NuScale Rockets Higher On Amazon Deal: How High Can It Go?

Amazon’s AMZN latest foray into nuclear energy shows the technology has reached a critical mass. Long known to be a critical component of carbon reduction goals, costs, time constraints, and safety were barriers. Today’s difference is Small Modular Reactor technology, which is about to blossom. The name says it all: SMR focuses on smaller, modular reactors that are more accessible, more cost-efficient to build, and scalable, a win-win for today’s big tech companies. Companies like NuScale Power Company SMR, which develops SMRs, are positioned to win as the industry blossoms.

Big tech companies like Amazon, Microsoft MSFT, and Google GOOGL are leaning toward SMR technology to power their data centers. Data centers use the most advanced, highest-powered semiconductors and servers, consuming far more power than any technology that has come before. Recent estimates show that power consumption per AI data center is 1.5x that of their predecessors or higher, with the number of DCs growing and technology advancing rapidly. The technology is also critical to corporate carbon neutrality plans. It also has a bonus: SMRs will support the national grid, not just the power-hungry AI data centers built alongside them, reducing demand for carbon-based energy.

What Is NuScale Technology And Why It Matters

NuScale Technology designs, manufactures, and deploys the only U.S.-regulated SMR available. Its NuScale Power Module can produce 77 megawatts of power, a tiny amount compared to US demand. Still, the NPM can be scaled up with the VOYGR production plant technology, linking up to 12 reactors into a single unit. The reactors are designed for multipurpose use, producing power and using the heat generated for other applications, including desalinization and hydrogen production. NuScale commercializes its products through a partnership with ENTRA1.

NuScale hasn’t produced significant revenue yet but is on track to ramp sales in 2025. A recent deal with Standard Power is only the tip of the iceberg. Standard Power will build two facilities to produce power for its data centers in Pennsylvania and Ohio. Standard Power is a private equity firm focused on data centers and colocation services for cryptocurrency miners, AI, and other high-power computing needs. The plans are for two 12-unit VOYGR plants for a total capacity of 1,848 MWe.

Sell-Side Lends Support, Headwinds Are Present

Analysts are warming to NuScale in 2024 and may provide a tailwind for the market in Q4 and 2025. Among the most recent reports are initiated coverage from CSLA and Craig Hallum, which peg the stock at Moderate Buy/Buy. However, the consensus target is about 50% below the recent action, and the recent price pop puts the market above the range’s high end. Without new revisions, this stock could experience a sharp correction to realign with analysts’ sentiment.

Institutional support is building and provides a tailwind for the market. The caveat is that ownership remains light at 15% of the shares, and quarterly activity slowed as share prices rose in 2024. Short interest is also high, likely to have amplified the upswings and cause for concern. Investors should expect volatility. Because short interest is so high, over 25% at the end of September, the short sellers may be repositioning at the new highs. This stock price could be corrected by 15% to 30% before hitting solid support levels in this scenario.

The Technical Outlook: NuScale Powers To A New High

The price action in SMR shares is vigorous. The market surged more than 40% following Amazon’s news and could continue to increase on momentum, short-covering, and the bubble named Small Modular Reactors. The market has broken above critical resistance at $16.75, with indicators confirming the move, so the chart has a significant bullish bias. Because the indicators are low in their respective ranges, the market could continue to advance for several more weeks before topping out.

The article “NuScale Rockets Higher on Amazon Deal: How High Can It Go?” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Glimpse of SmartFinancial's Earnings Potential

SmartFinancial SMBK is set to give its latest quarterly earnings report on Monday, 2024-10-21. Here’s what investors need to know before the announcement.

Analysts estimate that SmartFinancial will report an earnings per share (EPS) of $0.47.

The market awaits SmartFinancial’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

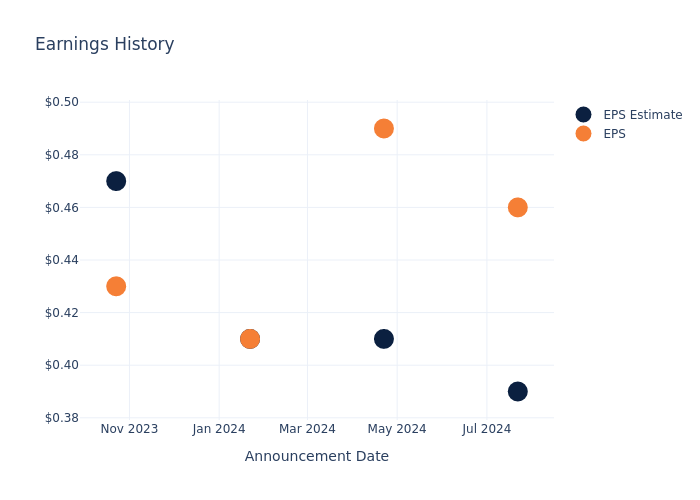

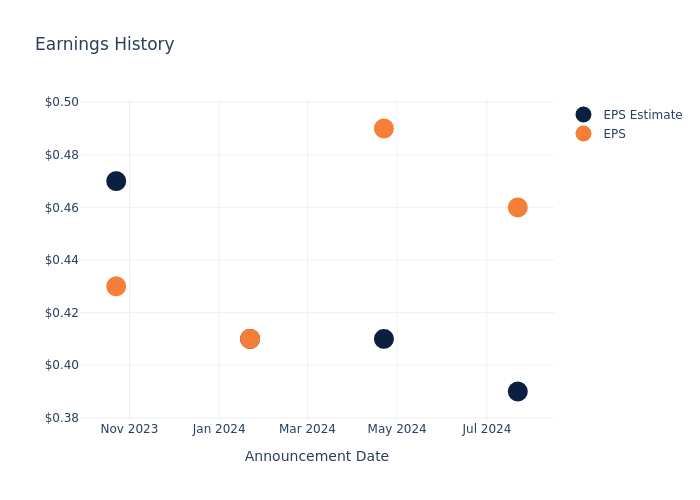

Performance in Previous Earnings

The company’s EPS beat by $0.07 in the last quarter, leading to a 3.43% increase in the share price on the following day.

Tracking SmartFinancial’s Stock Performance

Shares of SmartFinancial were trading at $31.5 as of October 17. Over the last 52-week period, shares are up 54.35%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for SmartFinancial visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trick Or Treat: Rivian Rolls Out Spooky Halloween Update Featuring Car Costumes, Creepy Chirps

EV startup Rivian Automotive RIVN said on Thursday that it will launch its Halloween software update starting Oct. 18, complete with spooky features and car costumes.

What Happened: The company announced the update in a video posted on social media platform X featuring actor David Hasselhoff who starred in the Knight Rider series.

One of the car costumes available with the update is inspired by Knight Rider. The costume will alter the Rivian’s interior display system and the exterior lightbar on Gen 2 R1 vehicles will cascade a red beam to replicate the experience of K.I.T.T, the robotic automobile that featured in the series.

There are also other car costumes available with the update, inspired by iconic and classic vehicles from pop culture, such as one inspired by the time machine in Universal Pictures and Amblin Entertainment’s Back to the Future, in addition to a spooky option.

The haunted Rivian car costume has eight different sound effects and three different color themes to choose from ranging between purple, yellow, red, and green. The interior display screen will feature static and ghosts to increase the spooky feeling when the vehicle is parked with the costume.

Besides Costumes: Besides costumes, Rivian’s new update changes pedestrians on the driver display to zombies and bicyclists and motorcyclists into headless horsemen.

Vehicle owners can also play multiple spooky chirp sounds, including one resembling the owl.

However, the spooky features will only be available for a limited time until November 4, the company warned. Additionally, both the vehicle and the Rivian mobile app must be updated to their latest versions for the features, it added.

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read More:

Photo courtesy: Rivian

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Examining the Future: Preferred Bank's Earnings Outlook

Preferred Bank PFBC is preparing to release its quarterly earnings on Monday, 2024-10-21. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect Preferred Bank to report an earnings per share (EPS) of $2.38.

Preferred Bank bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

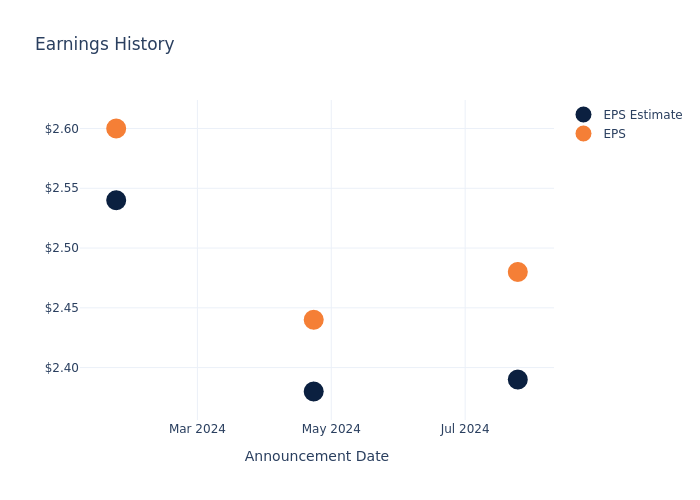

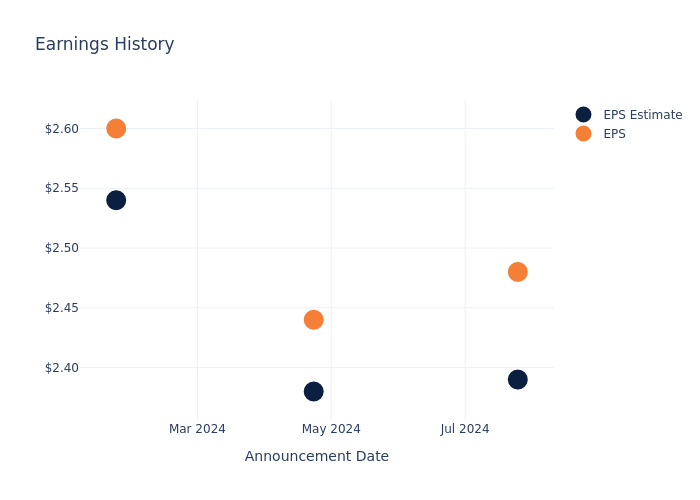

Overview of Past Earnings

During the last quarter, the company reported an EPS beat by $0.09, leading to a 4.68% increase in the share price on the subsequent day.

Here’s a look at Preferred Bank’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 2.39 | 2.38 | 2.54 | 2.56 |

| EPS Actual | 2.48 | 2.44 | 2.60 | 2.71 |

| Price Change % | 5.0% | -0.0% | -3.0% | -4.0% |

Performance of Preferred Bank Shares

Shares of Preferred Bank were trading at $85.08 as of October 17. Over the last 52-week period, shares are up 40.6%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Preferred Bank visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At Apple's Recent Unusual Options Activity

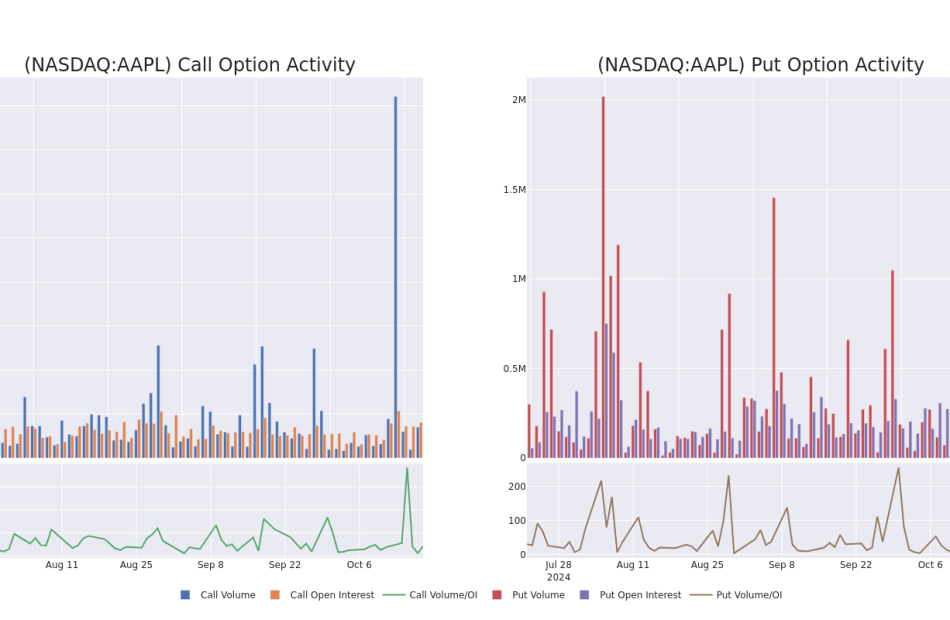

Whales with a lot of money to spend have taken a noticeably bearish stance on Apple.

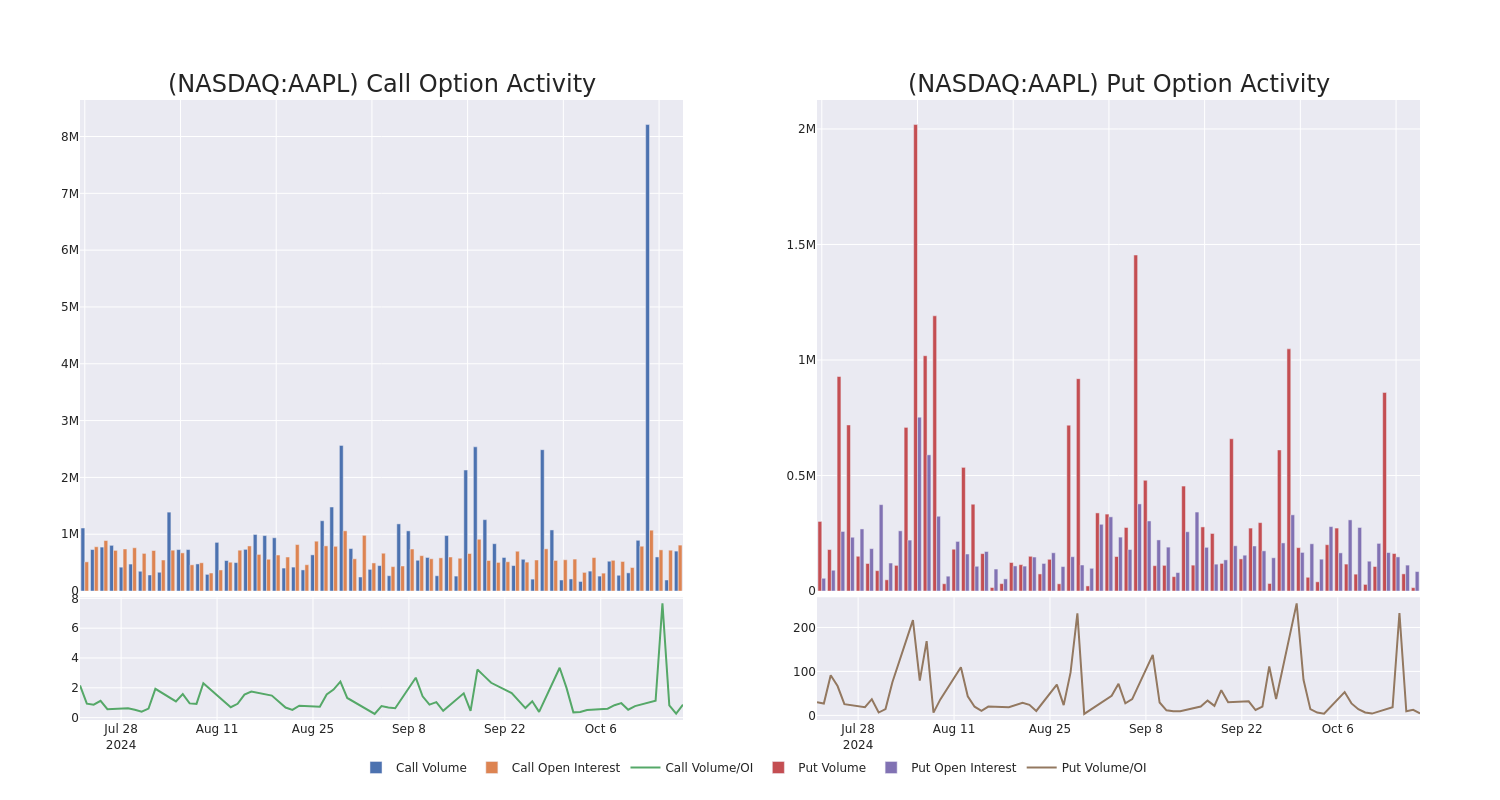

Looking at options history for Apple AAPL we detected 100 trades.

If we consider the specifics of each trade, it is accurate to state that 38% of the investors opened trades with bullish expectations and 47% with bearish.

From the overall spotted trades, 13 are puts, for a total amount of $745,832 and 87, calls, for a total amount of $5,521,596.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $100.0 to $250.0 for Apple over the recent three months.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Apple options trades today is 17176.67 with a total volume of 717,783.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Apple’s big money trades within a strike price range of $100.0 to $250.0 over the last 30 days.

Apple Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | CALL | SWEEP | BEARISH | 10/25/24 | $2.4 | $2.39 | $2.4 | $235.00 | $435.0K | 29.5K | 29.0K |

| AAPL | CALL | SWEEP | BEARISH | 10/18/24 | $7.3 | $7.2 | $7.2 | $227.50 | $249.1K | 9.5K | 859 |

| AAPL | PUT | SWEEP | BULLISH | 06/20/25 | $3.8 | $3.7 | $3.71 | $190.00 | $186.5K | 17.8K | 533 |

| AAPL | CALL | SWEEP | BEARISH | 06/20/25 | $45.8 | $45.65 | $45.73 | $200.00 | $137.2K | 7.4K | 30 |

| AAPL | CALL | SWEEP | NEUTRAL | 10/18/24 | $59.95 | $59.6 | $59.75 | $175.00 | $119.5K | 1.8K | 64 |

About Apple

Apple is among the largest companies in the world, with a broad portfolio of hardware and software products targeted at consumers and businesses. Apple’s iPhone makes up a majority of the firm sales, and Apple’s other products like Mac, iPad, and Watch are designed around the iPhone as the focal point of an expansive software ecosystem. Apple has progressively worked to add new applications, like streaming video, subscription bundles, and augmented reality. The firm designs its own software and semiconductors while working with subcontractors like Foxconn and TSMC to build its products and chips. Slightly less than half of Apple’s sales come directly through its flagship stores, with a majority of sales coming indirectly through partnerships and distribution.

Present Market Standing of Apple

- Trading volume stands at 26,764,299, with AAPL’s price up by 1.62%, positioned at $235.91.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 13 days.

What Analysts Are Saying About Apple

5 market experts have recently issued ratings for this stock, with a consensus target price of $237.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Needham downgraded its action to Buy with a price target of $260.

* In a cautious move, an analyst from B of A Securities downgraded its rating to Buy, setting a price target of $256.

* An analyst from Needham downgraded its action to Buy with a price target of $260.

* Maintaining their stance, an analyst from Barclays continues to hold a Underweight rating for Apple, targeting a price of $186.

* An analyst from Piper Sandler has revised its rating downward to Neutral, adjusting the price target to $225.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Apple options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elevance, CVS, UnitedHealth Struggle With Rising Medical Costs After COVID-19 Medicaid Policy Ends

Several large insurers have reported higher-than-expected medical costs, particularly in their government-sponsored Medicaid plans, following the end of a pandemic-era policy that required insurers to keep members enrolled.

The Details: The end of the COVID-19 public health emergency triggered significant changes to Medicaid coverage, including the end of the continuous enrollment provision, which prevented states from disenrolling members during the pandemic. Beginning on April 1, 2023, states began the process of redetermining eligibility for all Medicaid enrollees, which created a disparity between payments from states and rising trends in medical expenses for insurers.

Analysts at William Blair recently noted that large managed care organizations (MCOs) seem to be facing pressure regarding Medicaid utilization. At the same time, outdated data often determine the premiums they receive from states.

Effects on Insurers: Elevance Health, Inc. ELV lowered its annual profit forecast Thursday due to persistently high medical costs tied to its Medicaid plans, which account for 20% of the company’s total medical membership.

“The issues impacting the Medicaid business are time-bound,” Elevance CEO Gail Boudreaux said on the company’s earnings call.

CVS Health Corp. CVS replaced its CEO on Friday and cut its third-quarter outlook to earnings of between $1.05 and $1.10, compared to the consensus estimate of $1.70. The company cited “elevated medical cost pressures in the Health Care Benefits segment” as a cause of the revision.

UnitedHealth Group Inc. UNH reported its third-quarter results on Tuesday and also lowered its annual profit forecast as challenges across its government-supported health insurance businesses continue.

UnitedHealth’s president and CFO John Rex pointed to “the continued timing mismatch between the current health status of Medicaid members and state rate updates” as an ongoing pressure point for the company.

“As a result of the lagging care activity data, as well as the annual rate cycle timing, updates remain well short of current care activity, a factor that for us was more pronounced through the period than anticipated,” Rex said on the company’s post-earnings conference call.

Read Also:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oriental Rise Serves Up Steamy IPO For Tea Lovers

Key Takeaways:

- Oriental Rise’s shares posted strong gains in their Nasdaq trading debut, as the company raised a relatively modest $7 million

- The company will use IPO proceeds to help fund a major expansion that will boost its land area under cultivation by 50%

By Doug Young

Move over, bubble tea chains.

Oriental Rise Holding Ltd. ORIS has just served up a new kind of tea offering on the Nasdaq, this one far more traditional than the trendy new generation of bubble teas offered by the likes of ChaBaiDao (2555.HK) and Nayuki (2150.HK) in Hong Kong. Investors certainly seemed to like the flavor of Oriental Rise’s business cultivating and selling white tea leaves, boosting the stock by 50% on Thursday, its first trading day.

The company raised a relatively modest $7 million from the listing, which saw it issue 1.75 million shares priced at $4 each. Tiger Securities was the sole underwriter.

Unlike the ultracompetitive bubble tea space, China’s traditional tea sector is relatively underrepresented on public markets, despite the nation’s thousands of years of history cultivating the leaves. China is more focused on promoting high-tech companies in sectors like microchips and autonomous driving these days, leaving little room for this kind of traditional tea producer to raise funds on the country’s policy-driven domestic financial markets.

But such companies still offer some big potential due to the industry’s fragmented nature, populated by lots of small producers operating in relatively remote areas due to the requirement for high elevations, often in mountainous regions, needed to grow tea. Oriental Rise is also noteworthy for its niche in white tea, which is relatively unknown outside China compared to more common green and black teas.

Known for its anti-oxidant properties and more subtle taste due to relative lack of processing compared with those other types, China’s white tea market is growing far faster than the overall tea market, according to Oriental Rise’s prospectus. Third-party data in the document shows China’s white tea sales more than tripled from 2.9 billion yuan ($407 million) in 2017 to 9.1 billion yuan in 2021, representing 32.8% annual growth. The figure is expected to further grow to 16 billion yuan in annual sales by 2026.

By volume, the sale of white tea leaves also grew by a similar 34.1% annually from 21,800 tons in 2017 to 70,500 tons in 2021. By comparison, overall domestic tea sales in China grew by a far slower 6.1% annually from 1.8 million tons to 2.3 million tons over that period, with the figure expected to reach 2.8 million tons in 2026, according to the prospectus.

Oriental Rise’s own growth is far less impressive, largely constrained by the company’s limited land supply. The company operates farms under contract with local villages in Zherong county of South China’s Fujian province, known for its year-round mild weather, abundant rainfall and mountainous area that is conducive to tea planting. It works closely in contractual arrangements with local committees in the villages of Zhaizhong and Huangbai.

Such arrangements are common in China, where land is typically controlled by local village committees, and thus good relations with those committees are critical to doing successful business. Such arrangements also present one of the greatest risks for companies like Oriental Rise and other agri-businesses, since land use policies are constantly changing in China, and what’s allowable one day may become improper the next.

“Based on the advice of our PRC legal advisers, we believe that the village committees of Zhaizhong and Huangbai Village had been properly authorized to act on behalf of all of the farmer-households in the relevant villages,” it said in the prospectus, addressing such risk.

Big Expansion

As we’ve previously noted, Oriental Rise’s revenue and profits have been relatively steady in the last two years due to constraints caused by the size of its tea farms. Its revenue totaled $24.1 million last year, roughly flat from $24.3 million in 2022. Its net profit was also quite steady at $11.5 million last year from $11.9 million in 2022.

Some simple math will show Oriental Rise’s gross margin was quite enviable for this kind of traditional company, rising slightly to 53% last year from 52% in 2022. Those margins should continue to improve if the company can expand its operation and gain greater economies of scale, which brings us back to the issue of land constraints.

The company notes that it actually received more orders than it could fill in the last two years, forcing it to turn away around 92 million yuan worth of business in both 2022 and 2023. It’s planning to address that issue with a major expansion, which will be an important use for its IPO proceeds. We should also note Oriental Rise is quite cash-rich for a company of its size, with $36.7 million in its coffers at the end of last year, up sharply from $25.7 million a year earlier.

The company currently produces its teas on 7.2 square kilometers of land in Zherong county. But it has entered into letters of intent with the two villages where it operates for rights to cultivate another 3.5 square kilometers, which would increase its land area by roughly 50%. It said the land acquisition would cost about 87.6 million yuan, which it would finance from its cash flow and IPO proceeds.

The company is also in the process of building a new tea processing plant, which would require about $5 million for land acquisition and another $730,000 to build and equip the new facility. That means that altogether the acquisition of new farmland and construction of the new processing plant would cost the company about $18 million, which looks quite affordable given its current cash reserves and positive cash flow.

Oriental Rise’s big jump on its first trading day contrasts sharply with a 3.2% decline for the MSCI China Small-Cap Index on Thursday, and gives Oriental Rise a market value of about $132 million. Even after the big first-day jump, the company still trades at a relatively modest price to earnings (P/E) ratio of just 13. Most similar tea producers, many from India, trade far higher, such as CCL Products (CCL.NS) with a P/E of 34 and Goodricke Group (GOODRICKE.BO) at 22. That could indicate some strong upside potential for Oriental Rise’s stock, as it offers up a new type of tea flavor for western investors.

This article is from an unpaid external contributor. It does not represent Benzinga’s reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Mid-Cap Stocks Under $20 With Insider Buying and Major Upside

The financial news frequently emphasizes stocks with heavy insider selling, premised on the assumption that insiders believe the stock is overpriced and that they are taking profits ahead of retail investors. However, most of the time, these sales are part of a previously disclosed plan and disclosed to the SEC months in advance.

This proves the saying that investors have many reasons to sell a stock, but the same is not necessarily true of insider buying. Typically, insiders have only one reason to buy a stock. That is, they believe it’s fundamentally undervalued.

When you combine an undervalued stock with a price below $20, you have a chance for impressive gains. That’s the case with the three stocks on this list. Plus, you can factor in the idea that these are mid-cap stocks that offer more potential for growth than more mature large-cap stocks but remove the risk that can be found in unprofitable small-cap stocks.

Transocean Is Well-Positioned for a Potential Oil Supercycle

Transocean Ltd. RIG leases rigs and drilling equipment for oil companies. The company’s lease rate directly correlates to the price of oil at the time the contracts are originated. RIG stock is trading at $4.26 as of October 11, 2024.

However, even with a consensus Hold rating, analysts are forecasting a price of $6.88, which offers a 61% upside.

An insider has bought shares on two separate occasions since its second-quarter earnings report in July. The transactions amounted to $3.5 million shares of RIG stock.

But why should you believe the insiders? First, the macroeconomic picture is favorable. The Federal Reserve started its interest rate cutting cycle with an aggressive 50-basis point cut in September. Energy stocks are expected to benefit as lower rates tend to stimulate business activity which is generally bullish for oil.

Second, the company signed two high-value contracts which will have over 90% of its fleet committed through 2025. And the company is well-positioned for more contracts if offshore drilling projects become less regulated in 2025.

Crescent Energy Nears 52-Week High and New Highs Could Be Ahead

Another mid-cap stock in the energy sector is Crescent Energy Co. CRGY. The company has a different way of playing the energy sector because its business model focuses on acquiring resources rather than developing them. Its portfolio is heavily concentrated in the Eagle Ford and Uinta Basins.

Since the company’s second-quarter earnings report in August, different executives and insiders have purchased CRGY stock on four separate occasions.

The purchases seem well timed, as the stock was up 31% in the month ending October 11 and is nearing its 52-week high. The short-term catalyst for the stock is its inclusion in the S&P SmallCap 600 index, which usually brings with it a flurry of buying from institutional investors whose funds use the index as a benchmark.

That said, the longer-term catalyst for CRGY stock is similar to that of other oil companies: a resurgence in oil prices due to increased drilling activity in 2025 and beyond. Analysts give the stock a $16.20 price target, which offers investors a 20% upside.

Forget the Robo Taxi; Mobileye May Be a Better Short-Term Buy

When combing through the list of stocks with heavy insider buying on MarketBeat, Mobileye Global Inc. MBLY instantly caught my eye. The company, which is partially owned by Intel Corp. INTC, is a leader in autonomous driving technology.

The company’s EyeQ chips power Mobileye’s flagship SuperVision platform, consisting of 11 cameras and autonomous vehicle maps that grow smarter over time.

MBLY stock went public in October 2022. The meme stock movement was over at that point, but for about a year, Mobileye delivered an impressive return for investors. It’s been a long fall from that point. In fact, the stock is down over 72% in 2024. The Mobileye analyst forecasts on MarketBeat show the stock with three uncomfortable sell ratings.

Still, the stock has a consensus Hold and a $26.85 price target, which provides an upside of over 107%. Autonomous driving may still be years away (the Robo Taxi isn’t set for production until 2027), but no matter who wins the White House, the move towards non-carbon transportation is not slowing down.

The article “3 Mid-Cap Stocks Under $20 With Insider Buying and Major Upside” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.