Closed System Transfer Devices (CSTD) Market Size Set to Expand with a 10.0% CAGR, Reaching USD 3.6 Billion by 2034| Analysis by Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 17, 2024 (GLOBE NEWSWIRE) — The value of the global closed system transfer devices (CSTD) market sector was estimated at US$ 1.2 billion in 2023. Between 2024 and 2034, it is expected to increase at a CAGR of 10.0%, reaching US$ 3.6 billion.

Public awareness campaigns promoting the risks associated with hazardous medications and the need to handle them with care have resulted in the growing usage of CSTDs. An educational program designed to make healthcare workers aware of the benefits of closed medication preparation and delivery systems should be aimed at healthcare workers.

By preventing contamination during transfer and administration, CSTDs contribute to maintaining pharmaceutical purity and effectiveness. Contamination can lead to serious financial losses or negatively impact patient results regarding expensive or delicate medications.

Request Your PDF Sample Report Now! https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=55230

In the medical field, patient safety is of utmost importance. CSTDs help to improve patient safety outcomes during chemotherapy and other drug delivery procedures by reducing the danger of drug exposure and contamination.

The general increase in healthcare spending, especially in industrialized nations, encourages the purchase of technology that enhances patient safety and care. Healthcare facilities must include CSTDs as an essential part of their infrastructure when they budget for safety precautions and regulatory compliance. With biosimilar medications becoming more widely available and being used, CSTDs are necessary for handling these medications.

Competitive Landscape

- ICU Medical

- Baxter

- B. Braun

- BD

- Equashield

- Yukon Medical

- Caragen Ltd.

- JMS Co. Ltd.

Key Findings of the Market Report

- Based on the product, the system segment is expected to drive the closed system transfer devices (CSTD) market.

- In terms of application, the nursing segment will be a major market for the closed system transfer devices (CSTD) market.

- Increasing distributor demand is expected to drive a closed system transfer devices (CSTD) market.

- A dominant position was held by North America in 2023 in the global closed system transfer devices (CSTD) market.

Global Closed System Transfer Devices (CSTD) Market: Growth Drivers

- The adoption of CSTDs is fueled by tightening requirements imposed by regulatory organizations, including the European Medicines Agency (EMA), US Pharmacopeia (USP), and the Occupational Safety and Health Administration (OSHA) regulating the handling of dangerous medications. To comply with these rules, patients and healthcare professionals must be protected from exposure to closed systems.

- Increasing global cancer incidence is causing doctors to use chemotherapy medications more frequently, which are often dangerous and must be handled carefully. A safer method of administering these medications is through CSTDs, which pose less risk of contamination and exposure for healthcare workers.

- A growing focus on protecting healthcare personnel from occupational dangers is driving healthcare institutions to invest in technology that improves workplace safety.

- A CSTD is considered to be an essential component of ensuring the safety of workers who are responsible for preparing and administering dangerous medications.

- Standards and safety measures are in greater demand as the global healthcare infrastructure grows, particularly in emerging nations. Using technologies such as CSTDs is one way of ensuring compliance with global safety standards.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=55230

Global Closed System Transfer Devices (CSTD) Market: Regional Landscape

- North America is expected to drive the demand for CSTD in the coming years. North America, especially the United States and Canada, has some of the most stringent restrictions for handling dangerous medications. According to the US Pharmacopeia (USP) and the US Occupational Safety and Health Administration (OSHA), strict regulations protect healthcare professionals from hazardous material exposure.

- Due to the increasing rate of cancer in North America, there is a need for safe handling procedures as well as chemotherapy medications. In particular, the United States suffers from a considerable cancer burden that is primarily treated by chemotherapy. Therefore, CSTDs, which ensure safe medication administration, have a thriving market.

- Healthcare personnel in North America are strongly encouraged to prevent occupational hazards. Hospitals and other healthcare facilities prioritize worker safety over anything else, so they invest in tools like CSTDs to minimize the risk of exposure to dangerous medications.

- Modern clinics, hospitals, and specialty treatment facilities are all part of North America’s sophisticated healthcare network. As part of their regular practices, these hospitals are more likely to incorporate cutting-edge technologies, such as CSTDs, to enhance patient care and safety.

Global Closed System Transfer Devices (CSTD) Market: Key Players

Closed system transfer devices (CSTD) manufacturers invest heavily in research and development to improve their products. To increase their product portfolio and meet the demand from expanding healthcare facilities, closed system transfer devices (CSTD) companies have to leverage strategic collaborations, mergers, and acquisitions.

Key Developments

- In October 2023, EQUASHIELD, the industry leader in Closed System Transfer Devices (CSTDs) for hazardous drugs, announced that its EQUASHIELD® Syringe Unit has been cleared for full volume use by the FDA.

- Syringe units with closed plungers are designed to prevent deliberate and unintentional syringe plunger detachment and to allow the use of hazardous drugs up to the maximum nominal volume of the system.

Global Closed System Transfer Devices (CSTD) Market: Segmentation

By Product

- Needle-free Systems

- Needle Systems

- Vial Adaptors

- Syringe Adaptors

- Tubing Sets and Accessories

By Application

- Pharmacy

- Nursing

- Veterinary

By Distribution Channel

By Region

- North America

- Latin America

- Asia Pacific

- Europe

- Middle East & Africa

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights! https://www.transparencymarketresearch.com/checkout.php?rep_id=55230<ype=S

Explore wide-ranging Coverage of TMR’s Healthcare Market Insights Landscape

- Influenza Diagnostics Market – The global influenza diagnostics market is estimated to flourish at a CAGR of 5.6% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for influenza diagnostics is estimated to reach US$ 2.0 billion by the end of 2031.

- Sharps Containers Market – The sharp containers accounted for US$ 701.1 million in 2022. A CAGR of 4.7% is projected from 2023 to 2031. The market is expected to reach US$ 1.0 billion by 2031. Developing economies generate more medical waste, particularly as their healthcare infrastructure expands. Healthcare facilities are increasingly relying on sharp containers as a safe and effective way to dispose of waste.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wound Care Market to Witness 3.1% CAGR by 2031 | SkyQuest Technology

Westford, USA, Oct. 17, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that Wound Care Market will attain the value of USD 16.32 Billion by 2031, with a CAGR of 3.1% during the forecast period (2024-2031). The growth of wound care market can be attributed to factors such as increasing aging population, increasing incidence of chronic wounds, advancements in wound care technology. Furthermore, there is growing awareness of its importance that wound management and availability of advanced wound care products drives market growth.

Wound Care Market Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | USD 13.18 Billion |

| Estimated Value by 2031 | USD 16.32 Billion |

| Growth Rate | Poised to grow at a CAGR of 3.1% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product, Application, End-use, Mode of Purchase, Distribution Channel and Region |

| Geographies Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Report Highlights | Updated financial information / product portfolio of players |

| Key Market Opportunities | Rising Demand for Home Healthcare Solutions |

| Key Market Drivers | Growing Prevalence of Chronic Diseases |

To Learn More About This Report, Request a Free Sample Copy – https://www.skyquestt.com/sample-request/wound-care-market

Wound Care Market Segmental Analysis

The Global Wound Care Market is segmented into Product, Application, End Use, and Region.

Based on Product, the market is segmented into Advanced Wound Dressing, Surgical Wound Dressing, and Traditional Wound Dressing.

Based on Application, the market is segmented into Chronic Wound and Acute Wound.

Based on End Use, the market is segmented into Hospitals, Specialty Clinics, Home Healthcare, Physician’s Office, Nursing Homes, and Others.

By Region, the market is segmented into North America, Europe, Asia-Pacific, Middle East and Africa, and Latin America.

Institutional Sales Segment to Dominate Due to High Volume of Patients in Hospitals and Clinics

The institutional sales segment is dominating in the market. Manufacturers of wound care products can also sell the products directly to healthcare providers, such as hospitals and clinics, or to patients through direct-to-consumer marketing. This approach can provide significant potential on how it is distributed to enable manufacturers to build relationships with their customers. Marketing companies consist of direct distributors and specialists. Hospitals, clinics, wound care centers, and other health care facilities, such as nursing homes, long-term care facilities, research centers, and maternity care centers, often have contracts and relationships that it lasts longer with the distributors and manufacturers.

Home Healthcare Segment to Drive Market Due to Introduction of Single-use NPWT Systems

The home healthcare segment is expected to grow at the fastest pace at a CAGR of 5.51% during the forecast period. During the pandemic outbreak, home healthcare wound care products were more in demand. Wound care in home care centers begins primarily with the introduction of single-use NPWT systems. These devices are small, portable and easy to use. In addition, the cost of such wound healing also encourages patients to opt for home care facilities during their hospital stay.

Get Customization on this Report for Specific Research Solutions: https://www.skyquestt.com/speak-with-analyst/wound-care-market

Asia Pacific is Growing Due to Increasing Incidence of Chronic Diseases

The Asia Pacific region is estimated to witness the highest growth in the wound care market at a CAGR of 4.8% during the forecast period. The presence of developing countries such as China, India and Japan are expected to drive the market growth in this region. This can be attributed to the increasing lifestyle changes that are contributing to the increased incidence of chronic diseases in the region. Furthermore, technological advancement, increasing age population, increasing incidence of chronic diseases like diabetes & cancer are expected to boost the growth of the regional market. Thus, Asia Pacific is expected to witness the fastest growth during the forecast period due to the aforementioned factors.

Drivers

- Growing Prevalence of Chronic Diseases

- Technological Advancements

- Rise in the Aging Population

Restraints

- Limited Awareness in Developing Regions

- Regulatory Hurdles and Approvals

- High Cost of Advanced Wound Care Products

Prominent Players in Wound Care Market

- Smith & Nephew

- Mölnlycke Health Care AB

- ConvaTec Group PLC

- Ethicon (Johnson & Johnson)

- Baxter International

- URGO Medical

- Coloplast Corp.

- Medtronic

- 3M

- Derma Sciences Inc. (Integra LifeSciences)

- Medline Industries

- Advancis Medical

- B. Braun Melsungen AG

Take Action Now: Secure Your Wound Care Market Today – https://www.skyquestt.com/buy-now/wound-care-market

Key Questions Answered in Wound Care Market Report

- How big is the Global Wound Care Market?

- What are the key drivers of Global Wound Care Market size?

- Which is the fastest growing region in the Global Wound Care Market?

This report provides the following insights:

Analysis of key drivers (growing prevalence of chronic diseases, technological advancements, rise in the aging population), restraints (regulatory hurdles and approvals, high cost of advanced wound care products), opportunities (rising demand for home healthcare solutions), influencing the growth of Wound Care Market.

- Market Dynamics: Comprehensive information about the various products offered by the dominant players in the Wound Care Market.

- Product Development/Innovation: An overview of emerging trends, R&D activities and product launches in the Wound Care Market.

- Market Growth: Detailed information on profitable growing industries.

- Market Trends: Complete information about new products, emerging geographical areas and recent developments in the market.

- Competitive Analysis: An in-depth analysis of the market segments, growth strategies, revenue analysis, and products of the key market players.

Read Wound Care Market Report Today – https://www.skyquestt.com/report/wound-care-market

Checkout More Related Studies Published by SkyQuest Technology:

Advanced Wound Care Market is growing at a CAGR of 5.4% in the forecast period (2024-2031)

Pressure Ulcers Treatment Market is growing at a CAGR of 5.2% in the forecast period (2024-2031)

Europe Home Healthcare Market is growing at a CAGR of 7.6% in the forecast period (2024-2031)

Low Trauma/Skin Friendly Adhesives Market is growing at a CAGR of 6.7% in the forecast period (2024-2031)

Europe Advanced Wound Care Market is growing at a CAGR of 6% in the forecast period (2024-2031)

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact Us:

Mr. Jagraj Singh

Skyquest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Supernus Announces Promising Data from Open-Label Phase 2a Study of SPN-820 in Adults with Major Depressive Disorder

Phase 2a study demonstrated rapid and substantial decrease in depressive symptoms

SPN-820 was well-tolerated with few adverse events

SPN-820 is a novel, first-in-class intracellular modulator of mTORC1 for the treatment of depression

Company to host webcast today at 4:30 p.m. ET to discuss the topline data

Topline results from Phase 2b randomized double-blind placebo-controlled study of SPN-820 in adults with treatment-resistant depression expected first-half 2025

ROCKVILLE, Md., Oct. 17, 2024 (GLOBE NEWSWIRE) — Supernus Pharmaceuticals, Inc. SUPN, a biopharmaceutical company focused on developing and commercializing products for the treatment of central nervous system (CNS) diseases, today announced data from its exploratory open-label Phase 2a clinical study of SPN-820 in adults with major depressive disorder. The study examined the safety and tolerability of SPN-820 2400 mg given once every 3 days as an adjunctive treatment to the current baseline antidepressant therapy, as well as assessed the rapid onset of improvement in depressive symptoms. The analysis is based on 40 enrolled subjects, of which 38 completed the 10-day treatment period.

Summary of the Data

- Clinically meaningful improvement of –6.1 at two hours and –9.6 at Day 10 on the Hamilton Depression Rating Scale-6 Items (HAM-D6) total score.

- Clinically meaningful improvement of –16.6 at four hours and –22.9 at Day 10 on the Montgomery Åsberg Depression Rating Scale (MADRS) total score.

- Suicidal ideation decreased by 80% (12.5% with suicidal ideation at baseline decreased to 2.6% with suicidal ideation at Day 10).

- SPN-820 was well-tolerated with few adverse events (AEs) and had acceptable tolerability with a discontinuation rate of 2.5% due to AEs.

- Most common AEs related to the drug included headache, nausea, somnolence, and dizziness. Additional AEs such as cognitive disorder, dry mouth, fatigue, nasal decongestion, and paresthesia oral were observed.

“These Phase 2a data underscore our belief that SPN-820 has the potential as a novel treatment option for patients with depression, with the opportunity to decrease symptoms quickly and without certain burdensome side effects,” said Jack Khattar, President and CEO of Supernus. “We expect to complete enrollment in the Phase 2b randomized double-blind placebo-controlled study of SPN-820 in adults with treatment-resistant depression in November of this year, with topline results expected in the first half of 2025.”

Webcast Details

Supernus will host a conference call and webcast today, October 17, 2024, at 4:30 p.m. ET to discuss these topline results. A live webcast with presentation slides will be available via this webcast link or in the Events & Presentations section of the Company’s Investor Relations website at www.supernus.com/Investors. Following management’s prepared remarks and discussion of the interim trial results, the call will open for questions.

Participants may also pre-register any time before the call here. Once registration is completed, participants will be provided a dial-in number with a personalized conference code to access the call. Please dial in 15 minutes prior to the start time.

Following the live call, a replay will be available on the Company’s Investor Relations website at www.supernus.com/Investors. The webcast will be available on the Company’s website for 60 days following the live call.

About SPN-820

SPN-820 is a first-in-class, orally active small molecule that increases the brain mechanistic target of rapamycin complex 1 (mTORC1) mediated synaptic function intracellularly. SPN-820 is being developed to provide a rapid-onset antidepressant response via oral administration for adult patients with depression. The compound has a novel mechanism of action that enhances synaptic activity and cellular metabolism in the brain and has demonstrated a rapid onset of action (signal at two hours) in early clinical studies. SPN-820 is expected to provide rapid antidepressant efficacy without potential dissociative side effects. A Phase 2b clinical study of SPN-820 in approximately 227 adult patients with treatment-resistant depression is ongoing.

About the SPN-820 Phase 2a Clinical Study

The study is a Phase 2a open-label study in 40 subjects with major depressive disorder (MDD). The primary objective of the study is to assess efficacy in MDD, as well as onset of efficacy and safety.

About Supernus Pharmaceuticals, Inc.

Supernus Pharmaceuticals is a biopharmaceutical company focused on developing and commercializing products for the treatment of central nervous system (CNS) diseases.

Our diverse neuroscience portfolio includes approved treatments for epilepsy, migraine, ADHD, hypomobility in Parkinson’s disease (PD), cervical dystonia, chronic sialorrhea, and dyskinesia in PD patients receiving levodopa-based therapy. We are developing a broad range of novel CNS product candidates including new potential treatments for hypomobility in PD, epilepsy, depression, and other CNS disorders.

For more information, please visit www.supernus.com.

Forward Looking Statements

This press release includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements do not convey historical information but relate to predicted or potential future events that are based upon management’s current expectations. These statements are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by such statements. In addition to the factors mentioned in this press release, such risks and uncertainties include, but are not limited to, the Company’s reporting on preliminary and exploratory open label clinical study on SPN-820, the Company’s ability to sustain and increase its profitability; the Company’s ability to raise sufficient capital to fully implement its corporate strategy; the implementation of the Company’s corporate strategy; the Company’s future financial performance and projected expenditures; the Company’s ability to increase the number of prescriptions written for each of its products and the products of its subsidiaries; the Company’s ability to increase net revenue; the Company’s ability to commercialize its products and the products of its subsidiaries; the Company’s ability to enter into future collaborations with pharmaceutical companies and academic institutions or to obtain funding from government agencies; the Company’s ability to conduct and progress product research and development activities, including the timing and progress of the Company’s clinical trials, and projected expenditures; the Company’s ability to receive, and the timing of any receipt of, regulatory approvals to develop and commercialize the Company’s product candidates including SPN-820; the Company’s ability to protect its intellectual property and the intellectual property of its subsidiaries and operate its business without infringing upon the intellectual property rights of others; the Company’s expectations regarding federal, state and foreign regulatory requirements; the therapeutic benefits, effectiveness and safety of the Company’s product candidates including SPN-820; the accuracy of the Company’s estimates of the size and characteristics of the markets that may be addressed by its product candidates; the Company’s ability to increase its manufacturing capabilities for its products and product candidates including SPN-820; the Company’s projected markets and growth in markets; the Company’s product formulations and patient needs and potential funding sources; the Company’s staffing needs; and other risk factors set forth from time to time in the Company’s filings with the Securities and Exchange Commission made pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended. The Company undertakes no obligation to update the information in this press release to reflect events or circumstances after the date hereof or to reflect the occurrence of anticipated or unanticipated events.

CONTACTS:

Jack A. Khattar, President and CEO

Timothy C. Dec, Senior Vice President and CFO

Supernus Pharmaceuticals, Inc.

(301) 838-2591

or

INVESTOR CONTACT:

Peter Vozzo

ICR Westwicke

(443) 213-0505

peter.vozzo@westwicke.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Mortgage Rates Continue to Increase

MCLEAN, Va., Oct. 17, 2024 (GLOBE NEWSWIRE) — Freddie Mac FMCC today released the results of its Primary Mortgage Market Survey® (PMMS®), showing the 30-year fixed-rate mortgage (FRM) averaged 6.44 percent.

“The 30-year fixed-rate mortgage increased for the third consecutive week, moving closer to 6.5%,” said Sam Khater, Freddie Mac’s Chief Economist. “In general, higher rates reflect the strength in the economy that is supportive of the housing market. But notably, as compared to a year ago, rates are more than one percentage point lower and potential homebuyers can stand to benefit, especially by shopping around for the best quote as rates can vary widely between mortgage lenders.”

News Facts

- The 30-year FRM averaged 6.44 percent as of October 17, 2024, up from last week when it averaged 6.32 percent. A year ago at this time, the 30-year FRM averaged 7.63 percent.

- The 15-year FRM averaged 5.63 percent, up from last week when it averaged 5.41 percent. A year ago at this time, the 15-year FRM averaged 6.92 percent.

The PMMS® is focused on conventional, conforming, fully amortizing home purchase loans for borrowers who put 20 percent down and have excellent credit. For more information, view our Frequently Asked Questions.

Freddie Mac’s mission is to make home possible for families across the nation. We promote liquidity, stability, affordability and equity in the housing market throughout all economic cycles. Since 1970, we have helped tens of millions of families buy, rent or keep their home. Learn More: Website | Consumers | X | LinkedIn | Facebook | Instagram | YouTube

MEDIA CONTACT:

Angela Waugaman

(703)714-0644

Angela_Waugaman@FreddieMac.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/1c0b88be-40a6-4f31-8bc9-41be51faecc3

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Medicare Trust Fund Under Fire: Critics Accuse VP Harris Of 'Highway Robbery' For Allegedly 'Violating' Vital Healthcare Resources

Vice President Kamala Harris is facing criticism over a new Medicare policy that’s stirring up controversy. Critics accuse her of backtracking on promises to safeguard the Medicare trust fund, sparking a fiery debate about whether the administration’s recent moves are helping or hurting the nation’s seniors.

Harris recently reassured the public that Medicare is a priority, telling AARP, “I will always fight to protect and strengthen Medicare for this and future generations.” She emphasized that big corporations and wealthy individuals must step up and pay their fair share, which she believes will help sustain critical programs like Medicare.

Don’t Miss:

But critics aren’t buying it. According to the latest Congressional Budget Office (CBO) analysis, a program introduced by the Centers for Medicare and Medicaid Services (CMS) to keep premiums low could cost taxpayers over $21 billion in the next three years.

This demonstration project, as it’s called, was designed to stabilize Medicare Part D premiums, which are set to rise sharply. Some, however, view it as a ploy to shield the administration from political fallout.

The plan stems from the Inflation Reduction Act, a bill to reduce drug costs for Medicare recipients. While the intent sounds good on paper, it comes with a significant catch: insurance companies will likely hike premiums substantially soon.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

With the average bids for Part D plans expected to triple by 2025, many argue that the administration’s subsidy plan is just a short-term patch on a long-term problem.

Stephen Moore, co-founder of the Heritage Foundation, didn’t mince words. “More highway robbery from the Dems on the Medicare trust fund,” he said, echoing concerns that the government is siphoning off money meant to protect seniors’ health care to fund other initiatives.

Sen. Chuck Grassley, a key Republican voice, was equally critical. He suggested that instead of facing the consequences of their policies, Democrats are using taxpayer dollars to mask the impact.

See Also: Many are using this retirement income calculator to check if they’re on pace — here’s a breakdown on how on what’s behind this formula.

“This nonpartisan CBO analysis confirms CMS’s cost-shifting plan is a dishonest election year gimmick to cover up those consequences,” Grassley said in a statement, calling the move an attempt to “artificially” lower premiums in time for the election.

The backlash on social media was swift. According to the advocacy group Commitment to Seniors, Harris has violated her pledge to secure Medicare.

They argue that this short-term fix could have long-term consequences for the trust fund, putting future generations at risk. “Seniors beware,” they wrote, warning of potential threats to the program the Vice President claimed she was protecting.

On the other side of the debate, administration defenders argue that the program provides necessary relief in an inflationary climate where drug prices and premiums are skyrocketing.

They emphasize that the Medicare trust fund still has safeguards in place and that the additional costs are a small price to pay for ensuring seniors don’t face crippling medical bills.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Medicare Trust Fund Under Fire: Critics Accuse VP Harris Of ‘Highway Robbery’ For Allegedly ‘Violating’ Vital Healthcare Resources originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Strong September Retail Sales Put Fed's Next Move In Doubt: Interest Rate Cuts Are 'Not A Slam Dunk'

A sharp rise in September retail sales is sparking fresh debate among economists about the Federal Reserve’s next move, as stronger-than-expected consumer resilience raises doubts about the need for further interest rate cuts.

Retail sales rose 0.4% month-over-month in the last month of the quarter, far exceeding the 0.1% growth recorded in August and surpassing economists’ forecasts of 0.3%. Even more notably, excluding volatile sectors like autos and gasoline, sales surged by 0.7%, marking the second-largest increase over the past 12 months.

The stronger-than-expected sales report is pushing analysts to rethink whether the Federal Reserve will move forward with another interest rate cut in November. While market participants overwhelmingly anticipate a 25 basis point reduction following the 50-basis-point move last month, the latest economic data may complicate that outlook.

Economists Debate On Fed Interest Rates

Quincy Krosby, chief global strategist at LPL Financial, said, “Retail sales came in well above expectations and continue to defy the weak economy thesis.”

Krosby added that the key question for monetary policy is whether the Fed will be concerned that the economy’s renewed strength could drive inflation higher.

However, she expects that a 25-basis-point cut will occur, especially if hurricane damage significantly impacts the labor market.

Speaking to CNBC, Stifel chief economist Lindsey Piegza said, “I think this was a very strong number and underscores the notion that the Fed maybe took too big of a step out of the gate with that 50 basis point cut.” Looking ahead, Piegza explained that there’s a stronger argument for a more patient approach, potentially holding off on a November cut.

Kathy Bostjancic, chief economist at Nationwide, also commented on the retail data: “That’s positive, right, for the overall economy. It’s really big consumer spending buoying the overall GDP growth in the US.”

Regarding the next Fed moves, Bostjancic added that “it’s not a slam dunk that they will cut rates.”

LPL Financial’s chief economist Jeffrey Roach maintains that the Fed will proceed with gradual cuts.

“Strong consumer spending in September suggests economic growth in the previous quarter was solidly above trend. Looking ahead, investors need to monitor any signs that the unemployed are finding it more difficult to earn a paycheck. Our baseline remains that the Fed will likely cut a quarter of a percent in both November and December.” Roach said.

Investors still largely anticipate a cut at the upcoming Fed meeting. Market-implied odds of a 25-basis-point rate cut in November dipped only slightly from 94% to 87% on Thursday.

Market Reactions: Treasury Yields Rise, Gold Hits Record Highs

Stronger-than-expected retail sales data, combined with a drop in unemployment claims, sparked a sharp rise in Treasury yields on Thursday, putting the brakes on further stock market gains.

The yield on the 10-year Treasury jumped 8 basis points to 4.10%, while the 30-year yield surged 9 basis points to 4.39%. This spike in yields hit Treasury-related assets hard, with the iShares 20+ Year Treasury Bond ETF TLT tumbling 1.5%. The surge in Treasury yields weighed on investor risk sentiment.

After opening 0.6% higher to fresh record highs, the S&P 500 was up just 0.3% by 12:15 p.m. in New York. The tech-heavy Nasdaq 100, tracked by the Invesco QQQ Trust QQQ, which had risen over 1% at the open, was up 0.7% at the time of publication.

Meanwhile, gold prices, as tracked by the SPDR Gold Trust GLD, rose 0.7%, hitting new all-time highs.

Read Next:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

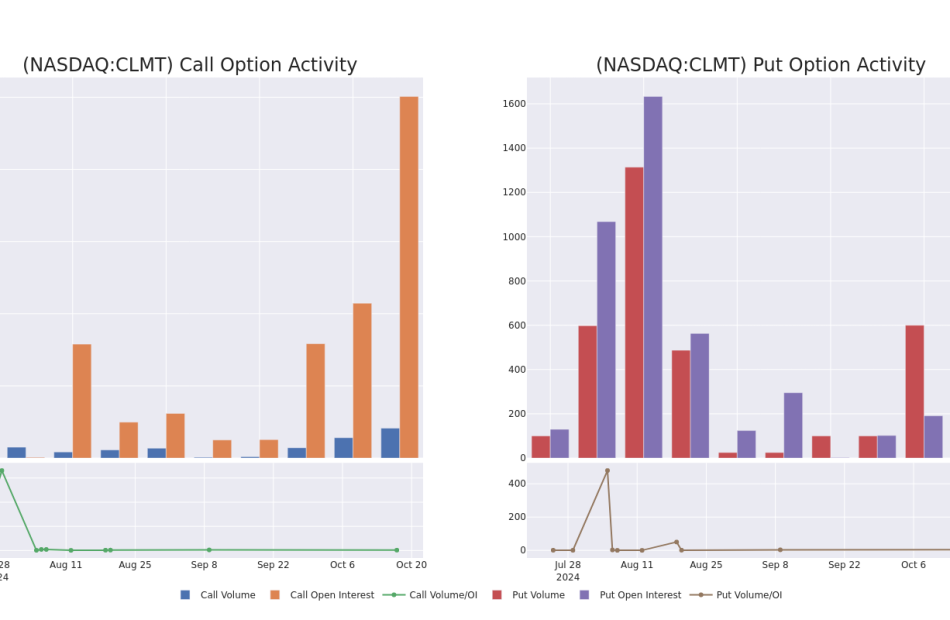

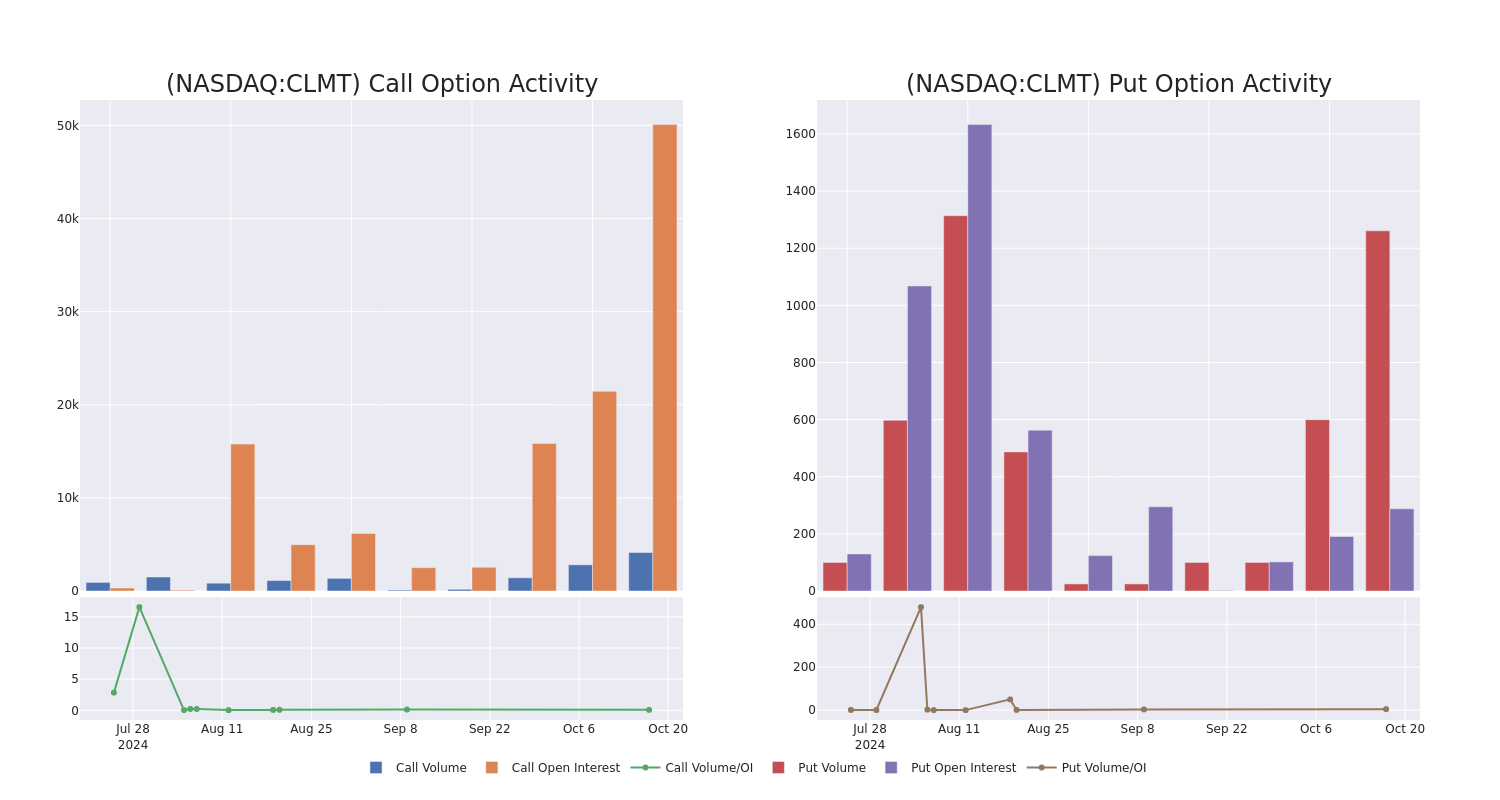

What the Options Market Tells Us About Calumet

Investors with a lot of money to spend have taken a bearish stance on Calumet CLMT.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with CLMT, it often means somebody knows something is about to happen.

Today, Benzinga’s options scanner spotted 14 options trades for Calumet.

This isn’t normal.

The overall sentiment of these big-money traders is split between 28% bullish and 50%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $40,200, and 13, calls, for a total amount of $1,144,494.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $13.0 and $40.0 for Calumet, spanning the last three months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Calumet options trades today is 4198.58 with a total volume of 5,404.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Calumet’s big money trades within a strike price range of $13.0 to $40.0 over the last 30 days.

Calumet Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CLMT | CALL | SWEEP | BULLISH | 01/17/25 | $9.5 | $9.3 | $9.5 | $15.00 | $475.0K | 1.8K | 0 |

| CLMT | CALL | SWEEP | BEARISH | 01/17/25 | $3.5 | $3.0 | $3.0 | $26.00 | $135.0K | 5 | 601 |

| CLMT | CALL | TRADE | BULLISH | 01/17/25 | $3.7 | $2.95 | $3.4 | $25.00 | $85.0K | 11.6K | 251 |

| CLMT | CALL | TRADE | BEARISH | 12/20/24 | $1.75 | $1.5 | $1.55 | $30.00 | $77.5K | 11 | 500 |

| CLMT | CALL | SWEEP | BEARISH | 11/15/24 | $3.8 | $3.6 | $3.6 | $20.00 | $72.0K | 1.2K | 214 |

About Calumet

Calumet Inc is a producer of specialty products, including base oils, specialty oils, solvents, esters, and waxes, as well as a variety of fuel and fuel-related products, including asphalt and heavy fuel oils. The company manufactures, formulates, and markets a variety of specialty branded products to customers in various consumer-facing and industrial markets.

After a thorough review of the options trading surrounding Calumet, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is Calumet Standing Right Now?

- With a volume of 1,520,256, the price of CLMT is up 15.37% at $25.3.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 21 days.

What The Experts Say On Calumet

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $25.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from HC Wainwright & Co. has revised its rating downward to Buy, adjusting the price target to $25.

* In a cautious move, an analyst from HC Wainwright & Co. downgraded its rating to Buy, setting a price target of $25.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Calumet options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Gold Could Reach $3,000 By 2025, Bank Of America Analyst Says: 'Ultimate Perceived Safe Haven'

Bank of America released a bullish note on gold Thursday, just as the precious metal reached new record highs at $2,696 per ounce (oz).

Gold remains “the ultimate perceived safe haven asset” in today’s macroeconomic environment, according to Bank of America’s commodity analyst Michael Widmer, amid rising concerns over U.S. fiscal policies and their potential impact on Treasury yields.

Gold Trends Higher As Fed Shifts Policy

Despite nominal U.S. Treasury yields trending upward, gold prices, as tracked by the SPDR Gold Trust GLD, have been climbing in recent weeks, supported by various factors.

Widmer explained that a key driver behind this surge is the rising inflation expectations paired with the Federal Reserve’s policy shifts.

Rate cuts triggered a surge in inflation expectations, which in turn kept downward pressure on real yields, increasing gold’s appeal as an inflation hedge.

“Accompanying the first Fed’s 50bp rate cut, inflation expectations have risen, meaning that 10-year real yields, usually the most significant gold price driver, kept declining through September,” Widmer said.

Gold Hits All-Time Highs On Oct. 17

U.S. Fiscal Policy Boosts Bullish Gold Outlook

A key factor bolstering Bank of America’s bullish stance on gold is the U.S.’s fiscal trajectory.

Rising interest rates have significantly increased the federal government’s debt servicing costs, triggering concerns about fiscal sustainability. According to government projections, the national debt is projected to reach a new record high as a share of the U.S. economy within the next three years.

Widmer highlighted that “whoever wins the 2024 presidential election will face an unprecedented fiscal situation upon taking office. Neither Kamala Harris nor Donald Trump seems to prioritize fiscal consolidation.”

The CRFB report details that Vice President Harris’s proposed policies could increase the national debt by $3.5 trillion through 2035, while former President Trump’s platform might raise it by as much as $7.5 trillion. “

The large and growing national debt threatens to “to slow economic growth, boost interest rates and payments, weaken national security, constrain policy choices, and raise the risk of an eventual fiscal crisis.”

Global Trends Also Favor Gold

According to Widmer, fiscal expansion policies are gaining traction across advanced economies, contributing to gold’s global appeal. The International Monetary Fund (IMF) estimates that new fiscal spending related to climate adaptation, demographic shifts, and rising defense costs could amount to 7-8% of global GDP annually by 2030.

This massive spending will likely force governments to issue more debt, and as volatility in the bond markets rises, gold will emerge as a refuge for investors, Widmer explained.

Central banks are also anticipated to increase their gold holdings as part of currency reserve diversification. The share of global central bank reserves held in gold has climbed to 10%, up from just 3% a decade ago.

Outlook for Gold: $3,000/oz By 2025

Bank of America sees gold reaching the $3,000/oz mark by the first half of 2025. The combination of macroeconomic uncertainty, rising debt levels, and central bank buying makes gold the “last safe haven asset standing.”

Read Next:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.