Behind the Scenes of Synopsys's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on Synopsys.

Looking at options history for Synopsys SNPS we detected 21 trades.

If we consider the specifics of each trade, it is accurate to state that 28% of the investors opened trades with bullish expectations and 33% with bearish.

From the overall spotted trades, 5 are puts, for a total amount of $423,980 and 16, calls, for a total amount of $811,190.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $420.0 and $610.0 for Synopsys, spanning the last three months.

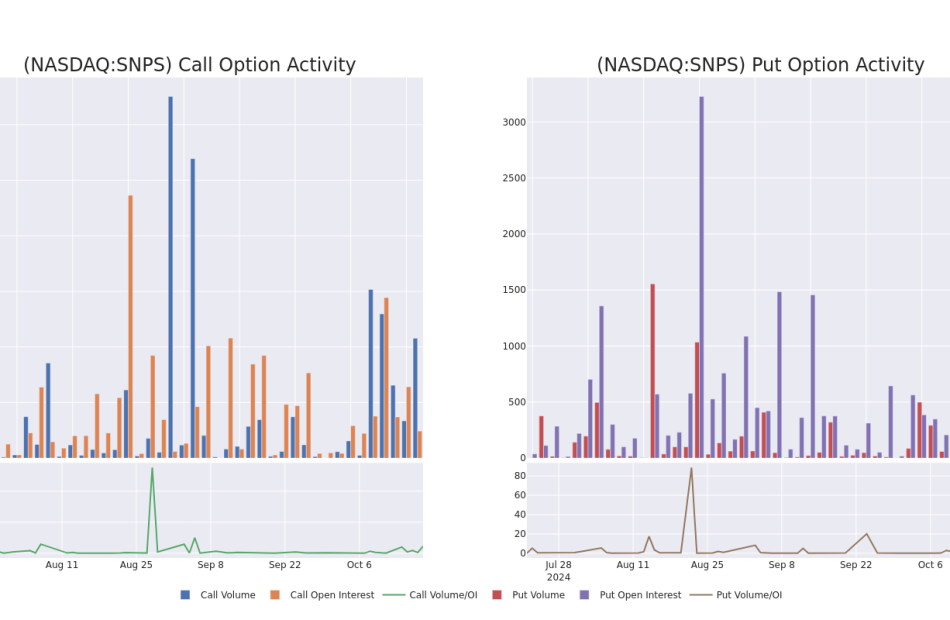

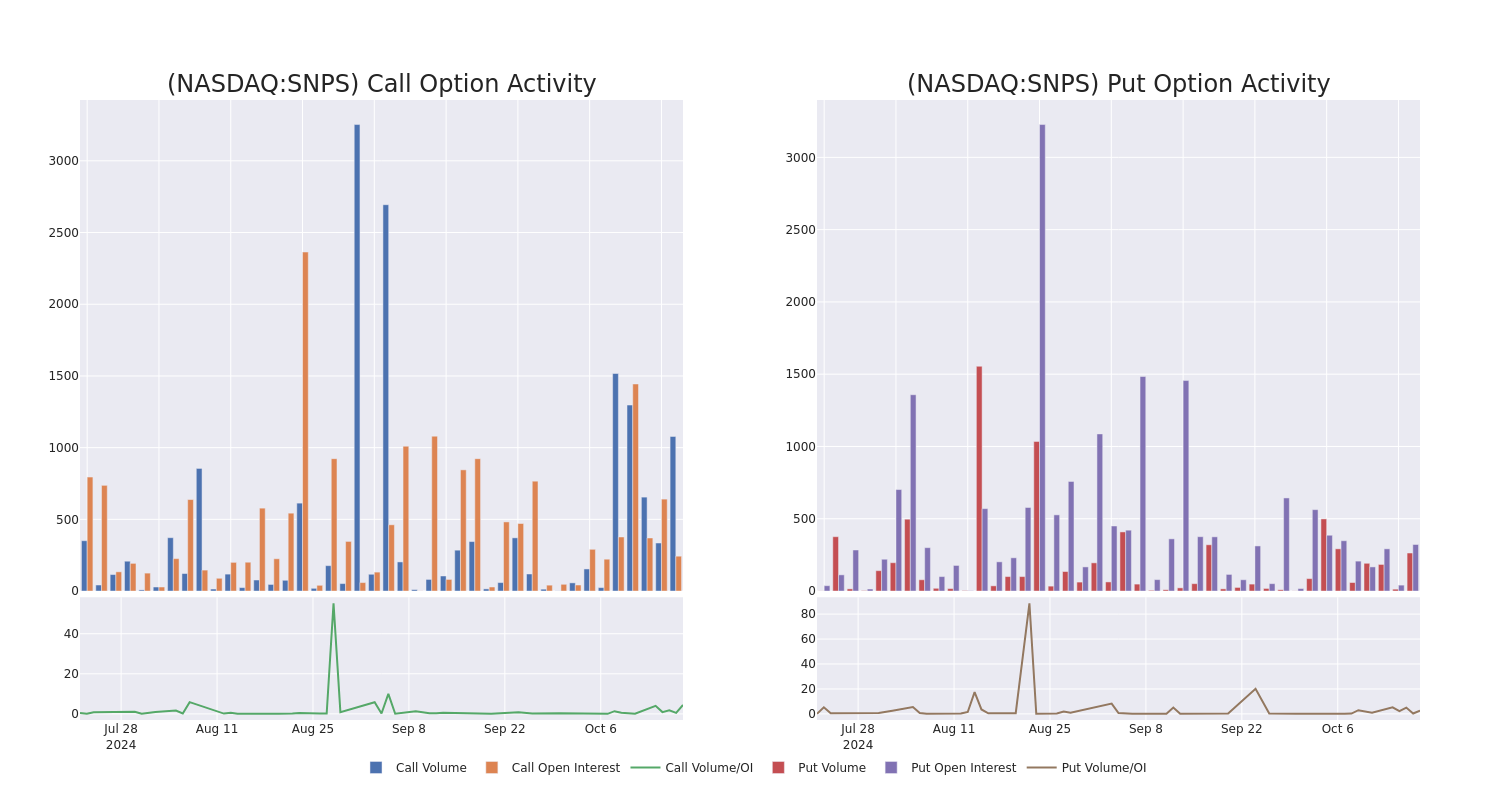

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Synopsys’s options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Synopsys’s significant trades, within a strike price range of $420.0 to $610.0, over the past month.

Synopsys Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNPS | PUT | SWEEP | BULLISH | 01/15/27 | $55.0 | $50.8 | $50.8 | $420.00 | $213.3K | 80 | 42 |

| SNPS | CALL | SWEEP | BEARISH | 01/16/26 | $63.3 | $61.0 | $61.0 | $600.00 | $91.5K | 150 | 64 |

| SNPS | PUT | TRADE | BULLISH | 12/20/24 | $31.9 | $31.4 | $31.6 | $510.00 | $69.5K | 103 | 50 |

| SNPS | PUT | TRADE | BULLISH | 12/20/24 | $31.9 | $31.5 | $31.5 | $510.00 | $63.0K | 103 | 72 |

| SNPS | CALL | SWEEP | BEARISH | 01/16/26 | $61.0 | $60.0 | $60.0 | $600.00 | $60.0K | 150 | 116 |

About Synopsys

Synopsys is a provider of electronic design automation software, intellectual property, and software integrity products. EDA software automates the chip design process, enhancing design accuracy, productivity, and complexity in a full-flow end-to-end solution. The firm’s growing SI business allows customers to continuously manage and test the code base for security and quality. Synopsys’ comprehensive portfolio is benefiting from a mutual convergence of semiconductor companies moving up-stack toward systems-like companies, and systems companies moving down-stack toward in-house chip design. The resulting expansion in EDA customers alongside secular digitalization of various end markets benefits EDA vendors like Synopsys.

Following our analysis of the options activities associated with Synopsys, we pivot to a closer look at the company’s own performance.

Where Is Synopsys Standing Right Now?

- Trading volume stands at 854,725, with SNPS’s price up by 0.46%, positioned at $507.03.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 40 days.

What Analysts Are Saying About Synopsys

In the last month, 1 experts released ratings on this stock with an average target price of $660.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* In a cautious move, an analyst from Berenberg downgraded its rating to Buy, setting a price target of $660.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Synopsys, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

I'll Bet You Didn't Know These 3 Things About Costco's Executive Membership

If you’re joining Costco, you have a choice. You could pay $65 a year for a basic Gold Star membership that lets you shop at the warehouse club. Or, you could upgrade to the Executive membership at a cost of $130 per year. In exchange for the extra $65 an Executive membership costs, you get to earn 2% cash back on your Costco purchases.

TODAY’S TOP OFFER

Earn up to $845 cash back this year just by changing how you pay at Costco! Learn more here.

You may be on the fence about buying Costco’s more expensive membership. Or maybe you already took that leap. Either way, here are three interesting facts to know about the Executive membership and how it works.

1. You’re guaranteed your upgrade fee even if you don’t make it back

The problem with upgrading to Costco’s Executive membership is that you risk not spending enough to recoup the extra $65 it costs. It takes $3,250 a year in Costco spending to earn $65, since the Executive membership gives you 2% back on purchases. So once you’ve spent even $1 more, you’re ahead financially.

But here’s a little-known secret about the Executive membership. If you don’t spend enough to earn $65 back during the year, Costco will allow you to downgrade your membership and refund you the difference. For example, if you spend $2,700 at Costco one year and only earn $54 back on your Executive membership, when you go to downgrade, Costco will refund you $11 so you get your $65 back either way.

Meanwhile, if you do end up spending more than $3,250, you may pocket quite a lot of cash for the year — especially if you combine the Executive membership benefit with a credit card offering great rewards. Click here for a list of the best credit cards for Costco shoppers.

2. It’s Costco’s most popular membership despite costing double

Since an Executive membership at Costco costs twice as much as a Gold Star membership, you might assume that most people aren’t willing to pony up the extra money. But actually, the Executive membership is Costco’s most popular. The company says 52 million members are of the Executive variety, representing a little more than half.

