Why Is Nano Nuclear Energy Stock Gaining Today?

Nano Nuclear Energy Inc. NNE shares are trading higher on Wednesday.

In fact, shares of all nuclear-linked stocks are trading higher after Amazon Web Services announced plans to invest over $500 million in nuclear power.

AWS, Amazon’s cloud computing subsidiary, has signed three agreements to support nuclear energy development, including building Small Modular Reactors (SMRs).

This includes a deal with Energy Northwest for four SMRs generating up to 960 MW and partnerships with X-energy and Dominion Energy to explore additional projects in Virginia.

Read More: Nuclear Stocks Soar As Amazon Becomes Latest Tech Giant To Invest In Nuclear Power

The company has appointed John G. Vonglis, the former Chief Financial Officer of the U.S. Department of Energy and Acting Director of its Advanced Research Projects Agency-Energy, as the Chairman of its Executive Advisory Board for Strategic Initiatives.

Vonglis served as the Senate-confirmed Chief Financial Officer and Chief Risk Officer of the DOE from 2017 to 2019.

Last month, the firm announced the launch of NANO Nuclear Space to explore the potential commercial applications of its developing micronuclear reactor technology in space.

Nano Nuclear Energy said that NNS would optimize NANO’s existing reactor designs, including the “ZEUS” solid core battery and “ODIN” low-pressure coolant reactor, for potential use in cis-lunar space—the area between Earth and the Moon. The company said these technologies aim to support extraterrestrial power systems, human habitation and propulsion for long-distance missions.

Price Action: NNE shares are trading higher by 14% to $17.76 at last check Wednesday.

Photo by Sundry Photography via Shutterstock

Read Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

NYCB to be renamed Flagstar Financial as turnaround gathers pace

(Reuters) -New York Community Bancorp will rename itself as Flagstar Financial, the U.S. regional lender said on Tuesday, amid efforts to turn around its struggling business.

The bank came under pressure after it reported in January increased stress in its commercial real estate portfolio that also rekindled concerns over the health of the sector recovering from the failures of a slew of regional banks in 2023.

Under Joseph Otting, a former comptroller of the currency who was named CEO in March, NYCB has laid out a plan to return to profitability and vowed to shrink its balance sheet by reducing non-core assets.

The name change marks “another milestone in our ongoing transformation”, Otting said in a statement on Tuesday.

NYCB will also change its stock symbol to “FLG.” The name change will become effective on Oct. 25.

Flagstar Bank is a subsidiary of New York Community Bancorp. The lender announced its $2.6 billion acquisition of Flagstar in 2021.

(Reporting by Jaiveer Singh Shekhawat in Bengaluru; Editing by Sriraj Kalluvila and Alan Barona)

Uncovering Potential: M&T Bank's Earnings Preview

M&T Bank MTB is gearing up to announce its quarterly earnings on Thursday, 2024-10-17. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that M&T Bank will report an earnings per share (EPS) of $3.64.

Investors in M&T Bank are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

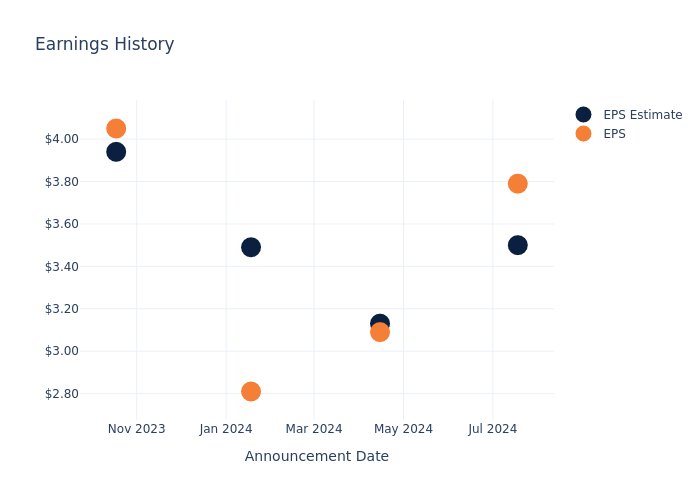

Historical Earnings Performance

In the previous earnings release, the company beat EPS by $0.29, leading to a 1.27% drop in the share price the following trading session.

Here’s a look at M&T Bank’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 3.50 | 3.13 | 3.49 | 3.94 |

| EPS Actual | 3.79 | 3.09 | 2.81 | 4.05 |

| Price Change % | -1.0% | -3.0% | 5.0% | -1.0% |

Tracking M&T Bank’s Stock Performance

Shares of M&T Bank were trading at $185.88 as of October 15. Over the last 52-week period, shares are up 57.78%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for M&T Bank visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Looking At WAVE Life Sciences's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on WAVE Life Sciences.

