United Rentals's Options: A Look at What the Big Money is Thinking

Deep-pocketed investors have adopted a bullish approach towards United Rentals URI, and it’s something market players shouldn’t ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in URI usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga’s options scanner highlighted 17 extraordinary options activities for United Rentals. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 52% leaning bullish and 23% bearish. Among these notable options, 2 are puts, totaling $60,500, and 15 are calls, amounting to $601,221.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $720.0 to $940.0 for United Rentals during the past quarter.

Insights into Volume & Open Interest

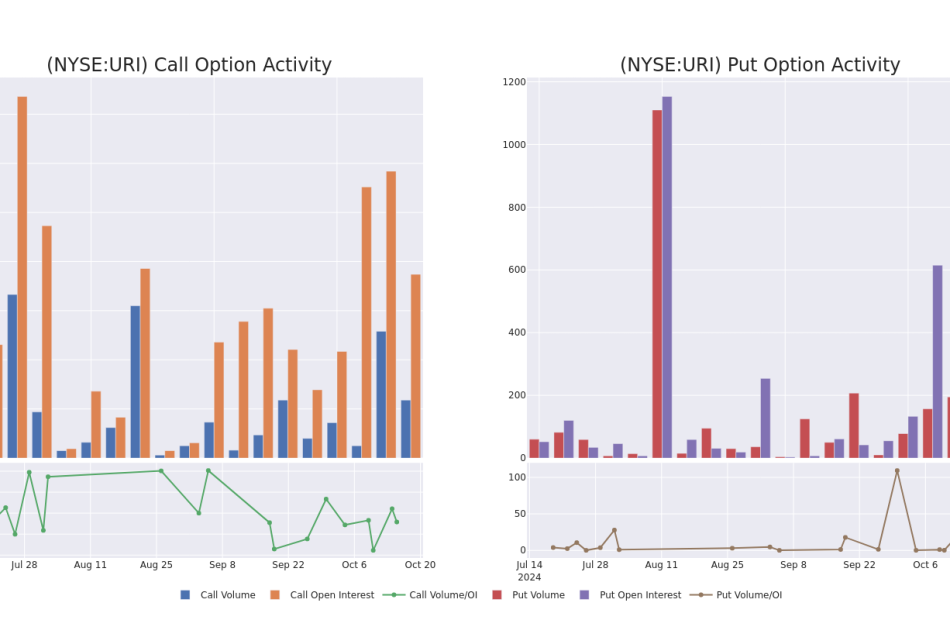

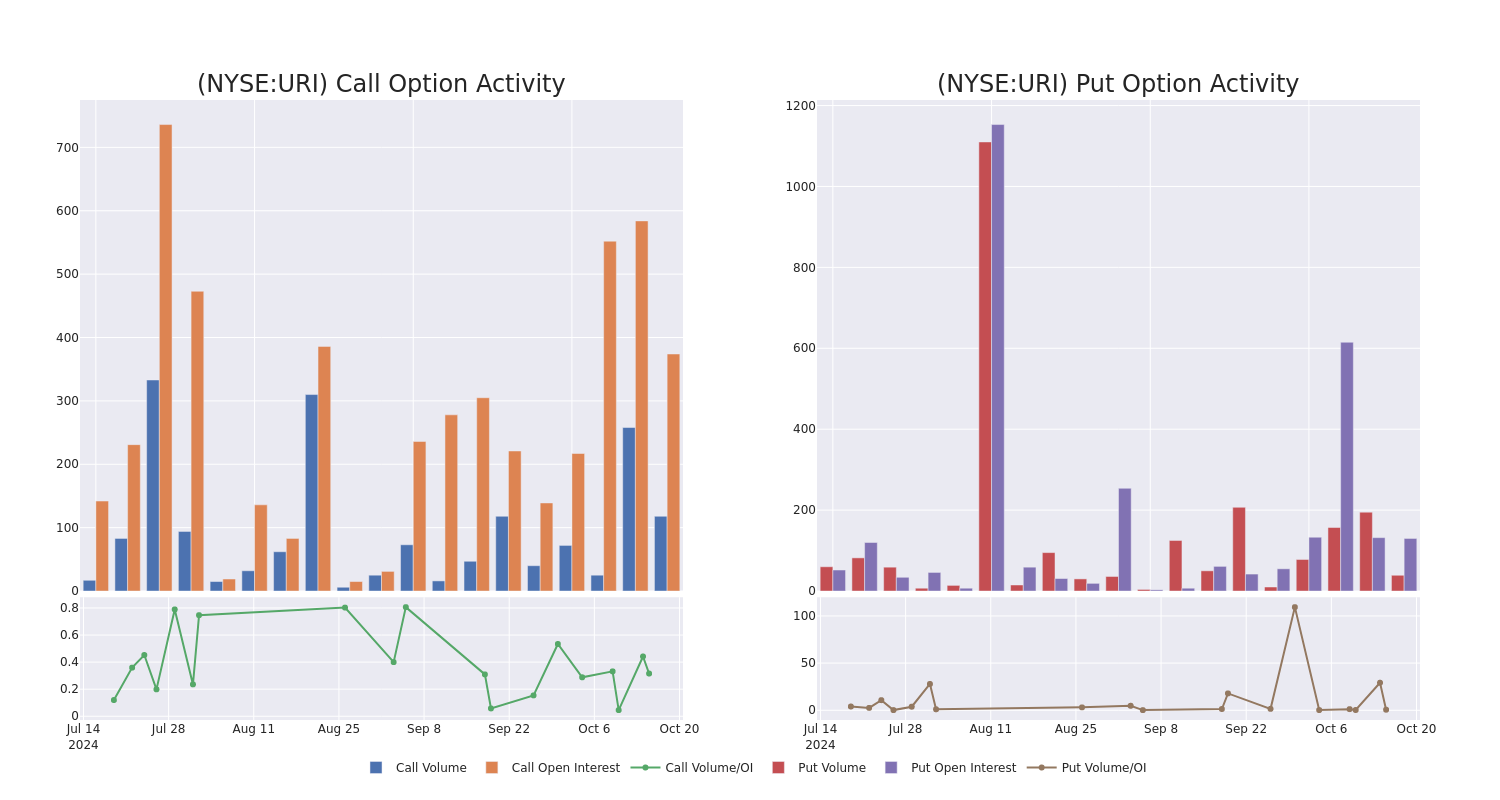

In today’s trading context, the average open interest for options of United Rentals stands at 127.71, with a total volume reaching 196.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in United Rentals, situated within the strike price corridor from $720.0 to $940.0, throughout the last 30 days.

United Rentals Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| URI | CALL | TRADE | NEUTRAL | 11/15/24 | $63.0 | $59.3 | $61.0 | $820.00 | $61.0K | 245 | 11 |

| URI | CALL | TRADE | BULLISH | 12/20/24 | $54.1 | $52.6 | $53.6 | $860.00 | $58.9K | 38 | 28 |

| URI | CALL | TRADE | BULLISH | 12/20/24 | $22.7 | $19.5 | $22.7 | $940.00 | $56.7K | 7 | 25 |

| URI | CALL | TRADE | BULLISH | 11/15/24 | $56.1 | $50.9 | $54.0 | $830.00 | $54.0K | 629 | 11 |

| URI | CALL | SWEEP | BEARISH | 12/20/24 | $51.9 | $49.9 | $50.32 | $860.00 | $50.3K | 38 | 38 |

About United Rentals

United Rentals is the world’s largest equipment rental company. It principally operates in the United States and Canada, where it commands approximately 15% share in a highly fragmented market. It serves three end markets: general industrial, commercial construction, and residential construction. Like its peers, United Rentals historically has provided its customers with equipment that was intermittently used, such as aerial equipment and portable generators. As the company has grown organically and through hundreds of acquisitions since it went public in 1997, its catalog (fleet size of $21 billion) now includes a range of specialty equipment and other items that can be rented for indefinite periods.

In light of the recent options history for United Rentals, it’s now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of United Rentals

- Currently trading with a volume of 138,882, the URI’s price is up by 1.97%, now at $850.07.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 7 days.

Professional Analyst Ratings for United Rentals

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $941.3333333333334.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* An analyst from JP Morgan has decided to maintain their Overweight rating on United Rentals, which currently sits at a price target of $940.

* Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for United Rentals, targeting a price of $954.

