ASML cuts sales forecasts in Q3 earnings published early; shares plummet

By Toby Sterling and Nathan Vifflin

AMSTERDAM (Reuters) -Computer chip equipment maker ASML forecast on Tuesday lower than expected 2025 sales and bookings on sustained weakness in parts of the semiconductor market, pushing its shares to their biggest one-day drop since 1998.

The company said that despite a boom in AI-related chips, other parts of the semiconductor market are weaker for longer than expected, leading companies that make logic chips to delay orders and customers that make memory chips to only plan “limited” new capacity additions.

ASML, Europe’s biggest tech firm, is the leading supplier of equipment used to manufacture chips, with customers including AI chipmaker TSMC of Taiwan, as well as logic chip makers Intel and Samsung, and memory chip specialists Micron and SK Hynix.

The company published its quarterly earnings on its website a day earlier than expected in what a spokesperson described as a “technical error.”

“We expect our 2025 total net sales to grow to a range between 30-35 billion euros, which is the lower half of the range” previously forecast, Chief Executive Christophe Fouquet said in a statement.

Chip market weakness “is expected to continue in 2025, which is leading to customer cautiousness”, he said.

Trading in the shares was halted several times in Amsterdam before they closed down 16% at 668.10 euros.

The company’s earnings showed net profit of 2.1 billion euros on sales of 7.5 billion euros ($8.2 billion), slightly ahead of analyst estimates.

However, the company’s bookings were 2.6 billion euros, well below forecasts that had ranged between 4 billion euros and 6 billion euros.

REDUCED EXPECTATIONS

ASML’s share price slumped over the summer months following news Intel would cut its capital spending, and weakness in memory chip prices.

Still, ASML’s change in outlook was a negative surprise for analysts.

“As recently as early September, management had reiterated that the low-end of the 2025 range was still ‘conservative’,” Citi said in a note.

“We look for additional detail as to the more recent changes in demand that are affecting ASML’s reduced expectation for 2025 and what it means for customer plans for 2026.”

Analyst Michael Roeg of bank Degroof Petercam said he expected ASML’s warning to drag down the wider sector, but noted the company’s sales were still expected to rise in 2025 from 2024.

“There is still no downturn in (demand for equipment) despite sluggish end markets for chips,” he said.

Separately, ASML’s sales to China set a record at 2.79 billion euros, or 47% of its total, in the quarter.

ASML dominates the market for lithography equipment, which uses lasers to help create the circuitry of chips.

While ASML cannot sell its most advanced product range in China due to U.S.-led restrictions, Chinese chipmakers have been investing heavily in its equipment to make older generations of computer chips.

($1 = 0.9172 euros)

(Reporting by Toby SterlingEditing by Tomasz Janowski and Emelia Sithole-Matarise)

Ford Secures Supply Deal With LG Energy For Electric Commercial Vans

Ford Motor Company F disclosed that it inked supply agreements with LG Energy Solution to provide power for its electrified commercial van models in Europe.

As per the contract, LG Energy Solution plans to supply Ford with a total of 109 GWh of batteries for its electric commercial vans beginning in 2026. The contract duration ranges from four to six years.

Both companies also agreed to produce batteries for the current Ford Mustang Mach-E at LG Energy Solution’s Michigan facility starting in 2025 instead of Poland.

This shift aims to enhance business efficiency and leverage competitive market conditions, including IRA tax credits.

David Kim, CEO of LG Energy Solution, said, “These agreements attest to our experience and expertise in powering commercial vehicles with innovative battery technologies designed to handle extreme user environments,”

“Capitalizing on our local production capacity, we will secure leadership in the European market and deliver unmatched values to our customers through advanced battery technologies that effectively address diverse needs.”

This month, the company stated that it sold 23,509 electric vehicles in the three months through the end of September, marking a jump of 12.2% from the corresponding period last year, despite a sales slump for its Mustang Mach-E SUV.

Investors can gain exposure to the stock via First Trust Nasdaq Transportation ETF FTXR and Invesco Exchange-Traded Fund Trust II Invesco S&P Ultra Dividend Revenue ETF RDIV.

Price Action: Ford shares are up 0.18% at $10.94 premarket at the last check Tuesday.

