Direct Drive Wind Turbine Market to Reach $31.7 Billion, Globally, by 2030 at 10.9% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 17, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Direct Drive Wind Turbine Market by Capacity (Less than 1MW, 1MW to 3MW and More than 3MW), Technology (Permanent Magnet Synchronous Generator (PMSG), Electrically Excited Synchronous Generator (EESG)), Installation (Offshore and Onshore), and End Use (Industrial, Commercial, Residential and Utility): Global Opportunity Analysis and Industry Forecast, 2024-2030″. According to the report, the direct drive wind turbine market was valued at $15.4 billion in 2023, and is estimated to reach $31.7 billion by 2030, growing at a CAGR of 10.9% from 2024 to 2030.

Download PDF Brochure: https://www.alliedmarketresearch.com/request-sample/A12847

Prime determinants of growth

The global direct drive wind turbine market has experienced growth due to surge in demand for renewable energy and favorable government incentives and policies. However, High initial capital investment hinders the market growth. Moreover, technological advancements in turbine design present additional opportunities for the direct drive wind turbine market. Advancements in digital technologies and control systems have enhanced the operational capabilities of direct drive wind turbines. Sophisticated sensors, real-time data analytics, and predictive maintenance tools enable more precise control of turbine performance and proactive management of potential issues. These technologies optimize the efficiency of direct drive systems and extend their operational lifespan and reduce maintenance requirements. By integrating these advanced technologies, direct drive turbines achieve higher levels of reliability and availability, which is critical for meeting the growing demand for renewable energy.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2030 |

| Base Year | 2023 |

| Market Size in 2023 | $15.4 billion |

| Market Size in 2030 | $31.7 billion |

| CAGR | 10.90% |

| No. of Pages in Report | 320 |

| Segments Covered | Capacity, Technology, Installation, End Use, and Region |

| Drivers | Growing demand for renewable energy |

| Favorable government incentives and policies | |

| Opportunity | Technological advancements in turbine design |

| Restraint | High initial capital investment |

The more than 3MW segment held the highest market share in 2023.

By capacity, the more than 3MW segment held the highest market share in 2023 and is estimated to maintain its leadership status during the forecast period. The proliferation of direct drive wind turbines with capacities exceeding 3MW is primarily driven by technological advancements and market demands aiming to enhance energy efficiency, reliability, and cost-effectiveness in renewable energy production. Compared to traditional geared wind turbines, which employ a gearbox to adjust the rotational speed of the turbine’s blades to the generator’s optimal speed, direct drive wind turbines utilize a direct connection between the rotor and the generator. This innovation eliminates the gearbox, reducing mechanical complexity and associated maintenance costs, thereby increasing operational reliability and lifespan.

Procure Complete Report (320 Pages PDF with Insights, Charts, Tables, and Figures) @ https://www.alliedmarketresearch.com/checkout-final/direct-drive-wind-turbine-market

The permanent magnet synchronous generator (PMSG) segment held the highest market share in 2023.

By technology, the permanent magnet synchronous generator (PMSG) segment held the highest market share in 2023 and is estimated to dominate the market during the forecast period. Advancements in magnet technology and manufacturing processes have contributed to the increased performance and affordability of PMSGs. The use of rare-earth magnets, such as neodymium-iron-boron (NdFeB), has improved the power density and efficiency of PMSGs, enabling the construction of larger turbines capable of generating higher outputs. Furthermore, ongoing R&D efforts continue to enhance the thermal management and overall reliability of PMSGs, ensuring their suitability for diverse environmental conditions and operational requirements.

The offshore segment held the highest market share in 2023.

By installation, the offshore segment held the highest market share in 2023 and is estimated to maintain its leadership status during the forecast period. Offshore wind turbines benefit from stronger and more consistent wind resources compared to onshore locations. Offshore wind speeds tend to be higher and more stable, allowing turbines to generate electricity more consistently and at higher capacities. This reliability in energy production is crucial for meeting demand and stabilizing the grid, especially in regions where land-based wind resources are less optimal or constrained.

The utility segment held the highest market share in 2023.

By end use, the utility segment held the highest market share in 2023 and is estimated to dominate during the forecast period. The reliability and efficiency of direct drive technology plays a significant role in its adoption by utility-scale projects. Direct drive turbines eliminate the gearbox, a component prone to wear and mechanical failure in traditional geared systems. By reducing the number of moving parts and eliminating gearbox losses, direct drive turbines achieve higher overall efficiency and lower maintenance costs over their operational lifetimes. This reliability is crucial for utility companies seeking consistent and dependable electricity generation to meet the demands of their customers and ensure grid stability.

For Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/A12847

Asia-Pacific held the highest market share in 2023.

By region, Asia-Pacific held the highest market share in 2023. The Asia-Pacific region is characterized by a surge in demand for electricity driven by rapid economic growth, industrialization, and urbanization. As countries in this region seek to meet their increasing energy needs while addressing environmental concerns and reducing carbon emissions, renewable energy sources such as wind power have emerged as viable solutions. Direct drive wind turbines with their higher efficiency and lower maintenance requirements compared to traditional geared turbines, offer a reliable and cost-effective means of generating clean electricity.

Leading Market Players:

- Siemens Gamesa Renewable Energy, S.A.U.

- Goldwind

- GE VERNOVA

- ENERCON Global GmbH

- Nordex SE

- Senvion India Pvt. Ltd.

- Hitachi Energy Ltd.

- ABB Ltd

- Voith GmbH & Co. KGaA

- Emergya Wind Technologies BV

The report provides a detailed analysis of these key players in the global direct drive wind turbine market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, and agreements to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to highlight the competitive scenario.

Trending Reports in Industry:

Wind Turbine Market Analysis and Industry Forecast, 2024-2033

Wind Turbine Nacelle Market Analysis and Industry Forecast, 2024-2033

Wind Turbine Foundation Market Size, Share Analysis and Industry Forecast, 2023-2032

Floating Wind Turbine Market Size, Share, Competitive Landscape, 2020-2027

Offshore Wind Turbine Market Size, Share Analysis and Industry Growth, 2022-2031

Air-Borne Wind Turbine Market Analysis and Industry Forecast, 2024-2030

About us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact us:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-8007925285

Fax: +1-800-792-5285

Blog: https://www.alliedmarketresearch.com/resource-center/trends-and-outlook/energy-and-power

Follow Us on | Facebook | LinkedIn | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Antiseptic and Disinfectant Market Size to Hit USD 61.2 billion by 2031 at 7.0% CAGR – Report by Transparency Market research Inc.

Wilmington, Delaware, United States, Transparency Market Research Inc. -, Oct. 17, 2024 (GLOBE NEWSWIRE) — The global antiseptic and disinfectant market (방부제 및 소독제 시장) is estimated to flourish at a CAGR of 7.0% from 2023 to 2031. Transparency Market Research projects that the overall sales revenue for antiseptic and disinfectant is estimated to reach US$ 61.2 billion by the end of 2031.

A prominent catalyst is the rise of antimicrobial resistance (AMR), where pathogens develop resistance to traditional antimicrobial agents. This escalating challenge underscores the demand for advanced formulations and strategies to combat resistant strains effectively. Collaborative efforts between researchers, healthcare providers, and industry players are thus crucial in developing innovative solutions.

Request Sample Copy of Report: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=1695

Some prominent players are as follows:

- Novartis AG

- 3M

- Johnson & Johnson

- STERIS plc

- Getinge Group

- Cardinal Health

- BD

- Whiteley Corporation

- Kimberly-Clark

The increasing prevalence of healthcare-associated infections (HAIs) has intensified the focus on infection control measures, spurring demand for potent antiseptics and disinfectants in diverse settings beyond traditional healthcare facilities. Industries such as food processing, hospitality, and transportation are increasingly adopting stringent hygiene protocols to mitigate infection risks, further propelling market growth.

The COVID-19 pandemic has emphasized the importance of rapid and effective disinfection methods in various sectors, leading to a surge in demand for antimicrobial products with proven efficacy against SARS-CoV-2 and other emerging pathogens. As organizations prioritize cleanliness and safety, there’s a growing need for versatile disinfection solutions suitable for diverse surfaces and environments, driving innovation in the antiseptic and disinfectant market.

Key Findings of the Market Report

- Quaternary ammonium compounds dominate the antiseptic and disinfectant market due to their broad spectrum effectiveness and safety for various applications.

- Healthcare providers lead the antiseptic and disinfectant market due to strict hygiene standards and increased demand for professional-grade products.

- North America leads the antiseptic and disinfectant market due to high healthcare standards, stringent regulations, and heightened consumer awareness.

Antiseptic and Disinfectant Market Growth Drivers & Trends

- Increasing knowledge about hygiene and infection prevention drives demand for antiseptics and disinfectants, especially amidst global health concerns like pandemics.

- Innovative formulations and delivery methods enhance efficacy and convenience, attracting consumers towards newer antiseptic and disinfectant products.

- Growing healthcare infrastructure and stringent regulations on infection control fuel demand for professional-grade antiseptics and disinfectants in hospitals and clinics.

- Rising environmental consciousness prompts the market to shift towards sustainable and biodegradable antiseptics and disinfectants, meeting consumer preferences for greener alternatives.

- Increasing urbanization, industrialization, and healthcare investments in developing regions drive the adoption of antiseptics and disinfectants, presenting lucrative growth opportunities for market players.

Global Antiseptic and Disinfectant Market: Regional Profile

- North America commands a significant share, driven by stringent infection control protocols, advanced healthcare infrastructure, and high awareness levels regarding hygiene. Key players in this region, including Procter & Gamble and Clorox, leverage technological advancements to develop innovative products catering to healthcare facilities, households, and commercial sectors.

- In Europe, stringent regulatory standards and robust healthcare infrastructure propel market growth. Companies such as Reckitt Benckiser and Ecolab dominate the landscape, offering a wide range of antiseptic and disinfectant solutions compliant with European Union regulations. Increasing focus on sustainability and eco-friendly products drives innovation and market expansion.

- Asia Pacific emerges as a lucrative market, fueled by rapid urbanization, rising healthcare expenditure, and growing awareness of infection control measures. With diverse consumer preferences and regulatory frameworks across countries, market players like 3M Company and Dettol tailor their strategies to meet local demands while ensuring product quality and safety.

- The COVID-19 pandemic has accelerated market growth in the region, with heightened emphasis on hygiene driving demand for antiseptic and disinfectant products across healthcare, hospitality, and residential sectors.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=1695

Antiseptic and Disinfectant Market: Competitive Landscape

The antiseptic and disinfectant market thrives amidst intense competition driven by increasing demand for infection control solutions across diverse sectors. Key players such as Procter & Gamble, 3M Company, and Reckitt Benckiser dominate the market with a wide array of products catering to healthcare, household, and industrial needs.

Innovative startups and regional players continually emerge, introducing niche products and disrupting traditional market dynamics. Competitive strategies revolve around product differentiation, pricing, and geographical expansion, with an emphasis on efficacy, safety, and regulatory compliance. As the global focus on hygiene intensifies, competition in the antiseptic and disinfectant market is poised to escalate further.

Product Portfolio

- STERIS plc offers a comprehensive portfolio of infection prevention and sterilization products, including sterilizers, surgical tables, and environmental monitoring systems. With a focus on patient safety and healthcare efficiency, STERIS delivers innovative solutions trusted by hospitals and healthcare facilities worldwide.

- Getinge Group specializes in providing advanced medical technology solutions, including surgical equipment, patient lifting systems, and infection control products. Committed to improving healthcare outcomes, Getinge’s comprehensive portfolio encompasses solutions for operating rooms, intensive care units, and sterilization departments, ensuring optimal patient care.

Antiseptic and Disinfectant Market: Key Segments

By Product

- Quaternary Ammonium Compounds

- Chlorine Compounds

- Alcohols

- Aldehydes

- Phenolic Compounds

- Hydrogen Peroxide

- Iodine

- Silver

- Others

By End User

- Healthcare Providers

- Commercial Users

- Domestic Users

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=1695<ype=S

More Trending Reports by Transparency Market Research –

Acute Migraine Treatment Market (急性片頭痛治療市場)– The global industry was valued at US$ 2.1 Bn in 2021 and it is projected to advance at a CAGR of 15.1% from 2022 to 2031 and reach more than US$ 7.9 Bn by the end of 2031

Periodontal Treatment Market (سوق علاج اللثة) – The global industry was valued at US$ 7.6 Bn in 2021 and it is projected to grow at a CAGR of 4.8% from 2022 to 2031 and reach more than US$ 12.2 Bn by the end of 2031

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

The stock market has flashed a sell signal not seen since February 2021, Bank of America says

-

A contrarian sell signal recently flashed in the stock market, according to Bank of America.

-

The drop below 4% in cash allocations suggests aggressive stock market investing, BofA said.

-

Investors are growing more optimistic about economic growth, but fear geopolitical conflicts and inflation.

A sell signal in the stock market just flashed for the first time since February 2021, according to a note from Bank of America.

The bank’s fund manager survey revealed that cash allocations dropped to 3.9% from 4.2%, representing the lowest level since February 2021.

According to the bank, a drop below the 4% level for cash allocations is a sell signal. It’s a contrarian sign, as it typically flashes when investors aggressively invest in the stock market with low cash levels.

