2 High-Yield REITs to Buy Hand Over Fist and 1 to Avoid

If you are looking at high-yielding stocks while the S&P 500 Index (SNPINDEX: ^GSPC) is trading near all-time highs, as it is today, you’ll likely be considering stocks with higher levels of risk. Simply put, the high yield is the compensation for the extra risk.

As an income investor, you need to make sure you are shouldering risks that are worth taking. AGNC Investment (NASDAQ: AGNC) and its nearly 14% yield have a very real chance of eventually letting you down. EPR Properties (NYSE: EPR) and W.P. Carey (NYSE: WPC) have let investors down, too, but they both look like they’re on an upward trajectory. Here’s what you need to know.

AGNC Investment is one to avoid

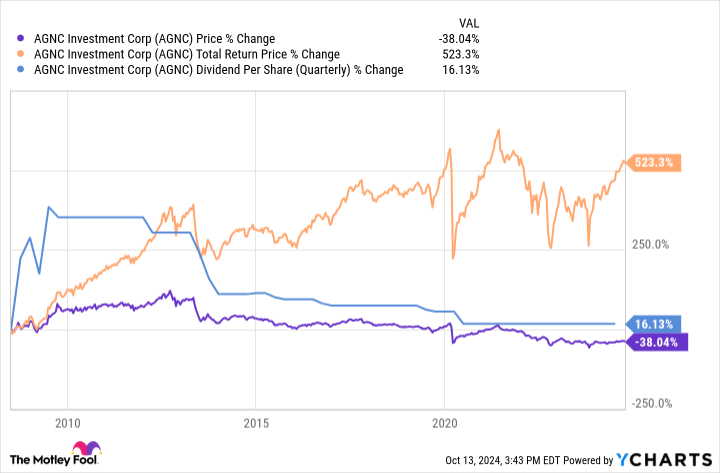

To be fair, AGNC Investment isn’t a bad company. It has produced a fairly strong total return since going public. But the total return includes reinvesting dividends.

If you are a dividend investor trying to live off your dividends, you won’t be buying more shares with that income, you will be spending it on things like food and housing. This is where the big problem comes in for this mortgage real estate investment trust (REIT).

As the chart above highlights, while the total return line (orange) is positive, the price (purple) and dividend (blue) have been trending steadily lower for years. And before that decline started, the dividend was volatile.

Even if the dividend is increased from its current level, there will always be a substantial risk that it will be cut again because of the nature of the mortgage REIT niche. Indeed, mortgage REITs are fairly complicated investments that only more aggressive and active investors should probably be looking at.

But dividend investors don’t really need a deep dive into the mortgage REIT sector to see that AGNC Investment’s payout history isn’t going to be appealing.

All dividend cuts aren’t the same

That said, just because a REIT cuts its dividend doesn’t mean you should permanently throw it off your high-yield wish list. Two dividend-cutting REITs that you might want to consider today are landlords EPR Properties and W.P. Carey.

EPR Properties cut its dividend during the pandemic because the experiential properties it owns (like casino resorts and movie theaters) were effectively shut down by social distancing.

W.P. Carey cut its dividend at the start of 2024 when it decided to exit the office sector in one quick move after the pandemic’s work-from-home trend led to ongoing difficulties for that property type.

What’s notable, however, is that both are growing their dividends again. W.P. Carey’s move was the more compelling, because it started back up with its cadence of quarterly increases in the quarter after the cut. It was a clear sign that it was nothing more than a reset driven by the large portfolio change it made (office space was 16% of assets prior to the exit from that property type).

And the REIT’s departure from the office sector has left it with a record level of liquidity. Management plans to put that cash to work buying more properties, which will add to the company’s portfolio and its ability to keep raising the dividend.

In other words, W.P. Carey’s 5.8% yield not only looks like it is on solid ground, but it also appears that the dividend is highly likely to keep growing. It’s the kind of dividend stock you’ll be glad to get your hands on before investors realize the opportunity they are missing.

EPR Properties’ story is a little less attractive, but hardly bad. Owning assets that bring people together is a solid model in the internet age, even though it was a terrible focus during the pandemic.

And while the portfolio is still overweight in movie theaters (37% of rents), overall rent coverage is now at 2.2 times, above the 1.9 times before the pandemic. Rental coverage for movie theaters, which were hit particularly hard, is back to where it was in 2019. Simply put, the risk profile here has vastly improved.

EPR’s payout ratio of its adjusted funds from operations in the second quarter of 2024 was roughly 72% — a very reasonable number. The dividend has now been increased three times since it was cut, with the last increase coming in March 2024.

