Warren Buffett Recently Sold $800 Million Worth of This Artificial Intelligence (AI) Stock, While Buying Another $345 Million Worth of His Favorite Stock

Warren Buffett has served as the CEO of Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) since 1965. He and his team manage a portfolio of publicly traded stocks and securities worth $318 billion, in addition to $277 billion in cash and numerous private wholly owned subsidiaries.

Berkshire stock has delivered a compound annual return of 19.8% under Buffett’s leadership, which could have turned an investment of $1,000 into more than $42 million over his 59-year tenure. That’s why Wall Street closely watches his every move.

During the second quarter of 2024, Berkshire went on a selling spree, cutting its $160 billion stake in Apple in half and trimming a number of other positions, including Chevron, T-Mobile, and Capital One Financial, to name just a few.

Berkshire also sold its entire $800 million position in data specialist Snowflake (NYSE: SNOW), which it had held since 2020. But there is one stock Buffett clearly still loves.

Snowflake wasn’t a great fit for Berkshire’s portfolio

Berkshire’s sales of Apple, Chevron, and T-Mobile might reflect Buffett‘s cautious view on the broader stock market overall. The S&P 500 index currently trades at a price-to-earnings (P/E) ratio of 27.8, which is a 53% premium to its long-term average P/E of 18.1 going back to the 1950s. Prudent portfolio management can involve taking money off the table when the market looks expensive.

However, I think Berkshire might have sold Snowflake stock for a different reason. Despite its growing portfolio of AI products and services, the cloud computing company is experiencing a deceleration in its revenue growth and blowout losses at the bottom line. Buffett often invests in companies for their robust profitability, because it allows them to maintain shareholder-friendly programs like stock buybacks and dividend schemes for the long term, which help compound his gains. Snowflake simply doesn’t fit the bill.

Berkshire bought Snowflake stock ahead of its IPO in 2020, so we don’t know exactly what price it paid. However, it floated at $120 per share, which is roughly where it’s trading today, so Snowflake basically hasn’t delivered any gains in its four-year period as a public company, despite the S&P 500 setting multiple record highs over that stretch.

Snowflake’s Data Cloud helps large organizations aggregate their valuable information in one place so they can analyze it to extract valuable insights. The company could do well in the AI race, because its new Cortex platform allows businesses to combine their data with ready-made large language models (LLMs) to build powerful AI software.

Cortex also comes with several pre-built AI tools to further enhance the Data Cloud. Document AI, for example, allows businesses to extract information from unstructured sources like contracts and invoices. In the past, human workers would have to read through those documents and manually transfer the data into a usable format, so Document AI could save the user an incredible amount of time.

I don’t think Snowflake stock is destined for an upside surge in the near term (and apparently neither does Buffett), but it’s a stock to watch as the AI industry expands.

Buffett continues to plow money into his favorite stock

You won’t find Buffett’s favorite stock in Berkshire’s quarterly 13F filings, because that stock is…Berkshire Hathaway! Despite his cautious approach to the broader market, Buffett continued to authorize stock buybacks during the second quarter of 2024, deploying $345 million into Berkshire shares.

Why do I call it his favorite stock? Besides the fact he has been at the helm of Berkshire Hathaway for 59 years, Buffett has authorized the repurchase of $77.8 billion worth of its shares since 2018, which is twice the amount he spent buying Apple! In other words, you could argue he often sees more value in his own company than any other across the entire market.

Buybacks are Buffett’s preferred way to return money to shareholders. Berkshire can continue repurchasing stock at management’s discretion as long as its cash, equivalents, and holdings in U.S. Treasury bills remain above $30 billion. Since the conglomerate is sitting on a whopping $277 billion in liquidity right now, the buybacks probably won’t stop anytime soon.

There is one caveat. Berkshire stock currently trades at a price-to-sales ratio of 2.5, which is 26% higher than its 10-year average of 1.98. That means it isn’t cheap, which probably explains why Buffett only authorized $345 million worth of buybacks in the second quarter — the smallest amount Berkshire spent acquiring its own shares in any quarter since it resumed buybacks in 2018.

What should investors do from here?

Snowflake is one of many AI stocks, and its issues aren’t necessarily typical of the others. Nvidia, for example, is experiencing triple-digit growth in its revenue and earnings, and its stock is trading near a record high. Simply put, Berkshire’s sale of Snowflake isn’t a sign investors should avoid the rest of the sector.

