3 Stocks to Buy on the Real Estate Operations Industry's Recovery

The Zacks Real Estate Operations industry constituents are poised to gain from the increased adoption of outsourced real estate services and emerging trends. The easing of monetary policy in many large markets is expected to result in a decrease in borrowing costs, more availability of credit and drive economic growth, in turn fueling transaction activity. Companies like Newmark Group, Inc. NMRK, Kennedy-Wilson Holdings, Inc. KW and RE/MAX Holdings, Inc. RMAX are set to benefit from these positive trends.

However, the industry faces challenges such as macroeconomic uncertainty and geopolitical tensions. Customers remain focused on cost controls and for certain asset categories are delaying their decision-making with respect to leasing.

About the Industry

The Zacks Real Estate Operations industry comprises companies that provide leasing, property management, investment management, valuation, development services, facility management, project management, transaction and consulting services, among others. However, real estate investment trusts or REITs are excluded from this group. Economic trends and government policies impact the real estate market (global and regional), which determines the industry’s performance. Economic activity, employment growth, office-based employment, interest-rate levels, costs and availability of credit, tax and regulatory policies, and the geopolitical environment are the major factors shaping the real estate market’s fate. Also, pandemic-induced public health challenges and geopolitical issues have affected property sales and the leasing lines of businesses.

What’s Shaping the Real Estate Operations Industry’s Future?

Interest Rate Cut Provides Relief for Transaction-Based Business: The latest cut in the interest rates by the Federal Reserve and anticipations of future reductions are expected to drive transaction-based businesses in the United States. Along with the United States, the easing of monetary policy in many large markets is expected to result in a decrease in borrowing costs, more availability of credit, and drive economic growth. This is expected to help investors in better price discovery and consequently result in reduced transaction completion times. It is also expected to lead to a rise in the average deal size, thereby bolstering the industry’s near-term revenue prospects.

Outsourcing of Real Estate Needs to Remain Strong: Real estate occupiers, including corporations, public sector entities, healthcare providers, and those in finance, industry, life sciences and technology, are increasingly preferring to outsource their real estate needs. They are entrusting third-party real estate experts to enhance execution and efficiency. Organizations are seeking strategic advice to reimagine their workplaces and workstyles to foster culture, attract talent and improve performance. These developments are creating opportunities for participants in the real estate operations industry. Major players in the industry are leveraging this transition, securing new clients and expanding relationships with existing ones. Also, companies in this industry continue to prioritize investments in technology as it consistently improves efficiency, delivers client services and supports market share growth.

Certain Real Estate Categories’ Demand Hurt: The pandemic has significantly reshaped the use of commercial real estate. Also, economic uncertainty continues to affect real estate sales and leasing activities. While companies are promoting the return to office, this transition is gradual, which is hindering tenants’ confidence in long-term commitments. As such, pre-pandemic office occupancy levels are likely to remain elusive in the near or intermediate term. Amid a volatile environment and geopolitical issues, customers remain focused on cost controls and delaying their decision-making with respect to leasing. As such, industrial real estate demand remains subdued and this trend is expected to continue in the near term. Additionally, the pace of business-related travel and in-person interactions has not fully rebounded to pre-pandemic norms.

Zacks Industry Rank Indicates Bright Prospects

The Zacks Real Estate Operations industry is housed within the broader Zacks Finance sector. It carries a Zacks Industry Rank #104, which places it in the top 42% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is the average of the Zacks Rank of all the member stocks, indicates robust near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperform the bottom 50% by a factor of more than two to one.

The industry’s positioning in the top 50% of the Zacks-ranked industries is a result of the upward earnings per share outlook for the constituent companies in aggregate. Looking at the aggregate earnings per share estimate revisions, it appears that of late, analysts are gaining confidence in this group’s growth potential. Over the past year, the industry’s earnings per share estimates for 2024 and 2025 have moved 46.8% and 37.2% north, respectively.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Outperforms the Sector & the S&P 500

The Zacks Real Estate Operations industry has outperformed the broader Zacks Finance sector and the S&P 500 composite over the past year.

The industry has advanced 40.8% during this period compared with the S&P 500’s growth of 32.5% and the broader Finance sector’s rise of 31.2%.

One-Year Price Performance

Industry’s Current Valuation

On the basis of the forward 12-month price-to-earnings, which is a commonly used multiple for valuing Real Estate Operations stocks, we see that the industry is currently trading at 17.06X compared with the S&P 500’s forward 12-month price-to-earnings (P/E) of 22.08X. The industry is trading above the Finance sector’s forward 12-month P/E of 16.66X. This is shown in the chart below.

Forward 12-Month Price-To-Earnings Ratio

Over the last five years, the industry has traded as high as 32.49X and as low as 11.45X, with a median of 17.26X.

