Intel Reportedly Considers Selling Minority Stake In Altera Unit For $17B Amid Market Challenges, Losing Ground To Nvidia And AMD As Stock Plummets Over 50% This Year

Intel Corp. INTC is reportedly considering selling a minority stake in its Altera unit to raise several billion dollars.

What Happened: Intel is looking to sell a minority stake in its Altera unit, which it acquired for $16.7 billion in 2015, reported CNBC, citing people familiar with the matter. The deal is expected to value Altera at around $17 billion.

Intel has been experiencing a significant drop in its stock price and a prolonged period of market share losses. The company has been reaching out to private equity and strategic investors to discuss the potential sale of a majority stake in the Altera business.

Intel’s CEO, Pat Gelsinger, had previously emphasized the importance of the Altera business to Intel’s future. However, the company is now considering selling a stake in Altera to fund its semiconductor fabrication ambitions and reassure investors of its future as an independent company.

See Also: As Boeing Workers Enter Second Month Of Strike, Rival Airbus Reportedly Plans To Cut 2,500 Jobs

Intel shares have plummeted by 50% this year, largely due to losing ground to NVIDIA Corp NVDA in AI chips and Advanced Micro Devices, Inc. AMD in the PC and data center market.

Intel did not immediately respond to Benzinga‘s request for comment.

Why It Matters: The potential sale of a stake in the Altera business comes at a time when Intel is facing significant challenges in the market. The company is also under scrutiny in China, where the Cybersecurity Association of China has called for a security review of Intel’s products, citing potential threats to national security amid escalating trade tensions with the U.S.

Intel has been taking steps to counter its market challenges, including partnering with Advanced Micro Devices to create an x86 Ecosystem Advisory Group.

Meanwhile, Intel’s stock has been struggling, down over 53% year-to-date, with its market cap dropping below $100 billion for the first time in over a decade. In contrast, Oracle Corp ORCL has been making significant strides in the AI and cloud space.

Price Action: Intel’s stock closed at $22.44 on Thursday, up 0.58% for the day. In after-hours trading, the stock rose 0.18%. Year to date, Intel shares have declined 53.05%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia CEO Jensen Huang Says His Day Is A Success Before He Even Starts Work. He Explains Why He's Never Too Busy For Interruptions

Jensen Huang, the CEO of Nvidia (NASDAQ:NVDA), starts his day inspiringly. While many leaders are overwhelmed by endless to-do lists, Huang ensures his priorities are in check before his workday begins.

“I begin each morning by doing my highest priority work first,” Huang says. “Before I even get to work, my day is already a success.”

Don’t Miss:

Huang’s strategy is simple but powerful: get the most important tasks done first no matter what. This gives him a sense of completion even before his workday officially begins and he doesn’t get upset by disruptions during the day because of it.

When people apologize for interrupting him, he tells them, “I have plenty of time.” He says it out of true courtesy, not merely to be nice. Because he sets priorities for his day and completes important tasks ahead of schedule, he has more time to assist others and handle unforeseen situations.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

Huang also prefers not to schedule one-on-one meetings with his direct reports but makes himself available whenever they need him. He shared at a Stanford University talk that his management team consists of 55 people reporting directly to him and the structure is meant to be agile and allow information to flow freely.

See Also: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

Instead of holding regular meetings, Huang prioritizes availability when needed. “Unless they need me,” he said, “then I’ll drop everything for them.” He and his team maintain open communication throughout the day, which also means there are no formal performance reviews – just ongoing, real-time feedback.

This sense of clarity and resilience helped Huang and Nvidia defy early critics. In the company’s early days, he was told that Nvidia would never grow larger than a billion dollars. But Huang didn’t let this underestimation limit him. “A long time ago, I was told that Nvidia could never be larger than a billion dollars,” he recalls. “Obviously, that was an underestimation, underimagination of the size of the opportunity.”

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

Instead of staying in its lane, Nvidia expanded far beyond graphics chips into AI, health care, autonomous vehicles and more, pushing its valuation to over three trillion dollars.

Huang approaches his work with a combination of perseverance, discipline and generosity. He sets sensible priorities, finds time for others and focuses on the big picture.

His advice to everyone is to find a craft to which you want to dedicate yourself, be resilient in the face of setbacks and prioritize what matters most. “When you do that, you have plenty of time,” Huang says, reminding us that time is best spent on the things that matter.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Nvidia CEO Jensen Huang Says His Day Is A Success Before He Even Starts Work. He Explains Why He’s Never Too Busy For Interruptions originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Colabor Group Reports Results for the Third Quarter 2024

SAINT-BRUNO-DE-MONTARVILLE, Quebec, Oct. 17, 2024 (GLOBE NEWSWIRE) — Colabor Group Inc. GCL (“Colabor” or the “Company”) reports its results for the third quarter ended September 7, 2024.

Third Quarter 2024 Financial Highlights:

- Sales decreased by 1.6% to $162.0 million, compared to $164.7 million for the corresponding period of 2023;

- Net earnings from continuing operations were $1.2 million compared to $3.5 million for the corresponding period of 2023;

- Adjusted EBITDA(1) decreased by 14.0% to $9.5 million from $11.0 million for the corresponding period of 2023 with an adjusted EBITDA(1) margin to 5.9% of sales compared to 6.7% of sales during the corresponding period of 2023;

- Cash flow from operating activities increased to $9.9 million compared to $8.0 million for the third quarter of 2023;

- Net debt(2) decreased to $50.7 million, compared to $61.5 million as at December 30, 2023. The leverage ratio(3) is 2.6x as at September 7, 2024, compared to 2.7x as at December 30, 2023.

Table of Third Quarter 2024 Financial Highlights:

| Financial highlights | 12 weeks | 36 weeks | ||

| (in thousands of dollars, except percentages, per share data and financial leverage ratio) | 2024 | 2023 | 2024 | 2023 |

| $ | $ | $ | $ | |

| Sales from continuing operations | 162,034 | 164,700 | 454,512 | 462,809 |

| Adjusted EBITDA(1) | 9,484 | 11,034 | 24,084 | 25,902 |

| Adjusted EBITDA(1) margin (%) | 5.9 | 6.7 | 5.3 | 5.6 |

| Net earnings from continuing operations | 1,164 | 3,539 | 1,067 | 5,693 |

| Net earnings | 1,113 | 3,539 | 996 | 5,693 |

| Per share – basic and diluted ($) | 0.01 | 0.03 | 0.01 | 0.06 |

| Cash flow from operating activities | 9,904 | 7,969 | 26,627 | 20,044 |

| Financial position | As at | As at | ||

| September 7, | December 30, | |||

| 2024 | 2023 | |||

| Net debt(2) | 50,749 | 61,481 | ||

| Financial leverage ratio(3) | 2.6x | 2.7x | ||

(1) Non-IFRS measure. Refer to the table Reconciliation of Net Earnings to adjusted EBITDA in MD&A section 5 “Non-IFRS Performance Measures”. Adjusted EBITDA corresponds to net operating earnings before costs not related to current operations, depreciation and amortization and expenses for stock-based compensation plan.

(2) Non-IFRS measure. Refer to MD&A section 5 “Non-IFRS Performance Measures”. Net debt corresponds to bank indebtedness, current portion of long-term debt and long-term debt, net of cash.

(3) Financial leverage ratio is an indicator of the Company’s ability to service its long-term debt. It is defined as net debt / adjusted EBITDA less lease liability payments and interests on lease obligations for the last four quarters. The corresponding figure for 2023 has been restated to reflect the new calculation method established for 2024. Refer to MD&A section 5 “Non-IFRS Performance Measures”.

“The contribution of new customers and the growth in purchasing volume among certain customers of the distribution sector allowed us to gain market share and mitigate the effect of headwinds currently operating in the restaurant and retail industries,” said Louis Frenette, President and Chief Executive Officer of Colabor.

“The sound management of our balance sheet and our ability to generate operational cash flows position us well in the current context, and allow us to continue to execute our strategic plan with optimism and determination,” added Pierre Blanchette, Senior Vice President and Chief Financial Officer.

Results for the Third Quarter of 2024

Consolidated sales for the third quarter were $162.0 million, a decrease of 1.6% compared to $164.7 million during the corresponding quarter of 2023. Sales for the distribution activities increased by 1.5%, primarily as a result of a volume increase, part of which is related to the development of new territories, as well as the recent acquisition and the impact of inflation. This growth was mitigated by a more difficult macroeconomic environment during the third quarter of 2024 directly affecting the restaurant and retail industries. Wholesale sales have declined by 10.1% mainly as a result of a more difficult macroeconomic environment during the third quarter of 2024, as explained previously, and mitigated by the impact of inflation.

Adjusted EBITDA(1) from continuing activities was $9.5 million or 5.9% of sales from continuing activities compared to $11.0 million or 6.7% during 2023. These variations were the result of a sales decline and higher operating expenses.

Net earnings from continuing operations and net earnings for the third quarter were $1.2 million and $1.1 million respectively, down from $3.5 million for the corresponding quarter of the previous year, as a result of increased financial expenses combined with a decreased adjusted EBITDA(1) and mitigated by lower income taxes expenses. The increase in financial charges is a result of the increased rental obligations, particularly for our premises located in Saint-Bruno-de-Montarville.

Results for the 36-week period of 2024

Consolidated sales for the 36-week period were $454.5 million compared to $462.8 million for the corresponding period of 2023. Sales for the distribution activities grew by 1.0% and the wholesale sales declined by 9.3%.

Adjusted EBITDA(1) from continuing operations was $24.1 million or 5.3% of sales from continuing operations compared to $25.9 million or 5.6% in 2023. These variations were the result of a sales decrease and higher operating expenses.

Net earnings from continuing operations were $1.1 million, down from $5.7 million in the previous fiscal year. This variation is a result of increased financial expenses as explained previously, combined with a decrease of adjusted EBITDA(1) and mitigated by lower income taxes expenses.

Cash Flow and Financial Position

Cash flows from operating activities were $9.9 million and $26.6 million for the 12 and 36-week periods of 2024 respectively, compared to $8.0 million and $20.0 million for the corresponding periods of 2023. This increase is mainly due to lower utilization of working capital(4), mitigated by the decrease of the adjusted EBITDA(1). The lower utilization of working capital(4) is explained by the improvement in the inventory turnover rate and the timing in supplier payments.

As at September 7, 2024, the Company’s working capital(4) was $48.2 million, down from $54.0 million at the end of the fiscal year 2023. This decrease is the result of an improvement in the inventory turnover rate and the timing in supplier payments.

As at September 7, 2024, the Company’s net debt(2) was down to $50.7 million, compared to $61.5 million at the end of the fiscal year 2023, resulting from the credit facility repayment of $5.5 million and an increase in cash.

Outlook

“While the restaurant and retail industries are currently going through a more challenging period, we will continue to act on several fronts to continue to improve our productivity and operational efficiency. With our new distribution center in Saint-Bruno-de-Montarville, we are well positioned to distinguish ourselves in a competitive market. We will pursue a strategy of prudent allocation of our cash flows by prioritizing debt repayment, while remaining on the lookout for investment opportunities that will maximize shareholder returns,” concluded Mr. Frenette.

(4) Working capital is a non-IFRS performance measure. Working capital is an indicator of the Company’s ability to hedge its current liabilities with its current assets. Refer to MD&A section 3.2 “Financial Position” for detailed calculation.

Non-IFRS Performance Measures

The information provided in this release includes non-IFRS performance measures, notably adjusted earnings before financial expenses, depreciation and amortization and income taxes (“Adjusted EBITDA”)(1). As these concepts are not defined by IFRS, they may not be comparable to those of other companies. Refer to Section 5 “Non-IFRS Performance Measures” in the Management’s Discussion and Analysis.

| Reconciliation of Net Earnings to Adjusted EBITDA(1) | 12 weeks | 36 weeks | |||

| (in thousands of dollars) | 2024 | 2023 | 2024 | 2023 | |

| $ | $ | $ | $ | ||

| Net earnings from continuing operations | 1,164 | 3,539 | 1,067 | 5,693 | |

| Income taxes | 591 | 1,362 | 530 | 2,109 | |

| Financial expenses | 2,823 | 1,271 | 8,196 | 3,896 | |

| Operating earnings | 4,578 | 6,172 | 9,793 | 11,698 | |

| Expenses for stock-based compensation plan | 28 | 63 | 80 | 212 | |

| Costs not related to current operations | 154 | 99 | 276 | 150 | |

| Depreciation and amortization | 4,724 | 4,700 | 13,935 | 13,842 | |

| Adjusted EBITDA(1) | 9,484 | 11,034 | 24,084 | 25,902 | |

Additional Information

The Management’s Discussion and Analysis and the consolidated financial statements of the Company are available on SEDAR+ (www.sedarplus.ca). Additional information, including the annual information form, about Colabor Group Inc. can also be found on SEDAR+ and on the Company’s website at www.colabor.com.

Forward-Looking Statements

This press release contains certain forward-looking statements as defined under applicable securities law. Forward-looking information may relate to Colabor’s future outlook and anticipated events, business, operations, financial performance, financial condition or results and, in some cases, can be identified by terminology such as “may”; “will”; “should”; “expect”; “plan”; “anticipate”; “believe”; “intend”; “estimate”; “predict”; “potential”; “continue”; “foresee”; “ensure” or other similar expressions concerning matters that are not historical facts. Particularly, statements regarding the Company’s financial guidelines, future operating results and economic performance, objectives and strategies are forward-looking statements. These statements are based on certain factors and assumptions including expected growth, results of operations, performance and business prospects and opportunities, which Colabor believes are reasonable as of the current date. Refer in particular to section 2.2 “Development Strategies and Outlook” of the Company’s MD&A. While Management considers these assumptions to be reasonable based on information currently available to the Company, they may prove to be incorrect. Forward-looking information is also subject to certain factors, including risks and uncertainties that could cause actual results to differ materially from what Colabor currently expects. For more exhaustive information on these risks and uncertainties, the reader should refer to section 6 “Risks and Uncertainties” of the Company’s MD&A. These factors are not intended to represent a complete list of the factors that could affect Colabor and future events and results may vary significantly from what Management currently foresees. The reader should not place undue importance on forward-looking information contained in this press release, information representing Colabor’s expectations as of the date of this press release (or as of the date they are otherwise stated to be made), which are subject to change after such date. While Management may elect to do so, the Company is under no obligation (and expressly disclaims any such obligation) and does not undertake to update or alter this information at any particular time, whether as a result of new information, future events or otherwise, except as required by law.

Conference Call

Colabor will hold a conference call to discuss these results on Friday, October 18, 2024, beginning at 9:30 a.m. Eastern time. Interested parties can join the call by dialing 1-888-510-2154 (from anywhere in North America) or 1-437-900-0527. If you are unable to participate, you can listen to a recording by dialing 1-888-660-6345 or 1-289-819-1450 and entering the code 53065# on your telephone keypad. The recording will be available from 1:30 p.m. on Friday, October 18, 2024, until 11:59 p.m. on October 25, 2024. Note that the recording will be available offline on our website at the following address:

https://colabor.com/en/investisseurs-en/evenements-et-presentations/

You can also use the QuickConnect link: https://emportal.ink/4gfDA9p. This new link allows any participant to access the conference call by clicking on the URL link and enter their name and phone number.

About Colabor

Colabor is a distributor and wholesaler of food and related products serving the hotel, restaurant and institutional markets or “HRI” in Quebec and in the Atlantic provinces, as well as the retail market. Within its two operating activities, Colabor offers specialty food products such as meat, fish and seafood, as well as food and related products through its Broadline activities.

Further information:

| Pierre Blanchette Senior Vice President and Chief Financial Officer Colabor Group Inc Tel.: 450-449-4911 extension 1308 investors@colabor.com |

Danielle Ste-Marie Ste-Marie Strategy and Communications Inc. Investor Relations Tel.: 450-449-0026 extension 1180 |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

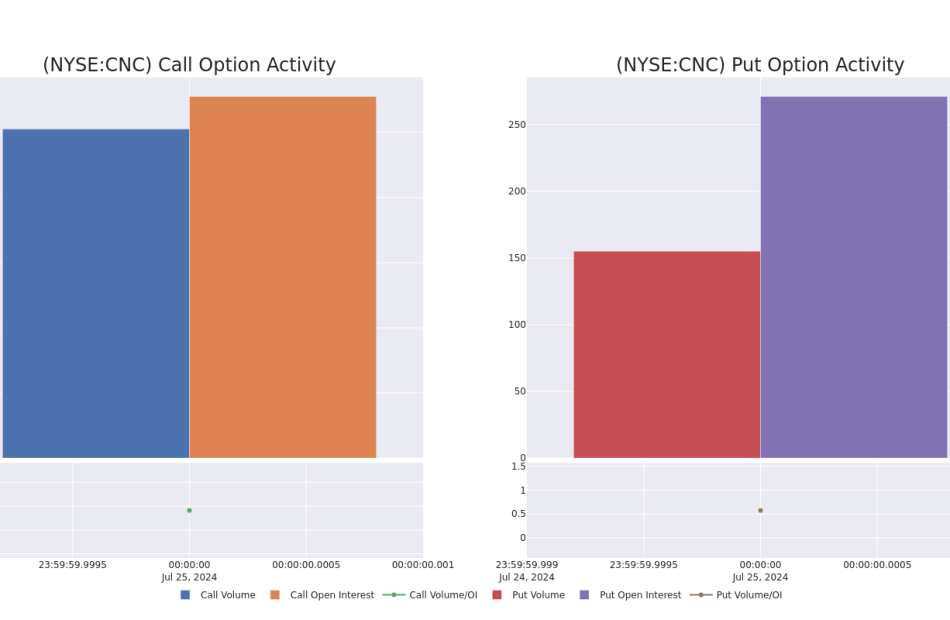

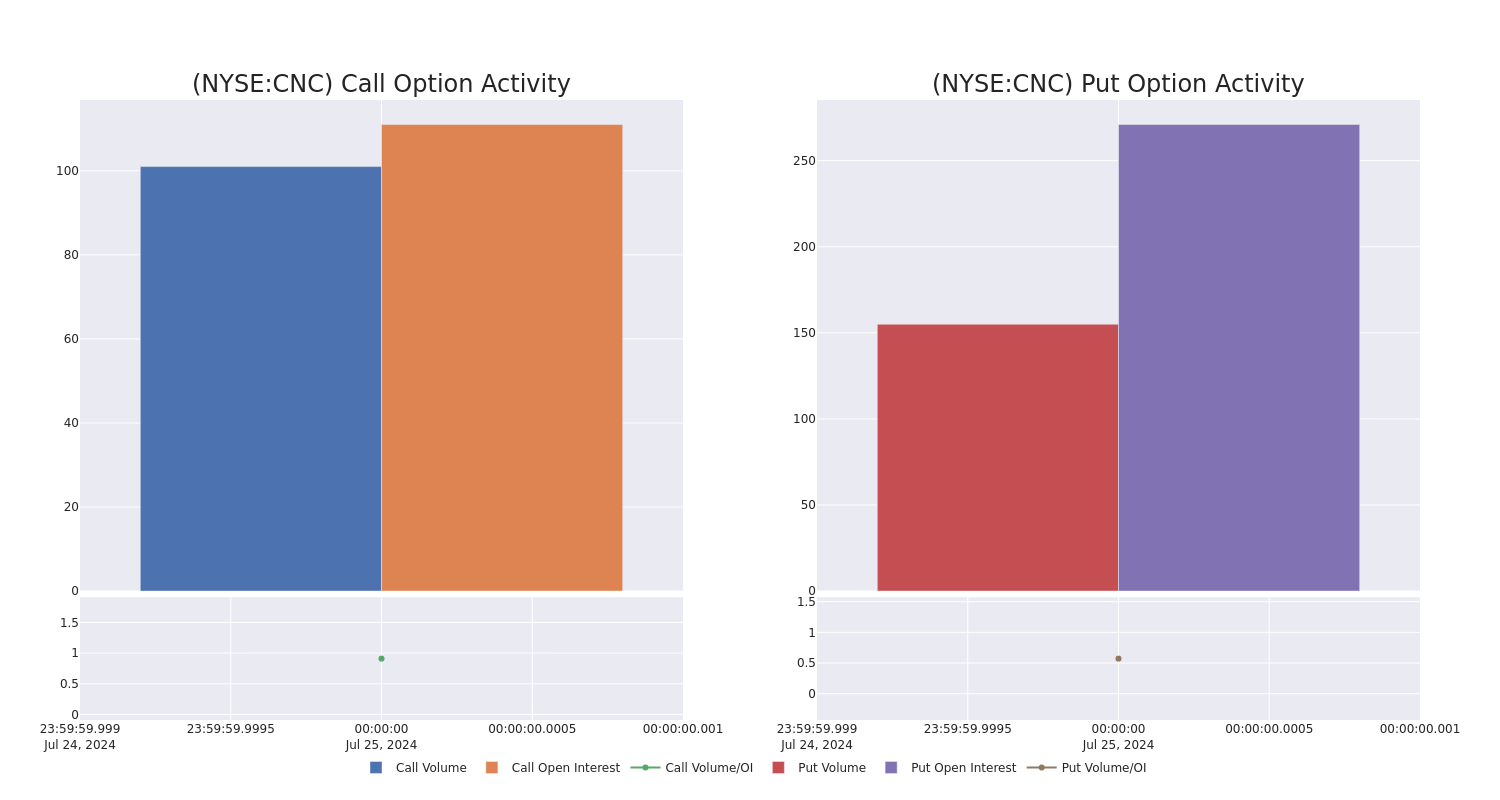

Centene Options Trading: A Deep Dive into Market Sentiment

Deep-pocketed investors have adopted a bearish approach towards Centene CNC, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CNC usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 21 extraordinary options activities for Centene. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 19% leaning bullish and 76% bearish. Among these notable options, 15 are puts, totaling $4,405,390, and 6 are calls, amounting to $307,439.

What’s The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $55.0 to $67.5 for Centene during the past quarter.

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Centene’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Centene’s whale trades within a strike price range from $55.0 to $67.5 in the last 30 days.

Centene 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CNC | PUT | TRADE | BEARISH | 10/18/24 | $3.4 | $3.0 | $3.3 | $66.00 | $1.6M | 11.9K | 8.9K |

| CNC | PUT | TRADE | BULLISH | 11/29/24 | $1.1 | $0.9 | $0.95 | $55.00 | $730.0K | 0 | 7.6K |

| CNC | PUT | SWEEP | BEARISH | 10/18/24 | $3.3 | $3.2 | $3.3 | $66.00 | $330.1K | 11.9K | 1.0K |

| CNC | PUT | TRADE | BEARISH | 10/18/24 | $3.2 | $2.5 | $3.0 | $66.00 | $300.0K | 11.9K | 11.9K |

| CNC | PUT | SWEEP | BEARISH | 10/18/24 | $3.4 | $2.95 | $3.0 | $66.00 | $273.6K | 11.9K | 3.0K |

About Centene

Centene is a managed-care organization focused on government-sponsored healthcare plans, including Medicaid, Medicare, and the individual exchanges. Centene served 24 million medical members as of June 2023, mostly in Medicaid (67% of membership), the individual exchanges (14%), and Medicare Advantage (6%) plans. The company also serves traditional Medicare users with its Medicare Part D pharmaceutical program.

Having examined the options trading patterns of Centene, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Where Is Centene Standing Right Now?

- With a volume of 14,571,018, the price of CNC is down -8.8% at $63.2.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 8 days.

What Analysts Are Saying About Centene

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $90.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $90.

* An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $90.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Centene with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Intuitive Surgical Stock Pops On Q3 Earnings Beat, Da Vinci Procedures Climb 18%, Regulatory Clearance Update And More

Intuitive Surgical, Inc. ISRG reported third-quarter financial results after markets closed on Thursday. Here’s a rundown of everything you need to know.

Q3 Earnings Top Estimates: Intuitive Surgical reported third-quarter revenue of $2.04 billion, beating the consensus estimate of $2 billion. The robotic-assisted surgery company reported third-quarter adjusted earnings of $1.84 per share, beating analyst estimates of $1.63 per share, according to Benzinga Pro.

Revenue climbed 17% on a year-over-year basis. Worldwide da Vinci procedures increased approximately 18% year-over-year. The company said it placed 379 da Vinci surgical systems in the quarter, versus 312 in the prior year’s quarter; 110 of the systems placed during the quarter were Intuitive’s da Vinci 5 systems.

Intuitive Surgical’s da Vinci surgical system installed base totaled 9,539 systems as of Sept. 30, up 15% year-over-year. The company ended the quarter with $8.31 billion in cash, cash equivalents and investments, up $628 million during the quarter.

“Core measures of our business were healthy this quarter, and we are pleased by customer adoption of da Vinci 5,” said Gary Guthart, CEO of Intuitive Surgical. “We remain focused on delivering the goals we share with our customers, centered on improving patient outcomes.”

Intuitive Surgical said it obtained regulatory clearance in South Korea for the da Vinci 5 surgical system in October. The company’s latest surgical systems can now be used in urologic, general, gynecologic, thoracoscopic, thoracoscopically-assisted cardiotomy and transoral otolaryngology surgical procedures.

Intuitive Surgical scheduled a conference call to discuss the company’s quarterly performance with analysts and investors at 4:30 p.m. ET.

ISRG Price Action: Intuitive Surgical shares were up 6.39% in after-hours, trading at $505 at the time of publication Thursday, according to Benzinga Pro.

Read Next:

Photo: Courtesy of Intuitive Surgical.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

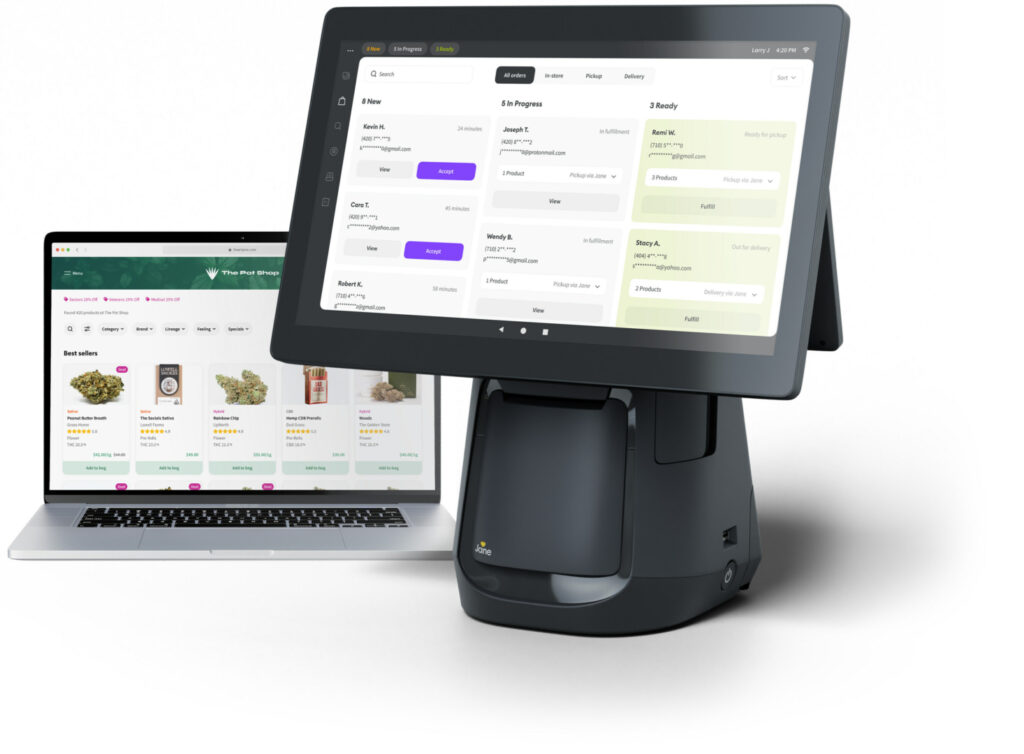

This Tech Company Is Turning Cannabis Shopping Into Spotify – Are Retailers Ready?

With cutting-edge technology and a consumer-centric approach, Jane Technologies, led by CEO and co-founder Socrates Rosenfeld, is transforming how consumers buy cannabis, making the process as intuitive as choosing music on Spotify.

Rosenfeld’s team at Jane Technologies is developing tools that not only personalize the cannabis shopping experience but also integrate seamlessly with retail infrastructure. In an exclusive interview with Benzinga Cannabis, Rosenfeld shares insights into their approach, how they are revolutionizing cannabis retail, and what lies ahead.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

From E-Commerce To Integrated Ecosystems: Cannabis Shopping Into Spotify

Jane Technologies began as an e-commerce provider, focusing on data integration and scalability. “We started really as an e-commerce provider for a long time and focused on that because there was a lot of work to do and to establish a good foundation across data integrations,” Rosenfeld explained. With patents protecting their innovative software, Jane Technologies has become a leading e-commerce solution provider in the cannabis industry.

However, the cannabis retail market is limited, with fewer retailers compared to other industries. To continue growing, the company expanded vertically, venturing into adjacent areas. “We introduced a very large ads business and infrastructure,” Rosenfeld said, detailing their expansion into point-of-sale (POS) systems, self-service kiosks and consumer rewards programs like Jane Gold.

A Spotify-Like Experience

One of Jane Technologies’ most revolutionary developments is the personalization of the cannabis shopping experience. Drawing comparisons to Netflix NFLX and Spotify SPOT, Rosenfeld explains how machine learning algorithms are used to recommend products to customers based on their preferences. “Your Netflix is personalized, your YouTube’s personalized, your Amazon is personalized. Cannabis should be no different.”

Much like how Spotify curates playlists based on user preferences, Jane Technologies’ platform creates customized cannabis menus for each consumer.

This personalized approach ensures that the right products are recommended at the right time, optimizing the shopping experience. “If you consume a strain and I consume the same product, we’re going to feel differently based on our endocannabinoid systems. That’s why personalization is key.”

Jane Gold: A Win-Win-Win Approach

One of Jane Technologies’ standout innovations is Jane Gold, a consumer rewards program that bridges the gap between brands, retailers and consumers. Historically, brands offering discounts had little insight into who their customers were. With Jane Gold, that changes.

“Wyld [a top edibles brand], for example, can now directly interact with customers through the Jane platform, rewarding them with discounts while building a direct relationship,” Rosenfeld explained.:

This system benefits everyone involved. Consumers enjoy discounts on their favorite products, retailers attract more foot traffic and brands gain valuable consumer data, enabling them to target their marketing efforts more effectively.

“It’s a win-win-win. The customer wins, the store wins, and the brand wins,” Rosenfeld told Benzinga.

POS And Kiosks: Enhancing The Retail Experience

Jane Technologies’ POS solutions integrate seamlessly into the cannabis retail environment, creating a more efficient and personalized shopping experience. “We’ve been cataloging every single SKU in every single state market at every dispensary we power. This allows us to cleanse and standardize product data across different retailers,” he said.

By linking the POS system with its extensive data catalog, Jane Technologies enables retailers to offer personalized recommendations to in-store customers. “When you walk into a store, we know who you are, and we can push that information to the budtenders. They can see which products you’ve liked in the past and recommend similar ones.”

Their self-service kiosks further streamline the in-store experience, allowing customers to place orders without interacting with a budtender. “If you don’t want to talk to a budtender and there’s a long line, you can use the kiosk to get the same curated experience as you would online.”

Future Growth Strategy

“We don’t need to subsidize our growth through outside investment. We’re growing based on our ability to generate revenue and profit,” he explained.

Their focus on reinvesting profits into the business allows them to remain independent and sustainable while continuing to innovate and expand into new markets. “We’re not playing the same game as other companies. We’re playing our music,” Rosenfeld said.

Read Next: Cannabis Robots: Meet The Company Boosting Efficiency And Margins Through Packaging Automation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Citizens Financial Group Inc

Summary

Based in Providence, Rhode Island, Citizens Financial Group, Inc. operates as the bank holding company for Citizens Bank, National Association and Citizens Bank of Pennsylvania. As of March 31, 2023, the company had approximately 18,000 employees in 14 New England, mid-Atlantic, Western and Midwes

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Brilliant Earth to Report Third Quarter 2024 Financial Results on November 7th

SAN FRANCISCO, Oct. 17, 2024 (GLOBE NEWSWIRE) — Brilliant Earth Group, Inc. (“Brilliant Earth” or the “Company”) BRLT, an innovative, global leader in ethically sourced fine jewelry, today announced that it will report third quarter 2024 earnings results after the market closes on Thursday, November 7, 2024.

The Company will host an investor conference call and webcast to review these financial results and business outlook at 5:00pm ET/2:00pm PT on the same day. The webcast can be accessed at https://investors.brilliantearth.com. The conference call can be accessed by using the following link: Brilliant Earth’s 3Q24 Earnings Call. After registering, an email will be sent including dial-in details and a unique conference call pin required to join the live call. A replay of the event will be available on the Brilliant Earth investor website after the live webcast concludes.

About Brilliant Earth

Brilliant Earth is a digitally native, omnichannel fine jewelry company and a global leader in ethically sourced fine jewelry. With 2023 full year Net Sales of $446 million and 12 consecutive quarters of positive adjusted EBITDA since its initial public offering in 2021, the Company’s mission since its 2005 founding has been to create a more transparent, sustainable, and compassionate jewelry industry. Headquartered in San Francisco, CA and Denver, CO, Brilliant Earth has more than 35 showrooms across the United States and has served customers in over 50 countries worldwide.

Contacts:

Investor Relations:

Colin Bourland

investorrelations@brilliantearth.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.