As US Tackles Inflation With Rate Cuts, IMF MD Sounds Alarm: 'Not Yet Time To Celebrate' Amid Looming Low Growth, High Debt

Amid ongoing global economic recovery efforts, Kristalina Georgieva, Managing Director of the International Monetary Fund, has issued a cautionary note regarding persistent challenges such as high debt and low growth. Her remarks come as the U.S. and EU implement rate cuts to tackle inflation.

What Happened: Georgieva highlighted that despite progress, governments are increasingly reliant on borrowing, which, coupled with “anemic growth,” complicates debt management. She praised central banks for their inflation control efforts but noted uneven benefits across regions, with some still facing high prices and related unrest, CNBC reported on Friday.

“It’s not yet time to celebrate,” she said.

“When we look into the challenges ahead of us, the biggest one is low growth, high debt. This is where we can and must do better.”

Georgieva’s comments precede the 2024 annual meetings of the IMF and World Bank Group in Washington, D.C., where global economic issues will be discussed. She also pointed out that international trade is no longer the “engine of growth” it once was, citing restrictive policies and U.S.-EU tariffs against China as potential risks. Additionally, she expressed concern over geopolitical tensions, particularly in the Middle East, affecting global financial stability.

Why It Matters: Georgieva’s comment arrived a day after the European Central Bank (ECB) cut interest rates for the third time this year to stimulate a sluggish economy, shifting focus from inflation control to economic growth. This move follows the Federal Reserve’s 50 basis point rate cut in September, marking a significant policy shift as both regions tackle economic challenges.

Meanwhile, the U.S. faces a staggering debt situation, with estimates suggesting a true national debt of $175 trillion when accounting for entitlements like Social Security and Medicare. This escalating debt underscores the urgency of addressing fiscal challenges.

In China, the government is reportedly considering issuing $850 billion in special treasury bonds to stimulate its slowing economy and manage local debt. These developments highlight the global nature of economic challenges and the varied approaches being taken to address them.

Read Next:

Image via Shutterstock

This story was generated using Benzinga Neuro and edited by Pooja Rajkumari

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Powell Max Limited Announces First Half 2024 Unaudited Financial Results

HONG KONG, Oct. 18, 2024 (GLOBE NEWSWIRE) — Powell Max Limited PMAX (the “Company” or “Powell Max“), a financial communications services provider headquartered in Hong Kong, today announced its unaudited financial results for the six months ended June 30, 2024.

Overview:

| ● | Revenue was HK$22.7 million (US$2.9 million) for the six months ended June 30, 2024, representing a decrease of 11.0% from the same period in 2023. | |

| ● | Net income was HK$0.8 million (US$98,456) for the six months ended June 30, 2024, as compared with HK$3.6 million for the same period in 2023. | |

Six Month Financial Results Ended June 30, 2024

Revenue. Revenue decreased by 11.0% from HK$25.2 million for the six months ended June 30, 2023 to HK$22.7 million (US$2.9 million) for the six months ended June 30, 2024, which was mainly due to a reduction in capital market activities in Hong Kong, which in turn has resulted in the postponement of many public offerings and other transactions of our customers. As a result of which, the demands for our financial communications services have reduced.

General and administrative expenses. General and administrative expenses increased by 12.7% from HK$5.4 million for the six months ended June 30, 2023 to HK$6.2 million (US$0.8 million) for the six months ended June 30, 2024, which was mainly due to an increase in the number of staff in our production team, an increase in the professional fee and an increase in expenses on expected credit loss.

Selling and distribution expenses. Selling and distribution expenses increased by 38.5% from HK$1.8 million for the six months ended June 30, 2023 to HK$3.0 million (US$0.4 million) for the six months ended June 30, 2024, which was mainly due to an increase in the number of staff in our sales team and an increase in other expenses on business development and marketing. In light of the reduction of capital market activities in Hong Kong, we have engaged extra resources on sales and marketing with the view to maintain our market presence.

Net income. Net income decreased by HK$2.8 million to HK$0.8 million (US$98,456), which was mainly due to the decrease in revenue and increase in general and administrative expenses, and selling and distribution expenses.