3 Real Estate Operation Stocks to Bet On

RE/MAX Holdings: Headquartered in Denver, CO, it is a franchisor in the real estate industry. The company franchises real estate brokerages globally under the RE/MAX brand and mortgage brokerages within the United States under the Motto Mortgage brand. It also sells ancillary products and services, such as loan processing services, mainly to its Motto network.

RE/MAX is poised to benefit from its strategic growth initiatives. With its efforts to expand the mortgage business and its objective to maintain a strong liquidity position, RE/MAX is well-poised to ride the growth curve.

RE/MAX Holdings currently sports a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for the company’s 2024 earnings per share currently stands at $1.24. The stock has increased 20.8% in the past three months.

Newmark Group, Inc.: Headquartered in New York City, Newmark is a leading commercial real estate services company that is rapidly expanding its presence globally. Together with its subsidiaries, Newmark Group advises and provides services to large institutional investors, global corporations and other owners and occupiers of commercial real estate.

With investments in talent and technology, the company is expected to experience decent performance going forward. It is poised to benefit from the opportunities from the large and highly fragmented market, institutional investor demand for commercial real estate and from the favorable trend toward outsourcing of commercial real estate services.

Newmark carries a Zacks Rank of 2 (Buy) at present. The Zacks Consensus Estimate for the company’s 2024 EPS has remained unchanged at $1.15 over the past month. This also suggests 9.5% growth year over year. NMRK shares have gained 22.7% over the past three months.

Kennedy Wilson: Headquartered in Beverly Hills, CA, Kennedy Wilson is a global real estate investment company that invests in high-growth markets across the United States, the U.K. and Ireland. KW is engaged in the ownership, operation and investment in real estate on its own and through its investment management platform.

The company is expected to benefit from the continued growth of its investment management business and healthy demand for its high-quality multifamily and commercial portfolio.

Kennedy Wilson has a Zacks Rank of 2 at present. The Zacks Consensus Estimate for 2024 EPS has moved significantly upward over the past two months to $2.96. This suggests a notable increase year over year. The company’s shares have appreciated 32.1% in the past six months.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

53-Year-Old 'Getting Ready To Retire' Earning $48,000 In Dividend Income Shares Portfolio: Top 9 Stocks And ETFs

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Dividend investing hardly loses its allure but gains more attention when the Fed cuts interest rates. A recent report from Sterling Capital showed that dividend stocks outperform non-dividend stocks after the first rate cut. The report also said that dividend growers perform better than high-yield stocks in this environment.

But for those looking to buy and hold dividend stocks for decades, these short-term trends might not matter. What matters for such investors is to pick reliable and safe dividend stocks and keep adding to them to reach their financial goals.

Don’t Miss:

About six months ago, a Redditor shared his detailed dividend income report on r/Dividends – a community of about 600,000 members on Reddit. The investor, who said he’s 53 years old, was making just over $48,000 in annual dividend income, according to the portfolio screenshots he shared publicly. The total value of his portfolio was about $1.23 million.

The investor said he was “getting ready” to retire. Asked what he did for a living, here was his response:

“Retired military (enlisted). Wife works in tech and will be retiring this year because she gets annoyed I’m going fishing while she works.”

He said he started investing when he was 26 (talk about long-term goals!).

“Lost the bulk of our money three separate times ($20k, $25k and $90k) before changing my investment strategy. Once I stopped chasing high flyers and went for the long-term plan I started making money. When I was young, I kept trying to get a jump on our retirement savings and it kept burning me. Slow and steady really does work.”

There were about 23 ETFs and stocks in the portfolio. Let’s look at some of the biggest holdings in the portfolio.

Schwab U.S. Dividend Equity ETF

About 33% of the portfolio of the Redditor making $48,000 per year was allocated to Schwab U.S. Dividend Equity ETF (NYSE:SCHD). According to the portfolio details, he made approximately $13,480 in annual income from the fund. Schwab U.S. Dividend Equity ETF (NYSE:SCHD) tracks the Dow Jones U.S. Dividend 100 Index and exposes you to some of the top dividend stocks trading in the U.S., including Home Depot, Coca-Cola, Verizon, Lockheed Martin, Pepsi and AbbVie, among many others. Since SCHD’s holdings are mostly conservative dividend payers, it’s suitable for investors close to retirement looking for consistent dividend income.

The Vanguard High Dividend Yield Index Fund ETF

The Vanguard High Dividend Yield Index Fund ETF (NYSE:VYM) tracks the FTSE High Dividend Yield Index, providing investors with exposure to high-yield U.S. dividend stocks. The fund’s top holdings include Broadcom, JPMorgan, ExxonMobil and Procter and Gamble. VYM is up 15% so far this year. It pays quarterly dividends.

