Thermal Energy Storage Market Predicted to Grow at $12.10 Billion by 2031 | SkyQuest Technology

Westford, US, Oct. 17, 2024 (GLOBE NEWSWIRE) — The global thermal energy Storage market size was valued at around $5.88 billion in 2023 and Expected to reach a value of $12.10 billion by 2031, at a CAGR of 9.45% from 2024 to 2031. The market is growing rapidly due to a shift in preference toward renewable energy generation, including concentrated solar power, and rising demand for thermal energy storage TES systems in HVAC. The thermal energy storage demand will be positively affected by the increasing requirement for enhanced energy efficiency rates, along with the ongoing efforts to use energy more productively.

Broad commercialization due to the escalating need for electricity, increased use of electricity in peak hours, and a heated demand for heating and cooling applications in smart infrastructure is expected to be the trend propelling market growth. Additionally, the market will benefit from the plethora of government policies in developed as well as developing countries for renewable energy technologies, as it forms an integral part of the investments made by countries worldwide in renewables.

Request Sample of the Report: https://www.skyquestt.com/sample-request/thermal-energy-storage-market

Browse in-depth TOC on the “Thermal Energy Storage Market” Pages – 197, Tables – 95, Figures – 76

Thermal Energy Storage Market Report Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $5.88 Billion |

| Estimated Value by 2031 | $12.10 Billion |

| Growth Rate | Poised to grow at a CAGR of 12.10 % |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Product, Technology, Storage Material, Application, End User, and Region |

| Geographies Covered | North America, Europe, Asia-Pacific, and the Rest of the world |

| Report Highlights | Rising necessity for sustainable energy solution |

| Key Market Opportunities | Rising focus on energy efficiency |

| Key Market Drivers | Increasing popularity for renewable energy |

Get Customized Reports with your Requirements, Free – https://www.skyquestt.com/speak-with-analyst/thermal-energy-storage-market

Rising Demand for Thermal Energy to Boost Thermal Energy Market Growth

The rise in thermal energy demand is boosting the requirements for thermal energy storage solutions. Factors like expansion of industries and urban populations is increasing the demand for thermal energy. Furthermore, the transition toward cleaner fuels, regardless of whether it is manufacturing, residential heating and cooling, agriculture, off-road transportation or renewable energy conversion, increase thermal energy demand. Concurrently, the elevating importance of energy management and optimization tends to focus on how well thermal energy is utilized. Thus, it is apparent that thermal energy storage is increasingly crucial in terms of energy security, sustainability, and resilience.

Advancements of Thermal Energy Storage Technology to Increase Reliability on Renewable Energy Generation

Thermochemical storage technologies have also experienced significant progress which is stemmed from high-temperature material development. This approach makes TES systems operate at high temperatures that consequently provides higher energy storage capacity and efficiencies. This also allows for a higher level of heat utilization from renewable sources such as concentrated solar power. Such technologies also improve the feasibility and reliability of renewable generation. A series of thermochemical storage technologies makes use of reversible chemical reactions that are employed to store and release heat energy and provide relatively long-duration storage. In addition, the integration of multiple storage technologies through implementing hybrid TES systems provides immense advantages like improved energy density, cycling stability or flexibility. As well, system integration and control strategies advance to improve real-time adjustment of the TES system in response to demand and weather conditions, as well as energy price. Advanced smart control algorithms are employed, making TES and renewable energy sources a well-integrated system unit.

Strict Environmental Regulations to Promote Renewable Energies to Drive Market Growth in Europe

Europe dominates the global thermal energy storage market and is expected to expand substantially in the future. The TES market in Europe is growing rapidly because the need for energy storage and grid stabilization is growing. This growth is driven by the fact that very stringent environmental regulations and policies across Europe have been put in place to promote the use of renewable energies as well as energy efficiency. Europe has a vast reserve of renewable energies, for example, wind and solar energy sources. These types of energies must be balanced by TES systems since they can be very intermittent and fluctuating. In Europe stakeholders are carrying out diverse strategic activities including mergers and acquisitions, extensions, fundraising, and new product development, among others to enhance their positions in the market.

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/thermal-energy-storage-market

Thermal Energy Storage Market Insights

Driver

- Growing demand for renewable energy sources

- Increasing government policies and incentives related to renewable energy

- Rising demand for electricity due to growing commercialization

Restraints

- High initial investment expenses

- Rising competition from alternative energy storage technologies

- Restrictions due to strict governmental regulations and policies

Key Players Operating in the Thermal Energy Storage Market

- Abengoa Solar

- BrightSource Energy

- Burns & McDonnell

- CALMAC

- Cryogel Thermal Energy Storage

- DN Tanks

- EDF Renewables

- EnergyNest

- Evapco

- Goss Engineering

- Ice Energy

Key Questions Answered in the Thermal Energy Storage Market

- What are the key factors driving the thermal energy storage market?

- Who are the major companies operating in the market?

- Which region is expected to hold the largest market share?

