Billionaire Ken Griffin Sold Most of Citadel's Nvidia Stock and Is Buying This Stock-Split AI Stock Instead

Billionaire Ken Griffin is the founder and CEO of Citadel Advisors, the most profitable hedge fund in history as measured by net gains, according to LCH Investments. That makes Griffin one of Wall Street’s most successful money managers, so investors should consider following his trades with quarterly Forms 13F.

In the second quarter, Griffin sold 9.2 million shares of Nvidia (NASDAQ: NVDA), reducing his exposure by 79%. Meanwhile, he bought 98,752 shares of Super Micro Computer (NASDAQ: SMCI), increasing his position by 96%. Currently, Citadel still has more capital invested in Nvidia than Supermcro, but the trades are noteworthy nevertheless because they may hint at a shift in sentiment.

Here’s what investors should know about each of these companies.

Nvidia

Nvidia is best known for its graphics processing units (GPUs), chips used to accelerate data center workloads like training large language models and running artificial intelligence (AI) applications. “Nvidia sets the pace for AI infrastructure worldwide. Without Nvidia GPUs, modern AI wouldn’t be possible,” according to analysts at Forrester Research.

Indeed, Nvidia has around 90% market share in AI chips, and analysts expect the same level of dominance for at least two or three years. That seems likely for two reasons.

First, developers prefer Nvidia GPUs because they are the fastest accelerators on the market, but also because they are backed by a more robust ecosystem of software development tools than competing products. Second, Nvidia provides adjacent data center hardware, including central processing units (CPUs) and network switches, designed for AI. The company also provides software and cloud services that support AI application development. That means Nvidia can innovate across the entire data center computing stack, which leads to better-performing systems with lower energy requirements, according to CEO Jensen Huang.

Importantly, when Ken Griffin was selling shares in the second quarter, Nvidia stock traded at an average valuation of 67 times earnings, which peaked around 79 times earnings. But Nvidia’s earnings more than doubled in the June quarter, which lowered its valuation multiple. The stock currently trades at 64 times earnings, a slight discount to where it was when Griffin was selling.

Additionally, Wall Street anticipates Nvidia’s earnings will grow at 37% annually over the next three years. That is an upward revision from the average consensus of 34% during the second quarter.

In other words, Nvidia shares are a bit cheaper, and earnings are expected to grow a bit faster versus when Ken Griffin was selling shares. Those changes make the stock more attractive, so Griffin may have added to Citadel’s position in Nvidia since the second quarter ended.

Super Micro Computer

Super Micro Computer manufacturers servers, including complete server racks equipped with storage and networking, to provide a turnkey solution for data center infrastructure. The company’s internal engineering capabilities and modular approach to product design allow it to bring new technologies to market more quickly than its competitors. That advantage has helped Supermicro secure a leadership position in AI servers.

Importantly, while the market will likely become more competitive as Dell Technologies and other equipment manufacturers lean into demand for AI infrastructure, Supermicro’s leadership in direct liquid cooling (DLC) technology may defend its position in AI servers. DLC can reduce data center power consumption by 40% versus traditional air cooling, so the percentage of liquid-cooled installations is expected to soar alongside AI server deployments.

Supermicro reported mixed financial results in the fourth quarter of fiscal 2024 (ended June 30). Revenue rose 143% to $5.3 billion. But gross margin fell nearly 6 percentage points to 11.2%, such that non-GAAP (generally accepted accounting principles) earnings increased only 78%, growing much slower than sales. That may signal waning pricing power amid increased competition, but management said gross margin will return to normal (14% to 17%) by the end of fiscal 2025.

Importantly, Ken Griffin was buying Supermicro stock in the second quarter, but his stance on the company may have changed since short-seller Hindenburg Research accused Supermicro of accounting manipulation in August. CEO Charles Liang said the accusations were “false or inaccurate statements.” But the company delayed filing its Form 10-K for fiscal 2024 and has yet to correct the problem.

For readers with déjà vu, Supermicro was fined $17.5 million in 2020 for infractions similar to those outlined by Hindenburg, including recognizing revenue prematurely and understating expenses. The incidents occurred between 2014 and 2017, and caused the company to file its 10-K for fiscal 2017 nearly two years after it was due, which resulted in the stock being temporarily delisted from the Nasdaq Stock Exchange.

In September, The Wall Street Journal reported that the Justice Department was investigating Supermicro based on allegations made by a former employee. The allegations are similar to those made by Hindenburg, but the probe is in its early stages, and details are scant. Nevertheless, investors should be aware of the risk.

Looking ahead, Statista estimates AI server sales will increase at 30% annually through 2033, and Wall Street anticipates Supermicro’s adjusted earnings will grow 54% over the next 12 months. Those estimates make the current valuation of 22 times adjusted earnings look cheap. However, given the overhanging regulatory issues, I would not be surprised if Ken Griffin has trimmed his position in Supermicro since the second quarter.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Billionaire Ken Griffin Sold Most of Citadel’s Nvidia Stock and Is Buying This Stock-Split AI Stock Instead was originally published by The Motley Fool

US Interest Burden Hits 28-Year High, Escalating Political Risk

(Bloomberg) — The US debt interest-cost burden climbed to the highest since the 1990s in the financial year that’s just ended, escalating the risk that fiscal worries limit the policy options for the next administration in Washington.