* An analyst from Citigroup has decided to maintain their Buy rating on United Rentals, which currently sits at a price target of $930.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for United Rentals with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Top Income Stocks Offering Big Dividend Yields and Future Growth

Combining growth and income can be extremely valuable when investing in the stock market. While dividends can provide a stable and consistent stream of cash, the potential for growth can lead to capital appreciation. These three stocks have provided significant income to shareholders and are expected to keep doing so. Additionally, they show avenues for solid growth.

Frontline: Income the Size of an Oil Tanker

First up is Frontline PLC FRO. Frontline operates a fleet of oil tankers. As of Jun. 30, 2024, the company operated 82 vessels. The company operates these ships using various ownership structures. These include outright ownership, leasing, and charter agreements. Over the past three years, the company’s trailing twelve-month revenues have seen very strong growth. Revenue has achieved a compound annual growth rate of 35% over that period.

This has coincided with the company’s share price rising 175% over the last three years. That big rise in share price has also given shareholders big dividends. Over the past twelve months, the company’s dividend yield is 7.9%. Its dividend yield has fluctuated widely over time from 0% to upwards of 20%. However, over the last 10 years, its average is 7.2%.

In addition, analysts see the company maintaining strong revenue and earnings per share growth. Analysts expect those figures to rise at a compound annual rate of 20.8% and 9.7%, respectively. Furthermore, Wall Street analysts see solid upside in the stock despite its strong rise in recent years. The average price target for the company implies a 16% upside from its current level. A recent upgrade by BTIG Research supports this potential upside. The firm moved its rating from Neutral to Buy, placing a $30 target on Frontline.

It is important to note that many of Frontline’s vessels, particularly its largest ones, transport oil from the Middle East to other regions. This adds geopolitical risk to the firm.

Blackstone: 3% Dividend Yield Combined with A Bottoming Market?

Next up is Blackstone BX. The financial services company is the largest alternative asset manager in the world. The company manages various, mostly private, investment funds. They focus on real estate, private equity, infrastructure, and hedge fund strategies. It generates revenue from fees that it charges for managing these funds, as well as from incentive fees generated when the funds perform well. Over the past year, the company has achieved strong share price returns and provided a notable amount of dividend income.

Shares are up 42%, and the company’s trailing twelve-month dividend yield is 2.3%. Analysts project that figure will rise by 3% in the next twelve-month period. On average, analysts expect the company’s revenue and earnings per share to continue growing strongly over the next two years. The expected compound annual growth rates for these metrics are 24% and 22%, respectively.