The sell signal has typically preceded weak returns in the short term.

“Since 2011, there have been 11 prior ‘sell’ signals which saw global equity returns of -2.5% in the 1 month after and -0.8% in the 3 months after the ‘sell’ signal was triggered,” Bank of America strategist Michael Hartnett said.

The sell signal from Bank of America flashes at a time when stocks are trading near record highs. And investors are exhibiting very bullish behavior, according to the note.

“The biggest jump in investor optimism since Jun’20 on Fed cuts, China stimulus, soft landing,” Hartnett said, adding that “froth” is on the rise.

Fueling the optimism is expectations that the global economy is on a solid footing and ready to grow in the years ahead. The survey saw global growth expectations rise from -47% to -10%, representing the 5th largest jump since 1994.

Meanwhile, 76% of institutional investors surveyed by the bank see a probability of a “soft landing” in the economy, while the prevailing alternative scenario is a “no landing” rather than a “hard landing.”

The main difference between a soft landing and a hard landing in the economy is how fast the economy will grow going forward rather than contract in a hard landing scenario.

As to potential risks in the market, investors are most worried about geopolitical conflicts, which rose to 33% from 19% last month. Other risks on the radar of investors include an increase in inflation and a potential recession.

Finally, the most crowded trade continues to be long the Magnificent Seven mega-cap tech stocks, according to the survey.

“Long Magnificent 7 is considered the most crowded trade (per 43% of investors) followed by #2 long gold (17%), and #3 long China equities (14%),” Hartnett said.

Read the original article on Business Insider

Empowering the Immunocompromised and Elderly: ExeVir Bio presents promising XVR013m data at ID Week 2024

GHENT, Belgium, Oct. 17, 2024 (GLOBE NEWSWIRE) — ExeVir Bio, a biotech company developing robust heavy chain-only antibody therapies for broad protection against infectious diseases, is pleased to announce its participation in ID Week 2024, where it will present a poster on XVR013m, a potent VHH-FC antibody for the prevention and treatment of COVID-19. This year’s conference will be held in Los Angeles from October 16-19, 2024.

- Poster Title: XVR013m, a broadly neutralizing VHH-FC antibody targeting the S2 subunit of SARS-CoV-2 with high potency.

- Session: Z4: COVID-19: Treatment

- Date & Time: Saturday October 19, 2024; 12:15 PM – 1:30 PM Pacific Time

- Presenting Author: F. Herschke, Head of Non-clinical Development

- Virtual Link/Access: P-2023

The poster will highlight the uniqueness of XVR013m, providing key findings relevant to the protection of the most vulnerable against COVID-19.

ExeVir’s XVR013m, COVID-19 program focuses on addressing the high unmet medical need to protect and treat immunocompromised and elderly individuals that account for respectively 4% and 10% of the global population. Despite the availability of effective vaccines, the immunocompromised and elderly remain at a higher risk for severe COVID-19 as they are often unable to elicit an adequate immune response to vaccination and therefore would benefit greatly from additional protection in the form of antibody therapeutics.

ExeVir is currently making preparations to start the clinical development of the variant-proof XVR013m as a solution for the prevention of COVID-19 in the target populations of immunocompromised and elderly individuals.

Dr Jeanne Bolger, CEO of ExeVir and Chair of the Board of Directors, said: “COVID-19 is here to stay and is now clearly established as the most important respiratory infectious disease causing substantially more hospitalizations and deaths compared to influenza and RSV. Unlike flu and RSV, COVID-19 can cause long-term adverse health sequelae in the form of Long COVID, with significant economic and societal burden. It is imperative that we continue to invest in interventions to protect individuals from this disease. We are excited to present our latest findings on XVR013m, an S2 binder aiming to provide consistent and long-lasting protection for the most vulnerable at this year’s ID Week. This presentation underscores our commitment to addressing critical public health challenges and improving outcomes for those most at risk.”

References

1. Impact of COVID-19 on immunocompromised populations during the Omicron era: insights from the observational population-based INFORM study, Evans et al, The Lancet, 2023.

https://www.thelancet.com/journals/lanepe/article/PIIS2666-7762%2823%2900166-7/fulltext.

