I Want to Give $50k to My Daughter for a Down Payment on a Home – Do I Need to Worry About Taxes?

SmartAsset and Yahoo Finance LLC may earn commission or revenue through links in the content below.

Imagine you have $50,000 to give to your daughter and her husband for a down payment on their new home. The question is, will you owe gift taxes because of your generous gesture?

Despite popular framing, the federal gift and estate taxes only apply to very wealthy households. Unless you have approximately $13 million to give away over your lifetime, these taxes likely won’t apply to you.

A financial advisor can help you navigate and plan for gift and estate taxes. Find an advisor today.

To be very clear, these are the rules for federal taxation. Every state also has its own tax laws and every tax profile is different, so make sure to speak with a financial or tax professional before making any plans for your own assets. However, there are two main issues to consider within this scenario: the mortgage process and potential gift tax implications.

Down Payments and Gifts

With the mortgage and lender process, you want to ensure that you fill out all forms and requirements correctly. It is extremely unlikely that you can complicate the title to this property, but you can certainly complicate or invalidate the loan by making a mistake.

When your daughter applies for her mortgage, the lender will go through her finances in detail. They want to know what assets she has, where they came from, what income she has and any other information related to how she will repay this debt. The down payment is intended as an indicator of this financial stability, so receiving it from a third party can raise concerns.

Many lenders have rules around who can provide the money for a down payment. It’s common for them to reject a mortgage with a gifted down payment unless that money comes from someone with a longstanding relationship to the borrower. Among other issues, this is intended to prevent fraud and money laundering. Since the borrower is your daughter, that shouldn’t be a problem.

If you are giving the money directly to your daughter you will typically either need to “season” the money or provide a gift letter. Seasoning the money means transferring it more than 60 days in advance, again as an indicator of legitimacy against fraudulent transfers. A gift letter is a document signed by both the giver and the recipient confirming that this is a unilateral transfer with no right to repayment.

The specific format of the gift letter will vary based on lender and jurisdiction, so consult an attorney about this document. A financial advisor can also potentially help you through this process.

You may also make this transfer through the loan process, making the down payment on your daughter’s behalf rather than transferring the money to her. The lender will require you and your daughter to disclose this during the loan application process. In and of itself, your gift will typically not be a problem, but failing to specify the difference between borrower and payer will almost always complicate (if not invalidate) the loan.

Gift Tax Exclusions and Exemption Limits

Beyond the rules that surround making a gift of this sort, your main consideration here is the gift tax.

This is a tax that the IRS places on unilateral transfers. If you give someone money or assets without expecting fair-value compensation in return, you have given them a gift. If you give them enough money, eventually you (the gift giver) must pay taxes on the transfer. Gift tax rates range from 18% to 40% based on the size of the gift.

However, the gift tax only applies to very few households due to a pair of important tax provisions: an annual exclusion and a lifetime exemption limit. And if you have additional questions about either, consider speaking with a financial advisor.

Annual Exclusion

The first is the gift tax’s annual exclusion. This is the amount of money you can give to someone each year regardless of gifts in past or future years. In 2023, the annual exclusion is set at $17,000 for individuals and $34,000 for married couples who file their taxes jointly. In 2024, those limits will increase to $18,000 for individuals and $36,000 for married couples.

The annual exclusion applies on a per-recipient basis. So, for example, say that you had four children. You could give each of them $17,000 in 2023 without triggering any gift taxes.

Lifetime Exemption

The lifetime gift and estate tax exemption is the amount of money you can give away over the course of your life – or at your death – without triggering either gift or estate taxes. For gifts that exceed the annual exclusion, the difference is applied to your lifetime exemption. If you give someone a gift over that year’s annual exclusion and have exhausted your lifetime exemption, you’ll owe gift taxes on the amount of money that exceeds that year’s exclusion.

In 2023, the lifetime gift and estate tax exemption is $12.92 million for individuals, which means married couples have a combined exemption limit of $25.84 million. In 2024, the exemption will increase to $13.61 million for individuals and $27.22 million for married couples. If an individual has already gifted $12.92 million over the exclusion limits by 2023, they will be able to gift another $690,000 in 2024 (not including the annual exclusion amount).

Unlike the annual exclusion, the lifetime exemption does not reset. While you can gift up to the annual exclusion each year, any remainder permanently reduces your lifetime cap. The lifetime exemption is on a per-donor basis, meaning that it applies collectively to all gifts you have given. For example, say that in 2023 you give $20,000 to each of your four children. Each gift exceeds the exclusion by $3,000. Collectively, they would lower your lifetime gift and estate tax exemption by $12,000.

Gift Taxes And Down Payments

When it comes to your daughter’s down payment, the tax issues are this: Are you married? And how much have you given away throughout your life? Let’s assume you’re single for simplicity’s sake.

First, if you give her the down payment money in 2023, the first $17,000 of the gift will automatically be free of any potential tax liability. However, since the gift exceeds the annual exclusion by $33,000, that remainder will lower your lifetime exemption.

So, for example, if you have never given anyone a taxable gift, you will pay no gift tax and your annual exclusion will be reduced to $12.887 million ($12.92 million minus $33,000). If you have already exhausted your lifetime exemption, you would have to pay taxes on the $33,000.

However, there would still be ways to manage this potential tax liability. If you could wait until 2024 to give your daughter the money, your lifetime exemption would go up to $13.61 million. You can apply the remainder to the newly raised cap and will owe no taxes on the excess gift. But if you need additional help managing your tax liability, consider working with a financial advisor.

Bottom Line

Unless you have gifted more than $12.92 million over your lifetime, you can almost certainly give a $50,000 down payment to your daughter or other family member and not owe gift taxes in 2023. Just be careful to do the paperwork right, otherwise, it could complicate the loan.

Gift Tax Tips

-

Will the fact that this is your daughter complicate things? While the IRS does not treat gifts from parents differently, large gifts within a wealthy family can potentially complicate future planning around trusts and estates.

-

A financial advisor can help you strategically give away assets to lower your potential estate tax liability. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

-

Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

-

Are you a financial advisor looking to grow your business? SmartAsset AMP helps advisors connect with leads and offers marketing automation solutions so you can spend more time making conversions. Learn more about SmartAsset AMP.

Photo credit: ©iStock.com/gradyreese, ©iStock.com/payphoto, ©iStock.com/designer491

The post I Want to Give My Daughter and Her Husband $50,000 For a Down Payment. Do I Have to Worry About the Gift Tax? appeared first on SmartReads by SmartAsset.

Donald Trump-Backed World Liberty Financial Off To A Slow Start — Raises Just 4% Of The Token Fundraising Target

Donald Trump-backed cryptocurrency project World Liberty Financial (WLFI) has been off to a slow start, managing to raise just 4% of its token presale target within the first 48 hours of its launch.

What happened: About $12.46 million worth of the platform’s WLFI governance token have been sold as of this writing, according to a Dune Analytics dashboard, well short of the $300 million target announced earlier.

Roughly 830.43 million tokens have been sold to 9,881 unique wallets, with the total number of sales closing in on 12,000. Each token costs $0.015 at the time of writing.

Adam Cochran, a cryptocurrency market observer and Trump critic, said on the flop start, “If you think “the markets” favor Trump being president, why aren’t accredited investors lining up to buy this project?”

The WLFI team didn’t immediately respond to Benzinga’s request for comment on the slow start.

Why It Matters: Promoted aggressively by Trump and his family in recent weeks, the decentralized finance (DeFi) project has garnered massive hype right in the middle of the GOP nominee’s presidential campaign.

The WLFI token would serve as the platform’s governance token, enabling users to engage in borrowing, lending, and other DeFi activities.

However, the token is non-transferable and non-yielding, disallowing investors from speculating on its price in the market as they do for other cryptocurrency tokens, a feature that might be contributing to the project’s dull token presale.

In X Spaces earlier this week, the team behind WLFI said that the project was focused on preserving the supremacy of the U.S. dollar through dollar-backed stablecoins rather than speculative assets like Bitcoin BTC/USD.

Price Action: At the time of writing, Dogecoin was exchanging hands at $0.1252, up 7.58% in the last 24 hours, according to data from Benzinga Pro.

Image via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Breaking Update: Jeffrey B Brown Engages In Options Exercise At AXIL Brands

In a new SEC filing on October 15, it was revealed that Brown, CFO at AXIL Brands AXIL, executed a significant exercise of company stock options.

What Happened: Brown, CFO at AXIL Brands, exercised stock options for 0 shares of AXIL stock. This information was disclosed in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The exercise price of the options was $0.0 per share.

AXIL Brands shares are trading, exhibiting up of 0.52% and priced at $3.87 during Wednesday’s morning. This values Brown’s 0 shares at $0.

About AXIL Brands

AXIL Brands Inc is a company which is is a manufacturer and marketer of premium hearing enhancement and protection products, including ear plugs, earmuffs, and ear buds, under the AXIL brand. AXIL delivers top hearing enhancement, protection, & audio devices. From ultra comfortable fitting processes, to stereo quality sound performance, to reliable & durable engineering.

AXIL Brands: Financial Performance Dissected

Revenue Challenges: AXIL Brands’s revenue growth over 3 months faced difficulties. As of 31 August, 2024, the company experienced a decline of approximately -4.18%. This indicates a decrease in top-line earnings. When compared to others in the Consumer Staples sector, the company excelled with a growth rate higher than the average among peers.

Exploring Profitability:

-

Gross Margin: The company maintains a high gross margin of 70.99%, indicating strong cost management and profitability compared to its peers.

-

Earnings per Share (EPS): With an EPS below industry norms, AXIL Brands exhibits below-average bottom-line performance with a current EPS of -0.02.

Debt Management: AXIL Brands’s debt-to-equity ratio is below the industry average at 0.02, reflecting a lower dependency on debt financing and a more conservative financial approach.

Market Valuation:

-

Price to Earnings (P/E) Ratio: The current P/E ratio of 21.39 is below industry norms, indicating potential undervaluation and presenting an investment opportunity.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 1.84 is above industry norms, reflecting an elevated valuation for AXIL Brands’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): AXIL Brands’s EV/EBITDA ratio of 13.31 exceeds industry averages, indicating a premium valuation in the market

Market Capitalization Analysis: Falling below industry benchmarks, the company’s market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

In the complex landscape of investment decisions, investors should approach insider transactions as part of a comprehensive analysis, considering various elements.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Deciphering Transaction Codes in Insider Filings

Investors prefer focusing on transactions that take place in the open market, indicated in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S indicates a sale. Transaction code C indicates the conversion of an option, and transaction code A indicates grant, award or other acquisition of securities from the company.

Check Out The Full List Of AXIL Brands’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Steel Dynamics Reports Third Quarter 2024 Results

FORT WAYNE, Ind., Oct. 16, 2024 /PRNewswire/ —

Third Quarter 2024 Performance Highlights:

- Steel shipments of 3.2 million tons

- Net sales of $4.3 billion, operating income of $395 million, net income of $318 million, and adjusted EBITDA of $557 million

- Cash flow from operations of $760 million

- Strong liquidity of $3.1 billion, as of September 30, 2024

- Share repurchases of $310 million of the company’s common stock, representing 1.6 percent of its outstanding shares

Steel Dynamics, Inc. (NASDAQ/GS: STLD) today announced third quarter 2024 financial results. The company reported third quarter 2024 net sales of $4.3 billion and net income of $318 million, or $2.05 per diluted share. Comparatively, the company’s sequential second quarter 2024 net income was $428 million, or $2.72 per diluted share and prior year third quarter net income was $577 million, or $3.47 per diluted share.

“The teams achieved a solid third quarter 2024 performance across the platforms, with adjusted EBITDA of $557 million and cash flow from operations of $760 million,” said Mark D. Millett, Co-Founder, Chairman, and Chief Executive Officer. “With our proven through-cycle cash generation, we increased liquidity to $3.1 billion, while also investing $621 million in our internal ongoing growth initiatives and distributing $381 million to our shareholders through cash dividends and share repurchases. Our three-year after-tax return-on-invested capital of 26 percent is a testament to our ongoing high-return capital allocation execution.

“Underlying steel demand continued to be stable in the third quarter,” continued Millett. “However, earnings declined sequentially, based on lower average realized steel pricing, primarily within the flat rolled operations as generally 80 percent of this business is contractually based and tied to lagging pricing indices. Steady steel demand, coupled with continued low customer inventory and stabilized scrap prices, resulted in stabilization and improvement in flat rolled steel prices during the later part of the third quarter. Our long product steel operations realized a slight improvement in metal spread as scrap pricing declined more than average realized pricing.”

Third Quarter 2024 Comments

Third quarter 2024 operating income for the company’s steel operations was $305 million, lower than sequential results, as realized selling values declined more than scrap costs in the quarter. The third quarter 2024 average external product selling price for the company’s steel operations decreased $79 per ton sequentially to $1,059 per ton. The average ferrous scrap cost per ton melted at the company’s steel mills decreased $21 sequentially to $367 per ton. The company’s Sinton Texas Flat Roll Steel Mill team has completed the planned changes discussed on the second quarter 2024 earnings call. The team had great operating momentum in September and operated at 72 percent of its capability, excluding scheduled downtime.

Compared to the sequential quarter, third quarter 2024 operating income from the company’s metals recycling operations decreased to $12 million, based on softer demand as many domestic steel mills had scheduled maintenance outages. Shipments and pricing declined for both ferrous and nonferrous materials in the quarter. Additionally, the platform experienced an unexpected unrealized, non-cash copper hedging loss of $10 million, as copper prices sequentially increased significantly from August to September.

The company’s steel fabrication operations achieved strong operating income of $166 million in the third quarter 2024, modestly lower than sequential second quarter results, as demand remained steady, and average realized pricing softened five percent yet remained historically strong. The order backlog was steady, extending into the first quarter 2025 at attractive pricing levels. Current order activity is steady with expectations for improved volumes in 2025, as interest rates decline and the support from the U.S. infrastructure program and onshoring are expected to positively impact demand for not only steel joist and deck products, but also for flat rolled and long product steels.

Year-to-Date September 30, 2024 Comparison

For the nine months ended September 30, 2024, net income was $1.3 billion, or $8.46 per diluted share, with net sales of $13.7 billion, as compared to net income of $2.0 billion, or $11.98 per diluted share, with net sales of $14.6 billion for the same period in 2023.

For the first nine months 2024, net sales decreased six percent to $13.7 billion and operating income declined 35 percent to $1.7 billion, when compared to the same period in 2023. Decreased earnings were the result of lower volume and pricing from the company’s steel and steel fabrication operations during the period. For the first nine months 2024, operating income from the company’s steel fabrication operations was $525 million, compared to $1.3 billion in the same prior year period. Operating income from the company’s steel operations was $1.4 billion, compared to $1.5 billion for the same prior year period. The average nine-month 2024 external selling price for the company’s steel operations decreased $38 per ton to $1,133 per ton compared to the first nine months of 2023, and the average ferrous scrap cost per ton melted at the company’s steel mills decreased $30 per ton to $391 per ton.

Based on the company’s differentiated business model and highly variable cost structure, the company achieved cash flow from operations of $1.5 billion in the first nine months of 2024, representing a strong performance. The company also invested $1.4 billion in capital investments, paid cash dividends of $212 million, and repurchased $917 million of its outstanding common stock, representing 4.5 percent of its outstanding shares, while maintaining strong liquidity of $3.1 billion.

Outlook

“Based on domestic steel demand fundamentals, we are constructive regarding the outlook for 2025 metal market dynamics,” said Millett. “We expect steel pricing to recover with an anticipated lower domestic interest rate environment, coupled with continuing onshoring of manufacturing businesses, and the expectation of significant fixed asset investment to be derived from public funding related to the U.S. Infrastructure, Inflation Reduction Act, and Department of Energy programs. We believe current trade actions could also reduce volumes of unfairly traded steel imports into the United States, especially for coated flat rolled steel, which could have a significant positive impact for us, as we are the largest non-automotive flat rolled steel coater in the United States. We believe these dynamics collectively could benefit all of our operating platforms, especially our steel and steel fabrication businesses.

“Our four new value-added flat rolled steel coating lines that began operating earlier this year continue to increase production. The teams have produced prime quality galvanized and painted products on all four lines in record time. We have had limited benefit from these new lines so far this year, as we have been increasing production, and expect to realize the additional earnings potential in 2025. Value-added product investments such as these enhance our differentiated supply-chain capabilities, while also increasing our higher-margin product offerings, which already represent upwards of 65 percent of our steel revenues.

“We are also quickly progressing on our aluminum flat rolled products mill construction and are incredibly excited about this meaningful growth opportunity, which is aligned with our existing business and operational expertise,” said Millett. “We plan to begin operating the aluminum flat rolled mill mid-2025. We have intentionally grown with our customers’ needs, providing efficient sustainable supply chain solutions for the highest quality products. We are pleased to further diversify our end markets with plans to supply aluminum flat rolled products with high recycled content to the countercyclical sustainable beverage can and packaging industry, in addition to the automotive, industrial, and construction sectors. Our customers and our people are incredibly excited for this growth opportunity.

“Our commitment is to the health and safety of our teams, families, and communities, while meeting the current and future needs of our customers. Our culture and business model continue to positively differentiate our performance from the rest of the industry. We are competitively positioned and focused to generate long-term sustainable value,” concluded Millett.

Conference Call and Webcast

Steel Dynamics, Inc. will hold a conference call to discuss third quarter 2024 operating and financial results on Thursday, October 17, 2024, at 11:00 a.m. Eastern Daylight Time. You may access the call and find dial-in information on the Investors section of the company’s website at www.steeldynamics.com. A replay of the call will be available on our website until 11:59 p.m. Eastern Daylight Time on October 24, 2024.

About Steel Dynamics, Inc.

Steel Dynamics is one of the largest domestic steel producers and metals recyclers in North America, based on estimated annual steelmaking and metals recycling capability, with facilities located throughout the United States, and in Mexico. Steel Dynamics produces steel products, including hot roll, cold roll, and coated sheet steel, structural steel beams and shapes, rail, engineered special-bar-quality steel, cold finished steel, merchant bar products, specialty steel sections, and steel joists and deck. In addition, the company produces liquid pig iron and processes and sells ferrous and nonferrous scrap.

Note Regarding Financial Metrics

The company believes that after-tax return-on-invested capital (After-tax ROIC) provides an indication of the effectiveness of the company’s invested capital and is calculated as follows:

|

After-tax |

Net Income Attributable to Steel Dynamics, Inc. |

|

(Quarterly Average Current Maturities of Long-term Debt + Long-term Debt + Total Equity) |

Note Regarding Non-GAAP Financial Measures

The company reports its financial results in accordance with U.S. generally accepted accounting principles (GAAP). Management believes that the non-GAAP financial measures EBITDA and Adjusted EBITDA provide additional meaningful information regarding the company’s performance and financial strength. Non-GAAP financial measures should be viewed in addition to and not as an alternative for the company’s reported results prepared in accordance with GAAP. In addition, not all companies use identical calculations for EBITDA or Adjusted EBITDA; therefore, EBITDA and Adjusted EBITDA included in this release may not be comparable to similarly titled measures of other companies.

Forward-Looking Statements

This press release contains some predictive statements about future events, including statements related to conditions in domestic or global economies, conditions in steel, aluminum, and recycled metals market places, Steel Dynamics’ revenues, costs of purchased materials, future profitability and earnings, and the operation of new, existing or planned facilities. These statements, which we generally precede or accompany by such typical conditional words as “anticipate”, “intend”, “believe”, “estimate”, “plan”, “seek”, “project”, or “expect”, or by the words “may”, “will”, or “should”, are intended to be made as “forward-looking”, subject to many risks and uncertainties, within the safe harbor protections of the Private Securities Litigation Reform Act of 1995. These statements speak only as of this date and are based upon information and assumptions, which we consider reasonable as of this date, concerning our businesses and the environments in which they operate. Such predictive statements are not guarantees of future performance, and we undertake no duty to update or revise any such statements. Some factors that could cause such forward-looking statements to turn out differently than anticipated include: (1) domestic and global economic factors; (2) global steelmaking overcapacity and imports of steel, together with increased scrap prices; (3) pandemics, epidemics, widespread illness or other health issues; (4) the cyclical nature of the steel industry and the industries we serve; (5) volatility and major fluctuations in prices and availability of scrap metal, scrap substitutes and supplies, and our potential inability to pass higher costs on to our customers; (6) cost and availability of electricity, natural gas, oil, and other energy resources are subject to volatile market conditions; (7) increased environmental, greenhouse gas emissions and sustainability considerations from our customers or related regulations; (8) compliance with and changes in environmental and remediation requirements; (9) significant price and other forms of competition from other steel and aluminum producers, scrap processors and alternative materials; (10) availability of an adequate source of supply of scrap for our metals recycling operations; (11) cybersecurity threats and risks to the security of our sensitive data and information technology; (12) the implementation of our growth strategy; (13) litigation and legal compliance; (14) unexpected equipment downtime or shutdowns; (15) governmental agencies may refuse to grant or renew some of our licenses and permits; (16) our senior unsecured credit facility contains, and any future financing agreements may contain, restrictive covenants that may limit our flexibility; and (17) the impacts of impairment charges.

More specifically, we refer you to our more detailed explanation of these and other factors and risks that may cause such predictive statements to turn out differently, as set forth in our most recent Annual Report on Form 10-K under the headings Special Note Regarding Forward-Looking Statements and Risk Factors, in our Quarterly Reports on Form 10-Q, or in other reports which we file with the Securities and Exchange Commission. These reports are available publicly on the Securities and Exchange Commission website, www.sec.gov, and on our website, www.steeldynamics.com under “Investors – SEC Filings.”

|

Steel Dynamics, Inc. CONSOLIDATED STATEMENTS OF INCOME (UNAUDITED) (in thousands, except per share data) |

|||||||||||||||

|

Three Months Ended |

Nine Months Ended |

Three Months |

|||||||||||||

|

September 30, |

September 30, |

Ended |

|||||||||||||

|

2024 |

2023 |

2024 |

2023 |

June 30, 2024 |

|||||||||||

|

Net sales |

$ |

4,341,615 |

$ |

4,587,057 |

$ |

13,668,252 |

$ |

14,561,893 |

$ |

4,632,634 |

|||||

|

Costs of goods sold |

3,736,398 |

3,635,038 |

11,307,400 |

11,246,894 |

3,857,797 |

||||||||||

|

Gross profit |

605,217 |

952,019 |

2,360,852 |

3,314,999 |

774,837 |

||||||||||

|

Selling, general and administrative expenses |

167,692 |

145,896 |

487,215 |

431,414 |

160,016 |

||||||||||

|

Profit sharing |

34,444 |

64,413 |

145,149 |

224,978 |

48,053 |

||||||||||

|

Amortization of intangible assets |

7,644 |

8,160 |

22,953 |

25,962 |

7,645 |

||||||||||

|

Operating income |

395,437 |

733,550 |

1,705,535 |

2,632,645 |

559,123 |

||||||||||

|

Interest expense, net of capitalized interest |

17,071 |

18,415 |

41,768 |

61,689 |

12,719 |

||||||||||

|

Other (income) expense, net |

(29,659) |

(39,464) |

(75,151) |

(105,748) |

(18,708) |

||||||||||

|

Income before income taxes |

408,025 |

754,599 |

1,738,918 |

2,676,704 |

565,112 |

||||||||||

|

Income tax expense |

87,131 |

174,817 |

398,834 |

636,412 |

133,422 |

||||||||||

|

Net income |

320,894 |

579,782 |

1,340,084 |

2,040,292 |

431,690 |

||||||||||

|

Net income attributable to noncontrolling interests |

(3,092) |

(2,587) |

(10,243) |

(13,680) |

(3,692) |

||||||||||

|

Net income attributable to Steel Dynamics, Inc. |

$ |

317,802 |

$ |

577,195 |

$ |

1,329,841 |

$ |

2,026,612 |

$ |

427,998 |

|||||

|

Basic earnings per share attributable to |

|||||||||||||||

|

Steel Dynamics, Inc. stockholders |

$ |

2.06 |

$ |

3.49 |

$ |

8.50 |

$ |

12.04 |

$ |

2.73 |

|||||

|

Weighted average common shares outstanding |

154,061 |

165,170 |

156,528 |

168,259 |

156,856 |

||||||||||

|

Diluted earnings per share attributable to |

|||||||||||||||

|

Steel Dynamics, Inc. stockholders, including the |

|||||||||||||||

|

effect of assumed conversions when dilutive |

$ |

2.05 |

$ |

3.47 |

$ |

8.46 |

$ |

11.98 |

$ |

2.72 |

|||||

|

Weighted average common shares |

|||||||||||||||

|

and share equivalents outstanding |

154,810 |

166,105 |

157,248 |

169,150 |

157,579 |

||||||||||

|

Dividends declared per share |

$ |

0.46 |

$ |

0.425 |

$ |

1.38 |

$ |

1.275 |

$ |

0.46 |

|||||

|

Steel Dynamics, Inc. CONSOLIDATED BALANCE SHEETS (in thousands) |

||||||

|

September 30, |

December 31, |

|||||

|

Assets |

2024 |

2023 |

||||

|

(unaudited) |

||||||

|

Current assets |

||||||

|

Cash and equivalents |

$ |

1,015,210 |

$ |

1,400,887 |

||

|

Short-term investments |

645,343 |

721,210 |

||||

|

Accounts receivable, net |

1,564,957 |

1,608,307 |

||||

|

Inventories |

3,044,887 |

2,894,632 |

||||

|

Other current assets |

173,179 |

162,790 |

||||

|

Total current assets |

6,443,576 |

6,787,826 |

||||

|

Property, plant and equipment, net |

7,825,869 |

6,734,218 |

||||

|

Intangible assets, net |

234,806 |

257,759 |

||||

|

Goodwill |

477,471 |

477,471 |

||||

|

Other assets |

678,099 |

651,146 |

||||

|

Total assets |

$ |

15,659,821 |

$ |

14,908,420 |

||

|

Liabilities and Equity |

||||||

|

Current liabilities |

||||||

|

Accounts payable |

$ |

1,079,816 |

$ |

1,088,330 |

||

|

Income taxes payable |

6,248 |

5,524 |

||||

|

Accrued expenses |

724,219 |

778,455 |

||||

|

Current maturities of long-term debt |

882,013 |

459,987 |

||||

|

Total current liabilities |

2,692,296 |

2,332,296 |

||||

|

Long-term debt |

2,801,871 |

2,611,069 |

||||

|

Deferred income taxes |

943,154 |

944,768 |

||||

|

Other liabilities |

143,200 |

180,760 |

||||

|

Total liabilities |

6,580,521 |

6,068,893 |

||||

|

Commitments and contingencies |

||||||

|

Redeemable noncontrolling interests |

171,212 |

171,212 |

||||

|

Equity |

||||||

|

Common stock |

651 |

651 |

||||

|

Treasury stock, at cost |

(6,799,219) |

(5,897,606) |

||||

|

Additional paid-in capital |

1,220,089 |

1,217,610 |

||||

|

Retained earnings |

14,660,426 |

13,545,590 |

||||

|

Accumulated other comprehensive income (loss) |

(445) |

421 |

||||

|

Total Steel Dynamics, Inc. equity |

9,081,502 |

8,866,666 |

||||

|

Noncontrolling interests |

(173,414) |

(198,351) |

||||

|

Total equity |

8,908,088 |

8,668,315 |

||||

|

Total liabilities and equity |

$ |

15,659,821 |

$ |

14,908,420 |

||

|

Steel Dynamics, Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED) (in thousands) |

|||||||||||

|

Three Months Ended |

Nine Months Ended |

||||||||||

|

September 30, |

September 30, |

||||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||

|

Operating activities: |

|||||||||||

|

Net income |

$ |

320,894 |

$ |

579,782 |

$ |

1,340,084 |

$ |

2,040,292 |

|||

|

Adjustments to reconcile net income to net cash provided by |

|||||||||||

|

operating activities: |

|||||||||||

|

Depreciation and amortization |

121,052 |

107,418 |

353,357 |

326,082 |

|||||||

|

Equity-based compensation |

12,828 |

12,044 |

41,453 |

39,800 |

|||||||

|

Deferred income taxes |

14,832 |

19,625 |

(1,615) |

72,013 |

|||||||

|

Other adjustments |

(10,523) |

(12,163) |

1,779 |

(20,628) |

|||||||

|

Changes in certain assets and liabilities: |

|||||||||||

|

Accounts receivable |

210,435 |

260,915 |

43,350 |

173,022 |

|||||||

|

Inventories |

28,169 |

102,376 |

(151,501) |

188,330 |

|||||||

|

Other assets |

(11,851) |

(13,423) |

(22,054) |

(10,504) |

|||||||

|

Accounts payable |

(13,852) |

(57,532) |

(11,604) |

(54,233) |

|||||||

|

Income taxes receivable/payable |

(12,971) |

(7,105) |

7,017 |

96,656 |

|||||||

|

Accrued expenses |

100,840 |

121,762 |

(102,635) |

(195,542) |

|||||||

|

Net cash provided by operating activities |

759,853 |

1,113,699 |

1,497,631 |

2,655,288 |

|||||||

|

Investing activities: |

|||||||||||

|

Purchases of property, plant and equipment |

(621,355) |

(558,361) |

(1,414,831) |

(1,142,960) |

|||||||

|

Purchases of short-term investments |

(430,826) |

(170,887) |

(699,879) |

(692,716) |

|||||||

|

Proceeds from maturities of short-term investments |

204,543 |

282,592 |

775,851 |

821,668 |

|||||||

|

Other investing activities |

(4,357) |

(5,891) |

(15,656) |

(221,453) |

|||||||

|

Net cash used in investing activities |

(851,995) |

(452,547) |

(1,354,515) |

(1,235,461) |

|||||||

|

Financing activities: |

|||||||||||

|

Issuance of current and long-term debt |

1,185,657 |

345,563 |

2,145,538 |

1,066,605 |

|||||||

|

Repayment of current and long-term debt |

(527,977) |

(316,511) |

(1,531,969) |

(1,042,933) |

|||||||

|

Dividends paid |

(71,584) |

(70,713) |

(212,216) |

(201,834) |

|||||||

|

Purchase of treasury stock |

(309,901) |

(331,318) |

(917,024) |

(1,065,521) |

|||||||

|

Other financing activities |

1,177 |

1,953 |

(13,153) |

(39,075) |

|||||||

|

Net cash provided by (used in) financing activities |

277,372 |

(371,026) |

(528,824) |

(1,282,758) |

|||||||

|

Increase (decrease) in cash, cash equivalents, and restricted cash |

185,230 |

290,126 |

(385,708) |

137,069 |

|||||||

|

Cash, cash equivalents, and restricted cash at beginning of period |

835,526 |

1,480,862 |

1,406,464 |

1,633,919 |

|||||||

|

Cash, cash equivalents, and restricted cash at end of period |

$ |

1,020,756 |

$ |

1,770,988 |

$ |

1,020,756 |

$ |

1,770,988 |

|||

|

Supplemental disclosure information: |

|||||||||||

|

Cash paid for interest |

$ |

9,102 |

$ |

9,848 |

$ |

59,466 |

$ |

61,225 |

|||

|

Cash paid for income taxes, net |

$ |

81,742 |

$ |

160,178 |

$ |

383,455 |

$ |

472,936 |

|||

|

Steel Dynamics, Inc. SUPPLEMENTAL INFORMATION (UNAUDITED) (dollars in thousands) |

||||||||||||||||||

|

Third Quarter |

Year to Date |

|||||||||||||||||

|

2024 |

2023 |

2024 |

2023 |

1Q 2024 |

2Q 2024 |

|||||||||||||

|

External Net Sales |

||||||||||||||||||

|

Steel |

$ |

2,917,021 |

$ |

3,187,181 |

$ |

9,415,490 |

$ |

9,725,226 |

$ |

3,366,237 |

$ |

3,132,232 |

||||||

|

Steel Fabrication |

447,265 |

630,184 |

1,367,276 |

2,278,361 |

447,179 |

472,832 |

||||||||||||

|

Metals Recycling |

565,596 |

520,746 |

1,721,501 |

1,696,587 |

569,473 |

586,432 |

||||||||||||

|

Other |

411,733 |

248,946 |

1,163,985 |

861,719 |

311,114 |

441,138 |

||||||||||||

|

Consolidated Net Sales |

$ |

4,341,615 |

$ |

4,587,057 |

$ |

13,668,252 |

$ |

14,561,893 |

$ |

4,694,003 |

$ |

4,632,634 |

||||||

|

Operating Income (Loss) |

||||||||||||||||||

|

Steel |

$ |

304,950 |

$ |

482,336 |

$ |

1,421,915 |

$ |

1,531,154 |

$ |

674,648 |

$ |

442,317 |

||||||

|

Steel Fabrication |

165,634 |

330,061 |

524,795 |

1,343,495 |

178,381 |

180,780 |

||||||||||||

|

Metals Recycling |

11,616 |

18,505 |

66,383 |

101,727 |

22,635 |

32,132 |

||||||||||||

|

Aluminum |

(23,593) |

(7,172) |

(56,372) |

(13,005) |

(13,531) |

(19,248) |

||||||||||||

|

458,607 |

823,730 |

1,956,721 |

2,963,371 |

862,133 |

635,981 |

|||||||||||||

|

Non-cash amortization of intangible assets |

(7,644) |

(8,160) |

(22,953) |

(25,962) |

(7,664) |

(7,645) |

||||||||||||

|

Profit sharing expense |

(34,444) |

(64,413) |

(145,149) |

(224,978) |

(62,652) |

(48,053) |

||||||||||||

|

Non-segment operations |

(21,082) |

(17,607) |

(83,084) |

(79,786) |

(40,842) |

(21,160) |

||||||||||||

|

Consolidated Operating Income |

$ |

395,437 |

$ |

733,550 |

$ |

1,705,535 |

$ |

2,632,645 |

$ |

750,975 |

$ |

559,123 |

||||||

|

Adjusted EBITDA |

||||||||||||||||||

|

Net income |

$ |

320,894 |

$ |

579,782 |

$ |

1,340,084 |

$ |

2,040,292 |

$ |

587,500 |

$ |

431,690 |

||||||

|

Income taxes |

87,131 |

174,817 |

398,834 |

636,412 |

178,281 |

133,422 |

||||||||||||

|

Net interest expense (income) |

(8,063) |

(10,350) |

(30,257) |

(18,574) |

(14,327) |

(7,867) |

||||||||||||

|

Depreciation |

111,558 |

97,707 |

325,437 |

295,355 |

106,030 |

107,849 |

||||||||||||

|

Amortization of intangible assets |

7,644 |

8,160 |

22,953 |

25,962 |

7,664 |

7,645 |

||||||||||||

|

EBITDA |

519,164 |

850,116 |

2,057,051 |

2,979,447 |

865,148 |

672,739 |

||||||||||||

|

Non-cash adjustments |

||||||||||||||||||

|

Unrealized (gains) losses on derivatives |

||||||||||||||||||

|

and currency remeasurement |

25,114 |

14,005 |

24,585 |

(12,570) |

(1,347) |

818 |

||||||||||||

|

Equity-based compensation |

12,823 |

11,989 |

40,503 |

37,366 |

14,825 |

12,855 |

||||||||||||

|

Adjusted EBITDA |

$ |

557,101 |

$ |

876,110 |

$ |

2,122,139 |

$ |

3,004,243 |

878,626 |

686,412 |

||||||||

|

Other Operating Information |

||||||||||||||||||

|

Steel |

||||||||||||||||||

|

Average external sales price (Per ton) |

$ |

1,059 |

$ |

1,191 |

$ |

1,133 |

$ |

1,171 |

$ |

1,201 |

$ |

1,138 |

||||||

|

Average ferrous cost (Per ton melted) |

$ |

367 |

$ |

405 |

$ |

391 |

$ |

421 |

$ |

417 |

$ |

388 |

||||||

|

Flat Roll shipments |

||||||||||||||||||

|

Butler, Columbus, and Sinton |

1,924,098 |

1,783,581 |

5,860,986 |

5,617,322 |

1,993,305 |

1,943,583 |

||||||||||||

|

Steel Processing divisions * |

471,441 |

452,139 |

1,319,267 |

1,308,221 |

418,547 |

429,279 |

||||||||||||

|

Long Product shipments |

||||||||||||||||||

|

Structural and Rail Division |

397,047 |

469,638 |

1,263,263 |

1,444,174 |

440,921 |

425,295 |

||||||||||||

|

Engineered Bar Products Division |

176,131 |

201,903 |

563,270 |

649,789 |

191,373 |

195,766 |

||||||||||||

|

Roanoke Bar Division |

138,096 |

142,195 |

393,125 |

447,532 |

124,920 |

130,109 |

||||||||||||

|

Steel of West Virginia |

74,564 |

98,246 |

240,260 |

290,978 |

86,528 |

79,168 |

||||||||||||

|

Total Shipments (Tons) |

3,181,377 |

3,147,702 |

9,640,171 |

9,758,016 |

3,255,594 |

3,203,200 |

||||||||||||

|

External Shipments (Tons) |

2,754,853 |

2,676,068 |

8,311,539 |

8,302,311 |

2,803,569 |

2,753,117 |

||||||||||||

|

Steel Mill Production (Tons) |

2,785,128 |

2,782,870 |

8,579,232 |

8,620,531 |

2,992,018 |

2,802,086 |

||||||||||||

|

Metals Recycling |

||||||||||||||||||

|

Nonferrous shipments (000’s of pounds) |

293,470 |

279,877 |

886,923 |

845,477 |

289,436 |

304,017 |

||||||||||||

|

Ferrous shipments (Gross tons) |

1,459,206 |

1,442,964 |

4,420,054 |

4,415,949 |

1,453,619 |

1,507,229 |

||||||||||||

|

External ferrous shipments (Gross tons) |

537,082 |

547,646 |

1,665,175 |

1,693,028 |

536,973 |

591,120 |

||||||||||||

|

Steel Fabrication |

||||||||||||||||||

|

Average sales price (Per ton) |

$ |

2,836 |

$ |

3,916 |

$ |

2,980 |

$ |

4,452 |

$ |

3,141 |

$ |

2,978 |

||||||

|

Shipments (Tons) |

158,595 |

161,697 |

461,506 |

512,537 |

143,842 |

159,069 |

||||||||||||

|

Effective the fourth quarter 2023, we added a new reporting segment, Aluminum Operations. All prior periods presented have been recast to reflect those changes. |

||||||||||||||||||

|

* Includes Heartland, The Techs and United Steel Supply operations |

||||||||||||||||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/steel-dynamics-reports-third-quarter-2024-results-302278373.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/steel-dynamics-reports-third-quarter-2024-results-302278373.html

SOURCE Steel Dynamics, Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

American Lithium Announces Financial and Operating Highlights for Second Quarter Ended August 31, 2024

VANCOUVER, British Columbia, Oct. 16, 2024 (GLOBE NEWSWIRE) — American Lithium Corp. (“American Lithium” or the “Company”) LIAMLI Frankfurt:5LA1))) is pleased to provide financial and operating highlights for the second quarter ended August 31, 2024. Unless otherwise stated, all amounts presented are in Canadian dollars.

Highlights for the Quarter:

- Falchani Flow Sheet Optimization

- Implementation of numerous additional tried and tested hydrometallurgical processing steps to optimize the core flow sheet and materially reduce costs;

- Reduction of sulfuric acid consumption by approximately 50%; and

- Improvement in the specification of key by-products, sulfate of potash and cesium.

- Application to Nasdaq for Extension to Minimum Price Requirement

- Additional 180 calendar day extension to regain compliance with the Minimum US$1 Bid Price Rule.

Board Appointment:

The Company is also pleased to announce the appointment of Rona Sellers to its Board of Directors, including joining the corporate governance, nominating and compensation committee. Ms. Sellers is an experienced board and governance professional with more than 12 years of experience in corporate and securities law. Most recently, she held the role of Vice President (“VP”) Compliance and Corporate Secretary at Maple Gold Mines Ltd. and previous to that she was Corporate Secretary at two publicly traded companies listed in Canada and the United States.

Ms. Sellers currently is VP Commercial and Compliance and Corporate Secretary for Apollo Silver Corp. and VP Compliance and Corporate Secretary for United Lithium Corp. She holds a Bachelor of Arts degree from Simon Fraser University and an LLB (Honours) from City, University of London School of Law.

Alex Tsakumis, Interim CEO of American Lithium, comments, “We continue to make progress on the ground both in Nevada and Peru diligently advancing all our projects while recognizing the challenging market backdrop across the lithium sector. However, recent global events in our space specifically in M&A has sparked some renewed optimism as we are poised to benefit as market conditions improve. We are also excited to welcome Rona to the team. Her independence, along with her legal and governance experience, will be a valuable addition to our board, and we are looking forward to working with her.”

Selected Financial Data

The following selected financial data is summarized from the Company’s consolidated financial statements and related notes thereto (the “Financial Statements“) for the second quarter ended August 31, 2024. Copies of the Financial Statements and MD&A are available at www.americanlithiumcorp.com or on SEDAR+ at www.sedarplus.ca.

| Three Months August 31, 2024 |

Three Months August 31, 2023 |

|||||

| Loss and comprehensive loss | ($6,051,064) | ($10,579,027) | ||||

| Loss per share – basic and diluted | ($0.03) | ($0.05) | ||||

| As At August 31, 2024 |

As At February 29, 2024 |

|

| Cash and cash equivalents | $5,726,605 | $11,889,416 |

| Total assets | $163,115,078 | $173,594,831 |

| Total current liabilities | $2,267,489 | $3,115,623 |

| Total liabilities | $2,955,785 | $4,246,386 |

| Total shareholders’ equity | $160,159,293 | $169,348,445 |

Ted O’Connor, PGeo, Executive Vice-President of American Lithium and a qualified person as defined by NI 43-101, has reviewed and approved the scientific and technical information contained in this news release.

About American Lithium

American Lithium is developing two of the world’s largest, advanced-stage lithium projects, along with the largest undeveloped uranium project in Latin America. They include the TLC claystone lithium project in Nevada, the Falchani hard rock lithium project and the Macusani uranium deposit, both in southern Peru. All three projects, have been through robust preliminary economic assessments, exhibit significant expansion potential and enjoy strong community support.

For more information, please contact the Company at info@americanlithiumcorp.com or visit our website at www.americanlithiumcorp.com.

Follow us on Facebook, Twitter and LinkedIn.

On behalf of the Board of Directors of American Lithium Corp.

“Alex Tsakumis”

Interim CEO

Tel: 604 428 6128

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Statement Regarding Forward Looking Information

This news release contains certain forward-looking information and forward-looking statements (collectively “forward-looking statements”) within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release include, but are not limited to, statements regarding the business plans, expectations and objectives of American Lithium. Forward-looking statements are frequently identified by such words as “may”, “will”, “plan”, “expect”, “anticipate”, “estimate”, “intend”, “indicate”, “scheduled”, “target”, “goal”, “potential”, “subject”, “efforts”, “option” and similar words, or the negative connotations thereof, referring to future events and results. Forward-looking statements are based on the current opinions and expectations of management and are not, and cannot be, a guarantee of future results or events. Although American Lithium believes that the current opinions and expectations reflected in such forward-looking statements are reasonable based on information available at the time, undue reliance should not be placed on forward-looking statements since American Lithium can provide no assurance that such opinions and expectations will prove to be correct. All forward-looking statements are inherently uncertain and subject to a variety of assumptions, risks and uncertainties, including risks, uncertainties and assumptions related to: American Lithium’s ability to achieve its stated goals; which could have a material adverse impact on many aspects of American Lithium’s businesses including but not limited to: the ability to access mineral properties for indeterminate amounts of time, the health of the employees or consultants resulting in delays or diminished capacity, social or political instability in Peru which in turn could impact American Lithium’s ability to maintain the continuity of its business operating requirements, may result in the reduced availability or failures of various local administration and critical infrastructure, reduced demand for the American Lithium’s potential products, availability of materials, global travel restrictions, and the availability of insurance and the associated costs; the ongoing ability to work cooperatively with stakeholders, including but not limited to local communities and all levels of government; the potential for delays in exploration or development activities; the interpretation of drill results, the geology, grade and continuity of mineral deposits; the possibility that any future exploration, development or mining results will not be consistent with our expectations; risks that permits will not be obtained as planned or delays in obtaining permits; mining and development risks, including risks related to accidents, equipment breakdowns, labour disputes (including work stoppages, strikes and loss of personnel) or other unanticipated difficulties with or interruptions in exploration and development; risks related to commodity price and foreign exchange rate fluctuations; risks related to foreign operations; the cyclical nature of the industry in which American Lithium operates; risks related to failure to obtain adequate financing on a timely basis and on acceptable terms or delays in obtaining governmental approvals; risks related to environmental regulation and liability; political and regulatory risks associated with mining and exploration; risks related to the uncertain global economic environment and the effects upon the global market generally, any of which could continue to negatively affect global financial markets, including the trading price of American Lithium’s shares and could negatively affect American Lithium’s ability to raise capital and may also result in additional and unknown risks or liabilities to American Lithium. Other risks and uncertainties related to prospects, properties and business strategy of American Lithium are identified in the “Risk Factors” section of American Lithium’s Management’s Discussion and Analysis filed on October 15, 2024 and in recent securities filings available at www.sedarplus.ca. Actual events or results may differ materially from those projected in the forward-looking statements. American Lithium undertakes no obligation to update forward-looking statements except as required by applicable securities laws. Investors should not place undue reliance on forward-looking statements.

Cautionary Note Regarding 32 Concessions

Thirty-two of the one-hundred-seventy-four concessions comprising the Falchani and Macusani Projects are currently subject to Administrative and Judicial processes in Peru to overturn resolutions issued by INGEMMET and the Mining Council of MINEM in February 2019 and July 2019, respectively, which declared title to thirty-two concessions invalid due to late receipt of the annual validity payments. On November 2, 2021, American Lithium was awarded a favorable ruling in regard to title to the concessions, but on November 26, 2021, appeals of the judicial ruling were lodged by INGEMMET and MINEM. A three-judge tribunal of Peru’s Superior Court unanimously upheld the ruling in a decision reported in November 2023. American Lithium was subsequently notified that INGEMMET and MINEM have filed petitions to the Supreme Court of Peru to assume jurisdiction in the proceedings. Given the precedent of the original ruling it is hoped that the Supreme Court will not assume jurisdiction; however, there is no assurance of the outcome at this time.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At GE Aero's Recent Unusual Options Activity

Financial giants have made a conspicuous bearish move on GE Aero. Our analysis of options history for GE Aero GE revealed 24 unusual trades.

Delving into the details, we found 33% of traders were bullish, while 58% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $214,808, and 19 were calls, valued at $1,154,257.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $155.0 to $230.0 for GE Aero over the recent three months.

Volume & Open Interest Development

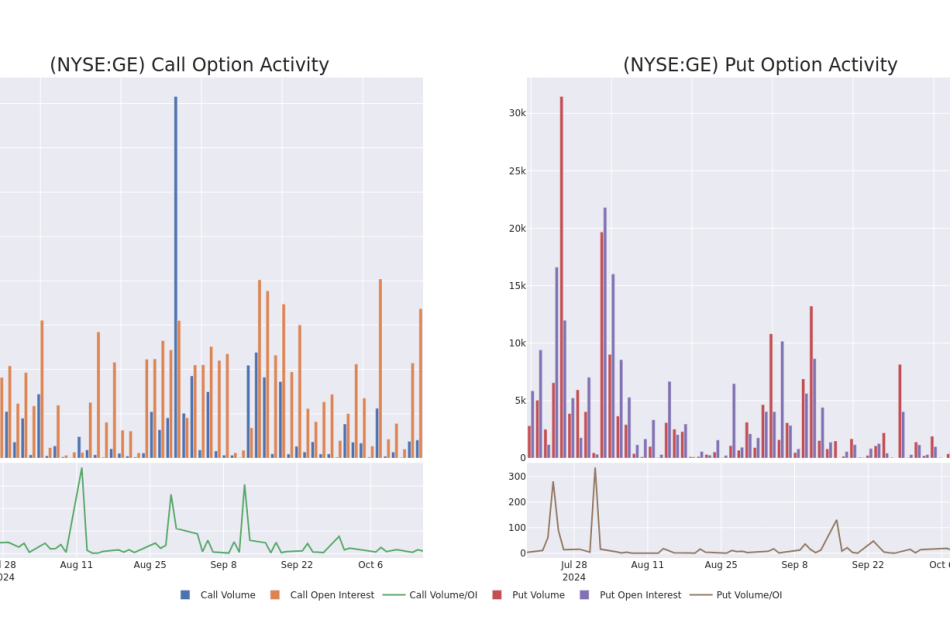

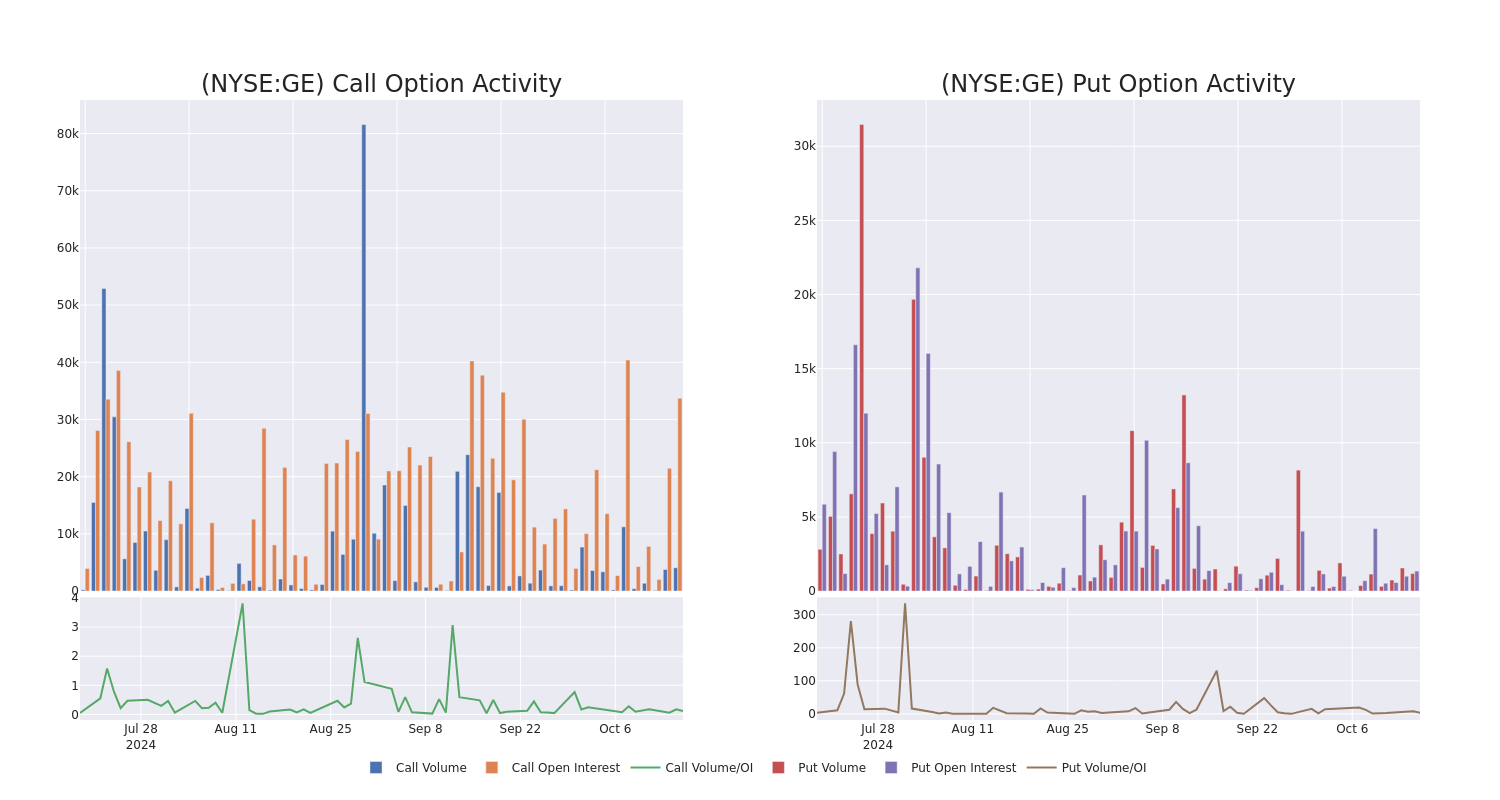

In terms of liquidity and interest, the mean open interest for GE Aero options trades today is 2505.5 with a total volume of 5,246.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for GE Aero’s big money trades within a strike price range of $155.0 to $230.0 over the last 30 days.

GE Aero Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GE | CALL | SWEEP | BEARISH | 06/20/25 | $21.9 | $21.85 | $21.85 | $190.00 | $188.2K | 217 | 409 |

| GE | CALL | SWEEP | BEARISH | 06/20/25 | $22.05 | $21.9 | $21.94 | $190.00 | $120.8K | 217 | 56 |

| GE | CALL | SWEEP | BEARISH | 06/20/25 | $22.0 | $21.95 | $21.93 | $190.00 | $118.5K | 217 | 94 |

| GE | CALL | SWEEP | BEARISH | 06/20/25 | $22.0 | $21.95 | $21.93 | $190.00 | $83.3K | 217 | 207 |

| GE | CALL | SWEEP | BEARISH | 06/20/25 | $22.0 | $21.95 | $21.95 | $190.00 | $74.6K | 217 | 145 |

About GE Aero

GE Aerospace is the global leader in designing, manufacturing, and servicing large aircraft engines, along with partner Safran in their CFM joint venture. With its massive global installed base of nearly 70,000 commercial and military engines, GE Aerospace earns most of its profits on recurring service revenue of that equipment, which operates for decades. GE Aerospace is the remaining core business of the company formed in 1892 with historical ties to American inventor Thomas Edison; that company became a storied conglomerate with peak revenue of $130 billion in 2000. GE spun off its appliance, finance, healthcare, and wind and power businesses between 2016 and 2024.

After a thorough review of the options trading surrounding GE Aero, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Where Is GE Aero Standing Right Now?

- Trading volume stands at 2,902,187, with GE’s price up by 0.87%, positioned at $192.22.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 6 days.

Professional Analyst Ratings for GE Aero

A total of 4 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $222.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Deutsche Bank persists with their Buy rating on GE Aero, maintaining a target price of $235.

* Maintaining their stance, an analyst from Bernstein continues to hold a Outperform rating for GE Aero, targeting a price of $225.

* An analyst from Deutsche Bank persists with their Buy rating on GE Aero, maintaining a target price of $212.

* An analyst from Citigroup has decided to maintain their Buy rating on GE Aero, which currently sits at a price target of $216.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GE Aero options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Lend Bucket Launches Comprehensive Credit Builder Program to Help Businesses Build Strong Credit

Corpus Christi, TX October 16, 2024 –(PR.com)– Lend Bucket is excited to announce the launch of its Credit Builder Program, a solution tailored to help both new and established businesses improve their business credit. With our program, businesses can establish and boost their credit score by over 100 points in just 2-3 months. Reporting to the three major credit bureaus—Experian, Dun & Bradstreet, and Equifax—this program opens the door to better financing, business growth, and increased credibility.

Why Building Business Credit is Essential for Growth

Having a solid business credit score is crucial for any company aiming to grow, and here’s why:

Access to Larger Loans and Lower Interest Rates: A high business credit score allows you to secure larger loans with lower interest rates. Strong business credit enables companies to get the funding they need for expansion, purchasing equipment, or boosting cash flow. Banks and lenders rely on your business credit profile to determine risk, and having a good score ensures you get better financing options.

Separate Personal and Business Finances: Building business credit separates your personal financial obligations from your business’s. This is important because it helps protect personal assets like your home or savings in case of business challenges. Plus, with a good business credit score, you can access financing without using personal guarantees.

Improved Vendor Relationships: Businesses with good credit can negotiate better payment terms with vendors and suppliers. This means more flexibility and better deals, improving cash flow and allowing you to manage your business finances more effectively.

Leverage for Negotiations: A strong business credit score gives you leverage when negotiating with investors, partners, or lenders. It shows that your business is financially stable and reliable, which can help secure better terms in partnerships, contracts, or loans.

Opportunities for Business Expansion: As your business credit improves, so do your chances of growing your operations, securing new office space, or entering new markets. Many landlords, vendors, and financial institutions review your business’s credit history before agreeing to deals, so building credit is key to unlocking these opportunities.

How the Lend Bucket Credit Builder Program Works

Their Lend Bucket Credit Builder Program is designed to meet businesses at different stages of their journey, providing three tailored tiers that report directly to the top three credit bureaus. Whether you’re a startup or an established company, these options will help you establish or improve your business credit.

Installment Flex (For Established Businesses)

Minimum Monthly Sales: $5,000

Program Fee: $500

Loan Amount: $250 with 10% interest

Total Payback: $775 within 15 business days

Daily Payback: $51.66

Credit Boost: Over 100 points

Perfect for businesses that already have cash flow, the Installment Flex program allows companies to report a short-term installment loan that boosts their credit quickly. By paying off the loan daily, businesses can significantly increase their credit score, which helps in securing larger loans and better terms in the future.

Installment Zone (For Newer Businesses: 0-3 Years Old)

Program Fee: $600

Credit Reporting: 6 months installment loan

Ideal for startups or businesses with no established financials, this program allows you to report an installment loan over six months, building a strong credit history with the credit bureaus. Even though the loan is paid upfront, they continue to report positive balances for six months, helping your business build credibility and establish a solid foundation for future financing.

Revolving Flex (Long-Term Credit for All Businesses)

Program Fee: $650

Credit Reporting: 2 years revolving credit

Designed to create long-term credit stability, this program establishes a revolving line of credit that reports consistently over two years. Maintaining a good revolving credit account shows your ability to manage ongoing credit, which is vital for securing bigger loans and better terms down the line.

How Building Business Credit with Lend Bucket Benefits Your Business

Their program doesn’t just stop at boosting your credit score—it sets the stage for long-term financial success. By enrolling in our Credit Builder Program, your business will enjoy:

Access to Larger Loans: As your business credit improves, you’ll be eligible for larger loans with better terms. Lend Bucket is committed to helping your business secure the funding it needs to grow.

Regular Credit Reporting: They report your positive financial activities to Experian, Dun & Bradstreet, and Equifax, ensuring that your progress is reflected across all major credit bureaus.

Quick Credit Boost: Businesses can experience a credit score increase of over 100 points within just 2-3 months, unlocking opportunities for better financing and vendor relationships.

Why Businesses Need Strong Credit to Expand

Establishing good business credit is a necessity for any business that plans to grow. Without it, a company is limited in its ability to secure financing, negotiate favorable terms, or build a solid reputation with vendors and partners. Whether you’re looking to lease a new office, purchase equipment, or expand into new markets, strong business credit opens up more opportunities for growth.

How Their Program Helps Businesses Succeed

Short-Term Installment Loans: Our installment programs provide a quick and impactful way to boost credit. By repaying the loan in 15 days, established businesses can see an immediate improvement in their credit profile.

Revolving Credit for Long-Term Growth: Revolving credit is one of the most valuable tools for maintaining good business credit. Their Revolving Flex program allows businesses to maintain a revolving line of credit over two years, proving financial responsibility and building a strong credit history.

New Business Credit: For startups and businesses with little to no credit, our programs help establish a solid credit foundation, ensuring that you can qualify for bigger loans and better rates as your business grows.

Conclusion: Take Control of Your Business’s Financial Future

Building business credit is a critical step in securing your company’s financial future. With the Lend Bucket Credit Builder Program, you can quickly and effectively improve your business credit score, gaining access to better financing, more opportunities, and the credibility needed to expand. Whether you’re a new business or an established company, Lend Bucket’s tailored programs ensure you can build credit that works for your growth.

Start building your business credit today with LendBucket.com and unlock the financial opportunities your business deserves.

Contact Information:

Lend Bucket

Robert Reyna

540-447-9432

Contact via Email

lendbucket.com

Read the full story here: https://www.pr.com/press-release/923180

Press Release Distributed by PR.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Russell 2000 Poised For Major Technical Breakout: Analyst Eyes 'A Trend Reversal In Favor Of Small Caps Outperforming' S&P 500

The Russell 2000 Index, a benchmark for small-cap stocks, is on the verge of a significant technical breakout that could push it to levels not seen since late November 2021.

On Wednesday, the index is testing a crucial resistance zone around the 2,300-point level, a ceiling last reached on July 31.

While the S&P 500, Dow Jones and Nasdaq 100 have set fresh all-time highs in 2024, the Russell 2000, as tracked by the iShares Russell 2000 ETF IWM, still remains 6.7% below its peak.

Market participants are now closely watching whether small-cap stocks can rally to catch up large-cap counterparts on the back of economic growth resilience and lower interest rates.

“Small caps have been stuck in a consolidation range over the last few months as investors questioned the likelihood of a soft-landing scenario and the path of monetary policy. Small caps tend to be more sensitive to economic conditions and interest rates versus their larger cap peers,” commented Adam Turnquist, chief technical strategist at LPL Financial.

The outlook for small caps has brightened amid strong economic data and optimism surrounding Federal Reserve policy.

The U.S. economy continues to show resilience, with the Atlanta Fed GDPNow model forecasting 3.2% GDP growth for the fourth quarter of 2024, marking an acceleration from 3% growth in the third quarter.

Additionally, the U.S. labor market has recently outperformed even the rosiest expectations, with 254,000 jobs added in September, marking the strongest monthly job growth in six months. This was a substantial increase from the 159,000 jobs added in August, far surpassing forecasts of 140,000. The unemployment rate fell to 4.1%, while wage growth also accelerated.

Turnquist highlighted, “With the growth outlook recently improving — underpinned by better-than-feared labor market conditions — and increased visibility into Fed rate cuts, the Russell 2000 has rallied off the lower end of its rising price channel.

The banking sector has been a key driver behind the recent surge in small-cap stocks, fueled by solid earnings from major financial heavyweights.

Leading U.S. banks — including JPMorgan Chase & Co. JPM, Goldman Sachs Group Inc. GS, Bank of America Corp. BAC, Citigroup Inc. C, Wells Fargo & Co. WFC, Bank of New York Mellon Corp. BK, and Charles Schwab Corp. SCHW — all reported better-than-expected thrid-quarter earnings, sparking investor optimism in the broader financial sector.

The bullish momentum on large banks has had a ripple effect on regional banks, which make up the largest sector of the Russell 2000.

The SPDR S&P Regional Banking ETF KRE extended its rally to six consecutive days, fully rebounding from the banking crisis triggered in March 2023 by the collapse of Silicon Valley Bank and Signature Bank.

“Technically, a close above 2,275 would confirm a breakout from its current symmetrical triangle and leave the 2021 highs as the next resistance hurdle to clear. Momentum indicators have also recently turned bullish, adding to the evidence of a topside breakout,” Turnquist explained.

However, it’s important to note that despite recent improvements, the Russell 2000’s relative performance against the S&P 500 — tracked by the IWM/SPDR S&P 500 ETF SPY ratio — remains in a downtrend.

The ratio is still below its declining 200-day moving average, signaling that small caps have yet to fully outperform their large-cap counterparts.

“A close above the July highs would validate a trend reversal in favor of small caps outperforming,” Turnquist added.

Read Now:

Photo: IConcept via Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.