Robinhood Legend Desktop App Launches To High Demand — CEO Vlad Tenev Reveals 1,000 Early-Access Users Opted In In '46 Seconds'

Robinhood Markets Inc. HOOD unveiled its new desktop trading platform, Robinhood Legend, at the HOOD Summit 2024, marking another step in the company’s transformation from a mobile-first trading app to a comprehensive wealth management platform.

What Happened: The new platform, which offers advanced charting capabilities including up to eight simultaneous charts and enhanced technical indicators, aims to attract more sophisticated retail investors. CEO Vlad Tenev announced that initial demand was strong, with the first thousand early access spots claimed in under a minute.

“Our first thousand early access spots to Robinhood Legend were claimed in 46 seconds,” Tenev wrote on X.

“We really think for many people, including those in this room, this will likely become the primary way you trade on Robinhood,” Tenev said during the summit presentation. “I think we’ve come a long way from an investing app on your phone all the way to a desktop platform for advanced [traders].”

The platform will be available free to Robinhood users and will roll out gradually over the coming weeks. During the summit, Abhishek Fatehpuria, Senior Director of Product at Robinhood, demonstrated Legend’s features, which allow users to conduct detailed technical analysis before executing trades through the platform.

Tenev also outlined several upcoming platform enhancements, including:

- Lower margin rates

- Simulated returns

- Futures trading capabilities

- Realized profit and loss tracking

- Index options trading

The company offered immediate early access to summit attendees and the first thousand users who visit robinhood.com/legend on a desktop or laptop computer.

This launch represents Robinhood’s latest effort to expand its service offerings beyond its initial mobile-focused, commission-free trading model that gained popularity during the meme stock trading boom. The move positions the company to compete more directly with traditional brokerages that offer comprehensive desktop trading tools.

Why It Matters: Robinhood’s introduction of the Legend platform comes amid a series of strategic expansions. Robinhood announced also the launch of futures and index options trading, signaling a major expansion of its offerings. CEO Tenev highlighted the availability of index options trading in the coming months, with extended-hours trading expected next year.

Additionally, Robinhood’s efforts to attract younger investors have been bolstered by its crypto strategy, which has significantly increased its revenue. The company’s acquisition of Bitstamp and expansion into the European Union are part of its strategy to enhance its crypto trading services.

Furthermore, the company’s stock has seen positive momentum, with a recent re-rating by Piper Sandler analyst Patrick Moley, who raised the price target from $23 to $27.

Price Action: Robinhood stock closed at $26.93 on Wednesday, up 0.49% for the day. In after-hours trading, the stock rose an additional 2.49%. Year to date, Robinhood’s stock has surged by an impressive 117.70%, according to data from Benzinga Pro.

Read Next:

Image Via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

CCA Industries, Inc. Reports Results of Operations for the Quarter and Nine Months ended August 31, 2024

FORT WASHINGTON, Pa., Oct. 16, 2024 /PRNewswire/ — CCA Industries, Inc. CAWW, announced today its results for the three and nine months ended August 31, 2024. The results can be found in the chart below.

The net loss was $444,878 for the three months ended August 31, 2024, compared to a loss of $452,394 for the three months ended August 31, 2023. As shown in the chart below, EBITDA for the third quarter of fiscal 2024 was a loss of $399,175 compared to an EBITDA loss of $456,962 for the third quarter of fiscal 2023. Christopher Dominello, Chief Executive Officer, commented, “I don’t believe EBITDA gives the full picture of the progress we are actually achieving at CCA. So, I thought it would be helpful for me to walk you through some of the specifics to help clarify our situation and why I am optimistic about our future.

But first, I would be remiss if I didn’t start by thanking you, the shareholder, for your patience as we continue our substantial paradigm shift from a 100% brick-and-mortar retail company to a hybrid company through the growth of our online channels. It was a necessary move so we could take control of our future as opposed to being at the mercy of the retailers who forced low margins and the constant fear of being discontinued even when successful. The move towards a hybrid model increases our revenue’s reliability and quality compared to operating in a brick-and-mortar environment. Now, this journey certainly has faced its challenges, and challenges remain. However, we feel that our initiatives will put CCA in a position of strength as we move into 2025 and beyond – increasing shareholder value.

When we started this business model shift, our primary focus was to decrease expenses while building an online/Amazon business as the insurance policy for brick-and-mortar retail. With regard to decreasing costs, we drove down our operating expenses from an average of approximately $5.1M to around $2.1M (a 60% reduction). We have grown our Amazon business from $250K Gross Sales per year and negative profitability to over $5M and double-digit positive profitability. With Amazon, we control the pricing, the placement, and the offering, which gives us some control over our destiny vs being at the mercy of brick-and-mortar retail and decisions that are outside our control.

We have found challenges with the Neutein rollout at CVS. No easy way to say it other than it has been less than desirable. Their initial order was substantially below the norm – ordering approximately 2 units per store, whereas a normal order would be in the 4-6 units per store range. It is impossible to advertise in that situation because if your ad works, it moves the unit off the shelf, and then the shelf is empty for 2-3 weeks until replenished. We are working with CVS on ways to address this issue, and they have been responsive.

Also, regarding Neutein, we had a meeting in Chicago with senior members at Walmart and were awarded the coveted open-call fast pass to present Neutein to the Walmart buyer. Mike Singletary, Dr. Mike Roussell, and I attended this meeting that was held at Walmart’s headquarters. Last week, we received a “New item Submission Form” from Walmart, which is an encouraging next step but certainly not the finish line and shouldn’t be taken as such.

Now, getting to profitability. Profitability can come from both expense reduction and/or revenue creation, and we have looked to do both.

Our most significant initiative for additional expense reduction is our move from three warehouses in two states to one warehouse in Kansas City. This has been a huge effort led by Steve Heit, our CFO, and it will reduce our freight, warehousing, delivery, and packing costs. We expect to see north of a 20% reduction in those sizeable cost buckets which will certainly help profitability as we move forward.

Our other initiative is increasing our prices across all our brands. This is a large paradigm shift that will come with some pain as we hold firm to the price increases and risk the possibility of discontinuation as we reject retail orders that are not at the new pricing. This is a necessity for CCA to be able to move forward, which led us to not expect to be profitable in the third quarter and possibly the fourth quarter as we make the tough moves for the right reasons. With that said, we do not have any brick-and-mortar retailer that makes up more than 15% of our business, making the move less risky. The primary beneficiary of the price increase will be our Amazon business, as it removes the price pressure on our items.

For organic growth, Lobe Miracle has grown 267 percent over the last 3 years, going from $300K to $1.1M, and currently has a year-over-year growth rate of 42% percent with a profit margin of over 70%. We are leveraging this success with the launch of line extensions under the Lobe Miracle brand, starting with the Lobe Miracle Rejuvenating Serum, which will launch in the next 6-8 weeks. It will be incremental revenue to Lobe Miracle Patches, and leveraging the anchor product’s success, we expect strong revenues and margins from the brand in 2025.

We are not out of the weeds yet but are very clear-eyed on what we need to do and where we are going. We have made great strides to date, and we feel our “go forward” strategy will take us to growth and profitability. The fourth quarter will likely also be a loss, but all the initiatives we are undertaking – and have completed – should lead to dramatic improvements in profitability in 2025 and beyond.”

