Robinhood, Novavax, Phunware, Lucid Group, And Tesla: Why These 5 Stocks Are On Investors' Radars Today

On Wednesday, major U.S. indices saw gains, with the Dow Jones Industrial Average climbing nearly 0.8% to 43,077.70, while the S&P 500 increased 0.5% to 5,842.47. The Nasdaq finished the day up almost 0.3% at 18,367.08.

These are the top stocks that gained the attention of retail traders and investors throughout the day:

Robinhood Markets, Inc. HOOD

Robinhood’s stock saw a slight increase of 0.49% to close at $26.93. The stock’s intraday high and low were $27.17 and $26.57 respectively, with a 52-week range of $7.91 to $27.33. The company’s CEO, Vlad Tenev, announced the launch of futures trading and index options trading at the HOOD Summit 2024 in Miami, Florida.

Novavax Inc. NVAX

Novavax’s stock took a hit, dropping 19.44% to close at $10.15. The intraday high and low were $10.67 and $9.62, with a 52-week range of $3.53 to $23.86. The FDA has placed a clinical hold on Novavax’s COVID-19-influenza combination vaccine candidates due to a serious adverse event reported in a Phase 2 trial participant.

Phunware, Inc. PHUN

Phunware’s shares traded higher by 17.63% to close at $6.34. The stock’s intraday high and low were $6.62 and $5.8, with a 52-week range of $2.85 to $24.5. The company announced plans to invest in its AI-powered platform for advocacy and voter engagement, recalling its successful development of the Donald Trump 2020 Presidential Campaign app.

Lucid Group Inc LCID

Lucid Group’s shares saw a minor increase of 0.31% to close at $3.28. The stock’s intraday high and low were $3.33 and $3.26, with a 52-week range of $2.29 to $5.31. The company announced a public offering of 262,446,931 shares of its common stock, along with a corresponding investment from an affiliate of the Public Investment Fund (PIF).

Tesla Inc. TSLA

Tesla’s stock rose 0.80% to close at $221.33. The stock’s intraday high and low were $222.82 and $218.93, with a 52-week range of $138.8 to $271. Tesla dominated the U.S. EV market in the third quarter with three of the top five best-selling models, according to estimates from Kelley Blue Book.

Photo by WHYFRAME on Shutterstock

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

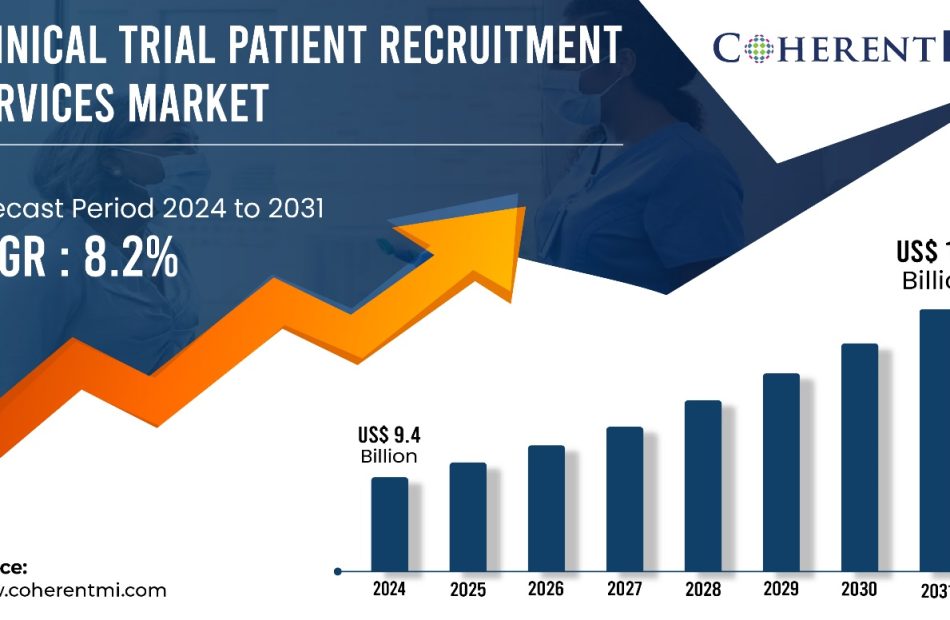

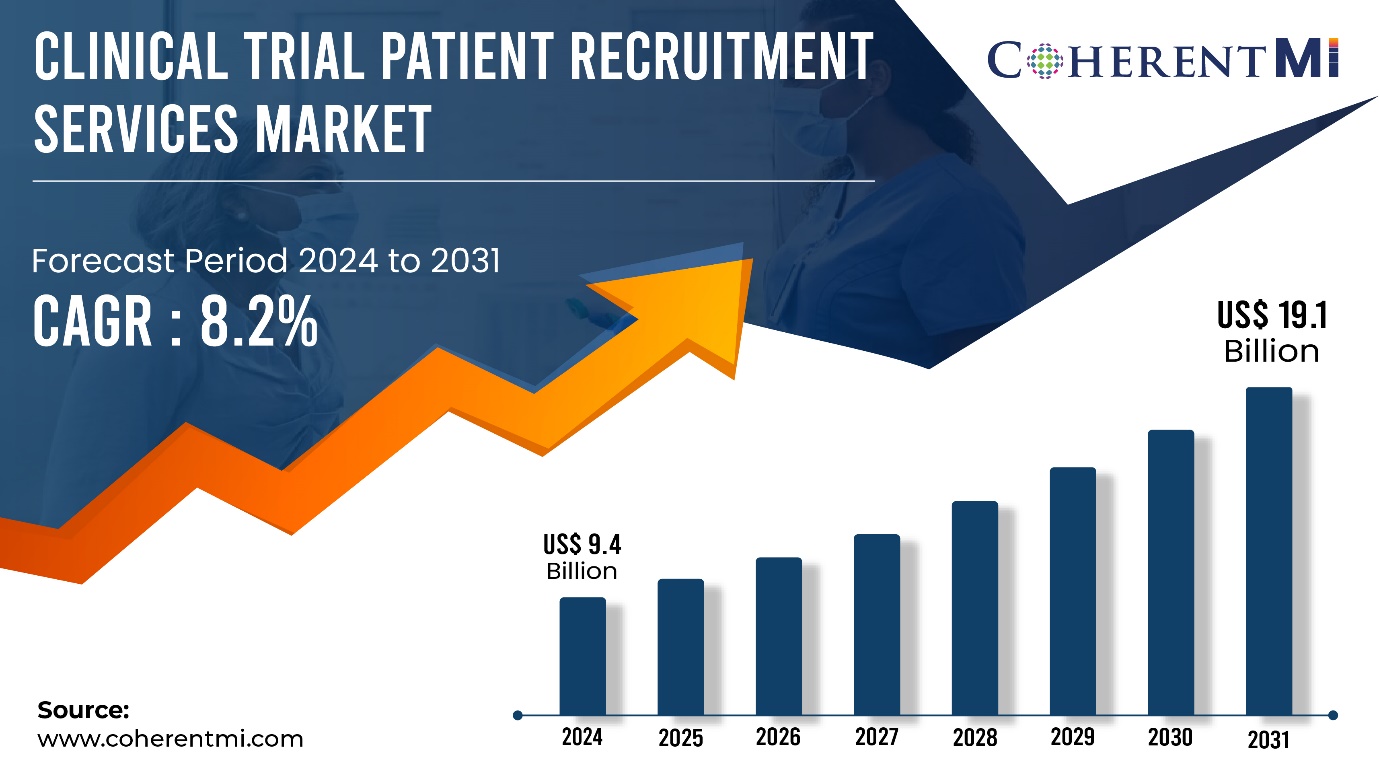

Clinical Trial Patient Recruitment Services Market to Hit US$ 19.1 Billion by 2031 at 8.2% CAGR, Says CoherentMI

Burlingame, Oct. 16, 2024 (GLOBE NEWSWIRE) — CoherentMI published a report, titled, Clinical Trial Patient Recruitment Services Market is estimated to value at US$ 9.4 Billion in the year 2024 and is anticipated to reach US$ 19.1 Billion by 2031, at a CAGR of 8.2% during forecast period 2024-2031. The increasing number of clinical trials being conducted across the world has emerged as a key driver boosting the demand for patient recruitment services. In the past decade alone, the number of clinical trials have doubled and are rising at an annual rate of over 5%. With the rising R&D investment in drug development by pharmaceutical and biotech companies, there is greater focus on testing new molecules through clinical trials.

Market Dynamics:

The clinical trial patient recruitment services market is driven by increasing R&D expenditure in the pharmaceutical industry and rising prevalence of chronic diseases. Pharmaceutical companies are investing heavily in R&D activities for developing new drugs and therapeutics. For instance, according to the Pharmaceutical Research and Manufacturers of America (PhRMA), the R&D expenditure of biopharmaceutical companies based in the U.S. increased from US$ 79.6 billion in 2015 to US$ 83.8 billion in 2020. The increasing R&D expenditure is fueling demand for clinical trial services including patient recruitment.

Request for Sample Copy of this Report: https://www.coherentmi.com/industry-reports/clinical-trial-patient-recruitment-services-market/request-sample

Report Coverage & Scope:

| Report Coverage | Details |

| Market Revenue in 2024: | US$ 9.4 Billion |

| Estimated Value by 2031: | US$ 19.1 Billion |

| Growth Rate: | Poised to grow at a CAGR of 8.2% |

| Historical Data: | 2019–2023 |

| Forecast Period: | 2024–2031 |

| Forecast Units: | Value (USD Million/Billion) |

| Report Coverage: | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| Segments Covered: | By Patient Recruitment Step, By Trial Phase |

| Geographies Covered: | Global |

| Major Players: | IQVIA, Syneos Health, Parexel, PPD, PRA Health Sciences and Among Others. |

| Growth Drivers: | • Increase in the number of clinical trials |

| • Rising complexity in patient enrollment processes | |

| Restraints & Challenges: | • High costs associated with patient recruitment |

Key Market Takeaways:

- The global clinical trial patient recruitment services market size is anticipated to witness a CAGR of 8.2% during the forecast period 2024-2031, owing to growing R&D investments in drug development and rise in complex trial designs.

- On the basis of patient recruitment step, pre-screening segment is expected to hold a dominant position, owing to its ability to save costs and streamline patient screening.

- On the basis of trial phase, phase I segment is expected to hold a dominant position over the forecast period, due to higher number of early phase trials conducted annually.

- On the basis of region, North America is expected to hold a dominant position over the forecast period, due to presence of majority of clinical trial sponsors and CROs.

- Key players operating in the clinical trial patient recruitment services market include IQVIA, Syneos Health, Parexel, PPD, PRA Health Sciences, Medpace, ICON, Labcorp Drug Development, Worldwide Clinical Trials and Charles River Laboratories. These players are focusing on expansion in emerging markets through partnerships.

Market Trends:

Social media recruitment and telehealth/virtual recruitment are some of the key trends gaining traction in the clinical trial patient recruitment services market. Growing internet and smartphone penetration is enabling pharmaceutical companies and CROs to leverage social media platforms for recruiting patients. They create awareness about ongoing clinical trials through advertisements on Facebook, Instagram, and other platforms. Furthermore, the COVID-19 pandemic has accelerated the adoption of telehealth and virtual technologies for patient screening and recruitment. Many clinical trials shifted from traditional in-person visits to remote visits using video conferencing. This not only improved patient access but also helped in maintaining social distancing norms.

Recent Development:

- In August 2023, Ripple Science appointed Mike Stratton as VP of Business Development to enhance their patient recruitment technology platform.

- In July 2023, TrialWire received Citeline Best Patient-facing Technology Initiative 2023 award for their proprietary recruitment platform.

Market Opportunities:

Pre-screening platforms allow pharmaceutical companies and CROs to connect with potential clinical trial participants with the relevant medical conditions and demographic profiles. These platforms help assess eligibility and save time by filtering out ineligible patients beforehand.

Identifying investigator sites and principal investigators who have a strong track record of timely patient recruitment helps speed up clinical trials. Recruitment service providers leverage their extensive network and site performance databases to quickly connect sponsors with suitable sites and investigators.

Clinical Trial Patient Recruitment Services Market Segmentation:

- By Patient Recruitment Step

- By Trial Phase

- Phase I

- Phase II

- Phase III

- Phase IV

Purchase Latest Edition of this Research Report @ https://www.coherentmi.com/industry-reports/clinical-trial-patient-recruitment-services-market/buynow

Clinical Trial Patient Recruitment Services Market Report – Table of Contents

- Research Objectives And Assumptions

- Market Dynamics, Regulations, And Trends Analysis

- Global Clinical Trial Patient Recruitment Services Market, By Patient Recruitment Step, 2024-2031, (USD Bn)

- Global Clinical Trial Patient Recruitment Services Market, By Trial Phase, 2024-2031, (USD Bn)

- Phase I

- Phase II

- Phase III

- Phase IV

- Global Clinical Trial Patient Recruitment Services Market, By Region, 2019 – 2031, Value (USD Bn)

- Latin America

- Europe

- Asia Pacific

- Middle East

- Africa

- Competitive Landscape

- Analyst Recommendations

- References and Research Methodology

Have a Look at Trending Research Reports:

Age-related Vision Dysfunction Market is estimated to be valued at USD 3.8 Bn in 2024 and is expected to reach USD 5.75 Bn by 2031, growing at a compound annual growth rate (CAGR) of 6.1% from 2024 to 2031.

Intracranial Hemorrhage Diagnosis Market is estimated to be valued at USD 1.9 Bn in 2024 and is expected to reach USD 3.4 Bn by 2031, growing at a compound annual growth rate (CAGR) of 8.1% from 2024 to 2031.

Giant Papillary Conjunctivitis Market is estimated to be valued at USD 1.2 Bn in 2024 and is expected to reach USD 1.99 Bn by 2031, growing at a compound annual growth rate (CAGR) of 7.5% from 2024 to 2031.

AL Amyloidosis Diagnostic Market is estimated to be valued at USD 1.068 billion in 2024 and is expected to reach USD 1.693 billion by 2031, growing at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2031.

Author of this marketing PR:

Alice Mutum is a seasoned senior PR writer, leveraging extensive expertise gained from her previous role as a content writer. With seven years in content development, Alice masterfully employs SEO best practices and cutting-edge digital marketing strategies to craft high-ranking, impactful content. As a writer, she meticulously ensures flawless grammar and punctuation, precise data accuracy, and perfect alignment with audience needs in every research report. Alice’s dedication to excellence and her strategic approach to content make her an invaluable asset in the world of market insights.

About Us:

At CoherentMI, we are a leading global market intelligence company dedicated to providing comprehensive insights, analysis, and strategic solutions to empower businesses and organizations worldwide. Moreover, CoherentMI is a subsidiary of Coherent Market Insights Pvt Ltd., which is a market intelligence and consulting organization that helps businesses in critical business decisions. With our cutting-edge technology and experienced team of industry experts, we deliver actionable intelligence that helps our clients make informed decisions and stay ahead in today’s rapidly changing business landscape.

Mr. Shah CoherentMI, U.S.: +1-650-918-5898 U.K: +44-020-8133-4027 Australia: +61-2-4786-0457 INDIA: +91-848-285-0837 Email: sales@coherentmi.com Website: https://www.coherentmi.com

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Prediction: This Will Be the Best Stock in the Dow Jones Next Year

The Dow Jones Industrial Average is comprised of 30 stocks, but one stands out from the pack.

The “Magnificent Seven” is a moniker used to collectively describe a market-moving cluster of some of the world’s largest technology enterprises: Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta Platforms, and Tesla. Each is putting its own stamp on the artificial intelligence (AI) landscape, and all have received a lot of attention from media outlets and investors alike.

But another AI stock that gets less press has handily outperformed five of the Magnificent Seven over the past two years. Enterprise software leader and Dow Jones Industrial Average (DJIA) component Salesforce (CRM 0.87%) has gained a whopping 98% in just two years.

Even with that impressive run-up behind it, I think Salesforce’s next growth phase is just beginning. In fact, given the lucrative opportunity the company has in AI, I think Salesforce could be the top-performing stock in the Dow next year.

What about the rest of the Dow Jones?

Asserting that Salesforce could be the top performer in the Dow next year is a bold claim. After all, what about the other 29 companies?

The Dow is a curated index that includes some of the world’s largest companies across most major industry sectors. In my opinion, both financial services and consumer goods stocks still carry some risk. Specifically, I see both of these industries as particularly vulnerable to macroeconomic forces including inflation and interest rates. While inflation has been cooling for quite some time and the Federal Reserve has instituted an interest rate tapering protocol, I do not think the broader economy is quite out of the woods just yet.

Moreover, I think energy stocks are going to experience excessive volatility for the time being. Broadly speaking, energy policies tend to differ between which parties are in control of Congress. Even after the results of the 2024 election shake out next month, I could easily see energy stocks moving pretty dramatically depending on any policy changes that could go into effect.

This leaves the technology sector, where the DJIA includes major tech players including Amazon, Apple, Cisco, IBM, Intel, and Microsoft. While I’m bullish on Amazon and Microsoft, I think both companies are facing a lot of pressure and scrutiny to drive consistent impressive results, considering that they have both poured billions into their AI initiatives.

Meanwhile, Apple’s AI roadmap is in its early stages — making it hard to predict how its decisions will pan out. Unfortunately, I think Intel’s best days may be behind it. And IBM and Cisco are stuck competing in saturated markets. For all of these reasons, I think Salesforce has the most upside compared to its peers.

Image Source: Getty Images.

A huge opportunity for Salesforce

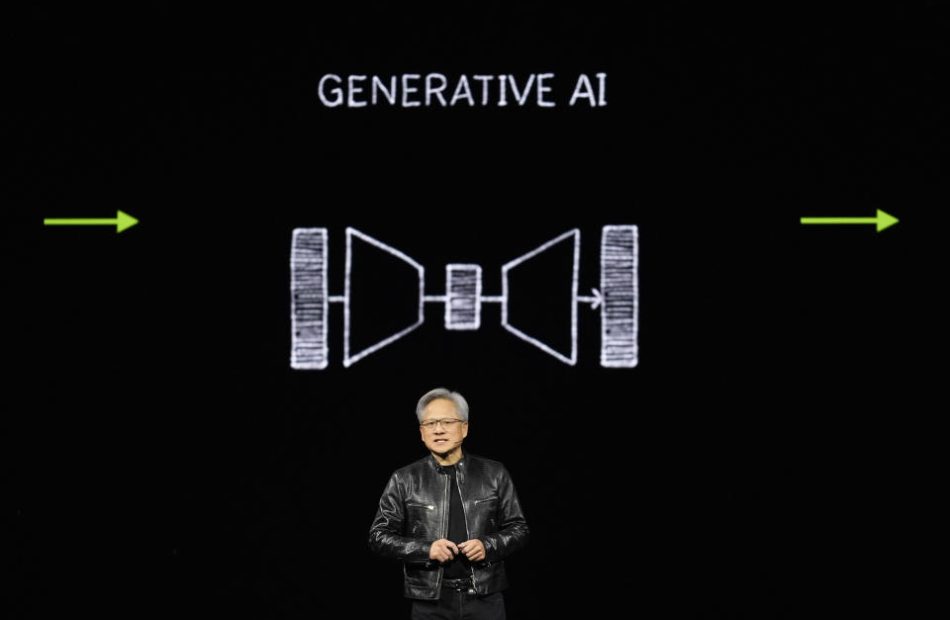

If you’ve been paying attention to artificial intelligence narratives over the last couple of years, you’ve heard the term “generative AI” ad nauseam. But what does it actually mean?

In simple terms, generative AI is software that has the capability to digest datasets to help answer complicated questions extremely quickly. When generative AI tools are at their best, employees across a company’s workforce are running sophisticated queries and creating robust data-driven dashboards — leading to enhanced productivity and efficiency. No more spinning your wheels and burning the midnight oil.

One of the leading types of applications in generative AI right now is the virtual agent. Microsoft has been a big winner in this regard thanks to its CoPilot assistant, which runs on ChatGPT and has been integrated throughout the company’s ecosystem, spanning cloud computing, productivity tools, and software development.

Salesforce has taken note of Microsoft’s success and decided to challenge its big tech cohort. Enter Agentforce, a virtual assistant that can help customers with things such as scheduling appointments, billing resolutions, cybersecurity threat analysis, and a host of other use cases. Salesforce’s vision is to remove the friction of human-led customer service and allow AI-powered agents to resolve customers’ needs.

Salesforce already has a deep penetration among large-scale corporations and small and midsize enterprises thanks to its customer relationship management (CRM) platform, data analytics tools powered by Tableau, and messenger tool Slack. To me, Agentforce should be an easy cross-selling opportunity to Salesforce’s existing customer base, and the company has a unique chance to emerge as a strong pillar supporting digital solutions.

Is Salesforce stock a buy right now?

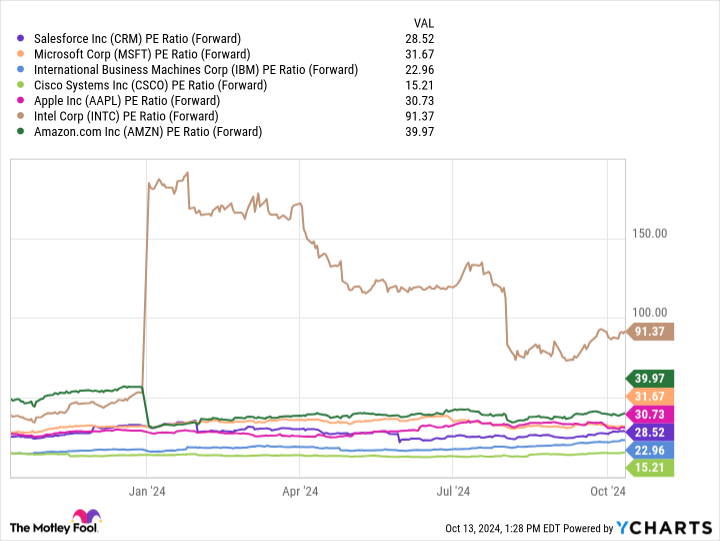

Right now, Salesforce shares trade at a forward price-to-earnings (P/E) multiple of 28.5. This is a healthy premium compared to the S&P 500‘s forward P/E of 22.9.

CRM PE Ratio (Forward) data by YCharts.

Although Salesforce may be valued as a superior investment compared to the broader market, the company is trading at a discount to the majority of its technology industry counterparts in the DJIA.

I think Agentforce is going to be a major tailwind for Salesforce so long as the AI narrative holds up. Investors may want to be on the lookout over the next year to see how the adoption of Agentforce is progressing and what kind of growth it’s driving for Salesforce.

If Microsoft CoPilot serves as any proxy, I think much better days are ahead for Salesforce, and I expect to see the stock soaring over the next year.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Cisco Systems, Meta Platforms, Microsoft, Nvidia, Salesforce, and Tesla. The Motley Fool recommends Intel and International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Clinical Pathway Information System Market to Reach $1.7 Billion, Globally, by 2033 at 7.8% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 16, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Clinical Pathway Information System Market by Type (Group Order Type, Embodied Variant Type and Reconstructed Information Type), Mode of Delivery (On-Premises, Cloud-Based and Web-Based), and End User (Hospitals, Ambulatory Care Centers, Specialty Clinics and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the clinical pathway information system market was valued at $0.8 billion in 2023, and is estimated to reach $1.7 billion by 2033, growing at a CAGR of 7.8% from 2024 to 2033.

Request Sample of the Report on Clinical Pathway Information System Market 2033 – https://www.alliedmarketresearch.com/request-sample/A323981

Prime determinants of growth

Increasing prevalence of chronic diseases and growing focus on patient safety and outcomes are the major factors that drive the growth of the clinical pathway information system market. However, the high cost of implementation hinders the market growth. Moreover, technological advancements offer remunerative opportunities for the expansion of the global Clinical Pathway Information System market.

Report coverage & details

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $0.8 billion |

| Market Size in 2033 | $1.7 billion |

| CAGR | 7.8% |

| No. of Pages in Report | 216 |

| Segments Covered | Type, Mode of delivery, End user and Region |

| Drivers |

|

| Opportunities |

|

| Restraints |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A323981

Segment Highlights

Group Order Type and Embodied Variant Type Clinical Pathway Information System

In CPIS, Group Order Type organizes clinical tasks into categories for streamlined management, enhancing workflow efficiency. Embodied Variant Type focuses on customizing clinical pathways to specific patient profiles or conditions, ensuring tailored care. Group Order Type standardizes processes, while Embodied Variant Type personalizes treatment, improving patient outcomes.

Preference for Cloud-Based Clinical Pathway Information Systems (CPIS)

By mode of delivery, cloud-based CPIS are preferred for their scalability, cost-effectiveness, and ease of access. They allow real-time updates, remote accessibility, and seamless integration with other healthcare systems. Additionally, cloud solutions offer enhanced data security, automatic backups, and reduced IT infrastructure costs, making them an attractive choice for healthcare providers.

Hospitals are the most efficient user of Clinical Pathway Information Systems (CPIS)

Hospitals are the most efficient end users of Clinical Pathway Information Systems (CPIS) due to their need for coordinated, evidence-based care across multiple departments. CPIS enhances workflow efficiency, ensures compliance with clinical guidelines, and improves patient outcomes by standardizing treatment protocols and facilitating real-time decision support in complex hospital settings.

Regional Outlook

The Clinical Pathway Information Systems (CPIS) market shows varied growth across regions. North America leads due to advanced healthcare infrastructure and high adoption rates. Europe follows with strong emphasis on quality care and regulatory support. The Asia-Pacific region exhibits rapid growth driven by expanding healthcare systems and increased focus on standardizing care. Latin America and the Middle East & Africa are emerging markets, with gradual adoption spurred by improving healthcare technologies.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A323981

Key Players

- Koninklijke Philips N.V.

- Epic Systems Corporation

The report provides a detailed analysis of these key players in the global Clinical Pathway Information System market. These players have adopted different strategies to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, Product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Healthcare Industry:

Cell Therapy Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Cancer Tumor Profiling Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Otorhinolaryngology Devices Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Digital Diabetes Management Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Media's Stock Went on a Wild Ride Today

Scott Olson / Getty Images

Key Takeaways

-

Shares of the parent company of Donald Trump’s Truth Social platform finished lower today after racing higher in morning trading, building on Monday gains.

-

Shares had soared earlier in the day as 2024 election odds shifted in former President Donald Trump’s direction on Polymarket.

-

Truth Social on Monday introduced a web version of its Truth+ streaming service.

Shares of Trump Media & Technology Group (DJT) can be volatile. Tuesday was something else.

Shares of Truth Social’s parent company, majority-owned by former President Donald Trump, finished the day down nearly 10% at about $27. But that came after they’d risen to near $34, about a 13% rise from Monday’s close. Trading in the shares was halted during the session.

Trump Media’s stock has generally raced upward from September lows, trading at levels last seen in July. Even after today’s whipsaw trading, with most of the pullback taking place in late-afternoon action, the shares are still back at August prices.

The earlier gains came as the perceived likelihood that former President Donald Trump, majority owner of Trump Media’s shares, could win the 2024 presidential election race against Vice President Kamala Harris rose. Trump’s chances on prediction market Polymarket have climbed roughly 3 percentage points since Monday to around 58%.

Trump Media on Monday launched a web version of its Truth+ TV streaming service. The platform includes a selection of “news, entertainment, faith-based programming, weather, documentaries, children’s content, and more.”

In addition to a recently announced Truth+ Android app, the company says it plans to introduce an iOS app and bring the service to connected TV platforms including Apple TV and Amazon Fire.

Trump Media shares are well off their 2024 highs around $80.

UPDATE: This article has been updated to reflect final share price information.

Read the original article on Investopedia.

Nvidia is set to dominate another Big Tech earnings season

We’re rolling into what is expected to be another wild tech earnings season, and you can bet AI is going to be front and center. And if there’s one company that everyone is watching, it’s Nvidia (NVDA).

Shares of the chip giant are up more than 16% in the last month, and the stock is currently on pace to unseat Apple as the largest publicly traded company by market capitalization.

The jump comes after Nvidia CEO Jensen Huang said demand for the company’s upcoming Blackwell chip is “insane” during an interview with CNBC on Oct. 3. Since then, shares of Nvidia have climbed roughly 18%, topping out at $130. But reports that the Biden administration will establish a cap on the number of AI chips that can be shipped to certain countries put the rally on hold Tuesday before recovering some ground Wednesday.

Nvidia’s incredible stock performance and meteoric rise in data center sales over the last year have put the company in a difficult position for its upcoming earnings announcement, which it has yet to officially schedule.

In the company’s fiscal Q3 2024, overall revenue soared 206% to $18.1 billion, while data center revenue rose a whopping 279% to $14.5 billion. And while Nvidia isn’t staring down a decline in revenue, its growth will likely slow versus the same period last year, which could spook investors.

Don’t believe me? Just take a look at what happened after the company announced its Q2 earnings back in August. While the company beat on revenue and earnings per share, with data center revenue increasing 154% year over year to $26.3 billion, Nvidia shares still fell more than 6% immediately following the announcement. It took more than a month for the company’s stock price to recover.

The AI trade hasn’t raised all ships, either. Shares of Broadcom (AVGO) jumped 59% year to date, outpacing the broader S&P 500 (GSPC), which rose 21%. Qualcomm (QCOM) climbed 19% and AMD (AMD) added just 6% to its stock price. Intel (INTC), meanwhile, fell a stunning 55%.

Broadcom benefits from its involvement in AI infrastructure, connecting servers and the like, while Qualcomm is seen as a potential beneficiary of on-device AI growth via AI smartphones and AI PCs. AMD is facing off against Nvidia and serves as an alternative on both price and availability.

Then there’s Intel, which is struggling amid its enormous turnaround effort that includes building out its third-party chip fabrication capabilities as well as trying to catch Nvidia and AMD in the AI processor space.

But Nvidia is still the hands-down star of the show this earnings season. Investors will be looking for signs of continued AI spending from hyperscalers like Microsoft (MSFT), Google (GOOG, GOOGL), Meta (META), and Amazon (AMZN), which make up a huge portion of AI sales, to get a sense of how well Nvidia chips are selling.

They’ll also look at how other chip companies perform this quarter ahead of Nvidia’s announcement, which tends to be far later in the earnings cycle than its contemporaries.

Wall Street will similarly be on the lookout for information about Nvidia’s Blackwell rollout and whether the company is facing any supply constraints as it did with its Hopper chips. Either way, it’s going to be a wild few weeks. Buckle up.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

Read the latest financial and business news from Yahoo Finance.

The Government of Canada launches selection process for the Chair of the Board of Directors of Jacques Cartier and Champlain Bridges Incorporated

MONTREAL, Oct. 16, 2024 /CNW/ – Today, the Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities, announced that a selection process is underway for the position of Chair of the Board of Directors at Jacques Cartier and Champlain Bridges Incorporated (JCCBI).

The Government of Canada is seeking applications from qualified, diverse, and talented individuals to fill this position through an open, transparent, and merit-based selection process. Interested candidates are encouraged to apply prior to November 12, 2024.

Former Chair Catherine Lavoie stepped down in November 2023 and Sylvain Villiard, the Vice-chair, was appointed by the Governor in Council to be the Interim Chair until a replacement could be identified.

This process encourages applications from individuals with experience at the senior executive level on transportation infrastructure management and a solid track record of implementing effective corporate governance practices, who are also proficient in both official languages. Experience with complex financing, executive compensation, and risk assessment and management practices would be considered assets.

The Notice of Appointment Opportunity is published and applications for this opportunity can be submitted through the Government of Canada’s Governor in Council appointments website.

Quotes

“The Jacques Cartier and Champlain Bridges Incorporated play an essential role in managing important federal transportation corridors to provide safe and efficient travel routes as well as support national and international supply chains. I invite candidates to apply to serve as Chair on its Board and support JCCBI’s vital work in the years to come.”

The Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities

Quick facts

- JCCBI is a Crown corporation that operates at arm’s length from the government, overseen by an independent Board of Directors and reports to Parliament through the Minister of Housing, Infrastructure and Communities.

- JCCBI manages and operates federal transportation corridors in the Montréal area, including the:

- Jacques Cartier Bridge

- The Estacade

- Melocheville Tunnel

- Honoré Mercier Bridge (federal portion)

- Bonaventure Expressway (federal portion)

- JCCBI was responsible for the original Champlain Bridge and completed its deconstruction in November 2023, on time and on budget, with a final review on April 11, 2024.

- JCCBI is also responsible for the Bonaventure Expressway reconfiguration project. This major project is scheduled to run until 2029.

- At the request of Housing, Infrastructure and Communities Canada, JCCBI provides technical and financial advice for infrastructure maintenance and rehabilitation projects in Quebec, including the Samuel De Champlain Bridge.

Associated links

Appointment Opportunity for the position of Chair of the Board of Directors of JCCBI

Governor in Council Appointments

Housing, Infrastructure and Communities Canada

Jacques Cartier and Champlain Bridges Incorporated

Follow us on Twitter, Facebook, Instagram and LinkedIn

Web: Housing, Infrastructure and Communities Canada

SOURCE Department of Housing, Infrastructure and Communities

![]() View original content: http://www.newswire.ca/en/releases/archive/October2024/16/c1448.html

View original content: http://www.newswire.ca/en/releases/archive/October2024/16/c1448.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.