Unpacking the Latest Options Trading Trends in Intuitive Surgical

Whales with a lot of money to spend have taken a noticeably bearish stance on Intuitive Surgical.

Looking at options history for Intuitive Surgical ISRG we detected 8 trades.

If we consider the specifics of each trade, it is accurate to state that 37% of the investors opened trades with bullish expectations and 50% with bearish.

From the overall spotted trades, 4 are puts, for a total amount of $236,238 and 4, calls, for a total amount of $250,299.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $470.0 and $485.0 for Intuitive Surgical, spanning the last three months.

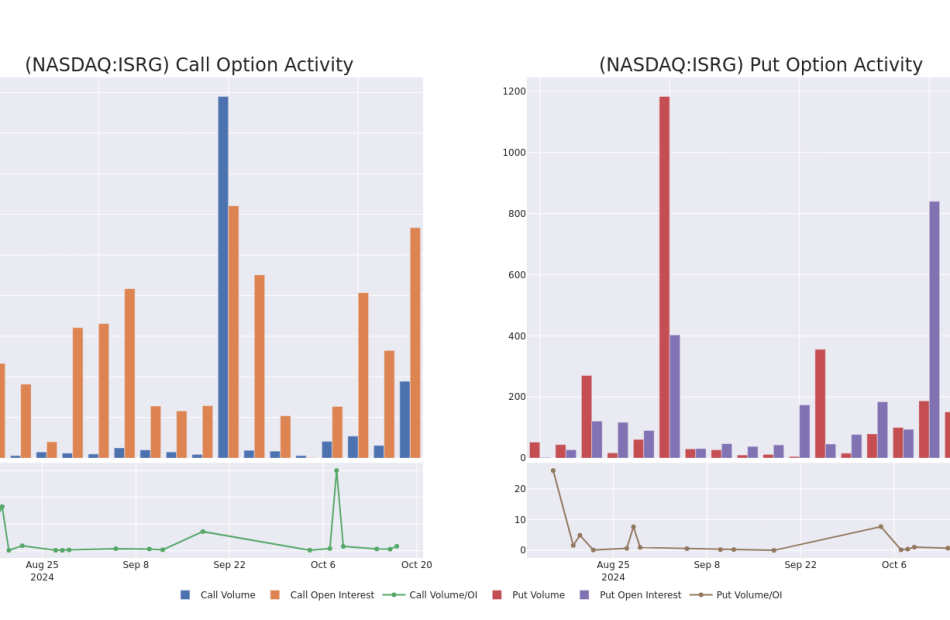

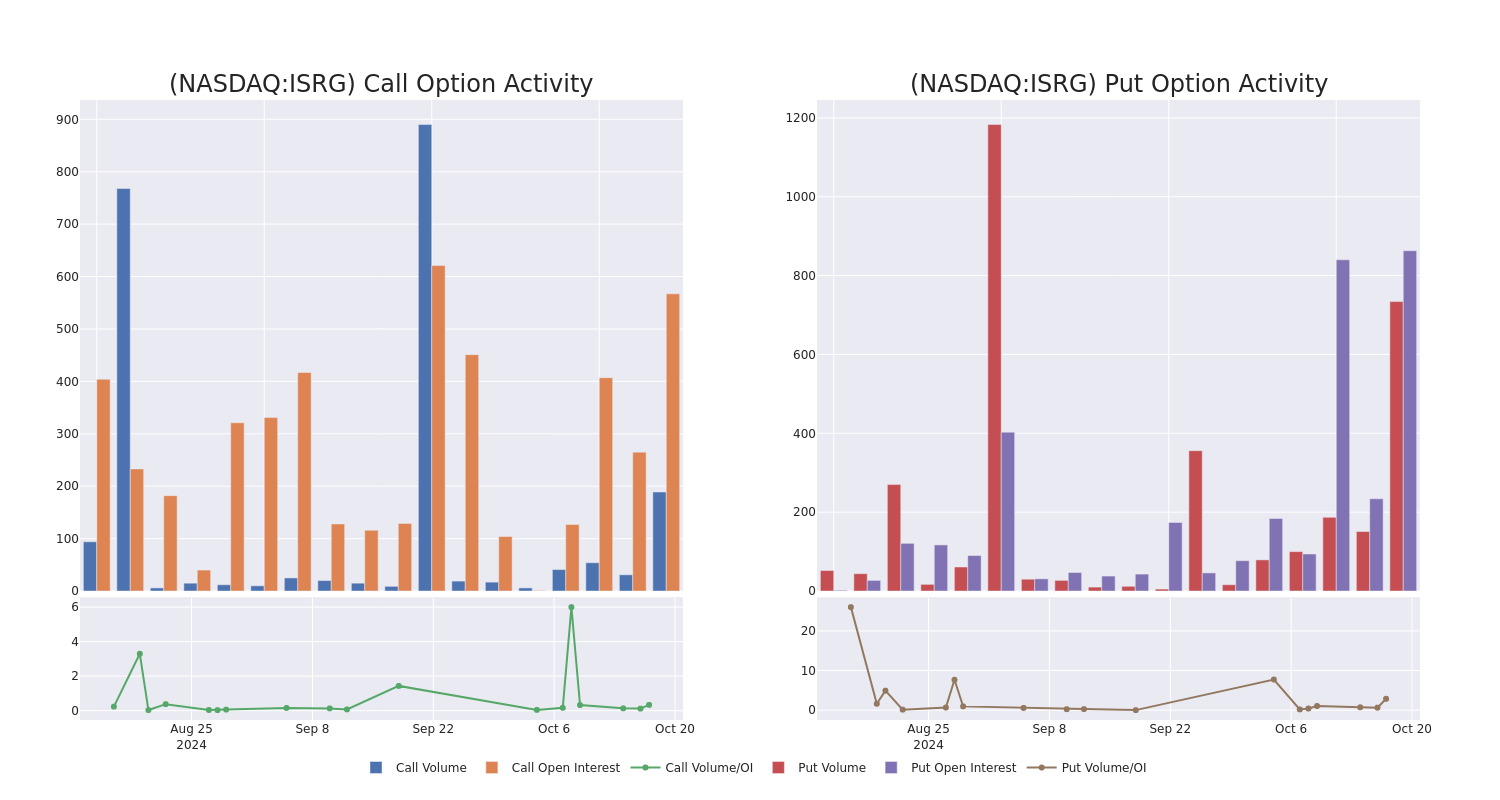

Insights into Volume & Open Interest

In today’s trading context, the average open interest for options of Intuitive Surgical stands at 238.33, with a total volume reaching 923.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Intuitive Surgical, situated within the strike price corridor from $470.0 to $485.0, throughout the last 30 days.

