What went wrong at CVS? Departing CEO Karen Lynch’s reign started brilliantly, then unraveled fast

Karen Lynch, a superstar CEO championing the biggest of big ideas, is out.

As chief of corner drug store and health insurance colossus CVS, Lynch headed the largest Fortune 500 enterprise, measured by sales, of any female CEO, and for years reigned as the most powerful woman in American business. In her first two years after being chosen for the top job in late 2020, Lynch seemed on the road to glory. By late 2022, she’d lifted CVS’s share price from $70 to roughly $110. Investors were buying her daring new strategy: Making CVS a one-stop shop for and basic care, right in their own neighborhoods, augmented by hands-on, data-driven management from their in-house insurer that reminded folks to refill prescriptions and get their annual physical.

Lynch pledged to “revolutionize healthcare as we know it” by repurposing thousands of CVS’s more than 9,000 stores into either fully-dedicated providers of such services as diabetic retinopathy and cholesterol screening, and mental health counseling, or hybrid retail and PC centers called HealthHUBs. CVS would then store tons of data on the patients’ condition at its Aetna insurance arm, whose costs would fall because seniors were getting preventive care that curbed heart disease and other chronic conditions that account for the bulk of our health care spending. Rival insurers would also reward CVS with part of the savings they achieved from the spread of primary care from far-away doctors’ offices requiring long waits, to the CVS just around the block, where you could also pick up your pills and buy shampoo and candy bars.

It was an intriguing vision that targeted our hugely expensive, largely consumer-unfriendly healthcare system. But Lynch couldn’t fully deliver on the paradigm that’s already starting to upend the current regime, and where CVS will continue playing a pivotal role going forward––one that will likely determine whether it rebounds from its current tailspin.

At press time, CVS hadn’t responded to a Fortune email requesting comment.

CVS underperforms already low expectations

On October 18, CVS disclosed that its heretofore weak financial performance was even worse the low expectations that already pushed big investors, including activist Glenview Capital, to demand changes in the C-suite. The board pre-announced that earnings for Q3 would prove far lower than both the company’s forecast, and Wall Street’s predictions. CVS posited EPS at $1.05 to $1.10, well below the FactSet consensus of $1.69. Accounting for most of the shortfall: Extremely tight margins in the health benefits business at Aetna, and especially in its giant Medicare Advantage franchise. CVS disclosed that its medal cost ratio of premiums to expenses had soared from an estimated 91% to over 95%. “That represents some combination of providing benefits that are too rich and underpricing premiums,” says Michael Ha of Robert W. Baird.

The same press release stated that Lynch “stepped down from her position in agreement with the company’s board of directors,” and will be replaced by David Joyner, a CVS veteran who’s been heading Caremark, the pharmacy benefits business.

Where Lynch’s transformation went awry

A trifecta of problems, some that started before she took the top job, ended a reign that appeared to start brilliantly, then unraveled fast. The first was CVS’s errors in vastly overpaying for acquisitions, a practice that piled on amounts of capital so huge that only magical performance could provide shareholders with decent returns going forward. In the years following its successful acquisition of Caremark in 2007, CVS was thriving. By late 2017, its shares had jumped around three-fold to $75. Then, it unveiled its acquisition of Aetna, where Lynch had risen to the position of heir apparent based on her skill in building the Medicare Advantage side.

CVS paid a gigantic $68 billion, or a 73% premium for Aetna. The day of the announcement, the two companies boasted a combined market cap of $128 billion. Proof that CVS hasn’t come close to generating the extra profits needed to cover that Brobdingnagian price: Its valuation now stands at just $76 billion, only slightly higher than what it paid for Aetna. The Aetna lesson didn’t deter Lynch and the board. In 2023, CVS made another hugely expensive deal, purchasing Oak Street Health, owner of over 200 centers in 25 states providing care for the elderly, this time laying out $10.5 billion, 30% or $2 billion more than the target’s cap prior to clinching the purchase. CVS made still another big bet by acquiring Signify, a health care analytics provider, for $8 billion. The Oak Street and Signify buys signaled that CVS was making desperate moves, adding big pieces to bolster the complex construct that Lynch conceived, but that wasn’t performing.

