Alibaba Launches Upgraded AI Tool, Says Its Better Than What Google And ChatGPT Have To Offer

The international arm of Alibaba Group Holding Ltd BABA has unveiled an upgraded version of its artificial intelligence-driven translation tool, which it claims surpasses the offerings of Alphabet Inc.‘s GOOGL GOOG subsidiary Google, DeepL, and ChatGPT.

What Happened: Alibaba’s international division has introduced an improved iteration of its AI translation tool, Marco MT, which it asserts is superior to the translation tools provided by Google, DeepL, and ChatGPT, reported CNBC.

“The idea is that we want this AI tool to help the bottom line of the merchants, because if the merchants are doing well, the platform will be doing well,” Kaifu Zhang, vice president of Alibaba International Digital Commerce Group and head of the business’ artificial intelligence initiative told CNBC on Tuesday.

The tool supports 15 languages and is intended to enhance the performance of merchants using Alibaba’s platform.

Alibaba’s AI translation tool, based on its proprietary model Qwen, is designed to help merchants create product pages in the language of their target market. The new version, powered by large language models, can interpret contextual clues such as cultural and industry-specific terms.

Why It Matters: Alibaba’s international business has been a significant growth driver for the company, especially with the slowing growth of its China-focused Taobao and Tmall businesses. The international unit, which includes platforms like AliExpress and Lazada, reported a 32% year-on-year sales growth to $4.03 billion in the quarter ended June.

Alibaba’s focus on AI and technological advancements has been evident in its recent moves. In September, the company launched a new AI-powered sourcing tool to simplify the sourcing process for American buyers, despite ongoing tensions between Beijing and Washington. Additionally, Alibaba’s AI-driven English version of its Taobao app in Singapore quickly soared to the top of the charts, demonstrating the potential of AI in expanding the company’s global reach.

Alibaba’s focus on AI has also extended to open-source AI models, with the company releasing over 100 open-source AI models under the name Qwen 2.5, covering a range of industries from automobiles to gaming and scientific research.

Read Next:

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Unstoppable Stocks to Buy With the Dow at an All-Time High

Happy belated anniversary, bull market. On Oct. 12, 2022, a new bull market began. Tech stocks led the charge then and are doing so now, fueled by surging demand for anything related to artificial intelligence (AI).

However, the venerable Dow Jones Industrial Average (DJINDICES: ^DJI) is holding its own. The Dow is up close to 47% since the bull market began. Are there still some Dow stocks worth buying? Absolutely. Here are three unstoppable stocks to buy with the Dow at an all-time high.

1. Amazon

Amazon (NASDAQ: AMZN) is a relatively new member of the Dow Jones Industrial Average. The e-commerce and cloud-services giant replaced Walgreens Boots Alliance in February 2024. Amazon has been a great addition to the Dow so far, outperforming many other stocks in the index this year.

Perhaps the best indicator of Amazon’s strength is its rapidly improving free cash flow. The company generated free cash flow of $53 billion in the trailing 12 months ending June 30, 2024, compared with $7.9 billion for the trailing 12 months ending June 30, 2023.

Amazon’s cloud business, Amazon Web Services (AWS), continues to be the company’s most important growth driver. Organizations across the world are migrating to the cloud. AI, especially generative AI, is accelerating this trend. Amazon CEO Andy Jassy said in August that AWS remains “customers’ top choice” thanks largely to its broad functionality.

But Amazon is always looking for new ways to grow. The company has found one with advertising. In the second quarter of 2024, advertising-services revenue jumped 20% year over year excluding foreign exchange, slightly higher than AWS revenue growth. Jassy said in the Q2 earning call that Amazon is “at the very beginning of what’s possible in our video advertising.”

2. The Home Depot

The Home Depot (NYSE: HD) isn’t a newbie in the Dow like Amazon. The leading home improvement retailer joined the index on Nov. 1, 1999. Home Depot has more than quadrupled the Dow’s total return since then and has continued to outperform the index in 2024.

You might not think Home Depot looks unstoppable based on its Q2 results. The company’s revenue rose only 0.6% year over year and would have decreased by 3.3% if not for the acquisition of SRS Distribution. However, this temporary snapshot doesn’t tell the full story about Home Depot’s prospects.

Keep one number in mind with Home Depot: 42. That’s the median age of owner-occupied U.S. homes, according to Statista. With a large number of older houses, the demand for home improvement supplies should remain strong for years to come.

Home Depot also has another long-term tailwind. The U.S. continues to face a major housing shortage. Zillow estimates the country needs another 4.5 million homes. Home Depot should have a significant opportunity providing materials to professionals building new homes over the next decade and beyond.

3. Visa

Visa (NYSE: V) joined the Dow Jones Industrial Average on Sept. 23, 2013. The payments-technology company has nearly doubled the Dow’s total return since then.

Granted, Visa has lagged behind the Dow in 2024. This underperformance is due primarily to regulatory issues. In June, a federal judge rejected a settlement between Visa, Mastercard, and retailers over swipe fees. In September, the U.S. Justice Department filed an antitrust lawsuit alleging that Visa is monopolizing debit-network markets.

I’m not sure how these regulatory challenges will play out. However, Visa should remain a dominant force in the payments market regardless of the outcomes.

And that market should continue to grow. Cash is going the way of the dinosaurs as people increasingly use digital-payment methods. Visa could have an especially big growth opportunity as the middle classes expand in developing nations.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat in buying the most successful stocks? Then you’ll want to hear this.

On rare occasions, our expert team of analysts issues a “Double Down” stock recommendation for companies that they think are about to pop. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: if you invested $1,000 when we doubled down in 2010, you’d have $21,266!*

-

Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,047!*

-

Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $389,794!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

*Stock Advisor returns as of October 14, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Keith Speights has positions in Amazon and Mastercard. The Motley Fool has positions in and recommends Amazon, Home Depot, Mastercard, Visa, and Zillow Group. The Motley Fool recommends the following options: long January 2025 $370 calls on Mastercard and short January 2025 $380 calls on Mastercard. The Motley Fool has a disclosure policy.

3 Unstoppable Stocks to Buy With the Dow at an All-Time High was originally published by The Motley Fool

United Airlines Q3 Earnings: Revenue Beat, EPS Beat, $1.5B Buyback — 'Clear Inflection Point'

United Airlines Holdings Inc UAL reported third-quarter financial results after the market close on Tuesday. Here’s a rundown of the report.

Q3 Earnings: United Airlines reported third-quarter revenue of $14.843 billion, beating the consensus estimate of $14.783 billion, according to Benzinga Pro. The airline company reported adjusted earnings of $3.33 per share, beating analyst estimates of $3.13 per share.

Capacity was up 4.1% on a year-over-year basis. TRASM (total revenue per available seat mile) was down 1.6% while CASM (cost per available seat mile) was up 0.1%. United said this was its busiest third quarter as measured by revenue passenger volumes in company history.