EPR Properties did what it needed to do to get through a massive exogenous event. At this point, it looks like it is getting back on the growth track, which suggests that grabbing a fistful of its 7.1% yielding shares could be well worth it.

Investing involves risk, but only some risks are worth taking

Every investment you make requires you to shoulder some risk, even if you own cash (which could lead you to miss out on other investment opportunities). The goal is to balance risk and reward in a way that allows you to sleep at night.

For income investors, the dividend risk at AGNC Investment just isn’t likely to be worth it. But the dividend risk at W.P. Carey and EPR Properties seems pretty low even though both have cut their dividends in the recent past.

Wall Street’s perception of heightened dividend risk, however, could be offering long-term dividend investors an opportunity to lock in high yields from these two REITs that have already started growing their dividends again.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Reuben Gregg Brewer has positions in W.P. Carey. The Motley Fool recommends EPR Properties. The Motley Fool has a disclosure policy.

2 High-Yield REITs to Buy Hand Over Fist and 1 to Avoid was originally published by The Motley Fool

Sterilization Services Market Projected to Expand at a CAGR of 9.5%, Elevating to a Valuation of USD 10.1 billion by 2031: Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 18, 2024 (GLOBE NEWSWIRE) — The global sterilization services market (살균 서비스 시장) is estimated to flourish at a CAGR of 9.5% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for sterilization services is estimated to reach US$ 10.1 billion by the end of 2031.

Increasing outsourcing of sterilization services by medical device manufacturers and healthcare facilities to specialized service providers is driving market growth. Outsourcing allows companies to focus on core activities while benefiting from specialized expertise and cost efficiencies.

Growing awareness of environmental sustainability is prompting the adoption of eco-friendly sterilization methods and packaging materials. Companies are investing in technologies such as hydrogen peroxide sterilization and reusable packaging to minimize environmental impact and meet sustainability goals.

Request a PDF Sample of this Report Now!

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=53523

Collaboration among regulatory authorities to harmonize sterilization standards and requirements globally is facilitating market growth. Harmonization streamlines compliance efforts for companies operating in multiple regions, reducing regulatory burdens and facilitating market access.

The emergence of telesterilization services, enabled by remote monitoring and automation technologies, is revolutionizing the sterilization landscape. Telesterilization allows for real-time monitoring and control of sterilization processes from remote locations, enhancing efficiency, flexibility, and scalability in sterilization operations.

Key Findings of the Market Report

- The ethylene oxide method segment leads the sterilization services market due to its versatility and effectiveness in sterilizing various medical devices.

- Contract sterilization services emerge as the leading segment in the sterilization services market due to the growing demand for outsourced sterilization solutions.

- Offsite sterilization services emerge as the leading segment in the sterilization services market due to their widespread availability and convenience.

Sterilization Services Market Growth Drivers & Trends

- Growth in healthcare facilities and surgeries drives demand for sterilization services to ensure patient safety.

- Compliance with evolving regulations fuels market growth.

- Innovation in sterilization technologies enhances efficiency and effectiveness.

- Focus on infection prevention drives demand for reliable sterilization services.

- Expansion of healthcare infrastructure in emerging economies boosts demand for sterilization services.

Global Sterilization Services Market: Regional Profile

- In North America, stringent regulatory standards and a robust healthcare infrastructure drive market growth. Key players like Steris Corporation and Cantel Medical lead with comprehensive sterilization solutions tailored to meet stringent FDA requirements. The increasing prevalence of healthcare-associated infections emphasizes the need for effective sterilization services, further fueling market expansion.

- Europe boasts a mature sterilization services market, characterized by a strong focus on quality and innovation. Companies such as Sterigenics and Synergy Health PLC dominate, leveraging advanced sterilization technologies and adherence to strict EU regulations. Rising healthcare expenditure and a growing emphasis on patient safety propel market growth.

- In the Asia Pacific, rapid urbanization and expanding healthcare infrastructure drive market demand. Companies like E-BEAM Services, Inc. and Cosmed Group are capitalizing on the region’s burgeoning healthcare sector, offering cost-effective sterilization solutions tailored to meet diverse market needs. Increasing medical tourism and government initiatives to improve healthcare standards further contribute to market growth, positioning the Asia Pacific as a key growth engine in the global sterilization services market.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=53523

Sterilization Services Market: Competitive Landscape

The sterilization services market is fiercely competitive, driven by stringent regulatory requirements and the increasing demand for sterile medical devices.