Some evidence shows that the private investment fund industry may be nearing a bottom. If current trends continue, the amount of capital raised for private equity and venture capital funds in 2024 will be the lowest since 2016. The number of these funds launched in the first half of 2024 is down 47% compared to the first half of 2023. Additionally, falling interest rates have historically led to more deals in this industry. Continued falls in interest rates would increase demand for new Blackstone funds, all else being equal. Additionally, the fact that the industry may be at a fundraising bottom could provide a strong tailwind going forward.

Seagate: More Data Means More Storage

Last up is Seagate Technology STX. Seagate makes hardware that stores data on computers. This includes things like hard drives and solid-state drives (SSDs). These devices are where files, videos, and various other types of information are stored on a computer.

Seagate mainly sells its storage solutions to large customers, like data centers. “Mass capacity” customers that require large-scale solutions make up over 90% of the storage Seagate sells. One might consider the company semiconductor-adjacent. Its products rely on semiconductors made by companies like Samsung.

As the world becomes more digitized, there must be more hardware to store digital information. The company cites an International Data Corporation report stating that increased digitization and increased information created by AI will drive demand for data storage. The report expects storage needs to rise by 24% annually through 2028. Analysts are projecting the company’s revenue to rise by 26% annually over the next two years. Additionally, Seagate is expected to provide a respectable dividend yield of 2.6% over the next twelve months.

The article “Top Income Stocks Offering Big Dividend Yields and Future Growth” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Probiotics Industry Growth Anticipating $105.7 Billion by 2029 with an Impressive 8.2% CAGR

Delray Beach, FL, Oct. 16, 2024 (GLOBE NEWSWIRE) — The probiotics market is poised for significant growth, driven by increasing consumer awareness, technological advancements, and a rising demand for functional foods. As the industry evolves, innovative products and applications are expected to cater to diverse consumer needs, ensuring a healthy and thriving market landscape in the years to come.

The probiotics market size is on a remarkable growth trajectory, projected to reach USD 105.7 billion by 2029, up from USD 71.2 billion by 2024, reflecting a CAGR of 8.2% during this period, according to a recent report published by MarketsandMarkets™. This expansion is driven by a growing consumer interest in preventive healthcare, with probiotics increasingly perceived as a natural means to enhance gut health and digestion. Consumer awareness of gut health issues is escalating, with more individuals seeking potential relief through probiotic consumption. This trend is leading to a significant demand for functional foods fortified with probiotics, expanding options beyond traditional supplements. The increased prevalence of digestive disorders, such as irritable bowel syndrome (IBS) and inflammatory bowel disease (IBD), further fuels this growth as millions look for natural remedies to alleviate symptoms.

Technological Innovations Driving Probiotics Market Growth

Technological advancements, particularly in microencapsulation, are revolutionizing the probiotics market. This innovation addresses challenges related to product stability and shelf life, as microencapsulation provides a protective barrier for probiotic bacteria against harsh environmental conditions, enhancing their viability and effectiveness. As a result, this technology not only extends the shelf life of probiotic products but also allows for their incorporation into a wider range of food and beverage applications, catering to diverse consumer preferences.

Want to dive deeper? Get your PDF copy today!

Human Segment Growth Driven by Awareness and Innovation

The human segment is experiencing predominant growth due to rising awareness of gut health and the gut microbiome’s influence on overall well-being. Continuous product innovation, including personalized formulations targeting specific health concerns, has further propelled market growth. Probiotics have transcended traditional supplements and yogurt, finding applications in fortified foods, beverages, and even topical products.

Asia Pacific’s Probiotics Market: An Overview of Leading Brands and Innovations

The APAC probiotics market has emerged as a dominant player, with established brands like Yakult Honsha Co., Ltd. cultivating a culture of probiotic consumption. The region also features a strong presence of other companies, including Morinaga Milk Industry CO., LTD. and Meiji Holdings Co., Ltd.. Growing health consciousness and awareness of the gut microbiome’s health impact further drive demand for probiotics addressing various health concerns.

The region’s market is characterized by an increasing embrace of innovation, with probiotics diversifying into fortified foods, beverages, topical applications, and even pet probiotics. The popularity of e-commerce, favorable regulatory environments, and government initiatives promoting preventive healthcare and healthy lifestyles contribute to the region’s robust market ecosystem.

Distribution Channels: Supermarkets and Hypermarkets

Hypermarkets and supermarkets dominate the distribution of probiotics, offering unparalleled convenience and a wide variety of products. These retail formats cater to busy consumers seeking to incorporate probiotic products into their grocery shopping. Their expansive product offerings, including various brands and formulations, enable informed decision-making tailored to individual health goals.

The Future of Probiotics: Innovations in Functional Food and Beverage Offerings

Consumer demand for convenient and proactive wellness solutions has significantly boosted the popularity of probiotic-fortified products, including yogurts, kefir, kombucha, and enhanced beverages. These products provide an easy and enjoyable means for individuals to incorporate probiotics into their daily routines. They resonate with the growing trend of preventive healthcare, appealing to consumers who wish to take a proactive approach to their health and well-being. This segment thrives on continuous innovation and diversification, as manufacturers introduce a variety of new probiotic-infused options to satisfy different taste preferences and dietary requirements. Offerings now include probiotic-infused waters, shots, snack bars, and chocolates, catering to diverse consumer demographics and lifestyle choices, such as vegan and lactose-free diets.

