At $43 is it Time to Take Profit with Palantir?

There’s a saying that stocks don’t move in one direction all the time. Palantir Technologies Inc. PLTR is testing the logic behind that saying. PLTR stock is up a whopping 151% in 2024 nearly matching the 168% gain in NVIDIA Corp.

Furthermore, the stock is up 24% in the last month alone. This has brought Palantir’s market cap close to $100 billion. For context, the company started out the year with a $37 billion market cap.

The recent stock price move corresponds to the company’s inclusion in the S&P 500. That was expected to raise the stock price as institutional money flowed in. However, many investors expected there to be an initial pullback.

However, that hasn’t been the case. But with the stock above $43 a share, it’s now moving into an area that is overbought by technical indicators. If you’re a long-term investor, any talk of selling Palantir at this price is quickly dismissed. But at its current price, many traders are asking if now is a time to take some profit. Without giving specific investment advice, let’s look at what you should know before making a decision.

Palantir is Objectively Overvalued

By any objective fundamental measure, PLTR stock is expensive. The price-to-earnings (P/E) ratio is 359.45, the price-to-sales (P/S) is 41.7, and the PEG is 4.6.

Even among technology stocks, metrics like those suggest that investors are pulling forward a lot of future earnings. However, bulls will argue that there’s a difference between price and value. And stocks like Palantir and NVIDIA can be overvalued for a long time before they grow into their valuation.

Palantir is Different

But it may be expensive for a reason. A key reason is Palantir’s ontology, which is how Palantir’s software makes large language models (LLMs) useful. In layman’s terms, Palantir’s ontology allows businesses to get useful insight from their AI investments.

Without a useful ontology, AI has little value for companies. However, as Palantir continues to stack up contracts from both the government and commercial sides, it’s clear that many people are seeing the value in Palantir’s software. It’s also important to note that Palantir’s platform gives its customers the ability to leverage multiple LLMs so customers can experiment with the strengths of various models within the same platform.

Why You Shouldn’t Sell PLTR Stock

Palantir skeptics will point out that there’s been a large amount of insider selling in PLTR stock in the last 90 days. You can find a list of these on the Insider Trades page for Palantir stock on MarketBeat. However, in many of these cases, the trading was done as part of a Rule 10b5-1 trading plan. That means that these trades were planned for a long time without the insiders having any knowledge of what the stock price would be at the time they sold.

This should remind investors that there are many reasons to sell a stock. In the case of Palantir, many of these executives may receive a significant part of their compensation as stock.

A Possible Options Trade

If you’re comfortable with options trading, an option could be to buy puts on PLTR with a longer-dated expiration date. That gives you the right, but not the obligation, to purchase shares if the stock falls to your strike price. If you do buy the shares, you’ll be getting them at the new price which could help your average cost if you bought the shares recently. Otherwise, you can simply let the option(s) expire, and you’ll have the same position in the stock.

One Size Doesn’t Fit All

The challenge with a stock like Palantir is that your decision to buy or sell will depend on many factors. For example, if you purchased shares when they were at $30 a share, the decision to take some profit may be easier than if you bought shares when the stock was trading for around $8.

It’s possible, but unlikely, that the stock will trade at that level again. Selling some of those shares gives you a larger profit, but you’ll never get shares at that low price again.

Tough call.

Ultimately, investors should always remember that, like corporate insiders, retail investors have many reasons to sell a stock. Only you can answer how you would feel if PLTR stock dropped by 20% or more.

The article “At $43 is it Time to Take Profit with Palantir?” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Guess What Percent Of Households Have Over $1 Million? You Might Be Shocked By The Number Of Millionaires

Many people dream of joining the millionaire club and that dream has become a reality for many Americans.

According to the Federal Reserve’s latest data from the end of 2022, the number of millionaire households in the U.S. is rising – and it’s not just inflation making the numbers look bigger. Even when adjusting for inflation, the percentage of households with a net worth of at least $1 million surged from 2019 to 2022 after being relatively flat for nearly two decades.

Don’t Miss:

So, just how many millionaires are out there? According to the Federal Reserve’s 2022 survey, approximately 18% of U.S. households had at least seven figures net worth. That’s roughly 23.7 million millionaire households across the country. And with the stock market and real estate values performing strongly since then, even more households will likely join the ranks of millionaires in 2024.

While these numbers are exciting, they also come with some interesting insights into building that kind of wealth. Millionaire households share certain characteristics that offer clues for boosting their net worth.

See Also: I’m 62 Years Old And Have $1.2 Million Saved. Is This Enough to Retire Stress-Free?

Common Traits and Characteristics of Millionaire Households

Most millionaires don’t fit the luxury-laden stereotype. Many built their wealth through disciplined saving and investing, often in employer-sponsored retirement accounts like 401(k)s. Roughly 70% of millionaires accumulated their wealth this way and a surprising 73% have never carried a credit card balance. The majority aren’t high earners either – most didn’t hit six-figure salaries during their careers.

According to MillennialMoney, most millionaires are 60-79 years old, which shows that it takes time for most people to accumulate wealth.

Trending: Studies show 50% of consumers think Financial Advisors cost much more than they do — to debunk this, this company provides matching for free and a complimentary first call with the matched advisor.

Real estate also plays a big role, with primary residences contributing about 32% of a typical millionaire’s net worth. Millionaires also prioritize education, with over 60% holding a degree from public universities and only 8% from Ivy League schools.

Another characteristic is saving. Millionaires often live below their means and prioritize saving over spending. This discipline helps them build up their assets while avoiding lifestyle inflation – the temptation to spend more as income rises.

Many millionaires also have multiple streams of income. Whether through investments, side businesses or diversified career paths, they don’t rely on a single source of earnings.

See Also: Many are using this retirement income calculator to check if they’re on pace — here’s a breakdown on how on what’s behind this formula.

What Does This Mean for You?