Intuitive Surgical Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ISRG | CALL | SWEEP | BULLISH | 01/17/25 | $28.0 | $27.9 | $28.0 | $485.00 | $145.5K | 299 | 54 |

| ISRG | PUT | TRADE | BULLISH | 01/17/25 | $27.9 | $27.4 | $27.5 | $475.00 | $110.0K | 243 | 63 |

| ISRG | PUT | SWEEP | BEARISH | 10/18/24 | $10.0 | $9.6 | $9.9 | $470.00 | $46.5K | 370 | 48 |

| ISRG | PUT | SWEEP | BEARISH | 10/18/24 | $13.4 | $12.9 | $13.3 | $475.00 | $41.2K | 250 | 340 |

| ISRG | CALL | SWEEP | NEUTRAL | 10/18/24 | $15.4 | $15.3 | $15.3 | $472.50 | $39.7K | 8 | 26 |

About Intuitive Surgical

Intuitive Surgical develops, produces, and markets a robotic system for assisting minimally invasive surgery. It also provides the instrumentation, disposable accessories, and warranty services for the system. The company has placed more than 8,600 da Vinci systems in hospitals worldwide, with more than 5,000 installations in the US and a growing number in emerging markets.

Having examined the options trading patterns of Intuitive Surgical, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Intuitive Surgical

- Currently trading with a volume of 1,808,262, the ISRG’s price is up by 5.54%, now at $503.0.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 0 days.

Expert Opinions on Intuitive Surgical

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $537.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Intuitive Surgical with a target price of $575.

* Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Intuitive Surgical, targeting a price of $475.

* An analyst from RBC Capital persists with their Outperform rating on Intuitive Surgical, maintaining a target price of $525.

* An analyst from Truist Securities has decided to maintain their Buy rating on Intuitive Surgical, which currently sits at a price target of $570.

* Consistent in their evaluation, an analyst from Raymond James keeps a Outperform rating on Intuitive Surgical with a target price of $540.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Intuitive Surgical with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mark Cuban Dismisses Dogecoin Founder's Concerns: Kamala Harris Is 'Night And Day Away From Biden And Far Ahead Of Trump' On Crypto Understanding

A recent exchange on X between entrepreneur Mark Cuban and a crypto enthusiast has shed light on Vice President Kamala Harris’s evolving stance on cryptocurrency, particularly Bitcoin (CRYPTO: BTC), in light of the November election.

What Happened: Cuban, responding to a suggestion that Harris should transfer the U.S. government’s 200,000 bitcoin to the treasury, provided insights into his discussions with Harris’s team about crypto policy.

Don’t Miss:

He pointed out that the treasury is legally obligated to dispose of confiscated assets, including the 69,000 Bitcoin currently in its possession, in a manner that benefits taxpayers.

“I was pushing for all confiscations in crypto to be held and not sold,” Cuban revealed, adding that he advised the team about the potential market impact of selling large amounts of Bitcoin quickly. He noted that the treasury “can’t sell in a way that will move the market” due to legal constraints.

Trending: Dogecoin millionaires are increasing – investors with $1M+ in DOGE revealed!

Cuban highlighted Harris’s recent statements about protecting digital asset holders, suggesting a significant shift in her understanding of the crypto ecosystem. “If you saw what she said today about protecting people who hold digital assets, it’s really clear they now get it. And it’s not just about btc and favoring the maxis,” he wrote.

Importantly, Cuban emphasized Harris’s recognition of the “app economy” and its relevance to younger generations. “She understands completely, and it really resonates with her that there are a lot of people who are in the ‘app economy’. They don’t open bank accounts. They use apps like Robinhood and Coinbase etc, and it’s easier to understand how to buy crypto,” Cuban explained.

He further noted that Harris is aware that many Gen Z individuals, particularly men, have a significant portion of their net worth in crypto. According to Cuban, Harris has pledged to “do what she can to protect them as consumers and as owners.”

Trending: 1 in 4 Americans own a share of Bitcoin according to NASDAQ, how many people got started through this free crypto faucet?

Dogecoin co-creator Billy Markus popularly known as Shibetoshi Nakamoto also responded to his tag on the Cuban post. He believes that cryptocurrency is beyond the understanding of many lawmakers and it “messes with the existing laws.”

Why It Matters: Cuban’s defense of Harris’s cryptocurrency knowledge comes amid her unveiling of a new regulatory framework aimed at supporting digital assets. As part of her “Opportunity Agenda for Black Men,” Harris’s proposal acknowledges the growing importance of cryptocurrencies among Black Americans, with over 20% reportedly owning or having owned crypto assets, according to her team.

In another statement, Cuban defended Harris and emphasized her genuine approach compared to other political figures. He noted, “She doesn’t know everything. Unlike your guy [Trump], she doesn’t pretend. She understands the connection cryptocurrency has to young people.”

What’s Next: The Benzinga Future of Digital Assets event on Nov. 19. will explore the question of digital asset regulations and the influence of Bitcoin as an institutional asset class.

Read Next:

Image: Shutterstock

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Mark Cuban Dismisses Dogecoin Founder’s Concerns: Kamala Harris Is ‘Night And Day Away From Biden And Far Ahead Of Trump’ On Crypto Understanding originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CROWN HOLDINGS, INC. REPORTS THIRD QUARTER 2024 RESULTS

TAMPA, Fla., Oct. 17, 2024 /PRNewswire/ — Crown Holdings, Inc. CCK today announced its financial results for the third quarter ended September 30, 2024.

Net sales in the third quarter were $3,074 million compared to $3,069 million in the third quarter of 2023 reflecting higher shipments of both global beverage cans and food cans in North America, offset by lower volumes in most other businesses and unfavorable foreign currency translation of $9 million.

Income from operations was $444 million in the third quarter compared to $374 million in the third quarter of 2023. Segment income in the third quarter of 2024 was $472 million, up 10%, compared to the $430 million in the prior year third quarter driven by improved results in global beverage operations, partially offset by the impact of lower volumes in Transit Packaging and the beverage can equipment business.

Commenting on the quarter, Timothy J. Donahue, Chairman, President and Chief Executive Officer, stated, “The Company continued its strong 2024 performance during the third quarter, with results in each of its global beverage can businesses exceeding original expectations. Global beverage shipments improved 5% during the quarter, with Brazil, Europe, Mexico and the United States all recording increases of 5% or more. Segment income on a combined basis advanced 10% over the prior year third quarter, as the Company benefited from favorable manufacturing performance and exposure to a well-balanced portfolio of end markets. Transit Packaging performed in line with expectations while global manufacturing activity continues in contraction.

“Strong operating performance combined with lower capital expenditures resulted in the Company generating cash from operating activities of $897 million and adjusted free cash flow of $668 million for the nine months ended September 30, 2024. In the first nine months of 2024, the Company repurchased $117 million of common stock and continued to reduce net debt, ending the quarter with a net leverage ratio of 3.0 times adjusted EBITDA and remains committed to the long-term target of 2.5 times adjusted EBITDA.”

During the third quarter, the Company transferred portions of its U.S. and Canadian pension plan obligations to insurers, resulting in total pension settlement charges of $517 million. As part of the U.S. transaction the Company contributed approximately $100 million into the pension plan and settled nearly all pension obligations for retiree and deferred vested participants.

Net loss attributable to Crown Holdings in the third quarter was $175 million, reflecting pension settlement charges of $517 million, compared to net income of $159 million in the third quarter of 2023. Reported diluted loss per share was $1.47 in the third quarter of 2024 compared to diluted earnings per share of $1.33 in 2023. Adjusted diluted earnings per share were $1.99 compared to $1.73 in 2023.

Nine Month Results

Net sales for the first nine months of 2024 were $8,898 million compared to $9,152 million in the first nine months of 2023, reflecting 5% higher global beverage can shipments, offset by the pass through of $214 million in lower material costs, lower volumes in most other businesses and unfavorable foreign currency translation of $12 million.

Income from operations was $1,068 million in the first nine months of 2024 compared to $1,010 million in the first nine months of 2023. Segment income in the first nine months of 2024 was $1,217 million, up 5%, versus the $1,164 million in the prior year period driven by improved results in global beverage operations, partially offset by the impact of lower volumes in most other businesses and higher corporate costs.

Net income attributable to Crown Holdings in the first nine months of 2024 was $66 million, reflecting pension settlement charges of $519 million, compared to $418 million in the first nine months of 2023. Reported diluted earnings per share were $0.55 compared to $3.49 in 2023. Adjusted diluted earnings per share were $4.82 compared to $4.61 in 2023.

Outlook

The Company now projects full-year adjusted diluted earnings per share in the range of $6.25 to $6.35 compared to previous guidance of $6.00 to $6.25. After deducting the $100 million pension contribution made during the third quarter, adjusted free cash flow for the year is still expected to be at least $750 million with no more than $450 million of capital spending.

Fourth quarter adjusted diluted earnings per share are expected to be in the range of $1.45 to $1.55.

Non-GAAP Measures

Segment income, adjusted free cash flow, adjusted net leverage ratio, adjusted net income, the adjusted effective tax rate, adjusted diluted earnings per share, net interest expense, EBITDA and adjusted EBITDA are not defined terms under U.S. generally accepted accounting principles (non-GAAP measures). Non-GAAP measures should not be considered in isolation or as a substitute for income from operations, cash flow, leverage ratio, net income, effective tax rates, diluted earnings per share or interest expense and interest income prepared in accordance with U.S. GAAP and may not be comparable to calculations of similarly titled measures by other companies.

The Company views segment income as the principal measure of the performance of its operations and adjusted free cash flow and adjusted net leverage ratio as the principal measures of its liquidity. The Company considers all of these measures in the allocation of resources. Adjusted free cash flow has certain limitations, however, including that it does not represent the residual cash flow available for discretionary expenditures since other non-discretionary expenditures, such as mandatory debt service requirements, are not deducted from the measure. The amount of mandatory versus discretionary expenditures can vary significantly between periods. The Company believes that adjusted free cash flow and adjusted net leverage ratio provide meaningful measures of liquidity and a useful basis for assessing the Company’s ability to fund its activities, including the financing of acquisitions, debt repayments, share repurchases or dividends. The Company believes that adjusted net income, segment income, the adjusted effective tax rate and adjusted diluted earnings per share are useful in evaluating the Company’s operations as these measures are adjusted for items that affect comparability between periods. Segment income, adjusted free cash flow, adjusted net leverage ratio, adjusted net income, the adjusted effective tax rate, adjusted diluted earnings per share, net interest expense, EBITDA and adjusted EBITDA are derived from the Company’s Consolidated Statements of Operations, Cash Flows and Consolidated Balance Sheets, as applicable, and reconciliations to segment income, adjusted free cash flow, adjusted net leverage ratio, adjusted net income, the adjusted effective tax rate, adjusted diluted earnings per share and adjusted EBITDA can be found within this release. Reconciliations of estimated adjusted diluted earnings per share, adjusted effective tax rate and adjusted net leverage ratio for the fourth quarter and full year of 2024 to estimated diluted earnings per share, the effective tax rate and income from operations on a GAAP basis are not provided in this release due to the unavailability of estimates of the following, the timing and magnitude of which the Company is unable to reliably forecast without unreasonable efforts, which are excluded from estimated adjusted diluted earnings per share and could have a significant impact on earnings per share, adjusted effective tax rates and adjusted net leverage ratios on a GAAP basis: gains or losses on the sale of businesses or other assets, restructuring and other costs, asset charges, asbestos-related charges, losses from early extinguishment of debt, pension settlement and curtailment charges, the tax and noncontrolling interest impact of the items above, and the impact of tax law changes or other tax matters.

Conference Call

The Company will hold a conference call tomorrow, October 18, 2024 at 9:00 a.m. (EDT) to discuss this news release. Forward-looking and other material information may be discussed on the conference call. The dial-in numbers for the conference call are 630-395-0194 or toll-free 888-324-8108 and the access password is “packaging.” A live webcast of the call will be made available to the public on the internet at the Company’s website, www.crowncork.com. A replay of the conference call will be available for a one-week period ending at midnight on October 25, 2024. The telephone numbers for the replay are 203-369-3268 or toll free 800-391-9851.

Cautionary Note Regarding Forward-Looking Statements

Except for historical information, all other information in this press release consists of forward-looking statements. These forward-looking statements involve a number of risks, uncertainties and other factors, including the Company’s ability to continue to operate its plants, distribute its products, and maintain its supply chain; the future impact of currency translation; the continuation of performance and market trends in 2024, including consumer preference for beverage cans and global beverage can demand; the future impact of inflation, including the potential for higher interest rates and energy prices and the Company’s ability to recover raw material and other inflationary costs; future demand for food cans; the Company’s ability to deliver continuous operational improvement; future demand in the Transit Packaging segment; the timing and ultimate completion of the Eviosys sale and the Company’s ability to decrease capital expenditures and increase cash flow and to further reduce net leverage that may cause actual results to be materially different from those expressed or implied in the forward-looking statements. Important factors that could cause the statements made in this press release or the actual results of operations or financial condition of the Company to differ are discussed under the caption “Forward Looking Statements” in the Company’s Form 10-K Annual Report for the year ended December 31, 2023 and in subsequent filings made prior to or after the date hereof. The Company does not intend to review or revise any particular forward-looking statement in light of future events.

Crown Holdings, Inc., through its subsidiaries, is a worldwide leader in the design, manufacture and sale of packaging products for consumer goods and industrial products. World headquarters are located in Tampa, Florida.

For more information, contact:

Kevin C. Clothier, Senior Vice President and Chief Financial Officer, (215) 698-5281

Thomas T. Fischer, Vice President, Investor Relations and Corporate Affairs, (215) 552-3720

Unaudited Consolidated Statements of Operations, Balance Sheets, Statements of Cash Flows, Segment Information and Supplemental Data follow.

|

Consolidated Statements of Operations (Unaudited) (in millions, except share and per share data)

|

|||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Net sales |

$ 3,074 |

$ 3,069 |

$ 8,898 |

$ 9,152 |

|||

|

Cost of products sold |

2,383 |

2,427 |

7,009 |

7,301 |

|||

|

Depreciation and amortization |

114 |

124 |

344 |

372 |

|||

|

Selling and administrative expense |

146 |

129 |

450 |

437 |

|||

|

Restructuring and other |

(13) |

15 |

27 |

32 |

|||

|

Income from operations (1) |

444 |

374 |

1,068 |

1,010 |

|||

|

Pension settlements and curtailments |

517 |

519 |

|||||

|

Other pension and postretirement |

6 |

11 |

28 |

38 |

|||

|

Foreign exchange |

3 |

13 |

15 |

31 |

|||

|

Earnings (loss) before interest and taxes |

(82) |

350 |

506 |

941 |

|||

|

Interest expense |

119 |

111 |

344 |

323 |

|||

|

Interest income |

(24) |

(13) |

(60) |

(34) |

|||

|

Income (loss) from operations before income taxes |

(177) |

252 |

222 |

652 |

|||

|

Provision for income taxes |

(39) |

62 |

55 |

163 |

|||

|

Equity earnings |

6 |

10 |

1 |

20 |

|||

|

Net income (loss) |

(132) |

200 |

168 |

509 |

|||

|

Net income attributable to noncontrolling interests |

43 |

41 |

102 |

91 |

|||

|

Net income (loss) attributable to Crown Holdings |

$ (175) |

$ 159 |

$ |

66 |

$ 418 |

||

|

Earnings (loss) per share attributable to Crown Holdings common shareholders: |

|||||||

|

Basic |

$ (1.47) |

$ 1.33 |

$ 0.55 |

$ 3.50 |

|||

|

Diluted |

$ (1.47) |

$ 1.33 |

$ 0.55 |

$ 3.49 |

|||

|

Weighted average common shares outstanding: |

|||||||

|

Basic |

119,267,481 |

119,495,455 |

119,497,199 |

119,375,527 |

|||

|

Diluted |

119,267,481 |

119,740,429 |

119,725,711 |

119,658,885 |

|||

|

Actual common shares outstanding at quarter end |

119,637,068 |

120,646,389 |

119,637,068 |

120,646,389 |

|||

|

(1) Reconciliation from income from operations to segment income follows.

|

|||||||

Consolidated Supplemental Financial Data (Unaudited)

(in millions)

Reconciliation from Income from Operations to Segment Income

The Company views segment income, as defined below, as a principal measure of performance of its operations and for the allocation of resources. Segment income is defined by the Company as income from operations adjusted to exclude intangibles amortization charges and provisions for restructuring and other.

|

Three Months Ended |

Nine Months Ended September 30, |

||||||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||||

|

Income from operations |

$ |

444 |

$ |

374 |

$ |

1,068 |

$ |

1,010 |

|||||

|

Intangibles amortization |

41 |

41 |

122 |

122 |

|||||||||

|

Restructuring and other |

(13) |

15 |

27 |

32 |

|||||||||

|

Segment income |

$ |

472 |

$ |

430 |

$ |

1,217 |

$ |

1,164 |

|||||

|

Segment Information

|

|||||||||||||

|

Net Sales |

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||||

|

Americas Beverage |

$ |

1,368 |

$ |

1,295 |

$ |

3,915 |

$ |

3,848 |

|||||

|

European Beverage |

573 |

536 |

1,615 |

1,547 |

|||||||||

|

Asia Pacific |

284 |

307 |

853 |

977 |

|||||||||

|

Transit Packaging |

526 |

554 |

1,596 |

1,715 |

|||||||||

|

Other (1) |

323 |

377 |

919 |

1,065 |

|||||||||

|

Total net sales |

$ |

3,074 |

$ |

3,069 |

$ |

8,898 |

$ |

9,152 |

|||||

|

Segment Income |

|||||||||||||

|

Americas Beverage |

$ |

280 |

$ |

232 |

$ |

712 |

$ |

621 |

|||||

|

European Beverage (2) |

86 |

73 |

225 |

181 |

|||||||||

|

Asia Pacific |

50 |

33 |

147 |

107 |

|||||||||

|

Transit Packaging |

70 |

89 |

211 |

256 |

|||||||||

|

Other (1) |

27 |

37 |

49 |

100 |

|||||||||

|

Corporate and other unallocated items (2) |

(41) |

(34) |

(127) |

(101) |

|||||||||

|

Total segment income |

$ |

472 |

$ |

430 |

$ |

1,217 |

$ |

1,164 |

|||||

|

(1) |

Includes the Company’s food can, aerosol can and closures businesses in North America, and beverage tooling and equipment operations in the U.S. and United Kingdom. |

|

(2) |

During the fourth quarter of 2023, the Company recast its segment reporting to reclassify European corporate costs that were previously included in Corporate and other unallocated items into the European Beverage segment. The change was effective December 31, 2023, and segment results for prior periods were recast to conform to the new presentation. |

Consolidated Supplemental Data (Unaudited)

(in millions, except per share data)

Reconciliation from Net Income and Diluted Earnings Per Share to Adjusted Net Income and Adjusted Diluted Earnings Per Share

The following table reconciles reported net income and diluted earnings per share attributable to the Company to adjusted net income and adjusted diluted earnings per share, as used elsewhere in this release.

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||||||||||||||

|

Net income (loss)/diluted earnings per share attributable to Crown Holdings, as reported |

$ |

(175) |

$ |

(1.47) |

$ |

159 |

$ |

1.33 |

$ |

66 |

$ |

0.55 |

$ |

418 |

$ |

3.49 |

||||||||||||

|

Intangibles amortization (1) |

41 |

0.34 |

41 |

0.34 |

122 |

1.02 |

122 |

1.02 |

||||||||||||||||||||

|

Restructuring and other (2) |

(13) |

(0.11) |

15 |

0.12 |

27 |

0.22 |

32 |

0.27 |

||||||||||||||||||||

|

Pension settlements/curtailments (3) |

517 |

4.33 |

519 |

4.34 |

6 |

0.05 |

||||||||||||||||||||||

|

Income taxes (4) |

(134) |

(1.12) |

(10) |

(0.08) |

(171) |

(1.43) |

(33) |

(0.28) |

||||||||||||||||||||

|

Equity earnings (5) |

2 |

0.02 |

2 |

0.02 |

14 |

0.12 |

7 |

0.06 |

||||||||||||||||||||

|

Adjusted net income/diluted earnings per share |

$ |

238 |

$ |

1.99 |

$ |

207 |

$ |

1.73 |

$ |

577 |

$ |

4.82 |

$ |

552 |

$ |

4.61 |

||||||||||||

|

Effective tax rate as reported |

22.0 % |

24.6 % |

24.8 % |

25.0 % |

||||||||||||||||||||||||

|

Adjusted effective tax rate |

25.8 % |

23.4 % |

25.4 % |

24.1 % |

||||||||||||||||||||||||

Adjusted net income, adjusted diluted earnings per share and the adjusted effective tax rate are non-GAAP measures and are not meant to be considered in isolation or as a substitute for net income, diluted earnings per share and effective tax rates determined in accordance with U.S. generally accepted accounting principles. The Company believes these non-GAAP measures provide useful information to evaluate the performance of the Company’s ongoing business.

|

(1) |

In the third quarter and first nine months of 2024, the Company recorded charges of $41 million ($33 million net of tax) and $122 million ($94 million net of tax) for intangibles amortization arising from prior acquisitions. In the third quarter and first nine months of 2023, the Company recorded charges of $41 million ($31 million net of tax) and $122 million ($92 million net of tax) for intangibles amortization arising from prior acquisitions. |

|

(2) |

In the third quarter of 2024, the Company recorded net restructuring and other gains of $13 million ($12 million net of tax), including a gain of $22 million for the sale of food can assets in Mexico. In the first nine months of 2024, the Company recorded net restructuring and other charges of $27 million ($24 million net of tax) primarily related to severance and other exit costs in the Company’s European Beverage and Other segments. In the third quarter and first nine months of 2023, the Company recorded net restructuring and other charges of $15 million ($15 million net of tax) and $32 million ($30 million net of tax). |

|

(3) |

In the first nine months of 2024, the Company recorded charges of $519 million ($391 million net of tax) related to the partial settlements of the Company’s defined benefit pension plan obligations in the U.S. and Canada. In the first nine months of 2023, the Company recorded a one-time termination charge of $6 million ($5 million net of tax) related to business reorganization activities in Europe. |

|

(4) |

The Company recorded income tax benefits of $134 million and $171 million in the third quarter and first nine months of 2024 and $10 million and $33 million in the third quarter and first nine months of 2023, primarily related to the items described above. In the first nine months of 2024, the Company also recorded an income tax benefit related to a valuation allowance release. |

|

(5) |

In the third quarters and first nine months of 2024 and 2023, the Company recorded its proportional share of intangible amortization and restructuring charges, net of tax, recorded by its European tinplate equity method investment, in the line Equity earnings. |

|

Consolidated Balance Sheets (Condensed & Unaudited) (in millions) |

||||||||

|

September 30, |

2024 |

2023 |

||||||

|

Assets |

||||||||

|

Current assets |

||||||||

|

Cash and cash equivalents |

$ |

1,738 |

$ |

807 |

||||

|

Receivables, net |

1,577 |

1,751 |

||||||

|

Inventories |

1,565 |

1,664 |

||||||

|

Prepaid expenses and other current assets |

230 |

230 |

||||||

|

Total current assets |

5,110 |

4,452 |

||||||

|

Goodwill and intangible assets, net |

4,169 |

4,242 |

||||||

|

Property, plant and equipment, net |

5,021 |

4,876 |

||||||

|

Other non-current assets |

795 |

751 |

||||||

|

Total assets |

$ |

15,095 |

$ |

14,321 |

||||

|

Liabilities and equity |

||||||||

|

Current liabilities |

||||||||

|

Short-term debt |

$ |

89 |

$ |

51 |

||||

|

Current maturities of long-term debt |

749 |

774 |

||||||

|

Accounts payable and accrued liabilities |

3,398 |

3,132 |

||||||

|

Total current liabilities |

4,236 |

3,957 |

||||||

|

Long-term debt, excluding current maturities |

6,672 |

6,240 |

||||||

|

Other non-current liabilities |

1,142 |

1,296 |

||||||

|

Noncontrolling interests |

513 |

487 |

||||||

|

Crown Holdings shareholders’ equity |

2,532 |

2,341 |

||||||

|

Total equity |

3,045 |

2,828 |

||||||

|

Total liabilities and equity |

$ |

15,095 |

$ |

14,321 |

||||

|

Consolidated Statements of Cash Flows (Condensed & Unaudited) (in millions) |

||||||||||

|

Nine months ended September 30, |

2024 |

2023 |

||||||||

|

Cash flows from operating activities |

||||||||||

|

Net income |

$ |

168 |

$ |

509 |

||||||

|

Depreciation and amortization |

344 |

372 |

||||||||

|

Restructuring and other |

27 |

32 |

||||||||

|

Pension and postretirement expense |

564 |

54 |

||||||||

|

Pension contributions |

(122) |

(10) |

||||||||

|

Stock-based compensation |

32 |

27 |

||||||||

|

Working capital changes and other |

(116) |

(152) |

||||||||

|

Net cash provided by operating activities |

897 |

832 |

||||||||

|

Cash flows from investing activities |

||||||||||

|

Capital expenditures |

(254) |

(614) |

||||||||

|

Equity method investment distribution |

56 |

|||||||||

|

Other |

46 |

38 |

||||||||

|

Net cash used for investing activities |

(208) |

(520) |

||||||||

|

Cash flows from financing activities |

||||||||||

|

Net change in debt |

3 |

116 |

||||||||

|

Dividends paid to shareholders |

(90) |

(86) |

||||||||

|

Common stock repurchased |

(117) |

(12) |

||||||||

|

Dividends paid to noncontrolling interests |

(45) |

(44) |

||||||||

|

Other, net |

(11) |

(9) |

||||||||

|

Net cash provided by/(used for) financing activities |

(260) |

(35) |

||||||||

|

Effect of exchange rate changes on cash and cash equivalents |

4 |

(14) |

||||||||

|

Net change in cash and cash equivalents |

433 |

263 |

||||||||

|

Cash and cash equivalents at January 1 |

1,400 |

639 |

||||||||

|

Cash, cash equivalents and restricted cash at September 30 (1) |

$ |

1,833 |

$ |

902 |

||||||

|

(1) Cash and cash equivalents include $95 million of restricted cash at September 30, 2024 and 2023. |

Adjusted free cash flow is defined by the Company as net cash from operating activities less capital expenditures and certain other items. A reconciliation of net cash from operating activities to adjusted free cash flow for the three and nine months ended September 30, 2024 and 2023 follows.