The Vanguard International High Dividend Yield Index Fund ETF

The Vanguard International High Dividend Yield Index Fund ETF (VYMI) was the third biggest holding of the 53-year-old Redditor earning $48,000 a year in dividends. According to the portfolio screenshots shared publicly, he owned about $131,000 worth of VYMI shares. VYMI tracks the FTSE All-World ex U.S. High Dividend Yield Index. It’s a suitable ETF for those seeking exposure to non-US dividend stocks. Nestle, Novartis and Roche are the three biggest holdings of the fund.

Trending: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

SPDR Portfolio S&P 500 High Dividend ETF

The investor who shared his portfolio details, claiming to be earning over $48,000 per year in dividends, showed that 6.6% of his portfolio is allocated to SPDR Portfolio S&P 500 High Dividend ETF (NYSE:SPYD) and the total worth of the stake was about $81,600. SPYD yields over 4% and tracks the total return performance of the S&P 500 High Dividend Index. Some of the fund’s top holdings include Kellanova, Public Storage, Hasbro and Simon Property, among others. The fund brought about $3,600 in annual income for the investor.

The Fidelity High Dividend ETF

The Fidelity High Dividend ETF (FDVV) tracks the Fidelity High Dividend Index, which consists of mid- and large-cap dividend stocks. The fund’s top holdings are Apple, ExxonMobil, Nvidia and Broadcom.

Vanguard Dividend Appreciation Index Fund ETF

The Redditor making $48,000 per year in dividend income had a $40,000 position in Vanguard Dividend Appreciation Index Fund (VIG). According to his portfolio screenshots, his annual dividend income from the fund was about $710. VIG is ideal for anyone seeking exposure to companies that consistently grow dividends. The fund tracks the S&P U.S. Dividend Growers Index. The fund’s portfolio consists of about 337 stocks, most large-cap companies. Apple, Microsoft, Broadcom, UnitedHealth, ExxonMobil and Procter & Gamble are among the ETF’s top holdings.

The iShares International Select Dividend ETF

The iShares International Select Dividend ETF (BATS:IDV) gives investors exposure to dividend stocks from developed markets outside the US. It tracks the Dow Jones EPAC Select Dividend Index, which includes dividend-paying companies from Europe, Asia and Australia.

Pfizer

The Redditor had a $27,800 position in Pfizer Inc. (NYSE:PFE), which has raised its dividends for 15 consecutive years. The stock brought about $1,680 in annual income for the investor. However, PFE shares are down about 11% over the past year.

Reaves Utility Income Fund

Reaves Utility Income Fund (UTG) was bringing about $2,300 in annual income for the 53-year-old Redditor, according to the details he shared publicly on the social platform. The fund invests in utilities and infrastructure companies to generate monthly dividend income for investors. UTG yields about 8% and distributes monthly dividends. Some of the fund’s top holdings include Talen Energy Corp., Constellation Energy, Vistra and CenterPoint Energy.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article 53-Year-Old ‘Getting Ready To Retire’ Earning $48,000 In Dividend Income Shares Portfolio: Top 9 Stocks And ETFs originally appeared on Benzinga.com

2 Ultra-High-Yield Dividend Stocks You Can Buy Now and Hold at Least a Decade

Everyday investors looking for ultra-high-yield dividend stocks have limited options to choose from. Dividend yields drop as prices rise, and the market has been soaring over the past few years.

The benchmark S&P 500 index has risen by 51% since the end of 2022. In such a buoyant market, finding top dividend payers that offer high yields is a challenge, but it isn’t impossible.

Ares Capital (NASDAQ: ARCC) and PennantPark Floating Rate Capital (NYSE: PFLT) are a pair of well-manged business development companies (BDCs) that offer eye-popping dividend yields. Here’s why income-seeking investors want to add them to a diversified portfolio now and hold them for the long run.

Ares Capital

The first ultra-high-yield dividend stock investors want to load up on is Ares Capital. At recent prices, it offers a huge 9% yield.

Ares Capital is the world’s largest publicly traded BDC. These specialized entities are generally popular among income-seeking investors because they can legally avoid paying income taxes by distributing nearly all their earnings to shareholders as dividend payments.

The BDC industry is a lucrative one because U.S. banks have been increasingly hesitant to lend to businesses directly for decades. All over America, companies starved for capital are willing to pay higher interest rates than you might imagine. The average yield on debt securities in Ares Capital’s portfolio was 12.2% in the second quarter.

The folks who run Ares Capital’s investment committee have 30 years of experience on average and it shows. The BDC’s portfolio grew to $25 billion at the end of June with loans out to 525 different companies. Just 1.5% of the portfolio, at cost, was on nonaccrual status.

Investing in any one midsize business or industry can be dangerous, but Ares Capital’s portfolio is well diversified. Its largest components are in the software, software services, and healthcare services industries. These industries represent just 37% of the overall portfolio.

