Billionaires Are Buying a BlackRock Index Fund That Could Soar Up to 73,000%, According to Wall Street Experts

In the first half of 2024, the billionaires listed below started positions in BlackRock‘s exchange-traded fund (ETF) that tracks the spot price of Bitcoin (CRYPTO: BTC). The fund is called the iShares Bitcoin Trust (NASDAQ: IBIT). Their positions remain small, but their ownership is still noteworthy because they manage the three best-performing hedge funds in history as measured by net gains, according to LCH Investments.

-

Ken Griffin of Citadel Advisors bought a net total of 63,186 shares of the iShares Bitcoin Trust. The position represents less than one-tenth of a percent of his $494 billion portfolio.

-

David Shaw of D.E. Shaw & Company bought a net total of 2.6 million shares of the iShares Bitcoin Trust. The position represents one-tenth of a percent of his $107 billion portfolio.

-

Israel Englander of Millennium Management bought a net total of 10.8 million shares of the iShares Bitcoin Trust. The position represents two-tenths of a percent of his $216 billion portfolio.

Bitcoin more than doubled in value over the last year, and some Wall Street experts are predicting monster gains in the coming decades. Indeed, one forecast leaves room for Bitcoin’s price to appreciate 73,000% by 2045, which implies equivalent gains in the iShares Bitcoin Trust. Here’s what investors should know.

Wall Street bulls think Bitcoin could soar as much as 73,000%

Bernstein analyst Gautam Chhugani estimates Bitcoin could reach $500,000 by 2029 and $1 million by 2033 as the cryptocurrency is made increasingly mainstream by spot Bitcoin ETFs. The latter figure in that forecast implies about 1,390% upside from its current price of $67,000.

Cathie Wood at Ark Invest estimates Bitcoin could hit $3.8 million by 2030, provided that institutional investors “allocate a little more than 5% of their portfolios to Bitcoin,” which she sees as a likely outcome. That forecast implies 5,570% upside from its current price.

MicroStrategy Executive Chairman Michael Saylor estimates Bitcoin will reach $13 million by 2045, though he sees a bear-case scenario where it stops at $3 million and a bull-case scenario where it surges to $49 million. Saylor’s base case implies 19,300% upside from the current price, but the bull case implies 73,000% upside.

Those Wall Street bulls have at least one thing in common. They believe spot Bitcoin ETFs will unlock demand among institutional investors. Importantly, institutions have about $120 trillion in assets under management. Even a small percentage of those assets allocated to Bitcoin could cause its price to increase substantially.

The investment thesis for Bitcoin depends on adoption by institutions

The investment thesis for Bitcoin is simple: With supply limited to 21 million coins, its price is primarily determined by demand. Spot Bitcoin ETFs could boost demand among retail and institutional investors by eliminating traditional sources of friction associated with cryptocurrency exchanges.

To elaborate, spot Bitcoin ETFs let investors add Bitcoin to existing brokerage accounts, such that they no longer need distinct cryptocurrency exchange accounts. Also, spot Bitcoin ETFs tend to be cheaper than transacting on cryptocurrency exchanges. For instance, the iShares Bitcoin Trust has an expense ratio of 0.25%, but Coinbase Global charges 0.6% per transaction for orders under $10,000.

In January, Yassine Elmandjra at Ark Invest enumerated the benefits of spot Bitcoin ETFs following their approval in January 2024 by the SEC.

First, a spot ETF provides a direct way for institutional and retail investors to gain exposure to Bitcoin without dealing with the complexities of self-custody or other onboarding requirements. Second, spot ETFs legitimize Bitcoin as an institutional asset, which should catalyze Bitcoin’s acceptance and integration into traditional financial systems. Finally, spot ETFs should increase Bitcoin’s liquidity and trading volumes significantly.

Wood believes institutional investors will allocate about $6 trillion to Bitcoin by 2030, while Chhugani at Bernstein estimates a slightly more conservative $3 trillion by 2033. For context, spot Bitcoin ETFs have accumulated $63 billion in assets, which is about 1% of Wood’s prediction and 2% of Chhugani’s prediction.

However, spot Bitcoin ETFs have undoubtedly peaked institutional interest. 13F forms indicate that about 600 institutional investors had stakes in the iShares Bitcoin Trust as of the second quarter, up from about 450 in the first quarter. That figure should trend higher as time passes and professional money managers become more comfortable with Bitcoin.

Bitcoin is a very risky asset that could theoretically go to zero

Time for a reality check. Investors should bear in mind that forecasts are unreliable. There is no guarantee that Bitcoin comes anywhere close to the targets proposed by Chhugani, Wood, or Saylor. In fact, there is no guarantee that Bitcoin will be worth anything at all a decade from now.

