RLF, NATIONAL TRIAL COUNSEL, Encourages Metagenomi, Inc. Investors to Secure Counsel Before Important Deadline in Securities Class Action – MGX

NEW YORK, Oct. 18, 2024 (GLOBE NEWSWIRE) —

WHY: Rosen Law Firm, a global investor rights law firm, reminds purchasers of stock of Metagenomi, Inc. MGX pursuant and/or traceable to the Company’s initial public offering conducted between February 9 and 13, 2024 (the “IPO”), of the important November 25, 2024 lead plaintiff deadline.

SO WHAT: If you purchased Metagenomi stock you may be entitled to compensation without payment of any out of pocket fees or costs through a contingency fee arrangement.

WHAT TO DO NEXT: To join the Metagenomi class action, go to https://rosenlegal.com/submit-form/?case_id=29254 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action. A class action lawsuit has already been filed. If you wish to serve as lead plaintiff, you must move the Court no later than November 25, 2024. A lead plaintiff is a representative party acting on behalf of other class members in directing the litigation.

WHY ROSEN LAW: We encourage investors to select qualified counsel with a track record of success in leadership roles. Often, firms issuing notices do not have comparable experience, resources or any meaningful peer recognition. Many of these firms do not actually litigate securities class actions, but are merely middlemen that refer clients or partner with law firms that actually litigate the cases. Be wise in selecting counsel. The Rosen Law Firm represents investors throughout the globe, concentrating its practice in securities class actions and shareholder derivative litigation. Rosen Law Firm has achieved the largest ever securities class action settlement against a Chinese Company. Rosen Law Firm was Ranked No. 1 by ISS Securities Class Action Services for number of securities class action settlements in 2017. The firm has been ranked in the top 4 each year since 2013 and has recovered hundreds of millions of dollars for investors. In 2019 alone the firm secured over $438 million for investors. In 2020, founding partner Laurence Rosen was named by law360 as a Titan of Plaintiffs’ Bar. Many of the firm’s attorneys have been recognized by Lawdragon and Super Lawyers.

DETAILS OF THE CASE: According to the lawsuit, Metagenomi introduced itself to investors during its IPO as a “genetic medicines company” having a long-standing business relationship with Moderna, one of the leading Covid-19 vaccine companies. Integral to Metagenomi’s collaboration with Moderna was the claim that the two companies had entered into a Strategic Collaboration and License Agreement on October 29, 2021, which included multiple four-year research programs and a subsequent licensed product-by-licensed product agreement. Metagenomi completed its initial public offering on February 13, 2024, selling 6.25 million shares at $15 per share. However, less than three months later, on May 1, 2024, Metagenomi announced that it and Moderna had “mutually agreed to terminate their collaboration” agreement. When the true details entered the market, the lawsuit claims that investors suffered damages.

To join the Metagenomi class action, go to https://rosenlegal.com/submit-form/?case_id=29254 or call Phillip Kim, Esq. toll-free at 866-767-3653 or email case@rosenlegal.com for information on the class action.

No Class Has Been Certified. Until a class is certified, you are not represented by counsel unless you retain one. You may select counsel of your choice. You may also remain an absent class member and do nothing at this point. An investor’s ability to share in any potential future recovery is not dependent upon serving as lead plaintiff.

Follow us for updates on LinkedIn: https://www.linkedin.com/company/the-rosen-law-firm, on Twitter: https://twitter.com/rosen_firm or on Facebook: https://www.facebook.com/rosenlawfirm/.

Attorney Advertising. Prior results do not guarantee a similar outcome.

Contact Information:

Laurence Rosen, Esq.

Phillip Kim, Esq.

The Rosen Law Firm, P.A.

275 Madison Avenue, 40th Floor

New York, NY 10016

Tel: (212) 686-1060

Toll Free: (866) 767-3653

Fax: (212) 202-3827

case@rosenlegal.com

www.rosenlegal.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

20 new affordable homes in New Glasgow

NEW GLASGOW, NS, Oct. 18, 2024 /CNW/ – Today, the federal government, the provincial government, and Nova Scotia Co-operative Council announced they had contributed nearly $4 million in combined funding to help build 20 affordable homes in New Glasgow.

