Lucid Group announces pricing of public offering of common stock

Lucid Group announced that it priced its underwritten public offering of 262,446,931 shares of its common stock. The public offering is expected to close on or about October 18, 2024, subject to customary closing conditions. BofA Securities is acting as the sole underwriter for the public offering. In addition, Lucid has entered into an agreement with its majority stockholder and affiliate of the Public Investment Fund, Ayar Third Investment Company, pursuant to which Ayar has agreed to purchase 374,717,927 shares of common stock from Lucid in a private placement, at the same price per share initially paid by the underwriter in the public offering. The private placement is expected to close on October 31, 2024 and is subject to completion of the public offering and customary closing conditions. As a result of these purchases, Ayar expects to maintain its approximate 58.8% ownership of Lucid’s outstanding common stock. In addition, Ayar has agreed to purchase from us, in the event that the underwriter exercises its option, additional shares of our common stock to maintain its ownership of Lucid’s outstanding common stock, and an additional closing for such purchase would be held 10 business days after the underwriter’s exercise of its option. Lucid intends to use the net proceeds from the public offering, as well as from the private placement by its majority stockholder, for general corporate purposes, which may include, among other things, capital expenditures and working capital. Aggregate gross proceeds are expected to be approximately $1.67B.

Published first on TheFly – the ultimate source for real-time, market-moving breaking financial news. Try Now>>

See today’s best-performing stocks on TipRanks >>

Read More on LCID:

1 Vanguard Index Fund to Buy to Beat the S&P 500 as the Artificial Intelligence (AI) Boom Unfolds

The S&P 500 (SNPINDEX: ^GSPC) tracks the performance of 500 large-cap stocks that cover roughly 80% of U.S. equities and about 50% of global equities by market value. The index includes many of the world’s most influential companies, and investors frequently use it as a performance benchmark for their own portfolios.

However, most investors fail to outperform the S&P 500 over long periods. Even professional money managers typically come up short. Indeed, 90% of large-cap funds underperformed the benchmark index over the last 10 years. But investors could beat the odds with a technology-focused index fund.

The Vanguard Information Technology ETF (NYSEMKT: VGT) more than doubled the gains in the S&P 500 over the last decade, and the market-beating returns could continue as artificial intelligence spending soars in the coming years. Here’s what investors should know.

The technology sector has consistently crushed the S&P 500

The S&P 500 includes companies from 11 stock market sectors, but a single sector has been responsible for a large percentage of the index’s gains in recent years. “The technology sector has generated 32% of global equity returns and 40% of U.S. equity market returns since 2010,” according to Goldman Sachs.

The chart below further illustrates that point. It compares the technology sector’s total return to the S&P 500’s total return over different periods. Notice that technology stocks have often doubled the gains in the index.

|

Total Return |

Technology Sector |

S&P 500 |

|---|---|---|

|

3 Years |

68% |

36% |

|

5 Years |

225% |

110% |

|

10 Years |

720% |

275% |

|

20 Years |

1,810% |

677% |

Source: YCharts.

Importantly, the technology sector’s outperformance has not been a product of hype or irrational valuations, but rather solid financial fundamentals. “The global tech sector’s earnings per share have risen about 400% from its peak before the great financial crisis, while all other sectors together have risen 25% during that span,” according to Goldman Sachs.

The Vanguard Information Technology ETF could outperform the S&P 500 over the next decade

The Vanguard Information Technology ETF tracks 316 technology stocks that fall into four broad categories: (1) chipmakers and semiconductor equipment manufacturers, (2) cloud infrastructure and platform services providers, (3) software vendors, and (4) hardware and equipment manufacturers. The five largest holdings in the fund are listed by weight below.

-

Apple: 16%

-

Microsoft: 14%

-

Nvidia: 13.9%

-

Broadcom: 4.6%

-

Oracle: 1.8%

The technology sector’s long-term outperformance can be attributed to explosive growth in cloud computing, though other secular trends have contributed, including the proliferation of mobile devices, online shopping, and streaming media. Those technologies will only become more relevant, but artificial intelligence (AI) looks like the next decade-defining technological transformation.

Indeed, Grand View Research estimates spending across AI hardware, software, and services will increase at 37% annually through 2030. And the five companies listed above could be some of the biggest beneficiaries of the AI boom.

-

Apple will add AI features to iPhones and MacBooks with software updates reportedly coming on Oct. 28, and some analysts expect a historic upgrade cycle to follow.

-

Microsoft is the second-largest cloud services provider and an early leader in generative AI due to its partnership with the creator of ChatGPT, OpenAI.

-

Nvidia is the market leader in data center graphics processing units (GPUs), chips that are the industry standard in accelerating workloads like AI training and inference.

-

Broadcom is the market leader in networking chips and custom silicon, two semiconductor categories that should see strong demand as businesses build out their AI infrastructure.

-

Oracle is the fifth-largest cloud services company, and it’s currently building a data center that will be used to train one of the world’s largest AI models.

The last item of consequence is the fee structure. The Vanguard Information Technology ETF has an expense ratio of 0.1%, meaning investors will pay $1 annually for every $1,000 invested in the fund. Comparatively, the average index fund had an expense ratio of 0.36% in 2023, according to Morningstar.

Here’s the bottom line: The Vanguard Information Technology ETF is a relatively cheap and simple way to gain exposure to stocks in the technology sector, the best-performing market sector in recent history. The index fund is a particularly attractive option right now because many technology companies are likely to benefit as the artificial intelligence boom unfolds in the years ahead.

Should you invest $1,000 in Vanguard World Fund – Vanguard Information Technology ETF right now?

Before you buy stock in Vanguard World Fund – Vanguard Information Technology ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard World Fund – Vanguard Information Technology ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $831,707!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Trevor Jennewine has positions in Nvidia. The Motley Fool has positions in and recommends Apple, Goldman Sachs Group, Microsoft, Nvidia, and Oracle. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

1 Vanguard Index Fund to Buy to Beat the S&P 500 as the Artificial Intelligence (AI) Boom Unfolds was originally published by The Motley Fool

'Dogecoin Killer' Shiba Inu Is The 'Obvious Catch Up Play' For Those Who Missed DOGE Rally, Trader Touts

Shiba Inu SHIB/USD is riding a price pump off the back of Dogecoin DOGE/USD leading a broader meme coin rally.

What Happened: On-chain intelligence firm Arkham Intelligence recently reported an unknown whale withdrawing 105.9 billion SHIB, valued at $1.99 million, from Coinbase in a transaction split into three parts. This address hasn’t appeared in prior on-chain activity, signaling potential bullish momentum for the meme coin.

Lucie, Shiba Inu’s marketing lead, announced that the Shiba Inu Decentralized Autonomous Organization (DAO) and foundation are set to launch in 2024/2025. She added that the “Shib ecosystem is on the brink of a transformative shift, putting power in the hands of true holders.”

Amid Dogecoin’s 13% surge over the past 24 hours, crypto trader Bluntz advized that Shiba Inu and Floki FLOKI/USD are the “obvious catch-up plays” for those who missed the DOGE breakout.

Another trader, CryptoJack, noted that Shiba Inu is holding firm on its support trendline, anticipating a “huge pump” in the near future.

Why It Matters: While Shiba Inu has seen gains, IntoTheBlock data shows large transaction volume decreasing by 32.3% and daily active addresses falling by 16.9%. Transactions greater than $100,000 are down from 190 to 118 in a single day. With gains rising for the meme coin, holders making profit have now spiked to 53%.

In the last 24 hours, 3.27 million SHIB coins were burned, driving the burn rate up by 27.2%. The meme coin rally follows Dogecoin’s recent surge, fueled by Elon Musk’s playful mention of a hypothetical “DOGE department” under a Trump administration.

What’s Next: The influence of meme coins is expected to be thoroughly explored at Benzinga’s upcoming Future of Digital Assets event on Nov. 19.

Read Next:

Image: Shutterstock

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Millennial Couple Is Making $134,000 A Year After Turning Cheap Home Into A Rental – And Detailing Exactly How They Did It

A couple’s inspiring journey of turning their home renovations into a booming Airbnb business has gone viral on TikTok, capturing the attention of thousands of viewers. Kelsein (@kelseinwealleans) and her fiancé took to the platform to share how years of hard work renovating their properties turned into a lucrative venture, netting them over $134,000 in 2023 alone.

Their story isn’t just about luck or stumbling upon the right opportunity at the right time – it’s about the grit, determination and strategic planning that transformed their home in Northumberland, England and other properties into a serious income stream.

Don’t Miss:

Kelsein, who is 29 years old, and her fiancé didn’t start with big numbers. In 2021, they made just £10,618.46 (about $13,808) from their Airbnb business. That might not seem like a huge sum for many, but it was a solid start that motivated the couple to continue expanding. They kept pushing, reinvesting their earnings into additional renovations and in 2022, their income jumped to £54,649.24 (around $71,066).

But their most impressive year came in 2023. By this time, they had expanded their rental business to three properties, each carefully renovated to attract guests seeking more than just a place to stay. According to the TikTok clip, they brought in a whopping £103,483.34 (around $134,636) in revenue that year – representing the fruits of their dedication and hard work.

Trending: ‘Beating the market through ethical real estate investing’ — this platform aims to give tenants equity in the homes they live in while scoring 17.38% average annual returns for investors – here’s how to join with just $100

The couple’s TikTok video shares their financial milestones and offers a peek into the labor-intensive process of transforming their homes. They’re shown tearing down walls, revamping the floors and modernizing the interiors with a sharp eye for detail. Their goal was clear: create stunning, stylish spaces that would stand out on Airbnb and draw in guests.

And it wasn’t just the inside of the properties that got a makeover – the couple also worked on creating outdoor spaces that added to the overall experience. One of their homes even boasts a Jacuzzi in the backyard, a feature that appeals to guests looking for a little luxury during their stay.

Trending: Commercial real estate has historically outperformed the stock market, and this platform allows individuals to invest in commercial real estate with as little as $5,000 offering a 12% target yield with a bonus 1% return boost today!

In one of the TikTok clips, Kelsein mentions that the renovation costs for their properties ranged between £30,000 (about $39,015) and £50,000 (around $65,032). While that’s no small investment, the couple made sure every penny counted by putting in much of the labor themselves, allowing them to stretch their budget further.

It’s important to remember that success stories like this aren’t without challenges. Inflation, rising construction costs and a shortage of contractors have made home renovations more expensive than ever. Yet Kelsein and her fiancé pushed through. Their commitment to their vision and willingness to do the work themselves allowed them to avoid some of the costliest pitfalls.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” These high-yield real estate notes that pay 7.5% – 9% make earning passive income easier than ever.

The comments on TikTok praise the couple’s journey, with viewers calling the transformation “stunning” and “inspiring.” But, like with most things on social media, not everyone is convinced. One commenter joked, “Just gotta spend 800k buying the house and restoring it first,” to which Kelsein responded by clarifying that one of their properties was purchased for just £53,000 ($68,900).

Despite the occasional naysayer, the overwhelming response to the couple’s success story has been positive. They’ve managed to tap into a dream that many share – turning a home into a profitable business – and have shown that it’s possible to achieve with careful planning and hard work.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Should 3M Stock Be Part Of Your Portfolio Ahead Of Q3 Earnings?

3M Company MMM is scheduled to release third-quarter 2024 results on Oct. 22, before market open.

The Zacks Consensus Estimate for earnings is pegged at $1.93 per share, reflecting an increase of 0.5% in the past 60 days. The consensus mark implies a 28% decline from the year-ago reported actuals. The Zacks Consensus Estimate for revenues is pegged at $6.1 billion, indicating a 26.6% decrease year over year.

Estimate Movement

Image Source: Zacks Investment Research

It is worth noting that in April 2024, 3M completed the spin-off of its Health Care business into a separate public company. Notably, the spin-off is likely to have weighed on MMM’s year-over-year top-line comparison in the quarter.

Despite the unfavorable impacts of the Health Care spin-off, the company’s third-quarter performance is likely to have benefited from strength across its end markets, channel inventory normalization, solid operational execution and cost-saving initiatives.

