Interactive Brokers Reports Mixed Q3 Results: EPS Miss, Revenue In-Line

Interactive Brokers Group, Inc. IBKR reported its third-quarter financial results after Tuesday’s closing bell. Here’s a look at the details from the report.

The Details: Interactive Brokers reported quarterly earnings of $1.75 per share, which missed the analyst consensus estimate of $1.82. Quarterly revenue of $1.33 billion met the analyst consensus estimate and is an increase over revenue of $1.15 billion from the same period last year.

- Commission revenue increased 31% to $435 million on higher customer trading volumes. Customer trading volume in options, stocks and futures increased 35%, 22% and 13%, respectively.

- Net interest income increased 9% to $802 million on higher customer margin loans and customer credit balances.

- Other fees and services increased $20 million, or 38%, to $72 million, driven by increases of $13 million in risk exposure fees, $5 million in payments for order flow from exchange-mandated programs, and $2 million in FDIC sweep program fees.

- Execution, clearing and distribution fees expenses increased 18% to $116 million, driven by a higher SEC fee rate and higher customer trading volumes.

- General and administrative expenses increased $30 million, or 67%, to $75 million, driven primarily by a one-time charge of $12 million related to the consolidation of its European subsidiaries and a $9 million increase related to legal and regulatory matters.

- Pretax profit margin for the current quarter was 72%. compared to pretax margin of 73% from the year-ago quarter.

- Total equity of $16.1 billion.

Read Also: Oil Prices Drop After Netanyahu Says Israel Will Attack Military, Not Oil Or Nuclear Targets In Iran

IBKR Price Action: According to Benzinga Pro, Interactive Brokers shares are down 3.27% after-hours at $147.98 at the time of publication Tuesday.

Read Next:

Photo: Courtesy of Interactive Brokers Group, Inc.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ASML Stock Tanks After Its Unexpectedly Early Results Include Weak Outlook

Peter Boer / Bloomberg via Getty Images

Key Takeaways

-

ASML Holding accidentally posted its third-quarter results a day earlier than expected.

-

The Dutch semiconductor-gear manufacturer’s 2025 net sales outlook was on the low end of its previously forecast range.

-

Third-quarter net bookings were well below analyst expectations.

New York Registry Shares of ASML Holding (ASML) plunged Tuesday after the company accidentally released its third-quarter results a day earlier than expected.

“Due to a technical error, information relating to our Q3 2024 results was erroneously published earlier today on part of our website asml.com,” the company said. “For transparency, ASML brought forward publication of its full Q3 2024 results to October 15th.”

The Dutch semiconductor-gear manufacturer now expects 2025 net sales to land between 30 billion euros and 35 billion euros ($33.1 billion to $38.6 billion). That’s within the lower half of the company’s previously projected range and below the 36.10-billion-euro consensus estimate of analysts compiled by Visible Alpha.

For the third quarter, net sales were above estimates at 7.47 billion euros, but net bookings of 2.63 billion euros fell well short of the expected 5.59 billion euros.

ASML CEO Warns of ‘Customer Cautiousness’

“While there continue to be strong developments and upside potential in AI, other market segments are taking longer to recover. It now appears the recovery is more gradual than previously expected,” Chief Executive Officer (CEO) Christophe Fouquet said. “This is expected to continue in 2025, which is leading to customer cautiousness.”

ASML shares tumbled 17% intraday Tuesday, bringing them into negative territory for the year.

Read the original article on Investopedia.

UPS Shareholder Alert: Shareholder Rights Law Firm Robbins LLP Reminds Investors of the United Parcel Service, Inc. Class Action

SAN DIEGO, Oct. 15, 2024 (GLOBE NEWSWIRE) — Robbins LLP reminds investors that a shareholder filed a class action on behalf of all persons and entities who purchased or otherwise acquired United Parcel Service, Inc. UPS securities between January 30, 2024 and July 22, 2024. UPS is a multinational parcel delivery and supply chain management solutions company operating in more than 200 countries and territories.

For more information, submit a form, email attorney Aaron Dumas, Jr., or give us a call at (800) 350-6003.

The Allegations: Robbins LLP is Investigating Allegations that United Parcel Service, Inc. (UPS) Misled Investors Regarding its Business Prospects

According to the complaint, during the class period, defendants created the false impression that they possessed reliable information pertaining to the Company’s projected revenue outlook and anticipated growth while also minimizing risk from seasonality and macroeconomic fluctuations. In truth, UPS’ optimistic reports of growth, plans to handle volume variability, upcoming profit growth, and consistent claims that the first quarter would present the worst margins of the fiscal year fell short of reality; the Company was not truly equipped to handle a volume surge without causing a corresponding significant decline in their operating margin.

Plaintiff alleges that the truth emerged on July 23, 2024, when UPS announced its financial results for the second quarter of fiscal 2024, provided lower-than-expected guidance for the third quarter, and reduced its margin guidance for the full fiscal year 2024. The Company attributed its results and lowered guidance on the shift in “U.S. volume mix both in terms of product and customer segmentation . . . toward value products.” On this news, the price of UPS common stock fell from $145.18 per share on July 22, 2024, to close at $127.68 per share on July 23, 2024, a decline of $17.50 per share, or about 12.05% according to the complaint.

What Now: You may be eligible to participate in the class action against United Parcel Service, Inc. Shareholders who want to serve as lead plaintiff for the class must submit their application to the court by December 9, 2024. A lead plaintiff is a representative party who acts on behalf of other class members in directing the litigation. You do not have to participate in the case to be eligible for a recovery. If you choose to take no action, you can remain an absent class member. For more information, click here.

All representation is on a contingency fee basis. Shareholders pay no fees or expenses.

About Robbins LLP: Some law firms issuing releases about this matter do not actually litigate securities class actions; Robbins LLP does. A recognized leader in shareholder rights litigation, the attorneys and staff of Robbins LLP have been dedicated to helping shareholders recover losses, improve corporate governance structures, and hold company executives accountable for their wrongdoing since 2002. Since our inception, we have obtained over $1 billion for shareholders.

To be notified if a class action against United Parcel Service, Inc. settles or to receive free alerts when corporate executives engage in wrongdoing, sign up for Stock Watch today.

Attorney Advertising. Past results do not guarantee a similar outcome.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/3b941eee-14f2-4809-82d4-157e942d2653

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

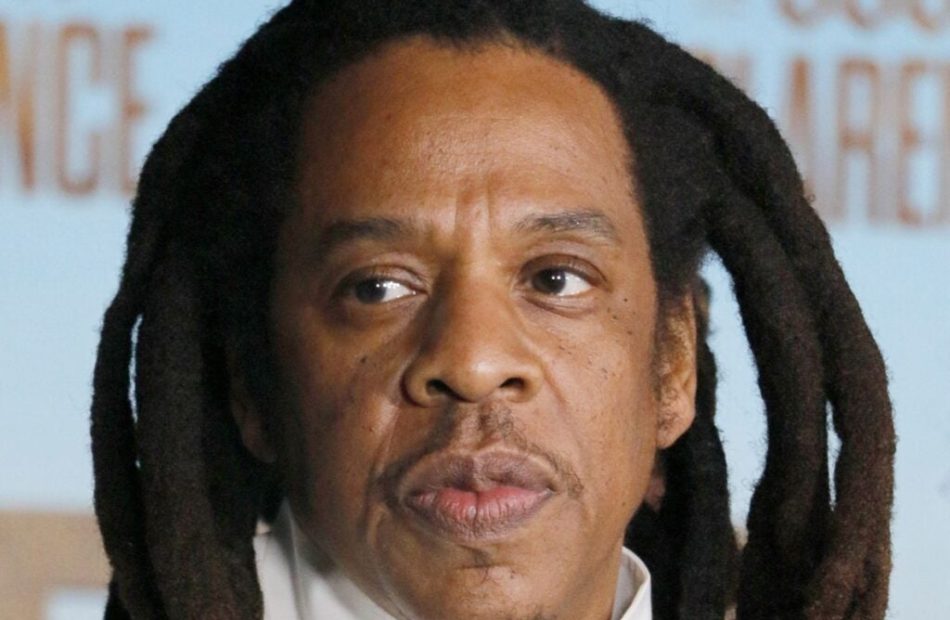

Jay-Z, Praised by Warren Buffett as 'The Guy to Learn From,' Once Said He Wasn't Taught Emotional Intelligence, But How To Survive — The Rap Legend's Growth Has Made Him Not Just A Better Person, But Also Worth $2.5B Today

Shawn Carter, better known as Jay-Z, once praised by legendary investor Warren Buffett as “the guy to learn from,” has come a long way from his Brooklyn roots.

The hip-hop mogul’s journey from survival mode to embracing emotional intelligence offers valuable insights into his personal and professional growth.

What Happened: In a 2022 conversation with comedian Kevin Hart, Jay-Z opened up about his personal growth and the importance of emotional intelligence.

The rapper, who became hip-hop’s first billionaire in 2019, admitted that growing up in the projects taught him survival skills but not emotional intelligence.

“I’ve been taught everything but emotional intelligence,” Jay-Z said, adding, “As a young man growing up in the projects, you’re taught to survive.”

However, he also spoke about how learning to see things from other people’s perspectives has helped him grow.

This growth mindset has not only improved his personal life but also contributed to his professional success.

Why It’s Important: Since 2019, Jay-Z has more than doubled his fortune, with Forbes estimating his current net worth at $2.5 billion.

The rapper’s wealth stems from his Armand de Brignac champagne and D’Usse cognac brands, while his holdings span from venture capital funds to his entertainment company Roc Nation.

Over the years, Jay-Z has made several high-profile business moves.

This includes selling a 50% stake in his champagne brand Armand de Brignac also known as Ace of Spades to French luxury giant LVMH in 2021.

In February last year, he offloaded a majority stake in his cognac brand D’Usse to Bacardi.

Beyond these ventures, his diverse portfolio also includes a valuable fine art collection, his extensive music catalog, and investments in major companies such as Block and Uber.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Dental Handpiece Air Turbines Market to Reach $680.2 Million, Globally, by 2033 at 5.7% CAGR: Allied Market Research

Wilmington, Delaware, Oct. 15, 2024 (GLOBE NEWSWIRE) — Allied Market Research published a report, titled, “Dental Handpiece Air Turbines Market by End user (Hospitals, Dental clinics and Others), and Distribution channel (Online channel and Offline channel): Global Opportunity Analysis and Industry Forecast, 2024-2033″. According to the report, the dental handpiece air turbines market was valued at $390.3 million in 2023, and is estimated to reach $680.2 million by 2033, growing at a CAGR of 5.7% from 2024 to 2033.

The global dental handpiece air turbines market is experiencing growth due to increase in dental disorders and rise in adoption of advanced dental handpiece air turbines which is expected to drive the growth of the market.

Request Sample of the Report on Dental Handpiece Air Turbines Market 2033 – https://www.alliedmarketresearch.com/request-sample/A324403

Prime determinants of growth

The rising prevalence of dental disorders among the population is driving growth in the global market for dental handpiece air turbines. Dental handpieces are considered essential tools in any dental practice. The dental handpieces market is expected to witness growth during the forecast period owing to rise in geriatric population, increase in the number of root canal procedures, and surge in awareness among the people regarding oral hygiene. A range of sophisticated high quality instruments such as the air turbine dental handpiece are needed for the increasing number of persons seeking routine dental examinations and cleanings.

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2024–2033 |

| Base Year | 2023 |

| Market Size in 2023 | $390.34 million |

| Market Size in 2033 | $680.14 million |

| CAGR | 5.7% |

| No. of Pages in Report | 280 |

| Segments Covered | End User, Distribution Channel, and Region. |

| Drivers |

|

| Opportunities |

|

| Restraint |

|

Want to Explore More, Connect to our Analyst – https://www.alliedmarketresearch.com/connect-to-analyst/A324403

Segment Highlights

Dental clinics segment is likely to be lucrative by 2033

The growth of dental clinics is driven by several key factors, owing to rise in number of people suffering from dental diseases and increase in number of key players offering dental tools. This has led to increase in the number of dental clinics that offer specialized dental treatment. Dental clinics typically handle a higher volume of patients compared to individual practices. The efficiency and thoroughness provided by these clinics are essential for managing and diagnosing multiple cases effectively.

Online Channel segment is expected to be lucrative

The dominance of the rising demand for air turbine dental handpiece through online channel is indeed a lucrative segment, driven by the increased adoption of digital health solutions, convenience, cost savings, and advancements in technology. As end user preferences shift towards online purchasing and as the sector evolves with improved regulations and infrastructure, online channel are set to become a major player in the healthcare market.

Regional Outlook

By region, North America held the largest market share in terms of revenue in 2023, the global dental handpiece air turbines market revenue, and is likely to dominate the market during the forecast period. This is attributed to its advanced technology, strong demand & availability of dental handpiece air turbines, supportive regulatory environment, and collaborative ecosystem fostering innovation and market growth in the dental handpiece air turbines market.

However, the Asia-Pacific region is expected to witness rapid industrialization in countries like China and India which has led to the establishment and expansion of manufacturing facilities, including advancements and accessibility of such dental handpiece air turbines products and is expected to drive the market growth in the forecast period.

For Purchase Related Queries/Inquiry – https://www.alliedmarketresearch.com/purchase-enquiry/A324403

Key Players: –

The report provides a detailed analysis of these key players in the global dental handpiece air turbines market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in Healthcare Industry:

Medical Imaging Reagents Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Pain Management Drugs Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

DNA Sequencing Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

Medical Imaging Informatics Market – Global Opportunity Analysis and Industry Forecast, 2023-2032

AVENUE- A Subscription-Based Library (Premium on-demand, subscription-based pricing model) Offered by Allied Market Research:

AMR introduces its online premium subscription-based library Avenue, designed specifically to offer cost-effective, one-stop solution for enterprises, investors, and universities. With Avenue, subscribers can avail an entire repository of reports on more than 2,000 niche industries and more than 12,000 company profiles. Moreover, users can get an online access to quantitative and qualitative data in PDF and Excel formats along with analyst support, customization, and updated versions of reports.

Get an access to the library of reports at any time from any device and anywhere. For more details, follow the link: https://www.alliedmarketresearch.com/library-access

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains. AMR offers its services across 11 industry verticals including Life Sciences, Consumer Goods, Materials & Chemicals, Construction & Manufacturing, Food & Beverages, Energy & Power, Semiconductor & Electronics, Automotive & Transportation, ICT & Media, Aerospace & Defense, and BFSI.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Toll Free: +1-800-792-5285

Int’l: +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Solitron Devices, Inc. Announces Fiscal 2025 Second Quarter Results

WEST PALM BEACH, Fla., Oct. 15, 2024 (GLOBE NEWSWIRE) — Solitron Devices, Inc. SODI (“Solitron” or the “Company”) is pleased to announce fiscal 2025 second quarter results.

FISCAL 2025 SECOND QUARTER HIGHLIGHTS

- Net sales increased 39% to approximately $3.58 million versus $2.58 million in the prior year period.

- Net bookings decreased 21% to $1.75 million versus $2.23 million in the prior year period.

- Backlog decreased 14% to $7.57 million at the end of the fiscal 2025 second quarter as compared to $8.79 million at the end of the fiscal 2024 second quarter.

- Net income decreased to $0.02 million, or $0.01 per share, in the fiscal 2025 second quarter versus net income of $0.20 million, or $0.10 per share, in the fiscal 2024 second quarter.

This is our fourth quarter since we closed the acquisition of Micro Engineering (MEI). Thus far we are pleased with the results. We continue the process of integration of systems and are excited about the potential to expand our relationship with existing customers. MEI contributed $1.58 million in revenue in the fiscal 2025 second quarter.

While revenue increased from the prior year, it declined sequentially from $3.97 million in the fiscal first quarter to $3.58 million in the fiscal second quarter. Net income declined significantly due to the decreased revenue and increase in cost of sales. We had a number of issues negatively impact the quarter. The most significant was an issue with a plating supplier that resulted in fully reserving over 2,000 parts. To put that in some perspective we shipped approximately 9,200 units from Solitron’s WPB facility in the quarter. Scrapping the parts caused a loss of revenue while incurring the cost to reserve all raw material and work in process up until the time of scrapping. We are still in discussions with the supplier about recovering costs. We are withholding payment on existing payables while the matter is resolved. Also included in costs for the fiscal 2025 second quarter are $53,000 of intangible amortization; and $26,000 of non-cash interest costs related to the accrued contingent consideration.

While reported operating income was $50,000 in the fiscal 2025 second quarter, if we adjust for the intangible amortization, it was $103,000. That number excludes the $26,000 of non-cash interest costs, which are non-operating. We believe the adjusted number more accurately reflects the performance of the business during the quarter. Regardless, it was a significant decline from the previous quarter due mainly to the scrapping of parts noted above.

Bookings in the quarter were down compared to the prior year quarter. We once again want to reiterate that our bookings have historically been lumpy. Based on conversations, it is our expectation that the two largest programs Solitron generates revenue from will place orders in the coming months. At present, we expect the orders to be similar in size to the past year, thus we do not expect the orders to include any additional demand related to the stockpile program. We also recently quoted a large end-of-life order with expected deliveries over a three-year period. Our current expectation is to receive between $7 million and $12 million of bookings between today and calendar year end. The $12 million amount would include being awarded the end-of-life order near the maximum quantities quoted.

We continue to see increased interest in new product development, including silicon carbide. We have developed various prototypes for testing by potential customers and continue to be optimistic about creating additional revenue sources.

| SOLITRON DEVICES, INC. | |||||||||||||||

| CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS | |||||||||||||||

| FOR THE THREE AND SIX MONTHS ENDED AUGUST 31, 2024 AND AUGUST 31, 2023 | |||||||||||||||

| (in thousands except for share and per share amounts) | |||||||||||||||

| For The Three Months ended |

For The Three Months ended |

For The Six Months ended |

For The Six Months ended |

||||||||||||

| August 31, 2024 | August 31, 2023 | August 31, 2024 | August 31, 2023 | ||||||||||||

| unaudited | unaudited | unaudited | unaudited | ||||||||||||

| Net sales | $ | 3,581 | $ | 2,579 | $ | 7,548 | $ | 4,617 | |||||||

| Cost of sales | 2,843 | 1,682 | 5,135 | 3,113 | |||||||||||

| Gross profit | 738 | 897 | 2,413 | 1,504 | |||||||||||

| Selling, general and administrative expenses | 688 | 614 | 1,571 | 1,156 | |||||||||||

| Operating income | 50 | 283 | 842 | 348 | |||||||||||

| Other income (loss) | |||||||||||||||

| Interest income | 1 | 6 | 6 | 20 | |||||||||||

| Interest expense | (77 | ) | (26 | ) | (127 | ) | (53 | ) | |||||||

| Dividend income | 6 | 18 | 22 | 19 | |||||||||||

| Realized gain on investments | 22 | 210 | 33 | 332 | |||||||||||

| Unrealized gain (loss) on investments | 21 | (291 | ) | 48 | (637 | ) | |||||||||

| Total other (loss) | (27 | ) | (83 | ) | (18 | ) | (319 | ) | |||||||

| Net income (loss) before tax | $ | 23 | $ | 200 | $ | 824 | $ | 29 | |||||||

| Income taxes | (6 | ) | – | (218 | ) | – | |||||||||

| Net income (loss) | $ | 17 | $ | 200 | $ | 606 | $ | 29 | |||||||

| Net income (loss) per common share – basic and diluted | $ | 0.01 | $ | 0.10 | $ | 0.29 | $ | 0.01 | |||||||

| Weighted average shares outstanding – basic and diluted | 2,083,436 | 2,083,436 | 2,083,436 | 2,083,436 | |||||||||||

For more information see our 10-Q filing at https://www.sec.gov/edgar/browse/?CIK=91668&owner=exclude

The unaudited financial information disclosed in this press release for the three months ended August 31, 2024, is based on management’s review of operations for that period and the information available to the Company as of the date of this press release. The Company’s results included herein have been prepared by, and are the responsibility of, the Company’s management. The Company’s independent auditors have audited the Company’s results for the fiscal year ending February 29, 2024. The financial results presented herein should not be considered a substitute for the information filed or to be filed with the SEC in the Company’s Annual Report on Form 10-K and Quarterly Report on Form 10-Q for the respective periods once such reports become available.

About Solitron Devices, Inc.

Solitron Devices, Inc., a Delaware corporation, designs, develops, manufactures, and markets solid state semiconductor components and related devices primarily for the military and aerospace markets. The Company manufactures a large variety of bipolar and metal oxide semiconductor (“MOS”) power transistors, power and control hybrids, junction and power MOS field effect transistors (“Power MOSFETS”), and other related products. Most of the Company’s products are custom made pursuant to contracts with customers whose end products are sold to the United States government. Other products, such as Joint Army/Navy (“JAN”) transistors, diodes, and Standard Military Drawings voltage regulators, are sold as standard or catalog items.

Effective September 1, 2023, Solitron closed its acquisition of Micro Engineering Inc. (MEI) based in Apopka, Florida. MEI specializes in solving design layout and manufacturing challenges while maximizing efficiency and keeping flexibility to meet unique customer needs. Since 1980 the MEI team has been dedicated to overcoming obstacles to provide cost efficient and rapid results. MEI specializes in low to mid volume projects that require engineering dedication, quality systems and efficient manufacturing.

Forward-Looking Statements

This press release contains forward-looking statements regarding future events and the future performance of Solitron Devices, Inc. that involve risks and uncertainties that could materially affect actual results, including statements regarding the Company’s expectations regarding future performance and trends, including production levels, government spending, backlog and delivery timelines, new product development, our efforts and performance following our acquisition of MEI, and potential future revenue and trends with respect thereto from each of the foregoing. Factors that could cause actual results to vary from current expectations and forward-looking statements contained in this press release include, but are not limited to, the risks and uncertainties arising from potential adverse developments or changes in government budgetary spending and policy including with respect to the war in Ukraine, which may among other factors be affected by the upcoming presidential election and the possibility of reduced government spending on programs in which we participate depending on the outcome thereof and the policy interests of elected officials, inflation, elevated interest rates, adverse trends in the economy and the possibility of a recession the likelihood of which appears to have increased based on recent economic data, the possibility that management’s estimates and assumptions regarding bookings, sales and other metrics prove to be incorrect; the timing and size of orders from our clients, our delivery schedules and our liquidity and cash position; our ability to make the appropriate adjustments to our cost structure; our ability to properly account for inventory in the future; the demand for our products and potential loss of, or reduction of business from, substantial clients our dependence on government contracts, which are subject to termination, price renegotiations and regulatory compliance and which may among other factors be adversely affected by the factors described elsewhere herein, our ability to continue to integrate MEI in an efficient and effective manner, and the possibility that such acquisition or any other acquisition or strategic transaction we may pursue does not yield the results or benefits desired or anticipated. Descriptions of other risk factors and uncertainties are contained in the Company’s Securities and Exchange Commission filings, including its most recent Annual Report on Form 10-K for the fiscal year ended February 29, 2024.

Tim Eriksen

Chief Executive Officer

(561) 848-4311

Corporate@solitrondevices.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

From Vacation To Legal Nightmare: How A Georgia Veteran's CBD Arrest In Dubai Landed Him Behind Bars

A retired Navy veteran from Covington, Georgia, is facing an uncertain legal situation in Dubai after being arrested for possessing medically prescribed CBD pills.

Charles Wimberly, 52, was detained at a Dubai airport on September 27 when officials discovered the pills during a security check as he was preparing to board a flight back to Georgia.

See Also: Rachel Sennott Arrested In Cayman Islands: I Wanted ‘To Be Arrested For Something Awesome’ Not CBD

Despite showing his prescription for medical marijuana, authorities accused Wimberly of drug trafficking due to Dubai’s strict laws against cannabidiol (CBD) products.

“They got me on a no-travel ban right now, because they’re basically saying I was trafficking drugs with my prescription medicine,” Wimberly told Channel 2’s Tom Regan (via YahooNews)

Chronic Pain, CBD And An Unexpected Arrest

Wimberly, who suffers from chronic back pain, diabetes and PTSD, had been on vacation in Dubai with friends when the incident occurred. A doctor in Georgia had prescribed the CBD and prescription-strength ibuprofen to manage his symptoms, which include severe pain due to a pending surgery.

On the day of his arrest, a routine security screening at the airport turned into a nightmare for Wimberly. As he emptied his pockets, several pills fell to the floor, prompting immediate suspicion from airport officials.

“He said what kind of medicine is this? I said Ibuprofen and CBD. He said CBD is not allowed. He called police and they were like, ‘Are you trafficking drugs?'” Wimberly recounted. Despite presenting his prescription, authorities deemed it insufficient and charged him with drug trafficking.

Detainment, Health Scare And No Resolution In Sight

Wimberly was taken into custody, where he suffered a diabetic shock while in a holding cell. After receiving medical attention, he was transferred to a larger jail.

“There were like 240 people in there. I said can you give me something. My back is killing me. I can hardly walk,” Wimberly said.

Although he was later released without bond and sent to a hotel, Wimberly remains stranded in Dubai. His passport has been flagged, preventing him from leaving the country. No court date has been set to resolve his case.

“I talked to the U.S. Embassy. And a woman there told me we can’t get involved. That’s all she said.”

Family’s Plea For Help

Wimberly’s father, Lonnie Wimberly, a retired Army veteran from Augusta, is deeply concerned about his son’s situation, particularly the impact it could have on his health.

“He’s diabetic, he has a serious back injury. He has PTSD issues. It’s not something to take lightly to deny his medications. It’s very concerning to me.” Lonnie said. “The number of pills he had, five maybe, doesn’t meet their threshold for trafficking. So, what they holding him for? It doesn’t make sense to me.”

Diplomatic Efforts Underway

An organization called Detained in Dubai, which specializes in assisting foreigners facing legal issues in the United Arab Emirates (UAE), has taken up Wimberly’s case. They are working through diplomatic channels to secure his release, along with the U.S. Department of State, which has warned American citizens about the risks of traveling to Dubai with even prescribed CBD products.

Wimberly remains hopeful that prosecutors will conclude that there was no intent to distribute and that he will only face a fine before being allowed to return home. But the situation is taking a toll on his mental health.

“It’s scary. My PTSD is at another level,” Wimberly said.

Meanwhile, Georgia Senator Jon Ossoff’s office has confirmed that it will begin investigating the matter this week.

Read Next:

Cover image made with AI.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

ASML Shares Plunge as Bookings Miss Signals Chipmaker Woes

(Bloomberg) — ASML Holding NV’s shares plunged the most in 26 years after it booked only about half the orders analysts expected, a startling slowdown for one of the bellwethers of the semiconductor industry.

Most Read from Bloomberg

The Dutch company, which makes the world’s most advanced chipmaking machines, lowered its guidance for 2025 and reported bookings of €2.6 billion ($2.8 billion) in the third quarter, missing an average estimate of €5.39 billion by analysts surveyed by Bloomberg.

The results caused ASML shares to plunge 16% in Amsterdam, the biggest decline since June 12, 1998. It also triggered a broad downturn in chip-related stocks, with Nvidia Corp. falling 4.5% and the benchmark Philadelphia Semiconductor Index sliding 5.3%. Makers of chip-manufacturing equipment were especially hard hit: Applied Materials Inc. and Lam Research Corp. both suffered their worst declines since 2020, and KLA Corp. had its biggest one-day drop in nearly a decade.

“It now appears the recovery is more gradual than previously expected. This is expected to continue in 2025, which is leading to customer cautiousness,” ASML Chief Executive Officer Christophe Fouquet said in the statement.

The weak results were amplified by the company mistakenly releasing its financial results a day earlier than scheduled. ASML published the release, which was expected on Wednesday, prematurely “due to a technical error,” it said in a separate statement.

The chip industry is experiencing strangely uneven times. In areas such as artificial intelligence accelerators, companies like Nvidia can’t keep up with demand. But in other sectors, including automotive and industrial, it’s in a prolonged slump with customers cutting back orders because they have too much inventory. Intel Corp. is cutting expenses in a restructuring that includes delays to planned factories in Germany and Poland, while memory chipmakers such as Samsung Electronics Co. and SK Hynix Inc. are also being careful with spending.

“While bookings are typically lumpy, we have to concede given lowered guidance that it’s looking like the delayed cyclical recovery and specific customer challenges are weighing heavily on ASML’s 2025 expectations,” said Bernstein analyst Sara Russo.

ASML lowered its guidance for 2025 total net sales to between €30 billion and €35 billion, compared to as much as €40 billion previously. Next year, the company expects a gross margin between 51% and 53%, compared to a prior range between 54% and 56%, mainly due to delayed timing for its top-end extreme ultraviolet machines, Fouquet said in the statement.

ASML didn’t give a detailed explanation of why its bookings fell so short of estimates, beyond a few delays in plant constructions. The company will hold a call with investors Wednesday.

Europe’s most valuable technology company’s shares have fallen by a third since hitting a record high in July, hurt by the prospect of more US restrictions on its business in China, as well as a broader weakness in the semiconductor sector.

“Many will debate whether this release was an accident or planned, but clearly disappointing,” Cantor Fitzgerald analyst C. J. Muse said in an emailed statement. “Weakness across Intel and Samsung is clearly leading to 2025 tracking worse than we thought,” he said.

Last month, the Netherlands published new export control rules that made ASML apply for export licenses in The Hague instead of US for some of its older machines. That came on the heels of a Bloomberg report that the Dutch government would limit some of ASML’s ability to repair and maintain its semiconductor equipment in China.

China remained ASML’s biggest market, accounting for 47% of sales in the quarter. Sales to the Asian nation jumped by nearly 20% from previous quarter to €2.79 billion.

But the demand from China may slow in the upcoming period and Washington’s ongoing chip war against Beijing continues to be a long-term overhang on ASML shares. The company could lose nearly a quarter of its sales in China next year, and 45% of its overall revenue generated in the country is at risk from further restrictions, according to UBS analyst Francois-Xavier Bouvignies.

–With assistance from Henry Ren and Subrat Patnaik.

(Updates US trading in third paragraph.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.