Ark Invest's flagship fund realized $3.5 billion in losses in a year. Here were its 10 biggest losers.

-

Ark Invest’s Innovation ETF realized $3.5 billion in losses in the fiscal year ending July 2024.

-

Ark Invest saw an accumulated loss of $22 billion across its suite of ETFs.

-

Cathie Wood said in an X post this summer that trading losses are useful for offsetting future taxes.

Cathie Wood’s Ark Invest recently filed its annual report for its fiscal year ending July 31, and it reveals some steep losses.

Ark’s flagship Innovation ETF realized $3.5 billion in losses from July 31, 2023, through July 31, 2024.

Across Ark’s suite of eight innovation and disruption-focused ETFs, the total accumulated loss was $21.7 billion, according to the annual report.

The past few years have been tough for the kinds of speculative growth stocks Ark funds have focused on. The losses for its funds followed the deflation of the speculative trade in 2021, as investors fled the kinds of money-losing companies in which Ark Invest is heavily invested amid high inflation and rising interest rates.

The Financial Times flagged a now-deleted thread on X in July, in which Ark CEO Cathie Wood defended her fund’s losses by arguing that they’re an “under-appreciated asset associated with our strategies.”

“As a result, our trading-related capital tax losses should offset trading-related capital tax gains for years, an under-appreciated asset associated with our strategies,” Wood said in the post.

The Ark Innovation ETF is down 9% year-to-date and off 70% from its record high.

Ark Invest did not respond to a request for comment.

Here are the stocks in Ark Invest’s flagship ETF that saw the biggest realized losses for the fiscal year ending July 31.

10. Veracyte

Ticker: VCYT

Ark’s Realized Loss: $6.8 million

9. PagerDuty

Ticker: PD

Ark’s Realized Loss: $10.0 million

8. Beam Therapeutics

Ticker: BEAM

Ark’s Realized Loss: $47.3 million

7. Twist Bioscience

Ticker: TWST

Ark’s Realized Loss: $50.0 million

6. 2U

Ticker: Delisted (Bankruptcy)

Ark’s Realized Loss: $195.4 million

5. UiPath

Ticker: PATH

Ark’s Realized Loss: $270.9 million

4. Invitae

Ticker: Delisted (Bankruptcy)

Ark’s Realized Loss: $453.4 million

3. Roku

Ticker: ROKU

Ark’s Realized Loss: $467.3 million

2. Ginkgo Bioworks

Ticker: DNA

Ark’s Realized Loss: $510.3 million

1. Teladoc Health

Ticker: TDOC

Ark’s Realized Loss: $1.50 billion

Read the original article on Business Insider

Trade Credit Insurance Market to Reach $41.1 billion, Globally, by 2033 at 10.7% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 17, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Trade Credit Insurance Market By Component (Product and Services), Enterprise Size (Large Enterprises and Small and Medium-sized Enterprises), Coverage (Whole Turnover Coverage and Single Buyer Coverage), Industry Vertical (Food and Beverages, IT and Telecom, Metals and Mining, Healthcare, Energy and Utilities, Automotive, and Others), and Application (Domestic and International): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the trade credit insurance market was valued at $14.9 billion in 2023, and is estimated to reach $41.1 billion by 2033, growing at a CAGR of 10.7% from 2024 to 2033.

Get Your Sample Report & TOC Today: https://www.alliedmarketresearch.com/request-sample/A08305

Prime Determinants of Growth

Numerous benefits provided by trade credit insurance solutions, rapid expansion of new geographic markets, and increase in commercial threat to the trade are the factors expected to propel the growth of the global trade credit insurance market. However, the varied and conflicting trade regulations across different jurisdictions and lack of awareness toward trade credit insurance across the globe are anticipated to hamper the growth of the global market. On the contrary, surge in small and medium enterprises globally and untapped potential of emerging economies are further expected to create lucrative opportunities for the growth of the global trade credit insurance market.

Report Coverage & Details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $14.9 Billion |

| Market Size in 2033 | $41.1 Billion |

| CAGR | 10.7% |

| Segments covered | Component, Enterprise Size, Coverage, Industry Vertical, Application and Region |

| Drivers |

|

| Opportunities |

|

| Restraints |

|

Purchase This Comprehensive Report (PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/3AawJO8

Segment highlights

The product segment to maintain its lead position during the forecast period.

