Nu Skin Navigates Growth With Innovation Amid Industry Challenges

Nu Skin Enterprises, Inc. NUS is driving its growth strategy through key initiatives that aim to revitalize its market presence and tap into high-growth areas. The company continues to prioritize thoughtful product introductions that align with shifting consumer preferences. A recent example is the launch of MYND360, a new line of clinically validated nutritional formulas tailored to support cognitive well-being.

Featuring six products, MYND360 is designed to enable users to manage stress, remain focused, enhance memory and sleep better. This innovation reflects Nu Skin’s focus on the fast-growing brain health market. While these upsides, along with strength in the Rhyz business, have been working well. Nu Skin remains troubled by persistent macroeconomic obstacles.

Product Launches a Key Driver for Nu Skin

With the help of advanced technology and well-strategized product programs, Nu Skin tries to capture greater market share and maintain growth momentum. The company’s long-term strategies stand on three key pillars — Products, Programs and Platforms. NUS has been successfully launching innovative beauty devices, which have become an important part of its growth.

Nu Skin’s second-quarter 2024 results included positive contributions from new products such as Ageloc, Wellspa IO and RenewspA IO, along with the company’s TRME weight management system. The ageLOC WellSpa iO has been a solid addition to the company’s beauty device system brands, generating impressive response.

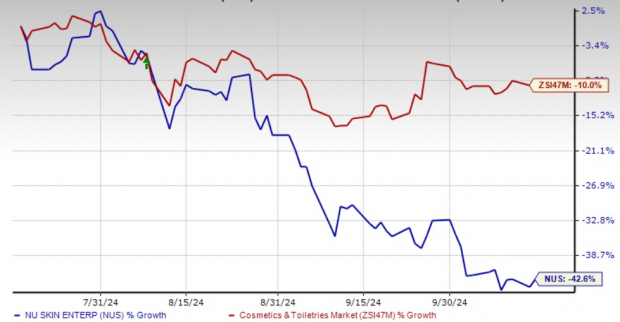

Image Source: Zacks Investment Research

Nu Skin Gains From Rhyz Business

Nu Skin’s Rhyz business emerges as a cornerstone of its strategic vision, highlighted by its remarkable growth trajectory and significant contribution to the company’s revenue stream. Rhyz represents a cohesive ecosystem comprising consumer, technology, and manufacturing entities, all dedicated to pioneering innovation within the realms of beauty, wellness, and lifestyle. Experiencing 32.3% revenue growth in the second quarter of 2024, Rhyz accounted for 15% of total enterprise revenues and is anticipated to reach 20% to 25% by 2025.

The success of this business reflects Nu Skin’s commitment to capitalizing on evolving consumer trends, particularly in influencer and affiliate marketing, which are projected to surge in the coming years. By investing in Rhyz’s manufacturing capabilities, technology advancements, and creator-led indie beauty brands, Nu Skin is strategically positioning itself to drive sustained growth and value creation within the beauty, wellness, and lifestyle market.

Challenges Faced by NUS

Nu Skin’s second-quarter 2024 performance was hurt by continuous macroeconomic headwinds across most regions, which weighed on consumer spending and customer acquisition, especially for premium products. The company also grappled with pressures in the direct selling industry. These headwinds, along with foreign adverse currency fluctuations, hurt Nu Skin’s quarterly revenues, which tumbled 12.2% year over year to $439.1 million in the second quarter.

The operating environment for Nu Skin’s core business remains challenging, primarily due to macroeconomic factors and pressures within the direct selling industry. Taking into account the company’s first-half 2024 performance and rising foreign exchange headwinds, management tightened the annual guidance range for 2024 in its second-quarter earnings release.

Nu Skin now anticipates revenues in the band of $1.73-$1.81 billion for 2024, which suggests a 12-8% decline from the year-ago period’s reported figure. Earlier, the metric was expected to be in the range of $1.73-$1.87 billion. Management envisions adjusted earnings per share of 75-95 cents. The projection suggests a decline from adjusted earnings of $1.85 recorded in 2023. Management had earlier envisioned an adjusted EPS of 95 cents to $1.35 for 2024.