Owned and operated by Nova Scotia Co-operative Council, Coady’s Place, Phase 2 – located at 917 East River Road – has studio, one-bedroom, and two-bedroom apartments for low-income individuals, seniors, and families.

The apartments are fully furnished, with power, heat, water and waste management costs included in the rent. Of the twenty units, four are accessible, and all the common areas are barrier free, ensuring that individuals with mobility challenges can live there comfortably.

In May 2022, Coady’s Place received close to $2.1 million in federal funding to support 36 new affordable apartments for individuals and families in New Glasgow under the Rapid Housing Initiative for Phase 1. The project also received $3 million from the Nova Scotia Department of Municipal Affairs and Housing for operating support and to help ensure affordability of the housing units.

Funding for this project include:

- $500,000 as a forgivable loan from the federal government’s Affordable Housing Fund.

- $496,125 as a low interest, repayable loan from the federal government’s Affordable Housing Fund.

- $77,619 from the federal government through Canada Mortgage and Housing Corporation’s SEED funding program.

- $1.5 million from the Province of Nova Scotia’s Affordable Housing Development Program.

- $305,593 in land and cash equity from Nova Scotia Co-operative Council.

Quotes:

“Affordable housing is one of the core issues facing our community and this investment in phase two of Coady’s Place will provide more people and families a safe and affordable place to call home. We will continue to work with partners to invest in affordable housing projects here at home and across the country.” – The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

“Across the province, we’re hearing from Nova Scotians who are struggling to find a place to call home, and we’re working to change that. We’re grateful to be partnering with Coady’s Place and with the federal government to help bring more affordable housing to New Glasgow.”– Pat Dunn, Member of Legislative Assembly for Pictou Centre, Province of Nova Scotia, on behalf of the Honourable John Lohr, Minister of Municipal Affairs and Housing

“We are thrilled to officially open Coady’s Place Phase 2, which will provide safe, affordable housing to 28 individuals including seniors, woman and their children, and newcomers. We won’t stop this critically important work, until every person who needs a safe, affordable place where they can lay their ‘head on a pillow”, has one. We hope our Federal and Provincial governments will continue to support us in this mission.” – Dianne Kelderman, President and CEO, Nova Scotia Co-operative Council

Quick facts:

- The Affordable Housing Fund (AHF) provides funding through low-interest and/or forgivable loans or contributions to help build new affordable homes and renovate and repair existing, affordable and community housing.

- This program under the National Housing Strategy (NHS) gives priority to projects that help people who need it most, including women and children fleeing family violence, seniors, Indigenous peoples, people living with disabilities, those with mental health or addiction issues, veterans, and young adults.

- Through the 2023 Fall Economic Statement, the government announced an additional $1 billion for the Affordable Housing Fund, bringing the total funding to over $14 billion. To further support non-profit, co-operative, and public housing providers and respond to the needs of those most impacted by the housing crisis, Budget 2024 committed an additional $1 billion to the fund.

- As of June 2024, the federal government has committed $54.28 billion through the NHS to support the creation of over 149,000 units and the repair of over 288,000 units.

Additional Information:

- Visit Canada.ca/housing for the most requested Government of Canada housing information.

- CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that everyone in Canada has a home they can afford and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

- To find out more about the National Housing Strategy, please visit www.placetocallhome.ca.

SOURCE Government of Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/18/c2159.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/18/c2159.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oleochemicals Market to Reach $54.43 Billion by 2031 – SkyQuest Technology

Westford, US, Oct. 18, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the global oleochemicals market size will reach a value of USD 54.43 Billion by 2031, with a CAGR of 6.3% during the forecast period (2024-2031). The market has witnessed considerable growth in the recent past owing to the rising demand for biodegradable and sustainable products coupled with strict regulations on derivatives of petrochemicals. The growing inclination towards green alternatives and modernization in product applications also fuels the market. Furthermore, increasing demand for chemicals from the food & beverages industry is impacting market growth.

