2 Millionaire-Maker Artificial Intelligence (AI) Stocks

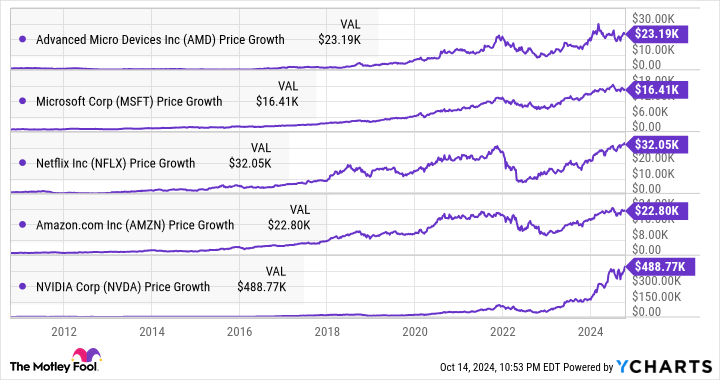

Goldman Sachs notes that the tech sector has been the driving force behind the U.S. stock market since 2010, generating 40% of the equity markets’ gains over the past 14 years.

Many tech stocks have delivered outsize gains since 2010. For example, $1,000 invested in Advanced Micro Devices would now be worth more than $23,000. Other companies — including Microsoft, Amazon, and Netflix — have also been multibaggers during this period, while Nvidia recorded stunning gains from multiple catalysts, the latest one being artificial intelligence (AI).

With AI still in its early phases of growth, Bloomberg estimates that the technology could generate $1.3 trillion in revenue in 2032, up from this year’s estimate of $137 billion. So, if you’re looking to build a million-dollar portfolio, you might do well to buy AI-focused companies and hold them for a long time.

In this article, we will take a closer look at two names that could soar in the long run, delivering outstanding gains to investors while contributing toward a million-dollar portfolio with AI-fueled growth.

1. Palantir Technologies

Companies like Nvidia have been in the limelight with their powerful chips capable of training AI models. But those models eventually need to be deployed for real-world applications. Palantir Technologies (NYSE: PLTR) is helping customers do just that with its Artificial Intelligence Platform (AIP).

AIP users can build generative AI applications, integrate large language models (LLMs) into their workflows, and deploy pre-built AI applications. Palantir has smartly been conducting its “boot camps” to show customers how to deploy generative AI for their businesses’ needs. This strategy has landed sizable contracts.

And customers signing up for AIP are reportedly looking to deploy the platform across their operations, creating a land-and-expand effect that significantly increased Palantir’s commercial customer base and contract value. That share of its business was up 55% year over year in the second quarter, exceeding the 41% increase in its overall customer base, which includes its government clients.

The company booked $946 million in total contract value in the second quarter, an increase of 47% from the prior-year period. And AI has helped boost the net retention rate (NRR) to 114%, up 300 basis points. (A reading of more than 100% means that existing customers are spending more money year over year.)

This metric does not include revenue from new customers acquired in the past 12 months, management says, so it has not yet fully captured the acceleration in its U.S. commercial business over the past year.

The 26% year-over-year increase to $4.3 billion in the company’s total remaining deal value is a further indicator of the impact of AI on its business. This metric refers to the total remaining value of Palantir’s contracts at the end of a reporting period. Given that the company has generated $2.5 billion in revenue in the trailing 12 months, the sizable remaining value in its deals points toward healthier revenue growth in the future.

Palantir says that its adjusted operating margin jumped by 12 percentage points in the second quarter to 37% because of “the strong unit economics of our business.” Translation: The company is generating more profit from each customer, driven by the increased spending on its products thanks to AIP.

Consensus estimates put Palantir’s annual earnings growth at 57% for the next five years. And with the global AI market expected to increase beyond the next five years, the company could sustain that healthy earnings growth for a longer period.

So if you’re looking for an AI stock with the long-term potential that could contribute toward making a million-dollar portfolio, you would do well to take a closer look at Palantir before it soars higher.

2. Oracle

The software platforms that Palantir offers to customers run on cloud infrastructure provided by the likes of Oracle (NYSE: ORCL). The two companies are already in a partnership, with Palantir using Oracle’s distributed cloud and AI infrastructure for its AIP, among other offerings. And it’s not the only company using Oracle’s cloud to reach customers.

Companies have been renting Oracle’s cloud infrastructure for training AI models, apart from offering their cloud-based AI services on its cloud platform. The demand for Oracle’s cloud infrastructure has been strong and exceeding availability. Management said on the September earnings call that its infrastructure cloud services business has attained an annualized revenue run rate of $8.6 billion, driven by a 56% increase in consumption.

Oracle has generated just under $54 billion in revenue in the past year. So, the AI-driven increase in demand for its cloud infrastructure has started moving the needle in a big way. That robust demand is the reason its remaining performance obligations (RPO) shot up 53% year over year to $99 billion in the first quarter of fiscal 2025.

RPO refers to the total value of a company’s contracts that will be fulfilled at a future date. So the faster growth in this metric when compared to Oracle’s revenue growth last quarter is an indication of stronger top-line growth in the future.

Goldman Sachs estimates that infrastructure as a service is set to generate $580 billion in revenue by 2030 powered by AI, which means that Oracle has a massive opportunity. Consensus estimates project an acceleration in growth following a 6% increase in revenue in the previous fiscal year to $53 billion.

Considering the huge addressable opportunity, Oracle could maintain strong growth over the long run as well. Finally, with the stock trading at 28 times forward earnings as compared to the U.S. tech sector’s average price-to-earnings ratio of 46, investors are getting a good deal on this AI stock. It seems like a good fit if you’re looking to create a million-dollar portfolio.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Goldman Sachs Group, Microsoft, Netflix, Nvidia, Oracle, and Palantir Technologies. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

2 Millionaire-Maker Artificial Intelligence (AI) Stocks was originally published by The Motley Fool

Bush Hog, RhinoAg, and Dixie Chopper Announce Sales Team Consolidation to Strengthen Dealer Support and Efficiency

Selma, AL October 18, 2024 –(PR.com)– Bush Hog, RhinoAg, and Dixie Chopper are pleased to announce the consolidation of their sales teams, effective January 1, 2025. This strategic initiative will streamline operations, enhance efficiency, and provide superior support to dealers and customers across all three brands.

