China's economy set to grow 4.8% in 2024, missing target: Reuters poll

By Kevin Yao

BEIJING (Reuters) – China’s economy is likely to expand 4.8% in 2024, undershooting the government’s target, and growth could cool further to 4.5% in 2025, a Reuters poll showed, maintaining the pressure on policymakers as they consider more stimulus measures.

Gross domestic product is forecast to have risen 4.5% in the third quarter from a year earlier, slowing from 4.7% in the second quarter and hitting the weakest since the first quarter of 2023, according to the poll, which was conducted between Sept. 27 and Oct. 15.

Authorities have sharply ramped up policy stimulus since late September in a bid to revive the flagging economy and ensure growth will reach the government’s target of around 5% this year.

“The main pressure is from the consumption side, which is linked to deflationary pressures,” said Xing Zhaopeng, ANZ’s senior China strategist.

Xing expects economic activity to improve in the fourth quarter as a raft of stimulus measures kick in, but still maintains his 2024 growth forecast at 4.9%.

China, which has rarely failed to reach its growth target, last missed it in 2022 when the pandemic knocked growth to 3%, sharply lower than the goal of around 5.5%.

The government is due to release third-quarter GDP data and September retail sales, industrial production and investment data at 0200 GMT on Oct. 18.

The latest poll showed a broadly pessimistic outlook when compared to the previous poll in July, when economists predicted 2024 growth of 5.0%.

Out of 75 common contributors, who participated in both the July and October polls, a majority of economists, or 57%, have downgraded their growth forecasts for this year and 32% have kept it unchanged.

All the polling was conducted after the latest monetary measures, but this has not moved the needle on GDP forecasts at all for the two years Reuters poll on, underlining the depth of pessimism around the growth outlook amid a prolong property crisis.

Analysts and investors expect a meeting of China’s parliament later this month will unveil more specific stimulus plan.

Growth in the world’s second-largest economy is forecast to slow further to 4.5% in 2025, according to the poll, unchanged from the poll in July.

Last week, China’s finance minister pledged to “significantly increase” debt to revive growth, but left investors guessing on the overall size of the stimulus package.

China may raise an additional 6 trillion yuan ($850 billion) from special treasury bonds over three years to help bolster a sagging economy through expanded fiscal stimulus, Caixin Global reported, citing multiple sources with knowledge of the matter.

Reuters reported last month that China plans to issue special sovereign bonds worth about 2 trillion yuan this year as part of fresh fiscal stimulus.

The central bank in late September announced the most aggressive monetary support measures since the COVID-19 pandemic, including interest rate cuts, a 1 trillion yuan liquidity injection and other steps to support the property and stock markets.

Analysts polled by Reuters expect the central bank to cut the one-year loan prime rate, the benchmark lending rate, by 20 basis points in the fourth quarter, and reduce banks’ reserve requirement ratio (RRR) by 25 basis points.

The PBOC is likely to cut the seven-day reverse repo rate – its main policy rate – by 20 basis points in the first quarter of 2025. The bank cut the rate by 20 bps on September 27.

China’s consumer inflation unexpectedly eased in September, while producer price deflation deepened, heightening pressures on Beijing to take steps to spur demand as exports lose steam.

Analysts polled by Reuters estimate a 0.5% rise in China’s consumer prices for this year, well below the government’s target of around 3%, before picking up 1.4% in 2025.

(For other stories from the Reuters global long-term economic outlook polls package:)

(Polling by Susobhan Sarkar and Anant Chandak in Bengaluru and Jing Wang in Shanghai; Reporting by Kevin Yao; Editing by Shri Navaratnam)

CANCELLED – MEDIA ADVISORY – FEDERAL GOVERNEMENT TO MAKE HOUSING-RELATED ANNOUNCEMENT IN LA BAIE

SAGUENAY, QC, Oct. 14, 2024 /CNW/ – Media are invited to join the Honourable Jean-Yves Duclos, Minister of Public Services and Procurement, Quebec Lieutenant, and Member of Parliament for Québec, on behalf of the Honourable Sean Fraser, Minister of Housing, Infrastructure and Communities, for the announcement.

|

Date: |

October 15, 2024 |

|

Time: |

2:00 PM ET |

|

Location: |

Centre Le Phare 293 rue Onésime Coté La Baie (Québec) G7B 3J7 |

SOURCE Canada Mortgage and Housing Corporation (CMHC)

![]() View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/14/c0909.html

View original content to download multimedia: http://www.newswire.ca/en/releases/archive/October2024/14/c0909.html

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

JNPR's Solution to Boost Seoul Semiconductor's Network: Stock to Gain?

