Why ASML Stock Was Sliding Again Today

Shares of ASML (NASDAQ: ASML) were falling for the second day in a row today. After the chip equipment maker accidentally reported results yesterday, investors seemed to give a thumbs-down to its earnings call this morning that added some color to its downbeat guidance for 2025.

The chip stock was down 5.6% on the news as of 12:23 p.m. ET on Wednesday.

ASML sees slowing demand

There weren’t any groundbreaking revelations in today’s earnings report, but it underscored the challenges the company is facing as it sees a slower demand recovery than expected.

Management said that sales from China, which made up 47% of its revenue in the quarter, would return to normal historical levels closer to around 20% in 2025, showing a slowdown in demand from that country. Pressure from the U.S. has also led to a ban on exporting its most advanced equipment to China.

Yesterday, the company said that it expected 2025 revenue of 30 billion to 35 billion euros ($32.7 billion to $38.1 billion), down from a forecast in 2022 of 30 billion to 40 billion euros. Wall Street seemed to focus on weakness at customers like Intel and Samsung, though ASML didn’t get into specifics on which companies were scaling back orders. It expects some of that demand to be pushed out into 2026.

Can ASML bounce back?

In its comments yesterday, ASML said it still saw a lot of potential from AI, and this setback seems to be more of a delay, rather than the result of a structural flaw with the business or the industry.

Analysts are likely to slash their estimates on the news, but the stock looks reasonably priced after the two-day sell-off. Considering its wide economic moat in lithography equipment and the temporary nature of the slowdown, ASML still looks like a smart long-term buy.

Should you invest $1,000 in ASML right now?

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $806,459!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ASML. The Motley Fool recommends Intel and recommends the following options: short November 2024 $24 calls on Intel. The Motley Fool has a disclosure policy.

Why ASML Stock Was Sliding Again Today was originally published by The Motley Fool

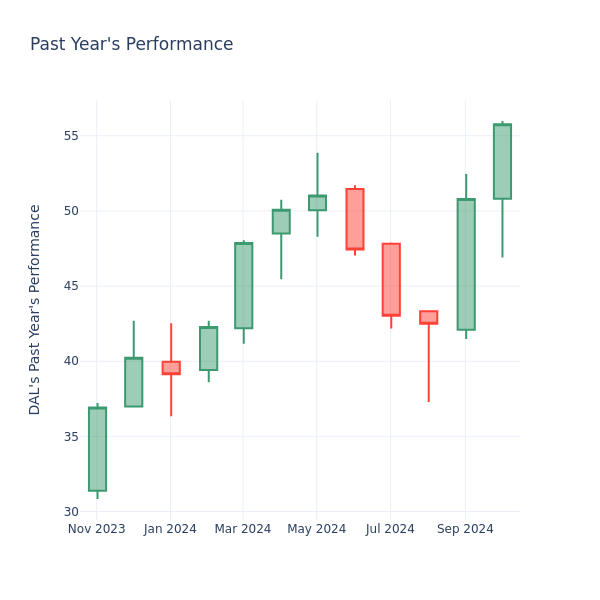

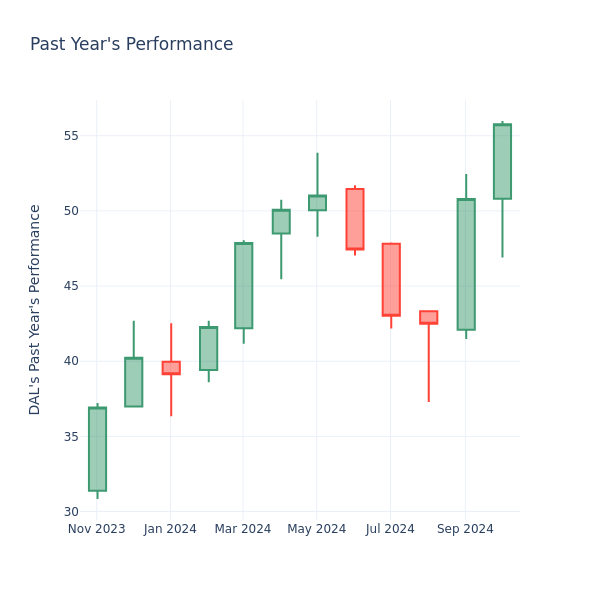

A Look Into Delta Air Lines Inc's Price Over Earnings

In the current session, the stock is trading at $55.76, after a 5.74% spike. Over the past month, Delta Air Lines Inc. DAL stock increased by 18.83%, and in the past year, by 70.45%. With performance like this, long-term shareholders are optimistic but others are more likely to look into the price-to-earnings ratio to see if the stock might be overvalued.

Evaluating Delta Air Lines P/E in Comparison to Its Peers

The P/E ratio is used by long-term shareholders to assess the company’s market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Delta Air Lines has a lower P/E than the aggregate P/E of 33.99 of the Passenger Airlines industry. Ideally, one might believe that the stock might perform worse than its peers, but it’s also probable that the stock is undervalued.

In summary, while the price-to-earnings ratio is a valuable tool for investors to evaluate a company’s market performance, it should be used with caution. A low P/E ratio can be an indication of undervaluation, but it can also suggest weak growth prospects or financial instability. Moreover, the P/E ratio is just one of many metrics that investors should consider when making investment decisions, and it should be evaluated alongside other financial ratios, industry trends, and qualitative factors. By taking a comprehensive approach to analyzing a company’s financial health, investors can make well-informed decisions that are more likely to lead to successful outcomes.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top Real Estate AI Firms Restb.ai and Lundy Team Up to Deliver A More Powerful Voice-Driven Home Shopping Experience for Agents, Buyers and Sellers

DALLAS, Oct. 16, 2024 /PRNewswire/ — In a groundbreaking collaboration, Restb.ai, the leading provider of AI-powered computer vision for real estate, and Lundy, Inc., creators of the most comprehensive voice-driven property search platform, have announced a new collaboration designed to deliver a more powerful and robust voice-driven home shopping search experience for home shoppers.

This new venture offers a significant benefit for Multiple Listing Services (MLSs). Any MLS currently utilizing Restb.ai’s AI Advanced Tagging will receive a complimentary upgrade to one of Lundy’s “Finding Homes Pro” features—expanding the capabilities for users without any additional cost.

This collaboration addresses a crucial need in the real estate industry: accessibility. According to the CDC – the U.S. Centers for Disease Control and Prevention – one in four American adults has a disability, and vision impairment ranks as one of the top five disabilities. The 2022 National Health Interview Survey revealed that over 50 million American adults experience some degree of vision loss. This includes nearly 4 million individuals who struggle to see even with corrective lenses, more than 340,000 who are blind, and 45.95 million adults who report having trouble seeing, even with glasses.

Restb.ai and Lundy combine their collective AI technology to help address this significant consumer need – and base.

“Our mission is to provide the most comprehensive search engine available by voice to ensure the homebuying journey is accessible to everyone,” said Justin Lundy, CEO of Lundy, Inc. “By joining forces with Restb.ai to leverage their market-leading computer vision technology, we’re dramatically advancing our efforts at Lundy to make voice search a staple feature for every MLS. Together, we’re setting a new standard for accessibility and user-friendly technology.”

Restb.ai notes that beyond the vital services the new combined technology provides in the marketplace, it will also help deliver safe, proven AI to more real estate agents to help more clients.

“MLSs are leading the way in delivering practical AI to hundreds of thousands of real estate professionals nationwide,” said Nathan Brannen, Chief Product Officer at Restb.ai. “By teaming up with Lundy, we’re accelerating the momentum of AI adoption in the industry, allowing agents to match homebuyers and sellers to deliver the perfect home with unparalleled speed and precision. This partnership will profoundly impact how agents serve their clients, bringing more AI innovation to the forefront of real estate.”

Lundy’s voice-driven search capabilities go beyond the limitations of traditional screen readers, providing natural language home searches without interruptions from ads or pop-ups. MLSs currently offering Lundy’s Finding Home Access benefit from a host of features, including Basic, Extended, and Scenario Search, Bilingual (English and Spanish) capabilities, and its Intelligent Listing Q&A.

The integration of Lundy’s voice-driven search capabilities with Restb.ai’s visual tagging system provides features that far exceed traditional search methods. This collaboration harnesses the full power of Restb.ai’s 700+ visual search insights, adds custom search fields, intelligent image-based filtering, and enhanced listing inquiries with voice-powered Q&A to the Finding Homes platform, significantly improving how both agents and consumers interact with property listings.

“This collaboration between Restb.ai and Lundy marks a significant step forward for the real estate industry as it helps MLSs unlock the full power of our computer vision and paves the way for AI-powered search tools to become an integral part of the home buying experience,” added Dominik Pogorzelski, General Manager MLS at Restb.ai, adding, “This is a great example of two complementary technologies coming together to better serve the customer; the whole truly is greater than the sum of its parts.”

Restb.ai offers advanced generative AI and computer vision software solutions for the MLS industry, integrated into all leading MLS technology providers, and powers many of the leading standalone MLS technology systems.

More information about Restb.ai MLS software solutions is here – restb.ai/customers/MLS.

About Lundy, Inc.

Lundy Inc. is revolutionizing the real estate industry with its innovative voice interface, Finding Homes, which offers access to property listings through voice command, made possible by its LundyAI Core language-modeling technology. The company equips agents and brokers with the capabilities of superpowered voice assistants, significantly elevating their operational effectiveness and establishing new industry benchmarks.

About Restb.ai

Restb.ai, the leader in AI-powered computer vision for real estate, provides image recognition and data enrichment solutions for many of the industry’s top brands and leading innovators. Its advanced AI-powered technology automatically analyzes property imagery to unlock visual insights at scale that empower real estate companies with relevant and actionable property intelligence. Restb.ai can provide deep insight into each of the 1 million property photos uploaded daily.

For more information on Restb.ai, visit its website. For Restb.ai-related media inquiries, please contact Maya Makarem at contact@restb.ai or maya@restb.ai or Kevin Hawkins at 1-206-866-1220 or kevin@wavgroup.com.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/top-real-estate-ai-firms-restbai-and-lundy-team-up-to-deliver-a-more-powerful-voice-driven-home-shopping-experience-for-agents-buyers-and-sellers-302277577.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/top-real-estate-ai-firms-restbai-and-lundy-team-up-to-deliver-a-more-powerful-voice-driven-home-shopping-experience-for-agents-buyers-and-sellers-302277577.html

SOURCE Restb.ai

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Billionaire Mark Cuban Warns When You Win The Lottery, Never Invest – Stick It In The Bank And Live Comfortably: 'You'll Sleep Better'

You’ve just won the lottery, and visions of luxury cars and private islands fill your head. But before you rush off to make those purchases, take a moment to consider some straightforward advice from billionaire investor Mark Cuban: don’t invest your winnings—just put it in the bank and live comfortably forever.

Don’t Miss:

While this might be surprising coming from a man who invests in new companies on Shark Tank, he acknowledges that not everyone is an investor—and he wants you to realize that, too.

In a 2016 interview with the Dallas Morning News, Cuban said, “You don’t become a smart investor by winning the lottery. Don’t make investments. You can put it in the bank and live comfortably forever.” Cuban advises keeping things simple and avoiding the temptation to make risky investments that could easily wipe out your newfound fortune. He added, “You’ll sleep a lot better knowing you won’t lose money.”

See Also: Many are using this retirement income calculator to check if they’re on pace — here’s a breakdown on how on what’s behind this formula.

Sure, it can be tempting to double your money. But unless you know what you’re doing, it’s a gamble. He says when you instantly become a millionaire — relax and enjoy the newfound wealth. Avoid the urge to flip the winnings into even more.

Lump Sum or Annuity: The First Big Decision

One of the first decisions lottery winners face is whether to take a lump sum or an annuity. If you opt for the lump sum, you’ll receive a reduced amount upfront—typically around half of the advertised jackpot after taxes. For instance, if you win a $150 million jackpot, your lump sum would be around $71.5 million. On the other hand, if you choose the annuity, you’ll receive the full jackpot amount spread out over 30 years, with payments increasing annually to adjust for inflation.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

Playing It Safe in the Stock Market

Cuban suggests keeping it conservative with the stock market for those feeling nervous about the potential long-term effects of inflation on their winnings. He has been a proponent of low-cost index funds, especially for those unfamiliar with the complexities of investing. In a 2017 interview with Hayman Capital Management, reported by MarketWatch, Cuban said, “For those investors not too knowledgeable about markets, the best bet is a cheap S&P 500 fund.” This approach offers a safer, low-cost way to grow your money over time without taking on unnecessary risks.

See Also: These five entrepreneurs are worth $223 billion – they all believe in one platform that offers a 7-9% target yield with monthly dividends

Spend Wisely and Enjoy

Once your winnings are secure, financial advisors generally recommend tackling any high-interest debt first. After that, you can focus on covering daily expenses and perhaps allow yourself some guilt-free splurges. Cuban’s advice is not about denying yourself the good life—it’s about making sure you don’t squander your windfall on bad decisions.

By following Cuban’s straightforward advice to avoid risky investments and opt for a safe, conservative approach, lottery winners can enjoy their sudden wealth for years.

Whether you hit the lottery or not, the message still stands. Not everyone’s an investor, and it’s okay to start small. Just avoid risks that make you uncomfortable. And if you need some guidance on managing your money, talking to a financial advisor can help—even if you’re not a sudden millionaire.

Read Next:

Up Next: Transform your trading with Benzinga Edge’s one-of-a-kind market trade ideas and tools. Click now to access unique insights that can set you ahead in today’s competitive market.

Get the latest stock analysis from Benzinga?

This article Billionaire Mark Cuban Warns When You Win The Lottery, Never Invest – Stick It In The Bank And Live Comfortably: ‘You’ll Sleep Better’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Amazon Prime Video India to Introduce Ads in 2025, Intensifying Rivalry with Reliance and Disney+

In 2025, Amazon.Com Inc’s AMZN Prime Video in India will introduce limited advertisements in its shows and movies to support ongoing content investments.

The company plans to include fewer ads than traditional TV and streaming services. Prime members will also have the option to choose an ad-free version, with pricing details to be shared later.

Also Read: Amazon To Boost Workforce by 250K for 2024 Holidays, Joining Retail Hiring Surge

Prime membership prices will remain unchanged, and Prime Lite subscribers will not be affected by this change.

Amazon’s move marks its intense rivalry with Reliance and Walt Disney’s Co’s DIS $8.5 billion merger, which can potentially win 50% of India’s streaming users, Bloomberg cites data analytics firm Comscore.

Amazon remains heavily invested in India as Amazon Prime Video gained traction in the land of 1.4 billion population.

Previously, Amazon Prime Video aimed to undercut Netflix on advertising pricing to win market share.

Recently, Kelly Day of Prime Video International told Amazon that in 2025, it would place more advertisements on Prime Video shows and movies, following similar strategies from Netflix Inc NFLX and Disney+. The company gradually retracted from its “meaningfully fewer ads” plans than its competitors.

In January, Citi estimated that Prime Video could generate over $5 billion in high-margin advertising revenue.

Amazon’s digital advertising business revenues increased 20% to $12.8 billion during the second quarter of 2024.

Amazon’s pureplay streaming rival, Netflix, has gained 95% in stock value in the last 12 months. Meanwhile, Amazon, an e-commerce and cloud juggernaut, gained slightly above 40%.

Price Action: AMZN stock is down 0.86% at $186.09 at the last check Wednesday.

Also Read:

Photo via Shutterstock

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

60-Year-Old Canadian Earning $9,000 in Dividends Per Month Shares His Top 9 Stock Holdings

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Dividend investing is roaring back to the limelight as investors flock to attractive income-generating equities following the first rate cut by the Federal Reserve. Financial services company First Trust estimates that dividend-focused ETFs saw inflows worth a whopping $4.5 billion in July and August. The firm said in a report:

“If we had to pick a group that would eventually benefit the most from multiple rate cuts, we would suggest dividend-paying companies. In a market enthralled by expensive momentum stocks, quality, inexpensive dividend stocks are hiding in plain sight.”

Check It Out:

But which quality, inexpensive dividend stocks should you pick to increase your wealth? Inspiration and ideas come from those who are doing it right. Let’s take a look at an interesting success story.

About two years ago, a Redditor shared his detailed income report and portfolio screenshots on r/Dividends (a community with over 590,000 members on Reddit), saying that he was earning about $110,666 annually or $9,222 per month, in dividend income.

The investor, 60 and from Canada, said he planned to retire in two years. Asked why two years, since his dividend income was enough to retire immediately, the investor responded:

“It takes time to close down a practice (MD) and my youngest is still in University, so that’s a last major expense.”

Someone asked him for advice or tips. Here’s what he said:

“Basically just dca every month 15% of income. (I) didn’t really start making over 150,000 a year until 34 years old. So almost all of this has accumulated over the last 25 years. I should have pivoted to dividends earlier as many of my non dividend tech stocks have crashed hard.”

The investor said he made about $200,000 after taxes. Answering a question about how many years he’d been accumulating wealth, he said:

“30. I have paid off my house, rec property and three cars.”

Let’s look at some of the biggest holdings in the portfolio.

Vanguard FTSE Canadian High Dividend Yield Index ETF (VDY.TO)

Vanguard FTSE Canadian High Dividend Yield Index ETF exposes investors to some of the top high-yield Canadian dividend stocks. It tracks the FTSE Canada High Dividend Yield Index. Royal Bank of Canada (RY), Enbridge (ENB) and Toronto-Dominion Bank (TD) are among the fund’s top holdings. This was the biggest holding of the Redditor, earning over $9,000 per month in dividends, accounting for about 8.5% of the total portfolio.

Enbridge

With a dividend yield of 6.6%, Canadian energy infrastructure company Enbridge Inc. (ENB.TO) was the second biggest holding of the Redditor, earning about $9,000 per month in dividends. The stock accounted for about 6.7% of the $3.6 million portfolio. The company has consistently raised its dividends for about three decades now.

Brookfield Asset Management

Brookfield Asset Management Ltd. (BAM.TO) is a Canadian alternative investment management company that focuses on real estate, renewable power, infrastructure, credit and private equity. About 5.8% of the total portfolio of the Redditor making $9,000 per month in dividends was allocated to this company. BAM.TO has a dividend yield of about 3.3%.

Canadian Natural Resources

Canadian Natural Resources Limited (CNQ.TO) was the fourth-biggest holding of Redditor, making $9,000 in dividends a month. The stock offers a dividend yield of over 4% and the company has consistently raised dividends for 24 straight years. About 5.1% of the $3.6 million portfolio of Redditor was allocated to CNQ.

Bank of Montreal (BMO.TO)

Bank of Montreal (BMO.TO) is another top high-yield dividend stock in the investor’s portfolio, raking in over $9,000 per month in dividends. The portfolio screenshots shared by the Redditor publicly showed BMO accounted for 4.5% of the total portfolio. The stock is up 14% over the past year.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Schwab U.S. Dividend Equity ETF

The Canadian investor earning over $9,000 monthly had about 4.1% of his total $3.6 million portfolio invested in Schwab U.S. Dividend Equity ETF (NYSE:SCHD). The ETF tracks the Dow Jones U.S. Dividend 100 Index and exposes you to some of the top dividend stocks trading in the U.S., including Home Depot, Coca-Cola, Verizon, Lockheed Martin, Pepsi and AbbVie, among many others. Since SCHD’s holdings are mostly conservative dividend payers, it’s suitable for investors close to retirement looking for consistent dividend income.

However, the investor noted a caveat of investing in SCHD for Canadian investors during the discussion:

“But the real issue with JEPI SCHD and similar is that if you hold them in Canada, you get 15% less dividend and are taxed differently on non-Canadian dividend products. If you are in the U.S., it’s more of a no-brainer when you reach retirement.”

Tourmaline Oil Corp.

Canadian natural gas company Tourmaline Oil Corp. (TOU.TO) was among Redditor’s top 10 holdings, earning $9,000 per month in dividends. When asked what stocks he thought were the best for his income portfolio, the investor said TOU stood out because of its special dividends.

Microsoft

About 3.4% of Redditor’s portfolio was invested in Microsoft Corp (NASDAQ:MSFT). The company recently raised its quarterly dividend by 10%. It offers a sweet spot between dividend income and capital gains through stock price appreciation. MSFT is up 30% over the past 12 months.

Broadcom

Broadcom Inc (NASDAQ:AVGO) usually gets attention for its AI chips instead of dividends. However, the company has a strong dividend growth track record, having raised its annual dividend for 13 consecutive years. AVGO has a dividend yield of 1.2%.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article 60-Year-Old Canadian Earning $9,000 in Dividends Per Month Shares His Top 9 Stock Holdings originally appeared on Benzinga.com

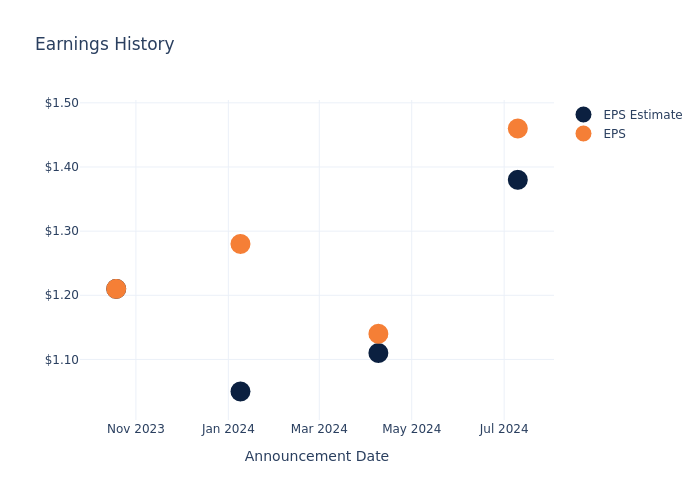

Earnings Outlook For WD-40

WD-40 WDFC will release its quarterly earnings report on Thursday, 2024-10-17. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate WD-40 to report an earnings per share (EPS) of $1.34.

The announcement from WD-40 is eagerly anticipated, with investors seeking news of surpassing estimates and favorable guidance for the next quarter.

It’s worth noting for new investors that guidance can be a key determinant of stock price movements.

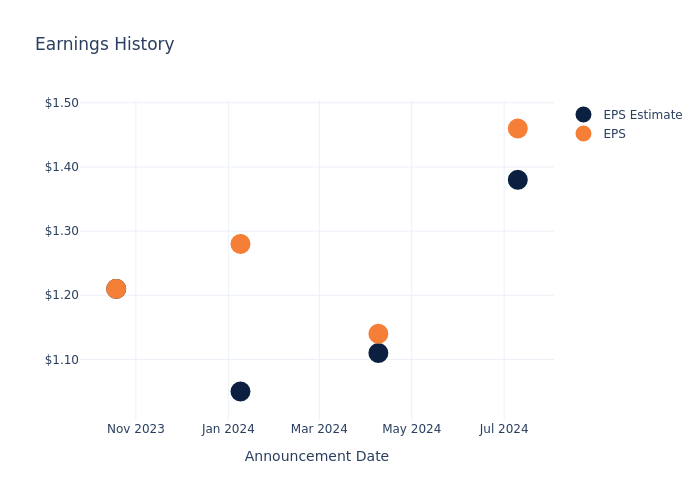

Earnings History Snapshot

In the previous earnings release, the company beat EPS by $0.08, leading to a 4.04% increase in the share price the following trading session.

Here’s a look at WD-40’s past performance and the resulting price change:

| Quarter | Q3 2024 | Q2 2024 | Q1 2024 | Q4 2023 |

|---|---|---|---|---|

| EPS Estimate | 1.38 | 1.11 | 1.05 | 1.21 |

| EPS Actual | 1.46 | 1.14 | 1.28 | 1.21 |

| Price Change % | 4.0% | -9.0% | 15.0% | -0.0% |

Market Performance of WD-40’s Stock

Shares of WD-40 were trading at $260.85 as of October 15. Over the last 52-week period, shares are up 29.56%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for WD-40 visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Vertex 10% Owner Trades Company's Stock

It was reported on October 15, that ITEM SECOND IRR TRUST FBO ANNE MARIE WESTPHAL ua of JEFFREY R WESTPHAL dated October , 10% Owner at Vertex VERX executed a significant insider sell, according to an SEC filing.

What Happened: According to a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday, sold 75,175 shares of Vertex. The total transaction value is $3,018,885.

As of Wednesday morning, Vertex shares are up by 0.41%, currently priced at $41.43.

All You Need to Know About Vertex

Vertex Inc is a provider of tax technology and services. Its software, content, and services help customers stay in compliance with indirect taxes that occur in taxing jurisdictions all over the world. Vertex provides cloud-based and on-premise solutions to specific industries for every line of tax, including income, sales, consumer use, value-added, and payroll. The company offers solutions such as tax determination, Tax Data Management, document management, and compliance and reporting among others. The company derives revenue from software subscriptions.

Financial Insights: Vertex

Revenue Growth: Vertex’s revenue growth over a period of 3 months has been noteworthy. As of 30 June, 2024, the company achieved a revenue growth rate of approximately 15.33%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Evaluating Earnings Performance:

-

Gross Margin: Achieving a high gross margin of 63.74%, the company performs well in terms of cost management and profitability within its sector.

-

Earnings per Share (EPS): Vertex’s EPS reflects a decline, falling below the industry average with a current EPS of 0.03.

Debt Management: Vertex’s debt-to-equity ratio stands notably higher than the industry average, reaching 1.51. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: Vertex’s stock is currently priced at a premium level, as reflected in the higher-than-average P/E ratio of 317.23.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 10.47 is above industry norms, reflecting an elevated valuation for Vertex’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Vertex’s EV/EBITDA ratio, surpassing industry averages at 76.18, positions it with an above-average valuation in the market.

Market Capitalization Analysis: The company’s market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Navigating the Impact of Insider Transactions on Investments

Insider transactions shouldn’t be used primarily to make an investing decision, however, they can be an important factor for an investor to consider.

When discussing legal matters, the term “insider” refers to any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated in Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and significant hedge funds. Such insiders are required to report their transactions through a Form 4 filing, which must be completed within two business days of the transaction.

A new purchase by a company insider is a indication that they anticipate the stock will rise.

On the other hand, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Unlocking the Meaning of Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Vertex’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.