Looking at options history for WAVE Life Sciences WVE we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 53% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $251,490 and 10, calls, for a total amount of $481,968.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $7.5 to $15.0 for WAVE Life Sciences during the past quarter.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for WAVE Life Sciences options trades today is 608.71 with a total volume of 10,303.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for WAVE Life Sciences’s big money trades within a strike price range of $7.5 to $15.0 over the last 30 days.

WAVE Life Sciences Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WVE | PUT | TRADE | BULLISH | 01/17/25 | $2.15 | $1.7 | $1.7 | $12.50 | $170.0K | 1 | 1.0K |

| WVE | CALL | SWEEP | BEARISH | 11/15/24 | $2.5 | $1.95 | $2.0 | $15.00 | $84.8K | 3 | 1.9K |

| WVE | CALL | SWEEP | BEARISH | 01/17/25 | $7.9 | $7.5 | $7.7 | $7.50 | $77.0K | 510 | 111 |

| WVE | CALL | SWEEP | BULLISH | 01/17/25 | $7.7 | $7.4 | $7.5 | $7.50 | $75.0K | 510 | 212 |

| WVE | CALL | SWEEP | BEARISH | 10/18/24 | $5.9 | $5.6 | $5.67 | $7.50 | $56.9K | 1.3K | 114 |

About WAVE Life Sciences

WAVE Life Sciences Ltd is unlocking the broad potential of RNA medicines also known as oligonucleotides, it targeting ribonucleic acid (RNA), to transform human health. RNA medicines platform, PRISMTM, combines multiple modalities, chemistry innovation, and deep insights into human genetics to deliver scientific breakthroughs that treat both rare and prevalent disorders. Its toolkit of RNA-targeting modalities includes RNA editing, splicing, antisense silencing, and RNA interference, providing capabilities for designing and sustainably delivering candidates that optimally address disease biology. Its programs are for rare and prevalent diseases, including alpha-1 antitrypsin deficiency, obesity, Duchenne muscular dystrophy, and Huntington’s disease.

In light of the recent options history for WAVE Life Sciences, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

WAVE Life Sciences’s Current Market Status

- Currently trading with a volume of 13,020,486, the WVE’s price is up by 74.92%, now at $14.97.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 22 days.

Professional Analyst Ratings for WAVE Life Sciences

5 market experts have recently issued ratings for this stock, with a consensus target price of $14.4.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Consistent in their evaluation, an analyst from RBC Capital keeps a Sector Perform rating on WAVE Life Sciences with a target price of $7.

* An analyst from B. Riley Securities has revised its rating downward to Buy, adjusting the price target to $11.

* Maintaining their stance, an analyst from B. Riley Securities continues to hold a Buy rating for WAVE Life Sciences, targeting a price of $19.

* An analyst from JP Morgan has revised its rating downward to Overweight, adjusting the price target to $13.

* An analyst from HC Wainwright & Co. has decided to maintain their Buy rating on WAVE Life Sciences, which currently sits at a price target of $22.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for WAVE Life Sciences with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Fed's Bostic Projects Just A Single Rate Cut By January — One And Done, For Real?

Raphael Bostic, the President of the Atlanta Federal Reserve, has projected only one more interest rate cut this year.

What Happened: Bostic revealed his projection at an event in Atlanta, stating that he anticipates a single additional interest rate reduction of 25 basis points for the remainder of the year. This is a deviation from the median projection of 50 basis points more, Reuters reported on Wednesday.

“The median was for … 50 basis points more, above and beyond the 50 basis points that was done in September. My dot was 25 basis points more,” said Bostic.

The Federal Reserve had previously reduced rates by 50 basis points in September, with further reductions expected over the next year to alleviate some of the policy restraints imposed to lower inflation.

Bostic, however, emphasized that his projection is not set in stone and will be adjusted as necessary in response to incoming data on inflation and the job market.

See Also: Why Nasdaq, S&P 500 Could Start Tuesday’s Session In The Red

Why It Matters: The potential rate cut projection by Bostic follows a series of events that have shaped the Federal Reserve’s current stance. In August, Bostic expressed caution regarding rate cuts, emphasizing the need for confirmation from upcoming economic reports.

In September, Bostic faced scrutiny after a Jerome Powell-led investigation revealed breaches of FOMC rules, potentially affecting his impartiality.

Additionally, recent economic data has influenced the Fed’s cautious approach. The September jobs report showed stronger-than-expected payroll growth, complicating the case for aggressive rate cuts.

Moreover, Fed Governor Christopher J. Waller recently expressed concerns over inflation data, urging caution in proceeding with rate cuts.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ASML Holding Stock Continues To Slide, Other Chipmakers Bounce Back: 'We Are Still Quite Optimistic About AI'

ASML Holding N.V. ASML shares continue to move lower on Wednesday, adding to steep losses from Tuesday after the chip equipment maker cut its full-year outlook.

What Happened: ASML shares closed Tuesday down 16% after the company lowered its sales outlook due to weak demand for chips outside of AI.

ASML reported third-quarter net sales of 7.5 billion euros ($8.16 billion), beating analyst estimates of 7.12 billion euros, but the Dutch company lowered the high end of its full-year sales guidance from a range of 30 billion euros to 40 billion euros to a new range of 30 billion euros to 35 billion euros.

“While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover. It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, which is leading to customer cautiousness,” ASML CEO Christopher Fouquet said in the earnings release.

Check This Out: ASML Stock Plunges Further On Lower 2025 Sales Outlook: Analysts Break Down Semiconductor Challenges

To make matters worse, the company’s quarterly results were accidentally published a day ahead of the scheduled release time. On a conference call with investors and analysts Wednesday morning, Fouquet apologized for the mishap and called it “unfortunate, “according to MarketWatch.

The ASML CEO reportedly said on the call that the forecasted weakness in the semiconductor market is expected to mainly impact sales of its less advanced systems in China. He also explained that lower chip demand is primarily coming from the automobile and consumer electronics industries.

“We are still quite optimistic about AI,” Fouquet said on the call.

AI chip leader NVIDIA Corp NVDA fell more than 4% on Tuesday while other chipmakers like Advanced Micro Devices Inc AMD, Intel Corp INTC and Micron Technology Inc MU all faced significant selling pressure. Nvidia was up more than 2% on Wednesday, Micron was up about 4%, AMD was trading narrowly higher and Intel was down about 1% at the time of writing.

Bloomberg reported this week that the Biden administration was weighing capping sales of advanced AI chips from Nvidia and other U.S. chipmakers. That report also weighed on chip stocks on Tuesday.

ASML Price Action: ASML Holding shares were down 5.86% at $687.61 at the time of publication, according to Benzinga Pro.

Photo: Shutterstock.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

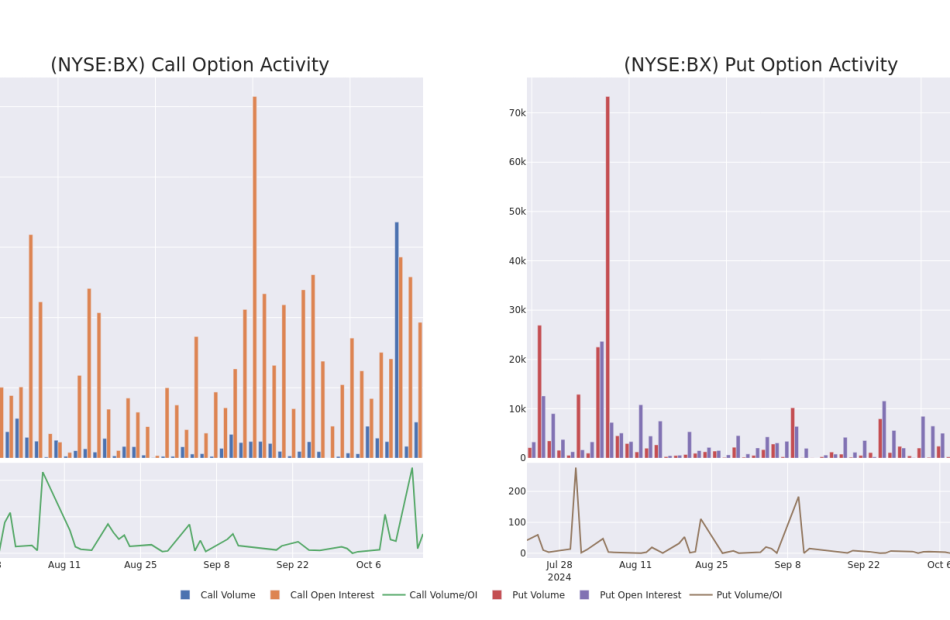

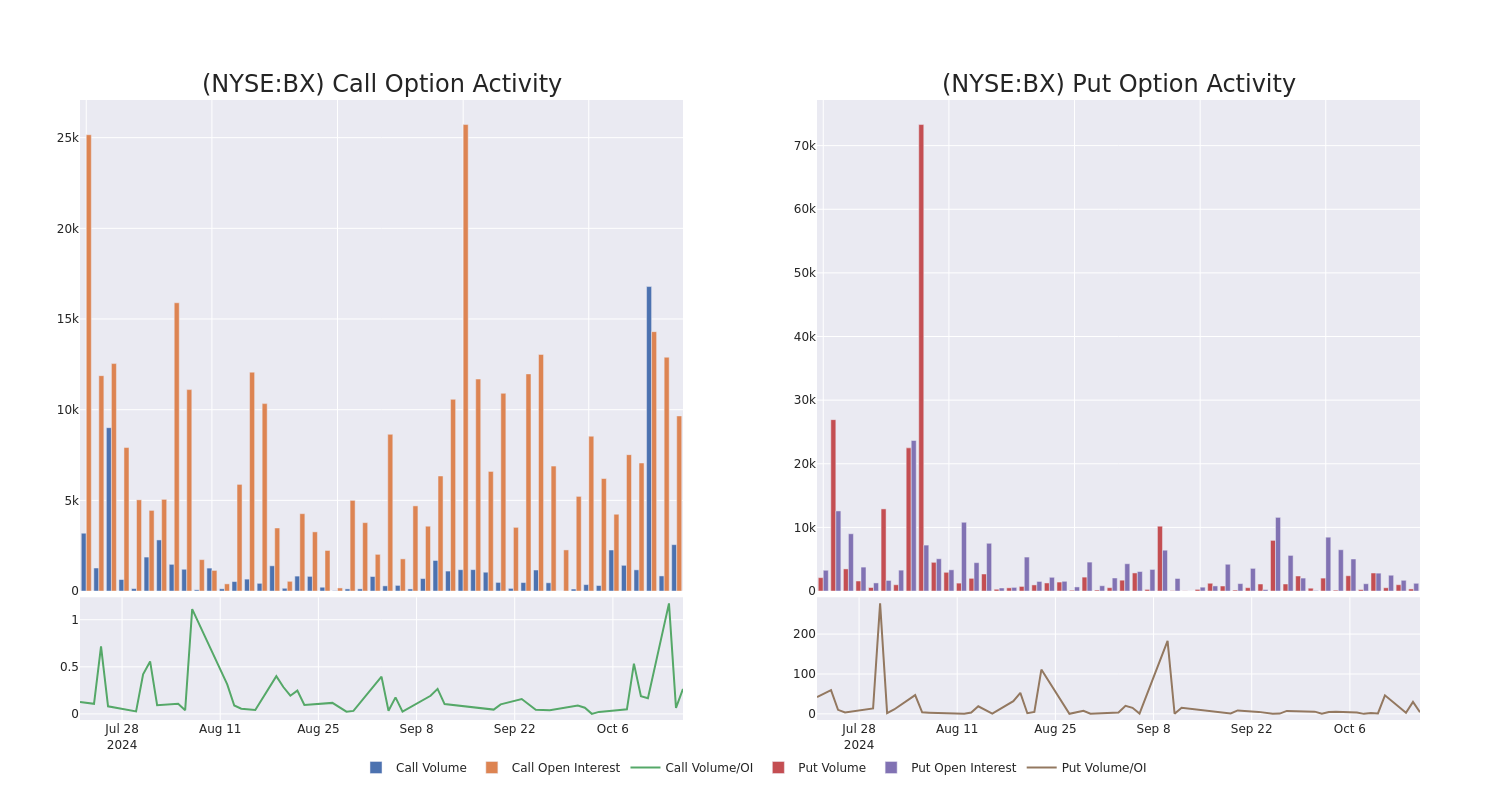

Check Out What Whales Are Doing With Blackstone

Financial giants have made a conspicuous bearish move on Blackstone. Our analysis of options history for Blackstone BX revealed 18 unusual trades.

Delving into the details, we found 44% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $322,390, and 12 were calls, valued at $740,378.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $125.0 to $195.0 for Blackstone over the recent three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Blackstone’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Blackstone’s whale trades within a strike price range from $125.0 to $195.0 in the last 30 days.

