Melania Trump Says Barron Was Blocked From Opening A Bank Account, Pointing To 'Cancel Culture'

Melania Trump recently claimed that her son, Barron, was denied a bank account due to “cancel culture” after the family left the White House. In her new memoir Melania, released recently, the former first lady expresses frustration over what she describes as politically motivated discrimination.

Don’t Miss:

“I was shocked and dismayed to learn that my longtime bank decided to terminate my account and deny my son the opportunity to open a new one,” she writes. According to her memoir, Melania suggests that the decision was rooted in political bias and raised concerns about civil rights violations. Some speculators, however, suggest that there may be other reasons, such as hefty fines and overdraft fees owed to specific financial institutions by Trump himself, that caused these account closures.

See Also: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

The timing of this incident coincided with the period following the Jan. 6 Capitol riot, although Melania doesn’t mention the event directly. She points out that she and Barron felt the sting of “cancel culture” during this time. “It is troubling to see financial services withheld based on political affiliation,” she stated, calling the decision unfair.

Her grievances weren’t limited to banking issues. Melania also shared how a media deal she worked on fell through after the backers pulled out, citing personal hatred toward her husband, Donald Trump. She wrote that the private equity firm backing her media initiative refused to honor their agreement despite her efforts to focus on business, not politics.

Trending: This Adobe-backed AI marketing startup went from a $5 to $85 million valuation working with brands like L’Oréal, Hasbro, and Sweetgreen in just three years – here’s how there’s an opportunity to invest at $1,000 for only $0.50/share today.

Another incident involved Melania’s charitable initiative, the Fostering the Future scholarship program, which provided educational support to foster care children. According to the memoir, a ‘leading tech-education company’ partnered with the initiative and later cut ties after her involvement became public.

She claims the company’s board didn’t want to be associated with her. “Despite my willingness to avoid any public association with the program, the school remained firm and terminated the agreement,” Melania explained.

In 2022, her Fostering the Future program was scrutinized when The New York Times reported that it wasn’t registered with Florida’s Consumer Services Division, triggering an investigation. Melania, however, fired back, accusing the media of attempting to “cancel” her and her charitable efforts.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

Though Barron’s financial setback with the bank was highlighted in the memoir, Melania emphasized that it hasn’t affected him negatively. “He is doing great,” she shared during an appearance on Fox News’s The Five. “He loves his classes and professors. He is doing well. He is striving and enjoying being in New York City again.”

At 18, Barron Trump is now a student at New York University’s Stern School of Business, where he began classes in September. Melania’s book also touches on Barron’s past struggles with online bullying, referencing rumors that circulated in 2010 regarding his health. She described the bullying as “irreparable damage,” calling attention to the harsh treatment her son endured.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Melania Trump Says Barron Was Blocked From Opening A Bank Account, Pointing To ‘Cancel Culture’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

American Express Shows Bullish Signals Ahead Of Q3 Earnings, But Analysts Hold Back

American Express Co AXP will be reporting its third-quarter earnings on Oct. 18. Wall Street expects $3.80 in earnings per share and $16.67 billion in revenues as the company reports before market hours.

The stock is up 84.29% over the past year, 51.1% year-to-date.

Let’s look at what the charts indicate for the New York-based company and how its stock currently maps against Wall Street estimates.

American Express Stock Chart Is Bullish

American Express stock is exhibiting strong bullish momentum based on several technical indicators.

Chart created using Benzinga Pro

The stock is currently trading at $281.68, which places it above key moving averages—its five-day, 20-day and 50-day exponential moving averages—indicating significant buying pressure.

American Express’ stock price is above its eight-day SMA of $275.54. The 20-day SMA of $272.03 further confirms a bullish outlook. This suggests continued upward movement. The stock’s 50-day SMA at $259.88 and its 200-day SMA at $232.73 are also well below the current price, reinforcing this positive trend.

Chart created using Benzinga Pro

Additionally, the MACD indicator is at 5.32, which signals further bullish potential for American Express stock. However, caution is warranted as the RSI stands at 67.74, and rising to approach the overbought territory. This could suggest a short-term pullback.

