Dry Van Container Market is Predicted to Reach US$ 9.6 Billion by 2033, Expanding at a CAGR of 5.4% | Fact.MR Report

Rockville, MD, Oct. 17, 2024 (GLOBE NEWSWIRE) — Expanding at a CAGR of 5.4% from 2023 to 2033, the global dry van containers market is estimated to reach a valuation of US$ 9.6 billion by the end of 2033. This study by Fact.MR, a market research and competitive intelligence provider, reveals that Asian countries such as India, China, and Japan are projected to make APAC the leading regional market for dry van containers.

Rapid industrialization and globalization are the two prime prospects that are anticipated to boost sales of dry van containers in the Asia Pacific region over the next ten years. Supportive government initiatives to boost manufacturing sector growth and expanding population in countries such as China and India are also estimated to increase the number of imports and exports from the region, resulting in high dry van container demand through 2033.

Meanwhile, the North American European regions are estimated to tussle for the second position in terms of share of the global dry van container market across the study period. Increasing adoption of smart containers in these regions is projected to create new opportunities for dry van container companies.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=1015

Key Takeaways from Market Study

- The global dry van container market stands at a valuation of US$ 5.65 billion in 2023.

- Demand for dry van containers is projected to expand at a CAGR of 4% from 2023 to 2033.

- The market is anticipated to reach a size of US$ 9.6 billion by 2033-end.

- Increasing globalization, supportive government initiatives to boost trading activity, growing world population, and increasing demand for imports and exports are set to be prime market drivers.

- High availability of alternative shipping containers is projected to hurt market growth prospects to some extent.

- Asia Pacific accounts for around 40% share of the global market in 2023.

- A majority of dry van containers are currently manufactured using steel.

- Sea transport is forecasted to account for high sales of dry van containers through 2033.

“Dry van container manufacturers need to focus on product innovation to cash in on the growing popularity of smart containers in the logistics industry,” says a Fact.MR analyst

Leading Players Driving Innovation in the Dry Van Container Market:

Dry van container market players are W&K Containers Inc., Sea Box Inc., Singamas Container Holdings Limited, A.P. Moller – Maersk A/S, China Shipping Container Lines Co. Ltd., Charleston Marine Containers Inc., CIMC Group, CXIC Group Containers Company Limited, Hyundai Translead Inc., Hapag-Lloyd AG.

Winning Strategy

Dry van container producers are focusing on expanding their business scope and making it futureproof by integrating advanced technologies that create smart containers. Automation of the global supply chain and changing trade conditions are also estimated to open up new avenues of opportunities for dry van container suppliers in the long run.

Dry Van Container Industry News:

- Ocean Network Express (ONE), a well-known brand in the container transportation sector, declared in February 2023 that it will be working with Sony Network Communications Europe to provide an intelligent container solution. ONE intends to embrace the era of smart logistics by integrating this solution for its worldwide fleet.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=1015

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the global dry van containers market, presenting historical demand data (2018 to 2022) and forecast statistics for the period (2023 to 2033).

The study divulges essential insights on the market based on container size (dry van 20 ft., dry van 40 ft., dry van 40 ft. high cube, others), material (steel, aluminium, others), application (sea transport, land transport, intermodal transport), and end-use industry (chemicals, pharmaceuticals, food & beverages, electronics, automotive, others), across five major regions of the world (North America, Europe, Asia Pacific, Latin America, and MEA).

Check out More Related Studies Published by Fact.MR:

Logging Trailer Market: Size is expected to grow at a compound annual growth rate (CAGR) of 4.4%, from US$ 535.6 million in 2024 to US$ 823.8 million by the end of 2034.

Compact Wheel Loader Market: Size is set to reach a value of US$ 40.64 billion in 2024. Projections are that the market will expand at a CAGR of 5.1% to end up at US$ 66.83 billion by the year 2034.

Automotive Automatic Transmission Market: Size is estimated at US$ 76.11 billion in 2024 and has been forecasted to increase at 3.6% CAGR to climb to US$ 122.81 billion by the end of 2034.

Electric Vehicle Market: Size is estimated at US$ 442.34 billion in 2024 and has been projected to increase at a CAGR of 14% to reach US$ 1,639.84 billion by the end of 2034.

Fixed Wing Drone Market: Size is estimated to reach US$ 8.3 billion in 2024 and has been forecasted to climb to a value of US$ 40.6 billion by the end of 2034, expanding at a CAGR of 17.2% between 2024 and 2034.

Automotive Tire Market: Size is projected to increase from a value of US$ 403.53 billion in 2024 to US$ 626.67 billion by the end of 2034. Worldwide sales of automobile tires have been projected to rise at 3.6% CAGR from 2024 to 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Earnings Update: Marijuana Lenders And Top Operator To Report Results, Here's What Investors Need To Know

Chicago Atlantic

Chicago Atlantic Real Estate Finance, Inc. REFI will issue its earnings and supplemental financial information for the third quarter that ended Sept. 30, 2024, before the market opens on Thursday, Nov. 7.

The Chicago-based and cannabis-focused commercial mortgage real estate investment trust said a conference call and live audio webcast, both open for the general public, will be held later that day at 9:00 am Eastern Time.

The company’s portfolio performance remained strong with a total loan principal outstanding of $383.3 million across 31 investments, Chicago Atlantic said in August, on the heels of its second quarter financial results. Also, the weighted average yield to maturity as of June 30, 2024, was approximately 18.7%, a slight decrease from 19.4% as of March 31, 2024, attributed to amendments in borrower performance and pricing structures.

Chicago Atlantic’s shares traded 0.06% higher at $15.79 at the time of writing on Thursday morning.

NewLake Capital

NewLake Capital Partners, Inc. NLCP announced its plans Wednesday to host a conference call and report its financial results for the third quarter that ended Sept. 30, 2024, on Thursday, Nov. 14, 2024, at 11:00 am Eastern Time.

The company has emerged as a compelling player in the cannabis REIT sector. In May it announced its acquisition of a 58,500-square-foot industrial property in East Hartford, Connecticut. The company also said at the time that it had entered into a long-term triple net lease with an affiliate of Michigan-based C3 Industries Inc.

NewLake’s shares traded 1.44% higher at $20.05 per share on Thursday morning.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Cresco Labs

Cresco Labs Inc. CL CRLBF 6CQ will report financial results for the third quarter that ended Sept. 30, 2024 on Friday, Nov. 8, before the market opens.

Cresco, operator of Sunnyside dispensaries, said it will host a conference call and webcast to discuss its results and provide investors with key business highlights the same day.

The company’s second quarter report published in August demonstrated “the sustainability of the improvements we’ve made to the business over the past year with $184 million in revenue at a 29% Adjusted EBITDA margin,” said CEO Charles Bachtell.

Cresco Labs made its debut in Chicago in 2013 when Illinois passed the Compassionate Use of Medical Cannabis Act. “The company’s goal and that of its management team has been to help normalize and professionalize this industry,” Bachtell told the crowd gathered at the Benzinga Cannabis Capital Conference in Chicago in early October.

A September note from Zuanic & Associates rated Cresco as “Overweight” among the top five multi-state operators (MSOs) in the U.S. According to Zuanic, Cresco’s financial performance in Q2 2024 underscores its efficiency-focused strategy, adding that key opportunities lie in Cresco’s footprint in states like Ohio, Florida and Pennsylvania.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Poised To Open Higher As TSMC Earnings Expected To Kick Off Rally In Tech Stocks: Strategist Says AI Trade Will Have Legs Even In Case Of Recession In 2025

Technology stocks, specifically chipmakers, could lead from the front on Thursday as a stellar third-quarter earnings report from Taiwan Semiconductor Manufacturing Company Ltd. TSM is triggering positive sentiment toward all artificial intelligence plays. Oil prices have rebounded and gold traded at a fresh record, while bond yields held steady ahead of a slew of market-moving data that include retail sales, a regional manufacturing activity index, industrial production, and jobless claims.