Now, you might assume that if you’re only an occasional Costco shopper, it doesn’t make sense to pay extra for the Executive membership. But you never know when a one-time purchase might put you over the $3,250 mark, making it so the Executive membership pays off. Because there’s no risk involved, it’s worth giving it a try even if you’re doubtful you’ll make your money back.

3. The maximum amount of cash back you can earn just increased

On Sept. 1, Costco raised the cost of an Executive membership from $120 to $130. At the same time, it increased the maximum amount of cash back you can earn per year from an Executive membership from $1,000 to $1,250.

That may seem like a positive change at first. But it’s also unlikely to affect you.

To earn $1,250 in cash back from an Executive membership, you have to spend $62,500 a year at Costco. That’s a lot of bulk groceries. For the average shopper, that change won’t have much of an impact. However, if you happen to have a lot of large purchases, it’s possible you could end up pocketing extra cash back.

For example, say you just bought a house and need to furnish every room. If you buy a living room set, several bedrooms sets, a kitchen table, chairs, accessories, patio furniture, and several TVs from Costco on top of your typical groceries and household supplies, then it’s conceivable that you could benefit from the new maximum reward.

But in general, your goal shouldn’t be to chase a higher Executive membership reward by making more purchases than you need to. Instead, shop like you normally do and see how much cash back you get at the end of the year — knowing that in a worst-case scenario, you’re going to break even on your $65 upgrade cost.

There’s a reason Costco’s Executive membership is so popular. Consider giving it a try and seeing how much you benefit from it.

Top credit card to use at Costco (and everywhere else!)

We love versatile credit cards that offer huge rewards everywhere, including Costco! This card is a standout among America’s favorite credit cards because it offers perhaps the easiest $200 cash bonus you could ever earn and an unlimited 2% cash rewards on purchases, even when you shop at Costco.

Add on the competitive 0% interest period and it’s no wonder we awarded this card Best No Annual Fee Credit Card.

Click here to read our full review for free and apply before the $200 welcome bonus offer ends!

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Maurie Backman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Costco Wholesale and JPMorgan Chase. The Motley Fool has a disclosure policy.

I’ll Bet You Didn’t Know These 3 Things About Costco’s Executive Membership was originally published by The Motley Fool

'You Threw A Hornet's Nest In The Closet' — Couple Buried In $91,000 Debt Turns to Dave Ramsey After Panicking, Making Their Situation Worse

When Elizabeth and her husband filed for Chapter 13 bankruptcy, they thought they were making a smart move to manage their growing debt. But fast-forward a few months and they’re having serious second thoughts. Elizabeth explained during a call with Dave Ramsey, “We panicked and did some stupid things,” and boy, has that panic come with a price –$91,000 in debt and two car payments they can barely handle.

Don’t Miss:

It all started when Elizabeth lost her job, leaving the couple to juggle everything on one income. Trying to stay afloat, they made what she describes as “some stupid decisions” to dig deeper into debt rather than step back and assess the situation. They filed for Chapter 13 bankruptcy, which, in their words, “seemed like the only way out” at the time. However, as Elizabeth shared, they quickly realized the payment plan tied to Chapter 13 was putting a strain on their monthly income, even after she landed a better job.

See Also: I’m 62 Years Old And Have $1.2 Million Saved. Is This Enough to Retire Stress-Free?

They’re working hard to turn things around – having yard sales and selling everything they can – but there’s one big obstacle they can’t shake: that Chapter 13 payment. It’s become an unwanted guest at the table, eating up their income and standing in the way of their debt-free dreams.

“You’ve Got a Hornet’s Nest in the Closet”

When Elizabeth called into the Ramsey Show for advice, Dave Ramsey painted quite the picture for her. “Pretend like you took a baseball bat and you hit a hornet’s nest and you threw the hornet’s nest in a closet and closed the door,” he said. If they dismiss their bankruptcy, “you’re getting ready to open the door” to all the creditors they owe money to – credit cards, personal loans and those pesky car payments.

Trending: Many are using this retirement income calculator to check if they’re on pace — here’s a breakdown on how on what’s behind this formula.

In other words, those creditors won’t be pleased. They’ll come after the couple “with everything they’ve got.” And Elizabeth knew it: “Oh Lord,” she responded, immediately grasping the gravity of what that meant. Filing for Chapter 13 might have put their creditors on pause, but dismissing the case would unleash the swarm and they’d need a solid plan to deal with the fallout.

“Some Stupid Decisions” and $91,000 in Debt

Let’s breakdown the numbers. Elizabeth and her husband owe $30,000 on each of their two cars and have about $25,000 in credit card debt. On top of that, there’s $6,000 in personal loans hanging over their heads. The irony? According to Elizabeth, these cars aren’t even worth what they owe – probably closer to $26,000 or $27,000.

Now that she’s back to work and they’ve stabilized their income, they’re ready to take control and dump their debt, but the bankruptcy payments are still choking their budget. With a combined monthly income of $5,100 after taxes, health insurance and a $1,400 rent payment, those debts feel like an anchor they just can’t pull up.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

The Path Forward: Opening the Door to the Hornets

Dave’s advice? If they want to voluntarily dismiss the Chapter 13 bankruptcy and avoid the hornets, they need a plan. “You’ve got to have a plan for taking care of every one of them if you’re going to open the door,” he explained. For starters, it’s time to sell those cars. And the good news is, Elizabeth and her husband have been saving up from their yard sales and hustling in gazelle mode. They’ve got enough to cover the difference and pay off the cars.

The personal loans, according to Dave, will be the toughest to deal with because those lenders are “bottom feeders” who will come after them hard and fast. On the other hand, credit card companies are “incompetent and inefficient,” giving them a bit more breathing room to set up payment plans. But once the bankruptcy protection is gone, the couple must stay on top of things and negotiate with creditors to keep the swarm at bay.

Trending: How do billionaires pay less in income tax than you? Tax deferring is their number one strategy.

Lesson Learned

Looking back, Elizabeth and her husband wish they hadn’t panicked and rushed into bankruptcy. Now, with a clearer head and some solid advice from Dave, they’re ready to dig out of debt the old-fashioned way – through hard work, sacrifice and patience. But one thing’s certain: they won’t forget Dave’s warning. They’ll be ready for whatever flies out when they open that door.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article ‘You Threw A Hornet’s Nest In The Closet’ — Couple Buried In $91,000 Debt Turns to Dave Ramsey After Panicking, Making Their Situation Worse originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

RLI's Earnings: A Preview

RLI RLI is set to give its latest quarterly earnings report on Monday, 2024-10-21. Here’s what investors need to know before the announcement.

Analysts estimate that RLI will report an earnings per share (EPS) of $0.99.

Investors in RLI are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

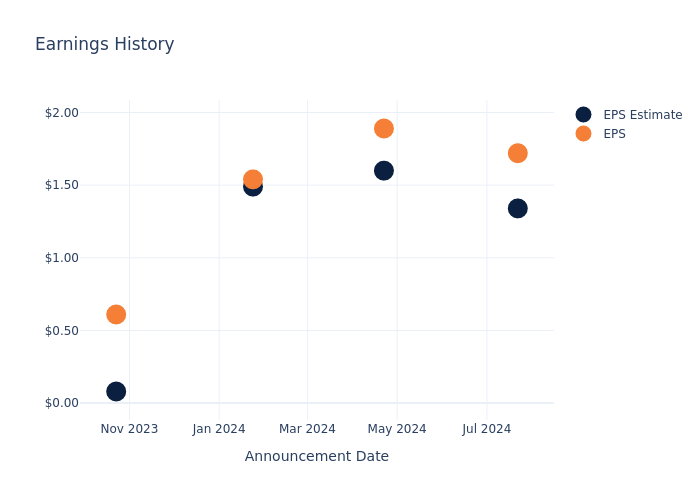

Past Earnings Performance

The company’s EPS beat by $0.38 in the last quarter, leading to a 2.95% increase in the share price on the following day.

Here’s a look at RLI’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.34 | 1.60 | 1.49 | 0.08 |

| EPS Actual | 1.72 | 1.89 | 1.54 | 0.61 |

| Price Change % | 3.0% | 3.0% | -4.0% | 6.0% |

Performance of RLI Shares

Shares of RLI were trading at $164.21 as of October 17. Over the last 52-week period, shares are up 26.05%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for RLI visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Marjorie Taylor Greene Continues Her Stock-Buying Bonanza; Here Are 6 Stocks She Just Bought

U.S. Rep. Marjorie Taylor Greene, a Republican from Georgia, is doggedly working toward rallying votes for the GOP on Election Day, but she’s certainly not losing sight of her investments. Greene continues to make additions to her portfolio as she has steadfastly done over the past few months.

Consistent with her previous rounds of buying activity, Greene recently added to her artificial intelligence (AI) exposure, picking up shares of Applied Materials (NASDAQ: AMAT), ASML (NASDAQ: ASML), Dell Technologies (NYSE: DELL), Lam Research (NASDAQ: LRCX), and Meta Platforms (NASDAQ: META). But it wasn’t only AI stocks that caught her attention. Greene also clicked the buy button on Costco Wholesale (NASDAQ: COST). Although the exact amounts that Greene invested in each of the stocks is not clear, her regulatory filing acknowledges that each transaction on Oct. 4 was valued between $1,001 and $15,000.

More of the same AI names — at lower prices

Taking even a cursory glance at Greene’s trading history, investors will find that the representative from the Peach State often builds positions over time, practicing a dollar-cost averaging approach. In July, for example, Greene bought shares of both semiconductor equipment manufacturer Applied Materials and Dell, a stalwart in building computers and data centers. On the day that Greene bought Applied Materials and Dell in July, they closed at $219.65 and $125.85, respectively, and it’s likely she lowered the average price she paid for them. On Oct. 4, Applied Materials closed at $201.97, while Dell ended the trading session at $120.42.

Similarly, Greene increased her position in semiconductor powerhouse ASML during her latest buying round. On June 24, when Greene first bought ASML stock, shares ended the day at $1,002.01, having climbed about 37% since the start of the year. The latest purchase, however, was considerably less expensive. Shares of the semiconductor equipment maker have suffered recently as analysts have espoused bearish stances of ASML stock. This helped Greene to lower her average price paid for the stock as she picked up shares on a day when the stock ended the trading session at $833.

Greene isn’t afraid of stocks that aren’t hanging on the discount rack

Not every repeat purchase for Greene during this latest buying round required a stock to be at a lower price. Initially, Greene gained exposure to Lam Research, which provides wafer fabrication equipment and services to semiconductor manufacturers, on Sept. 20, when shares closed at $77.32 (adjusted for the recent stock split). On Oct. 4, shares of Lam Research closed at $81.54.

Like Lam Research, Greene paid a higher price for Costco stock in October than when she first bought shares of the membership warehouse company. When Greene first invested in Costco on June 24, shares closed at $848.16, yet when she bought shares on Oct. 4, they ended the trading session at $883.11. While Greene paid more for Costco stock, many analysts believe that the stock has additional room to run. Oppenheimer and Evercore ISI, for example, have price targets of $980 and $990, respectively.

A new name added to the portfolio

In addition to growing established positions, Greene bought Meta stock for the first time earlier this month. Expanding Greene’s AI exposure beyond semiconductor stocks, Meta is at the forefront of AI due to its diverse offerings such as its large language model, Llama, which Nvidia CEO Jensen Huang contends “has profoundly impacted the advancement of state-of-the-art AI.” Meta also offers content creators a valuable tool with its recently released generative AI product, Movie Gen.

Is now a good time to pick these stocks up for yourself?

For those of us outside the Beltway who are interested in AI stocks, all of Greene’s recent purchases are compelling options that are well worth deeper investigation. Investors who are keen on finding stocks in the bargain bin will find ASML appealing right now as shares are trading at 31.4 times operating cash flow — admittedly, a little pricey but a discount nonetheless considering their five-year average cash flow multiple of 38.2.

On the other hand, investors looking to generate passive income from their AI investments will want to consider Lam Research and Dell, which offer forward yields of 1.2% and 1.4%, respectively.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $831,707!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Scott Levine has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML, Applied Materials, Costco Wholesale, Lam Research, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

Marjorie Taylor Greene Continues Her Stock-Buying Bonanza; Here Are 6 Stocks She Just Bought was originally published by The Motley Fool

Taiwan Semiconductor Soars On Earnings With More Room To Run

Many investors still hold high regard for the technology sector in the United States today, which makes sense as the services PMI index is carrying most—if not all—of the economic growth left in the country, compared to the 23-month contraction in the manufacturing sector, as seen in that PMI index. However, not all technology sectors are equal.

The semiconductor and chipmaking niche of the sector receives special attention, which has been present all of 2024 and extrapolated since the shortages seen since the COVID-19 pandemic. In recent quarters, all the pressure seems to have been placed on shares of Taiwan Semiconductor Manufacturing Co. TSM, the global leader in chip sales with major customers all over the sector.

However, investors might have been concerned after seeing NVIDIA Co. NVIDIA sell-off after its last quarter, which announced a state of “lots and lots of supply,” according to its CEO, which would ultimately hurt margins and earnings per share (EPS). More recently, ASML Holding ASML stock sold off by over 17% in a single day after missing booking guidance.

Taiwan Semiconductor Stock Soars 12%: Strong Earnings and Growing Demand Fuel Rally

To ease some of the ASML and NVIDIA concerns, Taiwan Semiconductor stock rallied by over 12% in a single day following the blowout earnings results posted. This may have caused a surprise figure to outperform some of its peers during the quarter.

Investors would have been ready for this rally by looking at a few metrics beforehand. Some of these metrics include the monthly revenue growth rate and the fact that markets were willing to pay a premium valuation only to get exposure to the company’s future earnings, which is often a bullish sign.

Building on these views that investors enjoyed the rally, here’s what investors can now keep in mind moving forward and decide whether there is still further upside left in Taiwan Semiconductor stock. To start with revenue, the company’s earnings press release shows a jump of 39% over the past 12 months.

Then, investors can lean on the fact that the company’s net income jumped by 54% during the quarter to significantly boost potential valuation targets from Wall Street analysts. But that’s all in the past; in order to accurately predict the stock’s value, investors need to look into the future.

Easing some of the fears of demand from the industry, the company’s CEO said, “Demand is real, and I believe it’s just the beginning,” speaking of other peers in the space like NVIDIA. These words were quantified further after the statement, though management guidance to blow most expectations out of proportion.

Revenue projections, even after a 54% jump over the past quarter, are still expected to outpace current guidance projections. For the next quarter, Taiwan Semiconductor management expects to deliver up to $26.9 billion in revenues compared to the estimate of $24.9 billion.

Not only is revenue expected to rise by another double-digit rate, but here’s where valuations can be boosted in the coming months. Gross margins are guided to land nearer to 57% against the former consensus of 54.7%, which speaks to the state of pricing power present in the industry as demand outpaces supply to help costs and prices.

Wall Street Weighs In On Taiwan Semiconductor Stock: What Investors Can Expect Next

Recently, analysts at Needham & Co. decided to reiterate their “Buy” rating on Taiwan Semiconductor stock on the day of earnings. Still, their valuations seem a bit out of touch. They see the stock going to $210, which is still roughly a dollar lower than where it rallied.

More significant is the previous price target set by those at Susquehanna in August 2024. Those analysts saw a “Positive” rating for the stock, this time boosting their targets and valuation up to $250 a share to call for a further 18.5% upside from where the stock trades today.

Realizing that the demand trends might favor more profitability and margins in the industry, bearish traders decided to step away from the market during the past quarter. Taiwan Semiconductor stock’s short interest has declined from $5.6 billion at the peak of last quarter to $4.5 billion today.

As the stock rallies by double-digits this week, more short sellers might be forced to cover their positions and add additional buying pressure to a stock whose bullish momentum seems to just be getting started.

The article “Taiwan Semiconductor Soars on Earnings With More Room to Run” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Spotlight on Charles Schwab: Analyzing the Surge in Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Charles Schwab.

Looking at options history for Charles Schwab SCHW we detected 16 trades.

If we consider the specifics of each trade, it is accurate to state that 56% of the investors opened trades with bullish expectations and 25% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $168,127 and 12, calls, for a total amount of $617,347.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $60.0 and $77.5 for Charles Schwab, spanning the last three months.

