3 Signs You Should Avoid Costco Shopping at All Costs

Shopping at Costco is a great thing — for some people. You can buy Kirkland Signature brand products, which have a devoted following. You can bulk buy household products to pay a lower price. And you can save even more if you pay with a good cash back or rewards credit card.

TODAY’S TOP OFFER

Earn up to $845 cash back this year just by changing how you pay at Costco! Learn more here.

Unfortunately, not everyone benefits from a Costco trip, though. In fact, you should watch out for these three signs that avoiding Costco is the best idea for your checking account.

1. You save a fortune using coupons

According to a study conducted by CouponFollow, the average U.S. household could save $1,465 per year from coupon use, including $316 in savings on groceries and food at home, and $272 in savings from buying other household items with coupons.

Not everyone uses coupons wisely, however. And some people who do become experts at it likely save a whole lot more. If you fall into the former group and aren’t interested in seeking out coupons, Costco probably provides some of the best deals for you. But if you fall into the latter group, you should not shop at Costco.

Costco does not accept any manufacturer coupons, so you’ll lose the chance to take advantage of a savings technique that’s working for you. Don’t give up your coupon habit, which can sometimes help you get items for free or for pennies on the dollar, just because of the promise of Costco deals. Keep shopping at your current supermarket and drug stores instead.

Missing your savings from coupons, but want to keep shopping at Costco? Click here to apply for one of the cards on our curated list of the best credit cards for Costco shopping to maximize the rewards on your spending.

2. You love to shop online

If you are an online shopper, you might want to avoid Costco.com. The site charges a higher price than you’ll pay when you purchase in-store. There’s very little reason to sign up for a Costco membership, only to negate most or all of the savings that come with it by shopping online.

If you don’t want to give up your online shopping habit in favor of regular trips to the warehouse club to make purchases in person, then you should likely forgo Costco altogether. Buying primarily online simply won’t provide the best deals, and you’re better off with a different merchant designed for the digital experience.

Many of the best credit cards provide strong fraud protections to keep your card safe when used online and also offer generous rewards. Since the Costco warehouse only accepts Visa cards, you’ll have your pick of a broader selection of great rewards cards to sign up for if you pass up Costco in favor of your favorite digital storefronts.

3. You have no storage space

Costco is well known for offering bulk deals, but you’ll need a place at home to put all of that stuff. According to a survey conducted by StorageCafe, 38% of Americans are self-storage users. Those who have homes sized between 1,500 and 3,500 square feet making up the bulk of the clients for self-storage facilities.

If you already have so little room that you have to pay for a separate place to store your possessions, adding 300 rolls of toilet paper or enough canned chili to hold a festival is not going to make your life any better.

If you recognize yourself in these three signs, skip Costco entirely. Your efforts to save money there are likely to backfire and you’re better off sticking with your coupons, continuing to buy at your favorite online merchants, or maintaining enough space to move around your home without knocking over an industrial-sized container of mustard every time you go to the kitchen for a snack.

Top credit card to use at Costco (and everywhere else!)

We love versatile credit cards that offer huge rewards everywhere, including Costco! This card is a standout among America’s favorite credit cards because it offers perhaps the easiest $200 cash bonus you could ever earn and an unlimited 2% cash rewards on purchases, even when you shop at Costco.

Add on the competitive 0% interest period and it’s no wonder we awarded this card Best No Annual Fee Credit Card.

Click here to read our full review for free and apply before the $200 welcome bonus offer ends!

We’re firm believers in the Golden Rule, which is why editorial opinions are ours alone and have not been previously reviewed, approved, or endorsed by included advertisers. The Ascent does not cover all offers on the market. Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team.Christy Bieber has positions in Visa. The Motley Fool has positions in and recommends Costco Wholesale and Visa. The Motley Fool has a disclosure policy.

3 Signs You Should Avoid Costco Shopping at All Costs was originally published by The Motley Fool

News Hampshire Lawmakers Reject Psychedelics Bill Citing Safety Concerns Though Support Continued Research

New Hampshire lawmakers voted decisively against House Bill 1693, a proposed measure aimed at establishing a state-regulated therapeutic psychedelic program. The bill, which sought to allow the use of psilocybin, mescaline and LSD to treat mental health conditions such as depression, anxiety, PTSD and substance use disorders, was rejected by the House Health, Human Services, and Elderly Affairs Committee with a 14-1 vote.