By component, the product segment held the largest market share in 2023, accounting for more than two-thirds of the trade credit insurance market revenue and is estimated to maintain its leadership status during the forecast period, owing to the growing demand for customized insurance solutions and the rising awareness of credit risk management among companies. However, the services segment is expected to attain the largest CAGR of 12.9% from 2023 to 2033 and is projected to maintain its lead position during the forecast period, owing to the increasing need for risk management consulting, claims processing, and advisory services, which drives the growth of this segment in the global trade credit insurance market.

The large enterprises segment to maintain its lead position during the forecast period

By enterprise size, the large enterprises segment accounted for the largest share in 2023, contributing to more than three-fifths of the trade credit insurance market revenue, owing to the significant financial exposure that large corporations face in their global operations, which needs trade credit insurance for the risk management, drives the segment growth. However, the small and medium-sized enterprises segment is expected to attain the largest CAGR of 12.9% from 2023 to 2033 and is projected to maintain its lead position during the forecast period, owing to increasing awareness among SMEs about the benefits of trade credit insurance, such as safeguarding their cash flow and mitigating risks from non-payment by clients, thereby driving the growth of this segment in the global trade credit insurance market.

The whole turnover coverage segment to maintain its lead position during the forecast period

By coverage, the whole turnover coverage segment accounted for the largest share in 2023, contributing to more than four-fifths of the trade credit insurance market revenue, owing to its comprehensive risk protection, which safeguards all of a company’s credit sales rather than individual transactions. However, the single buyer coverage segment is expected to attain the largest CAGR of 14.2% from 2023 to 2033 and is projected to maintain its lead position during the forecast period, owing to its targeted risk management capabilities, allowing businesses to insure specific high-risk clients or major buyers that significantly impact their revenue, which is driving the segment growth.

The others segment to maintain its lead position during the forecast period.

By industry vertical, the others segment accounted for the largest share in 2023, contributing to more than one-fourth of the trade credit insurance market revenue, owing to the inclusion of diverse sectors such as technology, healthcare, and professional services, which fall outside traditional industries such as manufacturing or retail. As these industries increasingly engage in global trade, their exposure to credit risks has grown, thereby prompting a rising demand for trade credit insurance to safeguard against non-payment. However, the healthcare segment is expected to attain the largest CAGR of 15.9% from 2023 to 2033 and is projected to maintain its lead position during the forecast period, owing to the increasing global trade in medical products, including pharmaceuticals and medical devices, which often involve high-value transactions. The risk of non-payment in these transactions can have a significant financial impact, making trade credit insurance an essential tool for healthcare companies.

The domestic segment to maintain its lead position during the forecast period.

By application, the domestic segment accounted for the largest share in 2023, contributing to more than half of the trade credit insurance market revenue, owing to the high volume of domestic trade, where businesses often engage more frequently with local buyers compared to international clients. However, the international segment is expected to attain the largest CAGR of 12.4% from 2023 to 2033 and is projected to maintain its lead position during the forecast period, owing to the expanding volume of global trade, as businesses increasingly seek to enter international markets. The cross-border transactions come with higher financial risks, including currency fluctuations, geopolitical uncertainties, and varying legal frameworks, all of which increase the demand for trade credit insurance to protect against non-payment.

Get More Information Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A08305

North America region to maintain its dominance by 2033.

By region, North America held the largest market share in terms of revenue in 2023, owing to the benefits from robust economic activity characterized by high levels of both domestic and international trade. This strong economic foundation creates a favorable environment for businesses to engage in trade credit insurance as a means of safeguarding their transactions, which drives regional growth. However, Asia-Pacific is projected to attain the highest CAGR of 12.4% from 2023 to 2033, owing to the regions’ rapid economic expansion, particularly in countries such as China and India, which is increasing trade activities and the need for risk management solutions.

Leading Market Players

- American International Group Inc.

- QBE Insurance (Australia) Ltd.

- Chubb Group Holdings Inc.

- Zurich Insurance Company Ltd

- Authorized Policy Insurance Brokers Ltd.

