ACRES Commercial Realty Corp. to Report Results for Third Quarter 2024

UNIONDALE, N.Y., Oct. 16, 2024 /PRNewswire/ — ACRES Commercial Realty Corp. ACR (the “Company”) announced today that it will release its results for the third quarter 2024, on Wednesday, October 30, 2024, after the market closes. The Company invites investors and other interested parties to listen to its live conference call via telephone or webcast on Thursday, October 31, 2024, at 10:00 a.m. Eastern Time.

The conference call can be accessed by dialing 1-800-274-8461 (U.S. domestic) or 1-203-518-9814 (International), Conference ID ACRES or from the investor relations section of the Company’s website at www.acresreit.com.

For those unable to listen to the live conference call, a replay will be available on the Company’s website and telephonically through November 14, 2024 by dialing 1-844-512-2921 (U.S. domestic) or 1-412-317-6671 (International), passcode 11156888.

About ACRES Commercial Realty Corp.

ACRES Commercial Realty Corp. is a real estate investment trust that is primarily focused on originating, holding and managing commercial real estate (“CRE”) mortgage loans and equity investments in commercial real estate property through direct ownership and joint ventures. The Company is externally managed by ACRES Capital, LLC, a subsidiary of ACRES Capital Corp., a private commercial real estate lender exclusively dedicated to nationwide middle market CRE lending with a focus on multifamily, student housing, hospitality, industrial and office property in top U.S. markets. For more information, please visit the Company’s website at www.acresreit.com or contact investor relations at IR@acresreit.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/acres-commercial-realty-corp-to-report-results-for-third-quarter-2024-302278023.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/acres-commercial-realty-corp-to-report-results-for-third-quarter-2024-302278023.html

SOURCE ACRES Commercial Realty Corp.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Blowout Growth From 3 Stocks Is About To Leave Nvidia In The Dust

Investors are on the lookout for blowout revenue growth in the S&P 500’s ongoing third-quarter earnings season. And believe it or not, Nvidia isn’t the top dog.

↑

X

Beating The Market: How To Find Outperforming Stocks

Three S&P 500 companies, including Super Micro Computer (SMCI), Micron Technology (MU) and Newmont (NEM), are expected to post 88% or higher revenue growth in the third quarter, says an Investor’s Business Daily analysis of data from S&P Global Market Intelligence and MarketSurge. That’s even higher than the 82% top-line growth expected from Nvidia.

Seeing a materials company plus two smaller tech firms outgrow Nvidia (NVDA) is further proof of how the S&P 500 market rally continues to include more sectors and companies. Revenue in the S&P 500 as a whole is only seen rising 4.6%. That makes companies putting up double-digit growth all the more interesting.

Biggest S&P 500 Grower: Super Micro Computer

There’s no question where analysts think the most top-line growth will come from. They’re looking squarely at Super Micro Computer.

The maker of high-end computer systems is expected to post $6.6 billion in third quarter revenue, up 205% from the same year-ago period. No other S&P 500 company comes even close. Micron’s predicted revenue growth in the quarter is 91%, making it a distant No. 2.

Super Micro’s stock has been sliding below its moving averages, knocking its RS Rating down to just 20. But with an EPS Rating of 99, it’s still a powerhouse. Shares are up more than 65% this year. The company is due to report quarterly results on Oct. 29.

Micron is no slouch either. It’s shares, too, are down in the past few weeks, explaining the low RS Rating of 57. But the stock is still up 27% this year. And it has an EPS Rating of 80.

Not Just S&P 500 Tech

It’s tempting to think only tech stocks are putting up growth. But that’s not true.

Analysts like miner Newmont will post revenue of 88%. That’s a solid Nvidia-beating number. S&P 500 companies in communications services, health care and utilities are seen putting up 8%, 6.8% and 6.7% revenue growth, respectively in the quarter.

So if you’re looking for growth, don’t assume Nvidia is your only option.

Biggest S&P 500 Revenue Growth Expected

| Company | Ticker | Rev growth |

|---|---|---|

| Super Micro Computer | SMCI | 204.6% |

| Micron Technology | MU | 90.7% |

| Newmont | NEM | 87.5% |

| Nvidia | NVDA | 81.6% |

| Broadcom | AVGO | 51.4% |

| Western Digital | WDC | 49.8% |

| ONEOK | OKE | 48.4% |

| RTX | RTX | 47.2% |

| Seagate Technology | STX | 45.7% |

| Atmos Energy | ATO | 43.8% |

Sources: IBD, S&P Global Market Intelligence

Follow Matt Krantz on X (Twitter) @mattkrantz

YOU MAY ALSO LIKE:

Peter Schiff Questions 'Trump-Inspired' Bitcoin Pump: 'One Of The Promises He Did Not Make Was To Buy Any'

Influential economist Peter Schiff expressed skepticism about the surge in Bitcoin’s BTC/USD value, attributing it to misplaced expectations of a potential Donald Trump administration’s support for the cryptocurrency.

What Happened: Schiff shared his thoughts on Bitcoin’s latest rally on his YouTube channel. He noted that the price increase was part of the “Trump trade,” as many in the cryptocurrency community believe that a Trump victory would be bullish for Bitcoin.

“It’s not going to happen,” Schiff dismissed the narrative. “He’s [Trump] made a lot of promises and I’ve gone over some of those promises on the podcast. But one of the promises he did not make was to buy any Bitcoin.”

Schiff reminded his viewers that though the GOP presidential nominee talked about setting up a Bitcoin reserve, he never mentioned funding the reserve by buying Bitcoin. Rather, Trump simply committed not to sell off the Bitcoin that the government already owns.

In another X post, Schiff called the so-called Trump-inspired Bitcoin pump “meaningless.”

The Trump campaign team didn’t immediately return Benzinga’s request to confirm Schiff’s assertion.

Why It Matters: Schiff’s comments followed his previous remarks where he suggested that Trump’s endorsement of Bitcoin was a strategic move to secure votes and contributions from the cryptocurrency community, not a genuine commitment to make it a reserve asset.

He also questioned Trump’s strategy of holding onto Bitcoin to start a strategic U.S. reserve, arguing that if Trump truly intended to implement this strategy, he would have kept it under wraps until he was back in office.

Digital asset trading firm QCP Capital attributed Bitcoin’s rise to higher odds of a Trump win on betting markets, adding that his cryptocurrency policies are much friendlier and more supportive than those of Kamala Harris.

Price Action: At the time of writing, Bitcoin was exchanging hands at $67,447.94, up 0.48% in the last 24 hours, according to data from Benzinga Pro.

Photo courtesy: Gage Skidmore on Flickr

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TSMC bullish on outlook as AI boom blows Q3 profit past forecasts

By Yimou Lee, Ben Blanchard and Faith Hung

TAIPEI (Reuters) -TSMC, the world’s largest contract chipmaker, bet on sustaining its strong growth, after reporting on Thursday a forecast-beating 54% jump in quarterly profit driven by soaring demand for chips used in artificial intelligence (AI).

Taiwan Semiconductor Manufacturing Co, the dominant producer of advanced chips used in AI applications whose customers include Apple and Nvidia, has benefited from a surge towards AI across a spectrum of industries.

TSMC estimated its capital spending in the current quarter would more than double to around $11.5 billion and that the budget was likely to increase further next year, as it expects healthy demand for its products.

It said 2024 full-year revenue will grow close to 30% in U.S. dollar terms, compared to a previous guidance of slightly above the mid-20% range.

TSMC said revenue from AI processors is set to account for mid-teens percentage of its overall revenue this year.

“The demand is real,” Chairman and CEO C.C. Wei told an earnings call, referring to AI and adding it would last for many years.

The company’s robust performance and outlook underscore the continued strong demand for AI, after some industry watchers raised doubts following a lower than expected 2025 sales outlook earlier this week from ASML, the world’s biggest chipmaking equipment supplier.

At its quarterly earnings call on Thursday, TSMC said it expects capital expenditure for this year at slightly higher than $30 billion, compared with a previous forecast of $30 billion-$32 billion, as it races to expand production.

Capital expenditure for 2025 was likely to be higher than this year, TSMC said, although it did not provide a figure.

It said next year looks to be “healthy”, and forecast a similar outlook for the next five years.

Piter Yang, a fund manager of Fuh Hwa Securities Investment Trust, said TSMC’s results had wiped away concerns about the industry that had been sparked by ASML’s earnings.

“TSMC is a dominant company,” he said. “It is the only one with advanced process technologies that won’t be found at companies like Intel or Samsung.”

TSMC is spending tens of billions of dollars building new factories overseas, including $65 billion on three plants in the U.S. state of Arizona, though it has said most manufacturing will remain in Taiwan.

It said on Thursday it expects its first fab in Arizona to see volume production in 2025, while its second fab there should start volume production in 2028. It forecasts the third Arizona fab to begin volume production by the end of the decade.

The Taiwan chipmaker said it expected fourth-quarter revenue of $26.1 billion-$26.9 billion, up from $19.62 billion in the same period of 2023.

RECORD QUARTERLY PROFIT

The bellwether for the chip industry reported earlier on Thursday a net profit of T$325.3 billion ($10.11 billion) for the quarter ended Sept. 30, its highest for any quarter, compared with the T$300.2 billion predicted by an LSEG SmartEstimate drawn from 22 analysts. SmartEstimates give greater weighting to forecasts from analysts who are more consistently accurate.

TSMC, Asia’s most valuable publicly listed company, said third-quarter revenue rose 36% year-on-year to $23.5 billion, better than the company’s previous forecast of $22.4 billion to $23.2 billion. The company last week announced third-quarter revenue in Taiwan dollars, coming in at T$759.69 billion.

“Our business in the third quarter was supported by strong smartphone and AI-related demand for our industry-leading 3nm and 5nm technologies,” Wendell Huang, TSMC’s CFO, told an earnings call. “Moving into the fourth quarter of 2024, we expect our business to continue to be supported by strong demand for our leading-edge process technologies.”

The second half of the year is traditionally the peak season for Taiwanese tech companies as they race to supply customers ahead of the year-end holiday season in major Western markets.

Capital expenditure in the third quarter was $6.4 billion, TSMC said, compared with $6.36 billion in the second quarter.

The AI boom has helped drive up TSMC shares, with its Taipei-listed stock leaping 75% so far this year, compared with a 28% gain for the broader market, giving the company a market capitalisation of around $840 billion.

TSMC, colloquially referred to in Taiwan as the “sacred mountain protecting the country” for its critical role in Taiwan’s export-dependent economy, faces little competition, though both Intel and Samsung are trying to challenge its dominance.

($1 = 32.1700 Taiwan dollars)

(Reporting by Yimou Lee, Ben Blanchard and Faith Hung; Editing by Christopher Cushing, Muralikumar Anantharaman and Tomasz Janowski)

Anthony Scaramucci Tells What Percentage Of His Wealth Is Tied Up In Bitcoin: 'I Haven't Sold Any. Thank God, Knock On Wood!'

Anthony Scaramucci, CEO of SkyBridge Capital, revealed his significant investments in Bitcoin BTC/USD, the world’s largest cryptocurrency by market capitalization.

What happened: During an interaction with well-known podcaster Natalie Brunell, Scaramucci shared anecdotes about his conversation with MicroStrategy CEO Michael Saylor.

While working on his book “The Little Book of Bitcoin,” the foreword of which was penned by Saylor, Scaramucci recalled being asked by fellow Bitcoin bull how much he owned in the apex cryptocurrency.

“55% of my net worth is tied up in Bitcoin,” Scaramucci said. “I haven’t sold any Bitcoin thank God, knock on wood!”

Scaramucci added that initially, he finished his book by presenting a case of allocating around 1-3% of one’s portfolio toward Bitcoin. But after Saylor asked him to mention his exposure as well along with the recommendation, he reworded it.

According to Amazon, the book is a guide to understanding the implications of digital asset technology on finance, touching down on basic Bitcoin concepts like blockchain, hashes, and mining.

Why It Matters: A passionate advocate of Bitcoin, Scaramucci predicted last month that the apex cryptocurrency would reach $150,000-$200,000 as ownership continues to grow.

Saylor is another prominent Bitcoin bull, holding nearly $1 billion in Bitcoin and intending to buy more in the future.

Price Action: At the time of writing, Bitcoin was exchanging hands at $67,622.70, up 0.47% in the last 24 hours, according to data from Benzinga Pro.

Photo by World Economic Forum on Flickr

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

TSMC Hikes Revenue Outlook in Show of Confidence in AI Boom

(Bloomberg) — Taiwan Semiconductor Manufacturing Co. raised its target for 2024 revenue growth after quarterly results beat estimates, allaying concerns about global chip demand and the sustainability of an AI hardware boom.

Most Read from Bloomberg

The main chipmaker to Nvidia Corp. and Apple Inc. now expects sales to climb roughly 30% in US dollar terms this year, up from previous projections for about a mid-20% rise. That’s after TSMC reported better-than-predicted earnings for the September quarter. And it foresees capital expenditure rising in 2025 from roughly $30 billion this year.

TSMC’s outlook should help tamp down concerns that investors mis-judged the AI and semiconductor demand. Those fears crystallized after chip industry linchpin ASML Holding NV stunned markets by reporting about half the orders investors had expected. On Thursday, Chief Executive Officer C. C. Wei sought to dispel those doubts.

“The demand is real and I believe it’s just the beginning,” Wei said, echoing a number of executives including Nvidia’s CEO. In terms of overall chip demand, “everything’s stabilized and start to improve.”

Its American depositary receipts rose more than 6% in pre-market trading in New York. Nvidia’s stock gained about 2.5%. Shares of Japanese chip gear makers including Lasertec Corp. pared losses in Tokyo, while Infineon Technologies AG rose in Europe alongside sector peers.

TSMC’s shares have surged more than 70% this year, outpacing many of Asia’s biggest tech firms in a reflection of strong sales of the Nvidia chips vital to artificial intelligence development.

For a liveblog on TSMC’s earnings, click here.

Taiwan’s largest company had raised its outlook for 2024 revenue just a few months ago in July, underscoring expectations for spending on AI infrastructure from the likes of Microsoft Corp. and Amazon.com Inc. Steady adoption of artificial intelligence should also help fuel sales of iPhones and other gadgets in the long run.

Still, investors had watched for deviations in TSMC’s outlook after ASML blamed slower-than-expected recovery in the automotive, mobile and PC markets for stalling chip plant expansion plans. AI remains a bright spot, its executives said.

“TSMC is not just an AI machine,” said Ben Barringer, technology analyst at Quilter Cheviot. “They are much better positioned than both Intel and Samsung, which have had their own well-documented issues. TSMC has positioned itself well and should any real downturn hit the sector, it should be in a strong position to weather this and emerge in a good place.”

What Bloomberg Intelligence Says

TSMC’s 57%-plus gross-margin guidance for 4Q (vs. consensus’ 54.7%) — coupled with the fast ramp-up of N3-node revenue — indicates still-strong demand for its AI chips from Nvidia and others, consistent with our view. Sales growth of about 25% in 2025 looks feasible, based on our calculations, supported by TSMC’s leadership in 3- and 5-nm nodes, and its advanced CoWoS proprietary semiconductor packaging technology.

– Charles Shum, analyst

Click here for the research.

On Thursday, TSMC reported a better-than-projected 54% rise in September-quarter net profit to NT$325.3 billion ($10.1 billion). And it expects revenue of $26.1 billion to $26.9 billion in the final quarter, beating an estimate for $24.9 billion.

The world’s largest maker of advanced chips has been one of the biggest beneficiaries of a global race to develop artificial intelligence. Its shares have more than doubled since that boom took off in late 2022 with the debut of OpenAI’s ChatGPT. TSMC’s market capitalization briefly crossed the $1 trillion mark in the US.

Yet even before ASML, some investors have grown cautious about the trajectory of global AI spending. They question whether big tech firms like Meta Platforms Inc. and Alphabet Inc. will continue to splash out on chips and data centers without a truly killer application.

The risks of data center over-capacity and geopolitical issues have unnerved some investors. Bloomberg reported this week that Biden administration officials have discussed capping sales of advanced AI chips from Nvidia and other American companies on a country-specific basis.

On Thursday, Wei said he expects revenue from AI server processors to more than triple this year, yielding a mid-teens percentage of total sales in 2024.

Longer-term, TSMC is pursuing a rapid international expansion.

It’s planning more plants in Europe with a focus on the market for artificial intelligence chips, according to a senior Taiwanese official. That’s on top of construction underway in Japan, Arizona and Germany.

–With assistance from Vlad Savov, Cindy Wang, Mayumi Negishi, Lianting Tu and Henry Ren.

(Updates with Nvidia shares and analyst’s comment from the fifth paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Unable to get its cosmetics plant project financed, Global Bioenergies is now focusing all its efforts on SAF opportunities

PRESS RELEASE

Unable to get its cosmetics plant project financed, Global Bioenergies is now focusing all its efforts on SAF opportunities

Evry, 17 October 2024 – 07:30 a.m.: After several months of efforts, the Company has been unable to find investors for its 2,500-ton plant dedicated to the cosmetics market, in a highly unfavorable context for the financing of first-of-a-kind projects. The Company is now devoting all its energy to applying its technology to the production of Sustainable Aviation Fuel (“SAF”), with a model of industrial partnerships.

Samuel Dubruque, Chief Financial Officer of Global Bioenergies, commented: “Despite all our efforts over the last few months, and with the conviction that we have presented the most mature case possible, we are now coming to the conclusion that our plant project will not reach final investment decision. Like all first-of-a-kinds, this project necessarily involves risks at various levels. The prospect of a significant return on investment linked to the cosmetics market should have been a sufficient counterbalance, allowing us to convince private investors to commit to the project, but we must realize that this is not the case in the current political, economic and financial context. Today, infrastructure investors limit themselves to less risky industrial replica projects1, and to projects more directly focused on energy markets.”

Marc Delcourt, co-founder and Chief Executive Officer, added: “Global Bioenergies regrets that this project is not moving forward, and draws the necessary conclusions: the Company will therefore not be carrying out any plant projects of its own in the short or medium term, and will be focusing all its efforts on a partnership model. The intrinsic value of the process developed by Global Bioenergies is not diminished by the non-realization of this first industrial project designed to meet the needs of the niche cosmetics market. Our main ambition remains to produce much larger volumes of SAF, in order to reduce the carbon footprint of the aviation sector and fight global warming, now an absolute priority. To achieve this, the technology partnership approach is the most appropriate.”

As a reminder, the Company’s process is one of only a dozen solutions to have obtained ASTM certification. The SAF market is currently in the start-up phase, and will really accelerate in 2030, when the European mandate increases to 6% (i.e. around 3 million tons/year) and production in the United States reaches the “Grand Challenge” target of 3 billion gallons per year (i.e. 9 million tons/year)2. The Company still aims to contribute to achieving these 2030 objectives on both sides of the Atlantic. Alongside this future large-scale SAF production, the Company intends to continue serving niche markets, in particular cosmetics.

About GLOBAL BIOENERGIES

As a committed player in the fight against global warming, Global Bioenergies has developed a unique process to produce SAF and e-SAF from renewable resources, thereby meeting the challenges of decarbonising air transport. Its technology is one of the very few solutions already certified by ASTM. Its products also meet the high standards of the cosmetics industry, and L’Oréal is its largest shareholder with a 13.5% stake. Global Bioenergies is listed on Euronext Growth in Paris (FR0011052257 – ALGBE).

Contacts

1 Réussir le passage à l’échelle des cleantech en France (website-files.com) – Cleantech for France (in French

2 Sustainable Aviation Fuel Market Outlook – June 2024, SkyNRG

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

SpaceX Rival Rockets Past Buy Point, But Beware Of Reentry

Aerospace manufacturer and satellite launcher Rocket Lab cleared an aggressive buy point Wednesday as shares of the SpaceX rival spiked. Meanwhile, space-based telecommunications provider AST SpaceMobile (ASTS) rebounded above a key moving average.

↑

X

How To Buy Stocks: Three-Weeks-Tight Chart Pattern

Long Beach, Calif.-based Rocket Lab USA (RKLB) provides aerospace launching services and produces components for small to medium-sized spacecraft and satellites, with the goal of making space launches more accessible and affordable. The company on Oct. 7 announced it was selected by NASA to complete a study for retrieving rock samples from Mars and returning them to Earth. Financial details were not disclosed.

Rocket Lab is working on a mission concept, which it says will be delivered at a “fraction” of the current projected program cost and conclude several years earlier than the current expected return date in 2040.

“Retrieving samples from Mars is one of the most ambitious and scientifically important endeavors humanity has ever embarked upon,” founder and CEO Sir Peter Beck said in the news release. “Rocket Lab has been methodically implementing a strategy for cost-effective planetary science in recent years, making us uniquely suited to deliver a low cost, rapid Mars Sample Return.”

Rocket Lab previously delivered a NASA mission to the Moon and delivered two spacecraft to NASA for a Mars mission. The company also helped facilitate operations in orbit and successfully re-entered a capsule from orbit to Earth, among other missions.

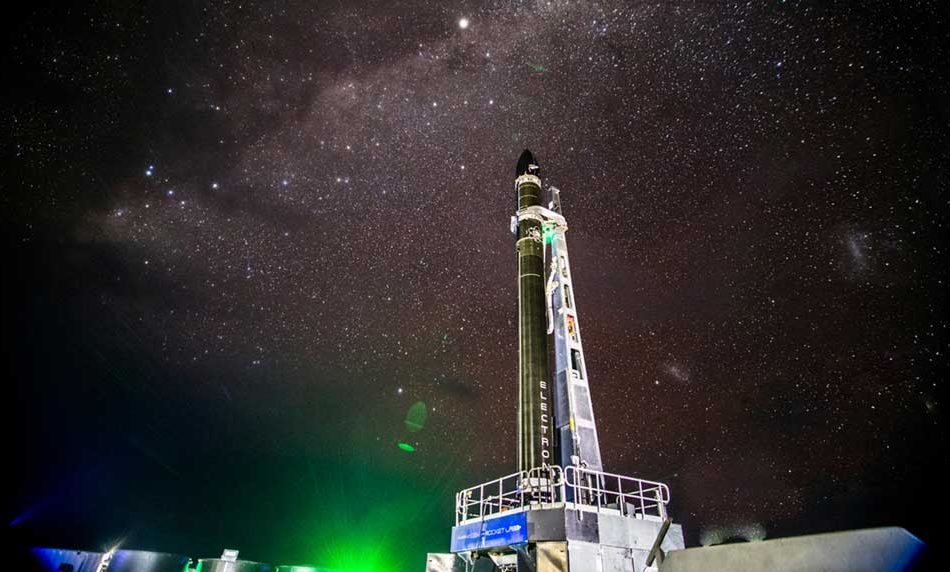

Rocket Lab boasts that it successfully deployed 197 satellites across 53 launches of its Electron rocket. Meanwhile, there are more than 1,700 satellites in orbit with Rocket Lab technology, according to the company website.

But that pales in comparison to SpaceX, which dominates launch services. Elon Musk’s company has completed 392 total launches and hopes to eventually colonize Mars. Meanwhile, Starlink, Musk’s satellite company, has more than 6,400 satellites in orbit as of September, Space.com reported.

Analyst Outlooks

Meanwhile, KeyBanc lifted its price target on Rocket Lab stock to $11 from $8 at the end of September after a roadshow with the company, The Fly reported. KeyBank says it is increasingly confident in Rocket Lab’s ability to scale its business. Additionally, KeyBanc also believes Rocket Lab is positioning itself to be an industry leader in launch services and satellite manufacturing and design. The firm maintained an overweight rating on RKLB stock.

JMP Securities initiated coverage of Rocket Lab in mid-September with a market perform rating. The firm said there are “several strong, fundamental aspects” to Rocket Lab. However, there are near-term risks, including rising launch costs and increased competition, particularly with the threat of SpaceX. There’s also uncertainty around Neutron, Rocket Lab’s deep-space cargo spacecraft, JMP added. The firm omitted a price target until there is more positive clarity.

Rocket Lab Stock

Rocket Lab stock leapt 12.6% to 11.19 Wednesday to clear a 10.29 buy point for a three-weeks-tight pattern.

Investors could also view the pattern as a high-tight flag following a strong run-up.

RKLB stock has vaulted more than 220% from its mid-April lows. Shares rallied 102% so far this year.

The huge advance makes Rocket Labs stock vulnerable to a sharp pullback. Revenue growth has accelerated for three straight quarters, but the company is still losing money. The space business is fraught with major risks.

Meanwhile, ASTS stock spiked 16.4% Wednesday and cleared resistance to close above its 50-day moving average. The above the technical level also made shares actionable.

AST SpaceMobile rocketed about 368% in 2024.

AST SpaceMobile’s business has some overlap with Starlink but is using SpaceX for satellite launches.

You can follow Harrison Miller for more stock news and updates on X/Twitter @IBD_Harrison

YOU MAY ALSO LIKE:

Best Growth Stocks To Buy And Watch: See Updates To IBD Stock Lists

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

Join IBD Live And Learn Top Chart Reading And Trading Techniques From Pros

Learn How To Time The Market With IBD’s ETF Market Strategy

Futures: Nvidia Rises In Buy Area; Why Nuclear Stocks Are Radioactive Now