3M has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in each of the trailing four quarters, the average surprise being 12.6%. In the last reported quarter, it delivered an earnings surprise of 16.3%.

3M’s Earnings Surprise History

Image Source: Zacks Investment Research

Earnings Whispers

Our proven model predicts an earnings beat for 3M this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is the case here, as elaborated below.

Earnings ESP: MMM has an Earnings ESP of +1.81% as the Most Accurate Estimate is pegged at $1.97 per share, which is higher than the Zacks Consensus Estimate of $1.93. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: 3M presently carries a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Factors Shaping Quarterly Performance

Strength in electronics, automotive, aerospace, commercial branding and transportation end markets is expected to have augmented the Transportation and Electronics segment’s revenues in the third quarter. Continued channel inventory normalization, supported by strong growth in electronics demand, is likely to have driven its performance. Also, solid demand for its products in the automotive electrification market, supported by an increase in auto OEM (original equipment manufacturer) build rates, might have been a tailwind for the segment.

Improvement in demand across end markets is anticipated to have been a tailwind for 3M’s industrial adhesives & tapes, personal safety and automotive aftermarket businesses under the Safety and Industrial segment. However, weakness across the abrasives and industrial specialties markets is likely to have been a spoilsport. The Zacks Consensus Estimate for Safety and Industrial segment revenues is pegged at $2.79 billion, indicating a 1.4% increase from the year-ago number.

The company is expected to have benefited from its restructuring actions, including headcount reduction, which are likely to have reduced costs and improved margins in the quarter. Its restructuring savings and spending discipline are also likely to have boosted its margins and profitability.

Despite the positives, weakness in 3M’s packaging and expression as well as home and auto care businesses is likely to have dragged its performance. Lower consumer retail discretionary spending on hardline goods is likely to hurt its Consumer segment’s results. The consensus mark for the Consumer segment’s revenues is pegged at $1.31 billion, indicating a 0.8% decline from the year-ago number.

Given the company’s extensive geographic presence, its operations are subject to foreign exchange headwinds. A stronger U.S. dollar is also likely to have hurt 3M’s overseas business.

Price Performance & Valuation

MMM’s shares have exhibited an uptrend in the past three months, outperforming its peers and the Zacks Diversified Operations industry. The conglomerate giant’s shares have surged 30.6%, outperforming the industry’s and the S&P 500’s growth of 1.8% and 5.6%, respectively. The company’s peers Honeywell International Inc. HON and Federal Signal Corporation FSS have gained 2.3% and 2.4%, respectively, in the same period.

MMM Outperforms Industry, S&P 500 & Peers

Image Source: Zacks Investment Research

In terms of valuation, MMM’s forward 12-month price-to-earnings (P/E) is 17.55X, a premium to its industry average of 16.17X. This indicates that investors will be paying a higher price than the company’s expected earnings growth compared with its peers. Also, the stock is overvalued compared with its peer, Griffon Corporation GFF, which is trading at 11.88X.

Price-to-Earnings (Forward 12 Months)

Image Source: Zacks Investment Research

Investment Thesis

3M’s robust and diversified portfolio encompassing industrial abrasives, automotive components, electrical products and packaging materials, along with strength in its segments, is likely to drive its growth. The company’s ongoing restructuring actions are expected to improve margins and cash flow in the long run. It expects these actions to be completed by 2025 and yield annual pre-tax savings. Also, its commitment to rewarding its shareholders handsomely through dividend payments and share buybacks adds to its strength.

However, weakness in the packaging and expression as well as home and auto care businesses remains concerning for its near-term performance. The company has been subject to several litigations, including earplug lawsuits. It has committed substantial funds to resolve these disputes as ongoing litigation might lead to additional expenses.

Also, a high debt level, if not controlled, is likely to be a drag on 3M’s profitability. Exiting the second-quarter 2024, the company’s long-term debt was high at $11.8 billion. This is evident from its long-term debt-to-capital ratio compared with its industry.

MMM’s Long-Term Debt-to-Capital

Image Source: Zacks Investment Research

Should You Buy 3M Stock Now?

Investors interested in 3M stock should wait for a better entry point, considering its premium valuation and the challenges it is facing in the retail market. Also, a VGM Score of D does not reflect major strength in the stock.

One should monitor the stock’s developments closely before buying it, as an erroneous and hasty decision could affect portfolio gains. Therefore, it might be prudent to wait for MMM’s earnings report before making an investment decision.

However, those who already own this stock may stay invested as the company’s upbeat estimates, strong share price returns and strength across most end markets offer solid long-term prospects.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

FBI Arrests Alabama Man Who Allegedly Hacked SEC's X Account To Prematurely Announce Bitcoin ETF Approval

The Federal Bureau of Investigation (FBI) has arrested an Alabama resident for allegedly hacking the U.S. Securities and Exchange Commission (SEC)‘s social media account on X earlier this year.

What Happened: The FBI apprehended Eric Council Jr. on Thursday, accusing him of conspiring with others to gain unauthorized access to the SEC’s X account in January.

Council allegedly used the name of SEC Chair Gary Gensler to falsely announce the approval of a Bitcoin BTC/USD exchange-traded fund (ETF).

This fake announcement caused Bitcoin’s price to surge by over $1,000 before it plummeted more than $2,000 after the SEC regained control of its account and labeled the announcement a security breach. The SEC did not implement multi-factor authentication for its profile at the time.

Council is accused of executing the hack through an unauthorized SIM swap, tricking a cellphone carrier into reassigning a phone number to a SIM card he controlled. This allowed him to access the social media accounts linked to the number and post the premature Bitcoin ETF announcement.

FBI Criminal Investigative Division Assistant Director Chad Yarbrough stated, “The defendant allegedly deceived the public by impersonating the victim and making fraudulent statements on behalf of the SEC.”

Council faces charges of conspiracy to commit aggravated identity theft and access device fraud, with a potential five-year prison sentence.

Why It Matters: The incident highlights the vulnerabilities in social media account security, particularly for high-profile organizations.

In January, the SEC confirmed that its official Twitter (now X) account was compromised, leading to a false tweet about Bitcoin ETF approvals.

This unauthorized post caused significant market disruption, with over $220 million liquidated and more than 70,000 traders affected.

The SEC, in collaboration with the FBI, launched an investigation into the hack, emphasizing that the unauthorized content was not created by the SEC.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Market Clubhouse Morning Memo – October 18th, 2024 (Trade Strategy For SPY, QQQ, AAPL, MSFT, NVDA, GOOGL, META And TSLA)

Good Morning Traders! In today’s Market Clubhouse Morning Memo, we will discuss SPY, QQQ, AAPL, MSFT, NVDA, GOOGL, META, and TSLA.

Our proprietary formula, exclusive to Market Clubhouse, dictates these price levels. This dynamic equation takes into account price, volume, and options flow. These levels are updated every day and shared with all Clubhouse Members, prior to the opening of the market.

We recommend closely monitoring these stocks, and be prepared to leverage potential breakouts or reversals. As always, stay alert and ready to adjust your tactics based on the market’s pulse to optimize your trading gains. Now, let’s dive into the stock analysis:

SPDR S&P 500 ETF Trust

SPY SPY is trading near the key level of 583.18. For the bulls, the goal is to push the price towards 585.37, which should act as strong support if held. A continuation in buying momentum could lift the price higher towards 587.31. If this level holds throughout the session, we could see a further rally to 589.71. The highest target for the bulls today is at 593.59.

On the downside, if 583.18 fails to hold as support, sellers are expected to test the strength of 581.97. If selling continues, we could see a move down to 580.67. A break below this level could trigger a drop towards the more significant support level at 579.12. In a scenario of heavy selling pressure, the low bear target for today is set at 577.87.

Invesco QQQ Trust Series 1

The QQQs QQQ are currently trading near the key level of 493.60. If buyers can maintain support above this level, the next target would be 495.35. Continued bullish action could bring the price up towards 496.94. Should the rally persist, QQQ could aim for 498.37, with the highest bull target for the day being 499.44.

Should 493.60 fail to hold, sellers might attempt to push the price down towards 491.82. Further selling pressure could lead to a drop to 490.05, with the next key level at 487.69. If that breaks, the bears will be eyeing the low bear target for the day at 486.10.

Apple Inc.

Apple AAPL is auctioning around the key level of 235.74. For bullish momentum to continue, it is crucial to hold this level as support and target 236.69. If buyers maintain strength, we could see the price rally towards 237.49. In a strong bull session, AAPL may push towards its high bull target for the day at 238.63.

On the flip side, if 235.74 cannot hold as support, we anticipate a test lower at 234.97. A break below this level could lead to further downside pressure toward 234.20. If sellers remain in control, Apple could fall to 233.28, with the low bear target for the day set at 231.76.

Microsoft Corp.

Microsoft MSFT is currently trading near 417.25. Bulls will want to hold this level and push the price higher toward 419.17. If 419.17 is established as a strong support level, further buying could drive the price to 420.26. If momentum continues to the upside, we may see Microsoft reach the high bull target for the day at 421.62.

If the price breaks below 417.25, the bears may attempt to test lower levels, starting with 416.32. Continued selling pressure could drive the price down to 414.56, and if that level fails, Microsoft could drop to the low bear target for the day at 411.72.

NVIDIA Corporation

NVIDIA NVDA is currently trading near the important level of 138.55. Bulls will be looking to reclaim 139.42 as support and drive the price higher towards 140.28. A strong bullish session could see the price test 141.21, with the high bull target for the day sitting at 142.35.

If the price breaks below 138.55, the bears may step in and push the price lower to 137.94. If selling pressure intensifies, we may see the price fall to 136.98. In a weaker auction today, NVIDIA could drop to 135.64, with the low bear target set at 134.56.

Alphabet Inc Class A

Alphabet GOOGL is trading near the key level of 163.79. Bulls will want to establish 163.79 as a solid support and push the price towards 165.41. Continued bullish momentum could see the price rally up to 167.04, which is the high bull target for the day.

If 163.79 fails to hold as support, the bears will likely attempt to drive the price down to 161.79. A breakdown of this level could see further selling pressure, targeting 160.36. If the bears continue to dominate, the low bear target for Alphabet is set at 158.54.

Meta Platforms Inc

Meta META is auctioning around 580.17. For the bulls, holding this level as support is key to pushing the price higher toward 585.73. Continued buying momentum could drive the price further to 591.29, with the high bull target for Meta being 598.17 if buyers dominate today’s session.

If 580.17 fails as support, bears will likely push the auction down to 573.25. Continued selling pressure could see the price dip to 565.53. If sellers are persistent, the price could fall to our low bear target at 559.29.

Tesla Inc.

Tesla TSLA is trading near its key level of 219.39. Bulls will be looking for a push up to 220.65. Continued strength in the auction could see Tesla test higher levels, with the next target at 222.19. If the market stays bullish, Tesla could rally towards 223.98, with the high bull target set at 226.53.

If 219.39 fails to hold, we expect bears to test the downside, starting with 217.78. Further selling pressure could drive the price down to 216.31, and if sellers maintain control, Tesla may drop to the low bear target of 213.88.

Final Word: Today’s trading session offers limited economic data, but at 8:30 AM ET, market participants will focus on the Housing Starts and Building Permits for September. Additionally, Fed’s Waller, a voting member, is set to speak at 12:10 PM ET, and his remarks on decentralized finance from Vienna could create market ripples, particularly in the financial and tech sectors. Despite the light economic calendar, traders should be prepared for potential volatility driven by market sentiment and order flow due to monthly options expiries. As always, it’s crucial to manage risk and adjust strategies according to market developments. Good luck, trade safely, and Happy Friday!

The Morning Memo is curated by RIPS, a pro trader with years of experience in equities, options, and futures trading. RIPS is at the heart of the exclusive Market Clubhouse community, offering his insights, expertise, and real-time mentorship.

Start your day with a live daily market analysis, a carefully selected watch list, early access to the Morning Memo, and exclusive Market Clubhouse price levels, providing precise support and resistance indicators. When you become a member of Market Clubhouse, you will gain early access to the Morning Memo, just like this one, every single day—hours before it’s published. You will also have access to a live stream with zero latency and screen sharing, enabling you to witness Rips executing his trades in real-time and sharing his exclusive trading plans, strategies, and live decision-making.

For a limited time during our special promotion, you can join RIPS and get a full access pass to Market Clubhouse for 7 full days for just $7. Check it out at https://marketclubhouse.club/7Days/ where you can trade live with him and tap into his wealth of knowledge and experience. You can also catch Rips on his live day trading streams every Monday-Friday at 8 am EST on the Market Clubhouse YouTube channel: https://www.youtube.com/@MarketClubhouse.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

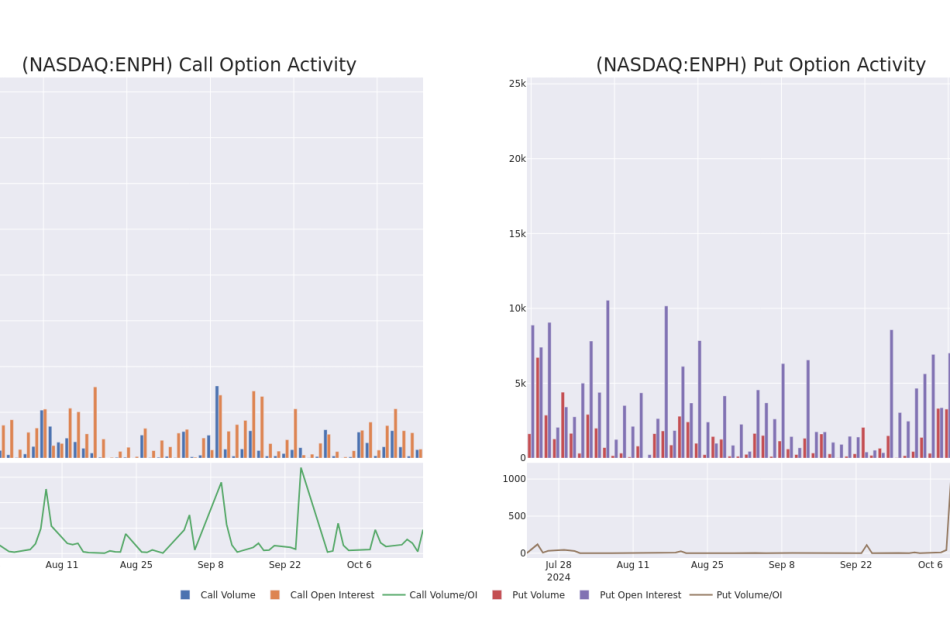

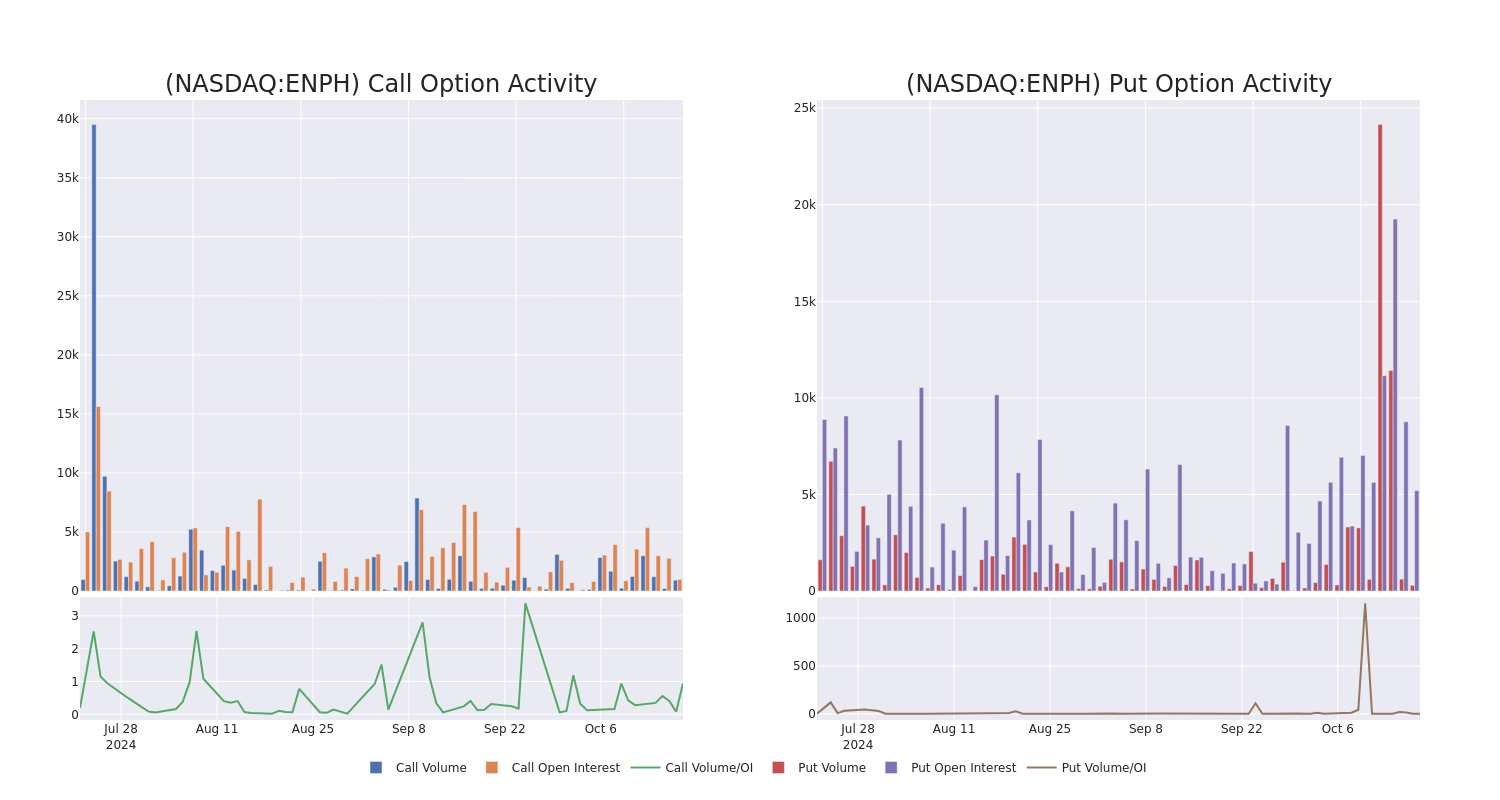

Enphase Energy Unusual Options Activity For October 18

Investors with a lot of money to spend have taken a bearish stance on Enphase Energy ENPH.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ENPH, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Enphase Energy.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 66%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $134,200, and 5 are calls, for a total amount of $1,216,801.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $120.0 for Enphase Energy over the recent three months.

Analyzing Volume & Open Interest

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Enphase Energy’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Enphase Energy’s whale activity within a strike price range from $70.0 to $120.0 in the last 30 days.

