in the middle of the market space. For more information, please visit efhutton.com.

EF Hutton Contact:

David W. Boral

Chief Executive Officer

590 Madison Avenue, 39th Floor

New York, NY 10022

info@efhutton.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Here's Exactly How I Plan to Spend My Social Security Checks in Retirement

There’s no denying the United States’ Social Security program is on the defensive. Without any changes to how — or how well — it’s funded, experts anticipate a roughly 20% reduction to benefits sometime in the mid-2030s.

I’m still hopeful, however, and even if a cut to payouts is possible, I’m still planning on receiving most of my expected benefits in the future. In fact, I’m even budgeting for them.

This optimism raises an important question. What will my spending look like in retirement? Will my Social Security be enough to cover all my expenditures?

Here’s exactly how I plan to spend my Social Security checks in retirement. I’m willing to bet your budget will look rather similar.

Breaking down the average retiree’s spending

First things first: My Social Security benefits won’t be my only retirement income. I doubt it will even make up the majority of my income, presuming there are no major setbacks for the long-term growth of my retirement savings. My intended budget reflects both sources of future income the best I can predict them. It’s all going into the same pot, so to speak.

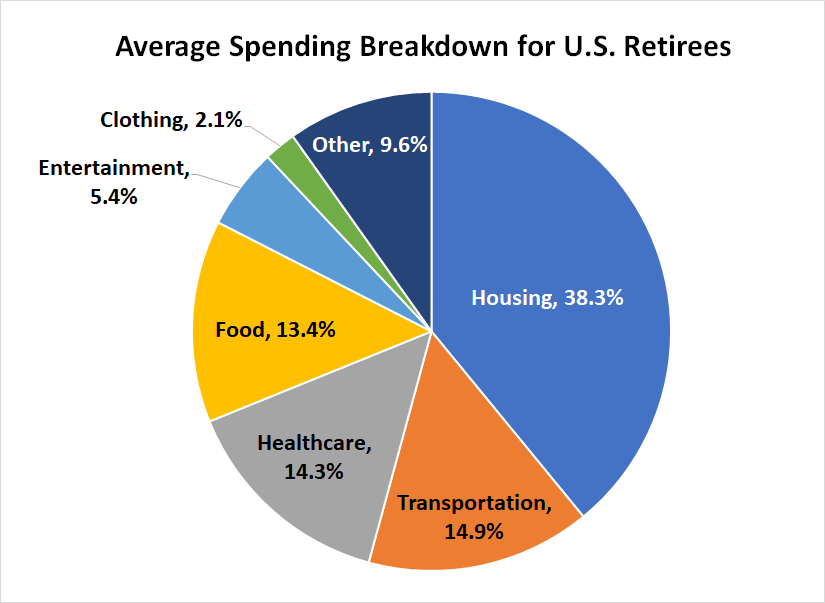

Regardless, whatever the future holds, I expect my budget’s percentage-based breakdown to be about average. This average is laid out in the graphic below.

For additional perspective, the U.S. Census Bureau reports the average U.S. retiree’s annual income stands right around $75,000, while the median is just under $48,000. This, of course, includes a combination of Social Security and income from Americans’ personal retirement savings. The Social Security Administration says its average payments are only putting a tad less than $23,000 in retirees’ pockets this year. Also, bear in mind these numbers are per-person figures. The average household income is at least slightly higher, reflecting the lifetime earnings and savings of two or more individuals.

These are just averages, though. Your actual spending may differ a little, or even a lot. For instance, although spending on clothing might be about the same regardless of how much retirement income you have access to, housing costs can vary widely. If you’ve been a lifelong renter rather than a home owner, you’ll likely continue paying rent in retirement with more of your income going to housing. If instead you purchased a home, it’s likely paid for by the time you enter your golden years. Although you’ll still owe taxes and pay for utilities, at least the mortgage is paid off.

Perhaps the most disappointing data nugget in the budgetary breakdown above, however, is how little the average retiree is spending on entertainment. People have worked hard to reach this stage in life where they have leisure time, but they’re putting little money towards it.