While these habits may serve as a road map, wealth-building isn’t a one-size-fits-all process. If you’re aiming for millionaire status, consulting a financial advisor can help you craft a strategy that fits your lifestyle and goals. A pro can guide you in picking investments that align with your risk tolerance and financial timeline – because, let’s face it, the road to a million is smoother with some expert advice along the way.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article Guess What Percent Of Households Have Over $1 Million? You Might Be Shocked By The Number Of Millionaires originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Magnificent High-Yield Energy Stock Down 20% to Buy and Hold Forever

Stocks in the energy sector tend to be volatile, largely because oil prices often swing dramatically and quickly. That’s just par for the course if you want to invest in oil and natural gas stocks. That said, there’s a way to position yourself to survive the frequent ups and downs in relative stride.

One way is to invest in an energy stock that has a generous yield, a strong balance sheet, and is trading roughly 20% below its most recent high water mark. Chevron (NYSE: CVX) is one such magnificent high-yield energy stock. Here’s why you might want to buy today and hold forever.

What does Chevron do?

Chevron is really three businesses in one. It produces oil and natural gas in the upstream segment of the energy industry. It transports these commodities, and the products into which they get turned, in the midstream segment. And it processes oil and natural gas in the downstream, which encompasses both chemicals and refining operations. Each of these business segments operates a little differently from the others, which helps to smooth out the company’s financial results over time.

This diversification is what makes Chevron an integrated energy company. But there’s more to consider here. On top of being spread across the industry, the company also has a global reach. This allows Chevron to put money to work where it will have the biggest impact on its financial results. For example, if liquified natural gas heading into Japan is earning a premium, Chevron may be able to shift its business to get more natural gas into that market. Lately, Chevron has been finding value in expanding its onshore U.S. drilling presence.

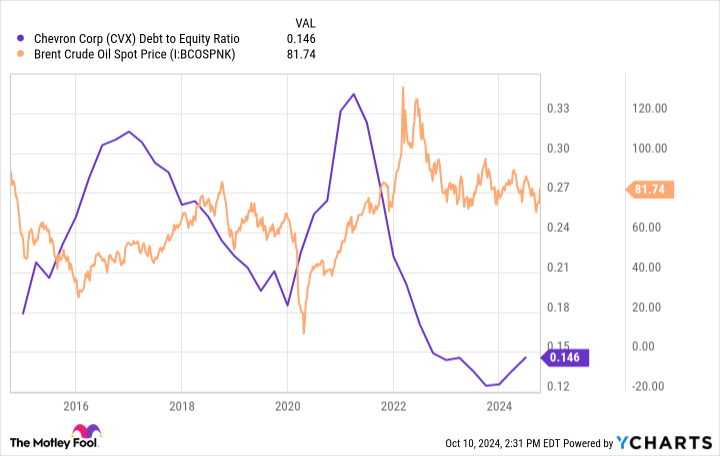

There’s yet another key aspect to consider about Chevron: its balance sheet. Chevron’s debt-to-equity ratio is a tiny 0.15 times, lower than any of its closest peers. This provides Chevron the leeway to take on debt when energy prices are weak (and its financial results are under pressure) so that it can continue to invest in its business and support its dividend. When you add it all together, Chevron has the business and financial resilience to roll with the inevitable punches that come with operating in the highly volatile energy sector.

The proof is in Chevron’s dividend pudding

For income investors, however, the real evidence of Chevron’s long-term desirability comes from its dividend. The company has increased its dividend annually for a huge 37 consecutive years. That period includes the deep oil downturn during the early days of the coronavirus pandemic and the Great Recession, to name just two recent difficult economic periods. It is this level of consistency that should give dividend investors the comfort to buy Chevron and hold it for the long term, perhaps even forever.

What’s interesting about Chevron at the moment is that the stock is down around 20% from its peak levels in late 2022. That drop broadly tracks the drop in oil prices over the span, but, as the company’s diversified and financially strong business foundation would suggest, Chevron’s price decline hasn’t been as dramatic as the fall in the price of oil. Compare that to Devon Energy (NYSE: DVN), a pure play driller operating only in the upstream segment of the industry. Its stock has dropped a touch further than Brent Crude, a key global oil benchmark.

In addition to the price decline and impressive dividend resiliency, Chevron is also attractive for the income you can generate from owning it. Right now the stock’s dividend yield is roughly 4.4%, which is multiples of the 1.2% yield you would collect from the S&P 500 index and well above the 3.4% yield of the average energy stock, using Energy Select Sector SPDR ETF as an industry proxy.

If you are looking to add energy exposure to your portfolio, Chevron is one of the most attractive ways to do it right now. And it is the kind of company that you can comfortably keep in your portfolio year after year, knowing that it can handle the industry’s often wide swings while continuing to pay you well all along.

Chevron is your all-weather friend

To be fair, the best time to buy Chevron is during a deep energy industry downturn. The dividend yield can rise toward 10% when investors are running scared. If you have the fortitude to make a contrarian buy like that, hold off. But the fact is that buying when it feels like the world is coming to an end is very, very difficult. It is probably a better idea to buy Chevron while it looks reasonably attractive and steel yourself for the inevitable energy downturns to come. Once you own it and see how reliable a dividend stock it is, it will be easier for you to step in and add to your position when the stock is even cheaper.

Should you invest $1,000 in Chevron right now?

Before you buy stock in Chevron, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chevron wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chevron. The Motley Fool has a disclosure policy.

1 Magnificent High-Yield Energy Stock Down 20% to Buy and Hold Forever was originally published by The Motley Fool

ASML, Walgreens, Trump Media, United Airlines, And Tesla: Why These 5 Stocks Are On Investors' Radars Today

On Tuesday, major U.S. indices saw losses, with the Dow Jones Industrial Average falling 0.75% to 42,740.42, while the S&P 500 slipped by a comparable margin to 5,815.26. The Nasdaq dropped nearly 1%, closing at 18,315.59.

These are the top stocks that gained the attention of retail traders and investors throughout the day:

ASML Holding ASML

ASML Holding saw a significant drop of 16.26% to close at $730.43 after an accidental early release of the company’s third-quarter earnings report. The Dutch semiconductor giant revised its 2025 net sales guidance to between 30 billion euros and 35 billion euros, a reduction from the previously stated range. The news sent shockwaves through the semiconductor sector.