Probiotic Leaders: The Leading Brands Shaping the Future of Gut Health

- Probi (Sweden)

- Nestlé (Switzerland)

- ADM (US)

- Danone (France)

- International Flavors & Fragrances Inc. (US)

- Yakult Honsha Co., Ltd. (Japan)

- BioGaia (Sweden)

- MORINAGA MILK INDUSTRY CO., LTD. (Japan)

- Meiji Holdings Co., Ltd. (Japan)

- Lifeway Foods, Inc. (US)

- Adisseo (France)

Rising Digestive Health Awareness to Propel Growth in the US Probiotics Industry

The U.S. probiotics industry is witnessing a significant surge in demand for products that promote digestive health, driven by a growing awareness of how dietary choices affect overall well-being. This increasing interest in gut health can be attributed to several factors, including a shift towards preventive healthcare, an aging population, and a rising preference for natural and holistic wellness approaches.

Make an Inquiry to Address your Specific Business Needs

Expert Guidance Awaits: Let Us Help You in Understanding!

- What are the Known and Unknown Adjacencies Impacting the Probiotics Market

- Who will be your Top Customer; what will make them switch?

- Defend your Market Share or Win Competitors

- What will your New Revenue Sources be?

Adjacent Markets

About MarketsandMarkets™ MarketsandMarkets™ has been recognized as one of America's best management consulting firms by Forbes, as per their recent report. MarketsandMarkets™ is a blue ocean alternative in growth consulting and program management, leveraging a man-machine offering to drive supernormal growth for progressive organizations in the B2B space. We have the widest lens on emerging technologies, making us proficient in co-creating supernormal growth for clients. Earlier this year, we made a formal transformation into one of America's best management consulting firms as per a survey conducted by Forbes. The B2B economy is witnessing the emergence of $25 trillion of new revenue streams that are substituting existing revenue streams in this decade alone. We work with clients on growth programs, helping them monetize this $25 trillion opportunity through our service lines - TAM Expansion, Go-to-Market (GTM) Strategy to Execution, Market Share Gain, Account Enablement, and Thought Leadership Marketing. Built on the 'GIVE Growth' principle, we work with several Forbes Global 2000 B2B companies - helping them stay relevant in a disruptive ecosystem. Our insights and strategies are molded by our industry experts, cutting-edge AI-powered Market Intelligence Cloud, and years of research. The KnowledgeStore™ (our Market Intelligence Cloud) integrates our research, facilitates an analysis of interconnections through a set of applications, helping clients look at the entire ecosystem and understand the revenue shifts happening in their industry. To find out more, visit www.MarketsandMarkets™.com or follow us on Twitter, LinkedIn and Facebook. Contact: Mr. Rohan Salgarkar MarketsandMarkets Inc. 1615 South Congress Ave. Suite 103, Delray Beach, FL 33445 USA : 1-888-600-6441 UK +44-800-368-9399 Email: sales@marketsandmarkets.com Visit Our Website: https://www.marketsandmarkets.com/

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ESG Risk Rating 2024: Techem achieves top ranking again

- Morningstar Sustainalytics, a global ESG data, research and ratings provider, rates Techem’s ESG risk at 9.6 and thus as “negligible”

- Internationally, this puts Techem in the top 3 percent of over 16,000 companies

- Within the sub-industry “Business Support Services,” Techem ranks 6th out of 186 worldwide

ESCHBORN, Germany, Oct. 16, 2024 /PRNewswire/ — Techem, one of the leading energy service providers in the real estate industry, has been awarded an ESG risk score of 9.6 by Morningstar Sustainalytics, a global ESG data, research and ratings provider, and thus a “Negligible Risk” for the second time in a row. This means the Eschborn-based energy service provider once again ranks in the best possible of five categories and remains among the top 3 percent of over 16,000 companies from various sectors internationally. Within the sub-industry “Business Support Services,” Techem came in 6th place out of 186 and within the “Commercial Services” industry in 50th place out of 475 companies worldwide.

ESG risk rating as a reliable indicator for the economy

The ESG risk rating is comprised of the assessment of the ESG risk exposure and the corresponding management. With a score of 27.5 in the area of ESG risk exposure (“Low”) and 68.2 in the area of ESG risk management (“Strong”), Techem is at the top in both cases. ESG risk management was assessed on the basis of eight different criteria, with Techem achieving the best results in the areas of “emissions, wastewater and waste”, “data protection” and “cyber security”.

“As a partner at eye level, we support our customers in facing the challenges of the energy transition and contribute to the decarbonization of the building stock both along our value chain and with regard to our sustainability-related activities. We have aligned our sustainability program with clear targets and key figures, thus ensuring the effective implementation of our sustainability strategy,” explains Techem CFO Dr.-Ing. Carsten Sürig.

Strong partners in achieving sustainability goals with TPG and GIC

At the beginning of October, TPG Rise Climate, a fund specializing in climate investments as part of TPG’s global impact investing platform, and GIC, a leading global investor in infrastructure, signed an agreement to acquire the Techem Group. TPG Rise Climate, one of the world’s largest private equity funds for global climate solutions, invests in companies like Techem, which has an increasingly comprehensive decarbonization offering driven by new digital services and is consistently driving this forward. Together with its new partners TPG and GIC, Techem will now build on this foundation and further expand and advance its position as a leading platform for the digitalization and decarbonization of the building sector in Europe. Techem will also benefit from TPG’s and GIC’s expertise in effective decarbonization in achieving its own ambitious sustainability goals and thus build on the successful efforts of the previous year.