Blackstone Option Activity Analysis: Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| BX | CALL | TRADE | BEARISH | 01/15/27 | $16.25 | $15.1 | $15.1 | $195.00 | $149.4K | 0 | 100 |

| BX | CALL | TRADE | BEARISH | 10/18/24 | $2.32 | $2.18 | $1.98 | $160.00 | $110.6K | 2.7K | 1.2K |

| BX | CALL | TRADE | BULLISH | 10/18/24 | $4.7 | $4.45 | $4.7 | $155.00 | $94.0K | 2.7K | 221 |

| BX | PUT | SWEEP | BEARISH | 01/17/25 | $9.7 | $9.6 | $9.7 | $160.00 | $93.1K | 233 | 107 |

| BX | PUT | SWEEP | BEARISH | 01/15/27 | $33.6 | $31.0 | $33.6 | $175.00 | $84.0K | 31 | 60 |

About Blackstone

Blackstone is the world’s largest alternative-asset manager with $1.076 trillion in total asset under management, including $808.7 billion in fee-earning assets under management, at the end of June 2024. The company has four core business segments: private equity (25% of fee-earning AUM and 28% of base management fees), real estate (37% and 42%), credit and insurance (29% and 23%), and multi-asset investing (9% and 7%). While the firm primarily serves institutional investors (87% of AUM), it also caters to clients in the high-net-worth channel (13%). Blackstone operates through 25 offices in the Americas (8), Europe and the Middle East (9), and the Asia-Pacific region (8).

After a thorough review of the options trading surrounding Blackstone, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Blackstone

- Currently trading with a volume of 1,180,589, the BX’s price is up by 2.06%, now at $159.54.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 1 days.

What The Experts Say On Blackstone

5 market experts have recently issued ratings for this stock, with a consensus target price of $154.2.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

* Maintaining their stance, an analyst from Barclays continues to hold a Equal-Weight rating for Blackstone, targeting a price of $155.

* Consistent in their evaluation, an analyst from Goldman Sachs keeps a Neutral rating on Blackstone with a target price of $135.

* In a cautious move, an analyst from Piper Sandler downgraded its rating to Neutral, setting a price target of $149.

* Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Blackstone, targeting a price of $177.

* An analyst from Evercore ISI Group persists with their Outperform rating on Blackstone, maintaining a target price of $155.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Blackstone, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Chief Financial Officer Of IDT Makes $114K Sale

MARCELO FISCHER, Chief Financial Officer at IDT IDT, disclosed an insider sell on October 15, according to a recent SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Tuesday showed that FISCHER sold 2,406 shares of IDT. The total transaction amounted to $114,787.

IDT‘s shares are actively trading at $46.59, experiencing a down of 0.38% during Wednesday’s morning session.

Discovering IDT: A Closer Look

IDT Corp is a multinational holding company. It primarily operates in the telecommunications and payment industries. It has four reportable business segments, Fintech, National Retail Solutions & net2phone and Traditional Communications, The Fintech segment is comprised of National Retail Solutions (NRS), an operator of a nationwide point of sale (POS) network providing payment processing, digital advertising, transaction data, and ancillary services, and BOSS Money, a provider of international money remittance and related value/payment transfer services. The net2phone segment provides unified cloud communications and telephony services to business customers.

Understanding the Numbers: IDT’s Finances

Revenue Growth: Over the 3 months period, IDT showcased positive performance, achieving a revenue growth rate of 3.07% as of 31 July, 2024. This reflects a substantial increase in the company’s top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Communication Services sector.

Exploring Profitability:

-

Gross Margin: The company issues a cost efficiency warning with a low gross margin of 33.09%, indicating potential difficulties in maintaining profitability compared to its peers.

-

Earnings per Share (EPS): IDT’s EPS lags behind the industry average, indicating concerns and potential challenges with a current EPS of 1.45.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.01.

Valuation Overview:

-

Price to Earnings (P/E) Ratio: IDT’s current Price to Earnings (P/E) ratio of 18.41 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: The Price to Sales ratio is 0.99, which is lower than the industry average. This suggests a possible undervaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): The company’s EV/EBITDA ratio 12.01 is above the industry average, suggesting that the market values the company more highly for each unit of EBITDA. This could be attributed to factors such as strong growth prospects or superior operational efficiency.

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Unmasking the Significance of Insider Transactions

Investors should view insider transactions as part of a multifaceted analysis and not rely solely on them for decision-making.

Exploring the legal landscape, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities, as stipulated by Section 12 of the Securities Exchange Act of 1934. This encompasses executives in the c-suite and major hedge funds. These insiders are required to report their transactions through a Form 4 filing, which must be submitted within two business days of the transaction.

Highlighted by a company insider’s new purchase, there’s a positive anticipation for the stock to rise.

But, insider sells may not necessarily indicate a bearish view and can be motivated by various factors.

Important Transaction Codes

Surveying the realm of stock transactions, investors often give prominence to those unfolding in the open market, systematically detailed in Table I of the Form 4 filing. A P in Box 3 indicates a purchase, while S signifies a sale. Transaction code C denotes the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of IDT’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.