Key players such as Steris Corporation, Cantel Medical, and Sterigenics dominate with their extensive service offerings and global presence. Emerging contenders like E-BEAM Services, Inc. and Cosmed Group challenge established norms with innovative sterilization solutions.

Customized service packages, advanced technologies, and adherence to industry standards are pivotal in gaining a competitive edge. Strategic partnerships and acquisitions are prevalent as companies seek to expand their service portfolios and cater to the growing needs of healthcare facilities worldwide. Some prominent players are as follows:

- E-BEAM Services Inc.

- Medistri SA

- BGS

- Sterigenics U.S. LLC – A Sotera Health company

- Cosmed Group

- Microtrol Sterilization Services Pvt. Ltd.

- Midwest Sterilization Corporation

- Andersen Caledonia

- SteriTek Inc.

- Medivators Inc.

- STERIS

- WuXi AppTec

- Avantti Medi Clear

- Viant Technology LLC

Product Portfolio

- SE-BEAM Services Inc. specializes in providing comprehensive structural engineering solutions. With a focus on innovation and client satisfaction, SE-BEAM offers expertise in structural design, analysis, and consulting services, ensuring safe and efficient construction projects across various industries.

- Medistri SA is a leading provider of sterilization process monitoring solutions for healthcare facilities. With cutting-edge technology and rigorous quality standards, Medistri offers innovative products and services to ensure compliance and safety in sterilization processes, contributing to enhanced patient care worldwide.

- BGS is a trusted supplier of precision instrumentation and control systems for industrial applications. With a commitment to reliability and performance, BGSt offers a diverse portfolio of products, including sensors, actuators, and control systems, catering to the needs of industries such as manufacturing, energy, and automation.

Sterilization Services Market: Key Segments

By Method

By Type

- Contract Sterilization Services

- Sterilization Validation Services

By Mode of Delivery

- Offsite Sterilization Services

- Onsite Sterilization Services

By End-user Industry

- Medical Device Companies

- Hospitals & Clinics

- Food & Beverages

- Pharmaceuticals

- Others

By Region

- North America

- Latin America

- Asia Pacific

- Europe

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=53523<ype=S

More Trending Reports by Transparency Market Research –

Food Ingredients Sterilization Market (食品素材の殺菌市場) – The global food ingredients sterilization Market is projected to advance at a CAGR of 4% from 2023 to 2029

mHealth Services Market (سوق الخدمات الصحية) – The global mHealth Services Market is projected to expand at a CAGR of 15.7% during the forecast period from 2023 to 2031

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

On-demand Transportation Market Surges to USD 287.6 Billion by 2031, Registering at a 7.2% | States Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 18, 2024 (GLOBE NEWSWIRE) — The on-demand transportation market (주문형 운송 시장) was valued at US$ 153.2 billion in 2022. A CAGR of 7.2% is expected between 2023 and 2031, increasing the market to US$ 287.6 billion.

Connectivity and digitalization have significantly impacted on-demand transportation. In addition to making it easier to book rides, the Internet and mobile apps have also enabled service operators to offer flexible options for transportation.

In the future of transportation and mobility, on-demand services are expected to become increasingly popular. The investment in on-demand transit has tripled over the past few years, making it the fastest-growing on-demand industry. These services bridge single occupancy vehicles and fixed-route mass transit via shared, autonomous, technology-enabled transportation.

As autonomous technology develops, on-demand transportation will be further revolutionized. On-demand transportation systems will become safer, more efficient, and more accessible with the use of self-driving vehicles in the future.

On-demand transportation services have also grown in popularity due to the increased cost of owning and operating a vehicle. In urban areas with high parking costs and vehicle maintenance expenses, on-demand services can be a more cost-efficient alternative to owning a vehicle

Request for sample PDF copy of report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=55536

Key Findings of the Market Report

- The ride-sharing segment is expected to grow the market for on-demand transportation services.

- On-demand transportation is poised to gain much traction in the coming years as passenger cars become more popular.

- The manual segment is predicted to hold the largest share of the market for on-demand transportation in the near future.

- The tourism industry largely drives the on-demand transportation market.

- Asia Pacific holds the largest market share and is expected to lead in the coming years.

Global On-demand Transportation Market: Growth Drivers

- Increasing smartphone usage and the accessibility of app-based transportation services like Uber, Lyft, and Grab are facilitating the growth of the on-demand transportation market.

- As traffic congestion and rapid urbanization increase in the world’s largest cities, commuters are looking for alternatives to traditional transportation methods. Transportation solutions on demand are becoming more important as public and private cars become less prevalent.

