More Than 4 in 5 Americans with Credit Card Debt Say They Have Struggled to Make Ends Meet This Year

STAFFORD, Texas, Oct. 17, 2024 (GLOBE NEWSWIRE) — According to a new survey conducted by The Harris Poll on behalf of Money Management International (MMI), over four in five Americans with credit card debt (83%) report having struggled to make ends meet this year, with inflation likely a primary factor. With the rising cost of living, MMI has seen a significant increase in the number of people seeking financial counseling and help with managing credit card debt.

The survey highlights that nearly three in four Americans with credit card debt (73%) point to inflation as one of the most significant pressures on their household budget. The cost of essential items like groceries and utilities has compounded financial stress for many households. New clients seeking financial counseling from MMI report an average household budget deficit of nearly $300 per month, a shortfall that has doubled in the last two years.

Real-Life Struggles

In our survey, those with credit card debt who made changes to finances to make ends meet shared some of their challenges. A 71-year-old male shared that one of the most difficult changes they’ve had to make is “trying to find the cheapest foods to prepare, especially meat proteins. I can’t afford beef at all anymore, and I’m only buying the cheapest chicken and pork…I buy canned and frozen fruits and vegetables because they are cheaper than fresh.” Similarly, a 46-year-old female shared that one of the most difficult changes they’ve had to make is, “delaying a vacation and a new car purchase due to discretionary income reduction.”

Surge in Credit Counseling

MMI’s proprietary data reflects the growing financial stress among consumers. Through Q3 2024, MMI has experienced a 42% increase in new clients overall, with a 9% increase in the total unsecured debt they carry, compared to the first three quarters of 2023.

“Americans are clearly feeling the pinch of rising costs,” said Thomas Nitzsche, Sr. Director of Media & Brand at MMI. “More people are turning to us for help as they try to keep up with everyday necessities like groceries and utility bills. We’re seeing firsthand how inflation is driving people to cut back on non-essential spending and seek out debt management solutions.”

Demographic Insights: A Broadening Crisis

MMI’s data reveals significant demographic shifts in those seeking assistance in 2024. Among the key findings:

- More younger Americans have sought out credit counseling, with disproportionate increases among those under 35 years of age.

- Hispanic Americans seeking credit counseling grew by 66%, while non-Hispanic clients increased by 40%.

- African Americans seeking help grew by 31%, while Asian Americans saw a 50% increase.

- The states of Arizona, Minnesota, New York, Oklahoma, and Texas have seen above-average increases in both counseling volume and unsecured debt loads.

- Puerto Rico has experienced a notable 125% surge in demand for credit counseling.

Changing Financial Habits

As Americans adjust to new financial realities, many are making difficult choices. Among those with credit card debt who have struggled financially, MMI’s survey with The Harris Poll found that more than nine in ten (92%) have made changes to their spending habits. The most common adjustment is reduced spending on dining out and/or entertainment (54%). Other shifts include cutting back on vacations or travel (48%), postponing major purchases (40%), and increasing use of credit cards (38%). Nearly one in three (30%) have reduced their savings or retirement contributions.

Survey Methodology

This survey was conducted online within the United States by The Harris Poll on behalf of MMI from October 3-7, 2024 among 2,085 U.S. adults ages 18 and older, among whom 1,049 have credit card debt. The sampling precision of Harris online polls is measured by using a Bayesian credible interval. For this study, the sample data is accurate to within +/- 2.5 percentage points using a 95% confidence level. This credible interval will be wider among subsets of the surveyed population of interest. For complete survey methodology, including weighting variables and subgroup sample sizes, please contact Thomas.Nitzsche@MoneyManagement.org.

About MMI

Money Management International (MMI) has been at the forefront of financial health solutions for over 65 years. As a leading nonprofit organization, MMI is dedicated to changing how America overcomes financial challenges by offering timely and expert guidance. Recognized by major financial organizations and media outlets, MMI’s programs help individuals reach their financial goals and foster a life of financial wellness. Learn more at MoneyManagement.org.

For reporters looking to interview real people for stories, MMI has created a group of nearly 500 clients from across the country who are willing to share their experiences with the media in the hopes of helping others challenged with debt. These peer advocates have paid off over $19 million of debt and now serve as MMI ambassadors. Hear from them on MMI’s podcast, Long Story $hort.

To schedule an interview with an MMI expert or debt management client, please contact:

Thomas Nitzsche, 404.490.2227, Thomas.Nitzsche@MoneyManagement.org

Lori Geary, 404.551.2151, lgeary@lexiconstrategies.com

Thomas Nitzsche Money Management International 404.490.2227 Thomas.Nitzsche@MoneyManagement.org Lori Geary Lexicon Strategies 404.551.2151 lgeary@lexiconstrategies.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

We're 65 With $1.9 Million in Retirement Funds and $5,200 Social Security. What's Our Budget?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

To really build a complete retirement budget as a couple, you’ll need to take into account both potential income sources and realistic expenses. While it’s possible to come up with an estimated income or range of incomes from these figures, the expense side of the budget is equally important and potentially much more variable. Other variables include your planned retirement date, whether you have any other sources of retirement income and how you want to plan to handle hard-to-foresee expenses, such as healthcare and long-term care costs.

To get a full picture of your expenses and income in retirement, consider talking to a financial advisor.

Determining Your Anticipated Income

Since 65 is within the normal range of retirement ages, you may well plan to retire immediately. If so, you’ll have to generate your investment-based income from the $1.9 million you currently have in retirement accounts. If you were willing and able to wait a few years, this amount might grow somewhat and allow you to increase your retirement income.

More specifically, if you wait until full retirement age at 67, your Social Security benefit will also increase. However, right now, a nest egg of this size and the Social Security benefit described could generate a solid retirement income.

The 4% rule is a historic rule of thumb you can use to start thinking about how much you can safely withdraw from your retirement investments each year. It employs a conservative strategy in some markets, or overly aggressive in others, so there’s risks to following this rule on both sides. However, the same can be said for any path you might choose.

Applying this rule suggests you could withdraw 4% of your $1.9 million the first year and a similar amount, adjusted for inflation, each year thereafter for 25 years, though that doesn’t account for any potential earnings. In this limited example, that means you’d withdraw $76,000 the first year. Then if inflation is 3% the next year, your withdrawal would increase by that same amount up to $78,280.

On an annual basis, your combined Social Security benefits come to $62,400, at $5,200 a month. Combined with $76,000 from investments, your total income would equal $138,400 in year one. Depending on the lifestyle you want to maintain as a retiree, this should give you quite a bit of flexibility as a couple.

What Your Anticipated Spending Might Look Like

For many retirees, $138,400 annually is adequate income for a comfortable lifestyle. In the absence of any details on spending habits, another rule of thumb can be applied. Multiplying pre-retirement income by a percentage is one way to come up with a likely post-retirement income need. This percentage can range from 70% to 90% or higher, depending on the retiree.

In this case, let’s assume 80% would be accurate for you and your spouse. If so, $138,400 would be sufficient to maintain your pre-retirement lifestyle if you were earning approximately $172,000 combined per year prior to retiring. If you’re used to living on more than that, you might have to cut back in retirement.

Speak with a financial advisor about retirement planning today.

Tax Considerations

Since you don’t have a Roth IRA, you’ll owe income taxes in retirement. Under 2024 tax rules (which will undoubtedly change in future years), you could use the married, filing jointly standard deduction of $32,200 available to married couples when both spouses are 65 or older. This would reduce your taxable income to $106,200.

Since your taxable income is more than $34,000, you’ll owe taxes on 85% of your Social Security income. This means just 15%, or $9,360, of your Social Security income won’t be taxable. So now your taxable income is $96,840 after all deductions.

Using the 2024 tax brackets, $96,840 of taxable income puts you, at the highest level, in the 22% bracket. At that income level, your tax bill will be approximately $11,715 the first year.

How RMDs Come Into Play

When you turn 73, you’ll start taking required minimum distributions (RMDs) from your retirement accounts. Using the IRS table for calculating these distributions, your first-year RMD will come to $71,698.

RMD income is taxable, so this income could have tax implications. However, the $71,698 amount of the RMD is less than the amount you’ll withdraw the first year of your retirement. So RMDs are unlikely to have much effect on your tax bill as a retiree, unless circumstances in one way or another.

Accounting for Long-Term Care

Your retirement plan may want to also consider long-term care. A 2021 Genworth Financial Cost of Care Survey uncovered that annual costs for a semi-private room in a skilled nursing facility could be as high as $94,000 per year, and that will likely continue moving up every year. This is more than two-thirds of your entire first-year anticipated income, so a long stay in one of these could be a significant financial concern.

To insulate yourself from these potential costs, you might consider long-term care insurance. Be aware that the premiums are not inexpensive, especially if you start later in life. Prices rise sharply as you age and it may be difficult to get it if you are past age 70 or in poor health.