Juniper Networks, Inc. JNPR recently announced that Seoul Semiconductor has deployed its cutting-edge AI-Native Networking Platform. The deployment by this South Korea-based lighting technology firm aims to provide dependable and measurable wired and wireless access services that boost employee productivity while cutting operational costs. Central to this initiative is Juniper’s sophisticated AI engine, Mist AI, which utilizes advanced AIOps and a microservices cloud to enhance both user and operator experiences.

How Will JNPR’s Solutions Aid Seoul Semiconductor?

In today’s hyper-connected, fast-paced business environment, the existing network infrastructure is facing growing pressure to facilitate ever-increasing data center workloads. Recognizing the limitations of its outdated wired and wireless infrastructure, Seoul Semiconductor decided to upgrade its hardware to address issues related to data throughput and coverage. This strategic move also aimed to alleviate inefficiencies stemming from vendor lock-in. By selecting Juniper’s solutions, the company aims to achieve greater agility, automation and assurance across its network, essential for supporting its expanding operations.

The deployment of Mist AI, a key part of Juniper’s AI-Native Networking Platform, is likely to enable Seoul Semiconductor to streamline its wireless operations and gain valuable insights into user experiences through service level monitoring. This integrated management solution uses a combination of artificial intelligence, machine learning and data science techniques to optimize user experiences and simplify operations across wireless access, wired access, SD-WAN, WAN Edge, data center and security domains.

It facilitates real-time monitoring and automates network settings, significantly reducing the time required for manual troubleshooting. With a rich data science toolkit and years of reinforced learning, Mist AI can also transform insights into automated actions, enhancing overall IT and user satisfaction.

In addition, the introduction of the Marvis Virtual Network Assistant (VNA) will likely provide the IT team with an intuitive conversational interface to detect and resolve networking issues efficiently. The state-of-the-art VNA is central to Juniper’s unique AI-Native Network support model and constantly ingests data and learns from network devices and applications. This ensures a wide breadth of expertise with the highest level of efficacy.

Increasing Client Base to Drive Performance for JNPR

Juniper’s leading-edge AI native networking portfolio is well-suited for both traditional and emerging AI workloads. This platform equips Seoul Semiconductor to leverage data effectively, respond in real-time and maintain a resilient infrastructure, ultimately delivering superior experiences for both operators and end-users.

With a strong presence in more than 100 countries, the leading provider of networking solutions and communication devices is expected to benefit from the increasing customer base. This will likely enable the company to generate higher revenues in the upcoming quarters. Improving financial performance is likely to propel the stock upward.

JNPR’s Stock Price Performance

Shares of Juniper have gained 47.4% over the past year compared with the industry’s growth of 55.4%.

Image Source: Zacks Investment Research

JNPR’s’ Zacks Rank and Key Picks

Juniper currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader industry have been discussed below.

Ubiquiti Inc. UI sports a Zacks Rank #1 (Strong Buy) at present. Its highly flexible global business model remains apt to adapt to the changing market dynamics to overcome challenges while maximizing growth.

Its excellent global business model, which is flexible and adaptable to evolving changes in markets, helps it to beat challenges and maximize growth. The company’s effective management of its strong global network of more than 100 distributors and master resellers improved UI’s visibility for future demand and inventory management techniques. In the last reported quarter, Ubiquiti delivered an earnings surprise of 4.19%.

Workday Inc. WDAY sports a Zacks Rank #1 at present. In the last reported quarter, it delivered an earnings surprise of 7.36%. WDAY is a leading provider of enterprise-level software solutions for financial management and human resource domains.

