3 No-Brainer Pharmaceutical Stocks to Buy With $500 Right Now

Pharmaceutical stocks make fantastic long-term investments because they can excel in any market environment. Regardless of the economic situation, patients need their medicines and will continue to buy them, resulting in a certain steadiness in revenue and growth for pharma companies.

What’s a no-brainer pharma stock? It’s one that you can hold onto for the long term due to its solid portfolio of products and strong pipeline. This sort of company would have proven its strength by delivering earnings growth over time, and innovation may extend this strength well into the future.

Pharma companies also are known for paying dividends, offering you a guaranteed stream of annual revenue. Below are three no-brainer pharma stocks to buy now if you have $500 to invest.

1. Abbott Laboratories

Abbott Laboratories (NYSE: ABT) makes pharmaceuticals, but the company also has three other winning businesses: medical devices, diagnostics, and nutrition. This diversification is Abbott’s strength; if one business reaches a stumbling block, others can compensate. For example, today, a drop in coronavirus testing sales is weighing on the diagnostics business, but medical devices saw double-digit revenue growth in the recent quarter.

Abbott continues to grow, thanks to a steady flow of new product approvals, and has proven its ability to deliver returns to investors over time. The company is the most profitable healthcare stock ever for investors, according to a report by Hendrik Bessembinder at Arizona State University. Abbott stock delivered a cumulative compound return of 7,803,730% between 1937 and December of last year, the professor’s report showed.

Investors in this healthcare company also benefit from its commitment to dividend growth. Abbott is a Dividend King, meaning it’s raised the dividend payment annually for more than 50 consecutive years. This shows rewarding shareholders is a priority, suggesting the company will continue along this path.

On top of this, Abbott recently authorized a new repurchase program of up to $7 billion in stock — another effort to reward shareholders and demonstrate confidence in the company’s future.

2. Pfizer

Pfizer (NYSE: PFE) stock hasn’t made much of a move this year and has slipped nearly 30% over the past three years. The stock is trading today at a dirt cheap valuation of 11x forward earnings estimates, so now is a good time to get in on the stock.

The company has traversed tough times, posting a steep drop in coronavirus vaccine and treatment sales, but a whole new batch of new products, current blockbusters, and a big investment in the oncology business should significantly add to growth in the coming years. Pfizer predicts that new products outside of the coronavirus business should contribute $20 billion to 2030 revenue.

The acquisition of oncology specialist Seagen already has started to bear fruit, too. “Seagen products are contributing meaningfully to our revenue,” Chief Executive Officer Albert Bourla said in the latest earnings call. And the company is working toward a goal of launching at least eight blockbuster oncology medicines by 2030.

Though Pfizer isn’t a Dividend King, the company pays a dividend of $1.68 per share at a high yield of 5.6% and has committed to growing its dividend over time.

3. Johnson & Johnson

Johnson & Johnson (NYSE: JNJ) spun out its consumer health business last year into a separate entity — Kenvue — to focus on the higher-growth businesses of pharmaceuticals and medtech, and this move is proving to be a winner. The company reported operational sales growth of 6.3% for its innovative-medicines branch and 6.4% growth for medtech in the most recent quarter.

This marked the second-straight quarter of innovative-medicine sales surpassing $14 billion — and 11 of the company’s major brands soared in the double digits. In other impressive news, immunotherapy Darzalex became the first product in J&J’s portfolio to deliver $3 billion in sales in a single quarter. And recent approvals of Tremfya in ulcerative colitis and Rybrevant plus Lazcluze in non-small cell lung cancer should add to growth ahead.

As for medtech, recent acquisitions and divestitures positively impacted growth by nearly 3% in the quarter. Thanks to J&J’s purchases of Shockwave and Abiomed, the company has become a leader in four of the biggest and fastest-growing cardiovascular-intervention markets.

J&J’s solid financial situation — with $19 billion in free cash flow — should help it maintain its position as a Dividend King well into the future. It’s a fantastic buy for passive income, as well as long-term earnings growth.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Abbott Laboratories, Kenvue, and Pfizer. The Motley Fool recommends Johnson & Johnson and recommends the following options: long January 2026 $13 calls on Kenvue. The Motley Fool has a disclosure policy.

3 No-Brainer Pharmaceutical Stocks to Buy With $500 Right Now was originally published by The Motley Fool

How Does Cannabis Legalization Affect Organized Crime? New Research Sheds Light

The five years after Canada legalized recreational cannabis have produced enough data for researchers to look at important questions like how organized crime is affected by legalization, or not.

A recent study, published in Sociological Inquiry, explores how the shift to a legal market has reshaped criminal enterprises once heavily involved in the illicit cannabis trade.

Key Findings On Organized Crime & Cannabis

The research, conducted by scientists Martin Bouchard, Naomi Zakimi -of Simon Fraser University-, and Benoît Gomis -of the University of Toronto– shows that the legal cannabis market now dominates in Canada, accounting for over 71% of household expenditures on cannabis as of 2023. However, nearly 29% of the market still belongs to unlicensed sellers.

Some of the study’s most notable findings include:

- A Shrinking Illicit Market: Legal cannabis sales have steadily increased since legalization, gradually cutting into the black market.