Retirement Planning Tips

-

A financial advisor can help you build a comprehensive plan for retirement. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

You can use SmartAsset’s retirement calculator to generate what-if scenarios that can help you decide whether it’s safe for you to retire.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/AlexanderFord, ©iStock.com/adamkaz

The post We Are 65 With $1.9 Million in a 401(k) and IRA, and $5,200 Monthly From Social Security. What’s Our Retirement Budget? appeared first on SmartReads by SmartAsset.

Pharmerging Market Size Projected to Surpass USD 7.1 Billion by 2034 at an 11.6% CAGR| Report by Transparency Market Research, Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc., Oct. 17, 2024 (GLOBE NEWSWIRE) — The pharmerging market accounted for US$ 2.1 billion in 2023. It is expected to advance at a CAGR of 11.6% from 2024 to 2034 and reach US$ 7.1 billion by the end of 2034. Pharmaceuticals are in higher demand to manage and treat chronic diseases, including diabetes, cardiovascular disease, and cancer, as they become more prevalent in emerging economies.

The pharmaceutical industry’s healthcare infrastructure is receiving more funding from governments and the private sector in emerging nations to facilitate better access and quality to healthcare. Pharmerging markets frequently encounter issues with healthcare access and drug affordability. Innovative pricing strategies, biosimilar, and generic medications could reduce healthcare costs in the future.

Telemedicine and digital health solutions may change how healthcare is delivered in emerging nations as smartphone and internet access expands. Remote consultations can be facilitated, healthcare access can be improved, and chronic illness monitoring can be simplified through these innovations.

Request a PDF Sample of this Report Now!

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=8200

Building hospitals, clinics, and diagnostic centers is essential to improving healthcare access and provision worldwide. Among the creative ways to develop infrastructure, modular and prefabricated construction techniques could hasten the development of healthcare facilities worldwide.

Developing economies are going through a transition in terms of disease patterns as their economies develop. Pharmaceutical research and development activities are proving to be a driving force in the growth of various regional markets in the pharmaceutical industries.

Key Players Profiled

- Abbott Laboratories

- Koninklijke Philips N.V.

- F. Hoffmann-La Roche Ltd.

- Merck & Co., Inc.

- Novartis AG

- Johnson & Johnson

- Teva Pharmaceutical Industries Ltd.

- AstraZeneca

- GlaxoSmithKline plc

- Lupin

- Tata Consultancy Services Ltd.

- Sun Pharmaceutical Industries Ltd.

- Huadong Medicine Co. Ltd.

Key Findings of the Market Report

- Based on product type, the pharmaceuticals segment is likely to drive demand for pharmerging market.

- In terms of indication, cancer and autoimmune diseases are expected to drive pharmerging market growth.

- The hospitals segment generated a major share of revenue in 2023.

- In 2023, the Asia-Pacific region held the majority of the market share.

Global Pharmerging Market: Growth Drivers

- The regulatory environment of pharmaceutical businesses is constantly changing, which impacts their strategies and operations as well as the prices, reimbursement policies, and entry into the market. Healthcare infrastructure advancements such as increased accessibility to healthcare facilities and distribution networks, make pharmacies more accessible in emerging markets.

- Innovations in biotechnology and personalized medicine are propelling pharmaceutical research and development. This results in novel treatments and therapies being introduced. Biotechnology advancements are propelling the creation of customized medications based on the genetic composition and disease attributes of particular patients.

- Pharmaceutical markets may be able to make use of these advancements to lower medical expenses and enhance treatment results. Drug delivery innovations, like implantable devices and systems based on nanotechnology, have the potential to improve patient adherence to treatment plans and increase medication safety and efficacy.

- Pharmaceutical companies have benefited from health insurance plans and universal healthcare coverage, increasing patient access to pharmaceuticals and improving healthcare quality. Growing patient empowerment and health knowledge encourage people to seek medical treatment and prescription drugs, propelling the growth of the pharmaceutical industry in emerging markets.

Global Pharmerging Market: Regional Landscape

- Asia Pacific is expected to lead the pharmerging market. With countries like China and India having large populations, the Asia-Pacific area is home to a sizable share of the global population. Numerous governments in the area are investing in healthcare infrastructure, including broadening the reach of healthcare facilities, implementing universal health coverage, and improving regulatory frameworks to facilitate pharmaceutical growth.

- The need for pharmaceuticals for prevention, treatment, and management is driven by changes in disease patterns, such as an increase in the prevalence of non-communicable diseases (NCDs) like diabetes, cardiovascular disease, and cancer. Healthcare reforms drive pharmaceutical market expansion to enhance healthcare quality, cost, and access. Intellectual property rights, pricing and reimbursement practices, and regulatory harmonization are a few examples of these reforms.

- Healthcare technology, including telemedicine, digital health solutions, and genomics, is advancing quickly in Asia-Pacific. Pharmaceutics research, development, and market expansion are fueled by these developments, especially in the biotechnology and specialty medication sectors.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=8200

Global Pharmerging Market: Competitive Landscape

Pharma and healthcare companies can form strategic partnerships with other companies, research institutions, and healthcare providers to drive innovation, expand market reach, and improve drug discovery, development, and delivery capabilities.

Key Developments

- Abbott Laboratories is a leading product manufacturer of medical devices, generic pharmaceuticals, diagnostics, nutritional products, and branded pharmaceuticals.

- Koninklijke Philips N.V. is an international company that specializes in healthcare, lighting, and consumer products. Aside from healthcare equipment, they offer a variety of services.

- F. Hoffmann-La Roche Ltd. is one of the world’s leading pharmaceutical and diagnostic companies. Innovative treatments are offered in fields such as immunology, oncology, infectious diseases, and others.

Global Pharmerging Market: Segmentation

Product Type

- Branded Prescription Drugs

- Generic Drugs

- Branded Generics

- Unbranded Generics

- Healthcare

- Medical Devices

- Diagnostic Instruments

- Others (IT and Record Management)

Indication

- Lifestyle Diseases

- Cancer and Autoimmune Diseases

- Infectious Diseases

- Others

Distribution Channel

- Hospitals

- Clinics

- Retail Pharmacies

- E-commerce

- Drugs Stores

Region

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=8200<ype=S

More Trending Reports by Transparency Market Research –

- Vaccines Market– The global vaccines market is projected to advance at a CAGR of 4.2% from 2023 to 2031.

- Diabetes Devices Market – The global diabetes devices market is projected to expand at a CAGR of 6.0% during the forecast period from 2022 to 2031.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Oil and Copper Are Under Pressure

Source: Michael Ballanger 10/15/2024

Michael Ballanger of GGM Advisory Inc. sends his thoughts on the current state of the market, looking at oil, copper, gold, and silver.

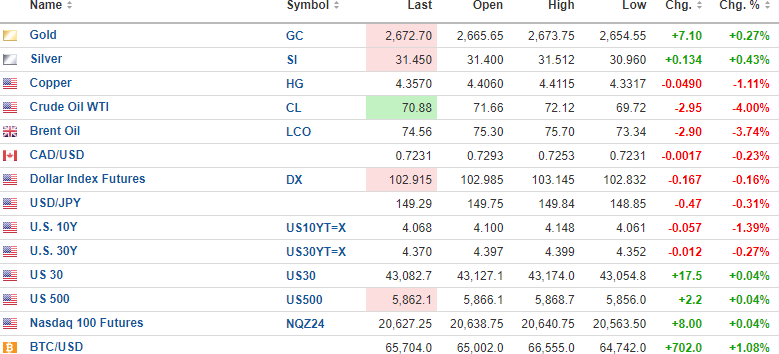

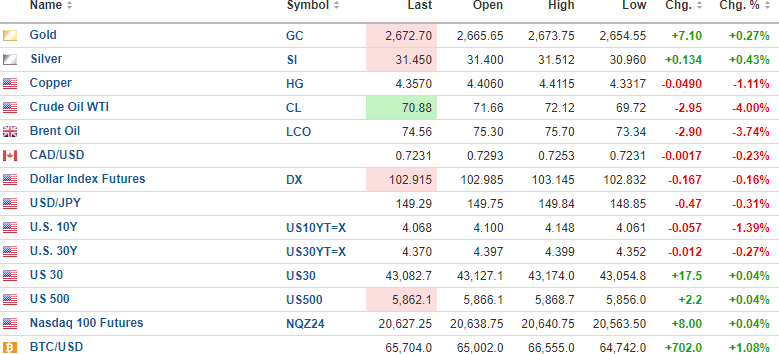

The USD Index futures are down 0.167% to 102.915 this morning with the 10-yr. (-1.39%) yield down to 4.068% and 30-yr. (-0.27%) down at 4.37%.

The metals are mixed with gold (+0.27%) and silver (+0.43%) higher, but copper (-1.11%) is down to $4.35/lb. Oil (-3.74%) is sharply lower, trading at USD $70.88/bbl. Stock futures are higher, with the DJIA futures up .04% and the S&P 500 futures (+0.04%) up, while NASDAQ futures are up by 0.04%. Risk barometer Bitcoin is up $702 to $65,704(+ 1.08%).

Due largely to the “Seasonal MACD Buy Signal” issued by The Stocks Trader’s Almanac yesterday, the Best Six Months of the trading year have just kicked into gear, with the major averages at or near all-time highs. The DJIA hit an all-time high yesterday at 43,139, with the S&P 500 hitting its ATH last Friday.

The NASDAQ Composite hit an ATH on July 11 at 18,671 and remains 169 points away. The Russell 2000 (small cap index) hit its ATH back in October 2021, with the ETF trading at $230.72 and is now $7.83 points away. Considering that September and October are seasonally weak months, it has been a statistical anomaly to be registering ATHs in mid-October during a presidential election year, but then again, this entire market is a “statistical anomaly” in many respects as I indicated last evening with those four charts. There was a time when one could use historical market patterns to time entries and exits, but with the algobots now controlling well over 70% of the volume on the NYSE, these historical norms are becoming less relevant every year.

Nonetheless, the markets are quickly approaching overbought territory and as can be observed from the chart of the S&P, it is trading a full 11.1% above its 200-dma, which is “overextended”, to put it mildly. I have to respect seasonality, so if there has been no meaningful drawdown by the end of this week, I will be looking to add a few calls in anticipation of a year-end rally.

Copper

I am posting the copper chart this morning and drawing your attention to the 100-DMA at $4.36/lb. With the price now beneath that level at $4.35 along with the overnight low of $4.3317, a close below the 100-dma sets up a test of the convergence zone between the 50- dma @ $4.27 and the 200-dma @ $4.24. That should be enough to take Freeport-McMoRan Inc. FCX back below the gap it created after the Chinese stimulus package was announced that took the stock from $45 on the close the prior session only to open $3.00 higher the following day at $48.10.

I was uneasy about selling the FCX calls and half of the shares back in the $51.50 range a few weeks back, but sometimes the discipline one acquires after being beaten like a common farm animal so many times pays off. I cannot count the number of times I stayed in a position that moved from a win to a loss because I failed to heed the old adage, “When conditions change, one must change.” When copper went into overbought conditions in late September, conditions changed. Hopefully, they are about to change again for the better.

Important Disclosures:

- Michael Ballanger: I, or members of my immediate household or family, own securities of: Freeport-McMoRan Inc. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

- Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Behind the Scenes of Novo Nordisk's Latest Options Trends

Investors with a lot of money to spend have taken a bullish stance on Novo Nordisk NVO.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with NVO, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

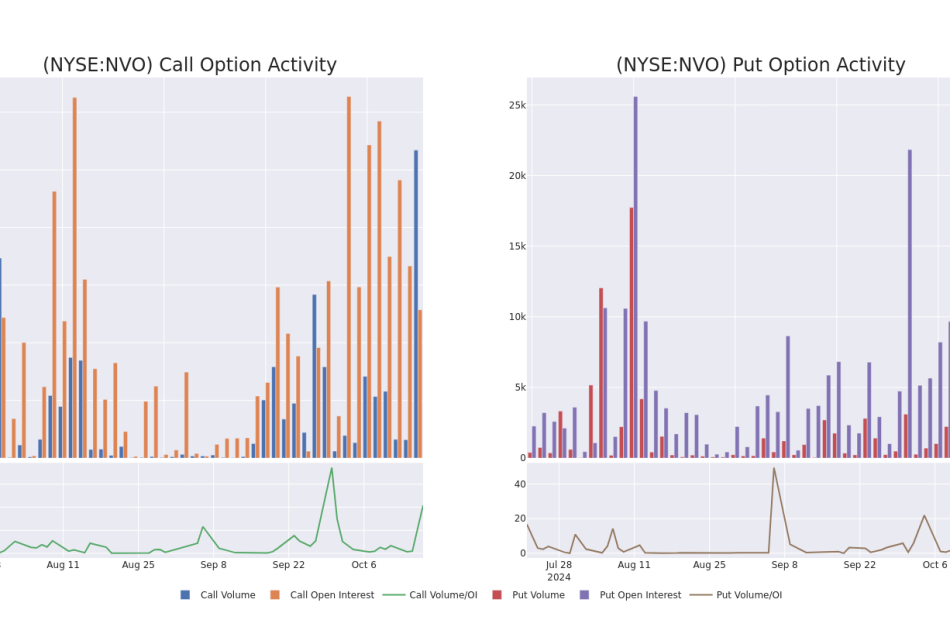

Today, Benzinga‘s options scanner spotted 15 uncommon options trades for Novo Nordisk.

This isn’t normal.

The overall sentiment of these big-money traders is split between 53% bullish and 40%, bearish.

Out of all of the special options we uncovered, 4 are puts, for a total amount of $369,668, and 11 are calls, for a total amount of $1,968,285.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $90.0 to $130.0 for Novo Nordisk over the last 3 months.

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Novo Nordisk’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Novo Nordisk’s substantial trades, within a strike price spectrum from $90.0 to $130.0 over the preceding 30 days.

Novo Nordisk Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVO | CALL | SWEEP | BULLISH | 11/15/24 | $5.05 | $5.0 | $5.0 | $120.00 | $494.5K | 955 | 695 |

| NVO | CALL | TRADE | BULLISH | 11/15/24 | $5.3 | $5.25 | $5.3 | $120.00 | $431.9K | 955 | 2.9K |

| NVO | PUT | SWEEP | BEARISH | 01/17/25 | $6.45 | $6.3 | $6.45 | $115.00 | $208.3K | 2.2K | 330 |

| NVO | CALL | SWEEP | BULLISH | 11/15/24 | $5.3 | $5.25 | $5.25 | $120.00 | $193.2K | 955 | 2.1K |

| NVO | CALL | SWEEP | BULLISH | 11/15/24 | $5.15 | $5.1 | $5.1 | $120.00 | $189.2K | 955 | 1.4K |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

In light of the recent options history for Novo Nordisk, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Novo Nordisk

- With a trading volume of 1,633,351, the price of NVO is up by 0.47%, reaching $118.59.

- Current RSI values indicate that the stock is may be oversold.

- Next earnings report is scheduled for 20 days from now.

What Analysts Are Saying About Novo Nordisk

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $158.66666666666666.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Cantor Fitzgerald has revised its rating downward to Overweight, adjusting the price target to $160.

* Consistent in their evaluation, an analyst from BMO Capital keeps a Outperform rating on Novo Nordisk with a target price of $156.

* Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $160.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Novo Nordisk with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Want Decades of Passive Income? 2 Stocks to Buy Right Now

Buying and holding stocks is easier said than done. Ideally, you find a great company, buy the stock, and let it grow and pay you dividends forever. The problem is that few companies fit that bill. The world changes, and the competition is ruthless. A company must evolve and stay on top to justify owning the stock year in and year out.

Yet, there are some exceptions, and these are companies with wide moats and competitive advantages that have stood the test of time. If you want decades of passive income from steady dividend streams, listen up. Consider buying and holding these two stocks right now.

1. The battle-tested leader of big oil

ExxonMobil (NYSE: XOM) is an integrated oil major, a company that explores and drills for oil and gas, refines it, and sells it to the market. Participating in different parts of the oil and gas supply chain diversifies the company, helping it withstand fluctuations in commodity prices. For example, falling oil prices would hurt ExxonMobil’s exploration business but boost profit margins in the refining business. In total, ExxonMobil generates over $340 billion in annual revenue.

The company boasts a sprawling portfolio of assets, including land and equipment, valued at nearly half a trillion dollars on its balance sheet. ExxonMobil has proven able to shuffle its assets, selling pieces to raise cash or acquiring new assets when an opportunity arises. It acquired Pioneer Energy for almost $60 billion earlier this year, which boosted ExxonMobil’s footprint in resource-rich regions like the Permian Basin and Guyana.

ExxonMobil’s management team has also managed the company’s balance sheet well, which acts as a safety net when industry downturns hurt profits. The company has a stellar AA- credit rating from Standard & Poor’s and a debt-to-equity ratio of just 0.16, its lowest in a decade.

If that’s not enough to give you peace of mind, look at ExxonMobil’s dividend history. Management has raised the dividend for 42 consecutive years, including during multiple recessions and a worldwide pandemic that essentially froze the global economy and even took oil prices below zero for the first time.

ExxonMobil is as battle-tested as it comes in the energy sector. Renewable energy and climate change could start to eat into demand for fossil fuels over the coming decades, but oil and gas aren’t going away anytime soon. At the very least, ExxonMobil should have time to diversify its business or acquire smaller competitors as the industry consolidates.

The stock offers investors a solid 3% yield at its current share price, so investors can confidently buy ExxonMobil and collect the dividends for the foreseeable future.

2. An agricultural titan with top-notch brand power

Deere & Company (NYSE: DE) sells agricultural, forestry, and construction equipment worldwide. The company’s iconic John Deere brand is famous for its trademark green paint, arguably among the world’s most recognizable colors. Deere does more than sell equipment; it also makes money on financing, repair, and maintenance services.

In all, Deere generates over $54 billion in annual revenue. There is competition, but Deere’s long history and recognizable brand have earned consistently strong loyalty among farmers.

The Earth is only so large, and the world’s population continues to grow. According to the United Nations, the global population could increase from 8.2 billion to 9.7 billion by 2050. That means it will be crucial to farm as efficiently as possible and to get the most out of the land society has. Deere sells next-generation technology, such as autonomous equipment and cloud-based software, designed to help farmers become more efficient.

Farmers generally finance this expensive equipment, which adds some risk to Deere since it holds those loans. However, Deere comfortably maintains an investment-grade balance sheet with an A credit rating from Standard & Poor’s. When it comes to the dividend, management doesn’t always raise it. But make no mistake, Deere is a dividend growth stock. The dividend has grown 145% over the past decade.

Perhaps most importantly, Deere hasn’t cut the dividend since the 1980s, so management has maintained it through multiple cycles in the agricultural industry. The dividend yields 1.4% today, which isn’t a ton, but it is poised to grow over time. Analysts estimate Deere will grow earnings by an average of 12% annually over the next three to five years.

I wouldn’t be surprised to see many more years of solid growth ahead in a world that will need more food and efficient farming. The dividends should follow.

Should you invest $1,000 in ExxonMobil right now?

Before you buy stock in ExxonMobil, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ExxonMobil wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $831,707!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Deere & Company and S&P Global. The Motley Fool has a disclosure policy.

Want Decades of Passive Income? 2 Stocks to Buy Right Now was originally published by The Motley Fool

Super Micro Computer Says It's Shipping 100,000 GPUs Per Quarter. Time to Buy the Stock?

The artificial intelligence (AI) competition is in full swing, and each company is racing to build the best AI model possible and capture a potentially huge market. This parallels events like the California gold rush.

Not every prospector found gold, and many lost everything searching for it. However, one industry boomed during this time: picks and shovels. This gives rise to an investing strategy that looks for companies that sell modern-day picks and shovels to businesses that are competing in a category like AI.

Super Micro Computer (NASDAQ: SMCI) fits this description. It recently announced that it shipped more than 100,000 graphics processing units (GPUs, the main piece of hardware that does AI computing) in a quarter. That’s an unreal amount, but does it add up to a stock that’s worth buying?

Supermicro’s technology sets it apart from the competition

Supermicro (as it’s commonly called) provides parts and full-scale solutions for computing servers that can be customized to any size and tailored to specific workload types. This flexibility sets it apart from competitors, as does its liquid-cooled technology.

These servers consume a lot of power. That power is converted to heat, which must be dealt with; otherwise, the server would overheat and ruin millions of dollars worth of GPUs.

The standard solution is to cool the room with air conditioning, but that’s costly. Instead, Supermicro uses liquid-cooling technology, which eliminates the need for these giant air conditioning units specifically tailored for server rooms.

According to Supermicro, its cooling technology saves 40% on energy costs and provides 80% space savings because airflow is not required. With AI leaders building up their computing power, space becomes a premium, which is why Supermicro’s solution has risen to the top as a best-in-class option, even if its products cost more than its competitors’.

With Supermicro shipping racks filled with more than 100,000 GPUs per quarter, it’s clear the demand is high. But does that make the stock worth buying?

The stock is incredibly cheap, but there’s risk involved

While business appears to be booming, some other issues under the hood must be discussed.

In August, famed short-seller Hindenburg Research released a report on Supermicro claiming that the company is involved in accounting malpractice, something it was fined for by the Securities and Exchange Commission for issues that occurred in 2018.

Although Supermicro denied these allegations, it announced it was delaying filing its end-of-year Form 10-K report to assess the “effectiveness of internal controls over financial reporting.” That’s not a great look.

The Department of Justice also launched a probe into the company’s accounting practices, but it will be some time before we know the results.

Because there are a lot of unknowns with the company, you would be forgiven if you don’t want to invest in it. There are plenty of fine companies out there and taking a risk on Supermicro, considering all the controversy about its accounting, might not be worth it for you.

However, if it doesn’t bother you, the stock has real value.

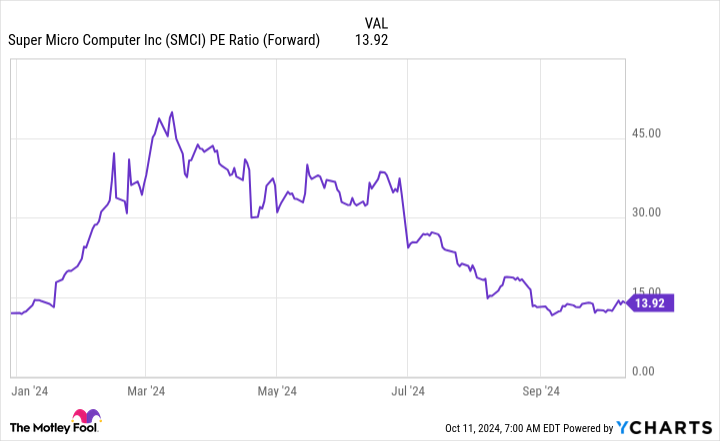

Super Micro Computer trades for a dirt-cheap 13.9 times forward earnings right now. Compared to the S&P 500, which trades at 23.5 times forward earnings, it’s a massive discount to the broader market.

Management also expects its growth to continue for some time, because it believes it’s on a path to $50 billion in annual revenue. It expects $26 billion to $30 billion for fiscal year 2025 (ending June 30, 2025), which is significant growth from 2024’s $14.9 billion total.

Whether Supermicro stock is a buy right now is about risk tolerance. If you’re OK with some risk on the table, then there are many compelling reasons to buy the stock. But if you’re not, there are still plenty of great companies out there with market-beating potential.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,139!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,239!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $380,729!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Keithen Drury has positions in Super Micro Computer. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer Says It’s Shipping 100,000 GPUs Per Quarter. Time to Buy the Stock? was originally published by The Motley Fool

Melania Trump Says Barron Was Blocked From Opening A Bank Account, Pointing To 'Cancel Culture'

Melania Trump recently claimed that her son, Barron, was denied a bank account due to “cancel culture” after the family left the White House. In her new memoir Melania, released recently, the former first lady expresses frustration over what she describes as politically motivated discrimination.

Don’t Miss:

“I was shocked and dismayed to learn that my longtime bank decided to terminate my account and deny my son the opportunity to open a new one,” she writes. According to her memoir, Melania suggests that the decision was rooted in political bias and raised concerns about civil rights violations. Some speculators, however, suggest that there may be other reasons, such as hefty fines and overdraft fees owed to specific financial institutions by Trump himself, that caused these account closures.

See Also: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

The timing of this incident coincided with the period following the Jan. 6 Capitol riot, although Melania doesn’t mention the event directly. She points out that she and Barron felt the sting of “cancel culture” during this time. “It is troubling to see financial services withheld based on political affiliation,” she stated, calling the decision unfair.

Her grievances weren’t limited to banking issues. Melania also shared how a media deal she worked on fell through after the backers pulled out, citing personal hatred toward her husband, Donald Trump. She wrote that the private equity firm backing her media initiative refused to honor their agreement despite her efforts to focus on business, not politics.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

Another incident involved Melania’s charitable initiative, the Fostering the Future scholarship program, which provided educational support to foster care children. According to the memoir, a ‘leading tech-education company’ partnered with the initiative and later cut ties after her involvement became public.

She claims the company’s board didn’t want to be associated with her. “Despite my willingness to avoid any public association with the program, the school remained firm and terminated the agreement,” Melania explained.

In 2022, her Fostering the Future program was scrutinized when The New York Times reported that it wasn’t registered with Florida’s Consumer Services Division, triggering an investigation. Melania, however, fired back, accusing the media of attempting to “cancel” her and her charitable efforts.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

Though Barron’s financial setback with the bank was highlighted in the memoir, Melania emphasized that it hasn’t affected him negatively. “He is doing great,” she shared during an appearance on Fox News’s The Five. “He loves his classes and professors. He is doing well. He is striving and enjoying being in New York City again.”

At 18, Barron Trump is now a student at New York University’s Stern School of Business, where he began classes in September. Melania’s book also touches on Barron’s past struggles with online bullying, referencing rumors that circulated in 2010 regarding his health. She described the bullying as “irreparable damage,” calling attention to the harsh treatment her son endured.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Melania Trump Says Barron Was Blocked From Opening A Bank Account, Pointing To ‘Cancel Culture’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.