But the S&P 500 is undeniably expensive right now. That doesn’t mean it has to fall — Buffett himself will tell you he has no idea what the market will do tomorrow, or even a year from now. He’s a long-term investor who buys quality companies and lets time do the hard work.

He does have a duty to Berkshire’s shareholders, though, which means he is obligated to make decisions that he thinks will deliver the most value. That occasionally involves selling large volumes of stock, as Berkshire has done this year.

Buffett often recommends that regular investors buy exchange-traded funds (ETFs), which directly track the performance of indexes like the S&P 500. Even though the market looks expensive today, its current price will probably look cheap when we reflect on this moment 10 years from now. Therefore, consistently adding to an ETF each month can yield powerful results over time.

Berkshire holds positions in the Vanguard S&P 500 ETF and the SPDR S&P 500 ETF Trust, both of which are great options for investors.

Should you invest $1,000 in Snowflake right now?

Before you buy stock in Snowflake, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Snowflake wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple, Berkshire Hathaway, Chevron, Nvidia, Snowflake, and Vanguard S&P 500 ETF. The Motley Fool recommends T-Mobile US. The Motley Fool has a disclosure policy.

Warren Buffett Recently Sold $800 Million Worth of This Artificial Intelligence (AI) Stock, While Buying Another $345 Million Worth of His Favorite Stock was originally published by The Motley Fool

Lucid CEO Peter Rawlinson Talks Saudi Investment, Elon Musk's Political Views And Taking Business From Tesla

In an interview with Semafor published on Thursday, Peter Rawlinson, CEO of Lucid Group, Inc. LCID discussed the company’s relationship with the Public Investment Fund (PIF) of Saudi Arabia, Lucid’s rivalry with Tesla, Inc. TSLA and Elon Musk‘s political views.

Saudi Money: Saudi Arabia’s PIF has invested approximately $8 billion in Lucid, and the sovereign wealth fund holds about a 60% stake in the EV maker, making it the company’s largest shareholder. Lucid is also building a factory in Saudi Arabia with an annual production capacity of 150,000 vehicles. The PIF has said that it views Lucid as an important part of its strategy to diversify Saudi Arabia’s economy and invest in future technologies.

“They are looking for multipliers that can help their transition,” Rawlinson said regarding the Saudi partnership. “I didn’t go out and try to seek Saudi money specifically. But I needed billions of dollars.”

Lucid announced a public offering of its stock on Wednesday and Saudi PIF-affiliate Ayar Third Investment Company had agreed to purchase an additional 374,717,927 shares of Lucid’s stock in a private placement in connection with the offering. The company expects to receive another $970.2 million in gross proceeds from the PIF’s latest investment.

Rawlinson on Elon Musk’s Politics: Rawlinson revealed that he knows Elon Musk “very well” after working for him for three years, but that the Tesla CEO has become “distracted with politics.”

“His mind is not where it was, and you see the result now,” Rawlinson said in the interview. “We’re the new leader, and many of my team from Tesla have come and joined me.”

Rawlinson went so far as to claim that he was not only taking staff from Tesla due to Musk’s political involvement, but said former Tesla customers are fleeing to Lucid as well. He illustrated his point with an anecdote about an email from a customer who switched from Tesla to Lucid.

“We just couldn’t drive around in a Tesla anymore. We bought a Lucid out of disdain for Elon, but now we’ve got it, we can’t believe what we’ve got,” Rawlinson said the customer wrote.

EV Demand: Lucid recently scaled back its production targets, though Rawlinson claims Lucid is outperforming luxury EV competitors in certain markets.

“In some markets now, Lucid Air is outselling Tesla Model S,” Rawlinson stated.

The Lucid CEO said vehicle manufacturing is not a problem and pointed to the company’s production levels of 100 EVs per day in 2022. He sees Lucid’s problem as low EV market demand.

“The market is tough. The actual sales numbers of EVs are increasing. It’s just that the rate of increase was not what we anticipated.”

LCID Price Action: According to Benzinga Pro, Lucid shares ended Friday’s session at $2.63, down more than 22% over the past five days.

Read Also:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Veterans United Launches Homebuyer Readiness Index

Proprietary Index Shows More Buyers Feel Ready to Enter the Market as Optimism About the U.S. Economy Reaches Highest Level in Six Quarters

COLUMBIA, Mo., Oct. 18, 2024 /PRNewswire/ — Today marks the official launch of the Veterans United Homebuyer Readiness Index, a proprietary measure of financial aptitude and optimism among prospective Veteran and civilian homebuyers created by Veterans United Home Loans, the nation’s largest VA lender. Buoyed by growing optimism about the U.S. economy, the latest quarterly index reading shows that prospective buyers are more optimistic about a new home purchase than anytime over the past 18 months.