Help yourself

The thing is, you don’t have to be quite so budget-minded or stressed out about whether or not Social Security benefits will see cuts. The best thing you can do is take matters into your own hands by saving for retirement on your own, even if your efforts seem modest. With enough time, even a little bit of savings now can grow into a surprisingly sizable nest egg later.

Don’t believe it? A little number-crunching might change your mind.

Let’s say an investor can come up with an extra $300 per month to tuck away for retirement. Assuming it’s invested in the stock market and earning an average of 10% per year, their investments would be worth somewhere in the ballpark of $62,000. If you can up the monthly contribution to $500, that nest egg grows to more than $100,000. And if you can commit $500 per month for 20 years, the account swells to an incredible $380,000. Putting $500 into the market each month for 30 years will likely leave you with over $1.1 million. Earning a 4% yield on this amount of money would generate annual income of more than $40,000, nicely supplementing any other income you’re due in retirement.

There are tax considerations, of course, and you may not want to be wholly invested in the stock market as your retirement date approaches. Many people dial back their risk as they near retirement by transitioning to assets with more stability.

The key point here is that time is money, and a modest but consistent savings habit can go a long way when given enough time.

Just start somewhere, even if it’s small

Whatever you decide to do or change about your spending and savings plan, know this: While I’m counting on at least some Social Security income — and at the same time have every reason to believe my retirement spending budget will be quite typical — I also know that Social Security alone isn’t going to cut it. I have to keep saving on my own, and you should as well.

Of course, if you’re going to bother saving at all, you’ll also want to optimize your returns. For most, that means investing in the stock market.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

Here’s Exactly How I Plan to Spend My Social Security Checks in Retirement was originally published by The Motley Fool

Prediction: These 3 Phenomenal Stocks Are Set to Soar

Peter Lynch, one of the greatest investors of all time, has said: “I can’t say enough about the fact that earnings are the key to success in investing in stocks. No matter what happens to the market, the earnings will determine the results.”

I believe this. Therefore, as a long-term investor, I try to watch earnings growth and predict where it will be in five years or so. The idea is that if earnings go up, the stock price eventually will as well. The ups and downs along the way are just noise.

However, I was recently reminded of just how patient investors have to be sometimes. Take Sprouts Farmers Market as an example. Its earnings per share (EPS) has consistently increased since it went public 11 years ago. But after going nowhere for 10 years, Sprouts’ stock has skyrocketed 200% in the past year, finally reflecting its long-term EPS growth.

Investors must stay patient because sometimes it can take time for earnings to lift a stock price higher. But sooner or later, they will be rewarded. Therefore, patience is needed for investors in Airbnb (NASDAQ: ABNB), PayPal Holdings (NASDAQ: PYPL), and PubMatic (NASDAQ: PUBM). But here’s why I believe earnings are headed higher for this trio of phenomenal stocks.

1. Airbnb

With over 125 million nights and experiences booked in the second quarter of 2024 alone, Airbnb is a well-known and well-adopted travel booking platform. Hosts list their spaces for rent as well as posting tailored travel experiences.

Travelers go to the platform to book, and Airbnb sits in the middle, quietly taking its high-margin cut of the deal.

Indeed, Airbnb’s business model is extremely lucrative. With its second-quarter profit margin of 20%, few companies can surpass its profitability. And from the perspective of free cash flow, things are even better with a 41% margin.

If there’s a knock against Airbnb, it’s that the platform is already large, and growth is consequently slowing: Second-quarter revenue was up only 11% year over year. That’s why management is turning its attention elsewhere.

The truth is, Airbnb’s core platform is rock solid — millions of people use it without prompting from advertising. This is allowing management to enter a “new phase.” It aims to launch multiple new businesses every year. Many will fail. But it hopes that a small percentage will succeed and contribute to the growth of the company.

Airbnb’s earnings are strong and should stay strong. And if this phenomenal stock can find new sources of growth, earnings could head higher in the coming years, lifting the stock price.

2. PayPal

Over the last 12 months, fintech pioneer PayPal has earned just over $4 per share. Four years ago, its earnings were about the same, meaning growth has been lacking. And investors can point fingers at its lack of earnings growth when explaining the lackluster stock price.