Most Read from Bloomberg

The Treasury spent $882 billion on net interest payments in the fiscal year through September — an average of roughly $2.4 billion a day, according to data the department released Friday. The cost was the equivalent of 3.06% as a share of gross domestic product, the highest ratio since 1996.

Historically high budget deficits, which caused total debt outstanding to soar in recent years, are a key reason for the increase. Those deficits reflect a steady rise in spending on Social Security and Medicare, as well as the extraordinary spending the US unleashed to battle Covid and constraints on revenue from sweeping 2017 tax cuts. Another big driver: the inflation-driven surge in interest rates.

“The higher interest costs are, the more politically salient these issues are,” said Wendy Edelberg, director of the Brookings Institution’s Hamilton Project. It raises the chance of politicians recognizing that “funding our spending priorities through borrowing is not costless,” she said.

While neither former President Donald Trump nor Vice President Kamala Harris has made deficit reduction a central element of their campaign, the debt issue looms over the next administration nonetheless. With Congress heading for a narrow partisan split, it could only take a handful, or potentially lone, deficit-wary legislator to stymie tax and spending plans.

That scenario was already seen in the outgoing Biden administration, when then-Democrat Joe Manchin forced a scaling back of spending items the White House favored as the price for passing signature legislative packages in 2021 and 2022.

Even if Republicans take control of both chambers, and Trump takes the White House, the likely narrowness of the majority could leave GOP fiscal hawks with the power to demand changes to sweeping tax cuts.

“It would just be remarkable if what came out of the tax debate next year was a whole group of policymakers looking at our debt trajectory and deciding just to make it worse,” said Edelberg, a former chief economist at the Congressional Budget Office.

The net interest bill exceeded the Defense Department’s spending on military programs for the first time, according to data from the Treasury Department and the Office of Management and Budget. It also amounted to about 18% of federal revenues — almost double the ratio from two years ago.

The Federal Reserve’s shift to lowering rates is offering some relief to the Treasury. The weighted average interest on outstanding US debt was 3.32% at the end of September, marking the first monthly decline in nearly three years.

Even so, the scale of the interest costs is now so large that they are by themselves adding to the overall debt load held by the public, which stands at $27.7 trillion — approaching 100% of GDP. Debt servicing was among the fastest growing parts of the budget last year. Spending on interest also risks weighing on economic growth by crowding out private investment.

The nonpartisan CBO estimates that every additional dollar of deficit-financed spending reduces private investment by 33 cents.

“From a variety of standpoints, the fact that the interest costs are growing the debt and causing other economic ramifications is a problem for our economy,” said Shai Akabas, executive director of the Bipartisan Policy Center’s Economic Policy Program.

Treasury Secretary Janet Yellen has played down concerns, saying that the key metric to track in assessing US fiscal sustainability is inflation-adjusted interest payments compared with GDP. That ratio has jumped the past year, but the White House sees it stabilizing at about 1.3% over the coming decade. Yellen has said it’s important to stay below 2%, a level seen by some as a key threshold for sustainability.

The White House projections, however, assume passage of revenue-raising measures that the outgoing Biden administration proposed. Harris, too, has called for raising taxes on the wealthiest Americans and on corporations.

Trump says the key to addressing the fiscal outlook is yet more tax cuts, which he argues will boost economic growth, offsetting the hit to the government’s bottom line.

Most economists see debt continuing to climb under either candidate. The Committee for a Responsible Federal Budget estimates the Harris economic plan would increase the debt by $3.5 trillion over a decade, while Trump’s would sending it soaring by $7.5 trillion.

Besides the election outcome, the magnitude of Fed rate cuts will affect the fiscal outlook. While rate hikes were quickly reflected in the Treasury’s interest bill after policymakers kicked them off in March 2022, rate cuts may take more time to bring down the government’s borrowing costs.

That’s in part because a swath of the US debt maturing in coming years carries particularly low rates, which preceded the Fed’s tightening cycle. Many securities will be replaced by Treasuries that will be costlier to service. And that may prove to be the case for years to come — especially if the Fed halts rate cuts at a higher level than pre-Covid. The Fed’s short-term benchmark rate averaged less than 0.75% over the decade through 2019; policymakers in September projected the rate would settle around 2.9% in time.

In the meantime, costs tied to Social Security and Medicare will keep rising as the US population ages, contributing to outsize budget deficits for decades ahead unless reforms are made. That pressure, and an aversion of politicians to take on changing the popular programs, has put pressure on the remaining areas of federal spending, known as discretionary.

Back in the 1960s, discretionary spending made up about 70% of the federal total, but now the ratio is just 30%, according to analysis by Torsten Slok, chief economist at Apollo Global Management.

For now, investors are showing little sign of concern about US fiscal challenges, with the Fed’s easing cycle and concerns about a weakening job market continuing to support demand for Treasuries. But if and when they do, that could prove decisive for Washington, said Gary Schlossberg, global strategist at Wells Fargo Investment Institute.

“The landscape has changed,” Schlossberg said. “Before, we had more of a free ride — with rates low. You could run up the debt and it didn’t really show up much in interest expenses. That’s obviously not there now.”

–With assistance from Ben Holland and Liz Capo McCormick.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

TD INVESTIGATION UPDATE: TD Bank Investors are Notified of Securities Fraud Investigation into Money Laundering Violations; Contact BFA Law if You Lost Money (NYSE:TD)

NEW YORK, Oct. 19, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces an investigation into The Toronto-Dominion Bank TD for potential violations of the federal securities laws.