Lots of diversification and a terrific track record support an investment-grade credit rating that makes it easier to turn a profit in good times and bad. This July, Ares Capital’s excellent credit rating allowed it to raise $850 million by offering five-year notes with a 5.95% coupon. That’s less than half the yield it receives from the debt securities in its portfolio.

This dividend payer isn’t risk-free, but it would take a prolonged recession that forces a wave of defaults across not just one but several of the economy’s more reliable industries before investors need to worry about a severe dividend cut.

PennantPark Floating Rate Capital

PennantPark Floating Rate Capital is another BDC that gives investors an ultra-high dividend yield to consider. At recent prices, it offers a 10.5% yield and monthly payments.

Other BDCs like Ares Capital compete over up-market businesses, but PennantPark gets the pick of the litter when it comes to smaller companies that earn between $10 million and $50 million annually.

As its name implies, practically all of PennantPark Floating Rate Capital’s debt investments collect interest at variable rates. Nearly all of its loans are of the first-lien senior secured variety too. These loans are first in line to be repaid in the event of bankruptcy.

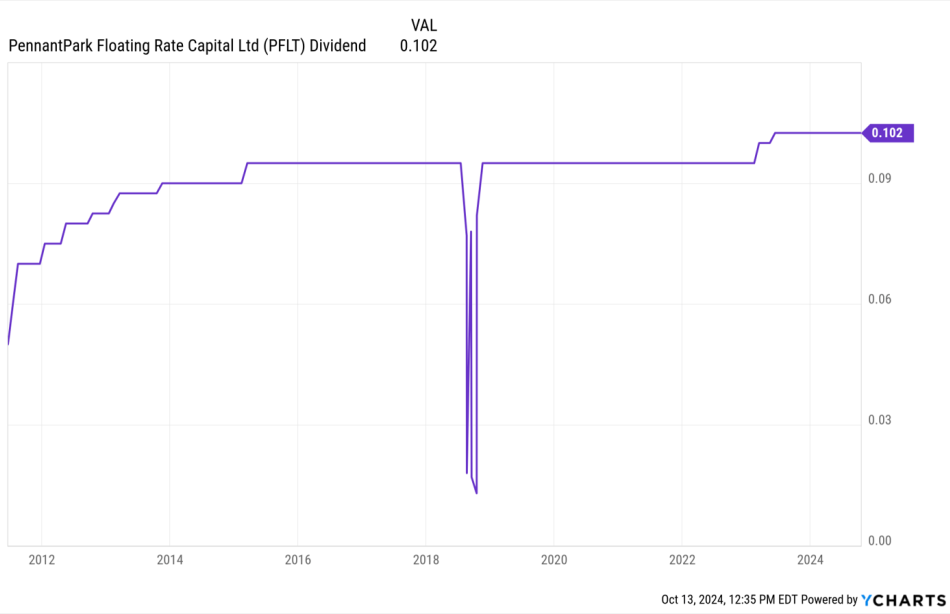

With 26 years of industry experience, PennantPark’s underwriting team is nearly as experienced as Ares Capital’s. With a brief exception in 2018, it’s raised or maintained its dividend payout since its initial public offering in 2011.

Investors can reasonably expect continued stability from PennantPark in the decade ahead. Just three companies representing 1.5% of its overall portfolio at cost were on nonaccrual status at the end of June.

This BDC is most exposed to the professional services, aerospace, and defense industries. The portfolio is so diversified that these industries represent just 15.4% of the total.

While smaller, PennantPark’s portfolio is arguably even more diverse than Ares Capital’s portfolio. Buying some shares now to lock in a dividend yield at a double-digit percentage looks like a great idea for just about any income-seeking investor.

Should you invest $1,000 in Ares Capital right now?

Before you buy stock in Ares Capital, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Ares Capital wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Cory Renauer has positions in Ares Capital. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2 Ultra-High-Yield Dividend Stocks You Can Buy Now and Hold at Least a Decade was originally published by The Motley Fool

Analyst Report: Bank Of America Corp.

Summary

Bank of America is one of the largest financial companies in the world. The company is primarily a U.S. retail and commercial bank, with a network of more than 4,000 branches across much of the country. The 2005 acquisition of MBNA made Bank of America the nation’s largest credit-card lender. As such, trends in consumer interest rates, employment, income growth and borrowing patterns represent a significant risk to the company’s earnings. The 2008 acquisition of Country

Upgrade to begin using premium research reports and get so much more.

Exclusive reports, detailed company profiles, and best-in-class trade insights to take your portfolio to the next level

Synnefo Partners with Aprecomm to Deliver a Cloud- and AI-powered Customer Experience Management Super-stack Tailored for Mid-size Broadband Service Providers

The new strategic partnership combines Aprecomm’s customer experience applications suite with Synnefo’s OSS and BSS solutions. The best-of-breed super-stack enables broadband service providers to transform subscriber management through a unified package that can be deployed instantaneously from the cloud.

BENGALURU, India, Oct. 16, 2024 /PRNewswire/ — Aprecomm (www.aprecomm.ai), the intuitive network and customer experience platform provider, announced today that it has entered into a strategic partnership with Synnefo (www.synnefoims.com), an OSS, BSS, IMS, SMS supplier to Internet Service Providers (ISPs) and Multi-System Operators (MSOs) in India and across the globe.

The move combines both companies’ market-leading solutions, enabling Synnefo to offer a customer experience ‘super-stack’ that brings service providers an integrated and seamless approach for CPE management, subscriber billing, support, and network performance optimization to save time and money.

“In today’s highly competitive market where there are fewer barriers to churn, providers must move to compete on the actual experience that customers receive,” said Pramod Gummaraj, Founder & CEO of Aprecomm. “With multiple failure points, such as WiFi interference, and the low latency high-performance needs of intensive applications such as video and gaming, raw speed no longer guarantees customer satisfaction. By combining our solution—including advanced quality of experience measurement, performance optimization and proactive support tools—with its OSS and BSS, Synnefo can bring all types of communications service providers a low-friction, turnkey solution, enabling them to offer the best customer experience at every touch point.”

Synnefo has integrated Aprecomm’s ACS and quality of experience software with its OSS and BSS solution, offering the software super-stack to existing customers and new prospects. The combined solution suits ISPs and Broadband Service Providers looking for a unified experience management platform and billing solution that removes the headache of engaging and integrating multiple vendor offerings. The Software-as-a-Service (SaaS) approach means that the software can be launched imminently from the cloud and includes all the tools needed for CPE device configuration and upgrade, customer billing, and network performance and optimization, right down to the granular application level. The solution is perfectly positioned to enable service providers to increase customer satisfaction and drive operational efficiencies.

“We are constantly looking for ways to bring the latest tools to ISPs and Broadband Service Providers,” said Vijay Ahire, Co-founder & CTO of Synnefo. “Synnefo OSS and BSS are already deployed with over 350 service providers—this move presents opportunities to upgrade existing customers and target new markets in India, Africa and the Middle East, which is saturated with mid-size service providers looking for a cost-effective solution.”

Serving both residential and business subscribers, Aprecomm’s CX suite helps broadband service providers transform their approaches to connectivity, ensuring that consumers can enjoy online experiences without wasting time managing their WiFi networks. By using sophisticated artificial intelligence—including a unique quality of experience algorithm—Aprecomm is paving the way to intuitive zero-touch networks by taking a self-optimizing and self-healing approach to managed WiFi, tuning the network to the unique needs of each user and the application they are using.

On the back end, Aprecomm’s advanced analytics and automated support tools provide access to real-time data, enabling service providers to monitor end-to-end network performance to predict and resolve problems before they reach the subscriber. Its CX suite is field-proven to increase subscriber satisfaction and reduce operational costs—service providers have seen multiple improvements[1] across 100% of their networks, such as a 62% reduction in truck rolls, a 35% improvement in first-call resolutions and a 30% reduction in call resolution times.

The combined solution will be demonstrated at Syneffo’s booth D4 at SCAT2024 in Mumbai from October 17th to 19th.

About Aprecomm

Aprecomm harnesses the power of AI to provide a unique applications suite that enables service providers to create self-optimizing and self-healing broadband networks.

Our quality of experience engine monitors and optimizes WiFi performance to ensure that consumers enjoy the best possible internet experiences, at the same time, our cloud-based support applications leverage real-time data to predict and resolve customer service issues before they happen, saving providers time and money.

Aprecomm manages over 7 million home and business locations, partnering with more than 45 service providers worldwide.

Together, we are making intuitive networks a reality.

Follow Aprecomm on LinkedIn here.

#IntuitiveNetworks

Visit www.aprecomm.ai to discover more.

Press contact:

About Synnefo

Since its founding in 2010, Synnefo has remained dedicated to revolutionizing software solutions for ISPs. Over the years, we’ve partnered with small, medium, and large ISPs globally, offering comprehensive software solutions and continuous research that goes beyond conventional approaches. Our mission is to maximize revenue and minimize technical complexities, easing the operations and positioning Synnefo as the ultimate one-stop platform for ISPs and MSOs. From broadband management to CATV services, we provide seamless, scalable solutions that drive efficiency and innovation in the ISP industry.

Synnefo was built by a team of experts in CRM, ISP networks, and system architecture dedicated to managing the ISP lifecycle. With a focus on ease and transparency, Synnefo seamlessly manages the entire ecosystem. Regardless of geographical boundaries, our core objective is to collaborate for our clients’ success, driven by years of dedication to achieving excellence in all that we do.