CVS became a revolving door at the top, and the vision proved overly complex

Lynch also kept changing her group of lieutenants at an alarming rate. It isn’t clear if she kept choosing the wrong people for the wrong roles, or was unable to get the talent she recruited to do their best work. From the spring of 2023 through this month, no fewer than seven C-suite stalwarts, all of whom she’d hired after officially taking charge in February of 2021, departed. The exodus encompassed the head of Aetna, who left after less than a year, the CFO (whose statement cited health reasons), the chiefs of HR, communications, healthcare delivery, and the retail stores. Two other longstanding CVS execs exited as well, the general counsel and chief marketing officer.

The third and final rub: The lofty, intricate blueprint proved beyond Lynch’s capacity to implement. It was her predecessor, Larry Merlo, who launched the initial phase via the purchase of Aetna, the first time ever that a huge insurer combined with a pharmacy chain. Lynch extended the framework through her plan for bringing primary care to America’s doorstep. Though the idea was a big one, CVS was getting a late start on the retail component, since Walgreens, Concentra and sundry others, including Oak Street, were invading what promised to become a gigantic market. Besides, the culture formed from running drugstores clashed with the mindset required to manage a major insurer, making it difficult to mate Aetna’s data troves with the folks CVS attempted to lure to its stores for primary care. The sudden drop in profitability for Aetna’s Medicare Advantage arm further undermined the ambition plan to meld the two businesses.

In the last couple of years, CVS has made scant mention of the original HeathHUBs concept. The focus now appears to be building out the well established Oak Street network. And according to Ha of Baird, it’s an excellent strategy. “That initiative will drive their growth for the next decade,” he says. “Oak Street-style, value-based care is still the future for CVS.”

The Pharmacy Division, the Health Services Division she set up, and the retail are doing well. Aetna’s margins collapsed as the Federal Government reduced their payments to Medicare Advantage. United and Cigna are both suffering too. That was unforeseen but it happened just as Aetna increased its Medicare rolls by 300,000 seniors. That was either unlucky or an unforced error. This extremely personable, charismatic leader deserves great credit for developing and superbly articulating a vision. It may even turn out that Lynch just needed more time. But that was a luxury that was, at least for CVS, out of stock.

This story was originally featured on Fortune.com

Prediction: Nvidia Could Be Headed to $175 in 2025

Bloomberg recently reported the U.S. could impose caps on exports of advanced artificial intelligence (AI) chips to some Middle Eastern countries. Semiconductor fabrication equipment maker ASML lowered its 2025 guidance. Both were widely viewed as bad news for Nvidia (NASDAQ: NVDA).

Is Nvidia’s huge multiyear run nearly over? I don’t think so. Instead, I predict that Nvidia’s share price could be headed to $175 in 2025.

Why a 30% gain is achievable

Nvidia’s stock would have to jump 30% to reach $175 next year. I believe this gain is achievable for three key reasons.

First, the shift to accelerated computing appears to be unstoppable. This trend should easily offset any negative impact on Nvidia from restrictions on shipping advanced AI chips to some Middle Eastern countries. During the first half of 2024, only 6.5% of the company’s total revenue came from countries other than the U.S., Singapore, Taiwan, and China. Middle Eastern revenue is only a portion of that percentage.

But what about ASML’s weaker outlook? I suspect it’s more related to overcapacity at factories that manufacture chips than anything else. Just because the demand for chipmaking equipment declines doesn’t necessarily mean that the demand for chips will fall, too.

Second, Blackwell is coming. Nvidia CEO Jensen Huang told CNBC the demand for its new GPU platform is “insane.” Morgan Stanley learned in a meeting with Nvidia’s management that Blackwell GPUs are already sold out for the next 12 months.

Huang has said in the past that Blackwell could be the most successful product in Nvidia’s history. I think he could be right. As Nvidia begins to report sales numbers for Blackwell in the next few quarters, I expect the stock to rise.

Third, look for Nvidia to announce its next generation of AI chips sometime next year. Even if the company doesn’t begin shipping these chips until the end of 2025 (or even early 2026), investors’ excitement about the next big GPU advance could provide a catalyst for the stock.

Many on Wall Street don’t agree (yet)

Granted, many Wall Street analysts aren’t nearly as bullish. The average 12-month price target reflects an upside potential for Nvidia of around 10%.

Of the 38 analysts surveyed by financial data provider LSEG in October, 15 rated Nvidia as a “hold.” Another recommended selling the stock. That’s a marked change from September, when 55 of 60 analysts rated Nvidia as a “buy” or a “strong buy.”

