Dividend Investor Making $1,000 Per Month With Just $40,000 Invested Shares His 'Hyper Dividend' Portfolio: Top 9 Stocks and ETFs

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Giving yields too much importance in dividend investing comes with risks and caveats. But high-yield dividend stocks have never lost their allure over the past several decades. For beginner investors with a limited budget and high-risk appetite, focusing on stocks with high yields is the only way to reach a significant dividend income.

While dividend growth stocks with strong fundamentals and growth history provide investors better long-term opportunities, many are crushing it by investing in high-yield stocks.

Check It Out:

About two months ago, a dividend investor shared his portfolio and income report on r/Dividends, a discussion board for dividend investors on Reddit. The investor said he collected about $1,000 monthly with $40,000 invested, giving the portfolio an insane yield of about 34%.

“I created a hyper dividend portfolio last month and collected 1k last month. Goal is to reach 2.5k /month by next August,” the investor said.

As expected, most of the holdings in the portfolio are risky high-yield options ETFs. When asked whether he’s aware of the risks of losses in principal that come with investing in such kinds of ETFs, the investor said:

“Yes, I know. These are called synthetic ETFs. Don’t care how they pay it as long as principal + interest < final value.”

Let’s look at some of the biggest holdings in this extremely high-yield dividend portfolio.

Please note that many of these holdings are risky ETFs. This article is based on an income report shared publicly by an investor. It’s not investment advice.

The YieldMax MSTR Option Income Strategy ETF

The YieldMax MSTR Option Income Strategy ETF (NYSE:MSTY) generates income by selling call options on MicroStrategy (MSTR) stock. Its distribution rate is about 75%.

The Simplify Volatility Premium ETF

The Simplify Volatility Premium ETF (NYSE:SVOL) is a high-yield (16%) dividend ETF gaining popularity on Reddit. The ETF generates income by shorting the CBOE Volatility Index (VIX) and betting that volatility will remain stable or decrease. Since the broader market tends to go higher in the long term, investing in this ETF suits those looking for stable income checks. The Redditor, earning $1,000 monthly with a $40,000 investment, said he owned 200 SVOL shares.

The Pacer Pacific Asset Floating Rate High Income ETF

The Redditor earned $1,000 monthly and said he owned about 100 shares of The Pacer Pacific Asset Floating Rate High Income ETF (NYSE:FLRT). FLRT generates income by primarily investing in floating-rate loans of non-investment-grade companies. These ETFs gain traction when interest rates are rising. The fund yields about 8%.

JPMorgan Equity Premium Income ETF

JPMorgan Equity Premium Income ETF (NYSE:JEPI) was among the notable dividend ETFs in the portfolio of the Redditor earning $1,000 a week with $40,000. His hyper-dividend portfolio had 100 JEPI shares. JEPI makes money by investing in large-cap U.S. stocks and selling call options. JEPI is ideal for those looking for exposure to defensive stocks. It usually underperforms during bull markets but protects investors against large losses during bear markets, as its portfolio consists of defensive equities like Trane Technologies PLC (NYSE:TT), Southern Co (NYSE:SO), Progressive Corp (NYSE:PGR), among others.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

YieldMax AMZN Option Income Strategy ETF

The YieldMax AMZN Option Income Strategy ETF (NYSE:AMZY) generates income by selling call options on Amazon. The Redditor with the hyper-dividend portfolio said he owned 100 AMZY shares. The fund has a distribution rate of about 41%. AMZY is down 9% so far this year.

YieldMax TSLA Option Income Strategy ETF

YieldMax TSLA Option Income Strategy ETF (NYSE:TSLY) is a popular YieldMax dividend ETF for high-yield seekers. With a distribution rate of over 120%, TSLY generates income by selling call options on Tesla shares. Over the past year, TSLY has been down about 55%, while Tesla stock has been down 7%.

Realty Income

Realty Income Corp (NYSE:O) is a staple in Reddit dividend portfolio success stories. The REIT has a dividend yield of over 5% and has raised its payouts for 30 years. The Redditor making $1,000 a month with $40,000 said he owned 100 shares of Realty Income.

JPMorgan Nasdaq Equity Premium Income ETF

The Redditor earning $1,000 a month had about 100 shares of JPMorgan Nasdaq Equity Premium Income ETF (NASDAQ:JEPQ) in his portfolio. JEPQ invests in Nasdaq companies and generates extra income by selling call options. As of Oct. 14, the ETF yields about 9.4%.

YieldMax NVDA Option Income Strategy ETF

YieldMax NVDA Option Income Strategy ETF (NYSE:NVDY) makes money by selling call options on Nvidia. Recently, the ETF has gained popularity amid the buzz around Nvidia. The fund has a distribution rate of about 57%. NVDY suits investors who believe in Nvidia’s long-term potential but want to hedge against possible declines in the chipmaker’s shares.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Dividend Investor Making $1,000 Per Month With Just $40,000 Invested Shares His ‘Hyper Dividend’ Portfolio: Top 9 Stocks and ETFs originally appeared on Benzinga.com

A Look Ahead: Sandy Spring Bancorp's Earnings Forecast

Sandy Spring Bancorp SASR will release its quarterly earnings report on Monday, 2024-10-21. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Sandy Spring Bancorp to report an earnings per share (EPS) of $0.46.

Anticipation surrounds Sandy Spring Bancorp’s announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

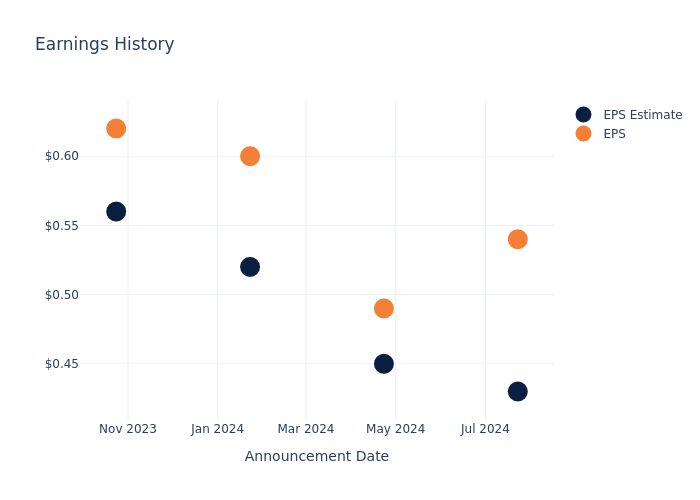

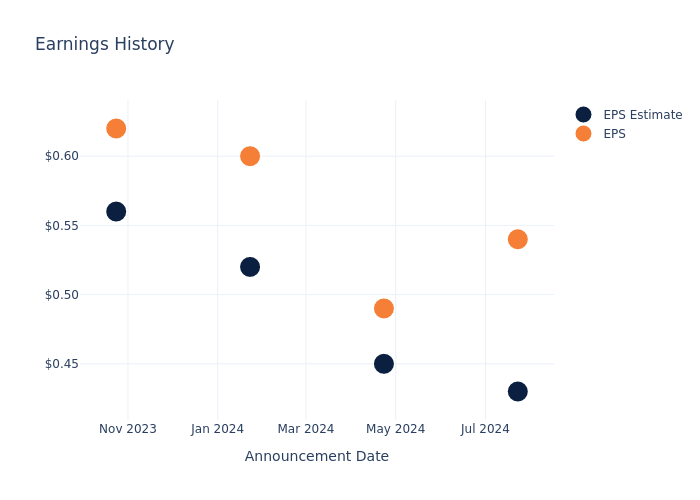

Performance in Previous Earnings

The company’s EPS beat by $0.11 in the last quarter, leading to a 2.86% drop in the share price on the following day.

Here’s a look at Sandy Spring Bancorp’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.43 | 0.45 | 0.52 | 0.56 |

| EPS Actual | 0.54 | 0.49 | 0.60 | 0.62 |

| Price Change % | -3.0% | -2.0% | 0.0% | -1.0% |

Stock Performance

Shares of Sandy Spring Bancorp were trading at $33.11 as of October 17. Over the last 52-week period, shares are up 66.74%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Sandy Spring Bancorp visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

PIMCO Canada Announces Special Meeting Details for the Proposed Mergers of Certain Closed-end Funds

TORONTO, Oct. 18, 2024 (GLOBE NEWSWIRE) — PIMCO Canada Corp. (“PIMCO Canada”) announces further details about the previously announced proposed mergers (the “Mergers”) of PIMCO Tactical Income Fund PTI, PIMCO Tactical Income Opportunities Fund PTO and PIMCO Multi-Sector Income Fund PIX (collectively, the “Existing Funds”) into a new closed-end fund to be managed by PIMCO Canada, PIMCO Monthly Enhanced Income Fund (“PMEI”).

Pursuant to the terms of the Mergers, holders of units of the Existing Funds will become holders of the same class of units of PMEI. PIMCO Canada has determined that it is in the best interests of unitholders of the Existing Funds to merge into a single fund, which would permit PMEI to: (i) increase liquidity on the secondary market, and (ii) benefit from significant economies of scale, including greater investment flexibility. None of the costs and expenses associated with the Mergers will be borne by the Existing Funds or their respective unitholders. All such costs will be borne by the Manager.

The Mergers will be voted on at special meetings (the “Meetings”) of unitholders of the Existing Funds to be held on December 4, 2024. If required, adjourned meetings will be held on December 5, 2024. The record date for the purpose of determining which unitholders are entitled to receive notice of, and to vote at, the Meetings is October 16, 2024. Subject to the receipt of all necessary regulatory, unitholder and other third party approvals, and obtaining a receipt for the final non-offering prospectus of PMEI, it is expected that the proposed Mergers will take effect on or about December 20, 2024, or such other date as the Manager may determine in its sole discretion.

In advance of the Meetings, a notice-and-access document will be sent on or about October 31, 2024 to unitholders of record as at October 16, 2024. The notice-and-access document will describe how unitholders can obtain a copy of the management information circular (the “Circular”) that contains full details of the proposed Mergers. The notice-and-access document and the Circular are also available at www.sedarplus.ca and www.pimco.ca.

The independent review committee of each Existing Fund has reviewed the proposed Mergers, including the proposed steps to be taken in implementing the proposed Mergers, and has concluded that the proposed Mergers represent the business judgment of the Manager, uninfluenced by considerations other than the best interests of the Existing Funds, and the proposed Mergers will achieve a fair and reasonable result for each of the Existing Funds.

In addition, in anticipation of the proposed Merger, PIMCO Tactical Income Fund has terminated its “at-the-market” equity program effective today.

For further information on PIMCO Canada and the PIMCO funds, please visit www.pimco.ca or call us at 1 866 341 3350 (416 368 3350 in Toronto).

About PIMCO

PIMCO is one of the world’s premier fixed income investment managers. With its launch in 1971 in Newport Beach, California, PIMCO introduced investors to a total return approach to fixed income investing. In the 50+ years since, the firm continued to bring innovation and expertise to our partnership with clients seeking the best investment solutions. Today PIMCO has offices across the globe and 2,500+ professionals united by a single purpose: creating opportunities for investors in every environment. PIMCO is owned by Allianz SE, a leading global diversified financial services provider.

Forward-Looking Statements

Certain statements included in this news release constitute forward-looking statements, including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions to the extent they relate to the Funds. The forward-looking statements are not historical facts but reflect the Fund’s, PIMCO Canada and/or PIMCO’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations, including, but not limited to, market factors. Although the Fund, PIMCO Canada and/or PIMCO believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. The Fund, PIMCO Canada and/or PIMCO undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other factors which affect this information, except as required by law.

You will usually pay brokerage fees to your dealer if you purchase or sell units of the investment funds on Toronto Stock Exchange. If the units are purchased or sold on the TSX, investors may pay more than the current net asset value when buying units of the investment fund and may receive less than the current net asset value when selling them. There are ongoing fees and expenses associated with owning units of an investment fund. An investment fund must prepare disclosure documents that contain key information about the fund. You can find more detailed information about the fund in these documents. Investment funds are not guaranteed, their values change frequently and past performance may not be repeated.

A word about risk: All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2024, PIMCO

The products and services provided by PIMCO Canada Corp. may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose.

PIMCO Canada has retained PIMCO LLC as sub-adviser. PIMCO Canada will remain responsible for any loss that arises out of the failure of its sub-adviser.

PIMCO Canada Corp. 199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2 is a company of PIMCO, 416-368-3350

Contact:

Agnes Crane

PIMCO – Media Relations

Ph. 212-597-1054

Email: agnes.crane@pimco.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Hilton Hospitality, Apple Simplicity, Uber Convenience: ElevateOS Is the Future of Multifamily

Elevating Property Management and Resident Experiences Like Never Before

CHICAGO, Oct. 17, 2024 /PRNewswire/ — Elevated Living, the premier provider of integrated resident experience solutions, is excited to announce its rebranding to ElevateOS — the all-in-one resident operating system set to redefine how multifamily properties operate. Much like Apple transformed personal computing and Hilton reimagined hospitality, ElevateOS is reshaping the future of multifamily by offering a seamless, tech-driven platform that integrates every facet of property management and resident engagement.

A Full Operating System for Multifamily Living

Over the years, our solution has evolved from a custom-branded resident app to a comprehensive operating system that now powers entire portfolios, coast to coast. ElevateOS enables property owners, managers, and developers to streamline their operations, reduce costs, and accelerate decision-making — all while saving on-site management teams hours of time. With our all-in-one platform, everything from access control and smart home tech to service bookings is handled effortlessly, creating a frictionless experience for residents and staff alike.

“At ElevateOS, we believe in simplicity and efficiency,” said Konrad Koczwara, CEO of ElevateOS. “Our rebranding reflects the evolution of our technology into a full operating system, designed to unify the resident management process, improve property performance, and create smarter buildings.”

Introducing ElevateAI: The Future of Real-Time Property Insights

As part of the rebrand, we are thrilled to introduce ElevateAI, our new artificial intelligence module that is being seamlessly integrated into the ElevateOS platform. ElevateAI will provide real-time insights to property managers, enabling them to predict at-risk lease renewals and automate critical property-related tasks. By implementing ElevateAI throughout our platform, managers will have a powerful tool to make data-driven decisions, streamline operations, and improve retention and profitability.

“With ElevateAI, property managers can not only react faster but also proactively anticipate resident needs and optimize their workflows like never before,” Koczwara added.

Seamless Integration with What Properties Already Use

ElevateOS integrates the software and hardware already deployed in most properties, eliminating the need for multiple apps for residents and unnecessary logins for property staff. By consolidating an average of 4.7 point solutions per community, ElevateOS helps property owners cut operating expenses by $6–23 per unit per month. This reduction in OPEX represents a significant cost saving for multifamily properties while streamlining operations and improving resident experiences. ElevateOS allows owners and operators to view and analyze all property data and resident insights in one centralized platform.

Revolutionizing Resident Experiences with Uber-Like Convenience

One of the standout features of ElevateOS is its Uber-like functionality for residents, offering them the ability to book concierge services directly from the app. From housekeepers and dog walkers to personal trainers and grocery deliveries, residents can access a full suite of services at their fingertips. Some properties are already seeing more than $30+/unit per month in additional service revenue, driven entirely by the convenience of the platform.

“By unifying resident needs and property management into one cohesive platform, ElevateOS is transforming how multifamily communities operate,” said Mitch Karren, Chief Product & Strategy Officer. “We’ve created a technology solution that improves resident satisfaction while driving significant financial benefits for property owners.”

The Future of Multifamily is Here

With its rebranding, ElevateOS is cementing its place as the leader in multifamily property technology. Whether it’s simplifying operations, enhancing resident experiences, or driving revenue, ElevateOS — now with the power of ElevateAI — is designed to meet the needs of the modern multifamily property.

For more information about ElevateOS and how it’s reshaping the future of multifamily, visit https://elevateOS.com

About ElevateOS:

ElevateOS is the industry’s first all-in-one resident operating system for multifamily properties, integrating resident management, property operations, and concierge services into a single platform. With ElevateAI providing real-time insights and predictive analytics, ElevateOS empowers property owners and managers to make real-time decisions, improve operational efficiency, and boost NOI while delivering a seamless resident experience.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/hilton-hospitality-apple-simplicity-uber-convenience-elevateos-is-the-future-of-multifamily-302279947.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/hilton-hospitality-apple-simplicity-uber-convenience-elevateos-is-the-future-of-multifamily-302279947.html

SOURCE Elevated Living

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Insider Decision: Global Infrastructure Investors III LLC Offloads $2.99B Worth Of EnLink Midstream Stock

Disclosed on October 17, Global Infrastructure Investors III LLC, 10% Owner at EnLink Midstream ENLC, executed a substantial insider sell as per the latest SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday, LLC sold 200,340,753 shares of EnLink Midstream. The total transaction value is $2,985,077,219.

At Friday morning, EnLink Midstream shares are up by 0.96%, trading at $14.74.

All You Need to Know About EnLink Midstream

EnLink Midstream LLC is an integrated midstream company. The company’s operating segment includes Permian; North Texas; Oklahoma; Louisiana and Corporate. The company generates maximum revenue from the Louisiana segment. The Louisiana segment includes natural gas pipelines, natural gas processing plants, storage facilities, fractionation facilities, and NGL assets.

Unraveling the Financial Story of EnLink Midstream

Revenue Growth: EnLink Midstream’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 2.18%. This indicates a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Energy sector.

Profitability Metrics:

-

Gross Margin: The company faces challenges with a low gross margin of 21.05%, suggesting potential difficulties in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): EnLink Midstream’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of 0.07.

Debt Management: EnLink Midstream’s debt-to-equity ratio surpasses industry norms, standing at 5.11. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: EnLink Midstream’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 48.67.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.98 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 9.15 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Impact of Insider Transactions on Investments

Insider transactions shouldn’t be used primarily to make an investing decision, however an insider transaction can be an important factor in the investing decision.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

A Deep Dive into Insider Transaction Codes

In the domain of transactions, investors frequently turn their focus to those taking place in the open market, as meticulously outlined in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of EnLink Midstream’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

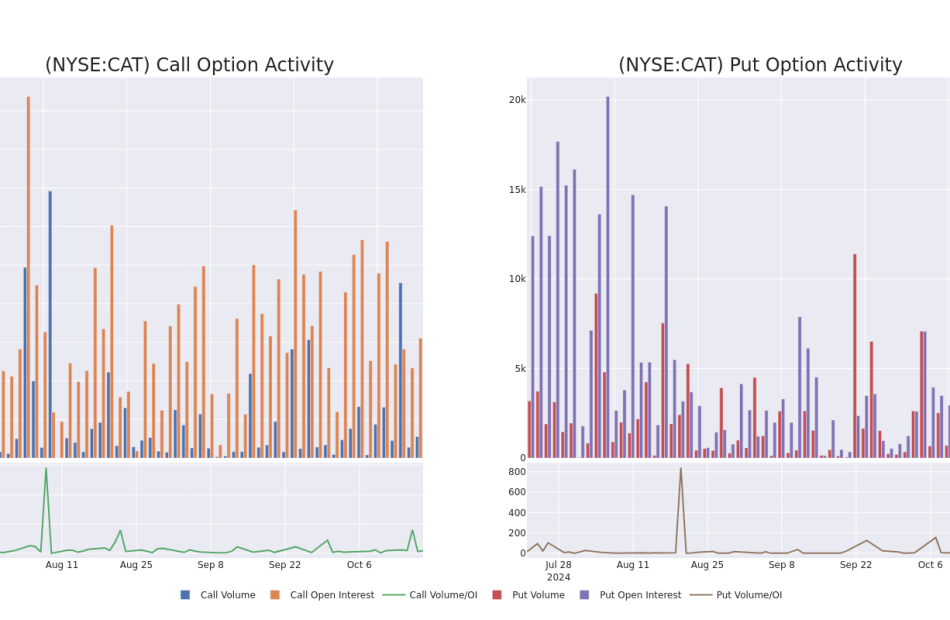

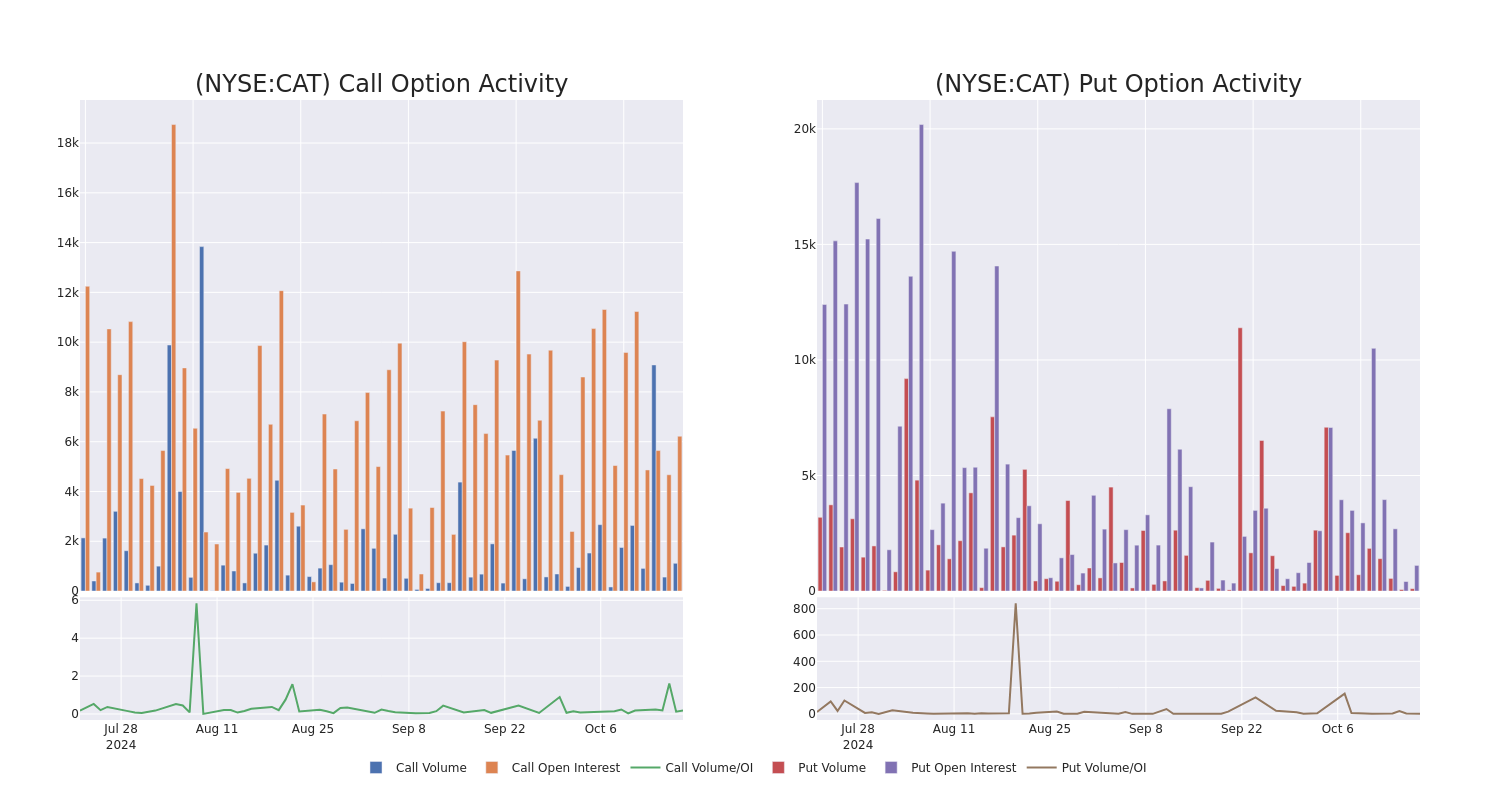

This Is What Whales Are Betting On Caterpillar

Financial giants have made a conspicuous bearish move on Caterpillar. Our analysis of options history for Caterpillar CAT revealed 16 unusual trades.

Delving into the details, we found 18% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $250,984, and 10 were calls, valued at $1,135,248.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $290.0 to $420.0 for Caterpillar over the recent three months.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Caterpillar options trades today is 666.27 with a total volume of 1,219.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Caterpillar’s big money trades within a strike price range of $290.0 to $420.0 over the last 30 days.

Caterpillar Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | CALL | SWEEP | BEARISH | 10/18/24 | $12.25 | $11.35 | $12.25 | $380.00 | $616.1K | 1.1K | 516 |

| CAT | CALL | TRADE | BULLISH | 12/20/24 | $14.8 | $14.4 | $14.8 | $400.00 | $97.6K | 753 | 122 |

| CAT | CALL | SWEEP | NEUTRAL | 11/15/24 | $35.45 | $34.9 | $35.19 | $360.00 | $91.5K | 1.0K | 32 |

| CAT | CALL | SWEEP | NEUTRAL | 11/15/24 | $37.25 | $36.8 | $36.99 | $360.00 | $85.1K | 1.0K | 121 |

| CAT | CALL | SWEEP | NEUTRAL | 11/15/24 | $37.1 | $36.65 | $36.93 | $360.00 | $70.1K | 1.0K | 59 |

About Caterpillar

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world’s largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

After a thorough review of the options trading surrounding Caterpillar, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Caterpillar

- With a volume of 850,803, the price of CAT is down -0.12% at $394.04.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 12 days.

What The Experts Say On Caterpillar

5 market experts have recently issued ratings for this stock, with a consensus target price of $433.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Morgan Stanley has revised its rating downward to Underweight, adjusting the price target to $332.

* Consistent in their evaluation, an analyst from B of A Securities keeps a Buy rating on Caterpillar with a target price of $434.

* Consistent in their evaluation, an analyst from Truist Securities keeps a Buy rating on Caterpillar with a target price of $456.

* An analyst from JP Morgan persists with their Overweight rating on Caterpillar, maintaining a target price of $500.

* An analyst from Citigroup has decided to maintain their Buy rating on Caterpillar, which currently sits at a price target of $445.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Caterpillar, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Heavily Shorted Stocks That Are Down More Than 75% Since 2021. Can They Turn Things Around?

Investing in struggling stocks that are also heavily shorted can be an incredibly risky move. But if these types of stocks are able to turn things around and prove their doubters wrong, the upside can also be significant. It’s not a suitable investment strategy for most investors, but if you have a high risk tolerance, there are three potential contrarian plays to consider.

Medical Properties Trust (NYSE: MPW), Beyond Meat (NASDAQ: BYND), and Plug Power (NASDAQ: PLUG) are three beaten-down stocks that many short-sellers are betting will continue to struggle. Below, I’ll look at just how heavily shorted these stocks are, what has to happen for them to turn things around, and whether they are worth potentially investing in today.

Medical Properties Trust: 50% short interest

A real estate investment trust (REIT) can sometimes be an attractive investment for its recurring dividend income and stability. But a REIT is only as stable as its tenants. And Medical Properties Trust is a REIT which has had problems with key tenants in the past, including Steward Health, which filed for bankruptcy protection earlier this year.

The turbulence in Medical Properties’ earnings has resulted in a disastrous performance for the stock, which is down a whopping 79% since 2021. And while the REIT has distanced itself from Steward Health and is relying on new tenants, short interest remains incredibly high at around 50% of the stock’s float.

For Medical Properties to turn things around, it needs to prove that it can get back to generating positive earnings numbers and that its new tenants are much safer. The healthcare REIT has incurred a net loss for three consecutive quarters. It’ll take time for Medical Properties to demonstrate it’s a safer option for investors, and with the company cutting its dividend twice since last year, it won’t be easy for many investors to trust this stock.

With interest rates potentially coming down further next year, I think there could be a contrarian play here as REITs may become more attractive investments amid lower rates. And with so much bearishness priced into its valuation, Medical Properties may not have to perform too well to impress the market these days. This is a highly risky stock, but there are reasons to consider taking a chance on it. The safe option, however, would be to wait at least a couple of quarters to see if Medical Properties is able to find some stability in its earnings.

Beyond Meat: 40% short interest

Another heavily shorted stock is Beyond Meat. The fake meat company hasn’t been doing well for multiple reasons. Not only has demand been unimpressive, but its gross margins are also often negative, which makes it difficult to see a path to profitability for the business anytime soon. With short interest as high as 40%, investors clearly aren’t believing the hype around Beyond Meat’s plant-based foods. Since 2021, Beyond Meat has lost a staggering 95% of its value; it’s nearly impossible for the stock to have performed worse since then.

In the trailing 12 months, Beyond Meat’s net loss of $314.4 million is nearly as high as its revenue of $317.8 million. Unfortunately, there’s no easy way to see a turnaround for Beyond Meat. It needs a plant-based product that is in high demand and for which it can charge a high enough price to significantly bolster its margins. And until that happens, it’s difficult to even see a path for a turnaround.

This food stock may be too risky an investment, even for contrarian investors.

Plug Power: 29% short interest

Shares of Plug Power are also down more than 90% since 2021 as the hype surrounding hydrogen energy has crumbled drastically in recent years. The company has reported massive losses, which make Beyond Meat’s numbers almost look decent. Over the past four quarters, Plug has incurred a net loss of nearly $1.5 billion on sales of $684.5 million. And like Beyond Meat, it regularly reports a negative gross margin, which is a huge red flag for investors. Short interest in Plug Power is just under 30%.

If you’re a believer in hydrogen energy, you might be tempted to take a chance on Plug Power. But the risk is that the company may not be around even if hydrogen energy takes off and becomes the preferred power solution in the future. While Plug Power may boast about a leadership position in the hydrogen industry, that hasn’t amounted to a strong financial position for the business, and that’s what’s arguably more important for investors.

Plug Power reported $285.2 million cash (including restricted cash) as of the end of June. And for a company that has burned through $422.5 million in just the past six months from its day-to-day operating activities, the problem is clear: The business needs to drastically slow its cash burn and cut expenses. Regardless of the potential in hydrogen, it’ll be all for naught if Plug Power continues to accumulate these types of losses. That’s why I think it may be the riskiest stock on this list, and the one which may have the hardest path to turning things around.

Without clear evidence of a significant improvement in its financials, this is a stock that you’ll probably want to steer clear of.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Beyond Meat. The Motley Fool has a disclosure policy.

3 Heavily Shorted Stocks That Are Down More Than 75% Since 2021. Can They Turn Things Around? was originally published by The Motley Fool

Ohio Woman Scores $15M Lottery Win, But A Huge Tax Bill Means She May Only Take Home $4.5M – Here's Why

In a stroke of unbelievable fortune, Jeanne, a Sandusky, Ohio resident, won $15 million in the state’s 50th Anniversary scratch-off game this past June.

Describe when Jeanne told the Ohio Lottery Commission that she had “dropped to the floor” after realizing her win. At the store, the clerk and Jeanne had cried together, leaving bystanders wondering what on earth had just happened.

Don’t Miss:

While $15 million might seem like a life-altering sum, Jeanne’s final payout will be much less due to taxes, leaving her with around $4.5 million. It’s a classic example of a lottery winner facing a significant reduction in winnings after taxes – an issue many winners don’t see coming.

Jeanne had the option of receiving $600,000 annually over 25 years (which totals the advertised $15 million) or a lump sum of around $7.5 million. She chose the lump sum. According to Moneywise, Jeanne will be left with around $4.5 million after paying federal and state taxes, a far cry from the headline-making prize.

Trending: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

So, why is there such a huge difference between the $15 million jackpot and her final earnings?

The IRS requires lottery agencies to withhold 24% of any prize over $5,000. For Jeanne, that meant $1.8 million was withheld for federal taxes from her $7.5 million lump sum. But the story doesn’t end there.

Since lottery winnings are taxed as ordinary income, Jeanne’s windfall pushes her into the highest federal income tax bracket of 37%. This means her total federal tax liability rises to approximately $2.73 million, Moneywise reported.

State taxes also take a bite out of Jeanne’s winnings. Ohio taxes lottery income at 3.5%, which means Jeanne will owe around $262,000 to the Buckeye State. Jeanne’s total tax burden is nearly $3 million, leaving her with just $4.5 million. It’s not bad for a $50 scratch-off, but far from the $15 million advertised.

Given these eye-watering deductions, one might wonder if Jeanne should have opted for the annuity. Would she have taken home more money in the long run?

By choosing the $600,000 annual payment for 25 years, Jeanne would receive the full $15 million over time. Her tax burden would be spread out and she’d pay yearly taxes based on her income.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

In 2024, that means she’d owe roughly $180,000 in federal taxes and $20,000 in state taxes on the first $600,000 installment, according to current tax brackets. However, tax rates could shift over the next two decades, potentially lightening her tax load if Ohio’s proposed income tax elimination passes.

Many financial experts advocate for the annuity option as it ensures a steady income stream. According to certified financial planner Michael Kitces, annuities can reduce the risk of quickly burning through a lump sum. Steady payments help prevent financial risks.

That said, the lump sum offers immediate financial freedom, likely why Jeanne chose it. Many winners use lump sums to pay off debts, buy homes or invest in growth opportunities.

But as tempting as immediate access to millions might be, experts warn that having a plan in place is essential. Without solid financial advice, it’s easy for winners to blow through their money faster than they think.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Ohio Woman Scores $15M Lottery Win, But A Huge Tax Bill Means She May Only Take Home $4.5M – Here’s Why originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.