Synnefo has successfully onboarded over 350 ISPs globally, establishing a presence in more than ten countries. Its key differentiator and unique selling point (USP) is exceptional support.

Press contact:

Logo – https://stockburger.news/wp-content/uploads/2024/10/1729052930_251_Aprecomm_Logo.jpg

Logo – https://stockburger.news/wp-content/uploads/2024/10/Synnefo_Logo_Logo.jpg

[1] Data sampled from a broadband service provider who monitored 400,000 subscribers over 12 months ending August 2022.

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/synnefo-partners-with-aprecomm-to-deliver-a-cloud–and-ai-powered-customer-experience-management-super-stack-tailored-for-mid-size-broadband-service-providers-302276988.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/synnefo-partners-with-aprecomm-to-deliver-a-cloud–and-ai-powered-customer-experience-management-super-stack-tailored-for-mid-size-broadband-service-providers-302276988.html

SOURCE Aprecomm

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Clipper Realty Soars 9.9%: Is Further Upside Left in the Stock?

Clipper Realty Inc. CLPR shares soared 9.9% in the last trading session to close at $6.65. The move was backed by solid volume with far more shares changing hands than in a normal session. This compares to the stock’s 12.7% gain over the past four weeks.

The increased investor optimism in the stock can be attributed to the favorable operating environment.

This company is expected to post quarterly funds from operations (FFO) of $0.12 per share in its upcoming report, which represents a year-over-year change of -20%. Revenues are expected to be $38 million, up 8.2% from the year-ago quarter.

FFO and revenue growth expectations certainly give a good sense of the potential strength in a stock, but empirical research shows that trends in FFO estimate revisions are strongly correlated with near-term stock price movements.

For Clipper Realty, the consensus FFP per share estimate for the quarter has been revised 33.3% higher over the last 30 days to the current level. And a positive trend in FFO estimate revision usually translates into price appreciation. So, make sure to keep an eye on CLPR going forward to see if this recent jump can turn into more strength down the road.

The stock currently carries a Zacks Rank #1 (Strong Buy).

Clipper Realty is part of the Zacks REIT and Equity Trust – Other industry. NNN REIT NNN, another stock in the same industry, closed the last trading session 1% higher at $47.95. NNN has returned -2.6% in the past month.

For NNN REIT, the consensus FFO per share estimate for the upcoming report has remained unchanged over the past month at $0.84. This represents a change of +2.4% from what the company reported a year ago. NNN REIT currently has a Zacks Rank of #3 (Hold).

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Ekinops Revenue up +9% in Q3 2024

PARIS, Oct. 15, 2024 /PRNewswire/ — EKINOPS (Euronext Paris – FR0011466069 – EKI), a leading supplier of telecommunications solutions for telecom operators and enterprises, reports its Q3 2024 consolidated revenue (July 1 to September 30, 2024).

|

€m – IFRS |

2023 |

2024 |

Change |

|

Q1 revenue |

31.9 |

28.3 |

-11 % |

|

Q2 revenue |

39.2 |

29.2 |

-25 % |

|

Q3 revenue |

27.8 |

30.4 |

+9 % |

|

9-month revenue |

98.8 |

87.9 |

-11 % |

Q3 2024 revenue up +9% to €30.4m

In Q3 2024, Ekinops reported revenue of 30.4 m€, up +9% year-on-year and up +4% sequentially relative to Q2 2024. Ekinops thus returns to growth, posting its highest level of revenue since Q2 2023.

At constant exchange rates, Q3 2024 revenue increased by +10%.

For the first nine months of 2024, consolidated revenue was 87.9 m€, down -11% compared to the same period last year (identical at constant exchange rates).

Access up +8%, Optical Transport down -34% over nine months

Sales for Access solutions were up +8% over the period, driven by the significant rebound in business in France since the start of the year (+27% over nine months) with operators gradually rebuilding their equipment inventories.

Nine-month sales of Optical Transport solutions were down -34% year-on-year. In addition to an unfavorable basis for comparison (+23% over nine months in 2023), operators are still reluctant to start making investments in a context of overcapacity with a slowdown in internet traffic growth. However, Optical Transport sales grew +16% on a sequential basis compared to Q2 2024.

As of end-September 2024, Software & Services’ revenue represented 16% of the Group’s total revenue (vs. 15% a year earlier) with an increasing share of recurring revenue, particularly in Services.

+18% activity growth in France, -26% internationally

The first nine months of the year were characterized by Ekinops’ strong performance in France, with robust growth of +18% over the period, propelled by the rebound in sales of Access solutions, the company’s main business line in its home market. Over the period, the Group reported 45% of its total business volume in this region, versus 34% a year earlier.

