GameU Advances Inclusivity in Video Game Design with Autism In Entertainment Workgroup

GameU signs educational partnership with not-for-profit, Autism in Entertainment, highlighting career pathways in coding for the neurologically diverse

FLEMINGTON, N.J. and IRVINE, Calif., Nov. 20, 2024 /PRNewswire/ — GameU – the provider of premium online coding courses, with a social mission to promote inclusivity in video game design – has signed an educational partnership with California-based not-for-profit initiative, the Autism in Entertainment Workgroup.

Under the terms of the agreement with Orange County Asperger’s Support Group (OCASG), the governing body of Autism in Entertainment (AIE), GameU will both sponsor AIE programs as well as run a series of complimentary game design webinars for AIE members. Delivered by working professionals in the computer game industry, the GameU webinars will teach basics in game design, highlight the strong links between coding proficiency and autism, and provide pathways for future learning.

The first of those webinars, From Consumer to Creator: Becoming a Video Game Developer, will take place Thursday 21st November 2024, 3pm EST.

Register for the first GameU – AIE webinar here: https://us06web.zoom.us/meeting/register/tZwocOippzItHNTD1hlNZcsFtf4V6mwWC26E#/registration

“GameU is focused on equipping students, including those with special needs, with the skills to thrive in today’s and tomorrow’s digital economy,” said GameU President and CEO, Mike Kawas. “AIE’s belief that individuals on the autism spectrum can forge strong careers in entertainment-related fields, including game design, means our missions are well-aligned.

“We’re excited to work alongside AIE to help build career pathways in STEM-based fields for those in our community with high-functioning autism, including game design, coding and 3D modeling.”

OCASG President and Chair of the Autism In Entertainment Workgroup, Judi Uttal, said “Connecting AIE talent with industry-grade learning opportunities is an important aspect of enhancing employment prospects for neurodivergent individuals. We are thrilled to have GameU as our newest educational partner.

“Working hand-in-glove with an autism-friendly game design course provider, like GameU, enables AIE to better-help its members acquire skills and industry connections that pave the way to employment,” said Uttal. “The AIE – GameU Education Partnership is an example of tangible benefits that help drive inclusivity and diversity in the entertainment sector.”

For a free trial, of any one of GameU’s 1-to-1 All Abilities classes, sign-up here:

game-u.com/pages/free-trial-abilities

Register for the first GameU – AIE webinar here:

https://us06web.zoom.us/meeting/register/tZwocOippzItHNTD1hlNZcsFtf4V6mwWC26E#/registration

About GameU

GameU is a leading provider of premium online video game design courses, which teach students the skills they need to succeed in the video game industry. With curriculums crafted and taught by education experts and professional game developers, GameU virtually delivers a wide range of programs across three main avenues:

- All Abilities: Private one-to-one classes, tailored to each students’ needs, including neurologically diverse individuals

- For schools and districts: Built for specifically for K-12 school environments, GameU’s Hybrid+ Program transform students’ love of gaming into valuable STEAM skills with a blend of live instruction, on-demand learning and 1-to-1 training for in-classroom educators

- On-demand: Access to recorded classes, curriculum and game design software via Orbit, GameU’s Self-Guided Learning Platform

GameU provides a comprehensive learning experience that includes both live instruction and self-paced study. GameU is dedicated to empowering students and educators alike, helping them stay ahead of industry trends, to prepare them for the future of game development.

For more information, visit game-u.com

To keep up-to-date with GameU classes, programs, events and more, follow GameU on social media: LinkedIn (GameU), Facebook (@GameUSchool), YouTube (@Gameunj), Instagram (@gameuschool), TikTok (@gameuschool_), X (@GameUSchool)

For regular news and thought leadership regarding video game design, video game coding and more, subscribe to GameU’s blog here: www.game-u.com/pages/contact-us

About Autism in Entertainment

Autism in Entertainment (AIE) is the result of a strategic collaboration between the non-profit Orange County Asperger’s Support Group (OCASG), disability-focused staffing and consulting firm Zavikon, and generous grant funding from the California Department of Developmental Services (DDS). AIE seeks to connect entertainment top brass with work-ready job candidates who are on the spectrum. Established in May 2022, the Autism In Entertainment Workgroup includes educators, professionals, and family members who believe that individuals on the autism spectrum can contribute in entertainment-related fields, including film, television, social media, and game design. The goal of AIE is to drive employment efforts in entertainment-related careers.

For more information, visit autisminentertainment.org

About Orange County Asperger’s Support Group (OCASG)

The Orange County Asperger’s Support Group (OCASG) is the proud parent organization of Autism in Entertainment (AIE). OCASG is a nonprofit organization dedicated to improving the quality of life for autistic teens, adults, and their families in the community. We achieve this through providing support, organizing social activities, and education. Our goal is to empower the autism community by creating a safe and welcoming environment where individuals and families can connect with others who share similar experiences and challenges. We believe that through support and education, individuals with autism can achieve their full potential and become valued members of the community. For more information, visit www.ocaspergers.org or contact ocasupport@gmail.com

For further media information, interviews or images, please contact:

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/gameu-advances-inclusivity-in-video-game-design-with-autism-in-entertainment-workgroup-302311089.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/gameu-advances-inclusivity-in-video-game-design-with-autism-in-entertainment-workgroup-302311089.html

SOURCE GameU

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Thompson Thrift Hosts Ribbon Cutting for The Maddox, a Luxury Apartment Community Near Phoenix

PHOENIX, Nov. 19, 2024 /PRNewswire/ — Thompson Thrift, a full-service nationally recognized real estate company and one of the nation’s leading multifamily developers, hosted a ribbon cutting for The Maddox in the Phoenix suburb of Buckeye on Thursday, November 14, with Mayor Eric Orsborn in attendance. The first residents began moving into the 252-unit Class A multifamily community in the third quarter of 2024, and Thompson Thrift expects construction to be completed by January 2025.

“Thompson Thrift is well-versed in meeting the needs and desires of Arizona residents after delivering a variety of luxury multifamily communities throughout the Phoenix area,” said Tamera Greene, vice president of community management, west for Thompson Thrift. “When residents choose The Maddox for their home, they will enjoy distinct features and amenities carefully curated to maximize style, luxury and convenience.”

Located at 23683 W Yuma Rd. near Interstate 10, The Maddox consists of seven, three-story garden style structures with 80 detached garages. The one-, two- and three-bedroom layouts average nearly 1,000 square feet and feature luxury amenities including gourmet kitchens with elegant quartz countertops, timeless tile backsplash, stainless steel appliances, designer fixtures and finishes, Alexa-compatible smart hub to integrate all smart devices, smart thermostat and smart door locks, walk-in closets, full-size washers and dryers, as well as patio, balcony, and private yard options.

At the ribbon cutting, visitors were able to view model tours and preview community amenities such as a professionally decorated clubhouse, resort-style heated swimming pool, 24-hour fitness center, Amazon Package Hub, thoughtfully designed courtyards, grilling stations, outdoor game area, firepits with seating area, a dog park, pet spa with grooming station, pickleball court and more.

In support of Thompson Thrift’s commitment to community outreach, they presented a check to local non-profit Special Olympics Arizona. Special Olympics Arizona has been serving the people of Arizona since 1975, providing year-round sports training and athletic competition in a variety of Olympic-type sports for children and adults with intellectual disabilities. Today they work with more than 21,000 athletes and nearly 25,000 volunteers, striving to create a better world by fostering the acceptance and inclusion of all people.

Thompson Thrift is a full-service real estate development company focused on multifamily, ground-up commercial and mixed-use development across the Midwest, Southeast and Southwest. For nearly 40 years, Thompson Thrift has invested more than $6 billion into local communities and has become known as a trusted partner committed to developing high-quality, attractive multifamily, commercial and industrial projects.