However, I’ve noticed a pattern with Wall Street recommendations and price targets for Nvidia. The consensus tends to be modestly optimistic until the company reports its next quarterly results. Then, analysts frantically scramble to revise their estimates upward.

I fully expect that history will repeat itself as we move into 2025. As Nvidia reveals its sales figures for Blackwell, my hunch is that the average price target for the stock will increase significantly — and perhaps to my predicted level of $175.

What could go wrong?

Of course, my prediction could fall flat on its face. What could go wrong? Several things.

The U.S. economy could run into trouble. An escalation of tensions around the world could negatively impact Nvidia’s business. Major cloud service providers could choose to scale back their investments in GPUs. They could also shift some of their spending to buy chips from Nvidia’s rivals or rely more heavily on their own AI chips.

While I acknowledge these risks, I stand by my prediction. Nvidia’s share price could reach $175 next year. How long it stays at or above that level, though, is another question.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,285!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,456!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $411,959!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML and Nvidia. The Motley Fool has a disclosure policy.

Prediction: Nvidia Could Be Headed to $175 in 2025 was originally published by The Motley Fool

Warren Buffett Dumps Nearly $10 Billion of 1 Key Stock and Buys $345 Million of His Favorite Stock. Here's What You Need to Know.

The “Oracle of Omaha” didn’t get that name for his lack of foresight. Warren Buffett‘s ability to read the tea leaves, as it were, has made him a very rich man over his 60-year career. So when the billionaire investor makes substantive changes in his company’s key holdings, people pay attention. Why, then, is Buffett scaling back one of Berkshire Hathaway‘s (NYSE: BRK.A) (NYSE: BRK.B) central investments?

The firm’s latest shedding of Bank of America stock brings the total sold to nearly $10 billion in just a few months — almost a quarter of its original stake. In turn, Berkshire bought $345 million of a Buffett favorite. Why?

The latest sale is particularly interesting

The Securities and Exchange Commission (SEC) requires large shareholders — investors owning more than 10% of a company’s stock — to report any trade within two business days. After the last sale of almost 10 million shares, Berkshire now owns just shy of 10% of the bank and no longer has to report transactions in a timely manner. Now, any transactions will be reported quarterly on the company’s 13-F filing.

That means any future sales will happen out of the public eye until months later. Although this could make it easier for Berkshire to further reduce its stake without spooking the market, it doesn’t necessarily mean that is what’s happening here. Still, it’s an important factor to keep in mind.

Buffett and Berkshire have done well with Bank of America

Buffett helped Bank of America recover from the 2008 financial crisis, infusing the struggling bank with $5 billion in exchange for preferred stock and warrants to buy an additional 700 million shares at just over $7 per share before 2021. He exercised the warrant in 2017 when the stock was trading above $24. Although he didn’t sell the shares, he netted an on-paper profit of $12 billion in just six years. Over the course of their relationship, Berkshire has turned a total $20 billion investment into more than $40 billion — not bad.

Given the incredible return on his money and the fact that capital gains and corporate taxes are in a favorable place — one that could change under a new administration — a plausible explanation for Buffett’s selling streak is that he’s simply happy with his investment’s performance. He may want to lock in that profit before his company might have to pay more in taxes to Uncle Sam.

Given Buffett’s comments, more could be at play

I think there is truth to this, but it’s not the whole picture. From comments he’s made in the past year or so, it seems clear that Buffett is at least somewhat uneasy with the state of things. In his 2023 shareholder letter, he talked of Wall Street loving “feverish activity” and described the current market as more “casino-like” than in the past, warning that while panics don’t happen often, “they will happen.” This was before the huge stock-market run thus far in 2024. Since Buffett made these comments, the S&P 500 is up about 23%, and by many metrics, the stock market is at one of its highest valuations ever.

I think Buffett’s concern is more specific here, however — it’s not just the market as a whole. There are some reasons to be concerned about the banking sector, and about Bank of America specifically. In the years before 2022, banks bought a large number of debt securities that are now a drain on income.

They bought them when interest rates were low, which meant they had relatively low yields. This would have been fine had things continued as usual, but as we know, rates didn’t stay low. Between 2022 and 2023, the Federal Reserve raised rates rapidly. Although this helped curb inflation, it meant the banks took a loss on these securities. Why? The yields on these securities are fixed. They don’t rise as rates rise, but the rates the banks have to pay depositors do. That means banks are stuck with a large number of securities that pay less to the bank than what the bank must pay to depositors, reducing net interest income — a key metric in the banking sector.

