Lucid sparks selloff with plan for dilutive new stock sale, Q3 loss expectations

(Reuters) -Electric vehicle maker Lucid Group said it anticipates to report a bigger-than-expected loss for the third quarter and announced a public offering of over 262 million shares, sending its shares down 12% in after-market trading on Wednesday.

Additionally, Saudi Arabia’s Public Investment Fund, a majority stockholder in Lucid, said it would purchase 374.7 million shares of the company. The fund expects to maintain an ownership of nearly 59% in Lucid.

The latest investment by the sovereign wealth fund underscores the importance of this lifeline for Lucid in the race for survival among struggling EV startups.

The electric carmaker intends to use the proceeds from the offering as well the private placement from PIF to fund its capital expenditure and other corporate finance needs.

PIF had said in August that it would inject up to $1.5 billion in cash through its affiliate, Ayar Third Investment, as Lucid looks to ramp up production of a new SUV.

The Saudi government, which has maintained a nearly 60% stake in Lucid, has invested billions in the company as part of the kingdom’s strategy to diversify its economy beyond oil.

Lucid expects to report a loss from operations in the range of $765 million to $790 million for the quarter ended Sept. 30, compared with analysts’ average estimate of $751.65 million loss, according to data compiled by LSEG.

The company is scheduled to report its third-quarter results on Nov. 7.

Demand for electric vehicles in the United States has been weakening due to high interest rates and the availability of cheaper hybrid alternatives.

EV firms such as Tesla, Rivian and Lucid have slashed their prices and have been offering incentives such as cheaper financing options to woo customers.

(Reporting by Shivansh Tiwary in Bengaluru; Editing by Shreya Biswas)

Pikangikum First Nation and Canada celebrate the grand opening of their new Knowledge Keepers Elders' Complex

PIKANGIKUM FIRST NATION, TREATY 5 TERRITORY, ON, Oct. 16, 2024 /CNW/ – Everyone deserves to live in comfort with access to healthcare and services close to home and near loved ones. When Elders receive culturally relevant services in a safe, coordinated, and efficient manner based on individual needs, it allows them to live their golden years with dignity and care.

Today, Pikangikum First Nation celebrates the grand opening of their new Knowledge Keepers Elders’ Complex in collaboration with Indigenous Services Canada (ISC) and the Canadian Mortgage and Housing Corporation (CMHC).

This new building more than doubles the capacity of the previous Elder’s care facility, going from eight rooms to 20 one-bedroom apartments with a full kitchen and living room area. Four of those apartments have an accessible bathroom and bathtub for those who require it. Each apartment includes a sundeck that opens to the outdoor courtyard, and there is a shared common area for visiting and socializing.

Community leadership is working with a funder to enable the facility to build a traditional food pantry so that Elders can have year-round access to moose, goose, and fish; install a medicine walkway (including local plants and flora) along the perimeter of the housing complex; and develop programming for children, youth, and Elders sharing circle that will include songs, stories, and recreational time together.

Quotes

“The Knowledge Keepers housing complex will provide a safe and dignified place for our Elders to age in their golden years. A place to call their very own.”

“Our Elders wish to continue living in the community—being close to their friends and family is important for them.”

Pikangikum First Nation Health Authority

“Congratulations to Pikangikum First Nation for the opening of the expanded Knowledge Keepers Elders’ Complex. This is a testament to their dedication to enabling Elders to stay close to loved ones within their community while receiving compassionate support that proudly prioritizes their culture.”

The Honourable Patty Hajdu

Minister of Indigenous Services and Minister responsible for FedNor

“Everyone deserves a safe and affordable place to call home. We are proud to partner with the Pikangikum First Nation to build new affordable homes that will allow more seniors to stay in their community near their loved ones.”

The Honourable Sean Fraser

Minister of Housing, Infrastructure and Communities

Quick facts

- The Knowledge Keepers Elders’ Complex provides acute, end-of-life, rehabilitation, maintenance and long-term supportive care.

- Staff at the facility will support and enhance the care provided by families and loved ones in the community.

- The Canada Mortgage and Housing Corporation has provided more than $6.2 million in support of this project through the second round of the Rapid Housing Initiative (RHI2).

- Indigenous Services Canada invested more than $1.1 million in this project through the ISC Capital Facilities and Maintenance Program (CFMP).

Stay connected

Join the conversation about Indigenous Peoples in Canada:

Twitter: @GCIndigenous

Facebook: @GCIndigenous

Instagram: @gcindigenous

You can subscribe to receive our news releases and speeches via RSS feeds. For more information or to subscribe, visit www.isc.gc.ca/RSS.

SOURCE Indigenous Services Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/16/c1349.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/16/c1349.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What to Expect from Acme United's Earnings

Acme United ACU is gearing up to announce its quarterly earnings on Friday, 2024-10-18. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Acme United will report an earnings per share (EPS) of $0.72.

The announcement from Acme United is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

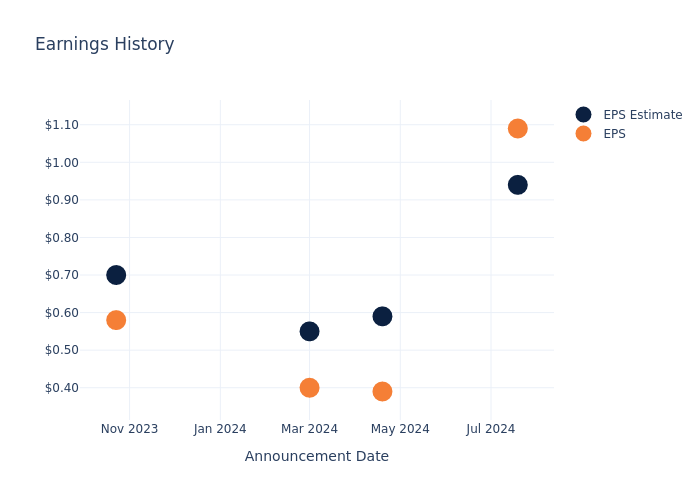

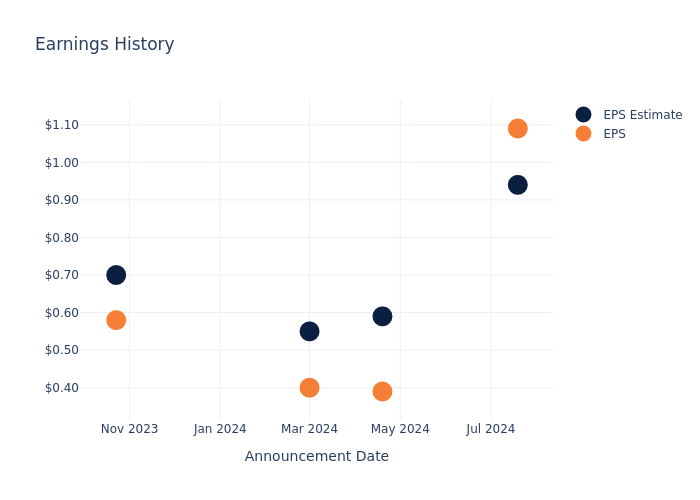

Past Earnings Performance

In the previous earnings release, the company beat EPS by $0.15, leading to a 0.0% drop in the share price the following trading session.

Here’s a look at Acme United’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.94 | 0.59 | 0.55 | 0.70 |

| EPS Actual | 1.09 | 0.39 | 0.40 | 0.58 |

| Price Change % | 4.0% | -10.0% | -7.000000000000001% | 3.0% |

Market Performance of Acme United’s Stock

Shares of Acme United were trading at $44.45 as of October 16. Over the last 52-week period, shares are up 53.38%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for Acme United visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rapid Medical Diagnostic Kits Market to Surpass $26 Billion with 4% CAGR by 2034 | Fact.MR Analysis

Rockville, MD, Oct. 17, 2024 (GLOBE NEWSWIRE) — Fact.MR, a market research and competitive intelligence provider, reveals in its updated research report that the global rapid medical diagnostic kit market is approximated at a size of US$ 17.6 billion in 2024 and is forecasted to increase to US$ 26 billion by the end of 2034.

Increasing elderly population across the world who are more prone to chronic disorders such as diabetes and cardiac-related diseases are substantially contributing to the demand growth for rapid medical diagnostic technologies. Rising prevalence of contagious diseases is further increasing the need for rapid medical diagnostic kits.

Integration of advanced technologies such as artificial intelligence, machine learning, and big data analytics are enhancing the features of rapid medical diagnostic solutions. These advancements are increasing the efficiency and reliability of diagnostic kits and driving up their sales. Manufacturers of diagnostic solutions are also focusing on innovations in molecular, point-of-care, predictive, and critical diagnostics. Introduction of real-time polymerase chain reaction (RT-PCR) kits is one of the significant developments in the field of diagnosis.

North America is a hub for research and development and is constantly developing advanced diagnostic and treatment technologies. Presence of established companies in the region is further contributing to its dominance in this space. Growing investments in the development of advanced healthcare infrastructures in the Asia Pacific region by present governments are expected to boost the demand for rapid medical diagnostic kits and technologies.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=5584

Key Takeaways from Market Study

- Global demand for rapid medical diagnostic kits is foreseen to rise at a CAGR of 4% from 2024 to 2034.

- The United States market is evaluated at US$ 1.9 billion in 2024.

- Sales of rapid medical diagnostic kits in Japan are forecasted to reach US$ 1.8 billion by 2034.

- Canada is estimated to hold 33.6% of the North American market share in 2024.

- Sales of blood glucose testing solutions are projected to reach US$ 3.8 billion by 2034.

- Rapid medical diagnostic kit demand in hospitals and clinics is estimated at a market value of US$ 2.5 billion in 2024.

“At-home medical diagnostic solutions are more convenient, affordable, and easy to use for senior citizens, which is why their demand is high,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Rapid Medical Diagnostic Kit Market:

Key industry participants like ACON Laboratories Inc.; Becton, Dickinson, and Company; BTNX, Inc.; Bio-Rad Laboratories, Inc.; Danaher Corporation; Creative Diagnostics; bioMérieux SA; Abbott Laboratories; Trinity Biotech; Zoetis; Meridian Bioscience, Inc.; F. Hoffmann-La Roche AG; McKesson Medical-Surgical, Inc.; Artron Laboratories Inc.; Alfa Scientific Designs, Inc.; Cardinal Health Sight Diagnostics Ltd., etc. are driving the rapid medical diagnostic kit industry.

Winning Strategies Differ from Company to Company

Leading manufacturers of rapid medical diagnostic kits are keenly adopting geographical expansion tactics. Expansion of manufacturing units in other regions opens opportunities to serve more consumers and earn higher profits. Companies are concentrating on product development and are making use of highly sophisticated technologies to stay ahead of the competition.

New companies are focused on innovation and niche marketing. These strategies are effective for start-ups to mark their presence in the competitive space. Niche marketing or specific product offerings will attract more target consumers and contribute to popularity growth.

- United States-based start-up Sherlock Biosciences offers rapid and cost-effective diagnostic tests through the use of CRISPR technology. Sherlock Biosciences also received a grant in 2022 from the Bill & Melinda Gates Foundation to enhance its instrument-free molecular diagnostic testing platform.

Rapid Medical Diagnostic Kit Industry News:

- Hindustan Antibiotics and LordsMed partnered in January 2023 to distribute quick antigen kits at a reasonable price for the diagnosis of a variety of illnesses. Trials of LordsMed’s saliva-based diagnostic kits for diabetes and liver disorders have been completed with success.

- Innova Medical Group, Inc. declared in January 2021 that the INNOVA SARS-CoV-2 Antigen Rapid Qualitative Test Kit would be produced for the US market.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=S&rep_id=5584

More Valuable Insights on Offer

Fact.MR, in its new offering, presents an unbiased analysis of the global rapid medical diagnostic kit market, presenting historical demand data (2019 to 2023) and forecast statistics for the period (2024 to 2034).

The study divulges essential insights on the market based on test (cholesterol monitoring, infectious diseases testing, fertility & pregnancy testing, blood glucose testing, substance abuse testing, others), technology (flow-through assays, lateral flow immunoassays, latex agglutination assays, solid-phase assays), and end user (hospitals & clinics, homecare settings, veterinary settings), across seven major regions of the world (North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and MEA).

Check out More Related Studies Published by Fact.MR Research:

Medical Radiation Detection, Monitoring and Safety Market was valued at around US$ 880 Million in 2020, and is projected to expand 1.7X to top US$ 1.5 Billion by 2031.

Biomedical Textiles Market is expected to hold a market value of US$ 17 Billion while expanding at a CAGR of 5% through 2022-2032.

Biomedical Refrigerators and Freezers Market to reach a valuation of US$ 6 Billion with demand for blood bank refrigerators to register nearly 4% CAGR by 2031.

Medical Waste Containers Market projects US$ 36 Billion valuations by 2031. Rising cancer cases spur chemotherapy medical waste containers’ growth by 5% CAGR.

Medical Holography Market is valued at US$ 1 billion in 2023 and is thus expected to reach a size of US$ 16 billion by the end of 2033.

Medical Device Complaint Management Market is projected to reach US$ 10.52 billion in sales by 2032, with an expected positive CAGR of 7% during the forecast period of 2022-2032.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay competitive.

Contact:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Constellation Energy Stock Deserves 'Substantial Premium To The S&P 500' Says JPMorgan Analyst

As the largest producer of carbon-free power in the U.S., Constellation Energy Corp CEG is turning heads in the energy sector.

With a staggering capacity of over 33 GW — about 90% carbon-free — Constellation Energy carved out a niche that places it at the forefront of the nation’s energy transformation.

The company operates the largest nuclear generation fleet in the U.S. with 22 GW, complemented by 2.5 GW from hydro, wind and solar sources.

To top it off, Constellation Energy stock is experiencing impressive stock growth, up 145% year to date and 40.32% over the past month.

JPMorgan analyst Jeremy Tonet initiated coverage on Constellation Energy with an Overweight rating and a price target of $342. The stock is currently trading at around $281.

“We see structural tailwinds, including manufacturing onshoring, broader electrification trends, as well data center development underpinning a paradigm shift in power demand,” he noted. This sentiment reflects a growing recognition that the demand for carbon-free power will outpace competitive market supply growth.

Tonets’s report highlights Constellation Energy’s unique positioning as the largest merchant nuclear generator in the U.S.

“More specifically, we see burgeoning hyperscaler demand growth focused on firm, carbon-free power, transforming nuclear power into a unique, scarce offering that will command a substantial premium.”

The analyst is confident that Constellation Energy’s nuclear franchise offers significant upside, especially as the company inks more contracts with hyperscalers looking for reliable energy sources.

Backing this bullish outlook is the nuclear Production Tax Credit (PTC). “CEG’s unparalleled nuclear fleet underpins unique PTC-backed base business stability and leading EPS growth visibility, with upside from the largest nuclear contracting opportunity set,” says Tonet.

According to Tonet, Constellation Energy carries industry-leading growth visibility through the end of the decade. The company aims for a +13% base EPS CAGR through 2030, driven by nuclear contracting and enhanced margins.

With a strong balance sheet (less than 2.0x leverage) and investment-grade ratings, Constellation Energy is poised for strategic growth.

Tonet notes, “We anticipate nuclear contracting to drive a large portion of CEG’s upside as the company secures long-term agreements with hyperscalers at premium prices.”

Read Also: CEG Stock Is Up 60% In A Month: Is Constellation Energy The New Power Play?

As the energy landscape shifts, Constellation Energy stands out as a powerhouse in the nuclear sector. With a robust portfolio and a keen eye on emerging market trends, the company is not just generating electricity; it’s generating excitement among investors.

As Tonet aptly summarizes, “Given CEG’s stability, growth, upside opportunities, and strong balance sheet, we view these factors as deserving a substantial premium to the S&P 500.”

Investors will want to keep a close eye on this unique play in an evolving energy market.

Read Next:

Photo: Bigjom Jom via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kinder Morgan misses estimates, lowers annual profit forecast on weak prices

By Sourasis Bose

(Reuters) -Kinder Morgan fell short of Wall Street estimates for third-quarter profit on Wednesday and lowered its annual forecast as the U.S. pipeline operator contends with weaker commodity prices and lower crude volumes.

Shares of the company, whose pipelines move about 40% of total U.S. natural gas production, fell 2.6% in extended trade.

“For the full year, we expect refined product volumes to be slightly below our plan to 2% over 2023,” President Thomas Martin said in a conference call.

U.S. WTI crude oil prices declined about 8.1% during the third quarter from a year earlier and concerns persist over global demand.

Crude and condensate volumes fell 4% from the year-ago quarter, while natural gas transported rose 2%.

The company projected annual adjusted core profit to be 2% below its prior forecast, compared to previous expectations of in line or within 1-2% below.

Kinder Morgan also cited start-up delays at its renewable natural gas facilities for the revised forecast.

The company, like many U.S. energy peers, is pinning its hopes on the artificial intelligence boom-driven data center power need to buoy natural gas sales.

“Data center demand has skyrocketed,” CEO Kimberly Dang said. The overall gas market could grow by 25 billion cubic feet per day over the next five years, she said.

The company said the Gulf Coast Express Pipeline, which it operates and holds a stake in, has green-lighted an about $455 million expansion project that would raise natural gas deliveries by 570 million cubic feet per day from the Permian Basin to South Texas markets.

Kinder Morgan posted an adjusted profit of 25 cents per share, compared with analysts’ average expectation of 27 cents, according to estimates compiled by LSEG.

At its products pipelines unit, which includes refined products, adjusted core profit decreased about 11.5% to $277 million.

The company is working with agencies to defend its permits related to the Cumberland gas pipeline project in Tennessee after a U.S. appeals court put them on hold.

(Reporting by Sourasis Bose in Bengaluru; Editing by Sriraj Kalluvila)

Is It Worth Investing in Chipotle Based on Wall Street's Bullish Views?

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed (or sell-side) analysts often influence a stock’s price, but are they really important?

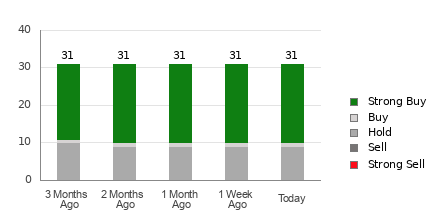

Let’s take a look at what these Wall Street heavyweights have to say about Chipotle Mexican Grill CMG before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

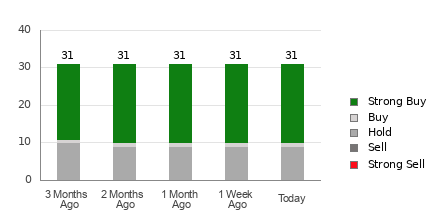

Chipotle currently has an average brokerage recommendation of 1.61, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by 31 brokerage firms. An ABR of 1.61 approximates between Strong Buy and Buy.

Of the 31 recommendations that derive the current ABR, 21 are Strong Buy and one is Buy. Strong Buy and Buy respectively account for 67.7% and 3.2% of all recommendations.

Brokerage Recommendation Trends for CMG

The ABR suggests buying Chipotle, but making an investment decision solely on the basis of this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Are you wondering why? The vested interest of brokerage firms in a stock they cover often results in a strong positive bias of their analysts in rating it. Our research shows that for every “Strong Sell” recommendation, brokerage firms assign five “Strong Buy” recommendations.

This means that the interests of these institutions are not always aligned with those of retail investors, giving little insight into the direction of a stock’s future price movement. It would therefore be best to use this information to validate your own analysis or a tool that has proven to be highly effective at predicting stock price movements.

Zacks Rank, our proprietary stock rating tool with an impressive externally audited track record, categorizes stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), and is an effective indicator of a stock’s price performance in the near future. Therefore, using the ABR to validate the Zacks Rank could be an efficient way of making a profitable investment decision.

ABR Should Not Be Confused With Zacks Rank

In spite of the fact that Zacks Rank and ABR both appear on a scale from 1 to 5, they are two completely different measures.

Broker recommendations are the sole basis for calculating the ABR, which is typically displayed in decimals (such as 1.28). The Zacks Rank, on the other hand, is a quantitative model designed to harness the power of earnings estimate revisions. It is displayed in whole numbers — 1 to 5.

It has been and continues to be the case that analysts employed by brokerage firms are overly optimistic with their recommendations. Because of their employers’ vested interests, these analysts issue more favorable ratings than their research would support, misguiding investors far more often than helping them.

In contrast, the Zacks Rank is driven by earnings estimate revisions. And near-term stock price movements are strongly correlated with trends in earnings estimate revisions, according to empirical research.

Furthermore, the different grades of the Zacks Rank are applied proportionately across all stocks for which brokerage analysts provide earnings estimates for the current year. In other words, at all times, this tool maintains a balance among the five ranks it assigns.

Another key difference between the ABR and Zacks Rank is freshness. The ABR is not necessarily up-to-date when you look at it. But, since brokerage analysts keep revising their earnings estimates to account for a company’s changing business trends, and their actions get reflected in the Zacks Rank quickly enough, it is always timely in indicating future price movements.

Is CMG Worth Investing In?

In terms of earnings estimate revisions for Chipotle, the Zacks Consensus Estimate for the current year has increased 0.3% over the past month to $1.09.

Analysts’ growing optimism over the company’s earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher, could be a legitimate reason for the stock to soar in the near term.

The size of the recent change in the consensus estimate, along with three other factors related to earnings estimates, has resulted in a Zacks Rank #2 (Buy) for Chipotle.

Therefore, the Buy-equivalent ABR for Chipotle may serve as a useful guide for investors.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

If You Invested $1,000 In Bitcoin When Mark Cuban Said 'Throw The Hail Mary,' Here's How Much You'd Have Now

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Billionaire entrepreneur Mark Cuban has never been one to shy away from providing lessons he learned in his early years or advice for people today on how to overcome obstacles and accumulate wealth.

In a 2017 interview, Cuban suggested invested a small portion of money into Bitcoin (CRYPTO: BTC). Here’s a look at how that investment would have turned out.

Don’t Miss:

What Happened: Cuban was a hustler from a young age, selling trash bags door to door before founding his first companies, which were later acquired and helped him buy the Dallas Mavericks.

In an interview with Vanity Fair, Cuban shared his advice on “getting rich,” providing nine tips for saving money, getting a better return on investments and building wealth.

“Rich is all relative,” Cuban said in the video on Oct. 18, 2017.

Along with advice like living like a student, not using credit cards, saving six month worth of income and investing savings into a mutual fund, Cuban said that people could invest 10% into cryptocurrency.

“If you’re a true adventurer and you want to throw the Hail Mary, you might take 10% and put it into Bitcoin or Ethereum.”

Cuban cautioned that investors who go this route should treat the investment like collecting art, baseball cards and shoes as items that are only “worth what somebody else will pay for it.”

“If you do that you’ve got to pretend you’ve already lost your money.”

While Cuban said the investment advice at the time was “a flyer,” anyone following the thought on that day likely knows they are sitting on a highly-valuable investment.

Someone who invested $1,000 in Bitcoin at its high price of $5,603.82 on Oct. 18, 2017, could have bought 0.1784 BTC. Today, that investment would be worth $11,838.45, up 1,083.8% from the time of Cuban’s comments.

The same $1,000 invested in Ethereum (CRYPTO: ETH), the other cryptocurrency mentioned by Cuban, could have bought 3.1815 ETH based on a price of $314.32 at the time. The $1,000 investment would be worth $8,232.67 today, up 723.3%.

An investor who split the $1,000 equally between the two cryptocurrencies could have bought 0.0892 BTC and 1.5907 ETH. The investments would be worth $5,919.22 and $4,116.21, respectively, for a total of $10,035.43, up 903.5%.

Trending: Powell’s moves don’t have to doom your high yields. You can still make great returns in private credit. Find out how.

Why It’s Important: While Cuban’s comments weren’t complete investment advice and just an idea of how people could get rich by changing spending and investment habits, the results are worth monitoring.

Cuban suggested saving money and putting it into a mutual fund, which might track the S&P 500.

The same $1,000 invested in the SPDR S&P 500 ETF Trust, which tracks the S&P 500, could have bought 3.91 SPY shares. The investment would be worth $2,276.32 today, up 127.6% over the same time period.

Investing in cryptocurrency when Cuban made the comments outperformed the broader U.S. stock market.

The commentary shows that putting a small amount of money in an investment portfolio into cryptocurrency could produce strong returns over time, despite the sector’s occasional volatility.

Cuban shared in an Ask Me Anything on X earlier this year that he holds positions in several cryptocurrencies including Bitcoin and Ethereum.

The billionaire entrepreneur, who publicly supports Kamala Harris in the 2024 election, has been one of several individuals the vice president has looked to for advice on the cryptocurrency sector.

Interest Rates Are Falling, But These Yields Aren’t Going Anywhere

Lower interest rates mean some investments won’t yield what they did in months past, but you don’t have to lose those gains. Certain private market real estate investments are giving retail investors the opportunity to capitalize on these high-yield opportunities.

Arrived Homes, the Jeff Bezos-backed investment platform, offers a Private Credit Fund. This fund provides access to a pool of short-term loans backed by residential real estate with a target of 7% to 9% net annual yield paid to investors monthly. The best part? Unlike other private credit funds, this one has a minimum investment of only $100.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

This article If You Invested $1,000 In Bitcoin When Mark Cuban Said ‘Throw The Hail Mary,’ Here’s How Much You’d Have Now originally appeared on Benzinga.com