For the third quarter of 2024, the company expects revenues between $430 million and $465 million, which suggests a decline of 14% to 7% from the year-ago quarter’s reported level. The company expects adjusted EPS of 15-25 cents in the third quarter of 2024 compared with 56 cents recorded in the same period last year. Shares of NUS have plunged 42.6% in the past three months compared with the industry’s decline of 10%.

Final Words on NUS

Nu Skin continues to drive growth through strategic initiatives, innovative product launches, and the expanding Rhyz business. While the company has made significant strides in capturing market opportunities, especially in the beauty and brain health sectors, it faces ongoing challenges from macroeconomic pressures and headwinds in the direct selling industry. Moving forward, the Zacks Rank #3 (Hold) company’s ability to balance innovation with market realities will be key to sustaining its growth trajectory.

Top 3 Staple Bets

Inter Parfums IPAR is engaged in the manufacturing, distribution and marketing of a wide range of fragrances and related products. It currently carries a Zacks Rank of 2 (Buy).

The Zacks Consensus Estimate for IPAR’s current financial-year sales and earnings indicates advancements of 10.2% and 8.4%, respectively, from the prior-year figures. It has a trailing four-quarter earnings surprise of 2.5%, on average.

Flowers Foods FLO, one of the largest producers of packaged bakery foods in the United States, currently carries a Zacks Rank #2. FLO has a trailing four-quarter earnings surprise of 1.9%, on average.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales and earnings implies growth of around 1% and 5%, respectively, from the year-ago reported numbers.

McCormick & Company, Inc. MKC is a leading manufacturer, marketer and distributor of spices, seasonings, specialty foods and flavors. It currently carries a Zacks Rank #2.

The Zacks Consensus Estimate for McCormick & Company’s current fiscal-year sales and earnings indicates advancements of 0.6% and 8.2%, respectively, from the year-ago reported figures. MKC has a trailing four-quarter earnings surprise of 13.8%, on average.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

What's Going On With Micron Technology Stock Wednesday?

Micron Technology, Inc. MU shares are trading higher on Wednesday as some stocks in the chip sector rebound from Tuesday’s drop. The company also unveiled its new clock driver, the DDR5 memory portfolio.

What To Know: Micron announced its DDR5 memory portfolio, designed to fuel a new wave of AI PCs. The company introduced two clock driver memory modules capable of delivering speeds of up to 6,400 MT/s (megatransfers per second), more than twice as fast as DDR4.

Micron’s new portfolio integrates a clock driver directly onto the memory module, ensuring improved speed stability and signal integrity. DDR5 is designed to provide more speed stability, faster downloads and better refresh rates for next-generation PCs.

Micron also announced that it validated its DDR5 solutions for use with Intel Corp INTC Core Ultra processors, which were launched on Oct. 10.

“As AI takes flight, a memory paradigm shift is needed to keep pace with unprecedented system performance requirements,” said Dinesh Bahal, corporate vice president and general manager of Micron’s Commercial Products Group.

“Micron is shipping the industry’s first JEDEC-standard, commercially available DDR5 CUDIMM and CSODIMM solutions to power fast, out-of-the-box speeds for AI PCs and high-end workstations. With this new category, we are arming the ecosystem with next-generation memory solutions to future-proof today’s devices for tomorrow’s AI workloads.”

Related Link: Intel, AMD Join Forces To Shape The Future Of Computing

What Else: Several chip stocks are recovering from Tuesday’s weakness, largely driven by soft guidance out of ASML Holding.

The Dutch chip company slashed its full-year sales guidance from a range of 30 billion euros ($32.59 billion) to 40 billion euros to a new range of 30 billion euros to 35 billion euros.

In addition, reports surfaced this week that the U.S. is exploring the possibility of curbing chip exports to some countries, which negatively impacted stocks in the chip sector.

Currently, the U.S. limits exports of chips to select countries, such as China. However, the new potential controls on chip exports would reportedly focus on Persian Gulf Nations.

How To Buy Micron Technology Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Micron Technology’s case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

MU Price Action: Micron Technology shares were up 4.14% at $108.65 Wednesday afternoon, according to data from Benzinga Pro.