If you invested in TD Bank, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/the-toronto-dominion-bank.

Why Did TD Bank’s Stock Drop?

TD Bank is the 10th largest bank in the United States.

On October 10, 2024, TD Bank pleaded guilty to criminal money-laundering-related charges and agreed to pay more than $3 billion in fines to the U.S. Department of Justice, the Federal Reserve, the Comptroller of the Currency, and the Treasury Department’s Financial Crimes Enforcement Network. The Comptroller of the Currency also imposed an “asset cap” that prevents TD Bank from growing any larger than its current size.

The news caused a significant decline in the price of TD Bank stock. On October 10, 2024, the price of the company’s stock fell 6.4%, from a closing price of $63.51 per share on October 9, 2024, to $59.44 per share on October 10, 2024.

Click here for more information: https://www.bfalaw.com/cases-investigations/the-toronto-dominion-bank.

What Can You Do?

If you invested in TD Bank you may have legal options and are encouraged to submit your information to the firm. All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/the-toronto-dominion-bank

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/the-toronto-dominion-bank

Attorney advertising. Past results do not guarantee future outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Behind the Scenes of United Airlines Holdings's Latest Options Trends

Financial giants have made a conspicuous bearish move on United Airlines Holdings. Our analysis of options history for United Airlines Holdings UAL revealed 59 unusual trades.

Delving into the details, we found 42% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 18 were puts, with a value of $4,003,104, and 41 were calls, valued at $5,898,846.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $38.0 to $90.0 for United Airlines Holdings during the past quarter.

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for United Airlines Holdings’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of United Airlines Holdings’s whale activity within a strike price range from $38.0 to $90.0 in the last 30 days.

United Airlines Holdings 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UAL | PUT | SWEEP | NEUTRAL | 06/20/25 | $9.15 | $9.1 | $9.15 | $75.00 | $935.2K | 5.6K | 2.5K |

| UAL | CALL | SWEEP | BULLISH | 12/20/24 | $5.3 | $5.25 | $5.25 | $75.00 | $368.5K | 17.1K | 2.2K |

| UAL | CALL | SWEEP | BEARISH | 12/20/24 | $11.35 | $11.2 | $11.2 | $65.00 | $340.5K | 6.5K | 825 |

| UAL | PUT | SWEEP | BULLISH | 06/20/25 | $9.3 | $9.15 | $9.15 | $75.00 | $334.9K | 5.6K | 2.5K |

| UAL | CALL | SWEEP | BEARISH | 12/20/24 | $5.25 | $5.2 | $5.2 | $75.00 | $329.9K | 17.1K | 1.2K |

About United Airlines Holdings

United Airlines is a major US network carrier with hubs in San Francisco, Chicago, Houston, Denver, Los Angeles, New York/Newark, and Washington, D.C. United operates a hub-and-spoke system that is more focused on international and long-haul travel than its large US peers.

United Airlines Holdings’s Current Market Status

- With a volume of 8,318,667, the price of UAL is up 0.78% at $73.9.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 95 days.

What The Experts Say On United Airlines Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $83.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Susquehanna has decided to maintain their Positive rating on United Airlines Holdings, which currently sits at a price target of $70.

* An analyst from Jefferies has decided to maintain their Buy rating on United Airlines Holdings, which currently sits at a price target of $75.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on United Airlines Holdings with a target price of $100.

* An analyst from Susquehanna has decided to maintain their Positive rating on United Airlines Holdings, which currently sits at a price target of $85.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for United Airlines Holdings, targeting a price of $88.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest United Airlines Holdings options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kevin O'Leary Calls for 400% Tariffs On China, But His 'Shark Tank' Co-Star And Friend Mark Cuban Fires Back With Business Concerns

“Shark Tank” co-stars Mark Cuban and Kevin O’Leary, aka “Mr Wonderful,” have locked horns over tariffs on China.

What Happened: On Friday, O’Leary voiced his discontent with China’s trade practices on X, formerly Twitter.

He argued for drastic action in the form of raising tariffs to 400%, saying that China has been unfair in its business practices for decades. “I can tell you firsthand they DON’T play fair.”

“I’m calling for REAL action, raise tariffs to 400%. Make it SO painful they have no choice but to come to the table,” O’Leary stated, referring to Republican presidential nominee Donald Trump’s stance on the subject.

See Also: Mark Cuban Battles Former Trump Advisor Over Ex-President’s Comments On American Auto Workers

Cuban swiftly responded to O’Leary’s call for increased tariffs, highlighting the adverse effects such measures could have on U.S. companies.

He cited a Deutsche Bank report and a Goldman Sachs survey, indicating that companies were “cutting costs, putting off investments, and paying extra to build up inventory to help cushion the impact of China tariffs.”

Why It Matters: This isn’t the first time the two “Shark Tank” co-stars have publicly disagreed. In August, they had a social media showdown following O’Leary’s controversial comments on Democratic nominee Kamala Harris, whom Cuban is publicly supporting.

Their latest disagreement comes amid a heated debate on tariffs. Last month, the Joe Biden administration hiked tariffs on Chinese goods, causing stocks of Alibaba and JD.com to drop.

Meanwhile, Trump has defended his plans to impose 200% tariffs on cars imported from China and Mexico, aiming to protect American automotive jobs. “I hope the union workers, auto workers understand that I saved their jobs.”