Browse in-depth TOC on the “Oleochemicals Market” Pages – 197, Tables – 95, Figures – 76

Request Sample of the Report: https://www.skyquestt.com/sample-request/oleochemicals-market

Oleochemicals Market Report Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $35.43 Billion |

| Estimated Value by 2031 | $54.43 Billion |

| Growth Rate | Poised to grow at a CAGR of 6.3% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Type, Application, and Region |

| Geographies Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa |

| Report Highlights | Growing number of patent filings by major market players |

| Key Market Opportunities | Mounting Demand for Biofuels |

| Key Market Drivers | Growing Demand from Numerous End-Use Industries like Personal Care and Cosmetics |

Growing Demand for Personal Care Products to Propel Fatty Acids Segment

By type, the fatty acids segment held maximum share of the oleochemicals market in 2023 with a remarkable revenue share owing to its easy availability and rising demand for organic personal care goods in the globe. Moreover, these acids function as better surfactants in soaps and detergent because of their amphipathic properties. These are vital raw materials to produce numerous downstream derivatives like biocides, toiletry, elastomers, wax, and softeners for multiple industries, thus impacting the segment’s growth. Glycerin is anticipated to lead the market owing to its broader use in industrial and food applications. They are also widely used to preserve and develop botanical extracts that are further used as flavoring agents in different products.

Get Customized Reports with your Requirements, Free – https://www.skyquestt.com/speak-with-analyst/oleochemicals-market

Growing Health Trends and Heavy Adoption in Food to Drive Food & Beverages Domain

By application, the food & beverages segment registered for a considerable share of the market and will lead over the forecast period as well owing to increased adoption of stabilizers, bio-based thickeners, and several food additives in the food industry. Moreover, rising awareness for healthier and natural ingredients is fueling the demand for oleochemicals than other synthetic substitutes. On the other hand, the chemicals segment is expected to progress on the back of increased demand for eco-friendly or green alternatives for petroleum-based chemicals. These chemicals are extensively used in wide applications like detergents, surfactants, lubricants, and more, increasing their significance in diverse industries.

Availability of Ample Raw Materials and Growing Urbanization to Fuel Market in Asia-Pacific

Geographically, Asia-Pacific led the Oleochemicals market in 2023 owing to the availability of abundant raw materials and speedy urbanization and industrialization. The region is a leading producer of several vegetable oils including palm oil, thus offering a steady amount of feedstock for the production of oleochemicals. Speedy industrialization and growing urbanization, along with rising disposable incomes in emerging nations are fueling the demand for personal care products, consumer goods, and food and beverages. This ultimately impacts the market growth.

North America is expected to be the fastest growing region owing to the established industry infrastructure and heavy demand for sustainable products. The region holds a well-established production base with prominent companies that have broad experience in manufacturing oleochemicals. Also, there is an increased demand for biodegradable, sustainable, and eco-friendly products, raising interest in oleochemicals than petrochemicals, thus fueling the market growth in the region.

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/oleochemicals-market

Oleochemicals Market Insight

Drivers:

- Growing Sustainability Trends

- Strict Regulations for Synthetic Chemicals

- Growing Applications in Diverse Industries

Restraints:

- Competition from Petrochemicals

- Fluctuating Prices of Raw Materials

- Low Availability of Feedstock

Prominent Players in Oleochemicals Market

- BASF SE

- Procter & Gamble Chemicals

- Wilmar International Ltd.

- IOI Oleochemicals

- Emery Oleochemicals Group

- Kuala Lumpur Kepong Berhad

- Godrej Industries Limited

- Cargill, Inc.

- Kao Chemicals

- Vantage Specialty Chemicals

Key Questions Answered in Oleochemicals Market Report

- What are the leading drivers of the oleochemicals market?

- Which type segment held the maximum share of the market in 2023 and why?

- Which strategies are adopted by the key players profiled in the market?