About Thompson Thrift Real Estate Company

Thompson Thrift is an integrated full-service real estate company with offices in Indianapolis and Terre Haute, Indiana; Denver; Houston and Phoenix. Three business units drive Thompson Thrift’s success—Thompson Thrift Residential which is focused on upscale Class A multifamily communities and luxury leased homes, Thompson Thrift Commercial which is focused on ground-up commercial development, and Thompson Thrift Construction, a full-service construction company. Through these business units, Thompson Thrift is engaged in all aspects of development, construction, leasing, and management of quality commercial real estate projects across the country. The company earned national recognition as a winner of a 2024 Top Workplaces USA award, the latest accolade that reflects the company’s ongoing commitment to excellence in the community and workplace. For more information, please visit www.thompsonthrift.com

Contact:

Jennifer Franklin

Spotlight Marketing Communications

949.427.1385

jennifer@spotlightmarcom.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/thompson-thrift-hosts-ribbon-cutting-for-the-maddox-a-luxury-apartment-community-near-phoenix-302310326.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/thompson-thrift-hosts-ribbon-cutting-for-the-maddox-a-luxury-apartment-community-near-phoenix-302310326.html

SOURCE Thompson Thrift

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yatsen Announces Third Quarter 2024 Financial Results

Conference Call to Be Held at 7:30 A.M. U.S. Eastern Time on November 20, 2024

GUANGZHOU, China, Nov. 20, 2024 /PRNewswire/ — Yatsen Holding Limited (“Yatsen” or the “Company”) YSG, a leading China-based beauty group, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Highlights

- Total net revenues for the third quarter of 2024 decreased by 5.7% to RMB677.0 million (US$96.5 million) from RMB718.1 million for the prior year period.

- Total net revenues from Skincare Brands[1] for the third quarter of 2024 increased by 3.6% to RMB267.9 million (US$38.2 million) from RMB258.5 million for the prior year period. As a percentage of total net revenues, total net revenues from Skincare Brands for the third quarter of 2024 were 39.6%, as compared with 36.0% for the prior year period.

- Gross margin for the third quarter of 2024 increased to 75.9% from 71.4% for the prior year period.

- Net loss for the third quarter of 2024 was RMB121.1 million (US$17.3 million), as compared with RMB197.9 million for the prior year period. Non-GAAP net loss[2] for the third quarter of 2024 was RMB76.6 million (US$10.9 million), as compared with RMB130.2 million for the prior year period.

Mr. Jinfeng Huang, Founder, Chairman and Chief Executive Officer of Yatsen, stated, “China’s beauty industry encountered significant challenges in the third quarter, with beauty sales declining year over year for four consecutive months from June to September. Against this backdrop, our three major clinical and premium skincare brands, including Galénic, DR.WU and Eve Lom, delivered another solid performance, bolstering our skincare segment overall. Going forward, we will continue to execute our development strategy, enhancing brand equity and product mix while further optimizing our cost structure to drive growth and profitability.”

Mr. Donghao Yang, Director and Chief Financial Officer of Yatsen, commented, “Our third quarter total net revenues declined by 5.7% year over year in line with our previous guidance. However, our three major skincare brands together continued to grow steadily, with combined net revenues increasing by 10.5% year over year. Furthermore, we improved our gross margin to 75.9% from 71.4% in the prior year period, while narrowing our net loss margin and non-GAAP net loss margin to 17.9% and 11.3%, respectively. We remain confident in our strategy and execution capabilities, and committed to propelling the Company’s sustainable development.”

Third Quarter 2024 Financial Results

Net Revenues

Total net revenues for the third quarter of 2024 decreased by 5.7% to RMB677.0 million (US$96.5 million) from RMB718.1 million for the prior year period. The decrease was primarily due to a 10.0% year-over-year decrease in net revenues from Color Cosmetics Brands,[3] partially offset by a 3.6% year-over-year increase in net revenues from Skincare Brands.

Gross Profit and Gross Margin

Gross profit for the third quarter of 2024 increased by 0.2% to RMB513.8 million (US$73.2 million) from RMB512.8 million for the prior year period. Gross margin for the third quarter of 2024 increased to 75.9% from 71.4% for the prior year period. The increase was primarily driven by an increase in sales of higher-gross-margin products.

Operating Expenses

Total operating expenses for the third quarter of 2024 decreased by 12.0% to RMB655.2 million (US$93.4 million) from RMB744.3 million for the prior year period. As a percentage of total net revenues, total operating expenses for the third quarter of 2024 were 96.8%, as compared with 103.6% for the prior year period.

- Fulfillment Expenses. Fulfillment expenses for the third quarter of 2024 were RMB50.4 million (US$7.2 million), as compared with RMB56.0 million for the prior year period. As a percentage of total net revenues, fulfillment expenses for the third quarter of 2024 decreased to 7.4% from 7.8% for the prior year period. The decrease was primarily due to an increase in the overall average selling price of the Company’s products, as well as further improvements in logistics efficiency.

- Selling and Marketing Expenses. Selling and marketing expenses for the third quarter of 2024 were RMB494.4 million (US$70.4 million), as compared with RMB511.7 million for the prior year period. As a percentage of total net revenues, selling and marketing expenses for the third quarter of 2024 increased to 73.0% from 71.3% for the prior year period. The increase was primarily due to increased investments in the Douyin platform, in line with the growing revenue contribution from Douyin, partially offset by lower marketing expenses as a result of the Company’s more strategic marketing spending.

- General and Administrative Expenses. General and administrative expenses for the third quarter of 2024 were RMB85.0 million (US$12.1 million), as compared with RMB151.8 million for the prior year period. As a percentage of total net revenues, general and administrative expenses for the third quarter of 2024 decreased to 12.6% from 21.1% for the prior year period. The decrease was primarily attributable to lower payroll expenses resulting from a reduction in general and administrative headcount and lower share-based compensation expenses.

- Research and Development Expenses. Research and development expenses for the third quarter of 2024 were RMB25.3 million (US$3.6 million), as compared with RMB24.7 million for the prior year period. As a percentage of total net revenues, research and development expenses for the third quarter of 2024 increased to 3.7% from 3.4% for the prior year period. The increase was primarily attributable to the deleveraging effect of lower total net revenues in the third quarter of 2024.

Loss from Operations

Loss from operations for the third quarter of 2024 was RMB141.3 million (US$20.1 million), as compared with RMB231.5 million for the prior year period. Operating loss margin was 20.9%, as compared with 32.2% for the prior year period.

Non-GAAP loss from operations[4] for the third quarter of 2024 was RMB98.5 million (US$14.0 million), as compared with RMB164.6 million for the prior year period. Non-GAAP operating loss margin was 14.5%, as compared with 22.9% for the prior year period.

Net Loss

Net loss for the third quarter of 2024 was RMB121.1 million (US$17.3 million), as compared with RMB197.9 million for the prior year period. Net loss margin was 17.9%, as compared with 27.6% for the prior year period. Net loss attributable to Yatsen’s ordinary shareholders per diluted ADS[5] for the third quarter of 2024 was RMB1.22 (US$0.17), as compared with RMB1.81 for the prior year period.

Non-GAAP net loss for the third quarter of 2024 was RMB76.6 million (US$10.9 million), as compared with RMB130.2 million for the prior year period. Non-GAAP net loss margin was 11.3%, as compared with 18.1% for the prior year period. Non-GAAP net loss attributable to Yatsen’s ordinary shareholders per diluted ADS[6] for the third quarter of 2024 was RMB0.77 (US$0.11), as compared with RMB1.19 for the prior year period.

Balance Sheet and Cash Flow

As of September 30, 2024, the Company had cash, restricted cash and short-term investments of RMB1.31 billion (US$186.5 million), as compared with RMB2.08 billion as of December 31, 2023.

Net cash used in operating activities for the third quarter of 2024 was RMB175.9 million (US$25.1 million), as compared with RMB163.4 million for the prior year period.

Business Outlook

For the fourth quarter of 2024, the Company expects its total net revenues to be between RMB1.07 billion and RMB1.18 billion, representing a year-over-year increase of approximately 0% to 10%. These forecasts reflect the Company’s current and preliminary views on the market and operational conditions, which are subject to change.

Exchange Rate

This announcement contains translations of certain Renminbi (“RMB”) amounts into U.S. dollars (“US$”) at specified rates solely for the convenience of the reader. Unless otherwise noted, all translations from RMB to US$ were made at a rate of RMB7.0176 to US$1.00, the exchange rate in effect as of September 30, 2024, as set forth in the H.10 statistical release of The Board of Governors of the Federal Reserve System. The Company makes no representation that any RMB or US$ amounts could have been, or could be, converted into US$ or RMB, as the case may be, at any particular rate, or at all.

|

[1] Include net revenues from Galénic, DR.WU (its mainland China business), Eve Lom and other skincare brands of the Company. |

|

[2] Non-GAAP net loss is a non-GAAP financial measure. Effective from the fourth quarter of 2023, non-GAAP net loss is defined as net loss excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, (iv) impairment of goodwill and (v) tax effects on non-GAAP adjustments. Non-GAAP net loss for the prior year period presented in this document is also calculated in the same manner. |

|

[3] Include Perfect Diary, Little Ondine, Pink Bear and other color cosmetics brands of the Company. |

|

[4] Non-GAAP loss from operations is a non-GAAP financial measure. Effective from the fourth quarter of 2023, non-GAAP loss from operations is defined as loss from operations excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions and (iii) impairment of goodwill. Non-GAAP loss from operations for the prior year period presented in this document is also calculated in the same manner. |

|

[5] ADS refers to American depositary shares, each of which represents twenty Class A ordinary shares, effective from March 18, 2024. Prior to that date, each ADS represented four Class A ordinary shares. Unless otherwise stated, the current ADS ratio has been applied retrospectively to all periods presented in this document. |

|

[6] Non-GAAP net loss attributable to ordinary shareholders per diluted ADS is a non-GAAP financial measure. Non-GAAP net loss attributable to ordinary shareholders per diluted ADS is defined as non-GAAP net loss attributable to ordinary shareholders divided by the weighted average number of diluted ADS outstanding for computing diluted earnings per ADS. Effective from the fourth quarter of 2023, non-GAAP net loss attributable to ordinary shareholders is defined as net loss attributable to ordinary shareholders excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, (iv) impairment of goodwill, (v) tax effects on non-GAAP adjustments and (vi) accretion to redeemable non-controlling interests. Non-GAAP net loss attributable to ordinary shareholders per diluted ADS for the prior year period presented in this document is also calculated in the same manner. |

Conference Call Information

The Company’s management will hold a conference call on Wednesday, November 20, 2024, at 7:30 A.M. U.S. Eastern Time or 8:30 P.M. Beijing Time to discuss its financial results and operating performance for the third quarter 2024.

|

United States (toll free): |

+1-888-346-8982 |

|

International: |

+1-412-902-4272 |

|

Mainland China (toll free): |

400-120-1203 |

|

Hong Kong, SAR (toll free): |

800-905-945 |

|

Hong Kong, SAR: |

+852-3018-4992 |

|

Conference ID: |

6604822 |

The replay will be accessible through Wednesday, November 27, by dialing the following numbers:

|

United States: |

+1-877-344-7529 |

||||||

|

International: |

+1-412-317-0088 |

||||||

|

Replay Access Code: |

6604822 |

A live and archived webcast of the conference call will also be available on the Company’s investor relations website at http://ir.yatsenglobal.com.

About Yatsen Holding Limited

Yatsen Holding Limited YSG is a leading China-based beauty group with the mission of creating an exciting new journey of beauty discovery for consumers around the world. Founded in 2016, the Company has launched and acquired numerous color cosmetics and skincare brands including Perfect Diary, Little Ondine, Pink Bear, Galénic, DR.WU (its mainland China business), Eve Lom and EANTiM. The Company’s flagship brand, Perfect Diary, is one of the leading color cosmetics brands in China in terms of retail sales value. The Company primarily reaches and engages with customers directly both online and offline, with expansive presence across all major e-commerce, social and content platforms in China.

For more information, please visit http://ir.yatsenglobal.com.

Use of Non-GAAP Financial Measures

The Company uses non-GAAP income (loss) from operations, non-GAAP net income (loss), non-GAAP net income (loss) attributable to ordinary shareholders and non-GAAP net income (loss) attributable to ordinary shareholders per diluted ADS, each a non-GAAP financial measure, in reviewing and assessing its operating performance. The presentation of these non-GAAP financial measures is not intended to be considered in isolation or as a substitute for the financial information prepared and presented in accordance with U.S. GAAP. The Company presents these non-GAAP financial measures because they are used by the management to evaluate operating performance and formulate business plans. Non-GAAP financial measures help identify underlying trends in its business, provide further information about its results of operations, and enhance the overall understanding of its past performance and future prospects. The Company defines non-GAAP income (loss) from operations as income (loss) from operations excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions and (iii) impairment of goodwill. The Company defines non-GAAP net income (loss) as net income (loss) excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, (iv) impairment of goodwill and (v) tax effects on non-GAAP adjustments. The Company defines non-GAAP net income (loss) attributable to ordinary shareholders as net income (loss) attributable to ordinary shareholders excluding (i) share-based compensation expenses, (ii) amortization of intangible assets resulting from assets and business acquisitions, (iii) revaluation of investments on the share of equity method investments, (iv) impairment of goodwill, (v) tax effects on non-GAAP adjustments and (vi) accretion to redeemable non-controlling interests. Non-GAAP net income (loss) attributable to ordinary shareholders per diluted ADS is computed using non-GAAP net income (loss) attributable to ordinary shareholders divided by weighted average number of diluted ADS outstanding for computing diluted earnings per ADS.

However, the non-GAAP financial measures have limitations as analytical tools as the non-GAAP financial measures are not presented in accordance with U.S. GAAP and may differ from the non-GAAP information used by other companies, including peer companies, and therefore their comparability may be limited. The Company compensates for these limitations by reconciling the non-GAAP financial measures to the nearest U.S. GAAP performance measure, all of which should be considered when evaluating performance. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure. Reconciliations of Yatsen’s non-GAAP financial measure to the most comparable U.S. GAAP measure are included at the end of this press release.

Safe Harbor Statement

This announcement contains statements that may constitute “forward-looking” statements which are made pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,” “plans,” “believes,” “estimates,” “likely to,” and similar statements. The Company may also make written or oral forward-looking statements in its periodic reports to the Securities and Exchange Commission (“SEC”), in its annual report to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the Company’s beliefs, plans, outlook and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: the Company’s growth strategies; its future business development, results of operations and financial condition; its ability to continue to roll out popular products and maintain popularity of existing products; its ability to anticipate and respond to changes in industry trends and consumer preferences and behavior in a timely manner; its ability to attract and retain new customers and to increase revenues generated from repeat customers; its expectations regarding demand for and market acceptance of its products and services; its ability to integrate newly-acquired businesses and brands; trends and competition in and relevant government policies and regulations relating to China’s beauty market; changes in its revenues and certain cost or expense items; and general economic conditions globally and in China. Further information regarding these and other risks is included in the Company’s filings with the SEC. All information provided in this press release is as of the date of this press release, and the Company does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

For investor and media inquiries, please contact:

In China:

Yatsen Holding Limited

Investor Relations

E-mail: ir@yatsenglobal.com

Piacente Financial Communications

Hui Fan

Tel: +86-10-6508-0677

E-mail: yatsen@thepiacentegroup.com

In the United States:

Piacente Financial Communications

Brandi Piacente

Tel: +1-212-481-2050

E-mail: yatsen@thepiacentegroup.com

|

YATSEN HOLDING LIMITED |

||||||||||||

|

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS |

||||||||||||

|

(All amounts in thousands, except for share, per share data or otherwise noted) |

||||||||||||

|

December 31, |

September 30, |

September 30, |

||||||||||

|

2023 |

2024 |

2024 |

||||||||||

|

RMB’000 |

RMB’000 |

USD’000 |

||||||||||

|

Assets |

||||||||||||

|

Current assets |

||||||||||||

|

Cash and cash equivalents |

836,888 |

503,075 |

71,688 |

|||||||||

|

Restricted Cash |

21,248 |

– |

– |

|||||||||

|

Short-term investments |

1,218,481 |

805,851 |

114,833 |

|||||||||

|

Accounts receivable, net |

198,851 |

208,285 |

29,680 |

|||||||||

|

Inventories, net |

352,090 |

438,419 |

62,474 |

|||||||||

|

Prepayments and other current assets |

303,841 |

431,583 |

61,500 |

|||||||||

|

Amounts due from related parties |

20,200 |

7,181 |

1,023 |

|||||||||

|

Total current assets |

2,951,599 |

2,394,394 |

341,198 |

|||||||||

|

Non-current assets |

||||||||||||

|

Investments |

618,752 |

628,355 |

89,540 |

|||||||||

|

Property and equipment, net |

64,878 |

72,315 |

10,305 |

|||||||||

|

Goodwill, net |

556,567 |

571,129 |

81,385 |

|||||||||

|

Intangible assets, net |

671,396 |

638,079 |

90,926 |

|||||||||

|

Deferred tax assets |

1,375 |

1,426 |

203 |

|||||||||

|

Right-of-use assets, net |

114,348 |

129,303 |

18,426 |

|||||||||

|

Other non-current assets |

27,100 |

25,728 |

3,666 |

|||||||||

|

Total non-current assets |

2,054,416 |

2,066,335 |

294,451 |

|||||||||

|

Total assets |

5,006,015 |

4,460,729 |

635,649 |

|||||||||

|

Liabilities, redeemable non-controlling interests and |

||||||||||||

|

Current liabilities |

||||||||||||

|

Accounts payable |

105,691 |

70,781 |

10,086 |

|||||||||

|

Advances from customers |

41,579 |

31,604 |

4,504 |

|||||||||

|

Accrued expenses and other liabilities |

391,217 |

392,448 |

55,923 |

|||||||||

|

Amounts due to related parties |

9,431 |

14,832 |

2,114 |

|||||||||

|

Income tax payables |

17,946 |

19,112 |

2,723 |

|||||||||

|

Lease liabilities due within one year |

45,464 |

47,484 |

6,766 |

|||||||||

|

Total current liabilities |

611,328 |

576,261 |

82,116 |

|||||||||

|

Non-current liabilities |

||||||||||||

|

Deferred tax liabilities |

111,591 |

111,972 |

15,956 |

|||||||||

|

Deferred income-non current |

30,556 |

18,401 |

2,622 |

|||||||||

|

Lease liabilities |

67,767 |

83,042 |

11,833 |

|||||||||

|

Total non-current liabilities |

209,914 |

213,415 |

30,411 |

|||||||||

|

Total liabilities |

821,242 |

789,676 |

112,527 |

|||||||||

|

Redeemable non-controlling interests |

51,466 |

49,737 |

7,087 |

|||||||||

|

Shareholders’ equity |

||||||||||||

|

Ordinary Shares (US$0.00001 par value; 10,000,000,000 ordinary |

173 |

173 |

25 |

|||||||||

|

Treasury shares |

(864,568) |

(1,066,199) |

(151,932) |

|||||||||

|

Additional paid-in capital |

12,260,208 |

12,263,026 |

1,747,467 |

|||||||||

|

Statutory reserve |

24,177 |

24,177 |

3,445 |

|||||||||

|

Accumulated deficit |

(7,345,153) |

(7,669,093) |

(1,092,837) |

|||||||||

|

Accumulated other comprehensive income |

60,200 |

76,710 |

10,933 |

|||||||||

|

Total Yatsen Holding Limited shareholders’ equity |

4,135,037 |

3,628,794 |

517,101 |

|||||||||

|

Non-controlling interests |

(1,730) |

(7,478) |

(1,066) |

|||||||||

|

Total shareholders’ equity |

4,133,307 |

3,621,316 |

516,035 |

|||||||||

|

Total liabilities, redeemable non-controlling interests and |

5,006,015 |

4,460,729 |

635,649 |

|||||||||

|

YATSEN HOLDING LIMITED |

|||||||||||||

|

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|||||||||||||

|

(All amounts in thousands, except for share, per share data or otherwise noted) |

|||||||||||||

|

For the Three Months Ended September 30, |

|||||||||||||

|

2023 |

2024 |

2024 |

|||||||||||

|

RMB’000 |

RMB’000 |

USD’000 |

|||||||||||

|

Total net revenues |

718,125 |

677,016 |

96,474 |

||||||||||

|

Total cost of revenues |

(205,325) |

(163,191) |

(23,255) |

||||||||||

|

Gross profit |

512,800 |

513,825 |

73,219 |

||||||||||

|

Operating expenses: |

|||||||||||||

|

Fulfilment expenses |

(56,025) |

(50,412) |

(7,184) |

||||||||||

|

Selling and marketing expenses |

(511,706) |

(494,357) |

(70,445) |

||||||||||

|

General and administrative expenses |

(151,830) |

(85,046) |

(12,119) |

||||||||||

|

Research and development expenses |

(24,739) |

(25,338) |

(3,611) |

||||||||||

|

Total operating expenses |

(744,300) |

(655,153) |

(93,359) |

||||||||||

|

Loss from operations |

(231,500) |

(141,328) |

(20,140) |

||||||||||

|

Financial income |

30,319 |

7,722 |

1,100 |

||||||||||

|

Foreign currency exchange gain |

1,800 |

12,825 |

1,828 |

||||||||||

|

Loss from equity method investments, net |

(6,655) |

(6,510) |

(928) |

||||||||||

|

Other income, net |

8,780 |

6,239 |

889 |

||||||||||

|

Loss before income tax expenses |

(197,256) |

(121,052) |

(17,251) |

||||||||||

|

Income tax expenses |

(654) |

(4) |

(1) |

||||||||||

|

Net loss |

(197,910) |

(121,056) |

(17,252) |

||||||||||

|

Net loss (income) attributable to non-controlling interests and |

1,371 |

(11) |

(2) |

||||||||||

|

Net loss attributable to Yatsen’s shareholders |

(196,539) |

(121,067) |

(17,254) |

||||||||||

|

Shares used in calculating loss per share (1): |

|||||||||||||

|

Weighted average number of Class A and Class B ordinary shares: |

|||||||||||||

|

Basic |

2,173,360,208 |

1,986,538,509 |

1,986,538,509 |

||||||||||

|

Diluted |

2,173,360,208 |

1,986,538,509 |

1,986,538,509 |

||||||||||

|

Net loss per Class A and Class B ordinary share |

|||||||||||||

|

Basic |

(0.09) |

(0.06) |

(0.01) |

||||||||||

|

Diluted |

(0.09) |

(0.06) |

(0.01) |

||||||||||

|

Net loss per ADS (20 ordinary shares equal to 1 ADS) (2) |

|||||||||||||

|

Basic |

(1.81) |

(1.22) |

(0.17) |

||||||||||

|

Diluted |

(1.81) |

(1.22) |

(0.17) |

||||||||||

|

For the Three Months Ended September 30, |

|||||||||||||

|

2023 |

2024 |

2024 |

|||||||||||

|

Share-based compensation expenses are included in the |

RMB’000 |

RMB’000 |

USD’000 |

||||||||||

|

Fulfilment expenses |

767 |

252 |

36 |

||||||||||

|

Selling and marketing expenses |

9,485 |

2,289 |

326 |

||||||||||

|

General and administrative expenses |

42,635 |

23,743 |

3,383 |

||||||||||

|

Research and development expenses |

24 |

763 |

109 |

||||||||||

|

Total |

52,911 |

27,047 |

3,854 |

||||||||||

|

(1) Authorized share capital is re-classified and re-designated into Class A ordinary shares and Class B ordinary shares, with each |

|||||||||||||

|

(2) Effective from March 18, 2024, the Company changed its ADS to Class A Ordinary Share ratio from one ADS representing |

|||||||||||||

|

YATSEN HOLDING LIMITED |

|||||||||||||

|

UNAUDITED RECONCILIATIONS OF GAAP AND NON-GAAP RESULTS |

|||||||||||||

|

(All amounts in thousands, except for share, per share data or otherwise noted) |

|||||||||||||

|

For the Three Months Ended September 30, |

|||||||||||||

|

2023 |

2024 |

2024 |

|||||||||||

|

RMB’000 |

RMB’000 |

USD’000 |

|||||||||||

|

Loss from operations |

(231,500) |

(141,328) |

(20,140) |

||||||||||

|

Share-based compensation expenses |

52,911 |

27,047 |

3,854 |

||||||||||

|

Amortization of intangible assets resulting from assets and |

13,956 |

15,779 |

2,248 |

||||||||||

|

Non-GAAP loss from operations |

(164,633) |

(98,502) |

(14,038) |

||||||||||

|

Net loss |

(197,910) |

(121,056) |

(17,252) |

||||||||||

|

Share-based compensation expenses |

52,911 |

27,047 |

3,854 |

||||||||||

|

Amortization of intangible assets resulting from assets and |

13,956 |

15,779 |

2,248 |

||||||||||

|

Revaluation of investments on the share of equity method |

3,227 |

3,266 |

465 |

||||||||||

|

Tax effects on non-GAAP adjustments |

(2,430) |

(1,586) |

(226) |

||||||||||

|

Non-GAAP net loss |

(130,246) |

(76,550) |

(10,911) |

||||||||||

|

Net loss attributable to Yatsen’s shareholders |

(196,539) |

(121,067) |

(17,254) |

||||||||||

|

Share-based compensation expenses |

52,911 |

27,047 |

3,854 |

||||||||||

|

Amortization of intangible assets resulting from assets and |

13,701 |

15,385 |

2,192 |

||||||||||

|

Revaluation of investments on the share of equity method |

3,227 |

3,266 |

465 |

||||||||||

|

Tax effects on non-GAAP adjustments |

(2,430) |

(1,559) |

(222) |

||||||||||

|

Non-GAAP net loss attributable to Yatsen’s shareholders |

(129,130) |

(76,928) |

(10,965) |

||||||||||

|

Shares used in calculating loss per share: |

|||||||||||||

|

Weighted average number of Class A and Class B ordinary shares: |

|||||||||||||

|

Basic |

2,173,360,208 |

1,986,538,509 |

1,986,538,509 |

||||||||||

|

Diluted |

2,173,360,208 |

1,986,538,509 |

1,986,538,509 |

||||||||||

|

Non-GAAP net loss attributable to ordinary shareholders per |

|||||||||||||

|

Basic |

(0.06) |

(0.04) |

(0.01) |

||||||||||

|

Diluted |

(0.06) |

(0.04) |

(0.01) |

||||||||||

|

Non-GAAP net loss attributable to ordinary shareholders per |

|||||||||||||

|

Basic |

(1.19) |

(0.77) |

(0.11) |

||||||||||

|

Diluted |

(1.19) |

(0.77) |

(0.11) |

||||||||||

|

(1) Effective from March 18, 2024, the Company changed its ADS to Class A Ordinary Share ratio from one ADS representing |

|||||||||||||

![]() View original content:https://www.prnewswire.com/news-releases/yatsen-announces-third-quarter-2024-financial-results-302311003.html

View original content:https://www.prnewswire.com/news-releases/yatsen-announces-third-quarter-2024-financial-results-302311003.html

SOURCE Yatsen Holding Limited

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SpaceX's Starlink Enables Real Time Views Of Earth During Starship's 6th Test Flight: Could It Be The Future Of Space Connectivity?

SpaceX’s Starlink revealed that it enabled real-time views of Earth during the sixth flight test of Starship.

What Happened: Starlink, the satellite internet segment of SpaceX, announced via a tweet that it had enabled real-time views of Earth during the sixth flight test of Starship.

This comes as SpaceX continues to increase its launch cadence, with 17 launches in the last 31 days, including the launch of 24 Starlink satellites to low-Earth orbit from Florida.

“Starlink enabled real-time views of Earth during Starship’s sixth flight test earlier today,” the Elon Musk-owned satellite internet service provider said in a post on X.

Starlink operates a constellation of satellites around the world to offer internet connectivity to its more than four million subscribers. Musk recently said that Starlink is SpaceX’s primary source of funding for the Starship program, with contributions from NASA, too.

“Starlink is how we are paying for humanity to get to Mars. That’s why there is a Hohmann transfer orbit diagram on the Starlink router.”

With Starlink demonstrating the capability of live streaming during re-entry and landing, its capabilities could eventually be leveraged to offer connectivity on future space missions.

Starship, a rocket designed to transport astronauts to the moon and Mars, successfully launched from SpaceX’s Texas rocket development site, with the first stage booster, Super Heavy, detaching at an altitude of about 40 miles.

While SpaceX is currently a privately held company, investors can leverage Destiny Tech100 Inc. DXYZ to participate in the Musk-led space company’s growth. According to data from Benzinga Pro, DXYZ has gained over 198% in the past 6 months.

Why It Matters: The successful launch and the real-time views enabled by Starlink are significant milestones for SpaceX. The company’s CEO, Musk, has been vocal about his vision for space exploration and colonization, and Starship plays a crucial role in this vision.

Gwynne Shotwell, COO of SpaceX, recently stated that Starlink is expected to become profitable in 2024. With over 7,000 Starlink satellites launched to date, the company is building 50-60 satellites per week as it expands its network in low-earth orbit.

Moreover, NASA has endorsed the initial deployment of 400 Starlink satellites closer to Earth and is conducting a study to assess the impact of this deployment on travel to and from the International Space Station (ISS.)

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Resonance Consultancy Reveals the World's Best Cities for 2025

LONDON, Nov. 20, 2024 (GLOBE NEWSWIRE) — Resonance is a leading advisor in place strategy, place branding, and place marketing, and its annual World’s Best Cities rankings quantify and benchmark the relative quality of place, reputation and competitive identity of the planet’s metropolitan areas with a metro population of 1M or more.

The Best Cities data is lauded as one of the world’s most thorough annual city rankings, based on original methodology that analyzes both the performance and perception of cities around the world.

The 10th annual World’s Best Cities rankings—powered this year by a new partnership with Ipsos—is an important, timely analysis of the urban regions that are leading in the areas most important to attracting workforce, visitors and businesses.

Download the 2025 World’s Best Cities Report and all 100 city profiles at WorldsBestCities.com.

Learn more about how Resonance Consultancy can help your city or community at ResonanceCo.com.

“Resonance once again analyzed the principal cities of global metropolitan areas with populations of more than 1M,” says Resonance President & CEO Chris Fair. “Our goal in producing these reports for a decade now is to create the most comprehensive and holistic approach to measuring and benchmarking both perception and performance of cities available.”

This year’s rankings are more revelatory than ever, powered by Resonance’s new partnership with Ipsos to incorporate perception-based data by surveying more than 22,000 people in 30 countries for the first time—the results of which also demonstrate that people all over the world still very much aspire to live, visit and work in the world’s largest cities.

The overall World’s Best Cities rankings are determined by analyzing this public perception, combined with a wide range of factors that have demonstrated moderate to strong correlations with attracting prime age population (age 25 – 44), visitor expenditure, and/or business formation.

“The phrase ‘perception is reality’ is often used when developing reputation management strategies for companies, but the same holds true for destinations,” says Jason McGrath, Executive Vice President, Head of Corporate Reputation at Ipsos. “By merging the top-of-mind destinations where people tell us they want to live, work and visit with the rigorous evaluation of place that Resonance has been conducting for a decade, we have created a more comprehensive evaluation of cities and can better advise destinations on how to strengthen their reputation.”

Based on each city’s perception and performance for livability, lovability, and prosperity, these are the World’s Top 10 Best Cities for 2025:

1. London, UK

2. New York, USA

3. Paris, France

4. Tokyo, Japan

5. Singapore

6. Rome, Italy

7. Madrid, Spain

8. Barcelona, Spain

9. Berlin, Germany

10. Sydney, Australia

(The full ranking and extensive profiles of all 100 of the World’s Best Cities are available at WorldsBestCities.com.)

Dive deeper into the ranking with the free Secrets of the World’s Best Cities webinar on Dec. 10, 2024.

About Resonance Consultancy

Resonance creates transformative strategies, brands and campaigns that empower destinations, cities and communities to realize their full potential. As leading advisors in real estate, tourism and economic development, Resonance combines expertise in research, strategy, branding and communications to make destinations, cities and developments more valuable and more vibrant. ResonanceCo.com

About Ipsos

Ipsos is one of the largest market research and polling companies globally, operating in 90 markets and employing nearly 20,000 people. Our passionately curious research professionals, analysts and scientists have built unique multi-specialist capabilities that provide true understanding and powerful insights into the actions, opinions and motivations of citizens, consumers, patients, customers or employees. Our 75 business solutions are based on primary data from our surveys, social media monitoring, and qualitative or observational techniques. “Game Changers”—our tagline—summarizes our ambition to help our 5,000 clients navigate with confidence our rapidly changing world. Founded in France in 1975, Ipsos has been listed on the Euronext Paris since July 1, 1999. The company is part of the SBF 120 and Mid-60 indices and is eligible for the Deferred Settlement Service (SRD). ISIN code FR0000073298, Reuters ISOS.PA, Bloomberg IPS:FP www.ipsos.com

About World’s Best Cities

Best Cities is the home of Resonance’s exclusive ranking of the world’s top urban regions. The data is used by leading news outlets, trusted by city leaders, and is widely considered to be the world’s most comprehensive annual city ranking. Bloomberg calls it, “The most comprehensive study of its kind; it identifies cities that are most desirable for locals, visitors, and businesspeople alike, rather than simply looking at livability or tourism appeal.” WorldsBestCities.com | #BestCities

Tom Gierasimczuk Resonance Consultancy 604-649-8664 tom@resonanceco.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SoFi Stock vs. Palantir Stock: Wall Street Expects Earnings to Soar 48% for One and 115% for the Other in 2025

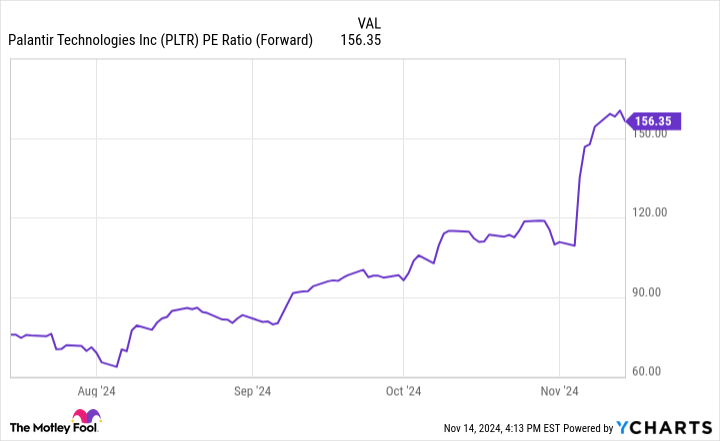

Many tech and artificial intelligence (AI) stocks trade at huge valuations, implying big earnings growth in the years to come, which is why investors are so bullish on these companies. They are buying earnings and growth in the future. The fintech SoFi Technologies (NASDAQ: SOFI) and the artificial intelligence company Palantir Technologies (NYSE: PLTR) both fit this description. Each has had a big year, with SoFi’s stock up over 41% this year and Palantir’s up over 296%.

With 2024 winding down, Wall Street is forecasting 48% earnings growth for one and a whopping 115% earnings growth for the other, according to data provided by Visible Alpha. Is Wall Street too optimistic about these stocks?

Are You Missing The Morning Scoop? Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

Analysts expect Palantir’s diluted earnings per share to rise from $0.21 this year to $0.31 in 2025, implying a nearly 48% upside. Nine brokers provided estimates, with a low estimate of $0.25 and a high estimate of $0.42. Companies and governments use Palantir’s software to analyze vast amounts of data. The platform bridges the gap between complex AI and machine-learning language models and human analysis.

For example, the government uses Palantir in its counter-terrorism efforts to analyze and visualize data from unrelated sources to detect patterns and gain actionable insights. Palantir has raised awareness for its platform with its Artificial Intelligence Platform boot camps. The company allows customers to test out its platform and helps them use the tech to solve real problems with their business.

It’s easy to see how Palantir’s products could be useful for nearly every sector. What’s unclear is how differentiated Palantir is and whether that constitutes a true moat. You could probably say this about most AI businesses right now. Some believe Palantir is a leader, while others are less inclined to agree with its huge valuation.

After a stellar run for the stock, some analysts believe it will be more difficult to maintain the growth because the company will be up against difficult comparables. Palantir’s 48% earnings growth is nothing to sneeze at but it likely doesn’t justify this kind of valuation.

The fintech company SoFi aims to serve customers’ financial needs by providing bank accounts, personal budgeting tools, an investment platform, and loans including mortgages, student loans, and personal loans. SoFi also has a tech division that sells products and services that help power core banking activities for banks and other companies looking to add financial services.

NIO Inc. Reports Unaudited Third Quarter 2024 Financial Results

Quarterly Total Revenues reached RMB18,673.5 million (US$2,661.0 million)i

Quarterly Vehicle Deliveries were 61,855 units

SHANGHAI, Nov. 20, 2024 (GLOBE NEWSWIRE) — NIO Inc. NIO HKEX: 9866,NIO) (“NIO” or the “Company”), a pioneer and a leading company in the global smart electric vehicle market, today announced its unaudited financial results for the third quarter ended September 30, 2024.

Operating Highlights for the Third Quarter of 2024

- Vehicle deliveries were 61,855 in the third quarter of 2024, consisting of 61,023 vehicles from the Company’s premium smart electric vehicle brand NIO and 832 vehicles from the Company’s family-oriented smart electric vehicle brand ONVO, representing an increase of 11.6% from the third quarter of 2023, and an increase of 7.8% from the second quarter of 2024.

| Key Operating Results | ||||

| 2024 Q3 | 2024 Q2 | 2024 Q1 | 2023 Q4 | |

| Deliveries | 61,855 | 57,373 | 30,053 | 50,045 |

| 2023 Q3 | 2023 Q2 | 2023 Q1 | 2022 Q4 | |

| Deliveries | 55,432 | 23,520 | 31,041 | 40,052 |

Financial Highlights for the Third Quarter of 2024

- Vehicle sales were RMB16,697.6 million (US$2,379.4 million) in the third quarter of 2024, representing a decrease of 4.1% from the third quarter of 2023 and an increase of 6.5% from the second quarter of 2024.

- Vehicle marginii was 13.1% in the third quarter of 2024, compared with 11.0% in the third quarter of 2023 and 12.2% in the second quarter of 2024.

- Total revenues were RMB18,673.5 million (US$2,661.0 million) in the third quarter of 2024, representing a decrease of 2.1% from the third quarter of 2023 and an increase of 7.0% from the second quarter of 2024.

- Gross profit was RMB2,007.4 million (US$286.0 million) in the third quarter of 2024, representing an increase of 31.8% from the third quarter of 2023 and an increase of 18.9% from the second quarter of 2024.

- Gross margin was 10.7% in the third quarter of 2024, compared with 8.0% in the third quarter of 2023 and 9.7% in the second quarter of 2024.

- Loss from operations was RMB5,237.8 million (US$746.4 million) in the third quarter of 2024, representing an increase of 8.1% from the third quarter of 2023 and an increase of 0.5% from the second quarter of 2024. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB4,590.7 million (US$654.2 million) in the third quarter of 2024, representing an increase of 8.3% from the third quarter of 2023 and a decrease of 2.3% from the second quarter of 2024.

- Net loss was RMB5,059.7 million (US$721.0 million) in the third quarter of 2024, representing an increase of 11.0% from the third quarter of 2023 and an increase of 0.3% from the second quarter of 2024. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB4,412.6 million (US$628.8 million) in the third quarter of 2024, representing an increase of 11.6% from the third quarter of 2023 and a decrease of 2.7% from the second quarter of 2024.

- Cash and cash equivalents, restricted cash, short-term investment and long-term time deposits were RMB42.2 billion (US$6.0 billion) as of September 30, 2024.

| Key Financial Results for the Third Quarter of 2024 | |||||||||||||

| (in RMB million, except for percentage) | |||||||||||||

| 2024 Q3 | 2024 Q2 | 2023 Q3 | % Changeiii | ||||||||||

| QoQ | YoY | ||||||||||||

| Vehicle Sales | 16,697.6 | 15,679.6 | 17,408.9 | 6.5% | -4.1% | ||||||||

| Vehicle Margin | 13.1% | 12.2% | 11.0% | 90bp | 210bp | ||||||||

| Total Revenues | 18,673.5 | 17,446.0 | 19,066.6 | 7.0% | -2.1% | ||||||||

| Gross Profit | 2,007.4 | 1,688.7 | 1,523.3 | 18.9% | 31.8% | ||||||||

| Gross Margin | 10.7% | 9.7% | 8.0% | 100bp | 270bp | ||||||||

| Loss from Operations | (5,237.8) | (5,209.3) | (4,843.9) | 0.5% | 8.1% | ||||||||

| Adjusted Loss from Operations (non-GAAP) | (4,590.7) | (4,698.5) | (4,240.4) | -2.3% | 8.3% | ||||||||

| Net Loss | (5,059.7) | (5,046.0) | (4,556.7) | 0.3% | 11.0% | ||||||||

| Adjusted Net Loss (non-GAAP) | (4,412.6) | (4,535.2) | (3,953.2) | -2.7% | 11.6% | ||||||||

Recent Developments

Deliveries in October 2024

- The Company delivered 20,976 vehicles in October 2024. The deliveries consisted of 16,657 vehicles from the Company’s premium smart electric vehicle brand NIO, and 4,319 vehicles from the Company’s family-oriented smart electric vehicle brand ONVO. As of October 31, 2024, the Company had delivered 170,257 vehicles in 2024, with cumulative deliveries reaching 619,851.

Launch of ONVO L60

- On September 19, 2024, ONVO’s first model, the L60, a mid-size family smart electric SUV was launched. The production and delivery of the ONVO L60 have been steadily ramping up since late September 2024.

NIO China Strategic Investment

- On September 29, 2024, the Company entered into definitive agreements for investment in NIO Holding Co., Ltd., a PRC subsidiary in which it holds 92.1% controlling equity interest (“NIO China”), with Hefei Jianheng New Energy Automobile Investment Fund Partnership (Limited Partnership), Anhui Provincial Emerging Industry Investment Co., Ltd. and CS Capital Co., Ltd. (collectively, the “Strategic Investors”), pursuant to which the Strategic Investors will invest an aggregate of RMB3.3 billion in cash in NIO China. Concurrently, NIO will invest an aggregate of RMB10 billion in cash in NIO China (collectively, the “Investment Transaction”). Upon completion of the Investment Transaction, NIO will hold 88.3% controlling equity interest in NIO China. In addition, NIO also has the right to invest an additional RMB20 billion in NIO China by December 31, 2025, based on the same price and terms of the Investment Transaction. The Investment Transaction is subject to regulatory and internal approvals, as well as the satisfaction of customary closing conditions. NIO and the Strategic Investors will each inject cash into NIO China in two installments according to the arrangements in the definitive agreements.

CEO and CFO Comments

“In the third quarter of 2024, we achieved a record-breaking delivery of 61,855 smart electric vehicles. NIO brand has firmly secured the top position in China’s BEV market for vehicles priced over RMB 300,000, holding more than a 40% market share in the first three quarters of this year,” said William Bin Li, founder, chairman and chief executive officer of NIO, “Deliveries of the ONVO L60 have also commenced, with production capacity set to rapidly expand in the next few months. The Company’s total delivery volume for the fourth quarter is expected to reach a new record.”

“NIO’s executive flagship, the ET9, is in the final preparation stage of mass production. The ET9 embodies NIO’s full-stack technological expertise with cutting-edge global innovations, and its mass production will further solidify NIO’s positioning in the premium segment. In addition, firefly, a boutique brand positioned in the compact vehicle segment, will be unveiled at NIO Day 2024, further enriching our product portfolio and catering to a larger user base,” added William Bin Li.

“Ongoing cost optimizations helped increase the vehicle gross margin to 13.1% in the third quarter of 2024. With continued expansion in sales volume and steady improvement in gross margin, our free cash flow turned positive this quarter,” added Stanley Yu Qu, NIO’s chief financial officer, “Starting next year, our three brands are poised to embark on a robust product cycle, projected to elevate the Company’s sales volume to new heights. We expect this momentum will drive continued improvements in the Company’s operational and financial performance.”

Financial Results for the Third Quarter of 2024

Revenues

- Total revenues in the third quarter of 2024 were RMB18,673.5 million (US$2,661.0 million), representing a decrease of 2.1% from the third quarter of 2023 and an increase of 7.0% from the second quarter of 2024.

- Vehicle sales in the third quarter of 2024 were RMB16,697.6 million (US$2,379.4 million), representing a decrease of 4.1% from the third quarter of 2023 and an increase of 6.5% from the second quarter of 2024. The slight decrease in vehicle sales over the third quarter of 2023 was mainly due to the lower average selling price as a result of changes in product mix, partially offset by the increase in delivery volume. The increase in vehicle sales over the second quarter of 2024 was mainly attributable to an increase in delivery volume.

- Other sales in the third quarter of 2024 were RMB1,976.0 million (US$281.6 million), representing an increase of 19.2% from the third quarter of 2023 and an increase of 11.9% from the second quarter of 2024. The increase in other sales over the third quarter of 2023 was mainly due to the increase in sales of parts, accessories and after-sales vehicle services, and provision of power solutions, as a result of the continued growth in the number of users, and partially offset by a decrease in revenue from sales of used cars. The increase in other sales over the second quarter of 2024 was mainly due to the increase in sales of parts, accessories and after-sales vehicle services and provision of power solutions, as a result of the continued growth in the number of users.

Cost of Sales and Gross Margin

- Cost of sales in the third quarter of 2024 was RMB16,666.2 million (US$2,374.9 million), representing a decrease of 5.0% from the third quarter of 2023 and an increase of 5.8% from the second quarter of 2024. The decrease in cost of sales over the third quarter of 2023 was mainly attributable to the decreased material cost per vehicle, partially offset by the increase in delivery volume. The increase in cost of sales over the second quarter of 2024 was mainly attributable to the increase in delivery volume, partially offset by the decreased material cost per vehicle.

- Gross profit in the third quarter of 2024 was RMB2,007.4 million (US$286.0 million), representing an increase of 31.8% from the third quarter of 2023 and an increase of 18.9% from the second quarter of 2024.

- Gross margin in the third quarter of 2024 was 10.7%, compared with 8.0% in the third quarter of 2023 and 9.7% in the second quarter of 2024. The increase in gross margin over the third quarter of 2023 was mainly attributable to the increased vehicle margin and the increased sales of parts, accessories and after-sales vehicle services with relatively higher margins. The increase in gross margin over the second quarter of 2024 was mainly attributable to the increased vehicle margin.

- Vehicle margin in the third quarter of 2024 was 13.1%, compared with 11.0% in the third quarter of 2023 and 12.2% in the second quarter of 2024. The increase in vehicle margin from the third quarter of 2023 was mainly attributable to decreased material cost per unit, and partially offset by lower average selling price as a result of changes in product mix. The increase in vehicle margin from the second quarter of 2024 was mainly due to the decreased material cost per unit.

Operating Expenses

- Research and development expenses in the third quarter of 2024 were RMB3,318.7 million (US$472.9 million), representing an increase of 9.2% from the third quarter of 2023 and an increase of 3.1% from the second quarter of 2024. Excluding share-based compensation expenses, research and development expenses (non-GAAP) were RMB2,902.8 million (US$413.6 million), representing an increase of 9.8% from the third quarter of 2023 and an increase of 0.5% from the second quarter of 2024. The increase in research and development expenses over the third quarter of 2023 was mainly due to the increased personnel costs in research and development functions. Research and development expenses remained relatively stable compared with the second quarter of 2024.

- Selling, general and administrative expenses in the third quarter of 2024 were RMB4,108.8 million (US$585.5 million), representing an increase of 13.8% from the third quarter of 2023 and an increase of 9.3% from the second quarter of 2024. Excluding share-based compensation expenses, selling, general and administrative expenses (non-GAAP) were RMB3,901.4 million (US$555.9 million), representing an increase of 13.9% from the third quarter of 2023 and an increase of 8.5% from the second quarter of 2024. The increase in selling, general and administrative expenses over the third quarter of 2023 and the second quarter of 2024 was mainly attributable to (i) the increase in personnel costs related to sales functions, and (ii) the increase in sales and marketing activities associated with new product launch.

Loss from Operations

- Loss from operations in the third quarter of 2024 was RMB5,237.8 million (US$746.4 million), representing an increase of 8.1% from the third quarter of 2023 and an increase of 0.5% from the second quarter of 2024. Excluding share-based compensation expenses, adjusted loss from operations (non-GAAP) was RMB4,590.7 million (US$654.2 million) in the third quarter of 2024, representing an increase of 8.3% from the third quarter of 2023 and a decrease of 2.3% from second quarter of 2024.

Net Loss and Earnings Per Share/ADS

- Net loss in the third quarter of 2024 was RMB5,059.7 million (US$721.0 million), representing an increase of 11.0% from the third quarter of 2023 and an increase of 0.3% from the second quarter of 2024. Excluding share-based compensation expenses, adjusted net loss (non-GAAP) was RMB4,412.6 million (US$628.8 million) in the third quarter of 2024, representing an increase of 11.6% from the third quarter of 2023 and a decrease of 2.7% from the second quarter of 2024.

- Net loss attributable to NIO’s ordinary shareholders in the third quarter of 2024 was RMB5,141.6 million (US$732.7 million), representing an increase of 11.1% from the third quarter of 2023 and an increase of 0.3% from the second quarter of 2024. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted net loss attributable to NIO’s ordinary shareholders (non-GAAP) was RMB4,403.2 million (US$627.5 million) in the third quarter of 2024.

- Basic and diluted net loss per ordinary share/ADS in the third quarter of 2024 were both RMB2.50 (US$0.36), compared with RMB2.67 in the third quarter of 2023 and RMB2.50 in the second quarter of 2024. Excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, adjusted basic and diluted net loss per share/ADS (non-GAAP) were both RMB2.14 (US$0.31), compared with RMB2.28 in the third quarter of 2023 and RMB2.21 in the second quarter of 2024.

Balance Sheet

- Balance of cash and cash equivalents, restricted cash, short-term investment and long-term time deposits was RMB42.2 billion (US$6.0 billion) as of September 30, 2024.

Business Outlook

For the fourth quarter of 2024, the Company expects:

- Deliveries of vehicles to be between 72,000 and 75,000 units, representing an increase of approximately 43.9% to 49.9% from the same quarter of 2023.

- Total revenues to be between RMB19,676 million (US$2,804 million) and RMB20,383 million (US$2,904 million), representing an increase of approximately 15.0% to 19.2% from the same quarter of 2023.

This business outlook reflects the Company’s current and preliminary view on the business situation and market condition, which is subject to change.

Conference Call

The Company’s management will host an earnings conference call at 7:00 AM U.S. Eastern Time on November 20, 2024 (8:00 PM Beijing/Hong Kong/Singapore Time on November 20, 2024).

A live and archived webcast of the conference call will be available on the Company’s investor relations website at https://ir.nio.com/news-events/events.

For participants who wish to join the conference using dial-in numbers, please register in advance using the link provided below and dial in 10 minutes prior to the call. Dial-in numbers, passcode and unique access PIN would be provided upon registering.

https://s1.c-conf.com/diamondpass/10043136-gh7y6t.html

A replay of the conference call will be accessible by phone at the following numbers, until November 27, 2024:

| United States: | +1-855-883-1031 |

| Hong Kong, China: | +852-800-930-639 |

| Mainland, China: | +86-400-1209-216 |

| Singapore: | +65-800-1013-223 |

| International: | +61-7-3107-6325 |

| Replay PIN: | 10043136 |

About NIO Inc.

NIO Inc. is a pioneer and a leading company in the global smart electric vehicle market. Founded in November 2014, NIO aspires to shape a sustainable and brighter future with the mission of “Blue Sky Coming”. NIO envisions itself as a user enterprise where innovative technology meets experience excellence. NIO designs, develops, manufactures and sells smart electric vehicles, driving innovations in next-generation core technologies. NIO distinguishes itself through continuous technological breakthroughs and innovations, exceptional products and services, and a community for shared growth. NIO provides premium smart electric vehicles under the NIO brand, and family-oriented smart electric vehicles through the ONVO brand.

Safe Harbor Statement

This press release contains statements that may constitute “forward-looking” statements pursuant to the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,” “aims,” “future,” “intends,” “plans,” “believes,” “estimates,” “likely to” and similar statements. NIO may also make written or oral forward-looking statements in its periodic reports to the U.S. Securities and Exchange Commission (the “SEC”), in its annual report to shareholders, in announcements, circulars or other publications made on the websites of each of The Stock Exchange of Hong Kong Limited (the “SEHK”) and the Singapore Exchange Securities Trading Limited (the “SGX-ST”), in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about NIO’s beliefs, plans and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited to the following: NIO’s strategies; NIO’s future business development, financial condition and results of operations; NIO’s ability to develop and manufacture vehicles of sufficient quality and appeal to customers on schedule and on a large scale; its ability to ensure and expand manufacturing capacities including establishing and maintaining partnerships with third parties; its ability to provide convenient and comprehensive power solutions to its customers; the viability, growth potential and prospects of the battery swapping, BaaS, and NIO Assisted and Intelligent Driving and its subscription services; its ability to improve the technologies or develop alternative technologies in meeting evolving market demand and industry development; NIO’s ability to satisfy the mandated safety standards relating to motor vehicles; its ability to secure supply of raw materials or other components used in its vehicles; its ability to secure sufficient reservations and sales of its vehicles; its ability to control costs associated with its operations; its ability to build its current and future brands; general economic and business conditions globally and in China and assumptions underlying or related to any of the foregoing. Further information regarding these and other risks is included in NIO’s filings with the SEC and the announcements and filings on the websites of each of the SEHK and SGX-ST. All information provided in this press release is as of the date of this press release, and NIO does not undertake any obligation to update any forward-looking statement, except as required under applicable law.

Non-GAAP Disclosure

The Company uses non-GAAP measures, such as adjusted cost of sales (non-GAAP), adjusted research and development expenses (non-GAAP), adjusted selling, general and administrative expenses (non-GAAP), adjusted loss from operations (non-GAAP), adjusted net loss (non-GAAP), adjusted net loss attributable to ordinary shareholders (non-GAAP) and adjusted basic and diluted net loss per share/ADS (non-GAAP), in evaluating its operating results and for financial and operational decision-making purposes. The Company defines adjusted cost of sales (non-GAAP), adjusted research and development expenses (non-GAAP), adjusted selling, general and administrative expenses (non-GAAP) and adjusted loss from operations (non-GAAP) and adjusted net loss (non-GAAP) as cost of sales, research and development expenses, selling, general and administrative expenses, loss from operations and net loss excluding share-based compensation expenses. The Company defines adjusted net loss attributable to ordinary shareholders (non-GAAP), adjusted basic and diluted net loss per share/ADS (non-GAAP) as net loss attributable to ordinary shareholders and basic and diluted net loss per share/ADS excluding share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value. By excluding the impact of share-based compensation expenses and accretion on redeemable non-controlling interests to redemption value, the Company believes that the non-GAAP financial measures help identify underlying trends in its business and enhance the overall understanding of the Company’s past performance and future prospects. The Company also believes that the non-GAAP financial measures allow for greater visibility with respect to key metrics used by the Company’s management in its financial and operational decision-making.

The non-GAAP financial measures are not presented in accordance with U.S. GAAP and may be different from non-GAAP methods of accounting and reporting used by other companies. The non-GAAP financial measures have limitations as analytical tools and when assessing the Company’s operating performance, investors should not consider them in isolation, or as a substitute for net loss or other consolidated statements of comprehensive loss data prepared in accordance with U.S. GAAP. The Company encourages investors and others to review its financial information in its entirety and not rely on a single financial measure.

The Company mitigates these limitations by reconciling the non-GAAP financial measures to the most comparable U.S. GAAP performance measures, all of which should be considered when evaluating the Company’s performance.

For more information on the non-GAAP financial measures, please see the table captioned “Unaudited Reconciliation of GAAP and Non-GAAP Results” set forth at the end of this press release.

Exchange Rate

This announcement contains translations of certain Renminbi amounts into U.S. dollars at specified rates solely for the convenience of the reader. Unless otherwise stated, all translations from Renminbi to U.S. dollars were made at the rate of RMB7.0176 to US$1.00, the noon buying rate in effect on September 30, 2024 in the H.10 statistical release of the Federal Reserve Board. The Company makes no representation that the Renminbi or U.S. dollars amounts referred could be converted into U.S. dollars or Renminbi, as the case may be, at any particular rate or at all.

For more information, please visit: http://ir.nio.com.

Investor Relations

ir@nio.com

Media Relations

global.press@nio.com

Source: NIO

| NIO INC. | ||||

| Unaudited Condensed Consolidated Balance Sheets | ||||

| (All amounts in thousands) | ||||

| As of | ||||

| December 31, 2023 | September 30, 2024 | September 30, 2024 | ||

| RMB | RMB | US$ | ||

| ASSETS | ||||

| Current assets: | ||||

| Cash and cash equivalents | 32,935,111 | 23,791,903 | 3,390,319 | |

| Restricted cash | 5,542,271 | 4,920,257 | 701,131 | |

| Short-term investments | 16,810,107 | 13,358,496 | 1,903,570 | |