The index reading for all would-be buyers rose to 67 in the third quarter, the highest yet for the score, which Veterans United began tracking in early 2023. Veterans and service members continue to feel more prepared for homebuying than their civilian counterparts. But the three distinct scores overall were the highest readings yet.

Veterans United Homebuyer Readiness Index

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Overall |

53 |

52 |

55 |

59 |

62 |

67 |

|

Veterans |

57 |

55 |

60 |

64 |

64 |

70 |

|

Civilians |

50 |

50 |

50 |

55* |

59 |

64 |

*Civilian sample not included in Q1 2024. This is an average of Q4 2023 and Q2 2024.

The index tracks homebuying sentiment and preparedness using the company’s quarterly national survey of Veterans, service members and civilians with near-term homebuying plans, creating unique scores related to four key areas: home purchase time frame, personal financial outlook, outlook on the U.S. economy and purchase motivators. Those unique scores roll up into an overall readiness score.

Optimism about the U.S. economy was the primary driver of homebuyer readiness in the latest quarter. More than half of homebuyers said the economy will be better off in the coming year, marking the first time a majority of respondents have offered a positive economic outlook.

Nearly three-quarters (74%) of Veterans and service members plan to buy in the next year, compared to 69% of civilians. This compares to 67% and 75% during the same period a year ago, respectively.

“This growing confidence in the economy is translating directly into the housing market in communities across the country,” said Chris Birk, vice president of mortgage insight at Veterans United. “With inflation showing signs of easing and more consumers believing mortgage rates will stabilize or even decrease, we’re seeing a significant boost in homebuying readiness. Although high interest rates and home prices remain a concern among prospective homebuyers, there is growing optimism, especially among Veterans and service members, which could drive increasing demand in the months ahead.”

Homebuyer Timeline

Veterans and service members are adjusting their buying timelines, while civilians are showing less intent to buy compared to last quarter.

The percentage of Veterans and service members intending to buy a home in the next three years dipped slightly in the third quarter. But the percentage of those who plan to buy in the next 12 months jumped to 74% in the third quarter from 67% in the third quarter of last year.

Fewer civilian respondents plan to buy homes in the next three years (40% in Q3). The percentage of civilians who plan to buy in the next year fell to 69% in the third quarter from 75% a year prior.

Homebuyer Timeframe Score

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Overall |

59 |

58 |

58 |

61 |

63 |

62 |

|

Veterans |

64 |

61 |

66 |

68 |

69 |

69 |

|

Civilians |

54 |

54 |

51 |

54* |

58 |

55 |

*Score is calculated by taking the average of the two time frames. No civilian sample was included in Q1 2024; data shown is an average of Q4 2023 and Q2 2024 used as a proxy.

Personal Finances Outlook

Financial confidence continues to improve, with the Personal Financial Outlook Score reaching 40 for Veterans and service members and 38 for civilians, both the highest readings yet. Nearly half (48%) of Veterans, service members and civilians (47%) reported feeling at ease with their finances.

The third quarter also shows a continued boost in optimism about would-be buyers’ own personal finances. About 70% of civilians and 65% of Veterans expect their personal finances to improve over the coming year, up from 58% and 56% a year ago, respectively.

Personal Financial Outlook Score

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Overall |

25 |

25 |

27 |

31 |

33 |

39 |

|

Veterans |

35 |

31 |

37 |

39 |

37 |

40 |

|

Civilians |

16 |

20 |

17 |

23* |

30 |

38 |

*No civilian sample was included in Q1 2024; data shown is an average of Q4 2023 and Q2 2024 used as a proxy.

U.S. Economic Outlook

Over the last year, there’s been a significant increase in feeling the economy is heading in the right direction. The overall U.S. Economic Outlook Score climbed to 102 in the third quarter, reflecting confidence in the economy and that inflation is easing.

There’s also growing optimism about mortgage rates. The percentage of Veterans and service members who think rates will be lower over the next year jumped 10 percentage points quarter-over-quarter (35%), while the percentage who think rates will be higher in the coming year fell to its lowest level in the history of the survey (38%).

Civilian prospective buyers remain more pessimistic about rates than Veterans. Only about a quarter of civilians expect mortgage rates to be lower in the coming year, while nearly half (47%) think they’ll be higher.

