United Group Named Accredited Management Organization (AMO) of The Year by the Institute of Real Estate Management (IREM®)

TROY, N.Y., Oct. 17, 2024 /PRNewswire/ — United Plus Property Management, LLC, AMO® (UPPM), the management arm of The United Group of Companies, Inc. has been named the “Accredited Management Organization (AMO) of The Year” by the Institute of Real Estate Management (IREM®).

IREM® named UPPM the AMO of the Year during the 2024 Real Estate Management Excellence (REME) International Awards in Indianapolis, Indiana. UPPM was also a finalist for REME’s Innovator Award which highlighted United Group’s award-winning lifestyle program the Senior Umbrella Network (SUN Program).

“I am honored and humbled to have my property management company, United Plus Property Management, LLC, chosen as the Best Accredited Management Organization (“AMO“) in the country by the Institute of Real Estate Management (“IREM”),” Michael Uccellini, United Group’s President and CEO said. “United founded the Albany Chapter of IREM and has been a staunch supporter and participant in IREM locally, regionally, and nationally. IREM is an amazing organization for the property management industry and its educational offerings are second to none.”

2024 marks the second year UPPM has been named AMO of the Year by IREM®. The management company also earned the title in 2019 after earning its AMO® accreditation in 2018.

“United takes full advantage of IREM’s educational offerings and has many Certified Property Managers (“CPMs”) and Accredited Resident Managers (“ARMs”) on its staff. United’s passion for education, cutting edge technology, and efficiencies in systems and programs is a continuous, transformational effort on a monthly and annual basis to deliver the best-in-class property and asset management to our owners, residents and tenants,” Michael Uccellini said.

According to IREM®, the AMO of the Year award recognizes an AMO firm that works to advance the real estate management profession, provide outstanding service to clients, tenants, and residents, bolsters employee participation in IREM activities, support employee professional development on industry-specific knowledge, and more.

To learn more about the IREM® REME Awards, click here.

About The United Group of Companies, Inc.

United Group is a full-service, vertically integrated leader in real estate development and management with over 50 years of industry expertise. This expertise includes over 25,000 units developed and acquired, $4 Billion+ in completed projects, 2,000+ units in development and construction, and over 28,000 units managed. Our mission is to develop vibrant communities where our residents and commercial tenants of all ages, backgrounds, and interests- feel welcome, connected, and supported. We take pride in our award-winning lifestyle programs, firmly believing that where you live and work should be an experience that enriches and improves your life. We provide a place to call home and a space where businesses thrive in each community we serve. Our commitment to innovation sets us apart, ensuring that our investors, partners, and residents experience the true United difference.

CONTACT: Jeddy Johnson

EMAIL: Jeddy.Johnson@UGOC.com

CELL: 518-805-7884

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/united-group-named-accredited-management-organization-amo-of-the-year-by-the-institute-of-real-estate-management-irem-302279767.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/united-group-named-accredited-management-organization-amo-of-the-year-by-the-institute-of-real-estate-management-irem-302279767.html

SOURCE United Group of Companies

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Veteran's Widow Receives a New Roof Through the Owens Corning Roof Deployment Project

BURBANK, Calif., Oct. 18, 2024 /PRNewswire/ — Barbara MacMillan, widow of U.S. Navy veteran Kimball MacMillan, was recently awarded a new roof courtesy of Roof Repair Specialist, as part of the Owens Corning Roof Deployment Project. This nationwide initiative is dedicated to showing gratitude to veterans who served the United States, as well as the families who continue to support them. Since its launch in 2016, the project has provided more than 600 veterans and their families with free roof replacements.

The Owens Corning Roof Deployment Project partnered with Purple Heart Homes to select Barbara MacMillan as a recipient. Barbara needed a roof replacement for some time, struggling to find the necessary resources to repair her home. Nearly a year ago, she was referred to Purple Heart Homes by another non-profit organization that, unfortunately, could not provide the assistance she needed. As a result, she continued to live with a deteriorating roof in the home she shared with her late husband.