Walgreens Boots Alliance WBA

Walgreens Boots Alliance reported a rise of 15.78% to close at $10.42. The company’s fourth-quarter fiscal year 2024 sales beat the consensus, reflecting growth across all segments. However, adjusted operating income saw a decrease of 37.7% on a constant currency basis.

See Also: Columbus Day: Is Stock Market Open Today?

Trump Media & Technology Group DJT

Trump Media & Technology Group stock fell by 9.65% to close at $27.06. The company’s Truth+ streaming service launched on the web and an Android app, with plans to expand to other platforms.

United Airlines Holdings UAL

United Airlines Holdings reported a slight increase of 0.82% to close at $64.05. The airline company’s third-quarter revenue and adjusted earnings per share beat analyst estimates.

Tesla Inc. TSLA

Tesla Inc. saw a marginal increase of 0.19% to close at $219.57. The EV giant reportedly transferred nearly all of its Bitcoin BTC/USD stash to unknown wallets, sparking speculation about the company’s cryptocurrency holdings.

Photo by Phongphan on Shutterstock

Prepare for the day’s trading with top premarket movers and news by Benzinga.

Check This Out:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Aeries Technology Reports Results for First Fiscal Quarter 2025

NEW YORK, Oct. 15, 2024 (GLOBE NEWSWIRE) — Aeries Technology AERT, a global professional services and consulting partner for businesses in transformation mode and their stakeholders, today announced financial results for the fiscal quarter ended June 30, 2024.

“Our results for the quarter reflect the impact of investments in ongoing growth strategies which should yield long term benefits. While we expect the next few quarters to reflect the focus on our strategies, we are confident regarding the resultant business growth and the costs realigning to an optimum level required for sustaining a growth-oriented business. We are, in parallel, focused on accelerating our return to high profitability with a number of operational initiatives completed and underway that will achieve that goal,” said Sudhir Panikassery, CEO of Aeries Technology.

Fiscal Quarter Ended June 30, 2024 (First Fiscal Quarter 2025) Financial Highlights

Revenues: Revenues for the first fiscal quarter 2025 were $16.7 million, up 2% compared to $16.3 million for the first fiscal quarter of 2024.

Income from Operations: Income from operations for the first fiscal quarter 2025 was $(16.4) million, down compared to $0.8 million for the first fiscal quarter of 2024.

Net Income (Loss): Net loss for the first fiscal quarter 2025 was $(15.3) million compared to net income of $0.5 million for the first fiscal quarter of 2024.

Adjusted EBITDA: Adjusted EBITDA for the first fiscal quarter 2025 was $0.4 million compared to $2.9 million for the first fiscal quarter of 2024.

Conference Call Details

The company will host a conference call to discuss their financial results on Wednesday, October 16, 2024 at 8:30 AM ET. The call will be accessible by telephone at 1-877-407-0792 (domestic) or 1-201-689-8263 (international). The call will also be available live via webcast on the company’s investor relations website at https://ir.aeriestechnology.com or directly here.

A telephone replay of the conference call will be available following its conclusion at 1-844-512-2921 (domestic) or 1-412-317-6671 (international) with access code 13749658 and will be available until 11:59 PM ET, October 23, 2024. An archive of the webcast will also be available on the company’s investor relations website at https://ir.aeriestechnology.com.

About Aeries Technology

Aeries Technology AERT is a global professional services and consulting partner for businesses in transformation mode and their stakeholders, including private equity sponsors and their portfolio companies, with customized engagement models that are designed to provide the right mix of deep vertical specialty, functional expertise, and digital systems and solutions to scale, optimize and transform a client’s business operations. Founded in 2012, Aeries Technology now has over 1,700 professionals specializing in Technology Services and Solutions, Business Process Management, and Digital Transformation initiatives, geared towards providing tailored solutions to drive business success. Aeries Technology’s approach to staffing and developing its workforce has earned it the Great Place to Work Certification.

Non-GAAP Financial Measures

The Company uses non-GAAP financial information and believes it is useful to investors as it provides additional information to facilitate comparisons of historical operating results, identify trends in its underlying operating results and provide additional insight and transparency on how it evaluates the business. The Company uses non-GAAP financial measures to budget, make operating and strategic decisions, and evaluate its performance. The Company has detailed the non-GAAP adjustments that it makes in the non-GAAP definitions below. The adjustments generally fall within the categories of non-cash items. The Company believes the non-GAAP measures presented herein should always be considered along with, and not as a substitute for or superior to, the related GAAP financial measures. In addition, similarly titled items used by other companies may not be comparable due to variations in how they are calculated and how terms are defined. For further information, see “Reconciliation of Non—GAAP Financial Measures” below, including the reconciliations of these non-GAAP measures to their most directly comparable GAAP financial measures.

The Company defines Adjusted EBITDA as net income from operations before interest, income taxes, depreciation and amortization adjusted to exclude stock-based compensation and business combination related costs. Adjusted EBITDA is one of the key performance indicators the company uses in evaluating our operating performance and in making financial, operating, and planning decisions. The Company believes adjusted EBITDA is useful to investors in the evaluation of Aeries’ operating performance as such information was used by the Company’s management for internal reporting and planning procedures, including aspects of our consolidated operating budget and capital expenditures.

Forward-Looking Statements

All statements in this release that are not based on historical fact are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and the provisions of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Words such as “anticipate,” “believe,” “continue,” “could,” “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “should”, “would”, “will”, “understand” and similar words are intended to identify forward looking statements. These forward-looking statements include but are not limited to, statements regarding our future operating results, outlook, guidance and financial position, our business strategy and plans, our objectives for future operations, potential acquisitions and macroeconomic trends. While management has based any forward-looking statements included in this release on its current expectations, the information on which such expectations were based may change. These forward-looking statements rely on a number of assumptions concerning future events and are subject to a number of risks, uncertainties and other factors, many of which are outside of the control of Aeries and its subsidiaries, which could cause actual results to materially differ from such statements. Such risks, uncertainties, and other factors include, but are not limited to, changes in the business, market, financial, political and legal conditions in India, Singapore, the United States, Mexico, the Cayman Islands and other countries, including developments with respect to inflation, interest rates and the global supply chain, including with respect to economic and geopolitical uncertainty in many markets around the world, the potential of decelerating global economic growth and increased volatility in foreign currency exchange rates; the potential for our business development efforts to maximize our potential value; the ability to recognize the anticipated benefits of the business combination with Worldwide Webb Acquisition Corp., which may be affected by, among other things, competition, our ability to grow and manage growth profitably and retain its key employees; the ability to maintain the listing of our Class A ordinary shares and our public warrants on Nasdaq, and the potential liquidity and trading of our securities; changes in applicable laws or regulations and other regulatory developments in the United States, India, Singapore, Mexico, the Cayman Islands and other countries; our ability to develop and maintain effective internal controls, including our ability to remediate the material weakness in our internal controls over financial reporting; our success in retaining or recruiting, or changes required in, our officers, key employees or directors; our financial performance; our ability to continue as a going concern; our ability to make acquisitions, divestments or form joint ventures or otherwise make investments and the ability to successfully complete such transactions and integrate with our business; the period over which we anticipate our existing cash and cash equivalents will be sufficient to fund our operating expenses and capital expenditure requirements; the conflicts between Russia and Ukraine, and Israel and Hamas, and any restrictive actions that have been or may be taken by the U.S. and/or other countries in response thereto, such as sanctions or export controls; risks related to cybersecurity and data privacy; the impact of inflation; the impact of the COVID-19 pandemic and other similar pandemics and disruptions in the future; and the fluctuation of economic conditions, global conflicts, inflation and other global events on Aeries’ results of operations and global supply chain constraints. Further information on risks, uncertainties and other factors that could affect our financial results are included in Aeries’ periodic and current reports filed with the U.S. Securities and Exchange Commission. Furthermore, Aeries operates in a highly competitive and rapidly changing environment where new and unanticipated risks may arise. Accordingly, investors should not place any reliance on forward-looking statements as a prediction of actual results. Aeries disclaims any intention to, and undertakes no obligation to, update or revise forward-looking statements.

Contacts

Ryan Gardella

AeriesIR@icrinc.com

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME (In thousands, except percentages) |

||||||||

| Three Months Ended June 30, 2024 |

Three Months Ended June 30, 2023 |

|||||||

| Revenue, net | $ | 16,667 | $ | 16,330 | ||||

| Cost of revenue | 12,657 | 11,883 | ||||||

| Gross profit | 4,010 | 4,447 | ||||||

| Operating expenses | ||||||||

| Selling, general & administrative expenses | 20,430 | 3,670 | ||||||

| Total operating expenses | 20,430 | 3,670 | ||||||

| Income from operations | (16,420 | ) | 777 | |||||

| Other income/ (expense) | ||||||||

| Change in fair value of forward purchase agreement put option liability | (696 | ) | – | |||||

| Change in fair value of derivative warrant liabilities | 757 | – | ||||||

| Interest income | 79 | 64 | ||||||

| Interest expense | (147 | ) | (123 | ) | ||||

| Other income/(expense), net | 19 | (6 | ) | |||||

| Total other income/(expense), net | 12 | (65 | ) | |||||

| Income/(loss) before income taxes | (16,408 | ) | 712 | |||||

| Income tax (expense) / benefit | 1,091 | (218 | ) | |||||

| Net income / (loss) | $ | (15,317 | ) | $ | 494 | |||

| Less: Net income / (loss) attributable to noncontrolling interests | (506 | ) | 73 | |||||

| Less: Net income attributable to redeemable noncontrolling interests | 10 | – | ||||||

| Net income / (loss) attributable to shareholders’ of Aeries Technology, Inc. | $ | (14,821 | ) | $ | 421 | |||

| Weighted average shares outstanding of Class A ordinary shares, basic and diluted(1) | 37,852,036 | |||||||

| Basic and Diluted net loss per Class A ordinary share(1) | $ | (0.39 | ) | |||||

| (1) | Net loss per Class A ordinary share and weighted average Class A ordinary shares outstanding is not presented for the periods prior to the Business Combination, as defined in Note 1. For more information refer to Note 14. |

| RECONCILIATION OF NON-GAAP FINANCIAL MEASURES (In thousands, except percentages) |

||||||||

| Three Months Ended June 30, |

||||||||

| 2024 | 2023 | |||||||

| Net income | $ | (15,317 | ) | $ | 494 | |||

| Income tax expense | (1,091 | ) | 218 | |||||

| Interest income | (79 | ) | (64 | ) | ||||

| Interest expenses | 147 | 123 | ||||||

| Depreciation and amortization | 374 | 327 | ||||||

| EBITDA | $ | (15,966 | ) | $ | 1,098 | |||

| Adjustments | ||||||||

| (+) Stock-based compensation | 12,746 | 1,374 | ||||||

| (+) Business Combination related costs | 3,682 | 430 | ||||||

| (+) Change in fair value of derivative liabilities | (61 | ) | – | |||||

| Adjusted EBITDA | $ | 401 | $ | 2,902 | ||||

| (/) Revenue | 16,667 | 16,330 | ||||||

| Adjusted EBITDA Margin | 2.4 | % | 17.8 | % | ||||

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands) |

||||||||

| Three Months Ended June 30, 2024 |

Three Months Ended June 30, 2023 |

|||||||

| Cash flows from operating activities | ||||||||

| Net income / (loss) | $ | (15,317 | ) | $ | 494 | |||

| Adjustments to reconcile net income / (loss) to net cash (used in) / provided by operating activities: | ||||||||

| Depreciation and amortization expense | 374 | 327 | ||||||

| Stock-based compensation expense | 12,746 | 1,374 | ||||||

| Deferred tax (benefit) / expense | (1,241 | ) | 100 | |||||

| Accrued income from long-term investments | (52 | ) | (45 | ) | ||||

| Provision for expected credit loss | 1,024 | 1 | ||||||

| Profit on sale of property and equipment | (1 | ) | – | |||||

| Sundry balances written back | – | (5 | ) | |||||

| Change in fair value of forward purchase agreement put option liability | (757 | ) | – | |||||

| Change in fair value of derivative warrant liabilities | 696 | – | ||||||

| Loss on issuance of shares against accounts payable | 78 | – | ||||||

| Unrealized exchange (gain) / loss | (18 | ) | 5 | |||||

| Changes in operating assets and liabilities: | ||||||||

| Accounts receivable | 104 | (463 | ) | |||||

| Prepaid expenses and other current assets | (231 | ) | (1,607 | ) | ||||

| Operating right-of-use assets | 326 | (1,139 | ) | |||||

| Other assets | (217 | ) | (250 | ) | ||||

| Accounts payable | 105 | (639 | ) | |||||

| Accrued compensation and related benefits, current | (940 | ) | (834 | ) | ||||

| Other current liabilities | 1,617 | 1,147 | ||||||

| Operating lease liabilities | (321 | ) | 1,190 | |||||

| Other liabilities | 305 | 445 | ||||||

| Net cash (used in) / provided by operating activities | (1,720 | ) | 101 | |||||

| Cash flows from investing activities | ||||||||

| Acquisition of property and equipment | (370 | ) | (258 | ) | ||||

| Sale of property and equipment | 2 | – | ||||||

| Issuance of loans to affiliates | (276 | ) | (682 | ) | ||||

| Payments received for loans to affiliates | 36 | 374 | ||||||

| Net cash used in investing activities | (608 | ) | (566 | ) | ||||

| Cash flows from financing activities | ||||||||

| Net proceeds from short term borrowings | (166 | ) | 1,244 | |||||

| Payment of insurance financing liability | (220 | ) | – | |||||

| Proceeds from long-term debt | 240 | 490 | ||||||

| Repayment of long-term debt | (4 | ) | (186 | ) | ||||

| Payment of finance lease obligations | (123 | ) | (86 | ) | ||||

| Payment of deferred transaction costs | (20 | ) | (446 | ) | ||||

| Net changes in net shareholders’ investment | – | (10 | ) | |||||

| Proceeds from issuance of Class A ordinary shares, net of issuance cost | 4,678 | – | ||||||

| Net cash provided by financing activities | 4,385 | 1,006 | ||||||

| Effect of exchange rate changes on cash and cash equivalents | 56 | (8 | ) | |||||

| Net increase in cash and cash equivalents | 2,113 | 533 | ||||||

| Cash and cash equivalents at the beginning of the period | 2,084 | 1,131 | ||||||

| Cash and cash equivalents at the end of the period | $ | 4,197 | $ | 1,644 | ||||

| Supplemental cash flow disclosure: | ||||||||

| Cash paid for interest | $ | 118 | $ | 121 | ||||

| Cash paid for income taxes, net of refunds | $ | 802 | $ | 185 | ||||

| Supplemental disclosure of non-cash investing and financing activities: | ||||||||

| Unpaid deferred transaction costs included in accounts payable and other current liabilities | $ | 643 | $ | 1,317 | ||||

| Equipment acquired under finance lease obligations | $ | 38 | $ | 221 | ||||

| Property and equipment purchase included in accounts payable | $ | 1 | $ | 37 | ||||

| BALANCE SHEET (In thousands) |

||||||||

| JUNE 30, 2024 |

MARCH 31, 2024 |

|||||||

| (Unaudited) | ||||||||

| ASSETS | ||||||||

| Current assets: | ||||||||

| Cash and cash equivalents | $ | 4,197 | $ | 2,084 | ||||

| Accounts receivable, net of allowance of $2,299 and $1,263 as of June 30, 2024 and March 31, 2024, respectively | 22,406 | 23,757 | ||||||

| Prepaid expenses and other current assets, net of allowance of $1 and $1, as of June 30, 2024 and March 31, 2024, respectively | 7,196 | 6,995 | ||||||

| Total current assets | $ | 33,799 | $ | 32,836 | ||||

| Property and equipment, net | 3,552 | 3,579 | ||||||

| Operating right-of-use assets | 6,953 | 7,318 | ||||||

| Deferred tax assets | 3,203 | 1,933 | ||||||

| Long-term investments, net of allowance of $113 and $126, as of June 30, 2024 and March 31, 2024, respectively | 1,677 | 1,612 | ||||||

| Other assets, net of allowance of $1 and $1, as of June 30, 2024 and March 31, 2024, respectively | 2,584 | 2,129 | ||||||

| Total assets | $ | 51,768 | $ | 49,407 | ||||

| LIABILITIES, REDEEMABLE NONCONTROLLING INTEREST AND SHAREHOLDERS’ EQUITY (DEFICIT) | ||||||||

| Current liabilities: | ||||||||

| Accounts payable | $ | 6,633 | $ | 6,616 | ||||

| Accrued compensation and related benefits, current | 2,163 | 3,119 | ||||||

| Operating lease liabilities, current | 1,953 | 2,080 | ||||||

| Short-term borrowings | 6,395 | 6,778 | ||||||

| Forward purchase agreement put option liability | 10,940 | 10,244 | ||||||

| Other current liabilities | 10,744 | 9,288 | ||||||

| Total current liabilities | $ | 38,828 | $ | 38,125 | ||||

| Long term debt | 1,675 | 1,440 | ||||||

| Operating lease liabilities, noncurrent | 5,383 | 5,615 | ||||||

| Derivative warrant liabilities | 610 | 1,367 | ||||||

| Deferred tax liabilities | 118 | 92 | ||||||

| Other liabilities | 4,233 | 3,948 | ||||||

| Total liabilities | $ | 50,847 | $ | 50,587 | ||||

| Commitments and contingencies (Note 10) | ||||||||

| Redeemable noncontrolling interest | 735 | 734 | ||||||

| Shareholders’ equity (deficit) | ||||||||

| Preference shares, $0.0001 par value; 5,000,000 shares authorized; none issued or outstanding | – | – | ||||||

| Class A ordinary shares, $0.0001 par value; 500,000,000 shares authorized; 44,102,041 shares issued and outstanding as of June 30, 2024; 15,619,004 shares issued and outstanding as of March 31, 2024 | 4 | 2 | ||||||

| Class V ordinary shares, $0.0001 par value; 1 share authorized, issued and outstanding | – | – | ||||||

| Net shareholders’ investment and additional paid-in capital | 26,895 | – | ||||||

| Accumulated other comprehensive loss | (641 | ) | (574 | ) | ||||

| Accumulated deficit | (26,489 | ) | (11,668 | ) | ||||

| Total Aeries Technology, Inc. shareholders’ deficit | $ | (231 | ) | $ | (12,240 | ) | ||

| Noncontrolling interest | 417 | 10,326 | ||||||

| Total shareholders’ equity (deficit) | 186 | (1,914 | ) | |||||

| Total liabilities, redeemable noncontrolling interest and shareholders’ equity (deficit) | $ | 51,768 | $ | 49,407 | ||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trump Media stock plunges after weekslong rally

After a weekslong rally that saw shares of Trump Media & Technology Group (DJT) roughly triple in value, the stock took an 8% nosedive Tuesday afternoon.

Shares of the company behind former President Donald Trump’s right-wing social media platform Truth Social fell to $26.60 apiece after having been up roughly 10% that morning. Tuesday’s volatility led to the Nasdaq briefly halting trading.

The company’s stock has fluctuated wildly in value in the nearly seven months since it went public under the ticker DJT. Late last month, shares dropped as low as $12.15 each. Since Oct. 1, however, Trump Media shares are up 70%.

This see-sawing comes just weeks before the presidential election, which will see Trump face off against Democratic presidential candidate and Vice President Kamala Harris at the ballot box.

Trump is a majority shareholder of Trump Media, holding roughly 57% of the company’s stock — and he has said he has no plans to let go of his holdings. The stock’s recent rally has added some $2 billion to Trump’s net worth.

Trump Media has been widely considered a “meme stock” or “affinity stock,” with shares trading largely on sentiment about the former president by retail and individual investors, regardless of the company’s actual operating results or prospects.

“It’s purchasing his brand,” John Rekenthaler, vice president of research at Morningstar (MORN), previously told Quartz. He warned that the company’s stock could “go to zero” or close to it if Trump loses the coming election.

Trump Media has said in regulatory filings that its “success depends in part on the popularity of its brand and the reputation and popularity” of Trump and that “adverse reactions to publicity relating to [Trump], or the loss of his services, could adversely affect TMTG’s revenues and results of operations.”

JPMorgan CEO Jamie Dimon Says We Shouldn't Put Our Heads In The Sand, 'We Have To Find A Better Way To Help The People Who Get Hurt By AI'

During a recent interview with Bloomberg, Jamie Dimon, CEO of JPMorgan Chase (NYSE:JPM), had a lot to say about technology and artificial intelligence and how these advances could affect people’s jobs. With years of experience heading one of the biggest banks in the world, Dimon offered a cautious but optimistic assessment of the ongoing tech boom.

Don’t Miss:

Dimon pointed out that technological advancements are nothing new – they’ve been changing our lives for hundreds of years, from the printing press to steam engines to the Internet. He now thinks that another revolutionary wave is upon us due to the development of AI. “Tech is going to change many things,” he said. However, he also addressed the fear that comes with these changes, especially regarding job security.

Trending: ‘Scrolling to UBI’: Deloitte’s #1 fastest-growing software company allows users to earn money on their phones – invest today with $1,000 for just $0.25/share

Many people are concerned that AI will eliminate jobs, but Dimon stated that technology has always produced new jobs in addition to eliminating old ones. “Your job will be enhanced. You’ll get more research, more questions – you’ll have like a real super assistant chief of staff on your shoulder,” Dimon said, pointing out that AI has the potential to make people more productive in their roles.

Although he warned against putting “our head in the sand” or ignoring the issue, he conceded that some employment would probably be wiped out.

Trending: Beating the market through ethical real estate investing’ — this platform aims to give tenants equity in the homes they live in while scoring 17.17% average annual returns for investors – here’s how to join with just $100

Instead of just accepting job losses, Dimon emphasized that companies and society need to find better ways to help those impacted by these changes. “We have to find a better way to help the people who get hurt by it,” he stated. For its part, JPMorgan is committed to retraining and redeploying employees whose roles are affected: “We love to retrain people, redeploy them, re-educate them. And so I’m not worried about it.”

Dimon’s message was straightforward: technology has enormous advantages that can enhance our lives, increase productivity and keep us healthy. But we shouldn’t dismiss the potential consequences that these developments will bring about. While AI will undoubtedly alter how people work, he believes this won’t necessarily result in a general loss of jobs. “If it works for the customer and the client, we can kind of do more,” implying that successful businesses can continue to expand while assisting their employees in adjusting to these changes.

Trending: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you will work until you die.” Here’s how you can earn passive income with just $100.

Dimon also discussed how the current economic environment is affecting companies going public. He said that because they have access to private finance and wish to avoid the high costs and restrictions associated with initial public offerings (IPOs), many tech businesses opt not to go public now.

“It’s a little odd that public markets are quite elevated and IPOs haven’t come very much yet,” he said. He believes that eventually, companies will need to go public to provide liquidity for investors, but for now, the private markets are strong enough to support them.

Read Next:

UNLOCKED: 5 NEW TRADES EVERY WEEK. Click now to get top trade ideas daily, plus unlimited access to cutting-edge tools and strategies to gain an edge in the markets.

Get the latest stock analysis from Benzinga?

This article JPMorgan CEO Jamie Dimon Says We Shouldn’t Put Our Heads In The Sand, ‘We Have To Find A Better Way To Help The People Who Get Hurt By AI’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Rocky Mountain Chocolate Factory Reports Fiscal Second Quarter 2025 Financial Results

DURANGO, Colo., Oct. 15, 2024 (GLOBE NEWSWIRE) — Rocky Mountain Chocolate Factory Inc. RMCF (the “Company”, “we”, or “RMCF”), an international franchisor and producer of premium chocolates and other confectionery products including gourmet caramel apples, is reporting financial and operating results for its fiscal second quarter ended August 31, 2024.

“We are pleased with our progress this quarter as we begin executing our multi-year strategic plan,” said Jeff Geygan, Interim CEO of RMCF. “We have been focused on several critical areas of the business: strengthening the company’s liquidity, rebuilding a strong executive team, expanding our franchise network, and laying a solid foundation for sustainable growth and profitability.

“In recent months, we welcomed several key team members, including a new CFO to lead our finance organization. We are also beginning to drive momentum with the expansion of our franchise network across eight strategic markets in the U.S., starting with a new store opening in Edmond, Oklahoma next month. We are finalizing new franchise agreements for three additional store locations, which we expect to announce in the coming weeks. At the same time, our rebranding initiative is nearly complete, and we anticipate unveiling the new store design by year-end, which will enhance the RMCF experience for both franchisees and consumers.”

Geygan continued, “Subsequent to quarter end, we took an important step to improve our financial position with a new $6 million credit facility, which allowed us to retire our previous $4 million credit facility and raise additional capital for ongoing investments. With a strengthened balance sheet, improved liquidity and a committed franchise network, we believe we are well-positioned to execute our three-year strategic plan and drive RMCF toward sustainable growth and profitability.”

Fiscal Q2 2025 Financial Results vs. Year-Ago Quarter

- Total revenue for the second quarter of 2025 was $6.4 million compared to $6.6 million in the year-ago quarter.

- Total product and retail gross profit was $0.6 million compared to $0.4 million. Gross margin improved to 11.5% compared to 7.7%. The increase was primarily attributable to increased pricing and improved operating efficiencies.

- Total Costs and Expenses were reduced to $7.3 million compared to $7.6 million in the year-ago period.

- Net loss for the quarter was $0.7 million or ($0.11) per share, compared to net loss of $1.0 million or ($0.16) per share in fiscal Q2 2024.

Conference Call Information

The Company will conduct a conference call today at 5:00 p.m. Eastern time to discuss its financial results. A question-and-answer session will follow management’s opening remarks. The conference call details are as follows:

Date: Tuesday, October 15, 2024

Time: 5:00 p.m. Eastern time

Dial-in registration link: here

Live webcast registration link: here

Please dial into the conference call 5-10 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact the Company’s investor relations team at RMCF@elevate-ir.com.

The conference call will also be broadcast live and available for replay in the investor relations section of the Company’s website at https://ir.rmcf.com/.

About Rocky Mountain Chocolate Factory, Inc.

Rocky Mountain Chocolate Factory, Inc. is an international franchiser of premium chocolate and confection stores, and a producer of an extensive line of premium chocolates and other confectionery products, including gourmet caramel apples. Rocky Mountain Chocolate Factory was ranked in both the Franchise 500 by Entrepreneur Magazine and the Franchise 400 by Franchise Times for 2024. The Company is headquartered in Durango, Colorado. The Company and its franchisees and licensees operate over 260 Rocky Mountain Chocolate stores across the United States, with several international locations. The Company’s common stock is listed on the Nasdaq Global Market under the symbol “RMCF.”

Forward-Looking Statements

This press release includes statements of our expectations, intentions, plans and beliefs that constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to come within the safe harbor protection provided by those sections. These forward-looking statements involve various risks and uncertainties. The statements, other than statements of historical fact, included in this press release are forward-looking statements. Many of the forward-looking statements contained in this document may be identified by the use of forward-looking words such as “will,” “intend,” “believe,” “expect,” “anticipate,” “should,” “plan,” “estimate,” “potential,” or similar expressions. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. All statements that address operating performance, events or developments that we expect or anticipate will occur in the future – including statements expressing general views about future operational performance, financial results and execution of the Company’s strategic plan – are forward-looking statements. Management of the Company believes that these forward-looking statements are reasonable as and when made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date of this press release. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause our Company’s actual results to differ materially from historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to: inflationary impacts, changes in the confectionery business environment, seasonality, consumer interest in our products, receptiveness of our products internationally, consumer and retail trends, costs and availability of raw materials, competition, the success of our co-branding strategy, the success of international expansion efforts and the effect of government regulations. For a detailed discussion of the risks and uncertainties that may cause our actual results to differ from the forward-looking statements contained herein, please see the section entitled “Risk Factors” contained in our most recent Annual Report on Form 10-K and subsequent Quarterly Reports on Form 10-Q, each filed with the Securities and Exchange Commission.

Investor Contact

Sean Mansouri, CFA

Elevate IR

720-330-2829

RMCF@elevate-ir.com

| Rocky Mountain Chocolate Factory, Inc. and Subsidiaries Condensed Consolidated Balance Sheets (In thousands, except per share amounts) |

||||||||

| August 31, 2024 (unaudited) | February 29, 2024 | |||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash and cash equivalents | $ | 973 | $ | 2,082 | ||||

| Accounts receivable, less allowance for credit losses of $367 and $332, respectively | 2,439 | 2,184 | ||||||

| Notes receivable, current portion, less current portion of the allowance for credit losses of $18 and $30, respectively | 36 | 489 | ||||||

| Refundable income taxes | 63 | 46 | ||||||

| Inventories | 6,115 | 4,358 | ||||||

| Other | 702 | 443 | ||||||

| Current assets held for sale | 666 | – | ||||||

| Total current assets | 10,994 | 9,602 | ||||||

| Property and Equipment, Net | 7,724 | 7,758 | ||||||

| Other Assets | ||||||||

| Notes receivable, less current portion and allowance for credit losses of $12 and $0, respectively | 77 | 695 | ||||||

| Goodwill | 576 | 576 | ||||||

| Intangible assets, net | 224 | 238 | ||||||

| Lease right of use asset | 1,460 | 1,694 | ||||||

| Other | 75 | 14 | ||||||

| Total other assets | 2,412 | 3,217 | ||||||

| Total Assets | $ | 21,130 | $ | 20,577 | ||||

| Liabilities and Stockholders’ Equity | ||||||||

| Current Liabilities | ||||||||

| Accounts payable | $ | 2,714 | $ | 3,411 | ||||

| Line of credit | 3,450 | 1,250 | ||||||

| Accrued salaries and wages | 962 | 1,833 | ||||||

| Gift card liabilities | 688 | 624 | ||||||

| Other accrued expenses | 154 | 301 | ||||||

| Contract liabilities | 147 | 150 | ||||||

| Lease liability | 380 | 503 | ||||||

| Deposit Liability | 358 | – | ||||||

| Total current liabilities | 8,853 | 8,072 | ||||||

| Lease Liability, Less Current Portion | 1,081 | 1,191 | ||||||

| Contract Liabilities, Less Current Portion | 671 | 678 | ||||||

| Total Liabilities | 10,605 | 9,941 | ||||||

| Commitments and Contingencies | ||||||||

| Stockholders’ Equity | ||||||||

| Preferred stock, $.001 par value per share; 250,000 authorized; 0 shares issued and outstanding | – | – | ||||||

| Common stock, $.001 par value, 46,000,000 shares authorized, 7,588,587 shares and 6,306,027 shares issued and outstanding, respectively | 8 | 6 | ||||||

| Additional paid-in capital | 12,163 | 9,896 | ||||||

| Retained earnings (accumulated deficit) | (1,646 | ) | 734 | |||||

| Total stockholders’ equity | 10,525 | 10,636 | ||||||

| Total Liabilities and Stockholders’ Equity | $ | 21,130 | $ | 20,577 | ||||

| Rocky Mountain Chocolate Factory, Inc. and Subsidiaries Condensed Consolidated Statements of Operations (In thousands, except per share amounts) (Unaudited) |

||||||||||||||||

| Three Months Ended | Six Months Ended | |||||||||||||||

| August 31, | August 31, | |||||||||||||||

| 2024 | 2023 | 2024 | 2023 | |||||||||||||

| Revenues | ||||||||||||||||

| Sales | $ | 4,918 | $ | 5,016 | $ | 10,197 | $ | 10,032 | ||||||||

| Franchise and royalty fees | 1,462 | 1,542 | 2,590 | 2,962 | ||||||||||||

| Total Revenue | 6,380 | 6,558 | 12,787 | 12,994 | ||||||||||||

| Costs and Expenses | ||||||||||||||||

| Cost of sales | 4,350 | 4,632 | 9,936 | 9,391 | ||||||||||||

| Franchise costs | 952 | 614 | 1,493 | 1,293 | ||||||||||||

| Sales and marketing | 138 | 442 | 568 | 915 | ||||||||||||

| General and administrative | 1,622 | 1,687 | 2,861 | 3,619 | ||||||||||||

| Retail operating | 194 | 162 | 393 | 265 | ||||||||||||

| Depreciation and amortization, exclusive of depreciation and amortization expense of $190, $183, $386 and $354, respectively, included in cost of sales | 38 | 32 | 80 | 63 | ||||||||||||

| Total costs and expenses | 7,294 | 7,569 | 15,331 | 15,546 | ||||||||||||

| Loss from Operations | (914 | ) | (1,011 | ) | (2,544 | ) | (2,552 | ) | ||||||||

| Other Income (Expense) | ||||||||||||||||

| Interest expense | (63 | ) | (6 | ) | (98 | ) | (13 | ) | ||||||||

| Interest income | 7 | 18 | 14 | 38 | ||||||||||||

| Gain (loss) on disposal of assets | 248 | – | 248 | – | ||||||||||||

| Other income, net | 192 | 12 | 164 | 25 | ||||||||||||

| Loss Before Income Taxes | (722 | ) | (999 | ) | (2,380 | ) | (2,527 | ) | ||||||||

| Income Tax Provision (Benefit) | – | – | – | – | ||||||||||||

| Loss from Continuing Operations | (722 | ) | (999 | ) | (2,380 | ) | (2,527 | ) | ||||||||

| Discontinued Operations | ||||||||||||||||

| Earnings from discontinued operations, net of tax | – | – | – | 69 | ||||||||||||

| Gain on disposal of discontinued operations, net of tax | – | – | – | 635 | ||||||||||||

| Earnings from discontinued operations, net of tax | – | – | – | 704 | ||||||||||||

| Net Loss | $ | (722 | ) | $ | (999 | ) | $ | (2,380 | ) | $ | (1,823 | ) | ||||

| Basic Loss per Common Share | ||||||||||||||||

| Loss from continuing operations | $ | (0.11 | ) | $ | (0.16 | ) | $ | (0.37 | ) | $ | (0.40 | ) | ||||

| Earnings from discontinued operations | – | – | – | 0.11 | ||||||||||||

| Net loss | $ | (0.11 | ) | $ | (0.16 | ) | $ | (0.37 | ) | $ | (0.29 | ) | ||||

| Diluted Loss per Common Share | ||||||||||||||||

| Loss from continuing operations | $ | (0.11 | ) | $ | (0.16 | ) | $ | (0.37 | ) | $ | (0.40 | ) | ||||

| Earnings from discontinued operations | – | – | – | 0.11 | ||||||||||||

| Net loss | $ | (0.11 | ) | $ | (0.16 | ) | $ | (0.37 | ) | $ | (0.29 | ) | ||||

| Weighted Average Common Shares Outstanding – Basic | 6,686,537 | 6,239,078 | 6,507,323 | 6,284,846 | ||||||||||||

| Dilutive Effect of Employee Stock Awards | – | – | – | – | ||||||||||||

| Weighted Average Common Shares Outstanding – Diluted | 6,686,537 | 6,239,078 | 6,507,323 | 6,284,846 | ||||||||||||

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.