Economic Outlook Score

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Overall |

72 |

69 |

76 |

85 |

90 |

102 |

|

Veterans |

70 |

70 |

76 |

90 |

94 |

107 |

|

Civilians |

73 |

68 |

76 |

81* |

85 |

97 |

*No civilian sample was included in Q1 2024; data shown is an average of Q4 2023 and Q2 2024 used as a proxy.

Purchase Motivators

High home prices and interest rates remain the top two barriers to homebuying for all groups. But recent Federal Reserve rate cuts have both Veterans and civilians feeling significantly better about where mortgage rates are heading.

Just 46% of Veteran prospective buyers cited high interest rates as a barrier to homebuying in the third quarter, down from 52% the previous year. The civilian figure fell seven percentage points, from 46% in the third quarter of 2023 to 39% in the third quarter this year.

Purchase Motivators Score

|

Q2 2023 |

Q3 2023 |

Q4 2023 |

Q1 2024 |

Q2 2024 |

Q3 2024 |

|

|

Overall |

58 |

58 |

59 |

60 |

61 |

64 |

|

Veterans |

58 |

57 |

60 |

58 |

58 |

62 |

|

Civilians |

57 |

59 |

58 |

61* |

64 |

66 |

*No civilian sample was included in Q1 2024; data shown is an average of Q4 2023 and Q2 2024 used as a proxy.

To view the full Veterans United Homebuyer Readiness Index and methodology, visit https://www.veteransunited.com/education/homebuyer-readiness-index/

About Veterans United Home Loans

Based in Columbia, Missouri, the full-service national direct lender financed more than $17 billion in loans in Fiscal Year 2023 and is the country’s largest VA lender, according to the Department of Veterans Affairs Lender Statistics. The company’s mission is to help Veterans and service members take advantage of the home loan benefits earned by their service.

VeteransUnited.com | 1-800-884-5560 | 550 Veterans United Drive, Columbia, MO 65201 | Veterans United Home Loans NMLS # 1907 (www.nmlsconsumeraccess.org). A VA approved lender; Not endorsed or sponsored by the Dept. of Veterans Affairs or any government agency. Licensed in all 50 states. For State Licensing information, please visit https://www.veteransunited.com/licenses/. Equal Opportunity Lender.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/veterans-united-launches-homebuyer-readiness-index-302279415.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/veterans-united-launches-homebuyer-readiness-index-302279415.html

SOURCE Veterans United Home Loans

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

This $2.4 Billion Company Is About to Get a $1.2 Billion Payday. Here's Why I Couldn't Be More Optimistic

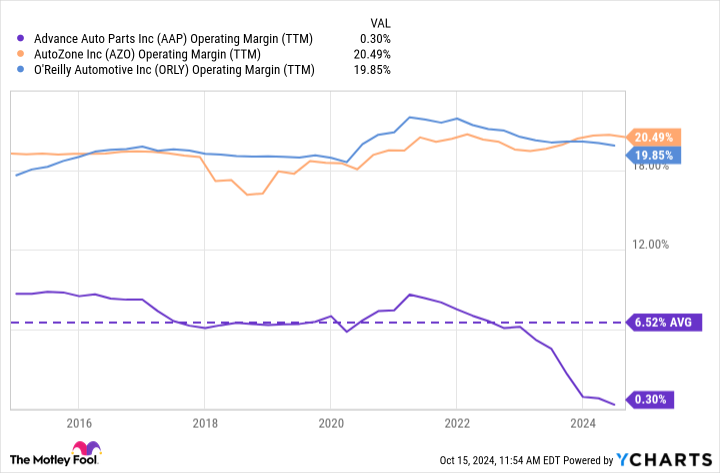

Autozone and O’Reilly are the two giants in the car-parts retail space. These two companies have market capitalizations of $53 billion and $71 billion, respectively. By comparison, Advance Auto Parts (NYSE: AAP) is tiny with its market cap of just $2.4 billion. But this value disparity is somewhat surprising.

Advance has almost 4,800 locations, while Autozone has nearly 7,400 and O’Reilly has around 6,200. So the latter two are bigger, but not by the margin that the market valuations would suggest.

For its part, Advance has problems that can’t be sugarcoated. But it’s working to fix them. And it’s about to get a $1.2 billion payday to help fund its turnaround, which is an unbelievable amount for a company with such a low valuation.

How is Advance getting a big payday?

On top of its namesake retail chain, Advance also owns other businesses, namely Carquest and Worldpac. Last year, the company hired CEO Shane O’Kelly, who’s trying to restructure the business. This restructuring includes selling the Worldpac business.