The cryptocurrency has declined more than 50% on several occasions and similar drawdowns are probable in the future. Indeed, the cryptocurrency could theoretically drop to zero. So, investors should be comfortable with the idea of losing everything before they invest anything in Bitcoin, whether directly or indirectly through an exchange-traded fund like the iShares Bitcoin Trust.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,121!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,917!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,844!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Trevor Jennewine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin and Coinbase Global. The Motley Fool has a disclosure policy.

Billionaires Are Buying a BlackRock Index Fund That Could Soar Up to 73,000%, According to Wall Street Experts was originally published by The Motley Fool

Why I Just Bought This Ultra-High-Yield Dividend Stock

I viewed utilities as boring investments for much of my life. The closer I get to retirement, though, the more I realize the truth of the statement, “Boring is beautiful.”

My portfolio now includes several utility stocks. And I recently added another: UGI Corporation (NYSE: UGI). Why did I buy shares of UGI? Three key reasons rank at the top of the list.

1. A resilient business

The last thing I want to invest in these days is a company that could go under because of a bad move or two. UGI isn’t that kind of company because its business is highly resilient.

UGI owns AmeriGas, the largest retail propane distributor in the U.S. It operates natural gas utilities serving customers in Pennsylvania, Maryland, and West Virginia.

The company’s electric utility serves customers in Pennsylvania, and its Energy Services subsidiary operates natural gas pipelines and natural gas storage facilities. UGI also owns a liquified petroleum gas (LPG) distribution unit that serves several European countries.

The company has been in business for 142 years. It expects to deliver average long-term earnings-per-share growth of between 4% and 6%.

Sure, AmeriGas’ earnings have been highly volatile. Last year, Fitch lowered its outlook on the business to negative from stable.

However, UGI is committed to stabilizing AmeriGas by controlling costs and strengthening its balance sheet. Those efforts seem to be bearing fruit, based on the company’s solid fiscal 2024 third-quarter results.

2. An impressive dividend

I’d be lying if I said UGI’s dividend wasn’t an important part of my decision to buy the stock. Its forward dividend yield is an ultra-high 5.95%. Its payout ratio also stands at a reasonable level of 47.8%.

UGI has paid a dividend for 140 consecutive years, and that’s not a typo. The utility company first paid a dividend way back in 1884 and hasn’t missed a beat since. Few dividend stocks have such a reliable track record.

Over the last 10 years, UGI has increased its dividend by a compound annual growth rate of 6%. Granted, the company won’t give shareholders a dividend hike this year and doesn’t expect to do so in fiscal 2025 or 2026, either, as it focuses on strengthening its balance sheet. However, UGI plans to return to increasing its dividend payout by roughly 4% per year in fiscal 2027 and beyond.

3. An attractive valuation

UGI’s share price has trended mainly downward over the last three years. Its AmeriGas challenges served as a primary culprit behind this disappointing performance. However, there’s a positive side effect of the stock’s decline — an attractive valuation.

Zacks Equity Research gives UGI a grade of “A” on valuation, and the stock trades at only 8x forward earnings. That’s less than half the average forward price-to-earnings ratio of 18.8 for the S&P 500 utilities sector.

I might view UGI as a value trap if I didn’t think its future looked brighter than its recent past, but that’s not the case as the company’s financials are improving. It expects to deliver reliable earnings growth going forward.

Plus one bonus

Some investors like to “bet on the jockey and not the horse.” My take is that if the horse is fast enough, it doesn’t matter much who the jockey is. That said, I want solid, capable management in charge of the companies in which I invest.

It was a nice bonus, therefore, when UGI named Bob Flexon as its new CEO, effective Nov. 1, 2024. Flexon served as UGI’s CFO for roughly six months in 2011 and was CEO of power company Dynegy from July 2011 to April 2018. He’s also been CEO of engineering and construction contractor Foster Wheeler and CFO and COO of NRG Energy.

I didn’t load up on UGI stock because Flexon is taking the helm of the company, but he exemplifies the kind of leadership I like to see. With Flexon as CEO, I expect UGI will deliver the steadiness that investors want.

Should you invest $1,000 in UGI right now?