This report provides the following insights:

Analysis of key drivers (Growing demand for renewable energy sources, increasing government policies and incentives related to renewable energy), restraints (High initial investment expenses, Rising competition from alternative energy storage technologies), opportunities (Rising demand for electricity due to growing commercialization), and challenges (Restrictions due to strict governmental regulations and policies) influencing the growth of thermal energy storage market.

- Market Penetration: Comprehensive information on the product offered by the top players in the thermal energy storage market.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the thermal energy storage market.

- Market Development: Comprehensive information on emerging regions.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the market.

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

Related Reports:

Wireline Services Market: Global Opportunity Analysis and Forecast, 2024-2031

Generator Sales Market: Global Opportunity Analysis and Forecast, 2024-2031

Smart Grid Market: Global Opportunity Analysis and Forecast, 2024-2031

Biofuels Market: Global Opportunity Analysis and Forecast, 2024-2031

Bunker Fuel Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

SkyQuest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Crude Oil Edges Higher; US Retail Sales Top Expectations

U.S. stocks traded higher midway through trading, with the Nasdaq Composite gaining around 0.5% on Thursday.

The Dow traded up 0.28% to 43,199.12 while the NASDAQ rose 0.53% to 18,464.23. The S&P 500 also rose, gaining, 0.30% to 5,860.00.

Check This Out: Top 3 Risk Off Stocks Which Could Rescue Your Portfolio This Quarter

Leading and Lagging Sectors

Information technology shares jumped by 1.1% on Thursday.

In trading on Thursday, real estate shares fell by 0.6%.

Top Headline

U.S. retail sales rose 0.4% month-over-month in September compared to a 0.1% increase in August and higher than market estimates of a 0.3% rise.

Equities Trading UP

- Gevo, Inc. GEVO shares shot up 18% to $2.6450 after the company announced it secured a DOE conditional commitment loan of $1.46 billion for its net-zero 1 sustainable aviation fuel plant in South Dakota.

- Shares of Nixxy, Inc. NIXX got a boost, surging 116% to $5.12 after the company provided updates on the business including its acquisition strategy in traditional markets and enhancing operations through technology and data analytics.

- Iridium Communications Inc IRDM shares were also up, gaining 16% to $35.11 after the company reported better-than-expected third-quarter revenue results and raised its FY24 OEBITDA guidance.

Equities Trading DOWN

- Proficient Auto Logistics, Inc. PAL shares dropped 23% to $10.68 after the company announced it expects its third-quarter net income to be significantly degraded due to a reduced level of revenue and resulting loss of operating leverage. Also, the company said it expects that the Longshoremen strike could have negatively impacted unit volumes during the fourth quarter and beyond.

- Shares of Cerus Corporation. CERS were down 20% to $1.4486 after the company provided updates on its INTERCEPT red blood cell programs in the US and Europe.

- Lucid Group, Inc. LCID was down, falling 15% to $2.7950 after the company announced the pricing of an offering and corresponding investment from an affiliate of the Public Investment Fund (PIF).

Commodities

In commodity news, oil traded up 0.5% to $70.76 while gold traded up 0.6% at $2,706.20.

Silver traded down 0.2% to $31.91 on Thursday, while copper fell 0.6% to $4.3435.

Euro zone

European shares were mostly higher today. The eurozone’s STOXX 600 gained 0.8%, Germany’s DAX rose 0.60% and France’s CAC 40 climbed 1.23%. Spain’s IBEX 35 Index fell 0.6%, while London’s FTSE 100 gained 0.56%.

The European Central Bank cut its three key interest rates by 25 bps in October. Annual inflation rate in the Eurozone fell to 1.7% in September versus initial estimates of 1.8% and compared to 2.2% in August.

Asia Pacific Markets

Asian markets closed lower on Thursday, with Japan’s Nikkei 225 falling 0.69%, Hong Kong’s Hang Seng Index falling 1.02%, China’s Shanghai Composite Index dipping 1.05% and India’s BSE Sensex falling 0.61%.

Economics

- Industrial production in the U.S. declined 0.3% from a month ago in September.

- U.S. initial jobless claims fell by 19,000 in the week ending Oct. 12.

- The Philadelphia Fed Manufacturing Index climbed to 10.3 in October compared to 1.7 in September and topping market estimates of 3.

- U.S. retail sales rose 0.4% month-over-month in September compared to a 0.1% increase in August and higher than market estimates of a 0.3% rise.

- Total business inventories increased by 0.3% month-over-month in August.

- The NAHB/Wells Fargo Housing Market Index climbed to 43 in October from 41 in the prior month.

- U.S. natural-gas stocks increased 76 billion cubic feet during the week ended Oct. 11, compared to market estimates of a 78 billion cubic feet gain.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

September Retail Sales Exceed Estimates, Jobless Claims Fall More Than Expected

Retail sales in September exceeded expectations, highlighting strong consumer spending and reinforcing positive signals for broader economic growth as the third quarter wrapped up.

Simultaneously, the latest labor market data saw a decline in jobless claims rose during the week ending Oct. 12.

September Retail Sales Report: Key Highlights

- Retail sales increased by 0.4% in September from the previous month, surpassing both the 0.3% economist consensus, as per TradingEconomics, and the 0.1% growth in August.