In August, Advance reached a deal to sell Worldpac for $1.5 billion. Taking transaction expenses into account, the company will net about $1.2 billion — half of its current market cap. The deal is expected to close in the fourth quarter.

Advance says that Worldpac has generated $2.1 billion in trailing-12-month revenue and has earned $100 million in earnings before interest, taxes, depreciation, and amortization (EBITDA). This means that Advance sold it for 0.7 times its sales and 15 times its EBITDA.

That’s more than a fair sales price. For perspective, Advance stock trades at 0.2 times sales and at about 7 times EBITDA. So the sales price for Worldpac represents a significant premium to where Advance stock itself trades today.

How Advance’s windfall can help

O’Kelly says that selling Worldpac gives Advance more “financial flexibility” as it navigates the changes it needs to make. And to be sure, the changes are going to be substantial.

They need to be, considering how poorly Advance has performed relative to its peers. Take one metric: the operating-profit margin. For the past decade, both Autozone and O’Reilly have had operating margins mostly between 18% and 20%. By comparison, Advance has averaged an operating margin of about 6%, and it’s fallen even lower than that lately.

Advance hired O’Kelly to fix this profitability problem. The new CEO is a supply chain expert and quickly realized that Advance is struggling with profitability because of its inefficient supply chain infrastructure.

A multiyear supply chain transformation is already underway for Advance, and I’m optimistic that this will completely transform returns for shareholders.

Consider that if Advance can squeeze a 10% margin from its business — still half of what its peers have — it can generate close to $1 billion in annual profits. After all, even after selling Worldpac, Advance still generates over $9 billion in annual sales. And if the stock is valued at 10 times its operating profit, then shares could quadruple in value in this scenario.

Therefore, restructuring the supply chain is crucial for Advance and its shareholders. But it’s costly, and the company’s balance sheet isn’t the greatest. It has almost $1.8 billion in long-term debt and less than $500 million in cash and equivalents. To be clear, it’s not in danger of running out of liquidity anytime soon. But this is an unattractive net-debt position nonetheless.

Selling Worldpac will even out Advance’s balance sheet and give it just a little more breathing room. And this breathing room will allow management to make the business decisions that will set it up best for long-term success.

This is why I couldn’t be more optimistic about Advance stock now that it’s selling Worldpac. And if the turnaround is successful, the stock is trading at quite the bargain valuation today.

Should you invest $1,000 in Advance Auto Parts right now?

Before you buy stock in Advance Auto Parts, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advance Auto Parts wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $845,679!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Jon Quast has positions in Advance Auto Parts. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

This $2.4 Billion Company Is About to Get a $1.2 Billion Payday. Here’s Why I Couldn’t Be More Optimistic was originally published by The Motley Fool

Elon Musk Spent His Teen Years Working Odd Jobs In Canada. For $18 An Hour, He'd Clean The Boiler Room With 'No Escape' In A Lumber Mill

Before Elon Musk became the billionaire CEO of Tesla and SpaceX, he was just a teenager trying to make ends meet in Canada. His ascent to the top wasn’t easy, nor was it particularly glamorous, as evident in Ashlee Vance’s book, Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic Future.

Don’t Miss:

At 17, Musk left his home in South Africa and headed to Canada, hoping to eventually make it to the United States. He obtained citizenship with the help of his mother, who was born in Canada, but in the interim, he had to accept whatever job he could find to make ends meet.

One of Musk’s first jobs was at his cousin’s farm in Saskatchewan, a small village with fewer than 300 people. He worked as a vegetable gardener and grain bin shoveler, not exactly the life of a tech startup founder you might expect from one of the most well-known businesspeople in the world. After that, Musk learned to cut logs with a chain saw in Vancouver, British Columbia.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

But Musk’s hardest job during his time in Canada was working in a lumber mill’s boiler room. After asking at the unemployment office which job paid the most, Musk took on a grueling gig that paid $18 an hour – good money for 1989, but at a steep cost.

The work was exhausting and dangerous, involving crawling through small tunnels wearing a hazmat suit to “shovel [sand and goop] through the same hole you came through.” The conditions were so tough that most workers didn’t last long. According to Musk, out of 30 people who started the job with him, only five were left by the third day. By the end of the week, just Musk and two others were still shoveling.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

“There is no escape,” Musk said in the biography. The job required him to crawl into a small space, shovel the hot residue through the same hole and hope the person on the other side managed to clear it out. It was physically demanding and the heat made it dangerous if anyone stayed too long inside.