Earnings news could provide an offsetting impact in the eventuality of the market construing the economic data as inclement. Netflix, Inc. NFLX is the first among the mega-cap earnings due after the market close and the results could evince interest among traders and set the tone for the tech reporting season.

| Futures | Performance (+/-) |

| Nasdaq 100 | +0.81% |

| S&P 500 | +0.42% |

| Dow | +0.11% |

| R2K | -0.09% |

In premarket trading on Thursday, the SPDR S&P 500 ETF Trust SPY edged up 0.42% to $584.76 and the Invesco QQQ ETF QQQ jumped 0.83% to $495, according to Benzinga Pro data.

Cues From Last Session:

Small-caps ripped higher on Wednesday, extending their recent gains amid hopes of a benign economic environment but the major averages opened on a tentative note. Solid earnings reports from financial companies and strong gains by real-estate and utility stocks helped the major indices close firmly in the green.

The Dow Jones Industrial Average turned solidly higher immediately after spending the better part of the session above the unchanged line. The 30-stock blue-chip average ended at a fresh high, although it did not have enough momentum to break above its Oct. 15 intraday high of 43,277.78.

The S&P 500 Index and the Nasdaq Composite had a lackluster first-half before picking up momentum in the afternoon.

Of the 11 S&P 500 sector classes, only communication services and consumer discretionary stocks declined in Wednesday’s session.

| Index | Performance (+/) | Value |

| Nasdaq Composite | +0.28% | 18,367.08 |

| S&P 500 Index | +0.47% | 5,842.47 |

| Dow Industrials | +0.79 | 43,077.70 |

| Russell 2000 | +1.64% | 2,286.68 |

Insights From Analysts:

Delving into the small-cap rally that has been on, LPL Financial Chief Technical Strategist Adam Turnquist said after being stuck in a consolidation phase over the past few months, small-caps have picked up some momentum in recent sessions, with the growth outlook recently improving — underpinned by better-than-feared labor market conditions — and increased visibility into Fed rate cuts, he said.

The strategist noted that the Russell 2,000 Index, or RTY, has rallied off the lower end of its rising price channel. “Recent strength in the banking space — the RTY’s largest sector by weighting — has further supported small caps,” he said.

Technically, a close above 2,275 would confirm a breakout from its current symmetrical triangle and leave the 2021 highs (2,243) as the next resistance hurdle to clear, Turnquist said, adding that momentum indicators have also recently turned bullish, adding to the evidence of a topside breakout.

“Despite the improving absolute performance, the RTY vs. S&P 500 ratio chart still remains in a downtrend and below its declining 200-day moving average (DMA),” he said. A close above the July highs would validate a trend reversal in favor of small caps outperforming, he added.

Meanwhile, a fund manager thinks AI-levered companies could be defensive plays. Louis Navellier said, “Semiconductor demand has become the new proxy for global growth trends, being incorporated into almost everything, and also has geopolitical implications with technology export controls in place and China continuing to saber rattle about taking Taiwan back.”

“The upshot here is the inference that AI will still have legs even if we slide into a global recession in ’25,” he added.

See also: Best Futures Trading Software

Upcoming Economic Data:

- The Labor Department is scheduled to release the weekly jobless claim report at 8:30 a.m. EDT. Economists, on average, expect the number of individuals claiming unemployment insurance to come in at 260,000 in the week ended Oct. 12, up from 258,000 in the previous week.

- The Commerce Department will release its September retail sales report at 8:30 a.m. EDT. The consensus estimates call for a 0.3% month-over-month increase in headline retail sales and a more modest 0.1% rise in retail sales, excluding the volatile auto sales. This compares to 0.1% increases for both in August.

- The Philadelphia Fed is due to release the results of its manufacturing survey at 8:30 a.m. EDT. The diffusion index of business activity is expected to rise from 1.7 in September to 3 in October.

- The Federal Reserve will release its industrial production report for September at 9:15 a.m. EDT. The consensus estimate models a 0.2% month-over-month decline in industrial output compared to 0.8% growth in August.

- The Commerce Department’s business inventories report, due at 10 a.m. EDT, is expected to show a 0.3% month-over-month increase in business inventories for August, slightly slower than July’s 0.4% increase.