- On a year-over-year basis, retail sales decelerated, down to 1.7% compared to 2.2% in August.

- Excluding motor vehicles and parts, retail sales grew 0.5% month-over-month, exceeding the forecasted 0.1% increase and the upwardly revised 0.2% growth in August.

- Stripping out gasoline, motor vehicles, and parts, sales climbed by a robust 0.7% in September, a sharp improvement from the upwardly revised 0.3% gain in August.

- Among spending categories, the largest monthly gains were recorded in miscellaneous store retailers, up 4%, and clothing & clothing accessories stores, up 1.5%.

- Conversely, gasoline station, electronics and appliance stores experienced the steepest monthly decline, with sales dropping by 1.6% and 3.3%, respectively.

Weekly Unemployment Claims: Key Highlights

- Initial jobless claims came in at 241,000, coming in below a consensus estimate of 260,000 claims, per TradingEconomics, and the prior week’s upwardly revised 260,000 figure.

- The four-week average of claims rose from 231,500 to 236,250.

- Continuing claims, reflecting those still receiving benefits after an initial week of aid, rose slightly to 1.867 million, remaining above the 1.87 million expected.

- States hardest hit by the increase in jobless claims include Georgia, where claims rose by 3,100 and Pennsylvania, with a surge of 1,300.

- Surprisingly, Florida recorded a decline of over 3,000 claims during the week, showing the Hurricane Milton had no major disruption on the region’s labor market.

Market Reactions: Stocks Rise Fueled By Chipmakers, Dollar Strengthens On ECB Cut

Stocks rallied in premarket trading on Thursday, driven by a tech-led surge that boosted futures for the S&P 500 and Nasdaq 100.

Futures on the S&P 500 climbed 0.5%, while Nasdaq 100 contracts advanced 1%, with semiconductor stocks leading the charge. Taiwan Semiconductor Manufacturing Company TSM soared nearly 9% on strong earnings, propelling the sector higher.

The iShares Semiconductor ETF SOXX was up 3% on the news.

Meanwhile, the U.S. dollar strengthened by 0.2% following the European Central Bank’s 25-basis-point rate cut, as the ECB signaled that disinflation was “well on track.”

Treasury yields rose in response to stronger-than-expected retail sales and lower-than-predicted jobless claims.

Read Next:

Photo via Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sight Sciences to Report Third Quarter Financial Results on November 7, 2024

MENLO PARK, Calif., Oct. 17, 2024 (GLOBE NEWSWIRE) — Sight Sciences, Inc. SGHT (“Sight Sciences” or the “Company”), an eyecare technology company focused on developing and commercializing innovative, interventional technologies that elevate the standard of care, today announced it will report financial results for the third quarter ended September 30, 2024, after the market close on Thursday, November 7, 2024. The Company’s management will discuss the results during a conference call beginning at 1:30 p.m. Pacific Time / 4:30 p.m. Eastern Time.

Investors interested in listening to the conference call may do so by accessing a live and archived webcast of the event at www.sightsciences.com, on the Investors page in the News & Events section. The webcast will be available for replay for at least 90 days after the event.

About Sight Sciences

Sight Sciences is an eyecare technology company focused on developing and commercializing innovative and interventional solutions intended to transform care and improve patients’ lives. Using minimally invasive or non-invasive approaches to target the underlying causes of the world’s most prevalent eye diseases, Sight Sciences seeks to create more effective treatment paradigms that enhance patient care and supplant conventional outdated approaches. The Company’s OMNI® Surgical System is an implant-free glaucoma surgery technology (i) indicated in the United States to reduce intraocular pressure in adult patients with primary open-angle glaucoma; and (ii) CE Marked for the catheterization and transluminal viscodilation of Schlemm’s canal and cutting of the trabecular meshwork to reduce intraocular pressure in adult patients with open-angle glaucoma. Glaucoma is the world’s leading cause of irreversible blindness. The SION® Surgical Instrument is a bladeless, manually operated device used in ophthalmic surgical procedures to excise trabecular meshwork. The Company’s TearCare® System is 510(k) cleared in the United States for the application of localized heat therapy in adult patients with evaporative dry eye disease due to meibomian gland dysfunction (“MGD”), enabling clearance of gland obstructions by physicians to address the leading cause of dry eye disease. Visit www.sightsciences.com for more information.

Sight Sciences and TearCare are trademarks of Sight Sciences registered in the United States. OMNI and SION are trademarks of Sight Sciences registered in the United States, European Union and other territories.

© 2024 Sight Sciences. All rights reserved.

Media contact:

pr@SightSciences.com

Investor contact:

Philip Taylor

Gilmartin Group

415.937.5406

Investor.Relations@Sightsciences.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Sell Alert: George J Christ Cashes Out $9.52M In Altair Engineering Stock

On October 15, a recent SEC filing unveiled that George J Christ, 10% Owner at Altair Engineering ALTR made an insider sell.

What Happened: Christ’s recent move involves selling 100,000 shares of Altair Engineering. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The total value is $9,523,390.

During Wednesday’s morning session, Altair Engineering shares down by 0.23%, currently priced at $94.0.

Discovering Altair Engineering: A Closer Look

Altair Engineering Inc is a provider of enterprise-class engineering software enabling origination of the entire product lifecycle from concept design to in-service operation. The integrated suite of software provided by the company optimizes design performance across multiple disciplines encompassing structures, motion, fluids, thermal management, system modeling, and embedded systems. It operates through two segments: Software which includes the portfolio of software products such as solvers and optimization technology products, modeling and visualization tools, industrial and concept design tools, and others; and Client Engineering Services which provides client engineering services to support customers. Majority of its revenue comes from the software segment.

Altair Engineering: Financial Performance Dissected

Revenue Growth: Over the 3 months period, Altair Engineering showcased positive performance, achieving a revenue growth rate of 5.41% as of 30 June, 2024. This reflects a substantial increase in the company’s top-line earnings. When compared to others in the Information Technology sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Evaluating Earnings Performance:

-

Gross Margin: Achieving a high gross margin of 79.49%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): Altair Engineering’s EPS is below the industry average, signaling challenges in bottom-line performance with a current EPS of -0.06.

Debt Management: With a below-average debt-to-equity ratio of 0.33, Altair Engineering adopts a prudent financial strategy, indicating a balanced approach to debt management.

In-Depth Valuation Examination:

-

Price to Earnings (P/E) Ratio: With a higher-than-average P/E ratio of 294.44, Altair Engineering’s stock is perceived as being overvalued in the market.

-

Price to Sales (P/S) Ratio: With a relatively high Price to Sales ratio of 12.66 as compared to the industry average, the stock might be considered overvalued based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 94.58 positions the company as being more valued compared to industry benchmarks.

Market Capitalization Analysis: Reflecting a smaller scale, the company’s market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Delving Into the Significance of Insider Transactions

Insightful as they may be, insider transactions should be considered alongside a thorough examination of other investment criteria.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

A Deep Dive into Insider Transaction Codes

Examining transactions, investors often concentrate on those unfolding in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Altair Engineering’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NuScale Power's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bearish approach towards NuScale Power SMR, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SMR usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 14 extraordinary options activities for NuScale Power. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 14% leaning bullish and 57% bearish. Among these notable options, 2 are puts, totaling $81,016, and 12 are calls, amounting to $584,935.

What’s The Price Target?

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $10.0 and $21.0 for NuScale Power, spanning the last three months.

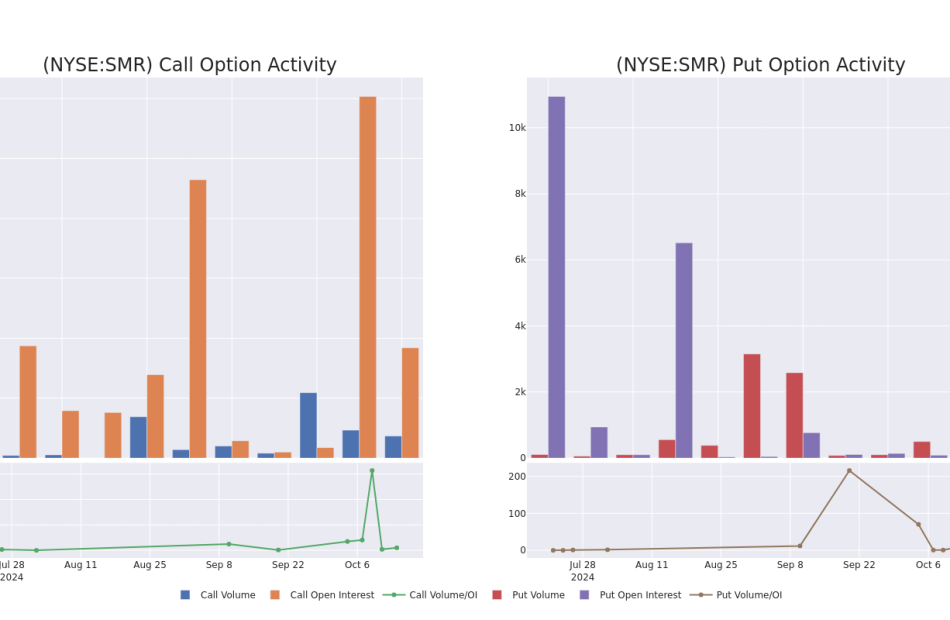

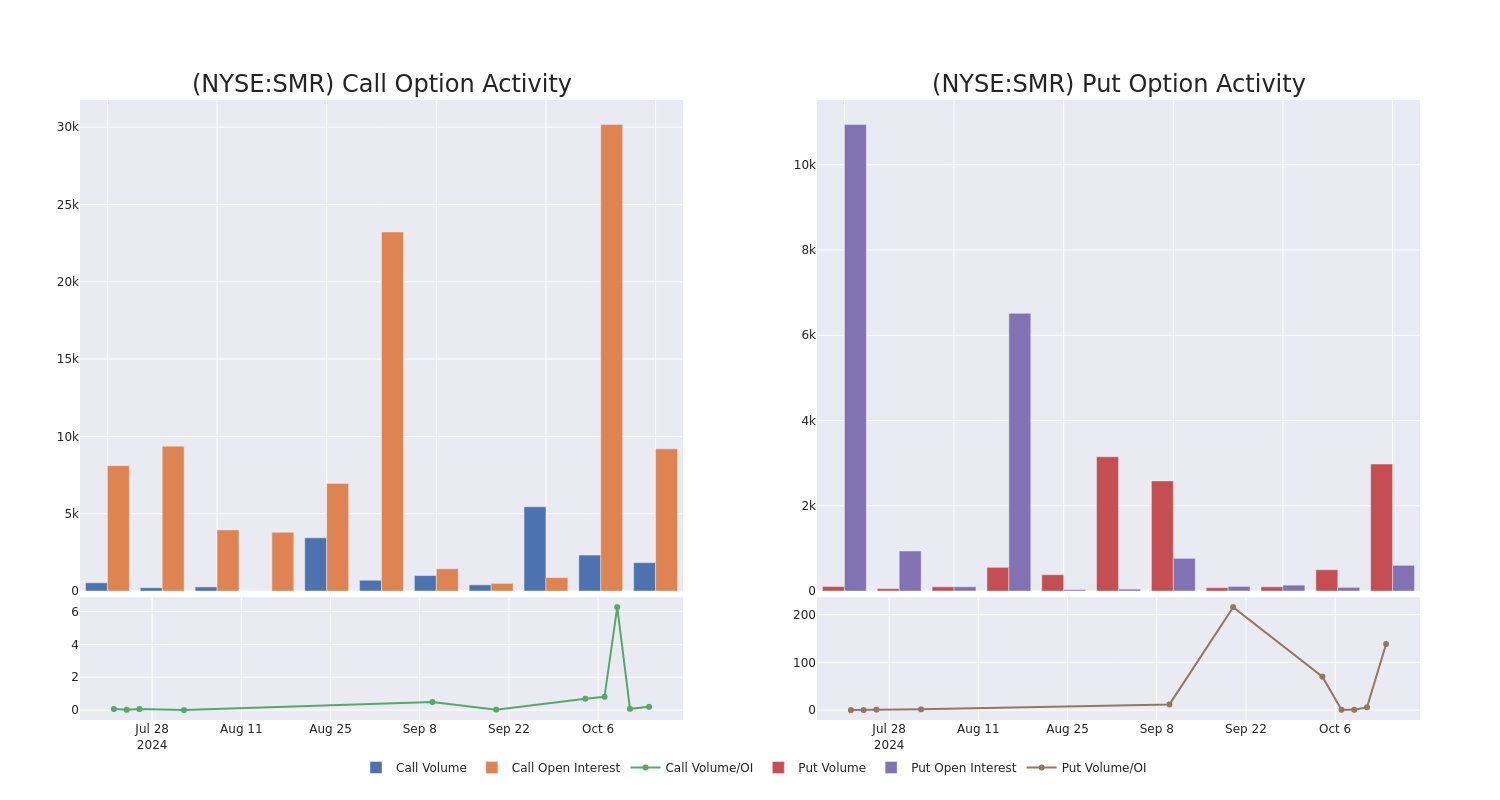

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in NuScale Power’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to NuScale Power’s substantial trades, within a strike price spectrum from $10.0 to $21.0 over the preceding 30 days.

NuScale Power Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMR | CALL | TRADE | BEARISH | 01/17/25 | $7.6 | $7.0 | $7.2 | $12.50 | $144.0K | 28.7K | 259 |

| SMR | CALL | TRADE | NEUTRAL | 10/18/24 | $3.6 | $3.3 | $3.45 | $15.00 | $103.5K | 2.2K | 344 |

| SMR | CALL | SWEEP | BEARISH | 10/25/24 | $1.4 | $1.35 | $1.35 | $20.00 | $51.5K | 553 | 2.6K |

| SMR | PUT | TRADE | NEUTRAL | 05/16/25 | $4.5 | $4.1 | $4.3 | $15.00 | $43.0K | 0 | 300 |

| SMR | CALL | TRADE | NEUTRAL | 01/15/27 | $11.0 | $9.0 | $10.0 | $10.00 | $40.0K | 278 | 10 |

About NuScale Power

NuScale Power Corp is engaged in the development of a new modular light water reactor nuclear power plant to supply energy for electrical generation, district heating, desalination, hydrogen production, and other process heat applications.

Having examined the options trading patterns of NuScale Power, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of NuScale Power

- Currently trading with a volume of 13,189,141, the SMR’s price is up by 0.57%, now at $19.18.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 21 days.

Expert Opinions on NuScale Power

2 market experts have recently issued ratings for this stock, with a consensus target price of $18.5.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Craig-Hallum downgraded its action to Buy with a price target of $16.

* Maintaining their stance, an analyst from Craig-Hallum continues to hold a Buy rating for NuScale Power, targeting a price of $21.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for NuScale Power with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

HOME SELLER PROFIT MARGINS DROP SLIGHTLY ACROSS U.S. AS HOUSING MARKET SLOWS DURING THIRD QUARTER

Returns on Typical U.S. Home Sales Remain High but Dip Down Quarterly and Annually;Typical Margin at 56 percent as Median U.S. Home Price Levels Out Over Summer; Median Raw Profits Hold Steady at Just Under $130,000

IRVINE, Calif., Oct. 17, 2024 /PRNewswire/ — ATTOM, a leading curator of land, property data, and real estate analytics, today released its third-quarter 2024 U.S. Home Sales Report, which shows that homeowners earned a 55.6 percent profit margin on typical single-family home and condo sales in the United States during the third quarter. That figure was down by small amounts both quarterly and annually, dipping by one percentage point from the second quarter of 2024 and two points from the third quarter of last year.

The nationwide investment return ticked downward as home-price spikes that had buoyed the housing market during the Spring of this year flattened out, leaving the U.S. median home value virtually unchanged at about $360,000. While home-seller profits remain historically high, the national margin has declined almost every quarter from a 64 percent peak hit in 2022.

The leveling off of prices during the third quarter also led to typical raw profits for sellers staying about the same, near an all-time high of just under $130,000.

“The latest price and profit numbers provided another round of generally good news for homeowners, tempered by a bit of a downside,” said Rob Barber, CEO for ATTOM. “Home values remained at or near record levels around large swaths of the country, keeping seller profits far above historical levels. At the same time, though, the housing market settled down after a big second quarter, which extended a slow fallback in profit margins that started last year. If history is a good guide, the fourth quarter is likely to bring more of the same as the peak buying season ends.”

He added that “this is far from a warning sign that the long market boom is ending. But there certainly are forces that could cut either way, especially as affordability remains a challenge for so many potential buyers.”

Profit margins slip quarterly in half of U.S. and annually in three-quarters of nation

Typical profit margins – the percent difference between median purchase and resale prices – stayed the same or decreased from the second quarter of 2024 to the third quarter of 2024 in 79 (50.6 percent) of the 156 metropolitan statistical areas around the U.S. with sufficient data to analyze. They were down annually in 112, or 71.8 percent, of those metros, and down in about the same portion since the second quarter of 2022, when the nationwide return on median-priced home sales peaked at 64.3 percent.

Profit margins have softened over the past year throughout all price segments of the market, from metro areas where home values mostly sit below $250,000 to those where they top $450,000. But the low end of the market has fared a bit better. Typical margins decreased annually in about 60 percent of the least expensive metro areas compared to about 75 percent elsewhere.

The biggest year-over-year decreases in typical profit margins during the third quarter of 2024 came in the metro areas of San Francisco, CA (margin down from 84.9 percent in the third quarter of 2023 to 61.4 percent in the third quarter of 2024); Punta Gorda, FL (down from 94.1 percent to 74.4 percent); Scranton, PA (down from 88.2 percent to 69.6 percent); South Bend, IN (down from 77.3 percent to 59.2 percent) and Hilo, HI (down from 86.5 percent to 70.5 percent).

Aside from San Francisco, the biggest annual profit-margin decreases in metro areas with a population of at least 1 million in the third quarter of 2024 were in Austin, TX (typical return down from 44.3 percent to 33.3 percent); Honolulu, HI (down from 53.9 percent to 43.3 percent); Riverside, CA (down from 78.6 percent to 69 percent) and Birmingham, AL (down from 52.1 percent to 42.7 percent).

The biggest annual improvements in returns on investment came in Trenton, NJ (margin up from 65.5 percent in the third quarter of 2023 to 87.4 percent in the third quarter of 2024); Albany, NY (up from 31.8 percent to 51.6 percent); Rockford, IL (up from 54.5 percent to 70.2 percent); Rochester, NY (up from 66.7 percent to 81.2 percent) and Evansville, IN (up from 47.2 percent to 61.7 percent).

Two-thirds of metro markets enjoying investment returns above 50 percent

Despite the downward trend, returns on investment for median-priced home sales during the third quarter of 2024 still surpassed 50 percent in 107 of the metro areas analyzed (68.6 percent). That was down from three quarters of those areas in the third quarter of last year but far above the level of 13 percent five years ago.

The leaders among areas with a population of at least 1 million in the third quarter of this year were San Jose, CA (typical return of 109.8 percent); Seattle, WA (90.3 percent); Providence, RI (84.6 percent); Miami, FL (83.9 percent) and Grand Rapids, MI (81.9 percent).

The lowest among areas with a population of at least 1 million were in New Orleans, LA (24.8 percent); San Antonio, TX (25.1 percent); Austin, TX (33.3 percent); Houston, TX (37.3 percent) and Dallas, TX (37.4 percent).

Raw profits remain near record level

The raw profit on median-priced home sales nationwide, measured in dollars, slipped 0.9 percent during the months running from July through September of this year, to $128,700. But it was still up 2.7 percent from the third quarter of 2023 and remained near the record of $135,000 hit in 2022.

Typical raw profits were flat or down quarterly in 74, or 47.4 percent, of the markets analyzed. Despite the nationwide year-over-year gain, raw profits were the same or down annually in 82, or 52.6 percent of those metro areas.

The biggest year-over-year increases in raw profits on typical sales among metro areas with a population of at least 1 million were in Rochester, NY (up 24.4 percent); Cleveland, OH (up 23.5 percent); Providence, RI (up 18.9 percent); Chicago, IL (up 18.8 percent) and Cincinnati, OH (up 15 percent).

Raw profits on median-priced sales exceeded $100,000 during the third quarter in 67.3 percent of the metro areas analyzed, with 19 of the top 20 along the east or west coasts. They were led by San Jose, CA (raw profit of $785,000); San Francisco, CA ($380,600); San Diego, CA ($377,000); Los Angeles, CA ($376,000) and Barnstable, MA ($361,968).

The 25 lowest raw profits were all in the Midwest or South. The smallest were in Beaumont, TX ($15,481); Lubbock, TX ($29,740); Montgomery. AL ($35,590); Macon, GA ($37,692) and McAllen, TX ($40.312).

National median home value stalls in Summer of 2024, but still at all-time high

Nationwide, the median price of single-family homes and condos rose from the second to the third quarter of 2024 by just 0.2 percent after spiking 7.4 percent in the Spring. But it still hit a new record of $360,500, up from $359,900 in the prior three-month period. The latest median was up 5.3 percent from $342,500 in the third quarter of last year.

The typical value increased quarterly in 52.5 percent of the metro areas around the country with enough data to analyze and annually in 81.6 percent. It hit new highs during the third quarter in 50 percent of those markets.

Metro areas in upper half of the U.S. market, concentrated in the West and South regions, suffered the largest quarterly price declines. About two-thirds of those locations, with typical values of at least $350,000, absorbed losses. Measured annually, the best gains came in low-priced areas, clustered more in the Midwest and Northeast.

Markets with a population of at least 1 million and the biggest quarterly decreases in median home prices were San Francisco, CA (down 11.1 percent from the second to the third quarter of this year, to $1 million); Austin, TX (down 10.5 percent, to $425,000); New Orleans, LA (down 6.6 percent, to $242,900); San Jose, CA (down 6.1 percent, to $1.5 million) and Indianapolis, IN (down 4.2 percent, to $263,560).

The largest annual median-price increases in metro areas with a population of at least 1 million were in Rochester, NY (up 11.1 percent from the third quarter of 2023 to the third quarter of 2024, to $250,000); Providence, RI (up 10.3 percent, to $480,000); Hartford, CT (up 9.6 percent, to $367,000); Detroit, MI (up 9.4 percent, to $255,000) and Cleveland, OH (up 9.4 percent, to $221,000).

Historical Median Home Sales Prices

Homeowners staying longer before selling

Homeowners who sold in the third quarter of 2024 had owned their homes an average of 8.09 years. That was up from 7.82 years in the second quarter of 2024 and from 7.74 years in the third quarter of 2023, marking the fifth increase in the last six quarters.

Average tenure was up from the third quarter of 2023 to the same period this year in 82 percent of metro areas with sufficient data. The largest annual increases were in Peoria, IL (tenure up 15 percent); Crestview, FL (up 14 percent); Medford, OR (up 14 percent); Salinas, CA (up 11 percent) and Fort Collins, CO (up 10 percent).

The longest average tenures for owners who sold in the third quarter were again in the Northeast or West regions of the U.S. They were led by Barnstable, MA (13.84 years); Bridgeport, CT (13.23 years); New Haven, CT (12.81 years); Hartford, CT (12.81 years) and San Francisco, CA (12.69 years).

Average U.S. Homeownership Tenure

The shortest average tenures among third-quarter sellers were in Provo, UT (6.62 years); Oklahoma City, OK (6.69 years); Lakeland, FL (6.81 years); San Antonio, TX (6.83 years) and Austin, TX (6.87 years).

Lender-owned foreclosures still decreasing

Home sales following foreclosures by banks and other lenders represented just 1.3 percent, or one of every 78 U.S. single-family home and condo sales in the third quarter of 2024. That was down from 1.4 percent in both the second quarter of 2024 and the third quarter of last year. The portion continues to represent just a tiny fraction of the 30.1 percent peak this century hit in 2009 during the aftermath of the Great Recession of 2007.

Among metro areas with sufficient data, those where REO sales represented the largest portion of all sales in the third quarter of 2024 included Honolulu (7.5 percent); Albany, NY (4.9 percent); Flint, MI (4.7 percent); Macon, GA (4.6 percent) and St. Louis, MO (3.6 percent).

Cash sales drop as portion of all transactions

Nationwide, all-cash sales accounted for 37.2 percent of single-family home and condo sales in the third quarter of 2024. That was down from 38.9 percent in the second quarter of 2024, although up slightly from 36.9 percent in the third quarter of last year.