Before you buy stock in UGI, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and UGI wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Keith Speights has positions in UGI. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Why I Just Bought This Ultra-High-Yield Dividend Stock was originally published by The Motley Fool

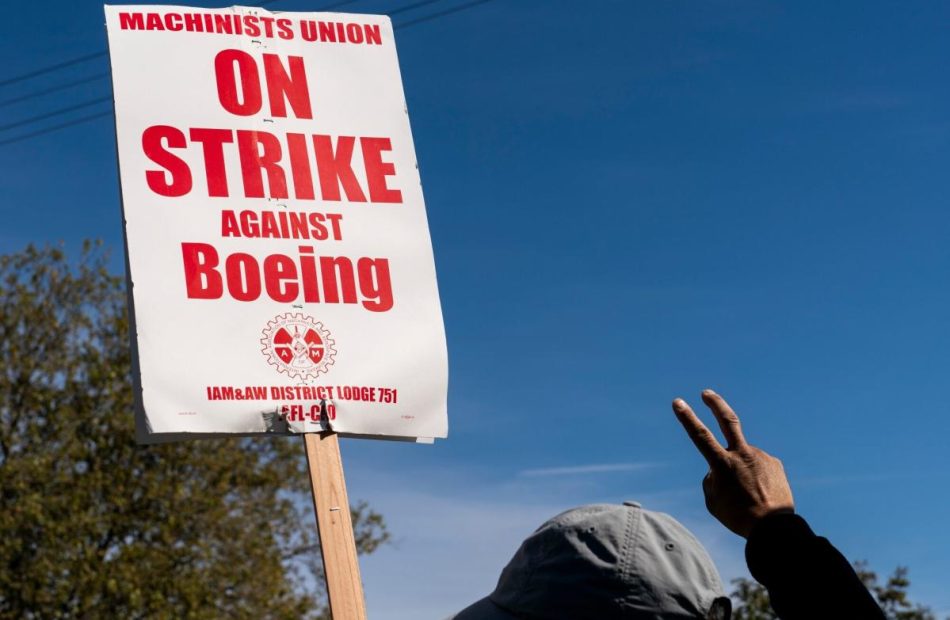

Boeing Proposes 35% Wage Hike in New Bid to End Lengthy Strike

(Bloomberg) — Boeing Co. and the union representing 33,000 striking workers reached a tentative agreement on a new contract with help from the White House, underscoring the high stakes to end a work stoppage that has crippled one of the largest US exporters.

Most Read from Bloomberg

The proposal hammered out overnight in Seattle includes a wage increase of 35% spread over four years, a guaranteed annual bonus of at least 4% and an additional $7,000 bonus if workers approve the contract, IAM District 751 said in a statement on its website Saturday. A ratification vote is set for Oct. 23.

The potential breakthrough ends a lengthy impasse marked by miscues and finger-pointing on both sides. The White House sent Acting Secretary of Labor Julie Su to Seattle to support the collective bargaining process, and she met multiple times with both the union and new Boeing Chief Executive Officer Kelly Ortberg to overcome the stalemate.

“President Biden believes the collective bargaining process is the best way to achieve good outcomes for workers, and the ultimate decision on a contract will be for the union workers to decide,” the White House said in a statement after the two sides confirmed that they’d reached a deal.

Resolving the strike would provide a boost to Ortberg, who joined Boeing in August with a mandate to revamp operations. He is slated to address analysts and investors for the first time Oct. 23, when Boeing reports its third-quarter results.

A tentative deal between Boeing and the union doesn’t guarantee that workers will also fall in line. When the first proposal, which was backed by both sides, was put to a vote last month, employees overwhelmingly turned it down.

Boeing has since come back twice with sweetened bids, first with a 30% increase that it took directly to workers, and now with the latest plan that is on the table and is 10 percentage points above the initial offer.

“We look forward to our employees voting on the negotiated proposal,” Boeing said in a statement.

Pressure Mounting

Pressure is mounting for Boeing, its suppliers and striking workers as the strike enters a sixth week. The work stoppage that began Sept. 13 stretches along the West Coast and has forced Boeing to shut down assembly lines for its cash-cow 737 Max, 767 and 777 aircraft.

The planemaker is moving forward with plans to cut 10% of its workforce, the first step toward a broader realignment of its businesses under Ortberg. The pain has also started to ripple through Boeing’s supply chain, with Spirit AeroSystems Holdings Inc. warning it would have to lay off 700 workers building components for the 767 and 777 programs.

Boeing has taken the initial steps to raise capital it will need to shore up its operations and maintain its investment-grade credit rating. The company has lined up a $10 billion credit facility with banks, and filed a shelf registration to raise as much as $25 billion over the next three years.

The strike by IAM District 751 marks the first major labor strife at Boeing in 16 years. As hourly workers are pushing for 40% pay increases and better retirement benefits, they’re driven by resentment over receiving paltry wage increases over the past decade while senior executives were richly rewarded.

The latest agreement addresses many of the frustrations that workers expressed with the company’s earlier proposals. But it doesn’t reinstate Boeing’s defined-benefit pension plan, a potential sticking point for some members.

Instead, Boeing would raise its contributions to workers’ retirement savings plans. The company would make a one-time contribution of $5,000 into the 401(k) plans of all eligible workers, and fully match their contributions of as much as 8% of salaries.

–With assistance from Allyson Versprille and Danny Lee.

(Updates with White House comment in fourth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Here's where investors worried about a stock market bubble should put their money, according to a top economist

-

Investors worried about a market correction should adjust their portfolios, David Rosenberg says.

-

The top economist has warned stocks are in a bubble and at risk of a major decline.

-

He advised investors to pay attention to key sectors and add “insurance” to their portfolios.

A number of Wall Street forecasters have been warning of a stock bubble as the market climbs to a series of fresh highs in 2024 — and investors worried about such a scenario should be putting their money in a handful of assets to protect themselves from the eventual bursting.

That’s according to David Rosenberg, a top economist and the founder of Rosenberg Research, who’s been warning of a potential craash in stocks for months. In the past, he’s warned of a 39% correction to stocks, among the more extreme predictions on Wall Street, where most investors are feeling optimistic about a soft landing amid a robust economy and easing interest rates.

“Watching the market these days is like watching a clown blowing up a balloon (or Chuck Prince dancing the ballroom), knowing the inevitable,” Rosenberg said in a note to clients on Friday. “When this mega-bubble pops, it will be spectacular.”

Investors need to exercise caution and avoid following the “herd mentality,” Rosenberg said, pointing to the fervor for mega-cap tech stocks. Instead, he said, investors should focus on stocks with strong business models, strong growth, and good prices, and add some “insurance” to their portfolios.

Below are his top investment ideas for to prepare for the potential bursting of a market bubble.

Healthcare and consumer staples

Investors should gear their investments towards what people will always need in the future. In particular, Rosenberg recommended that investors pay attention to options in the healtcare and consumer staples sectors.

“Focus on where people are going to focus on what they need, not what they want,” Rosenberg wrote. “Anything related to e- commerce, cloud services, and wiring up your home to become your new office has been in a budding secular growth phase.”

Utilities

Utility stocks also look promising. Other forecasters have predicted huge upside for utility firms, due to the growing need for power and data centers stemming from the AI boom.

“Utilities, as we have been saying for a long time, are as close to a ‘no brainer’ as there is, given their yield attributes and their being re-rated for ‘defensive growth’ owing to enhanced earnings visibility through the strong and secular outlook for US power needs,” Rosenberg said.

Aerospace, Defense

Aerospace and defense stocks could also be a buy, he added, given rising geopolitical tensions around the world.

“Aerospace/defense has been a long-standing bull call for us for several years, and the best hedge against an increasingly troubled world where military budgets are expanding everywhere — and not at all sensitive to who comes to power on November 5th.”

Big tech

While some areas of tech are exhibiting bubble characteristics, investors could still seize on opportunities in some large-cap tech names, given the prevalence of work-from-home, cloud services, and remote work, Rosenberg said. Still, investors should wait to scoop up tech names at better prices, he said.

“I’d prefer to pick these plays up at better prices than we have today because this last melt-up has eaten enough into future expected returns to keep us cautious for now. But we would be an avid buyer on any significant pullback.”

Safe bets

Investors should look to put a “dose of insurance” in their portfolios. That means gold — the “truest store of value,” Rosenberg says, — as well as government bonds.

“The beautiful thing about gold is that it is not a liability that a central bank can simply have forgiven or a currency that can simply be printed by government fiat,” he said of the precious metal. “I also favor the Treasury market because it commands just about the highest yield of any major industrial country – and with the great liquidity attributes.”

Real estate investment trusts could also be good ways to hedge risk, Rosenberg said. That particularly applies to REITs tied to the industrial and healthcare sectors.

“In any event, we all have to become increasingly thematic and thoughtful in our decision-making and more selective than normal because the stock market, and financial assets in general, have become nothing more than a momentum casino,” he added.

Most forecasters on Wall Street still expect a strong performance from equities into year-end and 2025. Goldman Sachs, UBS, BMO, and Deutsche Bank have raised their year-end price targets for the S&P 500 in recent weeks, with new forecasts ranging from 5,750 to 6,400.

Read the original article on Business Insider

3 Bargain Stocks to Buy in a Market That's Priced for Perfection

How richly valued are stocks right now? Legendary investor Warren Buffett has built Berkshire Hathaway‘s cash stockpile up to roughly $277 billion. When Buffett is sitting on that much cash because he can’t find appealing investments to buy, you know stocks are expensive.

There are exceptions, though. In a market that’s broadly speaking priced for perfection, three Motley Fool contributors have identified what they think are bargain stocks to buy: Axsome Therapeutics (NASDAQ: AXSM), CRISPR Therapeutics (NASDAQ: CRSP), and Pfizer (NYSE: PFE).

A biotech with multiple catalysts on the horizon

Prosper Junior Bakiny (Axsome Therapeutics): Few things can jolt biotechs, especially relatively small ones, like solid clinical and regulatory wins. Axsome Therapeutics, a drugmaker with a market cap of about $4.3 billion, could experience quite a few of those in the next two years. It has already made tremendous progress since the start of the decade, going from a clinical-stage biotech to one with two approved products on the market. But it isn’t done yet.

Within the next 12 months, AXS-07, a potential therapy for migraines, and AXS-14, an investigational treatment for fibromyalgia, could both earn regulatory approval. The company will also release results from multiple clinical trials in the coming months. Positive results could lift Axsome Therapeutics’ share price.

Is the biotech a bargain stock? In my view, the answer is yes. While Axsome Therapeutics generates little revenue and is still unprofitable — which isn’t unusual for biotechs of this size — its late-stage pipeline is incredibly promising. Before long, it should have a lineup with four to six products that will generate growing sales for years.

Axsome Therapeutics’ valuation continues to lag the potential of its pipeline. Sure, it could experience clinical and regulatory setbacks — indeed, it has already faced some. However, there is a good chance that it will generate strong returns in the next five years, partly because its likely successes aren’t baked into its valuation. That’s why I’d advise investors to buy the stock today.

A biotech with tons of upside

David Jagielski (CRISPR Therapeutics): Although it may seem like just about every growth stock is trading at a significant premium these days, there are some bargain-basement options available. One is gene-editing company CRISPR Therapeutics. It is down 24% this year, but optimism should be higher than ever for the business as it is on the cusp of some exciting growth opportunities.

Within the past year, the Food and Drug Administration approved CRISPR’s treatment Casgevy for two indications — sickle cell disease and transfusion-dependent beta-thalassemia. It could be a life-changing treatment for patients with these conditions as it provides them with a functional cure. That’s part of the reason why its list price is as high as it is — $2.2 million. CRISPR will split the profits on Casgevy 40/60 with its development partner, Vertex Pharmaceuticals.

Prior to this, CRISPR didn’t have any approved products; now, it may have a path to profitability. But despite this, the biotech stock is trading around the levels it was at back in 2019. Casgevy has the potential to generate more than $1 billion in annual revenue at its peak and is likely to play a pivotal role in CRISPR’s growth.

For investors looking for a real bargain, you don’t need to look much further than CRISPR Therapeutics. The business is still in the early stages of rolling out Casgevy, and over time investors should expect to see stronger financial results from the company. As that happens, it could trigger a big rally.

Post-pandemic problems but a brighter future

Keith Speights (Pfizer): I won’t sugarcoat matters: Pfizer faces some problems. Sales of COVID-19 vaccine Comirnaty have plunged as worries about the pandemic have subsided. Several of the company’s top blockbuster drugs will lose patent exclusivity over the next few years. And Pfizer recently voluntarily withdrew its sickle cell disease drug, Oxbryta, from the market because of safety concerns.

Because of these problems, Pfizer’s share price has fallen by more than 50% since late 2021. However, there have been two positive effects of this steep decline for investors. First, Pfizer’s forward dividend yield has risen to 5.7%. Second, the stock’s valuation has become much more attractive. Pfizer’s shares now trade at 10.6 times forward earnings. That’s well below the forward earnings multiple of 18.6 for the S&P 500 healthcare sector.

This low metric raises a question, though: Is Pfizer stock a value trap? I think the answer is a resounding “no.” The company’s future is brighter than you might think.

Pfizer recently returned to year-over-year revenue growth for the first time since late 2022, when its COVID-19 vaccine and antiviral sales were at their peak. Acquisitions have been key to this turnaround. Migraine drug Nurtec ODT, which Pfizer picked up with its 2022 acquisition of Biohaven, contributed $356 million in sales in the second quarter of 2024. Adcetris and Padcev, cancer drugs added to Pfizer’s lineup with its 2023 buyout of Seagen, together generated $673 million in sales in Q2.

I expect new products — both those developed in-house and those gained through acquisitions — will more than offset the declines in revenue from drugs that lose their exclusivity over the next several years. Pfizer’s pipeline, which features 33 late-stage programs, could produce other big winners.

Should you invest $1,000 in Axsome Therapeutics right now?

Before you buy stock in Axsome Therapeutics, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Axsome Therapeutics wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

David Jagielski has no position in any of the stocks mentioned. Keith Speights has positions in Berkshire Hathaway, Pfizer, and Vertex Pharmaceuticals. Prosper Junior Bakiny has positions in Vertex Pharmaceuticals. The Motley Fool has positions in and recommends Axsome Therapeutics, Berkshire Hathaway, CRISPR Therapeutics, Pfizer, and Vertex Pharmaceuticals. The Motley Fool has a disclosure policy.

3 Bargain Stocks to Buy in a Market That’s Priced for Perfection was originally published by The Motley Fool

SoFi Technologies price target raised to $12.50 from $11 at Citi

Citi analyst Andrew Schmidt raised the firm’s price target on SoFi Technologies (SOFI) to $12.50 from $11 and keeps a Buy rating on the shares. The firm says conditions for continuation of positive sector performance remain in place for the FinTech group heading into the Q3 reports. Citi believes a relatively benign macro environment thus far, steady-to-lower rates, more even fund flows, improving sentiment regarding larger-cap multiple ceilings and transitions, and further profitability ramps can better support stock valuations. The analyst’s stock preferences “shift further along the risk spectrum, which correspond to the new sector phase.”

Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>>

See today’s best-performing stocks on TipRanks >>

Read More on SOFI:

SCHD: Split or Not, This Is a Strong Dividend ETF

The Schwab U.S. Dividend Equity ETF (SCHD) is one of the most popular dividend ETFs in the market today with a massive $63.7 billion in assets under management (AUM).

The fund recently made some waves by executing a 3-for-1 split which went into effect on October 10th. We’ll discuss the rationale and details regarding the share split in this article. But more importantly, we’ll evaluate the merits of holding SCHD in an investment portfolio.

I’m bullish on this well-known dividend ETF based on the strength of its attractive yield, its diversified portfolio of highly-rated dividend stocks, and an ultra-low expense ratio.

What Is the SCHD ETF’s Strategy?

According to fund sponsor Charles Schwab, SCHD’s strategy is simply to invest in an index called the Dow Jones U.S. Dividend 100 Index. The index is “focused on the quality and sustainability of dividends.” The fund also “invests in stocks selected for fundamental strength relative to their peers, based on financial ratios.”

Examining the Split

As one of the most popular dividend ETFs in the market, SCHD recently made some waves when it conducted a 3-for-1 stock split that went effective on October 10, 2024. It’s much more common for company stocks to split than ETFs, and here is a rare case where an exchange-traded fund has split. The split doesn’t have any fundamental impact on SCHD’s investment prospects. What’s occurred is that investors now own three shares of SCHD for every one share previously held, while the market price of the ETF is 1/3 the value it would be without the split.

A share split has some minor benefits, such as the lower price per share making it easier for smaller investors to establish an investment. A stock split can also enhance liquidity. It may also trigger increased options activity on the ticker (an options contract consists of 100 shares). But with all that said, the outlook for SCHD stock should be no different now than if no split had taken place.

Many popular stocks that have engaged in stock splits over the past year, like Nvidia (NVDA) and Broadcom (AVGO), had share prices of well over $1,000 a share, making a split more meaningful. Those splits made it significantly more affordable for investors to buy a share, or one lot (100) of shares. SCHD, on the other hand, was trading at just under $85 per share before the split, so the need for a split seemed less apparent here. The ability to buy fractional shares on brokerages like Robinhood (HOOD) and others also mitigates the need for stock splits to some degree.

Regardless, at the end of the day, this is the same solid dividend ETF with the same holdings it had prior to the share split.

Portfolio of Blue-Chip Dividend Stocks

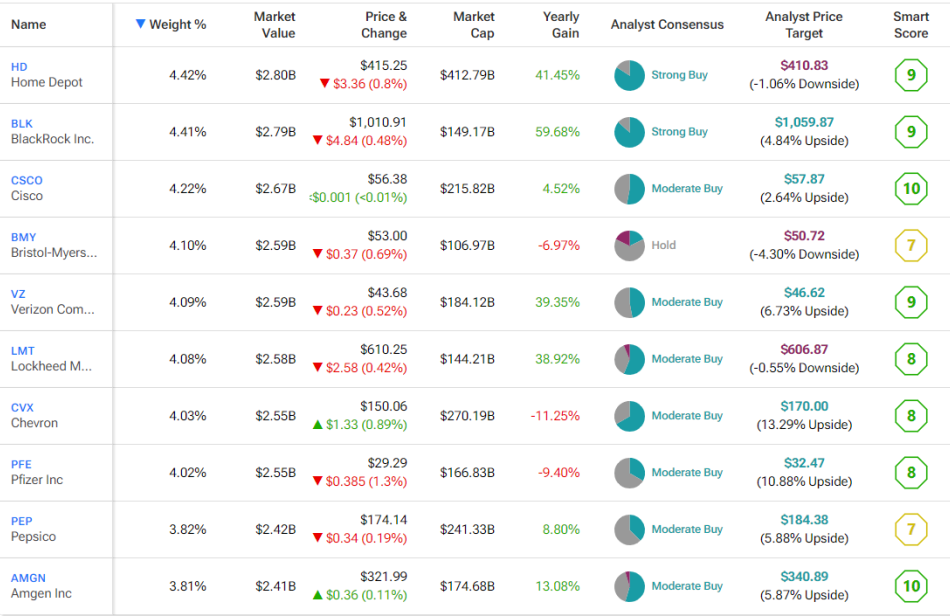

The SCHD ETF offers sound diversification to investors. It owns 100 stocks, and its top 10 holdings account for 41.0% of its assets. Below, you’ll find an overview of SCHD’s top 10 holdings from TipRanks’ holdings tool.