Broad Scope And Legal Challenges Sink Psychedelics Bill

As reMind reported, according to the committee the legislation was “far too broad,” raising concerns about its potential implementation. While many advocates have pointed to the growing body of research supporting the therapeutic use of psychedelics, lawmakers expressed unease about legalizing substances that remain federally illegal and tightly regulated under Schedule I of the Controlled Substances Act.

One of the bill’s most vocal critics, Republican Rep. Erica Layon, emphasized the challenges posed by these legal conflicts. “I can’t tell you how many times I’ve heard something about a [Journal of the American Medical Association] article comparing psychedelics to existing antidepressants,” she said, as reported by Marijuana Moment. “But right now, New Hampshire law prohibits a clinical trial from happening in the state with psychedelics because of its status as a controlled substance.”

Vague Language In Bill Raises Red Flags

In its rejection, the committee also highlighted the bill’s unclear provisions, particularly its borrowing of terms from the state’s medical marijuana laws. This included a provision allowing adult possession of up to two ounces of psychedelics — a volume critics argued was unreasonably large, particularly for substances like LSD. “The concerns we had with the bill as presented was it was far too broad,” Democratic Rep. Lucy Weber said.

Lawmakers Urge Further Psychedelic Research

While rejecting the proposal, lawmakers did express a willingness to explore future legislation that could better align with ongoing clinical research. “The Veterans Administration and Massachusetts General Hospital are currently conducting research for a number of disorders using these drugs,” the committee said. It also noted that the FDA has granted breakthrough therapy designation for several psychedelic substances. The panel recommended that New Hampshire expand research into psychedelics, with a focus on clinical trials that would allow patients access to experimental treatments without needing to travel out of state.

Massachusetts Set To Vote On Psychedelics Legalization

As New Hampshire steps back from advancing psychedelics legislation, neighboring Massachusetts is poised for a potential breakthrough. Voters there will decide in three weeks whether to approve Question 4, a measure that would legalize five psychedelics, including psilocybin, psilocin, DMT, ibogaine and mescaline for therapeutic use. If passed, the state could implement a regulated access model by 2028, beginning with the legalization of one substance in 2026.

Cover image made with AI

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dow Jumps 250 Points; U.S. Bancorp Earnings Top Views

U.S. stocks traded higher midway through trading, with the Dow Jones index gaining over 250 points on Wednesday.

The Dow traded up 0.59% to 42,994.38 while the NASDAQ fell 0.05% to 18,306.79. The S&P 500 also rose, gaining, 0.19% to 5,826.42.

Check This Out: Top 3 Tech And Telecom Stocks That Could Lead To Your Biggest Gains This Quarter

Leading and Lagging Sectors

Utilities shares jumped by 0.8% on Tuesday.

In trading on Tuesday, consumer staples shares fell by 0.5%.

Top Headline

U.S. Bancorp USB posted better-than-expected quarterly earnings on Wednesday.

The company reported third-quarter adjusted earnings per share of $1.03, beating the analyst consensus estimate of 99 cents. Quarterly revenues of $6.864 billion missed the analyst consensus estimate of $6.895 billion.

Equities Trading UP

- 180 Life Sciences Corp ATNF shares shot up 713% to $12.36. 180 Life Sciences interim CEO said that the company is planning to enter the online gaming industry with its newly acquired gaming technology platform.

- Shares of Altus Power, Inc. AMPS got a boost, surging 15% to $3.48 after the company announced that a formal review of strategic alternatives has been underway by its Board of Directors. Also, the company reaffirmed its FY24 guidance.

- Versus Systems Inc. VS shares were also up, gaining 399% to $5.64 after the company announced a $2.5 million investment and licensing agreement with ASPIS.

Equities Trading DOWN

- Bright Minds Biosciences Inc DRUG shares dropped 37% to $24.24. Firefly Neuroscience collaborated with Bright Minds Biosciences to analyze the data from its positive Phase 1 study using its Artificial Intelligence.

- Shares of Silvaco Group, Inc. SVCO were down 25% to $8.34 after the company reported a decline in orders from Asia during third quarter and cut its FY24 revenue outlook.

- Novavax, Inc. NVAX was down, falling 17% to $10.45 after the FDA placed a clinical hold on the company’s investigational new drug application for its COVID-19-influenza combination and standalone influenza vaccine candidates.

Commodities

In commodity news, oil traded down 0.2% to $70.46 while gold traded up 0.6% at $2,694.90.

Silver traded up 1.6% to $32.270 on Wednesday, while copper rose 1% to $4.3810.

Euro zone

European shares were mixed today. The eurozone’s STOXX 600 gained 0.02%, Germany’s DAX gained 0.1% and France’s CAC 40 fell 0.17%. Spain’s IBEX 35 Index rose 0.75%, while London’s FTSE 100 gained 1.15%.

Asia Pacific Markets

Asian markets closed mostly lower on Wednesday, with Japan’s Nikkei 225 falling 1.83%, Hong Kong’s Hang Seng Index falling 0.16%, China’s Shanghai Composite Index gaining 0.05% and India’s BSE Sensex falling 0.39%.

Economics

- U.S. mortgage applications fell by 17% from the previous week during the second week of October.

- Export prices in the U.S. declined by 0.7% month-over-month in September, exceeding market estimates of a 0.4% fall.

- Import prices declined by 0.4% from the previous month in September.

Now Read This:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chinese Stocks on Brink of Correction as Investor Patience Wanes

(Bloomberg) — Chinese stocks fell to the verge of a correction in a sign of growing disappointment over the pace of stimulus rollout.

Most Read from Bloomberg

The CSI 300 Index ended the day 0.6% lower, bringing its declines from an Oct. 8 high to nearly 10%. A gauge of Chinese shares listed in Hong Kong swung between gains and losses before trading up 0.4% as of 3:36 p.m. local time.

The market has been on a roller-coaster ride since late September, when a series of stimulus measures by the central bank unleashed a burst of optimism that’s now quickly cooling. As Beijing takes its time detailing a fiscal spending plan, skepticism is growing whether authorities are willing to deploy greater firepower to turn around the economy and markets.

“This historic surge in momentum at the end of September is of course unsustainable, and given how fast markets rose, it can fall equally fast,” said Marvin Chen, a strategist at Bloomberg Intelligence. “But overall policy actions are moving in the right direction at a quicker pace and when the dust settles, China equities may still trade in a higher range than before.”

While a decline of 10% would push a benchmark into a technical correction, the extreme volatility gripping Chinese stocks of late has made such milestones less meaningful. The CSI 300 soared more than 30% in about three weeks since mid-September before losing momentum.

Chinese investors have been split over whether the rally has already peaked out, or whether there’s room for further gains.

In a fund manager survey by BofA Securities performed Oct. 4-10, roughly half of the respondents saw up to 10% upside potential for Chinese offshore stocks over the next six months, while another 33% saw gains between 10% to 20%.

Nearly a third of them said they are building exposure on signs of easing, up sharply from just 8% in the previous month. Still, three quarters of the respondents said the market is going through a “structural de-rating.”

Property Stocks

The next key event is a press briefing by the housing minister on Thursday, where authorities may provide more details of measures to support the country’s slumping property sector and bolster economic growth. Any disappointment from that event may reignite a selloff.

Chinese property stocks jumped ahead of the briefing, with a Bloomberg Intelligence gauge of developer shares gaining as much as 10% after shedding 7% on Tuesday. The sector has been at the center of investor focus, with stocks seeing wild swings as policy expectations waxed and waned.

Minister Ni Hong will be the latest senior economic official to speak in public about the government’s pivot toward stabilizing growth, after People’s Bank of China Governor Pan Gongsheng, Minister of Finance Lan Fo’an and the chairman of the country’s economic planning agency, Zheng Shanjie.

The last two pressers by the National Development and Reform Commission and the MoF “have been disappointing so there should be no reason to lift hopes for the briefing tomorrow,” said Vey-Sern Ling, managing director at Union Bancaire Privee.

–With assistance from Abhishek Vishnoi and Jake Lloyd-Smith.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.

Insider Unloading: Joanne D Smith Sells $173K Worth Of Delta Air Lines Shares

Joanne D Smith, EVP & Chief People Officer at Delta Air Lines DAL, reported an insider sell on October 15, according to a new SEC filing.

What Happened: Smith’s recent move involves selling 3,431 shares of Delta Air Lines. This information is documented in a Form 4 filing with the U.S. Securities and Exchange Commission on Tuesday. The total value is $173,131.

The latest market snapshot at Wednesday morning reveals Delta Air Lines shares up by 4.36%, trading at $55.03.

Delving into Delta Air Lines’s Background

Atlanta-based Delta Air Lines is one of the world’s largest airlines, with a network of over 300 destinations in more than 50 countries. Delta operates a hub-and-spoke network, where it gathers and distributes passengers across the globe through its biggest hubs in Atlanta, New York, Salt Lake City, Detroit, Seattle, and Minneapolis-St. Paul. Delta has historically earned most of its international revenue and profits from flying passengers over the Atlantic Ocean.