United noted it generated $7.2 billion in operating cash flow and $3.4 billion in free cash flow year-to-date. The airline company ended the quarter with $17.1 billion in total liquidity and $25.7 billion in total debt and finance lease obligations.

“As predicted, unproductive capacity left the market in mid-August, and we saw a clear inflection point in our revenue trends that propelled United to exceed third-quarter expectations,” said Scott Kirby, CEO of United Airlines.

“A prosperous summer 2024 is just the beginning as our improved customer experience combined with United Next positions the airline at the top of the industry for the foreseeable future.”

United’s board approved a new share repurchase program of up to $1.5 billion of common stock and warrants originally issued to the U.S. Treasury under the CARES Act and Payroll Support Program.

Check This Out: Can United Airlines Stock Climb Higher After 56% Gain This Year? Bullish Momentum Builds Ahead Of Q3 Earnings

Outlook: United Airlines expects fourth-quarter adjusted earnings to be in the range of $2.50 to $3 per share versus estimates of $3.17 per share, according to Benzinga Pro. The company said it continues to expect full-year 2024 adjusted capital expenditures to be less than $6.5 billion.

Management will hold a conference call to further discuss these results Wednesday morning at 10:30 a.m. ET.

UAL Price Action: United Airlines shares were up 0.54% in after-hours, trading at $64.33 at the time of publication Tuesday, according to Benzinga Pro.

Photo: courtesy of United Airlines.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cannabis Stock Movers For October 15, 2024

GAINERS:

LOSERS:

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Click on the image for more info.

Cannabis rescheduling seems to be right around the corner

Want to understand what this means for the future of the industry?

Hear directly for top executives, investors and policymakers at the Benzinga Cannabis Capital Conference, coming to Chicago this Oct. 8-9.

Get your tickets now before prices surge by following this link.

Financial Sector Hits Record Highs As Goldman Sachs, Bank of America, Citi Beat Q3 Earnings Expectations

A basket of major U.S. bank stocks, as measured by the Financial Select Sector SPDR Fund XLF, is poised to extend its record highs following a wave of strong third-quarter earnings reports.

The fund rose nearly 0.7% in premarket trading, continuing its upward momentum from last week’s rally. Gains also spilled over to regional banks, as SPDR S&P Regional Banking ETF KRE rose 0.5%.

On Tuesday, top financial firms including Goldman Sachs Inc. GS, Bank of America Corp. BAC, Citigroup Inc. C, and Charles Schwab Corp. SCHW all exceeded analyst expectations, reinforcing investor confidence in the sector’s health.

Goldman Sachs Q3 2024: Major Revenue Beat Drives Stock To Record Highs

Goldman Sachs posted a robust third-quarter performance, significantly beating Wall Street’s earnings estimates. The bank reported earnings per share (EPS) of $8.40, surpassing the expected $6.88. Revenue came in at $12.7 billion, topping the $11.7 billion consensus estimate, with standout results in several key segments.

- Equities sales & trading revenue surged to $3.5 billion, well above the $2.95 billion estimate.

- Global banking and markets net revenue hit $8.55 billion, beating the forecast of $7.65 billion.

- Total deposits grew 2.8% quarter-over-quarter to $445 billion.

- Assets under management (AUM) reached $3.1 trillion, exceeding expectations of $2.99 trillion.

Stock Reaction: Shares of Goldman Sachs jumped nearly 3% in premarket trading, reaching a new record high of $537.50.

Bank of America Q3 2024: Solid Growth in Investment Banking and Trading

Bank of America also delivered a strong set of earnings, with an EPS of $0.81, beating the $0.76 consensus. Revenue totaled $25.34 billion, slightly above expectations of $25.25 billion, driven by solid growth in its investment banking and trading operations.

- Net interest income (NII) rose to $13.97 billion, surpassing the $13.9 billion forecast.

- Investment banking revenue reached $1.4 billion, exceeding the $1.24 billion estimate.

- Trading revenue, excluding debt valuation adjustments, hit $4.94 billion, beating the $4.57 billion consensus.

Richard Ramsden, equity analyst at Goldman Sachs, indicated that Bank of America delivered “another well-rounded beat,” highlighting that NII was 0.5% above the Street due to higher earning assets, loans, and trading balances.

Stock Reaction: Bank of America shares climbed 2% to $42.79 following the earnings report.

Citigroup Q3 2024: Strong Gains in Trading and Wealth Management

Citigroup outpaced analyst expectations, reporting an EPS of $1.51, beating the consensus of $1.31. Revenue for the quarter came in at $20.32 billion, ahead of the $19.86 billion estimate.

- FICC sales & trading revenue reached $3.58 billion, in line with forecasts, while equities sales & trading revenue surged to $1.24 billion, far above the $1.03 billion estimate.

- Wealth management revenue was a bright spot, hitting $2 billion compared to the $1.8 billion forecast.

- Markets revenue totaled $4.82 billion, topping estimates of $4.6 billion.

Citi’s investment banking revenue also surpassed expectations, coming in at $934 million versus the anticipated $874.5 million. This marks a solid quarter for Citigroup as it continues to streamline operations while growing its core business lines.

Stock Reaction: Citigroup shares rose 2.4% to $67.50, reaching levels not seen since mid-July.

Charles Schwab Q3 2024: Shares Skyrocket On Earnings Beat

Charles Schwab also joined the list of financial firms delivering upbeat Q3 results. The company reported an EPS of $0.77, exceeding the $0.75 consensus, with revenue of $4.847 billion, just above the $4.786 billion estimate.

This marks a strong recovery for Schwab, which faced pressure earlier this year. The bank benefited from steady client engagement and favorable market conditions.

Stock Reaction: Charles Schwab shares rocketed 9% to $73.78 in premarket trading, putting the stock on track for its best session since July 2023.

Read more:

Image created using artificial intelligence via Midjourney.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

KILLAM APARTMENT REIT ANNOUNCES INTERNAL REORGANIZATION TO SIMPLIFY ITS ORGANIZATIONAL STRUCTURE

HALIFAX, NS, Oct. 15, 2024 /CNW/ – Killam Apartment REIT KMP (“Killam” or the “REIT“) is pleased to announce that its Board of Trustees has unanimously approved a proposed internal reorganization that will be accomplished by way of a plan of arrangement (the “Arrangement“). The Arrangement will be subject to unitholder approval at a special meeting of Killam to be held on November 21, 2024 (the “Meeting“).

The Arrangement will simplify Killam’s organizational structure by eliminating Killam Properties Inc. (“KPI“), a wholly-owned subsidiary of the REIT, so that Killam Apartment Limited Partnership will hold its entire investment in Killam Apartment Subsidiary Limited Partnership (“Killam SLP“) directly, rather than partially through KPI. In the existing structure, KPI is allocated its share of income and capital gains as a partner of Killam SLP. The Arrangement is expected to reduce or eliminate potential corporate taxation in respect of income and capital gains allocated to KPI, thereby increasing future cash flow for distribution to the REIT. The Arrangement is also expected to reduce the complexity of accounting and legal reporting and of income tax compliance inherent in Killam’s existing structure. The REIT has received an advance income tax ruling of the Canada Revenue Agency in connection with the Arrangement.

The proposed Arrangement will not result in a change to Killam’s strategy, portfolio or operations. After completing the Arrangement, unitholders will continue to hold the same number, type and percentage of outstanding units as they held immediately before the Arrangement and the total number of units outstanding immediately following the Arrangement will be the same as before. The REIT’s trust units (“Trust Units“) will continue to be listed on the TSX and retain the same CUSIP number.

The Arrangement will be effected pursuant to a plan of arrangement under the Canada Business Corporations Act and is subject to the approval of 66⅔% of the votes cast by holders of the Trust Units and special voting units of the REIT (the “Special Voting Units“), voting together as a single class (Special Voting Units are associated with Class B limited partnership units of Killam Apartment Limited Partnership (“Exchangeable Units“), which is controlled by the REIT. The Exchangeable Units are intended to be economically equivalent to and exchangeable for Trust Units on a one-for-one basis and are accompanied by Special Voting Units of the REIT that provide their holders with equivalent voting rights to holders of Trust Units). Trustees and officers of Killam, who control collectively 3.72% of Killam’s Trust Units and Special Voting Units, have indicated their intention to vote in favour of the Arrangement. In addition to the requirement for unitholder approval, the completion of the Arrangement will be contingent on all necessary third party, court and regulatory approvals, including the approval of the Toronto Stock Exchange.

Unitholders who vote in favour of the Arrangement at the Meeting will also be authorizing and approving the adoption of an Amended and Restated Declaration of Trust of the REIT, which includes amendments to the REIT’s current governing Declaration of Trust necessary to effect the Arrangement and other amendments of a minor, housekeeping or clerical nature that are not prejudicial to the Unitholders.

Further details on the Arrangement will be set out in an information circular (the “Circular“) expected to be filed on SEDAR+ at sedarplus.ca and mailed to unitholders on or about October 24, 2024, in advance of the Meeting. Although the timing of the completion of the Arrangement cannot be predicted with certainty, management anticipates the Arrangement to become effective on November 30, 2024.

About Killam Apartment REIT

Killam Apartment REIT, based in Halifax, Nova Scotia, is one of Canada’s largest residential real estate investment trusts, owning, operating, and developing a $5.3 billion portfolio of apartments and manufactured home communities. Killam’s strategy to drive value and profitability focuses on three priorities: (1) increase earnings from the existing portfolio; (2) expand the portfolio and diversify geographically through accretive acquisitions, targeting newer properties and dispositions of non-core assets; and (3) develop high-quality properties in its core markets.

For information, please contact:

Claire Hawksworth, CPA

Senior Manager, Investor Relations

chawksworth@killamREIT.com

(902) 442-5322

Note: The Toronto Stock Exchange has neither approved nor disapproved of the information contained herein. Certain statements in this press release may constitute forward-looking statements. In some cases, forward-looking statements can be identified by the use of words such as “may,” “will,” “should,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “continue,” “remain,” or the negative of these terms or other comparable terminology, and by discussions of strategies that involve risks and uncertainties. Such forward-looking statements may include, among other things, statements regarding: the Arrangement and the timing and benefits thereof; the Meeting and the timing thereof; the effect of the Arrangement on holders of Trust Units and Special Voting Units; the approvals required for the completion of the Arrangement; the adoption of an Amended and Restated Declaration of Trust and the terms thereof; the contents, mailing, and availability of the Circular and the timing thereof; and Killam’s priorities.

Readers should be aware that these statements are subject to known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from those anticipated or implied, or those suggested by any forward-looking statements, including: Killam’s ability obtain the necessary regulatory and third-party approvals, including, among others, court, unitholder and Toronto Stock Exchange approval; risks related to tax legislation and the interpretation and application thereof; the effects and duration of local, international and global events, any government responses thereto and the effectiveness of measures intended to mitigate any impacts thereof; competition; legislation and the interpretation and enforcement thereof; litigation to which Killam may be subject; global, national and regional economic conditions (including interest rates and inflation); and the availability of capital to fund further investments in Killam’s business. For more exhaustive information on these risks and uncertainties, readers should refer to Killam’s most recently filed annual information form, Killam’s most recently filed MD&A, as well as the Circular, each of which is, or will be, available on SEDAR+ at www.sedarplus.ca. Given these uncertainties, readers are cautioned not to place undue reliance on any forward-looking statements contained in this press release. By their nature, forward-looking statements involve numerous assumptions, inherent risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, forecasts, projections and various future events may not occur. Although management believes that the expectations reflected in the forward-looking statements are reasonable, there can be no assurance that future results, levels of activity, performance or achievements will occur as anticipated. Further, a forward-looking statement speaks only as of the date on which such statement is made and should not be relied upon as of any other date. While Killam anticipates that subsequent events and developments may cause its views to change, Killam does not intend to update or revise any forward-looking statement, whether as a result of new information, future events, circumstances, or such other factors that affect this information, except as required by law.

The forward-looking statements in this press release are provided for the limited purpose of enabling current and potential investors to evaluate an investment in Killam. Readers are cautioned that such statements may not be appropriate and should not be used for any other purpose. The forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

SOURCE Killam Apartment Real Estate Investment Trust

![]() View original content: http://www.newswire.ca/en/releases/archive/October2024/15/c3279.html

View original content: http://www.newswire.ca/en/releases/archive/October2024/15/c3279.html

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Omnicom Reports Third Quarter 2024 Results

Revenue of $3.9 billion, with organic growth of 6.5%

Net income of $385.9 million

Diluted earnings per share of $1.95; $2.03 Non-GAAP adjusted

Operating income of $600.1 million; EBITA of $622.3 million and 16.0% margin

NEW YORK, Oct. 15, 2024 /PRNewswire/ — Omnicom OMC today announced results for the quarter ended September 30, 2024.

“Omnicom delivered a strong quarter, with 6.5% organic revenue growth, and 7.9% EBITA growth. We did so while continuing to strengthen our organization by investing in talent, service capabilities, and technology platforms to enhance our client offerings,” said John Wren, Chairman and Chief Executive Officer of Omnicom. “Our cash flow improved, and we continued our very disciplined capital allocation. With exceptional new business wins and exciting new work for our clients, we expect to finish the year with strong momentum.”

Third Quarter 2024 Results

|

$ in millions, except per share amounts |

Three Months Ended September 30, |

|||||

|

2024 |

2023 |

|||||

|

Revenue |

$ 3,882.6 |

$ 3,578.1 |

||||

|

Operating Income |

600.1 |

560.8 |

||||

|

Operating Income Margin |

15.5 % |

15.7 % |

||||

|

Net Income1 |

385.9 |

371.9 |

||||

|

Net Income per Share – Diluted1 |

$ 1.95 |

$ 1.86 |

||||

|

Non-GAAP Measures:2,3,4 |

||||||

|

EBITA6 |

622.3 |

576.5 |

||||

|

EBITA Margin |

16.0 % |

16.1 % |

||||

|

Adjusted EBITA |

622.3 |

576.5 |

||||

|

Adjusted EBITA Margin |

16.0 % |

16.1 % |

||||

|

Non-GAAP Adjusted Net Income per Share – Diluted |

$ 2.03 |

$ 1.92 |

||||

|

Notes 1-6, see page 10. |

||||||

Revenue

Revenue in the third quarter of 2024 increased $304.5 million, or 8.5%, to $3,882.6 million. Worldwide revenue growth in the third quarter of 2024 compared to the third quarter of 2023 was led by an increase in organic revenue of $231.3 million, or 6.5%. Acquisition revenue, net of disposition revenue, increased revenue by $74.4 million, or 2.1%, primarily due to the Flywheel Digital acquisition in the Precision Marketing discipline during the first quarter of 2024. The impact of foreign currency translation was neutral.

Organic growth by discipline in the third quarter of 2024 compared to the third quarter of 2023 was as follows: 9.4% for Advertising & Media, 35.3% for Experiential, 4.3% for Public Relations, 0.8% for Precision Marketing, and 0.3% for Execution & Support, partially offset by declines of 1.1% for Healthcare, and 5.4% for Branding & Retail Commerce.

Organic growth by region in the third quarter of 2024 compared to the third quarter of 2023 was as follows: 6.5% for the United States, 10.9% for Asia Pacific, 6.8% for Euro Markets & Other Europe, 24.8% for the Middle East & Africa, 8.7% for Latin America, and 1.5% for Other North America, partially offset by a decline of 0.2% for the United Kingdom.

Expenses

Operating expenses increased $265.2 million, or 8.8%, to $3,282.5 million in the third quarter of 2024 compared to the third quarter of 2023.

Salary and service costs increased $209.5 million, or 8.1%, to $2,796.0 million. These costs tend to fluctuate with changes in revenue and are comprised of salary and related costs, which include employee compensation and benefits costs, freelance labor, third-party service costs, and third-party incidental costs. Salary and related costs increased $90.2 million, or 5.1%, to $1,846.9 million, primarily due to our acquisition of Flywheel Digital. Third-party service costs include third-party supplier costs when we act as principal in providing services to our clients. Third-party incidental costs that are required to be included in revenue primarily consist of client-related travel and incidental out-of-pocket costs, which are billed back to the client directly at our cost. Third-party service costs increased $105.7 million, or 15.6%, to $784.5 million, primarily as a result of organic growth in our Advertising & Media and Experiential disciplines. Third-party incidental costs increased $13.6 million, or 9.0%, to $164.6 million.

Occupancy and other costs, which are less directly linked to changes in revenue than salary and service costs, increased $37.0 million, or 12.8%, to $325.6 million. The increase is primarily related to our acquisition activity during the year. Increased office and other related costs were partially offset by lower rent expense.

SG&A expenses increased $9.7 million, or 10.8%, to $99.5 million, primarily due to professional fees related to strategic initiatives.

Operating Income

Operating income increased $39.3 million, or 7.0%, to $600.1 million in the third quarter of 2024 compared to the third quarter of 2023, and the related margin decreased to 15.5% from 15.7%.

Interest Expense, net

Net interest expense in the third quarter of 2024 increased $2.1 million to $40.4 million compared to the third quarter of 2023. Interest expense increased $12.9 million to $66.4 million, primarily due to higher outstanding debt, and interest income increased, primarily due to higher cash balances. In August 2024, we issued $600 million aggregate principal amount of 5.3% Senior Notes due 2034. Net proceeds from the offering, along with available cash, will be used to fund the $750 million repayment of our 3.65% Senior Notes due November 1, 2024.

Income Taxes

Our effective tax rate for the three months ended September 30, 2024 increased period-over-period to 26.8% from 26.0%.

Net Income – Omnicom Group Inc. and Diluted Net Income per Share

Net income – Omnicom Group Inc. for the third quarter of 2024 increased $14.0 million, or 3.8%, to $385.9 million compared to the third quarter of 2023. Diluted shares outstanding for the third quarter of 2024 decreased 0.9% to 198.2 million from 199.9 million as a result of net share repurchases. Diluted net income per share of $1.95 increased $0.09, or 4.8%, from $1.86. Non-GAAP Adjusted Net Income per Share – Diluted for the third quarter of 2024 increased $0.11, or 5.7%, to $2.03 from $1.92. Non-GAAP Adjusted Net Income per Share – Diluted excluded $16.4 million and $11.6 million of after-tax amortization of acquired and internally developed strategic platform assets in the third quarters of 2024 and 2023, respectively. We present Non-GAAP Adjusted Net Income per Share – Diluted to allow for comparability with the prior year period.

EBITA

EBITA and Adjusted EBITA increased $45.8 million, or 7.9%, to $622.3 million in the third quarter of 2024 compared to the third quarter of 2023, and the related margin decreased to 16.0% from 16.1%. EBITA and Adjusted EBITA excluded amortization of acquired and internally developed strategic platform assets of $22.2 million and $15.7 million in the third quarters of 2024 and 2023, respectively.

Risks and Uncertainties

Current global economic disruptions, including geopolitical events, international hostilities, acts of terrorism, public health crises, high and sustained inflation in countries that comprise our major markets, high interest rates, and labor and supply chain issues could cause economic uncertainty and volatility. The impact of these issues on our business will vary by geographic market and discipline. We monitor economic conditions closely, as well as client revenue levels and other factors. In response to reductions in revenue, we can take actions to align our cost structure with changes in client demand and manage our working capital. However, there can be no assurance as to the effectiveness of our efforts to mitigate any impact of the current and future adverse economic conditions, reductions in client revenue, changes in client creditworthiness, and other developments.

Definitions – Components of Revenue Change

We use certain terms in describing the components of the change in revenue above.

Foreign exchange rate impact: calculated by translating the current period’s local currency revenue using the prior period average exchange rates to derive current period constant currency revenue. The foreign exchange rate impact is the difference between the current period revenue in U.S. Dollars and the current period constant currency revenue.

Acquisition revenue, net of disposition revenue: Acquisition revenue is calculated as if the acquisition occurred twelve months prior to the acquisition date by aggregating the comparable prior period revenue of acquisitions through the acquisition date. As a result, acquisition revenue excludes the positive or negative difference between our current period revenue subsequent to the acquisition date, and the comparable prior period revenue and the positive or negative growth after the acquisition date is attributed to organic growth. Disposition revenue is calculated as if the disposition occurred twelve months prior to the disposition date by aggregating the comparable prior period revenue of disposals through such date. The acquisition revenue and disposition revenue amounts are netted in the description above.