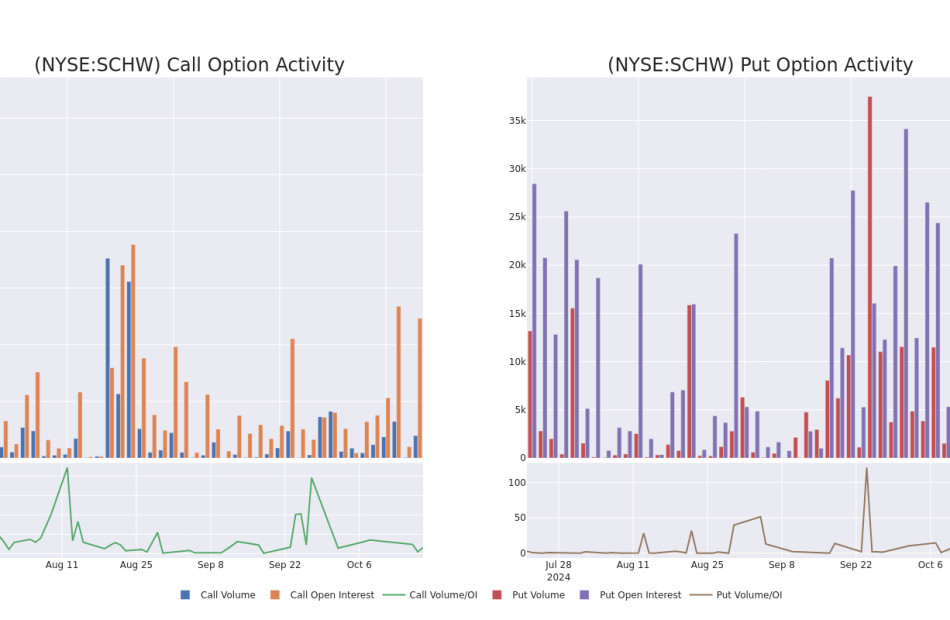

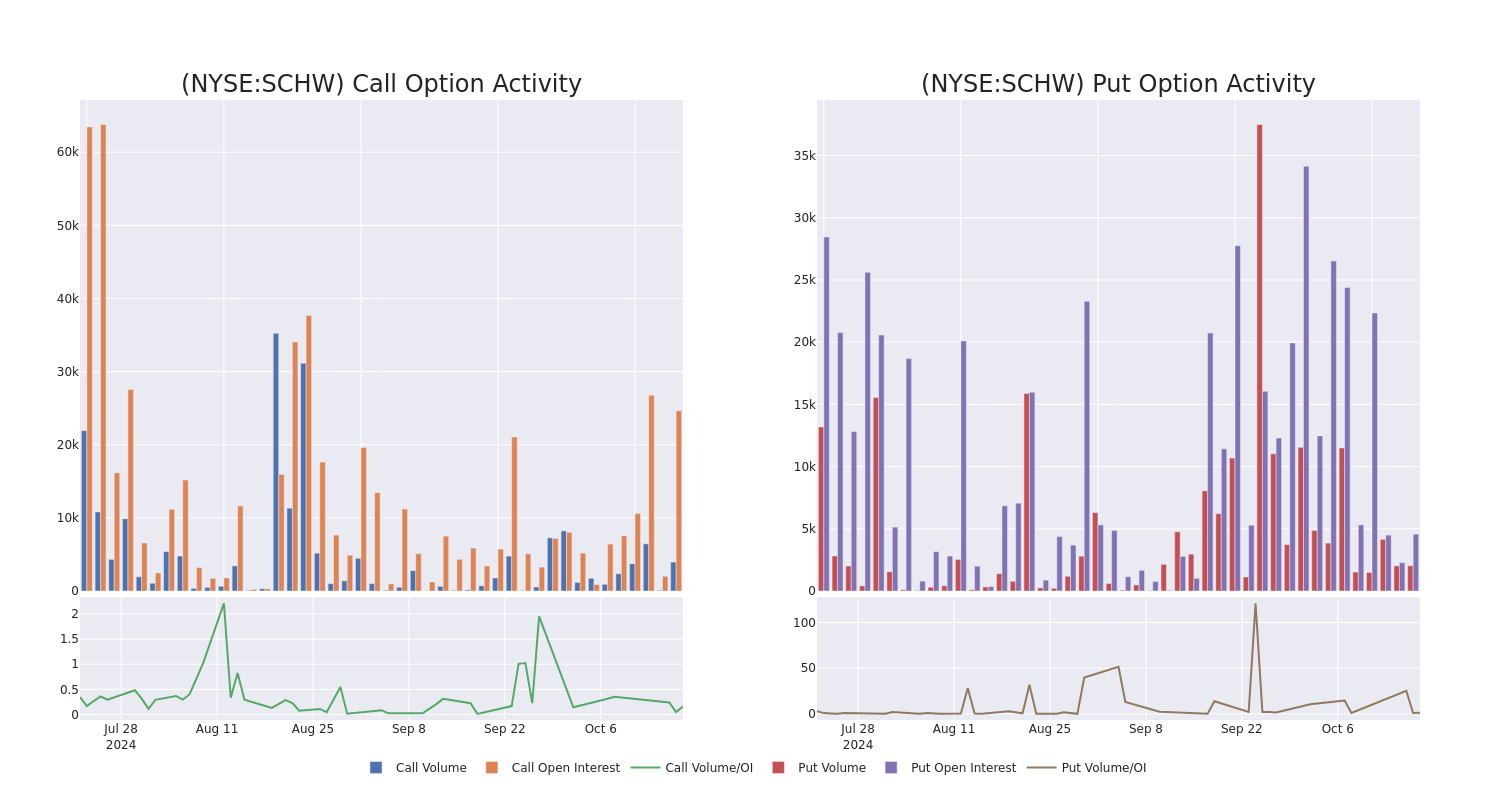

Volume & Open Interest Trends

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Charles Schwab’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Charles Schwab’s whale activity within a strike price range from $60.0 to $77.5 in the last 30 days.

Charles Schwab 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SCHW | CALL | SWEEP | BULLISH | 03/21/25 | $13.2 | $13.0 | $13.15 | $60.00 | $99.9K | 764 | 334 |

| SCHW | CALL | SWEEP | BULLISH | 03/21/25 | $13.2 | $13.0 | $13.15 | $60.00 | $77.5K | 764 | 258 |

| SCHW | CALL | SWEEP | NEUTRAL | 03/21/25 | $13.2 | $13.0 | $13.15 | $60.00 | $68.3K | 764 | 199 |

| SCHW | CALL | SWEEP | BEARISH | 11/15/24 | $1.36 | $1.3 | $1.31 | $72.50 | $59.8K | 3.9K | 1.4K |

| SCHW | PUT | SWEEP | BULLISH | 10/18/24 | $1.72 | $1.43 | $1.52 | $73.00 | $52.4K | 2.3K | 43 |

About Charles Schwab

Charles Schwab operates in brokerage, wealth management, banking, and asset management. It runs a large network of brick-and-mortar brokerage branch offices and a well-established online investing website, and it has mobile trading capabilities. It also operates a bank and a proprietary asset-management business and offers services to independent investment advisors. Schwab is among the largest firms in the investment business, with over $8 trillion of client assets at the end of December 2023. Nearly all of its revenue is from the United States.

Current Position of Charles Schwab

- Trading volume stands at 8,745,621, with SCHW’s price down by -0.76%, positioned at $71.36.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 89 days.

Expert Opinions on Charles Schwab

In the last month, 5 experts released ratings on this stock with an average target price of $71.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on Charles Schwab with a target price of $74.

* An analyst from Wells Fargo persists with their Equal-Weight rating on Charles Schwab, maintaining a target price of $75.

* An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Charles Schwab, which currently sits at a price target of $68.

* An analyst from Jefferies persists with their Buy rating on Charles Schwab, maintaining a target price of $73.

* An analyst from Piper Sandler persists with their Neutral rating on Charles Schwab, maintaining a target price of $65.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Charles Schwab with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Avocado Oil Market to Exceed Market Valuation of $892.3 Million by 2031- SkyQuest Technology

Westford, US, Oct. 18, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the global avocado oil market size will reach a value of USD 892.3 Million by 2031, with a CAGR of 5.82% during the forecast period (2024-2031). The market has witnessed substantial growth in the past years owing to the growing demand for organic and natural products and increasing awareness of health benefits. The market is majorly fueled by the rising trend toward sustainable sources and the progress of the food and beverage industry. The demand for avocado oil is surging as consumers are gaining awareness for better health choices, thus impacting advancements and competition among manufacturers.

Request Sample of the Report: https://www.skyquestt.com/sample-request/avocado-oil-market

Browse in-depth TOC on the “Avocado Oil Market” Pages – 197, Tables – 95, Figures – 76

Avocado Oil Market Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $578.34 Million |

| Estimated Value by 2031 | $892.3 Million |

| Growth Rate | Poised to grow at a CAGR of 5.82 % |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Million) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa |

| Report Highlights | Growing number of patent filings by major market players |

| Key Market Opportunities | Growing Product Innovations like Infused or Flavored Avocado Oils |

| Key Market Drivers | Shift Towards the Production of Organic Oil |

Get Customized Reports with your Requirements, Free – https://www.skyquestt.com/speak-with-analyst/avocado-oil-market

Virgin Oil Segment to Hold Major Market Share Owing to its Increased Health Advantages

By type, the virgin oil segment captured majority share of the avocado oil market in 2023 owing to increased health benefits and flavor petite. Virgin avocado is least processed and hence contains more original nutrients, healthy fats, and antioxidants that appeal to a wider audience, mainly the health-conscious group. It also holds a strong and rich flavor that improves culinary dishes, increasing its prominence among home cooks and chefs. On the other hand, the refined oil segment is expected to be the second leading owing to its versatility and long shelf-life. Refined avocado oil holds a high smoke point that increases its preference in diverse cooking methods. This increases its popularity in food processing and commercial kitchens. The refining process increases the oil’s shelf life, increasing its convenience for both manufacturers and consumers.

Food and Beverages Segment to Lead Market Due to Growing Awareness for Benefits of Healthy Fats

By application, the food and beverages segment is expected to hold a larger share of the market owing to growing health consciousness and the increasing prominence of healthy fats. Growing consumer awareness for healthy consumption is notably driving the demand for avocado oil since it is regarded as a highly nutritious substitute for conventional cooking oils. Also, the trend towards integrating healthy fats in eatables is aiding the demand for avocado oil that contains healthy amounts of monounsaturated fats. Conversely, the personal care and cosmetics segment is expected to grow considerably due to rising demand for natural products like organic and natural skincare that drives the demand as safe and clean ingredient. Anti-aging benefits of avocado oil is also fueling the segment’s growth.

Growing Health and Wellness Trends to Lead Market in North America

Geographically, North America dominated the avocado oil market in the previous years and will lead in the future as well owing to growing wellness and health trends and culinary prominence. The majority of the population in the region is focused on wellness and health, thus impacting significant demand for natural and nutritious products, such as avocado oil. Also, its versatility in diverse cuisines and cooking, especially among health-conscious individuals, is driving its adoption in the region.

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/avocado-oil-market

Asia-Pacific is expected to grow as the fastest-growing region over the estimated period owing to the growing health awareness and growing middle class population. Rising health awareness among consumers is propelling the demand for nutritious oils. The regional growth is further driven by the growing middle-class population with increased spending power, fueling the demand for premium foods and healthier cooking oils.

Avocado Oil Market Insight

Drivers:

- Growing Trend for Organic and Natural Foods

- Growing Use in Personal Care Applications

- Increasing Demand for Plant-Based Foods

Restraints:

- High Priced Avocado Oil

- Limited Shelf-Life of Avocado Oil

- Presence of Multiple Cooking Oils

Prominent Players in Avocado Oil Market

- Olivado

- Sesajal S.A. de C.V.

- The Grove Avocado Oil Co.

- Crofts Limited

- Chosen Foods LLC

- Grupo Industrial Batellero, S.A. de C.V.

- Tron Hermanos, S.A. de C.V.

- Proteco Oils

- La Tourangelle, Inc.

- Ahuacatlan Avocado Oil

Key Questions Answered in Global Avocado Oil Market Report

- What is the estimated value of avocado oil market by 2031, as per SkyQuest Technology?

- Which is the leading segment in market and why?

- Which region held a larger share in 2023 in the market?

This report provides the following insights:

Analysis of key drivers (growing preference for sustainable sourcing, expanding food industry, growing awareness for functional foods), restraints (low consumer awareness in some regions, expensive processing costs, variability in quality), opportunities (expanding health trends, growth of e-commerce for better reach, growing research and development), and challenges (price fluctuations, challenges with shelf-life and storage, cultural acceptance due to the strong presence of traditional cooking oils) influencing the growth of avocado oil market.

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the market.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the market.

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

Related Reports:

Food Container Market: Global Opportunity Analysis and Forecast, 2024-2031

Essential Oils Market: Global Opportunity Analysis and Forecast, 2024-2031

Black Seed Oil Market: Global Opportunity Analysis and Forecast, 2024-2031

Oilseeds Market: Global Opportunity Analysis and Forecast, 2024-2031

Grape Seed Oil Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

SkyQuest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.