However, PayPal is already on a better path for earnings growth now. The company reworked its management about a year ago, and this new team is forging important new partnerships, margins are improving, and it’s looking to develop new ways to grow the business.

Regarding specifics, PayPal has long known it has valuable consumer data. And it seems like management is finally figuring out ways to package this to improve its services for merchants. More details would be nice. But one important detail is that the company hired Mark Grether earlier this year to head up its advertising business — the same Grether who quickly built a $1 billion ad business for Uber.

With margins improving under new management and with new potential revenue streams coming online, PayPal’s earnings should finally return to growth, which should in turn lift the stock in coming years.

3. PubMatic

Whereas Airbnb and PayPal are household names, PubMatic is far smaller and obscure. But I still feel comfortable calling it phenomenal. As I’ll explain, this little company dares to be different.

PubMatic’s market capitalization is only $750 million as of this writing. But this small company is determined to keep a clean balance sheet, with no debt and $166 million in cash, cash equivalents, and short-term investments as of the second quarter of 2024. That’s unusual for a company this small.

Moreover, PubMatic chooses to own and operate all of its hardware infrastructure as well, rather than rely on public cloud providers, where it can’t control pricing. That’s not necessarily an easy road to walk, but it does give it a greater degree of control over its business.

PubMatic is an advertising technology company that works with publishers to monetize content. It hasn’t been a great environment for these kinds of companies lately. But PubMatic is still modestly growing and running a profitable business. And it’s in great shape for earnings growth when its market eventually heats back up.

In coming years, it will be important for investors to not focus so much on the stock prices for Airbnb, PayPal, and PubMatic. As I pointed out with Sprouts stock, the price can stagnate for a really long time. But if earnings are growing and the business has the opportunity for more growth in the future, then these will be stocks to continue holding, while expecting prices to eventually catch up.

Should you invest $1,000 in Airbnb right now?

Before you buy stock in Airbnb, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Airbnb wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Jon Quast has positions in Airbnb and PubMatic. The Motley Fool has positions in and recommends Airbnb, PayPal, PubMatic, and Uber Technologies. The Motley Fool recommends Sprouts Farmers Market and recommends the following options: short December 2024 $70 calls on PayPal. The Motley Fool has a disclosure policy.

Prediction: These 3 Phenomenal Stocks Are Set to Soar was originally published by The Motley Fool

Why I Just Swapped These 2 Well-Known Dividend Stocks

I enjoy investing in dividend stocks. I like to see the income flow into my portfolio. It gives me more money to reinvest into income-generating investments. That grows my passive income stream toward my ultimate goal of eventually reaching the level where it can offset my regular expenses.

I’ve hit a few speed bumps in achieving that goal over the years because companies I owned cut their dividends. One of those disappointing investments is 3M (NYSE: MMM). The industrial giant ended a streak of more than 60 straight years of dividend growth when it slashed its payment earlier this year. That cut led me to sell my stake. I used some of that cash to start a new position, adding Whirlpool (NYSE: WHR) to my income portfolio. Here’s why I made that switch.

Abdicating its throne

3M had been one of the most reliable dividend stocks around. Its more than a half-century history of dividend increases had it in the elite group of Dividend Kings. However, a series of issues forced the industrial giant to make some difficult decisions, including cutting its dividend.

A couple of the company’s products caused some very expensive legal issues. Ultimately, it agreed to pay about $18.5 billion to settle those claims. That’s a lot of money, even for a company as financially strong as 3M. As a result, the company has taken several steps to preserve its financial flexibility so that it can cover those payments and its other capital needs.

One of its moves was spinning off its healthcare unit to create Solventum. 3M loaded that entity with debt, which gave it more financial flexibility. However, the downside of the spinoff was that it removed a big chunk of 3M’s cash flow. As a result, the company reset its dividend following the spin, cutting it by about 50%.

3M’s dividend was a big reason why I initially invested in the company years ago. I was seeking a high-quality and steadily rising payout. While 3M delivered that steady growth for many years, its legal issues proved to be too much to maintain the payout any longer. With its dividend now a shell of its former self, I decided it was time to sell 3M. I also sold my shares in Solventum since that company has no plans to start paying a dividend anytime soon because it needs to pay down some of the debt 3M saddled it with before the spin.

This dividend stock hits close to home

I used some of the proceeds from my 3M/Solventum sale to buy shares of Whirlpool. The iconic appliance maker is a company that has been on my radar for a while, not just because it pays dividends. My wife and I recently bought a new home, and with that came the need to purchase some new appliances. Whirlpool makes many of the appliances that we’re looking to buy.

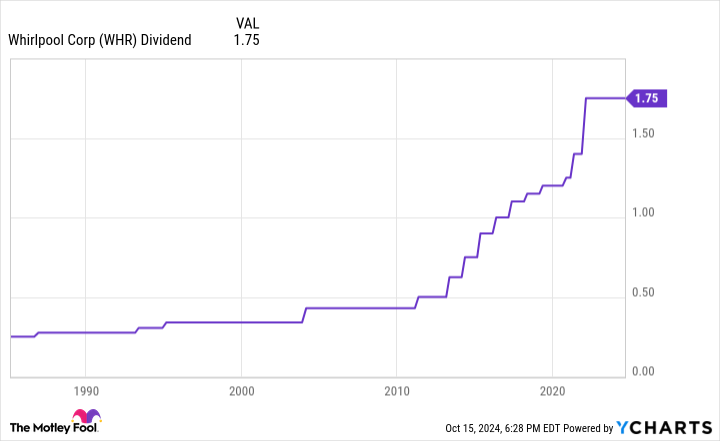

In researching appliances, I also started looking closer at the stock. I first noticed that it pays a pretty enticing dividend (it currently yields nearly 7%). The company has paid dividends for about 70 years. While it hasn’t increased its payment every year (it last raised its dividend in 2022), it has never cut its payout:

Now, as I learned from 3M (and others), a strong dividend history is no guarantee that the company will be able to achieve similar success in the future. However, Whirlpool is in a good position to maintain its dividend despite some current headwinds. Its dividend will cost it about $400 million this year, which it can easily cover with free cash flow (estimated to be about $500 million after capital expenses and other items). Whirlpool is looking to boost its free cash flow by selling off some of its international businesses, which, along with other initiatives, should reduce its global cost structure by $300 million-$400 million. It’s also working to reduce debt, which should cut interest expenses.

Meanwhile, the company expects the housing market to eventually recover as interest rates fall. That should drive higher sales as home sellers replace their appliances to appeal to more buyers or new homeowners buy new ones after moving in. I can vouch for this; my wife and I disliked the refrigerator at our new home (not a Whirlpool) so much that we’re buying a new one. That replacement cycle should boost Whirlpool’s sales and bottom line, putting its dividend on an even firmer foundation.

Spinning out lots of income

3M’s dividend cut was a huge disappointment, given its long history of steady growth. That’s why I recently sold my shares to make way for Whirlpool. The company pays a much higher-yielding dividend that it should be able to sustain through the current downcycle in the housing market. While it’s still facing some headwinds that will prevent it from increasing its payout in the near term, I think it will be a solid income stock over the long haul as it spins out cash into my account.

Should you invest $1,000 in 3M right now?

Before you buy stock in 3M, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and 3M wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Matt DiLallo has positions in Whirlpool. The Motley Fool recommends 3M, Solventum, and Whirlpool. The Motley Fool has a disclosure policy.

Why I Just Swapped These 2 Well-Known Dividend Stocks was originally published by The Motley Fool

Could Buying Rivian Automotive Stock Today Set You Up for Life?

Rivian Automotive (NASDAQ: RIVN) attracted a stampede of bulls with its IPO on Nov. 9, 2021. The electric vehicle (EV) maker went public at $78 per share, and its stock opened at $106.75 before touching a record high of $172.01 just a week later.

At that peak, Rivian’s market cap hit $153 billion, which was 92 times higher than the revenue it would generate in 2022. It briefly made the tiny EV maker more valuable than Ford or General Motors.

Rivian’s stock initially soared for three reasons: It was backed by Amazon and Ford, it was already producing thousands of EVs, and it went public at the apex of the meme stock craze. But today, Rivian shares trade for about $10, giving it a far humbler market cap of $10 billion. That’s less than 2 times the revenue it’s expected to generate next year.