2. World population above 65 years old: Population ages 65 and above, total | Data (worldbank.org)

For more information contact:

ExeVir Bio

Veronique Vandevoorde

vvandevoorde@exevir.com

About ExeVir Bio

ExeVir Bio is a clinical stage biotechnology company developing heavy-chain only antibody therapies focusing on infectious diseases. The company is harnessing its llama-derived antibody (VHH) technology platform to generate multi-specific antibodies for prophylaxis and treatment of infectious diseases. ExeVir’s initial focus is on prevention of COVID-19 for the immunocompromised patient population, including active chemotherapy, immunosuppressive drugs, solid organ transplantation, hematological malignancies, AIDS patients, and for the elderly, where there remains a high unmet need due to the limitations of current vaccines and therapeutic approaches. In addition, ExeVir Bio is actively developing its pipeline to target dengue and bolster pandemic preparedness, addressing critical global health challenges with innovative VHH antibody therapies.

ExeVir has demonstrated it can progress its candidates from research to the clinic in under one year, execute early clinical development, and conduct scale-up manufacturing. Leveraging this extensive experience, its XVR013m asset is being developed to start a First in Human clinical trial in 2025.

VHHs are smaller in size than whole antibodies, giving them access to hidden epitopes that traditional monoclonal antibodies are unable to reach with potential for deeper tissue penetration and simpler, more cost-effective manufacturing. VHHs can be linked together like building blocks into single multi-specific molecules to tackle different epitopes or act through different mechanisms of action at once, to address more complex and co-evolving infectious diseases.

ExeVir is a spin-out of VIB, the leading Belgium-based life sciences research institute. It is backed by strong investors including Fund+, which led the series A of EUR 42 million, together with an international consortium including UCB Ventures, SFPIM, V-Bio Ventures, VIB, Wallonie Entreprendre, Noshaq, Vives IUF and SambrInvest. ExeVir has received support from VLAIO, the SPW-Recherche and the European Union, leading to a total of EUR 18 million in non-dilutive funding.

Find out more on ExeVir’s LinkedIn or on ExeVir’s website

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

A Preview Of Taiwan Semiconductor's Earnings

Taiwan Semiconductor TSM is gearing up to announce its quarterly earnings on Thursday, 2024-10-17. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that Taiwan Semiconductor will report an earnings per share (EPS) of $1.80.

Taiwan Semiconductor bulls will hope to hear the company announce they’ve not only beaten that estimate, but also to provide positive guidance, or forecasted growth, for the next quarter.

New investors should note that it is sometimes not an earnings beat or miss that most affects the price of a stock, but the guidance (or forecast).

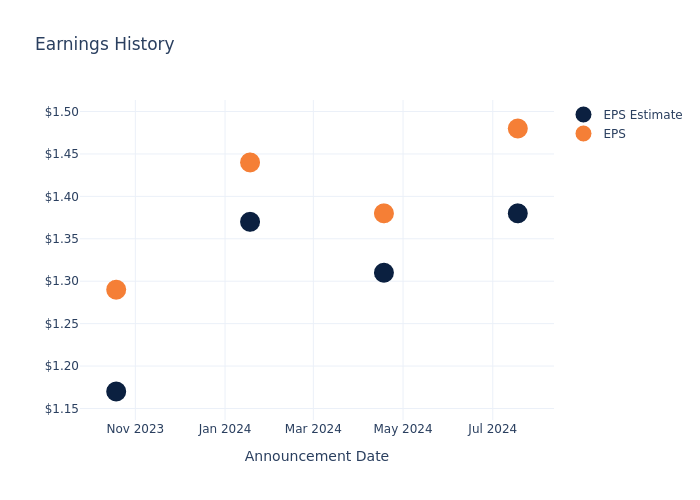

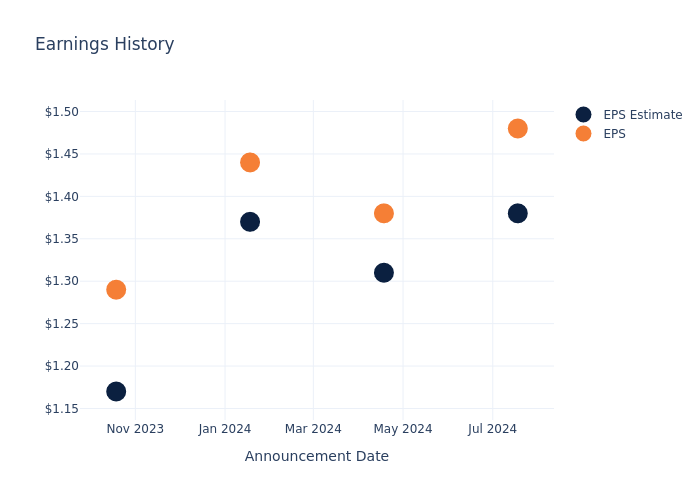

Historical Earnings Performance

During the last quarter, the company reported an EPS beat by $0.10, leading to a 3.55% drop in the share price on the subsequent day.

Here’s a look at Taiwan Semiconductor’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.38 | 1.31 | 1.37 | 1.17 |

| EPS Actual | 1.48 | 1.38 | 1.44 | 1.29 |

| Price Change % | -4.0% | -3.0% | 1.0% | -2.0% |

Market Performance of Taiwan Semiconductor’s Stock

Shares of Taiwan Semiconductor were trading at $187.13 as of October 15. Over the last 52-week period, shares are up 101.79%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts’ Perspectives on Taiwan Semiconductor

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Taiwan Semiconductor.

The consensus rating for Taiwan Semiconductor is Outperform, based on 3 analyst ratings. With an average one-year price target of $236.67, there’s a potential 26.47% upside.

Peer Ratings Comparison

In this comparison, we explore the analyst ratings and average 1-year price targets of Advanced Micro Devices, Qualcomm and Texas Instruments, three prominent industry players, offering insights into their relative performance expectations and market positioning.

- The consensus outlook from analysts is an Outperform trajectory for Advanced Micro Devices, with an average 1-year price target of $188.69, indicating a potential 0.83% upside.

- The consensus among analysts is an Neutral trajectory for Qualcomm, with an average 1-year price target of $201.5, indicating a potential 7.68% upside.

- Texas Instruments received a Neutral consensus from analysts, with an average 1-year price target of $217.89, implying a potential 16.44% upside.

Comprehensive Peer Analysis Summary

The peer analysis summary presents essential metrics for Advanced Micro Devices, Qualcomm and Texas Instruments, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Broadcom | Buy | 47.27% | $8.36B | -2.77% |

| Advanced Micro Devices | Outperform | 8.88% | $2.86B | 0.47% |

| Qualcomm | Neutral | 11.15% | $5.22B | 8.67% |

| Texas Instruments | Neutral | -15.65% | $2.21B | 6.59% |

Key Takeaway:

Taiwan Semiconductor ranks at the top for Revenue Growth and Gross Profit among its peers. It is in the middle for Return on Equity.

About Taiwan Semiconductor

Taiwan Semiconductor Manufacturing Co. is the world’s largest dedicated chip foundry, with over 60% market share. TSMC was founded in 1987 as a joint venture of Philips, the government of Taiwan, and private investors. It went public as an ADR in the U.S. in 1997. TSMC’s scale and high-quality technology allow the firm to generate solid operating margins, even in the highly competitive foundry business. Furthermore, the shift to the fabless business model has created tailwinds for TSMC. The foundry leader has an illustrious customer base, including Apple, AMD, and Nvidia, that looks to apply cutting-edge process technologies to its semiconductor designs. TSMC employs more than 73,000 people.

Taiwan Semiconductor: Delving into Financials

Market Capitalization Analysis: The company’s market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Taiwan Semiconductor’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 40.07%. This signifies a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Taiwan Semiconductor’s net margin surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 36.8% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Taiwan Semiconductor’s ROE excels beyond industry benchmarks, reaching 6.67%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Taiwan Semiconductor’s financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 4.21%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.27, Taiwan Semiconductor adopts a prudent financial strategy, indicating a balanced approach to debt management.

To track all earnings releases for Taiwan Semiconductor visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Repairing over 1000 homes in Calgary

CALGARY, AB, Oct. 16, 2024 /CNW/ -Today the government of Canada, the City of Calgary and Calgary Housing announced over $33 million to repair 1052 homes across the city.

These homes will undergo extensive repairs and renewals that include fixing building envelopes, replacing roofs, windows and doors, as well as making them more accessible and energy efficient.

Funding for these portfolios is as follows:

- $10.04 million from the federal government through the Affordable Housing Fund (AHF)

- $11.66 million from the City of Calgary

- $11.76 million from Calgary Housing

A detailed list of all the projects that received funding is provided in an appendix to this release.