“Regulatory authorities, banks and investors are increasingly pushing for clear sustainability strategies and are therefore making companies more accountable. For Techem, the ESG Risk Rating is therefore an important indicator of our sustainability performance and a key source of information for capital markets and investors. With TPG and GIC, we now also have strong new partners who will help us make important progress in implementing our sustainability strategies,” Sürig emphasizes.

ESG at Techem: a holistic approach

In fiscal year 2022 / 2023, Techem focused even more strongly on the impact of its own devices on the environment and climate in the “E” dimension with an updated “Devices Action Plan” and reduced emissions in its own value chain (Scope 3) by 18 %. The company is also pursuing specific goals in the “S” dimension and has set out clear diversity principles in a Group-wide diversity and anti-discrimination policy. In addition, Techem carried out the first gender pay equality audit in Germany last year, which shows the percentage pay gap between men and women, and established a procedure for determining and reporting this. In the “G” dimension, the Eschborn-based energy service provider focuses on continuous risk minimization. There were no violations of competition law regulations or significant violations of laws and regulations in the economic or social area within the Techem Group in fiscal year 2023. There were also no significant cases of corruption.

Sustainability as an integral component

In order to make the maximum contribution to all relevant reference groups, sustainability is also seen as a cross-cutting issue at Techem and is anchored across all areas of the company. Katharina Bathe-Metzler has been responsible for Sustainability, Communications & Public Affairs since March 2023 and coordinates the company’s sustainability strategy in this role. The Sustainability department manages sustainability-related activities and continuously develops them further together with the Techem Research Institute on Sustainability and the Finance department. Bathe-Metzler reports to CEO Matthias Hartmann, who heads the Sustainability Council and is responsible for sustainability performance.

About the ESG risk rating:

The ESG Risk Rating from Morningstar Sustainalytics provides clear insights into the ESG risk of companies by assessing the extent of an organization’s unmanaged ESG risk. On a scale from negligible risk (Techem’s rating) to high risk, the rating assesses the ESG performance of over 16,000 companies worldwide. The Sustainalytics rating scale ranges from 0 to 40+,* with Techem receiving a rating of 9.6 for fiscal year 2023 / 2024, putting it in the best category. Further information can be found at: www.sustainalytics.com.

* Negligible (0-10), Low (10-20), Medium (20-30), High (30-40) and Severe (40+).

Copyright ©2024 Morningstar Sustainalytics. All rights reserved. This press release contains information developed by Sustainalytics (www.sustainalytics.com). Such information and data are proprietary of Sustainalytics and/or its third-party suppliers (Third Party Data) and are provided for informational purposes only. They do not constitute an endorsement of any product or project, nor an in-vestment advice and are not warranted to be complete, timely, accurate or suitable for a particular purpose. Their use is subject to conditions available at https://www.sustainalytics.com/legal-disclaimers.

About Techem

Techem is a leading service provider for smart and sustainable buildings. The company’s services cover the topics of energy management and resource conservation, healthy living and process efficiency in properties. Founded in 1952, Techem is now active in 18 countries with over 4,000 employees and services more than 13 million dwellings. Techem offers efficiency improvements along the entire value chain of heat and water in real estate and regenerative supply concepts and solutions. As the market leader in remote radio detection of energy consumption in homes, Techem continues to drive networking and digital processes in real estate. Modern multi sensor devices, radio smoke detectors with remote inspection, metering point operation, charging infrastructure for electromobility and services related to improving drinking water quality in properties complement the solution portfolio for the housing as well as the commercial real estate industry. Further information can be found at https://www.techem.com/corp/en/about-us or follow us on LinkedIn.

Press contacts

Janina Schmidt

Head of Corporate Communications

Techem Energy Services GmbH

Phone: +49 (0) 174 / 744-4137

E-Mail: janina.schmidt@techem.de

Katharina Bathe-Metzler

Head of Sustainability, Communications & Public Affairs

Techem Energy Services GmbH

Phone: +49 (0) 1522 / 413-6702

E-Mail: katharina.bathe-metzler@techem.de

Photo – https://stockburger.news/wp-content/uploads/2024/10/Techem_CFO_Carsten_Suerig.jpg

Logo – https://stockburger.news/wp-content/uploads/2024/10/Techem_Logo.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/esg-risk-rating-2024-techem-achieves-top-ranking-again-302277764.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/esg-risk-rating-2024-techem-achieves-top-ranking-again-302277764.html

SOURCE Techem Energy Services GmbH

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pyrrhic Victory And Major Setbacks In Hemp Industry: New Jersey And California Rulings Stir Uncertainty For Stakeholders

Hemp regulation is among the most important regulation battles underway in the cannabis space at the moment. This ongoing conflict, which involves multiple stakeholders, has recently experienced various developments. Let’s review them.

In early October, hemp stakeholders faced significant challenges in both California and New Jersey as court rulings largely upheld strict regulations on intoxicating hemp products.

A federal judge in California ruled against hemp producers, affirming the state’s right to enforce emergency regulations that restrict the sale of intoxicating hemp substances, including synthetic products like delta-8 THC and HHC.

Meanwhile, in New Jersey, hemp businesses gained a partial victory when a judge found parts of the state’s new law violated federal commerce regulations, but most of the law remains intact.

California’s Regulatory Win Puts Hemp On Notice

California’s hemp industry suffered a major defeat when Judge Stephen I. Goorvitch ruled in favor of the state’s emergency regulations aimed at controlling intoxicating hemp products.