Additionally, the fair value of these securities — that is, what the bank could get for them in a sale — is now less than what they paid, representing an unrecognized paper loss. Of all the major commercial banks, which do you think took on the largest number of these? Yup, Bank of America.

Now, this is only a real issue if things turn south and the bank is forced to sell these securities and realize the loss. If that were to happen, it could affect its ability to remain solvent. This would be a pretty extreme situation and is not likely to happen, but it’s not impossible. Given Warren Buffett’s philosophy and temperament, it would make sense that this would concern him. After all, in the same 2023 shareholder letter, Buffett made it clear that given a black swan event, Berkshire would not be among those who “ignited the conflagration.” Rather, it would be an “asset to the country” as it was in 2008 and “help extinguish the financial fire.”

Buffett keeps buying one stock consistently

Warren Buffett’s favorite stock is his own. Berkshire has now repurchased $3 billion of its own shares this year alone after the most recent purchase. It’s the primary way the company rewards shareholders, since Berkshire offers no dividend. It’s also in line with Buffett’s attempt to keep Berkshire healthy and in a prime position to weather a potential financial storm.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Johnny Rice has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Warren Buffett Dumps Nearly $10 Billion of 1 Key Stock and Buys $345 Million of His Favorite Stock. Here’s What You Need to Know. was originally published by The Motley Fool

40+ Daytona Beach Residential Portfolio Hits Market Through Hilco Real Estate Sales

NORTHBROOK, Ill., Oct. 18, 2024 /PRNewswire/ — Hilco Real Estate Sales (HRE) announces November 19, 2024, as the start date of the auction for the portfolio of over 40 residential properties and development lots across Daytona Beach, Florida. The auction will conclude on November 21, 2024.

The portfolio consists of 44 prime sites: 23 single-family homes, nine multifamily complexes and eight land parcels, three mixed-use properties and one residential condominium. These are strategically located in highly desirable neighborhoods and towns such as Seabreeze Historic District, Surfside Historic District, Daytona Beach Shores and Port Orange. About 40% of the properties are tenant-occupied and can continue to generate rental income. With Daytona Beach being a popular tourist destination, several of these properties also present excellent opportunities for short-term rentals, appealing to vacationers and those looking for temporary stays.

The portfolio also includes two redevelopment assemblages. The first comprises of 10 properties that span an entire block, providing opportunity for a high-density multifamily development. The other assemblage features three adjacent land parcels that can accommodate single family homes or a larger fourplex structure. All the sites offer the potential to build custom beachside homes or enhance existing structures. With proximity to the Atlantic Ocean, recreational areas and Daytona’s lively entertainment scene, these residences and land parcels stand out as attractive prospects for investors and developers alike.

Long known as a tourist destination through its spring break and motorsports culture as well as hard-packed white sand beaches, Daytona Beach is rapidly transforming into a popular residential area. The city offers affordable coastal living, a year-round mild climate as well as a robust local economy driven by tourism, healthcare and education. Attracting retirees, young professionals and families, Daytona Beach has ranked fourth among the Fastest-Growing Places in the U.S. for 2024-2025 by U.S. News, with a population migration growth rate of 4.92%. This influx of new residents is driving increased demand for housing and development, making this portfolio particularly timely.

Jonathan Cuticelli, vice president at Hilco Real Estate Sales, said, “These residential sites offer a truly unique opportunity to invest in one of Florida’s most iconic and rapidly growing coastal cities. With Daytona Beach experiencing substantial growth, particularly in sought-after historic districts and waterfront neighborhoods, investors and developers alike can take advantage of these locations for either rental income, high-end residential development or someone looking for a new home.”

Individual bids are not required before the auction date for those interested in single properties. However, for those wishing to submit a bulk bid for multiple properties, these bids must be submitted to Hilco Real Estate Sales by November 13, 2024, at 5:00 p.m. (ET) ahead of the virtual auction beginning on November 19, 2024.

The sale is being conducted in cooperation with Jiovanny Restrepo PLLC, Florida Broker License #3105916. Bidders must agree to the Terms of Sale and the Florida Form Purchase Agreement, which includes an addendum for an “as-is, where-is” basis. A $5,000 deposit per property is required, with a maximum of five properties per bidder. A buyer’s seminar will be held on November 13, 2024, at 3:00 p.m. (ET) for those seeking more information about the bidding process and the online auction site.