Delta Air Lines’s Economic Impact: An Analysis

Positive Revenue Trend: Examining Delta Air Lines’s financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 1.22% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Insights into Profitability:

-

Gross Margin: The company excels with a remarkable gross margin of 24.41%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Delta Air Lines’s EPS is notably higher than the industry average. The company achieved a positive bottom-line trend with a current EPS of 1.98.

Debt Management: Delta Air Lines’s debt-to-equity ratio is below the industry average at 1.79, reflecting a lower dependency on debt financing and a more conservative financial approach.

Exploring Valuation Metrics Landscape:

-

Price to Earnings (P/E) Ratio: With a lower-than-average P/E ratio of 7.31, the stock indicates an attractive valuation, potentially presenting a buying opportunity.

-

Price to Sales (P/S) Ratio: With a P/S ratio of 0.56 below industry standards, the stock shows potential undervaluation, making it an appealing investment option for those focusing on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Delta Air Lines’s EV/EBITDA ratio stands at 8.37, surpassing industry benchmarks. This places the company in a position with a higher-than-average market valuation.

Market Capitalization Analysis: With a profound presence, the company’s market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Why Insider Activity Matters in Finance

While insider transactions provide valuable information, they should be part of a broader analysis in making investment decisions.

In legal terms, an “insider” refers to any officer, director, or beneficial owner of more than ten percent of a company’s equity securities registered under Section 12 of the Securities Exchange Act of 1934. This can include executives in the c-suite and large hedge funds. These insiders are required to let the public know of their transactions via a Form 4 filing, which must be filed within two business days of the transaction.

When a company insider makes a new purchase, that is an indication that they expect the stock to rise.

Insider sells, on the other hand, can be made for a variety of reasons, and may not necessarily mean that the seller thinks the stock will go down.

The Insider’s Guide to Important Transaction Codes

For investors, a primary focus lies on transactions occurring in the open market, as indicated in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C signals the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Delta Air Lines’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At Abercrombie & Fitch's Recent Unusual Options Activity

Investors with a lot of money to spend have taken a bearish stance on Abercrombie & Fitch ANF.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don’t know. But when something this big happens with ANF, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga‘s options scanner spotted 9 uncommon options trades for Abercrombie & Fitch.

This isn’t normal.

The overall sentiment of these big-money traders is split between 33% bullish and 44%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $348,432, and 3 are calls, for a total amount of $137,710.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $135.0 to $200.0 for Abercrombie & Fitch during the past quarter.

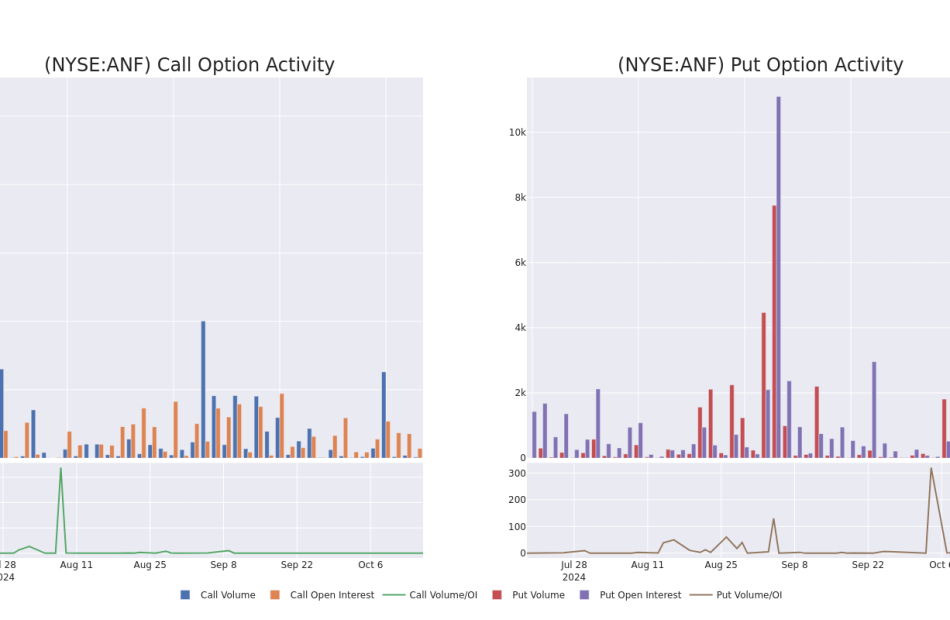

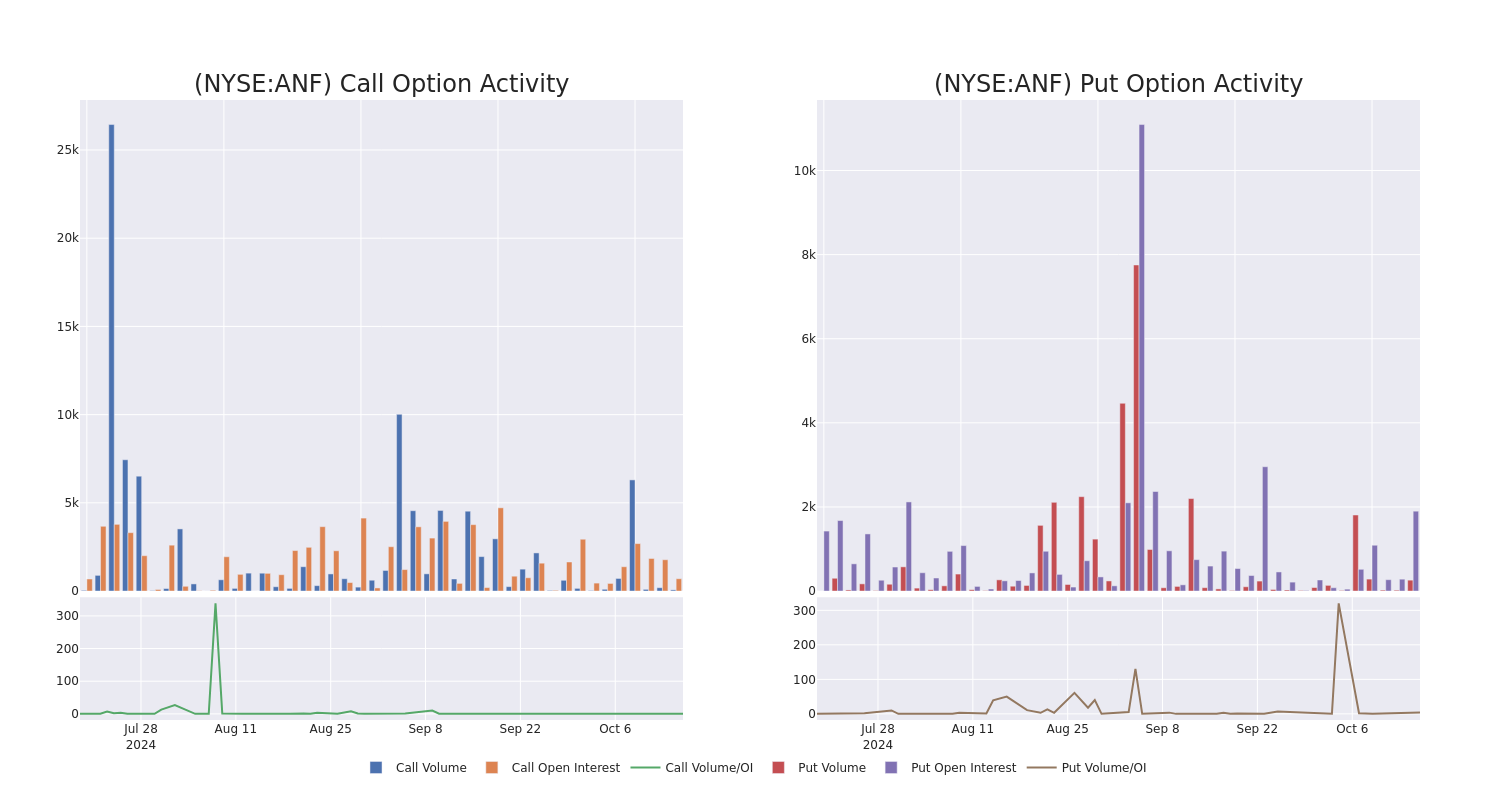

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Abercrombie & Fitch options trades today is 324.62 with a total volume of 326.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Abercrombie & Fitch’s big money trades within a strike price range of $135.0 to $200.0 over the last 30 days.