Further information, including the Unaudited Financial Statement for the third quarter, ended August 31, 2024, the Audited Financial Statements for the year ended November 30, 2023, and the Quarterly Disclosure Statement filed with the OTC, may be found on the Company’s investor web site: www.ccainvestor.com

CCA Industries, Inc. manufactures and markets health and beauty aids, each under its individual brand name. The products include, principally, “Plus White” toothpaste and teeth whiteners, “Nutra Nail” nail care treatments, “Porcelana” skin care products, “Scar Zone” scar treatment products, “Sudden Change” anti-aging skin care products, brands, “Hair Off” depilatory products, “Lobe Miracle” earlobe protection products and “Neutein” brain health supplements.

Statements contained in the news release that are not historical facts are forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks and uncertainties, which would cause actual results to differ materially, from estimated results. No assurance can be given that the results in any forward-looking statement will be achieved, and actual results could be affected by one or more factors, which could cause them to differ materially. For these statements, we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act.

|

CCA INDUSTRIES, INC. Financial Results (Unaudited) |

|||

|

Three Months Ended |

|||

|

August 31, 2024 |

August 31, 2023 |

||

|

Revenues |

$ 1,755,246 |

$ 2,891,918 |

|

|

Net Losses: |

$ (444,878) |

$ (452,394) |

|

|

Losses Per Share: |

|||

|

Basic |

$ (0.06) |

$ (0.06) |

|

|

Diluted |

$ (0.06) |

$ (0.06) |

|

|

Weighted Average Common Shares Outstanding: |

|||

|

Basic |

7,561,684 |

7,561,684 |

|

|

Diluted |

7,571,460 |

7,561,684 |

|

|

EBITDA * |

$ (399,175) |

$ (456,962) |

|

|

* Earnings before interest, taxes, depreciation and amortization |

|||

|

Reconciliation of Net Income to EBITDA: |

|||

|

Net Income |

$ (444,878) |

$ (452,394) |

|

|

Provision for income taxes |

16,169 |

(55,924) |

|

|

Interest expense |

28,004 |

50,054 |

|

|

Depreciation and Amortization |

1,530 |

1,302 |

|

|

EBITDA |

$ (399,175) |

$ (456,962) |

|

|

CCA INDUSTRIES, INC. Financial Results (Unaudited) |

|||

|

Nine Months Ended |

|||

|

August 31, 2024 |

August 31, 2023 |

||

|

Revenues |

$ 6,100,393 |

$ 8,353,598 |

|

|

Net Income |

$ (714,709) |

$ (868,521) |

|

|

Earnings Per Share: |

|||

|

Basic |

$ (0.09) |

$ (0.11) |

|

|

Diluted |

$ (0.09) |

$ (0.11) |

|

|

Weighted Average Common Shares Outstanding: |

|||

|

Basic |

7,561,684 |

7,561,684 |

|

|

Diluted |

7,671,565 |

7,561,684 |

|

|

EBITDA * |

$ (685,842) |

$ (873,429) |

|

|

* Earnings before interest, taxes, depreciation and amortization |

|||

|

Reconciliation of Net Income to EBITDA: |

|||

|

Net Income |

$ (714,709) |

$ (868,521) |

|

|

Provision for income taxes |

(61,259) |

(154,473) |

|

|

Interest expense |

85,585 |

145,662 |

|

|

Depreciation and Amortization |

4,541 |

3,903 |

|

|

EBITDA |

$ (685,842) |

$ (873,429) |

|

![]() View original content:https://www.prnewswire.com/news-releases/cca-industries-inc-reports-results-of-operations-for-the-quarter-and-nine-months-ended-august-31-2024-302278498.html

View original content:https://www.prnewswire.com/news-releases/cca-industries-inc-reports-results-of-operations-for-the-quarter-and-nine-months-ended-august-31-2024-302278498.html

SOURCE CCA Industries, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dividend Investor 'Feeling Doubly Awesome' By Earning $11,800 Per Year And Beating S&P 500 Shares Portfolio: Top 11 Stocks

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

The idea that you can’t beat the broader market and see your capital grow by sticking to dividend stocks is becoming outdated. With major tech companies like Meta Platforms, Salesforce and Alphabet, among many others, joining the growing ranks of dividend-paying growth stocks, the opportunities for investors looking for both dividend income and stock price appreciation are expanding.

About a year ago, a dividend investor on Reddit shared his success story, saying he was making over $10,000 in passive income and beating the S&P 500 by investing in dividend stocks. He shared screenshots of his investing portfolio, showing his annual income at about $11,800 a year or $991 per month.

When asked how much he had invested, the Redditor said his total value was $200,000. Since the investor had highlighted in his post that he was feeling “doubly awesome” by making significant dividend income and beating the market, someone asked him whether he had beaten the market for just one year.

Don’t Miss:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Your biggest returns may not come from the stock market. Invest the way colleges, pension funds, and the 1% do. Get started investing in commercial real estate today.

“3 years in a row,” the investor responded.

Let’s examine some of this portfolio’s biggest holdings to see which stocks helped the investor earn significant dividend income and beat the market.

Arbor Realty Trust

Arbor Realty Trust Inc. (NYSE:ABR) is a mortgage REIT with a dividend yield of over 11%. It was the biggest position in the portfolio of the Redditor making about $11,800 a year in dividends. Analysts believe the future is bright for REITs like ABR amid declining interest rates and hopes of a soft landing. Wells Fargo said in a recent note that “less restrictive” policy from the Fed can lay the groundwork for commercial real estate recovery.

Altria

With an over 8% dividend yield and more than 50 years of consecutive dividend hikes, Altria Group Inc. (NYSE:MO) is perhaps one of Reddit’s most popular dividend stocks despite concerns about the declining use of traditional tobacco products. Analysts believe Altria is making a timely shift toward smoke-free products like vapes and nicotine pouches. MO was the second-biggest holding of the Redditor earning $11,800 a year in dividends.

Petroleo Brasileiro

Petroleo Brasileiro ADR (NYSE:PBR) is a state-owned Brazilian energy company. Once famous for its eye-popping dividends, PBR’s dividend yield stands at about 13% amid a decline in payouts after a difference of opinion about cash allocation in management. The Redditor, who posted his income report in October 2023, said Petroleo Brasileiro ADR (NYSE:PBR) was his third-biggest holding.

United Parcel Service

The Redditor making $11,800 a year in dividend income had United Parcel Service Inc. (NYSE:UPS) among his biggest holdings. The stock has a dividend yield of about 5% and 15 years of consecutive payout increases. UPS shares are down 15% over the past year. In July, the company reported second-quarter results that missed Wall Street estimates on both EPS and revenue. However, the company restarting its $1 billion stock buyback program gave investors something to cheer about.

Texas Instruments

Texas Instruments Inc. (NASDAQ:TXN) has a dividend yield of about 2.6% and the stock has gained 28% over the past year. Citi recently published a bullish note on the semiconductor industry following better-than-expected August data driven by dynamic random access memory. The firm has a Buy rating on TXN.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

PepsiCo

PepsiCo Inc. (NASDAQ:PEP) has a dividend yield of about 3.2% and over 50 consecutive years of dividend increases. Like Coca-Cola, it’s considered a defensive stock that investors like for all market cycles. The portfolio screenshots shared by the Redditor making $11,800 annually showed Pepsi among the top holdings.

