There’s an Opportunity Brewing in These 2 Chip Software Stocks, Says Berenberg

The stock market continues to show bullish momentum, with tech companies, much like last year, emerging as key winners. Despite experiencing some volatility in late summer, the NASDAQ index has climbed 24% year-to-date and remains on a generally upward trajectory.

While industry giants like Nvidia have dominated headlines, Berenberg analyst Nay Soe Naing is turning attention toward under-the-radar names in the chip software space.

To delve deeper, we’ve leveraged the TipRanks data platform to gauge Wall Street’s sentiment on two such stocks recommended by Naing. Both come with Buy ratings and promising upside potential. Let’s dive into the details, along with key insights from the Berenberg analysis.

Synopsys (SNPS)

The first company we’ll look at here, Synopsys, is a specialist in electronic design automation, with a focus on silicon design, the important first step in the manufacturing process for silicon semiconductor chips. The company offers solutions for silicon design and verification, silicon intellectual property, and systems verification and validation, and bases its solutions on artificial intelligence (AI) and software-defined systems. Synopsys boasts that its technology, and the tech and software solutions that it provides, make possible the innovations behind many of today’s big headline generators – autonomous vehicles, machine learnings, and high-speed communications, among others.

In recent weeks, Synopsys has made announcements showing that it is both expanding and streamlining its business. On the streamlining side, the company sold off its optical solutions group to Keystone Technologies, a leader in the field of design and emulation test solutions. The terms of this deal were not disclosed. And on the expansion side, Synopsys at the end of September entered into an agreement with TSMC, the world’s second-largest chip maker by market cap and third-largest by revenue, to provide advanced EDA and IP solutions to support TSMC’s most advanced technological process and manufacturing lines.

Synopsys may not be a household name, but it is big business. The company has more than 35 years’ experience, and employs over 19,000 people – and brought in over $5.8 billion in revenue for calendar-year 2023.

In its most recently reported quarter, for fiscal 3Q24, the company brought in $1.526 billion at the top line, for a 13%-plus year-over-year gain and beating the forecast by $10 million. The company’s bottom line, by non-GAAP measures, came to $3.43 per share, growing 27% year-over-year and beating expectations by 14 cents per share. Synopsys followed these sound results by guiding toward 15% y/y revenue growth for fiscal 2024; achieving that would be a company record.

For Berenberg analyst Naing, the key here is this company’s solid position leading its niche, as he writes, “Synopsys, much like its peers, is benefiting from the innovation-driven secular tailwinds in the semiconductor industry. However, as the largest semiconductor design solutions provider in the world, and with a differentiated product portfolio that is indexed more towards higher-growth product markets, and peerless in terms of innovation, we believe Synopsys’s medium-term growth potential is superior to that of its competitors, including its direct competitor Cadence.”

At his own bottom line, Naing says of Synopsys’ prospects, “While Synopsys’s profit margins may not be at the same level as some of the other sector leaders, it operates at incremental margins that are among the highest in the sector. In our view, Synopsys’s exceptional financial potential deserves a higher valuation multiple premium than it currently attracts.”

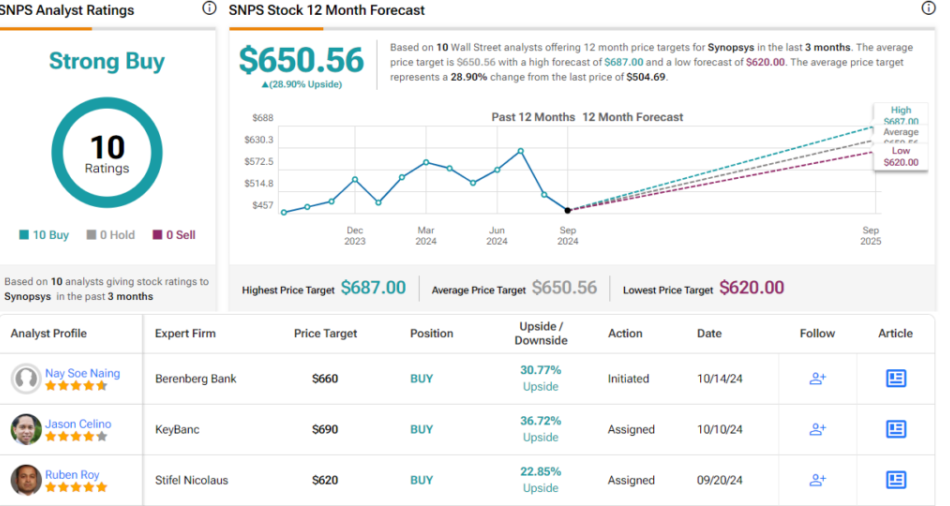

Naing initiates his firm’s coverage of SNPS with a Buy rating, and his $660 price target suggests that the stock will gain 31% heading out to the one-year horizon. (To watch Naing’s track record, click here)

The Strong Buy analyst consensus on Synopsys is unanimous, based on 10 recent reviews from the Street. The company’s shares are trading for $504.69 and the $650.56 average price target implies a potential one-year upside of 29%. (See SNPS stock forecast)

Cadence Design Systems (CDNS)

Next up is one of Synopsys’ chief competitors, Cadence Design Systems. Cadence has been in the business of electronic systems design since the early 1980s and is known for its software expertise. The company’s strategy is dubbed Intelligent System Design, and is used to deliver the best in software, hardware, and IP protections, and its services are used in a wide range of silicon-based technologies, including such vital components as semiconductor chips and integrated circuit boards and in industries from telecom to aerospace to life sciences.

Cadence saw $4.09 billion in sales last year, generated through a network that spans 26 countries around the world and employs over 11,000 people. The company’s product and service lines include analog and digital IC design; system verification; IC packaging and PCB design; Multiphysics and CFD analysis; and molecular modeling and biosimulation. The company’s work adds up to a broadly integrated set of end-to-end design solutions essential for today’s electronic designers to produce innovative products.

This month alone, Cadence has made a commitment to enter the imecAutomotive chiplet program, a collaborative endeavor to develop and produce the chiplets and chip sets that will inhabit the next generation of automobiles and make possible fully autonomous vehicles. In addition, Cadence has also announced that it will now integrate Nvidia NeMo and NIM microservices into its own generative AI applications, improving its own ability to innovate in semiconductor design.

On the financial side, Cadence saw 2Q24 revenues of $1.06 billion, $20 million better than had been anticipated and up 8.5% year-over-year. The quarterly EPS, of $1.28 in non-GAAP figures, was 5 cents per share better than the forecast. Looking ahead, Cadence finished the second quarter with a work backlog totaling $6 billion.

Opening his coverage of Cadence for Berenberg, Naing first points out the company’s solid industry position, saying, “Cadence, as one of the world’s largest semiconductor design solutions providers, plays an important role in driving innovation in the semiconductor industry. As such, it is benefiting from the structural trends in the semiconductor industry that are driven by technological advancements. At the same time, Cadence’s business, which is driven by R&D spending, is shielded from the cyclicality of the semiconductor industry.”

The analyst goes on to outline an upbeat path for Cadence in the coming year: “Also, owing to its best-in-class product portfolio and operational model, Cadence is outgrowing its peers and offers among the highest profitability potential of its peer group. In fact, we believe that Cadence will outgrow peers even faster than in recent years as it continues to capture the AI-driven semiconductor design opportunity.”

Unsurprisingly, this stance comes along with a Buy rating for the stock, and Naing’s $320 price target indicates his confidence in a one-year upside of 21.5%.

Like Synopsys above, Cadence has 10 recent Wall Street reviews on record. These include 8 to Buy, and one each to Hold and Sell, for a Moderate Buy consensus rating. The shares are trading for $263.03, with a $319.33 average price target, almost identical to Naing’s objective. (See CDNSstock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

1 Super Semiconductor ETF That Could Turn $400 Per Month Into $1 Million, With Nvidia's Help

Nvidia (NASDAQ: NVDA) pioneered the graphics processing unit (GPU) in 1999 to render computer graphics for gaming and multimedia purposes.

Since GPUs are capable of parallel processing — meaning they can seamlessly perform multiple tasks at the same time — they are also ideal for compute-intensive workloads like machine learning and artificial intelligence (AI) development. That led Nvidia to design new GPU architectures for data centers, and the semiconductor industry is now at the heart of the AI revolution.

