Ukraine's Military Veterans Turn To Ketamine For PTSD Treatment As Advocacy Grows

In the winter of 2023, combat medic Ihor Kholodylo faced a life-altering event on Ukraine’s eastern front. A shell from a Russian tank struck his medical evacuation van, leaving him severely injured. Though Kholodylo survived, the psychological toll was profound. Despite healing from physical injuries, he was left with a debilitating stutter, a symptom of post-traumatic stress disorder (PTSD).

As Kyiv Post reported, Kholodylo, a psychologist by profession, recognized that traditional PTSD treatments, such as talk therapy, would take too long. His search for faster relief led him to an emerging treatment: ketamine-assisted therapy (KAP). Conducted at the Expio Clinic in Kyiv, Kholodylo’s experience with ketamine revealed buried traumas from his time on the frontlines. After several sessions, his stutter vanished.

“I needed something different and more direct,” Kholodylo explained. “The concept [of ketamine] made sense to me, it helped access the unconscious.”

Kholodylo is now advocating for wider access to KAP for Ukrainian veterans. He envisions ketamine not only as a treatment for PTSD but as a preventive measure for soldiers between combat assignments.

Ketamine’s Role In PTSD Treatment

Ketamine, once known as an anesthetic, has shown significant promise for treating mental health conditions like PTSD. Unlike traditional antidepressants, which can take weeks to show results, ketamine works within hours, providing immediate relief from anxiety, depression and traumatic symptoms. According to several studies, ketamine acts on the brain’s glutamate system, which helps reset abnormal neural activity, a key factor in PTSD.

Dr. Vladislav Matrenitsky, founder of the Expio Clinic, emphasizes the scientific foundation of ketamine’s effectiveness. “We know why it works in terms of brain chemistry and physiology,” he says, explaining that ketamine restores neural functioning and helps patients process trauma without re-traumatization.

At Expio, more than 300 clients have undergone KAP since 2018, with military veterans becoming an increasing portion of the patient base following the 2022 Russian invasion. Matrenitsky reports that 70% of patients experience improvement, with ketamine showing a 50% greater impact than conventional therapy.

Scaling Ketamine For Ukrainian Veterans

Heal Ukraine Trauma (HUT), an NGO focused on mental health, has trained eight Ukrainian psychologists and psychiatrists in group ketamine therapy. According to HUT executive director Elise Wilson, the group model allows more veterans to be treated, fostering a sense of community among them.

“The group therapy model not only allows for more individuals to be treated but also creates a supportive network that extends beyond the therapy sessions,” Wilson told the Kyiv Post. HUT plans to train 64 more practitioners in 2025, hoping to eventually treat up to 9,600 veterans annually.

While KAP shows promise, advocates stress that ketamine is not a “silver bullet.” Wilson emphasizes that ketamine should be integrated into a comprehensive care framework that includes psychotherapy and long-term support.

A Path To National Recovery

As Ukraine grapples with the scars of war, psychedelic-assisted therapy offers new hope. Oleh Orlov, chair of the Ukrainian Psychedelic Research Association, views this approach as not just a medical advancement but a crucial step toward national recovery.

“For Ukraine, this represents not just a medical advancement but a crucial step towards emotional resilience,” says Orlov.

To this end, President Volodymyr Zelensky, signed a bill on medical cannabis early this year. But, although several studies have confirmed the potential of cannabis and psychedelics to treat PTSD, the country’s law does not explicitly list this condition for which the plant can be prescribed, as the Ministry of Health refused calls to include it.

“We worked hard to include more conditions, but the Ministry of Health has taken a conservative approach,” said Hanna Hlushchenko, founder of the Ukrainian Cannabis Consulting Group. “For example, we pushed for the inclusion of conditions like insomnia and PTSD, but these were not added”

Cover image made with AI

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CenterCal Properties and Heitman Announce Acquisition of The Streets of Brentwood Shopping Center

Lifestyle destination will soon welcome new outdoor spaces and first-to-market retailers

BRENTWOOD, Calif., Oct. 18, 2024 /PRNewswire/ — CenterCal Properties, a premier full-service commercial real estate company serving the western U.S., and Heitman, a global real estate investment management firm, today announced the joint acquisition of The Streets of Brentwood shopping center. The transaction underscores both companies’ commitment to enhancing community-oriented shopping centers and fostering vibrant guest experiences as they continue to expand in key markets across the western United States.

The Streets of Brentwood, a top-tier shopping destination located in Brentwood, Calif., features a dynamic and convenient mix of retail, dining, and entertainment. CenterCal Properties and Heitman plan to collectively reimagine and enhance the center’s offerings that make it a premier lifestyle destination, further solidifying its status as a cornerstone of the community. While a range of entertainment and shopping experiences are currently available, exciting additions are on the horizon, including a new community gathering space for hosting seasonal events and more renowned lifestyle brands and restaurants.

“The Streets of Brentwood is an important addition to our portfolio of premier, mixed-use properties,” said Jean Paul Wardy, CEO of CenterCal Properties. “We are committed to creating spaces that not only serve as shopping destinations but as community hubs where people can gather, relax, and enjoy a variety of experiences. We look forward to working closely with our retail partners and the Brentwood community to continue to elevate this vibrant center.”

Gordon Black, Portfolio Manager at Heitman adds, “Open-air lifestyle centers have demonstrated strong operating fundamentals post the COVID-19 pandemic. These fundamentals are further benefitting from minimal new supply and sustained demand from retailers, a trend we believe will continue. We believe this property has features that are critical to success, including partnership with an established regional operator and trade area demographics that are supportive of demand.”

The Streets of Brentwood serves four major California regions—Bay area, Tri-Valley, Sacramento Delta, and the Central Valley—with 358,700 square-feet of retail and mixed-use space.

About CenterCal Properties

CenterCal Properties LLC, a premier full-service commercial real estate company founded in 2004, is redefining the landscape of the western U.S. With a focus on community-building, the company creates spaces that foster connection, enjoyment, and a sense of belonging. Under the visionary leadership of Founder and CEO Jean Paul Wardy, CenterCal Properties has become synonymous with excellence and innovation, boasting a portfolio of iconic destinations across California, Idaho, Oregon, Utah and Washington. Rooted in core values that include creative persistence, high standards, resourcefulness, delivering today, and unwavering integrity, CenterCal Properties specializes in the investment, development, leasing and management of high-quality retail and mixed-use development from its headquarters in El Segundo, California. More information, including a full property portfolio, is available at www.centercal.com.

About Heitman

Heitman is a global real estate investment management firm with nearly $50 billion in assets under management as of June 30, 2024. Founded in 1966 and headquartered in Chicago, Heitman has 10 offices worldwide and is an active participant in the global real estate property and capital markets. Heitman makes real estate investments through private equity, debt, and publicly traded real estate securities.

Media Contact: Sandra Rollinson

E: srollinson@centercal.com; M: 503.819.4278

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/centercal-properties-and-heitman-announce-acquisition-of-the-streets-of-brentwood-shopping-center-302279941.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/centercal-properties-and-heitman-announce-acquisition-of-the-streets-of-brentwood-shopping-center-302279941.html

SOURCE CenterCal Properties

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

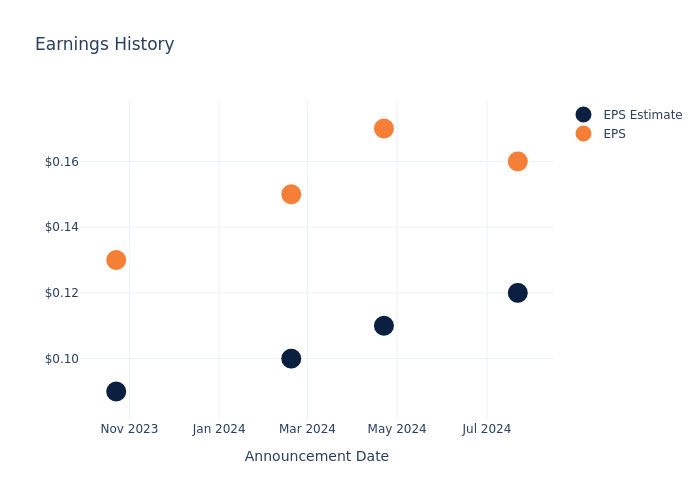

Earnings Preview For HealthStream

HealthStream HSTM will release its quarterly earnings report on Monday, 2024-10-21. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate HealthStream to report an earnings per share (EPS) of $0.12.

Anticipation surrounds HealthStream’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

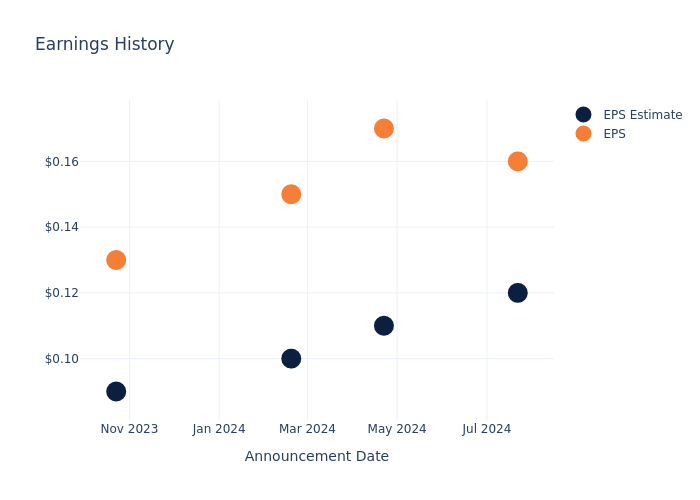

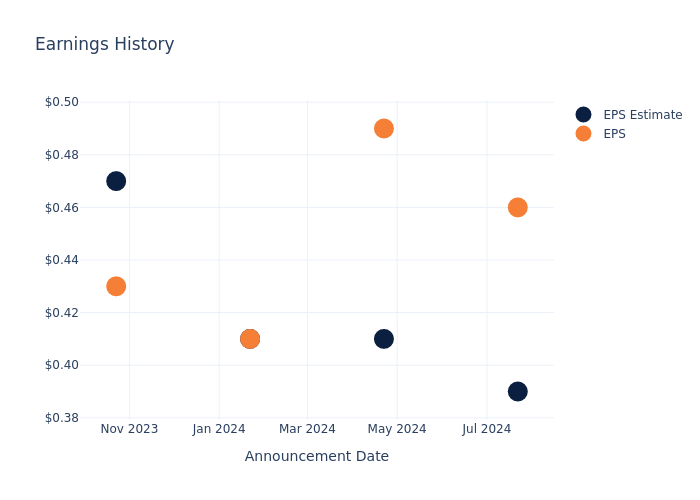

Past Earnings Performance

During the last quarter, the company reported an EPS beat by $0.04, leading to a 4.04% drop in the share price on the subsequent day.