However, the Bollinger Bands also indicate that the stock remains in a bullish phase with the stock trading in then upper bullish band.

Investors should monitor these technical signals closely as the stock approaches a potential breakout.

Read Also: Here’s How Much $1000 Invested In This Payments Company 15 Years Ago Would Be Worth Today

…But Analysts See 7% Downside

Ratings & Consensus Estimates: The consensus analyst rating on American Express stock stands at a Neutral currently with a price target of $228.60. The latest analyst ratings for American Express stock were issued by Morgan Stanley, Monness, Crespi, Hardt, and Barclays in October. These analysts have set an average price target of $266, indicating an implied downside of 6.54% for the stock.

AXP Price Action: American Express stock was trading at $284.62 at the time of publication.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

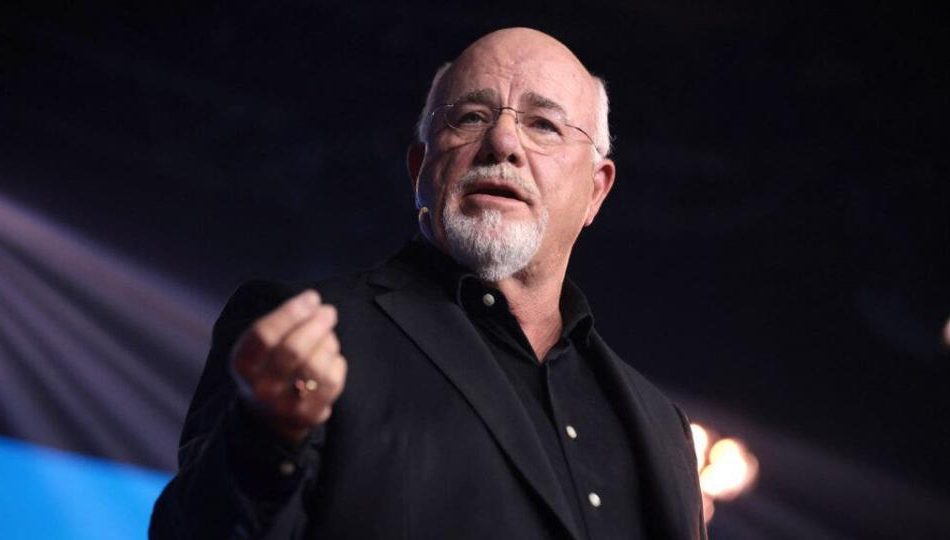

Dave Ramsey Says Buying Cars For Your Teenagers Leads To A Lifetime Of 'Ridiculous Expectations.' Better To Have Them 'Buy Their Own Cars'

Buying your teenager their first car might seem like a proud, memorable milestone. But according to financial expert Dave Ramsey, it’s not the best move if you want to set your kids up for a successful future.

Ramsey believes that buying your kids a car can create “ridiculous expectations” about money that could affect them for the rest of their lives. Rather, he advises letting them purchase a car independently, perhaps with some assistance.

Don’t Miss:

The best thing to do for your kids is have them buy their own cars.

When you buy new cars for teenagers, you’re setting them up for a life of ridiculous expectations. Think about their future.

If you have enough cash set aside, you and your child could agree on a matching plan…

— Dave Ramsey (@DaveRamsey) October 10, 2024

“When you buy new cars for teenagers, you’re setting them up for a life of ridiculous expectations,” Ramsey tweeted. In other words, handing over a car might give your teen the impression that big-ticket items are easy to come by. Instead of giving them a car, Ramsey advises giving them the opportunity to work, save and learn what it takes to make a major purchase independently.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

“Think about their future,” Ramsey says. Encouraging your teen to purchase a car independently helps them develop lifelong financial skills. It also motivates them to see the benefits of saving money, working hard and making wise financial decisions.

Now, this doesn’t mean you can’t help at all. Ramsey suggests a middle ground: “If you have enough cash, you and your child could agree on a matching plan to help buy the car. Whatever your child saves, you’ll match.”

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

This method encourages your adolescent to save money while also lending a helpful hand without making things too simple. It lets parents encourage their children while ensuring they contribute fairly.