Nvidia CEO Jensen Huang believes data center operators will spend $1 trillion building GPU-based AI infrastructure over the next five years. That’s an incredible financial opportunity, not only for his company, but for the entire semiconductor industry.

The iShares Semiconductor ETF (NASDAQ: SOXX) holds every leading chip stock, so it can give investors exposure to that trend in a diversified way. In fact, here’s how the exchange-traded fund (ETF) could turn $400 per month into $1 million over the long term.

Every top chip stock packed into one fund

The iShares Semiconductor ETF invests in U.S. companies that design, manufacture, and distribute chips — especially those poised to benefit from powerful trends like AI. Although ETFs can hold hundreds or even thousands of different stocks, the iShares Semiconductor ETF holds just 30, so it’s highly concentrated toward its singular theme.

Led by Nvidia, its top five holdings represent 37.9% of the entire value of its portfolio.

|

Stock |

iShares ETF Portfolio Weighting |

|---|---|

|

1. Nvidia |

8.88% |

|

2. Broadcom |

8.60% |

|

3. Advanced Micro Devices |

8.54% |

|

4. Qualcomm |

6.09% |

|

5. Texas Instruments |

5.84% |

Data source: iShares. Portfolio weightings are accurate as of Oct. 14, 2024, and are subject to change.

Nvidia was valued at $360 billion at the start of 2023. Less than two years later, it’s now the second largest company in the world, with a market capitalization of $3.2 trillion. The chip giant is delivering the revenue and earnings growth to support its incredible rise in value, thanks primarily to sales of its data center GPUs.

In the recent fiscal 2025 second quarter (ended July 28), Nvidia generated $26.3 billion in data center revenue, which was a whopping 154% increase from the year-ago period. The strong results are likely to continue, because the company is about to start shipping a new generation of GPUs based on its Blackwell architecture. Blackwell GPUs promise an incredible leap in performance of up to 30 times compared to Nvidia’s flagship H100 GPU, and Huang recently said demand for them is “insane.”

Broadcom also plays a key role in AI data centers. It makes AI accelerators (a type of chip) for hyperscale clients, which typically include tech giants like Microsoft and Amazon. It also makes Ethernet switches like the Tomahawk 5 and Jericho3-AI, which regulate how quickly data travels between GPUs and devices.

Advanced Micro Devices has emerged as a direct competitor to Nvidia in the GPU space. It will ship its new MI350X data center chip, which is designed to compete directly with the Blackwell lineup, in the second half of 2025. But AMD also makes neural processors (NPUs) for personal computers, which can handle AI workloads on-device, creating a faster user experience. This could be a big opportunity for the company outside the data center.

Beyond its top five positions, the iShares Semiconductor ETF also holds other top AI chip stocks like Micron Technology, which supplies memory and storage chips designed increasingly for AI workloads, and Taiwan Semiconductor Manufacturing, which fabricates many of the GPUs designed by Nvidia and AMD.

Turning $400 per month into $1 million

The iShares Semiconductor ETF has generated a compound annual return of 11.6% since its inception in 2001. However, its compound annual return has accelerated to 24.5% over the last 10 years, thanks to the rapid adoption of compute-intensive technologies like cloud computing, enterprise software, and AI.

The table below highlights the returns an investor could earn with $400 per month over 10 years, 20 years, and 30 years based on three different annual growth rates.

|

Monthly Investment |

Compound Annual Return |

Balance After 10 Years |

Balance After 20 Years |

Balance After 30 Years |

|---|---|---|---|---|

|

$400 |

11.6% |

$91,153 |

$379,042 |

$1,292,289 |

|

$400 |

18.1% (midpoint) |

$135,761 |

$951,779 |

$5,871,080 |

|

$400 |

24.5% |

$206,433 |

$2,535,833 |

$28,871,790 |

Calculations by author.

It’s unlikely that the iShares Semiconductor ETF will deliver an average annual return of 24.5% over the next 30 years — or even over the next 10 years, for that matter. The law of large numbers will eventually lead to a deceleration in growth. Nvidia is experiencing that phenomenon right now. Despite growing its data center revenue by 154% in its recent quarter, that was a much slower growth rate than the prior quarter just three months earlier, when its data center revenue jumped by 427%.