As you can see, the fund owns a plethora of well-known dividend stocks, ranging from top holding Home Depot (HD), to BlackRock (BLK), to Lockheed Martin (LMT).

In addition to being blue-chip dividend stocks, another thing that these top holdings have in common is that they offer strong Smart Scores. The Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from one to 10, based on eight key market factors. The score is data-driven and does not involve any human interpretation. Impressively, eight stocks from SCHD’s top 10 holdings have Smart Scores of eight or better.

The Smart Score system also rates SCHD itself favorably, giving it an Outperform-equivalent ETF Smart Score of 8.

Advantageous Valuation

Beyond being top dividend stocks, another nice thing about SCHD’s holdings is that overall, they are fairly inexpensive. The ETF’s holdings currently have a price-to-earnings ratio of 17.6x. This is another reason I’m bullish on the ETF.

While a 17.6x P/E ratio isn’t dirt cheap, it’s considerably more affordable than the broader market at a time when the S&P 500 has a price-to-earnings ratio of 24.7x.

This means that SCHD and its holdings probably offer a bit more downside protection than the broader market, and potentially have a bit more room for upside from multiple expansion. The fund also carries a beta of 0.74. This means that SCHD’s share price is only about three-quarters as volatile as the broader market. This adds credence to SCHD’s defensive qualities (as discussed above in the valuation section) which can be attractive for investors seeking to avoid volatility.

Assessing SCHD’s Performance

SCHD has generated solid returns for its shareholders over the years. As of September 30th, the ETF has produced a three-year annualized return of 8.2%, a five-year annualized return of 13.0%, and a 10-year annualized return of 11.7%.

It’s worth noting that SCHD has lagged behind broad market funds like the Vanguard S&P 500 ETF (VOO) over each of these time frames (for reference, VOO has posted an annualized five-year return of 15.9%). That is likely attributable to the growth opportunities many non-dividend paying companies have available.

SCHD’s underperformance against the S&P 500 index (SPX), and its tracking ETFs, comes at a time when many large-cap tech stocks with small (or no) dividends have powered the index. If we return to an environment where more value-oriented dividend stocks are favored again, SCHD could outperform the broad market. For example, SCHD has slightly outperformed VOO over the past three months in what has been a volatile time for tech stocks.

Regardless of comparisons, double-digit returns over a 10-year time horizon, like SCHD has delivered, are nothing to scoff at. Furthermore, for investors who own a large number of high-flying tech stocks, SCHD could provide worthwhile diversification benefits.

SCHD Offers an Attractive Yield

The SCHD ETF currently yields 3.4%. This is an attractive yield and more than double the current yield of the S&P 500. That’s pretty attractive.

Furthermore, the fund has a track record of dividend consistency. SCHD has paid a dividend for 12 straight years, and increased its payout annually. The dividend payout has been growing at a solid 12% clip over the past five years, so investors can likely expect continued increases in payouts over time. Unless, of course, hard times hit Corporate America, forcing some companies to cut their dividend.

Low Expense Ratio for SCHD

SCHD charges a bargain-bin expense ratio of just 0.06%. This means that an investor with $10,000 in the fund will pay just $6 in fees over the course of a year. It’s hard to argue with this expense ratio; it’s less than the price of a fast-food lunch these days.

The savings from a low-fee investment fund like SCHD can really add up over time. Assuming that the current expense ratio remains the same, and the fund returns 5% per year on an annualized basis going forward, an investor putting $10,000 into SCHD would pay just $77 in fees over the course of a decade.

Is SCHD Stock a Buy, According to Analysts?

Turning to Wall Street, SCHD earns a Moderate Buy consensus rating based on 54 Buys, 37 Holds, and 10 Sell ratings assigned in the past three months. The average SCHD stock price target of $30.16 implies about 5% upside potential from current levels.

In Conclusion

I’m bullish on SCHD based on its attractive 3.4% dividend yield, its diversified portfolio of highly-rated blue-chip dividend stocks, the relatively inexpensive valuation of these holdings, and the fund’s investor-friendly expense ratio.

The recent 3-for-1 split was an interesting development but ultimately doesn’t change much for the ETF or its holders.