- With the changing preferences of consumers in terms of shared mobility, flexibility, and convenience, transportation on-demand services are becoming increasingly popular, especially among millennials and urban dwellers.

- Enacting ridesharing rules and regulatory frameworks that facilitate the operation of ride-hailing businesses while guaranteeing passenger safety and high-quality service can help governments and municipalities expand the on-demand transportation sector.

- A growing awareness of environmental issues and concerns about air pollution and greenhouse gas emissions have led to the demand for environmentally friendly transportation options. A green, electric, and hybrid fleet has emerged to provide on-demand transportation services.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=55536

Global On-demand Transportation Market: Regional Landscape

- Asia Pacific is expected to drive demand for the on-demand transportation market. As urbanization and traffic increase, on-demand transport services will become increasingly important. Increasing tech-savvy citizens and the growing use of smartphones have contributed to the rise of app-based ride-hailing in countries such as South Korea and China.

- Regulatory assistance and advantageous regulations promote expanding on-demand transportation services in economies such as Japan. The growing demand for shared mobility solutions is driving the popularity of ride-sharing and bike-sharing services. In addition to e-scooters and bike rentals, micro-mobility options provide more on-demand transport alternatives.

- Integrating on-demand transportation with public transportation networks can be improved by working with local transportation authorities and providers. Digital wallets and novel payment mechanisms are becoming increasingly common in regions like China and India, allowing smooth transactions and improving customer satisfaction.

Global On-demand Transportation Market: Competitive Landscape

Sustainable and inclusive practices are increasingly incorporated by players operating in the on-demand transportation market. Cooperative transportation and shared mobility are being invested in by key players in the on-demand transportation market to improve consumer convenience and demand.

Key Players

- Uber Technologies Inc.

- ANI Technologies Pvt. Ltd. (OLA)

- Lyft Inc.

- Grab

- Careem

- Taxify OÜ

- Gett

- Beijing Xiaoju Technology Co Ltd. (Didi Chuxing)

- BlaBlaCar

- Wingz Inc.

- Curb Mobility

- Easy Taxi Serviços LTDA

- Cabify

- Turo

- Yandex

- Car2go NA, LLC

- DriveNow GmbH & Co. KG

- Cabio CarSharing

- Maven

- Mobility Cooperative

- SOCAR Mobility Malaysia

- Europcar

- Sixt SE

- The Hertz Corporation

- Avis Budget Group, Inc.

- Enterprise Holdings Inc.

Key Developments

- In June 2023, Uber, an app that offers ridesharing services, introduced its first electric vehicle product, Uber Green, at the Chhatrapati Shivaji Maharaj International Airport (CSMIA). As part of its electrification journey, the company offers zero-emission electric rides on-demand in Mumbai, a convenient and emission-free option.

Global On-demand Transportation Market: Segmentation

By Type

- Ride-sharing

- Vehicle Rental/Leasing

- Ride Sourcing

By Business Model

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Buses & Coaches

- Micro-mobility

By Autonomy Level

- Manual

- Semi-autonomous

- Autonomous

By Power Source

By Application

- Passenger Transportation

- Goods Transportation

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=55536<ype=S

More Trending Reports by Transparency Market Research –

Smart Transportation Market (スマート交通市場) – The global smart transportation market is projected to flourish at a CAGR of 21.30% from 2021 to 2031. As per the report published by TMR, a valuation of US$ 400.77 billion is anticipated for the market in 2031. As of 2023, the demand for smart transportation is expected to close at US$ 85.5 billion.

Electric Bus Market (سوق الحافلات الكهربائية) – The global electric bus market was estimated at 74.157 thousand units in 2020. It is anticipated to register a 17.89% CAGR from 2021 to 2031 and by 2031; the market is likely to head to 448.920 thousand units.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

These 4 Vanguard ETFs Are All You Need for a Well-Rounded Stock Portfolio

There are many misconceptions about investing, and a common one is that it’s difficult. Are there many moving parts that are confusing, even for those who study this for a living? Absolutely. Does it have to be complicated or require “advanced knowledge”? Not at all.

One way to simplify investing is to use exchange-traded funds (ETFs). Seasoned investors preach the importance of a well-rounded and diversified portfolio, and using ETFs is arguably the easiest way to accomplish this goal. There’s no need to invest in dozens (or hundreds) of individual stocks if you don’t want to do so. A few ETFs can do the trick.

Following are four Vanguard ETFs that can give you a well-rounded portfolio you can lean on for the long haul.

