Billionaire Israel Englander Just Bought 30.9 Million Shares in This Little-Known Warren Buffett and Cathie Wood Stock. Time to Buy?

Financial services is one of Warren Buffett’s favorite industries. His investment vehicle, Berkshire Hathaway, owns a number of insurance and bank stocks.

Another high-profile investor, Cathie Wood, also owns a number of financial services stocks across her exchange-traded funds (ETFs). One rare position that Wood and Buffett share is a fintech company called Nu Holdings (NYSE: NU).

Recently, I was taking a look at some 13F filings and discovered that another well-known Wall Street titan, Israel Englander of Millennium Management, purchased 30.9 million shares of Nu Holdings last quarter — increasing the hedge fund’s position by 370%.

If you’re unfamiliar with Nu Holdings, you might want to put it on your radar. Let’s dig into what makes this up-and-coming financial services company so attractive, and explore if now is a good opportunity to join Buffett, Wood, and Englander.

What does Nu Holdings do?

At its core, Nu is a banking platform. The company offers a variety of services including credit cards, lending, insurance, and investing — all made easy through the company’s online platform.

Simple enough, right? Well, there’s actually a little more to the picture.

While Nu may be seen as a commoditized business offering the same set of products as other larger industry incumbents, there is one big differentiator at play here. Namely, Nu absolutely dominates a key geographic region: Latin America.

Why Nu could be a lucrative opportunity

Financial services and online banking may seem second nature for many people. However, many areas around the world have not yet fully integrated these services and technology into everyday life.

In Latin America, digital banking is still an emerging product. According to a recent study by the Inter-American Development Bank (IDB), the number of fintech start-ups across Latin America and the Caribbean has risen by 340% during the past six years. Brazil, Mexico, and Colombia account for the majority of this growth in the region.

These trends have surely been a tailwind for Nu. At the end of the second quarter of 2018, Nu boasted roughly 5 million customers on its platform. As of the end of the 2024 second quarter, the company has grown more than 20-fold to 105 million customers.

As the company continues acquiring more customers, Nu should be able to strengthen its unit economics by cross-selling additional products and services — further boosting its average revenue per user (ARPU).

With revenue growth eclipsing 50% on a consistent basis, gross profit margin in excess of 40%, and consistent positive net income, Nu is demonstrating an impressive financial profile across the board and I don’t see that slowing anytime soon.

Is Nu a good stock to buy right now?

As of the time of this article, Nu trades at a forward price-to-earnings (P/E) multiple of 23.8.

To put this into perspective, Nu’s forward P/E is trading considerably lower than those of other emerging fintechs such as SoFi Technologies or Upstart — both of which compete in much more saturated markets. Moreover, the average forward P/E of the S&P 500 is 23 — nearly identical to that of Nu. I’d wager that most companies in the S&P 500 aren’t having top line growth of between 50% and 60% on a consistent basis all while widening their profit margins.

To me, Nu is very much overlooked and may be mistaken as “just another bank.” Financial services have a long runway in Latin America, and given Nu’s meteoric rise across the region I’m hard-pressed to believe the company’s penetration will be disrupted by another player anytime soon.

I think the stock could easily become a multibagger for long-term investors and see the latest purchase from Englander as a savvy move.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Adam Spatacco has positions in SoFi Technologies. The Motley Fool has positions in and recommends Berkshire Hathaway and Upstart. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.

Billionaire Israel Englander Just Bought 30.9 Million Shares in This Little-Known Warren Buffett and Cathie Wood Stock. Time to Buy? was originally published by The Motley Fool

The 2024 Shanghai International City and Architecture Expo to open on Oct. 31

SHANGHAI, Oct. 18, 2024 (GLOBE NEWSWIRE) — The 2024 Shanghai International City and Architecture Expo will be held from October 31 to November 2 at the Shanghai World Expo Exhibition and Convention Center.

As a supporting event for this year’s World Cities Day, the expo is hosted by the United Nations Human Settlements Programme and the Shanghai Municipal Commission of Housing, Urban-Rural Development and Management. The Shanghai Coordination Center of World Cities Day is the co-organizer, while the Shanghai Green Building Council is the organizer.

The theme of this year’s expo focuses on innovation-driven green development and empowering people-oriented urban development with new quality productive forces. It will showcase the achievements of urban construction and development in Shanghai through diverse means.

The expo will highlight the application of green and low-carbon transformation, intelligent construction and operation efficiency improvement, as well as the renewal and upgrading of urban infrastructure. It aims to comprehensively demonstrate the effectiveness of Shanghai’s innovative construction management.

The expo includes two main exhibition areas, namely the exhibition on achievements in people-centered urban construction and the best practices from 16 districts of Shanghai.

Meanwhile, there are five major thematic exhibition areas, including urban sustainable development and green architecture, digital transformation and architectural technological innovation, urban renewal and projects that cater to the needs of the people, urban safety and operational security, as well as urban space and landscape environment exhibition.

In addition to exhibitions, a series of concurrent events such as the opening ceremony, main forum, series of forums, and business and trade matchmaking meetings will also be held.

Specifically, the expo this year introduces a digital transformation exhibition area for the housing and urban-rural development industry, which will comprehensively showcase the achievements of digital transformation in the housing and urban-rural development industry in Shanghai.

Source: World Cities Day & Shanghai Green Building Council

Contact person: Ms. Liu, Tel: 86-10-63074558

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

AYR Wellness to Hold Third Quarter 2024 Conference Call on November 13th at 8:30 a.m. ET

MIAMI, Oct. 17, 2024 (GLOBE NEWSWIRE) — AYR Wellness Inc. AYRAYRWF (“AYR” or the “Company”), a leading vertically integrated U.S. multi-state cannabis operator (“MSO”), will hold a conference call on Wednesday, November 13, 2024, at 8:30 a.m. ET to discuss results for the third quarter ended September 30, 2024.

AYR Interim CEO Steven Cohen and CFO Brad Asher will host the conference call, followed by a question-and-answer period. The Company will provide its financial results in a press release prior to the call.

Date: Wednesday, November 13, 2024

Time: 8:30 a.m. ET

Toll-free dial-in number: (844) 763-8274

International dial-in number: (647) 484-8814

Webcast: LINK

A telephonic replay of the conference call will also be available for one month until end of day Friday, December 13, 2024.

Toll-free replay number: (855) 669-9658

International replay number: (412) 317-0088

Replay ID: 8552657

Please dial into the conference call 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact the company’s investor relations team at ir@ayrwellness.com.

About AYR Wellness Inc.

AYR Wellness is a vertically integrated, U.S. multi-state cannabis business. The Company operates simultaneously as a retailer with 90+ licensed dispensaries and a house of cannabis CPG brands.

AYR is committed to delivering high-quality cannabis products to its patients and customers while acting as a Force for Good for its team members and the communities that the Company serves. For more information, please visit www.ayrwellness.com.

Investor Relations Contact:

Sean Mansouri, CFA

Elevate IR

T: (786) 885-0397

Email: ir@ayrwellness.com

Media Contact:

Robert Vanisko

VP, Public Engagement

T: (786) 885-0397

Email: comms@ayrwellness.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Stocks Steady as Traders Assess China, Rates Path: Markets Wrap

(Bloomberg) — US stock futures ticked higher as a recovery in Big Tech looked set to extend Friday, thanks to results from Netflix Inc. that eclipsed Wall Street’s expectations.

Most Read from Bloomberg

Contracts on the tech-heavy Nasdaq 100 rose 0.5%, as Netflix jumped 7% in US premarket trading. The streaming company beat expectations on key metrics, including subscriber additions in the third quarter. Apple Inc. rose as data showed China sales of its latest iPhone increased 20% in the first three weeks compared with the 2023 model.

Treasuries steadied from their heavy selling after a batch of strong data on the US economy Thursday recast expectations for interest-rate cuts. Stronger than forecast retail sales underscored how consumer spending continues to power the American economy, lessening the urgency for the Federal Reserve to unwind restrictive rate policy.

One beneficiary of the improving US economic narrative has been small-cap stocks. The Russell 2000 index touched a 2024 high this week as weakening inflation spurs bets the Fed has room to cut rates, albeit not by as much as previously thought.

Small caps are also getting a boost from the so-called Trump Trade, according to Bank of America Corp. strategist Michael Hartnett. In a note, he said there are signs investors are positioning for presidential victory by Donald Trump, moving into banks, small-cap stocks and the dollar, assets that rallied in November 2016 in the wake of his last successful run.

Bitcoin, another Trump Trade, closed in on a fresh record.

A broadening out of the stock rally beyond tech megacaps would be a development that Gene Salerno, chief investment officer at SG Kleinwort Hambros Ltd., said he’d welcome.

“It’s something frankly we’ve wanted to see for some time,” he said.

Key events this week:

-

US housing starts, Friday

-

Fed’s Christopher Waller, Neel Kashkari speak, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures rose 0.2% as of 8:22 a.m. New York time

-

Nasdaq 100 futures rose 0.5%

-

Futures on the Dow Jones Industrial Average fell 0.1%

-

The Stoxx Europe 600 rose 0.3%

-

The MSCI World Index was little changed

Currencies

-

The Bloomberg Dollar Spot Index fell 0.2%

-

The euro rose 0.2% to $1.0848

-

The British pound rose 0.3% to $1.3045

-

The Japanese yen rose 0.1% to 150.03 per dollar

Cryptocurrencies

-

Bitcoin rose 1.1% to $67,693.99

-

Ether rose 0.9% to $2,620.52

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 4.10%

-

Germany’s 10-year yield was little changed at 2.20%

-

Britain’s 10-year yield was little changed at 4.09%

Commodities

-

West Texas Intermediate crude rose 0.1% to $70.77 a barrel

-

Spot gold rose 0.7% to $2,711.98 an ounce

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Meg Short and Tatiana Darie.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Meet the Newest Addition to the S&P 500. The Stock Has Soared 575% Since Early Last Year, and It's Still a Buy Right Now, According to 1 Wall Street Analyst

The S&P 500 is regarded as the best overall benchmark of the U.S. stock market and consists of the 500 largest publicly traded companies in the country. Given the range of its member companies, it is considered to be the most dependable gauge of overall stock market performance. To become part of the S&P 500, a company must meet the following prerequisites:

-

Be a U.S.-based company.

-

Have a market cap of at least $8.2 billion.

-

Be highly liquid.

-

Have a minimum of 50% of its outstanding shares available for trading.

-

Be profitable according to GAAP in the most recent quarter.

-

Be profitable over the preceding four quarters in aggregate.

Palantir Technologies (NYSE: PLTR) is one of the most recent additions to the S&P 500, being added to the fold on Sept. 23. It’s also one of only 11 companies to make the grade so far this year. Since the advent of generative AI in early 2023, Palantir stock has surged 575%, its gains fueled by robust sales and profit growth.

Even after gains of that magnitude, some on Wall Street believe there’s more to come. Let’s review what has driven the stock higher and whether its lofty price has simply made it too risky.

AI solutions for the masses

Palantir made a name for itself serving the U.S. intelligence and law enforcement communities. The company’s first-of-their-kind algorithms could sift through mounds of data and connect seemingly disparate bits of information to track down would-be terrorists.

In more recent years, Palantir has applied its sophisticated algorithms to give enterprises a competitive edge by providing actionable business intelligence. Thanks in part to its decades of experience, the company quickly recognized the opportunity represented by generative AI and developed timely solutions to meet the need. Palantir’s Artificial Intelligence Platform (AIP) was born of those efforts. By leveraging existing company data, AIP can provide businesses with solutions tailored to specific needs.

The proof is in the pudding

Palantir’s go-to-market strategy for AIP is what helped set the company apart. The company offers boot camps that pair customers with Palantir engineers to help them fashion solutions to their unique challenges. This strategy has proven to be wildly successful.

Just last month, Palantir announced a new multi-year, multi-million-dollar contract with Nebraska Medicine, which used AIP to improve healthcare by harnessing technology. After what it describes as “a series of targeted bootcamps,” the health system was able to implement a new workflow that resulted in a more than 2,000% increase in its Discharge Lounge utilization, which freed up beds earlier and decreased the time needed to discharge a patient by one hour (on average).

This is just one example of dozens of customer testimonials that show that AIP is saving customers time and money — which in turn boosts Palantir financial results. In the second quarter, it closed 96 deals worth at least $1 million. Of those, 33 were worth $5 million or more, while 27 were worth at least $10 million. Furthermore, many of these deals were inked within just weeks of a successful boot camp session.

Taking a step back helps illustrate the impact on the company’s overall results. In the second quarter, Palantir’s revenue grew 27% year over year to $678 million while also climbing 7% quarter over quarter. This also marked the company’s seventh successive quarter of profit generation. Consistent profitability was the final hurdle needed to secure its admission to the S&P 500. Furthermore, Palantir’s U.S. commercial revenue, fueled by the success of AIP, grew 55% year over year, while the segments customer count grew by 83%. Even more impressive was the segment’s remaining deal revenue (RDV) which soared 103%. When RDV is growing faster than revenue, it shows that future revenue growth is accelerating.

Most experts suggest this is still the early innings for the adoption of AI software. In Ark Invest’s Big Ideas 2024, Cathie Wood calculates the opportunity for generative AI software could balloon to $13 trillion by 2030. The bull case is even more eye-catching, at $37 trillion.

Given Palantir’s unique take on AI implementation and the magnitude of the opportunity, it’s clear the company can continue to prosper in an increasingly AI-centric world.

Wall Street’s biggest Palantir bull

I’m not the only one who thinks so. On the heels of its admittance into the S&P 500, Greentech Research analyst Hilary Kramer posited that Palantir “easily can be” a $100 stock. That represents potential upside of 130% compared to Monday’s closing price.

Kramer believes that given the company’s strong revenue and profit growth and increasing backlog, investment banks will eventually have to get on board and increase their estimates, which will cause others to look at the stock, fueling a virtuous cycle.

Despite the massive opportunity and stellar execution, some investors will be put off by Palantir’s frothy valuation. The stock is currently selling for 122 times forward earnings and 29 times forward sales. However, using the forward price/earnings-to-growth (PEG) ratio — which considers the company’s impressive growth rate — clocks in at 0.4, when any number less than 1 signals an undervalued stock.

In a case like this, when valuation is a stumbling block, dollar-cost averaging allows investors to ease into the stock over time, picking up more shares when the price is more reasonable.

Make no mistake: Palantir is positioned to profit from the AI revolution. Investors with a stomach for some volatility and a bit more risk should consider a position is this cutting-edge AI stock.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Danny Vena has positions in Palantir Technologies. The Motley Fool has positions in and recommends Palantir Technologies. The Motley Fool has a disclosure policy.

Meet the Newest Addition to the S&P 500. The Stock Has Soared 575% Since Early Last Year, and It’s Still a Buy Right Now, According to 1 Wall Street Analyst was originally published by The Motley Fool

MEDIA ADVISORY – GOVERNMENT OF CANADA TO MAKE MAJOR HOUSING-RELATED ANNOUNCEMENT IN EDMONTON

EDMONTON, AB, Oct. 17, 2024 /CNW/ – Media are invited to join the Honourable Randy Boissonnault, Minister of Employment, Workforce Development and Official Languages– on behalf of the Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities, and Andrew Knack, Councillor.

|

Date: |

October 18, 2024 |

|

Time: |

12:00 pm MT |

|

Location: |

10414 142nd Street, Edmonton (please do not share publicly due to privacy of project) |

SOURCE Government of Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/17/c7496.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/17/c7496.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

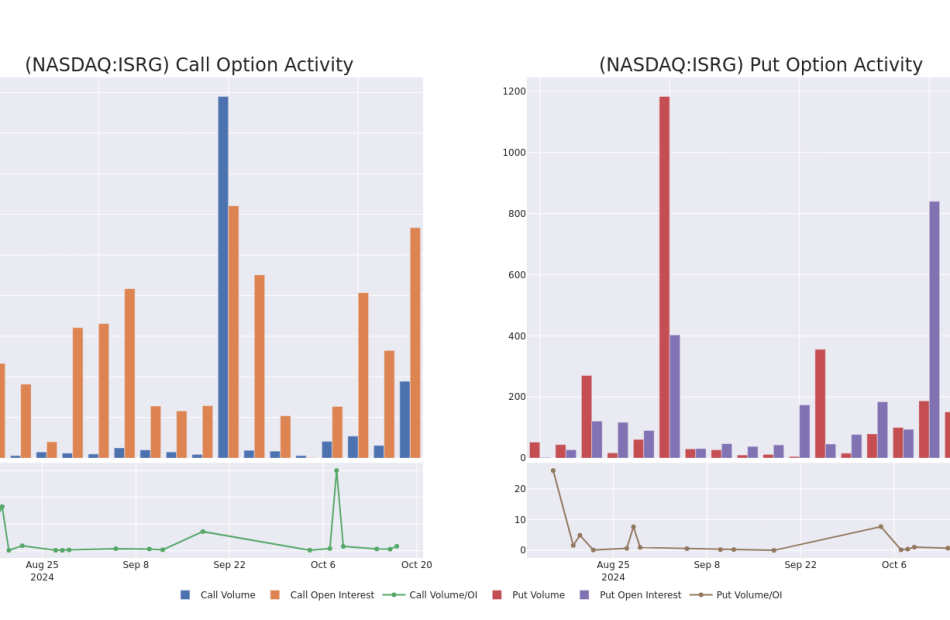

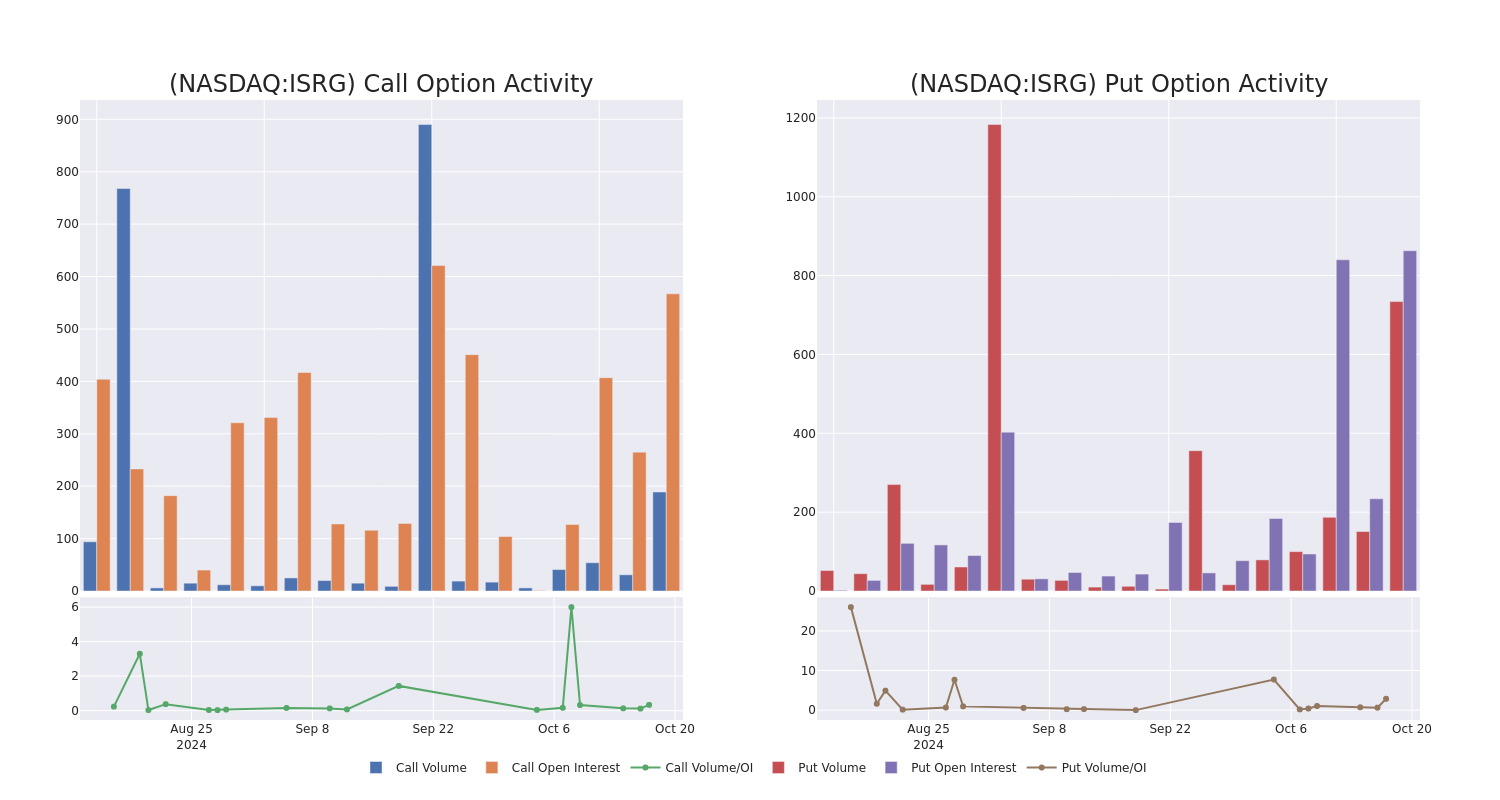

Unpacking the Latest Options Trading Trends in Intuitive Surgical

Whales with a lot of money to spend have taken a noticeably bearish stance on Intuitive Surgical.

Looking at options history for Intuitive Surgical ISRG we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $236,238 and 4, calls, for a total amount of $250,299.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $470.0 and $485.0 for Intuitive Surgical, spanning the last three months.

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of Intuitive Surgical stands at 238.33, with a total volume reaching 923.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Intuitive Surgical, situated within the strike price corridor from $470.0 to $485.0, throughout the last 30 days.

Intuitive Surgical Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ISRG | CALL | SWEEP | BULLISH | 01/17/25 | $28.0 | $27.9 | $28.0 | $485.00 | $145.5K | 299 | 54 |

| ISRG | PUT | TRADE | BULLISH | 01/17/25 | $27.9 | $27.4 | $27.5 | $475.00 | $110.0K | 243 | 63 |

| ISRG | PUT | SWEEP | BEARISH | 10/18/24 | $10.0 | $9.6 | $9.9 | $470.00 | $46.5K | 370 | 48 |

| ISRG | PUT | SWEEP | BEARISH | 10/18/24 | $13.4 | $12.9 | $13.3 | $475.00 | $41.2K | 250 | 340 |

| ISRG | CALL | SWEEP | NEUTRAL | 10/18/24 | $15.4 | $15.3 | $15.3 | $472.50 | $39.7K | 8 | 26 |

About Intuitive Surgical

Intuitive Surgical develops, produces, and markets a robotic system for assisting minimally invasive surgery. It also provides the instrumentation, disposable accessories, and warranty services for the system. The company has placed more than 8,600 da Vinci systems in hospitals worldwide, with more than 5,000 installations in the US and a growing number in emerging markets.

Having examined the options trading patterns of Intuitive Surgical, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Intuitive Surgical

- Currently trading with a volume of 1,808,262, the ISRG’s price is up by 5.54%, now at $503.0.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 0 days.

Expert Opinions on Intuitive Surgical

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $537.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Intuitive Surgical with a target price of $575.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Intuitive Surgical, targeting a price of $475.

* An analyst from RBC Capital persists with their Outperform rating on Intuitive Surgical, maintaining a target price of $525.

* An analyst from Truist Securities has decided to maintain their Buy rating on Intuitive Surgical, which currently sits at a price target of $570.

* Consistent in their evaluation, an analyst from Raymond James keeps a Outperform rating on Intuitive Surgical with a target price of $540.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intuitive Surgical with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mark Cuban Dismisses Dogecoin Founder's Concerns: Kamala Harris Is 'Night And Day Away From Biden And Far Ahead Of Trump' On Crypto Understanding

A recent exchange on X between entrepreneur Mark Cuban and a crypto enthusiast has shed light on Vice President Kamala Harris’s evolving stance on cryptocurrency, particularly Bitcoin (CRYPTO: BTC), in light of the November election.

What Happened: Cuban, responding to a suggestion that Harris should transfer the U.S. government’s 200,000 bitcoin to the treasury, provided insights into his discussions with Harris’s team about crypto policy.

Don’t Miss:

He pointed out that the treasury is legally obligated to dispose of confiscated assets, including the 69,000 Bitcoin currently in its possession, in a manner that benefits taxpayers.

“I was pushing for all confiscations in crypto to be held and not sold,” Cuban revealed, adding that he advised the team about the potential market impact of selling large amounts of Bitcoin quickly. He noted that the treasury “can’t sell in a way that will move the market” due to legal constraints.

Trending: Dogecoin millionaires are increasing – investors with $1M+ in DOGE revealed!

Cuban highlighted Harris’s recent statements about protecting digital asset holders, suggesting a significant shift in her understanding of the crypto ecosystem. “If you saw what she said today about protecting people who hold digital assets, it’s really clear they now get it. And it’s not just about btc and favoring the maxis,” he wrote.

Importantly, Cuban emphasized Harris’s recognition of the “app economy” and its relevance to younger generations. “She understands completely, and it really resonates with her that there are a lot of people who are in the ‘app economy’. They don’t open bank accounts. They use apps like Robinhood and Coinbase etc, and it’s easier to understand how to buy crypto,” Cuban explained.

He further noted that Harris is aware that many Gen Z individuals, particularly men, have a significant portion of their net worth in crypto. According to Cuban, Harris has pledged to “do what she can to protect them as consumers and as owners.”

Trending: 1 in 4 Americans own a share of Bitcoin according to NASDAQ, how many people got started through this free crypto faucet?

Dogecoin co-creator Billy Markus popularly known as Shibetoshi Nakamoto also responded to his tag on the Cuban post. He believes that cryptocurrency is beyond the understanding of many lawmakers and it “messes with the existing laws.”

Why It Matters: Cuban’s defense of Harris’s cryptocurrency knowledge comes amid her unveiling of a new regulatory framework aimed at supporting digital assets. As part of her “Opportunity Agenda for Black Men,” Harris’s proposal acknowledges the growing importance of cryptocurrencies among Black Americans, with over 20% reportedly owning or having owned crypto assets, according to her team.

In another statement, Cuban defended Harris and emphasized her genuine approach compared to other political figures. He noted, “She doesn’t know everything. Unlike your guy [Trump], she doesn’t pretend. She understands the connection cryptocurrency has to young people.”

What’s Next: The Benzinga Future of Digital Assets event on Nov. 19. will explore the question of digital asset regulations and the influence of Bitcoin as an institutional asset class.

Read Next:

Image: Shutterstock

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Mark Cuban Dismisses Dogecoin Founder’s Concerns: Kamala Harris Is ‘Night And Day Away From Biden And Far Ahead Of Trump’ On Crypto Understanding originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.