Previously, Harris criticized Trump’s tariff policy, naming it “Trump sales tax” during the presidential debate last month. At the time, she stated that the Trump administration contributed to a substantial trade deficit and instigated trade wars.

“Under Donald Trump’s presidency, he ended up selling American chips to China to help them improve and modernize their military,” Harris said then.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photos courtesy: Gage Skidmore via Flickr and Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PARKE BANCORP, INC. ANNOUNCES THIRD QUARTER 2024 EARNINGS

|

Highlights: |

||||

|

Net Income: |

$7.5 million for Q3 2024, increased 16.3% over Q2 2024 |

|||

|

Revenue: |

$33.0 million for Q3 2024, increased 5.2% over Q2 2024 |

|||

|

Total Assets: |

$2.07 billion, increased 2.1% over December 31, 2023 |

|||

|

Total Loans: |

$1.84 billion, increased 2.9% over December 31, 2023 |

|||

|

Total Deposits: |

$1.56 billion, increased 0.4% from December 31, 2023 |

|||

WASHINGTON TOWNSHIP, N.J., Oct. 18, 2024 /PRNewswire/ — Parke Bancorp, Inc. (“Parke Bancorp” or the “Company”) (NASDAQ: “PKBK”), the parent company of Parke Bank, announced its operating results for the three and nine months ended September 30, 2024.

Highlights for the three and nine months ended September 30, 2024:

- Net income available to common shareholders was $7.5 million, or $0.63 per basic common share and $0.62 per diluted common share, for the three months ended September 30, 2024, an increase of $6.5 million, or 634.1%, compared to net income available to common shareholders of $1.0 million, or $0.09 per basic common share and $0.08 per diluted common share, for the three months ended September 30, 2023. The increase was primarily due to the non-recurring $9.5 million contingent loss disclosed in Q3 2023, partially offset by a $1.0 million decrease in net interest income, a $0.9 million decrease in non-interest income, and a $0.4 million decrease in provision for credit losses.

- Net interest income decreased $1.0 million, or 6.1%, to $14.7 million for the three months ended September 30, 2024, compared to $15.7 million for the same period in 2023.

- The Company recorded a credit to provision for credit losses of $0.1 million for the three months ended September 30, 2024, compared to a provision for credit losses of $0.3 million for the same period in 2023.

- Non-interest income decreased $0.9 million, or 50.9%, to $0.9 million for the three months ended September 30, 2024, compared to $1.8 million for the same period in 2023.

- Non-interest expense decreased $9.5 million, or 59.8%, to $6.4 million for the three months ended September 30, 2024, compared to $15.8 million for the same period in 2023.

- Net income available to common shareholders was $20.1 million, or $1.68 per basic common share and $1.66 per diluted common share, for the nine months ended September 30, 2024, a decrease of $0.2 million, or 0.8%, compared to net income available to common shareholders of $20.3 million, or $1.70 per basic common share and $1.67 per diluted common share, for the same period in 2023. The decrease is primarily due to a decrease in net interest income, an increase in provision for credit losses, and a decrease in non-interest income, partially offset by a decrease in non-interest expense.

- Net interest income decreased $5.6 million, or 11.5%, to $43.1 million for the nine months ended September 30, 2024, compared to $48.7 million for the same period in 2023.

- The provision for credit losses increased $2.1 million, or 134.1%, to $0.5 million for the nine months ended September 30, 2024, compared to a recovery of provision for credit losses of $1.6 million for the same period in 2023.

- Non-interest income decreased $2.1 million, or 39.3%, to $3.2 million for the nine months ended September 30, 2024, compared to $5.2 million for the same period in 2023.

- Non-interest expense decreased $9.8 million, or 34.0%, to $19.1 million for the nine months ended September 30, 2024, compared to $29.0 million for the same period in 2023.

The following is a recap of the significant items that impacted the three and nine months ended September 30, 2024:

Interest income increased $3.0 million for the third quarter of 2024 compared to the same period in 2023, primarily due to an increase in interest and fees on loans of $2.9 million, or 10.5%, to $30.2 million, primarily driven by higher market interest rates and higher average portfolio balance. Also, interest earned on average deposits held at the Federal Reserve Bank (“FRB”) increased $0.2 million during the three months ended September 30, 2024, due to higher average balances being held on deposit. For the nine months ended September 30, 2024, interest income increased $9.4 million from the same period in 2023, primarily due to an increase in interest and fees on loans of $9.4 million, or 12.1%, to $87.0 million, primarily driven by an increase in average outstanding loan balances, and higher market interest rates.

Interest expense increased $4.0 million, or 29.5%, to $17.4 million for the three months ended September 30, 2024, compared to the same period in 2023, primarily due to higher market interest rates, combined with changes in the mix of deposits and borrowings. For the nine months ended September 30, 2024, interest expense increased $15.0 million, or 44.5%, to $48.7 million, primarily due to higher market interest rates, combined with changes in the mix of deposits and borrowings.