- The National Association of Home Builders will release its housing market index for October at 10 a.m. EDT. The headline index, which measures confidence among homebuilders, is expected to rise a point from September to 42. A reading below 50 suggests a lack of confidence.

- The Energy Information Administration will release its weekly oil inventories report at 11 p.m. EDT.

- The Treasury is scheduled to auction four- and eight-week bills at 11:30 a.m. EDT.

Stocks In Focus:

- Alcoa Corporation AA climbed nearly 5% in premarket trading following the aluminum maker’s quarterly results, and TSMC surged up over 8% on a beat-and-raise quarter.

- Other stocks moving on earnings are CSX Corporation CSX (down about 5%) Nokia Oyj NOK (down nearly 6%), and Steel Dynamics, Inc. STLD (up over 3%).

- Blackstone Inc. (BX), Marsh & McLennan Companies, Inc. MMC, Travelers Companies, Inc. TRV, KeyCorp KEY, and M&T Bank Corporation MTB are among the noteworthy companies reporting ahead of the market opening.

- Those reporting after the close include Netflix, Intuitive Surgical, Inc. ISRG, Crown Holdings, Inc. CCK, WD-40 Company WDFC, and Western Alliance Bancorporation WAL.

- Expedia Group, Inc. EXPE climbed over 7.7% on the news that Uber Technologies, Inc. UBER might be interested in buying the company.

- Lucid Group, Inc. LCID plunged over 15% on a common stock offering.

Commodities, Bonds And Global Equity Markets:

Crude oil futures are reversing course and were up modestly after their recent pullback and gold futures traded at a record. Bitcoin BTC/USD slipped over 1% over the past 24 hours and was at a sub-$67K level.

The 10-year U.S. Treasury note yield was little changed at 4.036%.

The Asian markets ended mixed on Wednesday, as the Japanese, Chinese, Hong Kong, Indian, and South Korean markets retreated. Most other markets ended on a firm note, tracking higher energy prices and the positive close on Wall Street overnight.

European stocks traded in the green in the early hours, thanks to earnings optimism.

Read Next:

Photo courtesy: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alcoa, Netflix And 3 Stocks To Watch Heading Into Thursday

With U.S. stock futures trading lower this morning on Thursday, some of the stocks that may grab investor focus today are as follows:

- Wall Street expects The Travelers Companies, Inc. TRV to report quarterly earnings at $3.64 per share on revenue of $11.49 billion before the opening bell, according to data from Benzinga Pro. Travelers shares gained 0.9% to $242.95 in after-hours trading.

- Alcoa Corporation AA reported better-than-expected earnings for its third quarter. The company posted adjusted earnings of 57 cents per share, beating market estimates of 28 cents per share. Alcoa shares climbed 6% to $44.61 in the after-hours trading session.

- Analysts expect Netflix Inc. NFLX to post quarterly earnings at $5.12 per share on revenue of $9.77 billion. The company will release earnings after the markets close. Netflix shares slipped 0.1% to $701.61 in after-hours trading.

Check out our premarket coverage here

- Steel Dynamics Inc STLD reported stronger-than-expected earnings for its third quarter on Wednesday. The company said it shipped 3.2 million tons of steel during the third quarter and generated cash flow from operations of $760 million. Steel Dynamics shares gained 1.9% to $132.26 in the after-hours trading session.

- Analysts expect Marsh & McLennan Companies, Inc. MMC to report quarterly earnings at $1.61 per share on revenue of $5.70 billion before the opening bell. Marsh & McLennan shares rose 0.5% to $228.99 in after-hours trading.

Check This Out:

Photo courtesy: Wikimedia

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The stock market is in a 'mania' that will push it higher before a potential 26% drop in 2025, Stifel says

-

The S&P 500 could lose a quarter of its value next year, according to Stifel.

-

The benchmark index looks like it’s caught in a “mania,” the firm’s strategists said in a note.

-

Investors could be impacted long-term, as manias tend to lead to poor returns in the next decade.

The S&P 500 looks like it’s in the midst of another “mania,” and investors could see a steep drop in the benchmark index sometime next year, according to Stifel.

Strategists at the investment firm pointed to lofty valuations, with the S&P 500 breaking through a series of record highs this year on the back of an improving economic outlook, expectations for Fed rate cuts, and hype for artificial intelligence.

But the benchmark index now looks similar to the past four manias that have taken place, the firm said, comparing the current investing environment to the pandemic stock boom, the dot-com bubble, and stock run-ups in the 1920s and late 1800s.

Growth returns “excess of Value” in today’s market look “almost exactly the same” as they did leading up to the 1929 stock crash, the firm added.

“We took a clean sheet look at the equity market and came away with the same smh (shaking my head) emoji reaction. Despite all the soft-ladning and Fed rate cut optimism, the S&P 500 up almost 40% y/y has simply over-shot,” strategists said in a note on Tuesday.

If the S&P 500 follows the path of a “classic mania,” that implies the benchmark index will rally to around 6,400 before falling back to 4,750 next year, strategists said.

“Sure, we can cherry-pick with the best of them and apply the most over-valued cyclically adjusted valuation level of the past 35 years to show about 10% further upside, but that same analysis of a century of manias also returns the S&P 500 in 2025 to where 2024 began (down 26% from that prospective peak),” the note added.

Stocks could be challenged next year due to the uncertain outlook for Fed rate cuts, the strategists suggested. While the Fed has signaled more cuts are coming, central bankers also risk undermining their inflation goals if they cut rates too soon.

“The conclusion … is that if the Fed cuts rates in 2025 absent a recession (two 25’s as this year comes to a close do not count) then that would be a mistake, with investors paying the price in latter 2025 / 2026, based on historical precedent,” strategists wrote.

Investors could be impacted for the long-term, they added, pointing to previous manias, which historically led to weak stock returns over the following decade.

“Or at least that has been the case for the past three generations, making manias as disruptive for capital markets on the way down as they are euphoric on the way up,” they said.

A handful of other Wall Street forecasters have also said stocks look overvalued, but investors remain generally optimistic about the outlook for equities, particularly as they expect more rate cuts into 2025.

Read the original article on Business Insider

Westamerica Bancorporation Reports Third Quarter 2024 Financial Results

SAN RAFAEL, Calif., Oct. 17, 2024 (GLOBE NEWSWIRE) — Westamerica Bancorporation WABC, parent company of Westamerica Bank, generated net income for the third quarter 2024 of $35.1 million and diluted earnings per common share (“EPS”) of $1.31, which includes gains from life insurance and sales of other assets equivalent to $0.04 EPS. Third quarter 2024 results compare to second quarter 2024 net income of $35.5 million and EPS of $1.33.

“Westamerica’s third quarter 2024 results benefited from the Company’s valuable low-cost deposit base, of which 48 percent was represented by non-interest bearing checking accounts during the quarter; the annualized cost of funding our loan and bond portfolios was 0.37 percent in the quarter. Operating expenses remained well controlled at 35 percent of total revenues in the third quarter 2024. The Company recognized no provision for credit losses in the third quarter 2024. At September 30, 2024, nonperforming assets were stable at $0.9 million and the allowance for credit losses was $15.3 million,” said Chairman, President and CEO David Payne. “Third quarter 2024 results generated an annualized 13.7 percent return on average common equity. Shareholders were paid a $0.44 per common share dividend during the third quarter 2024,” concluded Payne.

Net interest income on a fully-taxable equivalent (FTE) basis was $62.5 million for the third quarter 2024, compared to $64.1 million for the second quarter 2024. The annualized yield earned on loans, bonds and cash for the third quarter 2024 was 4.45 percent compared to 4.50 percent for the second quarter 2024. The annualized cost of funding the loan and bond portfolios was 0.37 percent for the third quarter 2024, compared to 0.35 percent for the second quarter 2024.

Noninterest income for the third quarter 2024 totaled $11.9 million compared to $10.5 million for the second quarter 2024. Third quarter 2024 results include $1.6 million in gains from life insurance and sales of other assets.

Noninterest expenses for the third quarter 2024 were $26.3 million compared to $26.1 million for the second quarter 2024.

Westamerica Bancorporation’s wholly owned subsidiary Westamerica Bank, operates commercial banking and trust offices throughout Northern and Central California.

Westamerica Bancorporation

1108 Fifth Avenue, San Rafael, CA 94901

Robert A. Thorson – SVP & Treasurer

707-863-6840

investments@westamerica.com

The following appears in accordance with the Private Securities Litigation Reform Act of 1995:

This press release may contain forward-looking statements about the Company, including descriptions of plans or objectives of its management for future operations, products or services, and forecasts of its revenues, earnings or other measures of economic performance. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.”

Forward-looking statements, by their nature, are subject to risks and uncertainties. A number of factors — many of which are beyond the Company’s control — could cause actual conditions, events or results to differ significantly from those described in the forward-looking statements. The Company’s most recent reports filed with the Securities and Exchange Commission, including the annual report for the year ended December 31, 2023 filed on Form 10-K and quarterly report for the quarter ended June 30, 2024 filed on Form 10-Q, describe some of these factors, including certain credit, interest rate, operational, liquidity and market risks associated with the Company’s business and operations. Other factors described in these reports include changes in business and economic conditions, competition, fiscal and monetary policies, disintermediation, cyber security risks, legislation including the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, the Sarbanes-Oxley Act of 2002 and the Gramm-Leach-Bliley Act of 1999, and mergers and acquisitions.

Forward-looking statements speak only as of the date they are made. The Company does not undertake to update forward-looking statements to reflect circumstances or events that occur after the date forward looking statements are made.