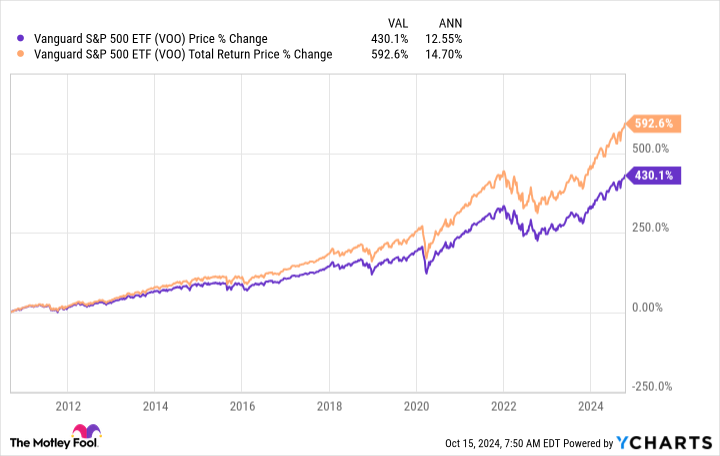

1. Vanguard S&P 500 ETF

If you ask me, no single investment serves as a better one-stop shop than an S&P 500 ETF. The Vanguard S&P 500 ETF (NYSEMKT: VOO) is my largest holding and likely will be for the remainder of my investing journey.

The S&P 500 index tracks 500 of the largest U.S. companies on the market, so investing in this ETF exposes you to some of the world’s most accomplished and promising companies. It contains businesses from all the major sectors, many of which are industry leaders. Here’s how the ETF is broken down by sector (as of Sept. 30):

-

Communication services: 8.9%

-

Consumer discretionary: 10.1%

-

Consumer staples: 5.9%

-

Energy: 3.3%

-

Financials: 12.9%

-

Health care: 11.6%

-

Industrials: 8.5%

-

Information technology: 31.7%

-

Materials: 2.2%

-

Other: 0.1%

-

Real estate: 2.3%

-

Utilities: 2.5%

There’s volatility with any stock or ETF on the market. However, this ETF generally has more long-term stability because it contains all large-cap companies better built to weather whatever storms come their way. Since it was created, it has averaged impressive annual returns.

If you’re looking for a single ETF that can be the bulk of your portfolio, this is it.

2. Vanguard Mid-Cap ETF

The Vanguard Mid-Cap ETF (NYSEMKT: VO) contains just over 310 mid-sized companies. Typically, mid-cap companies have a market capitalization between $2 billion and $10 billion. Because of the size of the companies in this ETF, it can be the sweet spot between stability and growth.

On the one hand, mid-cap companies are small enough to be agile and take on new growth opportunities. On the other hand, companies that managed to hit this market size typically have sustainable business models.

This ETF also contains companies from all major sectors, but it’s more diversified than the S&P 500. The top five represented sectors are industrials (21.1%), consumer discretionary (12.3%), financials (12.6%), technology (13.8%), and healthcare (9.2%).

I would feel comfortable with up to 10% of my stock portfolio being in mid-cap companies.

3. Vanguard Small-Cap ETF

Small-cap stocks are generally those with a market cap between $300 million and $2 billion. The Vanguard Small-Cap ETF (NYSEMKT: VB) contains over 1,300 of these companies, with a median market cap of $7.8 billion. This ETF doesn’t follow the Russell 2000 index like many other small-cap ETFs, but is still broad and diversified.

Small-cap stocks come with more risk than larger companies because they’re generally more volatile and still finding their lane in their respective industries, but they can also have more upside because of their growth potential.

To be clear, not all small-cap companies are young or early-stage companies; many are established businesses operating in niche markets.

Similar to mid-cap stocks, having around 10% of your stock portfolio is a good goal. That’s just enough to benefit from growth without relying too much on it.

4. Vanguard Total International Stock ETF

Part of having a well-rounded portfolio is investing in companies abroad. The Vanguard Total International Stock ETF (NASDAQ: VXUS) is a great way to do this because it contains companies from both developed and emerging markets.

Developed markets have more stable economies, a higher level of infrastructure, and mature financial markets (think the U.S., U.K., Japan, and Australia). Emerging markets have younger economies, increasing industrialization, and developing infrastructure (think: Brazil, China, Mexico, and Thailand).

Investing in companies from both markets is beneficial because they come with different risks and benefits. Developed markets are less risky because they have more economic (and often political) stability. However, they may not have room for rapid growth. Emerging markets carry more risk because of increased volatility and potential political instability, but they offer the possibility of higher growth.