The restrictions, enacted to protect young consumers, include bans on the sale of THC-containing products to those under 21 and limits on servings per package. Non-intoxicating CBD products, however, remain available for purchase.

The U.S. Hemp Roundtable which led the legal challenge, argued that the regulations would harm medicinal CBD users by limiting product availability. The court dismissed these concerns, with Goorvitch noting that THC-free CBD products can still be sold at retail stores, while products containing THC can only be sold in licensed dispensaries.

In an official statement, Attorney General Rob Bonta praised the decision.

“In California, we have established strict prohibitions against intoxicating cannabinoids in hemp products, regardless of whether they are naturally sourced or synthetic. The California Department of Justice remains steadfast in its commitment to safeguarding the interests of legitimate businesses that operate with integrity in this industry. I take immense pride in our Cannabis Control Section and the tireless dedication they have shown in ensuring the success of this initiative,” Bonta said.

Read Also: California Judge Rules Gov. Newsom’s Hemp Ban Stands Despite Industry Pushback

A Pyrrhic Victory For Hemp Industry In New Jersey

Meanwhile, in a mixed decision, U.S. District Court Judge Zahid N. Quraishi upheld much of New Jersey’s stringent law regulating intoxicating hemp products. The law places intoxicating hemp under the same restrictions as cannabis, requiring businesses to halt sales until licensed by the state’s Cannabis Regulatory Commission (CRC).

While Quraishi upheld the bulk of the law, he sided with plaintiffs on certain points, agreeing that parts of the law violate the dormant commerce clause of the U.S. Constitution.

- Get Benzinga’s exclusive analysis and the top news about the cannabis industry and markets daily in your inbox for free. Subscribe to our newsletter here. You can’t afford to miss out if you’re serious about the business.

Specifically, he ruled that New Jersey cannot unfairly burden out-of-state hemp businesses by subjecting them to civil and criminal penalties, reported New Jersey Monitor.

“The New Jersey Legislature can continue to otherwise regulate the production of hemp as stringently as it would like so long as it does not prohibit the transportation or shipment of hemp or hemp products,” Quraishi wrote in his decision.

Read Also: Gov. Newsom’s Hemp Ban Goes Into Effect: Consequences For Industry, Investors, Patients

Other States Join The Regulatory Battle: Tennessee And Utah

New Jersey and California are not alone in their crackdown on psychoactive hemp. Tennessee and Utah are also moving forward with stricter regulations, reported Hemp Today.

In Tennessee, new rules set to take effect on December 26, 2024 change how THC levels in products are measured, which could effectively ban hemp flower and other popular products.

Businesses have pushed back, with the Tennessee Growers Coalition filing a lawsuit arguing that the regulations overstep state law and conflict with the 2018 U.S. Farm Bill.

Meanwhile, Utah is in the final stages of its legislative push to ban hemp products. The state’s Department of Agriculture and Food has opened a public comment period, which ends October 15, before finalizing the regulations.

Cover: AI-generated image

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Suze Orman Reveals Hidden Danger Of Renting In Retirement – 'Make Sure You Are Not Blind To One Risk'

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Renting has become more common among older Americans, with homeownership rates for those 65 and older dropping from 80% to 74% in the past 20 years. While renting in retirement can be a sensible option for many, financial expert Suze Orman urges retirees to consider one often-overlooked risk: inflation.

According to Orman, while renting offers flexibility and can be a smart financial move, retirees should plan for the likelihood of rising rental costs. “I want to make sure you are not blind to one risk,” she warned in a recent blog post. “Landlords will raise your rent from time to time. I know that may sound obvious, but it’s not human nature to carefully think through what things might cost 5, 10 or 20 years from now.”

Check It Out:

-

This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing. -

Your biggest returns may not come from the stock market. Invest the way colleges, pension funds, and the 1% do. Get started investing in commercial real estate today.

A recent report from the Washington Post backs up her concerns. Data shows that average rents have increased by roughly 4% annually, though recent hikes have been even higher in many places. That means a monthly rent of $1,000 today could rise to $1,220 in five years and balloon to $2,670 over 25 years.

It’s worth noting that renting in retirement isn’t necessarily a bad decision but requires careful long-term financial planning. Orman stressed that retirees need to factor future rent increases into their budgeting. “If you’re planning to rent, make sure the rent fits within your means not just today but years from now,” she said. “Living below your means but within your needs has always been my advice.”

Experts across the board echo her advice. According to Bankrate, inflationary pressures are expected to persist, pushing up the costs of necessities, including housing. This is especially critical for retirees on fixed incomes who may not have the financial wiggle room to absorb higher costs over time.

Trending: A billion-dollar investment strategy with minimums as low as $10 — you can become part of the next big real estate boom today.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Orman points out that Social Security is crucial in managing future financial needs, particularly for covering rising housing expenses. “The longer you can delay claiming your Social Security benefits, the higher your payout,” she explained.

Experts recommend that retirees aim to delay Social Security benefits until at least their full retirement age – between 66 and 67, depending on their birth year – or ideally until 70 when the benefit amount is at its maximum. According to the Social Security Administration, the annual cost-of-living adjustment (COLA) is designed to help retirees keep up with inflation.