The Company booked a recovery of the provision for credit losses of $0.1 million for the three months ended September 30, 2024, compared to a provision of $0.3 million for the same period in 2023. The credit to provision expense for the three months ended September 30, 2024, was primarily driven by a decrease in the 1 – 4 family investment property loan portfolio qualitative factor rate from the quarter ended June 30, 2024. The provision for credit losses for the nine months ended September 30, 2024, increased $2.1 million, or 134.1%, to $0.5 million, compared to a recovery of $1.6 million for the same period in 2023. The increase was primarily driven by an increase in the outstanding loan balance of $52.6 million from the balance at December 31, 2023, specifically in the construction 1 – 4 family, and multi-family loan portfolios. The provision recovery of $1.6 million during the same period in 2023 was primarily related to decreases in loss factors related to the construction, commercial owner occupied loan portfolios, and residential 1 to 4 family investment property loan portfolio.

Non-interest income decreased $0.9 million, or 50.9%, for the three months ended September 30, 2024 compared to the same period in 2023, primarily as a result of a decrease in service fees on deposit accounts of $0.7 million and a decrease in other income of $0.2 million. For the nine months ended September 30, 2024, non-interest income decreased $2.1 million, or 39.3%, to $3.2 million, compared to the same period in 2023. The decrease was primarily driven by a decrease in service fees on deposit accounts of $2.1 million.

Non-interest expense decreased $9.5 million, or 59.8%, for the three months ended September 30, 2024, compared to the same period in 2023, primarily due to a $9.5 million loss contingency recorded in the third quarter of 2023. For the nine months ended September 30, 2024, non-interest expense decreased $9.8 million, or 34.0%, to $19.1 million, compared to the same period in 2023, due to the same item driving the quarter-to-date change.

Income tax expense increased $1.6 million for the three months ended September 30, 2024 compared to the same period in 2023. For the nine months ended September 30, 2024, income tax expense decreased $0.2 million, compared to the same period in 2023. The effective tax rate for the three and nine months ended September 30, 2024 were 20.1% and 24.3%, respectively, compared to 24.8% and 23.5% for the same periods in 2023.

September 30, 2024 discussion of financial condition

- Total assets increased to $2.07 billion at September 30, 2024, from $2.02 billion at December 31, 2023, an increase of $41.9 million, or 2.07%, primarily due to an increase in net loans, partially offset by a decrease in cash and cash equivalents.

- Cash and cash equivalents totaled $172.4 million at September 30, 2024, as compared to $180.4 million at December 31, 2023. The decrease in cash and cash equivalents was primarily due to an increase in loan balance, partially offset by an increase in deposits and borrowings.

- The investment securities portfolio decreased to $15.3 million at September 30, 2024, from $16.4 million at December 31, 2023, a decrease of $1.1 million, or 6.8%, primarily due to pay downs of securities.

- Gross loans increased $52.6 million or 2.9%, to $1.84 billion at September 30, 2024.

- Nonperforming loans at September 30, 2024 increased to $12.2 million, representing 0.66% of total loans, an increase of $4.9 million, or 68.0%, from $7.3 million of nonperforming loans at December 31, 2023. OREO at September 30, 2024 was $1.6 million, unchanged from December 31, 2023. Nonperforming assets (consisting of nonperforming loans and OREO) represented 0.67% and 0.44% of total assets at September 30, 2024 and December 31, 2023, respectively. Loans past due 30 to 89 days were $1.2 million at September 30, 2024, an increase of $0.9 million from December 31, 2023.

- The allowance for credit losses was $32.3 million at September 30, 2024, as compared to $32.1 million at December 31, 2023. The ratio of the allowance for credit losses to total loans was 1.76% at September 30, 2024, and 1.80% at December 31, 2023. The ratio of allowance for credit losses to non-performing loans was 264.9% at September 30, 2024, compared to 442.5%, at December 31, 2023.

- Total deposits were $1.56 billion at September 30, 2024, up from $1.55 billion at December 31, 2023, an increase of $6.1 million or 0.4% compared to December 31, 2023. The increase in deposits was primarily driven by an increase in brokered time deposits of $48.4 million and an increase in time deposits of $21.4 million, partially offset by a decrease in non-interest demand deposits and savings deposits of $33.7 million and $25.5 million, respectively.

- Total borrowings increased $20.1 million during the nine months ended September 30, 2024, to $188.3 million at September 30, 2024 from $168.1 million at December 31, 2023, primarily due to $20.0 million of new FHLBNY term borrowings.

- Total equity increased to $296.5 million at September 30, 2024, up from $284.3 million at December 31, 2023, an increase of $12.1 million, or 4.3%, primarily due to the retention of earnings, partially offset by the payment of $6.4 million of cash dividends. Book value per common share at September 30, 2024 was $24.92, compared to $23.75 at December 31, 2023.

CEO outlook and commentary

Vito S. Pantilione, President and Chief Executive Officer of Parke Bancorp, Inc. and Parke Bank, provided the following statement:

“After much speculation and conflicting projections by many economists and other experts, in September 2024 the Federal Reserve reduced interest rates by 50 basis points. In its statement, the Federal Reserve indicated its belief that inflation is going in the right direction and that employment growth is under control. The Federal Reserve further stated that additional rate cuts are possible in the remainder of 2024 and 2025. However, increased geopolitical conflicts with Israel, Iran, Russia, and Ukraine could trigger additional pressure on, among other things, oil prices and could instigate an increase in inflation. Perhaps most importantly, however, we should note the terrible price being paid by the people living in these warring countries. Another concern is that the United States may be drawn into a wider war in the Middle East.”

“As reported last quarter, we are seeing an increase in loan activity. Residential construction projects continue to be surprisingly stable and growing. We are also exploring new markets to support growth in our loan portfolio, as well as adding new, experienced commercial loan officers in our lending markets.”

“Asset quality and non-interest expense continue to be a primary focus for our bank. While lending is inherently risky, we mitigate that risk with strong loan underwriting and Allowance for Credit Losses. It remains difficult to predict the future, but we are committed to working hard, maintaining tight controls on our non-interest expenses, and continuing to monitor opportunities that may arise in the market.”

Forward Looking Statement Disclaimer

This release may contain forward-looking statements. Such forward-looking statements are subject to risks and uncertainties which may cause actual results to differ materially from those currently anticipated due to a number of factors; our ability to maintain a strong capital base, strong earning and strict cost controls; our ability to generate strong revenues with increased interest income and net interest income; our ability to continue the financial strength and growth of our loan portfolio; our ability to continue to increase shareholders’ equity, maintain strong loan underwriting and allowance for credit losses; our ability to react quickly to any increase in loan delinquencies; our ability to face current challenges in the market; our ability to be well positioned to take advantage of opportunities; our ability to continue to reduce our nonperforming loans and delinquencies and the expenses associated with them; our ability to increase the rate of growth of our loan portfolio; our ability to continue to improve net interest margin; our ability to enhance shareholder value in the future; our ability to continue growing our Company, our earnings and shareholders’ equity; the possibility of additional corrective actions or limitations on the operations of the Company. and Parke Bank being imposed by banking regulators, therefore, readers should not place undue reliance on any forward-looking statements. The Company does not undertake, and specifically disclaims, any obligations to publicly release the results of any revisions that may be made to any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such circumstance.

(PKBK-ER)

Financial Supplement:

|

Table 1: Condensed Consolidated Balance Sheets (Unaudited) |

|||

|

Parke Bancorp, Inc. and Subsidiaries |

|||

|

Condensed Consolidated Balance Sheets |

|||

|

September 30, |

December 31, |

||

|

2024 |

2023 |

||

|

(Dollars in thousands) |

|||

|

Assets |

|||

|

Cash and cash equivalents |

$ 172,449 |

$ 180,376 |

|

|

Investment securities |

15,269 |

16,387 |

|

|

Loans, net of unearned income |

1,839,929 |

1,787,340 |

|

|

Less: Allowance for credit losses |

(32,318) |

(32,131) |

|

|

Net loans |

1,807,611 |

1,755,210 |

|

|

Premises and equipment, net |

5,365 |

5,579 |

|

|

Bank owned life insurance (BOLI) |

28,904 |

28,415 |

|

|

Other assets |

35,811 |

37,534 |

|

|

Total assets |

$ 2,065,409 |

$ 2,023,500 |

|

|

Liabilities and Equity |

|||

|

Non-interest bearing deposits |

$ 198,499 |

$ 232,189 |

|

|

Interest bearing deposits |

1,360,384 |

1,320,638 |

|

|

FHLBNY borrowings |

145,000 |

125,000 |

|

|

Subordinated debentures |

43,253 |

43,111 |

|

|

Other liabilities |

21,813 |

18,245 |

|

|

Total liabilities |

1,768,949 |

1,739,183 |

|

|

Total shareholders’ equity |

296,460 |

284,317 |

|

|

Total liabilities and equity |

$ 2,065,409 |

$ 2,023,500 |

|

|

Table 2: Consolidated Income Statements (Unaudited) |

|||||||

|

For the three months ended |

For the nine months ended |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

(Dollars in thousands, except per share data) |

|||||||

|

Interest income: |

|||||||

|

Interest and fees on loans |

$ 30,161 |

$ 27,294 |

$ 86,976 |

$ 77,602 |

|||

|

Interest and dividends on investments |

265 |

308 |

761 |

745 |

|||

|

Interest on deposits with banks |

1,696 |

1,512 |

4,050 |

4,059 |

|||

|

Total interest income |

32,122 |

29,114 |

91,787 |

82,406 |

|||

|

Interest expense: |

|||||||

|

Interest on deposits |

14,983 |

11,385 |

42,123 |

28,046 |

|||

|

Interest on borrowings |

2,416 |

2,046 |

6,575 |

5,661 |

|||

|

Total interest expense |

17,399 |

13,431 |

48,698 |

33,707 |

|||

|

Net interest income |

14,723 |

15,683 |

43,089 |

48,699 |

|||

|

Provision for (recovery of) credit losses |

(141) |

300 |

546 |

(1,600) |

|||

|

Net interest income after provision for (recovery of) credit losses |

14,864 |

15,383 |

42,543 |

50,299 |

|||

|

Non-interest income |

|||||||

|

Service fees on deposit accounts |

321 |

1,003 |

1,059 |

3,149 |

|||

|

Gain on sale of SBA loans |

(2) |

— |

23 |

— |

|||

|

Other loan fees |

217 |

192 |

619 |

611 |

|||

|

Bank owned life insurance income |

166 |

153 |

488 |

443 |

|||

|

Other |

199 |

449 |

974 |

972 |

|||

|

Total non-interest income |

901 |

1,835 |

3,163 |

5,213 |

|||

|

Non-interest expense |

|||||||

|

Compensation and benefits |

3,178 |

2,834 |

9,466 |

9,414 |

|||

|

Professional services |

645 |

659 |

1,641 |

1,746 |

|||

|

Occupancy and equipment |

630 |

649 |

1,943 |

1,938 |

|||

|

Data processing |

348 |

368 |

978 |

1,037 |

|||

|

FDIC insurance and other assessments |

319 |

388 |

973 |

960 |

|||

|

OREO expense |

187 |

240 |

776 |

610 |

|||

|

Other operating expense |

1,058 |

10,711 |

3,358 |

13,276 |

|||

|

Total non-interest expense |

6,365 |

15,849 |

19,135 |

28,981 |

|||

|

Income before income tax expense |

9,400 |

1,369 |

26,571 |

26,531 |

|||

|

Income tax expense |

1,892 |

340 |

6,457 |

6,242 |

|||

|

Net income attributable to Company |

7,508 |

1,029 |

20,114 |

20,289 |

|||

|

Less: Preferred stock dividend |

(5) |

(7) |

(16) |

(20) |

|||

|

Net income available to common shareholders |

$ 7,503 |

$ 1,022 |

$ 20,098 |

$ 20,269 |

|||

|

Earnings per common share |

|||||||

|

Basic |

$ 0.63 |

$ 0.09 |

$ 1.68 |

$ 1.70 |

|||

|

Diluted |

$ 0.62 |

$ 0.08 |

$ 1.66 |

$ 1.67 |

|||

|

Weighted average common shares outstanding |

|||||||

|

Basic |

11,959,546 |

11,945,844 |

11,960,173 |

11,945,144 |

|||

|

Diluted |

12,153,393 |

12,131,825 |

12,134,828 |

12,137,208 |

|||

|

Table 3: Operating Ratios (unaudited) |

|||||||

|

Three months ended |

Nine months ended |

||||||

|

September 30, |

September 30, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Return on average assets |

1.49 % |

0.21 % |

1.37 % |

1.38 % |

|||

|

Return on average common equity |

10.08 % |

1.43 % |

9.20 % |

9.77 % |

|||

|

Interest rate spread |

1.88 % |

2.24 % |

1.91 % |

2.51 % |

|||

|

Net interest margin |

2.97 % |

3.21 % |

2.99 % |

3.40 % |

|||

|

Efficiency ratio* |

40.74 % |

90.47 % |

41.37 % |

53.76 % |

|||

|

* Efficiency ratio is calculated using non-interest expense divided by the sum of net interest income and non-interest income. |

|

Table 4: Asset Quality Data (unaudited) |

|||

|

September 30, |

December 31, |

||

|

2024 |

2023 |

||

|

(Amounts in thousands except ratio data) |

|||

|

Allowance for credit losses on loans |

$ 32,318 |

$ 32,131 |

|

|

Allowance for credit losses to total loans |

1.76 % |

1.80 % |

|

|

Allowance for credit losses to non-accrual loans |

264.88 % |

442.51 % |

|

|

Non-accrual loans |

$ 12,201 |

$ 7,261 |

|

|

OREO |

$ 1,562 |

$ 1,550 |

|

![]() View original content:https://www.prnewswire.com/news-releases/parke-bancorp-inc-announces-third-quarter-2024-earnings-302279333.html

View original content:https://www.prnewswire.com/news-releases/parke-bancorp-inc-announces-third-quarter-2024-earnings-302279333.html

SOURCE Parke Bancorp, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin Predicted To Hit 6-Figure Price In 2025, Bitwise CEO Says Next Year Will Be 'Exceptional' For King Crypto

What Happened: Hougan cited several factors that could propel Bitcoin’s price upward, in a recent interview on the Altcoin Daily channel.

He pointed to the recent halving event in April, which slashed miners’ rewards by half, as a significant influence on Bitcoin’s market dynamics.

“I think it’s going to be a new all-time high. I think it’s going to be six-figure Bitcoin for sure,” said Hougan.

“It’s a risky market. You should only invest what you can lose. But the setup for 2025 is really exceptional.”

Additionally, Hougan expects spot Bitcoin exchange-traded funds (ETFs) to become more prominent next year. He also highlighted potential Federal Reserve rate cuts as a bullish catalyst for Bitcoin’s price increase.

Hougan expressed confidence that Bitcoin might reach new all-time highs before the year ends, noting the substantial liquidity available for investment in the crypto market.

Why It Matters: Hougan’s prediction comes amid a backdrop of increasing institutional interest in Bitcoin.

Recently, MicroStrategy Inc. MSTR founder Michael Saylor challenged Bitcoin skeptics to short the company’s stock, emphasizing their commitment to holding Bitcoin.

Furthermore, Morgan Stanley, despite previous skepticism from its executive chairman James Gorman, has actively recommended Bitcoin-related investments to clients this year. This shift indicates a growing acceptance of Bitcoin among traditional financial institutions.

Additionally, the recent rise in Bitcoin’s price, with traders like Astronomer Zero reporting strong bullish signals, further supports the optimistic outlook for Bitcoin’s future.

Price Action: At the time of writing, Bitcoin’s price was hovering at $68,361, up by 0.31% in the past 24 hours, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

2 Millionaire-Maker Artificial Intelligence (AI) Stocks

Goldman Sachs notes that the tech sector has been the driving force behind the U.S. stock market since 2010, generating 40% of the equity markets’ gains over the past 14 years.

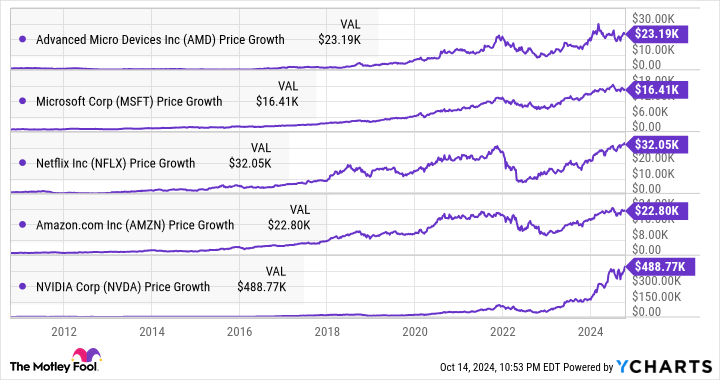

Many tech stocks have delivered outsize gains since 2010. For example, $1,000 invested in Advanced Micro Devices would now be worth more than $23,000. Other companies — including Microsoft, Amazon, and Netflix — have also been multibaggers during this period, while Nvidia recorded stunning gains from multiple catalysts, the latest one being artificial intelligence (AI).

With AI still in its early phases of growth, Bloomberg estimates that the technology could generate $1.3 trillion in revenue in 2032, up from this year’s estimate of $137 billion. So, if you’re looking to build a million-dollar portfolio, you might do well to buy AI-focused companies and hold them for a long time.

In this article, we will take a closer look at two names that could soar in the long run, delivering outstanding gains to investors while contributing toward a million-dollar portfolio with AI-fueled growth.

1. Palantir Technologies

Companies like Nvidia have been in the limelight with their powerful chips capable of training AI models. But those models eventually need to be deployed for real-world applications. Palantir Technologies (NYSE: PLTR) is helping customers do just that with its Artificial Intelligence Platform (AIP).

AIP users can build generative AI applications, integrate large language models (LLMs) into their workflows, and deploy pre-built AI applications. Palantir has smartly been conducting its “boot camps” to show customers how to deploy generative AI for their businesses’ needs. This strategy has landed sizable contracts.

And customers signing up for AIP are reportedly looking to deploy the platform across their operations, creating a land-and-expand effect that significantly increased Palantir’s commercial customer base and contract value. That share of its business was up 55% year over year in the second quarter, exceeding the 41% increase in its overall customer base, which includes its government clients.

The company booked $946 million in total contract value in the second quarter, an increase of 47% from the prior-year period. And AI has helped boost the net retention rate (NRR) to 114%, up 300 basis points. (A reading of more than 100% means that existing customers are spending more money year over year.)

This metric does not include revenue from new customers acquired in the past 12 months, management says, so it has not yet fully captured the acceleration in its U.S. commercial business over the past year.

The 26% year-over-year increase to $4.3 billion in the company’s total remaining deal value is a further indicator of the impact of AI on its business. This metric refers to the total remaining value of Palantir’s contracts at the end of a reporting period. Given that the company has generated $2.5 billion in revenue in the trailing 12 months, the sizable remaining value in its deals points toward healthier revenue growth in the future.

Palantir says that its adjusted operating margin jumped by 12 percentage points in the second quarter to 37% because of “the strong unit economics of our business.” Translation: The company is generating more profit from each customer, driven by the increased spending on its products thanks to AIP.

Consensus estimates put Palantir’s annual earnings growth at 57% for the next five years. And with the global AI market expected to increase beyond the next five years, the company could sustain that healthy earnings growth for a longer period.

So if you’re looking for an AI stock with the long-term potential that could contribute toward making a million-dollar portfolio, you would do well to take a closer look at Palantir before it soars higher.

2. Oracle

The software platforms that Palantir offers to customers run on cloud infrastructure provided by the likes of Oracle (NYSE: ORCL). The two companies are already in a partnership, with Palantir using Oracle’s distributed cloud and AI infrastructure for its AIP, among other offerings. And it’s not the only company using Oracle’s cloud to reach customers.

Companies have been renting Oracle’s cloud infrastructure for training AI models, apart from offering their cloud-based AI services on its cloud platform. The demand for Oracle’s cloud infrastructure has been strong and exceeding availability. Management said on the September earnings call that its infrastructure cloud services business has attained an annualized revenue run rate of $8.6 billion, driven by a 56% increase in consumption.

Oracle has generated just under $54 billion in revenue in the past year. So, the AI-driven increase in demand for its cloud infrastructure has started moving the needle in a big way. That robust demand is the reason its remaining performance obligations (RPO) shot up 53% year over year to $99 billion in the first quarter of fiscal 2025.

RPO refers to the total value of a company’s contracts that will be fulfilled at a future date. So the faster growth in this metric when compared to Oracle’s revenue growth last quarter is an indication of stronger top-line growth in the future.

Goldman Sachs estimates that infrastructure as a service is set to generate $580 billion in revenue by 2030 powered by AI, which means that Oracle has a massive opportunity. Consensus estimates project an acceleration in growth following a 6% increase in revenue in the previous fiscal year to $53 billion.

Considering the huge addressable opportunity, Oracle could maintain strong growth over the long run as well. Finally, with the stock trading at 28 times forward earnings as compared to the U.S. tech sector’s average price-to-earnings ratio of 46, investors are getting a good deal on this AI stock. It seems like a good fit if you’re looking to create a million-dollar portfolio.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Goldman Sachs Group, Microsoft, Netflix, Nvidia, Oracle, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Millionaire-Maker Artificial Intelligence (AI) Stocks was originally published by The Motley Fool