Quotes:

“Today marks a significant step forward for housing here in Calgary. By working with our city’s partners, we are making over 1000 homes safer and more accessible and improving the living conditions for thousands of people. This will truly make a difference in our ongoing work to provide safe and affordable housing for all Canadians.” – George Chahal, Member of Parliament for Calgary Skyview, Alberta

“One of the most effective ways to meet our affordable housing needs is to invest in the homes we already have. By prioritizing repairs and improvements, we can ensure that residents remain in their beloved communities. We must continue investing in the homes that have kept our neighbours safe and warm for decades.” – Jyoti Gondek, Mayor of Calgary

“With this funding contribution from our partners at CMHC, along with investment by The City of Calgary and Calgary Housing, we are protecting and renewing affordable homes that have provided security and dignity to thousands of Calgarians over the years. These efforts will ensure these homes continue to offer safe, secure, and affordable living for families and individuals—now and for decades to come.” – Sarah Woodgate, President, Calgary Housing

Quick facts:

- Canada’s National Housing Strategy (NHS) is a $115+ billion plan to give more Canadians a place to call home. Progress on programs and initiatives are updated quarterly at http://www.placetocallhome.ca. The Housing Funding Initiatives Map shows affordable housing projects that have been developed.

- As of June 2024, the federal government has committed $54.28 billion to support the creation of over 149,000 units and the repair of over 288,000 units. These measures prioritize those in greatest need, including seniors, Indigenous Peoples, people experiencing or at risk of homelessness, and women and children fleeing violence. NHS is built on strong partnerships between the federal, provincial, and territorial governments, and continuous engagement with others, including municipalities, Indigenous governments and organizations, and the social and private housing sectors. This includes consultations with Canadians from all walks of life, and people with lived experience of housing need.

- The Affordable Housing Fund (AHF), provides funding through low-interest and/or forgivable loans or contributions to partnered organizations for new affordable housing and the renovation and repair of existing, affordable and community housing. This is a $14.6 billion program under the National Housing Strategy (NHS) that gives priority to projects that help people who need it most, including women and children fleeing family violence, seniors, Indigenous peoples, people living with disabilities, those with mental health or addiction issues, veterans, and young adults.

- As of June 2024, the Government of Canada has committed $9.40 billion to support the creation of over 37,000 units and the repair of over 165,000 units through the Affordable Housing Fund.

Additional Information:

- Visit Canada.ca/housing for the most requested Government of Canada housing information.

- CMHC contributes to the stability of the housing market and financial system, provides support for Canadians in housing need, and offers unbiased housing research and advice to all levels of Canadian government, consumers and the housing industry. CMHC’s aim is that everyone in Canada has a home they can afford and that meets their needs. For more information, follow us on Twitter, Instagram, YouTube, LinkedIn and Facebook.

- To find out more about the National Housing Strategy, please visit www.placetocallhome.ca.

Appendix: Projects receiving funding

|

Project Names |

Units |

Funding |

|

Calgary Housing Repairs Portfolio: Erin Woods 4 |

Total for 9 projects: |

|

|

City of Calgary Repairs Portfolio: City Highrise |

80 |

|

|

These funds will be distributed by Calgary Housing and the City of Calgary for various repair projects across the region and more info will become available as repairs complete |

569 |

|

|

Total: |

1052 |

$33.34 million |

SOURCE Government of Canada

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/16/c4508.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/16/c4508.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Discover Reports Better-Than-Expected Q3 Results, Higher Delinquency Rates YOY: Details

Discover Financial Services DFS reported its third-quarter financial results after Wednesday’s closing bell. Here’s a look at the details from the report.

The Details: Discover reported quarterly earnings of $3.69 per share, which beat the analyst consensus estimate of $3.44. Quarterly revenue came in at $4.453 billion, which beat the analyst consensus estimate of $4.346 billion and is a 10.11% increase over sales of $4.044 billion from the same period last year.

The company reported third-quarter 30 or more days delinquency rates of 3.84%, up from 3.41% from the same quarter last year and 90 or more days delinquency rates of 1.87%, up from 1.57%.

- Digital Banking pretax income of $1.2 billion for the quarter was $401 million higher than the prior year period, reflecting increased revenue net of interest expense and a lower provision for credit losses partially offset by increased operating expenses.

- Total loans ended the quarter at $127.0 billion, up 4% year-over-year and down 1% sequentially. Credit card loans ended the quarter at $100.5 billion, up 3% year-over-year. Personal loans increased $879 million, or 9%. Private student loans were down 19% driven by the first closing of the private student loan portfolio sale.

- Net interest income for the quarter increased $333 million, or 10% year-over-year, driven by higher average receivables and net interest margin expansion.

- Net interest margin was 11.38%, up 43 basis points versus the prior year.

- Card yield was 16.23%, up 80 basis points from the prior year primarily driven by a lower promotional balance mix and lower payment rates, partially offset by higher interest charge-offs.

- Payment Services pretax income of $84 million was largely flat year-over-year. Payment Services volume was $100.5 billion, up 9% from the prior year period.

