Asset Performance Management Market to Grow at USD 6.17 Billion by 2031| SkyQuest Technology

Westford, US, Oct. 17, 2024 (GLOBE NEWSWIRE) — The global asset performance management market size was valued at $2.90 Billion in 2023 and expected to reach $6.17 Billion by 2031, growing at a CAGR of 9.9% from 2024 to 2031. The market is expected to grow significantly during the forecast period due to the rising demand for digital solutions across industries, such as oil & gas, manufacturing and chemicals, and others to curb operational expenses. APM system helps collect all forms of data from all forms of assets, such as machinery, heavy equipment and so on using sensors. The APM system, with the help of its data analysis software, interchanges between any facilities data.

An analytics platform is created for customers to best demonstrate all operational assets. They help by keeping all this information out to users, allowing them to streamline asset management processes and analyze which assets require priority maintenance. The APM system uses mobile solutions and geographic information system solutions among others, which are enabling few efficient use cases of the APM systems that drive the market. Another biggest driver is that APM systems in the market leverage industrial internet of things which provide equipment reliability as the fundamental capabilities of the APM systems. This is increasingly attracting the industrial sectors.

Request Sample of the Report: https://www.skyquestt.com/sample-request/asset-performance-management-market

Browse in-depth TOC on the “Asset Performance Management Market” Pages – 197, Tables – 95, Figures – 76

Asset Performance Management Market Overview:

| Report Coverage | Details |

| Market Revenue in 2023 | $2.90 Billion |

| Estimated Value by 2031 | $6.17 Billion |

| Growth Rate | Poised to grow at a CAGR of 9.9 % |

| Forecast Period | 2024–2031 |

| Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Component, Industry Vertical, Deployment Mode, and Region |

| Geographies Covered | North America, Europe, Asia-Pacific, and the Rest of the world |

| Report Highlights | Growing demand for IIoT to improve productivity |

| Key Market Opportunities | Increasing priority of predictive maintenance |

| Key Market Drivers | Increasing adoption of asset management software |

Get Customized Reports with your Requirements, Free – https://www.skyquestt.com/speak-with-analyst/asset-performance-management-market

Increasing Adoption of Asset Management Software to Improve Performance of Company Assets

It should be noted that the market is driven by the rapid uptake of asset management software and the increasing importance of asset tracking. Infrastructure support is essential for asset-intensive industries to ensure optimal performance of their asset base. Old tracking methods such as manual handling or incurring excel sheets are not capable of tracking the asset of a vast company. Besides, the asset tracking field is becoming more complex with the availability of higher industrial sensors, digital twin, and complex OT. In addition, with the growth of asset systems, such as mechanical and neural networks are being utilized for their automation. The systems use machine learning, statistical modeling tools, and algorithms to provide a comprehensive analysis of asset behavior, estimate labor safety and environment risks, and provide real-time insight. Furthermore, the hosted systems segment, especially public cloud offers huge benefits, such as the availability of abundant computing resources and the ability to scale up or down.

Growing Usage of Cloud-Based Asset Performance Management Services to Reduce Expenses of Asset Management

The market observes the increasing adoption of cloud-based asset performance management services. The use of cloud computing solutions to support the infrastructure has also become more popular among asset-intensive industries because of their flexibility and the reduction of costs. One of the applications of these solutions is the deployment of the digital twin technology. A digital twin is a 3D image of an asset that demonstrates its behavior, which is imitated through combined use of the asset’s sensors and industrial neural networks. Using machine learning algorithms and statistical modeling systems, risk-based inspection technologies may leverage efficiency of operational technology to decrease human labor safety and environmental risks. Furthermore, the hosted clouds systems segment provided by public clouds offer adequate computational resources to monitor asset performance and employ predictive maintenance in real-time. Cloud-based asset performance management systems guarantee immediate access to crucial data, which allows to track assets and the liquidity of reserves and make informed decisions.

Increasing Demand for Digital Transformation to Boost Market Growth in North America

Growing adoption of Industrial Internet of Things and rise in the use of Artificial Intelligence and other smart connected devices are the two factors driving the growth of North America asset performance management market. Additionally, the region increased its IT budget as there has been a rising demand for digital transformation from a lot of end users and developers in the convergence of different technologies, such as cloud computing and artificial intelligence. Also, the IT budget increased due to an increasing need to control heavy machinery because higher production has been happening in the industry.