Related Reports:

Surfactants Market: Global Opportunity Analysis and Forecast, 2024-2031

Wax Market: Global Opportunity Analysis and Forecast, 2024-2031

Ethanol Market: Global Opportunity Analysis and Forecast, 2024-2031

Hyaluronic Acid Market: Global Opportunity Analysis and Forecast, 2024-2031

This report provides the following insights:

Analysis of key drivers (growing health consciousness, shift towards renewable resources, growing urbanization and population), restraints (lack of awareness and associated benefits, regulatory challenges, economic fluctuations or downturns), opportunities (rising demand for biodegradable products, heavy R&D investment, innovations in applications), and challenges (supply chain disturbances, heavy competition from synthetic alternatives, time-consuming and costly production technologies) influencing the growth of oleochemicals market.

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the market.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the market.

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

SkyQuest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Rise of Spatial Computing Market: A $280.5 billion Industry Dominated by Meta (US), Microsoft (US) and Sony (Japan) | MarketsandMarkets™

Delray Beach, FL, Oct. 18, 2024 (GLOBE NEWSWIRE) — The Spatial Computing Market size is expected to grow to USD 280.5 billion by 2028 from USD 97.9 billion in 2023 at a Compound Annual Growth Rate (CAGR) of 23.4% during the forecast period, according to a new report by MarketsandMarkets™.

Browse in-depth TOC on “Spatial Computing Market“

254 – Tables

53 – Figures

296 – Pages

Download Report Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=233397982

Spatial Computing Market Dynamics:

Drivers

- Virtualization in fashion, art, and retail industries

- Increase in adoption of extended reality in healthcare sector

- Availability of affordable hardware

Restraints

- Rise in health concerns associated with excessive usage of VR/XR devices

- Diversity of AR/VR platforms and complex development landscape

- Lack of technical knowledge and expertise

Opportunities

- Increase in government initiatives toward cloud computing

- Continuous development in 5G technology

- Incorporation of spatial computing and adjacent technologies in aerospace & defense sector

List of Key Players in Spatial Computing Market:

- Meta (US)

- Microsoft (US)

- Apple (US)

- Sony (Japan)

- Qualcomm (US)

- Google (US)

- Epson (Japan)

- Samsung (South Korea)

- Magic Leap (US)

- PTC (US)

During the forecast period, virtualization in fashion, art, and retail industries drive the global Spatial Computing Market. With the advent of the metaverse, companies have started to showcase and sell their products in an immersive 3D metaverse through websites or social media. Virtual showrooms of art and paintings, VR-based fashion shows, and virtual dressing rooms are shifting from infancy to mass adoption.

Request Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=233397982

Based on component, the hardware segment will record the highest CAGR in the Spatial Computing Market during the forecast period.

Hardware plays a crucial role in spatial computing, enabling creation, interaction, and immersion within virtual and mixed-reality environments. Microsoft’s new HoloLens 2 is a fabulous example of how XR technology is evolving gradually. Qualcomm very particularly has the capacity to influence a host of future AR glasses. The firm’s Snapdragon XR2 5G Platform uses AI to achieve true mixed reality and immersion that responds as quickly as human reflexes. Glasses powered by Snapdragon chips will be unlike anything that the world has seen in spatial computing to date.

Apple’s Vision Pro, launched in June 2023, creates an infinite canvas for apps that scale beyond the boundaries of a mere traditional display by introducing a fully 3D user interface controlled by the most natural and intuitive inputs possible, such as the user’s eyes, hands, and voice. The breakthrough/flagship design of Vision Pro features an ultra-high-resolution display system that packs 23 million pixels across two displays, and custom Apple silicon in a unique dual-chip design so as to ensure every experience feels like the occurrence is taking place in front of the user’s eyes in real time. Spatial computing hardware are increasingly used across by individuals and enterprises to deliver the best-in-class 3D virtual experience in by creating a real-time ambience/ecosystem.

Based on hardware, the VR devices segment will hold a larger market share in 2023.