The roof replacement marks a significant milestone for Barbara, who had faced difficulty in finding trustworthy contractors after being the target of scams in the past. Barbara expressed her appreciation for Roof Repair Specialist, highlighting the professionalism and care they demonstrated throughout the project. “I felt safe with them at my home,” she shared. “They went the extra mile, cleaning around my property, taking extra precautions, and making sure I was doing okay,” Barbara added that the staff’s dedication and attention to detail far exceeded her expectations.

The Owens Corning Roof Deployment Project aims to give back to the military community by easing the burden of home repairs for veterans and their families. This recent partnership with Roof Repair Specialist and Purple Heart Homes exemplifies the ongoing commitment to making a difference in the lives of those who have served.

For more information about Roof Repair Specialist, visit https://www.roofrepairspecialist.com.

About the Owens Corning Roof Deployment Project:

The Owens Corning Roof Deployment Project is a nationwide program that honors veterans who served our country and the families who support them, providing free roof replacements to military families in need.

About Roof Repair Specialist:

A family-owned company with roots in Pasadena and Burbank CA, Roof Repair Specialist has over a decade of experience in roof repairs and replacement. They specialize in fixing leaks for residential and commercial properties and offer fair estimates without pushing for full roof replacements unless necessary. They promise to provide quality roofing solutions with exceptional customer service.

![]() View original content:https://www.prnewswire.com/news-releases/veterans-widow-receives-a-new-roof-through-the-owens-corning-roof-deployment-project-302279911.html

View original content:https://www.prnewswire.com/news-releases/veterans-widow-receives-a-new-roof-through-the-owens-corning-roof-deployment-project-302279911.html

SOURCE Roof Repair Specialist

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Timothy OShaughnessy At Graham Hldgs Executes Options Exercise, Realizing $2.49M

A large exercise of company stock options by Timothy OShaughnessy, President and CEO at Graham Hldgs GHC was disclosed in a new SEC filing on October 17, as part of an insider exercise.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Thursday showed that OShaughnessy, President and CEO at Graham Hldgs, a company in the Consumer Discretionary sector, just exercised stock options worth 25,752 shares of GHC stock with an exercise price of $719.15.

Currently, Graham Hldgs shares are trading down 0.95%, priced at $815.68 during Friday’s morning. This values OShaughnessy’s 25,752 shares at $2,485,840.

Unveiling the Story Behind Graham Hldgs

Graham Holdings Co. is a diversified education and media company made up of subsidiaries. Firm operations include educational services; television broadcasting; online, print, and local news; home health and hospice care; and manufacturing. The Company segments into the following seven reportable segments: Kaplan International, Higher Education, Supplemental Education, Television Broadcasting, Manufacturing, Healthcare, and Automotive. The majority of revenue comes from the Kaplan International segment, which includes higher education, test preparation, language instruction, and professional training. A large portion of company revenue also comes from the television broadcasting segment through advertising.

Understanding the Numbers: Graham Hldgs’s Finances

Revenue Growth: Graham Hldgs’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 7.27%. This signifies a substantial increase in the company’s top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Analyzing Profitability Metrics:

-

Gross Margin: With a low gross margin of 29.82%, the company exhibits below-average profitability, signaling potential struggles in cost efficiency compared to its industry peers.

-

Earnings per Share (EPS): Graham Hldgs’s EPS reflects a decline, falling below the industry average with a current EPS of -4.79.

Debt Management: With a below-average debt-to-equity ratio of 0.32, Graham Hldgs adopts a prudent financial strategy, indicating a balanced approach to debt management.

Navigating Market Valuation:

-

Price to Earnings (P/E) Ratio: Graham Hldgs’s P/E ratio of 27.21 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.8 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio of 5.94 trails industry averages, indicating a potential disparity in market valuation that could be advantageous for investors.

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

The Relevance of Insider Transactions

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

A Closer Look at Important Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Graham Hldgs’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Germany's Medical Marijuana Market Is Booming, Says Cannabis Producer Reporting Record Quarter

Cantourage Group SE reported its financial results for the period from July 1 to September 30 revealing a new record quarter in the company’s history. The Berlin-headquartered cannabis company posted revenue of EUR 13.2 million ($14.32 million).

Last month, the company announced that it had exceeded its total annual revenue for 2023 (EUR 23.6 million) from Jan.1 to August 30, 2024, by posting revenue of EUR 24.9 million. Another positive EBITDA, between EUR 900,000 and EUR 1.1 million in the third quarter of 2024, suggests Cantourage can convert current developments in European medical cannabis markets into sustainable, profitable growth. Revenue of at least EUR 40 million is expected for the full year of 2024.

“It is important for investors to realize that the only areas in Germany and Europe in which truly profitable and growing business models can be established and monetized are those related to medical cannabis,” stated Philip Schetter, CEO of Cantourage, according to translation. “I am not aware of any German company that is growing significantly and operating profitably with seeds, cuttings and non-commercial association structures.”

Read Also: German Medical Marijuana Sales To Reach $1.09B By 2028, New Report

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Partial cannabis legalization took effect in Germany on April 1, allowing people over 18 to legally possess up to 25 grams of dried cannabis and cultivate up to three plants at home. One of the biggest breakthroughs under the law is that medical cannabis is essentially regulated like ibuprofen.

Cannabis clubs became legal on July 1, 2024, and the first such marijuana social clubs opened their doors on July 8 in Lower Saxony. However, across many other states, applications for cannabis cultivation associations face multiple setbacks. In August, Berlin granted its first permission for cannabis cultivation.

“The real legalization of recreational cannabis that contains THC, as is the case in North America, for example, is off the table here for the time being,” added Schetter. “Nevertheless, medical cannabis is here to stay and will continue to grow. We are pleased that so many people in Germany have found their way to cannabis therapy in the past few months. This development will definitely continue in the future. Millions of cannabis users who have so far treated themselves for sleep disorders, pain or other widespread diseases – and have often resorted to unsafe products from the black market for this purpose – can now access safe preparations in pharmaceutical quality. We deliver these products through our flexible and efficient sourcing model, which we can and will continue to scale up in the months ahead. One thing is clear to us: regardless of what happens in the recreational market, the medical market will play the leading role in the years to come in ensuring that people in Germany and other European countries have access to safe, tested cannabis.”

Read Next:

Courtesy of Africa Studio on Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Progressive Leads the Way as Analysts Bet Big on Insurance Stocks

Most investors dismiss insurance stocks as the boring niche in the finance sector without realizing that this industry could significantly outperform all others during an economy ridden by threats of prolonged higher inflation. Today’s environment is ripe for insurance businesses to rally further into the year, if not continue their bullish momentum into 2025.

Markets don’t need to understand the insurance ins and outs to know that when the price of the assets being insured increases, so do the insurance premiums being charged to protect that item. Not only that, insurance companies will increase prices by a set premium to avoid any further inflation shocks that may come their way, making them the perfect business to keep in mind during interest rate cut cycles such as today.

The prime target, who holds significant market share and is a household name, has become the Progressive Co. PGR, especially after the company reported its latest set of quarterly earnings to show investors just how much growth awaits them by choosing to invest in insurance companies this cycle. Wall Street analysts agree, and markets love it just as much.

Progressive Stock Earnings Signal Strong Growth

With inflation up roughly 3% to 3.5% over the past 12 months, Progressive’s new signed-up policies had a compound effect on the company’s revenues. According to the latest quarterly earnings press release, Progressive reported up to 25% jumps in net premiums written.

The addition of new premiums through policies ended up raising Progressive’s premiums by 23%, laying the foundation for further double-digit growth in the rest of the business. The bottom line, exciting to investors, saw enough growth to get Wall Street’s attention this quarter.

A 108% expansion in net income should be enough to send any stock into a new rally. Progressive stock’s price action shows the company now trading at 96% of its 52-week high as a sign of bullish interest surrounding the stock today. But it doesn’t stop there.

Earnings per share (EPS) forecasts from Wall Street analysts today are set for a flattish pattern in the next 12 months, which is considerably below the recent track record Progressive has shown markets. Over the past 12 months, Progressive reported EPS growth of up to 110% to reach $3.97.

All of this growth might not be priced in, despite the stock trading near a 52-week high price, and that is something a few Wall Street analysts – alongside broader markets – have started to notice in the way they’ve expressed their views and action toward Progressive stock lately.

Wall Street Weighs In on Progressive Stock’s Future: Key Insights for Investors

Now, for another gauge, investors can consider moving forward in their hunt for upside in the insurance industry; here is what Wall Street has to say about Progressive stock. This is a particularly important view now that the company has reported such a strong quarterly trend.

The consensus price target for Progressive stock is $268.2 a share today, which calls for up to 5% upside from where it trades today. While this benchmark is good enough to beat inflation this year, that’s not why investors want to stick around for this insurance play.

After the company released its latest quarter, filled with double—and even triple-digit growth, analysts at Bank of America reiterated their Buy target for Progressive, this time coupling their view with a much higher price target. These analysts see the stock trading as high as $331 a share, daring it to rally by as much as 30% from where it trades today, not to mention a new all-time high for the company.

Broader markets are also willing to express their bullish view for Progressive stock today, a trend investors can see in the premiums paid for the stock compared to peers in the industry. Progressive’s price-to-book (P/B) ratio of 7.5x today commands a significant premium over the insurance industry’s average 2.2x valuation.

More than that, on a price-to-earnings (P/E) basis, Progressive stock again commands a premium as it trades at 21.7x compared to the industry’s 15.6x multiple. Markets will typically overpay for stocks they believe will grow at above-average rates, so this time, the premium is more than justified in Progressive’s triple-digit EPS growth during the year.

Lastly, there are even signs of bearish capitulation, judging by the 8% decline in short interest for Progressive over the past month, an accelerating trend as overall short interest has declined during the third quarter of 2024.

The article “Progressive Leads the Way as Analysts Bet Big on Insurance Stocks” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Rise, Netflix Soars To Record Highs, Oil Falls Below $70, Gold Miners Rally: What's Driving Markets Friday?

Wall Street was in positive territory in Friday midday trading, buoyed by upbeat quarterly earnings reports that kept investor sentiment bullish.

Netflix Inc. NFLX surged 10% to fresh record highs after delivering a strong earnings beat. The tech-heavy Nasdaq 100 rose 0.8%, pushing its weekly performance into positive territory for the sixth consecutive week.

The S&P 500 and Dow also edged higher, both on track for the sixth straight week of gains, with the Dow flirting with all-time highs.

Gold miners led industry performance as gold prices hit new record levels above $2,700 per ounce. The VanEck Gold Miners ETF GDX soared over 4%, hitting the highest level in over four years. Friday is poised to mark the fourth straight session of gains for both gold and silver, with silver jumping over 3%, heading for its best day since late September.

West Texas Intermediate (WTI) crude prices tumbled more than 2%, slipping below the $70-per-barrel mark. WTI is down over 8% for the week, on pace for its worst weekly decline since January.

Bitcoin BTC/USD climbed 2.8% to above $68,800.

Friday’s Performance In Major US Indices, ETFs

| Major Indices | Price | 1-day % change |

| Nasdaq 100 | 20,352.25 | 0.8% |

| S&P 500 | 5,870.75 | 0.5% |

| Dow Jones | 43,300.82 | 0.1% |

| Russell 2000 | 2,279.45 | -0.1% |

According to Benzinga Pro data:

- The SPDR S&P 500 ETF Trust SPY rose 0.5% to $585.12.

- The SPDR Dow Jones Industrial Average DIA inched 0.1% higher to $433.01.

- The tech-heavy Invesco QQQ Trust Series QQQ rose 0.8% to $495.21.

- The iShares Russell 2000 ETF IWM stalled at $226.03.

- The Communication Services Select Sector SPDR Fund XLC outperformed, up 0.9%. The Energy Select Sector SPDR Fund XLE lagged, down 0.6%.

Friday’s Stock Movers

- Stocks moving in reaction to earnings reports were Intuitive Surgical Inc. ISRG, up over 9%, Crown Holdings Inc. CCK, up over 4%, Western Alliance Bancorporation WAL, down 6%, American Express Company AXP, down 2.4%, Procter & Gamble Co. PG down 0.4%, Schlumberger N.V. SLB down 3.3%, Fifth Third Bancorp FITB, down 1.7%, Ally Financial Inc. ALLY, down 1% and Comerica Inc. CMA, up 4%.

- Lamb Weston Holdings Inc. LW soared 10% following a report indicating that activist investor Jana Partners has built a 5% stake in the company.

- CVS Health Corp. CVS fell over 6% after the company replaced its CEO and cut its third-quarter outlook.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

USD/JPY Adjusts Amid Mixed Signals From Japan's Economic Data

By RoboForex Analytical Department

USD/JPY is experiencing a correction phase following two days of gains as mixed economic signals emerge from Japan. Despite ongoing expectations for monetary tightening by the Bank of Japan (BoJ), the yen faces downward pressure from a slowdown in domestic inflation, potentially dampening the urgency for immediate rate hikes.

Japan’s consumer prices increased by 2.5% year-on-year in September, marking a decrease from the 3.0% inflation rate recorded in August. This slowdown has been the first since March of this year and represents the lowest inflation level since April of this year. The core inflation index, a key metric for the BoJ, rose by 2.4%, down from 2.8% in August, yet has remained above the BoJ’s target of 2.0% for 30 consecutive months. Notably, inflation excluding food and energy was recorded at 2.1% in September, a slight increase from 2.0% in August.

Recent comments from BoJ board member Seiji Adachi suggest a preference for moderate rate adjustments, reflecting concerns over global economic uncertainty and the domestic pace of wage increases. Additionally, the yen’s persistent weakness has drawn attention from Japan’s top currency diplomat, Atsushi Mimura, who reiterated the government’s focus on monitoring exchange rate fluctuations and its stance against excessive volatility.