- Howden Group Holdings Ltd.

- Islamic Corporation for the Insurance of Investment and Export Credit (ICIEC)

- HDFC ERGO General Insurance Company Limited

The report provides a detailed analysis of these key players in the trade credit insurance market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different countries. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the trade credit insurance market analysis from 2023 to 2033 to identify the prevailing trade credit insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the trade credit insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global trade credit insurance market trends, key players, market segments, application areas, and market growth strategies.

Access Your Customized Sample Report & TOC Now: https://www.alliedmarketresearch.com/request-for-customization/A08305

Trade Credit Insurance Market Key Segments:

By Application

By Component

By Enterprise Size

- Small and Medium-sized Enterprises

By Coverage

- Whole Turnover Coverage

By Region

- North America (U.S., Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

- LAMEA (Brazil, South Africa, Saudi Arabia, UAE, Argentina, Rest of LAMEA)

Trending Reports in BFSI Industry (Book Now with 10% Discount + Covid-19 scenario):

Specialty Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Distribution Channel, by End User : Global Opportunity Analysis and Industry Forecast, 2021-2031

Europe Travel Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Insurance Cover, Distribution Channel and End User : Regional Opportunity Analysis and Industry Forecast, 2020-2027

Insurance Fraud Detection Market Size, Share, Competitive Landscape and Trend Analysis Report, by Component, by Deployment Mode, by Enterprise Size, by Applications : Global Opportunity Analysis and Industry Forecast, 2021-2031

Health Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Insurance Type, by Coverage, by End User, by Age Group, by Distribution Channel : Global Opportunity Analysis and Industry Forecast, 2024-2032

Generative AI in Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Component, by Technology, by Application : Global Opportunity Analysis and Industry Forecast, 2023-2032

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington,

New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

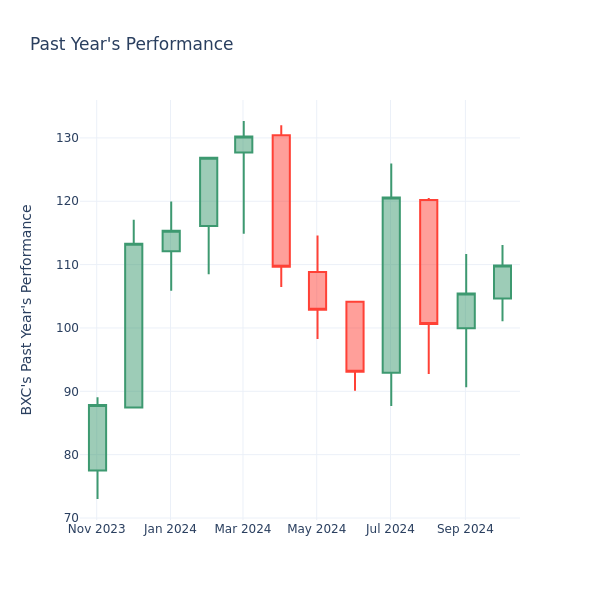

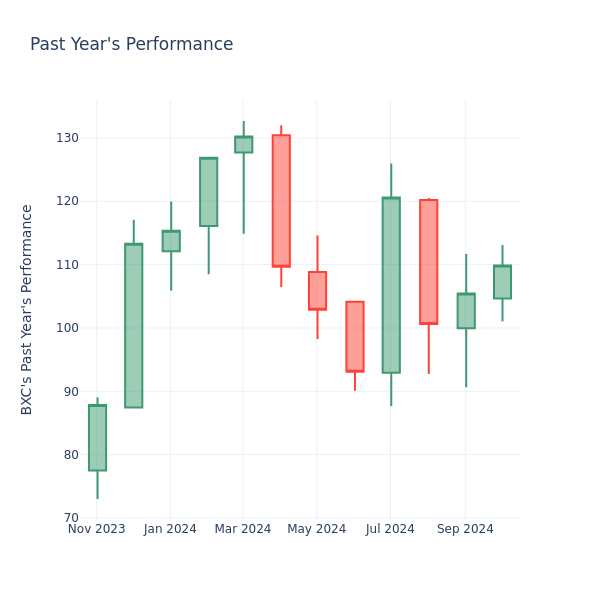

P/E Ratio Insights for BlueLinx Hldgs

Looking into the current session, BlueLinx Hldgs Inc. BXC shares are trading at $109.87, after a 2.60% drop. Over the past month, the stock fell by 0.53%, but over the past year, it actually increased by 53.97%. With questionable short-term performance like this, and great long-term performance, long-term shareholders might want to start looking into the company’s price-to-earnings ratio.

A Look at BlueLinx Hldgs P/E Relative to Its Competitors

The P/E ratio measures the current share price to the company’s EPS. It is used by long-term investors to analyze the company’s current performance against it’s past earnings, historical data and aggregate market data for the industry or the indices, such as S&P 500. A higher P/E indicates that investors expect the company to perform better in the future, and the stock is probably overvalued, but not necessarily. It also could indicate that investors are willing to pay a higher share price currently, because they expect the company to perform better in the upcoming quarters. This leads investors to also remain optimistic about rising dividends in the future.

BlueLinx Hldgs has a better P/E ratio of 25.75 than the aggregate P/E ratio of 17.76 of the Trading Companies & Distributors industry. Ideally, one might believe that BlueLinx Hldgs Inc. might perform better in the future than it’s industry group, but it’s probable that the stock is overvalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Springview Holdings Ltd Announces Closing of Initial Public Offering

Singapore, Oct. 17, 2024 (GLOBE NEWSWIRE) — Springview Holdings Ltd (the “Company” or “Springview”) SPHL, a company that designs and constructs residential and commercial buildings in Singapore, today announced the closing of its initial public offering (the “Offering”) of 1,500,000 Class A ordinary shares at a public offering price of US$4.00 per Class A ordinary share. The ordinary shares began trading on October 17, 2024 under the ticker symbol “SPHL.”

The Company received aggregate gross proceeds of US$6 million from the Offering, before deducting underwriting discounts and other related expenses payable by the Company.

Proceeds from the Offering will be used for business development and marketing activities, hiring and training skilled workforce, and working capital and other general corporate purposes.

The Offering was conducted on a firm commitment basis. AC Sunshine Securities LLC (“AC Sunshine”) acted as the underwriter for the Offering. Ortoli Rosenstadt LLP acted as U.S. counsel to the Company, and Olshan Frome Wolosky LLP acted as U.S. counsel to AC Sunshine in connection with the Offering.

A registration statement on Form F-1 relating to the Offering was filed with the U.S. Securities and Exchange Commission (the “SEC”) (File No. 333-278521) and was declared effective by the SEC on September 30, 2024. The Offering was made only by means of a prospectus, forming a part of the registration statement. Copies of the final prospectus relating to the Offering may be obtained from AC Sunshine by email at ib@acsunshine.com, by standard mail to AC Sunshine, 200 E. Robinson Street, Suite 295, Orlando, FL 32801, or by telephone at +1 (689) 689-9686. In addition, copies of the final prospectus relating to the Offering may be obtained via the SEC’s website at www.sec.gov.

This press release does not constitute an offer to sell, or the solicitation of an offer to buy any of the Company’s securities, nor shall such securities be offered or sold in the United States absent registration or an applicable exemption from registration, nor shall there be any offer, solicitation or sale of any of the Company’s securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of such state or jurisdiction.

About Springview Holdings Ltd

Springview Holdings Ltd designs and constructs residential and commercial buildings in Singapore. With an operating history dating back to 2002, the Company has established a positive reputation in the busy Singapore real estate development market through customer relationships. Springview’s projects cover four main types of work: (i) new construction, (ii) reconstruction, (iii) additions and alterations (A&A), and (iv) other general contracting services. Springview serves individual and independent homeowners in Singapore. With a skilled in-house team of experts, the Company provides a one-stop solution that fosters strong customer relationships, offering a comprehensive range of services such as design, construction, furniture customization and project management. The Company also offers post-project services, including defect repairs and maintenance, that further enhances its customer engagement and future project opportunities. For more information, please visit the Company’s website: https://ir.springviewggl.com/

Cautionary Note Regarding Forward-Looking Statements

Certain statements in this press release are “forward-looking statements” as defined under the federal securities laws, including, but not limited to, statements regarding the use of proceeds from the sale of the Company’s shares in the Offering. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Investors can find many (but not all) of these statements by the use of words such as “believe”, “plan”, “expect”, “intend”, “should”, “seek”, “estimate”, “will”, “aim” and “anticipate”, or other similar expressions in this press release. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the SEC.

For more information, please contact:

Springview Holdings Ltd

Investor Relations Department

Email: ir@springviewggl.com

Ascent Investors Relations LLC

Tina Xiao

Phone: +1-646-932-7242

Email: investors@ascent-ir.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ultra-High Performance Concrete Market to Reach $1,048.2 million, Globally, by 2032 at 5.3% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 17, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Ultra-High Performance Concrete Market by Product Type (Slurry-infiltrated Fibrous Concrete, Reactive Powder Concrete, Compact Reinforced Composite, and Others), Application (Roads and Bridge Construction, Building Construction, Military Construction, and Others), and End-User Industry (Construction Industry and Marine Industry): Global Opportunity Analysis and Industry Forecast, 2023-2032”. According to the report, the ultra-high performance concrete market was valued at $629 million in 2022, and is estimated to reach $1,048.2 million by 2032, growing at a CAGR of 5.3% from 2023 to 2032.

Prime determinants of growth

The Ultra High Performance Concrete (UHPC) market is driven by its superior mechanical properties, such as high compressive strength, durability, and resistance to environmental degradation, and makes it ideal for critical infrastructure projects such as bridges, tunnels, and high-rise buildings. Growth in infrastructure development, especially in emerging economies, is a major driver of UHPC demand. Further, the increasing focus on sustainable construction materials boosts UHPC adoption due to its longer lifespan, reduced maintenance, and lower lifecycle costs compared to conventional concrete. In addition, advancements in construction technology, which facilitate the integration of UHPC in complex architectural designs, and growth in use in defense and transportation sectors, further propel market growth.

Download Sample Copy @ https://www.alliedmarketresearch.com/request-sample/A08149

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2023–2032 |

| Base Year | 2022 |

| Market Size in 2022 | $629 million |

| Market Size in 2032 | $1,048.2 million |

| CAGR | 5.3% |

| No. of Pages in Report | 340 |

| Segments covered | Product Type, Application, End-User Industry, and Region. |

| Drivers | Rise in Adoption of Architectural UHPC in Building Projects Advancements in Material Science and Engineering |

| Opportunities | Growth in emphasis on sustainable construction practices Research and development for cost-effective production methods Customization of UHPC formulations for specific applications |

| Restraints | High Initial Capital Investment Costs |

The slurry-infiltrated fibrous concrete segment to maintain its leadership status throughout the forecast period.

By product type, the slurry-infiltrated fibrous concrete segment in the ultra high performance concrete market is experiencing growth owing to its superior strength, durability, and resistance to extreme conditions. Slurry-infiltrated fibrous concrete’s ability to enhance structural integrity in demanding applications, such as bridges, industrial floors, and military structures, drives its demand. In addition, the rising need for resilient and sustainable infrastructure, combined with advancements in construction technologies, supports the market’s expansion globally.

Buy This Research Report ( 340 Pages PDF with Insights, Charts, Tables, Figures):

https://bit.ly/48aD3BN

The roads and bridge construction segment to maintain its leadership status throughout the forecast period.

By application, the roads and bridge construction segment is experiencing growth owing to its exceptional strength, durability, and resistance to harsh environmental conditions. Its ability to extend the lifespan of infrastructure, reduce maintenance costs, and support innovative designs makes UHPC ideal for high-traffic roads and bridges. In addition, increasing government investments in resilient infrastructure and the need for sustainable, long-lasting materials are further driving the demand for UHPC in this segment.

The construction industry to maintain its leadership status throughout the forecast period.

By end-user industry, the construction industry in ultra high performance concrete market is experiencing growth owing to increase in its use in bridge construction, high-rise buildings, and prefabricated components. UHPC’s resilience to extreme weather and heavy loads makes it ideal for infrastructure projects. There is a growth in demand for longer-lasting structures with reduced maintenance, emphasis on green building solutions, and advancements in concrete technology.

Asia-Pacific is expected to exhibit fastest growth throughout the forecast period

Asia-Pacific accounted for the highest market share in 2023 and is expected to witness the highest CAGR during the forecast period due to rapid advancements in construction technologies and increased focus on seismic-resistant structures. Further, the adoption of UHPC for innovative architectural designs and prefabricated building components, leveraging its exceptional performance. The government funding for smart cities and infrastructure resilience, coupled with rise in demand for eco-friendly materials drive the growth. In addition, the region’s emphasis on reducing maintenance costs and improving the lifespan of critical infrastructure further accelerates the adoption of UHPC, ensuring its pivotal role in future construction projects.

Inquire Before Buying @ https://www.alliedmarketresearch.com/purchase-enquiry/A08149

Leading Market Players: –

- Elementbau Osthessen GmbH & Co

The report provides a detailed analysis of these key players in the ultra high performance concrete market. These players have adopted different strategies such as expansion, investment, agreement, and contract to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario

Trending Reports in Construction industry:

Concrete Market: Global Opportunity Analysis and Industry Forecast, 2021-2030

Mobile Concrete Mixer Market: Global Opportunity Analysis and Industry Forecast, 2021-2030

Interlocking Concrete Pavers Market: Global Opportunity Analysis and Industry Forecast, 2023-2032

Ready-Mix Concrete Market: Global Opportunity Analysis and Industry Forecast, 2020-2030

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” Allied Market Research has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CROMBIE REIT CLOSES STRATEGIC ACQUISITION OF ZEPHYR RESIDENTIAL AT 1661 DAVIE STREET

NEW GLASGOW, NS, Oct. 17, 2024 /CNW/ – Crombie Real Estate Investment Trust (“Crombie”) CRR announced that on October 15, 2024 it has completed the previously announced acquisition of the remaining 50% of Zephyr, in Vancouver, British Columbia, from its partner, Westbank Corp., for an aggregate purchase price of $133 million. Through this acquisition, Crombie will now own 100% of the residential component, in addition to its existing full ownership of the ground floor grocery-anchored retail.

As a result of the acquisition, Crombie will fully consolidate Zephyr and assume the additional 50% of existing mortgages, equivalent to approximately $89 million, with remaining term to maturity of over three years with the balance of the purchase price funded by drawing on a new unsecured bank credit facility. Concurrently with closing, the interest rate on the new unsecured bank credit facility was locked in and together, the total debt has an attractive blended interest rate of 3.5%.

Built in 2021, Zephyr is a mixed-use residential asset anchored by Safeway and includes other complementary necessity-based retailers. Well-located in the West End of downtown Vancouver, offering panoramic views of English Bay and Stanley Park, Zephyr is comprised of two residential towers, totalling 330 rental suites, and was 93.9% occupied at June 30, 2024. This community of homes is focused on living-locally and enjoys a high walkability score in a city ranked among the most walkable cities in the world.

Scotiabank acted as the exclusive advisor to Crombie on this acquisition.

About Crombie REIT

Crombie invests in real estate with a vision of enriching communities together by building spaces and value today that leave a positive impact on tomorrow. As one of the country’s leading owners, operators, and developers of quality real estate assets, Crombie’s portfolio primarily includes grocery-anchored retail, retail-related industrial, and mixed-use residential properties. As at June 30, 2024, our portfolio contains 304 properties comprising approximately 19.3 million square feet, inclusive of joint ventures at Crombie’s share, and a significant pipeline of future development projects. Learn more at www.crombie.ca.

Cautionary Statements

This press release contains forward-looking statements that reflect the current expectations of management of Crombie about Crombie’s future results, performance, achievements, prospects, and opportunities. Wherever possible, words such as “may”, “will”, “estimate”, “anticipate”, “believe”, “expect”, “intend”, and similar expressions have been used to identify these forward-looking statements.

Specifically, this press release includes forward-looking statements regarding the impact of the acquisition on the quality of Crombie’s residential platform. Forward-looking statements necessarily involve known and unknown risks and uncertainties. A number of factors, including the timing and need for regulatory approval, and those discussed in the 2023 annual Management’s Discussion and Analysis under “Risk Management” and the Annual Information Form for the year ended December 31, 2023 under “Risks”, could cause actual results, performance, achievements, prospects, or opportunities to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully, and a reader should not place undue reliance on the forward-looking statements. There can be no assurance that the expectations of management of Crombie will prove to be correct, and Crombie can give no assurance that actual results will be consistent with these forward-looking statements.

SOURCE Crombie REIT

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/17/c3672.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/17/c3672.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ECB Slashes Rates Again: Will Jerome Powell Take This As Cue For Another Fed Rate Cut? Here's What Analysts Say

In a move to stimulate a sluggish economy, the European Central Bank (ECB) has cut interest rates for the third time this year. This decision comes almost a month after the Federal Reserve announced a bold 50 basis point rate cut.

What Happened: The ECB’s latest rate cut marks the first time in 13 years that the bank has made consecutive rate reductions.

The central bank is shifting its focus from battling inflation to encouraging economic growth, which has been trailing behind the United States for the past two years.

In June, Morgan Stanley had predicted that both the ECB and the U.S. Federal Reserve would cut rates in September, citing decelerating inflation in both regions.

Shortly, the ECB reduced interest rates by 25 basis points, signaling a shift in policy to moderate monetary restrictions. This move was anticipated as the ECB assessed the inflation outlook and the effectiveness of monetary policy transmission.

The Fed also followed suit with a 50 basis point rate cut in September, as announced by Jerome Powell, with the probability of further rate cuts in the future drawing differing opinions.

The Analyst: The ECB has not provided specific guidance on future rate changes, emphasizing that decisions will be data-driven and made “meeting by meeting.”

However, as described by economist Mohamed El-Erian in a recent Bloomberg interview, the Federal Reserve is moving away from data dependency and taking a more strategic approach to interest rate cuts.

When asked about the difference in how ECB and Federal Reserve address the rate cuts, El-Erian noted it is partly because different countries within the Eurozone experience inflation differently.

“But I do agree with the notion…the market right now is pricing the same amount of cuts from the ECB and the Fed. And I don’t think that’s going to happen. I think the ECB will cut more than the Fed,” he added.

See Also: Trump Faces Backlash After Suggesting Car AsseMbly In America Is So Simple A ‘Child Could Do’

Potential Difficulties: Meanwhile, Joachim Klement, an investment strategist at Panmure Liberum, expressed in an op-ed published in Reuters about concerns over the potential difficulties that the European Central Bank (ECB) and the U.S. Federal Reserve may encounter in managing the escalating national debt amid rate cuts.

The International Monetary Fund (IMF) recently introduced the concept of “fiscal r-star,” the real interest rate needed to maintain stable national debt levels when an economy is growing at potential and inflation is on target.

Based on current consensus projections for eurozone budget deficits and GDP growth, the ECB’s policy rate would need to drop to about 2.0% in the next three to five years to stabilize debt levels. The situation is more alarming in the U.S., where the fed funds rate would need to fall below 2.5% to prevent the country’s debt-to-GDP ratio from increasing.

Why It Matters: The ECB’s decision to cut rates again comes as part of a broader trend among global central banks.

Economists have earlier suggested that the ECB’s actions could trigger a wave of coordinated rate cuts by central banks worldwide, potentially increasing market volatility in the coming months.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image made with Midjourney

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Automotive Aluminum Market to Reach $60.6 Billion, Globally, by 2033 at 8.7% CAGR: Allied Market Research

Wilmington, Delaware , Oct. 17, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Automotive Aluminum Market by Form (Sheet, Plate, Bar, Tube and Others), Vehicle Type (Light Commercial Vehicles, Heavy Commercial Vehicles, Passenger Cars and Others), and Application (Hood, Pillars, Hinges, Motors, Sunroof Railings and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the automotive aluminum market was valued at $26.2 billion in 2023, and is estimated to reach $60.6 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033.

Prime determinants of growth

Advancements in aluminum alloys are pivotal in fueling the demand for automotive aluminum. These advancements encompass innovations in alloy compositions, manufacturing methods and treatments all geared towards augmenting the properties and functionality of aluminum utilized in automotive applications. By continually refining aluminum alloys manufacturers produce materials with true attributes to address diverse automotive needs. For instance, certain alloys are crafted to exhibit exceptional formability facilitating the creation of complicated shapes and designs in vehicle parts. In addition, other alloys are tailored to bolster corrosion resistance, thereby ensuring prolonged durability and resilience across different environmental settings. Such tailored properties make aluminum alloys indispensable in meeting the exacting standards of the automotive industry, driving the demand for automotive aluminum market growth.

Download Sample Pages of Research Overview: https://www.alliedmarketresearch.com/request-sample/1978

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $26.2 billion |

| Market Size in 2033 | $60.6 billion |

| CAGR | 8.7% |

| No. of Pages in Report | 340 |

| Segments Covered | Form, Vehicle Type, Application, and Region. |

| Drivers | Advancements in aluminum alloy technology Regulatory support for lightweight materials. |

| Opportunity | Advanced manufacturing techniques. |

| Restraint | Recycling infrastructure constraints. |

The sheet segment maintains its dominance by 2033.

By form, the sheet segment held the highest market share in 2023 and is estimated to maintain its leadership status throughout the forecast period. Sheet is extensively utilized in automotive body panels, closures such as hoods and doors, and structural components due to its lightweight nature, formability, and corrosion resistance. The use of aluminum sheet allows for significant weight reduction in vehicles, contributing to improved fuel efficiency and performance.

The light commercial vehicles segment is expected to possess the highest market share till 2033.

By vehicle type, light commercial vehicles segment held the highest market share in 2023 and is estimated to dominate during the forecast period. Aluminum is commonly utilized in the construction of light commercial vehicles, such as vans, pickups, and smaller trucks. Light commercial vehicles often prioritize factors such as fuel efficiency, payload capacity, and maneuverability, all of which benefit from the lightweight properties of aluminum. Aluminum is frequently employed in body panels, chassis components, and structural reinforcements in light commercial vehicles, contributing to weight reduction and improved performance.

Procure Complete Report (340 Pages PDF with Insights, Charts, Tables, and Figure https://www.alliedmarketresearch.com/checkout-final/automotive-aluminum-market

The hoods segment is expected to possess the highest market share till 2033.

Based on the application, hoods segment held the highest market share in 2023 and is estimated to dominate during the forecast period. Hoods are increasingly common in modern vehicles thanks to their lightweight properties, which play a crucial role in enhancing fuel efficiency and handling. Automakers are opting for aluminum hoods to achieve significant weight reduction compared to traditional steel hoods, making aluminum the preferred material for boosting overall vehicle performance. Moreover, the use of aluminum hoods supports the structural integrity and safety of the vehicle. Despite being lighter, aluminum hoods maintain the necessary strength and durability to protect the engine compartment and absorb impact in the event of a collision. This combination of lightweight efficiency and robust performance makes aluminum hoods an ideal component for modern automotive design.

Asia-Pacific is expected to experience fastest growth throughout the forecast period.

Based on region, Asia-Pacific has emerged as the fastest-growing market for automotive aluminum in terms of revenue. The lightweight and recyclable properties of aluminum present promising solutions for improving fuel efficiency and reducing emissions within the automotive sector. As countries in Asia-Pacific experience rapid urbanization and a surge in vehicle demand, the necessity for sustainable and efficient automotive materials becomes increasingly critical. Automotive aluminum, with its capacity to lower vehicle weight and enhance performance while reducing environmental impact, perfectly aligns with the region’s sustainability goals. In addition, the abundant availability of raw materials and advanced manufacturing capabilities across many Asia-Pacific nations is fostering the widespread adoption of automotive aluminum, further driving market growth in the region.

Want to Access the Statistical Data and Graphs, Key Players’ Strategies: https://www.alliedmarketresearch.com/automotive-aluminum-market/purchase-options

Leading Market Players: –

- Nippon Light Metal Holdings Co., Ltd

- Vedanta Aluminium & Power

The report provides a detailed analysis of these key players in the global automotive aluminum market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

United States

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com

Blog: https://www.newsguards.com/

Follow Us on | Facebook | LinkedIn | YouTube |

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.