Basic and diluted EPS. Basic EPS was HK$0.062 (US$0.008) per ordinary share for the six months ended June 30, 2024, as compared to HK$0.285 per ordinary share for the six months ended June 30, 2023. Diluted EPS was the same as basic EPS for each period.

About Powell Max Limited

Powell Max Limited is a financial communications services provider headquartered in Hong Kong. The Company engages in the provision of financial communications services that support capital market compliance and transaction needs for corporate clients and their advisors in Hong Kong. Its financial communications services cover a full range of financial printing, corporate reporting, communications and language support services from inception to completion, including typesetting, proofreading, translation, design, printing, electronic reporting, newspaper placement and distribution. The Company’s clients consist of domestic and international companies listed in Hong Kong, together with companies who are seeking to list in Hong Kong, as well as their advisors.

Exchange Rate Information

The Company is a holding company with operations conducted in Hong Kong through JAN Financial Press Limited (“JAN Financial”), its sole operating subsidiary. JAN Financial’s reporting currency is Hong Kong dollars. The Hong Kong dollar is pegged to the U.S. dollar at a range of HK$7.75 to HK$7.85 to US$1. Unless otherwise noted, all translations from Hong Kong dollars to United States Dollars in this press release were calculated the noon middle rate of US$1 — HK$7.8083, as published in the H.10 statistical release of the Board of Governors of the Federal Reserve System on June 28, 2024, respectively. No representation is made that the HK$ amount represents or could have been, or could be, converted, realized or settled into US$ at that rate, or at any other rate.

Forward-Looking Statements

This press release contains certain forward-looking statements. Words such as “will,” future,” “expects,” “believes,” and “intends,” or similar expressions, are intended to identify forward-looking statements. Forward-looking statements are subject to inherent uncertainties in predicting future results and conditions. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

Rounding Amounts and Percentages

Certain amounts and percentages included in this press release have been rounded for ease of presentation. Percentage figures included in this press release have not in all cases been calculated on the basis of such rounded figures, but on the basis of such amounts prior to rounding.

For investor and media inquiries, please contact:

Company Info:

Powell Max Limited

Investor Relations

(852) 2158 2888

POWELL MAX LIMITED AND ITS SUBSIDIARY

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

| As of December 31, 2023 |

As of June 30, 2024 (unaudited) |

|||||||||||

| HK$ | HK$ | US$ | ||||||||||

| ASSETS | ||||||||||||

| Non-current assets | ||||||||||||

| Property, plant and equipment | 5,819,230 | 3,777,893 | 483,830 | |||||||||

| Total non-current assets | 5,819,230 | 3,777,893 | 483,830 | |||||||||

| Current assets | ||||||||||||

| Trade and other receivables | 12,547,210 | 16,040,646 | 2,054,307 | |||||||||

| Deferred IPO expense1 | 962,822 | 6,734,370 | 862,464 | |||||||||

| Cash and bank balances | 3,660,213 | 2,075,667 | 265,828 | |||||||||

| Total current assets | 17,170,245 | 24,850,683 | 3,182,599 | |||||||||

| Total assets | 22,989,475 | 28,628,576 | 3,666,429 | |||||||||

| LIABILITIES AND EQUITY | ||||||||||||

| Current liabilities | ||||||||||||

| Trade and other payables | 27,376,032 | 35,332,530 | 4,524,996 | |||||||||

| Contract liabilities | 1,524,761 | 612,761 | 78,476 | |||||||||

| Bank borrowings | 4,767,829 | 4,311,625 | 552,185 | |||||||||

| Lease liabilities | 3,361,230 | 2,765,854 | 354,220 | |||||||||

| Total current liabilities | 37,029,852 | 43,022,770 | 5,509,877 | |||||||||

| Non-current liabilities | ||||||||||||

| Trade and other payables | 150,000 | 150,000 | 19,210 | |||||||||

| Lease liabilities | 1,122,591 | – | – | |||||||||

| Total non-current liabilities | 1,272,591 | 150,000 | 19,210 | |||||||||

| Total liabilities | 38,302,443 | 43,172,770 | 5,529,087 | |||||||||

| Equity attributable to owners of the Company | ||||||||||||

| Share capital | 9,750 | 9,750 | 1,249 | |||||||||

| Accumulated losses | (15,680,728 | ) | (14,899,592 | ) | (1,908,174 | ) | ||||||