Here’s a look at HealthStream’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.12 | 0.11 | 0.10 | 0.09 |

| EPS Actual | 0.16 | 0.17 | 0.15 | 0.13 |

| Price Change % | -4.0% | 10.0% | -2.0% | 15.0% |

Performance of HealthStream Shares

Shares of HealthStream were trading at $28.93 as of October 17. Over the last 52-week period, shares are up 31.2%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analyst Opinions on HealthStream

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on HealthStream.

HealthStream has received a total of 1 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $28.0, the consensus suggests a potential 3.21% downside.

Understanding Analyst Ratings Among Peers

The analysis below examines the analyst ratings and average 1-year price targets of Simulations Plus, Phreesia and Definitive Healthcare, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Simulations Plus received a Outperform consensus from analysts, with an average 1-year price target of $47.0, implying a potential 62.46% upside.

- The prevailing sentiment among analysts is an Buy trajectory for Phreesia, with an average 1-year price target of $29.4, implying a potential 1.62% upside.

- Definitive Healthcare is maintaining an Neutral status according to analysts, with an average 1-year price target of $5.61, indicating a potential 80.61% downside.

Summary of Peers Analysis

Within the peer analysis summary, vital metrics for Simulations Plus, Phreesia and Definitive Healthcare are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| HealthStream | Neutral | 3.41% | $47.82M | 1.20% |

| Simulations Plus | Outperform | 14.23% | $13.26M | 1.75% |

| Phreesia | Buy | 18.97% | $69.30M | -7.15% |

| Definitive Healthcare | Neutral | 4.56% | $50.45M | -28.39% |

Key Takeaway:

HealthStream ranks in the middle for consensus rating among its peers. It is at the bottom for revenue growth. In terms of gross profit, HealthStream is at the top among its peers. However, its return on equity is at the bottom compared to the others.

About HealthStream

HealthStream Inc provides workforce and provider solutions for healthcare organizations. Its reportable segments include Workforce Solutions and Provider Solutions. Workforce development solutions consist of SaaS, subscription-based products that are used by healthcare organizations. Its Provider Solutions products offer healthcare organizations software applications for administering and tracking provider credentialing, privileging, call center and enrollment activities. The company generates a majority of its revenue from Subscription Services.

HealthStream’s Financial Performance

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: HealthStream’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 3.41%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: HealthStream’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 5.82% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): HealthStream’s ROE stands out, surpassing industry averages. With an impressive ROE of 1.2%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): HealthStream’s ROA excels beyond industry benchmarks, reaching 0.82%. This signifies efficient management of assets and strong financial health.

Debt Management: HealthStream’s debt-to-equity ratio is below the industry average at 0.05, reflecting a lower dependency on debt financing and a more conservative financial approach.

To track all earnings releases for HealthStream visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Procter & Gamble Faces A Weakened Demand In Both The U.S. And China

The Procter & Gamble Company PG issued its fiscal 2025 first-quarter earnings report on Friday, missing sales and net income estimates but topping adjusted profit estimates.

Fiscal First Quarter Highlights

For the quarter ended on September 30th, P&G reported net sales dropped 1% to $21.74 billion

Putting away foreign exchange, acquisitions and divestitures, organic revenue grew 2% helped by higher prices. However, volume was flat, which is a better reflection of sales. While in the U.S., P&G’s volume grew in eight of its 10 categories, Greater China told an entirely diferent story with both its hair care and oral care segments reporting volume declines.

Overall, health care and baby, feminine and family care divisions all reported 1% volume declines, the beauty business experienced a volume decline of 2%, while organic sales of the skin care segment tumbled more than 20%. Supported by innovation, grooming division was a rare bright spot with volume growth of 4%. Fabric and home care reported a mild volume rise of 1%.

Getting down to the bottom line, net income attributable to the company amounted to $3.96 billion, or $1.61 per share, with adjusted earnings per share amounting to $1.93 per share.

After several price hikes over the last few years, P&G has seen demand for its products drop. The last quarter was the first time in more than two years that P&G experienced an increase in volume, but it was apparently short-lived. With the falling global birth rate continues to drop, P&G has been trying to push consumers to buy more expensive baby care items but organic sales of the baby care segment fell by mid-single digits as that strategy cannot always make up for the volume decline.

P&G remains on track to deliver its guidance.

P&G reiterated its fiscal 2025 guidance, expecting revenue growth between 2% and 4% and net earnings per share ranging from $6.91 to $7.05. But, P&G CFO CFO Andre Schulten noted that the Chinese market will continue to be weak for quarters to come. The macroeconomic environment in the U.S. that accounts for almost half of total sales remains challenging with uncertainty pushing consumers to discount-offering rivals and cheaper brands. Its rival in packaged foods manufucating, Nestle S.A. NSRGY lowered its annual sales outlook. Nestle expects the weak demand environment to continue. After reporting dissapointing sales, Nestle announced changes corporate structure changes, aiming to streamline its operating structure. With the pandemic and the war in Ukraine, the packaged foods industry is not alone in struggling with soaring costs as prices of everything from raw materials to packaging continues to go through the roof. Even a Swiss giant like Nestle is dealing with a very painful and unprecedented reset as just like P&G, it faces not only a demand slowdown but a significantly weakened consumer in the eyes of unprecedented uncertainty that has been lingering for quite some time, without any signs of going away.