Image: courtesy of Micron

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Logansport Financial Corp. Reports Net Earnings for the Quarter Ended September 30, 2024

LOGANSPORT, Ind., Oct. 16, 2024 (GLOBE NEWSWIRE) — Logansport Financial Corp., (OTCQB, LOGN), parent company of Logansport Savings Bank, reported net earnings for the quarter ended September 30, 2024 of $192,000 or $0.31 per diluted share, compared to earnings in 2023 of $371,000 or $0.61 per diluted share. Year to date the company reported net earnings of $808,000 for 2024 compared to $1,501,000 for 2023. Diluted earnings per share for the nine months ended September 30, 2024 were $1.32 compared to $2.46 for the nine months ended September 30, 2023. Total assets at September 30, 2024 were $256.9 million compared to total assets at September 30, 2023 of $244.3 million. Total Deposits at September 30, 2024 were $216.6 million compared to total deposits of $219.4 million at September 30, 2023. The company paid a total of $1.35 per share in dividends in the first nine months of 2024 compared to $3.85 in 2023. This included a special dividend of $2.50 per share in 2023.

The statements contained in this press release contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, which involves a number of risks and uncertainties. A number of factors could cause results to differ materially from the objectives and estimates expressed in such forward-looking statements. These factors include, but are not limited to, changes in the financial condition of issuers of the Company’s investments and borrowers, changes in economic conditions in the Company’s market area, changes in policies of regulatory agencies, fluctuations in interest rates, demand for loans in the Company’s market area, changes in the position of banking regulators on the adequacy of our allowance for loan losses, and competition, all or some of which could cause actual results to differ materially from historical earnings and those presently anticipated or projected. These factors should be considered in evaluation of any forward-looking statements, and undue reliance should not be placed on such statements. The Company does not undertake and specifically disclaims any obligation to update any forward-looking statements to reflect occurrence of anticipated or unanticipated events or circumstances after the date of such statements.

| LOGANSPORT FINANCIAL CORP. | |||||||

| SELECTED FINANCIAL DATA (Unaudited) | |||||||

| (Dollars in thousands, except for share data) | |||||||

| 9/30/2024 | 9/30/2023 | ||||||

| Total assets | $256,930 | $244,277 | |||||

| Loans receivable, net | 172,097 | 168,710 | |||||

| Allowance for loan losses | 2,859 | 2,941 | |||||

| Cash and cash equivalents | 11,384 | 4,749 | |||||

| Securities available for sale | 26,783 | 28,524 | |||||

| Investment in Logansport Investments, Inc. | 29,859 | 27,237 | |||||

| Federal Home Loan Bank stock | 3,150 | 3,150 | |||||

| Equity Investment | – | – | |||||

| Deposits | 216,600 | 219,371 | |||||

| FHLB Borrowings and note payable | 15,000 | 5,000 | |||||

| Shareholders’ equity | 21,918 | 17,678 | |||||

| Unrealized gain (loss) on securities | (5,756) | (9,914) | |||||

| Shares O/S end of period | 611,597 | 611,334 | |||||

| Non-accrual loans | 3,288 | 572 | |||||

| Real Estate Owned | – | – | |||||

| Quarter ended 9/30 |

Nine months ended 9/30 | ||||||

| 2024 | 2023 | 2024 | 2023 | ||||

| Interest income | $2,852 | $2,814 | $8,894 | $8,058 | |||

| Interest expense | 1,570 | 1,420 | 4,657 | 3,343 | |||

| Net interest income | 1,282 | 1,394 | 4,237 | 4,715 | |||

| Provision for loan losses | -30 | – | -79 | – | |||

| Net interest income after provision | 1,312 | 1,394 | 4,316 | 4,715 | |||

| Gain on sale of Investments | – | – | – | – | |||

| Gain on sale of loans | 99 | 87 | 260 | 135 | |||

| Gain on sale of REO | – | – | – | – | |||

| Total other income | 257 | 293 | 889 | 840 | |||

| Gain (loss) on Logansport Investments, Inc. | 175 | 172 | 527 | 658 | |||

| Gain on BOLI Settlement | – | – | – | – | |||

| Total general, admin. & other expense | 1,732 | 1,537 | 5,171 | 4,667 | |||

| Earnings before income taxes | 111 | 409 | 721 | 1,681 | |||

| Income tax expense | -81 | 38 | -87 | 180 | |||

| Net earnings | $192 | $371 | $808 | $1,501 | |||

| Basic earnings per share | $0.31 | $0.61 | $1.32 | $2.46 | |||

| Diluted earnings per share | $0.31 | $0.61 | $1.32 | $2.46 | |||

| Weighted average shares o/s diluted | 611,597 | 611,334 | 611,597 | 611,334 | |||

Contact: Kristie Richey

Chief Financial Officer

Phone-574-722-3855

Fax-574-722-3857

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Warren Buffett Owns 2 Index Funds That Could Soar 158%, According to a Top Wall Street Analyst

Warren Buffett has served as the CEO of Berkshire Hathaway since 1965. He oversees a portfolio of 45 publicly traded stocks and securities worth $316 billion, plus a $277 billion cash pile and several private, wholly owned businesses.