| Reserve | 358,010 | 345,648 | 44,267 | |||||||||

| Total equity | (15,312,968 | ) | (14,544,194 | ) | (1,862,658 | ) | ||||||

| Total liabilities and equity | 22,989,475 | 28,628,576 | 3,666,429 | |||||||||

| 1 | Prior to our initial public offering, we had recorded certain legal, accounting and other third party fees that are directly associated with our initial public offering as deferred IPO expense. Nasdaq Capital Market and would be charged against the gross proceeds of the offering as a reduction of share capital.. As at June 30, 2024, the Company has not completed its IPO on Nasdaq Capital Market. |

POWELL MAX LIMITED AND ITS SUBSIDIARY

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF PROFIT OR LOSS

AND OTHER COMPREHENSIVE INCOME

| Six months ended June 30, | ||||||||||||

| 2023 (unaudited) |

2024 (unaudited) |

|||||||||||

| HK$ | HK$ | US$ | ||||||||||

| Revenue | 25,236,693 | 22,732,219 | 2,911,289 | |||||||||

| Cost of sales | (13,985,762 | ) | (12,549,020 | ) | (1,607,139 | ) | ||||||

| Gross profit | 11,250,931 | 10,183,199 | 1,304,150 | |||||||||

| Other income | 2,929 | 26,247 | 3,361 | |||||||||

| General and administrative expenses | (5,438,461 | ) | (6,228,824 | ) | (797,718 | ) | ||||||

| Selling and distribution expenses | (1,848,224 | ) | (3,005,905 | ) | (384,963 | ) | ||||||

| Profit from operations | 3,967,175 | 974,717 | 124,830 | |||||||||

| Finance costs | (300,428 | ) | (193,581 | ) | (24,791 | ) | ||||||

| Profit before income tax | 3,666,747 | 781,136 | 100,039 | |||||||||

| Income tax expense | – | – | – | |||||||||

| Profit for the period | 3,666,747 | 781,136 | 100,039 | |||||||||

| Other comprehensive income: | ||||||||||||

| Exchange differences on translation of foreign operations | (98,157 | ) | (12,362 | ) | (1,583 | ) | ||||||

| Total comprehensive income for the period | 3,568,590 | 768,774 | 98,456 | |||||||||

| Earnings per share attributable to owners of the Company | ||||||||||||

| Basic and diluted | 0.285 | 0.062 | 0.008 | |||||||||

| Weighted average number of ordinary shares | ||||||||||||

| Basic and diluted | 12,500,000 | 12,500,000 | 12,500,000 | |||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

MultiMetaVerse Holdings Limited Receives Nasdaq Notification Regarding Minimum Bid Price and Minimum Market Value of Listed Securities

SHANGHAI, Oct. 18, 2024 (GLOBE NEWSWIRE) — MultiMetaVerse Holdings Limited (the “Company”) received a letter from The Nasdaq Stock Market LLC (“Nasdaq”) stating that the Company was not in compliance with the minimum bid price of $1.00 per share requirement under Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Rule”) and the minimum market value of listed securities of $35 million requirement under Nasdaq Listing Rule 5550(b)(2) (the “MVLS Rule”), and had failed to regain compliance with the Bid Price Rule and the MVLS Rule during the extension period which ended on October 14, 2024. The Company has until October 22, 2024 to request a hearing before the Nasdaq Hearings Panel (the “Panel”),which it currently intends to do. If the Company does not request a hearing before the Panel by that date, trading in its Class A ordinary shares and warrants will be suspended at the opening of business on October 24, 2024 and a Form 25-NSE will be filed with the Securities and Exchange Commission (“SEC”) removing the securities from listing and registration on Nasdaq. In the event the Company’s securities are delisted from Nasdaq, its securities are expected to trade over-the-counter.

About MultiMetaVerse Holdings Limited

MultiMetaVerse Holdings Limited MMV is an animation and entertainment company dedicated to providing a high-quality, immersive entertainment experience through original, user-generated, and professional user-generated content. MMV commenced animation production in 2015 under its signature Aotu World brand, which has attracted a broad following with its inspiring storyline and unique graphic style, particularly among younger audiences in China. By leveraging the company’s established user base, MMV has built a diverse product portfolio, including animated content, comic books, short videos, collectibles, stationery, consumer products, and mobile games across the Aotu World brand. It has also developed and augmented new brands, stories, and characters, such as Neko Album.

For more information, please visit https://www.multi-metaverse.com/.

For investor and media inquiries, please contact:

MultiMetaVerse Holdings Limited

Investor Relations

E-mail: ir@multi-metaverse.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Top Cryptocurrency to Buy Before It Soars 20,000%, According to Michael Saylor of MicroStrategy

Over the past decade, Bitcoin (CRYPTO: BTC) has been one of the best-performing assets in the world. It has skyrocketed in value from just $100 to its current value of $65,000.

The good news is that it may not be too late to invest in Bitcoin’s extraordinary upside potential. According to Michael Saylor, founder and executive chairman of MicroStrategy, Bitcoin is likely to hit a price of $13 million by 2045. Based on today’s prices, that implies further gains of approximately 20,000%. That may sound hard to believe, but there are at least two good reasons why it might actually happen.

Institutional and corporate adoption

One key factor, says Saylor, is the growing institutional and corporate adoption of Bitcoin. On Wall Street, Bitcoin is increasingly viewed as a stand-alone asset class, and new investment products are being created to give investors exposure to it. The new spot Bitcoin exchange-traded funds (ETFs), which launched in January, are perhaps the best example of this.

And that’s just the tip of the iceberg regarding institutional and corporate adoption. For example, Cathie Wood of Ark Invest has outlined eight different use cases for Bitcoin, with all of them helping to bolster global demand for the cryptocurrency. For now, the primary use case has been that Bitcoin is a store of value, with institutional investors and central banks buying it as an alternative to gold.

This demand alone would probably not be enough to propel Bitcoin to extraordinary 20,000% gains. But when you add in the inherent scarcity of Bitcoin, that’s when things get interesting.

The lifetime supply of Bitcoin is capped at 21 million coins, and 19.8 million coins are already in circulation. According to the Bitcoin algorithm, the remaining supply will trickle out over the next 100+ years. When demand is growing rapidly, but supply is not, there is typically upward price pressure.

Bitcoin as “sound money”

A second major factor is Bitcoin’s potential ability to displace the U.S. dollar as the leading reserve currency in the world. Saylor refers to Bitcoin as “sound money,” to differentiate it from fiat currency, which he views as inherently flawed. In the United States, for example, government spending has led to a national debt of $35 trillion. The only way to pay off all that debt is to print more money, further devaluing the U.S. dollar. That approach has worked for now, but at some point, the massive mountain of debt could collapse.

Some investors are already starting to recognize this, and are moving their money out of dollars and into Bitcoin. At some point, this steady flow could turn into a tsunami. In fact, Saylor has now highlighted 2025 as the start of what he refers to as a decade-long “digital gold rush.” That’s when Bitcoin could really go mainstream, and everyone will be looking for the best way to get exposure.

It’s easy to be skeptical, but there is some merit to the fact that Saylor has become one of the biggest Bitcoin buyers in the world. He is, as they say, putting his money where his mouth is. His company, MicroStrategy, has become the leading corporate buyer of Bitcoin in the world, with a huge Bitcoin stash now valued at over $16 billion. And he’s so confident in the future of Bitcoin that MicroStrategy is now issuing debt to buy more.

Just how realistic is this price forecast?

Of course, it’s worth stress-testing some of these assumptions. Anytime someone tells you an asset will skyrocket in value by 20,000%, you should be wary. After all, just think of what a price of $13 million for Bitcoin implies. Such a lofty price tag would imply a valuation for Bitcoin of over $250 trillion. That’s a significantly higher valuation than for the entire S&P 500. Quite simply, Bitcoin would become the most important and most valuable asset in the world.