Ooma, Inc. OOMA currently carries a Zacks Rank #2 (Buy). In the last reported quarter, it delivered an earnings surprise of 7.14%.

Ooma provides communications solutions and other connected services to small business, home and mobile users. The Company’s products include Ooma Office for small businesses, Business Promoter, Ooma Telo for home, Ooma end-point devices, Ooma Premier Service for Telo, Talkatone Application as well as caller identification, call-waiting and voice mail services. Ooma, Inc. is based in Palo Alto, United States.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Automotive Smart Antenna Market Size Set to Achieve USD 8.5 Billion by 2034, Supported by an 8.1% CAGR | Transparency Market Research Inc.

Wilmington, Delaware, United States, Transparency Market Research, Inc. , Oct. 14, 2024 (GLOBE NEWSWIRE) — The global automotive smart antenna market (mercato delle antenne intelligenti per autoveicoli) stood at US$ 3.6 billion in 2023, and the global market is projected to reach US$ 8.5 billion in 2034. The global automotive smart antenna market is anticipated to expand at a CAGR of 8.1% between 2024 and 2034.

The automotive smart antenna market is experiencing significant growth, driven by technological advancements and the increasing integration of connectivity features in vehicles.

One of the primary catalysts for this market expansion is the transition to 5G connectivity. With its high data transfer speeds and low latency, 5G is revolutionizing vehicle communication systems, enabling real-time data exchange that is essential for advanced automotive applications.

Request a PDF Sample of this Report Now!

https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=59457

Autonomous vehicles are a major driving force behind the demand for automotive smart antennas. These vehicles rely heavily on seamless communication with other vehicles (V2V) and infrastructure (V2I) to ensure safety and efficiency.

Smart antennas play a critical role in facilitating this communication, providing robust and reliable connectivity that supports the complex data needs of autonomous driving systems.

Modern vehicles are equipped with a multitude of sensors and systems that require constant connectivity to function optimally. This includes navigation systems, infotainment, telematics, and advanced driver-assistance systems (ADAS). Smart antennas integrate multiple communication functions into a single unit, reducing complexity and enhancing the performance of these systems.

The automotive industry’s push towards electric vehicles (EVs) also contributes to the growth of the smart antenna market. EVs often incorporate advanced technology to optimize performance and efficiency, and smart antennas are integral to these systems. They ensure that EVs can communicate effectively with charging infrastructure and other vehicles, supporting the broader ecosystem of smart mobility.

Automotive Smart Antenna Market: Key Players

The automotive smart antenna market report features prominent players such as Laird Connectivity, Harman International, Continental AG, Hirschmann Car Communication GmbH, Kathrein Automotive GmbH, Ficosa International S.A., TE Connectivity Ltd., Schaffner Holding AG, Kymeta Corporation, Huf Hülsbeck & Fürst GmbH & Co. KG, Yokowo Co., Ltd., Airgain, Inc., Taoglas, Amphenol Corporation, Murata Manufacturing Co., Ltd., Cobham, Alps Alpine Co., Ltd., and Molex LLC.

Key Takeaways of Market Report

- Global automotive smart antenna market to generate absolute dollar opportunity worth US$ 8.5 billion until 2034.

- Global automotive smart antenna market is valued at US$ 3.6 billion in 2023.

- Europe is forecasted to hold the largest market share.

Global Automotive Smart Antenna Market: Growth Drivers

- The rise in vehicles equipped with electronic components for environmental sensing and data communication, facilitated by smart antennas, generates vast amounts of data for machine learning integration in vehicle computing systems. Autonomous vehicles present opportunities in mobility-as-a-service, ride-sharing, and logistics. Companies like Waymo offer autonomous ride-hailing services via mobile apps.

- The adoption of 5G connectivity, a key driver, optimizes smart antennas for low-latency, high-speed communication. Advanced technologies such as MIMO and beamforming enhance signal quality, ensuring reliable connectivity in diverse environments. These advancements drive the automotive smart antenna market, supporting the growing demand for intelligent, connected vehicle systems.