Under Buffett’s leadership, Berkshire stock has delivered a compound annual return of 19.8% over the last 59 years, which could have turned an investment of $1,000 into more than $42 million.

However, Buffett and his team are expert stock pickers who manage Berkshire’s investment portfolios full time. He knows the average investor would struggle to replicate his returns, so he recommends they buy exchange-traded funds (ETFs) to track the performance of an index like the S&P 500 instead.

In fact, Berkshire actually holds two S&P 500 index funds in its portfolio: the Vanguard S&P 500 ETF (NYSEMKT: VOO) and the SPDR S&P 500 ETF Trust (NYSEMKT: SPY). One top analyst on Wall Street predicts the S&P 500 will hit 15,000 by 2030, and if he’s right, those index funds could deliver a return of 158% from here!

The S&P 500 is home to the highest-quality stocks

The S&P 500 is an index of 500 companies from 11 different sectors of the U.S. economy, so it’s highly diversified. It has a very strict entry criteria and only the highest-quality names make the cut. Among other things, companies must be worth at least $18 billion, and they must be profitable based on the sum of their earnings per share over the most recent four quarters.

Even then, admission is at the discretion of a special committee that rebalances the index on a quarterly basis.

The S&P 500 is weighted by market capitalization, which means the largest companies in the index have a greater influence over its performance than the smallest. As a result, it’s no surprise the technology sector has a 32.2% weighting, considering it’s home to all six of America’s trillion-dollar companies.

Below are the top five holdings in the S&P 500 and their individual weightings:

|

Stock |

S&P 500 Weighting |

|---|---|

|

1. Apple |

7.13% |

|

2. Nvidia |

6.79% |

|

3. Microsoft |

6.33% |

|

4. Amazon |

3.57% |

|

5. Meta Platforms |

2.61% |

Data source: State Street Global Advisors. S&P 500 weightings are accurate as of Oct. 10, 2024, and are subject to change.

Each of the above five companies is developing artificial intelligence (AI) in some capacity, and given the sheer value of that emerging industry, they are likely to continue leading the S&P 500 higher from here.

Vanguard ETF vs. SPDR ETF: Which should you buy?

Investors can’t really go wrong buying either one. Both are designed to directly track the performance of the S&P 500, so there shouldn’t be a big difference in their returns.

However, the Vanguard ETF does have an edge because of its extremely low cost. It has an expense ratio of just 0.03%, which is the proportion of the fund deducted each year to cover management costs. The SPDR ETF is over three times as costly to own with an expense ratio of 0.0945%.

For that reason, the Vanguard ETF has delivered slightly better returns over time, because it’s able to track the performance of the S&P 500 more closely after fees are deducted:

|

Fund/Index |

Compound Annual Return (Last Three Years) |

Compound Annual Return (Last Five Years) |

Compound Annual Return (Last 10 Years) |

|---|---|---|---|

|

S&P 500 |

11.91% |

15.98% |

13.38% |

|

Vanguard ETF |

11.88% |

15.93% |

13.33% |

|

SPDR ETF |

11.78% |

15.82% |

13.23% |

Data source: Vanguard, State Street Global Advisors.

The S&P 500 could be poised for 158% upside by 2030

Investors should take every Wall Street forecast with a grain of salt because analysts don’t always get things right. But Tom Lee from Fundstrat Global Advisors has made some remarkable S&P 500 forecasts over the last couple of years.

Lee predicted the index would hit 4,750 in 2023 (while many other analysts were bearish), and it ended the year at 4,769. He came into 2024 expecting the index to hit 5,200, then he increased his target to 5,500, and then increased it again to 5,700 — all three levels have now been surpassed.

Lee recently issued a long-term forecast for the S&P 500, predicting it could reach 15,000 by 2030. That implies a whopping 158% upside from here, which is the return investors can expect in the Vanguard and SPDR ETFs if he’s right.

Will Tom Lee be right?

Tom Lee says the S&P 500 will benefit from a big demographic tailwind as we approach 2030, because millennials and Gen Zers will be entering the prime period of their lives (between 30 and 50 years of age). That’s when people typically earn the most money, and when they make important life decisions like investing.

Lee also points to AI as a potential driver of stock market returns. He says the global workforce could be short 80 million workers by 2030, which will direct more investment dollars into technologies like AI to drive automation.

For the S&P 500 to hit 15,000 by 2030, it will have to grow at a compound annual rate of 16.6% over the next six years. That’s much higher than its compound annual return of 10.5% since it was established in 1957, but it’s only marginally higher than its average return over the last five years, as we explored earlier.

If hypergrowth themes like AI continue to dominate the S&P 500 as they have for the last couple of years, there is a good chance Lee will be right. But even if the index doesn’t hit 15,000 by 2030, history suggests it will get there eventually, so it’s never a bad time for investors to buy an S&P 500 index fund as Warren Buffett recommends.

Should you invest $1,000 in Vanguard S&P 500 ETF right now?

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $846,108!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Warren Buffett Owns 2 Index Funds That Could Soar 158%, According to a Top Wall Street Analyst was originally published by The Motley Fool

Union Bankshares Announces Earnings for the three and nine months ended September 30, 2024 and Declares Quarterly Dividend

MORRISVILLE, Vt., Oct. 16, 2024 (GLOBE NEWSWIRE) — Union Bankshares, Inc. (NASDAQ – UNB) today announced results for the three and nine months ended September 30, 2024 and declared a regular quarterly cash dividend. Consolidated net income for the three months ended September 30, 2024 was $1.3 million, or $0.29 per share, compared to $2.5 million, or $0.56 per share, for the same period in 2023, and $5.8 million, or $1.27 per share, for the nine months ended September 30, 2024, compared to $8.2 million, or $1.82 per share for the same period in 2023. The decrease in earnings for the comparison periods was primarily due to the impact of the previously announced strategic balance sheet repositioning executed during the third quarter. The Company’s wholly-owned subsidiary, Union Bank, executed the sale of $38.8 million in book value of its lower-yielding available-for-sale debt securities for a pre-tax realized loss of $1.3 million, which was recorded in the third quarter of 2024.

Balance Sheet

Total assets were $1.52 billion as of September 30, 2024 compared to $1.40 billion as of September 30, 2023, an increase of $123.9 million, or 8.9%. Loan growth was the primary driver of the increase in total assets with total loans reaching $1.13 billion as of September 30, 2024 including $8.4 million in loans held for sale, compared to $1.03 billion as of September 30, 2023, with $6.5 million in loans held for sale. Asset quality remains strong with minimal past due loans and net recoveries of $5 thousand and $15 thousand for the three and nine months ended September 30, 2024, respectively.

Loan demand has remained strong during the third quarter of 2024 with growth in the residential, commercial, and municipal portfolios, despite higher interest rates and low residential inventory. Qualifying residential loans of $76.1 million were sold during the first nine months of 2024 compared to sales of $54.2 million for the first nine months of 2023.

Total deposits were $1.17 billion as of September 30, 2024 and include $80.0 million of purchased brokered deposits compared to deposits of $1.22 billion as of September 30, 2023 with $153.0 million of purchased deposits. Federal Home Loan Bank advances of $230.7 million were outstanding as of September 30, 2024 compared to $90.7 million outstanding as of September 30, 2023. In addition to borrowings from the Federal Home Loan Bank, $10.0 million in advances from the Federal Reserve’s Bank Term Funding Program were outstanding as of September 30, 2024.

The Company had total equity capital of $72.3 million and a book value per share of $15.98 as of September 30, 2024 compared to $49.2 million and a book value of $10.92 per share as of September 30, 2023. Total equity capital is reduced by accumulated other comprehensive loss as it relates to the fair market value adjustment for investment securities. Accumulated other comprehensive loss as of September 30, 2024 was $26.8 million compared to $47.1 million as of September 30, 2023.

Income Statement

Consolidated net income was $1.3 million for the third quarter of 2024 compared to $2.5 million for the third quarter of 2023, a decrease of $1.2 million, or 47.7%. The decrease in net income was comprised of the $1.3 million net loss on the sale of available-for-sale securities mentioned above, increases in credit loss expense of $564 thousand and noninterest expenses of $483 thousand, partially offset by increases of $282 thousand in net interest income, $431 thousand in noninterest income, and a decrease in income tax expense of $419 thousand.

Net interest income was $9.4 million for the three months ended September 30, 2024 compared to $9.1 million for the three months ended September 30, 2023, an increase of $282 thousand, or 3.1%. Interest income was $17.2 million for the three months ended September 30, 2024 compared to $14.8 million for the same period in 2023, an increase of $2.4 million, or 15.8%, due to the larger earning asset base and higher interest rates on new loan volume. Interest expense increased $2.1 million to $7.8 million for the three months ended September 30, 2024 compared to $5.7 million for the same period in 2023, due to utilization of higher cost wholesale funding, such as Federal Home Loan Bank advances and brokered deposits, and customers seeking higher returns on their deposits.

Credit loss expense of $425 thousand was recorded for the third quarter of 2024 compared to a benefit of $139 thousand recorded for the third quarter of 2023. The increase in expense was to support loan growth during the period and was not due to a deterioration in credit quality. Management continues to assess the adequacy of the Allowance for Credit Losses quarterly.

Noninterest income, excluding the loss on the bond sale, was $2.9 million for the three months ended September 30, 2024 compared to $2.5 million for the same period in 2023. Sales of qualifying residential loans to the secondary market for the third quarter of 2024 were $35.2 million resulting in net gains of $540 thousand, compared to sales of $24.7 million and net gains on sales of $336 thousand for the same period in 2023. Noninterest expenses increased $483 thousand, or 5.4%, to $9.4 million for the three months ended September 30, 2024 compared to $8.9 million for the same period in 2023. The increase during the comparison period was due to increases of $295 thousand in salaries and wages, $305 thousand in employee benefits, $46 thousand in occupancy expenses, $71 thousand in equipment expenses, partially offset by a decrease of $234 thousand in other expenses.

Income tax benefit was $123 thousand for the three months ended September 30, 2024 a decrease of $419 thousand compared to income tax expense of $296 thousand for the same period in 2023. The decrease is primarily attributable to the income tax benefit resulting from the $1.3 million loss on the bond sale.

Dividend Declared

The Board of Directors declared a cash dividend of $0.36 per share for the quarter payable November 7, 2024 to shareholders of record as of October 26, 2024.

About Union Bankshares, Inc.

Union Bankshares, Inc., headquartered in Morrisville, Vermont, is the bank holding company parent of Union Bank, which provides commercial, retail, and municipal banking services, as well as, wealth management services throughout northern Vermont and New Hampshire. Union Bank operates 19 banking offices, three loan centers, and multiple ATMs throughout its geographical footprint.

Since 1891, Union Bank has helped people achieve their dreams of owning a home, saving for retirement, starting or expanding a business and assisting municipalities to improve their communities. Union Bank has earned an exceptional reputation for residential lending programs and has been recognized by the US Department of Agriculture, Rural Development for the positive impact made in lives of low to moderate home buyers. Union Bank is consistently one of the top Vermont Housing Finance Agency mortgage originators and has also been designated as an SBA Preferred lender for its participation in small business lending. Union Bank’s employees contribute to the communities where they work and reside, serving on non-profit boards, raising funds for worthwhile causes, and giving countless hours in serving our fellow residents. All of these efforts have resulted in Union receiving and “Outstanding” rating for its compliance with the Community Reinvestment Act (“CRA”) in its most recent examination. Union Bank is proud to be one of the few independent community banks serving Vermont and New Hampshire and we maintain a strong commitment to our core traditional values of keeping deposits safe, giving customers convenient financial choices and making loans to help people in our local communities buy homes, grow businesses, and create jobs. These values–combined with financial expertise, quality products and the latest technology–make Union Bank the premier choice for your banking services, both personal and business. Member FDIC. Equal Housing Lender.

Forward-Looking Statements

Statements made in this press release that are not historical facts are forward-looking statements. Investors are cautioned that all forward-looking statements necessarily involve risks and uncertainties, and many factors could cause actual results and events to differ materially from those contemplated in the forward-looking statements. When we use any of the words “believes,” “expects,” “anticipates” or similar expressions, we are making forward-looking statements. The following factors, among others, could cause actual results and events to differ from those contemplated in the forward-looking statements: uncertainties associated with general economic conditions; changes in the interest rate environment; inflation; political, legislative or regulatory developments; acts of war or terrorism; the markets’ acceptance of and demand for the Company’s products and services; technological changes, including the impact of the internet on the Company’s business and on the financial services market place generally; the impact of competitive products and pricing; and dependence on third party suppliers. For further information, please refer to the Company’s reports filed with the Securities and Exchange Commission at www.sec.gov or on our investor page at www.ublocal.com.

Contact: David S. Silverman

(802) 888-6600

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

P/E Ratio Insights for Domino's Pizza

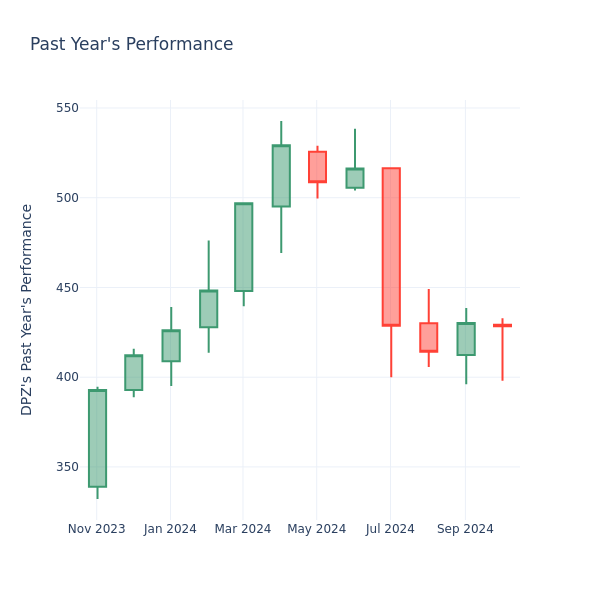

In the current session, the stock is trading at $428.36, after a 0.26% spike. Over the past month, Domino’s Pizza Inc. DPZ stock increased by 4.73%, and in the past year, by 24.41%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Evaluating Domino’s Pizza P/E in Comparison to Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 80.13 in the Hotels, Restaurants & Leisure industry, Domino’s Pizza Inc. has a lower P/E ratio of 26.26. Shareholders might be inclined to think that the stock might perform worse than it’s industry peers. It’s also possible that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

True North Commercial REIT Announces Timing of Release of Q3-2024 Results

/NOT FOR DISTRIBUTION IN THE U.S. OR OVER U.S. NEWSWIRES/

TORONTO, Oct. 16, 2024 /CNW/ – True North Commercial Real Estate Investment Trust TNT announced today it intends to release its financial results for the quarter ended September 30, 2024 after the close of the Toronto Stock Exchange on Tuesday, November 12, 2024.

About the REIT

The REIT is an unincorporated, open-ended real estate investment trust established under the laws of the Province of Ontario. The REIT currently owns and operates a portfolio of 40 properties consisting of approximately 4.6 million square feet in urban and select strategic secondary markets across Canada. The REIT is focused on growing its portfolio principally through acquisitions across Canada and such other jurisdictions where opportunities exist.

For more information regarding the REIT, please visit www.sedarplus.ca or the REIT’s website at www.truenorthreit.com.

SOURCE True North Commercial Real Estate Investment Trust

![]() View original content: http://www.newswire.ca/en/releases/archive/October2024/16/c5430.html

View original content: http://www.newswire.ca/en/releases/archive/October2024/16/c5430.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Small Personal Loans Market to Reach $158.7 Billion, Globally, by 2032 at 20.1% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 16, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Small Personal Loans Market by Type (P2P Marketplace Lending and Balance Sheet Lending), by Age (Less than 30 years, 30-50 years and More than 50 years), and Distribution Channel (Banks, Credit Unitions, Online Lenders and Peer-to-peer Lending): Global Opportunity Analysis and Industry Forecast, 2024-2032″. According to the report, the small personal loans market was valued at $31.3 billion in 2023, and is estimated to reach $158.7 billion by 2032, growing at a CAGR of 20.1% from 2024 to 2032.

Get Your Sample Report & TOC Today: https://www.alliedmarketresearch.com/request-sample/A324099

Prime determinants of growth

However, higher interest rates and data security and privacy concerns act as restraints for the small personal loans market. In addition, changes in demographic shift will provide ample opportunities for the market’s development during the forecast period.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2032 |

| Base Year | 2023 |

| Market Size in 2023 | $31.3 billion |

| Market Size in 2032 | $158.7 billion |

| CAGR | 20.1% |

| No. of Pages in Report | 350 |

| Segments Covered | Type, Age, Distribution Channel, and Region. |

| Drivers |

|

| Opportunities |

|

| Restraint |

|

Purchase This Comprehensive Report (PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/3YbgsjU

The P2P marketplace lending segment is expected to grow faster throughout the forecast period.

Based on the type, the P2P marketplace lending segment held the highest market share in 2023. The increase in P2P lending can be attributed to several factors, including technological advancements, the appeal of potentially higher returns for investors, and more accessible loan options for borrowers compared to conventional banking routes.

The 30-50 segment is expected to grow faster throughout the forecast period.

Based on age, the 30-50 segment held the highest market share in 2023. Individuals in the 30-50 age range are often more financially stable, with established careers and higher disposable incomes, making them more likely to engage in lending, investment, and borrowing activities.

The banks segment is expected to grow faster throughout the forecast period.

Based on the distribution channel, the banks segment held the highest market share in 2023. Banks offer a comprehensive range of financial products and services, from savings and checking accounts to loans and investment services.

North America to maintain its dominance by 2032.

Based on region, North America held the highest market share in terms of revenue in 2023, and is expected to boost in terms of revenue throughout the forecast timeframe. Well-developed financial infrastructure is accelerating the adoption of the most recent technologies, including small personal loans in North America.

Get More Information Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A324099

Players: -

- Social Finance, Inc.

- Truist Financial Corporation

The report provides a detailed analysis of these key players in the global small personal loans market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Industry Development:

- On March 2024, Achieve raised $200.63 million in funding in rated notes backed by achieve personal loans. This reflects the ongoing efforts that Achieve and its bank partners have taken to be responsive to both the evolving landscape in consumer lending and strong investor demand for differentiated loan assets.

- On July 2023, Jenius Bank launched a personal loan, its inaugural product. Jenius Bank intends to become a full-service bank for the U.S. market with additional offerings including a savings product and mobile app.

- On November 2022, Navi Technologies partnered with Piramal Capital and Housing Finance Ltd to offer digital personal loans. The partnership would allow the fintech startup to serve 11, 000+ pin codes across India.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the small personal loans market analysis from 2024 to 2032 to identify the prevailing small personal loans market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the small personal loans market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global small personal loans market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players and small personal loans market share.

- The report includes the analysis of the regional as well as global small personal loans market trends, key players, market segments, application areas, and small personal loans market growth strategies.

Access Your Customized Sample Report & TOC Now: https://www.alliedmarketresearch.com/request-for-customization/A324099

Small Personal Loans Market Key Segments:

By Type

- P2P Marketplace Lending

By Age

By Distribution Channel

By Region

- North America (U.S., Canada)

- Europe (France, Germany, Italy, Spain, UK, Rest of Europe)

- Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

- LAMEA (Latin America, Middwl East, Africa)

Trending Reports in BFSI Industry (Book Now with 10% Discount + Covid-19 scenario):

Loan Brokers Market Size, Share, Competitive Landscape and Trend Analysis Report, by Component, by Enterprise Size, by Application, by End User : Global Opportunity Analysis and Industry Forecast, 2021-2031

Student Loan Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Repayment Plan, by Age Group, by End User : Global Opportunity Analysis and Industry Forecast, 2021-2031

Wedding Loans Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Interest rate, by Provider : Global Opportunity Analysis and Industry Forecast, 2024-2033

Online Payday Loans Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Marital Status, by Customer Age Outlook : Global Opportunity Analysis and Industry Forecast, 2024-2032

Singapore Student Loan Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Repayment Plan, by Age Group, by End User : Opportunity Analysis and Industry Forecast, 2021-2031

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington,

New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.