That being said, it’s hard to ignore all the warning signs flashing red right now. Over the past 30 years, we’ve become almost numb to the idea of a massive U.S. government debt collapse. And emerging market nations have distanced themselves from the U.S. dollar. But what if Bitcoin really does become a reserve currency for the rest of the world?

I’m not nearly as bullish on Bitcoin as Michael Saylor, but I do buy into the idea of Bitcoin playing a more important role within the global financial system over the next 20 years. For that reason, I’m buying Bitcoin now and holding for the long haul.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,139!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,239!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $380,729!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Dominic Basulto has positions in Bitcoin. The Motley Fool has positions in and recommends Bitcoin. The Motley Fool has a disclosure policy.

1 Top Cryptocurrency to Buy Before It Soars 20,000%, According to Michael Saylor of MicroStrategy was originally published by The Motley Fool

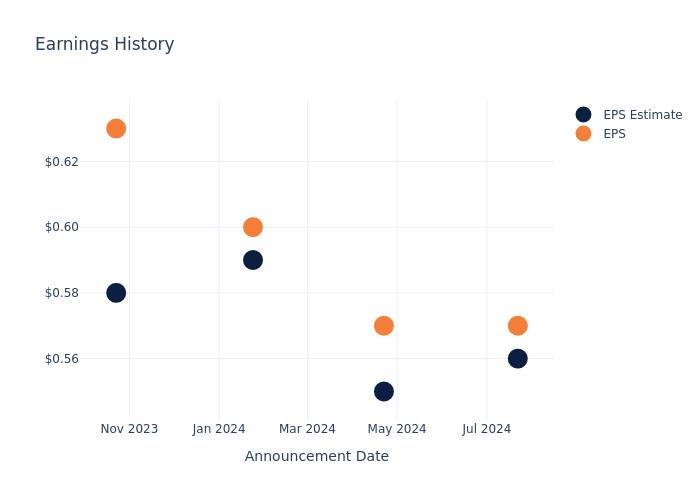

Insights into HBT Finl's Upcoming Earnings

HBT Finl HBT is gearing up to announce its quarterly earnings on Monday, 2024-10-21. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that HBT Finl will report an earnings per share (EPS) of $0.57.

HBT Finl bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

Earnings History Snapshot

During the last quarter, the company reported an EPS beat by $0.01, leading to a 3.56% increase in the share price on the subsequent day.

Here’s a look at HBT Finl’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.56 | 0.55 | 0.59 | 0.58 |

| EPS Actual | 0.57 | 0.57 | 0.60 | 0.63 |

| Price Change % | 4.0% | 0.0% | -1.0% | 0.0% |

Stock Performance

Shares of HBT Finl were trading at $23.1 as of October 17. Over the last 52-week period, shares are up 27.57%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for HBT Finl visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Huge Interest In Medical Cannabis Licenses In Kentucky, Nearly 5,000 Applications, Fees Announced

The Kentucky General Assembly’s Administrative Regulation Review Subcommittee has officially approved a set of regulations for medical cannabis businesses ahead of the program’s January 1, 2025 launch.

These regulations outline application fees, annual licensing costs, and safety compliance standards for businesses aiming to participate in Kentucky’s budding medical cannabis market, reported Kentucky Today.

Cultivators fall under four tiers, with non-refundable application fees ranging from $3,000 to $30,000, based on the scale of cultivation. For processors and dispensaries, the fee is set at $5,000, while safety compliance facilities will pay $3,000. Once approved, annual fees range from $12,000 to $100,000 depending on the tier.

Kentucky’s Office of Medical Cannabis executive director, Sam Flynn said there’s huge interest in the program, with nearly 5,000 applicants submitting their proposals.

“The total number of applications was 4,998,” Flynn stated, highlighting that 4,075 were dispensaries and 923 were cultivators, processors, or compliance facilities.

The initial wave of applications generated an impressive $27.7 million in non-refundable fees.

However, Flynn noted that these fees represent a one-time revenue stream. To maintain program sustainability, patient fees – set at $25 for both initial applications and annual renewals – will help support ongoing costs. The potential need for additional general fund appropriations may arise in the future to cover shortfalls.

Kentucky recently awarded its first medical cannabis license to a testing lab.

Meanwhile, Kentucky is gearing up for its next step, with plans to distribute licenses to cultivators and processors through a lottery system set for October 28.

Cover: AI generated image

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

BCB Bancorp Q3 Earnings And Revenues Surpass Estimates

BCB Bancorp BCBP came out with quarterly earnings of $0.36 per share, beating the Zacks Consensus Estimate of $0.32 per share. This compares to earnings of $0.39 per share a year ago. These figures are adjusted for non-recurring items.

This quarterly report represents an earnings surprise of 12.50%. A quarter ago, it was expected that this community bank would post earnings of $0.30 per share when it actually produced earnings of $0.14, delivering a surprise of -53.33%.

Over the last four quarters, the company has surpassed consensus EPS estimates just once.

BCB Bancorp, which belongs to the Zacks Banks – Northeast industry, posted revenues of $26.17 million for the quarter ended September 2024, surpassing the Zacks Consensus Estimate by 3.49%. This compares to year-ago revenues of $27.09 million. The company has topped consensus revenue estimates just once over the last four quarters.

The sustainability of the stock’s immediate price movement based on the recently-released numbers and future earnings expectations will mostly depend on management’s commentary on the earnings call.

BCB Bancorp shares have added about 3.5% since the beginning of the year versus the S&P 500’s gain of 22.5%.

What’s Next For BCB Bancorp?

While BCB Bancorp has underperformed the market so far this year, the question that comes to investors’ minds is: what’s next for the stock?

There are no easy answers to this key question, but one reliable measure that can help investors address this is the company’s earnings outlook. Not only does this include current consensus earnings expectations for the coming quarter(s), but also how these expectations have changed lately.

Empirical research shows a strong correlation between near-term stock movements and trends in earnings estimate revisions. Investors can track such revisions by themselves or rely on a tried-and-tested rating tool like the Zacks Rank, which has an impressive track record of harnessing the power of earnings estimate revisions.

Ahead of this earnings release, the estimate revisions trend for BCB Bancorp: favorable. While the magnitude and direction of estimate revisions could change following the company’s just-released earnings report, the current status translates into a Zacks Rank #2 (Buy) for the stock. So, the shares are expected to outperform the market in the near future.

It will be interesting to see how estimates for the coming quarters and current fiscal year change in the days ahead. The current consensus EPS estimate is $0.34 on $25.39 million in revenues for the coming quarter and $1.32 on $101.44 million in revenues for the current fiscal year.

Investors should be mindful of the fact that the outlook for the industry can have a material impact on the performance of the stock as well. In terms of the Zacks Industry Rank, Banks – Northeast is currently in the top 38% of the 250 plus Zacks industries. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than 2 to 1.

One other stock from the same industry, Carter Bankshares, Inc. CARE, is yet to report results for the quarter ended September 2024.

This company is expected to post quarterly earnings of $0.23 per share in its upcoming report, which represents a year-over-year change of +15%. The consensus EPS estimate for the quarter has been revised 7.1% lower over the last 30 days to the current level.

Carter Bankshares, Inc.’s revenues are expected to be $35.5 million, up 8.7% from the year-ago quarter.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The Price Of Overpromising: Under Armour's Legal Battle

- Under Armour, a Maryland-based sports apparel company, was experiencing rapid growth at the turn of the last decade.

- In April 2016, Under Armour reported first-quarter earnings, marking its 24th consecutive quarter of over 20% revenue growth.

- The company also predicted strong sales growth in the upcoming quarters.

- However, in January 2017, Under Armour announced disappointing quarterly earnings and the unexpected resignation of its CFO, causing the stock to drop by more than 25% in just one day.

- Shortly after, shareholders filed a lawsuit, claiming the company misled them about its financial health and revenue growth.

- Under Armour recently agreed to pay a massive $434 million settlement to investors to resolve the lawsuit. Affected investors can now file a claim to receive the payout.

Overview

During Under Armour, Inc. UAA expansion phase, the company claimed it could sustain a 20% revenue growth for a long time. However, it later emerged that management hid issues with meeting these expectations due to declining demand and used questionable accounting practices to cover up the company’s struggles. These claims were also backed by a separate investigation from the Securities and Exchange Commission. After years of legal disputes, the company has agreed to pay $434 million to affected shareholders over this situation.