In mid-September, the sales, marketing, and support teams from Bush Hog, RhinoAg, and Dixie Chopper convened in Nashville, TN, to discuss the consolidation, conduct product training, and map out a forward-looking strategy for continued success.

Realigning Teams for Improved Efficiency

This integration unites our sales teams into a multi-brand force, capitalizing on the strengths of Bush Hog, RhinoAg, and Dixie Chopper to deliver comprehensive service. Dealers will continue to offer their contracted product lines, with all products retaining their unique branding under the Bush Hog, Rhino, and Dixie Chopper names.

Optimized Territory Coverage

As part of this realignment, sales territories will be adjusted to optimize market coverage. This change will enable Territory Sales Managers to focus more effectively on local markets, ensuring personalized support and growing representation for all three brands.

Strengthening Strategic Partnerships

“Our goal is to foster stronger partnerships with dealers and customers to drive growth and expand market share,” said Dan Bratt, Vice President of Marketing and Sales. “By working collaboratively, we aim to fortify our market position and build long-lasting, mutually beneficial relationships.”

Looking Ahead

The consolidation strengthens Bush Hog, RhinoAg, and Dixie Chopper for long-term success and growth in a dynamic marketplace. We understand that questions may arise, and we are committed to ensuring a smooth transition. Our team is ready to assist dealers and customers throughout this process.

We sincerely thank you for your continued support and look forward to the opportunities ahead as we move forward together.

About Bush Hog, RhinoAg, and Dixie Chopper

Bush Hog, RhinoAg, and Dixie Chopper are industry-leading brands in agricultural and landscaping equipment. With a steadfast commitment to innovation, quality, and exceptional customer service, these brands continue to support dealers and customers with top-tier products and solutions.

For more information, please contact: ag-groupmarketing@alamo-group.com

Contact:

Dan Bratt, Vice President of Sales and Marketing, Bush Hog, RhinoAg, & Dixie Chopper

Dan Samet, NAAG Group Vice President

Lisa Tubbs, President, Dixie Chopper and RhinoAg

Trey Jenkins, President, Bush Hog

www.bushhog.com

www.rhinoag.com

www.dixiechopper.com

Contact Information:

Bush Hog

Dan Bratt

334-212-9094

Contact via Email

https://bushhog.com

Read the full story here: https://www.pr.com/press-release/922897

Press Release Distributed by PR.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Marijuana Stock Movers For October 18, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Chino Commercial Bancorp Reports Quarterly Earnings

CHINO, Calif., Oct. 18, 2024 (GLOBE NEWSWIRE) — The Board of Directors of Chino Commercial Bancorp CCBC, the parent company of Chino Commercial Bank, N.A., announced the results of operations for the Bank and the consolidated holding company for the third quarter ended September 30, 2024.

Net earnings year-to-date increased by 0.90% or by $33.2 thousand, to $3.74 million, as compared to $3.71 million for the same period last year. Year-to-date net earnings per share was $1.17 for the period ending September 30, 2024 and $1.16 for the same period last year. Net earnings for the third quarter of 2024, were $1.27 million, which represents a decrease of $7.6 thousand or 0.60% in comparison with the same quarter last year. Net earnings per basic and diluted share were $0.39 for the third quarter of 2024 and $0.40 for the same quarter in 2023, respectively.

Dann H. Bowman, President and Chief Executive Officer, stated, “The Bank’s operating performance for the third quarter, and year-to-date continue to be strong. Total deposits reached an all time record at quarter-end, and we are optimistic about additional opportunities for growth and expansion. Loan quality also remains stable, with the Bank having only one delinquent loan at quarter-end, and year-to-date credit losses were a net recovery of $10,241, meaning that the Bank collected more bad debt than was charged-off.

“In 2023 the Bank became a member of the Card Brand Association and began to offer Credit Card processing for its customers. Not only does this service provide an additional non-interest source of revenue, but the Bank has also been able to provide significant savings and transparency to its customers. For every business, efficient and cost effective processing of electronic payments has become a very important part of managing cash flow. In the future we can envision expanding this service outside of our immediate market; and the revenue from this service becoming an increasingly important part of the Bank’s business model.”

Financial Condition

At September 30, 2024, total assets were $464.4 million, an increase of $19.5 million or 11.68% over $446.4 million at December 31, 2023. Total deposits increased by $46.4 million or 14.52% to $366.2 million as of September 30, 2024, compared to $319.8 million as of December 31, 2023. At September 30, 2024, the Company’s core deposits represent 97.65% of the total deposits.

Gross loans increased by $15.1 million or 8.4% to $194.4 million as of September 30, 2024, compared to $179.0 million as of December 31, 2023. The Bank had three non-performing loans for the quarter ended September 30, 2024, and as of December 31, 2023. OREO properties remained at zero as of September 30, 2024 and December 31, 2023 respectively.

Earnings

The Company posted net interest income of $3.4 million for the three months ended September 30, 2024 and $3.3 million for the same quarter last year. Average interest-earning assets were $442.1 million with average interest-bearing liabilities of $248.4 million, yielding a net interest margin of 3.08% for the third quarter of 2024, as compared to the average interest-earning assets of $442.9 million with average interest-bearing liabilities of $235.8 million, yielding a net interest margin of 2.98% for the third quarter of 2023.

Non-interest income totaled $793.1 thousand for the third quarter of 2024, or an increase of 17.84% as compared with $673.1 thousand earned during the same quarter last year. The majority of the increase is attributed to the Company’s merchant services processing revenue that reached $129.2 thousand, representing an increase of $75.7 thousand during the third quarter as compared to $53.5 thousand for the same period last year.

General and administrative expenses were $2.5 million for the three months ended September 30, 2024, and $2.2 million for the same period last year. The largest component of general and administrative expenses was salary and benefits expense of $1.5 million for the third quarter of 2024 and $1.4 million for the same period last year.

Income tax expense was $500 thousand, which represents a decrease of $4 thousand or 0.77% for the three months ended September 30, 2024, as compared to $503 thousand for the same quarter last year. The effective income tax rate for the third quarter of 2024 and 2023 was approximately 28.3%.

Forward-Looking Statements

The statements contained in this press release that are not historical facts are forward-looking statements based on management’s current expectations and beliefs concerning future developments and their potential effects on the Company. Readers are cautioned not to unduly rely on forward-looking statements. Actual results may differ from those projected. These forward-looking statements involve risks and uncertainties, including but not limited to, the health of the national and California economies, the Company’s ability to attract and retain skilled employees, customers’ service expectations, the Company’s ability to successfully deploy new technology and gain efficiencies therefrom, and changes in interest rates, loan portfolio performance, and other factors.

Contact: Dann H. Bowman, President and CEO or Melinda M. Milincu, Senior Vice President and CFO, Chino Commercial Bancorp and Chino Commercial Bank, N.A., 14245 Pipeline Avenue, Chino, CA. 91710, (909) 393-8880.

| Consolidated Statements of Financial Condition | |||||||

| As of 9/30/2024 | |||||||

| Sep-2024 Ending Balance |

Dec-2023 Ending Balance |

||||||

| Assets | |||||||

| Cash and due from banks | $56,235,795 | $35,503,719 | |||||

| Cash and cash equivalents | $56,235,795 | $35,503,719 | |||||

| Fed Funds Sold | $34,246 | $25,218 | |||||

| Investment securities available for sale, net of zero allowance for credit losses | $6,735,550 | $6,736,976 | |||||

| Investment securities held to maturity, net of zero allowance for credit losses | $187,751,860 | $208,506,305 | |||||

| Total Investments | $194,487,410 | $215,243,281 | |||||

| Gross loans held for investments | $194,405,145 | $179,316,494 | |||||

| Allowance for Loan Losses | ($4,460,580 | ) | ($4,465,622 | ) | |||

| Net Loans | $189,944,565 | $174,850,872 | |||||

| Stock investments, restricted, at cost | $3,576,000 | $3,126,100 | |||||

| Fixed assets, net | $7,204,530 | $5,466,358 | |||||

| Accrued Interest Receivable | $1,466,479 | $1,439,178 | |||||

| Bank Owned Life Insurance | $8,421,648 | $8,247,174 | |||||

| Other Assets | $3,583,393 | $3,010,916 | |||||

| Total Assets | $464,413,004 | $446,414,238 | |||||

| Liabilities | |||||||

| Deposits | |||||||

| Noninterest-bearing | $186,644,255 | $167,131,411 | |||||

| Interest-bearing | $179,588,806 | $152,669,374 | |||||

| Total Deposits | $366,233,061 | $319,800,785 | |||||

| Federal Home Loan Bank advances | $0 | $15,000,000 | |||||

| Federal Reserve Bank borrowings | $40,000,000 | $57,000,000 | |||||

| Subordinated debt | $10,000,000 | $10,000,000 | |||||

| Subordinated notes payable to subsidiary trust | $3,093,000 | $3,093,000 | |||||

| Accrued interest payable | $1,556,057 | $2,156,153 | |||||

| Other Liabilities | $2,145,941 | $1,876,475 | |||||

| Total Liabilities | $423,028,059 | $408,926,413 | |||||

| Shareholder Equity | |||||||

| Common Stock ** | $10,502,558 | $10,502,558 | |||||

| Retained Earnings | $32,664,661 | $28,920,732 | |||||

| Unrealized Gain (Loss) AFS Securities | ($1,782,273 | ) | ($1,935,465 | ) | |||

| Total Shareholders’ Equity | $41,384,946 | $37,487,825 | |||||

| Total Liab & Shareholders’ Equity | $464,413,004 | $446,414,238 | |||||

| ** Common stock, no par value, 10,000,000 shares authorized and 3,211,970 shares issued and outstanding at 9/30/2024 and 12/31/2023 | |||||||

| Consolidated Statements of Net Income | ||||||||||||

| As of 9/30/2024 | ||||||||||||

| Sep-2024 QTD Balance |

Sep-2023 QTD Balance |

Sep-2024 YTD Balance |

Sep-2023 YTD Balance |

|||||||||

| Interest Income | ||||||||||||

| Interest & Fees On Loans | $3,035,928 | $2,467,400 | $8,564,927 | $7,245,563 | ||||||||

| Interest on Investment Securities | $1,843,696 | $1,166,387 | $5,725,365 | $3,444,135 | ||||||||

| Other Interest Income | $661,305 | $1,410,450 | $2,181,584 | $2,990,487 | ||||||||

| Total Interest Income | $5,540,929 | $5,044,237 | $16,471,876 | $13,680,185 | ||||||||

| Interest Expense | ||||||||||||

| Interest on Deposits | $1,168,014 | $841,282 | $3,255,683 | $1,835,134 | ||||||||

| Interest on Borrowings | $945,921 | $877,179 | $3,256,138 | $2,112,955 | ||||||||

| Total Interest Expense | $2,113,935 | $1,718,461 | $6,511,821 | $3,948,089 | ||||||||

| Net Interest Income | $3,426,994 | $3,325,776 | $9,960,055 | $9,732,096 | ||||||||

| Provision For Loan Losses | ($14,173 | ) | $6,578 | ($15,312 | ) | ($81,806 | ) | |||||

| Net Interest Income After Provision for Loan Losses | $3,441,167 | $3,319,198 | $9,975,367 | $9,813,902 | ||||||||

| Noninterest Income | ||||||||||||

| Service Charges and Fees on Deposit Accounts | $445,176 | $424,453 | $1,345,691 | $1,184,329 | ||||||||

| Interchange Fees | $113,647 | $106,418 | $308,680 | $314,803 | ||||||||

| Earnings from Bank-Owned Life Insurance | $59,599 | $48,677 | $174,474 | $142,799 | ||||||||

| Merchant Services Processing | $129,184 | $53,513 | $410,722 | $140,904 | ||||||||

| Other Miscellaneous Income | $45,488 | $39,989 | $149,010 | $130,747 | ||||||||

| Total Noninterest Income | $793,094 | $673,050 | $2,388,577 | $1,913,582 | ||||||||

| Noninterest Expense | ||||||||||||

| Salaries and Employee Benefits | $1,521,825 | $1,381,721 | $4,444,120 | $4,101,388 | ||||||||

| Occupancy and Equipment | $182,813 | $164,092 | $515,286 | $485,502 | ||||||||

| Merchant Services Processing | $77,452 | $47,345 | $222,055 | $82,807 | ||||||||

| Other Expenses | $684,102 | $619,533 | $1,964,230 | $1,876,220 | ||||||||

| Total Noninterest Expense | $2,466,192 | $2,212,691 | $7,145,691 | $6,545,917 | ||||||||

| Income Before Income Tax Expense | $1,768,070 | $1,779,556 | $5,218,253 | $5,181,566 | ||||||||

| Provision For Income Tax | $499,565 | $503,424 | $1,474,323 | $1,470,859 | ||||||||

| Net Income | $1,268,505 | $1,276,132 | $3,743,930 | $3,710,707 | ||||||||

| Basic earnings per share | $0.39 | $0.40 | $1.17 | $1.16 | ||||||||

| Diluted earnings per share | $0.39 | $0.40 | $1.17 | $1.16 | ||||||||

| Effective Income Tax Rate | 28.25 | % | 28.29 | % | 28.25 | % | 28.39 | % | ||||

| Financial Highlights | ||||||||||||

| As of 9/30/2024 | ||||||||||||

| Sep-2024 QTD |

Sep-2023 QTD |

Sep-2024 YTD |

Sep-2023 YTD |

|||||||||

| Key Financial Ratios | ||||||||||||

| Annualized Return on Average Equity | 12.42 | % | 14.34 | % | 12.73 | % | 14.57 | % | ||||

| Annualized Return on Average Assets | 1.08 | % | 1.09 | % | 1.06 | % | 1.13 | % | ||||

| Net Interest Margin | 3.08 | % | 2.98 | % | 2.97 | % | 3.11 | % | ||||

| Core Efficiency Ratio | 58.44 | % | 55.33 | % | 57.87 | % | 56.21 | % | ||||

| Net Chargeoffs/Recoveries to Average Loans | -0.01 | % | 0.00 | % | -0.01 | % | -0.02 | % | ||||

| Average Balances | ||||||||||||

| (thousands, unaudited) | ||||||||||||

| Average assets | $ | 466,891 | $ | 463,977 | $ | 472,470 | $ | 439,669 | ||||

| Average interest-earning assets | $ | 442,078 | $ | 442,870 | $ | 447,855 | $ | 418,593 | ||||

| Average interest-bearing liabilities | $ | 248,448 | $ | 235,812 | $ | 255,169 | $ | 209,835 | ||||

| Average gross loans | $ | 192,243 | $ | 178,251 | $ | 187,406 | $ | 179,089 | ||||

| Average deposits | $ | 344,372 | $ | 340,261 | $ | 335,140 | $ | 333,225 | ||||

| Average equity | $ | 40,630 | $ | 35,312 | $ | 39,297 | $ | 34,046 | ||||

| Credit Quality | ||||||||||||

| Non-performing loans | $ | 448,233 | $ | 492,242 | ||||||||

| Non-performing loans to total loans | 0.23 | % | 0.27 | % | ||||||||

| Non-performing loans to total assets | 0.10 | % | 0.11 | % | ||||||||

| Allowance for credit losses to total loans | 2.29 | % | 2.49 | % | ||||||||

| Nonperforming assets as a percentage of total loans and OREO | 0.23 | % | 0.27 | % | ||||||||

| Allowance for credit losses to non-performing loans | 995.15 | % | 907.20 | % | ||||||||

| Other Period-end Statistics | ||||||||||||

| Shareholders equity to total assets | 8.91 | % | 8.40 | % | ||||||||

| Net Loans to Deposits | 51.72 | % | 54.52 | % | ||||||||

| Non-interest bearing deposits to total deposits | 50.96 | % | 52.26 | % | ||||||||

| Company Leverage Ratio | 9.91 | % | 9.26 | % | ||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

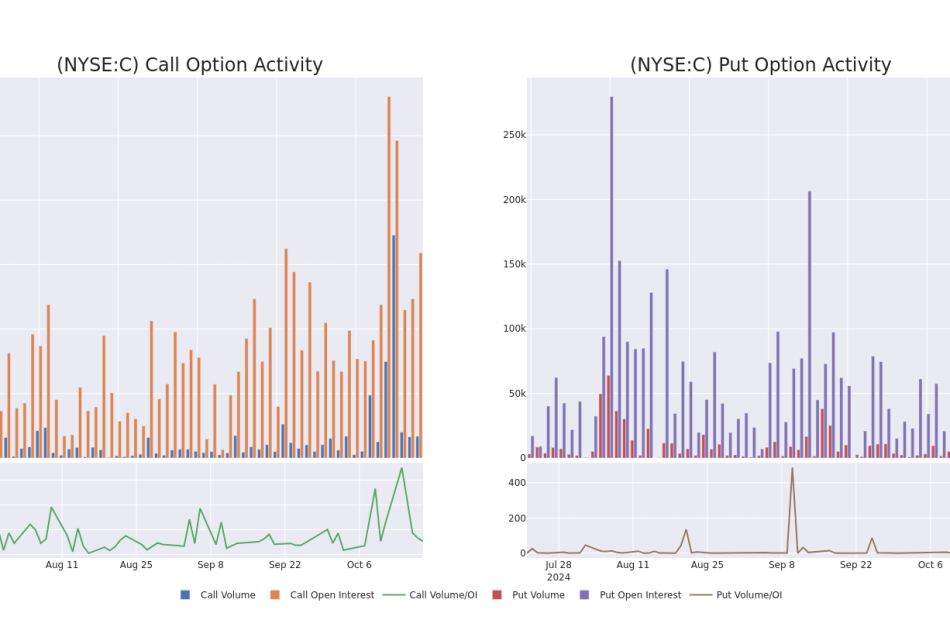

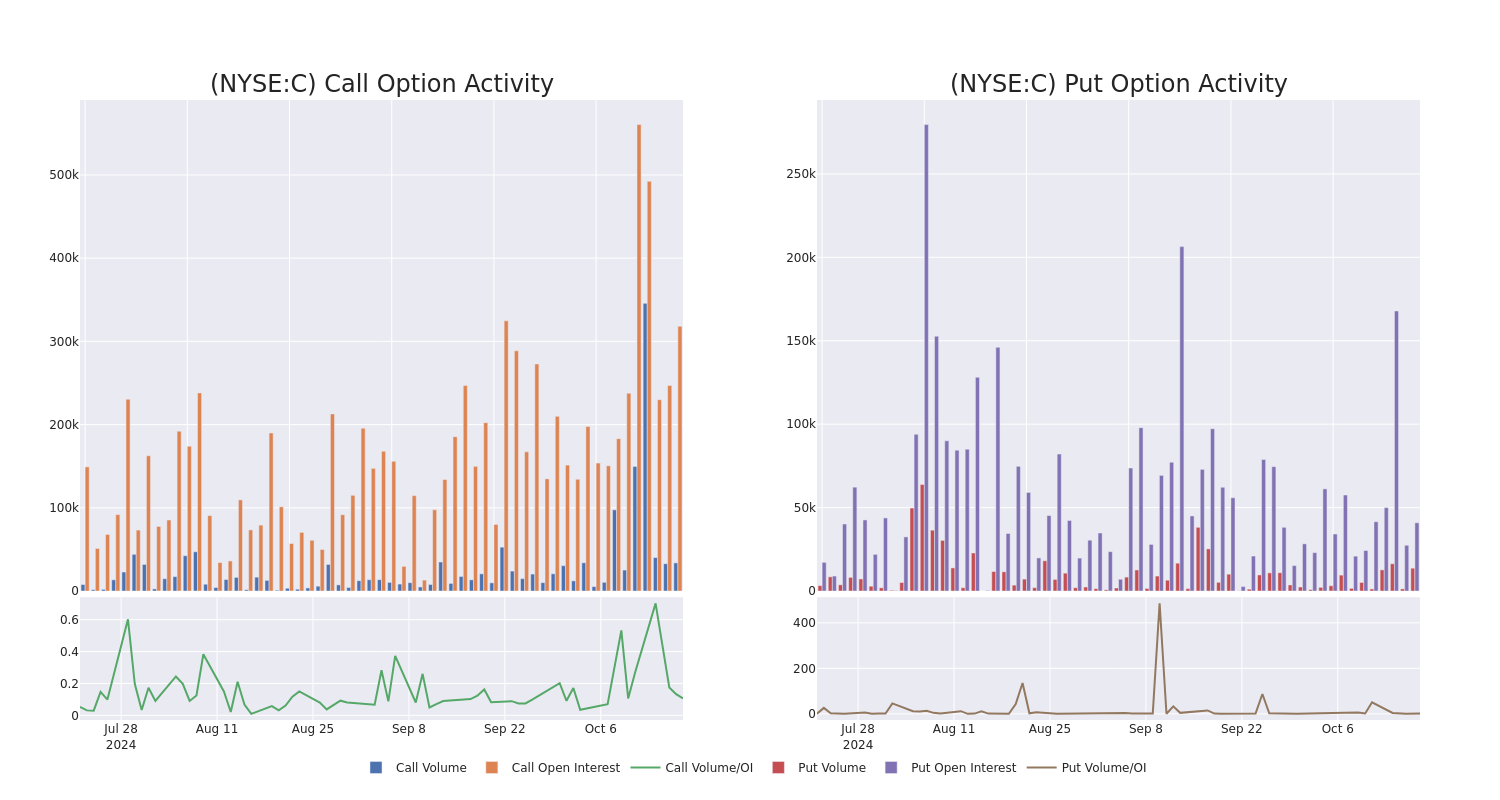

Smart Money Is Betting Big In Citigroup Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Citigroup.

Looking at options history for Citigroup C we detected 41 trades.

If we consider the specifics of each trade, it is accurate to state that 39% of the investors opened trades with bullish expectations and 51% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $1,005,393 and 36, calls, for a total amount of $2,928,597.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $42.5 to $75.0 for Citigroup during the past quarter.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Citigroup options trades today is 14959.83 with a total volume of 47,452.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Citigroup’s big money trades within a strike price range of $42.5 to $75.0 over the last 30 days.

Citigroup Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| C | PUT | TRADE | NEUTRAL | 06/20/25 | $5.0 | $4.9 | $4.95 | $62.50 | $814.7K | 14.6K | 3.2K |

| C | CALL | SWEEP | BEARISH | 01/17/25 | $13.55 | $13.5 | $13.5 | $50.00 | $472.5K | 39.1K | 352 |

| C | CALL | SWEEP | BULLISH | 01/17/25 | $13.3 | $13.25 | $13.25 | $50.00 | $198.7K | 39.1K | 761 |

| C | CALL | SWEEP | BULLISH | 01/17/25 | $13.3 | $13.25 | $13.25 | $50.00 | $198.7K | 39.1K | 611 |

| C | CALL | SWEEP | BULLISH | 01/17/25 | $15.8 | $15.7 | $15.8 | $47.50 | $145.3K | 23.9K | 2.1K |

About Citigroup

Citigroup is a global financial-services company doing business in more than 100 countries and jurisdictions. Citigroup’s operations are organized into five primary segments: services, markets, banking, US personal banking, and wealth management. The bank’s primary services include cross-border banking needs for multinational corporates, investment banking and trading, and credit card services in the United States.

In light of the recent options history for Citigroup, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Citigroup Standing Right Now?

- Trading volume stands at 13,599,539, with C’s price down by -1.75%, positioned at $62.85.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 89 days.

What Analysts Are Saying About Citigroup

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $82.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Citigroup, targeting a price of $64.

* An analyst from B of A Securities persists with their Buy rating on Citigroup, maintaining a target price of $78.

* Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on Citigroup with a target price of $86.

* An analyst from Oppenheimer persists with their Outperform rating on Citigroup, maintaining a target price of $92.

* Consistent in their evaluation, an analyst from Oppenheimer keeps a Outperform rating on Citigroup with a target price of $91.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Citigroup, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

There’s an Opportunity Brewing in These 2 Chip Software Stocks, Says Berenberg

The stock market continues to show bullish momentum, with tech companies, much like last year, emerging as key winners. Despite experiencing some volatility in late summer, the NASDAQ index has climbed 24% year-to-date and remains on a generally upward trajectory.

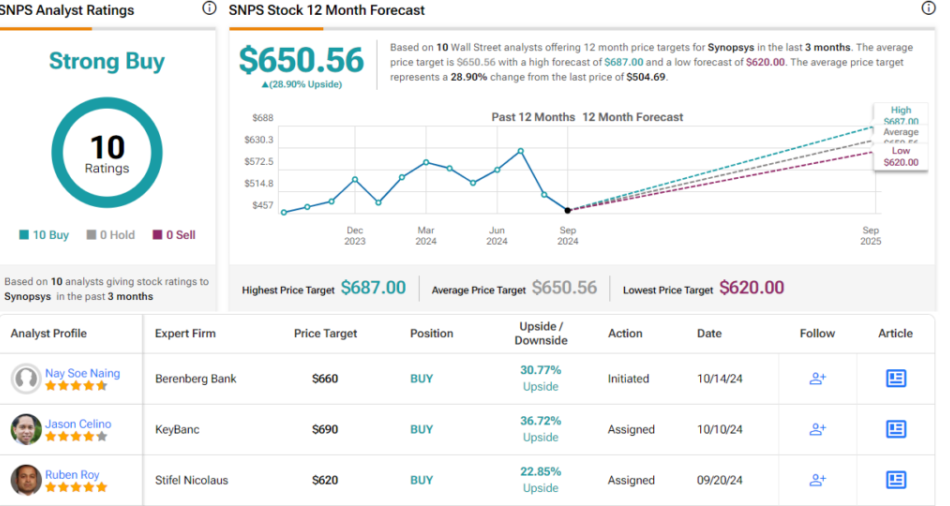

While industry giants like Nvidia have dominated headlines, Berenberg analyst Nay Soe Naing is turning attention toward under-the-radar names in the chip software space.

To delve deeper, we’ve leveraged the TipRanks data platform to gauge Wall Street’s sentiment on two such stocks recommended by Naing. Both come with Buy ratings and promising upside potential. Let’s dive into the details, along with key insights from the Berenberg analysis.

Synopsys (SNPS)

The first company we’ll look at here, Synopsys, is a specialist in electronic design automation, with a focus on silicon design, the important first step in the manufacturing process for silicon semiconductor chips. The company offers solutions for silicon design and verification, silicon intellectual property, and systems verification and validation, and bases its solutions on artificial intelligence (AI) and software-defined systems. Synopsys boasts that its technology, and the tech and software solutions that it provides, make possible the innovations behind many of today’s big headline generators – autonomous vehicles, machine learnings, and high-speed communications, among others.

In recent weeks, Synopsys has made announcements showing that it is both expanding and streamlining its business. On the streamlining side, the company sold off its optical solutions group to Keystone Technologies, a leader in the field of design and emulation test solutions. The terms of this deal were not disclosed. And on the expansion side, Synopsys at the end of September entered into an agreement with TSMC, the world’s second-largest chip maker by market cap and third-largest by revenue, to provide advanced EDA and IP solutions to support TSMC’s most advanced technological process and manufacturing lines.

Synopsys may not be a household name, but it is big business. The company has more than 35 years’ experience, and employs over 19,000 people – and brought in over $5.8 billion in revenue for calendar-year 2023.

In its most recently reported quarter, for fiscal 3Q24, the company brought in $1.526 billion at the top line, for a 13%-plus year-over-year gain and beating the forecast by $10 million. The company’s bottom line, by non-GAAP measures, came to $3.43 per share, growing 27% year-over-year and beating expectations by 14 cents per share. Synopsys followed these sound results by guiding toward 15% y/y revenue growth for fiscal 2024; achieving that would be a company record.

For Berenberg analyst Naing, the key here is this company’s solid position leading its niche, as he writes, “Synopsys, much like its peers, is benefiting from the innovation-driven secular tailwinds in the semiconductor industry. However, as the largest semiconductor design solutions provider in the world, and with a differentiated product portfolio that is indexed more towards higher-growth product markets, and peerless in terms of innovation, we believe Synopsys’s medium-term growth potential is superior to that of its competitors, including its direct competitor Cadence.”

At his own bottom line, Naing says of Synopsys’ prospects, “While Synopsys’s profit margins may not be at the same level as some of the other sector leaders, it operates at incremental margins that are among the highest in the sector. In our view, Synopsys’s exceptional financial potential deserves a higher valuation multiple premium than it currently attracts.”

Naing initiates his firm’s coverage of SNPS with a Buy rating, and his $660 price target suggests that the stock will gain 31% heading out to the one-year horizon. (To watch Naing’s track record, click here)

The Strong Buy analyst consensus on Synopsys is unanimous, based on 10 recent reviews from the Street. The company’s shares are trading for $504.69 and the $650.56 average price target implies a potential one-year upside of 29%. (See SNPS stock forecast)

Cadence Design Systems (CDNS)

Next up is one of Synopsys’ chief competitors, Cadence Design Systems. Cadence has been in the business of electronic systems design since the early 1980s and is known for its software expertise. The company’s strategy is dubbed Intelligent System Design, and is used to deliver the best in software, hardware, and IP protections, and its services are used in a wide range of silicon-based technologies, including such vital components as semiconductor chips and integrated circuit boards and in industries from telecom to aerospace to life sciences.

Cadence saw $4.09 billion in sales last year, generated through a network that spans 26 countries around the world and employs over 11,000 people. The company’s product and service lines include analog and digital IC design; system verification; IC packaging and PCB design; Multiphysics and CFD analysis; and molecular modeling and biosimulation. The company’s work adds up to a broadly integrated set of end-to-end design solutions essential for today’s electronic designers to produce innovative products.

This month alone, Cadence has made a commitment to enter the imecAutomotive chiplet program, a collaborative endeavor to develop and produce the chiplets and chip sets that will inhabit the next generation of automobiles and make possible fully autonomous vehicles. In addition, Cadence has also announced that it will now integrate Nvidia NeMo and NIM microservices into its own generative AI applications, improving its own ability to innovate in semiconductor design.

On the financial side, Cadence saw 2Q24 revenues of $1.06 billion, $20 million better than had been anticipated and up 8.5% year-over-year. The quarterly EPS, of $1.28 in non-GAAP figures, was 5 cents per share better than the forecast. Looking ahead, Cadence finished the second quarter with a work backlog totaling $6 billion.

Opening his coverage of Cadence for Berenberg, Naing first points out the company’s solid industry position, saying, “Cadence, as one of the world’s largest semiconductor design solutions providers, plays an important role in driving innovation in the semiconductor industry. As such, it is benefiting from the structural trends in the semiconductor industry that are driven by technological advancements. At the same time, Cadence’s business, which is driven by R&D spending, is shielded from the cyclicality of the semiconductor industry.”

The analyst goes on to outline an upbeat path for Cadence in the coming year: “Also, owing to its best-in-class product portfolio and operational model, Cadence is outgrowing its peers and offers among the highest profitability potential of its peer group. In fact, we believe that Cadence will outgrow peers even faster than in recent years as it continues to capture the AI-driven semiconductor design opportunity.”

Unsurprisingly, this stance comes along with a Buy rating for the stock, and Naing’s $320 price target indicates his confidence in a one-year upside of 21.5%.

Like Synopsys above, Cadence has 10 recent Wall Street reviews on record. These include 8 to Buy, and one each to Hold and Sell, for a Moderate Buy consensus rating. The shares are trading for $263.03, with a $319.33 average price target, almost identical to Naing’s objective. (See CDNSstock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

1 Super Semiconductor ETF That Could Turn $400 Per Month Into $1 Million, With Nvidia's Help

Nvidia (NASDAQ: NVDA) pioneered the graphics processing unit (GPU) in 1999 to render computer graphics for gaming and multimedia purposes.

Since GPUs are capable of parallel processing — meaning they can seamlessly perform multiple tasks at the same time — they are also ideal for compute-intensive workloads like machine learning and artificial intelligence (AI) development. That led Nvidia to design new GPU architectures for data centers, and the semiconductor industry is now at the heart of the AI revolution.

Nvidia CEO Jensen Huang believes data center operators will spend $1 trillion building GPU-based AI infrastructure over the next five years. That’s an incredible financial opportunity, not only for his company, but for the entire semiconductor industry.

The iShares Semiconductor ETF (NASDAQ: SOXX) holds every leading chip stock, so it can give investors exposure to that trend in a diversified way. In fact, here’s how the exchange-traded fund (ETF) could turn $400 per month into $1 million over the long term.

Every top chip stock packed into one fund

The iShares Semiconductor ETF invests in U.S. companies that design, manufacture, and distribute chips — especially those poised to benefit from powerful trends like AI. Although ETFs can hold hundreds or even thousands of different stocks, the iShares Semiconductor ETF holds just 30, so it’s highly concentrated toward its singular theme.

Led by Nvidia, its top five holdings represent 37.9% of the entire value of its portfolio.

|

Stock |

iShares ETF Portfolio Weighting |

|---|---|

|

1. Nvidia |

8.88% |

|

2. Broadcom |

8.60% |

|

3. Advanced Micro Devices |

8.54% |

|

4. Qualcomm |

6.09% |

|

5. Texas Instruments |

5.84% |

Data source: iShares. Portfolio weightings are accurate as of Oct. 14, 2024, and are subject to change.

Nvidia was valued at $360 billion at the start of 2023. Less than two years later, it’s now the second largest company in the world, with a market capitalization of $3.2 trillion. The chip giant is delivering the revenue and earnings growth to support its incredible rise in value, thanks primarily to sales of its data center GPUs.

In the recent fiscal 2025 second quarter (ended July 28), Nvidia generated $26.3 billion in data center revenue, which was a whopping 154% increase from the year-ago period. The strong results are likely to continue, because the company is about to start shipping a new generation of GPUs based on its Blackwell architecture. Blackwell GPUs promise an incredible leap in performance of up to 30 times compared to Nvidia’s flagship H100 GPU, and Huang recently said demand for them is “insane.”

Broadcom also plays a key role in AI data centers. It makes AI accelerators (a type of chip) for hyperscale clients, which typically include tech giants like Microsoft and Amazon. It also makes Ethernet switches like the Tomahawk 5 and Jericho3-AI, which regulate how quickly data travels between GPUs and devices.

Advanced Micro Devices has emerged as a direct competitor to Nvidia in the GPU space. It will ship its new MI350X data center chip, which is designed to compete directly with the Blackwell lineup, in the second half of 2025. But AMD also makes neural processors (NPUs) for personal computers, which can handle AI workloads on-device, creating a faster user experience. This could be a big opportunity for the company outside the data center.

Beyond its top five positions, the iShares Semiconductor ETF also holds other top AI chip stocks like Micron Technology, which supplies memory and storage chips designed increasingly for AI workloads, and Taiwan Semiconductor Manufacturing, which fabricates many of the GPUs designed by Nvidia and AMD.

Turning $400 per month into $1 million

The iShares Semiconductor ETF has generated a compound annual return of 11.6% since its inception in 2001. However, its compound annual return has accelerated to 24.5% over the last 10 years, thanks to the rapid adoption of compute-intensive technologies like cloud computing, enterprise software, and AI.

The table below highlights the returns an investor could earn with $400 per month over 10 years, 20 years, and 30 years based on three different annual growth rates.

|

Monthly Investment |

Compound Annual Return |

Balance After 10 Years |

Balance After 20 Years |

Balance After 30 Years |

|---|---|---|---|---|

|

$400 |

11.6% |

$91,153 |

$379,042 |

$1,292,289 |

|

$400 |

18.1% (midpoint) |

$135,761 |

$951,779 |

$5,871,080 |

|

$400 |

24.5% |

$206,433 |

$2,535,833 |

$28,871,790 |

Calculations by author.

It’s unlikely that the iShares Semiconductor ETF will deliver an average annual return of 24.5% over the next 30 years — or even over the next 10 years, for that matter. The law of large numbers will eventually lead to a deceleration in growth. Nvidia is experiencing that phenomenon right now. Despite growing its data center revenue by 154% in its recent quarter, that was a much slower growth rate than the prior quarter just three months earlier, when its data center revenue jumped by 427%.

However, even if the ETF reverts back to an annual return of 11.6%, that will still be enough to turn $400 per month into $1 million over 30 years. While nothing is guaranteed, that is a more realistic expectation for investors.

Plus, ETFs can be very flexible. The iShares Semiconductor ETF will rebalance over time, so new companies will find their way into its top holdings if they are outperforming their peers, which will support further returns.

AI is likely to be a game changer for the semiconductor industry over the long term. Goldman Sachs believes the technology will add $7 trillion to the global economy in the coming decade. If that’s true, it will drive a consistent reinvestment into chips and infrastructure to fuel future growth cycles.

However, there is always a risk that AI will fail to live up to the hype. That’s why it’s important for investors to buy the iShares Semiconductor ETF only as part of a balanced portfolio.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,121!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,917!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,844!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Goldman Sachs Group, Microsoft, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, Texas Instruments, and iShares Trust-iShares Semiconductor ETF. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Super Semiconductor ETF That Could Turn $400 Per Month Into $1 Million, With Nvidia’s Help was originally published by The Motley Fool

Meet the Unstoppable Stock That Could Join Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Taiwan Semiconductor Manufacturing in the $1 Trillion Club by 2035

One of the biggest secular tailwinds in recent years is the advent of artificial intelligence (AI). The latest advancements in AI went viral early last year, and the list of companies in the $1 trillion club is littered with businesses on the leading edge of this next-generation technology.

For example, Apple products — including Siri and Maps — have always embraced AI, while Microsoft, Alphabet, Amazon, and Meta Platforms have developed seemingly impenetrable moats by integrating AI deeply into their respective business operations. Nvidia and Taiwan Semiconductor Manufacturing have developed the chips that make AI possible.

Netflix (NASDAQ: NFLX) is one of the pioneers of AI, using cutting-edge algorithms to inform its streaming recommendations and production choices, yet the company has fallen out of favor with some who are busy chasing the latest shiny new thing. Investors might be surprised to learn that Netflix just delivered another quarter of double-digit growth. With a market cap of just $324 billion, it might seem premature to suggest Netflix is bucking to join its peers in the trillion-dollar club, yet the stock has gained more than 100% over the past year and 1,380% over the past decade, and the evidence suggests its ascent will continue.

Bullish results

Netflix just reported its third-quarter results and sailed past expectations on every important metric. Revenue of $9.83 billion climbed 15% year over year, generating robust profit growth as earnings per share (EPS) of $5.40 soared 45%. Revenue was fueled by strong paid subscriber growth that jumped by more than 5 million, an increase of 14%. The bottom line was driven higher by an expanding operating margin that increased by an incredible 720 basis points to 29.6%.

For context, analysts’ consensus estimates were calling for revenue of $9.77 billion and EPS of $5.12, accompanied by subscriber additions of 4.5 million, so Netflix beat across the board.

Perhaps more importantly, management expects its growth streak to continue. Netflix is guiding for fourth-quarter revenue of $10.1 billion, up nearly 15%, while EPS of $4.23 would more than double.

Incremental levers for growth

On the conference call to discuss the results, Netflix laid out plans to continue its impressive growth, highlighting three particularly significant opportunities.

Netflix has been dabbling in video games for some time now, but the company is beginning to see greater interest from its audience for the games based on the company’s growing library of intellectual property. Management is particularly excited about the title based on Squid Game, the company’s most-watched series.

Management is also leaning into its recent successes with live events. Netflix is live-streaming a boxing match between Mike Tyson and Jake Paul on Nov. 15. The company also has exclusive rights to two NFL games on Christmas Day: The Super Bowl LVII-winning Kansas City Chiefs vs. the Pittsburgh Steelers, and the Baltimore Ravens vs. the Houston Texans. Finally, Netflix is the new home of WWE Raw, the highly rated wrestling entertainment show, with weekly episodes beginning in January 2025.

However, the company’s biggest opportunity is its growing digital advertising business. Netflix noted during the call that its audience and ad inventory are currently growing faster than the company’s ability to capitalize on that growth. Members signing up for the lowest-priced ad tier increased 35% quarter over quarter and accounted for 50% of new members in the countries where Netflix shows advertising.

The company has a couple of important initiatives that are designed to accelerate its ads business. First, Netflix is launching its first-party ad server, beginning in Canada this quarter, then in the rest of its advertising markets in 2025. The company is also leaning into its partnership with The Trade Desk to expand its advertising reach. Netflix noted that ad-tier members are similar to other subscribers in terms of hours watched and preferred titles, which shows viewing patterns are consistent. Management expects ad revenue to double (off a small base) in 2025.

Each of these initiatives represents an incremental growth driver, which helps illustrate how Netflix plans to continue its robust growth.

The path to $1 trillion

Netflix currently has a market cap of $323 billion, which means it will take stock price gains of roughly 207% to drive its value to $1 trillion, but there’s a clear path for growth over the coming decade. According to Wall Street, Netflix is expected to generate revenue of $38.74 billion in 2024, giving it a forward price-to-sales (P/S) ratio of roughly 8. Assuming its P/S remains constant, Netflix would have to grow its revenue to roughly $357 billion annually to support a $1 trillion market cap.

Wall Street is currently forecasting revenue growth for Netflix of about 26% annually over the next five years. If the company achieves that benchmark, it could achieve a $1 trillion market cap as soon as 2035. It’s worth noting that Netflix has grown its annual revenue by 562% over the past decade, and its net income has soared 1,450%, so Wall Street’s outlook could well be conservative. Furthermore, as this quarter illustrates, Netflix has a habit of outpacing Wall Street’s expectations, which could also shave years off this timeline.

Finally, Netflix is currently selling for roughly 39 times earnings, which might seem expensive at first glance, but consider this: Wall Street expects Netflix to generate EPS of $23.11 in 2025, which would represent a multiple of 30 — the same as the S&P 500. Considering Netflix’s strong track record of growth and its significant opportunity, I’d say that’s a fair price to pay for a company expected to generate consistent double-digit growth over the next five years.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,121!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,917!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,844!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, and The Trade Desk. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, Taiwan Semiconductor Manufacturing, and The Trade Desk. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Unstoppable Stock That Could Join Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Taiwan Semiconductor Manufacturing in the $1 Trillion Club by 2035 was originally published by The Motley Fool