Interested bidders should review the requirements to participate in the auction sale process available on Hilco Real Estate Sale’s website. For further information, please contact Jonthan Cuticelli at (203) 561-8737 | jcuticelli@hilcoglobal.com or Jiovanny Restrepo at (847) 386-2282 | jrestrepo@hilcoglobal.com.

For further information on the property, sale process and terms or to obtain access to due diligence documents, please visit HilcoRealEstateSales.com or call (855) 755-2300.

About Hilco Real Estate Sales

Successfully positioning the real estate holdings within a company’s portfolio is a material component of establishing and maintaining a strong financial foundation for long-term success. At Hilco Real Estate Sales (HRE), a Hilco Global company (HilcoGlobal.com), we advise and execute strategies to assist clients seeking to optimize their real estate assets, improve cash flow, maximize asset value and minimize liabilities and portfolio risk. We help clients traverse complex transactions and transitions, coordinating with internal and external networks and constituents to navigate ever-challenging market environments.

The trusted, full-service HRE team has secured billions in value for hundreds of clients over 20+ years. We are deeply experienced in complex transactions including artful lease renegotiation, multi-faceted sales structures, strategic asset management and capital optimization. We understand the legal, financial and real estate components of the process, all of which are vital to a successful outcome. HRE can help identify the most viable options and direction for a company and its real estate portfolio, delivering impressive results in every situation.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/40-daytona-beach-residential-portfolio-hits-market-through-hilco-real-estate-sales-302280528.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/40-daytona-beach-residential-portfolio-hits-market-through-hilco-real-estate-sales-302280528.html

SOURCE Hilco Real Estate

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fuji Soft Sticks With KKR Despite Higher Takeover Offer From Bain

(Bloomberg) — Fuji Soft Inc. is standing by KKR & Co.’s tender for its shares despite receiving a higher bid from Bain Capital that’s won the support of the Japanese software developer’s founder.

Most Read from Bloomberg

The Yokohama-based company held a board meeting on Friday and decided to recommend its shareholders accept the first phase of KKR’s tender offer through Monday, the firm said in a statement dated Oct. 18.

Bain last week offered ¥9,450 ($63) a share for the company, compared with KKR’s ¥8,800 proposal, and said it would start its tender bid in late October if Fuji Soft expresses support for the move. Fuji Soft will continue to consider Bain’s “sincere” proposal, and the firm will release opinions on it at the start of the tender offer, according to the statement.

“We are pleased to have Fuji Soft’s continued support for our tender offer, and their recommendation to tender into it,” a KKR spokesperson said Friday evening by email.

Fuji Soft founder Hiroshi Nozawa said he supports Bain’s offer and that its approach aligned with the company’s, according to a letter obtained by Bloomberg. Nozawa said he hoped KKR will tender its shares if it acquires them from major shareholders including 3D Investment Partners Pte and Farallon Capital Management. The two shareholders had agreed to sell their stakes to KKR in a binding pact that ensured KKR at least 32.68% of Fuji Soft.

The special committee advising Fuji Soft on the tender offer said it would be difficult for Bain to achieve its goal of taking the company private, according to the statement. The committee added that there are concerns of not reaching a consensus among major shareholders if Bain were to carry out the tender offer, the release showed.

KKR had split its takeover into two stages, after it moved up the start of its tender to Sept. 5, following a non-binding proposal from Bain.

A weaker yen and regulators’ promotion of shareholder value are fueling M&A activity in Japan. Fuji Soft had earlier said it agreed to a buyout by KKR, even though it had received a higher-priced non-binding offer from Bain, because it judged KKR’s offer was more certain to occur.

Fuji Soft contracts software from Fujitsu Ltd., a supplier of computer systems for some of Japan’s biggest banks such as Mizuho Financial Group Inc. and government agencies. The software company’s been fielding demands from Singapore-based 3D Investment Partners, its largest shareholder according to Bloomberg-compiled data, to consider steps such as taking the company private.

–With assistance from Taro Fuse.

(Updates the story throughout with a statement from Fuji Soft.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

The World’s $100 Trillion Fiscal Timebomb Keeps Ticking

(Bloomberg) — Even before global finance chiefs fly into Washington over the next few days, they’ve been urged in advance by the International Monetary Fund to tighten their belts.

Most Read from Bloomberg

Listen to the Here’s Why podcast on Apple, Spotify or anywhere you listen

Two weeks ahead of a potentially era-defining US election, and with the world’s recent inflation crisis barely behind it, ministers and central bankers gathering in the nation’s capital face intensifying calls to get their fiscal houses in order while they still can.