Virtual Reality (VR) devices are advanced technologies that immerse users in entirely computer-generated environments, blocking the physical world and providing a highly immersive sensory experience through headsets or goggles. These devices are integrated into spatial computing, enabling users to navigate and interact within spatially-aware virtual worlds. Through high-resolution displays, motion-tracking sensors, and spatial audio, VR devices create a convincing sense of presence, allowing users to explore and manipulate digital spaces as if they were physically there. This technology is applied in various fields, including gaming, training, architecture, and therapy, to offer users unique and spatially immersive experiences that simulate real-world scenarios or create new spatial environments for education, entertainment, and problem-solving.

Inquire Before Buying: https://www.marketsandmarkets.com/Enquiry_Before_BuyingNew.asp?id=233397982

Based on vertical, the travel & hospitality segment to grow at the highest CAGR during the forecast period. In various countries, tourism is one of the largest industries. It depends on four key factors: accommodation, transportation, catering, and tourist attractions. Spatial computing technology plays a crucial role in the tourism industry as it provides tourists with new AR mobile applications that provide helpful information, navigation instructions, and guidance. This technology offers a unique experience to tourists by displaying virtual things in realistic environments to feel the presence of virtual things and enhance their live tourism experience.

Get access to the latest updates on Spatial Computing Companies and Spatial Computing Industry

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Celularity Inc. Receives Notice from Nasdaq; Confirms Intention to File an Appeal

FLORHAM PARK, N.J., Oct. 18, 2024 (GLOBE NEWSWIRE) — Celularity Inc. CELU (the “Company”), a regenerative medicine company developing and commercializing placental-derived technologies, today announced that it has received a formal notice from the Listing Qualifications department of the Nasdaq Stock Market LLC (“Nasdaq”) on October 16, 2024, indicating that the Company is subject to delisting due to its inability to timely file its Forms 10-Q for the the periods ended March 31, 2024, and June 30, 2024 (the “Forms 10-Q”) within the prescribed 180-day compliance period. Nasdaq’s notice has no immediate effect on the listing of the Company’s common stock and warrants, which continue to trade on the Nasdaq Capital Market under the symbols “CELU” and “CELUW”, respectively.

The Company will appeal the determination with the Nasdaq Hearings Panel prior to October 24, 2024, and request a hearing to present its plan to regain compliance and, if necessary, request a stay of suspension pending the hearing. However, there can be no assurance that Nasdaq will accept the plan, that the Company will regain compliance within any additional compliance period, or that the Company will maintain compliance with the other Nasdaq listing requirements.

The Company remains committed to regaining full compliance with Nasdaq’s listing requirements. The Company has filed its annual report on Form 10-K for fiscal year 2023 within the compliance period and its quarterly report on Form 10-Q for the first quarter 2024 on October 16, 2024. Additionally, the Company intends to file its Form 10-Q for the second quarter 2024 within the coming weeks.

Robert J. Hariri, MD, PhD, Chairman and CEO of the Company, commented, “Like many companies operating in our sector, we have faced significant financial challenges over the years, which affected our ability to file financial reports on time. It’s important to note that these delays are not due to any accounting irregularities or issues, but rather reflect the limitations imposed by our liquidity constraints and the stretched capacity of our internal resources. We remain confident in the path forward, particularly with the recently announced acquisition of the Rebound™ product, which will meaningfully enhance our cash position and provide a stronger foundation for operational stability. With this strengthened financial outlook, we do not expect similar delays to occur in the future.”

The Company remains dedicated to meeting its reporting obligations and is working diligently with its auditors to complete the necessary filings. The Company will provide further updates as developments occur.