I don’t recommend having a large portion of your portfolio in international stocks (mostly because U.S. companies have historically shown more long-term growth potential), but anything up to 20% of your portfolio is acceptable.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Stefon Walters has positions in Vanguard Index Funds-Vanguard Mid-Cap ETF, Vanguard Index Funds-Vanguard Small-Cap ETF, Vanguard S&P 500 ETF, and Vanguard Total International Stock ETF. The Motley Fool has positions in and recommends Vanguard Index Funds-Vanguard Mid-Cap ETF, Vanguard Index Funds-Vanguard Small-Cap ETF, Vanguard S&P 500 ETF, and Vanguard Total International Stock ETF. The Motley Fool has a disclosure policy.

These 4 Vanguard ETFs Are All You Need for a Well-Rounded Stock Portfolio was originally published by The Motley Fool

Billionaire Investor Ray Dalio Urges Xi Jinping's China To Implement This To Prevent Debt Crisis: 'They Have The Willingness To Do That'

Ray Dalio, the founder of Bridgewater Associates, has called on Xi Jinping‘s China to adopt a “beautiful deleveraging” strategy. This comes in the wake of China’s recent stimulus measures, which Dalio believes should be complemented with this strategy to avert a potential debt crisis.

What Happened: Dalio, while speaking at the FutureChina Global Forum in Singapore on Friday, underscored the importance of a balanced approach to deficits, which he terms “beautiful deleveraging,” CNBC reported.

This strategy encompasses debt restructuring, money printing, and debt monetization.

Dalio elaborated that debt restructuring is deflationary, while money creation is inflationary, thus making it an effective method to alleviate the debt burden. He expressed faith in China’s ability and readiness to execute this strategy, as demonstrated by their recent policies.

“That’s the real interesting question of China, in terms of how it’s approaching its debt issue,” Dalio said.

“They have the capacity to do that, and I believe they have the willingness to do that. That’s being demonstrated by [recent] policies,” he added.

Since the end of September, Beijing has rolled out several rounds of stimulus and reform measures to strengthen its economy. However, Dalio emphasized the need for debt restructuring amid these changes. He also drew attention to the speculation surrounding Beijing’s potential fiscal stimulus package, which some economists estimate could be as high as 10 trillion yuan ($1.4 trillion).

Despite the simplicity of creating money and credit, Dalio cautioned that this could aggravate other problems if not properly executed as part of a restructuring. He also highlighted other challenges, such as China’s local-level debt and aging population.

Why It Matters: Dalio’s recent remarks align with his previous observations about China’s economic landscape. In an earlier LinkedIn post, he highlighted three key factors that have set Chinese markets “on fire”: A “reflationary barrage” of fiscal and monetary policies, strong statements supporting free markets, and the current low valuation of Chinese assets.

However, Dalio also raised concerns about the complexities of investing in China amid the country’s shifting economic policies. He questioned China’s favorability towards capitalism and highlighted the challenges posed by significant structural changes in the Chinese economy.

Earlier in the year, Dalio had also warned of escalating U.S.-China tensions and stressed the importance of diversification in the face of growing global risks.

Meanwhile, several major Chinese companies saw significant gains in Friday pre-market. As per Benzinga Pro, Alibaba Group Holding Ltd – ADR BABA rose by 3.23%, while its rival PDD Holdings Inc. PDD increased by 5.38%. Baidu Inc BIDU climbed 4.23%, and JD.Com Inc JD was up 5.05%.

In the electric vehicle sector, Nio Inc – ADR NIO and Li Auto Inc LI saw increases of 5.44% and 6.48%, respectively. The jump came after China’s GDP grew by 4.6% year-over-year in the third quarter, surpassing expectations from a Reuters poll, though slightly below the 4.7% growth in the previous quarter.

Read Next:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

An Overview of HealthStream's Earnings

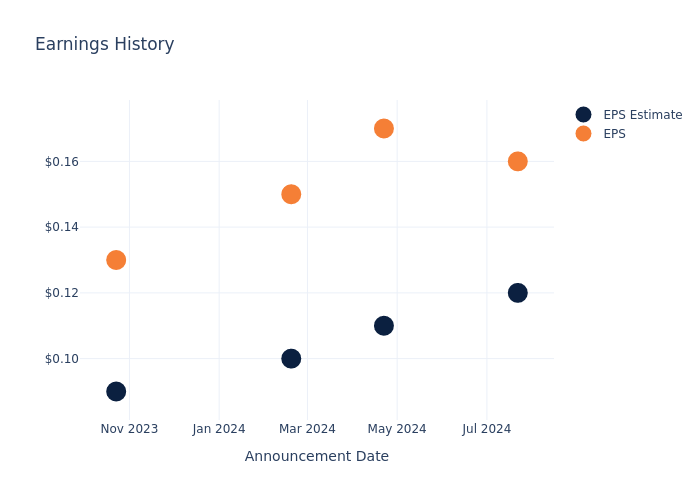

HealthStream HSTM is preparing to release its quarterly earnings on Monday, 2024-10-21. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect HealthStream to report an earnings per share (EPS) of $0.12.

The market awaits HealthStream’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

Past Earnings Performance

Last quarter the company beat EPS by $0.04, which was followed by a 4.04% drop in the share price the next day.

Here’s a look at HealthStream’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.12 | 0.11 | 0.10 | 0.09 |

| EPS Actual | 0.16 | 0.17 | 0.15 | 0.13 |

| Price Change % | -4.0% | 10.0% | -2.0% | 15.0% |

HealthStream Share Price Analysis

Shares of HealthStream were trading at $28.93 as of October 17. Over the last 52-week period, shares are up 30.86%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on HealthStream

For investors, staying informed about market sentiments and expectations in the industry is paramount. This analysis provides an exploration of the latest insights on HealthStream.

HealthStream has received a total of 1 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $28.0, the consensus suggests a potential 3.21% downside.

Peer Ratings Overview

The analysis below examines the analyst ratings and average 1-year price targets of Simulations Plus, Phreesia and Definitive Healthcare, three significant industry players, providing valuable insights into their relative performance expectations and market positioning.

- Simulations Plus received a Outperform consensus from analysts, with an average 1-year price target of $47.0, implying a potential 62.46% upside.

- The prevailing sentiment among analysts is an Buy trajectory for Phreesia, with an average 1-year price target of $29.4, implying a potential 1.62% upside.

- Analysts currently favor an Neutral trajectory for Definitive Healthcare, with an average 1-year price target of $5.61, suggesting a potential 80.61% downside.

Peer Metrics Summary

Within the peer analysis summary, vital metrics for Simulations Plus, Phreesia and Definitive Healthcare are presented, shedding light on their respective standings within the industry and offering valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| HealthStream | Neutral | 3.41% | $47.82M | 1.20% |

| Simulations Plus | Outperform | 14.23% | $13.26M | 1.75% |

| Phreesia | Buy | 18.97% | $69.30M | -7.15% |

| Definitive Healthcare | Neutral | 4.56% | $50.45M | -28.39% |

Key Takeaway:

HealthStream ranks in the middle for consensus rating among its peers. It is at the bottom for revenue growth. In terms of gross profit, HealthStream is at the top among its peers. However, its return on equity is at the bottom compared to the others.

All You Need to Know About HealthStream

HealthStream Inc provides workforce and provider solutions for healthcare organizations. Its reportable segments include Workforce Solutions and Provider Solutions. Workforce development solutions consist of SaaS, subscription-based products that are used by healthcare organizations. Its Provider Solutions products offer healthcare organizations software applications for administering and tracking provider credentialing, privileging, call center and enrollment activities. The company generates a majority of its revenue from Subscription Services.

HealthStream: Delving into Financials

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining HealthStream’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 3.41% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: HealthStream’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 5.82% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): HealthStream’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 1.2%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): HealthStream’s ROA surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 0.82% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.05.

To track all earnings releases for HealthStream visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

With $900k in a Roth and $2,200 Monthly Social Security, Is Retiring at 66 Feasible?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Imagine that you have $900,000 in a Roth IRA and collect another $2,200 per month in Social Security. Can you afford to retire at age 66?

A good way to answer this question is to start with your budget. What do you expect to spend on essentials, like housing and fixed monthly expenses, and what will it cost to maintain your lifestyle? Then take a look at your retirement income and see how all those figures compare. (And if you need additional help planning for retirement or building an income plan, consider speaking with a fiduciary financial advisor.)

Income and Expense Planning

For the sake of argument, let’s say that you earn the median household income of $75,000. Conventional wisdom suggests that you’ll need about 80% of your pre-retirement income to maintain your current lifestyle in retirement. That would mean that your Roth IRA withdrawals and Social Security benefits would need to generate about $60,000 before taxes and about $54,600 in after-tax income.

Can that work?

To start, you have $26,400 per year in Social Security benefits. Since full retirement age is 67 for most, your benefits would be around 7% by claiming at age 66. (Based on these numbers you would receive $28,295 per year in benefits if you retired at 67.)

You also have your Roth IRA, which will eliminate your potential tax liability on both your portfolio withdrawals and your Social Security. Since your Roth withdrawals aren’t taxable income, your Social Security benefits wouldn’t generate any federal income taxes either. Also, Roth accounts aren’t subject to required minimum distributions (RMDs) when you reach 73, giving you more flexibility compared to a pre-tax account.

The issue is that your Roth portfolio is relatively light to support a full retirement. You may be able to make the numbers work, but there wouldn’t be a lot of wiggle room in your budget.

For example, take the classic 4% rule for withdrawals, which calls for you to withdraw 4% from a balanced portfolio in your first year of retirement and then adjust subsequent withdrawals for inflation. The 4% rule is designed to stretch a portfolio at least 25 years.

Withdrawing 4% from a $900,000 Roth IRA would give you $36,000 in your first year of retirement. With Social Security, you’d have a combined retirement income of approximately $62,400. Again, this is a tax-free income. But it doesn’t surpass your spending needs by much, limiting your flexibility. More importantly, if your lifestyle or your area in which you live is even modestly more expensive than average, this might not work at all.

You could also consider investing an annuity. With $900,000, a representative lifetime annuity could pay you around $70,440 per year ($5,870 per month), according to Schwab’s Income Annuity Estimator. That would give a combined annual income of about $96,840 (with Social Security).

This may be enough to provide some households with a comfortable standard of living, this income won’t be inflation-protected. As a result, a large portion of your retirement income would lose purchasing power over time. (Whether you need help protecting your money from inflation or evaluating annuity options, consider working with a financial advisor.)

There’s Value in Waiting

Alternatively, you could consider delaying your retirement by just a few years. This may be especially attractive if you want to build more flexibility into your budget so you can afford some luxuries, leisure and travel.

If you delay retirement by three years and claimed Social Security at age 69, your benefit would increase to $32,823 per year ($2,735 per month). Second, at the S&P 500’s 10% average annual rate of return, your Roth IRA could potentially grow to about $1.22 million.

Even if you use a 4% withdrawal rate, your Roth portfolio could generate about $48,880 in your first year of retirement. Combined with Social Security, you’d have $81,712 in year 1. Or, you could invest the whole $1.2 million into an annuity that might pay you approximately $95,000 per year. As a result, you’d have a combined income of more than $127,000 in your first year of retirement.

In both of these cases, delaying retirement would give you much more financial flexibility for a comfortable, sustainable lifestyle. (A financial advisor can help you assess when you can afford to retire.)

Bottom Line

With $900,000 in a Roth IRA and $2,200 per month in Social Security, you may be able to afford to retire at age 66. However, it could mean some tight budgeting and thin margins. Instead, it might be wise to wait just an extra couple of years to let your portfolio and benefits grow a little bit more.

Retirement Budgeting Tips

-

Social Security plays a major role in most Americans’ retirement budgets. Figuring out when to claim your benefits is an important step in the retirement planning process. SmartAsset’s Social Security calculator can help you estimate how much your benefits will be at different claiming ages.

-

A financial advisor can help you build a comprehensive retirement plan. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/Charday Penn, ©iStock.com/Vadym Pastukh, ©iStock.com/Wasana Kunpol

The post I Have $900k in a Roth IRA and Would Receive $2,200 Monthly From Social Security. Can I Retire at 66? appeared first on SmartReads by SmartAsset.

Analyst Report: Crown Castle Inc.

Summary

Crown Castle is a domestic communications infrastructure REIT that owns and leases 40,000 towers, 105,000 small cells, and 90,000 route miles of fiber. The average number of tenants per tower in 2024 is 2.4. The company has both single-tenant and colocation towers, and operations in 49 states. While organic growth continues to be driven by tower revenue, the company added about 8,000 new small cell nodes in 2023.

Small cells are comprised of a series of smaller, lower-power antennas, and may be built either indoors or outdoors. They are able to boost wireless coverage in congested regions and extend coverage to hard-to-reach areas.

In 2023, the Tower segment generated about 68% of revenue, with Fiber accounting for about one-third. Within each segment, annual site rental revenues account for about 95% of revenues and service fees for the remainder. About three-quarters of CCI’s tower tenants are large cell phone carriers, with T-Mobile accounting for 36% of site revenues, and AT&T and Verizon 19% each. The company focuses on long-term lease agreements. The weighted-average remaining lease term is about six years, and the average number of tenants per tower is 2.5. About 40% of t

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level