DISCLAIMER: This content is for informational purposes only. It is not intended as investing advice.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oak Valley Bancorp Reports 3rd Quarter Results

OAKDALE, Calif., Oct. 18, 2024 (GLOBE NEWSWIRE) — Oak Valley Bancorp OVLY (the “Company”), the bank holding company for Oak Valley Community Bank and their Eastern Sierra Community Bank division, recently reported unaudited consolidated financial results. For the three months ended September 30, 2024, consolidated net income was $7,324,000, or $0.89 per diluted share (EPS), as compared to $5,889,000, or $0.71 EPS, for the prior quarter and $7,354,000, or $0.89 EPS, for the same period a year ago. Consolidated net income for the nine months ended September 30, 2024 was $18,940,000, or $2.30 EPS, compared to $24,983,000 or $3.04 EPS for the same period of 2023.

The increase in third quarter net income compared to the prior quarter was primarily due to loan recoveries that resulted in a reversal of allowance for credit losses of $1,620,000. The QTD and YTD decreases compared to the same periods of 2023 were related to an increase in deposit interest expense and general operating expenses.

Net interest income for the three months ended September 30, 2024 was $17,655,000, compared to $17,292,000 in the prior quarter, and $18,938,000 in the same period a year ago. The increase in net interest income over the prior quarter is attributed to earning asset growth and an increase of 3 basis points in the average earning asset yield. The decrease from the same period a year ago is due to an increase in deposit interest expense, as the average cost of funds increased to 0.83% bps for the third quarter of 2024, compared to 0.33% for the comparable period of 2023. The higher interest expense was partially offset by loan growth of $103.9 million over the same period. Net interest margin for the three months ended September 30, 2024 was 4.04%, compared to 4.11% for the prior quarter and 4.34% for the same period last year.

“Our strong core deposits have helped manage funding costs and maintain a healthy net interest margin. Loan growth is crucial to minimizing future margin compression amid possible interest rate drops. Oak Valley was founded on service-focused relationship banking, which drives these efforts. Our success in growing relationships relies on standing out from our competitors by meeting and surpassing client expectations,” stated Rick McCarty, President and Chief Operating Officer.

Non-interest income was $1,846,000 for the quarter ended September 30, 2024, compared to $1,760,000 for the prior quarter and $1,566,000 for the same period last year. The increases compared to prior periods was mainly due to unrealized gains on equity securities as a result of lower interest rates.

Non-interest expense totaled $11,324,000 for the quarter ended September 30, 2024, compared to $11,616,000 in the prior quarter and $10,578,000 in the same quarter a year ago. The decrease compared to the prior period is mainly due to charitable contributions and data processing expense. The third quarter increase compared to the same period a year ago is mainly due to staffing expense and general operating costs related to servicing the growing loan and deposit portfolios.

Total assets were $1.90 billion at September 30, 2024, an increase of $59.9 million and $65.1 million over June 30, 2024 and September 30, 2023, respectively. Gross loans were $1.08 billion at September 30, 2024, an increase of $5.1 million over June 30, 2024 and $103.9 million over September 30, 2023. The Company’s total deposits were $1.69 billion as of September 30, 2024, an increase of $45.6 million and $23.8 million from June 30, 2024 and September 30, 2023, respectively. Our liquidity position is very strong as evidenced by $213.9 million in cash and cash equivalents balances at September 30, 2024.

Non-performing assets (“NPA”) remained at zero as of September 30, 2024, as they were for all of 2024 and 2023. The allowance for credit losses (“ACL”) as a percentage of gross loans increased to 1.07% at September 30, 2024, compared to 1.04% at June 30, 2024 and 1.00% at September 30, 2023. The increase over the prior quarter is due to macro-economic forecasts, loan growth and other credit-risk factors included in the ACL calculation which dictated an increase of $358,000 in the ACL. Loan recoveries totaled $2.0 million during the third quarter of 2024, which consisted of two loans that dated back to the recession. The net impact of the $2.0 million loan recoveries and the $358,000 increase in the ACL calculation resulted in a reversal of ACL provisions totaling $1.62 million. Given industry concerns of credit risk specific to commercial real estate, management has performed a thorough analysis of this segment as part of the CECL credit risk model’s ACL computation, concluding that the credit loss reserves relative to gross loans remains at acceptable levels, and credit quality remains stable.

Oak Valley Bancorp operates Oak Valley Community Bank & their Eastern Sierra Community Bank division, through which it offers a variety of loan and deposit products to individuals and small businesses. They currently operate through 18 conveniently located branches: Oakdale, Turlock, Stockton, Patterson, Ripon, Escalon, Manteca, Tracy, Sacramento, Roseville, two branches in Sonora, three branches in Modesto, and three branches in their Eastern Sierra division, which includes Bridgeport, Mammoth Lakes, and Bishop.

For more information, call 1-866-844-7500 or visit www.ovcb.com.

This press release includes forward-looking statements about the corporation for which the corporation claims the protection of safe harbor provisions contained in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements are based on management’s knowledge and belief as of today and include information concerning the corporation’s possible or assumed future financial condition, and its results of operations and business. Forward-looking statements are subject to risks and uncertainties. A number of important factors could cause actual results to differ materially from those in the forward-looking statements. Those factors include fluctuations in interest rates, government policies and regulations (including monetary and fiscal policies), legislation, economic conditions, including increased energy costs in California, credit quality of borrowers, operational factors and competition in the geographic and business areas in which the company conducts its operations. All forward-looking statements included in this press release are based on information available at the time of the release, and the Company assumes no obligation to update any forward-looking statement.

| Contact: | Chris Courtney/Rick McCarty |

| Phone: | (209) 848-2265 |

| www.ovcb.com |

| Oak Valley Bancorp | ||||||||||||||||

| Financial Highlights (unaudited) | ||||||||||||||||

| ($ in thousands, except per share) | 3rd Quarter | 2nd Quarter | 1st Quarter | 4th Quarter | 3rd Quarter | |||||||||||

| Selected Quarterly Operating Data: | 2024 | 2024 | 2024 | 2023 | 2023 | |||||||||||

| Net interest income | $ | 17,655 | $ | 17,292 | $ | 17,241 | $ | 17,914 | $ | 18,938 | ||||||

| (Reversal of) provision for credit losses | (1,620 | ) | – | – | 1,130 | 300 | ||||||||||

| Non-interest income | 1,846 | 1,760 | 1,519 | 1,755 | 1,566 | |||||||||||

| Non-interest expense | 11,324 | 11,616 | 11,529 | 10,760 | 10,578 | |||||||||||

| Net income before income taxes | 9,797 | 7,436 | 7,231 | 7,779 | 9,626 | |||||||||||

| Provision for income taxes | 2,473 | 1,547 | 1,504 | 1,914 | 2,272 | |||||||||||

| Net income | $ | 7,324 | $ | 5,889 | $ | 5,727 | $ | 5,865 | $ | 7,354 | ||||||

| Earnings per common share – basic | $ | 0.89 | $ | 0.72 | $ | 0.70 | $ | 0.72 | $ | 0.90 | ||||||

| Earnings per common share – diluted | $ | 0.89 | $ | 0.71 | $ | 0.69 | $ | 0.71 | $ | 0.89 | ||||||

| Dividends paid per common share | $ | 0.225 | $ | – | $ | 0.225 | $ | – | $ | 0.160 | ||||||

| Return on average common equity | 16.54 | % | 14.19 | % | 13.86 | % | 16.44 | % | 19.85 | % | ||||||

| Return on average assets | 1.56 | % | 1.30 | % | 1.26 | % | 1.27 | % | 1.57 | % | ||||||

| Net interest margin (1) | 4.04 | % | 4.11 | % | 4.09 | % | 4.15 | % | 4.34 | % | ||||||

| Efficiency ratio (2) | 56.96 | % | 59.12 | % | 59.61 | % | 53.08 | % | 49.89 | % | ||||||

| Capital – Period End | ||||||||||||||||

| Book value per common share | $ | 22.18 | $ | 20.55 | $ | 19.97 | $ | 20.03 | $ | 16.29 | ||||||

| Credit Quality – Period End | ||||||||||||||||

| Nonperforming assets / total assets | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | 0.00 | % | ||||||

| Credit loss reserve / gross loans | 1.07 | % | 1.04 | % | 1.05 | % | 1.07 | % | 1.00 | % | ||||||

| Period End Balance Sheet | ||||||||||||||||

| ($ in thousands) | ||||||||||||||||

| Total assets | $ | 1,900,455 | $ | 1,840,521 | $ | 1,805,739 | $ | 1,842,422 | $ | 1,835,402 | ||||||

| Gross loans | 1,075,138 | 1,070,036 | 1,039,509 | 1,016,579 | 971,243 | |||||||||||

| Nonperforming assets | – | – | – | – | – | |||||||||||

| Allowance for credit losses | 11,479 | 11,121 | 10,922 | 10,896 | 9,738 | |||||||||||

| Deposits | 1,690,301 | 1,644,748 | 1,612,400 | 1,650,534 | 1,666,548 | |||||||||||

| Common equity | 185,393 | 171,799 | 166,916 | 166,092 | 135,095 | |||||||||||

| Non-Financial Data | ||||||||||||||||

| Full-time equivalent staff | 222 | 223 | 219 | 222 | 225 | |||||||||||

| Number of banking offices | 18 | 18 | 18 | 18 | 18 | |||||||||||

| Common Shares outstanding | ||||||||||||||||

| Period end | 8,358,711 | 8,359,556 | 8,359,556 | 8,293,168 | 8,293,468 | |||||||||||

| Period average – basic | 8,221,475 | 8,219,699 | 8,209,617 | 8,200,177 | 8,197,083 | |||||||||||

| Period average – diluted | 8,263,790 | 8,248,295 | 8,244,648 | 8,236,897 | 8,232,338 | |||||||||||

| Market Ratios | ||||||||||||||||

| Stock Price | $ | 26.57 | $ | 24.97 | $ | 24.78 | $ | 29.95 | $ | 25.08 | ||||||

| Price/Earnings | 7.52 | 8.69 | 8.86 | 10.55 | 7.05 | |||||||||||

| Price/Book | 1.20 | 1.22 | 1.24 | 1.50 | 1.54 | |||||||||||

| (1) Ratio computed on a fully tax equivalent basis using a marginal federal tax rate of 21%. | ||||||||||||||||

| (2) Ratio computed on a fully tax equivalent basis using a marginal federal tax rate of 21%. | ||||||||||||||||

| A marginal federal/state combined tax rate of 29.56%, was used for applicable revenue. | ||||||||||||||||

| NINE MONTHS ENDED SEPTEMBER 30, | ||||||||||||||||

| Profitability | 2024 | 2023 | ||||||||||||||

| ($ in thousands, except per share) | ||||||||||||||||

| Net interest income | $ | 52,188 | $ | 57,888 | ||||||||||||

| Provision for (reversal of) credit losses | (1,620 | ) | (160 | ) | ||||||||||||

| Non-interest income | 5,125 | 4,876 | ||||||||||||||

| Non-interest expense | 34,469 | 30,397 | ||||||||||||||

| Net income before income taxes | 24,464 | 32,527 | ||||||||||||||

| Provision for income taxes | 5,524 | 7,544 | ||||||||||||||

| Net income | $ | 18,940 | $ | 24,983 | ||||||||||||

| Earnings per share – basic | $ | 2.30 | $ | 3.05 | ||||||||||||

| Earnings per share – diluted | $ | 2.30 | $ | 3.04 | ||||||||||||

| Dividends paid per share | $ | 0.450 | $ | 0.320 | ||||||||||||

| Return on average equity | 14.90 | % | 23.71 | % | ||||||||||||

| Return on average assets | 1.38 | % | 1.76 | % | ||||||||||||

| Net interest margin (1) | 4.08 | % | 4.39 | % | ||||||||||||

| Efficiency ratio (2) | 58.55 | % | 47.48 | % | ||||||||||||

| Capital – Period End | ||||||||||||||||

| Book value per share | $ | 22.18 | $ | 16.29 | ||||||||||||

| Credit Quality – Period End | ||||||||||||||||

| Nonperforming assets/ total assets | 0.00 | % | 0.00 | % | ||||||||||||

| Credit loss reserve/ gross loans | 1.07 | % | 1.00 | % | ||||||||||||

| Period End Balance Sheet | ||||||||||||||||

| ($ in thousands) | ||||||||||||||||

| Total assets | $ | 1,900,455 | $ | 1,835,402 | ||||||||||||

| Gross loans | 1,075,138 | 971,243 | ||||||||||||||

| Nonperforming assets | – | – | ||||||||||||||

| Allowance for credit losses | 11,479 | 9,738 | ||||||||||||||

| Deposits | 1,690,301 | 1,666,548 | ||||||||||||||

| Stockholders’ equity | 185,393 | 135,095 | ||||||||||||||

| Non-Financial Data | ||||||||||||||||

| Full-time equivalent staff | 222 | 225 | ||||||||||||||

| Number of banking offices | 18 | 18 | ||||||||||||||

| Common Shares outstanding | ||||||||||||||||

| Period end | 8,358,711 | 8,293,468 | ||||||||||||||

| Period average – basic | 8,216,947 | 8,191,749 | ||||||||||||||

| Period average – diluted | 8,252,286 | 8,228,869 | ||||||||||||||

| Market Ratios | ||||||||||||||||

| Stock Price | $ | 26.57 | $ | 25.08 | ||||||||||||

| Price/Earnings | 8.65 | 6.15 | ||||||||||||||

| Price/Book | 1.20 | 1.54 | ||||||||||||||

| (1) Ratio computed on a fully tax equivalent basis using a marginal federal tax rate of 21%. | ||||||||||||||||

| (2) Ratio computed on a fully tax equivalent basis using a marginal federal tax rate of 21%. | ||||||||||||||||

| A marginal federal/state combined tax rate of 29.56%, was used for applicable revenue. | ||||||||||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amazon boss tells workers they can quit if they don't want to come to the office

Amazon (AMZN) Web Services chief Matt Garman doubled down on Amazon’s new five-day in-office work week, telling any disgruntled employees that they can find work elsewhere.

Garman, one of the company’s top executives, told workers in an all-hands meeting Thursday that if they don’t like the new policy, they can quit, according to a transcript of the meeting first reported by Reuters.

“If there are people who just don’t work well in that environment and don’t want to, that’s okay, there are other companies around,” Garman said.

“At Amazon, we want to be in an environment where we are working together, and we feel that collaborative environment is incredibly important for our innovation and for our culture,” he added.

That echoes similar comments from top brass at other major companies, who have labelled remote work as an innovation and collaboration killer. In August, former Google (GOOGL) CEO Eric Schmidt blamed remote work for the tech giant losing its edge in the artificial intelligence race. He later walked back the comments.

Other companies that have done away with remote and hybrid policies in recent years include JPMorgan Chase (JPM), Goldman Sachs (GS), Tesla (TSLA), and Walmart.

The tech giant announced the changes to office policy last month, and workers will have to completely ditch their remote work arrangements starting Jan 2. At the time, CEO Andy Jassy said he believes the move will better set Amazon up “to invent, collaborate, and be connected enough to each other and our culture to deliver the absolute best for customers and the business.”

For their part, workers at the tech giant called the decision “unfortunate” and “disheartening” on social media and internal messaging boards. Many were frustrated, calling the move was a step backward and expressing concerns about the impact it would have on their work-life balance.

Previous reports showed that Amazon had been keeping tabs on how much its employees were coming into the office and sending messages to delinquent employees.

Garman said at Thursday’s meeting, however, that “nine out of 10 people are actually quite excited by this change.” He added that in the era of hybrid work, there were days when his team “didn’t really accomplish anything” because team members were working remotely.

While executives have taken to bashing remote work, evidence of its impacts on productivity is mixed: Some studies have found that working from home can boost productivity — by as much as 24%, even — while others have said the opposite.

Earnings Outlook For SmartFinancial

SmartFinancial SMBK is preparing to release its quarterly earnings on Monday, 2024-10-21. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect SmartFinancial to report an earnings per share (EPS) of $0.47.

The market awaits SmartFinancial’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

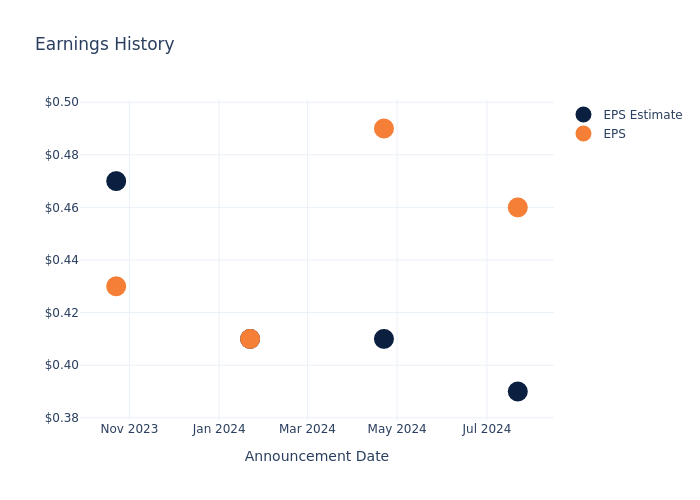

Performance in Previous Earnings

In the previous earnings release, the company beat EPS by $0.07, leading to a 3.43% increase in the share price the following trading session.

Here’s a look at SmartFinancial’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.39 | 0.41 | 0.41 | 0.47 |

| EPS Actual | 0.46 | 0.49 | 0.41 | 0.43 |

| Price Change % | 3.0% | 3.0% | -1.0% | -1.0% |

Tracking SmartFinancial’s Stock Performance

Shares of SmartFinancial were trading at $31.5 as of October 17. Over the last 52-week period, shares are up 54.35%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for SmartFinancial visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

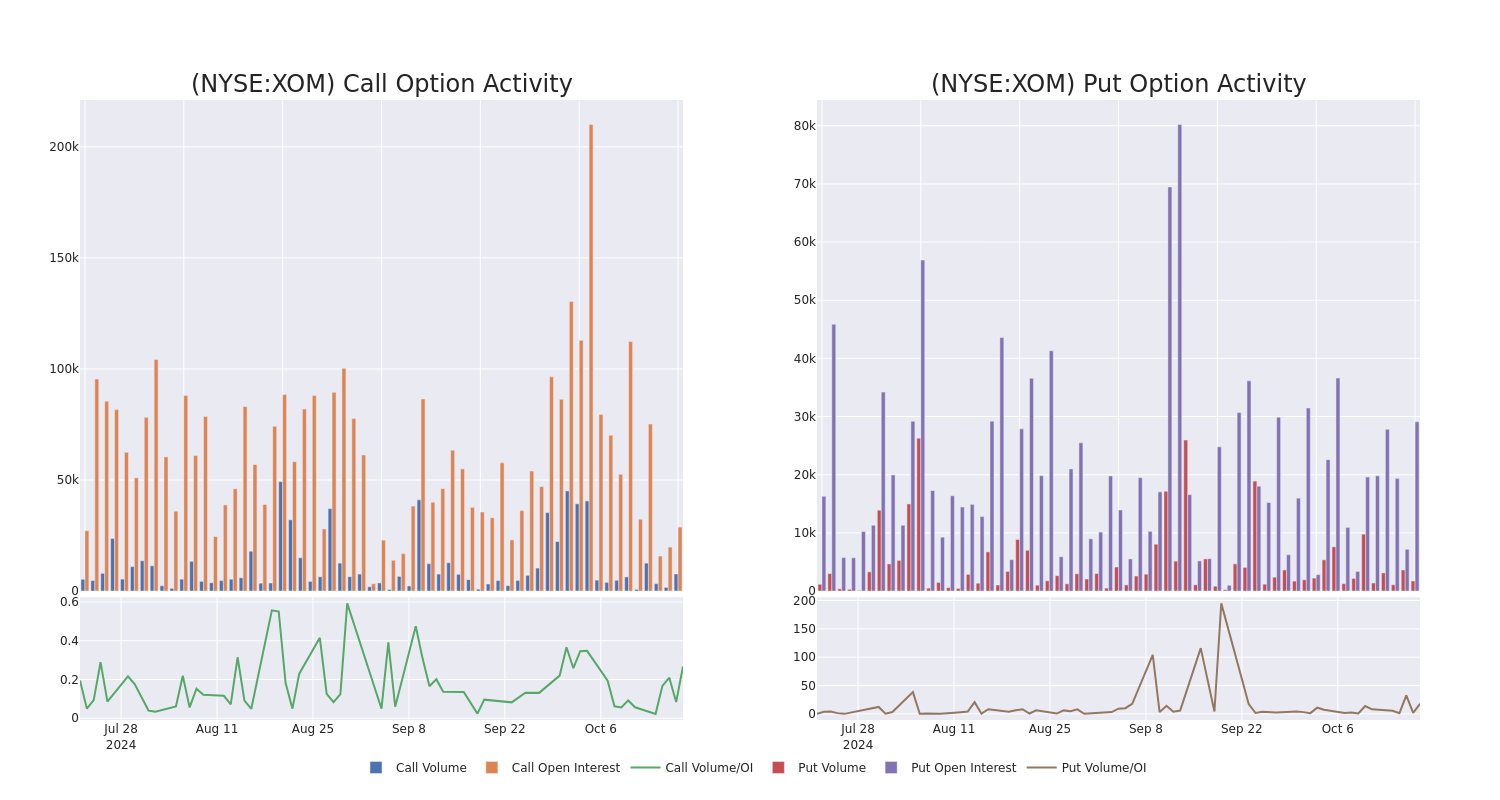

Unpacking the Latest Options Trading Trends in Exxon Mobil

Investors with a lot of money to spend have taken a bearish stance on Exxon Mobil XOM.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with XOM, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

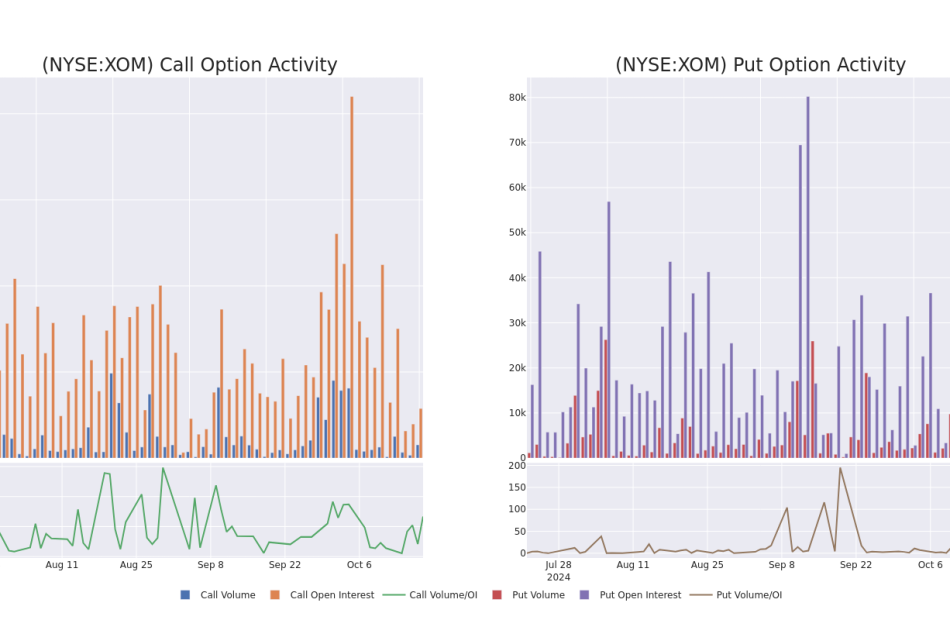

Today, Benzinga‘s options scanner spotted 16 uncommon options trades for Exxon Mobil.

This isn’t normal.

The overall sentiment of these big-money traders is split between 31% bullish and 56%, bearish.

Out of all of the special options we uncovered, 7 are puts, for a total amount of $353,298, and 9 are calls, for a total amount of $1,610,663.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $130.0 for Exxon Mobil during the past quarter.

Insights into Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Exxon Mobil’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Exxon Mobil’s whale activity within a strike price range from $105.0 to $130.0 in the last 30 days.

Exxon Mobil Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XOM | CALL | SWEEP | BEARISH | 09/19/25 | $6.15 | $6.1 | $6.15 | $130.00 | $1.1M | 215 | 1.9K |

| XOM | CALL | TRADE | BULLISH | 10/18/24 | $9.95 | $9.95 | $9.95 | $110.00 | $114.4K | 1.6K | 240 |

| XOM | PUT | TRADE | BULLISH | 11/01/24 | $10.2 | $10.05 | $10.1 | $130.00 | $113.1K | 27 | 112 |

| XOM | CALL | TRADE | NEUTRAL | 11/22/24 | $4.25 | $4.1 | $4.17 | $118.00 | $83.4K | 51 | 205 |

| XOM | PUT | TRADE | BEARISH | 11/22/24 | $3.75 | $3.3 | $3.7 | $120.00 | $74.0K | 205 | 236 |

About Exxon Mobil

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2023, it produced 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas per day. At the end of 2023, reserves were 16.9 billion barrels of oil equivalent, 66% of which were liquids. The company is one of the world’s largest refiners with a total global refining capacity of 4.5 million barrels of oil per day and is one of the world’s largest manufacturers of commodity and specialty chemicals.

Exxon Mobil’s Current Market Status

- Currently trading with a volume of 12,582,206, the XOM’s price is down by -0.28%, now at $120.01.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 14 days.

What The Experts Say On Exxon Mobil

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $128.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Truist Securities persists with their Hold rating on Exxon Mobil, maintaining a target price of $117.

* Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on Exxon Mobil with a target price of $136.

* Maintaining their stance, an analyst from BMO Capital continues to hold a Market Perform rating for Exxon Mobil, targeting a price of $130.

* Reflecting concerns, an analyst from Redburn Atlantic lowers its rating to Neutral with a new price target of $120.

* Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Exxon Mobil, targeting a price of $137.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Exxon Mobil options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.