About Celularity

Celularity Inc. CELU is a regenerative medicine company developing and commercializing advanced biomaterial products and allogeneic, cryopreserved, placental-derived cell therapies, all derived from the postpartum placenta. Its therapeutic programs target aging-related diseases, including degenerative diseases, cancer, and immune disorders, using mesenchymal-like adherent stromal cells (MLASCs), T-cells engineered with CAR (CAR T-cells), and genetically modified and unmodified natural killer (NK) cells. Celularity believes that by harnessing the placenta’s unique biology and ready availability, it can develop therapeutic solutions that address significant unmet global needs for effective, accessible, and affordable therapies. For more information, visit www.celularity.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, as well as within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. All statements other than statements of historical facts are “forward-looking statements,” including those relating to future events. In some cases, you can identify forward-looking statements by terminology such as “anticipate,” “believe,” “can,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “forecast,” “intends,” “may,” “might,” “outlook,” “plan,” “possible,” “potential,” “predict,” “project,” “seek,” “should,” “strive,” “target,” “will,” “would” and the negative of terms like these or other comparable terminology, and other words or terms of similar meaning. The forward-looking statements in this press release include express or implied statements regarding the expected timing of the Company’s filing of its quarterly report for the period ending June 30, 2024 on Form 10-Q, the potential submission of a plan to the Nasdaq Hearings Panel, the potential for Nasdaq to accept such plan or grant the Company any exception period, the Company’s ability to regain compliance with the Nasdaq continued listing standards, the Company’s financial outlook, and expectations regarding delays in future filings. Many factors could cause actual results to differ materially from those described in these forward-looking statements, including but not limited to: the Company’s liquidity situation; the volatility in the Company’s stock price; inherent risks in biotechnological development, including with respect to the development of novel advanced biomaterials; and the regulatory approval process; along with those risk factors set forth under the caption “Risk Factors” in the Company’s annual report on Form 10-K filed with the Securities and Exchange Commission (SEC) on July 30, 2024, and other filings with the SEC. If any of these risks materialize or underlying assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company does not presently know, or that the Company currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, these forward-looking statements reflect the Company’s current expectations, plans, or forecasts of future events and views as of the date of this communication. Subsequent events and developments could cause assessments to change. Accordingly, forward-looking statements should not be relied upon as representing the Company’s views as of any subsequent date, and the Company undertakes no obligation to update forward-looking statements to reflect events or circumstances after the date hereof, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Investor Contact:

Carlos Ramirez

Senior Vice President, Celularity Inc.

Carlos.ramirez@celularity.com

Media Contacts:

Raquel Cona / Michaela Fawcett

KCSA Strategic Communications

rcona@kcsa.com / mfawcett@kcsa.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Exploring Flexsteel Industries's Earnings Expectations

Flexsteel Industries FLXS is preparing to release its quarterly earnings on Monday, 2024-10-21. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Flexsteel Industries to report an earnings per share (EPS) of $0.62.

The announcement from Flexsteel Industries is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

Here’s a look at Flexsteel Industries’s past performance and the resulting price change:

| Quarter | Q4 2024 | Q3 2024 | Q2 2024 | Q1 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.56 | 0.56 | 0.24 | |

| EPS Actual | 0.75 | 0.67 | 0.57 | 0.14 |

| Price Change % | -2.0% | -16.0% | 8.0% | 5.0% |

Flexsteel Industries Share Price Analysis

Shares of Flexsteel Industries were trading at $43.68 as of October 17. Over the last 52-week period, shares are up 118.49%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Flexsteel Industries visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mattel To Report Q3 Earnings: Here's What To Expect From The Stock

Mattel, Inc. MAT is scheduled to report third-quarter 2024 results on Oct. 23, 2024, after the closing bell. In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate by 18.8%.

Trend In Estimate Revision

For the quarter to be reported, the Zacks Consensus Estimate for earnings is pegged at 94 cents, down 13% year over year. In the past seven days, earnings estimates for the quarter have been revised upward by 1 cent per share.

For revenues, the consensus mark is pegged at nearly $1.84 billion. The metric suggests a decline of 4.1% from the year-ago figure.

Let us discuss the factors that are likely to be reflected in the quarter to be reported.

Factors To Note

Mattel’s third-quarter 2024 results are likely to be negatively impacted by soft sales in North America. The dismal performance of Infant, Toddler, Preschool, Dolls and Vehicle products is likely to have hurt North America’ sales. The company is facing a challenging macroeconomic environment.

The Zacks Consensus Estimate for Worldwide gross billings by the top three Power Brands, Barbie, Fisher-Price and Hot Wheels is pegged at $524 million, $307 million and $455, respectively, down 13.4% and 3.2% and flat year over year.