Among metropolitan areas with sufficient data, those where all-cash sales represented the largest share of all transactions in the third quarter of 2024 included Myrtle Beach, SC (69 percent of all sales); Claremont–Lebanon, NH (64.8 percent); Macon, GA (59.9 percent); Warner Robins, GA (58.3 percent) and Hilton Head, SC (58 percent).

Those where cash sales represented the smallest share of all transactions in the third quarter of 2024 included Greeley, CO (15.7 percent); Hagerstown, MD (19.6 percent); Jacksonville, NC (21.6 percent); Washington, DC (22.2 percent) and Kennewick, WA (22.3 percent).

Institutional investment decreases again

Institutional investors nationwide accounted for 6 percent, or one of every 17 single-family home and condo sales in the third quarter of 2024. That was down from 6.2 percent in the second quarter of 2024 and from 6.6 percent in the third quarter of last year.

Among states with enough data to analyze, those with the largest percentages of sales to institutional investors in the third quarter of 2024 included Alabama (9.1 percent of all sales), Tennessee (8.9 percent), Oklahoma (8.4 percent), Georgia (8.2 percent) and Texas (8.1 percent).

FHA-financed purchases stay roughly the same

Nationwide, buyers using Federal Housing Administration (FHA) loans comprised 8.4 percent of all single-family home and condo sales in the third quarter of 2024 (one of every 12). That was about the same as the 8.2 percent level in second quarter of 2024 and down slightly from 8.7 percent a year earlier.

Among metropolitan areas with sufficient FHA-buyer data, those with the highest levels of FHA sales in the third quarter of 2024 included Lakeland, FL (24.1 percent of all sales); Merced, CA (23.5 percent); Bakersfield, CA (21.7 percent); Yuma, AZ (20.6 percent) and Visalia, CA (19.6 percent).

Report methodology

The ATTOM U.S. Home Sales Report provides percentages of REO sales and all sales that are sold to institutional investors and cash buyers, at the state and metropolitan statistical area. Data is also available at the county and zip code level, upon request. The data is derived from recorded sales deeds, foreclosure filings and loan data. Statistics for previous quarters are revised when each new report is issued as more deed data becomes available.

Definitions

All-cash purchase: sale where no loan is recorded at the time of sale and where ATTOM has coverage of loan data.

Homeownership tenure: for a given market and given quarter, the average time between the most recent sale date and the previous sale date, expressed in years.

Home seller price gains: the difference between the median sales price of homes in a given market in a given quarter and the median sales price of the previous sale of those same homes, expressed both in a dollar amount and as a percentage of the previous median sales price.

Institutional investor purchases: residential property sales to non-lending entities that purchased at least 10 properties in a calendar year.

REO sale: a sale of a property that occurs while the property is actively bank owned (REO).

About ATTOM

ATTOM provides premium property data and analytics that power a myriad of solutions that improve transparency, innovation, digitization and efficiency in a data-driven economy. ATTOM multi-sources property tax, deed, mortgage, foreclosure, environmental risk, natural hazard, and neighborhood data for more than 155 million U.S. residential and commercial properties covering 99 percent of the nation’s population. A rigorous data management process involving more than 20 steps validates, standardizes, and enhances the real estate data collected by ATTOM, assigning each property record with a persistent, unique ID — the ATTOM ID. The 30TB ATTOM Data Warehouse fuels innovation in many industries including mortgage, real estate, insurance, marketing, government and more through flexible data delivery solutions that include ATTOM Cloud, bulk file licenses, property data APIs, real estate market trends, property navigator and more. Also, introducing our newest innovative solution, making property data more readily accessible and optimized for AI applications – AI-Ready Solutions.

Media Contact:

Megan Hunt

megan.hunt@attomdata.com

Data and Report Licensing:

datareports@attomdata.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/home-seller-profit-margins-drop-slightly-across-us-as-housing-market-slows-during-third-quarter-302278524.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/home-seller-profit-margins-drop-slightly-across-us-as-housing-market-slows-during-third-quarter-302278524.html

SOURCE ATTOM

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

New York Mortgage Trust 2024 Third Quarter Conference Call Scheduled for Thursday, October 31, 2024

NEW YORK, Oct. 16, 2024 (GLOBE NEWSWIRE) — New York Mortgage Trust, Inc. NYMT (the “Company”) is scheduled to report financial results for the three and nine months ended September 30, 2024 after the close of market on October 30, 2024. New York Mortgage Trust’s executive management will host a conference call and audio webcast at 9:00 a.m., Eastern Time, on Thursday, October 31, 2024. To access the conference call, please pre-register using this link. Registrants will receive confirmation with dial-in details.

A live audio webcast of the conference call can be accessed, on a listen-only basis, at the Investor Relations section of the Company’s website at www.nymtrust.com or using this link. A webcast replay link of the conference call will be available on the Investor Relations section of the Company’s website approximately two hours after the call and will be available for 12 months.

About New York Mortgage Trust

New York Mortgage Trust, Inc. is a Maryland corporation that has elected to be taxed as a real estate investment trust (“REIT”) for federal income tax purposes. NYMT is an internally managed REIT in the business of acquiring, investing in, financing and managing primarily mortgage-related single-family and multi-family residential assets.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.