After a few stints working odd jobs across Canada, Musk eventually enrolled at Queen’s University in Ontario and then transferred to the University of Pennsylvania in the United States. He earned degrees in physics and economics, but not without keeping his entrepreneurial spirit alive. To help pay for tuition, Musk hosted large, ticketed house parties, turning his college house into a nightclub on the weekends.

See Also: If there was a new fund backed by Jeff Bezos offering a 7-9% target yield with monthly dividends would you invest in it?

Musk’s early years were full of tough work and key decisions to keep him on track. He even turned down a spot in Stanford’s graduate program to jump into the booming internet scene instead. He cofounded Zip2, which later sold for $300 million and used the money to start X.com, which eventually became PayPal.

That sale to eBay for $1.5 billion gave Musk the financial boost he needed to launch SpaceX and Tesla – ventures that would make him one of the richest people in the world.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Elon Musk Spent His Teen Years Working Odd Jobs In Canada. For $18 An Hour, He’d Clean The Boiler Room With ‘No Escape’ In A Lumber Mill originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

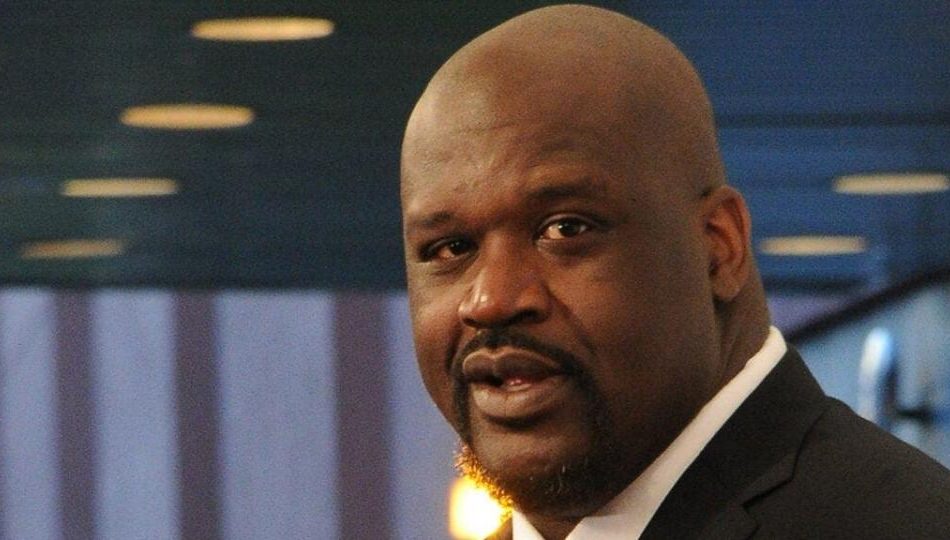

'He Taught Me A Word I Never Heard,' Says Shaquille O'Neal About The Time He Received The Greatest Investment Advice From A Rich 80-Year-Old

Shaquille O’Neal has developed a successful business, entertainment and investing career in addition to his illustrious athletic career. He also hosts a program called “The Break” on his YouTube channel, in which he talks to a group of guests in a lighthearted and informal discussion about important topics like money management.

But just like anyone else, he wasn’t born knowing all the ins and outs of managing money. In an episode called “Investing,” Shaq shared a story that perfectly sums up his journey from being rich to truly wealthy.

Don’t Miss:

“I used to see this rich guy, really rich, older – like 80 – driving a Rolls-Royce,” Shaq recalled. Curious, as many of us would be, Shaq asked the man how he got so wealthy. It wasn’t flashy stock picks or risky real estate deals that the man shared. Instead, he gave Shaq a word he’d never heard before: annuity.

Shaq went home to check it out because he didn’t want to miss anything important. He discovered that an annuity is an investment that lets you put money down now and get payouts regularly later on – think of it as a guaranteed retirement income.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

“I was making so much money from commercials and all, I didn’t know what to do with it,” Shaq said. But the advice clicked with him. The older man told Shaq that all the money he was making now could work for him in the future – he just needed to invest it wisely.

Shaq’s approach to handling his finances took a significant turn after that conversation. He said it was the best advice he ever got because it taught him to think about the future. “All this money you’re making, if you save it, you can invest it and start collecting at 50, 60 and 70,” the older man told him. Thus, instead of spending all his money or taking big risks, Shaq learned the importance of steady growth and safety.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

But before Shaq shared his story, Juan Toscano-Anderson, who won the NBA championship with the Golden State Warriors in 2022 and was one of the guests on the show, admitted that, like many people, he was often tempted by the idea of quick money.

He hired financial advisors but sometimes found their advice boring. He was more interested in seeing his $100,000 turn into $350,000 overnight. But after losing money in a friend’s business venture, he learned a crucial lesson: the basics might not be flashy, but they’re reliable. “It doesn’t [sic] have to be sexy. They’re the basics for a reason,” he said.

These examples teach a straightforward but important lesson – sometimes, the greatest investment advice isn’t to chase the latest hot stock or aim to double your money in a year. It all comes down to patience and realizing that wealth is accumulated gradually.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article ‘He Taught Me A Word I Never Heard,’ Says Shaquille O’Neal About The Time He Received The Greatest Investment Advice From A Rich 80-Year-Old originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

'Don't Normalize' Trump's Behavior, Warns Mark Cuban, Says It's An Insult To American Workers To Claim Their Job Could Be Done By A Child

In a recent social media clash, Mark Cuban called out Donald Trump for insulting American autoworkers. Cuban, the entrepreneur and part-owner of the Dallas Mavericks, took to Twitter to criticize Trump’s remarks during his interview at the Economic Club of Chicago.

Trump claimed that autoworkers in America were essentially just assembling car parts “out of a box” and even went as far as to say, “We could have our child do it.”

Don’t Miss:

Cuban was not having any of it. In a tweet, he said, “He still thinks it’s 1965. It’s obvious he has no idea what it takes to manufacture any advanced product, car or otherwise.” Cuban made it clear that Trump’s comments were completely out of touch with the reality of modern manufacturing and a direct insult to hardworking Americans who keep the industry going.

When Stephen Miller, a former advisor to Trump, rushed in to defend the former president, Cuban responded quickly. Miller suggested that Cuban had been “hoaxed” by a “deceptively edited clip” and argued that Trump’s comments were directed at European car manufacturers, not American workers.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

Cuban responded, “Stephen, the Mercedes plant is in the USA,” before continuing, “The workers are American. He said a child could do the job of an American worker. That’s an insult.”

Cuban wasn’t just upset about the specific comments on autoworkers. He also aimed at Trump’s behavior during the interview, calling it “awful.” According to Cuban, whenever Trump couldn’t answer a question, he insulted the interviewer instead, adding, “Now THAT is something a child can do.”

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

There was more back-and-forth. Cuban even provided extensive information via Grok chatbot to support his assertions, citing Mercedes-Benz U.S. International (MBUSI), the company that operates Mercedes-Benz activities in Alabama.

The company made a significant investment in this factory, which is close to Vance, Alabama. It manufactures models like the GLE and GLS, as well as electric EQS and EQE SUVs. Mercedes-Benz employs its ‘One Man–One Engine’ philosophy at this plant for its AMG models, where a single technician hand-builds an engine from start to finish. This philosophy emphasizes that American workers at this plant deserve respect for their skills and contributions.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

Cuban’s message was very clear: don’t accept Trump’s actions as usual, especially if doing so means disparaging hardworking Americans. He called on people like Stephen Miller not to excuse or justify the insults. “I know your guy insults hardworking Americans often, but don’t normalize this, Stephen,” Cuban tweeted.

Trump has a track record of opposing global trade deals and enacting tariffs to encourage homegrown manufacturing. But rather than bringing about the rebirth he frequently claims, it has been demonstrated that his policies – such as tariffs on steel and aluminum – damage the American auto sector, driving up costs and even resulting in plant closures.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article ‘Don’t Normalize’ Trump’s Behavior, Warns Mark Cuban, Says It’s An Insult To American Workers To Claim Their Job Could Be Done By A Child originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

‘I retired earlier than planned’: I’m 69 and will have $6,000 a month in retirement income. The bulk of my $3.6 million is equities. Is that OK?

Dear Quentin,

I appreciate and enjoy your column and advice.

I am 69, single, female and in good health. I worked extremely hard. I saved money and lived frugally. I retired earlier than planned, in April 2022, because our elderly mom required more care. She lived to 91, but in her final years had dementia and poor mobility, eventually needing 24/7 care. Luckily, she had lived modestly and invested wisely, which paid for in-home care, supplemented by my sisters’ and my labor.

Most Read from MarketWatch

My house is fully paid for, as is my modest five-year-old car, which I bought certified used using a lump payout from saved-up vacation hours. I have a great federal pension of $3,000 a month after taxes and health insurance, great federal health insurance, and $3 million invested after my self-managed stock portfolio exploded over the past three years. I don’t trade that much, just to invest extra money or move a bit here and there when it makes sense for taxes.

My inheritance raises that to about $3.6 million. My current investments are in Roth IRAs worth $600,000, which includes an $85,000 inherited Roth, so that has 10 years to grow tax-free. The rest is in stocks, exchange-traded funds and tax-deferred Thrift Savings Plan funds. It’s allocated about 60/40 tax-deferred/taxable accounts, except for about $100,000 in CDs and cash. My non-TSP accounts are tech-heavy, with the nontech stocks well diversified.

The common wisdom is to keep less in equities as we age. However, my pension, Social Security benefits — which I’ll draw at 70 and which will amount to about $3,000 per month after taxes — and health insurance are all federally backed, so those are all more like a Treasury bond. Even if Social Security payments decrease after 2035, I should be fine. I’ll keep the final inheritance money — about $90,000 — in cash and CDs in order to make significant repairs to my small house.

Do I have too much money in equities?

Single Retired Investor

Dear Investor,

I love that you bought your car using money saved from vacation time.

I found myself cheering you on as I read your letter because of your open, evenhanded approach to the story of your financial life. You weren’t grandstanding, nor did you express any lingering resentments or lamentations about the years you spent taking care of your elderly mother. In other words, you did all of this while climbing some pretty steep virtual mountains, and you did it by not having anyone to rely on but your good self.

Asset allocation should be based on a person’s income and expenses, not their age alone, says Jesica Ray, lead adviser at Brighton Jones, a Seattle-based registered investment adviser. “Portfolio immunization is an asset-allocation strategy that focuses on ensuring that a person is only taking the amount of risk they can afford,” she says. “The goal primarily is to safeguard the funding of liabilities. Then the rest can be put into the growth engine of the portfolio.”

You’re going against conventional wisdom by holding the bulk of your assets in equities, but you have made smart decisions, including going heavy on tech stocks, even if the group of tech stocks known as the Magnificent Seven may not show as much growth in the years ahead as they have recently. At age 70, most advisers would say to invest 30% in stocks and the rest in bonds and safer havens. But you have an appetite for risk and success. You also have a pension and Social Security to spread out that risk.

During the third quarter of 2024, the Magnificent Seven — Nvidia NVDA, Apple AAPL, Microsoft MSFT, Alphabet GOOGL, Tesla TSLA, Meta META and Amazon AMZN — underperformed the broader index for the first time since the final quarter of 2022. But as Michael Arone, chief investment strategist for State Street Global Advisors, said in an interview with MarketWatch in early October, “A few myths have been busted.” Chief among them: The stock market can rise without them.

You have $190,000 in cash and CDs, which is a smart move and gives you a de facto emergency fund, and I fully support your intention to do a bit of splurging here and there. You’ve worked extremely hard and given your mother your time and love, and now is the time for you to see a bit of the world, have an adventure and enjoy life. This is what good planning gives you: peace of mind, freedom and the opportunity to take trips to keep the cobwebs from the door.

Nate Ahlberg, a senior wealth adviser at wealth-management company Prosperity in Minneapolis, Minn., suggests moving on to the next phase of your wealth-management plan. “Your reference to your self-managed portfolio exploding’ over the past three years and that your non-TSP accounts are ‘tech-heavy’ leads me to suspect that you have some concentrated holdings,” he says. “That has likely helped you create significant wealth.”

Diversification can now help preserve your wealth, in whatever form that takes. “Diversification doesn’t necessarily mean making significant adjustments to your equity allocation,” Ahlberg says. “If your risk tolerance remains aggressive, you could consider diversifying within your equity allocation — growth versus value, large cap versus mid cap versus small cap, domestic versus international.”

And if there is a stock-market bust? It would probably take you less than a decade to get back to black. But you have, for the most part, enough cash to see you through. After the 1929 crash, when the stock market lost roughly 90% of its value, the Dow Jones Industrial Average DJIA took more than 25 years — until Nov. 23, 1954 — before it closed above the level at which it closed on that fateful day. But analysts say it actually took five to 10 years, accounting for deflation.

You lived through the recession of 2007-09, so you don’t need me to tell you that it took more than five years for the market to recover from that financial crisis, which was caused in part by predatory and subprime lending in the mortgage market and a lack of financial regulation. Keep in mind that diversification is also key to weathering such unexpected storms: Many companies survived the 1929 and 2008 financial crashes, but some did not.

If you can live comfortably on your existing income, I think you should stay the course.

More columns from Quentin Fottrell: