Unpacking the Latest Options Trading Trends in Rivian Automotive

Investors with significant funds have taken a bearish position in Rivian Automotive RIVN, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in RIVN usually indicates foreknowledge of upcoming events.

Today, Benzinga’s options scanner identified 10 options transactions for Rivian Automotive. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 20% being bullish and 70% bearish. Of all the options we discovered, 9 are puts, valued at $399,432, and there was a single call, worth $162,000.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $9.0 to $22.5 for Rivian Automotive over the recent three months.

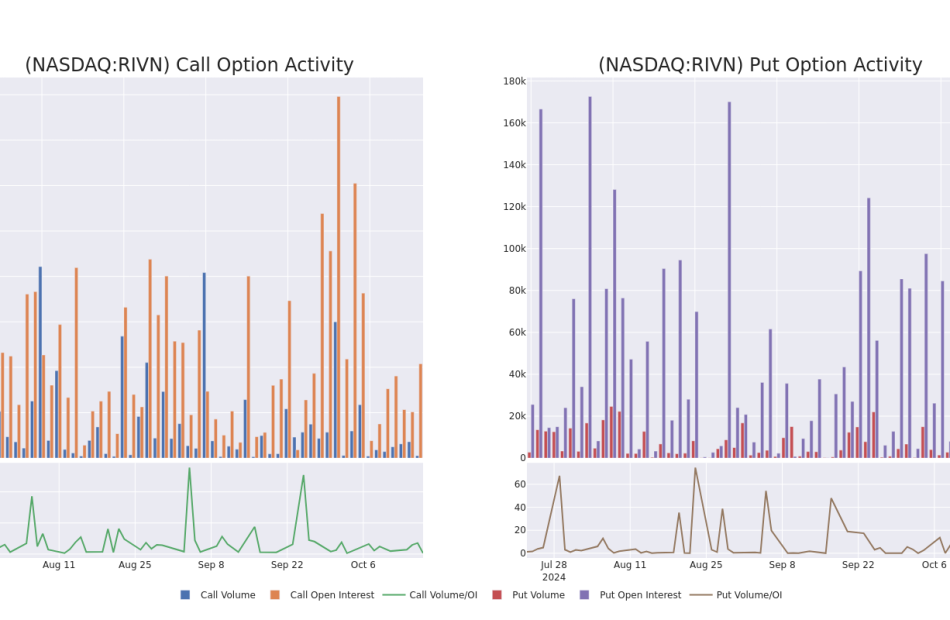

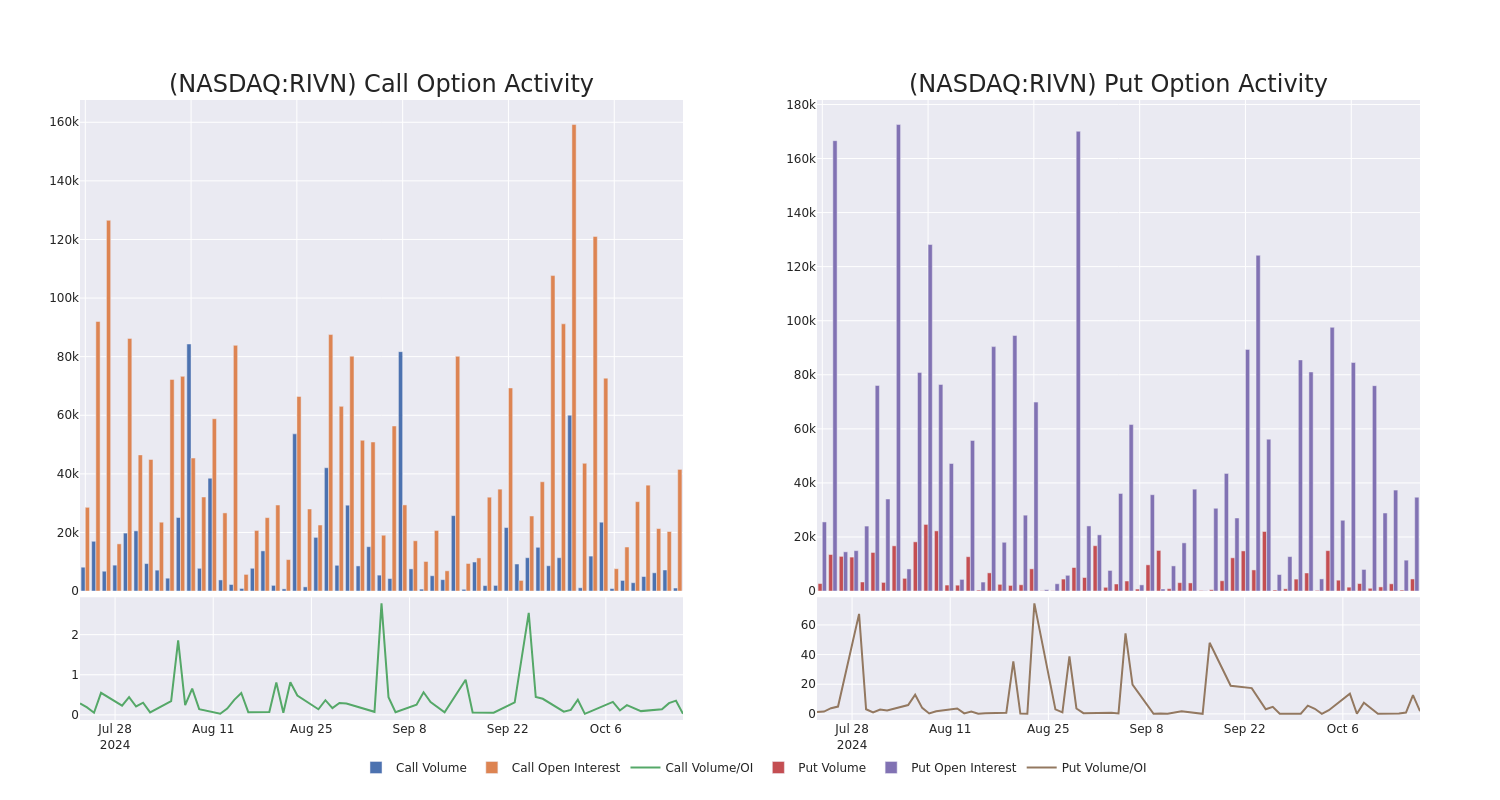

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Rivian Automotive stands at 10888.86, with a total volume reaching 5,495.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Rivian Automotive, situated within the strike price corridor from $9.0 to $22.5, throughout the last 30 days.

Rivian Automotive Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RIVN | CALL | SWEEP | BEARISH | 01/17/25 | $1.64 | $1.62 | $1.62 | $10.00 | $162.0K | 41.5K | 1.0K |

| RIVN | PUT | SWEEP | BEARISH | 10/18/24 | $1.86 | $1.71 | $1.86 | $12.00 | $74.1K | 1.5K | 1 |

| RIVN | PUT | SWEEP | BEARISH | 11/15/24 | $0.55 | $0.54 | $0.55 | $9.00 | $72.0K | 5.0K | 1.5K |

| RIVN | PUT | SWEEP | BULLISH | 12/20/24 | $1.32 | $1.31 | $1.31 | $10.00 | $57.9K | 20.3K | 771 |

| RIVN | PUT | SWEEP | BEARISH | 10/18/24 | $1.9 | $1.89 | $1.9 | $12.00 | $38.0K | 1.5K | 1.0K |

About Rivian Automotive

Rivian Automotive Inc designs, develops, and manufactures category-defining electric vehicles and accessories. In the consumer market, the company launched the R1 platform with the first generation of consumer vehicles: the R1T, a two-row, five-passenger pickup truck, and the R1S, a three-row, seven-passenger sport utility vehicle (SUV).

After a thorough review of the options trading surrounding Rivian Automotive, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Rivian Automotive

- With a volume of 16,578,088, the price of RIVN is down -2.12% at $10.02.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 21 days.

Professional Analyst Ratings for Rivian Automotive

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $14.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on Rivian Automotive, which currently sits at a price target of $11.

* An analyst from Goldman Sachs persists with their Neutral rating on Rivian Automotive, maintaining a target price of $11.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $19.

* An analyst from Morgan Stanley downgraded its action to Equal-Weight with a price target of $13.

* An analyst from Cantor Fitzgerald downgraded its action to Overweight with a price target of $19.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Rivian Automotive, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Look at SLB's Upcoming Earnings Report

SLB SLB is preparing to release its quarterly earnings on Friday, 2024-10-18. Here’s a brief overview of what investors should keep in mind before the announcement.

Analysts expect SLB to report an earnings per share (EPS) of $0.88.

The announcement from SLB is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

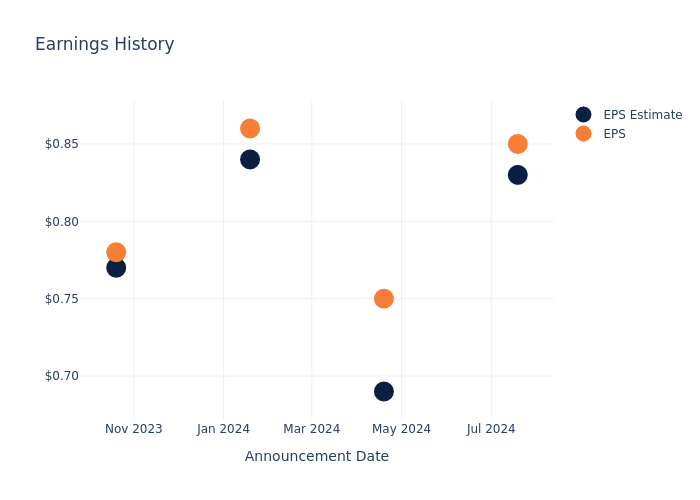

Performance in Previous Earnings

The company’s EPS beat by $0.02 in the last quarter, leading to a 0.0% drop in the share price on the following day.

Here’s a look at SLB’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.83 | 0.69 | 0.84 | 0.77 |

| EPS Actual | 0.85 | 0.75 | 0.86 | 0.78 |

| Price Change % | 2.0% | -2.0% | 2.0% | -3.0% |

Analysts’ Perspectives on SLB

Understanding market sentiments and expectations within the industry is crucial for investors. This analysis delves into the latest insights on SLB.

The consensus rating for SLB is Outperform, derived from 17 analyst ratings. An average one-year price target of $62.44 implies a potential 42.95% upside.

Peer Ratings Overview

In this comparison, we explore the analyst ratings and average 1-year price targets of Baker Hughes, Halliburton and TechnipFMC, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- Baker Hughes received a Outperform consensus from analysts, with an average 1-year price target of $43.42, implying a potential 0.6% downside.

- Analysts currently favor an Buy trajectory for Halliburton, with an average 1-year price target of $42.17, suggesting a potential 3.46% downside.

- Analysts currently favor an Buy trajectory for TechnipFMC, with an average 1-year price target of $33.0, suggesting a potential 24.45% downside.

Snapshot: Peer Analysis

In the peer analysis summary, key metrics for Baker Hughes, Halliburton and TechnipFMC are highlighted, providing an understanding of their respective standings within the industry and offering insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Schlumberger | Outperform | 12.84% | $1.88B | 5.32% |

| Baker Hughes | Outperform | 13.05% | $1.49B | 3.74% |

| Halliburton | Buy | 0.60% | $1.12B | 7.22% |

| TechnipFMC | Buy | 17.92% | $500.90M | 6.24% |

Key Takeaway:

SLB ranks highest in Gross Profit and Return on Equity among its peers. It is in the middle for Revenue Growth.

Unveiling the Story Behind SLB

SLB is the largest oilfield service firm in the world, with expertise in myriad disciplines, including reservoir performance, well construction, production enhancement, and more recently, digital solutions. It maintains a reputation as one of the industry’s leading innovators, which has earned it dominant share in numerous end markets.

SLB: Delving into Financials

Market Capitalization Highlights: Above the industry average, the company’s market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Positive Revenue Trend: Examining SLB’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 12.84% as of 30 June, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Energy sector.

Net Margin: SLB’s financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 12.17%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): SLB’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 5.32% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): SLB’s ROA excels beyond industry benchmarks, reaching 2.29%. This signifies efficient management of assets and strong financial health.

Debt Management: SLB’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.63.

To track all earnings releases for SLB visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Alcoa Analysts Increase Their Forecasts After Upbeat Earnings

Alcoa Corporation AA reported better-than-expected earnings for the third quarter on Wednesday.

The company reported third quarter sales of $2.904 billion, missing the consensus of $2.967 billion. Adjusted EPS of 57 cents exceeded the consensus of 28 cents.

Alcoa maintains its 2024 Alumina segment production forecast at 9.8 to 10 million metric tons while increasing its shipment projection to 12.9 to 13.1 million metric tons, up by 0.2 million metric tons from the prior forecast due to higher trading volumes.

Alcoa President and CEO William F. Oplinger said, “We gained flexibility after closing the Alumina Limited acquisition and announced the sale of our interest in the Ma’aden joint ventures.”

Alcoa shares fell 3.5% to trade at $40.60 on Thursday.

These analysts made changes to their price targets on Alcoa following earnings announcement.

- B. Riley Securities analyst Lucas Pipes upgraded Alcoa from Neutral to Buy and raised the price target from $41 to $50.

- BMO Capital analyst Katja Jancic maintained the stock with a Market Perform and raised the price target from $42 to $45.

- JP Morgan analyst Bill Peterson maintained Alcoa with a Neutral and raised the price target from $36 to $39.

Read More:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Global Surgical Robots Market to Develop at a Stellar 13.4% CAGR through 2031 | SkyQuest Technology

Westford, USA, Oct. 17, 2024 (GLOBE NEWSWIRE) — SkyQuest projects that the Surgical Robots Market will attain a value of USD 32.33 billion by 2031, with a CAGR of 13.4% over the forecast period (2024-2031). Advancements in robotic technologies and growing penetration of digital technologies in the healthcare industry are forecasted to primarily bolster the demand for surgical robots over the coming years. Increasing burden on medical professionals and growing acceptance of robotic surgeries are also projected to drive sales of surgical robots in the future.

Browse in-depth TOC on “Surgical Robots Market”

To Learn More About This Report, Request a Free Sample Copy – https://www.skyquestt.com/sample-request/surgical-robots-market

Surgical Robots Market Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $ 9.53 billion |

| Estimated Value by 2031 | $ 32.33 billion |

| Growth Rate | Poised to grow at a CAGR of 13.4% |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Component, Application, End User, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Report Highlights | Updated financial information / product portfolio of players |

| Key Market Opportunities | Integration of advanced technologies to enhance capabilities of surgical robots |

| Key Market Drivers | Advancements in robotic technologies and growing use of digital technologies in healthcare |

Surgical Robots Market Segmental Analysis

The Global Surgical Robots Market is segmented based on Offering, Application, End User, Region.

In terms of Offering, the market is trifurcated into Instruments & Accessories and Services.

Based on the Application, the market is segmented into Research Institutes, Pharmaceutical & Biotechnology Companies and Others.

Based on the End User, the market is divided into Hospitals & Clinics and Ambulatory Surgery Centers.

Based on Region, the market is segmented into North America, Europe, Asia Pacific, Central & South America and Middle East & Africa.

Robot Systems to Account for a Dominant Share of the Global Surgical Robot Demand Outlook

Robot systems are complete surgical systems that can operate without the need for other instruments or equipment. Robot systems can be supervised or partially controlled by surgeons to improve the safety of the surgical procedure. Increasing acceptance of robotic surgeries among patients will bolster the demand for autonomous surgical robots and contribute to the high market share of this segment.

Get Customization on this Report for Specific Research Solutions: https://www.skyquestt.com/speak-with-analyst/surgical-robots-market

Demand for Rapid Medical Response in Emergency Boosting Adoption of Surgical Robots in Ambulatory Surgical Centers

Rising incidence of accidents and disasters around the world has bolstered the demand for emergency medical response. Robots can adhere to guidelines and stay calm in face of adversities as compared to humans who might be affected in certain situations. This factor is primarily boosting sales of surgical robots for ambulatory surgical centers around the world.

North America to Spearhead Surgical Robots Consumption Owing to High Acceptance of Robotic Surgeries

North American patient population is open to robotic surgeries and has been known to quickly adopt advanced healthcare solutions, which makes this region a dominant one. Moreover, the presence of a developed healthcare infrastructure and easy availability of robotic surgery procedures in multiple healthcare establishments also help promote the demand for surgical robots in this region. The United States and Canada are forecasted to be the most opportune markets for surgical robot providers in this region.

Surgical Robots Market Insights:

Drivers

- Advancements in robotics technologies

- Acceptance of robotic surgeries

- Increasing use of digital technologies in the healthcare industry

Restraints

- High costs of surgical robots

- Risk of malfunction or surgical errors

Prominent Players in Surgical Robots Market

- Intuitive Surgical

- Stryker

- Medtronic

- Smith+Nephew

- Zimmer Biomet

- Asensus Surgical

- Siemens Healthineers

- CMR Surgical

- Johnson & Johnson

- Renishaw Plc

- avateramedical GmbH

- Brainlab AG

- THINK Surgical

- Medicaroid Corporation

- Globus Medical, Inc.

Take Action Now: Secure Your Surgical Robots Market Today – https://www.skyquestt.com/buy-now/surgical-robots-market

Key Questions Answered in Surgical Robots Market Report

- What drives the global Surgical Robots market growth?

- Who are the leading Surgical Robots providers in the world?

- Which region leads the demand for Surgical Robots in the world?

This report provides the following insights:

Analysis of key drivers (growing use of digital technologies in healthcare, rising acceptance of robotic surgeries, advancements in robotic technologies), restraints (high costs of surgical robots, risk of surgical errors and malfunctioning, stringent regulatory mandates for approval), and opportunities (integration of new technologies, targeting emerging countries), influencing the growth of Surgical Robots market.

- Market Penetration: All-inclusive analysis of product portfolio of different market players and status of new product launches.

- Product Development/Innovation: Elaborate assessment of R&D activities, new product development, and upcoming trends of the Surgical Robots market.

- Market Development: Detailed analysis of potential regions where the market has potential to grow.

- Market Diversification: Comprehensive assessment of new product launches, recent developments, and emerging regional markets.

- Competitive Landscape: Detailed analysis of growth strategies, revenue analysis, and product innovation by new and established market players.

Read Surgical Robots Market Report Today – https://www.skyquestt.com/report/surgical-robots-market

Checkout More Related Studies Published by SkyQuest Technology:

Nanorobots Market is growing at a CAGR of 11.10% in the forecast period (2024-2031)

Pharmaceutical Robots Market is growing at a CAGR of 9.20% in the forecast period (2024-2031)

Medical Robotic System Market is growing at a CAGR of 14.23% in the forecast period (2024-2031)

Surgical Blade Market is growing at a CAGR of 4.54% in the forecast period (2024-2031)

Hand-held Surgical Instruments Market is growing at a CAGR of 7.2% in the forecast period (2024-2031)

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact Us:

Mr. Jagraj Singh

Skyquest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Texas Instruments Options Trading: A Deep Dive into Market Sentiment

Financial giants have made a conspicuous bullish move on Texas Instruments. Our analysis of options history for Texas Instruments TXN revealed 11 unusual trades.

Delving into the details, we found 54% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $150,106, and 7 were calls, valued at $671,550.

What’s The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $175.0 to $250.0 for Texas Instruments over the recent three months.

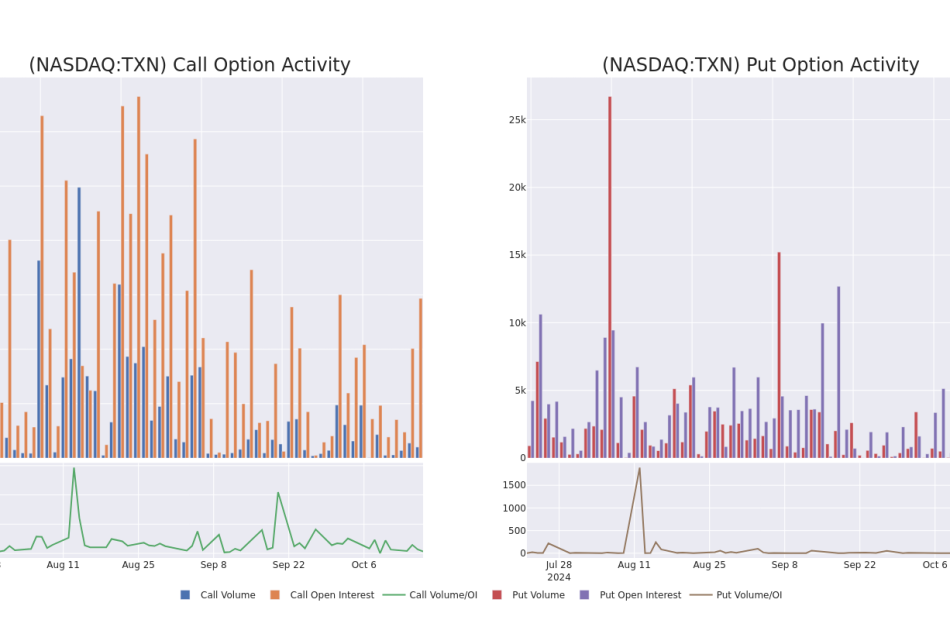

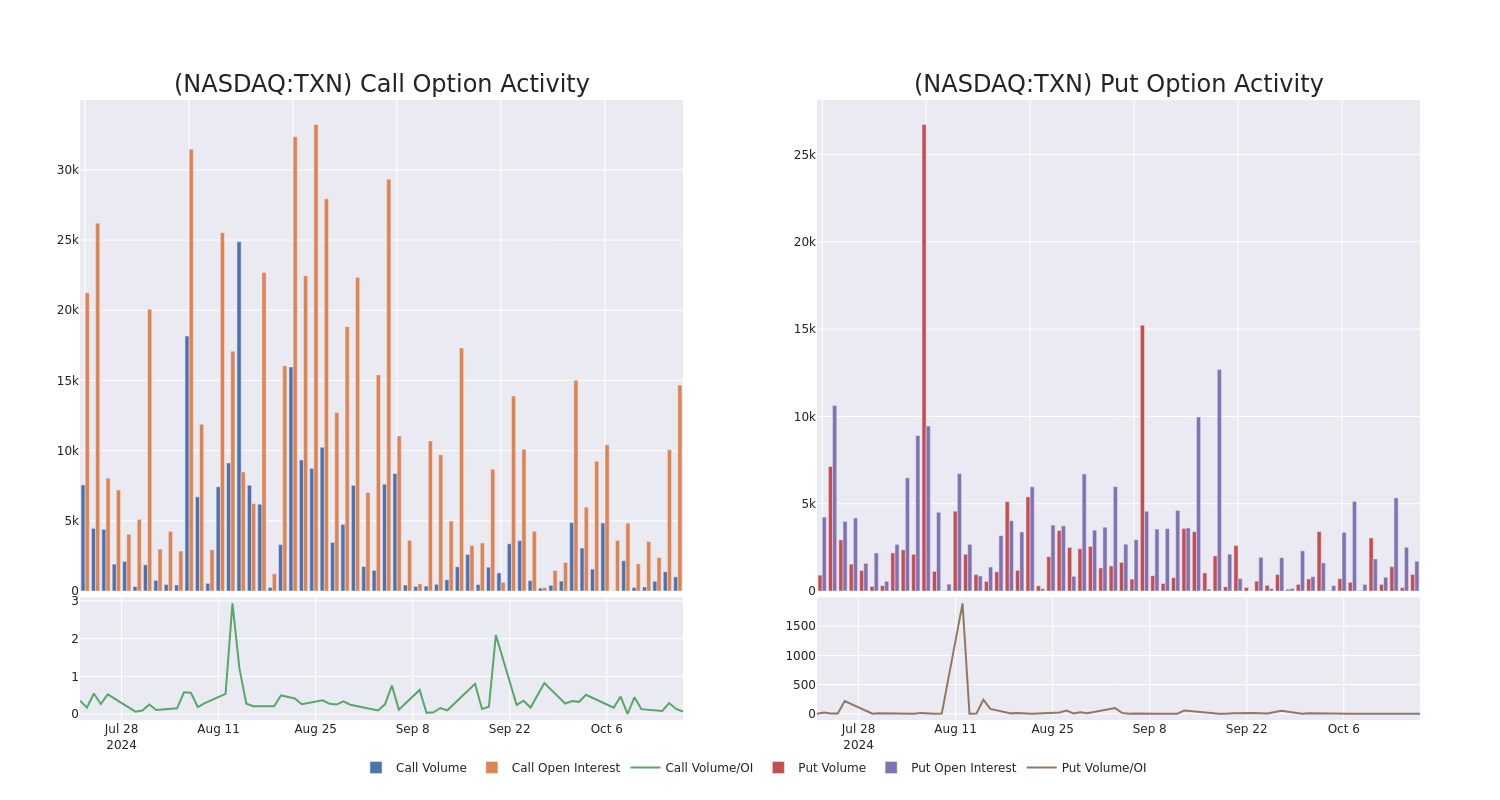

Volume & Open Interest Trends

In today’s trading context, the average open interest for options of Texas Instruments stands at 1820.33, with a total volume reaching 1,961.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Texas Instruments, situated within the strike price corridor from $175.0 to $250.0, throughout the last 30 days.

Texas Instruments 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | CALL | SWEEP | NEUTRAL | 03/21/25 | $12.4 | $12.2 | $12.3 | $210.00 | $245.4K | 1.1K | 202 |

| TXN | CALL | TRADE | BEARISH | 12/20/24 | $6.8 | $6.55 | $6.63 | $210.00 | $238.6K | 2.1K | 379 |

| TXN | CALL | SWEEP | BULLISH | 10/25/24 | $5.25 | $4.9 | $5.16 | $202.50 | $51.5K | 103 | 109 |

| TXN | CALL | SWEEP | BULLISH | 03/21/25 | $12.5 | $12.3 | $12.3 | $210.00 | $49.2K | 1.1K | 246 |

| TXN | PUT | SWEEP | BULLISH | 10/25/24 | $1.99 | $1.97 | $1.97 | $190.00 | $47.8K | 566 | 268 |

About Texas Instruments

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world’s largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

Following our analysis of the options activities associated with Texas Instruments, we pivot to a closer look at the company’s own performance.

Present Market Standing of Texas Instruments

- Trading volume stands at 1,538,568, with TXN’s price down by -0.12%, positioned at $200.45.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 5 days.

What Analysts Are Saying About Texas Instruments

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $225.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* An analyst from Rosenblatt has decided to maintain their Buy rating on Texas Instruments, which currently sits at a price target of $250.

* Maintaining their stance, an analyst from Cantor Fitzgerald continues to hold a Neutral rating for Texas Instruments, targeting a price of $200.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Texas Instruments, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dry Van Container Market is Predicted to Reach US$ 9.6 Billion by 2033, Expanding at a CAGR of 5.4% | Fact.MR Report

Rockville, MD, Oct. 17, 2024 (GLOBE NEWSWIRE) — Expanding at a CAGR of 5.4% from 2023 to 2033, the global dry van containers market is estimated to reach a valuation of US$ 9.6 billion by the end of 2033. This study by Fact.MR, a market research and competitive intelligence provider, reveals that Asian countries such as India, China, and Japan are projected to make APAC the leading regional market for dry van containers.

Rapid industrialization and globalization are the two prime prospects that are anticipated to boost sales of dry van containers in the Asia Pacific region over the next ten years. Supportive government initiatives to boost manufacturing sector growth and expanding population in countries such as China and India are also estimated to increase the number of imports and exports from the region, resulting in high dry van container demand through 2033.

Meanwhile, the North American European regions are estimated to tussle for the second position in terms of share of the global dry van container market across the study period. Increasing adoption of smart containers in these regions is projected to create new opportunities for dry van container companies.

For More Insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=1015

Key Takeaways from Market Study

- The global dry van container market stands at a valuation of US$ 5.65 billion in 2023.

- Demand for dry van containers is projected to expand at a CAGR of 4% from 2023 to 2033.

- The market is anticipated to reach a size of US$ 9.6 billion by 2033-end.

- Increasing globalization, supportive government initiatives to boost trading activity, growing world population, and increasing demand for imports and exports are set to be prime market drivers.

- High availability of alternative shipping containers is projected to hurt market growth prospects to some extent.

- Asia Pacific accounts for around 40% share of the global market in 2023.

- A majority of dry van containers are currently manufactured using steel.

- Sea transport is forecasted to account for high sales of dry van containers through 2033.

“Dry van container manufacturers need to focus on product innovation to cash in on the growing popularity of smart containers in the logistics industry,” says a Fact.MR analyst

Leading Players Driving Innovation in the Dry Van Container Market:

Dry van container market players are W&K Containers Inc., Sea Box Inc., Singamas Container Holdings Limited, A.P. Moller – Maersk A/S, China Shipping Container Lines Co. Ltd., Charleston Marine Containers Inc., CIMC Group, CXIC Group Containers Company Limited, Hyundai Translead Inc., Hapag-Lloyd AG.

Winning Strategy

Dry van container producers are focusing on expanding their business scope and making it futureproof by integrating advanced technologies that create smart containers. Automation of the global supply chain and changing trade conditions are also estimated to open up new avenues of opportunities for dry van container suppliers in the long run.

Dry Van Container Industry News:

- Ocean Network Express (ONE), a well-known brand in the container transportation sector, declared in February 2023 that it will be working with Sony Network Communications Europe to provide an intelligent container solution. ONE intends to embrace the era of smart logistics by integrating this solution for its worldwide fleet.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=1015

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the global dry van containers market, presenting historical demand data (2018 to 2022) and forecast statistics for the period (2023 to 2033).

The study divulges essential insights on the market based on container size (dry van 20 ft., dry van 40 ft., dry van 40 ft. high cube, others), material (steel, aluminium, others), application (sea transport, land transport, intermodal transport), and end-use industry (chemicals, pharmaceuticals, food & beverages, electronics, automotive, others), across five major regions of the world (North America, Europe, Asia Pacific, Latin America, and MEA).

Check out More Related Studies Published by Fact.MR:

Logging Trailer Market: Size is expected to grow at a compound annual growth rate (CAGR) of 4.4%, from US$ 535.6 million in 2024 to US$ 823.8 million by the end of 2034.

Compact Wheel Loader Market: Size is set to reach a value of US$ 40.64 billion in 2024. Projections are that the market will expand at a CAGR of 5.1% to end up at US$ 66.83 billion by the year 2034.

Automotive Automatic Transmission Market: Size is estimated at US$ 76.11 billion in 2024 and has been forecasted to increase at 3.6% CAGR to climb to US$ 122.81 billion by the end of 2034.

Electric Vehicle Market: Size is estimated at US$ 442.34 billion in 2024 and has been projected to increase at a CAGR of 14% to reach US$ 1,639.84 billion by the end of 2034.

Fixed Wing Drone Market: Size is estimated to reach US$ 8.3 billion in 2024 and has been forecasted to climb to a value of US$ 40.6 billion by the end of 2034, expanding at a CAGR of 17.2% between 2024 and 2034.

Automotive Tire Market: Size is projected to increase from a value of US$ 403.53 billion in 2024 to US$ 626.67 billion by the end of 2034. Worldwide sales of automobile tires have been projected to rise at 3.6% CAGR from 2024 to 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Earnings Update: Marijuana Lenders And Top Operator To Report Results, Here's What Investors Need To Know

Chicago Atlantic

Chicago Atlantic Real Estate Finance, Inc. REFI will issue its earnings and supplemental financial information for the third quarter that ended Sept. 30, 2024, before the market opens on Thursday, Nov. 7.

The Chicago-based and cannabis-focused commercial mortgage real estate investment trust said a conference call and live audio webcast, both open for the general public, will be held later that day at 9:00 am Eastern Time.

The company’s portfolio performance remained strong with a total loan principal outstanding of $383.3 million across 31 investments, Chicago Atlantic said in August, on the heels of its second quarter financial results. Also, the weighted average yield to maturity as of June 30, 2024, was approximately 18.7%, a slight decrease from 19.4% as of March 31, 2024, attributed to amendments in borrower performance and pricing structures.

Chicago Atlantic’s shares traded 0.06% higher at $15.79 at the time of writing on Thursday morning.

NewLake Capital

NewLake Capital Partners, Inc. NLCP announced its plans Wednesday to host a conference call and report its financial results for the third quarter that ended Sept. 30, 2024, on Thursday, Nov. 14, 2024, at 11:00 am Eastern Time.

The company has emerged as a compelling player in the cannabis REIT sector. In May it announced its acquisition of a 58,500-square-foot industrial property in East Hartford, Connecticut. The company also said at the time that it had entered into a long-term triple net lease with an affiliate of Michigan-based C3 Industries Inc.

NewLake’s shares traded 1.44% higher at $20.05 per share on Thursday morning.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. If you’re serious about the business, you can’t afford to miss out.

Cresco Labs

Cresco Labs Inc. CL CRLBF 6CQ will report financial results for the third quarter that ended Sept. 30, 2024 on Friday, Nov. 8, before the market opens.

Cresco, operator of Sunnyside dispensaries, said it will host a conference call and webcast to discuss its results and provide investors with key business highlights the same day.

The company’s second quarter report published in August demonstrated “the sustainability of the improvements we’ve made to the business over the past year with $184 million in revenue at a 29% Adjusted EBITDA margin,” said CEO Charles Bachtell.

Cresco Labs made its debut in Chicago in 2013 when Illinois passed the Compassionate Use of Medical Cannabis Act. “The company’s goal and that of its management team has been to help normalize and professionalize this industry,” Bachtell told the crowd gathered at the Benzinga Cannabis Capital Conference in Chicago in early October.

A September note from Zuanic & Associates rated Cresco as “Overweight” among the top five multi-state operators (MSOs) in the U.S. According to Zuanic, Cresco’s financial performance in Q2 2024 underscores its efficiency-focused strategy, adding that key opportunities lie in Cresco’s footprint in states like Ohio, Florida and Pennsylvania.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Wall Street Poised To Open Higher As TSMC Earnings Expected To Kick Off Rally In Tech Stocks: Strategist Says AI Trade Will Have Legs Even In Case Of Recession In 2025

Technology stocks, specifically chipmakers, could lead from the front on Thursday as a stellar third-quarter earnings report from Taiwan Semiconductor Manufacturing Company Ltd. TSM is triggering positive sentiment toward all artificial intelligence plays. Oil prices have rebounded and gold traded at a fresh record, while bond yields held steady ahead of a slew of market-moving data that include retail sales, a regional manufacturing activity index, industrial production, and jobless claims.

Earnings news could provide an offsetting impact in the eventuality of the market construing the economic data as inclement. Netflix, Inc. NFLX is the first among the mega-cap earnings due after the market close and the results could evince interest among traders and set the tone for the tech reporting season.

| Futures | Performance (+/-) |

| Nasdaq 100 | +0.81% |

| S&P 500 | +0.42% |

| Dow | +0.11% |

| R2K | -0.09% |

In premarket trading on Thursday, the SPDR S&P 500 ETF Trust SPY edged up 0.42% to $584.76 and the Invesco QQQ ETF QQQ jumped 0.83% to $495, according to Benzinga Pro data.

Cues From Last Session:

Small-caps ripped higher on Wednesday, extending their recent gains amid hopes of a benign economic environment but the major averages opened on a tentative note. Solid earnings reports from financial companies and strong gains by real-estate and utility stocks helped the major indices close firmly in the green.

The Dow Jones Industrial Average turned solidly higher immediately after spending the better part of the session above the unchanged line. The 30-stock blue-chip average ended at a fresh high, although it did not have enough momentum to break above its Oct. 15 intraday high of 43,277.78.

The S&P 500 Index and the Nasdaq Composite had a lackluster first-half before picking up momentum in the afternoon.

Of the 11 S&P 500 sector classes, only communication services and consumer discretionary stocks declined in Wednesday’s session.

| Index | Performance (+/) | Value |

| Nasdaq Composite | +0.28% | 18,367.08 |

| S&P 500 Index | +0.47% | 5,842.47 |

| Dow Industrials | +0.79 | 43,077.70 |

| Russell 2000 | +1.64% | 2,286.68 |

Insights From Analysts:

Delving into the small-cap rally that has been on, LPL Financial Chief Technical Strategist Adam Turnquist said after being stuck in a consolidation phase over the past few months, small-caps have picked up some momentum in recent sessions, with the growth outlook recently improving — underpinned by better-than-feared labor market conditions — and increased visibility into Fed rate cuts, he said.

The strategist noted that the Russell 2,000 Index, or RTY, has rallied off the lower end of its rising price channel. “Recent strength in the banking space — the RTY’s largest sector by weighting — has further supported small caps,” he said.

Technically, a close above 2,275 would confirm a breakout from its current symmetrical triangle and leave the 2021 highs (2,243) as the next resistance hurdle to clear, Turnquist said, adding that momentum indicators have also recently turned bullish, adding to the evidence of a topside breakout.

“Despite the improving absolute performance, the RTY vs. S&P 500 ratio chart still remains in a downtrend and below its declining 200-day moving average (DMA),” he said. A close above the July highs would validate a trend reversal in favor of small caps outperforming, he added.

Meanwhile, a fund manager thinks AI-levered companies could be defensive plays. Louis Navellier said, “Semiconductor demand has become the new proxy for global growth trends, being incorporated into almost everything, and also has geopolitical implications with technology export controls in place and China continuing to saber rattle about taking Taiwan back.”

“The upshot here is the inference that AI will still have legs even if we slide into a global recession in ’25,” he added.

See also: Best Futures Trading Software

Upcoming Economic Data:

- The Labor Department is scheduled to release the weekly jobless claim report at 8:30 a.m. EDT. Economists, on average, expect the number of individuals claiming unemployment insurance to come in at 260,000 in the week ended Oct. 12, up from 258,000 in the previous week.

- The Commerce Department will release its September retail sales report at 8:30 a.m. EDT. The consensus estimates call for a 0.3% month-over-month increase in headline retail sales and a more modest 0.1% rise in retail sales, excluding the volatile auto sales. This compares to 0.1% increases for both in August.

- The Philadelphia Fed is due to release the results of its manufacturing survey at 8:30 a.m. EDT. The diffusion index of business activity is expected to rise from 1.7 in September to 3 in October.

- The Federal Reserve will release its industrial production report for September at 9:15 a.m. EDT. The consensus estimate models a 0.2% month-over-month decline in industrial output compared to 0.8% growth in August.

- The Commerce Department’s business inventories report, due at 10 a.m. EDT, is expected to show a 0.3% month-over-month increase in business inventories for August, slightly slower than July’s 0.4% increase.

- The National Association of Home Builders will release its housing market index for October at 10 a.m. EDT. The headline index, which measures confidence among homebuilders, is expected to rise a point from September to 42. A reading below 50 suggests a lack of confidence.

- The Energy Information Administration will release its weekly oil inventories report at 11 p.m. EDT.

- The Treasury is scheduled to auction four- and eight-week bills at 11:30 a.m. EDT.

Stocks In Focus:

- Alcoa Corporation AA climbed nearly 5% in premarket trading following the aluminum maker’s quarterly results, and TSMC surged up over 8% on a beat-and-raise quarter.

- Other stocks moving on earnings are CSX Corporation CSX (down about 5%) Nokia Oyj NOK (down nearly 6%), and Steel Dynamics, Inc. STLD (up over 3%).

- Blackstone Inc. (BX), Marsh & McLennan Companies, Inc. MMC, Travelers Companies, Inc. TRV, KeyCorp KEY, and M&T Bank Corporation MTB are among the noteworthy companies reporting ahead of the market opening.

- Those reporting after the close include Netflix, Intuitive Surgical, Inc. ISRG, Crown Holdings, Inc. CCK, WD-40 Company WDFC, and Western Alliance Bancorporation WAL.

- Expedia Group, Inc. EXPE climbed over 7.7% on the news that Uber Technologies, Inc. UBER might be interested in buying the company.

- Lucid Group, Inc. LCID plunged over 15% on a common stock offering.

Commodities, Bonds And Global Equity Markets:

Crude oil futures are reversing course and were up modestly after their recent pullback and gold futures traded at a record. Bitcoin BTC/USD slipped over 1% over the past 24 hours and was at a sub-$67K level.

The 10-year U.S. Treasury note yield was little changed at 4.036%.

The Asian markets ended mixed on Wednesday, as the Japanese, Chinese, Hong Kong, Indian, and South Korean markets retreated. Most other markets ended on a firm note, tracking higher energy prices and the positive close on Wall Street overnight.

European stocks traded in the green in the early hours, thanks to earnings optimism.

Read Next:

Photo courtesy: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.