The bulls fled as Rivian’s growth slowed, it racked up steep losses, and rising interest rates popped its bubbly valuations. Ford also ditched its plans to co-develop an electric pickup with Rivian in 2021 and liquidated most of its stake in the company in 2022. But could buying Rivian now while the market is shunning it set you up for massive gains in the future?

Why did Rivian disappoint its investors?

Rivian currently produces three models of vehicle: the R1T pickup, the R1S SUV, and a custom delivery van it sells to Amazon. Before its public debut, Rivian claimed it would produce 50,000 vehicles in 2022. Instead, it produced 24,337 vehicles, and only delivered 20,332. It blamed those disappointing numbers on supply chain constraints, the cooling growth of the EV market, and other macro headwinds across the industry.

In 2023, Rivian overcame those challenges to produce 57,232 EVs and deliver 50,122. Its growth accelerated as it resolved its supply chain problems and ramped up production of its in-house Enduro drive unit to cut costs.

But for 2024, Rivian only expects to produce between 47,000 and 49,000 vehicles. Once again, it blamed supply chain problems — but its problems were exacerbated by the temporary shutdown of its main plant in Illinois for upgrades in April, intense competition in the EV space, and higher interest rates. It expects its full-year deliveries to land between 50,500 and 52,000 EVs.

Can Rivian finally scale up its business?

Rivian’s revenue soared by 167% to $4.43 billion in 2023, but it only slightly narrowed its net loss from $6.75 billion to $5.43 billion. For 2024, analysts expect its revenue to rise by just 6% to $4.71 billion, but expect it to narrow its net loss to $4.88 billion. Those losses are steep, but Rivian still had $9.18 billion in total liquidity (including $7.87 billion in cash, cash equivalents, and short-term investments) on its books at the end of June.

Volkswagen also launched a new joint venture with Rivian in June to co-develop new EV architecture and software. As part of the deal, the German automaker plans to invest up to $5 billion in Rivian and the joint venture over the next two years. That fresh cash should provide Rivian the breathing room to bring its cheaper new R2 SUV to market in 2026, launch its higher-end R3 and R3X SUVs in 2026 and 2027, and continue to fulfill Amazon’s massive order for 100,000 electric delivery vans through 2030. It also plans to start selling some of those delivery vans to other customers over the next few years.

To support its expansion plans, Rivian recently applied for a federal loan, seeking funds to resume construction on a new $5 billion plant in Georgia that could eventually triple its annual production capacity. That roadmap sounds promising, but Rivian still needs to resolve its latest supply chain bottlenecks and prove that it can scale up its business.

Unfortunately, Rivian insiders have sold nearly 86 times as many shares as they bought over the past three months, so it might take a long time for it to stabilize its shaky business and convince the market that it deserves a higher valuation. On the bright side, Amazon is still holding its stake in Rivian and remains its top investor.

Could Rivian’s stock set you up for life?

Rivian’s low price-to-sales ratio could make it a tempting turnaround play for value-seeking investors. If it can scale up its business in the same way Tesla did over the past decade, it could be a millionaire-maker stock from here. However, Tesla established an early-mover advantage in the EV space, was aided by more generous government subsidies, and didn’t face as much direct competition during its expansion phase. It’s far too early to assume Rivian could replicate Tesla’s growth trajectory.

But with Rivian shares trading at these prices, the downside risk for new investors could be limited — and it could be a worthwhile investment for aggressive speculative investors looking for long-term gains. Rivian certainly has the potential to turn a modest investment into a major asset, but its stock could also easily be cut in half again (or worse) if the company can’t meaningfully ramp up EV production.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Leo Sun has positions in Amazon. The Motley Fool has positions in and recommends Amazon, Tesla, and Volkswagen. The Motley Fool recommends General Motors and Volkswagen Ag and recommends the following options: long January 2025 $25 calls on General Motors. The Motley Fool has a disclosure policy.

Could Buying Rivian Automotive Stock Today Set You Up for Life? was originally published by The Motley Fool