The fund, whose annual meetings begin there on Monday, has already pointed to some of the themes it hopes to press home with a barrage of projections and studies on the global economy in coming days.

The IMF’s Fiscal Monitor on Wednesday will feature a warning that public debt levels are set to reach $100 trillion this year, driven by China and the US. Managing Director Kristalina Georgieva, in a speech on Thursday, stressed how that mountain of borrowing is weighing on the world.

“Our forecasts point to an unforgiving combination of low growth and high debt — a difficult future,” she said. “Governments must work to reduce debt and rebuild buffers for the next shock — which will surely come, and maybe sooner than we expect.”

Some finance ministers may get further reminders even before the week is over.

UK Chancellor of the Exchequer Rachel Reeves has already faced an IMF warning of the risk of a market backlash if debt doesn’t stabilize. Tuesday marks the last release of public finance data before her Oct. 30 budget.

The UK tax office is taking a tougher approach to clawing back debts, insolvency specialists say, a bid to squeeze £5 billion ($6.5 billion) in extra revenue.

What Bloomberg Economics Says:

“For all the talk of black holes, the overall effect of Reeves budget will be a policy that’s looser, not tighter, relative to the previous government’s plans.”

—Ana Andrade and Dan Hanson, economists. For full analysis, click here

Meanwhile, Moody’s Ratings has slated Friday for a possible report on France, which faces intense investor scrutiny at present. With its assessment one step higher than major competitors, markets will watch for any cut in the outlook.

As for the biggest borrowers of all, the glimpse of the IMF’s report already published contains a grim admonishment: your public finances are everyone’s problem.

“Elevated debt levels and uncertainty surrounding fiscal policy in systemically important countries, such as China and the United States, can generate significant spillovers in the form of higher borrowing costs and debt-related risks in other economies,” the fund said.

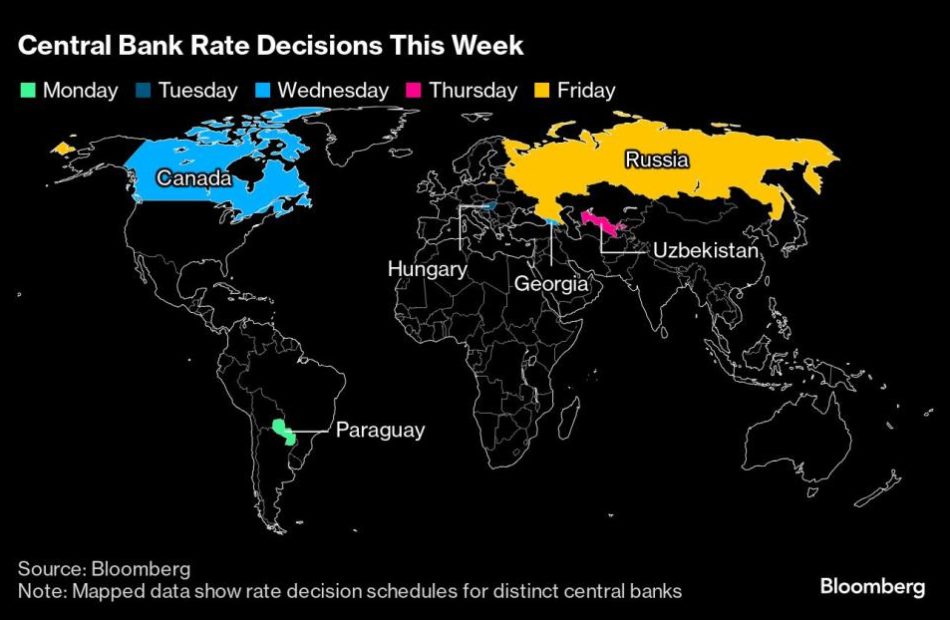

Elsewhere in the coming week, a rate cut in Canada and a hike in Russia are among the possible central bank moves anticipated by economists.

US and Canada

Economists see a pair of home sales reports showing that declining mortgage rates are merely helping to stabilize the US residential real estate market. On Wednesday, the National Association of Realtors will issue data on contract closings for previously owned homes, followed a day later by government figures on sales of new homes.