Apple

When asked which stocks helped him beat the S&P 500, the Redditor named Apple Inc. (NASDAQ:AAPL) among the top companies. Apple shares are up 28% over the past year and the company has raised its dividends for more than a decade in a row.

Broadcom

Broadcom Inc. (NASDAQ:AVGO) was one of the stocks that helped the Redditor beat the S&P 500. The stock is up more than 110% over the past year, thanks to the rising demand for the company’s custom AI chips. The stock has a dividend yield of about 1.1%.

Cisco Systems

Cisco Systems Inc. (NASDAQ:CSCO) yields over 3% and has increased its payouts yearly since 2011. Cisco’s CFO Scott Herren recently said in a conference that the company expects about $1 billion in AI product orders in fiscal 2025, with 30% growth in hyperscalers recorded by the company during the second half 2024 alone.

Home Depot

Home Depot Inc. (NYSE:HD) shares have gained 37% in the past year and the stock yields 2.2%. Home Depot Inc. was among the top holdings of the Redditor making $11,800 a year in dividends. The home improvement retailer has raised its dividends for 15 straight years.

Microsoft

When asked about stocks that helped him beat the market, the Redditor said Microsoft Corp. (NASDAQ:MSFT) was one of the companies that pulled his overall portfolio performance higher than the S&P 500. Microsoft shares are up 26% over the past year and the company announced a 10% bump in dividends last month.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Dividend Investor ‘Feeling Doubly Awesome’ By Earning $11,800 Per Year And Beating S&P 500 Shares Portfolio: Top 11 Stocks originally appeared on Benzinga.com

Farmers & Merchants Bancorp (FMCB) Reports Record Third Quarter 2024 Earnings

Third Quarter 2024 Highlights

- Record net income of $22.1 million, or $29.96 per share; up 2.50% on a per share basis from third quarter 2023;

- Achieved a return on average assets of 1.65% and a return on average equity of 15.03%;

- Solid liquidity position with $1.5 billion in cash and investment securities and a borrowing capacity of $2.1 billion with no outstanding borrowings as of September 30, 2024;

- Continued growth in capital with a total risk-based capital ratio of 14.95%, common equity tier 1 ratio of 13.47%, tier 1 capital ratio of 13.70% and a tangible common equity ratio of 10.91%;

- Credit quality remains strong with a total allowance for credit losses of 2.11%.

LODI, Calif., Oct. 16, 2024 (GLOBE NEWSWIRE) — Farmers & Merchants Bancorp FMCB (the “Company” or “FMCB”), the parent company of Farmers & Merchants Bank of Central California (the “Bank” or “F&M Bank”), reported record third quarter net income of $22.1 million, or $29.96 per diluted common share for the third quarter of 2024 compared with $22.0 million, or $29.23 per diluted common share for the third quarter of 2023 an increase of 2.50% on a per share basis. Annualized return on average assets was 1.65% and return on average equity was 15.03% for the third quarter of 2024 compared with 1.65% and 16.80% for the same period the prior year. The decrease in return on average equity was primarily the result of a $72.1 million or 13.58% increase in total shareholder’s equity even after paying record common stock cash dividends of $13.1 million to shareholders and repurchasing and retiring $14.0 million of the Company’s common stock during the last twelve months.

Net income over the trailing twelve months was $88.0 million compared with $86.9 million for the same trailing period a year earlier. Earnings per share over the trailing twelve months totaled $118.46, up 3.79% compared with $114.13 for the same trailing period a year ago and up from $90.70 for the same period two years ago.

CEO Commentary

Kent Steinwert, Farmers & Merchants Bancorp’s Chairman, President and Chief Executive Officer, stated, “We are pleased with the Company’s strong ongoing financial performance including the results in the first nine months of 2024 highlighted by net income of $66.6 million, return on average assets of 1.65%, and a return on average equity of 15.55%. Our earnings per share over the trailing twelve months ended September 30, 2024 totaled $118.46, up 3.79% compared with $114.13 per share for the same trailing period a year ago. We achieved these strong results while continuing to maintain a solid liquidity position and balance sheet at quarter end with $1.5 billion of cash and investments, access to $2.1 billion in borrowing capacity and total shareholders’ equity of $602.7 million up $72.1 million or 13.58% from September 30, 2023. Capital levels continued to strengthen and are significantly above the regulatory thresholds for “well-capitalized” banks. Our longstanding established client relationships have contributed to our resilient and stable deposit balances of $4.7 billion as of September 30, 2024 and 2023. The loan portfolio continues to grow both during the third quarter and year over year as we continue to serve the needs of our customers and local communities. Consistent with the last several years, credit quality remains a strength of the Bank with a total allowance for credit losses of 2.11% and only $677,000 in non-accrual loans as of quarter-end. Our Company remains in excellent financial condition and is well positioned to meet any challenges ahead as we have for the past 108 years. We are also pleased to be recognized by others for our performance as Farmers & Merchants Bancorp was named by Bank Director’s Magazine as the #2 best performing bank in the nation across all asset categories in their annual “Ranking Banking” study of the top performing banks for 2023. This follows our #1 ranking in the prior year of the top performing banks for 2022. The recognition over the last two years can be traced to our strong client relationships and the focus of our employees on serving our clients.”

Earnings

Net interest income for the quarter ended September 30, 2024 was $52.0 million, an increase from $50.8 million in the second quarter of 2024. For the third quarter of 2024 the net interest margin increased to 4.07% compared to 3.91% in the second quarter of 2024 driven by a decrease in the average cost of total deposits from 1.51% in the second quarter of 2024 to 1.39% in the third quarter of 2024. Net interest income for the nine-months ended September 30, 2024 was $154.5 million, a decrease of $7.1 million, or 4.39%, when compared with the $161.6 million for the same period in 2023 as the increase in deposit costs outpaced the increase in loan yields. Loan yields increased to 6.11% for the first nine-months of 2024 compared to 5.77% for the same period in 2023 while the average cost of total deposits increased to 1.39% for the first nine-months of 2024 compared to 0.70% in the first nine-months of 2023. The net interest margin of 4.04% and average cost of total deposits of 1.39% for the nine-months ended September 30, 2024 continue to outperform industry averages.

For the nine-months ended September 30, 2024, net income was $66.6 million, a slight decrease from the nine-months ended September 30, 2023 of $66.9 million. The nine-months ended September 30, 2023 benefited from cash proceeds from non-taxable death benefits on bank-owned life insurance (BOLI) of $4.3 million. Annualized return on average assets was 1.65% and return on average equity was 15.55% for the nine-months ended September 30, 2024 compared with 1.70% and 17.43% for the same period a year earlier.

Balance Sheet

Total assets were $5.4 billion as of September 30, 2024 consistent with September 30, 2023. Total loans and leases outstanding were $3.7 billion, an increase of $146.9 million or 4.13% from September 30, 2023. As of September 30, 2024 our total investment securities portfolio was $1.2 billion, an increase of $249.6 million from September 30, 2023. Over the last year, the portfolio mix has shifted as available-for-sale securities have increased from $106.5 million as of September 30, 2023 to $401.6 million as of September 30, 2024 while the held-to-maturity securities have decreased from $826.0 million as of September 30, 2023 to $780.5 million as of September 30, 2024. The increase in available-for-sale securities is due to purchases of $326.3 million in 2024. Accumulated other comprehensive losses on the available-for-sale securities portfolio decreased to $8.8 million as of September 30, 2024 compared to $20.2 million as of September 30, 2023. Total deposits remained consistent totaling $4.7 billion as of September 30, 2024 and September 30, 2023. Total deposits, at September 30, 2024, increased $111.6 million or 2.4% compared to June 30, 2024. Our loan to deposit ratio was 78.9% as of September 30, 2024 compared to 75.1% as of September 30, 2023.

Credit Quality

The Company’s credit quality remained resilient with only $677,000 in non-accrual loans as of September 30, 2024 and a minimal delinquency ratio of only 0.21% of total loans. Net charge-offs were $216,000 in the third quarter of 2024 compared to net recoveries of $47,000 in the third quarter of 2023. Net charge-offs were $149,000 for the first nine-months of 2024 compared to net recoveries of $274,000 for the first nine-months of 2023. Net charge-offs over the trailing twelve months were $93,000. Based on the credit performance of the loan and lease portfolio, no provision for credit losses has been necessary in the first nine-months of 2024. The Company’s allowance for credit losses on loans and leases and unfunded commitments was $78.5 million or 2.11% as of September 30, 2024 compared to $78.7 million or 2.13% as of June 30, 2024. We believe our allowance for credit losses is appropriate given the current economic environment including some stress in the agricultural sector. A few agricultural commodity prices have softened over the past two years due to the strong US Dollar impeding export competitiveness. This coupled with the higher short term interest rates and the effects of high inflation has created financial stress for some agriculture producers. We are diligently working with all borrowers affected by these market conditions in an effort to optimize performance during the current cycle.

Capital

The Company’s and Bank’s regulatory capital ratios remain strong while increasing from June 30, 2024. At September 30, 2024, the Company’s preliminary total risk-based capital ratio was 14.95%, the common equity tier 1 capital ratio was 13.47% and the tier 1 capital ratio was 13.70% an increase from 14.58%, 13.09% and 13.32% as of June 30, 2024, respectively. At September 30, 2024, all F&M Bank capital ratios exceeded the regulatory requirements to be classified as “well-capitalized”. At September 30, 2024, the tangible common equity ratio was 10.91% an increase of 127 basis points from the 9.64% as of September 30, 2023. Tangible book value per share increased to $799.04 at September 30, 2024, up 16.21% compared with $687.57 a year ago. During the third quarter, the Company repurchased 1,313 shares bringing the total to 9,976 shares for the nine-months ended September 30, 2024. The Company has repurchased a total of 10,400 shares or $10.5 million under the $25.0 million share repurchase program authorized in November 2023 which was cancelled on September 10, 2024. On September 10, 2024, the Company authorized a new share repurchase program for $55.0 million and has purchased 40 shares or $38,404 as of September 30, 2024. On October 3, 2024 the Company entered into and executed a Stock Purchase Agreement with the trust of one of our largest shareholders who passed away in January 2024. As a result, the Company repurchased 37,990 shares or $34.8 million under the Stock Purchase Agreement on October 3, 2024 leaving approximately $20.2 million remaining under the current share repurchase program which expires on December 31, 2026. After this transaction our total risk-based capital ratio was approximately 14.18% on a pro-forma basis.

About Farmers & Merchants Bancorp

Farmers & Merchants Bancorp, trades on the OTCQX under the symbol FMCB, is the parent company of Farmers & Merchants Bank of Central California, also known as F&M Bank. Founded in 1916, F&M Bank is a locally owned and operated community bank, which proudly serves California through 32 convenient locations. F&M Bank is financially strong, with $5.4 billion in assets, and is consistently recognized as one of the nation’s safest banks by national bank rating firms. The Bank has maintained a 5-Star rating from BauerFinancial for 34 consecutive years, longer than any other commercial bank in the State of California.

Farmers & Merchants Bancorp has paid dividends for 89 consecutive years and has increased dividends for 59 consecutive years. As a result, Farmers & Merchants Bancorp is a member of a select group of only 56 publicly traded companies referred to as “Dividend Kings,” and is ranked 17th in that group based on consecutive years of dividend increases. A “Dividend King” is a stock with 50 or more consecutive years of dividend increase.

In August 2024, Farmers & Merchants Bancorp was named by Bank Director’s Magazine as the #2 best performing bank in the nation across all asset categories in their annual “Ranking Banking” study of the top performing banks for 2023. Last year the Bank was named by Bank Director’s Magazine as the #1 best performing bank in the nation across all asset categories in their annual “Ranking Banking” study of the top performing banks for 2022.

In April 2024, F&M Bank was ranked 6th on Forbes Magazine’s list of “America’s Best Banks” in 2023. Forbes’ annual “America’s Best Banks” list looks at ten metrics measuring growth, credit quality, profitability, and capital for the 2023 calendar year, as well as stock performance in the 12 months through March 18, 2024.

In December 2023, F&M Bank was ranked 4th on S&P Global Market Intelligence’s “Top 50 List of Best-Performing Community Banks” in the US with assets between $3.0 billion and $10.0 billion for 2023. S&P Global Market Intelligence ranks financial institutions based on several key factors including financial returns, growth, and balance sheet risk profile.

In October, 2021, F&M Bank was named the “Best Community Bank in California” by Newsweek magazine. Newsweek’s ranking recognizes those financial institutions that best serve their customers’ needs in each state. This recognition speaks to the superior customer service the F&M Bank team members provide to its clients.

F&M Bank is the 15th largest bank lender to agriculture in the United States. F&M Bank operates in the mid-Central Valley of California including, Sacramento, San Joaquin, Solano, Stanislaus, and Merced counties and the east region of the San Francisco Bay Area, including Napa, Alameda and Contra Costa counties.

F&M Bank was inducted into the National Agriculture Science Center’s “Ag Hall of Fame” at the end of 2021 for providing resources, financial advice, guidance, and support to the agribusiness communities as well as to students in the next generation of agribusiness workforce. F&M Bank is dedicated to helping California remain the premier agricultural region in the world and will continue to work with the next generation of farmers, ranchers, and processors. F&M Bank remains committed to servicing the needs of agribusiness in California as has been the case since its founding over 108 years ago.

F&M Bank offers a full complement of loan, deposit, equipment leasing and treasury management products to businesses, as well as a full suite of consumer banking products. The FDIC awarded F&M Bank the highest possible rating of “Outstanding” in their last Community Reinvestment Act (“CRA”) evaluation.

Forward-Looking Statements

This press release may contain certain forward-looking statements that are based on management’s current expectations regarding the Company’s financial performance. Forward-looking statements can be identified by the fact that they do not relate strictly to historical or current facts. They often include the words “believe,” “expect,” “intend,” “estimate” or words of similar meaning, or future or conditional verbs such as “will,” “would,” “should,” “could” or “may.” Forward-looking statements in this press release include, without limitation, statements regarding loan and deposit production (including any growth representations), balance sheet management, levels of net interest margin, the ability to control costs and expenses, the competitive environment, financial and regulatory policies of the United States government, water management issues in California and general economic conditions, inflation, recessions, natural disasters, pandemics, geopolitical risks, economic uncertainty in the United States, changes in interest rates, deposit flows, real estate values, costs or effects of acquisitions, competition, changes in accounting principles, policies or guidelines, legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors (including external fraud and cybersecurity threats) affecting the Company’s operations, pricing, products and services. These and other important factors are detailed in the Company’s Form 10-K, Form 10-Qs, and various other securities law filings made periodically by the Company, copies of which are available from the Company’s website. The Company undertakes no obligation to release publicly the result of any revisions to these forward-looking statements that may be made to reflect events or circumstances after the date of this press release or to reflect the occurrence of unanticipated events, except as required by law.

For more information about Farmers & Merchants Bancorp and F&M Bank, visit fmbonline.com.

Investor Relations Contact

Farmers & Merchants Bancorp

Bart R. Olson

Executive Vice President and Chief Financial Officer

Phone: 209-367-2485

bolson@fmbonline.com

| FINANCIAL HIGHLIGHTS | |||||||||||||||||||||

| Three-Months Ended | Nine-Months Ended | ||||||||||||||||||||

| (dollars in thousands, except share and per share amounts) | September 30, 2024 |

June 30, 2024 | September 30, 2023 |

September 30, 2024 |

September 30, 2023 |

||||||||||||||||

| Earnings and Profitability: | |||||||||||||||||||||

| Interest income | $ | 68,635 | $ | 69,831 | $ | 65,713 | $ | 205,107 | $ | 186,362 | |||||||||||

| Interest expense | 16,642 | 19,050 | 12,272 | 50,620 | 24,777 | ||||||||||||||||

| Net interest income | 51,993 | 50,781 | 53,441 | 154,487 | 161,585 | ||||||||||||||||

| Provision for credit losses | – | – | 3,000 | – | 7,057 | ||||||||||||||||

| Noninterest income | 6,280 | 4,767 | 3,606 | 16,122 | 12,513 | ||||||||||||||||

| Noninterest expense | 27,755 | 25,422 | 24,468 | 78,698 | 79,473 | ||||||||||||||||

| Income before taxes | 30,518 | 30,126 | 29,579 | 91,911 | 87,568 | ||||||||||||||||

| Income tax expense | 8,397 | 8,359 | 7,545 | 25,300 | 20,679 | ||||||||||||||||

| Net income | $ | 22,121 | $ | 21,767 | $ | 22,034 | $ | 66,611 | $ | 66,889 | |||||||||||

| Diluted earnings per share | $ | 29.96 | $ | 29.39 | $ | 29.23 | $ | 89.91 | $ | 88.06 | |||||||||||

| Return on average assets | 1.65 | % | 1.58 | % | 1.65 | % | 1.65 | % | 1.70 | % | |||||||||||

| Return on average equity | 15.03 | % | 15.33 | % | 16.80 | % | 15.55 | % | 17.43 | % | |||||||||||

| Loan yield | 6.13 | % | 6.13 | % | 5.87 | % | 6.11 | % | 5.77 | % | |||||||||||

| Cost of average total deposits | 1.39 | % | 1.51 | % | 1.01 | % | 1.39 | % | 0.70 | % | |||||||||||

| Net interest margin – tax equivalent | 4.07 | % | 3.91 | % | 4.17 | % | 4.04 | % | 4.33 | % | |||||||||||

| Effective tax rate | 27.51 | % | 27.75 | % | 25.51 | % | 27.53 | % | 23.61 | % | |||||||||||

| Efficiency ratio | 47.63 | % | 45.77 | % | 42.89 | % | 46.13 | % | 45.65 | % | |||||||||||

| Book value per share | $ | 816.67 | $ | 779.40 | $ | 705.60 | $ | 816.67 | $ | 705.60 | |||||||||||

| Balance Sheet: | |||||||||||||||||||||

| Total assets | $ | 5,418,132 | $ | 5,267,485 | $ | 5,375,375 | $ | 5,418,132 | $ | 5,375,375 | |||||||||||

| Cash and cash equivalents | 293,250 | 295,936 | 668,361 | 293,250 | 668,361 | ||||||||||||||||

| of which held at Fed | 198,637 | 225,676 | 597,739 | 198,637 | 597,739 | ||||||||||||||||

| Total securities | 1,182,073 | 1,046,210 | 932,508 | 1,182,073 | 932,508 | ||||||||||||||||

| of which available-for-sale | 401,563 | 251,413 | 106,493 | 401,563 | 106,493 | ||||||||||||||||

| of which held-to-maturity | 780,510 | 794,797 | 826,015 | 780,510 | 826,015 | ||||||||||||||||

| Gross Loans | 3,713,735 | 3,692,237 | 3,567,807 | 3,713,735 | 3,567,807 | ||||||||||||||||

| Allowance for credit losses – loans and leases | 75,816 | 75,032 | 74,159 | 75,816 | 74,159 | ||||||||||||||||

| Total deposits | 4,708,682 | 4,597,055 | 4,748,767 | 4,708,682 | 4,748,767 | ||||||||||||||||

| Borrowings | – | – | – | – | – | ||||||||||||||||

| Subordinated debentures | 10,310 | 10,310 | 10,310 | 10,310 | 10,310 | ||||||||||||||||

| Total shareholders’ equity | $ | 602,696 | $ | 576,220 | $ | 530,623 | $ | 602,696 | $ | 530,623 | |||||||||||

| Loan-to-deposit ratio | 78.87 | % | 80.32 | % | 75.13 | % | 78.87 | % | 75.13 | % | |||||||||||

| Percentage of checking deposits to total deposits | 50.01 | % | 48.60 | % | 51.72 | % | 50.01 | % | 51.72 | % | |||||||||||

| Capital ratios (Bancorp) (1) | |||||||||||||||||||||

| Common equity tier 1 capital to risk-weighted assets | 13.47 | % | 13.09 | % | 12.48 | % | 13.47 | % | 12.48 | % | |||||||||||

| Tier 1 capital to risk-weighted assets | 13.70 | % | 13.32 | % | 12.72 | % | 13.70 | % | 12.72 | % | |||||||||||

| Risk-based capital to risk-weighted assets | 14.95 | % | 14.58 | % | 13.97 | % | 14.95 | % | 13.97 | % | |||||||||||

| Tier 1 leverage capital ratio | 11.32 | % | 10.66 | % | 10.22 | % | 11.32 | % | 10.22 | % | |||||||||||

| Tangible common equity ratio (2) | 10.91 | % | 10.72 | % | 9.64 | % | 10.91 | % | 9.64 | % | |||||||||||

| (1) Capital information is preliminary for September 30, 2024 | |||||||||||||||||||||

| (2) Non-GAAP measurement | |||||||||||||||||||||

| Non-GAAP measurement reconciliation: | |||||||||||||||||||||

| (Dollars in thousands) | September 30, 2024 |

June 30, 2024 | September 30, 2023 |

||||||||||||||||||

| Shareholders’ equity | $ | 602,696 | $ | 576,220 | $ | 530,623 | |||||||||||||||

| Less: Intangible assets | 13,007 | 13,145 | 13,563 | ||||||||||||||||||

| Tangible common equity | $ | 589,689 | $ | 563,075 | $ | 517,060 | |||||||||||||||

| Total assets | $ | 5,418,132 | $ | 5,267,485 | $ | 5,375,375 | |||||||||||||||

| Less: Intangible assets | 13,007 | 13,145 | 13,563 | ||||||||||||||||||

| Tangible assets | $ | 5,405,125 | $ | 5,254,340 | $ | 5,361,812 | |||||||||||||||

| Tangible common equity ratio (1) | 10.91 | % | 10.72 | % | 9.64 | % | |||||||||||||||

| (1) Tangible common equity divided by tangible assets | |||||||||||||||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Unpacking the Latest Options Trading Trends in Sirius XM Holdings

High-rolling investors have positioned themselves bullish on Sirius XM Holdings SIRI, and it’s important for retail traders to take note.

This activity came to our attention today through Benzinga’s tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in SIRI often signals that someone has privileged information.

Today, Benzinga’s options scanner spotted 14 options trades for Sirius XM Holdings. This is not a typical pattern.

The sentiment among these major traders is split, with 57% bullish and 21% bearish. Among all the options we identified, there was one put, amounting to $30,000, and 13 calls, totaling $552,046.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $23.0 to $35.0 for Sirius XM Holdings during the past quarter.

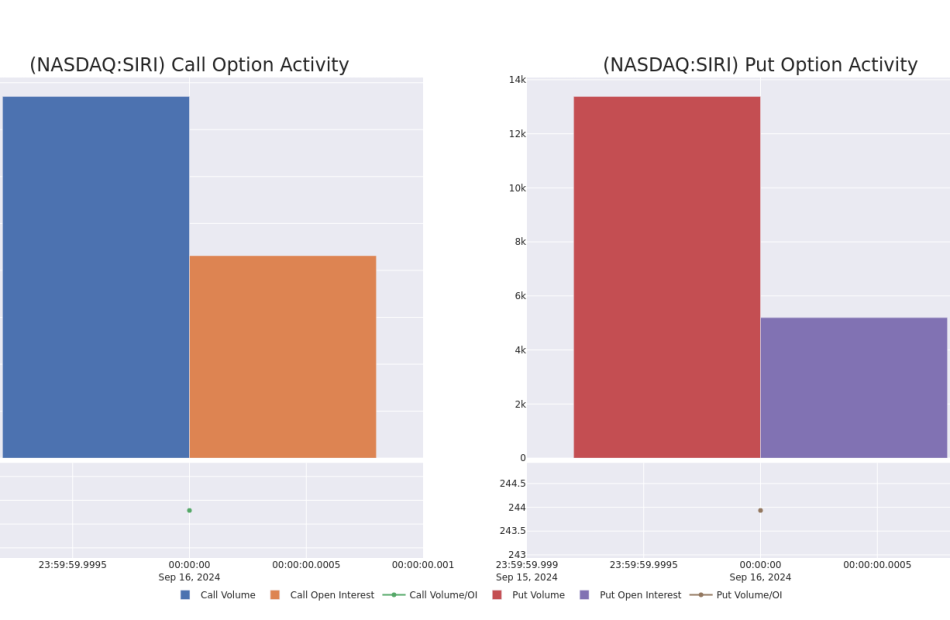

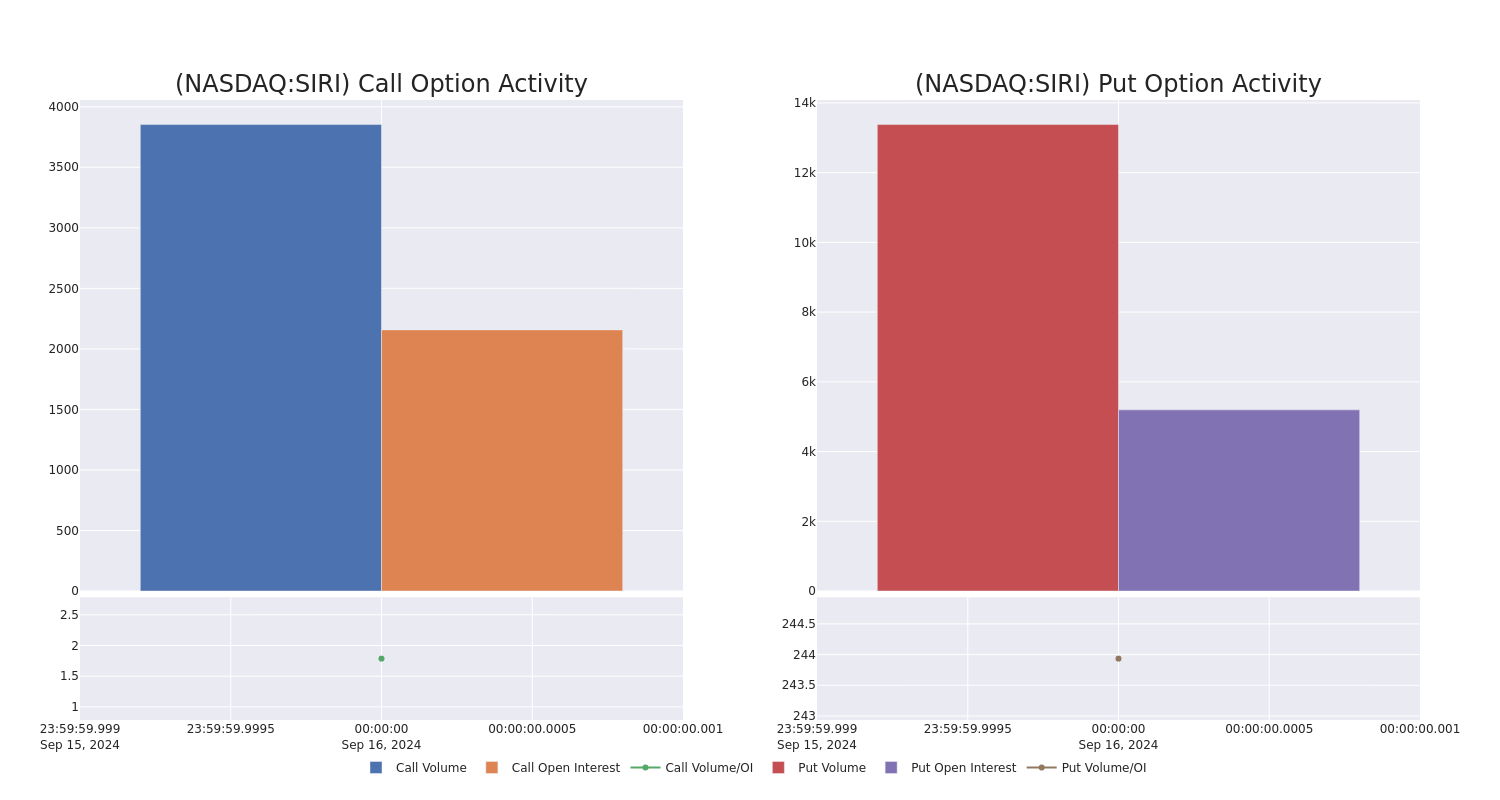

Volume & Open Interest Trends

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Sirius XM Holdings’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Sirius XM Holdings’s whale trades within a strike price range from $23.0 to $35.0 in the last 30 days.

Sirius XM Holdings Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SIRI | CALL | SWEEP | NEUTRAL | 11/08/24 | $2.53 | $2.23 | $2.62 | $26.00 | $52.2K | 18 | 1.6K |

| SIRI | CALL | SWEEP | BULLISH | 11/08/24 | $2.6 | $2.15 | $2.61 | $26.00 | $52.2K | 18 | 1.0K |

| SIRI | CALL | SWEEP | BULLISH | 11/08/24 | $2.56 | $2.19 | $2.49 | $26.00 | $51.1K | 18 | 1.2K |

| SIRI | CALL | SWEEP | BULLISH | 11/08/24 | $2.55 | $2.2 | $2.55 | $26.00 | $51.0K | 18 | 1.4K |

| SIRI | CALL | TRADE | BULLISH | 11/08/24 | $2.52 | $2.03 | $2.52 | $26.00 | $50.4K | 18 | 600 |

About Sirius XM Holdings

Sirius XM Holdings is composed of two businesses: SiriusXM and Pandora. SiriusXM transmits music, talk shows, sports, and news via its two satellite radio networks, primarily to consumers in vehicles who pay a subscription fee. The firm’s radios come preinstalled on a wide range of light vehicles in the US and Canada. The firm acquired Pandora Media in February 2019 via an all-stock transaction. Pandora is a streaming music platform that offers an ad-supported radio option and a paid on-demand service; it has a robust and growing podcast library. Liberty Media owns 84% of Sirius XM, traded through its Liberty Sirius XM Group tracking stock.

Current Position of Sirius XM Holdings

- Trading volume stands at 7,164,456, with SIRI’s price up by 0.59%, positioned at $27.24.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 15 days.

Expert Opinions on Sirius XM Holdings

5 market experts have recently issued ratings for this stock, with a consensus target price of $28.6.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Reflecting concerns, an analyst from Morgan Stanley lowers its rating to Underweight with a new price target of $23.

* An analyst from Benchmark has revised its rating downward to Buy, adjusting the price target to $43.

* Consistent in their evaluation, an analyst from Citigroup keeps a Sell rating on Sirius XM Holdings with a target price of $21.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Neutral rating on Sirius XM Holdings with a target price of $26.

* An analyst from Guggenheim upgraded its action to Buy with a price target of $30.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Sirius XM Holdings with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Why Cameco, Denison Mines, and Energy Fuels Stocks All Popped on Wednesday

Uranium mining stocks surged higher on Wednesday, with industry bellwether Cameco (NYSE: CCJ) rising 8.2% through 2:11 p.m. ET, Denison Mines (NYSEMKT: DNN) doing even better with a 14.7% gain, and smaller Energy Fuels (NYSEMKT: UUUU) performing best of all — up 17%.

Investors are betting on a resurgence in demand for nuclear energy, and their optimism is not without reason as tech giants like Microsoft (NASDAQ: MSFT), Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL), and Amazon.com (NASDAQ: AMZN) are placing multibillion-dollar bets on the sector.

What’s going on with nuclear power?

Last month, Microsoft ignited the rally in nuclear stocks when it signed a power purchase agreement with Constellation Energy (NASDAQ: CEG) under which the latter will reopen Unit 1 of its Three Mile Island nuclear power plant. Microsoft needs extra power to run the servers at its Azure business unit, and thinks nuclear might be the best way to produce that power in a carbon-free way.

Momentum in the sector picked up this week with announcements from first Alphabet and then Amazon that they, too, are looking to nuclear energy to power their data centers.

Alphabet’s Google business is partnering with privately held Kairos Power to open a series of small modular nuclear reactors (SMRs). Totaling only 500 megawatts (MW) in power production capacity, the Google news is only half as big as Microsoft’s. (Full-scale nuclear power plants generally generate power in the gigawatt range). But that’s not why the Google news is significant. It’s backing an entirely new kind of nuclear power plants — SMRs, which are expected to be both cheaper and faster to build than traditional plants.

In theory, that could drive demand for nuclear energy — and for uranium to fuel it — faster than simply building more gigawatt-scale power plants would do. It’s this prospect that lies behind the strong interest in uranium producer stocks Wednesday.

Enthusiasm only grew greater Wednesday morning when Amazon announced plans to partner with Energy Northwest, Dominion Energy (NYSE: D), and privately held X-energy to build four SMRs in the state of Washington and at least one in Virginia. Combined, these projects promise to bring at least 620 megawatts of nuclear power online — and potentially more than 1 gigawatt, equivalent to a full-scale nuclear power plant.

Should you buy uranium stocks now?

But should you be buying uranium stocks in the middle of a uranium stock-buying frenzy? While I’m bullish on the prospects for the nuclear power industry in general and am finding validation for that bullishness in all this recent news, I still think the answer to this question is … maybe, but tread carefully and watch the valuations.

With a market cap of less than $2 billion even after this latest share price surge, Denison Mines is arguably the cheapest of these three stocks, trading at “only” 47 times trailing earnings. Denison also has no debt on its balance sheet, and $93 million in cash — which is good news, because it will need it. It’s currently burning cash at the rate of $28 million a year, and isn’t expected to turn free cash flow positive until 2028, according to the analysts who follow it.

Cameco is a horse of a different color. Valued at more than $24 billion currently, it is easily the most valuable stock in this sector. On the other hand, it trades at a staggering 129 times trailing earnings. Cameco is both profitable and free cash flow positive, and analysts expect its profits to roughly triple over the next five years. Still, with a valuation that’s 27.5 times its forecast earnings in 2028, it’s hard to call the stock cheap.

And Energy Fuels? With a $1.3 billion market cap, Energy Fuels is only a little less expensive than Denison. Analysts hope Energy Fuels turns profitable next year, and begins generating free cash flow in 2027. It’s unprofitable today, however, and in its 25-year history, it hasn’t ever generated positive free cash flow.

While Energy Fuels stock looks speculative to me, it possesses cash reserves that should be sufficient to last until its free cash flow turns positive. In a momentum-driven market where none of these stocks looks cheap by the traditional valuation metrics of price to earnings, or price to free cash flow, tiny Energy Fuels might turn out to be the best performer of all.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,139!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,239!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $380,729!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Rich Smith has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Constellation Energy, and Microsoft. The Motley Fool recommends Cameco and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Why Cameco, Denison Mines, and Energy Fuels Stocks All Popped on Wednesday was originally published by The Motley Fool

I Want to Give $50k to My Daughter for a Down Payment on a Home – Do I Need to Worry About Taxes?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Imagine you have $50,000 to give to your daughter and her husband for a down payment on their new home. The question is, will you owe gift taxes because of your generous gesture?

Despite popular framing, the federal gift and estate taxes only apply to very wealthy households. Unless you have approximately $13 million to give away over your lifetime, these taxes likely won’t apply to you.

A financial advisor can help you navigate and plan for gift and estate taxes. Find an advisor today.

To be very clear, these are the rules for federal taxation. Every state also has its own tax laws and every tax profile is different, so make sure to speak with a financial or tax professional before making any plans for your own assets. However, there are two main issues to consider within this scenario: the mortgage process and potential gift tax implications.

Down Payments and Gifts

With the mortgage and lender process, you want to ensure that you fill out all forms and requirements correctly. It is extremely unlikely that you can complicate the title to this property, but you can certainly complicate or invalidate the loan by making a mistake.

When your daughter applies for her mortgage, the lender will go through her finances in detail. They want to know what assets she has, where they came from, what income she has and any other information related to how she will repay this debt. The down payment is intended as an indicator of this financial stability, so receiving it from a third party can raise concerns.

Many lenders have rules around who can provide the money for a down payment. It’s common for them to reject a mortgage with a gifted down payment unless that money comes from someone with a longstanding relationship to the borrower. Among other issues, this is intended to prevent fraud and money laundering. Since the borrower is your daughter, that shouldn’t be a problem.

If you are giving the money directly to your daughter you will typically either need to “season” the money or provide a gift letter. Seasoning the money means transferring it more than 60 days in advance, again as an indicator of legitimacy against fraudulent transfers. A gift letter is a document signed by both the giver and the recipient confirming that this is a unilateral transfer with no right to repayment.

The specific format of the gift letter will vary based on lender and jurisdiction, so consult an attorney about this document. A financial advisor can also potentially help you through this process.

You may also make this transfer through the loan process, making the down payment on your daughter’s behalf rather than transferring the money to her. The lender will require you and your daughter to disclose this during the loan application process. In and of itself, your gift will typically not be a problem, but failing to specify the difference between borrower and payer will almost always complicate (if not invalidate) the loan.

Gift Tax Exclusions and Exemption Limits

Beyond the rules that surround making a gift of this sort, your main consideration here is the gift tax.

This is a tax that the IRS places on unilateral transfers. If you give someone money or assets without expecting fair-value compensation in return, you have given them a gift. If you give them enough money, eventually you (the gift giver) must pay taxes on the transfer. Gift tax rates range from 18% to 40% based on the size of the gift.

However, the gift tax only applies to very few households due to a pair of important tax provisions: an annual exclusion and a lifetime exemption limit. And if you have additional questions about either, consider speaking with a financial advisor.

Annual Exclusion

The first is the gift tax’s annual exclusion. This is the amount of money you can give to someone each year regardless of gifts in past or future years. In 2023, the annual exclusion is set at $17,000 for individuals and $34,000 for married couples who file their taxes jointly. In 2024, those limits will increase to $18,000 for individuals and $36,000 for married couples.

The annual exclusion applies on a per-recipient basis. So, for example, say that you had four children. You could give each of them $17,000 in 2023 without triggering any gift taxes.

Lifetime Exemption

The lifetime gift and estate tax exemption is the amount of money you can give away over the course of your life – or at your death – without triggering either gift or estate taxes. For gifts that exceed the annual exclusion, the difference is applied to your lifetime exemption. If you give someone a gift over that year’s annual exclusion and have exhausted your lifetime exemption, you’ll owe gift taxes on the amount of money that exceeds that year’s exclusion.

In 2023, the lifetime gift and estate tax exemption is $12.92 million for individuals, which means married couples have a combined exemption limit of $25.84 million. In 2024, the exemption will increase to $13.61 million for individuals and $27.22 million for married couples. If an individual has already gifted $12.92 million over the exclusion limits by 2023, they will be able to gift another $690,000 in 2024 (not including the annual exclusion amount).

Unlike the annual exclusion, the lifetime exemption does not reset. While you can gift up to the annual exclusion each year, any remainder permanently reduces your lifetime cap. The lifetime exemption is on a per-donor basis, meaning that it applies collectively to all gifts you have given. For example, say that in 2023 you give $20,000 to each of your four children. Each gift exceeds the exclusion by $3,000. Collectively, they would lower your lifetime gift and estate tax exemption by $12,000.

Gift Taxes And Down Payments

When it comes to your daughter’s down payment, the tax issues are this: Are you married? And how much have you given away throughout your life? Let’s assume you’re single for simplicity’s sake.

First, if you give her the down payment money in 2023, the first $17,000 of the gift will automatically be free of any potential tax liability. However, since the gift exceeds the annual exclusion by $33,000, that remainder will lower your lifetime exemption.

So, for example, if you have never given anyone a taxable gift, you will pay no gift tax and your annual exclusion will be reduced to $12.887 million ($12.92 million minus $33,000). If you have already exhausted your lifetime exemption, you would have to pay taxes on the $33,000.

However, there would still be ways to manage this potential tax liability. If you could wait until 2024 to give your daughter the money, your lifetime exemption would go up to $13.61 million. You can apply the remainder to the newly raised cap and will owe no taxes on the excess gift. But if you need additional help managing your tax liability, consider working with a financial advisor.

Bottom Line

Unless you have gifted more than $12.92 million over your lifetime, you can almost certainly give a $50,000 down payment to your daughter or other family member and not owe gift taxes in 2023. Just be careful to do the paperwork right, otherwise, it could complicate the loan.

Gift Tax Tips

-

Will the fact that this is your daughter complicate things? While the IRS does not treat gifts from parents differently, large gifts within a wealthy family can potentially complicate future planning around trusts and estates.

-

A financial advisor can help you strategically give away assets to lower your potential estate tax liability. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/gradyreese, ©iStock.com/payphoto, ©iStock.com/designer491

The post I Want to Give My Daughter and Her Husband $50,000 For a Down Payment. Do I Have to Worry About the Gift Tax? appeared first on SmartReads by SmartAsset.

Donald Trump-Backed World Liberty Financial Off To A Slow Start — Raises Just 4% Of The Token Fundraising Target

Donald Trump-backed cryptocurrency project World Liberty Financial (WLFI) has been off to a slow start, managing to raise just 4% of its token presale target within the first 48 hours of its launch.

What happened: About $12.46 million worth of the platform’s WLFI governance token have been sold as of this writing, according to a Dune Analytics dashboard, well short of the $300 million target announced earlier.

Roughly 830.43 million tokens have been sold to 9,881 unique wallets, with the total number of sales closing in on 12,000. Each token costs $0.015 at the time of writing.

Adam Cochran, a cryptocurrency market observer and Trump critic, said on the flop start, “If you think “the markets” favor Trump being president, why aren’t accredited investors lining up to buy this project?”

The WLFI team didn’t immediately respond to Benzinga’s request for comment on the slow start.

Why It Matters: Promoted aggressively by Trump and his family in recent weeks, the decentralized finance (DeFi) project has garnered massive hype right in the middle of the GOP nominee’s presidential campaign.

The WLFI token would serve as the platform’s governance token, enabling users to engage in borrowing, lending, and other DeFi activities.

However, the token is non-transferable and non-yielding, disallowing investors from speculating on its price in the market as they do for other cryptocurrency tokens, a feature that might be contributing to the project’s dull token presale.

In X Spaces earlier this week, the team behind WLFI said that the project was focused on preserving the supremacy of the U.S. dollar through dollar-backed stablecoins rather than speculative assets like Bitcoin BTC/USD.

Price Action: At the time of writing, Dogecoin was exchanging hands at $0.1252, up 7.58% in the last 24 hours, according to data from Benzinga Pro.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.