Dollar Gen Options Trading: A Deep Dive into Market Sentiment

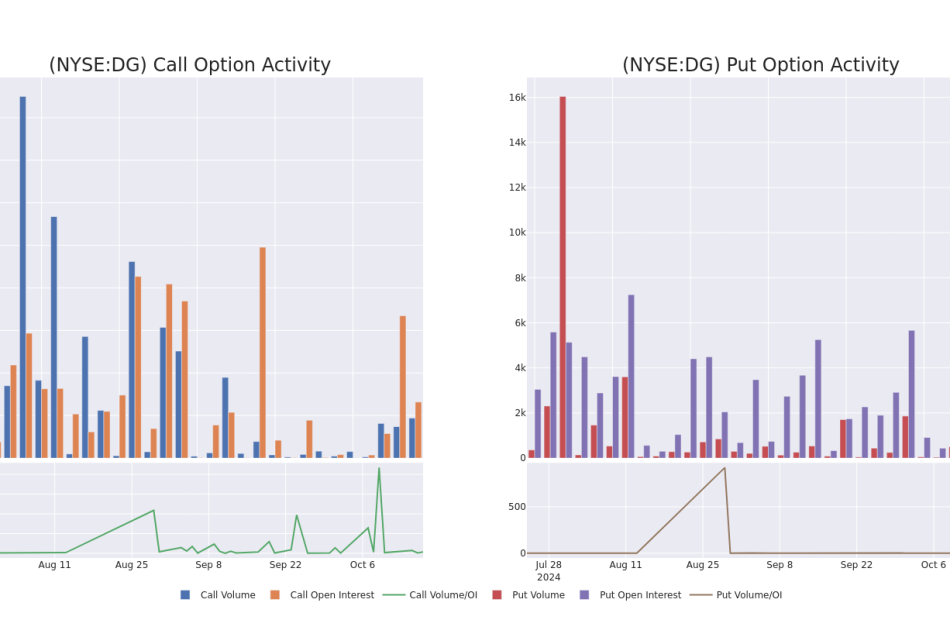

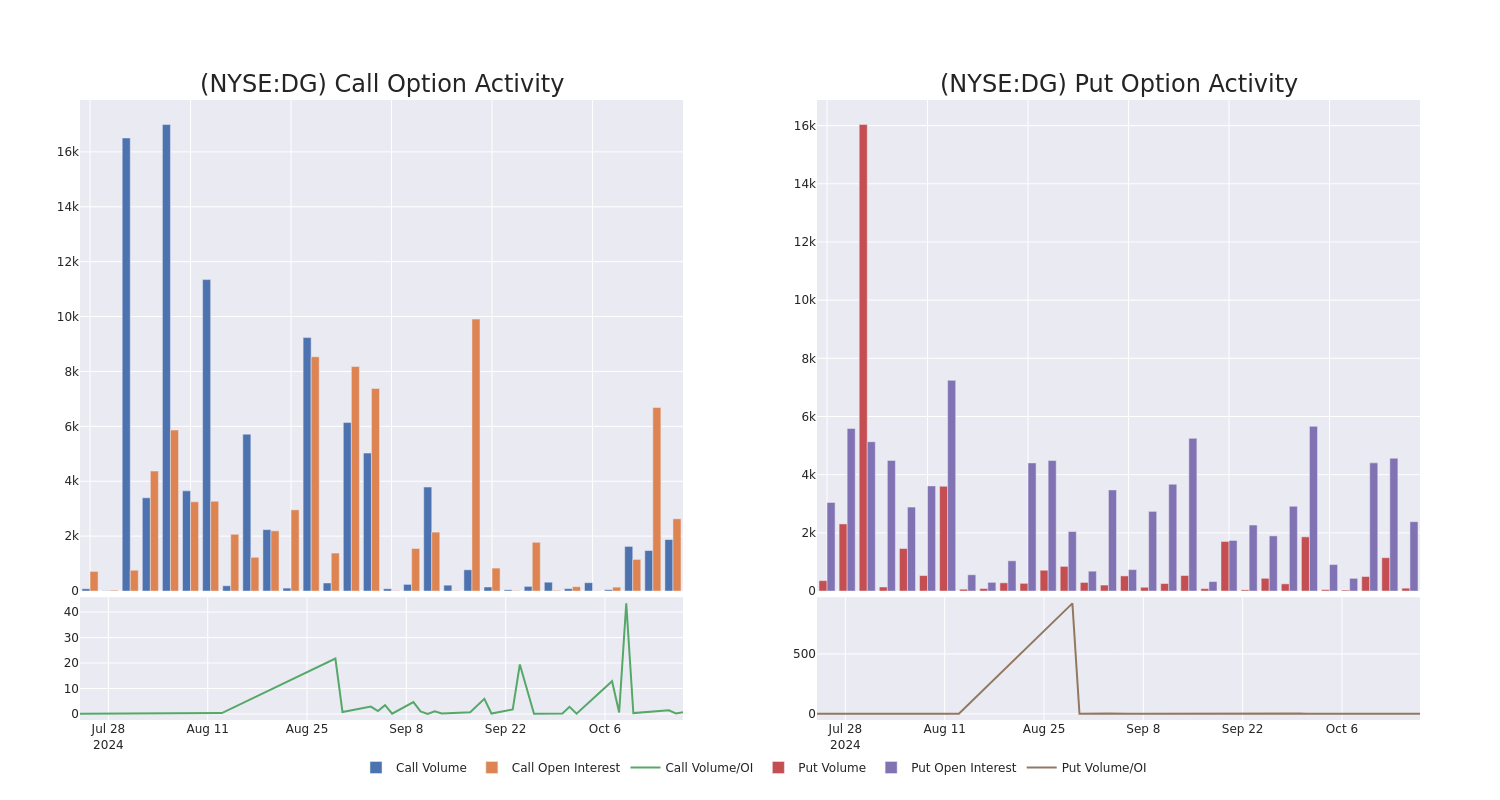

High-rolling investors have positioned themselves bearish on Dollar Gen DG, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in DG often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 9 options trades for Dollar Gen. This is not a typical pattern.

The sentiment among these major traders is split, with 44% bullish and 55% bearish. Among all the options we identified, there was one put, amounting to $39,618, and 8 calls, totaling $435,556.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $78.0 to $105.0 for Dollar Gen over the last 3 months.

Analyzing Volume & Open Interest

In today’s trading context, the average open interest for options of Dollar Gen stands at 836.0, with a total volume reaching 1,975.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Dollar Gen, situated within the strike price corridor from $78.0 to $105.0, throughout the last 30 days.

Dollar Gen Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DG | CALL | TRADE | BEARISH | 01/16/26 | $9.3 | $9.2 | $9.2 | $100.00 | $91.9K | 766 | 249 |

| DG | CALL | TRADE | BEARISH | 01/16/26 | $7.95 | $7.8 | $7.8 | $105.00 | $87.3K | 97 | 114 |

| DG | CALL | SWEEP | BULLISH | 10/25/24 | $3.8 | $3.15 | $3.79 | $78.00 | $54.1K | 4 | 144 |

| DG | CALL | SWEEP | BEARISH | 11/15/24 | $5.15 | $4.8 | $5.0 | $80.00 | $54.0K | 914 | 108 |

| DG | CALL | TRADE | BULLISH | 01/16/26 | $9.3 | $9.2 | $9.3 | $100.00 | $50.2K | 766 | 8 |

About Dollar Gen

With more than 20,000 locations, Dollar General’s banner is nearly ubiquitous across the rural United States. Dollar General serves as a convenient shopping destination for fill-in store trips, with its value proposition most relevant to consumers in small communities with a dearth of shopping options. The retailer operates a frugal store of about 7,500 square feet and primarily offers an assortment of branded and private-label consumable items (80% of net sales) such as paper and cleaning products, packaged and perishable food, tobacco, and health and beauty items at low prices. Dollar General also offers a limited assortment of seasonal merchandise, home products, and apparel. The firm sells most items at a price point of $10 or less.

After a thorough review of the options trading surrounding Dollar Gen, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Dollar Gen

- Trading volume stands at 3,735,581, with DG’s price down by -0.44%, positioned at $81.87.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 49 days.

Expert Opinions on Dollar Gen

2 market experts have recently issued ratings for this stock, with a consensus target price of $79.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Melius Research downgraded its action to Hold with a price target of $85.

* In a cautious move, an analyst from Citigroup downgraded its rating to Sell, setting a price target of $73.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Dollar Gen options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Iridium's Q3 Revenue Soars 8%, FY24 Outlook Brightens As Subscriber Base Expands

Iridium Communications Inc. IRDM shares are trading higher after the company reported better-than-expected third-quarter revenue results and revised its FY24 OEBITDA guidance.

The company reported earnings per share of 21 cents, in line with the consensus estimate. Quarterly sales of $212.77 million beat the street view of $206.18 million.

Overall, total revenue increased by 8% compared to the same period in 2023, driven largely by higher commercial service revenue and government engineering revenue.

The company reported $159.9 million in service revenue and $52.9 million from equipment sales and engineering support projects.

Service revenue, primarily recurring income from Iridium’s expanding subscriber base, grew 5% year-over-year, accounting for 75% of total revenue in the third quarter of 2024.

Also Read: ShiftPixy’s Big AI Move: Supercharges Workforce Management With $150M TurboScale Deal

The company concluded the quarter with 2.48 million total billable subscribers, up from 2.23 million in the same period last year and an increase from 2.41 million as of June 30. This represents an 11% year-over-year growth in total billable subscribers, driven primarily by an increase in commercial IoT.

Iridium paid a dividend of 14 cents per common share on September 30, resulting in year-to-date dividend payments of $49.1 million to stockholders.

“Since 2021, Iridium has returned over $1 billion to common shareholders through stock repurchase and dividend activities,” said Matt Desch, CEO, Iridium. Desch added, “Most recently, our board of directors further expanded our buyback program by authorizing the repurchase of an additional $500 million of Iridium common stock through December 31, 2027.”

Outlook: Iridium anticipates a 5% growth in service revenue for FY24, compared to the previous estimate of 4% to 6%, and expects OEBITDA to be between $465 million and $470 million, revised from the prior range of $460 million to $470 million.

Net leverage is expected to remain below 4.0 times OEBITDA through 2026, with a target of falling below 2.0 times OEBITDA by the end of the decade, assuming continued execution of the company’s share repurchase program and consistent quarterly dividend payments.

Price Action: IRDM shares are trading higher by 14.2% to $34.48 at last check Thursday.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.