Background

“Our first quarter revenues grew 30%, with the growth coming from every facet of our business. And to be clear, that 30% number was no accident. When Stephen Curry decided to average 30 points this season to take the scoring title while wearing the number 30, we thought that putting up 30% growth on our end was the best way for us to demonstrate our pride and support of Stephen and the Warriors.” – Kevin Plank (Q1 2016 earnings call)

Kevin Plank, the company’s founder, served as the CEO during this growth phase of the company. The growth of the company was fueled by sportswear, which has been one of the company’s principal products since its establishment in 1996. By 2014, the company reached a peak as it became the second-largest sportswear company in the United States by revenue. Committed to being positioned in the market at the high end and leveraging its cutting-edge technology on fabrics, Under Armour achieved 26 consecutive quarters of 20%+ YoY revenue growth from Q2 2010 to Q3 2016. The company’s management promised a 20% growth in the upcoming quarters as well. However, Under Armour fell short of these expectations and, compounding the issue, the company’s CFO also left. These events shook investor confidence, causing the stock price to drop over 25% in a single day in January 2017.

Under Armour’s Rosy Promises Met With Reality

After the third quarter of 2016, Under Armour began to see a significant decline in demand, particularly in its most profitable segment at the time: apparel. The company struggled to keep up with the rising “athleisure” trend, leading consumers to seek alternatives from its competitors.

In January 2017, when Under Armour announced its Q4 2016 earnings, investors were disappointed by weaker-than-expected sales growth. To make matters worse, CFO Lawrence Molloy also left the company, leading to a 26% drop in stock price on January 31, 2017. As shown below, Under Armour’s revenue growth never fully recovered to the levels seen between 2010 and 2016, highlighting that the company’s business was already weakening in 2016, despite its continued promises of growth.

Under Armour’s financial troubles, despite management’s promises, led to a shareholder lawsuit in 2017. While Under Armour asserted strong demand for its products, signs of trouble were apparent, such as the bankruptcy of The Sports Authority. The lawsuit highlighted the company’s inaccurate claims of achieving 20% YoY revenue growth amid rising inventory levels. This situation forced Under Armour to lower its prices significantly, damaging its reputation as a premium sports apparel brand while competitors like Nike maintained higher prices.

The suit also raised concerns about Under Armour’s accounting practices, with accusations that the company inflated its financial performance by pulling revenue from future quarters. This led to the SEC investigation, which discovered that Under Armour had not disclosed its strategy of accelerating $408 million in orders for the second half of 2015, further casting doubt on its financial reporting.

The company’s former executives later revealed that Under Armour frequently pressured retailers to take products early and shifted goods meant for factory stores to off-price chains to boost end-of-quarter sales. These tactics, along with other questionable practices, helped the company maintain its sales growth streak.

After the investigation, Under Armour was charged with securities fraud for withholding key information in its SEC filings. In 2021, to settle the case with the SEC, Under Armour agreed to a payment of $9 million.

These financial missteps have had a lasting impact. After reaching a high of over $50 in 2015 amid strong growth and rosy promises, once a high-flying stock, UAA is currently trading at around $8.50. Under Armour stock has lost more than 74% of its market value in the last 10 years.

Resolving The Case

Under Armour continues to face financial challenges, reporting a 3% YoY decline in revenue for the most recent financial year. Its operating income has fallen from $408.5 million in 2015 to just $221.5 million in the past year, highlighting difficulties in staying profitable amid increasing competition.

Despite these issues, Under Armour’s directors and management have consistently denied any violations of securities laws, asserting that their actions were normal and lawful. They claim that no material misrepresentations or omissions were made in their filings. Mehri Shadman, the company’s chief legal officer and corporate secretary, further clarified the management’s position:

“We firmly believe that our sales practices, accounting practices, and disclosures were appropriate, and deny any wrongdoing in this case.”

In a positive turn for shareholders facing significant losses, Under Armour reached a settlement in June 2024, agreeing to pay $434 million to affected investors. If you invested in Under Armour between 2015 and 2019, you can claim part of this settlement to recover some of your losses.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.