The one downside of SCHD is that it has lagged the broader market over the years, despite posting respectable double-digit annualized returns. As noted above, some of SCHD’s underperformance versus the S&P 500 is due to the dominant performance of large-cap tech stocks, companies that don’t generally pay attractive dividends.

SCHD stock could be serve a valuable purpose in an investor’s portfolio, by delivering strong dividend income and lower volatility. SCHD could also outperform should investors rotate away from growth and back toward value-oriented dividend stocks.

The S&P 500 Just Did This for the First Time in 13 Years. Here's What History Says Happens Next.

The S&P 500 (SNPINDEX: ^GSPC) is the most widely followed stock market index in the U.S. and includes the 500 largest companies in the country. Because it contains a broad swath of American businesses, it’s also considered by many to be the best overall benchmark and the most reliable gauge of overall stock market performance.

The storied index has been squarely in rally mode since it bottomed in October 2022, driven higher by waning inflation, the advance of artificial intelligence (AI), and the Federal Reserve Bank’s long-awaited decision to begin its campaign of interest rate cuts. These factors have combined to create an environment that’s ripe for the stock market rally to continue.

The S&P 500 just delivered its best January-through-September performance since 1997 and has now entered the third year of its current bull market run, something that hasn’t happened since 2011. If history is any indicator, the current rally still has much further to go.

A bull can run a long way

Fresh off the worst bear market since 2009, investors are relishing the good times — and well they should. History shows that bull markets have more stamina and tend to last much longer than their bearish counterparts.

Since World War II, the average bull market has lasted roughly four and a half years, according to data compiled by Bespoke Investment Group. For context, that’s far longer than the average bear market, which lasts roughly one year.

That said, not all bull markets are created equal. For example, the bull market that started in 1987 ran for more than 12 years, while the bull market that began in 2009 ran for 11 years. On the other end of the spectrum, the bull market that began in 2001 lasted just three months.

The current rally just completed its second full year, so — if history holds true — this bull market still has further to run. Of the 13 bull markets that have occurred over the past 77 years, seven have lasted three years or more, so history is on the side of the bulls.

Then there’s the matter of returns. Bull markets have generated returns of 152%, on average, which bodes well for current investors. However, the market gains varied greatly, depending on the length of the rally. For example, the bull market that began in 1987 generated returns of 582%, while the one that began in 2009 returned 400%. However, the short-lived rally of 2001 — which lasted just three months — returned just 21%.

Generally speaking, the longer the bull market, the greater the potential returns. That holds true for the ongoing run as well. Looking back to October 2022 — the beginning of the current market rally — the S&P 500 has generated returns of 63%. If history holds true, the current bull market has much more to give.

Where do we go from here?

There are plenty of opinions about the market and where we go from here. Goldman Sachs Chief U.S. Equity Strategist, David Kostin, just boosted his 2024 year-end target for the S&P 500 to 6,000 while lifting his 2025 target to 6,300. This suggests that after notching 22% gains already this year, the index is poised to tack on an additional 3%. It also suggests that the S&P 500 will climb 5% in 2025.

While market prognosticators will provide their best guesses about what happens from here, the truth is no one knows for sure. If the economy keeps ticking along, and business and consumer spending hold up, the current bull market has a shot at joining some of the longer bull market runs in history.

However, things don’t always go as planned. Investors should be aware of the potential for a “black swan” event, a random and seemingly unpredictable happening that can have an enormous impact on the financial landscape. Think the 2008 financial crisis or the recent global pandemic. Many a bull market run has been derailed by a black swan.

Does that mean investors should hunker down and fear the worst? Far from it. Market legend Peter Lynch — one of the most successful investors of all time — said, “Far more money has been lost by investors in preparing for corrections, or anticipating corrections, than has been lost in the corrections themselves.” This knowledge should help investors be mentally prepared for events that couldn’t possibly be foreseen.

The biggest takeaway from this exercise is that time is the biggest advantage that investors have. As illustrated by the above chart, the stock market has generated robust returns over time despite market downturns. Buying quality stocks and holding them for the long term is the best strategy for thriving in a bull market. Furthermore, continuing to add to your portfolio at regular intervals — a process known as dollar-cost averaging — and keeping it up during both bull and bear markets helps develop the discipline needed to thrive no matter what the conditions.

The stock market has returned 10% annually, on average, over the past 50 years, which helps illustrate the benefits of investing for the long term.

Should you invest $1,000 in S&P 500 Index right now?

Before you buy stock in S&P 500 Index, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and S&P 500 Index wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Danny Vena has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Goldman Sachs Group. The Motley Fool has a disclosure policy.

The S&P 500 Just Did This for the First Time in 13 Years. Here’s What History Says Happens Next. was originally published by The Motley Fool