On the other hand, the company’s bottom line is likely to have been hurt by higher input cost inflation, unfavorable fixed cost absorption and other supply-chain costs. Also, higher severance and restructuring expenses, incentive compensation and pay increases are likely to have negatively impacted the bottom line. However, its ongoing cost-saving program is expected to have partially offset the adverse effects of these headwinds. This includes simplifying its organizational structure and optimizing processes and supply chain to generate savings across operations.

Contributions from the IP-driven toy business, innovations across the toy portfolio and the expansion of entertainment offerings bode well. This and the focus on demand creation (in collaboration with retail partners) and licensing partnerships are likely to have aided the company’s performance in the to-be-reported quarter.

What Our Model Predicts

Our proven model doesn’t conclusively predict an earnings beat for Mattel this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Earnings ESP: Mattel has an Earnings ESP of -3.04%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Mattel has a Zacks Rank #3.

Stocks Poised To Beat Earnings Estimates

Here are some other stocks you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat.

AMC Entertainment Holdings, Inc. AMC has an Earnings ESP of +84.00% and a Zacks Rank of 2 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

AMC is expected to register a 33.3% increase year over year in earnings for the to-be-reported quarter. It reported better-than-expected earnings in two of the trailing four quarters and missed twice, the average negative surprise being 69.5%.

Boyd Gaming Corporation BYD currently has an Earnings ESP of +17.79% and a Zacks Rank of 2.

BYD’s earnings for the to-be-reported quarter are expected to increase 3.7% year over year. It reported better-than-expected earnings in two of the trailing four quarters and missed twice, the average surprise being 3.6%.

Marriott International, Inc. MAR currently has an Earnings ESP of +1.57% and a Zacks Rank of 3.

MAR’s earnings for the to-be-reported quarter are expected to increase 9.5% year over year. It reported better-than-expected earnings in three of the trailing four quarters and missed once, the average surprise being 16.9%.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