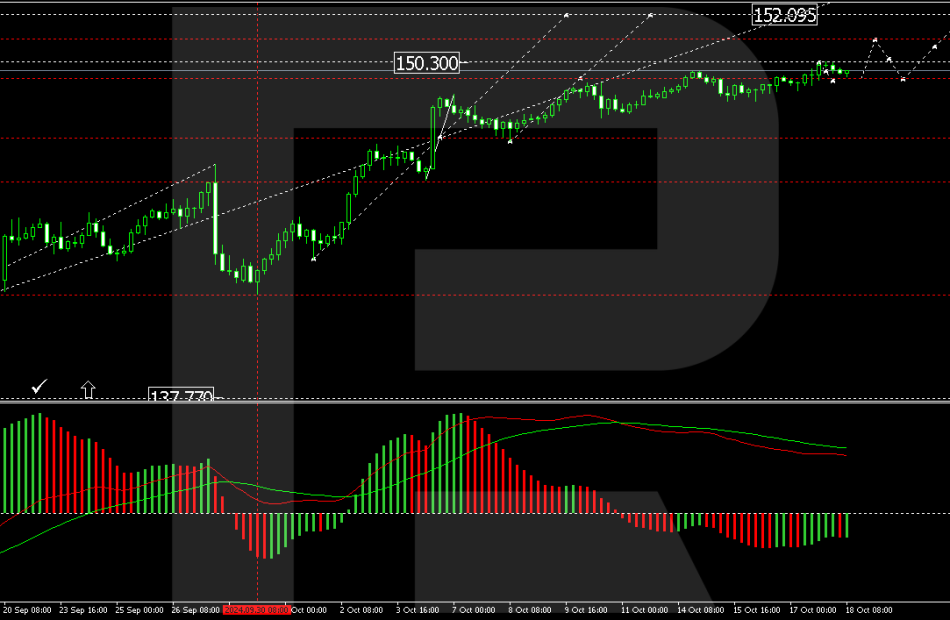

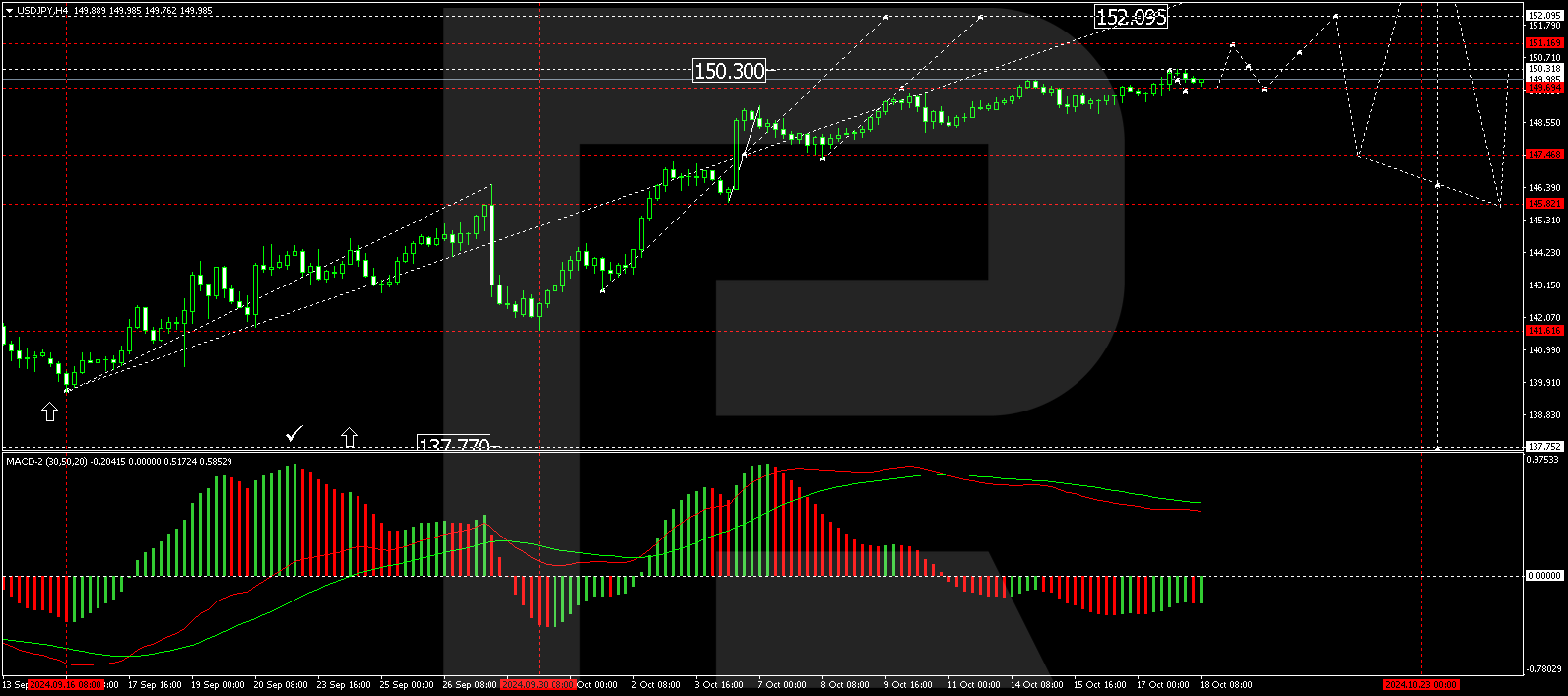

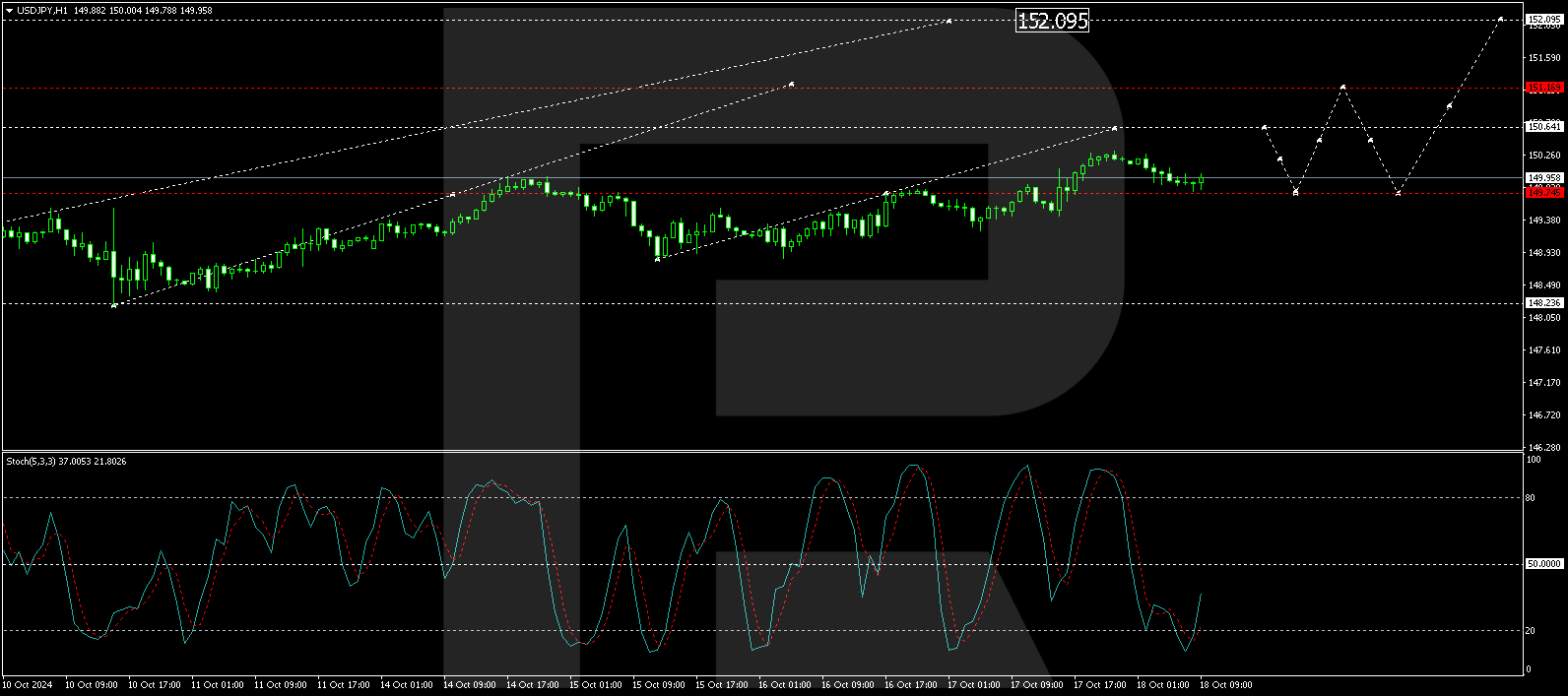

USD/JPY Technical Analysis

The USD/JPY pair recently peaked at 150.30 and is now forming a decline towards 149.75, testing this level from above. Looking ahead, we anticipate a potential resurgence towards 151.15. A successful breach of this level could open the way to 152.09. Conversely, a drop below 149.70 could trigger a further correction down to 147.70. The MACD indicator supports this potential upward trajectory, with the signal line positioned above zero and poised to reach new highs.

On the hourly chart, USD/JPY has established a consolidation range between 149.75 and 150.30. The current market dynamics suggest a correction towards 149.75. However, following this correction, there is a potential for a rebound to 150.65, setting the stage for an extended rise to 151.15. This bullish outlook is corroborated by the Stochastic oscillator, with its signal line advancing from 20 towards 80, indicating a strengthening momentum for upward movement.

Disclaimer

Any forecasts contained herein are based on the author’s particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Carbon Fiber Market Estimated to Reach $23.2 billion by 2033 Globally, at a CAGR of 12.6%, says MarketsandMarkets™

Delray Beach, FL, Oct. 17, 2024 (GLOBE NEWSWIRE) — The Carbon Fiber Market is projected to grow from USD 7.1 billion in 2023 to USD 23.2 billion by 2033, at a CAGR of 12.6% during the forecast period, as per the recent study by MarketsandMarkets. The growth of the carbon fiber market is being driven by a number of factors, including the The increasing demand for lightweight and fuel-efficient materials in the aerospace industry, Growing industrialization and rising disposable income in developing economies have contributed to the growth of the automotive industry and, in turn, the demand for carbon fibers. The high cost of carbon fiber production remains a concern that could hinder market growth. The growing adoption of carbon fibers in wind energy and renewable energy sectors has boosted the carbon fiber market.

Download PDF Brochure: https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=396

Browse in-depth TOC on “Carbon Fiber Market”

311 – Market Data Tables

32 – Figures

321 – Pages

List of Key Players in Carbon Fiber Market:

- Toray Industries Inc., (Japan)

- Teijin Limited (Japan)

- Mitsubishi Chemical Group Corporation (Japan)

- Hexcel Corporation (US)

- Solvay (Belgium)

- SGL Carbon (Germany)

- Hyosung Advanced Materials (South Korea)

- Zhongfu Shenying Carbon Co., Ltd. (China)

- Kureha Corporation (Japan)

- DowAksa (Turkey)

- Jilin Chemical Fiber Group Co., Ltd. (China)

- Jiangsu Hengshen Co., Ltd. (China)

- Anshan Sinoda Carbon Fibers Co., Ltd. (China)

- China National Bluestar (Group) Co., Ltd. (China) among others.

Drivers, Restraints, Opportunities and Challenges in Carbon Fiber Market:

- Driver: Rising demand of regular tow carbon in pressure vessels leading the growth of carbon fiber based composites

- Restraint: Lack of standardization in manufacturing technologies

- Opportunity: Increasing demand for fuel cell electric vehicles (FCEVs)

- Challenge: Production of low-cost carbon fiber

Key Findings of the Study:

- Based on the end-use industry, the pressure vessels segment is estimated to account for the highest CAGR in the Carbon Fiber market share during the forecast period.

- Based on application, composites application is anticipated to register the highest CAGR in the Carbon Fiber market.

- Europe to hold the largest market share during the forecast period.

Get Sample Pages: https://www.marketsandmarkets.com/requestsampleNew.asp?id=396

Based on raw material type, PAN-based segment is expected to have the largest share of the carbon fiber market in 2022 by value. The PAN-based carbon fiber segment dominated the overall carbon fiber market due to its high strength modulus compared to other types of carbon fibers. PAN-based carbon fiber has a higher demand due to its cost-effectiveness and better quality of fiber produced. PAN-based carbon fibers constitute the most important group and are highly desirable in high-performance composites for aircraft, aerospace, and other highly technical applications. Pitch-based carbon fibers possess unique structural characteristics that have offered a variety of new applications.

Based on application, The composite segment is expected to have the largest share of the carbon fiber market in 2022 by value. Carbon fiber’s exceptional strength, stiffness, and lightweight nature make it a vital material in composite applications. It enhances the composite’s durability, allowing for lighter and stronger designs in aircraft, cars, boats, and even sports equipment. This translates to improved fuel efficiency, increased payload capacity, and enhanced performance across various industries, despite the current challenge of high cost. As technology advances and production becomes more efficient, expected carbon fiber to continue shaping the future of lightweight and sustainable materials.

Get 10% Customization on this Report: https://www.marketsandmarkets.com/requestCustomizationNew.asp?id=396

The manufacturing process of carbon fiber involves several complex steps that transform the precursor materials into the final carbon fiber product. The high cost of carbon fiber production remains a concern that could hinder its market growth, and future efforts on carbon fiber research will be focused on cost reduction and property enhancement.

Based on Region, Europe was the largest market for the carbon fiber in 2022, with Germany being the largest market in the region. The European market has seen a rise in the demand for lightweight and fuel-efficient vehicles, leading to a higher consumption of carbon fibers in the automotive industry. Additionally, the presence of a wide base of electric car manufacturers in Europe has led to an increased demand for carbon fibers, as these vehicles require lightweight materials for improved efficiency, and the export-oriented nature of its industries contribute to the dynamic growth and development of the carbon fiber market across Europe.

Browse Adjacent Markets: Fibers and Composites Market Research Reports & Consulting

Related Reports:

- Poly Lactic Acid (PLA) Market – Global Forecast to 2028

- Green Hydrogen Market – Global Forecast to 2030

- Membranes Market – Global Forecast to 2029

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.