Economists project modest increases in September sales of both existing and new homes. Resales remain hamstrung by limited inventory that’s keeping asking prices elevated and hurting affordability. While purchases of previously owned properties remain near the weakest pace since 2010, builders have capitalized: New-home sales have gradually picked up over the past two years with the help of incentives.

Other US data in the coming week include September durable goods orders, plus capital goods shipments that will help economists fine-tune their estimates of third-quarter economic growth. The Federal Reserve also issues its Beige Book, an anecdotal readout of the economy.

Regional Fed officials speaking in the coming week include Jeffrey Schmid, Mary Daly and Lorie Logan.

Meanwhile, the Bank of Canada is increasingly expected to cut rates by 50 basis points after inflation cooled to 1.6% in September and some measures of the labor market remain weak.

Europe, Middle East, Africa

As with other regions, attention will largely be focused on Washington; more than a dozen appearances of European Central Bank’s Governing Council members are scheduled stateside.

That includes President Christine Lagarde, who’ll be interviewed by Bloomberg Television’s Francine Lacqua in Washington on Tuesday.

Similarly, Bank of England Governor Andrew Bailey will speak in New York on Tuesday, while Swiss National Bank President Martin Schlegel is scheduled to appear on Friday.

Among euro-area economic reports, consumer confidence on Wednesday, purchasing manager indexes the following day, and the ECB’s inflation expectations survey on Friday may be the highlights. Similarly, Germany’s Ifo Institute will release its closely watched business confidence gauge at the end of the week.

Aside from the possible rating assessment on France, S&P may also release reports on Belgium and Finland on Friday.

Turning east, two central bank decisions are likely to draw attention, starting on Tuesday with Hungary, which may keep borrowing costs unchanged.

The Bank of Russia has signaled that continued inflationary pressures could lead to another rate hike on Friday. They lifted it 100 basis points to 19% in September, and a similar move would return the rate to the 20% level imposed in an emergency increase after President Vladimir Putin began the February 2022 full-scale invasion of Ukraine.

Finally, data on Wednesday from South Africa is expected to show inflation slowed to 3.8% in September, boosting the chances of another rate cut next month. The central bank said it now forecasts consumer-price growth to stay in the bottom half of its 3% to 6% target band over the next three quarters.

Asia

Lenders in China, with a nudge from the People’s Bank of China, are expected to join the campaign to revive business activity by trimming their loan prime rates on Monday. The 1-year and 5-year rates are seen sliding by 20 basis points to 3.15% and 3.65%, respectively.

At the end of the week, data will show if the nation’s industrial profits bounced back in September after slumping more than 17% in August. The most recent numbers showed the economy expanding at the lowest pace in six quarters during that three-month period.

Elsewhere, the region gets a cluster of PMIs on Thursday, including from Japan, Australia and India.

Singapore is forecast to report Wednesday that consumer inflation slowed in September, with price growth updates for that month also due from Hong Kong and Malaysia.

On Friday, Japan will report Tokyo CPI for October, a key indicator that will capture corporate price changes at the start of the fiscal second half.

South Korea will release third-quarter growth figures on Wednesday that may show the economy’s momentum has slowed marginally.

During the week, South Korea releases early trade statistics for October, with Taiwan and New Zealand releasing trade numbers for September.

Among the region’s central banks, many leading officials will attend the IMF meetings in Washington. Reserve Bank of Australia Deputy Governor Andrew Hauser holds a fireside chat on Monday, and three days later the bank publishes its annual report.

Reserve Bank of New Zealand chief Adrian Orr speaks on policy on the sidelines of the IMF confab, and Uzbekistan’s central bank will decide Thursday whether to pause for a second meeting following its July rate cut.

Latin America

Brazil watchers will be keen to see the weekly forecasts in the central bank’s so-called Focus survey due on Monday.

Expectations for inflation, borrowing costs and debt metrics have lately taken a decidedly gloomy turn given doubts about the government’s fiscal discipline.

In Mexico, GDP proxy data should be consistent with the loss of momentum that has many economists marking down their third-quarter growth forecasts. The economy is expected to slow for a third year in 2024.

GDP proxy data for Argentina will probably show South America’s second-biggest economy sputtering and still in the grip of a recession that’s likely to extend into 2025.

Paraguay’s central bank holds its rate setting meeting; policymakers have kept borrowing costs at 6% for the past six months with inflation running slightly above the 4% target.

On the prices front, neither investors nor policymakers will be cheered by mid-month inflation reports from Brazil and Mexico given the early consensus for higher headline readings.