Enphase Energy Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ENPH | CALL | TRADE | BULLISH | 06/20/25 | $18.05 | $17.8 | $18.06 | $95.00 | $903.0K | 89 | 518 |

| ENPH | CALL | TRADE | BEARISH | 05/16/25 | $19.5 | $19.3 | $19.3 | $90.00 | $185.2K | 89 | 100 |

| ENPH | CALL | TRADE | BEARISH | 02/21/25 | $5.8 | $5.75 | $5.75 | $120.00 | $53.4K | 548 | 203 |

| ENPH | CALL | TRADE | BULLISH | 10/25/24 | $6.1 | $6.05 | $6.1 | $91.00 | $42.0K | 69 | 84 |

| ENPH | PUT | TRADE | BEARISH | 01/17/25 | $31.55 | $31.5 | $31.55 | $120.00 | $37.8K | 3.0K | 21 |

About Enphase Energy

Enphase Energy is a global energy technology company. The company delivers smart, easy-to-use solutions that manage solar generation, storage, and communication on one platform. The company’s microinverter technology primarily serves the rooftop solar market and produces a fully integrated solar-plus-storage solution. Geographically, it derives a majority of revenue from the United States.

Having examined the options trading patterns of Enphase Energy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Enphase Energy

- With a volume of 1,007,918, the price of ENPH is down -0.69% at $90.94.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 4 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Enphase Energy with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.