Read Next:

Image: Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Check Out What Whales Are Doing With Micron Technology

Whales with a lot of money to spend have taken a noticeably bullish stance on Micron Technology.

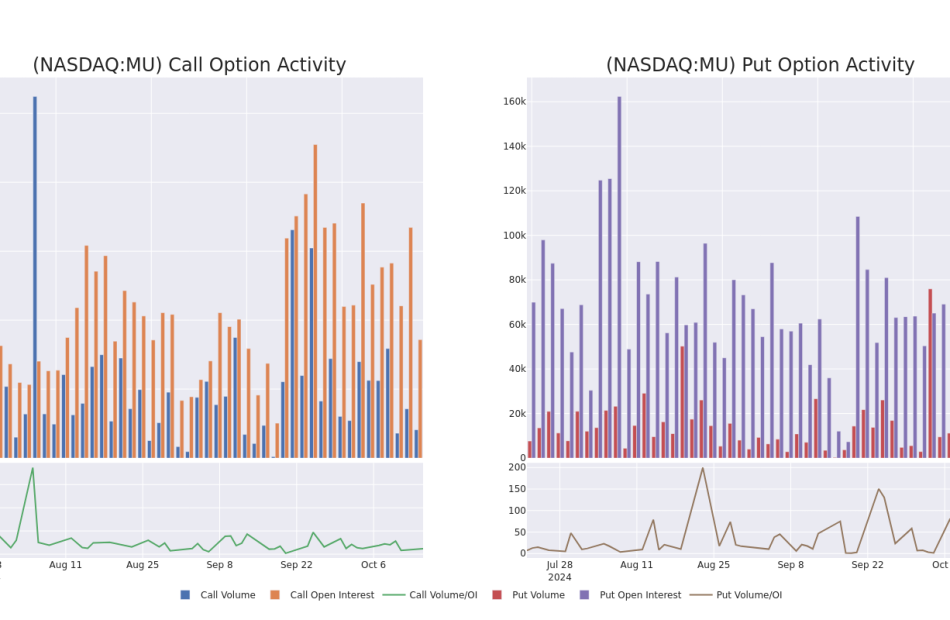

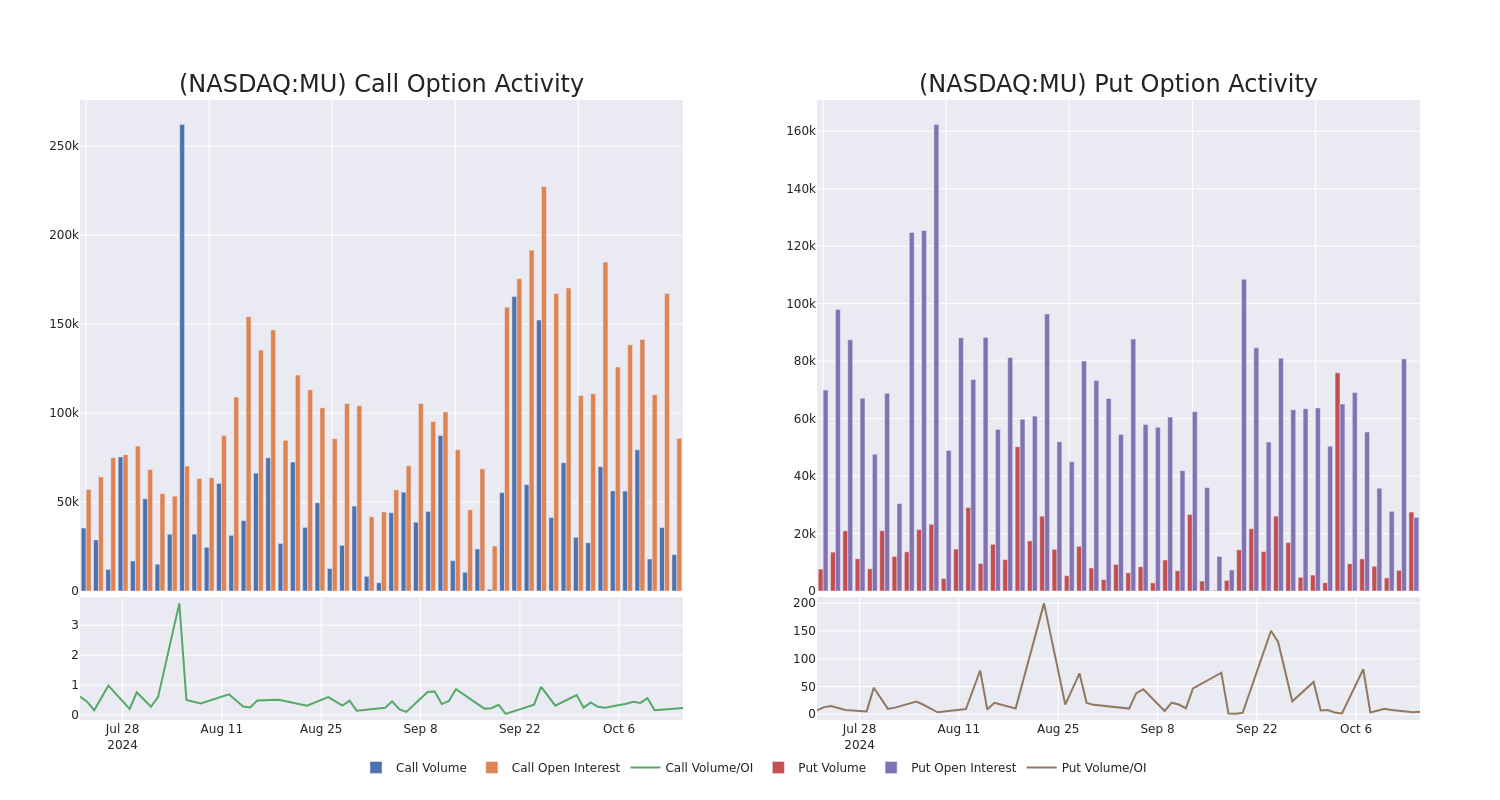

Looking at options history for Micron Technology MU we detected 38 trades.

If we consider the specifics of each trade, it is accurate to state that 47% of the investors opened trades with bullish expectations and 36% with bearish.

From the overall spotted trades, 10 are puts, for a total amount of $680,046 and 28, calls, for a total amount of $1,689,518.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $45.0 and $190.0 for Micron Technology, spanning the last three months.

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Micron Technology’s options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Micron Technology’s whale trades within a strike price range from $45.0 to $190.0 in the last 30 days.

Micron Technology Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | CALL | SWEEP | BULLISH | 06/18/26 | $25.5 | $24.6 | $25.7 | $115.00 | $385.1K | 276 | 150 |

| MU | PUT | TRADE | BULLISH | 01/17/25 | $13.8 | $13.7 | $13.7 | $115.00 | $274.0K | 4.5K | 200 |

| MU | CALL | TRADE | BULLISH | 06/20/25 | $11.25 | $11.05 | $11.25 | $120.00 | $135.0K | 3.4K | 277 |

| MU | PUT | SWEEP | BEARISH | 10/18/24 | $0.54 | $0.48 | $0.54 | $100.00 | $106.5K | 11.9K | 6.3K |

| MU | CALL | TRADE | BULLISH | 02/21/25 | $3.05 | $3.0 | $3.05 | $135.00 | $91.5K | 4.0K | 807 |

About Micron Technology

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

Micron Technology’s Current Market Status

- Trading volume stands at 9,812,124, with MU’s price down by -3.09%, positioned at $104.99.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 64 days.

Professional Analyst Ratings for Micron Technology

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $137.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge’s Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.

* Maintaining their stance, an analyst from TD Cowen continues to hold a Buy rating for Micron Technology, targeting a price of $135.

* An analyst from B of A Securities has decided to maintain their Buy rating on Micron Technology, which currently sits at a price target of $125.

* An analyst from Wells Fargo has decided to maintain their Overweight rating on Micron Technology, which currently sits at a price target of $175.

* Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on Micron Technology with a target price of $115.

* An analyst from Stifel has decided to maintain their Buy rating on Micron Technology, which currently sits at a price target of $135.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Micron Technology with Benzinga Pro for real-time alerts.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Jim Cramer Says 'I'm Worried' About Boeing After Plane Maker Lays Off 17,000 Employees Amid Safety And Financial Woes

Benzinga and Yahoo Finance LLC may earn commission or revenue on some items through the links below.

Jim Cramer expressed his concerns regarding Boeing Co.’s (NYSE:BA) financial health after the plane maker announced plans to lay off 17,000 employees in the wake of ongoing safety issues and worker strikes.

Don’t Miss Out:

What Happened: Cramer, in CNBC‘s Lightning Round on Saturday, voiced his worries about Boeing’s financial situation, stating, “I’m worried…The balance sheet’s not great, and they should have raised capital when they had a chance to.”

“This was a very jarring series of news tonight, and I don’t have any conviction whatsoever that they are getting this right,” he added.

Trending Now: This billion-dollar fund has invested in the next big real estate boom, here’s how you can join for $10.

This is a paid advertisement. Carefully consider the investment objectives, risks, charges and expenses of the Fundrise Flagship Fund before investing. This and other information can be found in the Fund’s prospectus. Read them carefully before investing.

Boeing’s CEO, Kelly Ortberg, disclosed the impending job cuts in an email to staff. The layoffs, which will affect a range of employees including executives and managers, represent about 10% of the company’s workforce and will be implemented over the coming months.

Why It Matters: The aerospace giant has been grappling with a series of challenges this year. In January, its 737 Max planes were grounded following a mid-flight incident. In July, Boeing admitted guilt in crashes involving the 737 Max in 2018 and 2019, which resulted in over 300 fatalities.

Further complications arose with Boeing’s Starliner spacecraft, which returned from the International Space Station in September without astronauts due to technical issues. Additionally, nearly 33,000 Boeing factory workers have been on strike since mid-September, further complicating the company’s situation.

Ortberg stressed the need for the layoffs to align with Boeing’s financial reality and future recovery plans. The delivery of the first 777X airplane has now been postponed to 2026, as stated in Ortberg’s memo.

Wondering if your investments can get you to a $5,000,000 nest egg? Speak to a financial advisor today. SmartAsset’s free tool matches you up with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Keep Reading:

This article Jim Cramer Says ‘I’m Worried’ About Boeing After Plane Maker Lays Off 17,000 Employees Amid Safety And Financial Woes originally appeared on Benzinga.com

Altair Engineering 10% Owner Trades $9.52M In Company Stock

It was reported on October 15, that GC Investments LLC, 10% Owner at Altair Engineering ALTR executed a significant insider sell, according to an SEC filing.

What Happened: A Form 4 filing from the U.S. Securities and Exchange Commission on Tuesday showed that LLC sold 100,000 shares of Altair Engineering. The total transaction amounted to $9,523,390.

During Tuesday’s morning session, Altair Engineering shares down by 0.0%, currently priced at $95.5.

Unveiling the Story Behind Altair Engineering

Altair Engineering Inc is a provider of enterprise-class engineering software enabling origination of the entire product lifecycle from concept design to in-service operation. The integrated suite of software provided by the company optimizes design performance across multiple disciplines encompassing structures, motion, fluids, thermal management, system modeling, and embedded systems. It operates through two segments: Software which includes the portfolio of software products such as solvers and optimization technology products, modeling and visualization tools, industrial and concept design tools, and others; and Client Engineering Services which provides client engineering services to support customers. Majority of its revenue comes from the software segment.

Altair Engineering: A Financial Overview

Revenue Growth: Altair Engineering’s remarkable performance in 3 months is evident. As of 30 June, 2024, the company achieved an impressive revenue growth rate of 5.41%. This signifies a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Navigating Financial Profits:

-

Gross Margin: The company excels with a remarkable gross margin of 79.49%, indicating superior cost efficiency and profitability compared to its industry peers.

-

Earnings per Share (EPS): Altair Engineering’s EPS is below the industry average. The company faced challenges with a current EPS of -0.06. This suggests a potential decline in earnings.

Debt Management: Altair Engineering’s debt-to-equity ratio is below the industry average. With a ratio of 0.33, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Financial Valuation:

-

Price to Earnings (P/E) Ratio: Altair Engineering’s current Price to Earnings (P/E) ratio of 298.62 is higher than the industry average, indicating that the stock may be overvalued according to market sentiment.

-

Price to Sales (P/S) Ratio: The current P/S ratio of 12.84 is above industry norms, reflecting an elevated valuation for Altair Engineering’s stock and potential overvaluation based on sales performance.

-

EV/EBITDA Analysis (Enterprise Value to its Earnings Before Interest, Taxes, Depreciation & Amortization): Altair Engineering’s EV/EBITDA ratio, surpassing industry averages at 95.97, positions it with an above-average valuation in the market.

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Now trade stocks online commission free with Charles Schwab, a trusted and complete investment firm.

Uncovering the Importance of Insider Activity

It’s important to note that insider transactions alone should not dictate investment decisions, but they can provide valuable insights.

Within the legal framework, an “insider” is defined as any officer, director, or beneficial owner holding more than ten percent of a company’s equity securities as per Section 12 of the Securities Exchange Act of 1934. This includes executives in the c-suite and major hedge funds. These insiders are mandated to disclose their transactions through a Form 4 filing, to be submitted within two business days of the transaction.

The initiation of a new purchase by a company insider serves as a strong indication that they expect the stock to rise.

However, insider sells may not always signal a bearish view and can be influenced by various factors.

Transaction Codes To Focus On

When dissecting transactions, the focal point for investors is often those occurring in the open market, meticulously detailed in Table I of the Form 4 filing. A P in Box 3 denotes a purchase, while S signifies a sale. Transaction code C indicates the conversion of an option, and transaction code A denotes a grant, award, or other acquisition of securities from the company.

Check Out The Full List Of Altair Engineering’s Insider Trades.

Insider Buying Alert: Profit from C-Suite Moves

Benzinga Edge reveals every insider trade in real-time. Don’t miss the next big stock move driven by insider confidence. Unlock this ultimate sentiment indicator now. Click here for access.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

First Community Earnings Preview

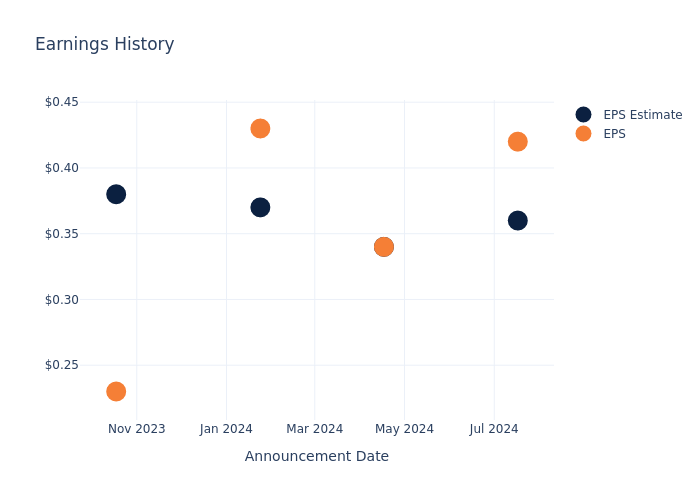

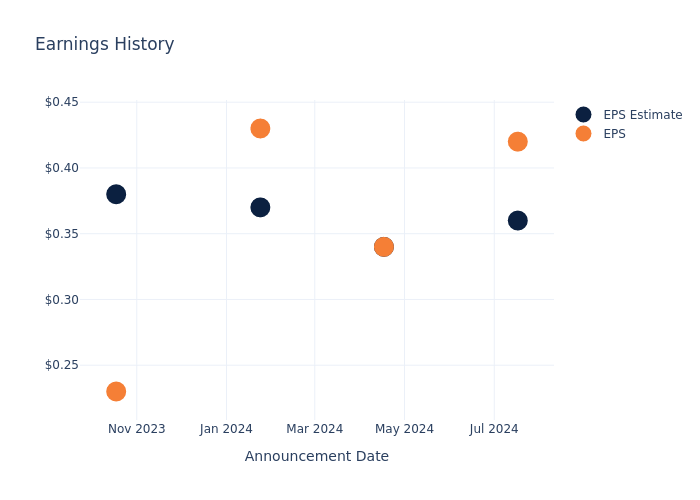

First Community FCCO is gearing up to announce its quarterly earnings on Wednesday, 2024-10-16. Here’s a quick overview of what investors should know before the release.

Analysts are estimating that First Community will report an earnings per share (EPS) of $0.44.

Investors in First Community are eagerly awaiting the company’s announcement, hoping for news of surpassing estimates and positive guidance for the next quarter.

It’s worth noting for new investors that stock prices can be heavily influenced by future projections rather than just past performance.

Performance in Previous Earnings

During the last quarter, the company reported an EPS beat by $0.06, leading to a 2.01% drop in the share price on the subsequent day.

Here’s a look at First Community’s past performance and the resulting price change:

| Quarter | Q2 2024 | Q1 2024 | Q4 2023 | Q3 2023 |

|---|---|---|---|---|

| EPS Estimate | 0.36 | 0.34 | 0.37 | 0.38 |

| EPS Actual | 0.42 | 0.34 | 0.43 | 0.23 |

| Price Change % | -2.0% | 0.0% | 4.0% | -1.0% |

Stock Performance

Shares of First Community were trading at $21.3 as of October 14. Over the last 52-week period, shares are up 21.35%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

To track all earnings releases for First Community visit their earnings calendar on our site.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Stock-Split Stock to Buy Hand Over Fist in October and 1 to Avoid

A continually rising share price is generally a good thing. However, that price can eventually get so high that individual investors can’t afford to accumulate company shares. To rectify this, companies sometimes perform stock splits, which lower the share price by proportionately increasing the number of shares on the market.

It’s a sign that a company has enjoyed prolonged success, and the lower share price often attracts investors, even though a split doesn’t change anything about the stock’s fundamental valuation or its per-share financials.

Earlier this year, Chipotle Mexican Grill (NYSE: CMG) and Williams-Sonoma (NYSE: WSM) performed respective 50-for-1 and 2-for-1 stock splits.

Ironically, neither stock has done well since splitting back over the summer. That said, one stands out as a buy, while investors are probably better off avoiding the other for now.

A management shake-up and strong growth outlook make this popular restaurant stock an obvious buy

Chipotle is a straightforward business with an eye-popping history of success. The casual dining chain sells Mexican inspired cuisine using fresh ingredients, and its popularity has fueled steady store expansion over the years. Since 2006, the stock has returned a mouth-watering 6,590%, trouncing the return of the S&P 500 index. Chipotle’s beauty lies in its simplicity. The product menu is simple, consisting of a handful of proteins and sides, served in a few form factors, such as burritos, bowls, or salads.

The company is profitable, generating $1.3 billion in free cash flow over the past four quarters, on $10.66 billion in sales. Management funds store expansion with some of Chipotle’s profits and repurchases stock with the rest, further boosting earnings growth. Chipotle’s split-adjusted share count has decreased nearly 12% over the past decade, while earnings per share have increased 262%. The great thing about Chipotle is that it still has just 3,146 stores, primarily located in the United States. It can continue opening stores and repurchasing stock for the foreseeable future.

Recently, Chipotle’s CEO Brian Niccol abruptly left the company to join Starbucks. His departure helped contribute to the stock’s lackluster post-split performance.

Market-beating stocks are seldom cheap, so it could be wise to snatch up Chipotle while it’s trading at a reasonable price. Analysts believe Chipotle will grow earnings by an average of 22% annually over the long term, making the stock’s forward P/E of 54 digestible for those planning to hold the stock for years since it can grow into its valuation.

Luxury goods aren’t in style while consumers struggle

People with money have seemingly always had a taste for the finer things. Williams-Sonoma is a specialty retailer that sells high-end home goods and furnishings. It operates store brands like Pottery Barn and has a strong e-commerce footprint. The company has been public since the 1980s and has delivered market-beating returns for decades. The stock’s lifetime total returns, between share price appreciation and dividends, exceed 42,000%. This is a company you want to keep in your portfolio.

If so, why should investors avoid the stock? Companies like Williams-Sonoma can struggle when consumers tighten up on discretionary purchases. While a $300 frying pan is probably nice to have, it’s not something most people will buy during tough times. Inflation has eaten away at consumers’ buying power over the past few years. Household savings in the United States are near multiyear lows, and credit card debt is at all-time highs. That’s not conducive to luxury purchases. Williams-Sonoma anticipates a 1.5% to 4% revenue decline in 2024 after lowering guidance in the second quarter.

Williams-Sonoma appears to be a much less expensive stock than Chipotle, at just under 18 times its estimated 2024 earnings. However, it doesn’t look like a better value. Analysts anticipate just over 6% annualized earnings growth over the next three to five years, and it’s hard to know whether that will hold if consumers continue struggling. High-earners can sometimes be resilient spenders, but Williams-Sonoma’s reduced guidance is reason to pause and exercise patience. I still like the company as a long-term stock, but economic turbulence could easily afford investors better buying opportunities in the future.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 7, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill, Starbucks, and Williams-Sonoma. The Motley Fool recommends the following options: short December 2024 $54 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.

1 Stock-Split Stock to Buy Hand Over Fist in October and 1 to Avoid was originally published by The Motley Fool

3 Small-Cap Stocks Ready to Deliver Significant Growth

Small-cap stocks faced a challenging environment for the last several years as inflation and high interest rates dampened lending opportunities. These companies—which are often in the early stages of development and lack stability—rely heavily on debt to fuel their growth.

Fortunately for the small-cap space, the Federal Reserve’s September rate cut of 50 basis points is a welcome relief that should make borrowing more accessible. The fact that the Fed has signaled that additional rate cuts are likely in the months to come makes the coming economic environment look all the more appealing for small-cap companies.

In anticipation of lowered rates, the small-cap-focused Russell 2000 Index is up by more than a quarter in the last year. While the increasingly favorable rate landscape should be a boon to small-caps in general, some companies will benefit more than others. Investors looking to small-cap stocks should consider a range of fundamentals and analyst forecasts.

TZOO: Shift to Paid Model Has Driven Stock Rally

Travelzoo Inc. TZOO provides a variety of websites and mobile apps relating to travel. The firm instituted a $40 annual membership fee at the start of 2024 after previously providing a similar set of services for free. While the shift to a fee-based subscription undoubtedly upset some members, the benefits for the company have so far dramatically outweighed the costs: the firm has yet to see a year-over-year drop in quarterly revenue and maintained more than 30 million members as of the end of the second quarter.

To be sure, Travelzoo has not yet completed its transition to a fee-based service. The company plans to monetize 95% of its existing member base through paid subscriptions by the beginning of 2025. This plan has fueled investor optimism in recent months, and Travelzoo shares have surged by almost 30% year-to-date and 130% in the last year. What’s more, based on a forward P/E ratio of 12.6 and projected earnings growth of 17.5%, the company may still have plenty of room to grow.

FBRT: REIT With Strong Projected Growth

The residential real estate market broadly stands to benefit from reduced interest rates, as buyers have an easier time accessing mortgages, and sellers are more motivated to offload when they have the prospect of a relatively low mortgage rate as well. Franklin BSP Realty Trust Inc. FBRT invests in residential mortgage pass-through securities, making it especially likely to benefit from a boost to home sales.

This real estate investment trust (REIT) has strong new commitments of well over $600 million in the most recent quarter, and cash on hand to be able to repurchase 3 million shares during that period as well. Its dividend payment history is strong and it has a dividend yield of 11.2%. Analysts project earnings to grow by more than 24% and see upside potential of more than 21%, too.

AURA: Positive Trial Results Fuel Optimism

Clinical-stage biotech firm Aura Biosciences Inc. AURA has had a tumultuous year with a number of brief spikes in stock price, though shares are down about 5% in the last 12 months as of October 10. Still, analysts are widely optimistic about the company, as AURA shares enjoy a “buy” rating and a consensus price target of $21.67, more than 160% above current levels.

Driving this optimism is the company’s recent positive results from its Phase 2 study of bel-sar, a treatment for certain types of ocular cancers. These results showed strong tumor control rates and vision preservation among patients, as well as a favorable safety profile.

Risk vs. Reward for Small-Cap Stocks

Small-cap stocks tend to be riskier investments than larger, well-established companies, but they can also offer the prospect of outsized returns when they succeed. Managing risk in the small-cap space also depends on the type of company, the industry and sector, and other factors. Biotechnology companies like Aura, for example, may remain unprofitable for a long period of time before seeing top- and bottom-line (and share price) spikes based on the success of a new drug treatment. This may make firms like this even more volatile than other small-cap companies.

The article “3 Small-Cap Stocks Ready to Deliver Significant Growth” first appeared on MarketBeat.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.