Organic growth: calculated by subtracting the foreign exchange rate impact component and the acquisition revenue, net of disposition revenue component from total revenue growth.

Conference Call

Omnicom will host a conference call to review its financial results on Tuesday, October 15, 2024, starting at 4:30 p.m. Eastern Time. A live webcast of the call, along with the related slide presentation, will be available at Omnicom’s investor relations website, investor.omnicomgroup.com, and a webcast replay will be made available after the call concludes.

Corporate Responsibility

At Omnicom, we are committed to promoting responsible practices and making positive contributions to society around the globe. Please explore our website (omnicomgroup.com/corporate-responsibility) for highlights of our progress across the areas on which we focus: Empower People, Protect Our Planet, Lead Responsibly.

About Omnicom

Omnicom OMC is a leading provider of data-inspired, creative marketing and sales solutions. Omnicom’s iconic agency brands are home to the industry’s most innovative communications specialists who are focused on driving intelligent business outcomes for their clients. The company offers a wide range of services in advertising, strategic media planning and buying, precision marketing, retail and digital commerce, branding, experiential, public relations, healthcare marketing and other specialty marketing services to over 5,000 clients in more than 70 countries. For more information, visit www.omnicomgroup.com.

Non-GAAP Financial Measures

We present financial measures determined in accordance with generally accepted accounting principles in the United States (“GAAP”) and adjustments to the GAAP presentation (“Non-GAAP”), which we believe are meaningful for understanding our performance. We believe these measures are useful in evaluating the impact of certain items on operating performance and allows for comparability between reporting periods. EBITA is defined as earnings before interest, taxes, and amortization of acquired intangible assets and internally developed strategic platform assets, and EBITA margin is defined as EBITA divided by revenue. We use EBITA and EBITA margin as additional operating performance measures, which exclude the non-cash amortization expense of acquired intangible assets and internally developed strategic platform assets. We also use Adjusted Operating Income, Adjusted Operating Income Margin, Adjusted EBITA, Adjusted EBITA Margin, Adjusted Income Tax Expense, Adjusted Net Income – Omnicom Group Inc. and Adjusted Net Income per share – Omnicom Group Inc. – Diluted as additional operating performance measures. Non-GAAP financial measures should not be considered in isolation from, or as a substitute for, financial information presented in accordance with GAAP. Non-GAAP financial measures as reported by us may not be comparable to similarly titled amounts reported by other companies.

Forward-Looking Statements

Certain statements in this document contain forward-looking statements, including statements within the meaning of the Private Securities Litigation Reform Act of 1995. In addition, from time to time, the Company or its representatives have made, or may make, forward-looking statements, orally or in writing. These statements may discuss goals, intentions and expectations as to future plans, trends, events, results of operations or financial position, or otherwise, based on current beliefs of the Company’s management as well as assumptions made by, and information currently available to, the Company’s management. Forward-looking statements may be accompanied by words such as “aim,” “anticipate,” “believe,” “plan,” “could,” “should,” “would,” “estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,” “may,” “will,” “possible,” “potential,” “predict,” “project” or similar words, phrases or expressions. These forward-looking statements are subject to various risks and uncertainties, many of which are outside the Company’s control. Therefore, you should not place undue reliance on such statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include: adverse economic conditions, including those caused by geopolitical events, international hostilities, acts of terrorism, public health crises, high and sustained inflation in countries that comprise our major markets, high interest rates, and labor and supply chain issues affecting the distribution of our clients’ products; international, national, or local economic conditions that could adversely affect the Company or its clients; losses on media purchases and production costs incurred on behalf of clients; reductions in client spending, a slowdown in client payments, and a deterioration or disruption in the credit markets; the ability to attract new clients and retain existing clients in the manner anticipated; changes in client advertising, marketing, and corporate communications requirements; failure to manage potential conflicts of interest between or among clients; unanticipated changes related to competitive factors in the advertising, marketing, and corporate communications industries; unanticipated changes to, or the ability to hire and retain key personnel; currency exchange rate fluctuations; reliance on information technology systems and risks related to cybersecurity incidents; effective management of the risks, challenges and efficiencies presented by utilizing Artificial Intelligence (AI) technologies and related partnerships in our business; changes in legislation or governmental regulations affecting the Company or its clients; risks associated with assumptions the Company makes in connection with its acquisitions, critical accounting estimates and legal proceedings; the Company’s international operations, which are subject to the risks of currency repatriation restrictions, social or political conditions, and an evolving regulatory environment in high-growth markets and developing countries; and risks related to our environmental, social, and governance goals and initiatives, including impacts from regulators and other stakeholders, and the impact of factors outside of our control on such goals and initiatives. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties that may affect the Company’s business, including those described in Item 1A, “Risk Factors” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2023 and in other documents filed from time to time with the Securities and Exchange Commission. Except as required under applicable law, the Company does not assume any obligation to update these forward-looking statements.

|

OMNICOM GROUP INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME (Unaudited) (In millions, except per share amounts) |

||||||||

|

Three Months Ended September 30, |

Nine Months Ended |

|||||||

|

2024 |

2023 |

2024 |

2023 |

|||||

|

Revenue |

$ 3,882.6 |

$ 3,578.1 |

$ 11,366.9 |

$ 10,631.3 |

||||

|

Operating Expenses: |

||||||||

|

Salary and service costs |

2,796.0 |

2,586.5 |

8,288.7 |

7,747.2 |

||||

|

Occupancy and other costs |

325.6 |

288.6 |

953.9 |

877.9 |

||||

|

Real estate and other repositioning costs1 |

— |

— |

57.8 |

191.5 |

||||

|

Gain on disposition of subsidiary1 |

— |

— |

— |

(78.8) |

||||

|

Cost of services |

3,121.6 |

2,875.1 |

9,300.4 |

8,737.8 |

||||

|

Selling, general and administrative expenses |

99.5 |

89.8 |

295.8 |

278.1 |

||||

|

Depreciation and amortization |

61.4 |

52.4 |

181.4 |

157.4 |

||||

|

Total operating expenses1 |

3,282.5 |

3,017.3 |

9,777.6 |

9,173.3 |

||||

|

Operating Income |

600.1 |

560.8 |

1,589.3 |

1,458.0 |

||||

|

Interest Expense |

66.4 |

53.5 |

182.9 |

165.9 |

||||

|

Interest Income |

26.0 |

15.2 |

74.0 |

80.9 |

||||

|

Income Before Income Taxes and Income From Equity Method Investments |

559.7 |

522.5 |

1,480.4 |

1,373.0 |

||||

|

Income Tax Expense1 |

150.2 |

136.1 |

389.9 |

360.7 |

||||

|

Income From Equity Method Investments |

0.4 |

1.9 |

4.6 |

3.1 |

||||

|

Net Income1 |

409.9 |

388.3 |

1,095.1 |

1,015.4 |

||||

|

Net Income Attributed To Noncontrolling Interests |

24.0 |

16.4 |

62.5 |

49.7 |

||||

|

Net Income – Omnicom Group Inc.1 |

$ 385.9 |

$ 371.9 |

$ 1,032.6 |

$ 965.7 |

||||

|

Net Income Per Share – Omnicom Group Inc.: |

||||||||

|

Basic |

$ 1.97 |

$ 1.88 |

$ 5.25 |

$ 4.84 |

||||

|

Diluted1 |

$ 1.95 |

$ 1.86 |

$ 5.19 |

$ 4.78 |

||||

|

Dividends Declared Per Common Share |

$ 0.70 |

$ 0.70 |

$ 2.10 |

$ 2.10 |

||||

|

Operating income margin |

15.5 % |

15.7 % |

14.0 % |

13.7 % |

||||

|

Non-GAAP Measures:4 |

||||||||

|

EBITA2 |

$ 622.3 |

$ 576.5 |

$ 1,654.5 |

$ 1,503.2 |

||||

|

EBITA Margin2 |

16.0 % |

16.1 % |

14.6 % |

14.1 % |

||||

|

EBITA – Adjusted1,2 |

$ 622.3 |

$ 576.5 |

$ 1,712.3 |

$ 1,615.9 |

||||

|

EBITA Margin – Adjusted1,2 |

16.0 % |

16.1 % |

15.1 % |

15.2 % |

||||

|

Non-GAAP Adjusted Net Income Per Share – Omnicom Group Inc. – Diluted1,3 |

$ 2.03 |

$ 1.92 |

$ 5.65 |

$ 5.39 |

||||

|

1) |

See Notes 3-5 on page 10 regarding our repositioning actions. |

|

2) |

See Note 6 on page 10 for the definition of EBITA. |

|

3) |

Beginning with the first quarter of 2024, Adjusted Net Income per Share – Diluted excludes after-tax amortization of acquired intangible assets and internally developed strategic platform assets. We believe these measures are useful in evaluating the impact of these items on operating performance and allows for comparability between reporting periods. |

|

4) |

See Non-GAAP reconciliations starting on page 8. |

|

OMNICOM GROUP INC. AND SUBSIDIARIES DETAIL OF OPERATING EXPENSES (Unaudited) (In millions) |

|||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Revenue |

$ 3,882.6 |

$ 3,578.1 |

$ 11,366.9 |

$ 10,631.3 |

|||

|

Operating Expenses: |

|||||||

|

Salary and service costs: |

|||||||

|

Salary and related costs |

1,846.9 |

1,756.7 |

5,531.1 |

5,306.7 |

|||

|

Third-party service costs1 |

784.5 |

678.8 |

2,293.8 |

2,033.9 |

|||

|

Third-party incidental costs2 |

164.6 |

151.0 |

463.8 |

406.6 |

|||

|

Total salary and service costs |

2,796.0 |

2,586.5 |

8,288.7 |

7,747.2 |

|||

|

Occupancy and other costs |

325.6 |

288.6 |

953.9 |

877.9 |

|||

|

Real estate and other repositioning costs3 |

— |

— |

57.8 |

191.5 |

|||

|

Gain on disposition of subsidiary3 |

— |

— |

— |

(78.8) |

|||

|

Cost of services |

3,121.6 |

2,875.1 |

9,300.4 |

8,737.8 |

|||

|

Selling, general and administrative expenses |

99.5 |

89.8 |

295.8 |

278.1 |

|||

|

Depreciation and amortization |

61.4 |

52.4 |

181.4 |

157.4 |

|||

|

Total operating expenses |

3,282.5 |

3,017.3 |

9,777.6 |

9,173.3 |

|||

|

Operating Income |

$ 600.1 |

$ 560.8 |

$ 1,589.3 |

$ 1,458.0 |

|||

|

1) |

Third-party service costs include third-party supplier costs when we act as principal in providing services to our clients. |

|

2) |

Third-party incidental costs primarily consist of client-related travel and incidental out-of-pocket costs, which we bill back to the client directly at our cost and which we are required to include in revenue. |

|

3) |

See Notes 3-5 on page 10 regarding our repositioning actions. |

|

OMNICOM GROUP INC. AND SUBSIDIARIES RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (Unaudited) (In millions) |

|||||||

|

Three Months Ended September 30, |

Nine Months Ended |

||||||

|

2024 |

2023 |

2024 |

2023 |

||||

|

Net Income – Omnicom Group Inc. |

$ 385.9 |

$ 371.9 |

$ 1,032.6 |

$ 965.7 |

|||

|

Net Income Attributed To Noncontrolling Interests |

24.0 |

16.4 |

62.5 |

49.7 |

|||

|

Net Income |

409.9 |

388.3 |

1,095.1 |

1,015.4 |

|||

|

Income From Equity Method Investments |

0.4 |

1.9 |

4.6 |

3.1 |

|||

|

Income Tax Expense |

150.2 |

136.1 |

389.9 |

360.7 |

|||

|

Income Before Income Taxes and Income From Equity Method Investments |

559.7 |

522.5 |

1,480.4 |

1,373.0 |

|||

|

Interest Expense |

66.4 |

53.5 |

182.9 |

165.9 |

|||

|

Interest Income |

26.0 |

15.2 |

74.0 |

80.9 |

|||

|

Operating Income |

600.1 |

560.8 |

1,589.3 |

1,458.0 |

|||

|

Add back: amortization of acquired intangible assets and internally developed strategic platform assets1 |

22.2 |

15.7 |

65.2 |

45.2 |

|||

|

Earnings before interest, taxes and amortization of intangible assets (“EBITA”)1 |

$ 622.3 |

$ 576.5 |

$ 1,654.5 |

$ 1,503.2 |

|||

|

Amortization of other purchased and internally developed software |

4.3 |

4.6 |

13.4 |

13.7 |

|||

|

Depreciation |

34.9 |

32.1 |

102.8 |

98.5 |

|||

|

EBITDA |

$ 661.5 |

$ 613.2 |

$ 1,770.7 |

$ 1,615.4 |

|||

|

EBITA |

$ 622.3 |

$ 576.5 |

$ 1,654.5 |

$ 1,503.2 |

|||

|

Real estate and other repositioning costs2 |

— |

— |

57.8 |

191.5 |

|||

|

Gain on disposition of subsidiary2 |

— |

— |

— |

(78.8) |

|||

|

EBITA – Adjusted1,2 |

$ 622.3 |

$ 576.5 |

$ 1,712.3 |

$ 1,615.9 |

|||

|

Revenue |

$ 3,882.6 |

$ 3,578.1 |

$ 11,366.9 |

$ 10,631.3 |

|||

|

Non-GAAP Measures: |

|||||||

|

EBITA1 |

$ 622.3 |

$ 576.5 |

$ 1,654.5 |

$ 1,503.2 |

|||

|

EBITA Margin1 |

16.0 % |

16.1 % |

14.6 % |

14.1 % |

|||

|

EBITA – Adjusted1,2 |

$ 622.3 |

$ 576.5 |

$ 1,712.3 |

$ 1,615.9 |

|||

|

EBITA Margin – Adjusted1 |

16.0 % |

16.1 % |

15.1 % |

15.2 % |

|||

|

1) |

See Note 6 on page 10 for the definition of EBITA. |

|

2) |

See Notes 3-5 on page 10 regarding our repositioning actions. |

|

The above table reconciles the U.S. GAAP financial measure of Net Income – Omnicom Group Inc. to EBITDA, EBITA, and EBITA – Adjusted. We use EBITA and EBITA Margin as additional operating performance measures, which exclude the non-cash amortization expense of acquired intangible assets and internally developed strategic platform assets. The above table also presents Non-GAAP adjustments to EBITA to present EBITA – Adjusted for the periods presented. Accordingly, we believe EBITA, EBITA Margin, EBITA – Adjusted, and EBITA Margin – Adjusted are useful measures for investors to evaluate the comparability of the performance of our business year to year. |

|

|

OMNICOM GROUP INC. AND SUBSIDIARIES RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (Unaudited) (In millions) |

||||||||||||

|

Three Months Ended September 30, |

||||||||||||

|

Reported |

Non-GAAP |

Non-GAAP |

Reported |

Non-GAAP |

Non-GAAP |

|||||||

|

Revenue |

$ 3,882.6 |

$ — |

$ 3,882.6 |

$ 3,578.1 |

$ — |

$ 3,578.1 |

||||||

|

Operating Expenses |

3,282.5 |

— |

3,282.5 |

3,017.3 |

— |

3,017.3 |

||||||

|

Operating Income |

600.1 |

— |

600.1 |

560.8 |

— |

560.8 |

||||||

|

Operating Income Margin |

15.5 % |

15.5 % |

15.7 % |

15.7 % |

||||||||

|

Nine Months Ended September 30, |

||||||||||||

|

Reported |

Non-GAAP |

Non-GAAP |

Reported |

Non-GAAP |

Non-GAAP |

|||||||

|

Revenue |

$ 11,366.9 |

$ — |

$ 11,366.9 |

$ 10,631.3 |

$ — |

$ 10,631.3 |

||||||

|

Operating Expenses1 |

9,777.6 |

(57.8) |

9,719.8 |

9,173.3 |

(112.7) |

9,060.6 |

||||||

|

Operating Income |

1,589.3 |

57.8 |

1,647.1 |

1,458.0 |

112.7 |

1,570.7 |

||||||

|

Operating Income Margin |

14.0 % |

14.5 % |

13.7 % |

14.8 % |

||||||||

|

Three Months Ended September 30, |

Nine Months Ended September 30, |

||||||||||

|

2024 |

2023 |

2024 |

2023 |

||||||||

|

Net Income |

Net Income |

Net Income |

Net Income |

Net Income |

Net Income |

Net Income |

Net Income |

||||

|

Net Income – Omnicom Group Inc. – Reported |

$ 385.9 |

$ 1.95 |

$ 371.9 |

$ 1.86 |

$ 1,032.6 |

$ 5.19 |

$ 965.7 |

$ 4.78 |

|||

|

Real estate and other repositioning costs1 |

— |

— |

— |

— |

42.9 |

0.22 |

145.5 |

0.72 |

|||

|

Gain on disposition of subsidiary1 |

— |

— |

— |

— |

— |

— |

(55.9) |

(0.28) |

|||

|

Amortization of acquired intangible assets and internally |

16.4 |

0.08 |

11.6 |

0.06 |

48.2 |

0.24 |

33.4 |

0.17 |

|||

|

Non-GAAP Net Income – Omnicom Group Inc. – Adjusted2,3 |

$ 402.3 |

$ 2.03 |

$ 383.5 |

$ 1.92 |

$ 1,123.7 |

$ 5.65 |

$ 1,088.7 |

$ 5.39 |

|||

|

1) |

See Notes 3-5 on page 10 regarding our repositioning actions. |

|

2) |

Beginning with the first quarter of 2024, Adjusted Net Income per Share – Diluted excludes after-tax amortization of acquired intangible assets and internally developed strategic platform assets. We believe these measures are useful in evaluating the impact of these items on operating performance and allows for comparability between reporting periods. |

|

3) |

Weighted-average diluted Shares for the three months ended September 30, 2024 and 2023 were 198.2 million and 199.9 million, respectively. Weighted-average diluted shares for the nine months ended September 30, 2024 and 2023 were 198.9 million and 202.0 million, respectively. The above tables reconcile the GAAP financial measures of Operating Income, Net Income – Omnicom Group Inc., and Net Income per Share – Diluted to adjusted Non-GAAP financial measures of Non-GAAP Operating Income – Adjusted, Non-GAAP Net Income-Omnicom Group Inc. – Adjusted and Non-GAAP Adjusted Net Income per Share – Diluted. Management believes these Non-GAAP measures are useful for investors to evaluate the comparability of the performance of our business year to year. |

|

NOTES: |

|

|

1) |

Net Income and Net Income per Share for Omnicom Group Inc. |

|

2) |

See non-GAAP reconciliations starting on page 8. |

|

3) |

For the nine months ended September 30, 2024, operating expenses include $57.8 million ($42.9 million after-tax) of repositioning costs, primarily related to severance, which reduce diluted net income per share- Omnicom Group Inc. by $0.22. There were no repositioning costs for the three months ended September 30, 2024. |

|

4) |

There were no repositioning costs impacting the three months ended September 30, 2023. |

|

5) |

For the nine months ended September 30, 2023, operating expenses included real estate operating lease impairment charges, severance, and other exit costs of $191.5 million ($145.5 million after-tax) related to repositioning actions we took in the first and second quarters of 2023 to reduce our real estate requirements, rebalance our workforce, and consolidate operations in certain markets. In addition, in the second quarter of 2023, we recorded a gain of $78.8 million ($55.9 million after tax) on disposition of certain of our research businesses in the Execution & Support discipline. The net impact of these actions reduced diluted net income per share- Omnicom Group Inc. by $0.44. |

|

6) |

Beginning with the first quarter of 2024, EBITA is defined as earnings before interest, taxes and amortization of acquired intangible assets and internally developed strategic platform assets. As a result, we reclassified the prior year periods to be consistent with the revised definition, which reduced EBITA from previously reported amounts. |

![]() View original content:https://www.prnewswire.com/news-releases/omnicom-reports-third-quarter-2024-results-302276965.html

View original content:https://www.prnewswire.com/news-releases/omnicom-reports-third-quarter-2024-results-302276965.html

SOURCE Omnicom Group Inc.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia vs. Palantir: Which Is the Better Red-Hot AI Stock?

Nvidia (NVDA) and Palantir (PLTR) have been two of 2024’s hottest stocks — Nvidia’s 179.6% year-to-date gain has made it the second-most valuable company in the world by market cap, while Palantir’s 153.3% gain has put it on the map as a mega-cap tech stock to be reckoned with, not to mention a new member of the S&P 500 (SPX).

Both stocks have benefitted from being key players in the AI revolution. Both companies have exciting futures ahead of them, but there is a key difference between the two that makes one the more compelling opportunity at this point in time. Which looks like the better choice for investors right now?

Massive Gap in Valuation on a Price-to-Earnings Basis

Nvidia’s 2024 surge has taken it to a relatively high valuation multiple of 47.5 times January 2025 earnings estimates. The S&P 500 trades at 24.7 times earnings, meaning that Nvidia is nearly twice as expensive as the broader market.

However, with consensus earnings per share projected to grow to $4.01 per share for the fiscal year ending in January 2026, Nvidia looks quite a bit more palatable at 33.6 times forward earnings. While this is still fairly expensive, it’s starting to look reasonable enough for a mega-cap powerhouse projected to grow earnings per share by over 40% for the year. While Nvidia sometimes catches flack from value-oriented investors for its above-average price-to-earnings multiple, Palantir is even more expensive.

The massive 153% YTD gain has pushed shares of Palantir to an incredible valuation of 122.4 times December 2024 earnings estimates. This is more than double Nvidia’s valuation and roughly five times the broader market. With the stock expected to grow earnings per share by 19.4% to $0.43 per share for December 2025, the stock’s valuation comes down a bit but is still trading at an exorbitant triple-digit multiple of 100.8 times forward earnings.

Looking Beyond Price-to-Earnings

Plus, it’s not just price-to-earnings that makes Palantir look significantly more expensive than Nvidia. When looking at the two stocks on a price-to-sales basis, a popular metric often used for evaluating high-growth names like technology stocks and software stocks, Palantir trades at an astronomical price-to-sales ratio of 35.3, while Nvidia trades for a high but comparatively cheaper 26.3 times sales.

What About the PEG Ratio?

Lastly, it’s worth comparing the two stocks based on their PEG ratios (price-to-earnings-to-growth ratio), a popular valuation metric useful for evaluating growth stocks like Nvidia and Palantir by accounting for earnings growth. PEG ratio is calculated by taking a stock’s price-to-earnings ratio and dividing it by its earnings growth rate. The lower the PEG ratio, the better a stock looks by this measure. Investors and analysts who utilize this metric typically view a PEG ratio of 1.0x or less to be undervalued.

So, how do Nvidia and Palantir stack up on this basis? Nvidia’s PEG ratio of 1.8 is a bit higher than ideal but not prohibitive. On the other hand, Palantir trades at a significantly higher PEG ratio of 10.4, indicating that it is likely overvalued even when accounting for its earnings growth.

Palantir is no doubt an exciting company, but it’s hard to sustain a valuation multiple like this, and it leaves little room for error — if the company falls short of analyst expectations or hits any speed bumps, shares could tumble quickly.

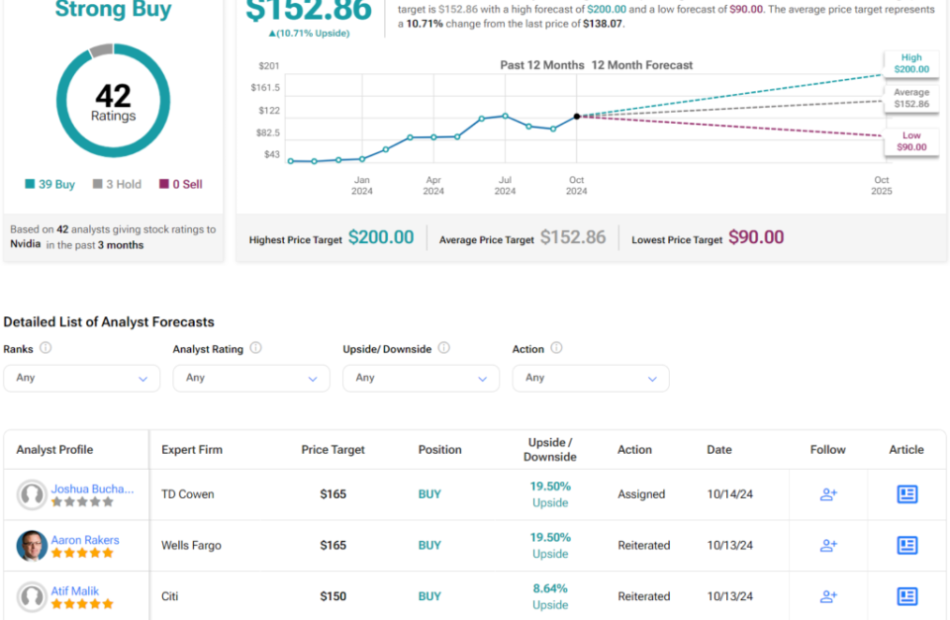

Is NVDA Stock a Buy, According to Analysts?

Turning to Wall Street, NVDA earns a Strong Buy consensus rating based on 39 Buys, three Holds, and zero Sells assigned in the past three months. The average NVDA stock price target of $152.86 implies 10.7% upside potential from current levels.

Is PLTR Stock a Buy, According to Analysts?

Turning to Wall Street, PLTR earns a Hold consensus rating based on four Buys, six Holds, and six Sell ratings assigned in the past three months. The average PLTR stock price target of $27.67 implies 36.2% downside potential from current levels.

Smarten Up

Wall Street analysts are far more constructive on Nvidia, and so is TipRanks’ proprietary Smart Score system. The Smart Score is a quantitative stock scoring system created by TipRanks. It gives stocks a score from one to 10, based on eight key market factors. Scores of eight, nine, or 10 are considered equivalent to an Outperform rating. Scores of four, five, six, or seven are considered Neutral, and scores of three or below are considered equivalent to an Underperform rating.

Nvidia boasts an Outperform-equivalent Smart Score of 9.

Meanwhile, Palantir receives a far less favorable Neutral Smart Score of 4.

Nvidia Is the Clear Choice

NVDA and PLTR are both high-flying AI stocks, and both are projected to grow earnings significantly in the year ahead. However, Nvidia is projected to grow earnings more than twice as much as Palantir. Despite this, Nvidia shares trade for a far cheaper valuation multiple. Nvidia is often criticized as an ‘expensive’ stock, but its forward earnings multiple is just a third of Palantir’s double-digit valuation, making it look downright cheap in comparison.

Plus, sell-side analysts rate Nvidia a Strong Buy and see an upside of 10.7% over the next 12 months, while they are considerably more cautious towards Palantir, rating it a Hold and forecasting a potential downside of 36.4% from current levels. This disparity in analyst views is another strong point in favor of Nvidia.

I’m bullish on Nvidia based on its significantly cheaper valuation and superior earnings growth, making it the clear-cut winner in this comparison of high-profile AI stocks. For investors looking to capitalize on the generative AI wave, Nvidia continues to look like a smart choice.