Encouraging your teenager to buy their own car isn’t just about getting the car. You’re teaching them important money skills. Dave Ramsey says, “Personal finance is 80% behavior and only 20% head knowledge.” When your teen saves for a car, they learn the habits they need to manage money well – which can help them a lot later in life.

See Also: I’m 62 Years Old And Have $1.2 Million Saved. Is This Enough to Retire Stress-Free?

Another essential component of this strategy is assisting teenagers in finding independent income sources. Ramsey points out that today, it’s arguably easier than ever for them to start making money through part-time jobs, freelance gigs or even small entrepreneurial ventures.

In the end, Ramsey stresses that allowing your adolescent or even older child to purchase a car on their own is “a tremendous gift” and a chance for them to learn responsibility, budgeting and the satisfaction of reaching a major objective.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Dave Ramsey Says Buying Cars For Your Teenagers Leads To A Lifetime Of ‘Ridiculous Expectations.’ Better To Have Them ‘Buy Their Own Cars’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SiriusPoint Announces Date for Third Quarter 2024 Earnings Release

HAMILTON, Bermuda, Oct. 17, 2024 (GLOBE NEWSWIRE) — SiriusPoint Ltd. SPNT (“SiriusPoint” or the “Company”) today announced that it is planning to release its third quarter 2024 financial results after the market close on Thursday, October 31, 2024. The Company will also hold a webcast, which can be accessed as a conference call, to discuss its financial results at 8:30 am (Eastern Time) on Friday, November 1, 2024.

The webcast of the live conference call can be accessed by logging onto the Investor Relations section of the Company’s website at www.siriuspt.com. The online replay of the webcast will be available on the Company’s website immediately following the call.

The conference call can be accessed by dialing 1-877-451-6152 (domestic) or 1-201-389-0879 (international) and asking for the SiriusPoint Ltd. Third Quarter 2024 Earnings Call. A replay will be available at the conclusion of the call and can be accessed by dialing 1-844-512-2921, or for international callers 1-412-317-6671, and providing the passcode 13748683. The replay will be available until 11:59 pm (Eastern Time) on November 15, 2024.

About SiriusPoint

SiriusPoint is a global underwriter of insurance and reinsurance providing solutions to clients and brokers around the world. Bermuda-headquartered with offices in New York, London, Stockholm and other locations, we are listed on the New York Stock Exchange (SPNT). We have licenses to write Property & Casualty and Accident & Health insurance and reinsurance globally. Our offering and distribution capabilities are strengthened by a portfolio of strategic partnerships with Managing General Agents and Program Administrators. With over $3.0 billion total capital, SiriusPoint’s operating companies have a financial strength rating of A- (Excellent) from AM Best, S&P and Fitch, and A3 from Moody’s. For more information, please visit https://www.siriuspt.com.

Contacts

Investor Relations

Liam Blackledge, SiriusPoint

liam.blackledge@siriuspt.com

+44 203 772 3082

Media

Sarah Hills, Rein4ce

sarah.hills@rein4ce.co.uk

+44 7718882011

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Analyst Report: Truist Financial Corporation

Analyst Profile

Stephen Biggar

Director of Financial Institutions Research

Stephen is responsible for coverage of large global banks, regional banks and domestic credit card companies. He has covered financial services stocks for more than 20 years. He is also a member of the Argus Investment Policy Committee and Senior Portfolio Group, and frequently appears in print and broadcast media discussing the equity markets. Previously, he was the global director of equity research for S&P Capital IQ. He holds a degree in economics from Rutgers University.

Kelly Services Senior Vice President Trades $200K In Company Stock

A new SEC filing reveals that Nicola Soares, Senior Vice President at Kelly Services KELYA, made a notable insider purchase on October 16,.

What Happened: Soares’s recent purchase of 9,843 shares of Kelly Services, disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Wednesday, reflects confidence in the company’s potential. The total transaction value is $200,009.

Kelly Services shares are trading down 0.0% at $20.62 at the time of this writing on Thursday morning.