Abercrombie & Fitch Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANF | PUT | SWEEP | BEARISH | 11/22/24 | $23.1 | $21.0 | $23.1 | $180.00 | $168.6K | 1.3K | 103 |

| ANF | CALL | TRADE | BULLISH | 11/15/24 | $16.4 | $16.0 | $16.24 | $155.00 | $64.9K | 402 | 46 |

| ANF | PUT | TRADE | NEUTRAL | 01/16/26 | $37.6 | $37.0 | $37.35 | $165.00 | $56.0K | 7 | 15 |

| ANF | PUT | TRADE | BEARISH | 01/17/25 | $42.1 | $41.9 | $42.1 | $200.00 | $42.1K | 26 | 20 |

| ANF | CALL | TRADE | BEARISH | 06/20/25 | $41.5 | $40.3 | $40.75 | $150.00 | $40.7K | 75 | 10 |

About Abercrombie & Fitch

Abercrombie & Fitch Co is a specialty retailer that sells casual clothing, personal-care products, and accessories for men, women, and children. It sells direct to consumers through its stores and websites, which include the Abercrombie & Fitch, Abercrombie kids, and Hollister brands. Most stores are in the United States, but the company does have many stores in Canada, Europe, and Asia. All stores are leased. Abercrombie ships to well over 100 countries via its websites. The company sources its merchandise from dozens of vendors that are primarily located in Asia and Central America. Abercrombie has two distribution centers in Ohio to support its North American operations. It uses third-party distributors for sales in Europe and Asia.

In light of the recent options history for Abercrombie & Fitch, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Abercrombie & Fitch’s Current Market Status

- With a trading volume of 653,080, the price of ANF is up by 0.98%, reaching $161.81.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 34 days from now.

Expert Opinions on Abercrombie & Fitch

1 market experts have recently issued ratings for this stock, with a consensus target price of $195.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from JP Morgan persists with their Overweight rating on Abercrombie & Fitch, maintaining a target price of $195.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Abercrombie & Fitch options trades with real-time alerts from Benzinga Pro.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

An Overview of Texas Capital Bancshares's Earnings

Texas Capital Bancshares TCBI will release its quarterly earnings report on Thursday, 2024-10-17. Here’s a brief overview for investors ahead of the announcement.

Analysts anticipate Texas Capital Bancshares to report an earnings per share (EPS) of $0.95.

The market awaits Texas Capital Bancshares’s announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It’s important for new investors to understand that guidance can be a significant driver of stock prices.

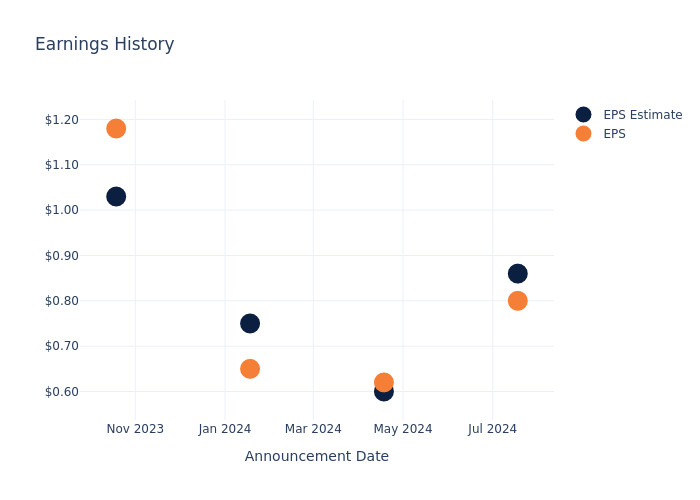

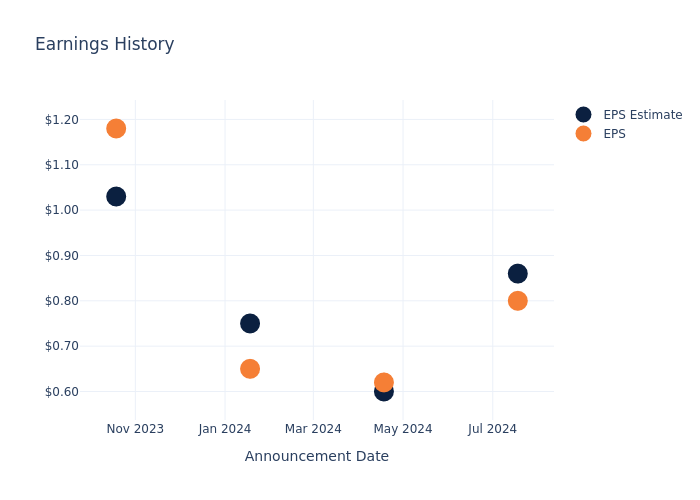

Earnings History Snapshot

During the last quarter, the company reported an EPS missed by $0.06, leading to a 0.06% drop in the share price on the subsequent day.

Here’s a look at Texas Capital Bancshares’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.86 | 0.60 | 0.75 | 1.03 |

| EPS Actual | 0.80 | 0.62 | 0.65 | 1.18 |

| Price Change % | -0.0% | 5.0% | 1.0% | -5.0% |

Market Performance of Texas Capital Bancshares’s Stock

Shares of Texas Capital Bancshares were trading at $77.57 as of October 15. Over the last 52-week period, shares are up 40.12%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

American Intl Gr's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bearish stance on American Intl Gr.

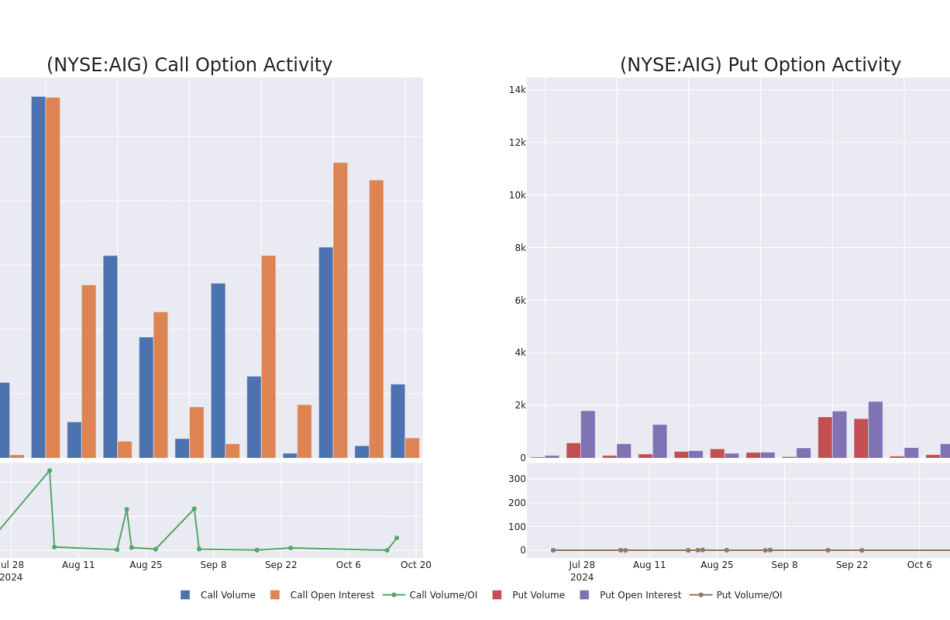

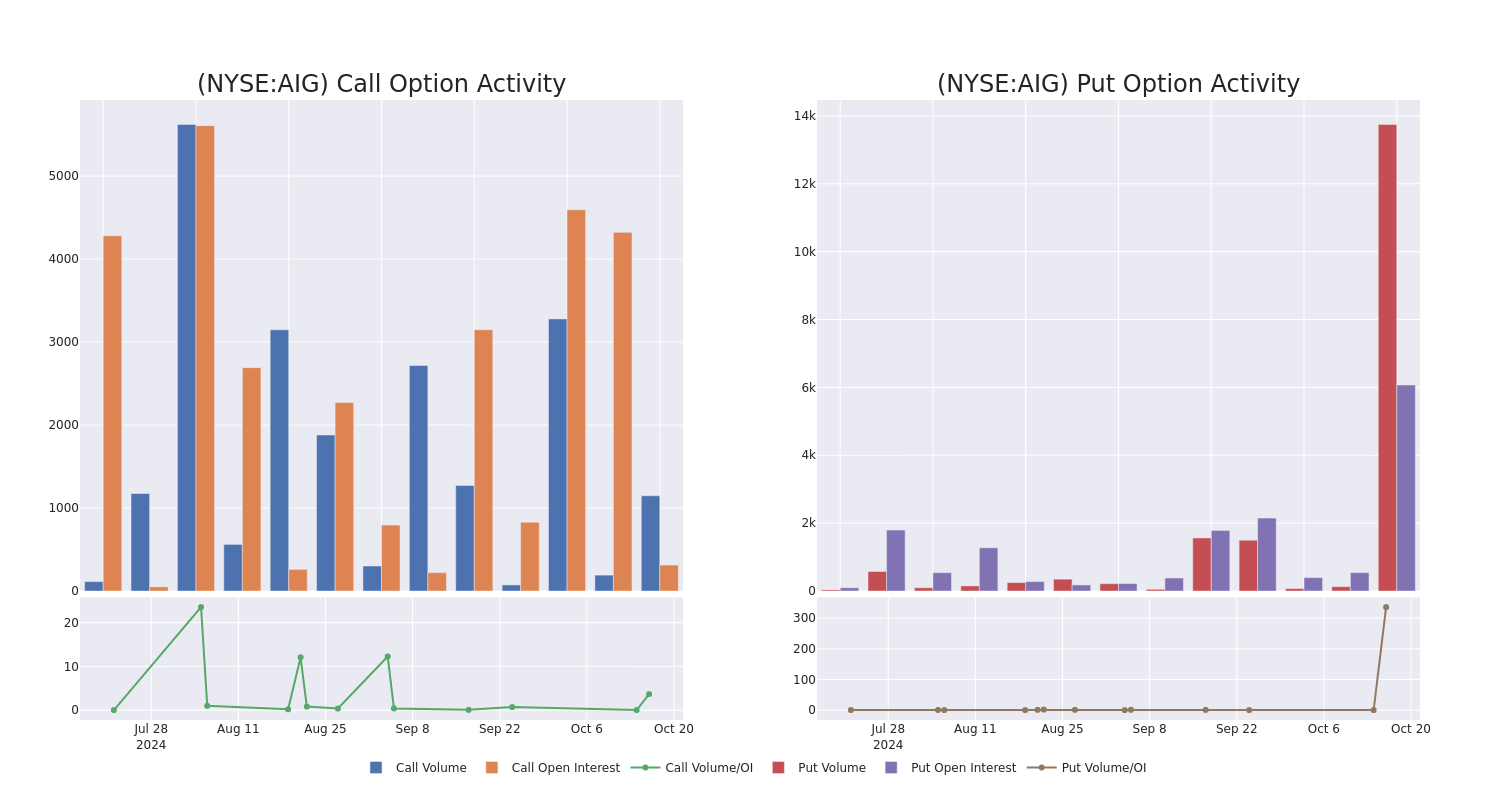

Looking at options history for American Intl Gr AIG we detected 11 trades.

If we consider the specifics of each trade, it is accurate to state that 45% of the investors opened trades with bullish expectations and 54% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $927,850 and 2, calls, for a total amount of $91,715.

Expected Price Movements

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $70.0 to $78.0 for American Intl Gr over the recent three months.

Analyzing Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in American Intl Gr’s options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to American Intl Gr’s substantial trades, within a strike price spectrum from $70.0 to $78.0 over the preceding 30 days.

American Intl Gr Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AIG | PUT | SWEEP | BULLISH | 12/20/24 | $2.2 | $2.15 | $2.15 | $75.00 | $430.0K | 3.0K | 1.8K |

| AIG | PUT | SWEEP | BEARISH | 12/20/24 | $1.05 | $0.95 | $1.05 | $70.00 | $105.0K | 3.0K | 3.2K |

| AIG | PUT | SWEEP | BEARISH | 11/01/24 | $1.25 | $1.15 | $1.2 | $77.00 | $100.4K | 9 | 1.3K |

| AIG | PUT | SWEEP | BEARISH | 11/01/24 | $1.25 | $1.2 | $1.25 | $77.00 | $70.2K | 9 | 1.3K |

| AIG | CALL | SWEEP | BEARISH | 02/21/25 | $10.0 | $9.9 | $9.9 | $70.00 | $53.4K | 157 | 55 |

About American Intl Gr

American International Group is one of the largest insurance and financial services firms in the world and has a global footprint. It operates through a wide range of subsidiaries that provide property, casualty, and life insurance. The company recently spun off its life insurance operations (Corebridge), but still retains a majority stake.

Following our analysis of the options activities associated with American Intl Gr, we pivot to a closer look at the company’s own performance.

Where Is American Intl Gr Standing Right Now?

- Currently trading with a volume of 889,881, the AIG’s price is up by 0.43%, now at $77.31.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 19 days.

Expert Opinions on American Intl Gr

5 market experts have recently issued ratings for this stock, with a consensus target price of $85.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from Jefferies has decided to maintain their Buy rating on American Intl Gr, which currently sits at a price target of $88.

* An analyst from BMO Capital downgraded its action to Market Perform with a price target of $84.

* An analyst from JP Morgan has elevated its stance to Overweight, setting a new price target at $89.

* An analyst from Evercore ISI Group persists with their In-Line rating on American Intl Gr, maintaining a target price of $78.

* Maintaining their stance, an analyst from UBS continues to hold a Buy rating for American Intl Gr, targeting a price of $88.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for American Intl Gr with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.