- Organized Crime’s Resilience: Criminal organizations are adapting, either by diverting legal cannabis into the unlicensed market or shifting their operations to illegal drugs.

- Consumer Challenges: High prices, inconsistent quality, and limited accessibility in the legal market continue to drive some consumers toward cheaper, unlicensed alternatives.

- Cross-Border Smuggling: Despite legalization, some unlicensed products are smuggled out of Canada into markets abroad, particularly in the U.S.

- Shifting Criminal Focus: With cannabis becoming less profitable, many criminal groups are focusing on more dangerous drugs like opioids.

Read Also: Legal Weed = Less Crime: FBI Data Shows Surprising Benefits Of Cannabis Legalization

Methods And Indicators

To draw these conclusions, the researchers conducted a comprehensive review of more than 5,000 sources, including academic papers, media reports and government publications.

The key indicators used to assess the impact of cannabis legalization on organized crime include several metrics, such as price comparison between legal and illicit cannabis markets, supply-demand balance and cash circulation.

Lower legal cannabis prices tend to pull consumers away from illegal sources, so price monitoring is crucial. Cannabis demand estimates and legal supply are also analyzed to measure how well the legal market meets consumption needs, which could reduce reliance on the illicit market. Other indicators include tracking illicit cannabis seizures by law enforcement, examining criminal justice data for organized crime ties and analyzing cash circulation as an indicator of illegal market transactions.

These methods, along with interviews and internal documents, provide a more nuanced understanding of how organized crime has responded to legalization.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Recommendations For Policy Makers

One key finding is that the link between unlicensed and licensed cannabis is persistent and complex.

“Policies and law enforcement interventions aiming to address the illicit cannabis trade in Canada may indeed have consequences on legal cannabis production, sales, and consumption as well. The legal market may need to compete by learning from the consumer preferences established in the illegal market.”

Thus there’s a need for a comprehensive approach.

“Regulators and politicians would do well to measure expectations: the illegal activities along cannabis supply chains will persist and eliminating them altogether is an unrealistic goal,” the researchers add.

Cover: Courtesy of the California Department of Cannabis Control.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

George Carrara Takes Money Off The Table, Sells $90K In Build-A-Bear Workshop Stock

Revealing a significant insider sell on October 17, George Carrara, Board Member at Build-A-Bear Workshop BBW, as per the latest SEC filing.

What Happened: Carrara opted to sell 2,500 shares of Build-A-Bear Workshop, according to a Form 4 filing with the U.S. Securities and Exchange Commission on Thursday. The transaction’s total worth stands at $90,675.

Monitoring the market, Build-A-Bear Workshop‘s shares down by 0.0% at $37.76 during Friday’s morning.

About Build-A-Bear Workshop

Build-A-Bear Workshop Inc is a U.S.-based specialty retailer of customized stuffed animals and related products. The company operates through three segments. Its Direct-to-consumer segment with key revenue, includes the operating activities of corporately-managed locations and other retail delivery operations in the U.S., Canada, China, Denmark, Ireland, and the U.K., including the company’s e-commerce sites and temporary stores. The international franchising segment includes the licensing activities of the company’s franchise agreements with store locations in Europe, Asia, Australia, the Middle East, and Africa. The commercial segment includes the transactions with other businesses, mainly comprised of licensing the intellectual properties for third-party use and wholesale activities.

Build-A-Bear Workshop’s Economic Impact: An Analysis

Revenue Growth: Build-A-Bear Workshop’s revenue growth over a period of 3 months has been noteworthy. As of 31 July, 2024, the company achieved a revenue growth rate of approximately 2.36%. This indicates a substantial increase in the company’s top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Evaluating Earnings Performance:

-

Gross Margin: The company maintains a high gross margin of 54.18%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): Build-A-Bear Workshop’s EPS is below the industry average. The company faced challenges with a current EPS of 0.64. This suggests a potential decline in earnings.

Debt Management: With a below-average debt-to-equity ratio of 0.81, Build-A-Bear Workshop adopts a prudent financial strategy, indicating a balanced approach to debt management.

Assessing Valuation Metrics:

-

Price to Earnings (P/E) Ratio: The Price to Earnings ratio of 10.67 is lower than the industry average, indicating potential undervaluation for the stock.

-

Price to Sales (P/S) Ratio: A higher-than-average P/S ratio of 1.1 suggests overvaluation in the eyes of investors, considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 7.69 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Understanding the Significance of Insider Transactions

Insider transactions contribute to decision-making but should be supplemented by a comprehensive investment analysis.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

Breaking Down the Significance of Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Build-A-Bear Workshop’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

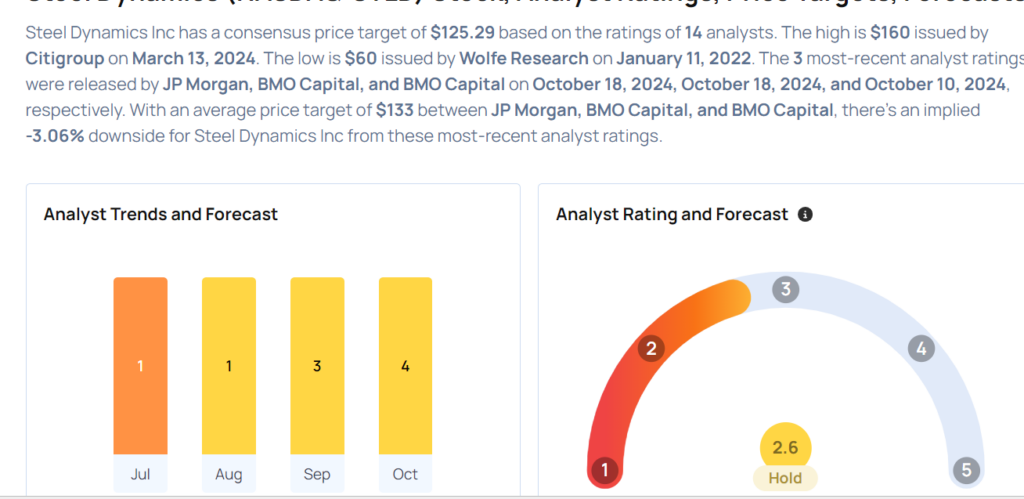

Steel Dynamics Analysts Increase Their Forecasts After Better-Than-Expected Earnings

Steel Dynamics Inc STLD posted better-than-expected third-quarter earnings, after the closing bell on Wednesday.

Steel Dynamics posted quarterly GAAP earnings of $2.05 per share, beating market estimates of $1.97 per share. The company’s quarterly sales came in at $4.34 billion versus expectations of $4.177 billion.

“The teams achieved a solid third quarter 2024 performance across the platforms, with adjusted EBITDA of $557 million and cash flow from operations of $760 million,” said Mark D. Millett, Co-Founder, Chairman, and Chief Executive Officer. “With our proven through-cycle cash generation, we increased liquidity to $3.1 billion, while also investing $621 million in our internal ongoing growth initiatives and distributing $381 million to our shareholders through cash dividends and share repurchases. Our three-year after-tax return-on-invested capital of 26 percent is a testament to our ongoing high-return capital allocation execution.

Steel Dynamics shares gained 1.2% to trade at $136.70 on Friday.

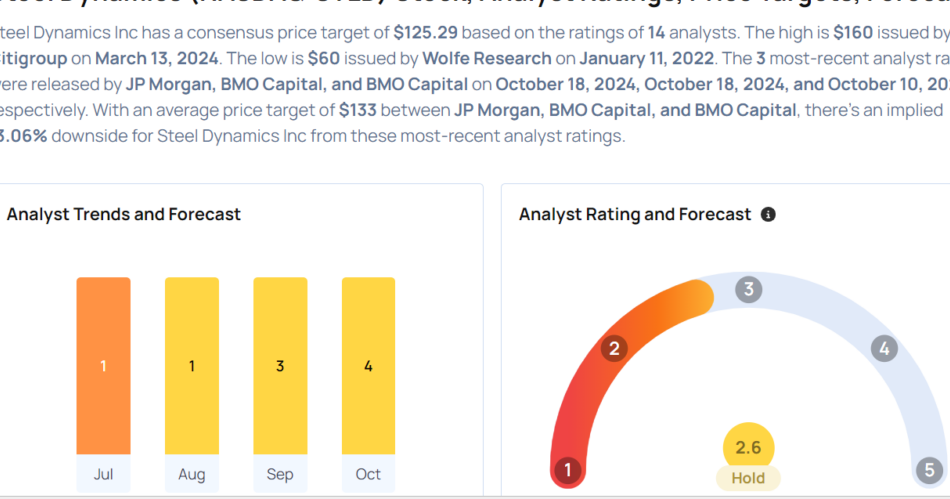

These analysts made changes to their price targets on Steel Dynamics following earnings announcement.

- BMO Capital analyst Katja Jancic maintained Steel Dynamics with a Market Perform and raised the price target from $130 to $135.

- JP Morgan analyst Bill Peterson maintained Steel Dynamics with a Neutral and raised the price target from $129 to $134.

Considering buying STLD stock? Here’s what analysts think:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

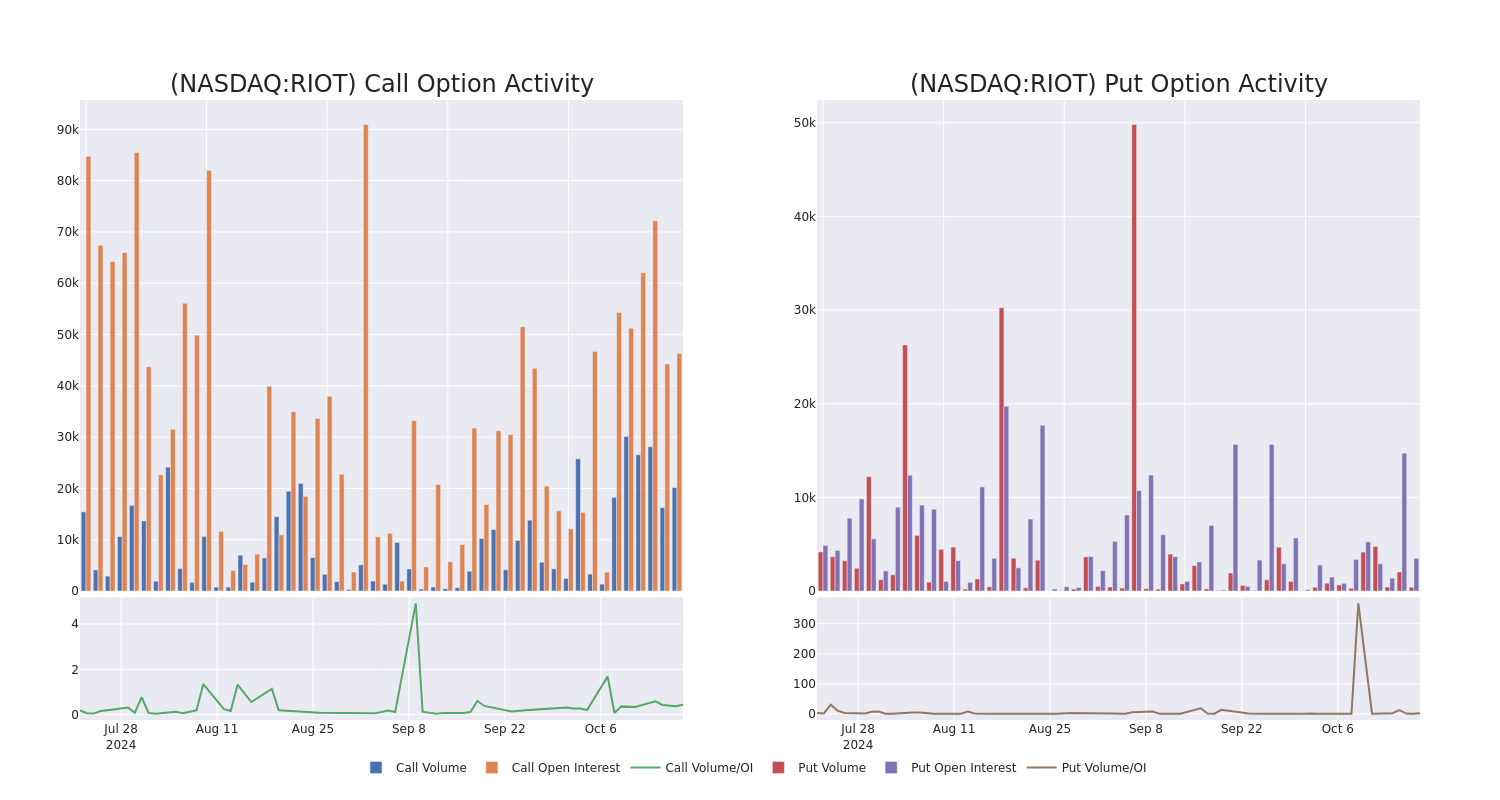

Riot Platforms Unusual Options Activity

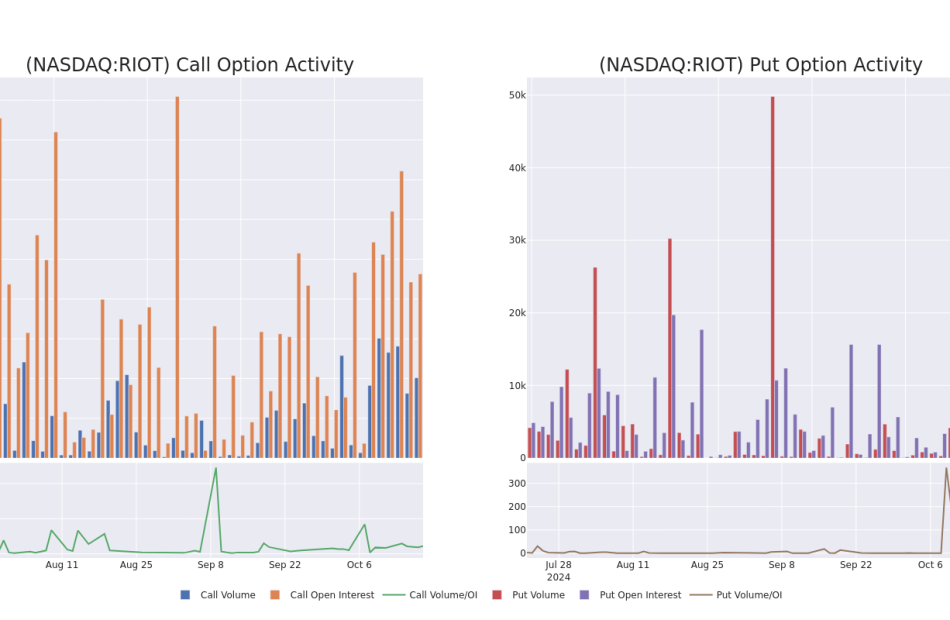

Financial giants have made a conspicuous bullish move on Riot Platforms. Our analysis of options history for Riot Platforms RIOT revealed 18 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 44% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $107,020, and 15 were calls, valued at $514,431.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $0.5 to $22.0 for Riot Platforms over the last 3 months.

Volume & Open Interest Development

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Riot Platforms’s options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Riot Platforms’s whale activity within a strike price range from $0.5 to $22.0 in the last 30 days.

Riot Platforms Option Activity Analysis: Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIOT | PUT | TRADE | BULLISH | 01/17/25 | $4.4 | $4.3 | $4.33 | $13.00 | $43.3K | 1.5K | 100 |

| RIOT | CALL | SWEEP | BEARISH | 03/21/25 | $0.88 | $0.79 | $0.88 | $19.00 | $41.1K | 1.6K | 467 |

| RIOT | CALL | SWEEP | BEARISH | 01/15/27 | $5.05 | $4.95 | $5.0 | $10.00 | $39.0K | 762 | 102 |

| RIOT | CALL | TRADE | BULLISH | 01/16/26 | $3.85 | $3.8 | $3.85 | $10.00 | $38.5K | 13.9K | 100 |

| RIOT | PUT | SWEEP | BULLISH | 01/16/26 | $3.85 | $3.75 | $3.75 | $10.00 | $37.5K | 1.8K | 109 |

About Riot Platforms

Riot Platforms Inc is a vertically integrated Bitcoin mining company focused on building, supporting, and operating blockchain technologies. The company’s segments include Bitcoin Mining; Data Center Hosting and Engineering. It generates maximum revenue from the Bitcoin Mining segment which generates revenue from the Bitcoin the company earns through its mining activities.

In light of the recent options history for Riot Platforms, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of Riot Platforms

- Currently trading with a volume of 13,946,007, the RIOT’s price is up by 6.8%, now at $9.83.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 12 days.

Expert Opinions on Riot Platforms

2 market experts have recently issued ratings for this stock, with a consensus target price of $18.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $22.

* In a cautious move, an analyst from Macquarie downgraded its rating to Outperform, setting a price target of $15.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Riot Platforms, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

French Central Bank Governor Cautious About Eurozone Inflation Falling Below ECB Target

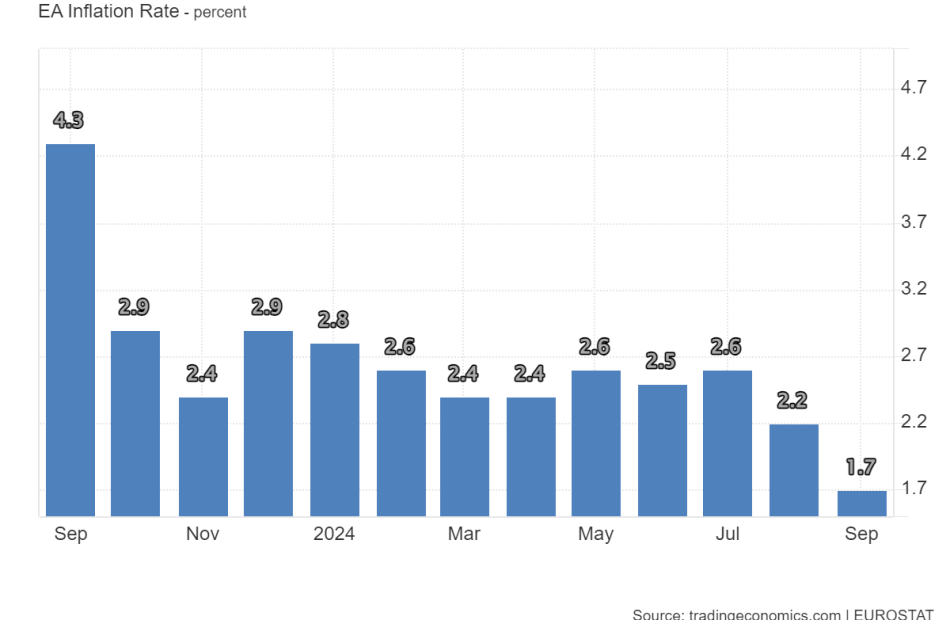

The European Central Bank (ECB) may need to adjust its monetary policy to manage the risk of eurozone inflation falling below its 2% target rather than exceed it, the French central bank governor François Villeroy de Galhau said today.

To stimulate a lagging economy, the ECB cut on Thursday its interest rates by 25 basis points. The move comes on the heels of eurozone inflation falling to 1.7% in September and sluggish growth, particularly in Germany.

“The risk of undershooting our target in the long term is now as present as the risk of overshooting it,” Villeroy said in a statement. “We should continue to reduce the degree of monetary policy restriction in a timely manner.”

Source: Euro Area Inflation, Trading Economics

The ECB has shifted from battling inflation to encouraging economic growth. The bank maintains a stance that risks to economic growth “remain tilted to the downside.”

Real GDP growth is forecast to grow by 0.7% in 2024 and 1.2% in 2025, or 0.1 percentage point lower than a previous survey for next year. Given this economic weakness, the ECB should make additional cuts, Villeroy said.

Source: Euro Area Quarterly GDP Growth, Trading Economics

ECB Will Keep Policy Rates ‘Sufficiently Restrictive’

The ECB has not provided specific guidance on future rate changes despite eurozone inflation undershooting its 2% target. ECB President Christine Lagarde said on Thursday that it would keep policy rates “sufficiently restrictive for as long as necessary to achieve” a 2% medium-term target in a timely manner.

“We believe the disinflationary process is well on track and all the information we received in the last five weeks were heading in the same direction – lower,” Lagarde said during the post-event press conference.

The ECB has lowered its deposit rate three times since June to 3.25%, the first back-to-back at such a clip in 13 years. Its latest decision came almost a month after the Federal Reserve announced a bold 50 basis point rate cut.

ECB deposit/refinancing rate 2000-2024, Source: Barrons

“Persistent moderate private investment and consumption with the recent rise in household savings rates in particular justify this new cut,” Villeroy said.

Although incomes rose in the second quarter, “households consumed less, contrary to expectations,” the ECB said on Thursday. “The saving rate stood at 15.7% in the second quarter, well above the pre-pandemic average of 12.9%.”

Source: Euro Area Savings Rate, Trading Economics

ECB Considers Geopolitics When Weighing Rate Decisions

Geopolitics also weigh on the ECB’s decision-making. “The pace must be dictated by an agile pragmatism: in a highly uncertain international environment, we maintain full optionality for our upcoming meetings,” Villeroy said.

EU officials are concerned that Donald Trump may impose new tariffs and turn more isolationist. Trump said in an interview on Tuesday with Bloomberg Editor-in-Chief John Micklethwait in Chicago that his proposals were for the “protection of the companies that we have here.”

The military conflict in Ukraine also shows no signs of ending and fighting in the Middle East still threatens regional stability and global oil shipments. However, concerns about a wider conflict in the region have started to ease.

As the “most open of the major economies,” Europe is more exposed as the global order shifts from “open trade” to “fragmented trade,” ECB Governor Christine Lagarde said on Wednesday.

“The global order we knew is fading,” Lagarde said on Wednesday in a speech to policymakers in Ljubljana. “Open trade is being replaced with fragmented trade, multilateral rules with state-sponsored competition and stable geopolitics with conflict.”

Lagarde did offer a message of optimism for Europe. IIf Europe approaches “uncertain times” with “the right spirit, I believe it can be an opportunity for renewal.”

Disclaimer

Any opinions expressed in this article are not to be considered investment advice and are solely those of the authors. European Capital Insights is not responsible for any financial decisions made based on the contents of this article. Readers may use this article for information and educational purposes only.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

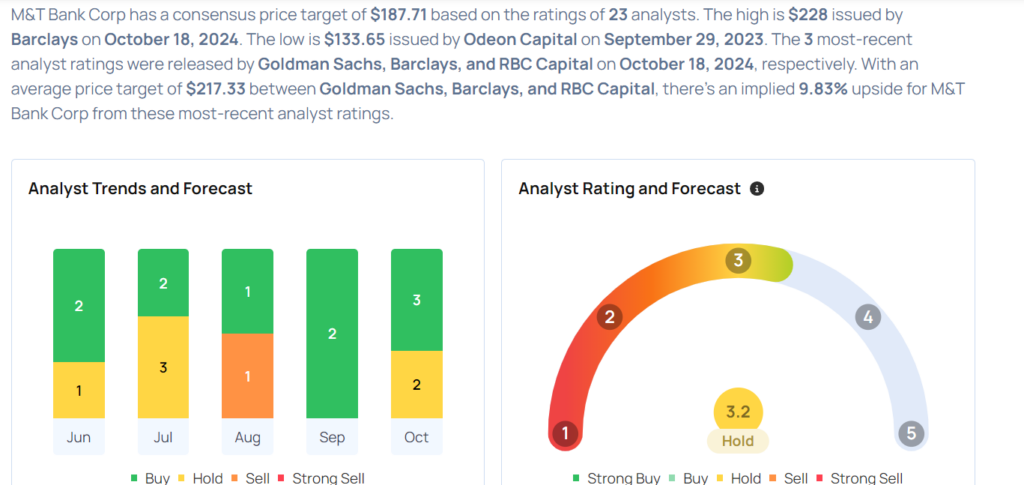

M&T Bank Analysts Boost Their Forecasts After Upbeat Earnings

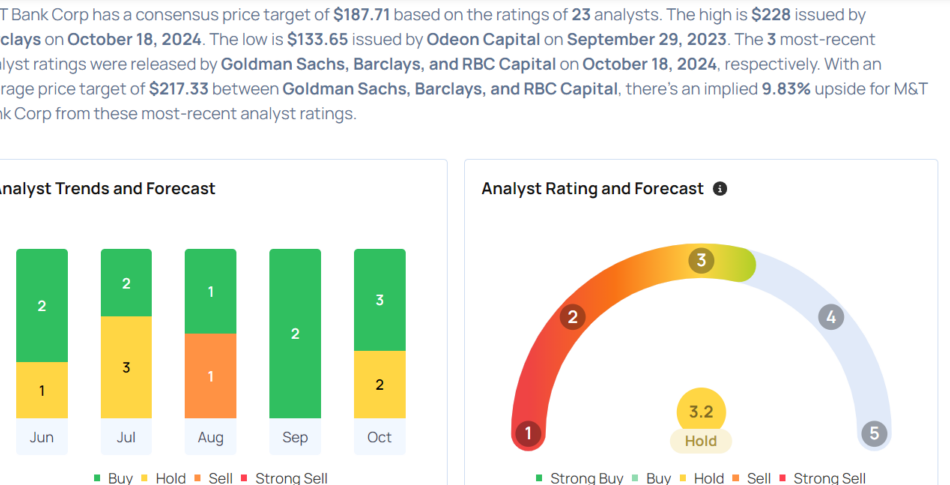

M&T Bank Corporation MTB reported better-than-expected third-quarter financial results on Thursday.

M&T Bank reported quarterly earnings of $4.08 per share which beat the analyst consensus estimate of $3.64 per share. The company reported quarterly sales of $2.332 billion which beat the analyst consensus estimate of $2.318 billion.

M&T’s Chief Financial Officer said, “M&T’s positive earnings momentum, strong capital position and unyielding focus on delivering for our customers and the communities we serve have positioned the franchise for a strong finish to 2024. I am proud of how our employees have exhibited our core values as we execute on our strategic priorities.”

M&T Bank shares fell 0.5% to trade at $197.98 on Friday.

These analysts made changes to their price targets on M&T Bank following earnings announcement.

- RBC Capital analyst Gerard Cassidy maintained M&T Bank with an Outperform and raised the price target from $190 to $208.

- Barclays analyst Jason Goldberg maintained the stock with an Equal-Weight and raised the price target from $170 to $228.

- Goldman Sachs analyst Ryan Nash maintained M&T Bank with a Neutral and raised the price target from $190 to $216.

Considering buying MTB stock? Here’s what analysts think:

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

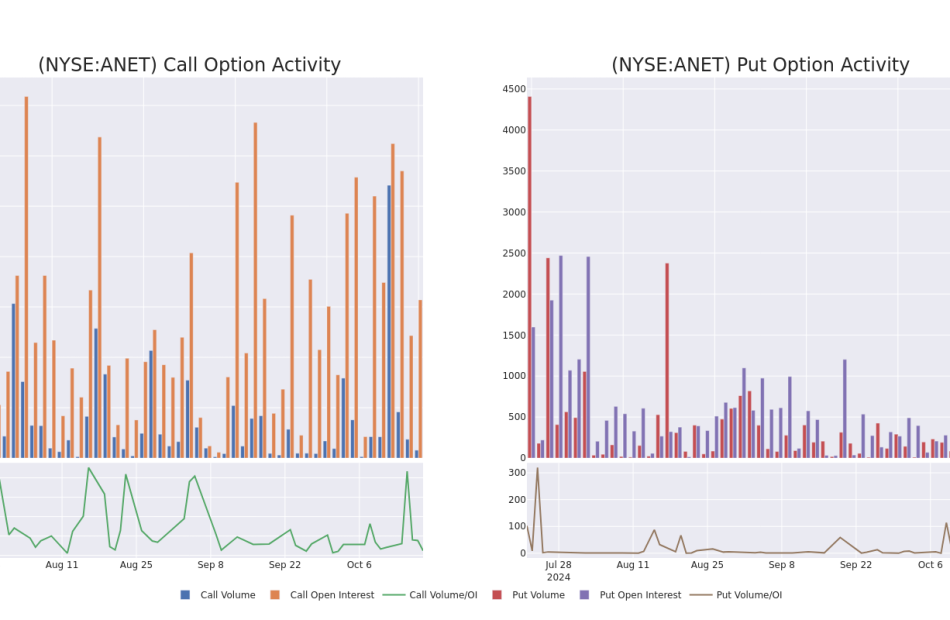

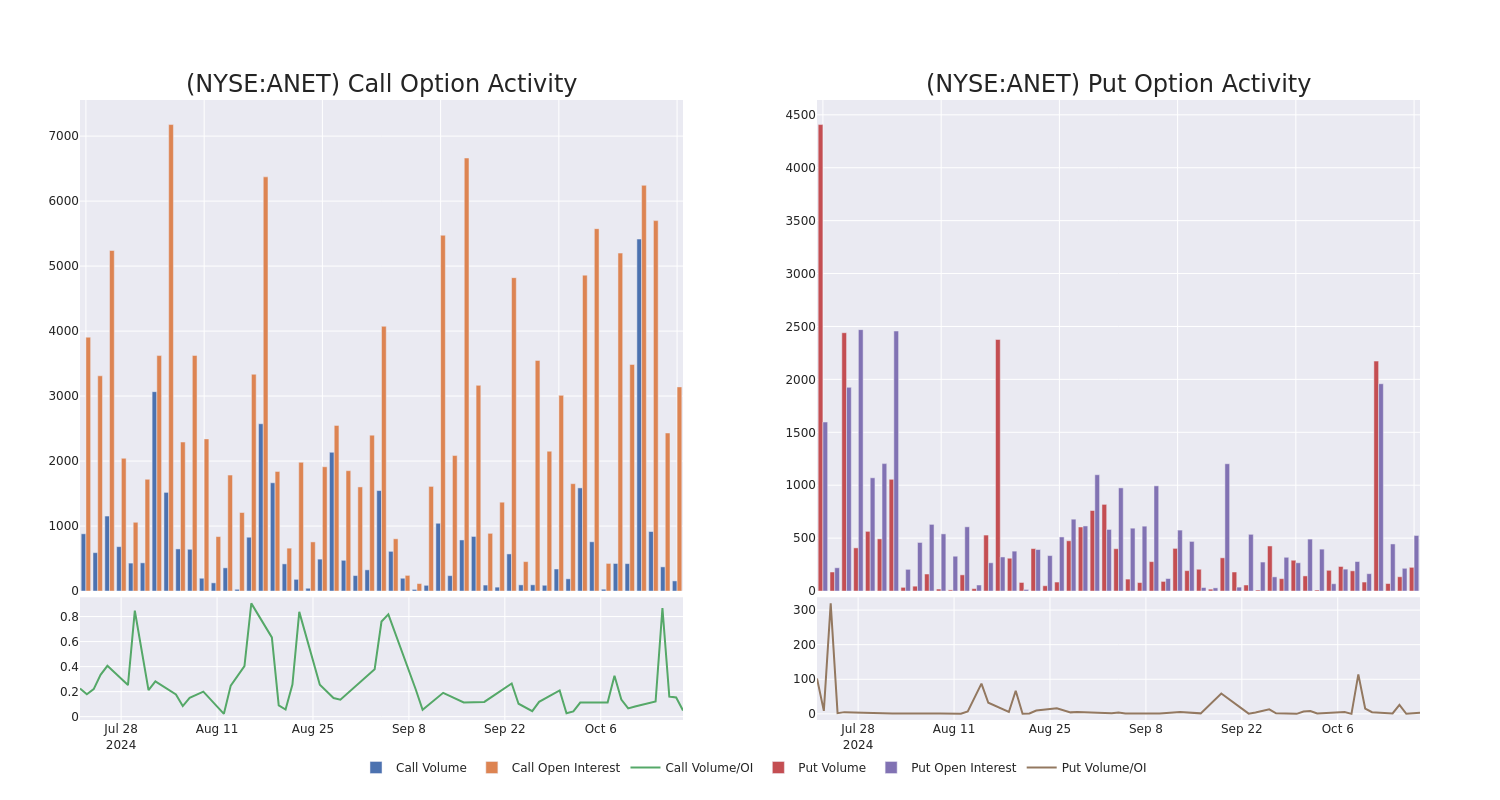

Arista Networks Options Trading: A Deep Dive into Market Sentiment

Financial giants have made a conspicuous bullish move on Arista Networks. Our analysis of options history for Arista Networks ANET revealed 21 unusual trades.

Delving into the details, we found 28% of traders were bullish, while 28% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $296,060, and 13 were calls, valued at $495,684.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $300.0 and $420.0 for Arista Networks, spanning the last three months.

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Arista Networks’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Arista Networks’s substantial trades, within a strike price spectrum from $300.0 to $420.0 over the preceding 30 days.

Arista Networks Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANET | CALL | TRADE | NEUTRAL | 11/15/24 | $94.1 | $92.6 | $93.47 | $310.00 | $65.4K | 118 | 7 |

| ANET | CALL | TRADE | NEUTRAL | 01/17/25 | $115.7 | $112.1 | $113.6 | $300.00 | $56.8K | 323 | 0 |

| ANET | PUT | TRADE | BEARISH | 11/15/24 | $22.0 | $21.6 | $21.92 | $400.00 | $54.8K | 176 | 55 |

| ANET | CALL | TRADE | BULLISH | 02/21/25 | $46.4 | $46.1 | $46.4 | $400.00 | $46.4K | 121 | 2 |

| ANET | PUT | TRADE | BULLISH | 10/25/24 | $8.2 | $4.6 | $4.6 | $405.00 | $45.9K | 44 | 0 |

About Arista Networks

Arista Networks is a networking equipment provider that primarily sells Ethernet switches and software to data centers. Its marquee product is its extensible operating system, or EOS, that runs a single image across every single one of its devices. The firm operates as one reportable segment. It has steadily gained market share since its founding in 2004, with a focus on high-speed applications. Arista counts Microsoft and Meta Platforms as its largest customers and derives roughly three quarters of its sales from North America.

Following our analysis of the options activities associated with Arista Networks, we pivot to a closer look at the company’s own performance.

Where Is Arista Networks Standing Right Now?

- With a trading volume of 612,154, the price of ANET is down by -1.35%, reaching $401.87.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 20 days from now.

Expert Opinions on Arista Networks

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $438.3333333333333.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Citigroup has decided to maintain their Buy rating on Arista Networks, which currently sits at a price target of $460.

* An analyst from Goldman Sachs has decided to maintain their Buy rating on Arista Networks, which currently sits at a price target of $430.

* An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Arista Networks, which currently sits at a price target of $425.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Arista Networks with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.