The data here will likely do nothing to dent the prospects of Brazil’s central bank tightening policy again on Nov. 6, while at the same time giving Banxico pause about a third straight cut at its Nov. 14 gathering.

—With assistance from Laura Dhillon Kane, Brian Fowler, Robert Jameson, Monique Vanek, Vince Golle, Brendan Scott and William Horobin.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Is gold safer than U.S. Treasury bonds as federal debt keeps soaring?

Backed by the full faith and credit of the federal government, U.S. Treasuries bonds have long been viewed as the gold standard in safe investments.

In times of uncertainty, economic downturns, or full-blown crises, investors have flocked to Treasuries as a haven. But what if actual gold is the new gold standard for a safe investment?

Analysts at Bank of America asked that question in a note on Wednesday, explaining that the outlook for U.S. debt is bullish for the precious metal.

With debt as a share of GDP set to break record highs in the coming years, the Treasury Department has to sell more and more bonds to investors, who may demand higher yields. And when yields rise, the price of bonds on the secondary market falls.

That has helped weaken the historic correlation between bond yields and gold prices. While lower rates are still bullish for gold, which doesn’t pay interest or dividends, higher rates don’t necessarily put pressure on bullion anymore, BofA said, maintaining a gold price target of $3,000 per ounce.

“Indeed, with lingering concerns over US funding needs and their impact on the US Treasury market, the yellow metal may become the ultimate perceived safe haven asset,” analysts wrote.

Gold has been on a tear recently, with prices up more than 30% so far this year, topping $2,700 per ounce for the first time ever this past week.

That’s even as bond yields have rebounded since the Federal Reserve’s first rate cut last month, while fresh budget data showed that the deficit was $1.8 trillion for the fiscal year that ended on Sept. 30. Meanwhile, the interest expense alone on U.S. debt was $950 billion, more than defense spending and up 35% from the prior due mostly to higher rates.

There is no relief in sight as the deficit will expand under either Donald Trump or Kamala Harris, though less so under the Democrat, according to the Penn Wharton Budget Model and the Committee for a Responsible Federal Budget.

“Indeed, rising funding needs, debt servicing costs and concerns over the sustainability of fiscal policy may well mean that gold prices could increase, if rates move up,” BofA said.

With the supply of U.S. debt poised to continue surging, concerns have grown about demand and whether investors will keep absorbing more Treasury bonds.

That provides a strong incentive to central banks around the world keep diversifying their reserves away from U.S. debt and toward gold, BofA added.

To be sure, the U.S. isn’t the only country overflowing with red ink. But its soaring debt and deficits have been notable as they come during a strong economy and not while fighting a world war or some other calamity like a pandemic.

Meanwhile, spending will likely go up as climate change, older demographics, and military needs add more pressure on budgets.

So is gold a safer investment than Treasuries?

“Ultimately, something has to give: if markets become reluctant to absorb all the debt and volatility increases, gold may be the last perceived safe haven asset standing,” BofA said.

This story was originally featured on Fortune.com

Boeing exploring asset sales to boost finances, WSJ reports

(Reuters) -Boeing is exploring asset sales in a bid to boost its fragile finances by shedding its non-core or underperforming units, the Wall Street Journal reported on Sunday.

The planemaker last week reached an agreement to offload a small defense unit that makes surveillance equipment for the U.S. military, the paper reported, citing people familiar with the deal.

Boeing has lurched from crisis to crisis this year, ever since Jan. 5 when a door panel blew off a 737 MAX jet in mid-air. Since then, its CEO has departed, its production has been slowed as regulators investigate its safety culture, and in September, 33,000 union workers went on strike.

The Journal reported that in recent financial-performance meetings, new CEO Kelly Ortberg asked the heads of the company’s units to lay out the value of those units to the company.

Boeing’s board recently met to discuss the next steps for the company, where directors questioned division heads and combed through reports to examine the state of each unit, the report said.

Boeing declined to comment on the report.

Striking machinists at the planemaker are set to vote Wednesday on a new contract proposal that includes a 35% pay hike over four years.

The work stoppage has halted production of the planemaker’s best-selling 737 MAX and its 767 and 777 widebodies, putting added pressure on its already weak finances.

Earlier this month, Boeing announced it would cut 17,000 jobs, or 10% of its global staff, and take $5 billion in charges.

(Reporting by Shivani Tanna in Bengaluru; Editing by Hugh Lawson)