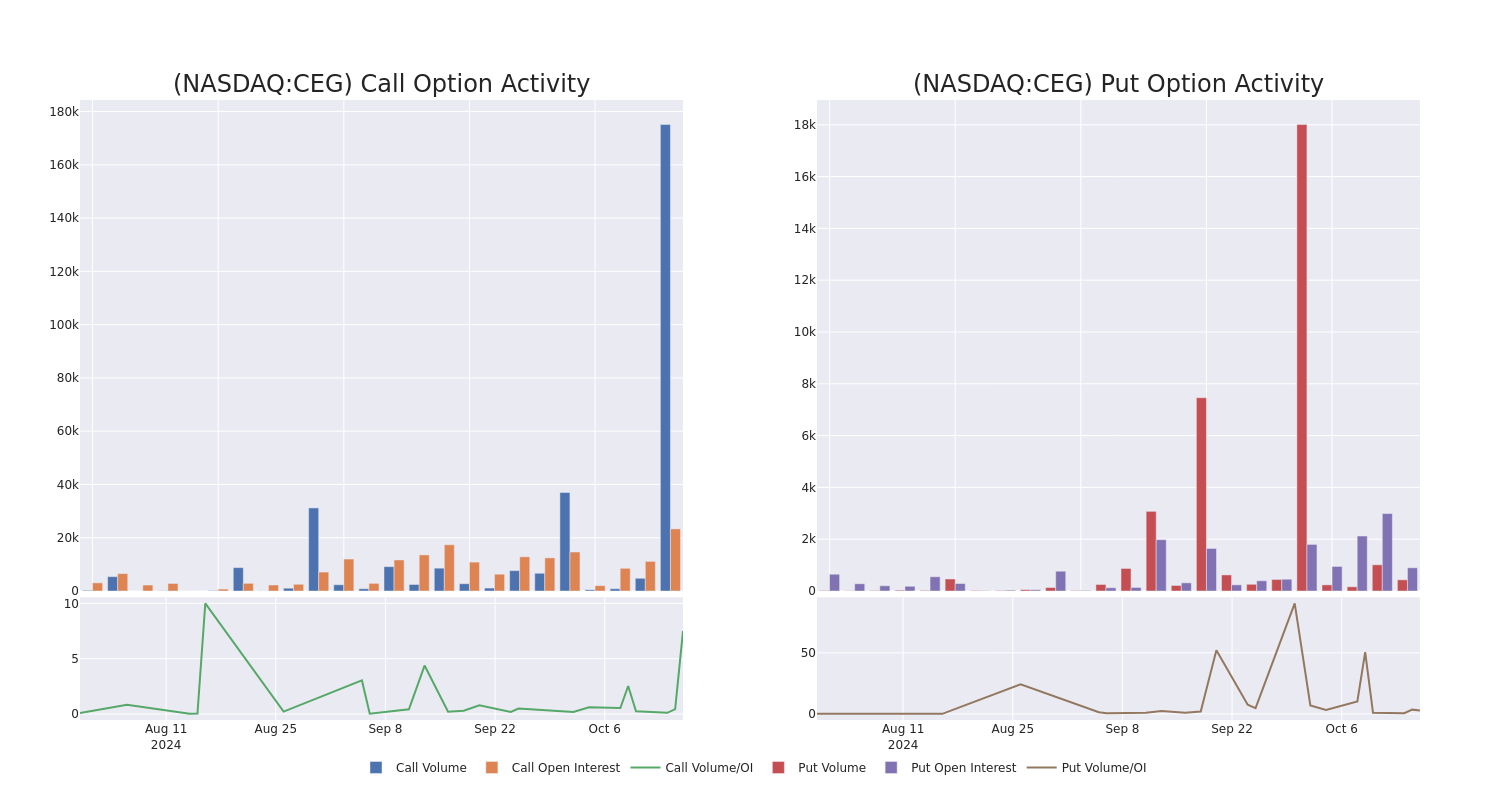

Constellation Energy Unusual Options Activity For October 18

Whales with a lot of money to spend have taken a noticeably bearish stance on Constellation Energy.

Looking at options history for Constellation Energy CEG we detected 36 trades.

If we consider the specifics of each trade, it is accurate to state that 41% of the investors opened trades with bullish expectations and 52% with bearish.

From the overall spotted trades, 14 are puts, for a total amount of $3,032,182 and 22, calls, for a total amount of $1,280,285.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $200.0 and $420.0 for Constellation Energy, spanning the last three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Constellation Energy’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Constellation Energy’s whale trades within a strike price range from $200.0 to $420.0 in the last 30 days.

Constellation Energy Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | PUT | SWEEP | BEARISH | 11/08/24 | $10.4 | $9.3 | $10.0 | $260.00 | $1.2M | 38 | 2.1K |

| CEG | PUT | SWEEP | BEARISH | 11/08/24 | $9.8 | $8.9 | $9.7 | $260.00 | $508.2K | 38 | 524 |

| CEG | PUT | SWEEP | BEARISH | 11/08/24 | $10.1 | $9.9 | $9.9 | $260.00 | $356.8K | 38 | 885 |

| CEG | PUT | SWEEP | BULLISH | 11/15/24 | $11.1 | $11.0 | $11.0 | $260.00 | $189.2K | 620 | 190 |

| CEG | PUT | TRADE | BEARISH | 01/16/26 | $155.8 | $154.7 | $155.8 | $420.00 | $155.8K | 0 | 10 |

About Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

In light of the recent options history for Constellation Energy, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Constellation Energy’s Current Market Status

- Trading volume stands at 1,683,648, with CEG’s price down by -0.4%, positioned at $270.12.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 17 days.

What The Experts Say On Constellation Energy

In the last month, 5 experts released ratings on this stock with an average target price of $294.2.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Constellation Energy, targeting a price of $279.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Sector Perform rating on Constellation Energy with a target price of $272.

* An analyst from BMO Capital has decided to maintain their Outperform rating on Constellation Energy, which currently sits at a price target of $278.

* An analyst from JP Morgan downgraded its action to Overweight with a price target of $342.

* Maintaining their stance, an analyst from Wells Fargo continues to hold a Overweight rating for Constellation Energy, targeting a price of $300.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Constellation Energy options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.