Unlock Growth Potential in Your Industry! Download PDF Brochure: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=59457

Global Automotive Smart Antenna Market: Regional Landscape

- Europe dominated the smart car antenna technology market and is expected to maintain its lead during the forecast period. This supremacy is largely due to Germany’s leadership in autonomous vehicle production. Additionally, premium car manufacturers are enhancing existing antenna technologies to retain their consumer base.

- Asia Pacific holds a significant share of the automotive smart antenna market, driven by the rising popularity of SUVs for weekend use. India and China are at the forefront of SUV consumption, a trend that is expected to continue. These dynamics are fueling the demand for advanced smart antenna solutions across the region, supporting the growth of connected and autonomous vehicle technologies.

Global Automotive Smart Antenna Market: Key Players

- In 2023, Harman International made significant strides in the automotive smart antenna market by introducing an advanced modular antenna system. This system integrates multiple communication technologies, such as 5G, V2X (vehicle-to-everything), and Wi-Fi, into a single compact unit.

- In 2023, Continental AG developed a smart antenna solution featuring cutting-edge beamforming technology. This advancement allows for more precise and reliable signal transmission, which is crucial for the efficient functioning of autonomous driving systems.

Global Automotive Smart Antenna Market: Segmentation

Antenna Type

- Shark Fin Antennas

- Patch Antennas

- Blade Antennas

- Low-profile Antennas

Frequency

- Ultra-High Frequency (UHF)

- Very High Frequency (VHF)

- Global Navigation Satellite System (GNSS)

- Cellular (4G, 5G)

- Wi-Fi

- Bluetooth

Technology Type

- MIMO (Multiple Input Multiple Output) Antennas

- Phased Array Antennas

- Switched Beam Antennas

- Adaptive Antennas

- Smart Beamforming Antennas

Antenna Location

- Roof-Mounted Antennas

- Side-Mounted Antennas

- Integrated into Windshield

- Rear-Mounted Antennas

Component

- Transceiver

- Electronic Control Units

- Others (Connector, Wire Harness, etc.)

Vehicle Type

- Light Commercial Vehicles

- Heavy Duty Trucks

- Buses & Coaches

- Off-road Vehicle

Sales Channel

Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Buy this Premium Research Report: https://www.transparencymarketresearch.com/checkout.php?rep_id=59457<ype=S

More Trending Reports by Transparency Market Research –

- Automotive Wiring Harness Market – The global automotive wiring harness market size (mercato dei cablaggi automobilistici) worth US$ 86.46 Billion by 2031, TMR Study| TMR

- Powertrain Market – The global powertrain market (mercato dei propulsori) to Exceed US$ 375.48 Billion by 2031: TMR Study, as per the market outlook report by TMR

- Agricultural Trailer Market –The global agricultural trailer market (mercato dei rimorchi agricoli ) is expected to reach US$ 58.7 Billion by the end of 2034.

- Winter Tire Market – The winter tire market (mercato degli pneumatici invernali) is has expected to reach a value of US$ 41.2 Billion by the end of 2034.

About Transparency Market Research

Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Contact:

Transparency Market Research Inc.

CORPORATE HEADQUARTER DOWNTOWN,

1000 N. West Street,

Suite 1200, Wilmington, Delaware 19801 USA

Tel: +1-518-618-1030

USA – Canada Toll Free: 866-552-3453

Website: https://www.transparencymarketresearch.com

Email: sales@transparencymarketresearch.com

Follow Us: LinkedIn| Twitter| Blog | YouTube

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Pinterest: Time to Jump Onboard for Long-Term Gains?

Pinterest PINS is a social media platform that is known for its visual inspiration and shopping features. However, Pinterest stock has experienced a lot of turbulence in the past few months. After a significant decline in share price, investors have started to question if the platform has the potential for a rebound.

A Look at Pinterest’s Terrain

Pinterest operates in the competitive social media and e-commerce sectors. Pinterest’s competitors include giants like Facebook, Instagram, and TikTok. These platforms are all vying for user attention, data, and advertising dollars, making a volatile and demanding environment for Pinterest. The company’s core business model relies heavily on advertising revenue, making Pinterest susceptible to broader economic headwinds as well as the advertising industry’s constant evolution. In the past few months, Pinterest’s financial performance has been significantly affected by these two key challenges.

Pinterest’s Case for Growth

Pinterest’s earnings report for the second quarter of 2024 offers evidence of the company’s ability to perform, grow, and implement new strategies. The report showcased several areas of success, providing a positive outlook for investors.

Pinterest’s revenue rose 21% year-over-year, reaching $854 million in the second quarter. This figure surpassed Pinterest’s analyst community’s expectations. This significant revenue growth demonstrates the company’s ability to effectively monetize its expanding user base and attract a growing number of advertisers.

The company’s continued investment in artificial intelligence (AI) powered products and experiences has proven effective, driving user engagement and improving the effectiveness of advertising campaigns. As CEO Bill Ready noted, Pinterest is “gaining share of advertising budgets with some of the world’s largest brands,” highlighting the platform’s growing influence in the advertising sector.

The report also underscored Pinterest’s continued user growth. Global monthly active users (MAUs) climbed 12% year-over-year, reaching a record 522 million. This continued user base expansion is a critical indicator of Pinterest’s ability to attract new users and retain existing ones, further solidifying its position as a dominant player in the social media sector.

A Look at the Future of Pinterest Stock

Looking ahead, Pinterest’s guidance for the third quarter of 2024 is a beacon of hope. The company anticipates a revenue range of $885 million to $900 million, signaling a projected 16-18% growth year-over-year. This forecast aligns with Pinterest’s strategic focus on monetizing its user base and attracting advertisers, suggesting a promising trajectory for revenue growth.

Moreover, Pinterest’s commitment to innovation is a reassuring sign for investors. The company anticipates a 17-20% growth in non-GAAP operating expenses for the third quarter, a clear indication of its continued investment in areas such as AI, innovation, and platform enhancements. This commitment drives user engagement, improves advertising effectiveness, and ultimately drives revenue growth.

Furthermore, Pinterest’s successful monetization efforts are a testament to its value proposition. The company emphasized, “Advertisers are seeing improved performance across key objectives on Pinterest – from brand awareness to conversion.” These statements underscore Pinterest’s continued focus on delivering value for its users and advertisers, instilling confidence in its future growth and monetization strategies.

The Analysts’ Perspectives

Despite recent volatility, analysts are increasingly optimistic about Pinterest’s prospects. Several analysts have issued positive commentary, citing the company’s growth potential and attractive valuation. Goldman Sachs has added Pinterest to its Americas Conviction List, highlighting the potential for revenue growth and margin expansion.

RBC Capital Markets included Pinterest in its top 30 Global Ideas For 2024 list, reinforcing the bullish sentiment. Oppenheimer OPY analysts see upside potential in user engagement and believe Pinterest is attractively valued, while other analysts have called the platform “increasingly indispensable” for advertisers.

This positive sentiment is reflected in the consensus rating for Pinterest stock. Currently, 30 analysts have issued ratings, resulting in a Moderate Buy consensus. Pinterest’s average analyst price target points to an upside above 30% over the coming 12 months, indicating significant potential for share price appreciation. Furthermore, analysts project strong revenue growth of 19% this year, with growth expected to remain above 10% through 2027. Earnings are projected to grow by 66.67% in the coming year, further bolstering the case for a potential upside in the stock price.

The Risks and Challenges

While Pinterest’s outlook appears promising, investors should be aware of several potential risks and challenges:

- Intense Competition: The social media sector is highly competitive, with established players vying for user attention and advertising dollars. Pinterest’s ability to maintain its user base and attract advertisers in this environment is crucial.

- Economic Uncertainty: The global economy faces ongoing challenges, including inflation and potential recession. A downturn in the economy could lead to reduced advertising spending, negatively impacting Pinterest’s revenue.

- Regulation and Privacy: Pinterest, like other social media platforms, faces increasing scrutiny regarding data privacy and content moderation. Regulatory changes or concerns about data privacy could affect the company’s operations and user trust.

- User Engagement: Pinterest’s success hinges on its ability to maintain and grow its user base. Any decline in user engagement due to competition, changes in consumer preferences, or platform misuse could significantly impact its financial performance.

- Monetization Challenges: While Pinterest has shown progress in monetizing its platform, effectively competing with larger players that have more diverse revenue streams continues to remain a challenge.

- Execution Risk: Pinterest’s ability to deliver on its growth plans, such as expanding its user base, integrating e-commerce seamlessly, and maximizing its AI capabilities, is crucial for its future success.

Considerations for Investing in Pinterest

While Pinterest has experienced a turbulent ride, its recent earnings report offers hope, suggesting a potential turnaround. While the company faces challenges in a fiercely competitive market, its focus on AI, e-commerce integration, and strategic partnerships, combined with a favorable valuation and a solid recent financial performance, indicate a “Cautious Buy” proposition for investors looking for long-term growth opportunities. However, investors must recognize the ongoing risks associated with competition, economic uncertainty, data privacy regulations, and the company’s ability to deliver on its promises consistently.

The article “Pinterest: Time to Jump Onboard for Long-Term Gains?” first appeared on MarketBeat.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

1 Magnificent Dividend Stock Down 29% to Buy Now for a Lifetime of Passive Income

Corporate spinoffs can be an odd investment proposition. Often, when companies split up, one of the resulting businesses seems like the “desirable” asset to own, while the other gets spurned by investors. Typically, that unloved company is the one that winds up with the parent’s less exciting operations or the businesses with lower projected growth. Indeed, the performance gaps between stodgy business units and higher-growth ones are often used as key justifications for spinoffs.

However, as counterintuitive as it sounds, sometimes, when the market seems to want nothing to do with a newly spun-off company, that just makes it a more interesting investment option to me.

That’s now the case with WK Kellogg (NYSE: KLG) — the pure-play cereal business that was spun off a year ago from the former Kellogg, which renamed itself Kellanova. In August, privately held behemoth confectioner Mars agreed to acquire the snack-centric Kellanova. But WK Kellogg is still fending for itself — and it is being viewed skeptically by the market.

Here’s why I think that the market’s current disdain toward WK Kellogg positions it as an excellent buy for investors seeking out a lifetime of passive income.

The market doesn’t like the new Kellogg — and that’s perfect

WK Kellogg owns more than a dozen well-known cereal brands, but considers the following to be its “core six:” Frosted Flakes, Special K, Fruit Loops, Raisin Bran, Frosted Mini Wheats, and Rice Krispies. These big brands are responsible for its leadership position in the cereal industry alongside peers General Mills and Post. Those three companies alone are responsible for roughly three-quarters of total sales in the niche.

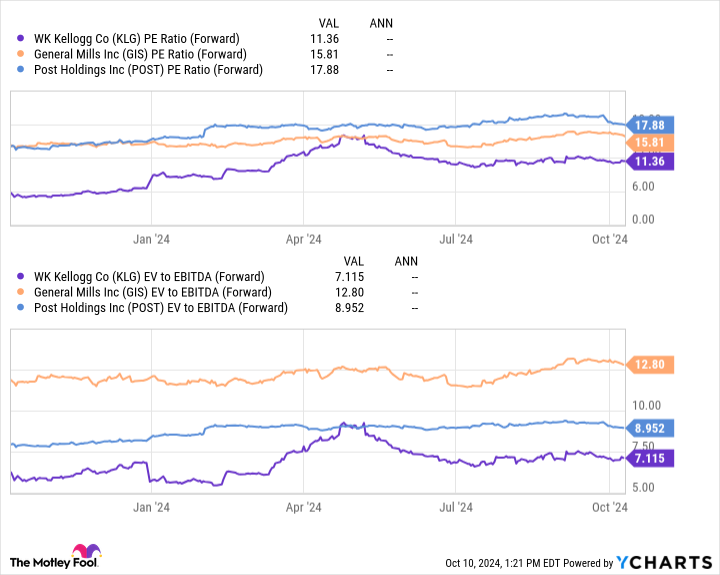

While this leadership position is excellent, Statista projects that cereal sales overall will only grow by 2% annually through 2029 — a tepid rate that has left the companies trading at sub-market valuations. However, WK Kellogg’s valuation, in particular, is deeply discounted — not just relative to the market but to its two main peers.

Following the company’s 29% dip from its previous highs set in May, WK Kellogg trades at a mere 11 times next year’s earnings, indicating that the market sees minimal growth potential. Just how little growth?

With management stating that it has historically converted 100% of its net income into free cash flow (FCF) on average over time, WK Kellogg would only need to grow by 2% in perpetuity to live up to this valuation. That means WK Kellogg would only need to maintain its share of the cereal industry to produce market-beating returns.

But management has grander plans than just holding serve.

Over the next two years, it plans to invest roughly $500 million into modernizing and consolidating its supply chain, adding automation and new digital capabilities that could dramatically improve efficiency. Should these upgrades go according to plan, management believes its earnings before interest, taxes, depreciation, and amortization (EBITDA) margin — lately 9% — will improve to 14% by 2026.

Given that General Mills and Post have been achieving EBITDA margins of 20% and 16% already, I don’t believe 14% is out of reach for WK Kellogg — especially considering that it should be able to streamline its operations as a pure-play cereal unit. Should it land anywhere near this 14% margin, the company would fly past the 2% growth it needs to live up to its current valuation.

WK Kellogg’s passive income potential

Best of all for investors, despite its plan to spend heavily on those supply chain upgrades, WK Kellogg still intends to reward shareholders handsomely for their patience. Its dividend at the current share price has a generous 3.7% yield. But its dividend payouts will equal roughly 35% of the company’s projected net income, so the payout’s sustainability does not appear to be at risk.

However, with the company’s debt-to-EBITDA ratio expected to rise to 3 by 2026 as it spends on its supply chain, investors shouldn’t expect significant dividend increases over the next year or two. If its improvements go to plan, though, and WK Kellogg’s profitability rises by roughly 50% or more as projected, it will be well-positioned to engage in major dividend hikes over a decade-long time frame.

In addition to this passive income potential, WK Kellogg’s higher margins would also allow for it to pay down debt and consider tuck-in acquisitions of better-for-you cereal upstarts that could modernize its offerings. With natural and organic brands like Kashi and Naked Bear already in its lineup, WK Kellogg recently launched a new high-protein, zero-sugar, premium cereal called Eat Your Mouth Off.

Ultimately, investors who are interested in WK Kellogg will want to be laser-focused on its earnings reports over the next two years, monitoring those readouts to see whether or not its projected EBITDA margin growth takes place. Thanks to the company’s pure-play focus on cereal, I’m optimistic that it can get its margins closer to those of its peers — and maybe one day surpass them — which would make the stock at today’s price a steal.

While investors will need to have patience with this stock, WK Kellogg’s combination of a deeply discounted valuation, its leadership positioning, a hefty dividend yield, and the potential for higher margins make it a great candidate for those seeking a passive income stream that can last a lifetime.

Should you invest $1,000 in WK Kellogg right now?

Before you buy stock in WK Kellogg, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and WK Kellogg wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $826,069!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 14, 2024

Josh Kohn-Lindquist has no position in any of the stocks mentioned. The Motley Fool recommends WK Kellogg. The Motley Fool has a disclosure policy.

1 Magnificent Dividend Stock Down 29% to Buy Now for a Lifetime of Passive Income was originally published by The Motley Fool

Enliven Therapeutics, Inc. Is a Great Choice for 'Trend' Investors, Here's Why

Most of us have heard the dictum “the trend is your friend.” And this is undeniably the key to success when it comes to short-term investing or trading. But it isn’t easy to ensure the sustainability of a trend and profit from it.

Often, the direction of a stock’s price movement reverses quickly after taking a position in it, making investors incur a short-term capital loss. So, it’s important to ensure that there are enough factors — such as sound fundamentals, positive earnings estimate revisions, etc. — that could keep the momentum in the stock going.

Investors looking to make a profit from stocks that are currently on the move may find our “Recent Price Strength” screen pretty useful. This predefined screen comes handy in spotting stocks that are on an uptrend backed by strength in their fundamentals, and trading in the upper portion of their 52-week high-low range, which is usually an indicator of bullishness.

Enliven Therapeutics, Inc.

ELVN is one of the several suitable candidates that passed through the screen. Here are the key reasons why it could be a profitable bet for “trend” investors.

A solid price increase over a period of 12 weeks reflects investors’ continued willingness to pay more for the potential upside in a stock. ELVN is quite a good fit in this regard, gaining 26.8% over this period.

However, it’s not enough to look at the price change for around three months, as it doesn’t reflect any trend reversal that might have happened in a shorter time frame. It’s important for a potential winner to maintain the price trend. A price increase of 25.1% over the past four weeks ensures that the trend is still in place for the stock of this company.

Moreover, ELVN is currently trading at 96.2% of its 52-week High-Low Range, hinting that it can be on the verge of a breakout.

Looking at the fundamentals, the stock currently carries a Zacks Rank #2 (Buy), which means it is in the top 20% of more than the 4,000 stocks that we rank based on trends in earnings estimate revisions and EPS surprises — the key factors that impact a stock’s near-term price movements.

The Zacks Rank stock-rating system, which uses four factors related to earnings estimates to classify stocks into five groups, ranging from Zacks Rank #1 (Strong Buy) to Zacks Rank #5 (Strong Sell), has an impressive externally-audited track record, with Zacks Rank #1 stocks generating an average annual return of +25% since 1988.

Another factor that confirms the company’s fundamental strength is its Average Broker Recommendation of #1 (Strong Buy). This indicates that the brokerage community is highly optimistic about the stock’s near-term price performance.

So, the price trend in ELVN may not reverse anytime soon.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Cathie Wood's Ark Invest Sells $5.7M Of Robinhood Shares As Bitcoin Surge Ignites Crypto Market — Buys Stock Of Nvidia Rival AMD

On Monday, Cathie Wood’s Ark Invest made significant trades, with the most notable being the sale of Robinhood Markets Inc HOOD shares across multiple ETFs.

The HOOD Trade: Ark Invest, under the leadership of Cathie Wood, sold off 210,374 Robinhood shares. The ARK Fintech Innovation ETF ARKF sold 14,458 shares, while the ARK Innovation ETF ARKK offloaded 181,900 shares. Notably on the day, Bitcoin BTC/USD surged above $65,000, driven by bullish sentiment and liquidations of downside bets, with market confidence boosted ahead of U.S. elections and a shift from neutral to greed in market sentiment. Robinhood, a popular platform among retail traders, enables users to trade cryptocurrencies such as Bitcoin, Ethereum ETH/USD, and Dogecoin DOGE/USD.

The ARK Next Generation Internet ETF ARKW also participated in the sell-off, disposing of 14,016 Robinhood shares while Ark Fintech Innovation ETF ARKF sold another 14,458 shares. The total value of the trade, based on the closing price of $27.00, is approximately $5.7 million.

Robinhood has been in the spotlight recently, with the company announcing its first investor day scheduled for December 4, 2024. The event, to be held in New York City, will be live-streamed and will provide an opportunity for the company to share its vision for the next decade. The announcement of the investor day had initially led to a surge in Robinhood’s stock price.

Earlier in the year, Robinhood reported impressive second-quarter earnings, with a 40% year-over-year increase in revenue and a significant 161% increase in crypto revenue. The platform also reached a milestone of 2 million Gold subscribers. Despite these positive developments, Ark has been on a Robinhood selling spree. It’s worth noting that Ark Invest had previously dumped $36 million worth of Robinhood stock earlier this month.

Other Key Trades:

- Advanced Micro Devices Inc AMD shares were bought by ARKX. The firm sold 2,400 shares worth $396,648.

- Markforged Holding Corp (MKFG) shares were sold by the ARK Autonomous Technology & Robotics ETF (ARKQ) and the ARK Space Exploration & Innovation ETF (ARKX). Materialise NV (MTLS) shares were sold by ARKQ. Blade Air Mobility Inc (BLDE) shares were bought by ARKQ and ARKX.

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.