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

|||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

|||||||||||||

|

Net cash provided by operating activities |

$ 554 |

$ 539 |

$ 897 |

$ 832 |

||||||||||||

|

Interest included in investing activities (2) |

12 |

12 |

25 |

25 |

||||||||||||

|

Capital expenditures |

(76) |

(160) |

(254) |

(614) |

||||||||||||

|

Other (3) |

(24) |

|||||||||||||||

|

Adjusted free cash flow |

$ 490 |

$ 391 |

$ 668 |

$ 219 |

||||||||||||

|

(2) |

Interest benefit of cross currency swaps included in investing activities. |

|

(3) |

Includes $23 million of insurance proceeds received in the first quarter of 2023 related to a tornado at the Bowling Green plant and $1 million repayment of the contribution the Company made in 2021 to settle the U.K. defined pension plan. |

|

Consolidated Supplemental Data (Unaudited) (in millions)

Impact of Foreign Currency Translation – Favorable/(Unfavorable) (1)

|

||||||||||||||||

|

Three Months Ended September 30, 2024 |

Nine Months Ended September 30, 2024 |

|||||||||||||||

|

Net Sales |

Segment Income |

Net Sales |

Segment Income |

|||||||||||||

|

Americas Beverage |

$ |

(12) |

$ |

$ |

(6) |

$ |

1 |

|||||||||

|

European Beverage |

4 |

1 |

9 |

|||||||||||||

|

Asia Pacific |

2 |

1 |

(10) |

(1) |

||||||||||||

|

Transit Packaging |

(2) |

(6) |

||||||||||||||

|

Other |

(1) |

1 |

1 |

|||||||||||||

|

$ |

(9) |

$ |

3 |

$ |

(12) |

$ |

– |

|||||||||

|

(1) |

The impact of foreign currency translation represents the difference between actual current year U.S. dollar results and pro forma amounts assuming constant foreign currency exchange rates for translation in both periods. In order to compute the difference, the Company compares actual U.S. dollar results to an amount calculated by dividing the current U.S. dollar results by current year average foreign exchange rates and then multiplying those amounts by the applicable prior year average foreign exchange rates. |

|

Reconciliation of Adjusted EBITDA and Adjusted Net Leverage Ratio |

||||||||||||||||

|

September |

September |

Full Year |

Twelve Months Ended |

Twelve Months Ended |

||||||||||||

|

YTD 2024 |

YTD 2023 |

2023 |

September 30, 2024 |

September 30, 2023 |

||||||||||||

|

Income from operations |

$ |

1,068 |

$ |

1,010 |

$ |

1,269 |

$ |

1,327 |

$ |

1,239 |

||||||

|

Add: |

||||||||||||||||

|

Intangibles amortization |

122 |

122 |

163 |

163 |

162 |

|||||||||||

|

Restructuring and other |

27 |

32 |

114 |

109 |

55 |

|||||||||||

|

Segment income |

1,217 |

1,164 |

1,546 |

1,599 |

1,456 |

|||||||||||

|

Depreciation |

222 |

250 |

336 |

308 |

324 |

|||||||||||

|

Adjusted EBITDA |

$ |

1,439 |

$ |

1,414 |

$ |

1,882 |

$ |

1,907 |

$ |

1,780 |

||||||

|

Total debt |

$ |

7,474 |

$ |

7,510 |

$ |

7,065 |

||||||||||

|

Less cash |

1,310 |

1,738 |

807 |

|||||||||||||

|

Net debt |

$ |

6,164 |

$ |

5,772 |

$ |

6,258 |

||||||||||

|

Adjusted net leverage ratio |

3.3x |

3.0x |

3.5x |

|||||||||||||

![]() View original content:https://www.prnewswire.com/news-releases/crown-holdings-inc-reports-third-quarter-2024-results-302279782.html

View original content:https://www.prnewswire.com/news-releases/crown-holdings-inc-reports-third-quarter-2024-results-302279782.html

SOURCE Crown Holdings, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lisa Su Just Delivered Incredible News for Advanced Micro Devices Stock Investors

Developing artificial intelligence (AI) software wouldn’t be possible without data centers and the powerful graphics processing chips (GPUs) inside them. For the past 18 months, Nvidia (NASDAQ: NVDA) has dominated the GPU industry with a staggering market share of up to 98%.

But competition was bound to emerge, and Advanced Micro Devices (NASDAQ: AMD) has stepped up to the plate with an exciting GPU roadmap. The company hosted its “Advancing AI” event on Oct. 10, where its CEO Lisa Su provided an update on its next-generation chips.

Although Advanced Micro Devices is still trailing Nvidia in the market for AI GPUs, Su’s comments suggest the company is catching up at a rapid clip. Here’s why investors should be excited.

Advanced Micro Devices was more than a year behind Nvidia in the AI GPU race

Nvidia’s H100 GPU set the benchmark for AI training and AI inference. The chip went into full production in September 2022, although sales didn’t ramp up until 2023, when AI fever gripped the tech sector. The H100 is still a hot product today, and Nvidia continues to struggle with supply constraints because demand is so high from leading AI companies like OpenAI, Amazon, Microsoft, and more.

Those supply challenges have opened the door for competitors like Advanced Micro Devices to steal some market share. The company announced its own data center GPU called the MI300X at the end of 2023, which was specifically designed to compete with the H100. So far, it has attracted some of Nvidia’s top customers, including Microsoft, Oracle, and Meta Platforms.

In fact, Advanced Micro Devices says some of those customers are seeing performance and cost advantages by using the MI300X compared to the H100. Despite being more than a year behind in terms of a launch date, the challenger delivered a very worthy product. It forecasts the MI300 series will propel its GPU revenue to a record $4.5 billion in 2024 — an estimate that has already been raised twice.

But Nvidia still has the edge. It started shipping its new H200 GPU earlier this year, which is capable of performing AI inference at nearly twice the speed of the H100. It meant Advanced Micro Devices was still a step behind. However, at the Advancing AI event, Lisa Su offered fresh details on her company’s new MI325X, which will deliver 80% more high-bandwidth memory than the H200 and 30% better inference performance.

That’s great news, but it isn’t expected to ship until the first quarter of 2025.

The race to catch up doesn’t stop there. Nvidia is now focused on its latest Blackwell chip architecture, which paves the way for the biggest leap in performance so far. The new GB200 NVL72 system is capable of performing AI inference at a whopping 30x the pace of the equivalent H100 system. Each individual GPU will be priced comparably to the H100 (when it was first launched), so Blackwell is going to deliver an incredible improvement in cost efficiency.

In other words, even though Advanced Micro Device’s MI325X might be a superior product to the H200, it’s going to be significantly behind Nvidia’s newest hardware.

Advanced Micro Device’s Blackwell competitor is right around the corner

Here’s where things get exciting. Lisa Su told the audience at Advancing AI that the company is preparing to ship another new GPU next year called the MI350X. It’s based on its new CDNA (compute DNA) 4 architecture, which offers a staggering leap in performance of 35x, compared to CDNA 3 chips like the original MI300X.

Advanced Micro Devices has explicitly said the MI350X will compete directly with Nvidia’s Blackwell chips.

Nvidia plans to ramp up shipments of Blackwell GPUs during its fiscal 2025 fourth quarter (which runs from November to January), whereas Su said Advanced Micro Devices will start shipping the MI350X in the second half of calendar 2025. That means after lagging behind Nvidia by more than a year with the MI300X, Advanced Micro Devices has an opportunity to reduce Nvidia’s lead to just months with the MI350X.

Advanced Micro Devices will report its latest financial results in a few weeks

The company could provide further updates on its new chips when it releases its financial results for the third quarter of 2024 (ended Sept. 30), which is expected to happen on or around Oct. 29.

During the second quarter, Advanced Micro Devices generated a record $2.8 billion in data center revenue, which was a 114% increase from the year-ago period. Another strong result could prompt management to lift its full-year GPU sales forecast beyond $4.5 billion. Given the company’s track record on that front, there’s a good chance it will happen.

Advanced Micro Devices stock currently trades at a very expensive price-to-earnings ratio (P/E) of 200.3 because it has generated modest earnings per share (EPS) of $0.82 over the past four quarters. For perspective, the Nasdaq-100 technology index currently trades at a P/E of 32.1.

However, Wall Street analysts estimate the company could deliver $5.43 in EPS during 2025, placing the stock at a more reasonable forward P/E of 30.6:

That means Advanced Micro Devices stock could be a great buy right now for investors who are willing to hold onto it for at least a couple of years — especially with the MI325X and MI350X rolling out in 2025.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,049!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,847!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $378,583!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, Meta Platforms, Microsoft, Nvidia, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Lisa Su Just Delivered Incredible News for Advanced Micro Devices Stock Investors was originally published by The Motley Fool

Why AT&T May Have Just Become an Even Better Dividend Stock to Own

If your priority is to receive a stable and recurring dividend, a good idea is to focus on businesses that aren’t trying to do too much. When a company tries to grow its business while also paying a dividend, it can be difficult to juggle both.

Good examples of that are Intel and Walgreens Boots Alliance. Intel is trying to build a chip foundry business, which has proven to be a significant challenge, ultimately resulting in the tech company suspending its dividend. Walgreens, meanwhile, has been trying to expand into healthcare, which is no easy task, either. And it ended up slashing its payout nearly in half at the start of the year.

When it comes to dividends, the best stocks to own are the ones whose businesses try to keep things simple. For a while, AT&T (NYSE: T) was looking like it might be a bad dividend stock when it was trying to grow aggressively into the streaming business with its acquisition of Time Warner. When it eventually gave up on that idea, it became a better dividend stock.

Now, with its latest move, it may be an even better one. Let’s see why.

AT&T is selling its stake in DirecTV

Last month, AT&T announced it would be selling the 70% stake it has in DirecTV to TPG, a private equity firm, for $7.6 billion. The move gets AT&T out of a competitive pay-TV business. At a time when viewers have more options than ever before for content, including myriad streaming options, simplifying its operations and focusing on its core telecom business could be a huge win for the company and AT&T shareholders.

Plus, the influx of cash can go a long way in helping AT&T strengthen its balance sheet by paying off some debt. As of the end of June, the company had a whopping $130.6 billion in debt on its books. Telecom companies normally carry a lot of debt on their books due to the capital-intensive nature of their operations, but with interest rates remaining high, that has been a reason for investors to be extra cautious with respect to these types of stocks. By injecting some additional cash into its operations, AT&T can reduce some of its debt and thus bring down some of that risk.

Could this pave the way for a dividend increase?

One thing investors may want to keep watching for is whether AT&T increases its dividend. The company is arguably already in a strong enough position to justify a boost to its payout, and now the sale of its stake in DirecTV might incentivize management to give investors more of a reason to buy the stock as it narrows its business.

Since spinning off WarnerMedia and adjusting its dividend in 2022, AT&T hasn’t increased its payout, and a hike may be overdue. Historically, AT&T was known to be a dividend growth stock and it may be waiting for the right time to announce an increase and to start that cycle again. Many telecom stocks often raise their payouts to give investors a reason to buy and hold.

Currently, AT&T has a payout ratio of 64% and over the trailing 12 months it has accumulated $21 billion in free cash flow, which is far more than the $8.2 billion it has paid out in dividends during that stretch. The dividend looks incredibly safe today and the sale of DirecTV could allow AT&T to better allocate resources to its fiber business and grow the dividend.

Should you buy AT&T stock today?

AT&T’s stock has rallied 27% this year as investors have grown more bullish on its future given its stronger results of late. Its yield has shrunk as a result, and is now down to around 5.2%. However, that’s still well above the S&P 500 average of 1.3%. As interest rates come down, more investors could load up on this high-yielding stock, which means this high of a yield may not last for long.

If you want a good dividend, then AT&T can make for a solid stock to add to your portfolio. By simplifying its operations and adding some cash, it looks like a much safer income investment to buy and hold. And it may only be a matter of time before the company announces an increase to its payout.

Should you invest $1,000 in AT&T right now?

Before you buy stock in AT&T, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and AT&T wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $831,707!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Why AT&T May Have Just Become an Even Better Dividend Stock to Own was originally published by The Motley Fool

This 1 Social Security Statistic Suggests Millions of Workers Could Be in Trouble

Social Security can make or break retirement for many older adults, so the more you can prepare heading into your senior years, the better off you’ll be.

However, a recent survey suggests that many workers may have unrealistic expectations about how much they’ll be relying on Social Security in retirement. While some workers expect their benefits to cover most or all of their expenses once they retire, surprisingly, the more pressing problem might actually be the opposite.

The mistake millions of workers may be making

Expecting Social Security to cover most or all of your costs in retirement can be dangerous, but it can be equally risky to assume that you won’t rely on your benefits heavily.

In a 2024 poll from Gallup, workers and current retirees were asked about the role their benefits play in their retirement plans. Among nonretired adults, only 35% said they expect Social Security to be a major source of income once they retire. However, a whopping 60% of current retirees said that their benefits are a major income source.

In other words, many workers may be underestimating how important Social Security will be in retirement, and millions might end up relying on their benefits more than they’re anticipating.

That may not sound like a major problem on the surface. After all, it’s normal to rely on Social Security to some extent in retirement. However, the average retiree only receives around $1,900 per month in benefits, so if your savings run out sooner than expected and you’re forced to depend primarily on your benefits, that money likely won’t go very far.

Social Security may be even less reliable going forward

Retirement benefits were only designed to replace around 40% of pre-retirement income, but given the program’s financial challenges in recent years, they may not even go that far in the future. Right now, Social Security is facing a cash deficit as its expenses outpace its income. Payroll taxes and other sources of income aren’t currently enough to pay out benefits in full, so the Social Security Administration (SSA) has been pulling cash from its trust funds to avoid cuts.

However, both of the trust funds are expected to run out by 2035, according to the SSA Board of Trustees’ latest estimates. At that point, the SSA will only have enough cash coming in to pay out around 83% of scheduled benefits. If nothing happens between now and 2035, then, benefits could be slashed by around 17%.

On top of that, Social Security is also struggling to keep up with inflation. Since 2010 alone, benefits have already lost around 20% of their buying power, a 2024 report from advocacy group The Senior Citizens League found.

Even with annual cost-of-living adjustments (COLAs), a whopping 81% of retirees say these adjustments do “very little” or nothing at all to help with critical living expenses, according to a 2024 survey from The Motley Fool. If benefits continue losing buying power and the COLAs continue to disappoint, it will only become harder to survive on Social Security in retirement.

What you can do right now to prepare

Perhaps the single best thing you can do right now is to take a realistic look at your future costs and how much you’ll need in savings to cover them. Many workers believe they won’t rely on their benefits a great deal in retirement, but the majority of retirees do, in fact, depend heavily on their monthly checks. Retirement is more expensive than many people realize, and some retirees could easily spend $1 million or more throughout their senior years.

Exactly how much you should save for retirement will depend on many factors, such as the cost of living in your area, your life expectancy, and your healthcare needs. But the more accurately you can map out your future expenses, the better idea you’ll have about how much you’ll need in savings.

This doesn’t necessarily mean you can’t rely on Social Security at all in retirement. But given the program’s shakiness, it may be wise to assume you’ll need more in savings than expected to enjoy retirement more comfortably.

The $22,924 Social Security bonus most retirees completely overlook

If you’re like most Americans, you’re a few years (or more) behind on your retirement savings. But a handful of little-known “Social Security secrets” could help ensure a boost in your retirement income. For example: one easy trick could pay you as much as $22,924 more… each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we’re all after. Simply click here to discover how to learn more about these strategies.

View the “Social Security secrets” »

The Motley Fool has a disclosure policy.

This 1 Social Security Statistic Suggests Millions of Workers Could Be in Trouble was originally published by The Motley Fool

Netflix, American Express And 3 Stocks To Watch Heading Into Friday

With U.S. stock futures trading mixed this morning on Friday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects American Express Company AXP to report quarterly earnings at $3.28 per share on revenue of $16.67 billion before the opening bell, according to data from Benzinga Pro. American Express shares gained 1.8% to $290.91 in after-hours trading.

- Netflix Inc NFLX reported stronger-than-expected third-quarter financial results, posting revenue of $9.825 billion, up 15% year-over-year, versus market estimates of $9.769 billion. The company ended the third quarter with 282.72 million global paid subscribers, up 14.4% year-over-year. Netflix shares climbed 5.1% to $722.35 in the after-hours trading session.

- Analysts are expecting The Procter & Gamble Company PG to post quarterly earnings at $1.90 per share on revenue of $21.91 billion. The company will release earnings before the markets open. Procter & Gamble shares gained 0.1% to $172.50 in after-hours trading.

Check out our premarket coverage here

- Intuitive Surgical, Inc. ISRG posted better-than-expected third-quarter financial results. The company also said it obtained regulatory clearance in South Korea for the da Vinci 5 surgical system in October. Intuitive Surgical shares climbed 6.1% to $502.80 in the after-hours trading session.

- Analysts expect Schlumberger Limited SLB to report quarterly earnings at 88 cents per share on revenue of $9.25 billion before the opening bell. SLB shares rose 0.4% to $44.16 in after-hours trading.

Check This Out:

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sun Title Creates Resources to Support Hispanic Home Buyers and Sellers

Company partners with local Hispanic leaders to create comprehensive set of resources to educate and empower Hispanic buyers and sellers on their journey to home ownership.

GRAND RAPIDS, Mich., Oct. 17, 2024 /PRNewswire/ — Sun Title, a leading provider of title and real estate services in West Michigan, is proud to announce the launch of its Hispanic Empowerment Initiative. This program is specifically designed to assist members of the Hispanic community in navigating the home buying and selling process, ensuring they have the resources, education and support needed to make informed decisions.

Recognizing the unique challenges faced by Hispanic buyers and sellers, Sun Title formed a Hispanic Impact Board over a year ago. This board, composed of community leaders and industry experts, was tasked with developing strategies and insights to better serve the Hispanic community as they consider buying and selling property. The culmination of their efforts is the Hispanic Empowerment Initiative, which offers a comprehensive suite of services, including bilingual support, educational workshops, a free AI resource in Spanish and personalized guidance throughout the real estate transaction process.

“We are committed to making the dream of homeownership accessible to everyone, and our Hispanic Empowerment Initiative is a crucial step in that direction,” said Thomas Cronkright, CEO of Sun Title. “By working closely with the Hispanic community in West Michigan and understanding their specific needs, we are able to provide the tools and resources necessary for a successful home buying or selling experience.”

The initiative has already garnered significant support from community organizations, including The Hispanic Center of Western Michigan. Alejandra Meza, Interim Co-Executive Director for the organization, expressed her enthusiasm for the program, stating, “We’re dedicated to removing barriers to homeownership, and the Hispanic Empowerment Initiative is essential in increasing accessibility for our community.”

Sun Title’s Hispanic Empowerment Initiative features translated real estate, title and settlement forms, including a comprehensive Guide to Buying and Selling Real Estate. With a large Hispanic title and escrow team, Sun remains committed to fostering an environment where every member of the community feels supported and informed throughout their real estate journey.

For more information about the Hispanic Empowerment Initiative, please visit https://www.suntitle.com/spanish-resources-es.

About Sun Title

Sun Title, a full-service title agency specializing in residential and commercial real estate transactions, is headquartered in Grand Rapids, Michigan and is one of the state’s largest title insurance agencies. Founded in 2005 by Lawrence Duthler and Thomas Cronkright II, the company is guided by its strong culture and commitment to creating transparency and simplicity in every real estate transaction for all parties, irrespective of their experience or background. The company’s team of title experts and on-staff attorneys provides a complete closing solution for all transaction types in Michigan.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/sun-title-creates-resources-to-support-hispanic-home-buyers-and-sellers-302279545.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/sun-title-creates-resources-to-support-hispanic-home-buyers-and-sellers-302279545.html

SOURCE Sun Title

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.