- Discover Network volume was down 4% reflecting a slowdown in Discover card sales volume.

- PULSE dollar volume was up 14% driven by increased debit transaction volume.

- Diners Club volume was up 7% year-over-year reflecting strength across most regions.

“Discover’s financial performance remained strong in the third quarter, benefiting from increased net interest margin, modest loan growth, and some credit improvement,” said Michael Shepherd, Discover’s Interim CEO and President. “We are pleased to have completed the first of four student loan sale closings, which will simplify our business. Additionally, we continued to make good progress on our risk management and compliance capabilities.”

DFS Price Action: According to Benzinga Pro, Discover Financial shares are down 0.64% after-hours at $146.58 at the time of publication Wednesday.

Read Also:

Photo: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Data Quality and Combating Bias Emerge as Top Hurdles for AI Innovation, According to New Report

NEW YORK, Oct. 17, 2024 (GLOBE NEWSWIRE) — Prove AI, a first-of-its kind AI governance tool powered by blockchain technology, today released a new report, The Essential Role of Governance in Mitigating AI Risk. The report, which polled 600+ global executives, found that AI governance is seen as a critical area of investment for leaders to maintain responsible AI systems and mitigate risk. Among other highlights from the findings, executives see strong AI governance as a key step towards improving trust with end-users, and ensuring AI’s long-term ROI.

The report, commissioned by Prove AI and conducted by Zogby Analytics, surveyed CEOs, CIOs and CTOs of large companies across the US, UK and Germany. Of the organizations polled, the vast majority, (96%) are already using AI to support business operations, with the same tally (96%) reporting AI budgets will increase in the coming year. Top motivations for AI investment were increasing productivity (82%), operational efficiency (73%), stronger decision making (65%) and cost savings (60%); top AI use cases included customer service and support, predictive analytics, and marketing and ad optimization.

While investments continue to surge, business leaders are also clearly recognizing the additional risk exposure that AI brings to their organizations. According to respondents, the biggest deterrent to implementing new AI solutions are data integrity and security. This concern adds to existing AI performance issues that executives have already encountered, including:

- Data quality issues (eg inconsistencies or inaccuracies): 41%

- Bias detection and mitigation challenges in AI algorithms, leading to unfair or discriminatory outcomes: 37%

- Difficulty in quantifying and measuring the return on investment (ROI) of AI initiatives, making it challenging to justify investments and prioritize projects: 28%

Executives exhibited confidence in the risk-management measures around AI applications, with 95% of respondents stating their organization is doing well with AI risk management today. However, in probing existing and upcoming priorities across risk management and AI governance, the report found:

- Only 5% of executives say their organization has implemented any AI governance framework.

- 82% of executives say that implementing AI governance solutions is a somewhat or extremely pressing priority; 85% cite plans to implement an AI governance solution by summer 2025.

- Most (82%) participants are supportive of an AI governance executive order to provide stronger oversight, while 65% are somewhat or very concerned about IP infringement and data security.

As the data shows, this confidence wavers when executives factor in the pending enforcement of global regulations like the EU AI Act. De-risking AI is a top priority, and there is still work to be done. For these reasons, implementing and/or optimizing a dedicated AI governance strategy has emerged as a top priority.

“Executives are making themselves clear: AI’s long-term efficacy, including providing a meaningful return on the massive investments organizations are currently making, is contingent on their ability to develop and refine comprehensive AI governance strategies,” said Prove AI CEO, Mrinal Manohar. “The wave of AI-focused legislation going into effect around the world is only increasing the urgency; for the current wave of innovation to continue responsibly, we need to implement clearer guardrails to manage and monitor the data informing AI systems.”

Prove AI Accepting Early User Applications

Prove AI is accepting applications for its early access program through the end of Q4 2024; interested parties can apply on the Prove AI website. The solution will also be demonstrated at IBM TechXchange 2024 in Las Vegas, on October 22.

To access the full report, go to: https://casperlabs.io/report/governance-mitigating-ai-risk

About Prove AI

Prove AI is a comprehensive AI governance solution that enables certifiable and tamper-proof auditing for organizations building, training and running AI models. Led by a team of proven operators and technologists from companies including IBM, Amazon, Accenture, Bain Capital and Dropbox, Prove AI brings unprecedented visibility and trust to AI solutions so that organizations can embrace the technology with confidence and comply with all relevant regulatory requirements. Learn more at proveai.com.

Media Contact

LaunchSquad

proveai@launchsquad.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.