Is this report aligned with your requirements? Interested in making a Purchase – https://www.skyquestt.com/buy-now/asset-performance-management-market

Asset Performance Management Market Insights

Driver

- Increasing popularity of asset management to monitor assets of companies

- Growing investments in asset management software by market leaders

- Increasing necessity to increase the economic returns on assets

Restraints

- Lack of understanding while choosing appropriate asset solutions

- Lack of skill among employees

- Increasing concern over data security and confidentiality

Key Players Operating in Asset Performance Management Market

- AVEVA (UK)

- SAP (Germany)

- GE Digital (US)

- IBM (US)

- ABB (Switzerland)

- Emerson (US)

- Bentley Systems (US)

- Rockwell Automation (US)

- Fluke (US)

- DNV (Norway)

- Siemens Energy (Germany)

Key Questions Answered in Asset Performance Management Market

- Which is the main factor driving the market?

- Who are the key players in the market?

- Which is the dominating region in the market?

Related Reports:

Armenia Stock Market: Global Opportunity Analysis and Forecast, 2024-2031

P2P Payment Market: Global Opportunity Analysis and Forecast, 2024-2031

Commercial Auto Insurance Market: Global Opportunity Analysis and Forecast, 2024-2031

Digital Insurance Platform Market: Global Opportunity Analysis and Forecast, 2024-2031

Digital Gift Card Market: Global Opportunity Analysis and Forecast, 2024-2031

About Us:

SkyQuest is an IP focused Research and Investment Bank and Accelerator of Technology and assets. We provide access to technologies, markets and finance across sectors viz. Life Sciences, CleanTech, AgriTech, NanoTech and Information & Communication Technology.

We work closely with innovators, inventors, innovation seekers, entrepreneurs, companies and investors alike in leveraging external sources of R&D. Moreover, we help them in optimizing the economic potential of their intellectual assets. Our experiences with innovation management and commercialization have expanded our reach across North America, Europe, ASEAN and Asia Pacific.

Contact:

Mr. Jagraj Singh

SkyQuest Technology

1 Apache Way,

Westford,

Massachusetts 01886

USA (+1) 351-333-4748

Email: sales@skyquestt.com

Visit Our Website: https://www.skyquestt.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

McKinsey Reportedly Trims China Workforce By A Third Amid Rising Tensions

Leading U.S. consulting firm McKinsey & Company is reportedly downsizing its workforce in China, eliminating around 500 positions, which equates to about one-third of its employees in the region. This decision is part of a strategic move to address security concerns linked to its operations in China.

What Happened: McKinsey is reportedly scaling back its dealings with clients connected to the Chinese government, The Wall Street Journal reported on Thursday. This restructuring aims to isolate its China unit from its global operations to minimize security risks.

Over the last two years, the firm has reduced its workforce in Greater China, including Hong Kong and Taiwan, by several hundred employees. As of June, McKinsey had nearly 1,500 employees listed on its Greater China website.

McKinsey has yet to respond to Benzinga’s queries.

Why It Matters: The job cuts at McKinsey come amid escalating tensions between the U.S. and China, particularly in the technology and trade sectors. U.S. tech giants like Alphabet Inc.’s Google and Microsoft Corp.-backed OpenAI have increased employee screening due to fears of Chinese espionage.

Concerns have risen that foreign governments might exploit compromised staff to access sensitive corporate data. Additionally, China has been urging its companies to reduce reliance on U.S. technology, such as Nvidia Corp.’s chips, to bolster its domestic semiconductor industry and counter U.S. sanctions.

The U.S. has also added several Chinese firms to its export control list, which China criticized as undermining international trade norms.

This move is perceived as an attempt to restrict Russia’s access to advanced U.S. technology. The ongoing geopolitical tensions have led to significant shifts in business strategies for companies like McKinsey, which are navigating the complexities of operating in both markets.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Photo courtesy: McKinsey

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cathie Wood Continues To Sell Shares Of Jack Dorsey's Bitcoin-Focused Company Block — Ark Also Dumps Moderna, Robinhood Stock

On Wednesday, Cathie Wood’s Ark Invest made significant trades involving Block Inc SQ and Moderna Inc MRNA.

The SQ Trade

Ark Invest sold off a significant amount of shares in the Jack Dorsey-led Block, despite the Bitcoin BTC/USD-focused company’s recent positive second-quarter results. The sale involved 23,473 shares from the ARK Innovation ETF ARKK, which, based on the closing price of $73.53 on Wednesday, is valued at approximately $1.72 million. Notably, this is the second day in running when Wood dumped Block shares. On Tuesday, Ark had offloaded 17,816 shares worth $1.28 million.

The MRNA Trade

Ark Invest also sold shares of Moderna Inc from both its ARK Genomic Revolution ETF ARKG and ARKK funds, totaling 46,186 shares. Based on the closing price of $57.46 per share on Wednesday, the value of this trade is approximately $2.65 million. Moderna recently outlined its post-Covid roadmap, highlighting its mRNA-based pipeline and revised financial plans, which could have influenced Ark’s decision. Earlier on Tuesday, Wood had sold 24,981 shares of Moderna. worth $1.4 million.

The HOOD Trade

Ark Invest also offloaded 2,636 shares of Robinhood Markets Inc HOOD from its ARK Next Generation Internet ETF ARKW. The trade, valued at approximately $71,000 based on the closing price of $26.93 on Wednesday, comes as Robinhood announced the launch of futures trading and index options trading, marking a major expansion of the platform’s offerings.

Other Key Trades:

- Ark Invest bought shares of Intellia Therapeutics Inc (NTLA) and shares of CRISPR Therapeutics AG (CRSP) for its ARKK fund.

- It also purchased shares of Tempus AI Inc (TEM) for the ARKK fund and shares for the ARKG fund. For its ARKQ fund, Ark sold shares of Markforged Holding Corp (MKFG) and shares of Materialise NV (MTLS), while buying shares of Blade Air Mobility Inc (BLDE).

Image via Wikimedia Commons

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Former FDIC Chief Warns Federal Reserve To 'Not Stir The Pot' With Further Rate Cuts: 'Some Have Called It A Goldilocks Economy, But…'

Amid a thriving economy, former United States Federal Deposit Insurance Corporation (FDIC) Chief Sheila Bair has raised alarms over the Federal Reserve’s potential rate cuts.

What Happened: Despite the economy showing positive signs such as increasing wages, a strong stock market, and robust job creation, the Federal Reserve, under the leadership of Chair Jerome Powell, is contemplating further rate cuts.

The aim is to stimulate a labor market that is perceived to be cooling, even though the unemployment rate is at 4.1% with 254,000 jobs added in September.

Core inflation remains a pressing issue, with the Consumer Price Index showing a 3.3% rise, excluding food and energy. A survey by the University of Michigan indicates growing consumer inflation expectations. Bair, in an opinion piece in the Financial Times, warns that additional rate cuts could worsen inflation, disproportionately affecting low- and middle-income households.

“Some have called it a ‘Goldilocks economy,’ but it feels more like Papa Bear’s soup, running a bit hot,” Bair wrote.

While some argue that rate cuts could enhance consumer spending by reducing borrowing costs, household debt has already reached a record $17.8 trillion. Bair stresses that stimulating demand through rate cuts might lead to increased inflation, offsetting any consumer savings from lower borrowing rates.

“The Fed should not stir the pot with further cuts,” she warned.

Why It Matters: The debate over interest rate cuts comes amidst differing views within the Federal Reserve. Raphael Bostic, President of the Atlanta Federal Reserve, recently projected only one more rate cut this year, deviating from the median projection of 50 basis points. He anticipates a single additional reduction of 25 basis points.

Meanwhile, Federal Reserve Governor Christopher J. Waller has expressed caution regarding interest rate cuts, citing disappointing recent inflation data. Waller emphasized the economy’s solid footing but acknowledged concerns over inflation upticks, suggesting a careful approach to rate adjustments.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Image via Federal Reserve

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Charter Communications Recent Insider Activity

Liberty Broadband Corp, Board Member at Charter Communications CHTR, executed a substantial insider sell on October 15, according to an SEC filing.

What Happened: Corp’s decision to sell 10,400 shares of Charter Communications was revealed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The total value of the sale is $3,448,120.

As of Wednesday morning, Charter Communications shares are down by 0.0%, currently priced at $331.94.

All You Need to Know About Charter Communications

Charter is the product of the 2016 merger of three cable companies, each with a decades-long history in the business: Legacy Charter, Time Warner Cable, and Bright House Networks. The firm now holds networks capable of providing television, internet access, and phone services to roughly 58 million US homes and businesses, around 40% of the country. Across this footprint, Charter serves 30 million residential and 2 million commercial customer accounts under the Spectrum brand, making it the second-largest US cable company behind Comcast. The firm also owns, in whole or in part, sports and news networks, including Spectrum SportsNet (long-term local rights to Los Angeles Lakers games), SportsNet LA (Los Angeles Dodgers), SportsNet New York (New York Mets), and Spectrum News NY1.

Charter Communications: A Financial Overview

Revenue Growth: Charter Communications displayed positive results in 3 months. As of 30 June, 2024, the company achieved a solid revenue growth rate of approximately 0.19%. This indicates a notable increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Communication Services sector.

Profitability Metrics:

-

Gross Margin: The company shows a low gross margin of 40.28%, suggesting potential challenges in cost control and profitability compared to its peers.

-

Earnings per Share (EPS): Charter Communications’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 8.58.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 7.58, caution is advised due to increased financial risk.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: Charter Communications’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 10.6.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 0.9 is below industry norms, suggesting potential undervaluation and presenting an investment opportunity for those considering sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): A high EV/EBITDA ratio of 6.89 reflects market recognition of Charter Communications’s value, positioning it as more highly valued compared to industry peers.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Emphasizing the importance of a comprehensive approach, considering insider transactions is valuable, but it’s crucial to evaluate them in conjunction with other investment factors.

From a legal standpoint, the term “insider” pertains to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as outlined in Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and significant hedge funds. These insiders are mandated to inform the public of their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

A company insider’s new purchase is a indicator of their positive anticipation for a rise in the stock.

While insider sells may not necessarily reflect a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

When it comes to transactions, investors tend to focus on those in the open market, detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S indicates a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Charter Communications’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

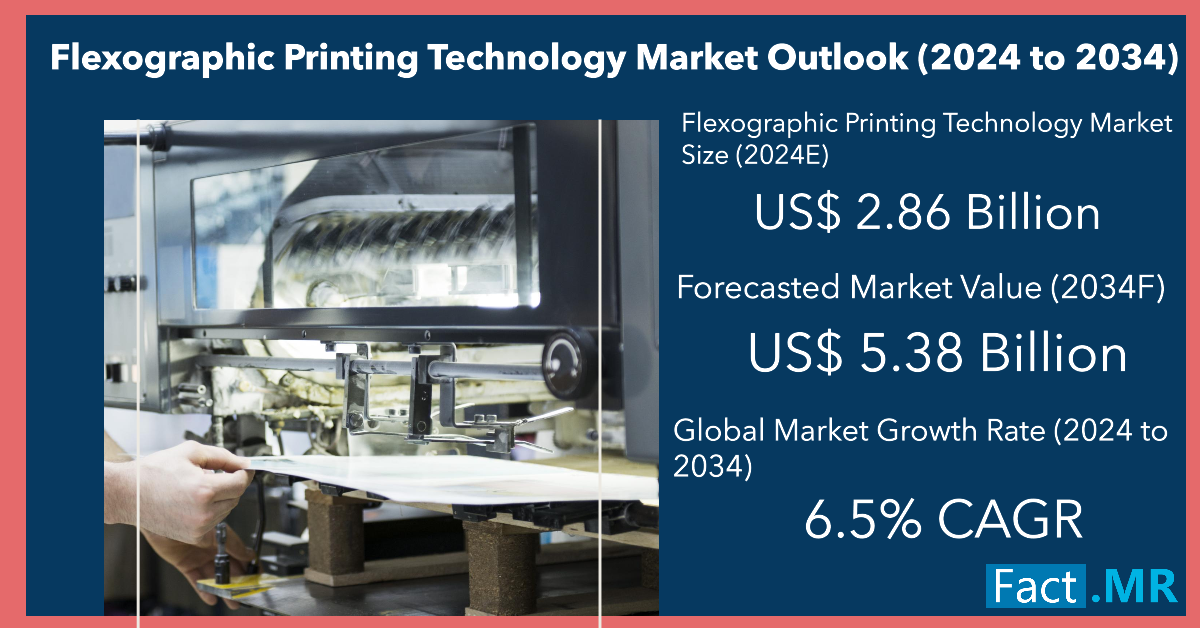

Flexographic Printing Technology Market is Projected to Reach a US$ 5.38 Billion with 6.5% CAGR by 2034 | Fact.MR Report

Rockville, MD , Oct. 17, 2024 (GLOBE NEWSWIRE) — According to a new industry research report published by Fact.MR, a market research and competitive intelligence provider, the global Flexographic Printing Technology Market is projected to reach a valuation of US$ 2.86 billion in 2024 and further expand at 6.5% CAGR over the next ten years. Due to rising consumer demand and increasingly stringent safety regulations, the packaging industry is growing globally, especially in sectors such as food and beverages, pharmaceuticals, e-commerce, personal care, and others.

Because flexographic printing is so adaptable, it is commonly used to print on a variety of substrates such as paper, films, plastics, and others. Because it produces flexible packaging of outstanding quality fast and affordable, it is ideal for mass production. Due to its adaptability and ability to ensure that businesses meet the diverse packaging requirements of different industries, flexographic printing is quickly becoming a critical technology in packaging solutions.

Due to the well-established packaging industry, the North American region holds a significant market share for flexographic printing technology. The North American market is seeing an increase in demand for flexographic printing technology due to the growing emphasis on sustainability and the use of eco-friendly materials and inks. East Asia’s market is growing at a noteworthy compound annual growth rate because of ongoing modernization and rising consumer demand for packaged products.

For More Insights into the Market, Request a Sample of this Report: https://www.factmr.com/connectus/sample?flag=S&rep_id=10418

Key Takeaways from Market Study:

- The worldwide market of flexographic printing technology is forecasted to touch US$ 5.38 billion by 2034.

- North America is analyzed to hold 24.6% of the global market share in 2024.

- The East Asia market is estimated to generate revenue worth US$ 655.9 million in 2024.

- Global sales of stack-type press are evaluated to rise at 6.6% CAGR between 2024 and 2034.

- Demand for automatic flexographic printing technology is forecasted to reach a worth of US$ 3.11 billion by 2034.

- The market in South Korea is projected to reach a size of US$ 339 million by 2034-end.

“Prominent manufacturers in the market for flexographic printing technologies are investing in R&D to create advanced products that are stronger, more reliable, and of higher quality to attract a larger consumer base,” says a Fact.MR analyst

Leading Players Driving Innovation in the Flexographic Printing Technology Market:

Amcor Plc; MPS Systems B.V.; Mark Andy Inc.; Comexi; Bobst; Wolverine Flexographic LLC; Nilpeter A/S; Asahi Kasei Corporation; Polygraph Limited; Heidelberger Druckmaschinen AG; Koenig & Bauer AG; Westrock Company.

High Preference for Automatic Flexographic Printing Technology:

Automatic flexographic printing technology outperforms semi-automatic systems in terms of productivity, efficiency, and accuracy, due to this reason they are gaining popularity all over the world. By decreasing the need for manual intervention, automatic flexographic printers optimize the printing process and enable quicker setup times, job modifications, and labor cost savings. Manufacturers benefit from higher output rates, less downtime, and consistent print quality due to these systems’ large-scale manufacturing design.

Automation also helps in reducing human error, enhancing the accuracy and dependability of print runs. Because of these advantages, automatic flexographic printing technology is becoming a more attractive option for companies looking to expand their production capabilities to stay in business and satisfy the needs of end users.

Flexographic Printing Technology Industry News:

- In September 2024, Domino Printing Sciences (Domino) announced the release of a new 1200dpi digital print engine designed to be integrated into flexographic lines in response to the increasing demand for digital hybrid printing and finishing. Based on Domino’s most recent Generation 7 platform, the N730i Integration Module enables label converters to provide high-resolution digital printing, including applications with variable data. It can print at up to 1200dpi and at fast rates.

Get Customization on this Report for Specific Research Solutions: https://www.factmr.com/connectus/sample?flag=S&rep_id=10418

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the flexographic printing technology market, presenting historical demand data (2019 to 2023) and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on product type (inline type press, stack type press, central impression type press), coloring capacity (2 colors, 4 colors, 6 colors & above), technology (automatic, semi-automatic), and application (print media, offices & admin, industrial applications), across seven major regions of the world (North America, Western Europe, Eastern Europe, East Asia, Latin America, South Asia & Pacific, and MEA).

Segmentation of Flexographic Printing Technology Market Research:

- By Product Type :

- Inline Type Press

- Stack Type Press

- Central Impression Type Press

- By Coloring Capacity :

- 2 Colors

- 4 Colors

- 6 Colors & Above

- By Technology :

- By Application :

- Print Media

- Offices & Admin

- Industrial Applications

Checkout More Related Studies Published by Fact.MR Research:

Mulching Heads Market: is estimated at US$ 521 Mn in 2022. Detailed industry analysis reveals that the market is projected to expand at a CAGR of 6.6% and reach a valuation of US$ 936 Mn by 2032.

Europe 3D Printer Filament Recycler Market: is estimated to be around US$ 161.6 million in 2024. 3D printer filament recycler sales are projected to increase at a CAGR of 3.6%, reaching over US$ 230.2 million by 2034.

Microreactor Technology Market: Expanding at a CAGR of 19.5%, the global microreactor technology market is projected to reach a valuation of US$ 161.82 billion in 2024 to US$ 960.95 billion by 2034.

Power Press Machine Market: is estimated to stand at US$ 5.92 billion in 2024 and is slated to increase at a CAGR of 5.4% to reach US$ 10.01 billion by 2034.

T-Shirt Printing Machine Market: based on a segmentation-wise analysis. The t-shirt printing machine market is broadly segmented into type, application, and region.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning.

With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Kintara Therapeutics Announces 1-for-35 Reverse Stock Split in Connection with the Proposed Merger with TuHURA Biosciences

SAN DIEGO, Oct. 16, 2024 /PRNewswire/ — Kintara Therapeutics, Inc. (“Kintara”) KTRA, a biopharmaceutical company focused on the development of new solid tumor cancer therapies, today announced that its Board of Directors (the “Board”) has approved a reverse stock split of Kintara’s common stock at a ratio of 1-for-35. Kintara’s common stock is expected to begin trading on a post-reverse stock split basis on the Nasdaq Capital Market on October 17, 2024, under the new name TuHURA Biosciences, Inc. and under the new symbol “HURA” following the anticipated closing of the merger (the “Merger”) with TuHURA Biosciences, Inc. (“TuHURA”), with a new CUSIP number 898920 103.

The reverse stock split was approved by Kintara’s stockholders at Kintara’s special meeting of stockholders held on October 4, 2024, to be effected in the Board’s discretion of not less than 1-for-20 and not more than 1-for-40. The final reverse stock split ratio of 1-for-35 was approved by the Board on October 4, 2024.

As a result of the reverse stock split, every thirty-five pre-split shares of Kintara’s common stock outstanding will become one share of common stock. The reverse stock split is expected to reduce the number of shares of Kintara’s outstanding common stock from approximately 55.6 million shares to approximately 1.6 million shares. The par value of Kintara’s common stock will remain unchanged at $0.001 per share after the reverse stock split. The reverse stock split will not change the authorized number of shares of Kintara’s common stock. The reverse stock split will affect all stockholders uniformly and will not alter any stockholder’s percentage interest in Kintara’s equity, except to the extent that the reverse stock split results in some stockholders owning a fractional share. No fractional shares will be issued in connection with the reverse stock split. Instead, in lieu of any fractional shares to which a stockholder of record would otherwise be entitled as a result of the reverse stock split, Kintara will issue to such stockholder such additional fraction of a share as is necessary to increase such resulting fractional share to a full share of common stock. The reverse stock split will also apply to common stock issuable upon the exercise of Kintara’s outstanding warrants and stock options, with a proportionate adjustment to the exercise prices thereof, and under Kintara’s equity incentive plans.

Following the closing of the Merger, the combined company’s total outstanding common stock is expected to be approximately 42.0 million shares.

Equinity Trust Company, LLC is acting as the exchange agent and transfer agent for the reverse stock split. Stockholders holding their shares in book-entry form or in brokerage accounts need not take any action in connection with the reverse stock split. Beneficial holders are encouraged to contact their bank, broker or custodian with any procedural questions.

About TuHURA Biosciences, Inc.

TuHURA Biosciences is a Phase 3 registration-stage immuno-oncology company developing novel technologies to overcome resistance to cancer immunotherapy. TuHURA’s lead personalized cancer vaccine candidate, IFx-2.0, is designed to overcome primary resistance to checkpoint inhibitors. TuHURA is preparing to initiate a single randomized placebo-controlled Phase 3 registration trial of IFx-2.0 administered as an adjunctive therapy to Keytruda® (pembrolizumab) in first line treatment for advanced Merkel Cell Carcinoma.

In addition, TuHURA is leveraging its Delta receptor technology to develop novel bi-functional antibody drug conjugates (ADCs), targeting Myeloid Derived Suppressor Cells to inhibit their immune suppressing effects on the tumor microenvironment to prevent T cell exhaustion and acquired resistance to checkpoint inhibitors and cellular therapies.

For more information, please visit tuhurabio.com and connect with TuHURA on Facebook, X, and LinkedIn.

About Kintara Therapeutics, Inc.

Located in San Diego, California, Kintara is dedicated to the development of novel cancer therapies for patients with unmet medical needs. Kintara is developing therapeutics for clear unmet medical needs with reduced risk development programs. Kintara’s lead program is REM-001 Therapy for cutaneous metastatic breast cancer (CMBC).

Kintara has a proprietary, late-stage photodynamic therapy platform that holds promise as a localized cutaneous, or visceral, tumor treatment as well as in other potential indications. REM-001 Therapy, which consists of the laser light source, the light delivery device, and the REM-001 drug product, has been previously studied in four Phase 2/3 clinical trials in patients with CMBC who had previously received chemotherapy and/or failed radiation therapy. In CMBC, REM-001 has a clinical efficacy to date of 80% complete responses of CMBC evaluable lesions and an existing robust safety database of approximately 1,100 patients across multiple indications.

Kintara Therapeutics, Inc. is headquartered in San Diego, California. For more information, please visit www.kintara.com or follow us on X at @Kintara_Thera, Facebook and LinkedIn.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements based upon Kintara’s and TuHURA’s current expectations. This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are identified by terminology such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “could,” “should,” “would,” “project,” “plan,” “expect,” “goal,” “seek,” “future,” “likely” or the negative or plural of these words or similar expressions. Examples of such forward-looking statements include but are not limited to express or implied statements regarding Kintara’s or TuHURA’s management team’s expectations, hopes, beliefs, intentions or strategies regarding the future including, without limitation, statements regarding: the proposed Merger and the expected effects, perceived benefits or opportunities and related timing with respect thereto, expectations regarding clinical trials and research and development programs, in particular with respect to TuHURA’s IFx-Hu2.0 product candidate novel bifunctional ADCs, and any developments or results in connection therewith; the anticipated timing of the results from those studies and trials; expectations regarding the use of capital resources, including the net proceeds from the financing that closed in connection with the signing of the definitive agreement, and the time period over which the combined company’s capital resources will be sufficient to fund its anticipated operations; and the expected trading of the combined company’s stock on the Nasdaq Capital Market. These statements are only predictions. Kintara and TuHURA have based these forward-looking statements largely on their then-current expectations and projections about future events, as well as the beliefs and assumptions of management. Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond each of Kintara’s and TuHURA’s control, and actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors, including but not limited to: (i) the risk that the conditions to the closing or consummation of the proposed Merger are not satisfied; (ii) uncertainties as to the timing of the consummation of the proposed Merger and the ability of each of Kintara and TuHURA to consummate the transactions contemplated by the proposed Merger; (iii) risks related to Kintara’s and TuHURA’s ability to correctly estimate their respective operating expenses and expenses associated with the proposed Merger, as applicable, as well as uncertainties regarding the impact any delay in the closing would have on the anticipated cash resources of the resulting combined company upon closing and other events and unanticipated spending and costs that could reduce the combined company’s cash resources; (iv) the occurrence of any event, change or other circumstance or condition that could give rise to the termination of the proposed Merger by either Kintara or TuHURA; (v) the effect of the announcement or pendency of the proposed Merger on Kintara’s or TuHURA’s business relationships, operating results and business generally; (vi) costs related to the proposed Merger; (vii) the outcome of any legal proceedings that may be instituted against Kintara, TuHURA, or any of their respective directors or officers related to the Merger Agreement or the transactions contemplated thereby; (vii) the ability of Kintara or TuHURA to protect their respective intellectual property rights; (viii) competitive responses to the proposed Merger; (ix) unexpected costs, charges or expenses resulting from the proposed Merger; (x) whether the combined business of TuHURA and Kintara will be successful; (xi) legislative, regulatory, political and economic developments; and (xii) additional risks described in the “Risk Factors” section of Kintara’s Annual Report on Form 10-K for the fiscal year ended June 30, 2024, and the Registration Statement on Form S-4 related to the proposed Merger filed with the SEC. Additional assumptions, risks and uncertainties are described in detail in Kintara’s registration statements, reports and other filings with the SEC, which are available on Kintara’s website, and at www.sec.gov. Accordingly, you should not rely upon forward-looking statements as predictions of future events. Neither Kintara nor TuHURA can assure you that the events and circumstances reflected in the forward-looking statements will be achieved or occur, and actual results could differ materially from those projected in the forward-looking statements. The forward-looking statements made in this communication relate only to events as of the date on which the statements are made. Except as required by applicable law or regulation, Kintara and TuHURA undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events. Investors should not assume that any lack of update to a previously issued “forward-looking statement” constitutes a reaffirmation of that statement.

INVESTOR INQUIRIES:

Robert E. Hoffman

Kintara Therapeutics

rhoffman@kintara.com

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/kintara-therapeutics-announces-1-for-35-reverse-stock-split-in-connection-with-the-proposed-merger-with-tuhura-biosciences-302278139.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/kintara-therapeutics-announces-1-for-35-reverse-stock-split-in-connection-with-the-proposed-merger-with-tuhura-biosciences-302278139.html

SOURCE Kintara Therapeutics

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Bitcoin, Ethereum Shift Sideways, Dogecoin Jumps As Stocks Hit New Record: Top Analyst Predicts King Crypto To Hit New High In 3-4 Weeks, $90K By Year-End

Bitcoin saw a halt in its rally, while the king of meme coins, Dogecoin, fared among the biggest gainers Wednesday.

| Cryptocurrency | Gains +/- | Price (Recorded at 9:30 p.m. EDT) |

| Bitcoin BTC/USD | +0.21% | $67,611.27 |

| Ethereum ETH/USD |

-0.24% | $2,617.40 |

| Dogecoin DOGE/USD | +7.19% | $0.1253 |

What Happened: The world’s largest cryptocurrency bounced above $68,000 in the early morning hours, a level not seen since the last week of July.

However, bulls faced stiff resistance subsequently, resulting in a sideways movement in the high $67,000s.

Dogecoin jumped over 7%, becoming the best-performing billon-dollar capitalization coin in the last 24 hours.

“BTC continues to remain resilient above the $65,000 level as betting markets point to higher odds of Trump’s win,” Digital asset trading firm QCP Capital said.

Total cryptocurrency liquidations hit $126.32 million in the last 24 hours after hitting a two-week high the previous day. More than $72 million in bullish bets was wiped out.

Bitcoin’s Open Interest jumped 3.20% in the last 24 hours. A rise in OI, coupled with a sideways price movement, indicated a potential breakout to the upside.

Market sentiment continued to be “Greed,” according to the Cryptocurrency Fear & Greed Index.

Top Gainers (24-Hours)

| Cryptocurrency | Gains +/- | Price (Recorded at 9:30 p.m. EDT) |

| Mog Coin (MOG) | +11.56% | $0.000002064 |

| Bonk (BONK) | +11.02% | $0.00002471 |

| Dogecoin (DOGE) | +6.39% | $0.1244 |

The global cryptocurrency stood at $2.32 trillion, following an increase of 0.63% in the last 24 hours.

Stocks recovered from Tuesday’s retrace to close at record highs. The Dow Jones Industrial Average surged 337.28 points, or 0.79%, to close at a new peak of 43,077.70. The S&P 500 gained 0.47% to end at 5,842.47, while the tech-heavy Nasdaq Composite rose 0.28% to close at 18,367.08.

Banking giant Morgan Stanley MS jumped 6.51% during Wednesday’s trading after its third-quarter profit beat estimates.

Traders have priced in a 92% probability of a 25 basis point rate cut during the next month’s FOMC meeting, according to CME FedWatch tool.

See More: Best Cryptocurrency Scanners

Analyst Notes: On-chain analytics firm Santiment highlighted the astronomical surge in Bitcoin whale transactions this week.

Furthermore, conversations around the apex cryptocurrency have spiked as it breached $68,000 for the first time since July.

“Both of these signals are signs that the rally may be on hold due to key stakeholder profit taking and high crowd FOMO,” Santiment said, clarifying that any retrace would likely be for a shorter period.

Widely followed cryptocurrency analyst Michaël van de Poppe predicted a new all-time high for King Crypto in the coming weeks.

“I think we’ll see this happening in the next 3-4 weeks that we’ll see that all-time high and likely $90K before EOY,” he added.

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.