All You Need to Know About Kelly Services

Kelly Services Inc is a provider of workforce solutions and consulting and staffing services. The company’s operations are divided into five business segments namely Professional & Industrial, Science, Engineering & Technology, Education, Outsourcing & Consulting, and International. Other than OCG, each segment delivers talent through staffing services, permanent placement, or outcome-based services. OCG segment delivers talent solutions including managed service providers, payroll process outsourcing, recruitment process outsourcing, and talent advisory services. International also delivers RPO talent solutions within its local markets. The majority of revenue is derived from Professional & Industrial.

Kelly Services: Delving into Financials

Revenue Challenges: Kelly Services’s revenue growth over 3 months faced difficulties. As of 30 June, 2024, the company experienced a decline of approximately -13.12%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Industrials sector.

Evaluating Earnings Performance:

-

Gross Margin: The company shows a low gross margin of 20.21%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Kelly Services’s EPS reflects a decline, falling below the industry average with a current EPS of 0.13.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.21.

Valuation Metrics: A Closer Look

-

Price to Earnings (P/E) Ratio: Kelly Services’s P/E ratio of 15.62 is below the industry average, suggesting the stock may be undervalued.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.17, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): With a below-average EV/EBITDA ratio of 10.38, Kelly Services presents an opportunity for value investors. This lower valuation may attract investors seeking undervalued opportunities.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Pay Attention to Insider Transactions

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

In the realm of legality, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities under Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are required to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

Notably, when a company insider makes a new purchase, it is considered an indicator of their positive expectations for the stock.

Conversely, insider sells may not necessarily signal a bearish stance on the stock and can be motivated by various factors.

Understanding Crucial Transaction Codes

Navigating through the landscape of transactions, investors often prioritize those unfolding in the open market, precisely detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Kelly Services’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Philippe Laffont Sold Coatue's Entire Stake in Palantir and Is Piling Into an Electrifying Growth Stock Instead

On Wall Street, investors are never hurting for data. We’re currently kicking off a six-week period (affably known as “earnings season”) where a majority of S&P 500 companies will lift the hood on their most recent quarterly operating performance. In addition to a barrage of operating results, economic data releases occur almost every day. It can be easy to miss something important.

On Aug. 14, you may have missed what can easily be described as the most pivotal data release of the third quarter. This date marked the filing deadline for institutional investors with at least $100 million in assets under management (AUM) to file Form 13F with the Securities and Exchange Commission. A 13F provides investors with a concise snapshot of what Wall Street’s brightest and historically successful money managers purchased and sold in the latest quarter (in this case, the June-ended quarter).

Although Berkshire Hathaway‘s Warren Buffett is arguably the most-followed of all billionaire asset managers, there are more than a dozen high-profile billionaire money managers that garner a lot of attention, including Coatue Management’s Philippe Laffont.

Laffont’s hedge fund, which is primarily focused on game-changing tech stocks, closed out June with approximately $25.7 billion in AUM spread across 74 holdings.

What might come as a bit of a surprise to investors is that Laffont was a big-time seller of one of Wall Street’s hottest artificial intelligence (AI) stocks, Palantir Technologies (NYSE: PLTR). While Coatue’s brightest minds, including Laffont, we’re showing Palantir to the door, they were piling into a growth stock that stands out in a notoriously slow-growing sector.

Laffont completely exited Coatue’s stake in Palantir

Let me preface the following discussion by pointing out that Coatue Management is an actively managed fund. The average top-10 holding has been held for less than a year. Further, Laffont reduced his fund’s stake in 30 companies and completely sold out of 23 during the second quarter. In other words, Palantir was far from the only stock to be sent to the chopping block.

Nevertheless, the 4,816,195 shares sold by Coatue marked one of the largest shares sales of Palantir stock during the June-ended quarter.

Profit-taking is the most-logical reason Laffont and his team may have chosen to ring the register. Palantir had been a continuous holding for Coatue since the first quarter of 2023. At that time, shares could have been purchased for roughly $8. With Palantir’s stock hovering in the low-$20s during the second quarter, it looks as if Coatue banked a triple-digit gain on its initial stake.

Laffont may have also been skittish about Palantir’s premium valuation. On one hand, there is no substitute for the company’s AI-driven Gotham platform, which helps federal governments plan missions and collect data, or its enterprise-focused Foundry platform. Irreplaceability at scale is a trait that investors will gladly pay a premium for on Wall Street.

On the other hand, Palantir’s stock is currently near an all-time high and valued at almost 100 times forward-year earnings and 29 times forward-year sales. These are eye-popping multiples for a company growing sales by roughly 20% per year. Though Foundry has the potential to reaccelerate growth for Palantir in the future, the company’s valuation premium right now is borderline unjustifiable.

Despite being an artificial intelligence bull, the third reason Laffont may have chosen to dump Coatue’s entire stake in Palantir is the possibility of an AI bubble brewing.

Since the internet began going mainstream roughly three decades ago, there hasn’t been a game-changing technology that’s avoided an early stage bubble. Without fail, investors overestimate how quickly new innovations, trends, or technologies will be utilized by consumers and/or businesses. This recipe eventually leads to disappointment and a bubble-bursting event.

Although direct AI players, such as Nvidia, would be hit the hardest if the AI bubble bursts, Palantir is likely to be hampered by a slowdown in Ai-related spending.

Laffont’s Coatue Management is piling into this electrifying growth stock

But while Laffont and his team were busy sending shares of Palantir to the chopping block, they were avid buyers of America’s leading electric utility, NextEra Energy (NYSE: NEE).

During the June-ended quarter, Laffont’s fund gobbled up 282,544 additional shares of NextEra, which increased Coatue’s stake by 36% in three months to 1,066,083 shares. If this position remained static during the third quarter, it’d be worth more than $88 million, as of the closing bell on Oct. 15.

Traditionally, the utility sector is slow-growing and, for lack of a better word, boring. Investors buy utility stocks for their dividends and the consistency of their cash flow. It’s a sector that tends to outperform during periods of economic uncertainty and low interest rates.

However, seemingly none of this applies to NextEra Energy, which has delivered consistent high-single-digit earnings growth for more than a decade.

The factor that’s differentiated NextEra from the dozens of other publicly traded, slow-growing utilities is its focus on renewable energy. Management laid out a plan to invest a cumulative $85 billion to $95 billion in American infrastructure between 2022 and 2025, a majority of which is tied to clean-energy resources.

As of June 2024, the company had 72 gigawatts (GW) in capacity, 34 GW of which can be traced back to its renewable energy portfolio. No electric utility in the world is generating more capacity from solar or wind power than NextEra.

While investing in the future hasn’t been cheap, it’s notably reduced the company’s electricity generation costs and provided a tangible lift to the company’s bottom line and dividends. If future policy proposals from Capitol Hill necessitate a green shift for America’s electric utilities, NextEra would be miles ahead of the curve.

In addition to low-cost generation and a superior growth rate to its peers, NextEra still enjoys the advantages that come with being an electric utility. This includes being a monopoly or duopoly in the areas it services and generating predictable cash flow year after year.

The final thing worth mentioning about NextEra is that the other half of its 72 GW in capacity — i.e., its traditional electric utility operations, via Florida Power & Light, which aren’t powered by renewables — is regulated by the Florida Public Service Commission (FPSC). The advantage of being a regulated utility and needing approval from the FPSC to raise rates is that it ensures no exposure to wholesale electricity pricing.

NextEra Energy may not be a traditional “growth” stock, but it has a lengthy track record of delivering for its shareholders.

Should you invest $1,000 in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $806,459!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Sean Williams has positions in NextEra Energy. The Motley Fool has positions in and recommends Berkshire Hathaway, NextEra Energy, Nvidia, and Palantir Technologies. The Motley Fool has a disclosure policy.

Billionaire Philippe Laffont Sold Coatue’s Entire Stake in Palantir and Is Piling Into an Electrifying Growth Stock Instead was originally published by The Motley Fool

Netflix earnings, subscriber growth top estimates as investors eye potential price hikes

Netflix (NFLX) stock rose as much as 5% in after-hours trading Thursday as the streaming giant beat third quarter EPS and revenue estimates and projected sales for the current quarter that came in ahead of Wall Street’s expectations.

Revenue beat Bloomberg consensus estimates of $9.78 billion to hit $9.83 billion in Q3, an increase of 15% compared to the same period last year, as the streamer continued to lean on revenue initiatives like its crackdown on password sharing and ad-supported tier, in addition to last year’s price hikes on certain subscription plans.

Netflix guided to fourth quarter revenue of $10.13 billion, a beat compared to consensus estimates of $10.01 billion.

For full-year 2025, the company sees revenue hitting between $43 billion and $44 billion compared to consensus estimates of $43.4 billion. This would represent growth of 11% to 13% from the company’s expected 2024 revenue guidance of $38.9 billion.

It expects full-year operating margins to hit 27%, an increase from the previous 26%, after the metric hit nearly 30% in the third quarter.

Diluted earnings per share (EPS) also beat estimates in the quarter, with the company reporting EPS of $5.40, above consensus expectations of $5.16 and well ahead of the $3.73 EPS figure it reported in the year-ago period. Netflix guided to fourth quarter EPS of $4.23, ahead of consensus calls for $3.90.

Subscribers also came in strong with another 5 million-plus subscribers added on the heels of breakout programming like “The Perfect Couple” and “Nobody Wants This.”

Subscriber additions of 5.07 million beat expectations of 4.5 million and follows the 8.05 million net additions the streamer added in the second quarter. The company had added 8.8 million paying users in Q3 2023.

“We expect paid net additions to be higher in Q4 than in Q3’24 due to normal seasonality and a strong content slate,” the company said, citing upcoming releases like “Squid Game” Season 2, the Jake Paul vs. Mike Tyson fight, and two NFL games on Christmas Day.

Investors have praised the company’s foray into sports and live events. Meanwhile, its ad tier continues to gain traction, accounting for over 50% of sign-ups in the countries where it’s offered during the third quarter.

“We continue to build our advertising business and improve our offering for advertisers,” the company said in the earnings release. “Ads membership was up 35% quarter on quarter, and our ad tech platform is on track to launch in Canada in Q4 and more broadly in 2025.”

Last quarter, Netflix revealed it secured “a 150% plus increase in upfront ad sales commitments over 2023.” The company has previously said its goal is to make ads “a more substantial revenue stream that contributes to sustained, healthy revenue growth in 2025 and beyond.”

On the earnings call, Netflix co-CEO Greg Peters said that while ads won’t be a primary driver of revenue next year as “we’re still scaling that audience and that inventory faster than our ability to monetize it,” the company sees an “opportunity to close that gap.”

Leading up to the results, Netflix’s stock had been on a tear, with shares up around 45% since the start of the year and trading near all-time highs.

Analysts expect another price hike by the end of the year, which will likely serve as yet another catalyst for shares. But the stock’s recent run-up has led to some apprehension on Wall Street.

Price hike to come?

The company recently revealed subscribers watched over 94 billion hours on the platform from January to June as part of its latest biannual viewership report, although year-over-year engagement levels came in roughly flat — a potential headwind when it comes to pricing power, which has become especially important for streaming companies as consumers become more picky.

On average, US consumers subscribe to four streaming services and spend about $61 per month, according to the latest Digital Media Trends report from Deloitte. Retaining loyal subscribers over time is a challenge due to consumers churning out of, or canceling, their subscription plans.

Netflix last raised the price of its Standard plan in January 2022, upping the monthly cost to $15.49 from $13.99. It also raised the price of its Premium tier by $2 to $19.99 a month at the same time; the company again raised the cost of that plan last October to $22.99.

The company has yet to raise the price of its ad-supported offering, introduced less than two years ago, which remains one of the cheapest ad plans among all of the major streaming players at $6.99 a month.

“Given Netflix’s low cost per viewed hour, we see scope for the firm to raise US prices by 12% in 2025,” Citi analyst Jason Bazinet said ahead of the report.

The company recently phased out its lowest-priced ad-free streaming plan, making the $15.49 Standard plan its cheapest offering for an ad-free experience.

Alexandra Canal is a Senior Reporter at Yahoo Finance. Follow her on X @allie_canal, LinkedIn, and email her at alexandra.canal@yahoofinance.com.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance.