Why I Keep Buying These 14 Incredible Growth Stocks

Investing in individual growth stocks can be a rollercoaster ride, but the potential rewards can be substantial. Since the 2008 financial crisis, numerous growth stocks have significantly outperformed passive index funds.

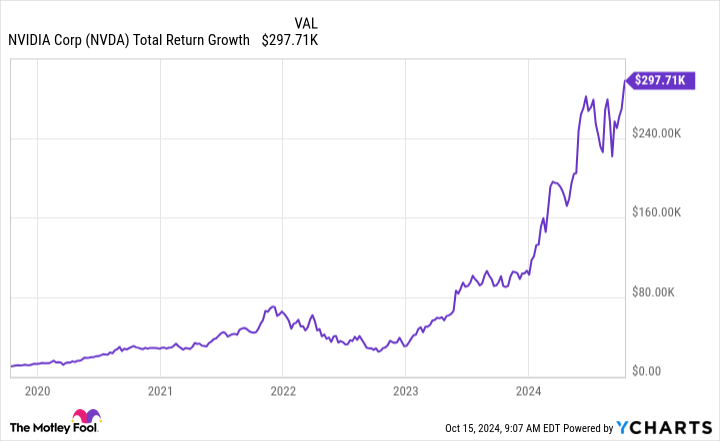

Some standout performers have even delivered returns exceeding 1,000% in less than five years. Nvidia (NASDAQ: NVDA), the chipmaker at the heart of the artificial intelligence (AI) revolution, exemplifies this potential, turning a $10,000 investment into nearly $300,000 over the past 60 months.

My tax-advantaged portfolios include 14 stocks primarily held for their growth prospects. While some of these growth stocks pay dividends, that’s not the main reason for owning them.

Here, I’ll explain why I continue to invest in each of these companies and discuss their 12-month upside potential based on Wall Street’s consensus price targets and year-to-date performance.

Archer Aviation: Pioneering electric air taxis

Archer Aviation (NYSE: ACHR) is at the forefront of the electric vertical takeoff and landing (eVTOL) aircraft industry. The company aims to revolutionize urban transportation with its electric air taxis, potentially disrupting the $1 trillion global urban air mobility market.

Wall Street’s consensus suggests a 209% upside potential for Archer Aviation, highlighting its promising long-term growth prospects despite a negative 49.8% year-to-date performance. The company’s progress in aircraft development and strategic partnerships with major airlines bolster its potential for future success.

Aspen Aerogels: Innovating in high-performance insulation

Aspen Aerogels (NYSE: ASPN) develops advanced aerogel insulation materials for various industries, including electric vehicles, energy infrastructure, and sustainable building materials. The company’s products offer superior thermal performance and energy efficiency.

Aspen Aerogels has outperformed the S&P 500 with a 44.2% year-to-date gain in 2024. The 43.8% upside potential projected by analysts over the next 12 months stems from the growing demand for high-performance insulation materials across multiple industries.

CRISPR Therapeutics: Pioneering gene-editing therapies

CRISPR Therapeutics (NASDAQ: CRSP) is at the forefront of developing gene-editing therapies for serious diseases. Fewer than 12 months ago, the company achieved a major milestone with the approval of Casgevy, its groundbreaking treatment for sickle cell disease and beta-thalassemia, developed in partnership with Vertex Pharmaceuticals.

Wall Street projections indicate a 72% upside for CRISPR Therapeutics over the next 12 months despite a negative 23.6% year-to-date performance. Along with the company’s robust pipeline, the recent approval of Casgevy, the first CRISPR-based therapy to reach the market, could drive significant long-term growth.

GE Aerospace: Focused on aviation innovation

Following its recent transformation, General Electric has become GE Aerospace (NYSE: GE), concentrating on its core aviation business. The company is a global leader in aircraft engines and systems, positioning it to benefit from the recovery and growth in the commercial aviation sector.

GE Aerospace has outperformed the S&P 500 with an 88.8% year-to-date gain. The 6.3% upside potential projected by analysts points to the company’s streamlined focus on aviation and improving industry dynamics.

Howmet Aerospace: Advancing aerospace innovation

Howmet Aerospace (NYSE: HWM) provides advanced engineered solutions for the aerospace and transportation industries. The company’s lightweight materials and innovative technologies are crucial for improving fuel efficiency and performance in aircraft and vehicles.

Howmet Aerospace has significantly outperformed the S&P 500 with an 89.6% year-to-date gain. The modest 2.6% upside projected by analysts highlights the company’s strong recent performance and solid position in the recovering aerospace market.

Intuitive Machines: Pioneering commercial lunar missions

Intuitive Machines (NASDAQ: LUNR) is a leader in commercial lunar payload delivery and orbital services. The company aims to become a key player in the growing commercial space industry with planned lunar missions and innovative space technologies.

Intuitive Machines has significantly outperformed the S&P 500 with a 206% year-to-date gain. Analysts’ 38.2% upside potential projected over the next 12 months underscores the company’s potential in the rapidly expanding commercial space market.

Joby Aviation: Transforming urban air mobility

Joby Aviation (NYSE: JOBY) is developing eVTOL aircraft for commercial passenger service. The company aims to launch an air taxi service that could revolutionize urban transportation. It also recently scored a major investment from Toyota Motor.

Wall Street projections indicate a 45.7% upside potential for Joby Aviation over the next 12 months despite a negative 17.2% year-to-date performance. The company’s progress in aircraft development and certification processes could position it as a leader in the emerging urban air mobility market.

Kratos Defense & Security Solutions: Innovating in defense technology

Kratos Defense & Security Solutions (NASDAQ: KTOS) specializes in uncrewed systems, satellite communications, and cybersecurity for defense and commercial markets. The company’s focus on next-generation defense technologies positions it well in the evolving defense landscape.

Kratos has gained 24.9% year to date, modestly outperforming the broader market represented by the S&P 500. The company’s innovative defense solutions and growing government contracts could drive significant future growth. That said, Wall Street analysts think the stock is fairly valued at current levels.

Navitas Semiconductor: Enabling efficient power electronics

Navitas Semiconductor (NASDAQ: NVTS) develops gallium nitride (GaN) power integrated circuits, which offer superior efficiency and performance compared to traditional silicon-based solutions. The company’s technology has applications in fast charging, renewable energy, and electric vehicles.

Despite a negative 67.7% year-to-date performance, Wall Street projections suggest a 114% upside potential for Navitas Semiconductor. The growing adoption of GaN technology in various industries could drive significant long-term growth for the company.

Nvidia: Powering the AI revolution

Nvidia is a leader in graphics processing units (GPUs) and is at the forefront of the AI computing revolution. The company’s chips are essential for training and running advanced AI models, positioning it to benefit from the rapidly growing AI market.

Nvidia’s stock has soared 178% year to date, significantly outperforming the S&P 500. The chipmaker’s strong market position and growth prospects in AI and other high-performance computing applications contribute to the 10.4% gain projected by analysts over the next 12 months.

Palantir Technologies: Harnessing data for actionable insights

Palantir Technologies (NYSE: PLTR) provides data analytics software to government agencies and commercial clients, helping them make better decisions. The company’s AI-powered platforms are increasingly crucial for organizations dealing with complex data challenges.

Palantir Technologies has surged 150% year to date, outperforming the S&P 500 by a wide margin. While current projections suggest a -34% potential downside from current levels, the company’s expanding commercial business and AI capabilities could drive long-term growth.

Prime Medicine: Advancing precision gene editing

Prime Medicine (NASDAQ: PRME) is developing a next-generation gene-editing platform called prime editing, which offers potential advantages over existing CRISPR technologies. The company aims to develop therapies for a wide range of genetic diseases.

Prime Medicine’s stock has fallen 57.7% year to date, but Wall Street projections suggest a 269% upside potential from current levels. The company’s innovative gene-editing technology and broad therapeutic potential could drive substantial long-term growth.

Rocket Lab USA: Expanding access to space

Rocket Lab USA (NASDAQ: RKLB) provides launch services and spacecraft solutions for the growing small satellite market. The company aims to increase the frequency and reliability of space access with its innovative rocket technology and manufacturing capabilities.

Rocket Lab USA has outperformed the S&P 500 with a 76.6% year-to-date gain. While current projections suggest a -20% potential downside, the company’s expanding launch capabilities and space systems business could drive long-term growth in the commercial space industry.

Taiwan Semiconductor Manufacturing: Dominating chip production

Taiwan Semiconductor Manufacturing (NYSE: TSM) is the world’s largest contract chipmaker, supplying advanced semiconductors to tech giants globally. The company’s technological leadership and scale give it a significant competitive advantage in the growing semiconductor market.

Taiwan Semiconductor Manufacturing has outperformed the S&P 500 with an 84.8% year-to-date gain. The modest 3.7% upside projected by analysts underscores the company’s strong recent performance and crucial role in the global technology supply chain.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,139!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $44,239!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $380,729!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

George Budwell has positions in Archer Aviation, Aspen Aerogels, CRISPR Therapeutics, GE Aerospace, Howmet Aerospace, Intuitive Machines, Joby Aviation, Kratos Defense & Security Solutions, Navitas Semiconductor, Nvidia, Palantir Technologies, Prime Medicine, Rocket Lab USA, Taiwan Semiconductor Manufacturing, and Toyota Motor. The Motley Fool has positions in and recommends CRISPR Therapeutics, Nvidia, Palantir Technologies, Taiwan Semiconductor Manufacturing, and Vertex Pharmaceuticals. The Motley Fool recommends Rocket Lab USA. The Motley Fool has a disclosure policy.

Why I Keep Buying These 14 Incredible Growth Stocks was originally published by The Motley Fool

Dogness Reports Financial Results for Fiscal Year Ended June 30, 2024

PLANO, Texas, Oct. 16, 2024 /PRNewswire/ — Dogness (International) Corporation (“Dogness” or the “Company”) DOGZ, a developer and manufacturer of a comprehensive line of Dogness-branded, OEM and private label pet products, today announced its financial results for the fiscal year ended June 30, 2024.

Silong Chen, Chief Executive Officer of Dogness, commented: “We continue to face challenges due to intense competition in the domestic market and the ongoing trade dispute between China and the United States, which are impacting and will likely continue impacting our domestic and export sales in the near future. In fiscal 2024, Dogness experienced intensified competition and a complex macro environment, which posed challenges to the Company resulting in a 15.6% revenue decline. Our gross profit for fiscal 2024 decreased to approximately $3.1 million, reflecting a 14.7% decline, primarily due to lower sales volumes in intelligent pet products. However, we effectively reduced our selling expenses by approximately $1.3 million and general and administrative expenses by $2.0 million, enhancing our operational efficiency. As a result, our overall gross profit margin improved slightly to 21.0%, up from 20.8% in fiscal 2023.”

“Looking ahead, we are committed to leveraging our strengths in traditional pet products to capture additional market share, particularly in international markets where we see significant growth potential. We are also exploring new product lines and enhancements to our intelligent pet products, aiming to align them with consumer trends and preferences. Our commitment to sustainability will drive our research and development efforts, focusing on eco-friendly materials and advanced technologies that resonate with our customer base.”

“Thanks to these strategic initiatives, our net loss improved by approximately $1.4 million, or 18.8%, decreasing from $7.5 million in fiscal 2023 to $6.1 million in fiscal 2024. We appreciate the continued support of our stakeholders as we strive for sustainable growth and profitability in the coming years, which we believe will position Dogness as a leader in the pet products industry.”

Financial Results for The Fiscal Year Ended June 30, 2024

Revenues

Revenues decreased by approximately $2.7 million, or 15.6%, to approximately $14.8 million in fiscal 2024 from approximately $17.6 million in fiscal 2023. The decrease in revenue was primarily attributable to an approximately $3.0 million decrease in the sales of intelligent pet products and an approximately $0.5 million decrease in the sales of climbing hooks and others, offset by an approximately $0.7 million increase in the sales of traditional pet products.

The breakdown of our revenue by products and services categories is as follows:

|

2024

|

2023

|

Changes

|

||||||||

|

Products and services |

Amount (USD Million) |

Amount (USD Million) |

% |

|||||||

|

Products |

||||||||||

|

Traditional pet products |

$ |

9.0 |

$ |

8.3 |

8.7 |

% |

||||

|

Intelligent pet products |

4.4 |

7.4 |

(40.8) |

% |

||||||

|

Climbing hooks and others |

1.4 |

1.8 |

(25.0) |

% |

||||||

|

Total revenue from products |

14.8 |

17.5 |

(15.7) |

% |

||||||

|

Services |

||||||||||

|

Dyeing services |

0.09 |

– |

– |

% |

||||||

|

Other services |

– |

0.07 |

(100.0) |

% |

||||||

|

Total revenue from services |

0.09 |

0.07 |

22.5 |

% |

||||||

|

Total |

$ |

14.8 |

$ |

17.6 |

(15.6) |

% |

||||

Traditional Pet Products

Revenue from traditional pet products rose by approximately $0.7 million or 8.7%, from $8.3 million in fiscal 2023 to $9.0 million in fiscal 2024. This increase was primarily due to higher sales volume, with $1.2 million coming from overseas markets, offset by a $0.5 million decline in the Chinese domestic market.

Intelligent Pet Products

Revenue from intelligent pet products fell by approximately $3.0 million, or 40.8%, from $7.4 million in fiscal 2023 to $4.4 million in fiscal 2024. This decline was driven by a 33.1% drop in sales volume and a $2.3 decrease in average selling price per unit. The Chinese market accounted for a $0.8 million decrease, while overseas markets contributed to a $2.2 million decline, as the pet product industry is facing reduced consumer spending on non-essential intelligent pet products items.

Climbing Hooks and Others

Revenue from climbing hooks and other products decreased by approximately $0.5 million, or 25.0%, from $1.8 million in fiscal 2023 to $1.4 million in fiscal 2024, mainly due to lower sales volume.

Dyeing Services

The Company provides dyeing solutions using our manufacturing capabilities, applying dyes to textiles for desired quality and color. Revenue from dyeing services was $0.1 million in fiscal 2024, up from no revenue in 2023.

Sales to Related Parties

During fiscal 2024, Dogness Network Technology Co., Ltd. (“Dogness Network”) and Dogness Technology Co., Ltd (“Dogness Technology”) were related parties of the Company. Dogness Technology ceased being a related party after December 31, 2023. Sales to Dogness Network and Dogness Technology Co., Ltd totaled $0.1 million and $1.7 million in fiscal 2024 and 2023, respectively, representing 0.7% and 9.7% of total revenue. Costs associated with these sales were $0.1 million in 2024 and $1.2 million in 2023.

International vs. Domestic sales

Total international sales dropped by approximately $1.2 million, or 10.6% to approximately $10.1 million in fiscal 2024, primarily due to 48.7% decline in intelligent pet product sales. Traditional pet product sales, however, rose by 21.6%.

Domestic sales decreased by approximately $1.5 million, or 24.4% to around $4.8 million, driven by reduced customer orders caused by intense competition in the domestic market. Domestic sales of traditional and intelligent pet products declined by 19.8% and 27.7% respectively in the domestic market.

Cost of revenues

Cost of revenues decreased by approximately $2.2 million or 15.8%, from approximately $13.9 million in fiscal 2023 to approximately $11.7 million in fiscal 2024. The decreased cost of revenues was the result of the decrease in average unit cost due to a shift toward lower cost traditional pet products.

Gross profit

Gross profit decreased by approximately $0.5 million or 14.7%, from approximately $3.7 million in fiscal 2023 to approximately $3.1 million in fiscal 2024, primarily attributable to the decreased sales volume of our intelligent pet products. Overall gross profit margin was 21.0% in fiscal 2024, an increase of 0.2 percentage points, as compared to 20.8% in fiscal 2023.

The breakdown of gross profit by products and services categories is as follows:

|

For the Year ended June 30, |

|||||||||||||||||||||

|

2024 |

2023 |

Changes |

|||||||||||||||||||

|

Products and services category |

Amount ($Million) |

Gross |

Amount ($Million) |

Gross |

Gross profit Pct. |

||||||||||||||||

|

Traditional pet products |

$ |

1.4 |

16.0 |

% |

$ |

1.2 |

14.3 |

% |

1.7 |

pct. |

|||||||||||

|

Intelligent pet products |

1.2 |

28.3 |

% |

1.8 |

24.4 |

% |

3.9 |

pct. |

|||||||||||||

|

Climbing hooks and others |

0.5 |

34.9 |

% |

0.6 |

34.2 |

% |

0.7 |

pct. |

|||||||||||||

|

3.1 |

21.4 |

% |

3.6 |

20.6 |

% |

0.8 |

pct. |

||||||||||||||

|

Services |

|||||||||||||||||||||

|

Dyeing services |

(0.03) |

(35.8) |

% |

– |

– |

% |

(35.8) |

pct. |

|||||||||||||

|

Other services |

– |

– |

% |

0.06 |

86.5 |

(86.5) |

pct. |

||||||||||||||

|

Total |

$ |

3.1 |

21.0 % |

% |

$ |

3.7 |

20.8 |

% |

0.2 |

pct. |

|||||||||||

Traditional pet products

Gross profit for traditional pet products rose by approximately $0.3 million in fiscal 2024, with the gross profit margin increasing by 1.7 percentage points from 14.3% to 16.0%, mainly due to a $0.15 reduction in average unit cost.

Intelligent pet products

For intelligent pet products, gross profit fell by approximately $0.6 million from $1.8 million to $1.2 million, largely due to a 33.1% drop in sales volume. However, gross profit margin improved by 3.9 percentage points from 24.4% to 28.3%, driven by a $2.42 decrease in average unit cost.

Climbing hooks and others

Gross profit for climbing hooks and others decreased by approximately $0.1 million from $0.6 million to $0.5 million, primarily due to a 25.2% decline in sales volume. The overall gross margin for this category increased by 0.7 percentage points from 34.2% to 34.9%. The increase was due a $0.02 reduction in average unit cost.

Expenses

Selling Expenses

Selling expenses decreased by approximately $1.3 million, or 54.4%, from $2.5 million in fiscal 2023 to $1.1 million in fiscal 2024, mainly due to reduced marketing research activities. As a percentage of sales, these expenses were 7.6% in fiscal 2024, down from 14.1% in 2023.

General and Administrative Expenses

General and administrative expenses decreased by approximately $2.0 million, or 20.0%, from $9.8 million in fiscal 2023 to $7.8 million in fiscal 2024, due to lower professional consulting and decoration costs. As a percentage of sales, these expenses were 52.8% in 2024, compared to 55.7% in 2023.

Research and Development Expenses

Research and development expenses decreased by approximately $0.3 million, or 34.4%, from $0.9 million in fiscal 2023 to $0.6 million in fiscal 2024. As a percentage of sales, these expenses were 4.1% in 2024, down from 5.3% in 2023. The company anticipates an increase in R&D spending to focus on environmentally-friendly materials and new high-tech products.

Net loss

As a result of the foregoing, our net loss decreased by approximately $1.4 million or 18.8%, from approximately $7.5 million in fiscal 2023 to approximately $6.1 million in fiscal 2024.

About Dogness

Dogness (International) Corporation was founded in 2003 from the belief that dogs and cats are important, well-loved family members. Through its smart products, hygiene products, health and wellness products, and leash products, Dogness’ technology simplifies pet lifestyles and enhances the relationship between pets and pet caregivers. The Company ensures industry-leading quality through its fully integrated vertical supply chain and world-class research and development capabilities, which has resulted in over 200 patents and patents pending. Dogness products reach families worldwide through global chain stores and distributors. For more information, please visit: ir.dogness.com.

Forward Looking Statements

No statement made in this press release should be interpreted as an offer to purchase or sell any security. Such an offer can only be made in accordance with the Securities Act of 1933, as amended, and applicable state securities laws. Certain statements in this press release concerning our future growth prospects are forward-looking statements regarding our future business expectations intended to qualify for the “safe harbor” under the Private Securities Litigation Reform Act of 1995, which involve a number of risks and uncertainties that could cause actual results to differ materially from those in such forward-looking statements. The risks and uncertainties relating to these statements include, but are not limited to, risks and uncertainties regarding our ability to raise capital on any particular terms, fulfillment of customer orders, fluctuations in earnings, fluctuations in foreign exchange rates, our ability to manage growth, our ability to realize revenue from expanded operation and acquired assets in China and the U.S., our ability to attract and retain highly skilled professionals, client concentration, industry segment concentration, reduced demand for technology in our key focus areas, our ability to successfully complete and integrate potential acquisitions, and unauthorized use of our intellectual property and general economic conditions affecting our industry. Additional risks that could affect our future operating results are more fully described in our United States Securities and Exchange Commission filings. These filings are available at www.sec.gov. Dogness may, from time to time, make additional written and oral forward-looking statements, including statements contained in the Company’s filings with the Securities and Exchange Commission and our reports to shareholders. In addition, please note that any forward-looking statements contained herein are based on assumptions that we believe to be reasonable as of the date of this press release. The Company does not undertake to update any forward-looking statements that may be made from time to time by or on behalf of the Company unless it is required by law.

For investor and media inquiries, please contact:

Wealth Financial Services LLC

Connie Kang, Partner

Email: ckang@wealthfsllc.com

Tel: +86 1381 185 7742 (CN)

|

DOGNESS (INTERNATIONAL) CORPORATION |

||||||||

|

CONSOLIDATED BALANCE SHEETS |

||||||||

|

(All amounts in USD) |

||||||||

|

As of June 30, |

As of June 30, |

|||||||

|

2024 |

2023 |

|||||||

|

ASSETS |

||||||||

|

CURRENT ASSETS |

||||||||

|

Cash and cash equivalents |

$ |

6,956,434 |

$ |

4,483,308 |

||||

|

Accounts receivable from third-party customers, net |

2,269,341 |

1,492,762 |

||||||

|

Accounts receivable from related parties |

582,182 |

1,272,384 |

||||||

|

Inventories, net |

3,119,827 |

2,679,275 |

||||||

|

Due from related parties |

97,037 |

87,430 |

||||||

|

Prepayments and other current assets |

3,328,189 |

3,748,955 |

||||||

|

Advances to supplier- related party |

50,908 |

239,729 |

||||||

|

Total current assets |

16,403,918 |

14,003,843 |

||||||

|

NON-CURRENT ASSETS |

||||||||

|

Property, plant and equipment, net |

61,303,327 |

61,686,849 |

||||||

|

Operating lease right-of-use lease assets |

16,325,988 |

17,537,096 |

||||||

|

Intangible assets, net |

1,780,856 |

1,845,006 |

||||||

|

Long-term investments in equity investees |

1,513,600 |

1,516,900 |

||||||

|

Deferred tax assets |

1,873,140 |

1,281,634 |

||||||

|

Total non-current assets |

82,796,911 |

83,867,485 |

||||||

|

TOTAL ASSETS |

$ |

99,200,829 |

$ |

97,871,328 |

||||

|

LIABILITIES AND EQUITY |

||||||||

|

CURRENT LIABILITIES |

||||||||

|

Short-term bank loans |

$ |

894,400 |

$ |

887,000 |

||||

|

Current portion of long-term bank loans |

759,339 |

2,959,918 |

||||||

|

Accounts payable |

1,286,981 |

895,694 |

||||||

|

Due to related parties |

518,003 |

85,843 |

||||||

|

Advances from customers |

264,832 |

121,687 |

||||||

|

Taxes payable |

1,007,482 |

1,015,444 |

||||||

|

Accrued expenses and other current liabilities |

1,452,225 |

1,026,218 |

||||||

|

Operating lease liabilities, current |

2,352,482 |

2,326,162 |

||||||

|

Total current liabilities |

8,535,744 |

9,317,966 |

||||||

|

NON-CURRENT LIABILITIES |

||||||||

|

Long-term bank loans |

3,315,715 |

1,595,549 |

||||||

|

Operating lease liabilities, non-current |

10,938,477 |

10,612,508 |

||||||

|

Total non-current liabilities |

14,254,192 |

12,208,057 |

||||||

|

TOTAL LIABILITIES |

22,789,936 |

21,526,023 |

||||||

|

Commitments and Contingencies (Note 10) |

||||||||

|

EQUITY |

||||||||

|

Class A Common shares, no par value, unlimited shares authorized; |

92,004,296 |

85,716,578 |

||||||

|

Class B Common shares, no par value, unlimited shares authorized; |

18,138 |

18,138 |

||||||

|

Statutory reserve |

291,443 |

291,443 |

||||||

|

(Accumulated deficit) retained earnings |

(5,391,709) |

664,004 |

||||||

|

Accumulated other comprehensive loss |

(10,511,317) |

(10,345,832) |

||||||

|

Equity attributable to owners of the Company |

76,410,851 |

76,344,331 |

||||||

|

Non-controlling interest |

42 |

974 |

||||||

|

Total equity |

76,410,893 |

76,345,305 |

||||||

|

TOTAL LIABILITIES AND EQUITY |

$ |

99,200,829 |

$ |

97,871,328 |

||||

|

DOGNESS (INTERNATIONAL) CORPORATION |

||||||||||||

|

STATEMENTS OF (LOSS) INCOME AND COMPREHENSIVE (LOSS) INCOME |

||||||||||||

|

(All amounts in USD) |

||||||||||||

|

For the Years Ended June 30, |

||||||||||||

|

2024 |

2023 |

2022 |

||||||||||

|

Revenues – third party customers |

$ |

14,746,447 |

$ |

15,884,281 |

$ |

24,882,618 |

||||||

|

Revenues – related parties |

101,455 |

1,700,173 |

2,212,579 |

|||||||||

|

Total Revenues |

14,847,902 |

17,584,454 |

27,095,197 |

|||||||||

|

Cost of revenues – third party customers |

(11,642,233) |

(12,760,852) |

(15,654,952) |

|||||||||

|

Cost of revenues – related parties |

(82,955) |

(1,162,314) |

(1,301,180) |

|||||||||

|

Total cost of revenues |

(11,725,188) |

(13,923,166) |

(16,956,132) |

|||||||||

|

Gross Profit |

3,122,714 |

3,661,288 |

10,139,065 |

|||||||||

|

Operating expenses: |

||||||||||||

|

Selling expenses |

1,129,671 |

2,478,163 |

2,077,174 |

|||||||||

|

General and administrative expenses |

7,838,024 |

9,800,714 |

6,742,687 |

|||||||||

|

Research and development expenses |

610,439 |

931,078 |

917,227 |

|||||||||

|

Loss from disposal of property, plant and |

1,075,490 |

15,306 |

327,921 |

|||||||||

|

Total operating expenses |

10,653,624 |

13,225,261 |

10,065,009 |

|||||||||

|

(Loss) income from operations |

(7,530,910) |

(9,563,973) |

74,056 |

|||||||||

|

Other income: |

||||||||||||

|

Interest expense, net |

(207,410) |

(330,824) |

(370,108) |

|||||||||

|

Foreign exchange transaction gain |

310,860 |

800,403 |

246,211 |

|||||||||

|

Other income, net |

541,468 |

112,109 |

115,016 |

|||||||||

|

Rental income from related parties, net |

337,743 |

295,362 |

173,089 |

|||||||||

|

Total other income |

982,661 |

877,050 |

164,208 |

|||||||||

|

(Loss) income before income taxes |

(6,548,249) |

(8,686,923) |

238,264 |

|||||||||

|

Income taxes benefit |

(491,600) |

(1,227,449) |

(2,777,868) |

|||||||||

|

Net (loss) income |

(6,056,649) |

(7,459,474) |

3,016,132 |

|||||||||

|

Less: net loss attributable to non-controlling |

(936) |

(259,211) |

(219,427) |

|||||||||

|

Net (loss) income attributable to Dogness |

(6,055,713) |

(7,200,263) |

3,235,559 |

|||||||||

|

Other comprehensive loss: |

||||||||||||

|

Foreign currency translation loss |

(165,481) |

(6,204,254) |

(3,203,448) |

|||||||||

|

Comprehensive loss |

(6,222,130) |

(13,663,728) |

(187,316) |

|||||||||

|

Less: comprehensive loss attributable to non- |

(932) |

(270,210) |

(230,583) |

|||||||||

|

Comprehensive (loss) income attributable |

$ |

(6,221,198) |

$ |

(13,393,518) |

$ |

43,267 |

||||||

|

(Loss) earnings per share |

||||||||||||

|

Basic |

$ |

(0.55) |

$ |

(0.68) |

$ |

0.31 |

||||||

|

Diluted |

$ |

(0.55) |

$ |

(0.68) |

$ |

0.31 |

||||||

|

Weighted Average Shares Outstanding* |

||||||||||||

|

Basic |

10,919,386 |

10,598,989 |

10,301,133 |

|||||||||

|

Diluted |

10,919,386 |

10,598,989 |

10,316,232 |

|||||||||

|

DOGNESS (INTERNATIONAL) CORPORATION |

||||||||||||

|

CONSOLIDATED STATEMENTS OF CASH FLOWS |

||||||||||||

|

(All amounts in USD) |

||||||||||||

|

For the Years Ended June 30, |

||||||||||||

|

2024 |

2023 |

2022 |

||||||||||

|

Cash flows from operating activities: |

||||||||||||

|

Net (loss) income |

$ |

(6,056,649) |

$ |

(7,459,474) |

$ |

3,016,132 |

||||||

|

Adjustments to reconcile net (loss) income to |

||||||||||||

|

Amortization of operating lease right-of-use |

1,179,776 |

1,023,500 |

408,566 |

|||||||||

|

Depreciation and amortization |

2,771,727 |

3,315,172 |

3,458,347 |

|||||||||

|

Loss from disposition of property, plant and |

1,075,490 |

15,306 |

327,921 |

|||||||||

|

Share-based compensation for services |

1,114,857 |

1,243,385 |

11,831 |

|||||||||

|

Change in inventory reserve |

– |

246,281 |

– |

|||||||||

|

Change in credit losses |

275,923 |

160,254 |

(16,776) |

|||||||||

|

Deferred tax benefit |

(597,241) |

(658,595) |

(118,424) |

|||||||||

|

Warrants modification |

239,308 |

– |

– |

|||||||||

|

Accrued interest income |

– |

– |

(1,320) |

|||||||||

|

Changes in operating assets and liabilities: |

||||||||||||

|

Accounts receivables |

(1,060,171) |

(109,090) |

683,119 |

|||||||||

|

Accounts receivables-related parties |

691,431 |

(272,301) |

(620,728) |

|||||||||

|

Inventories |

(447,631) |

268,593 |

740,265 |

|||||||||

|

Prepayments and other current assets |

97,647 |

(3,113,841) |

1,173,662 |

|||||||||

|

Advances to supplier- related party |

189,395 |

(249,986) |

– |

|||||||||

|

Accounts payables |

395,559 |

(62,237) |

224,676 |

|||||||||

|

Accounts payables-related parties |

– |

(379,124) |

58,190 |

|||||||||

|

Advance from customers |

144,236 |

(18,989) |

(52,365) |

|||||||||

|

Taxes payable |

(5,936) |

(441,390) |

(2,827,106) |

|||||||||

|

Accrued expenses and other liabilities |

423,456 |

34,381 |

(137,457) |

|||||||||

|

Operating lease liabilities |

382,649 |

(2,444,110) |

(168,075) |

|||||||||

|

Net cash provided by (used in) operating |

813,826 |

(8,902,265) |

6,160,458 |

|||||||||

|

Cash flows from investing activities: |

||||||||||||

|

Purchase of property, plant and equipment |

(3,524,713) |

(1,520,556) |

(15,259,272) |

|||||||||

|

Proceeds from disposition of property, plant |

79,850 |

14,872 |

22,213 |

|||||||||

|

Proceeds upon maturity of short-term |

– |

50,330 |

495,680 |

|||||||||

|

Net cash used in investing activities |

(3,444,863) |

(1,455,354) |

(14,741,379) |

|||||||||

|

Cash flows from financing activities: |

||||||||||||

|

Net proceeds from private placement |

4,920,800 |

– |

19,124,920 |

|||||||||

|

Adjustment relating to non-controlling |

– |

(26,245) |

– |

|||||||||

|

Net proceeds from exercise of warrants |

329,480 |

– |

4,444,136 |

|||||||||

|

Reverse split shares |

(810) |

– |

– |

|||||||||

|

Net proceeds from exercise of options |

– |

– |

180,000 |

|||||||||

|

Proceeds from short-term bank loans |

899,600 |

483,000 |

804,000 |

|||||||||

|

Repayment of short-term bank loans |

(887,000) |

(160,000) |

(944,446) |

|||||||||

|

Proceeds from long-term bank loan |

2,629,600 |

– |

– |

|||||||||

|

Repayment of long-term bank loans |

(3,102,838) |

(1,337,323) |

(796,416) |

|||||||||

|

Proceeds from (repayment of) related party |

425,007 |

(25,796) |

(1,943,408) |

|||||||||

|

Net cash provided by (used in) financing |

5,213,839 |

(1,066,364) |

20,868,786 |

|||||||||

|

Effect of exchange rate changes on cash and |

(109,676) |

(698,581) |

(617,747) |

|||||||||

|

Net increase (decrease) in cash and cash |

2,473,126 |

(12,122,564) |

11,670,118 |

|||||||||

|

Cash and cash equivalents, beginning of year |

4,483,308 |

16,605,872 |

4,935,754 |

|||||||||

|

Cash and cash equivalents, end of year |

$ |

6,956,434 |

$ |

4,483,308 |

$ |

16,605,872 |

||||||

|

SUPPLEMENTAL DISCLOSURES OF |

||||||||||||

|

Cash (refunded) paid for income tax |

$ |

– |

$ |

(2,593) |

$ |

3,195 |

||||||

|

Cash paid for interest |

$ |

294,628 |

$ |

396,517 |

$ |

471,443 |

||||||

|

Non-Cash Investing Activities |

||||||||||||

|

Transfer from construction-in-progress to |

$ |

– |

$ |

– |

$ |

597,594 |

||||||

|

Additions (reductions) to property, plant and |

$ |

7,301 |

$ |

(8,167) |

$ |

– |

||||||

|

Prepaid share-based compensation for |

$ |

– |

$ |

315,917 |

$ |

– |

||||||

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/dogness-reports-financial-results-for-fiscal-year-ended-june-30-2024-302278629.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/dogness-reports-financial-results-for-fiscal-year-ended-june-30-2024-302278629.html

SOURCE Dogness (International) Corporation

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Elon Musk Powers Dogecoin Rally — Meme Coin Jumps Over 7% After 'DOGE Will Fix It' Post

Elon Musk‘s favorite cryptocurrency, Dogecoin DOGE/USD, became one of the biggest market gainers in the last 24 hours, most likely due to his social media activity.

What happened: The biggest meme token by market cap, DOGE, bounced more than 7% in emerging as the third best-performing cryptocurrency in the last 24 hours.

The coin’s trading volume soared by 70%, making it the most traded meme coin in the last 24 hours.

With the latest rally, DOGE’s weekly and monthly gains lifted to 15.50% and 24%, respectively.

Why It Matters: The rally was likely spurred by yet another mention of DOGE, an acronym for Department of Government Efficiency, by Musk.

The tech mogul was responding to concerns of bureaucratic red-tapism by another X user, stating that “D.O.G.E will fix it.”

For the unknown, the so-called DOGE department, headed by Musk in a potential Donald Trump administration, would oversee the operations of different agencies and, in Musk’s words, weed out regulations that don’t make sense.

The Tesla CEO has been frequently mentioning DOGE in his X posts of late, causing the price of the associated meme coin to jump.

Price Action: At the time of writing, Dogecoin was exchanging hands at $0.1252, up 7.58% in the last 24 hours, according to data from Benzinga Pro.

Image via Pixabay

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Clinical Immunoanalyzer Market to Reach $8.0 Billion, Globally, by 2033 at 5.5% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 16, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Clinical Immunoanalyzer Market by Type (ELISA, CLIA, RIA and Others), Application (Clinical Chemistry, Endocrinology, Oncology, Infectious Disease Diagnostics, Cardiology and Others), and End User (Hospitals and Clinics, Diagnostic Laboratories, Research Institutes and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the clinical immunoanalyzer market was valued at $4.7 billion in 2023, and is estimated to reach $8.0 billion by 2033, growing at a CAGR of 5.5% from 2024 to 2033.

Request Sample of the Report on Clinical Immunoanalyzer Market 2033 – https://www.alliedmarketresearch.com/request-sample/A324391

Prime determinants of growth

Increasing prevalence of chronic diseases and focus on personalized medicine are the major factors that drive the growth of the clinical immunoanalyzer market. However, high cost of equipment hinders the market growth. Moreover, rise in awareness and health checkups offer remunerative opportunities for the expansion of the global clinical immunoanalyzer market.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $4.2 billion |

| Market Size in 2033 | $8.0 billion |

| CAGR | 5.5% |

| No. of Pages in Report | 216 |

| Segments Covered | Type, Application, End user and Region |

| Drivers |

|

| Opportunities |

|

| Restraints |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A324391

Segment Highlights

ELISA Is the most widely used type of Clinical Immunoanalyzer

BY type, ELISA (Enzyme-Linked Immunosorbent Assay) is the most widely used clinical immunoanalyzer due to its high sensitivity, specificity, and versatility. It allows for the quantitative and qualitative detection of antibodies, antigens, and proteins, making it essential for diagnostics, research, and therapeutic monitoring.

Infectious Disease Diagnostics significant application of clinical immunoanalyzer

Infectious disease diagnostics represent the most significant application of clinical immunoanalyzers. These devices are crucial for detecting and monitoring pathogens, enabling timely and accurate diagnosis. Their high sensitivity and specificity make them indispensable for managing outbreaks, guiding treatment, and improving patient outcomes in infectious disease management.

Hospitals and clinics are the important end users of clinical immunoanalyzers

Hospitals are the major end users of clinical immunoanalyzers, leveraging these systems to improve patient care and operational efficiency. These platforms assist healthcare professionals in making informed clinical decisions, reducing errors, and enhancing treatment outcomes. With extensive patient data and complex care requirements, hospitals benefit significantly from real-time insights and evidence-based recommendations provided by these platforms.

Regional Outlook

Region wise, the clinical immunoanalyzer market is experiencing significant growth across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominates due to advanced healthcare infrastructure and high adoption rates, while Asia-Pacific shows rapid growth driven by increasing healthcare investments and technological advancements.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A324391

Key Players

- Ortho-Clinical Diagnostics

- Thermo Fisher Scientific

The report provides a detailed analysis of these key players in the global clinical immunoanalyzer market. These players have adopted different strategies such as product launch, expansion, partnership, collaboration and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Developments in Clinical Immunoanalyzer Market Worldwide

- In May 2023, Beckman Coulter announced the launch of DxI 9000 Access Immunoassay Analyzer, the most productive immunoassay analyzer per footprint. The DxI 9000 Analyzer can run up to 215 tests per hour per square meter (tests/hr/m2) .

Trending Reports in Healthcare Industry:

Transplant Diagnostics Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Phytosterols Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Opioids Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Spirulina Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Senior Citizen Travel Insurance Market to Reach $16.7 Billion, Globally, by 2032 at 18.3% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 16, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Senior Citizen Travel Insurance Market by Insurance Cover (Single-trip travel insurance, Annual multi-trip travel insurance and Long-stay travel insurance), and Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers and Insurance Aggregators): Global Opportunity Analysis and Industry Forecast, 2024-2032″. According to the report, the senior citizen travel insurance market was valued at $3.6 billion in 2023, and is estimated to reach $16.7 billion by 2032, growing at a CAGR of 18.3% from 2024 to 2032.

Get Your Sample Report & TOC Today: https://www.alliedmarketresearch.com/request-sample/A323729

Prime Determinants of Growth

However, increasing complexity of Integration is anticipated to hamper the growth of global market. On the contrary, expanding need for increased processing power is expected to create lucrative opportunities for the growth of the market.

Report Coverage & Details:

| Report Coverage | Details |

| Forecast Period | 2024–2032 |

| Base Year | 2023 |

| Market Size in 2023 | $3.6 billion |

| Market Size in 2032 | $16.7 billion |

| CAGR | 18.3% |

| Segments covered | Insurance Cover, Distribution Channel, and Region. |

| Drivers | Increase in life expectancy Rise in healthcare costs |

| Opportunities | Customized insurance products Technological advancements |

| Restraints | Limited awareness |

Purchase This Comprehensive Report (PDF with Insights, Charts, Tables, and Figures) @ https://bit.ly/401DUTu

The single-trip travel insurance segment dominated the market in 2023

By insurance cover, the single-trip travel insurance segment accounted for the largest share in 2023, This type of insurance provides coverage for a specific trip, making it convenient and cost-effective for seniors who do not travel frequently, which is further expected to propel the overall market growth. However, the long-stay travel insurance segment is expected to attain the largest CAGR from 2024 to 2032 and is projected to maintain its lead position during the forecast period, owing more senior citizens are opting for extended trips or stays abroad, whether for leisure or retirement purposes. Long-stay insurance offers comprehensive coverage for longer durations, catering to the needs of seniors looking to spend an extended period of time away from home. Thereby, driving the growth of this segment in the global senior citizen travel insurance market.

The insurance intermediaries segment to maintain its lead position during the forecast period

By distribution channel, the insurance intermediaries segment accounted for the largest share in 2023, as intermediaries, such as brokers and agents, provide personalized assistance and guidance to older travelers in selecting the most suitable insurance plans. Seniors often prefer the expertise and human touch offered by intermediaries when navigating the complexities of travel insurance, which is further expected to propel the overall market growth. However, the insurance aggregators segment is expected to attain the largest CAGR from 2024 to 2032 and is projected to maintain its lead position during the forecast period, owing more seniors are turning to online platforms to compare multiple insurance options quickly and conveniently. Insurance aggregators offer a wide range of choices in one place, making it easier for older travelers to find competitive rates and tailored coverage that meet their specific needs. Thereby, driving the growth of this segment in the global senior citizen travel insurance market.

Get More Information Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A323729

Asia-Pacific region to maintain its dominance by 2032

By region, the North America segment held the highest market share in terms of revenue in 2022, owing to the high awareness and adoption of travel insurance among seniors in this region. North America has a large population of senior citizens who prioritize travel and understand the importance of having insurance coverage for their trips, anticipated to propel the growth of the market in this region. However, the Asia-Pacific segment is projected to attain the highest CAGR from 2024 to 2032, owing to increasing disposable income and rise in travel trends among seniors in countries within this region. As more seniors in Asia-Pacific countries embark on travel adventures, further expected to contribute to the growth of the market in this region.

Leading Market Players: -

- Zurich Insurance Group

- Assicurazioni Generali S.p.A.

- American International Group, Inc.

The report provides a detailed analysis of these key players in the senior citizen travel insurance market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different countries. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Recent Development:

- In May 2022, Wise Wanderer Insurance Agency introduced a senior travel assurance plan that provided coverage for trip interruptions, medical emergencies, and repatriation services for elderly travellers.

- In November 2023, ElderlyExplorer Insurance launched a travel security plan catering to senior citizens, offering coverage for adventurous activities, emergency medical expenses, and lost belongings.

- In April 2024, SeniorSafe Insurance Services unveiled a travel assurance package for seniors, featuring coverage for trip cancellations, emergency medical treatments, and travel assistance services.

- In October 2024, GoldenAge Insurance introduced a specialized travel protection plan for senior citizens, offering coverage for trip interruptions, lost luggage, and medical emergencies during travel.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the senior citizen travel insurance market analysis from 2024 to 2032 to identify the prevailing senior citizen travel insurance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the senior citizen travel insurance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global senior citizen travel insurance market size.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global senior citizen travel insurance market trends, key players, market segments, application areas, and senior citizen travel insurance market growth growth strategies.

Access Your Customized Sample Report & TOC Now: https://www.alliedmarketresearch.com/request-for-customization/A323729

Senior Citizen Travel Insurance Market Key Segments:

By Insurance Cover

- Single-trip travel insurance

- Annual multi-trip travel insurance

- Long-stay travel insurance

By Distribution Channel

- Insurance Intermediaries

By Region

- North America (U.S., Canada)

- Europe (France, Germany, Italy, Spain, UK, Rest of Europe)

- Asia-Pacific (China, Japan, India, South Korea, Australia, Rest of Asia-Pacific)

- LAMEA (Latin America, Middle East, Africa)

Trending Reports in BFSI Industry (Book Now with 10% Discount + Covid-19 scenario):

Travel Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Age Group, by Insurance Cover, by End User, by Distribution Channel : Global Opportunity Analysis and Industry Forecast, 2024-2033

Asia-Pacific Travel Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Distribution Channel, Insurance Cover and End User : Opportunity Analysis and Industry Forecast, 2016-2022

Business Travel Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Coverage Type, Distribution Channels and Application : Global Opportunity Analysis and Industry Forecast, 2021-2030

Student Travel Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Coverage, by Distribution Channel : Global Opportunity Analysis and Industry Forecast, 2024-2032

Business Travel Accident Insurance Market Size, Share, Competitive Landscape and Trend Analysis Report, by Type, by Application, by Distribution Channel : Global Opportunity Analysis and Industry Forecast, 2023-2032

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington,

New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022

Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060

Fax: +1-800-792-5285

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Orchid Island Capital Announces Estimated Third Quarter 2024 Results, October 2024 Monthly Dividend and September 30, 2024 RMBS Portfolio Characteristics

- October 2024 Monthly Dividend of $0.12 Per Share of Common Stock

- Estimated Book Value Per Share as of September 30, 2024 of $8.40

- Estimated GAAP net income of $0.24 per share for the quarter ended September 30, 2024, including an estimated $0.29 per share of net realized and unrealized gains on RMBS and derivative instruments

- Estimated 2.1% total return on equity for the quarter ended September 30, 2024

- Estimated book value, net income and total return on equity amounts are preliminary, subject to change, and subject to review by the Company’s independent registered public accounting firm

- RMBS Portfolio Characteristics as of September 30, 2024

- Next Dividend Announcement Expected November 13, 2024

VERO BEACH, Fla., Oct. 16, 2024 (GLOBE NEWSWIRE) — Orchid Island Capital, Inc. (the “Company”) ORC announced today that the Board of Directors of the Company declared a monthly cash dividend for the month of October 2024. The dividend of $0.12 per share will be paid November 27, 2024 to holders of record of the Company’s common stock on October 31, 2024, with an ex-dividend date of October 31, 2024. The Company plans on announcing its next common stock dividend on November 13, 2024.

The Company intends to make regular monthly cash distributions to its holders of common stock. In order to qualify as a real estate investment trust (“REIT”), the Company must distribute annually to its stockholders an amount at least equal to 90% of its REIT taxable income, determined without regard to the deduction for dividends paid and excluding any net capital gain. The Company will be subject to income tax on taxable income that is not distributed and to an excise tax to the extent that a certain percentage of its taxable income is not distributed by specified dates. The Company has not established a minimum distribution payment level and is not assured of its ability to make distributions to stockholders in the future.

As of October 16, 2024, the Company had 78,414,645 shares of common stock outstanding. As of September 30, 2024, the Company had 78,082,645 shares of common stock outstanding. As of June 30, 2024, the Company had 64,824,374 shares of common stock outstanding.

Estimated September 30, 2024 Book Value Per Share

The Company’s estimated book value per share as of September 30, 2024 was $8.40. The Company computes book value per share by dividing total stockholders’ equity by the total number of outstanding shares of common stock. At September 30, 2024, the Company’s preliminary estimated total stockholders’ equity was approximately $656.0 million with 78,082,645 shares of common stock outstanding. These figures and the resulting estimated book value per share are preliminary, subject to change, and subject to review by the Company’s independent registered public accounting firm.

Estimated Net Income Per Share and Realized and Unrealized Gains and Losses on RMBS and Derivative Instruments

The Company estimates it generated a net income per share of $0.24 for the quarter ended September 30, 2024, which includes an estimated $0.29 per share of net realized and unrealized gains on RMBS and derivative instruments. These amounts compare to total dividends declared during the quarter of $0.36 per share. Net income per common share calculated under generally accepted accounting principles can, and does, differ from our REIT taxable income. The Company views REIT taxable income as a better indication of income to be paid in the form of a dividend rather than net income. Many components of REIT taxable income can only be estimated at this time and our monthly dividends declared are based on both estimates of REIT taxable income to be earned over the course of the current quarter and calendar year and a longer-term estimate of the REIT taxable income of the Company. These figures are preliminary, subject to change, and subject to review by the Company’s independent registered public accounting firm.

Estimated Total Return on Equity

The Company’s estimated total return on equity for the quarter ended September 30, 2024 was 2.1%. The Company calculates total return on equity as the sum of dividends declared and paid during the quarter plus changes in book value during the quarter, divided by the Company’s stockholders’ equity at the beginning of the quarter. The total return was $0.18 per share, comprised of dividends per share of $0.36 and a decrease in book value per share of $0.18 from June 30, 2024.

RMBS Portfolio Characteristics

Details of the RMBS portfolio as of September 30, 2024 are presented below. These figures are preliminary and subject to change and, with respect to figures that will appear in the Company’s financial statements and associated footnotes as of and for the quarter ended September 30, 2024, are subject to review by the Company’s independent registered public accounting firm:

- RMBS Valuation Characteristics

- RMBS Assets by Agency

- Investment Company Act of 1940 (Whole Pool) Test Results

- Repurchase Agreement Exposure by Counterparty

- RMBS Risk Measures

About Orchid Island Capital, Inc.

Orchid Island Capital, Inc. is a specialty finance company that invests on a leveraged basis in Agency RMBS. Our investment strategy focuses on, and our portfolio consists of, two categories of Agency RMBS: (i) traditional pass-through Agency RMBS, such as mortgage pass-through certificates and collateralized mortgage obligations issued by Fannie Mae, Freddie Mac or Ginnie Mae, and (ii) structured Agency RMBS. The Company is managed by Bimini Advisors, LLC, a registered investment adviser with the Securities and Exchange Commission.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward-looking statements include, but are not limited to, statements about the Company’s distributions. These forward-looking statements are based upon Orchid Island Capital, Inc.’s present expectations, but these statements are not guaranteed to occur. Investors should not place undue reliance upon forward-looking statements. For further discussion of the factors that could affect outcomes, please refer to the “Risk Factors” section of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

| RMBS Valuation Characteristics | |||||||||||||||||||||||||||||||||||

| ($ in thousands) | |||||||||||||||||||||||||||||||||||

| Realized | |||||||||||||||||||||||||||||||||||

| Realized | Jul -24 – | ||||||||||||||||||||||||||||||||||

| Sep-24 | Sep-24 | ||||||||||||||||||||||||||||||||||

| Net | Weighted | CPR | CPR | ||||||||||||||||||||||||||||||||

| Weighted | Average | (1-Month) | (3-Month) | Modeled Interest | |||||||||||||||||||||||||||||||

| Current | Fair | % of | Current | Average | Maturity | (Reported | (Reported | Rate Sensitivity (1) | |||||||||||||||||||||||||||

| Type | Face | Value | Portfolio | Price | Coupon | GWAC | Age | (Months) | in Oct) | in Oct) | (-50 BPS) | (+50 BPS) | |||||||||||||||||||||||

| Fixed Rate RMBS | |||||||||||||||||||||||||||||||||||

| 30yr 3.0 | 1,313,569 | 1,192,650 | 21.91 | % | 90.79 | 3.00 | % | 3.46 | % | 42 | 312 | 4.9 | % | 6.4 | % | 36,156 | (37,050 | ) | |||||||||||||||||

| 30yr 3.5 | 180,159 | 170,463 | 3.13 | % | 94.62 | 3.50 | % | 4.04 | % | 55 | 293 | 7.3 | % | 8.6 | % | 4,631 | (4,728 | ) | |||||||||||||||||

| 30yr 4.0 | 534,812 | 515,427 | 9.47 | % | 96.38 | 4.00 | % | 4.64 | % | 68 | 285 | 3.2 | % | 4.6 | % | 11,715 | (12,733 | ) | |||||||||||||||||

| 30yr 4.5 | 312,192 | 308,236 | 5.66 | % | 98.73 | 4.50 | % | 5.44 | % | 27 | 330 | 5.5 | % | 6.8 | % | 5,377 | (6,191 | ) | |||||||||||||||||

| 30yr 5.0 | 517,497 | 518,746 | 9.53 | % | 100.24 | 5.00 | % | 5.93 | % | 25 | 330 | 7.9 | % | 7.0 | % | 7,905 | (9,531 | ) | |||||||||||||||||

| 30yr 5.5 | 259,123 | 265,083 | 4.87 | % | 102.30 | 5.50 | % | 6.43 | % | 18 | 338 | 3.3 | % | 5.8 | % | 3,498 | (4,475 | ) | |||||||||||||||||

| 30yr 6.0 | 1,248,052 | 1,287,954 | 23.66 | % | 103.20 | 6.00 | % | 6.98 | % | 9 | 347 | 11.7 | % | 9.5 | % | 8,892 | (12,035 | ) | |||||||||||||||||

| 30yr 6.5 | 776,146 | 806,065 | 14.81 | % | 103.85 | 6.50 | % | 7.43 | % | 9 | 348 | 15.8 | % | 11.9 | % | 5,418 | (7,020 | ) | |||||||||||||||||

| 30yr 7.0 | 346,282 | 362,445 | 6.66 | % | 104.67 | 7.00 | % | 7.94 | % | 11 | 343 | 22.4 | % | 22.7 | % | 2,291 | (2,777 | ) | |||||||||||||||||

| 30yr Total | 5,487,832 | 5,427,069 | 99.71 | % | 98.89 | 4.94 | % | 5.72 | % | 27 | 327 | 9.3 | % | 8.8 | % | 85,883 | (96,540 | ) | |||||||||||||||||

| Total Pass Through RMBS | 5,487,832 | 5,427,069 | 99.71 | % | 98.89 | 4.94 | % | 5.72 | % | 27 | 327 | 9.3 | % | 8.8 | % | 85,883 | (96,540 | ) | |||||||||||||||||

| Structured RMBS | |||||||||||||||||||||||||||||||||||

| IO 20yr 4.0 | 7,414 | 693 | 0.01 | % | 9.35 | 4.00 | % | 4.57 | % | 153 | 81 | 11.0 | % | 11.5 | % | 3 | (4 | ) | |||||||||||||||||

| IO 30yr 3.0 | 2,690 | 376 | 0.01 | % | 13.98 | 3.00 | % | 3.64 | % | 116 | 234 | 0.9 | % | 1.2 | % | (2 | ) | – | |||||||||||||||||

| IO 30yr 4.0 | 73,719 | 13,339 | 0.25 | % | 18.09 | 4.00 | % | 4.60 | % | 121 | 230 | 5.8 | % | 6.3 | % | (424 | ) | 302 | |||||||||||||||||

| IO 30yr 4.5 | 3,218 | 620 | 0.01 | % | 19.26 | 4.50 | % | 4.99 | % | 171 | 176 | 8.6 | % | 7.8 | % | (11 | ) | 7 | |||||||||||||||||

| IO 30yr 5.0 | 1,733 | 354 | 0.01 | % | 20.45 | 5.00 | % | 5.37 | % | 171 | 177 | 1.1 | % | 4.4 | % | (10 | ) | 7 | |||||||||||||||||

| IO Total | 88,774 | 15,382 | 0.28 | % | 17.33 | 4.01 | % | 4.60 | % | 126 | 214 | 6.1 | % | 6.6 | % | (444 | ) | 312 | |||||||||||||||||

| IIO 30yr 4.0 | 23,450 | 353 | 0.01 | % | 1.50 | 0.00 | % | 4.40 | % | 84 | 264 | 0.6 | % | 5.7 | % | 121 | (99 | ) | |||||||||||||||||

| Total Structured RMBS | 112,224 | 15,735 | 0.29 | % | 14.02 | 3.17 | % | 4.55 | % | 117 | 225 | 4.9 | % | 6.4 | % | (323 | ) | 213 | |||||||||||||||||

| Total Mortgage Assets | $ | 5,600,056 | $ | 5,442,804 | 100.00 | % | 4.90 | % | 5.70 | % | 29 | 325 | 9.2 | % | 8.8 | % | $ | 85,560 | $ | (96,327 | ) | ||||||||||||||

| Hedge | Modeled Interest | |||||||||||||

| Notional | Period | Rate Sensitivity (1) | ||||||||||||

| Hedge | Balance | End | (-50 BPS) | (+50 BPS) | ||||||||||

| 3-Month SOFR Futures(2) | $ | (455,900 | ) | Oct-25 | $ | (5,699 | ) | $ | 5,699 | |||||

| 10-Year Treasury Future(3) | (12,500 | ) | Dec-24 | (410 | ) | 397 | ||||||||

| Swaps | (3,486,800 | ) | Jun-30 | (91,274 | ) | 88,057 | ||||||||

| TBA | (300,000 | ) | Oct-24 | (8,387 | ) | 8,827 | ||||||||

| Swaptions | – | Jan-00 | – | – | ||||||||||

| Hedge Total | $ | (4,255,200 | ) | $ | (105,770 | ) | $ | 102,980 | ||||||

| Rate Shock Grand Total | $ | (20,210 | ) | $ | 6,653 | |||||||||

| (1) | Modeled results from Citigroup Global Markets Inc. Yield Book. Interest rate shocks assume instantaneous parallel shifts and horizon prices are calculated assuming constant SOFR option-adjusted spreads. These results are for illustrative purposes only and actual results may differ materially. |

| (2) | Amounts for SOFR futures contracts represents the average quarterly notional amount. |

| (3) | Ten-year Treasury futures contracts were valued at prices of $114.28 at September 30, 2024. The market value of the short position was $14.3 million. |

| RMBS Assets by Agency | ||||||

| ($ in thousands) | ||||||

| Percentage | ||||||

| Fair | of | |||||

| Asset Category | Value | Portfolio | ||||

| As of September 30, 2024 | ||||||

| Fannie Mae | $ | 3,692,047 | 67.8 | % | ||

| Freddie Mac | 1,750,757 | 32.2 | % | |||

| Total Mortgage Assets | $ | 5,442,804 | 100.0 | % | ||

| Investment Company Act of 1940 Whole Pool Test | ||||||

| ($ in thousands) | ||||||

| Percentage | ||||||

| Fair | of | |||||

| Asset Category | Value | Portfolio | ||||

| As of September 30, 2024 | ||||||

| Non-Whole Pool Assets | $ | 161,835 | 3.0 | % | ||

| Whole Pool Assets | 5,280,969 | 97.0 | % | |||

| Total Mortgage Assets | $ | 5,442,804 | 100.0 | % | ||

| Borrowings By Counterparty | |||||||||||||

| ($ in thousands) | |||||||||||||

| Weighted | Weighted | ||||||||||||

| % of | Average | Average | |||||||||||

| Total | Total | Repo | Maturity | Longest | |||||||||

| As of September 30, 2024 | Borrowings | Debt | Rate | in Days | Maturity | ||||||||

| ABN AMRO Bank N.V. | $ | 381,192 | 7.3 | % | 5.37 | % | 15 | 10/15/2024 | |||||

| Merrill Lynch, Pierce, Fenner & Smith | 379,748 | 7.3 | % | 5.20 | % | 35 | 11/15/2024 | ||||||

| ASL Capital Markets Inc. | 346,397 | 6.6 | % | 5.35 | % | 31 | 11/15/2024 | ||||||

| Cantor Fitzgerald & Co | 289,468 | 5.5 | % | 5.30 | % | 11 | 10/18/2024 | ||||||

| DV Securities, LLC Repo | 274,284 | 5.2 | % | 5.24 | % | 19 | 10/28/2024 | ||||||

| Mitsubishi UFJ Securities (USA), Inc | 263,580 | 5.0 | % | 5.35 | % | 23 | 10/28/2024 | ||||||

| J.P. Morgan Securities LLC | 254,798 | 4.9 | % | 5.33 | % | 9 | 10/25/2024 | ||||||

| Banco Santander SA | 248,472 | 4.8 | % | 5.33 | % | 49 | 11/18/2024 | ||||||

| Daiwa Securities America Inc. | 247,191 | 4.7 | % | 5.04 | % | 28 | 11/19/2024 | ||||||

| Citigroup Global Markets Inc | 244,746 | 4.7 | % | 5.04 | % | 25 | 10/25/2024 | ||||||

| Wells Fargo Bank, N.A. | 241,641 | 4.6 | % | 5.29 | % | 16 | 10/16/2024 | ||||||

| ING Financial Markets LLC | 225,593 | 4.3 | % | 5.01 | % | 39 | 11/8/2024 | ||||||

| Marex Capital Markets Inc. | 223,192 | 4.3 | % | 5.00 | % | 21 | 10/21/2024 | ||||||

| Goldman, Sachs & Co | 208,485 | 4.0 | % | 5.32 | % | 16 | 10/16/2024 | ||||||

| Bank of Montreal | 204,522 | 3.9 | % | 5.31 | % | 15 | 10/15/2024 | ||||||

| South Street Securities, LLC | 194,516 | 3.7 | % | 5.20 | % | 19 | 10/24/2024 | ||||||

| Clear Street LLC | 193,535 | 3.7 | % | 5.21 | % | 48 | 11/20/2024 | ||||||

| Mirae Asset Securities (USA) Inc. | 193,120 | 3.7 | % | 5.26 | % | 26 | 11/18/2024 | ||||||

| StoneX Financial Inc. | 159,098 | 3.0 | % | 5.03 | % | 21 | 10/21/2024 | ||||||

| The Bank of Nova Scotia | 149,958 | 2.9 | % | 5.29 | % | 15 | 10/15/2024 | ||||||

| RBC Capital Markets, LLC | 143,225 | 2.7 | % | 5.31 | % | 45 | 11/14/2024 | ||||||

| Nomura Securities International, Inc. | 75,278 | 1.4 | % | 5.31 | % | 15 | 10/15/2024 | ||||||

| Lucid Prime Fund, LLC | 48,322 | 0.9 | % | 5.29 | % | 17 | 10/17/2024 | ||||||

| Wells Fargo Securities, LLC | 23,004 | 0.4 | % | 5.06 | % | 25 | 10/25/2024 | ||||||

| Lucid Cash Fund USG LLC | 17,506 | 0.3 | % | 5.31 | % | 17 | 10/17/2024 | ||||||

| Total Borrowings | $ | 5,230,871 | 100.0 | % | 5.24 | % | 25 | 11/20/2024 | |||||

Contact:

Orchid Island Capital, Inc.

Robert E. Cauley

3305 Flamingo Drive, Vero Beach, Florida 32963

Telephone: (772) 231-1400

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Robinhood, Novavax, Phunware, Lucid Group, And Tesla: Why These 5 Stocks Are On Investors' Radars Today

On Wednesday, major U.S. indices saw gains, with the Dow Jones Industrial Average climbing nearly 0.8% to 43,077.70, while the S&P 500 increased 0.5% to 5,842.47. The Nasdaq finished the day up almost 0.3% at 18,367.08.

These are the top stocks that gained the attention of retail traders and investors throughout the day:

Robinhood Markets, Inc. HOOD

Robinhood’s stock saw a slight increase of 0.49% to close at $26.93. The stock’s intraday high and low were $27.17 and $26.57 respectively, with a 52-week range of $7.91 to $27.33. The company’s CEO, Vlad Tenev, announced the launch of futures trading and index options trading at the HOOD Summit 2024 in Miami, Florida.

Novavax Inc. NVAX

Novavax’s stock took a hit, dropping 19.44% to close at $10.15. The intraday high and low were $10.67 and $9.62, with a 52-week range of $3.53 to $23.86. The FDA has placed a clinical hold on Novavax’s COVID-19-influenza combination vaccine candidates due to a serious adverse event reported in a Phase 2 trial participant.

Phunware, Inc. PHUN

Phunware’s shares traded higher by 17.63% to close at $6.34. The stock’s intraday high and low were $6.62 and $5.8, with a 52-week range of $2.85 to $24.5. The company announced plans to invest in its AI-powered platform for advocacy and voter engagement, recalling its successful development of the Donald Trump 2020 Presidential Campaign app.

Lucid Group Inc LCID

Lucid Group’s shares saw a minor increase of 0.31% to close at $3.28. The stock’s intraday high and low were $3.33 and $3.26, with a 52-week range of $2.29 to $5.31. The company announced a public offering of 262,446,931 shares of its common stock, along with a corresponding investment from an affiliate of the Public Investment Fund (PIF).

Tesla Inc. TSLA

Tesla’s stock rose 0.80% to close at $221.33. The stock’s intraday high and low were $222.82 and $218.93, with a 52-week range of $138.8 to $271. Tesla dominated the U.S. EV market in the third quarter with three of the top five best-selling models, according to estimates from Kelley Blue Book.

Photo by WHYFRAME on Shutterstock

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs