Wearable Medical Devices Market to Soar to $151.8 Billion by 2029, Driven by a 27.5% CAGR from 2024

Boston, Oct. 15, 2024 (GLOBE NEWSWIRE) — “According to the latest BCC Research study, the demand for “Wearable Medical Devices: Technologies and Global Markets” is estimated to grow from $45.0 billion in 2024 to $151.8 billion by the end of 2029, at a compound annual growth rate (CAGR) of 27.5% from 2024 through 2029.”

The research report on the global market for wearable medical devices provides a comprehensive analysis segmented by product, application, and sales channel. Covering market estimations and trends through 2029, the report divides the market into North America, Europe, Asia-Pacific, and the Rest of the World (RoW), with 2023 as the base year for data and forecasts extending to 2029. It delves into major players, technologies, applications, and market dynamics, exploring geographic opportunities in detail. Analytical frameworks such as PESTEL analysis, ESG (Environmental, Social, and Governance) analysis, regulatory landscape, reimbursement scenarios, and competitive analysis are also featured, offering valuable insights for strategic planning by companies in the sector.

The following factors drive the global market for wearable medical devices:

Increasing Prevalence of Chronic Lifestyle Diseases: The global rise in chronic conditions like diabetes, hypertension, and cardiovascular diseases is a significant concern. Wearable devices have emerged as effective tools to monitor vital signs, track symptoms, and manage these chronic illnesses. The need for continuous health monitoring is driving the demand for wearable medical devices, providing individuals with the means to keep their conditions in check and potentially prevent complications.

Growing Population of Dependents: As the global population ages, there is an increasing demand for healthcare services. Wearable devices are instrumental in enabling remote patient monitoring, which allows caregivers to keep track of patient’s health without the need for frequent hospital visits. This technology is particularly beneficial for dependents, including the elderly and those with disabilities, offering them a better quality of life and more independence.

Rising Healthcare Expenditure: Both governments and individuals are investing more in healthcare, seeking cost-effective solutions for preventive care, early detection, and disease management. Wearable medical devices contribute to this by reducing the need for hospitalization and promoting better health outcomes. The cost savings associated with these devices are significant, making them an attractive option for managing healthcare expenditures.

Technological Advancements: The field of wearable devices has been transformed by innovations in sensor technology, miniaturization, and connectivity. Modern smartwatches, fitness trackers, and medical wearables offer accurate data collection, real-time alerts, and seamless smartphone integration. These technological advancements have driven the adoption of wearable devices, contributing to the market’s growth as more people recognize their benefits.

Corporate Wellness Programs and Incentives: Employers increasingly recognize the importance of employee health and well-being. Corporate wellness programs are designed to encourage healthier lifestyles among employees, and wearable devices play a crucial role in these initiatives. By promoting physical activity, stress management, and better sleep, wearable devices help improve overall employee health. Additionally, incentives such as insurance discounts further boost the adoption of wearable health technology, making these devices a key component of corporate wellness strategies.

Request a sample copy of the global market for wearable medical device reports.

Report Synopsis

| Report Metrics | Details |

| Base year considered | 2023 |

| Forecast Period considered | 2024-2029 |

| Base year market size | $35.6 Billion |

| Market Size Forecast | $151.8 Billion |

| Growth rate | CAGR of 27.5% from 2024 to 2029 |

| Segment Covered | By Product, Application, Sales Channel, and Region |

| Regions covered | North America, Europe, Asia-Pacific, and Rest of the World (RoW) |

| Countries covered | The U.S., Canada, Mexico, Germany, U.K., France, Italy, Spain, Japan, China, and India |

| Key Market Drivers |

|

Key Interesting Facts About the global market for wearable medical devices:

- 1 billion individuals use smart wearables daily.

- Over 7.5 billion people worldwide.

- 1 in 5 individuals uses a smartwatch or fitness tracker.

- 70% of wearable users show greater levels of physical activity.

The global market for wearable medical devices report includes in-depth data and analysis addressing the following important queries:

- What is the projected market size and growth rate?

- The global wearable medical devices market is valued at an estimated $45.0 billion in 2024. It is projected to reach $151.8 billion by 2029, at an estimated CAGR of 27.5% from 2024 to 2029.

- What are the key factors driving the growth of the market?

- Increasing prevalence of chronic lifestyle diseases.

- Growing population of dependents.

- Technological advancements.

- Rising demand for home healthcare and remote monitoring.

- Corporate wellness programs.

- What segments are covered in the market?

- The report will provide information on the wearable medical devices market and their growth projections in the coming years. Recent developments of companies operating in this market space have been covered. Information about technologies, applications, PESTEL analysis, reimbursement scenarios, and business strategies have been provided in the report. The report also identifies promising and emerging countries where the established players can expand their business.

- Which segment will dominate the market by the end of 2029 by application type?

- The health and fitness segment dominates the wearable medical devices market and will continue to do so by 2029.

- Which region has the highest market share?

- North America holds the highest share of the market.

Some of the Key Market Players Are:

- ABBOTT

- ACTIGRAPH LLC.

- DEXCOM INC.

- GE HEALTHCARE

- KONINKLIJKE PHILIPS N.V.

- MEDTRONIC

- MASIMO

- SENSORIA INC.

- TURINGSENSE INC.

- VITALCONNECT

- VIVALNK INC.

- VIVOSENSMEDICAL GMBH

- WAHOO FITNESS

- WHOOP

- YBRAIN INC.

- ZEPHYR (MEDTRONIC)

- ZOLL MEDICAL CORP.

Browse More Related Reports

3D Printing Medical Devices: Global Markets: This report provides an overview of the global 3D printing medical devices market and analyzes market trends. It features an updated review of the market, including a breakdown by product segments, technology, sales channel, and application. Using 2023 as the base year, the report offers estimated market data for the forecast period from 2024 to 2029. Geographical segments covered include North America (U.S., Canada, Mexico), Europe (U.K., Germany, France, Rest of Europe), Asia-Pacific (Mainland China, Japan, Australia, South Korea, Rest of Asia-Pacific), and the Rest of the World (South America, Middle East, Africa). The report also focuses on emerging technologies and the vendor landscape, concluding with profiles of the major players in the market. Notably, within the implants and prosthetics application segment, dental implants are not included, as they are categorized under the dental application segment.

Directly Purchase a copy of the report with BCC Research.

For further information or to make a purchase, please get in touch with info@bccresearch.com.

About BCC Research

BCC Research provides objective, unbiased measurement, and assessment of market opportunities with detailed market research reports. Our experienced industry analysts’ goal is to help you make informed business decisions, free of noise and hype.

Corporate HQ: 50 Milk St. Ste 16, Boston, MA 02109, USA Email: info@bccresearch.com, Phone: +1 781-489-7301 For media inquiries, email press@bccresearch.com or visit our media page for access to our market research library. Data and analysis extracted from this press release must be accompanied by a statement identifying BCC Research LLC as the source and publisher.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nisun International Reports Financial Results for the First Half of 2024

Company Reports 52% Revenue Growth, Initiates $15 Million Share Buyback Program

SHANGHAI, Oct. 15, 2024 /PRNewswire/ — Nisun International Enterprise Development Group Co., Ltd. (“Nisun International” or the “Company”) NISN, a technology and industry driven integrated supply chain solutions provider, today announced its reviewed but unaudited financial results for the six months ended June 30, 2024.

First Half 2024 Financial Highlights:

- Total revenue increased by 52% to $192.5 million, compared to $126.9 million for the first half of 2023.

- Supply chain trading business revenue increased by 114% to $142.1 million, up from $66.2 million in the prior-year period, driven primarily by growth in the gold trading sector.

- Small and medium-sized enterprises (“SME”) financing services revenue declined by 16% to $48.5 million due to the challenging market conditions, but the Company is optimistic about the future growth as recent government stimulus measures in China begin to take effect.

- Supply chain financing solutions revenue decreased by 30% to $1.9 million, also impacted by market conditions, but is expected to recover alongside broader economic improvements.

- Net income was $10.3 million, compared to $11.4 million for the first half of 2023.

- Earnings per share were $2.61, compared to $2.87 in the prior-year period.

Operational Highlights:

- Cash Position: As of June 30, 2024, The Company’s cash and cash equivalents were $47.8 million, compared to $114.4 million at the end of 2023. This decline was primarily driven by an increase in advances to suppliers, a strategic investment expected to fund future growth in sales and earnings. Additionally, a decrease in accounts payable contributed to the cash reduction.

- Cost Control: Operating expenses decreased by 31% to $5.7 million, reflecting effective cost management and efficiency improvements. Selling expenses fell by 69% as the Company maintained existing sales channels without expanding into new ones, and general and administrative expenses were reduced by 14% due to enhanced cost controls.

- Buyback Program: Nisun International has approved a $15 million share buyback program, which underscores the Company’s confidence in its future growth and commitment to enhancing shareholder value. The program will begin as soon as the trading window opens in the coming days.

Management Commentary:

Mr. Xin Liu, Chief Executive Officer of Nisun International, commented:

“We are very pleased with our strong financial performance in the first half of 2024, marked by a significant 52% increase in total revenue. Our supply chain trading business continues to grow at an impressive rate, particularly in the gold trading sector, which underscores the effectiveness of our business model and technology-driven approach. While the challenging economic conditions impacted our SME financing services, we are beginning to see signs of a turnaround following the government’s recent stimulus measures, and we are optimistic about the future of this segment.

Looking ahead, we remain committed to enhancing operational efficiency and seeking new growth opportunities. We also believe our stock is significantly undervalued, which is why we are excited to announce a $15 million share buyback program. Our largest shareholder has already demonstrated confidence in our future by increasing their stake by approximately $1 million during the first half of the year. We are confident that our growth initiatives and the share repurchase program will create additional value for our shareholders in the near term and beyond.”

2024 Outlook:

Nisun International expects the momentum in its supply chain trading business to continue through the second half of 2024 and into 2025. With the Chinese government’s stimulus measures beginning to take effect, the Company anticipates a more favorable environment for its SME financing and supply chain financing solutions, positioning Nisun International for sustained growth in the coming periods.

Details of the conference call, including dial-in information, will be announced in the coming days.

About Nisun International Enterprise Development Group Co., Ltd

Nisun International Enterprise Development Group Co., Ltd. NISN is a technology-driven, integrated supply chain solutions provider focused on transforming the corporate finance industry. Leveraging its industry experience, Nisun International is dedicated to providing professional supply chain solutions to Chinese and foreign enterprises and financial institutions. Through its subsidiaries, Nisun International provides users with professional solutions for technology supply chain management, technology asset routing, and digital transformation of tech and finance institutions, enabling the industry to strengthen and grow. At the same time, Nisun International continues to deepen the field of industry segmentation through industrial and financial integration. Focusing on industry-finance linkages, Nisun International aims to serve the upstream and downstream of the industrial supply chain while also assisting with supply-side sub-sector reform. For more information, please visit http://ir.nisun-international.com/

Cautionary Note Regarding Forward-Looking Statements

This press release contains information about Nisun International ‘s view of its future expectations, plans and prospects that constitute forward-looking statements. Actual results may differ materially from historical results or those indicated by these forward-looking statements as a result of a variety of factors including, but not limited to, risks and uncertainties associated with its ability to raise additional funding, its ability to maintain and grow its business, variability of operating results, its ability to maintain and enhance its brand, its development and introduction of new products and services, the successful integration of acquired companies, technologies and assets into its portfolio of products and services, marketing and other business development initiatives, competition in the industry, general government regulation, economic conditions, dependence on key personnel, the ability to attract, hire and retain personnel who possess the technical skills and experience necessary to meet the requirements of its clients, and its ability to protect its intellectual property. Nisun encourages you to review other factors that may affect its future results in Nisun’s registration statement and in its other filings with the Securities and Exchange Commission. Nisun assumes no obligation to update or revise its forward-looking statements as a result of new information, future events or otherwise, except as expressly required by applicable law.

Contacts

Nisun International Enterprise Development Group Co., Ltd

Investor Relations

Tel: +86 (21) 2357-0055

Email: ir@cnisun.com

![]() View original content:https://www.prnewswire.com/news-releases/nisun-international-reports-financial-results-for-the-first-half-of-2024-302276120.html

View original content:https://www.prnewswire.com/news-releases/nisun-international-reports-financial-results-for-the-first-half-of-2024-302276120.html

SOURCE Nisun International Enterprise Development Group Co., Ltd

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Nvidia, Apple, And Microsoft In Race For $4 Trillion Market Cap: 'Stage Is Set For Tech Stocks For Another 20% Move Higher In 2025'

The tech industry is witnessing fierce competition among Apple Inc. AAPL, Microsoft Corp MSFT, and NVIDIA Corp NVDA as they vie to reach a $4 trillion market cap. This race is expected to intensify in the next 6-9 months.

What Happened: Wedbush Securities analyst Dan Ives has predicted that the three tech giants will be the frontrunners in the race to a $4 trillion market cap.

This race is expected to be a key factor in the tech industry’s future, with a potential 20% surge in tech stocks by 2025, driven by the AI revolution.

“We believe the stage is set for tech stocks for another 20% move higher in 2025 with this tech bull market led by the AI Revolution,” Ives wrote on social media platform X.

Why It Matters: The race to a $4 trillion market cap has been a topic of interest for some time. In July, Ives predicted that Nvidia, Apple, and Microsoft were on track to reach this milestone, driven by the accelerating AI revolution. This was followed by an analyst’s prediction in August that Apple’s historic upgrade cycle would push its valuation past $4 trillion.

These predictions come amid a turbulent period for the tech industry. On Tuesday, a technical error led to a premature disclosure of ASML Holding NV‘s ASML third-quarter earnings, causing a sharp decline in the company’s stock. This incident also contributed to a broader decline in tech stocks, with the NASDAQ and other large-cap indices experiencing losses.

Read Next:

Tesla Stock Tumbles After Underwhelming Robotaxi Presentation

Image Via Shutterstock

This story was generated using Benzinga Neuro and edited by Kaustubh Bagalkote

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

3 Stocks to Buy on the Real Estate Operations Industry's Recovery

The Zacks Real Estate Operations industry constituents are poised to gain from the increased adoption of outsourced real estate services and emerging trends. The easing of monetary policy in many large markets is expected to result in a decrease in borrowing costs, more availability of credit and drive economic growth, in turn fueling transaction activity. Companies like Newmark Group, Inc. NMRK, Kennedy-Wilson Holdings, Inc. KW and RE/MAX Holdings, Inc. RMAX are set to benefit from these positive trends.

However, the industry faces challenges such as macroeconomic uncertainty and geopolitical tensions. Customers remain focused on cost controls and for certain asset categories are delaying their decision-making with respect to leasing.

About the Industry

The Zacks Real Estate Operations industry comprises companies that provide leasing, property management, investment management, valuation, development services, facility management, project management, transaction and consulting services, among others. However, real estate investment trusts or REITs are excluded from this group. Economic trends and government policies impact the real estate market (global and regional), which determines the industry’s performance. Economic activity, employment growth, office-based employment, interest-rate levels, costs and availability of credit, tax and regulatory policies, and the geopolitical environment are the major factors shaping the real estate market’s fate. Also, pandemic-induced public health challenges and geopolitical issues have affected property sales and the leasing lines of businesses.

What’s Shaping the Real Estate Operations Industry’s Future?

Interest Rate Cut Provides Relief for Transaction-Based Business: The latest cut in the interest rates by the Federal Reserve and anticipations of future reductions are expected to drive transaction-based businesses in the United States. Along with the United States, the easing of monetary policy in many large markets is expected to result in a decrease in borrowing costs, more availability of credit, and drive economic growth. This is expected to help investors in better price discovery and consequently result in reduced transaction completion times. It is also expected to lead to a rise in the average deal size, thereby bolstering the industry’s near-term revenue prospects.

Outsourcing of Real Estate Needs to Remain Strong: Real estate occupiers, including corporations, public sector entities, healthcare providers, and those in finance, industry, life sciences and technology, are increasingly preferring to outsource their real estate needs. They are entrusting third-party real estate experts to enhance execution and efficiency. Organizations are seeking strategic advice to reimagine their workplaces and workstyles to foster culture, attract talent and improve performance. These developments are creating opportunities for participants in the real estate operations industry. Major players in the industry are leveraging this transition, securing new clients and expanding relationships with existing ones. Also, companies in this industry continue to prioritize investments in technology as it consistently improves efficiency, delivers client services and supports market share growth.

Certain Real Estate Categories’ Demand Hurt: The pandemic has significantly reshaped the use of commercial real estate. Also, economic uncertainty continues to affect real estate sales and leasing activities. While companies are promoting the return to office, this transition is gradual, which is hindering tenants’ confidence in long-term commitments. As such, pre-pandemic office occupancy levels are likely to remain elusive in the near or intermediate term. Amid a volatile environment and geopolitical issues, customers remain focused on cost controls and delaying their decision-making with respect to leasing. As such, industrial real estate demand remains subdued and this trend is expected to continue in the near term. Additionally, the pace of business-related travel and in-person interactions has not fully rebounded to pre-pandemic norms.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Real Estate Operations industry is housed within the broader Zacks Finance sector. It carries a Zacks Industry Rank #104, which places it in the top 42% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates robust near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of the upward earnings per share outlook for the constituent companies in aggregate. Looking at the aggregate earnings per share estimate revisions, it appears that of late, analysts are gaining confidence in this group’s growth potential. Over the past year, the industry’s earnings per share estimates for 2024 and 2025 have moved 46.8% and 37.2% north, respectively.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Outperforms the Sector & the S&P 500

The Zacks Real Estate Operations industry has outperformed the broader Zacks Finance sector and the S&P 500 composite over the past year.

The industry has advanced 40.8% during this period compared with the S&P 500’s growth of 32.5% and the broader Finance sector’s rise of 31.2%.

One-Year Price Performance

Industry’s Current Valuation

On the basis of the forward 12-month price-to-earnings, which is a commonly used multiple for valuing Real Estate Operations stocks, we see that the industry is currently trading at 17.06X compared with the S&P 500’s forward 12-month price-to-earnings (P/E) of 22.08X. The industry is trading above the Finance sector’s forward 12-month P/E of 16.66X. This is shown in the chart below.

Forward 12-Month Price-To-Earnings Ratio

Over the last five years, the industry has traded as high as 32.49X and as low as 11.45X, with a median of 17.26X.

3 Real Estate Operation Stocks to Bet On

RE/MAX Holdings: Headquartered in Denver, CO, it is a franchisor in the real estate industry. The company franchises real estate brokerages globally under the RE/MAX brand and mortgage brokerages within the United States under the Motto Mortgage brand. It also sells ancillary products and services, such as loan processing services, mainly to its Motto network.

RE/MAX is poised to benefit from its strategic growth initiatives. With its efforts to expand the mortgage business and its objective to maintain a strong liquidity position, RE/MAX is well-poised to ride the growth curve.

RE/MAX Holdings currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for the company’s 2024 earnings per share currently stands at $1.24. The stock has increased 20.8% in the past three months.

Newmark Group, Inc.: Headquartered in New York City, Newmark is a leading commercial real estate services company that is rapidly expanding its presence globally. Together with its subsidiaries, Newmark Group advises and provides services to large institutional investors, global corporations and other owners and occupiers of commercial real estate.

With investments in talent and technology, the company is expected to experience decent performance going forward. It is poised to benefit from the opportunities from the large and highly fragmented market, institutional investor demand for commercial real estate and from the favorable trend toward outsourcing of commercial real estate services.

Newmark carries a Zacks Rank of 2 (Buy) at present. The Zacks Consensus Estimate for the company’s 2024 EPS has remained unchanged at $1.15 over the past month. This also suggests 9.5% growth year over year. NMRK shares have gained 22.7% over the past three months.

Kennedy Wilson: Headquartered in Beverly Hills, CA, Kennedy Wilson is a global real estate investment company that invests in high-growth markets across the United States, the U.K. and Ireland. KW is engaged in the ownership, operation and investment in real estate on its own and through its investment management platform.

The company is expected to benefit from the continued growth of its investment management business and healthy demand for its high-quality multifamily and commercial portfolio.

Kennedy Wilson has a Zacks Rank of 2 at present. The Zacks Consensus Estimate for 2024 EPS has moved significantly upward over the past two months to $2.96. This suggests a notable increase year over year. The company’s shares have appreciated 32.1% in the past six months.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

53-Year-Old 'Getting Ready To Retire' Earning $48,000 In Dividend Income Shares Portfolio: Top 9 Stocks And ETFs

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Dividend investing hardly loses its allure but gains more attention when the Fed cuts interest rates. A recent report from Sterling Capital showed that dividend stocks outperform non-dividend stocks after the first rate cut. The report also said that dividend growers perform better than high-yield stocks in this environment.

But for those looking to buy and hold dividend stocks for decades, these short-term trends might not matter. What matters for such investors is to pick reliable and safe dividend stocks and keep adding to them to reach their financial goals.

Don’t Miss:

About six months ago, a Redditor shared his detailed dividend income report on r/Dividends – a community of about 600,000 members on Reddit. The investor, who said he’s 53 years old, was making just over $48,000 in annual dividend income, according to the portfolio screenshots he shared publicly. The total value of his portfolio was about $1.23 million.

The investor said he was “getting ready” to retire. Asked what he did for a living, here was his response:

“Retired military (enlisted). Wife works in tech and will be retiring this year because she gets annoyed I’m going fishing while she works.”

He said he started investing when he was 26 (talk about long-term goals!).

“Lost the bulk of our money three separate times ($20k, $25k and $90k) before changing my investment strategy. Once I stopped chasing high flyers and went for the long-term plan I started making money. When I was young, I kept trying to get a jump on our retirement savings and it kept burning me. Slow and steady really does work.”

There were about 23 ETFs and stocks in the portfolio. Let’s look at some of the biggest holdings in the portfolio.

Schwab U.S. Dividend Equity ETF

About 33% of the portfolio of the Redditor making $48,000 per year was allocated to Schwab U.S. Dividend Equity ETF (NYSE:SCHD). According to the portfolio details, he made approximately $13,480 in annual income from the fund. Schwab U.S. Dividend Equity ETF (NYSE:SCHD) tracks the Dow Jones U.S. Dividend 100 Index and exposes you to some of the top dividend stocks trading in the U.S., including Home Depot, Coca-Cola, Verizon, Lockheed Martin, Pepsi and AbbVie, among many others. Since SCHD’s holdings are mostly conservative dividend payers, it’s suitable for investors close to retirement looking for consistent dividend income.

The Vanguard High Dividend Yield Index Fund ETF

The Vanguard High Dividend Yield Index Fund ETF (NYSE:VYM) tracks the FTSE High Dividend Yield Index, providing investors with exposure to high-yield U.S. dividend stocks. The fund’s top holdings include Broadcom, JPMorgan, ExxonMobil and Procter and Gamble. VYM is up 15% so far this year. It pays quarterly dividends.

The Vanguard International High Dividend Yield Index Fund ETF

The Vanguard International High Dividend Yield Index Fund ETF (VYMI) was the third biggest holding of the 53-year-old Redditor earning $48,000 a year in dividends. According to the portfolio screenshots shared publicly, he owned about $131,000 worth of VYMI shares. VYMI tracks the FTSE All-World ex U.S. High Dividend Yield Index. It’s a suitable ETF for those seeking exposure to non-US dividend stocks. Nestle, Novartis and Roche are the three biggest holdings of the fund.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

SPDR Portfolio S&P 500 High Dividend ETF

The investor who shared his portfolio details, claiming to be earning over $48,000 per year in dividends, showed that 6.6% of his portfolio is allocated to SPDR Portfolio S&P 500 High Dividend ETF (NYSE:SPYD) and the total worth of the stake was about $81,600. SPYD yields over 4% and tracks the total return performance of the S&P 500 High Dividend Index. Some of the fund’s top holdings include Kellanova, Public Storage, Hasbro and Simon Property, among others. The fund brought about $3,600 in annual income for the investor.

The Fidelity High Dividend ETF

The Fidelity High Dividend ETF (FDVV) tracks the Fidelity High Dividend Index, which consists of mid- and large-cap dividend stocks. The fund’s top holdings are Apple, ExxonMobil, Nvidia and Broadcom.

Vanguard Dividend Appreciation Index Fund ETF

The Redditor making $48,000 per year in dividend income had a $40,000 position in Vanguard Dividend Appreciation Index Fund (VIG). According to his portfolio screenshots, his annual dividend income from the fund was about $710. VIG is ideal for anyone seeking exposure to companies that consistently grow dividends. The fund tracks the S&P U.S. Dividend Growers Index. The fund’s portfolio consists of about 337 stocks, most large-cap companies. Apple, Microsoft, Broadcom, UnitedHealth, ExxonMobil and Procter & Gamble are among the ETF’s top holdings.

The iShares International Select Dividend ETF

The iShares International Select Dividend ETF (BATS:IDV) gives investors exposure to dividend stocks from developed markets outside the US. It tracks the Dow Jones EPAC Select Dividend Index, which includes dividend-paying companies from Europe, Asia and Australia.

Pfizer

The Redditor had a $27,800 position in Pfizer Inc. (NYSE:PFE), which has raised its dividends for 15 consecutive years. The stock brought about $1,680 in annual income for the investor. However, PFE shares are down about 11% over the past year.

Reaves Utility Income Fund

Reaves Utility Income Fund (UTG) was bringing about $2,300 in annual income for the 53-year-old Redditor, according to the details he shared publicly on the social platform. The fund invests in utilities and infrastructure companies to generate monthly dividend income for investors. UTG yields about 8% and distributes monthly dividends. Some of the fund’s top holdings include Talen Energy Corp., Constellation Energy, Vistra and CenterPoint Energy.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article 53-Year-Old ‘Getting Ready To Retire’ Earning $48,000 In Dividend Income Shares Portfolio: Top 9 Stocks And ETFs originally appeared on Benzinga.com

2 Ultra-High-Yield Dividend Stocks You Can Buy Now and Hold at Least a Decade

Everyday investors looking for ultra-high-yield dividend stocks have limited options to choose from. Dividend yields drop as prices rise, and the market has been soaring over the past few years.

The benchmark S&P 500 index has risen by 51% since the end of 2022. In such a buoyant market, finding top dividend payers that offer high yields is a challenge, but it isn’t impossible.

Ares Capital (NASDAQ: ARCC) and PennantPark Floating Rate Capital (NYSE: PFLT) are a pair of well-manged business development companies (BDCs) that offer eye-popping dividend yields. Here’s why income-seeking investors want to add them to a diversified portfolio now and hold them for the long run.

Ares Capital

The first ultra-high-yield dividend stock investors want to load up on is Ares Capital. At recent prices, it offers a huge 9% yield.

Ares Capital is the world’s largest publicly traded BDC. These specialized entities are generally popular among income-seeking investors because they can legally avoid paying income taxes by distributing nearly all their earnings to shareholders as dividend payments.

The BDC industry is a lucrative one because U.S. banks have been increasingly hesitant to lend to businesses directly for decades. All over America, companies starved for capital are willing to pay higher interest rates than you might imagine. The average yield on debt securities in Ares Capital’s portfolio was 12.2% in the second quarter.

The folks who run Ares Capital’s investment committee have 30 years of experience on average and it shows. The BDC’s portfolio grew to $25 billion at the end of June with loans out to 525 different companies. Just 1.5% of the portfolio, at cost, was on nonaccrual status.

Investing in any one midsize business or industry can be dangerous, but Ares Capital’s portfolio is well diversified. Its largest components are in the software, software services, and healthcare services industries. These industries represent just 37% of the overall portfolio.

Lots of diversification and a terrific track record support an investment-grade credit rating that makes it easier to turn a profit in good times and bad. This July, Ares Capital’s excellent credit rating allowed it to raise $850 million by offering five-year notes with a 5.95% coupon. That’s less than half the yield it receives from the debt securities in its portfolio.

This dividend payer isn’t risk-free, but it would take a prolonged recession that forces a wave of defaults across not just one but several of the economy’s more reliable industries before investors need to worry about a severe dividend cut.

PennantPark Floating Rate Capital

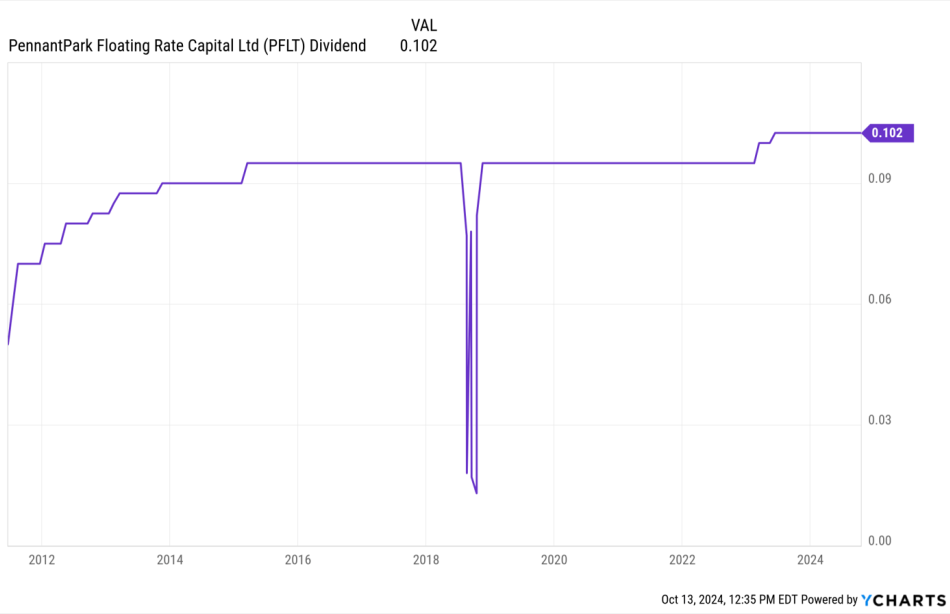

PennantPark Floating Rate Capital is another BDC that gives investors an ultra-high dividend yield to consider. At recent prices, it offers a 10.5% yield and monthly payments.

Other BDCs like Ares Capital compete over up-market businesses, but PennantPark gets the pick of the litter when it comes to smaller companies that earn between $10 million and $50 million annually.

As its name implies, practically all of PennantPark Floating Rate Capital’s debt investments collect interest at variable rates. Nearly all of its loans are of the first-lien senior secured variety too. These loans are first in line to be repaid in the event of bankruptcy.

With 26 years of industry experience, PennantPark’s underwriting team is nearly as experienced as Ares Capital’s. With a brief exception in 2018, it’s raised or maintained its dividend payout since its initial public offering in 2011.

Investors can reasonably expect continued stability from PennantPark in the decade ahead. Just three companies representing 1.5% of its overall portfolio at cost were on nonaccrual status at the end of June.

This BDC is most exposed to the professional services, aerospace, and defense industries. The portfolio is so diversified that these industries represent just 15.4% of the total.

While smaller, PennantPark’s portfolio is arguably even more diverse than Ares Capital’s portfolio. Buying some shares now to lock in a dividend yield at a double-digit percentage looks like a great idea for just about any income-seeking investor.

Should you invest $1,000 in Ares Capital right now?

Before you buy stock in Ares Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ares Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Cory Renauer has positions in Ares Capital. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Dividend Stocks You Can Buy Now and Hold at Least a Decade was originally published by The Motley Fool

Analyst Report: Bank Of America Corp.

Summary

Bank of America is one of the largest financial companies in the world. The company is primarily a U.S. retail and commercial bank, with a network of more than 4,000 branches across much of the country. The 2005 acquisition of MBNA made Bank of America the nation’s largest credit-card lender. As such, trends in consumer interest rates, employment, income growth and borrowing patterns represent a significant risk to the company’s earnings. The 2008 acquisition of Country

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Synnefo Partners with Aprecomm to Deliver a Cloud- and AI-powered Customer Experience Management Super-stack Tailored for Mid-size Broadband Service Providers

The new strategic partnership combines Aprecomm’s customer experience applications suite with Synnefo’s OSS and BSS solutions. The best-of-breed super-stack enables broadband service providers to transform subscriber management through a unified package that can be deployed instantaneously from the cloud.

BENGALURU, India, Oct. 16, 2024 /PRNewswire/ — Aprecomm (www.aprecomm.ai), the intuitive network and customer experience platform provider, announced today that it has entered into a strategic partnership with Synnefo (www.synnefoims.com), an OSS, BSS, IMS, SMS supplier to Internet Service Providers (ISPs) and Multi-System Operators (MSOs) in India and across the globe.

The move combines both companies’ market-leading solutions, enabling Synnefo to offer a customer experience ‘super-stack’ that brings service providers an integrated and seamless approach for CPE management, subscriber billing, support, and network performance optimization to save time and money.

“In today’s highly competitive market where there are fewer barriers to churn, providers must move to compete on the actual experience that customers receive,” said Pramod Gummaraj, Founder & CEO of Aprecomm. “With multiple failure points, such as WiFi interference, and the low latency high-performance needs of intensive applications such as video and gaming, raw speed no longer guarantees customer satisfaction. By combining our solution—including advanced quality of experience measurement, performance optimization and proactive support tools—with its OSS and BSS, Synnefo can bring all types of communications service providers a low-friction, turnkey solution, enabling them to offer the best customer experience at every touch point.”

Synnefo has integrated Aprecomm’s ACS and quality of experience software with its OSS and BSS solution, offering the software super-stack to existing customers and new prospects. The combined solution suits ISPs and Broadband Service Providers looking for a unified experience management platform and billing solution that removes the headache of engaging and integrating multiple vendor offerings. The Software-as-a-Service (SaaS) approach means that the software can be launched imminently from the cloud and includes all the tools needed for CPE device configuration and upgrade, customer billing, and network performance and optimization, right down to the granular application level. The solution is perfectly positioned to enable service providers to increase customer satisfaction and drive operational efficiencies.

“We are constantly looking for ways to bring the latest tools to ISPs and Broadband Service Providers,” said Vijay Ahire, Co-founder & CTO of Synnefo. “Synnefo OSS and BSS are already deployed with over 350 service providers—this move presents opportunities to upgrade existing customers and target new markets in India, Africa and the Middle East, which is saturated with mid-size service providers looking for a cost-effective solution.”

Serving both residential and business subscribers, Aprecomm’s CX suite helps broadband service providers transform their approaches to connectivity, ensuring that consumers can enjoy online experiences without wasting time managing their WiFi networks. By using sophisticated artificial intelligence—including a unique quality of experience algorithm—Aprecomm is paving the way to intuitive zero-touch networks by taking a self-optimizing and self-healing approach to managed WiFi, tuning the network to the unique needs of each user and the application they are using.

On the back end, Aprecomm’s advanced analytics and automated support tools provide access to real-time data, enabling service providers to monitor end-to-end network performance to predict and resolve problems before they reach the subscriber. Its CX suite is field-proven to increase subscriber satisfaction and reduce operational costs—service providers have seen multiple improvements[1] across 100% of their networks, such as a 62% reduction in truck rolls, a 35% improvement in first-call resolutions and a 30% reduction in call resolution times.

The combined solution will be demonstrated at Syneffo’s booth D4 at SCAT2024 in Mumbai from October 17th to 19th.

About Aprecomm

Aprecomm harnesses the power of AI to provide a unique applications suite that enables service providers to create self-optimizing and self-healing broadband networks.

Our quality of experience engine monitors and optimizes WiFi performance to ensure that consumers enjoy the best possible internet experiences, at the same time, our cloud-based support applications leverage real-time data to predict and resolve customer service issues before they happen, saving providers time and money.

Aprecomm manages over 7 million home and business locations, partnering with more than 45 service providers worldwide.

Together, we are making intuitive networks a reality.

Follow Aprecomm on LinkedIn here.

#IntuitiveNetworks

Visit www.aprecomm.ai to discover more.

Press contact:

About Synnefo

Since its founding in 2010, Synnefo has remained dedicated to revolutionizing software solutions for ISPs. Over the years, we’ve partnered with small, medium, and large ISPs globally, offering comprehensive software solutions and continuous research that goes beyond conventional approaches. Our mission is to maximize revenue and minimize technical complexities, easing the operations and positioning Synnefo as the ultimate one-stop platform for ISPs and MSOs. From broadband management to CATV services, we provide seamless, scalable solutions that drive efficiency and innovation in the ISP industry.

Synnefo was built by a team of experts in CRM, ISP networks, and system architecture dedicated to managing the ISP lifecycle. With a focus on ease and transparency, Synnefo seamlessly manages the entire ecosystem. Regardless of geographical boundaries, our core objective is to collaborate for our clients’ success, driven by years of dedication to achieving excellence in all that we do.

Synnefo has successfully onboarded over 350 ISPs globally, establishing a presence in more than ten countries. Its key differentiator and unique selling point (USP) is exceptional support.

Press contact:

Logo – https://stockburger.news/wp-content/uploads/2024/10/1729052930_251_Aprecomm_Logo.jpg

Logo – https://stockburger.news/wp-content/uploads/2024/10/Synnefo_Logo_Logo.jpg

[1] Data sampled from a broadband service provider who monitored 400,000 subscribers over 12 months ending August 2022.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/synnefo-partners-with-aprecomm-to-deliver-a-cloud–and-ai-powered-customer-experience-management-super-stack-tailored-for-mid-size-broadband-service-providers-302276988.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/synnefo-partners-with-aprecomm-to-deliver-a-cloud–and-ai-powered-customer-experience-management-super-stack-tailored-for-mid-size-broadband-service-providers-302276988.html

SOURCE Aprecomm

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.