Outside France, Ekinops saw a decline in its activities, which now account for 55% of its total revenue (vs. 66% a year earlier).

In North America, where sales are almost exclusively generated by Optical Transport solutions, the Group posted business volumes of 17.8 m€, down -29% versus the same period last year (-28% in US dollars), which represents a high comparison base (+18% growth at end-September 2023). The US market remains marked by a significant wait-and-see attitude adopted by service providers, linked to the slow deployment of the 42 billion dollars federal BEAD program (Broadband Equity, Access and Deployment), aimed at reducing the digital divide in the United States. Ekinops generated 20% of its revenue in this market in the first nine months of 2024 (vs. 26% one year prior).

The EMEA region (Europe, excluding France, the Middle East and Africa), representing 33% of Ekinops’ revenue (vs. 39% a year earlier), recorded a -23% decline in business over the period, mainly penalized by a significant decrease in sales of Optical Transport solutions, on the back of a +17% increase over the same period last year. However, it should be noted that on a sequential basis, Ekinops saw a return to growth in this region during Q3 2024 (+9%).

As of end-September 2024, revenue for Asia-Pacific, which remains reliant on just a few key accounts, was down -31%. Over nine months, the region accounted for 2% of Ekinops’ total revenue (identical to the prior year).

Outlook

In Q3 2024, Ekinops reported an improved level of revenue versus previous quarters, slightly over 30 m€, particularly thanks to Access inventory easing at operator-customers in France and EMEA, as well as the very first deliveries of the new 800G product for Optical Transport.

However, the market environment is still difficult, with operators across all regions notably cautious about their investment plans.

One of the company’s objectives for 2024 – to achieve quarter-on-quarter growth – has been fulfilled, as the company added approximately 1 m€ in revenue in each quarter between Q1 and Q3.

2024 financial calendar

|

Date |

Release |

|

January 13, 2025 |

FY 2024 revenue |

|

March 5, 2025 |

2024 annual results |

All press releases are published after Euronext Paris market close.

EKINOPS Contact

Didier Brédy, Chairman and CEO

contact@ekinops.com

Investors

Mathieu Omnes, Investor relation

Tel.: +33 (0)1 53 67 36 92

momnes@actus.fr

Press

Amaury Dugast, Press relation

Tel.: +33 (0)1 53 67 36 74

adugast@actus.fr

Photo – https://stockburger.news/wp-content/uploads/2024/10/ekinops_corporate.jpg

Logo – https://stockburger.news/wp-content/uploads/2024/10/Ekinops_Logo.jpg

![]() View original content to download multimedia:https://www.prnewswire.com/news-releases/ekinops-revenue-up-9-in-q3-2024-302276710.html

View original content to download multimedia:https://www.prnewswire.com/news-releases/ekinops-revenue-up-9-in-q3-2024-302276710.html

SOURCE Ekinops

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Automotive Body Control Module Market Size Projected to Hit USD 59.0 Billion by 2034, Growing at 4.0% CAGR as Demand for Embedded Control Systems Rises – Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 15, 2024 (GLOBE NEWSWIRE) — The global automotive body control module market (자동차 차체 제어 모듈 시장) is estimated to rise at a CAGR of 4.0% from 2024 to 2034. Transparency Market Research projects that the overall sales revenue for automotive body control module is estimated to reach US$ 59.0 billion by the end of 2034.

A significant factor is the rise of shared mobility services. The growing popularity of ride-sharing and car-sharing platforms necessitates robust BCMs capable of managing multiple user profiles, security features, and seamless connectivity, driving demand for advanced BCM solutions.

The trend towards vehicle personalization is impacting the BCM market. Consumers increasingly seek customizable features and user interfaces in their vehicles, prompting automakers to integrate more flexible and adaptable BCM systems that can accommodate individual preferences and aftermarket upgrades.

Download Sample PDF Brochure from Here: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=36311

Some prominent players are as follows:

- Robert Bosch GmbH

- Continental AG

- Aptiv PLC

- Lear Corporation

- ZF Friedrichshafen AG

- Panasonic Corporation

- Valeo SA

- Mitsubishi Electric Corporation

- DENSO Corporation

- Delphi (Phinia Inc.)

- Hella GmbH & Co. KGaA

- Magna International Inc.

- Hitachi Astemo, Ltd.

- Marelli Holdings Co., Ltd.

- Hyundai Mobis

- Infineon Technologies AG

- Texas Instruments Incorporated

- Renesas Electronics Corporation

- NXP Semiconductors N.V.

- STMicroelectronics N.V.

The influence of environmental sustainability initiatives cannot be overlooked. As governments worldwide implement stricter emissions regulations and encourage eco-friendly transportation solutions, BCM manufacturers are innovating to develop energy-efficient and lightweight components that contribute to overall vehicle efficiency and reduced environmental impact.

The growing emphasis on cybersecurity in the automotive industry presents a unique driver for the BCM market. With the proliferation of connected vehicles and digital systems, there is a heightened need for BCMs with robust security measures to protect against cyber threats and safeguard vehicle data and operations.

Key Findings of the Market Report

- Microcontrollers lead the automotive body control module market hardware segment, driving the integration of advanced functionalities and control features in vehicles.

- Passenger cars lead the automotive body control module market, driven by the demand for advanced safety, comfort, and convenience features.

- The electric propulsion segment, particularly battery electric vehicles, leads the automotive body control module market due to increasing electrification trends.

Automotive Body Control Module Market Growth Drivers & Trends

- Growing demand for electric vehicles fuels the adoption of advanced body control modules to manage electrical systems efficiently.

- Rising interest in autonomous vehicles drives the integration of sophisticated BCMs for enhanced control and safety features.

- Demand for connected cars stimulates the development of BCMs with seamless integration of infotainment and telematics systems.

- Stringent safety and emissions regulations globally push automakers to implement advanced BCMs to comply with regulatory requirements.

- Continuous innovation in semiconductor technology and sensor integration enables the development of more intelligent and efficient BCM solutions.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=36311

Global Automotive Body Control Module Market: Regional Profile

- In North America, particularly the United States, stringent safety regulations and consumer demand for advanced vehicle features drive the automotive body control module market. Key players like Aptiv PLC and Delphi Technologies lead with innovative solutions, catering to the region’s preference for connected and autonomous vehicles.

- In Europe, countries like Germany and the UK spearhead the market, propelled by a strong automotive manufacturing base and emphasis on vehicle electrification. Continental AG and Robert Bosch GmbH dominate, offering integrated BCM solutions that align with Europe’s push towards sustainable mobility and stringent safety standards.

- Asia Pacific emerges as a hub for automotive innovation, with countries like Japan, China, and South Korea leading the market. Rising urbanization, increasing disposable income, and government incentives for electric vehicles propel market growth. Local players like Denso Corporation and Hyundai Mobis Co., Ltd. compete alongside global giants, catering to the region’s diverse automotive landscape.

Automotive Body Control Module Market: Competitive Landscape

The automotive body control module market presents a dynamic competitive landscape driven by technological advancements and shifting consumer preferences. Key players like Robert Bosch GmbH, Continental AG, and Aptiv PLC dominate with comprehensive BCM solutions, offering advanced functionalities and integration capabilities.

Emerging players, including Infineon Technologies and Texas Instruments, challenge the market with innovative semiconductor solutions and sensor technologies. Strategic collaborations, mergers, and acquisitions characterize the market, fostering product innovation and market expansion. With the rise of electric and autonomous vehicles, the BCM market continues to evolve, offering tailored solutions to meet the demands of the modern automotive industry.

Product Portfolio:

- Continental AG specializes in intelligent mobility solutions, providing innovative automotive components, systems, and services. Their portfolio includes vehicle electronics, tires, and safety systems, shaping the future of transportation worldwide.

- Aptiv PLC is a global leader in smart mobility solutions, offering advanced software, vehicle components, and connectivity solutions. Their expertise in autonomous driving, electrification, and vehicle architecture transforms the future of mobility into reality.

Automotive Body Control Module Market: Key Segments

By Component

-

- Hardware

- Microcontrollers

- Sensors

- Switches

- Relays

- Connectors

- Interfaces

- Others

- Software

- Hardware

By Vehicle Type

-

- Two/Three Wheelers

- Passenger Cars

- Light Commercial Vehicles

- Heavy Duty Trucks

- Buses and Coaches

- Off-road Vehicles

By Communication Protocol

-

- Controller Area Network (CAN)

- Local Interconnect Network (LIN)

- FlexRay

- Ethernet

- Others

By Propulsion

-

- IC Engine

- Electric

- Battery Electric

- Plug-in Hybrid Electric

By Application

By Sales Channel

By Region

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=36311<ype=S

More Trending Reports by Transparency Market Research –

- Vehicle Subscription Market– The vehicle subscription market (차량 구독 시장) is estimated to grow at a CAGR of 21.1% from 2022 to 2031 and reach US$ 33.2 Billion by the end of 2031.

- Luxury Yacht Charter Market– The global luxury yacht charter industry (호화 요트 전세 산업) is projected to advance at a CAGR of 4.1% between 2022 and 2031 to reach more than US$ 19.0 Billion by the end of 2031.

- Agricultural Trailer Market – The global agricultural trailer market (농업 트레일러 시장) is expected to reach US$ 58.7 Billion by the end of 2034.

- Winter Tire Market – The global winter tire market (겨울 타이어 시장) is has expected to reach a value of US$ 41.2 Billion by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.