Additionally, having a portion of retirement investments in stocks could provide retirees with inflation-beating returns over time. “Remember that stocks deliver the best inflation-beating gains over the long term,” Orman said, suggesting that even in their 60s and 70s, retirees should keep a portion of their portfolio in the stock market to help cover future costs like rent.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Suze Orman Reveals Hidden Danger Of Renting In Retirement – ‘Make Sure You Are Not Blind To One Risk’ originally appeared on Benzinga.com

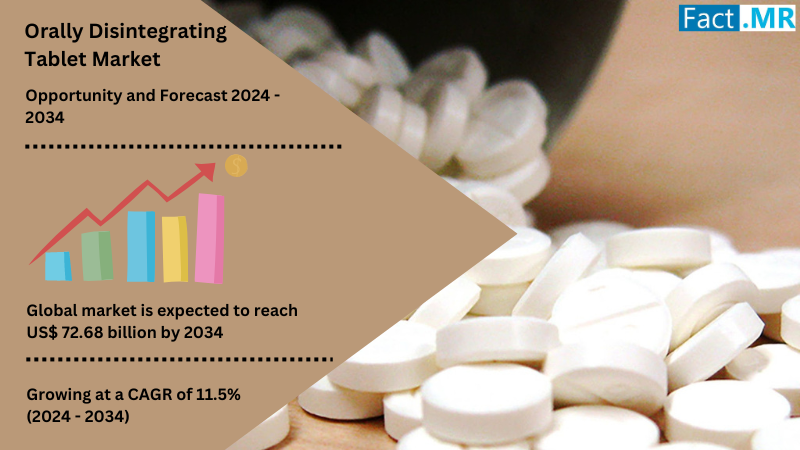

Orally Disintegrating Tablet Market is Projected to Reach US$ 72.68 Billion with a CAGR of 11.5% by 2034 | Fact.MR Report

Rockville, MD, Oct. 16, 2024 (GLOBE NEWSWIRE) — Based on a new research report published by Fact.MR, the global orally disintegrating tablet market is poised to reach a valuation of US$ 24.45 billion in 2024 and further advance at a CAGR of 11.5% from 2024 to 2034. Aftertaste and mouthfeel are two of the focus areas in which suppliers are active. More people are looking for tablets that are less bitter and work faster, which is where the market has the potential to evolve further over the coming years.

Orally disintegrating tablets (ODTs) have a pleasant mouthfeel, attracting a wide range of patients. These tablets do not require any additional liquid to swallow, making them suitable for use anywhere and at any time. The introduction of orally disintegrating tablets effectively addresses the challenge of swallowing traditional medications, particularly for babies, young children, and the elderly.

To improve their performance and desirability, ongoing developments in this field have resulted in the introduction of a variety of orally disintegrating pills with improved properties, such as better taste and faster disintegration. These advancements are key drivers for the increased adoption of orally disintegrating tablets, which are gaining prominence in the pharmaceutical industry.

For More Insights into the Market, Request a Sample of this Report-https://www.factmr.com/connectus/sample?flag=S&rep_id=10142

Key Takeaways from Market Study:

- The global orally disintegrating tablet market is forecasted to reach a valuation of US$ 72.68 billion by the end of 2034.

- The market in North America is calculated to expand at a CAGR of 4% from 2024 to 2034.

- The United States is analyzed to hold a significant share of 5% in the North American region by the end of 2034.

- The market in Chile is projected to expand at a CAGR of 9% from 2024 to 2034.

- Based on drug class, demand for anxiolytics is calculated to increase at a CAGR of 5% from 2024 to 2034.

“ODTs offer ease of administration, promoting better patient adherence to treatment regimens compared to traditional tablets. Companies are focusing on improving the taste and mouthfeel of ODTs to ensure increased adoption among patients,” says a Fact.MR analyst.

Leading Players Driving Innovation in the Orally Disintegrating Tablets Market:

Johnson & Johnson Services Inc; Teva Pharmaceutical Industries Ltd.; Sun Pharmaceutical Industries Ltd.; Takeda Pharmaceutical Company Limited; Eli Lily and Company; Dr. Reddy’s Laboratories Ltd; Mylan N.V.; Bausch Health; GlaxoSmithKline Plc; Merck & Co Inc.; AstraZeneca; Bayer AG; F Hoffman-La Roche Ltd.

High Level of Patient Compliance with ODTs:

Orally disintegrating tablets have established a niche among oral drug delivery systems due to the high level of compliance they achieve in patients, particularly in geriatrics and pediatrics. Patients with dysphagia, motion sickness, repeated emesis, and mental disorders prefer these medications because they are unable to swallow large amounts of water.

Drugs with good oral mucosal absorption or with immediate pharmacological action can be formulated in these dosage forms. However, the need to formulate these dosage forms with mechanical strength sufficient to withstand the rigors of handling while also disintegrating within a few seconds in contact with saliva is inextricably linked.

Orally Disintegrating Tablets Industry News:

Orally disintegrating tablets (ODTs) are a very competitive business, with a number of well-established and up-and-coming companies fighting for share.

Research, development, and commercialization of ODTs and other pharmaceutical products are undertaken by companies.

Among the primary tactics employed by these companies to hold onto and increase their market share are product innovation, joint ventures and alliances, mergers and acquisitions, and regional growth. Oral antivirals and oral solid dosage contracts are two emerging industry trends that major competitors in the oral disintegrating tablet market are adjusting to.

Get Customization on this Report for Specific Research Solutions-https://www.factmr.com/connectus/sample?flag=S&rep_id=10142

More Valuable Insights on Offer:

Fact.MR, in its new offering, presents an unbiased analysis of the orally disintegrating tablet market for 2019 to 2023 and forecast statistics for 2024 to 2034.

The study divulges essential insights into the market based on drug class (anti-psychotics, anti-epileptics, CNS stimulants, anxiolytics, anti-parkinsonian drugs, anti-hypertensives, NSAIDs, anti-allergy drugs, proton pump inhibitors, others), disease indication (CNS diseases, GI diseases, CVS disorders, allergies, others), distribution channel (hospital pharmacies, retail pharmacies, drug stores, online pharmacies), across seven major regions of the world (North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, and MEA).

Checkout More Related Studies Published by Fact.MR Research:

The global achalasia treatment market is currently valued at around US$ 472.12 million in 2024 and is forecasted to expand at a CAGR of 9.1% to reach US$ 1.13 billion by the end of 2034.

The global artificial eyes market is approximated to reach a valuation of US$ 2.3 billion in 2024 and further expand at a CAGR of 8.7% to end up at US$ 5.27 billion by the year 2034.

The global electromagnetic navigation bronchoscopy market is evaluated to reach a value of US$ 124.35 million in 2024 and is forecasted to expand at a CAGR of 8.9% to reach US$ 292.77 million by 2034.

The global endoscopic balloon dilator market is projected to generate revenue worth US$ 804.52 million in 2024 and has been thoroughly analyzed to increase at a CAGR of 9.2% to achieve a value of US$ 1.94 billion by 2034-end.

The global wax removal aid market is estimated at US$ 220.08 million in 2024. The market has been forecasted to increase at a CAGR of 5.8% and touch a value of US$ 386.32 million by the end of 2034.

About Us:

Fact.MR is a distinguished market research company renowned for its comprehensive market reports and invaluable business insights. As a prominent player in business intelligence, we deliver deep analysis, uncovering market trends, growth paths, and competitive landscapes. Renowned for its commitment to accuracy and reliability, we empower businesses with crucial data and strategic recommendations, facilitating informed decision-making and enhancing market positioning. With its unwavering dedication to providing reliable market intelligence, FACT.MR continues to assist companies in navigating dynamic market challenges with confidence and achieving long-term success. With a global presence and a team of experienced analysts, FACT.MR ensures its clients receive actionable insights to capitalize on emerging opportunities and stay ahead in the competitive landscape.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team: sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Apple stock hits record intraday high on bullish Wall Street outlooks, positive iPhone sales data

Apple (AAPL) hit an all-time intraday high Tuesday as Wall Street analysts issued bullish outlooks on the stock ahead of the release of Apple Intelligence.

Apple shares reached $237.49 on Tuesday before paring gains, eclipsing its prior record of $237.23 on July 15. The stock’s climb put it further ahead of Nvidia (NVDA) as the world’s most valuable company after Nvidia’s gains earlier in the week jeopardized the iPhone maker’s lead.

Apple shares closed the trading day up 1.1% to $233.85. Meanwhile, Nvidia (NVDA) fell around 4.5% Tuesday amid trade tensions in the semiconductor sector.

Analysts at Morgan Stanley (MS), Bernstein, and Evercore ISI have reiterated their Buy ratings on Apple stock this week. Positive preliminary iPhone shipment data posted by International Data Corporation (IDC) showed strong demand for Apple’s previous smartphone models. Sales were also helped by Apple’s rollout of the iPhone 16.

“Despite the staggered rollout of Apple Intelligence in markets outside the U.S., Apple will continue to grow in the upcoming holiday season,” said Nabila Popal, IDC’s data & analytics senior director, in a statement Monday. IDC data released Monday showed global iPhone shipments rising 3.5% in the third quarter from last year.

The news comes amid concerns over weak demand for Apple’s iPhone 16 lineup. Wall Street analysts initially interpreted shorter shipping times for the iPhones as an omen. The thinking was that if customers could easily get their hands on the new iPhones, then there was an oversupply of the phones available to purchase versus last year, Yahoo Finance’s Daniel Howley reported. Jefferies last week downgraded Apple stock from Buy to Hold, citing doubts over whether its newly AI-enabled phones will live up to expectations. But Morgan Stanley said in a note to investors Monday that Apple was simply better prepared for the iPhone 16 release than past launches.

“Our supply-chain checks suggest that this cycle, Apple has asked its suppliers to prepare component inventories earlier than typical patterns to avoid supply constraints, in contrast to past cycles where supply shortages kept new model iPhone Pro/Pro Max supply/demand imbalanced for months,” Morgan Stanley’s Erik Woodring wrote. “We believe that better supply conditions are one of the contributing factors to why iPhone lead times are shorter this cycle than in recent cycles.”

Apple released its new iPad mini equipped to run its suite of AI features, Apple Intelligence, on Tuesday. Apple will begin its rollout of Apple Intelligence on Oct. 28, though Morgan Stanley notes that more significant updates will come in December and then again in March of 2025.

Despite a rocky start to 2024 — from struggling iPhone sales and layoffs to clashes with antitrust regulators at home and abroad — Apple stock is up 31% from last year, rising 3.6% over the last week alone. Analysts see the stock climbing further to $245.40 over the next 12 months, according to consensus estimates compiled by Bloomberg.

Apple is set to report earnings Oct. 31, and Wall Street analysts tracked by Bloomberg expect earnings to rise 9% from last year to $1.59 per share. Some 40 analysts recommend buying the stock, while 19 have a Hold rating and two recommend selling shares, Bloomberg data shows.

Laura Bratton is a reporter for Yahoo Finance. Follow her on X @LauraBratton5.

Click here for the latest stock market news and in-depth analysis, including events that move stocks

Read the latest financial and business news from Yahoo Finance