However, even if the ETF reverts back to an annual return of 11.6%, that will still be enough to turn $400 per month into $1 million over 30 years. While nothing is guaranteed, that is a more realistic expectation for investors.

Plus, ETFs can be very flexible. The iShares Semiconductor ETF will rebalance over time, so new companies will find their way into its top holdings if they are outperforming their peers, which will support further returns.

AI is likely to be a game changer for the semiconductor industry over the long term. Goldman Sachs believes the technology will add $7 trillion to the global economy in the coming decade. If that’s true, it will drive a consistent reinvestment into chips and infrastructure to fuel future growth cycles.

However, there is always a risk that AI will fail to live up to the hype. That’s why it’s important for investors to buy the iShares Semiconductor ETF only as part of a balanced portfolio.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,121!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,917!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,844!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Goldman Sachs Group, Microsoft, Nvidia, Qualcomm, Taiwan Semiconductor Manufacturing, Texas Instruments, and iShares Trust-iShares Semiconductor ETF. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Super Semiconductor ETF That Could Turn $400 Per Month Into $1 Million, With Nvidia’s Help was originally published by The Motley Fool

Meet the Unstoppable Stock That Could Join Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Taiwan Semiconductor Manufacturing in the $1 Trillion Club by 2035

One of the biggest secular tailwinds in recent years is the advent of artificial intelligence (AI). The latest advancements in AI went viral early last year, and the list of companies in the $1 trillion club is littered with businesses on the leading edge of this next-generation technology.

For example, Apple products — including Siri and Maps — have always embraced AI, while Microsoft, Alphabet, Amazon, and Meta Platforms have developed seemingly impenetrable moats by integrating AI deeply into their respective business operations. Nvidia and Taiwan Semiconductor Manufacturing have developed the chips that make AI possible.

Netflix (NASDAQ: NFLX) is one of the pioneers of AI, using cutting-edge algorithms to inform its streaming recommendations and production choices, yet the company has fallen out of favor with some who are busy chasing the latest shiny new thing. Investors might be surprised to learn that Netflix just delivered another quarter of double-digit growth. With a market cap of just $324 billion, it might seem premature to suggest Netflix is bucking to join its peers in the trillion-dollar club, yet the stock has gained more than 100% over the past year and 1,380% over the past decade, and the evidence suggests its ascent will continue.

Bullish results

Netflix just reported its third-quarter results and sailed past expectations on every important metric. Revenue of $9.83 billion climbed 15% year over year, generating robust profit growth as earnings per share (EPS) of $5.40 soared 45%. Revenue was fueled by strong paid subscriber growth that jumped by more than 5 million, an increase of 14%. The bottom line was driven higher by an expanding operating margin that increased by an incredible 720 basis points to 29.6%.

For context, analysts’ consensus estimates were calling for revenue of $9.77 billion and EPS of $5.12, accompanied by subscriber additions of 4.5 million, so Netflix beat across the board.

Perhaps more importantly, management expects its growth streak to continue. Netflix is guiding for fourth-quarter revenue of $10.1 billion, up nearly 15%, while EPS of $4.23 would more than double.

Incremental levers for growth

On the conference call to discuss the results, Netflix laid out plans to continue its impressive growth, highlighting three particularly significant opportunities.

Netflix has been dabbling in video games for some time now, but the company is beginning to see greater interest from its audience for the games based on the company’s growing library of intellectual property. Management is particularly excited about the title based on Squid Game, the company’s most-watched series.

Management is also leaning into its recent successes with live events. Netflix is live-streaming a boxing match between Mike Tyson and Jake Paul on Nov. 15. The company also has exclusive rights to two NFL games on Christmas Day: The Super Bowl LVII-winning Kansas City Chiefs vs. the Pittsburgh Steelers, and the Baltimore Ravens vs. the Houston Texans. Finally, Netflix is the new home of WWE Raw, the highly rated wrestling entertainment show, with weekly episodes beginning in January 2025.

However, the company’s biggest opportunity is its growing digital advertising business. Netflix noted during the call that its audience and ad inventory are currently growing faster than the company’s ability to capitalize on that growth. Members signing up for the lowest-priced ad tier increased 35% quarter over quarter and accounted for 50% of new members in the countries where Netflix shows advertising.

The company has a couple of important initiatives that are designed to accelerate its ads business. First, Netflix is launching its first-party ad server, beginning in Canada this quarter, then in the rest of its advertising markets in 2025. The company is also leaning into its partnership with The Trade Desk to expand its advertising reach. Netflix noted that ad-tier members are similar to other subscribers in terms of hours watched and preferred titles, which shows viewing patterns are consistent. Management expects ad revenue to double (off a small base) in 2025.

Each of these initiatives represents an incremental growth driver, which helps illustrate how Netflix plans to continue its robust growth.

The path to $1 trillion

Netflix currently has a market cap of $323 billion, which means it will take stock price gains of roughly 207% to drive its value to $1 trillion, but there’s a clear path for growth over the coming decade. According to Wall Street, Netflix is expected to generate revenue of $38.74 billion in 2024, giving it a forward price-to-sales (P/S) ratio of roughly 8. Assuming its P/S remains constant, Netflix would have to grow its revenue to roughly $357 billion annually to support a $1 trillion market cap.

Wall Street is currently forecasting revenue growth for Netflix of about 26% annually over the next five years. If the company achieves that benchmark, it could achieve a $1 trillion market cap as soon as 2035. It’s worth noting that Netflix has grown its annual revenue by 562% over the past decade, and its net income has soared 1,450%, so Wall Street’s outlook could well be conservative. Furthermore, as this quarter illustrates, Netflix has a habit of outpacing Wall Street’s expectations, which could also shave years off this timeline.

Finally, Netflix is currently selling for roughly 39 times earnings, which might seem expensive at first glance, but consider this: Wall Street expects Netflix to generate EPS of $23.11 in 2025, which would represent a multiple of 30 — the same as the S&P 500. Considering Netflix’s strong track record of growth and its significant opportunity, I’d say that’s a fair price to pay for a company expected to generate consistent double-digit growth over the next five years.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,121!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,917!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $370,844!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Danny Vena has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, and The Trade Desk. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Netflix, Nvidia, Taiwan Semiconductor Manufacturing, and The Trade Desk. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Meet the Unstoppable Stock That Could Join Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Taiwan Semiconductor Manufacturing in the $1 Trillion Club by 2035 was originally published by The Motley Fool

Insights into Preferred Bank's Upcoming Earnings

Preferred Bank PFBC is preparing to release its quarterly earnings on Monday, 2024-10-21. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Preferred Bank to report an earnings per share (EPS) of $2.38.

The market awaits Preferred Bank’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Earnings Track Record

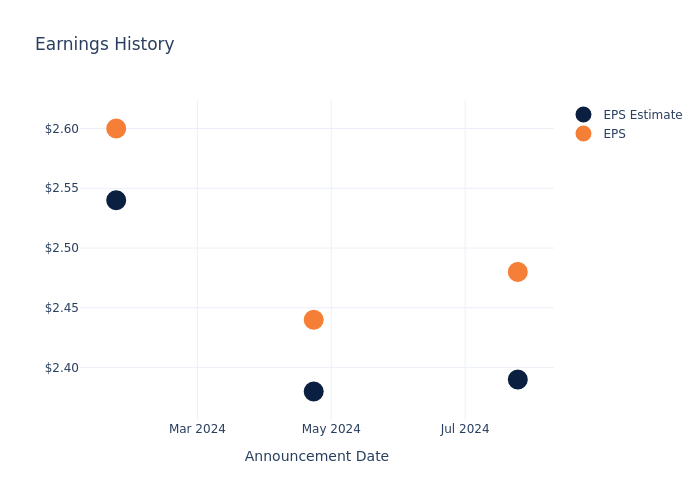

The company’s EPS beat by $0.09 in the last quarter, leading to a 4.68% increase in the share price on the following day.

Here’s a look at Preferred Bank’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.39 | 2.38 | 2.54 | 2.56 |

| EPS Actual | 2.48 | 2.44 | 2.60 | 2.71 |

| Price Change % | 5.0% | -0.0% | -3.0% | -4.0% |

Tracking Preferred Bank’s Stock Performance

Shares of Preferred Bank were trading at $85.08 as of October 17. Over the last 52-week period, shares are up 39.82%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Preferred Bank visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Investing $10,000 in Each of These 3 Stocks 10 Years Ago Would Have Made You $1.1 Million

To make $1 million in the stock market, you don’t need to invest a fortune. But you’ll definitely want to take the time to research and find good growth stocks to buy and hold, as they can play an important role in generating life-changing returns for your portfolio.

Three growth beasts that have performed incredibly well during the past decade are Advanced Micro Devices (NASDAQ: AMD), Eli Lilly (NYSE: LLY), and Builders FirstSource (NYSE: BLDR). Investing $10,000 into each of these stocks 10 years ago would have been enough to make you a millionaire today. Here’s why these stocks have been such great buys, and why it still may not be too late to invest in them.

1. Advanced Micro Devices

The rapid growth in technology has helped Advanced Micro Devices, also known as AMD, generate much stronger financial returns and earn a much higher valuation. The semiconductor company is often seen as a key rival to Nvidia, but at a market cap of about $270 billion, AMD is less than a tenth of the size.

But it has still made for an excellent investment because $10,000 worth of AMD shares bought a decade ago would be worth more than $630,000 today. The tech company has experienced particularly explosive growth in just the past few years with the artificial intelligence (AI) craze creating incredible demand for its chips. Last year, AMD reported $22.7 billion in sales, which is more than double the $9.8 billion it posted just a few years earlier in 2020.

AMD still possesses a lot of upside as it recently unveiled a new AI chip, the MI325X, which may rival Nvidia’s new Blackwell chips. But even if AMD lags its much larger rival, the enormous growth opportunities in AI leave plenty of room for both companies to do well in the years ahead. And with AMD being a more modestly valued company, its stock may have more upside than Nvidia from here on out.

2. Eli Lilly

Healthcare giant Eli Lilly has been more than 10-bagger investment over the past decade as it would have turned a $10,000 investment into about $150,000 today. The big catalyst behind its performance is the excitement surrounding GLP-1 weight loss drugs. The company has what looks to be the best drug on the market in tirzepatide, which is approved for diabetes (Mounjaro) and weight loss (Zepbound).

Analysts see tirzepatide potentially becoming the best-selling drug ever, with its sales topping an estimated $50 billion at its peak; Eli Lilly’s entire business generated $34 billion last year. And tirzepatide’s sales could go even higher than that as studies uncover more benefits from using the drug, including reducing the risk of heart failure, helping people with sleep apnea, and potentially being an effective treatment for fatty liver disease.

The potential for tirzepatide is what could ultimately send Eli Lilly to a $1 trillion valuation and higher in the future. The healthcare stock has a lot of room to rise as both Mounjaro and Zepbound are in their early growth stages. And while there are a growing number of competing weight loss drugs in development from other companies, it won’t be easy to convince patients that there’s a better option than tirzepatide, which has helped people lose close to 27% of their body weight in clinical trials.

3. Builders FirstSource

Builders FirstSource is a big name in construction as it is a key supplier of building products and materials, and it helps its clients with capital projects. A $10,000 investment in the company 10 years ago would be worth more than $390,000 today. Combined with the other $10,000 investments on this list, that would put your total portfolio value at about $1.17 million.

Strong demand for housing in recent years has helped boost Builders’ revenue and profit. In the trailing 12 months, the company reported profit of $1.4 billion on revenue of just over $17 billion, for a solid net margin of more than 8%. That’s up drastically from the $1.6 billion in total revenue and $18 million in earnings which the company generated back in 2014.

As interest rates come down, capital projects and home construction probably will accelerate, which should lead to even greater growth ahead for the business. Although demand hasn’t been great this year, shares of Builders have been rallying in recent months amid the growing optimism that interest rates will be much lower in the near future. But regardless how quickly rates decline, Builders’ position as a top company in building and home construction can make it a solid long-term investment to hold in your portfolio.

Should you invest $1,000 in Advanced Micro Devices right now?

Before you buy stock in Advanced Micro Devices, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Advanced Micro Devices wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $839,122!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

Investing $10,000 in Each of These 3 Stocks 10 Years Ago Would Have Made You $1.1 Million was originally published by The Motley Fool

SMCI LAWSUIT UPDATE: Super Micro Computer Investors are Notified of Imminent October 29 Legal Deadline; Contact BFA Law if You Lost Money (Nasdaq:SMCI)

NEW YORK, Oct. 19, 2024 (GLOBE NEWSWIRE) — Leading securities law firm Bleichmar Fonti & Auld LLP announces that it has filed a lawsuit against Super Micro Computer, Inc. SMCI and certain of the Company’s senior executives for potential violations of the federal securities laws.

If you invested in Super Micro Computer, you are encouraged to obtain additional information by visiting https://www.bfalaw.com/cases-investigations/super-micro-computer-inc.

Investors have until October 29, 2024 to ask the Court to be appointed to lead the case. BFA’s complaint asserts claims under Sections 10(b) and 20(a) of the Securities Exchange Act of 1934 on behalf of investors in Super Micro Computer securities. The complaint is pending in the U.S. District Court for the Northern District of California and is captioned Covey Financial Inc. v. Super Micro Computer, Inc., No. 24-cv-07274.

What is the Lawsuit About?

The complaint alleges that Super Micro Computer (“SMCI”) is one of the largest providers of high-performance and high-efficiency servers. The complaint further alleges that during the relevant period, the Company misrepresented that its: (1) financial statements were prepared in accordance with GAAP; (2) internal controls over financial reporting were effective; (3) robust gross margins were sustainable and driven by legitimate business factors; and that (4) SMCI did not sell products in Russia during fiscal years 2023 and 2024 in purported compliance with relevant trade control regulations.

On August 6, 2024, SMCI revealed a significant decline in its gross margin attributed to increased production costs that could no longer be passed on to customers. On this news, the price of SMCI stock declined over 20%, from $616.94 per share on August 6, 2024, to $492.70 per share on August 7, 2024.

On August 27, 2024, Hindenburg Research published a report that provided evidence of SMCI’s “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.” The Hindenburg Report further described how SMCI engaged in a fraudulent revenue recognition scheme by prematurely recording revenue for equipment that could not be delivered or installed and booking revenue for faulty or incomplete products not ready for sale. As a result, according to Hindenburg, SMCI’s “gross margins have started to collapse,” as reflected on August 6, 2024. In response to the Hindenburg Report, SMCI’s stock price declined approximately 3%, from $562.51 per share on August 26, 2024, to $547.64 per share on August 27, 2024.

The next day, August 28, 2024, SMCI announced that it would “not timely file its Annual Report on Form 10-K for the fiscal year ended June 30, 2024.” This news caused the price of SMCI stock to decline more than 19%, from $547.64 per share on August 27, 2024, to $443.49 per share on August 28, 2024.

Finally, on September 26, 2024, The Wall Street Journal reported that the United States Department of Justice had initiated an investigation into the Company. On this news, the price of SMCI stock declined more than 12%, from $458.15 per share on September 25, 2024, to $402.40 per share on September 26, 2024.

Click here for more information: https://www.bfalaw.com/cases-investigations/super-micro-computer-inc.

What Can You Do?

If you invested in Super Micro Computer, Inc. you may have legal options and are encouraged to submit your information to the firm.

All representation is on a contingency fee basis, there is no cost to you. Shareholders are not responsible for any court costs or expenses of litigation. The firm will seek court approval for any potential fees and expenses.

Submit your information by visiting:

https://www.bfalaw.com/cases-investigations/super-micro-computer-inc

Or contact:

Ross Shikowitz

ross@bfalaw.com

212-789-3619

Why Bleichmar Fonti & Auld LLP?

Bleichmar Fonti & Auld LLP is a leading international law firm representing plaintiffs in securities class actions and shareholder litigation. It was named among the Top 5 plaintiff law firms by ISS SCAS in 2023 and its attorneys have been named Titans of the Plaintiffs’ Bar by Law360 and SuperLawyers by Thompson Reuters. Among its recent notable successes, BFA recovered over $900 million in value from Tesla, Inc.’s Board of Directors (pending court approval), as well as $420 million from Teva Pharmaceutical Ind. Ltd.

For more information about BFA and its attorneys, please visit https://www.bfalaw.com.

https://www.bfalaw.com/cases-investigations/super-micro-computer-inc

Attorney advertising. Past results do not guarantee future outcomes.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

/R E P E A T — MEDIA ADVISORY – GOVERNMENT OF CANADA TO MAKE MAJOR HOUSING-RELATED ANNOUNCEMENT IN EDMONTON/

EDMONTON, AB, Oct. 17, 2024 /CNW/ – Media are invited to join the Honourable Randy Boissonnault, Minister of Employment, Workforce Development and Official Languages– on behalf of the Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities, and Andrew Knack, Councillor.

|

Date: |

October 18, 2024 |

|

Time: |

12:00 pm MT |

|

Location: |

10414 142nd Street, Edmonton (please do not share publicly due to privacy of project) |

SOURCE Government of Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/18/c9381.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/18/c9381.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ukraine's Military Veterans Turn To Ketamine For PTSD Treatment As Advocacy Grows

In the winter of 2023, combat medic Ihor Kholodylo faced a life-altering event on Ukraine’s eastern front. A shell from a Russian tank struck his medical evacuation van, leaving him severely injured. Though Kholodylo survived, the psychological toll was profound. Despite healing from physical injuries, he was left with a debilitating stutter, a symptom of post-traumatic stress disorder (PTSD).

As Kyiv Post reported, Kholodylo, a psychologist by profession, recognized that traditional PTSD treatments, such as talk therapy, would take too long. His search for faster relief led him to an emerging treatment: ketamine-assisted therapy (KAP). Conducted at the Expio Clinic in Kyiv, Kholodylo’s experience with ketamine revealed buried traumas from his time on the frontlines. After several sessions, his stutter vanished.

“I needed something different and more direct,” Kholodylo explained. “The concept [of ketamine] made sense to me, it helped access the unconscious.”

Kholodylo is now advocating for wider access to KAP for Ukrainian veterans. He envisions ketamine not only as a treatment for PTSD but as a preventive measure for soldiers between combat assignments.

Ketamine’s Role In PTSD Treatment

Ketamine, once known as an anesthetic, has shown significant promise for treating mental health conditions like PTSD. Unlike traditional antidepressants, which can take weeks to show results, ketamine works within hours, providing immediate relief from anxiety, depression and traumatic symptoms. According to several studies, ketamine acts on the brain’s glutamate system, which helps reset abnormal neural activity, a key factor in PTSD.

Dr. Vladislav Matrenitsky, founder of the Expio Clinic, emphasizes the scientific foundation of ketamine’s effectiveness. “We know why it works in terms of brain chemistry and physiology,” he says, explaining that ketamine restores neural functioning and helps patients process trauma without re-traumatization.

At Expio, more than 300 clients have undergone KAP since 2018, with military veterans becoming an increasing portion of the patient base following the 2022 Russian invasion. Matrenitsky reports that 70% of patients experience improvement, with ketamine showing a 50% greater impact than conventional therapy.

Scaling Ketamine For Ukrainian Veterans

Heal Ukraine Trauma (HUT), an NGO focused on mental health, has trained eight Ukrainian psychologists and psychiatrists in group ketamine therapy. According to HUT executive director Elise Wilson, the group model allows more veterans to be treated, fostering a sense of community among them.

“The group therapy model not only allows for more individuals to be treated but also creates a supportive network that extends beyond the therapy sessions,” Wilson told the Kyiv Post. HUT plans to train 64 more practitioners in 2025, hoping to eventually treat up to 9,600 veterans annually.

While KAP shows promise, advocates stress that ketamine is not a “silver bullet.” Wilson emphasizes that ketamine should be integrated into a comprehensive care framework that includes psychotherapy and long-term support.

A Path To National Recovery

As Ukraine grapples with the scars of war, psychedelic-assisted therapy offers new hope. Oleh Orlov, chair of the Ukrainian Psychedelic Research Association, views this approach as not just a medical advancement but a crucial step toward national recovery.

“For Ukraine, this represents not just a medical advancement but a crucial step towards emotional resilience,” says Orlov.

To this end, President Volodymyr Zelensky, signed a bill on medical cannabis early this year. But, although several studies have confirmed the potential of cannabis and psychedelics to treat PTSD, the country’s law does not explicitly list this condition for which the plant can be prescribed, as the Ministry of Health refused calls to include it.

“We worked hard to include more conditions, but the Ministry of Health has taken a conservative approach,” said Hanna Hlushchenko, founder of the Ukrainian Cannabis Consulting Group. “For example, we pushed for the inclusion of conditions like insomnia and PTSD, but these were not added”

Cover image made with AI

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.